Account

Sales-Driven VOLUME 25 I ssue 1 2023 STRATEGIC ACCOUNT MANAGEMENT ASSOCIATION

Strategic

Management Solution-Driven, Not

15 Five questions to improve a manufacturing SAM’s performance 20 Account-based growth: unlocking sustainable value through extraordinary customer focus 27 How to drive results and make an impact: a toolkit for strategic account managers 35 What to do when an account is no longer strategic 43 The SAM as a team builder: fostering alignment across boundaries 48 From difficult conversations to high-value dialogue Quick Takes .………………..………… 9 Data Watch …………………………… 13 V ELOCITY ® A PUBLICATION OF THE STRATEGIC ACCOUNT MANAGEMENT ASSOCIATION Publisher: Denise Freier | Editor-in-chief: Harvey Dunham | Associate Editor: Nic Halverson Creative Director: Aimee Waddell | Advertising: Ashley Davis The Strategic Account Management Association is a global knowledge-sharing and networking organization devoted to developing, promoting, and advancing strategic customer-supplier value, collaboration, and learning. No part of this publication may be reproduced or transmitted in any form or by any means without written permission. Copyright © 2023 by the Strategic Account Management Association (SAMA). The SAMA ® logo is a registered trademark of the Strategic Account Management Association. Velocity ® is published three times a year. The annual subscription rate is $65. Changes of address, suggested articles, and requests for extra copies of this publication should be directed to: SAMA, 4740 N. Cumberland Ave., #389, Chicago, IL 60656. Tel: 312-251-3131 Fax: 312-251-3132 Internet: www.strategicaccounts.org For membership information or to join SAMA, contact Chris Jensen at 312-251-3131 x10 or jensen@strategicaccounts.org. Features Departments Vol. 25 Issue 1 2023 Cover image credit: Vastram / Shutterstock.com

SAMA Corporate Members

Abbott

ABM Industries Inc.

Agilent

Airbus Defence and Space Air Liquide

Allergan

Amgen Canada

Arcadis

Astellas

Avient Corporation

AVI-SPL

Axis Communications Inc.

Bayer AG

Bellevue University bioMérieux

Boehringer Ingelheim

Bracco Diagnostics

Brenntag Specialties Inc

Buckman North America

Bunge CAS CenterPoint Energy Ceva Santé Animale Clarios Cox Automotive Danaher Companies DHL Donaldson Company, Inc.

Ecolab

Elanco Animal Health

EMERSON Automation Solutions

Endress + Hauser Expeditors

FCM Formerra Freeman

Genmab US, Inc. Greene, Tweed & Co.

Grifols Therapeutics Inc

Henkel

Hilton Worldwide Honeywell Hovione

Hyatt Hyland Hypertherm

IDEXX Laboratories, Inc.

John Deere

Johnson & Johnson Lilly USA, LLC. Lonza

LP Building Solutions Lubrizol Medtronic Merck+ Michelin

Mölnlycke Health Care AB New York Power Authority Inc. Nilfisk O-I Organon LLC Owens Corning Pfizer, Inc. Premier Inc.

Rockwell Automation Schneider Electric Sherwin-Williams Siemens Sonoco Suez Sunovion supplyFORCE

The AAK Group

The Qt Company UL Solutions United Airlines Vallourec W. L. Gore & Associates, Inc.

Wajax Corporation Waters Corporation

West Pharmaceutical Services, Inc. WorkCare, Inc. Zoetis Zurich Insurance Group

SAMA Board of Directors

Steve Andersen

President and Founder

PMI

Dino Bertani

Executive Director, International Strategic Account Management

AbbVie

Anju Birdy

Strategic Account Management Excellence, Vice President

Schneider Electric

Noel Capon

R.C. Kopf Professor of International Marketing

Columbia Business School

Mauro Cerati

Senior Vice President, Global Customers Bunge

Dominique Côté

Owner and Founder COSAWI in/Sprl

Ron Davis

Executive Vice President, Head of Customer Management

Zurich Insurance Group

Jim Ford

Chief Commercial Officer Solecta, Inc. Chairman of the SAMA Board

Denise Freier

President and CEO SAMA

*John F. Gardner

Retired - President, Global Strategic Accounts Emerson Automation Solutions

*Rosemary Heneghan

Retired - Director, International Sales & Operations, Worldwide IBM

Special thanks to SAMA’s providers

Gerilyn Horan

Vice President, Group Sales & Strategic Accounts

Hilton

Denise Juliano

Group Vice President, Life Sciences Premier Inc.

Renae Leary

Chief Commercial Officer – Americas Ansell

Mike Moorman

Managing Principal, Sales Solutions

ZS

Joseph Pinzon

Regional Vice President, Corporate Key Accounts Konica Minolta

Dr. Hajo Rapp

SVP Strategic Account Management & Sales Excellence TÜV SÜD AG

Kevin Reilly

Global Sales Development Leader, 3M Healthcare Business Group 3M Company

Tony Stanich

VP Global Corporate Accounts - Food & Beverage for Water and Process Services Nalco, an Ecolab Company

Jennifer Stanley Partner McKinsey & Company

*Dr. Kaj Storbacka

Retired - Hanken Foundation Professor Hanken School of Economics

Geoff Williams

Vice President, Global Accounts Danfoss

*Distinguished Board Advisors (lifetime contributors; nonvoting members)

4 V elocity ® Vol. 25 Issue 1 2023

Predictable, Repeatable & Sustainable Sales Success

Your sales team may be exceptional at selling legacy products, but are they adept at co-creating mutual value with your most important customers? Today’s industry leaders recognize that it takes agility to transition from a transactional, productfocused organization to a strategic, customer-focused organization, and this includes a mindset-shift and focus that goes beyond the traditional sales process.

To get there, you’ll need a contemporary approach to sales and account management that is customized to your business and a collaborative methodology that thoroughly assesses your customers’ needs and focuses your cross-functional account teams on the entire customer experience, not just the sale.

At PMI, our experienced consultants will help you better align your sales team to engage more strategically with your customers. Our proven approach to selling value equips salespeople and account managers to co-discover what matters most to their customers, articulate and co-create value that connects with customer objectives, and grow and evolve trust-based customer relationships for increased retention and loyalty.

Our Value-Focused Selling solution will ensure predictable, repeatable and sustainable success through the deployment and implementation of a sales performance solution that fits your business, exceeds your requirements, and helps you engage, win and grow with your customers.

Our approach equips your team to co-discover what matters most to their customers and co-create value to grow and evolve trust-based customer relationships for increased retention and loyalty.

Repeatable Sustainable Read our latest use case and learn more about our approach to value co-creation at performancemethods.com.

Predictable

Publisher: Denise Freier

Editor-in-Chief: Harvey Dunham

Associate Editor: Nic Halverson

Creative Director: Aimee Waddell

Advertising: Ashley Davis

SAMA Staff Executive

President & CEO: Denise Freier

Finance/Operations/Meetings

Director of Finance, Meetings and Operations: Fran Schwartz

Senior Manager, Meetings and Events & Individual

Member Liaison: Rhodonna Espinosa

Finance & Operations Manager: Jaclyn Such Registration Manager: Shannon Feeney

Business Development

Managing Director, Strategy and Marketing: Harvey Dunham

Director, Customer Solutions: Christopher Jensen

Sr. Corporate Account Manager: Bobbie Zimny

Corporate Account Manager: Michael Johnson Sr. Corporate Solutions Manager: Ed Zupanc Salesforce Analyst/Administrator: Erin Pallesen

Business Leader – AMS: Stephanie Fahey

Knowledge, Certification & Training

Director, Knowledge, Certification & Training: Libby Souder

Assistant Director of Certification & Training: Frankie Cusimano

Assistant Director, Knowledge & Training: David Schweizer Knowledge and Training Manager: Brad Maloney Research

General Manager, Research & Customer Experience: Joel Schaafsma

Marketing & Communications

Creative Director: Aimee Waddell

Associate Editor: Nic Halverson

Marketing Manager & Sponsorship: Ashley Davis

Join the conversation with SAMA on LinkedIn at www.linkedin.com/company/strategic-account-management-association.

Follow SAMA on Twitter at www.twitter.com/samatweet.

SAMA 2023 EVENTS

Academy Online - First Quarter 2023 January-April

SAMA Executive Symposium February 16

ABM Academy: Next Generation ABM Customer-Led, Team-Enabled February 22-23 | Virtual

Academy Online - APAC (CORE 0) March 20-23

Academy Online - Second Quarter 2023 April-June

Boost KAM with Account-Based Marketing April 4-5 | Virtual

SAMA 2023 Annual Conference May 23-25 | San Diego, CA

Academy Online - APAC (CORE 3) June 13-15

SAMA Academy Chicago July 18-20

Academy Online - Third Quarter 2023 July-September

SAMA Academy Online - APAC (CORE 4) September 19-20

SAMA Academy Europe October 24-26

Academy Online - Fourth Quarter 2023 October-December

SAMA Academy Online - APAC (CORE 1) November 27-30

For more information, visit https://strategicaccounts.org/en/events .

6 V elocity ® Vol. 25 Issue 1 2023

V

OF THE STRATEGIC

ELOCITY ® A PUBLICATION

ACCOUNT MANAGEMENT ASSOCIATION

EDITOR’S CORNER

Nic Halverson Associate Editor Strategic Account Management Association (SAMA)

Philosopher Alan Watts — interpreter of Eastern wisdom for the Western world — wrote, “If a problem can be solved at all, to understand it and to know what to do about it are the same thing.”1

In strategic account management, the same principle holds true. If you don’t understand and anticipate the problems your customers face, seeking a solution is like “trying to clear away darkness by thrusting it aside with your hands,” Watts writes.

As any enlightened SAM knows, to understand your customers’ problems takes a commitment to open communication, proactive account review, and buyer empathy, so you can respond to problems, rather than react to them.

In today’s hectic marketplace, it’s easy to succumb to putting out fires rather than finding the source of the flame. Which is why we’ve dedicated this issue of Velocity to providing a framework for a solutions-driven mindset, to maximize your vision and turn it into a clear path toward value co-creation.

Embarking upon this path always begins by listening and asking questions. But there’s an art to being on-target with tone and substance. “Problems that remain persistently insoluble should always be suspected as questions asked in the wrong way,” Watts observed.2

Thanks to SAMA’s open exchange of best practices, we’ve landed on the right way to ask questions, which is exactly what you’ll find in our first feature, “Five Questions to Improve a Manufacturing SAM’s Performance,” by Kay Cruse, Vice President of Customer Experience at Strategex.

From there, the wisdom continues, and the questions evolve into actionable advice. In their article on accountbased growth, Bev Burgess and Tim Shercliff, cofounders of Inflexion Group, offer guidance on how companies can

become more “customer-centric across multiple processes and teams.”

Next, Tom Kurt, Strategic Account Manager at Sonoco, and Aaron Erbe, Director of Film Segment at Sonoco, “ignite the spark of momentum” by blending years of SAMA applied learnings to create a battle-tested SAM toolkit that drives results and makes an impact.

But no SAM can walk this path alone, right? Dr. Javier Marcos, Professor of Strategic Sales Management and Negotiation at Cranfield School of Management, agrees. In the latest installment of his high-performing SAM series, Marcos attests that SAMs “are the orchestrators of multifaceted relationships” which “require the coordination and alignment of teams to create value and deliver complex solutions.”

Remember, no path is without obstacle. Conditions can change in an instant. Even the gentlest path can turn into rugged terrain. Same goes with the relationship between a SAM and their customers. Sometimes the ground underfoot can get a little rocky, and the relationship’s coveted balance can feel a bit unsteady. In these moments we pose the question, “What to Do When an Account is No Longer Strategic?” Read on for the answers, as we revisit a 2005 Velocity article about firing an account and update it to better serve the modern landscape of strategic account management.

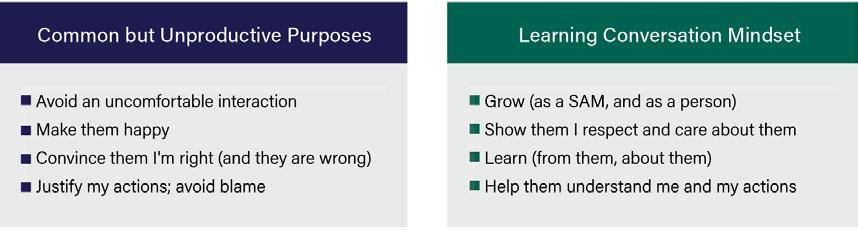

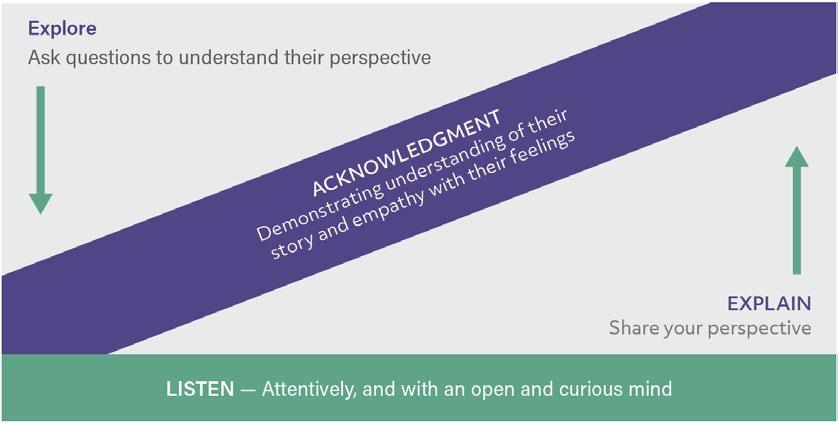

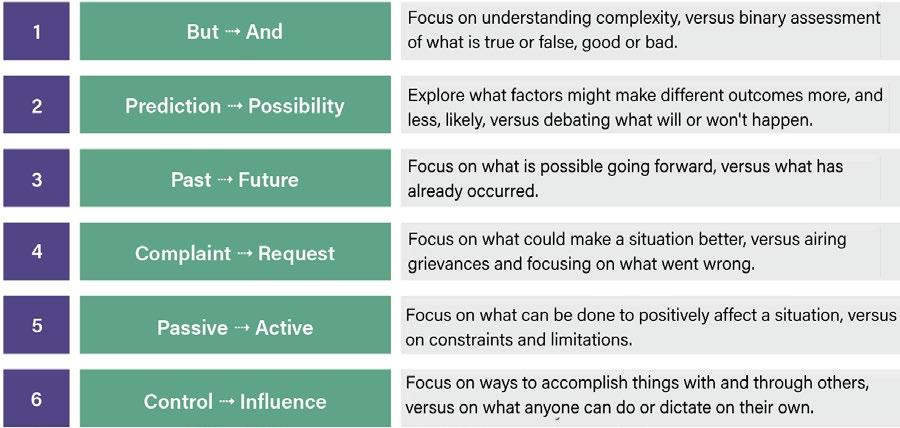

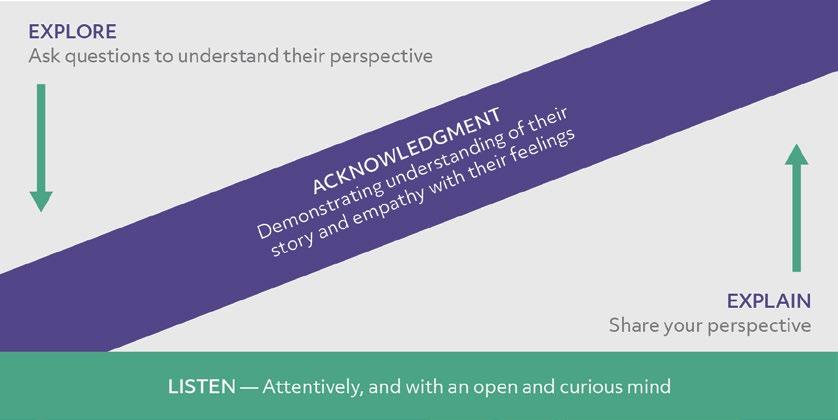

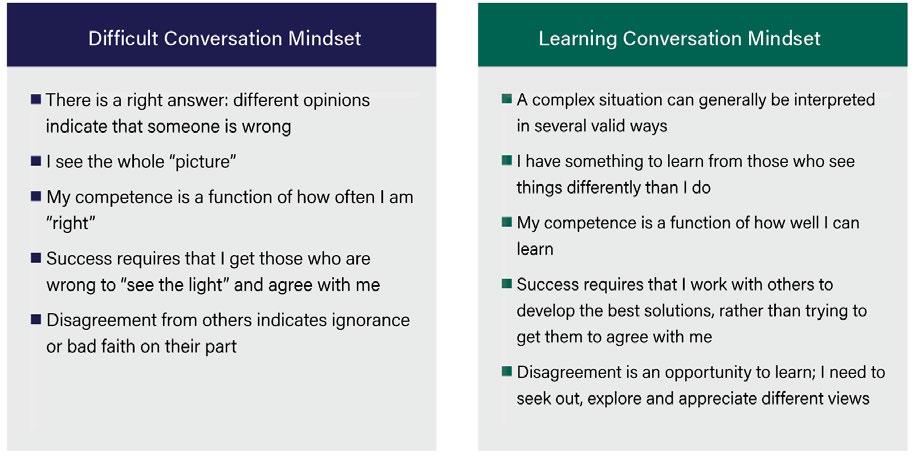

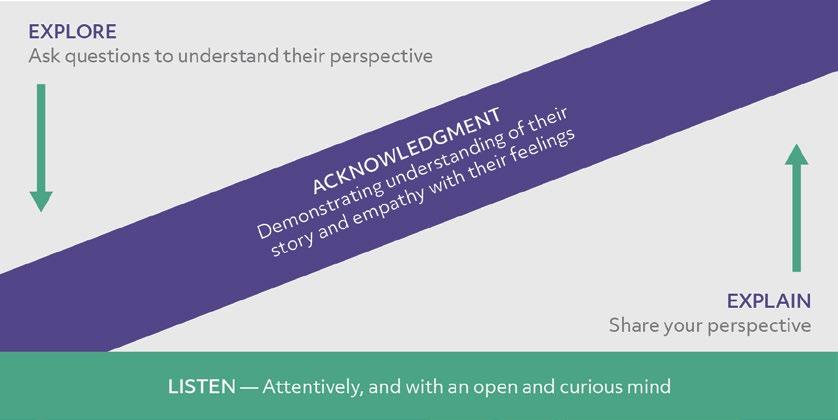

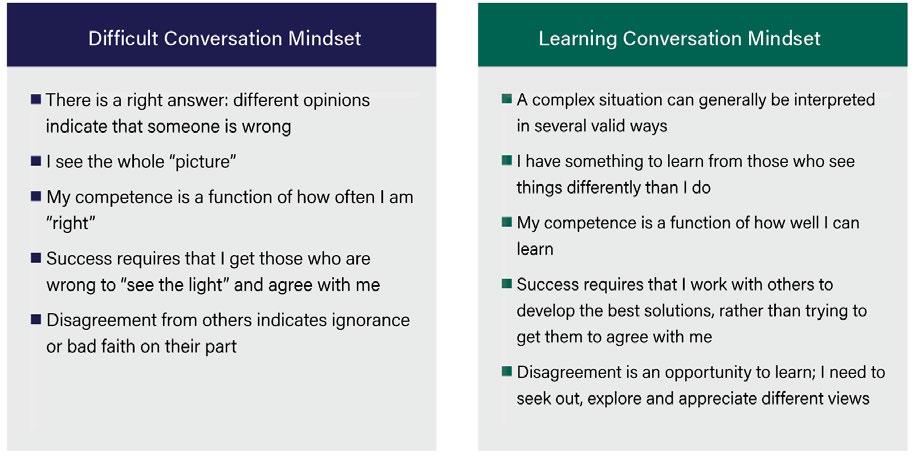

When a SAM’s customer relationship gets rocky, a difficult conversation awaits up ahead. But not to worry. Stand tall and go forth, as Jonathan Hughes, David Chapnick, and Ben Siddall advise in their excellent piece to close out the issue. As the Vantage Partners trio explain, “Rather than adopt a defensive stance toward difficult conversations — where we seek simply to limit the damage — we need to learn to embrace the challenge and opportunity they offer.”

As you tread upon your own solutions-driven path, I hope the pages ahead serve as guideposts and trail markers to light the way. n

1 Watts, A. (2021). The wisdom of insecurity: A message for an age of anxiety Rider Books.

2 Watts, A. W. (1989). The book: On the taboo against knowing who you are Vintage Books.

Vol. 25 Issue 1 2023 V elocity ® 7

QUICK TAKES

STRATEGIC ACCOUNT MANAGER TRAINING: BEGIN WITH

THE END IN MIND AND ASK THE RIGHT QUESTIONS

One of the most frequent conversations SAMA has with members of our community is about strategic account manager training. Oftentimes they are unsure about how to begin the process and what to consider when making training decisions. We always suggest starting with the end in mind by asking them three questions:

1. What do you want to achieve?

2. How quickly do you want to start?

3. What are the KPIs for measuring their progress toward achieving their goals?

The answers to these questions will become the reference when moving forward with training development.

Once you have established your goals, timeline, and ways to measure success, there are additional strategic considerations.

• How do you define strategic account management?

• Do you have a formal SAM program to support the SAMs?

• Why does your company want to train now?

• Who do you want to train? Consider these options:

º Newly appointed SAMs

º Experienced SAMs who need to refresh or to level up

º Subject-matter experts who support the SAM team

º High-potential salespeople or account managers for a future strategic account manager role

º Newly appointed SAM leaders who manage, coach, and evaluate the SAMs, but have never been SAMs themselves

º

Executive sponsor

• Do you want training for individuals where they are with other SAMs from other companies/industries, or do you want to bring the training to your company and have it customized? There are benefits to both options.

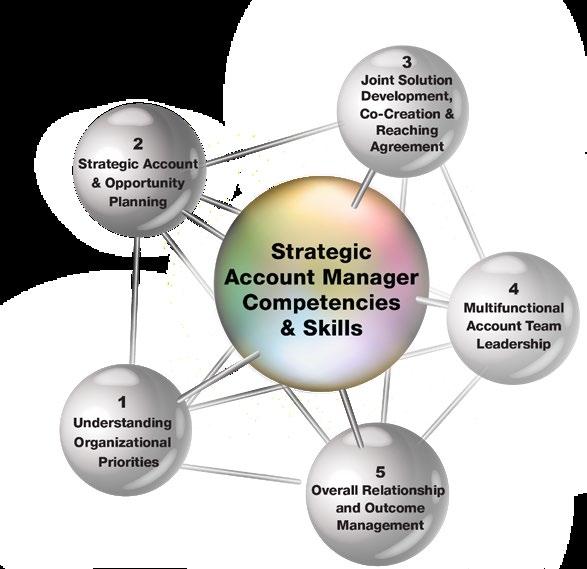

• Do you have SAM-specific competencies established?

• Does your organization know what good strategic account management looks like?

• Have you done a SAM competency assessment to establish a baseline of your SAMs’ strengths and weaknesses from an individual and organization level? If not, you might want to consider doing so.

• How will you measure the success of the training approach for the organization and the individual SAM?

• Will the SAM receive recognition at the end of their training such as a certificate of completion or SAM Certification? Note that “certificate” and “certification” are very different. A certificate is often given when someone has completed a training program. In SAMA’s opinion, SAM Certification means that not only did they complete a training program, but they have been tested for comprehension and application of the concepts taught and validated by their manager.

Once companies have taken a strategic look at what they hope to accomplish, they will look for a training partner. Many people tasked with this job are often unsure of what to look for in choosing a training partner.

Vol. 25 Issue 1 2023 V elocity ® 9

SAMA recommends asking the following questions while vetting training partners:

• What are the qualifications of the training organization?

• Do they offer SAM-specific training and, if so, for how long? Make sure you see evidence of this on their company website and in conversation. Many companies will say they do SAM training, but it isn’t really their specialty. This is particularly important when training on topics like account planning and value co-creation.

• Do they have outside references to validate the success of their approach?

• What are the qualifications of the instructor(s) who will be doing the training? Have they actually done the work of a SAM or SAM leader?

• If a certificate of completion or SAM Certification is desired, does the training organization offer them? Consider whether the training organization is an industry reference or affiliated with one, especially in the case of certification.

Training the people who manage your company’s most strategic customers can be complex and requires an investment in time and resources. Asking the right discovery questions can lead you down the right path to make sure the investment isn’t wasted with ineffective training. Having a well-defined training plan and using a qualified training partner will elevate your SAMs to greatness and ultimately lead to measurable business results.

Interested in knowing more about SAM training? Feel free to contact us. We have knowledgeable staff and a community of experts ready to help. n

Strategic Account Management Association, Tel: +1-312-251-3131, www.strategicaccounts.org

10 V elocity ® Vol. 25 Issue 1 2023

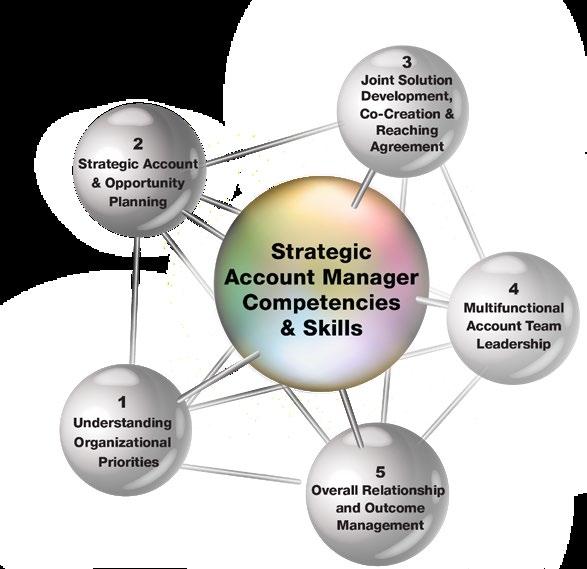

Want more information? Contact assessments@strategicaccounts.org. SAMA’s SAM Competency Model ELEVATE YOUR STRATEGIC MANAGERS FROM GOOD TO GREAT. Use SAMA’s Individual Competency Assessment to: • Understand your SAMs’ current strengths and weaknesses • Discover how your account managers compare to each other and/or to competitors • Find SAMA resources and training tied to specific skills in need of improvement

Facilitate meaningful coaching

QUICK TAKES (continued)

•

GET THE E-BOOK : Shortlink

Leaders Understand the DEI Imperative But Face Challenges

By and large, leaders understand that diversity, equity, and inclusion (DEI) are essential to developing a best-in-class commercial organization. However, without the right programs in place to support leader goals, and without backing across levels of management, DEI efforts may not improve employee experience in a material and sustainable way.

EXECUTIVES FACE SEVERAL KEY CHALLENGES IN DEVELOPING ROBUST DEI PROGRAMS:

Inconsistent Priorities

Although talent acquisition and retention is the primary catalyst for improving DEI programs, making DEI investments is one of the last levers pulled to gain advantage in the race for talent.

Vol. 25 Issue 1 2023 V elocity ® 13 DATA WATCH

Source: Alexander Group and Chief Executive Group Joint Survey, 2022

KANECT™ by The Chapman Group is a Voice of the Customer service offering to foster transparent, collaborative, and mutually beneficial relationships. KANECT IMAGINE if you could gain DEEPER INSI GHT S, especially during times of disruption and CHAN GE, by understanding both the OBSE RVAB LE and N ON-OBSE RVABLE BEHAVIORS of your accounts. TRANSFORM your relationships through DIRECT customer feedback. www.ChapmanHQ.com TM

FIVE QUESTIONS TO IMPROVE A MANUFACTURING SAM’S PERFORMANCE

Applying customer studies, 80/20 analysis, and custom CX strategies.

By Kay Cruse VP of Customer Experience Strategex

Every strategic account manager (SAM) knows key strategic accounts can make or break a company’s business (not to mention the SAM’s own personal income). The SAM plays a pivotal role in the company’s success. SAMs must protect and defend critical revenue with critical customers.

I specialize in customer experience and voice-of-the-customer research for B2B companies. For more than 30 years, I’ve guided strategic account teams to develop programs that lead to loyalty and growth. The key to success? Asking top accounts the right questions.

Here are five questions that every SAM should ask at their next account meeting to strengthen and protect their critical relationships. To illustrate my point, I’ll bring in quotes from my clients’ top customers. Their answers to these five questions demonstrate why this work is so important.

activities versus our annual business reviews?

While critical, business reviews are only one aspect of key account management. Too often, our studies show that account managers don’t take the time to ask their customer what they really want when it comes to meetings.

For example, when we asked our client’s biggest customer this question we heard: “The units run smoothly without any issues, but I don’t hear anything from our key account manager. If they would be more active in their customer care and support, they could become our number one supplier.” This is a direct quote from a vice president of operations at a $16 million account.

Our client immediately (and easily) fixed this engagement issue. By simply understanding what a top account expected beyond annual reviews, this SAM team was awarded $6 million in additional sales in less than six months to become the account’s number one supplier.

Strategic account managers shouldn’t

Vol. 25 Issue 1 2023 V elocity ® 15

QUESTION 1: What cadence would you like us to have for general account

QUESTION 2: We are working on new approaches to solve . Would you review some early concepts to see if we’re on the right track to help your business?

focus on the status quo — as a rule, they must continuously improve their processes to further their company’s growth, as well as their own personal growth and expertise. This is particularly evident when it comes to innovation, and the best SAMs are always on the lookout for ways to contribute to a strategic account’s success.

A recent customer study forced one of our client’s account managers to focus on innovation. The “aha” moment came when she heard a quote from a vice president of engineering at a $25 million account. The VP said, “I have regular conversations with other suppliers about what they’re working on regarding innovation. That doesn’t happen with them.”

What did the SAM do? She listened and adapted to her client’s needs. First, she engaged with her own innovation team to gather early product concepts that might apply to the account. Then, she met with that very same top account to gain preliminary feedback. She was able to identify features that were most important for their next generation of equipment. Plus, her account agreed to sit down with her engineering team to outline a focused test to ultimately help with commercialization.

Their collaborative effort brought incremental improvements to the existing product, as well as an outlined approach for a new product that was fully developed in less than 12 months.

QUESTION 3: When it comes to our partnership, where are we stumbling? What should we be doing to help your company be more successful?

We helped one client perform a microanalysis of the overall health of their biggest customer. We started to track

win/loss ratio at just this account. The client had to face the music: the number of lost opportunities at the key account was worth millions. He knew something needed to be done and lowering the price wasn’t in the cards. In this case, the SAM’s top account decision-makers had emotionally and professionally moved on. It ultimately cost the SAM company its relationship and business with its number one key account. In less than a year, the account pulled $10 million in new business, and the following year, the account awarded its entire business — worth more than $35 million annually — to a competitor.

We performed a post-mortem review to assess the failure. Our client’s key contact at the account (a VP of sales) stated, “I don’t really hear much on a normal basis. I have other suppliers that may give me a call and be more proactive. We only hear from them when there’s a problem or potential problem.”

The SAM took the hit, but importantly, he used it to change how he interacted with every top account he was assigned. Additionally, his new selling efforts were directed to identify, find, and land an account with all the characteristics of the one lost. He not only found another top account after 10 months with the same profile as his lost account, but his newfound dedication to proactively engage with his accounts helped secure his existing sales revenue from the accounts in his original portfolio.

QUESTION 4: Can I come to the plant with our VP of operations to observe how our product integrates in your manufacturing process? We’d like to see if we can simplify how our product works in your production, as well as to see if there are

16 V elocity ® Vol. 25 Issue 1 2023

other aspects we can contribute to enhance your throughput.

One of the hardest lessons SAMs must learn is that they shouldn’t be the only point of contact with a key account. Customer experience is the job of everyone — not just the SAM. Shipping, engineering, service, manufacturing, and just about everyone at the SAM’s company should be committed to delivering an exceptional CX to top accounts. In many cases, taking the time to bring another set of eyes into the key account’s operations can open huge opportunities — often with a simple solution.

One study participant demonstrated this point nicely. We interviewed senior influencers at a client’s top accounts. A vice president of procurement at a $12 million account told us, “It’s so frustrating — my team opened the pallet to find it’s been packed with the smallest items on the bottom while the largest were on top. Not to mention, the pallet documentation was from the previous order! It was totally incorrect.”

The client realized that he needed his whole company to be more committed to overserving this whale of an account. In this case, this SAM addressed the issue with his operations and customer service teams to identify ways to error proof his company’s process for this key account. The SAM recognized that his team’s last step (shipping) was his account’s first step (receiving) — and it was totally misaligned, but very correctable.

In as few as three months, the company’s shipping department had modified and perfected their method of packing and shipping pallets and documentation to be sure it was error proofed. The improved delivery process encouraged the SAM’s account to add additional stock-keeping units (SKUs) to its next order, resulting in a 10% increase in revenue month over month

QUESTION 5: If you could magically change one thing about our relationship, what would it be?

This is a simple question that always sheds light on opportunities for improvement.

According to one SAM, one of the biggest advantages she had in asking this question was its ability to change the conversation. She was able to identify areas that she didn’t

realize her key account cared about. A key stakeholder at a $60 million account told her, “You all have great programs for us as a company at the corporate level, but you’re terrible when it comes to local support.”

By focusing more resources and realigning territory responsibilities, this SAM successfully grew the relationship year over year by 20% annually. The key was rolling out a vendor-managed inventory program at the local level — a very difficult but highly rewarding strategy.

SAM Golden Rule: Helping Your Company Understand How Key Accounts Define Success

These five questions have one thing in common: they are all proactive ways for SAMs to engage at key accounts by changing the tone and conversation. In these cases, the SAM is proactively asking, observing, and exploring ways to make the strategic account more successful.

These questions are all solutiondriven, not sales-driven . Strategic accounts expect more than a quality product delivered on time and in full.

In today’s world, disruption (from supply to pricing) has put pressure on every aspect of a key account’s relationship with its suppliers.

The best companies help their strategic account managers prioritize which accounts matter the most. By their nature, strategic accounts matter, but if a company is trying to provide the same level of service and care to all accounts, the SAM program will fail.

Great SAM programs start first with data. Which customers are most critical? Use revenue data to identify the top accounts who are responsible for 50% (or more) of your company’s revenue. Then, determine which should have oversized resources — and a robust CX program. In many cases, that pool of your top 50% may only be three to five accounts.

How to Identify Which Accounts Really Should Be in a SAM Program

We use Quartile Analysis to identify which customers should matter enough to warrant a truly robust SAM approach. Use past revenues as your data basis. We

Vol. 25 Issue 1 2023 V elocity ® 17

recommend looking at 12-18 months if the sales cycle is more annualized, or 3-5 years if the sales cycle focuses more on capital-expense purchases. Divide all customers’ revenue into equal quartiles of 25% each. Our analyses for companies around the world consistently show that the top 25% of customers will be driving 89% of your revenue with the second 25% responsible for about 7%. That leaves the bottom 50% of customers contributing less than 5% of revenue. That top quartile should be a SAM’s priority.

Once you know your true SAM-level accounts, make sure you have addressed the five foundational questions to ensure basic customer success. Next, you will be ready to assess several additional CX options to profitably grow your top strategic accounts. Collaborate with internal leadership and your top accounts to configure and customize their CX for maximum ROI.

1. Should the account have its own customer service team?

2. Should the account have a dedicated manufacturing cell?

3. Should the top strategic account have a dedicated team of engineers to identify innovation, sustainability, or Internet of Things (IoT) initiatives that can be tested and commercialized with the account’s help?

4. Does this account warrant a manufacturing or fulfillment site that’s more strategically located?

5. Does this account need an operations liaison to monitor continuous improvement on a regularly scheduled basis?

Sometimes, there are strategic accounts that have not hit top-account status but will — perhaps they have all the characteristics of a strategic account and need to be nurtured. For these accounts, the only caution is to be sure they warrant the time and attention of your SAM program. And, most importantly, determine an ejection point: qualify and quantify a trigger point if they don’t live up to expectations.

The biggest responsibility of a SAM (aside from moving to a solutions-oriented approach) is to understand the best opportunities for profitable growth and retention of a key account in a three-tofive-year timeframe. The work starts by asking hard questions at the account and even harder questions among leadership. Can you fulfill the account’s needs, and will leadership provide the resources you need to do so?

Of course, the real question is are you willing to hear the answers? n

Kay Cruse is a seasoned veteran of customer research, strategic planning, and brand development. A proven leader with over 25 years of experience, she champions clients’ success by focusing on business strategy and maximizing their ROI. She specializes in customer insights, prioritizing strategic opportunities and tactical implementation. Kay can be reached at kcruse@Strategex.com or on LinkedIn at https://www.linkedin.com/in/kaycruse/

18 V elocity ® Vol. 25 Issue 1 2023

ACCOUNT-BASED GROWTH: UNLOCKING SUSTAINABLE VALUE THROUGH EXTRAORDINARY CUSTOMER FOCUS

By Bev Burgess Cofounder Inflexion Group and Tim Shercliff Cofounder Inflexion Group

By Bev Burgess Cofounder Inflexion Group and Tim Shercliff Cofounder Inflexion Group

When a business starts, it is based on a simple model. It solves a problem for a customer by providing a solution and is obsessed with delivering value to that customer. It’s likely that everyone on the team is very well attuned to every customer’s needs.

Over time, companies typically grow in two dimensions: find more customers who like what they do, and/or develop new solutions for existing customers. However, even in those early days with only a few dozen customers, a fundamental principle starts to emerge: some customers will be far more important than others. In fact, a pattern soon develops and will probably reveal that around 80% of profitable revenue comes from just 20% of customers.

Once the pattern starts to emerge, it doesn’t seem to change much over time. In fact, it may become even more pronounced.

Bev Burgess and Tim Shercliff recently published a book on account-based growth, bringing together their practical experience, original research, and 20 case studies and viewpoints from leading companies in the technology, professional services, and telecoms industries. Here, they explain the concept, feature insights from Vodafone and Accenture, and introduce a framework for account-based growth.

Fast forward a few years and guess what: the ratio applies equally in large companies! They may boast billions in revenues and have thousands of customers, tens of thousands of employees, and a complex partner-and-supplier ecosystem. But the self-same 80/20 rule applies to these companies too. In fact, it is often even more skewed: sometimes 90% of profitable revenues come from just 10% of the customers.

But that’s not all, because the 80/20 rule is fractal. This means that it’s a pattern that repeats itself, so within the first 80/20, there is another 80/20, leading to some remarkable findings.

We conducted research earlier in 2022, and we found that in B2B companies, on average, just 3.5% of customers accounted for 50% of their revenue (see Figure 1 on page 21).

Some companies, recognizing the value of their largest customers, have taken account management to new levels, investing in much more senior executives managing their most important customer relationships.

Sales, too, is going through its own revolution. Customer executives and increasingly sophisticated procurement functions expect their strategic suppliers to understand their business issues and be proactive in bringing them valuable insights and solutions that tackle these issues and challenges and achieve their business outcomes.

20 V elocity ® Vol. 25 Issue 1 2023

Figure 1. Annual Revenue

My company does not track that information

©Inflexion 2022. All rights reserved.

In parallel, over the last 20 years, the idea that a company should focus on its most important customers, treating them as a market in their own right and allocating marketing resources to build highly personalized marketing plans, has taken hold. Account-based marketing emerged in the 2010s and is now recognized as a key element of B2B marketing.

This is not just about marketing, however. It never was. It’s about how a company becomes customer-centric across multiple processes and teams. It’s about growth and, more specifically, how to grow profitably with this huge imbalance between customers large and small.

In enterprise software and now increasingly in other sectors, companies have built customer success teams to attempt to ensure that customers realize value and achieve their desired outcomes, becoming advocates within and beyond their own organizations.

As organizations establish long-term, company-to-company relationships, they build executive-to-executive relationships, both of which often last decades. The technologies and the ecosystems may change at an ever-increasing pace, but the relationships endure.

There is a lot to be gleaned by looking at how companies have approached the way they achieve sustainable, profitable growth with their most important customers. But, before we look at one such example, let’s examine the

challenge from a customer’s perspective. After all, customers see their strategic suppliers as key to their business, so they want them to perform well.

Below, Ninian Wilson, Group Procurement Director and CEO, Vodafone Procurement Company, shares his thoughts on what makes some strategic suppliers stand out from others.

What should companies expect from their strategic suppliers?

There are six key things:

1. The first is a dedicated account team. The supplier should invest sufficiently to make the strategic relationship work, and customers should reciprocate by ensuring access to the right executives.

2. Next, an unfair share of their research and development budget — if a customer is really strategic — should be translated into competitive advantage through access to innovation and assets.

3. Strategic customers need to be first to receive new products and services, and also be “first among equals” commercially.

4. Strategic suppliers should be highly connected at all different levels across the business, starting with CEO to

Vol. 25 Issue 1 2023 V elocity ® 21

What % of your annual revenue comes from your top account program? (N=55)

CEO, and right through the executive teams and functional leaders in both organizations.

5. Governance is very important, too. Governance reviews should start with current performance, and then move on to future innovation and opportunities.

6. It takes a seasoned, experienced executive to run this kind of strategic relationship. That person represents our voice into the supplier company. They need to be senior enough to be able to make things happen on our behalf.

What are best practices for strategic suppliers today?

In addition to the things we’ve already discussed, I would add executive sponsorship — someone from the supplier’s headquarters, allocated to you, as an account. That sponsor will come to the quarterly reviews and have full transparency as to how things are going in the relationship. If the account executive is not the right caliber, for example, both sides will see that. There’s nowhere to hide. And at Vodafone, we insist that the executive sponsor for our strategic suppliers is either the CEO or one of their direct reports.

The best strategic suppliers are those that stay the course, over the long term, even if the nature of the business changes and the level of the business fluctuates. It’s important to see these as long-term plays, sometimes lasting decades, such as the relationship between Ericsson and Vodafone, who sent and received the first-ever text message in 1992, and are still technology partners, some 30 years later.

And, typically, what are some of the main faults?

A lack of connection internally across the supplier’s account team is one that comes to mind. A lack of professionalism can be an issue, for example, not sending meeting materials in advance of the meeting so that the customer has time to prepare.

Leaving issues unresolved is a real problem that can really damage the relationships. The supplier’s account executive must be able to escalate problems and get them sorted quickly: cut a deal, sort it out, and move on.

A lack of commerciality, and empathy as to what our objectives are, is another issue. For example, as a customer, we’ll have objectives to reduce costs over time, so we want our strategic suppliers to acknowledge this and bring us ideas on how this can be achieved rather than try to hold on to the current revenue from the contract.

And, finally, I would say that trying to cut procurement out of discussions is the wrong way to go. Strategic suppliers need to understand the role and positioning of procurement leaders in the wider business.

How important are shared values and a focus on broader social issues when selecting strategic suppliers today?

These are becoming more important for two reasons. The first is that there is a huge interest from customers in how we’re running our business today. The second is that access to capital is being regulated by a company’s position on environment, sustainability, and governance (ESG) issues.

22 V elocity ® Vol. 25 Issue 1 2023

The best strategic suppliers are those that stay the course, over the long term, even if the nature of the business changes and the level of the business fluctuates.

This ESG focus is not going away. Customers are so much more aware of business practices, and it takes around 16 minutes for bad news to go viral, so there’s no time to respond after the event. You can’t change your agenda in 16 minutes.

For us at Vodafone, we have three main areas of focus: helping to digitize society, driving diversity and inclusion, and supporting the planet. I am the executive sponsor for the inclusion agenda, as we want to drive it through our whole supply chain.

And when supplier selection is based on weighted scores in a tender, with most decisions swung by just 3-4%, weightings around ESG can make the difference. For example, we might weight health and safety criteria at around 10%; diversity, equality, and inclusion at 5%; and care for the planet at another 5% across the whole tender. For suppliers who don’t take one of these seriously, it can mean losing the opportunity, even if they have a good track record — they need to put in the effort.

How can companies encourage smaller suppliers, who may have innovative solutions but no prior track record or relationships?

This is the holy grail of procurement — getting access to innovative ideas and capabilities for the future, particularly from up-and-coming companies. It’s a key part of the procurement leader’s role.

We set up an incubator five years ago as a joint venture with the Luxembourg government, to help scale-up companies connect better across the business at Vodafone. We’ve set up a website (tomorrowstreet.co) as a resource to help them.

We also run an annual two-day event called Arch Summit, as a “Dragons’ Den” style event.1 We have some of the actual dragons from the show come along, together with Vodafone executives, and there’s the chance to win a substantial investment or contract with Vodafone for the winners.

It can be difficult for these smaller suppliers to do business with large customers, so you must recognize this and try and make it easier. For example, we’ve moved to a two-page contract and 30-day payment terms for small suppliers.

Finally, what last piece of advice would you give suppliers trying to build long-term sustainable value with their customers?

Keep an eye on how the wider business environment is changing. For example, the whole area of supply chain risk is becoming more of a focus. We may even see companies verticalizing some of their supply chains, in a move back to the business models of 70 to 80 years ago, as we face increasing global uncertainty. How will that impact our relationships and ecosystems going forward?

Be humble. Even from a global, strategic supplier, I don’t want to see arrogance. If you’ve made a mistake, hold your hands up and learn from it; don’t pretend it didn’t happen. Do your homework and find out what the key drivers are for the relationship as it evolves. ***

It’s clear from Ninian’s perspectives about what he’s looking for in a strategic supplier and how he differentiates between those that work well with Vodafone and those that have room for improvement.

One of the best examples of a company that has excelled in the way it works with its most important companies, sustained over many years, is Accenture and its Diamond Client Program.

About Accenture

Accenture is a global professional services company with revenues in 2022 of over $60 billion and more than 700,000 employees. These employees and an ecosystem of 185 partners deliver on the promise of technology and human ingenuity every day, serving more than 7,000 clients in over 120 countries. Its focus is on embracing the power of change to create value and shared success for its clients, people, shareholders, partners, and wider communities.

Enduring client relationships

Accenture’s clients include more than three-quarters of the Fortune Global 500. Ninety-eight of its top 100 clients have been clients for over 10 years. In April 2022, it reported that 70% of its new bookings were sole-sourced; and in the two years since the pandemic was declared, it achieved a 50% increase over the prior two years in the number of clients with quarterly bookings over $100 million.

Accenture’s largest client relationships, which it refers to

Vol. 25 Issue 1 2023 V elocity ® 23

as “Diamond Clients,” comprise more than 50% of its total revenues. These numbers reflect the scale of Accenture’s work with its top clients and their level of trust, which sets the company apart. Accenture clients have increasingly taken on bold transformation programs, often spanning multiple parts of the enterprise and in accelerated timeframes — an approach the company refers to as “compressed transformation.”

Voice of the customer at the top of the company

Recognizing the importance of its Diamond Client relationships, Accenture has appointed a senior managing director, Arjun Bedi, to lead this strategic portfolio of clients as a member of the company’s Global Management Committee (GMC). In his role, Arjun leads an executive leadership team consisting of client account leaders representing the company’s three geographic regions — North America, Europe, and Growth Markets — who together bring the voice of the customer to the very top of the company.

Arjun commented: “Trust is at the heart of developing deep strategic relationships. We solve for our client’s interest first, and also ensure it aligns with value for Accenture. This requires understanding the industry context and the strategic objectives of the customer in order to provide a view of value across multiple dimensions to ensure a ‘360-degree

view of value.’ It means going beyond financial measures to include all dimensions of value that matter to the client.”

Creating value in all directions

To look beyond financial metrics and deliver broader longterm value for clients, Accenture has set a goal of achieving “360˚ Value,” which it defines as delivering the financial business case and unique value a client may be seeking, along with striving to partner with clients for greater progress on inclusion and diversity, reskilling and upskilling their people, achieving their sustainability goals, and creating meaningful experiences for their customers and employees.

As Accenture’s website explains, “360° Value makes a positive impact for all stakeholders — clients, partners, shareholders, people, and communities. From the financial business case clients are looking to achieve, to the unique impact they may be looking to create, we are focused on delivering 360° Value and helping our clients become the next and best versions of themselves.”

It continues, “We are now using our new 360° Value Meter with 330 Accenture clients worldwide, and we are activating the capability to monitor and measure the value we are creating together for them across Client, Talent, Inclusion & Diversity, Experience, Sustainability and Financial dimensions.”

24 V elocity ® Vol. 25 Issue 1 2023

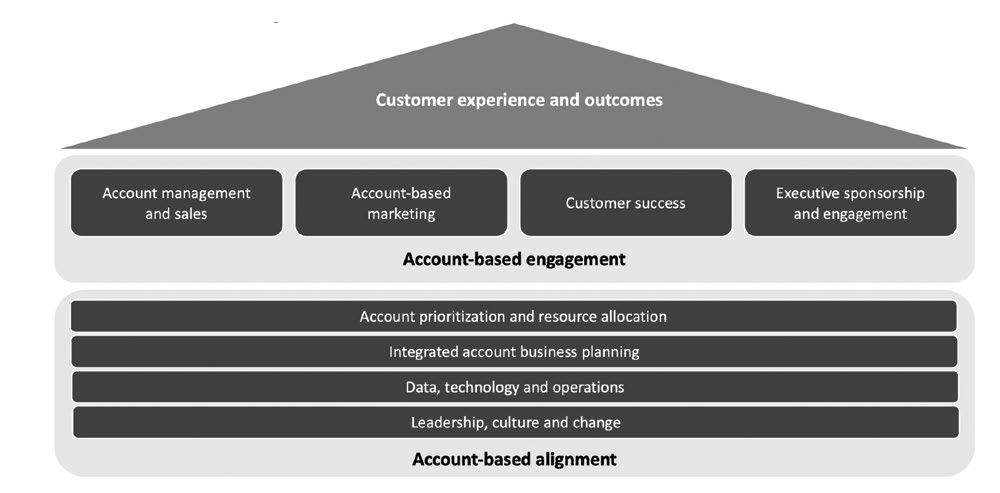

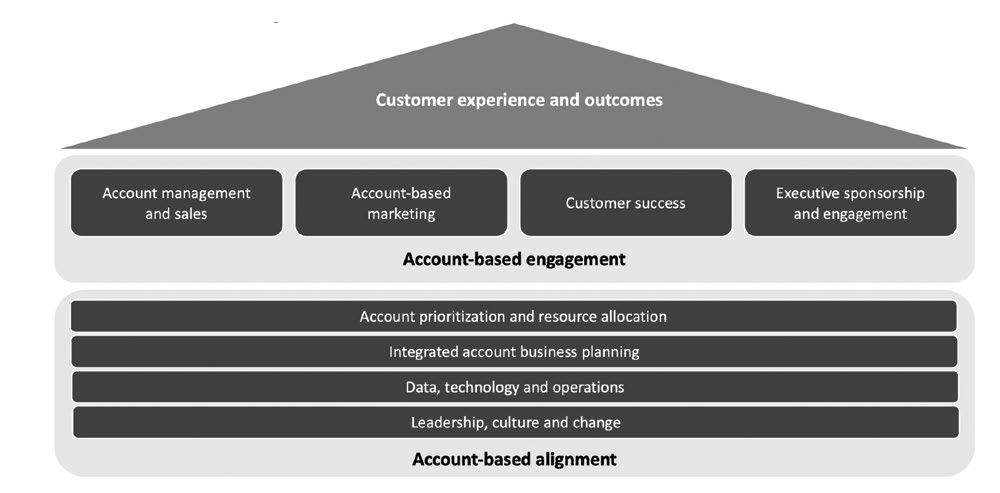

Figure 2. A framework for account-based growth ©Inflexion 2022. All rights reserved. Customer experience and outcomes Account management and sales Account prioritization and resource allocation Integrated account business planning Data, technology and operations Leadership, culture and change Account-based alignment Account-based engagement Account-based marketing Customer success Executive sponsorship and engagement

It is our belief that companies should take a more aligned view of how they manage, sell to, market to, deliver services to, and leverage their executive relationships for their customers, particularly the 3% or so that are driving half of their profitable revenue.

They need a holistic view as to how to allocate resources and organize themselves more effectively to deliver profitable, sustainable growth and outstanding value for the most important customers. Done effectively, the impact on longterm profitable growth is significant.

We have created the account-based growth framework to bring all these elements together (see Figure 2).

The account-based growth framework is examined further in our book “Account-Based Growth: Unlocking Sustainable Growth Through Extraordinary Customer Focus,” published by Kogan Page in November 2022. There is a chapter dedicated to each element, featuring case studies and viewpoints from leading companies. In the final chapter, there is an assessment tool, which you can use to assess how your own company stacks up and where you need to improve.

The book is divided into four parts:

• Part One makes the case for account-based growth as a key element of the company’s growth strategy. This section examines account-based growth in practice today, first from a customer’s perspective, then drawing on the experience of Accenture and Infosys. It introduces the accountbased growth framework, combining the elements that need to be better aligned internally and the elements that should be aligned for external engagement.

• Part Two discusses four essential elements that need to be aligned at a company level to implement an effective account-based growth strategy, looking at account prioritization and resource allocation; integrated account business plans; data, technology and operations; and leadership, culture and change. Further insights come from Atos, Cirrus (now owned by Accenture), Fujitsu, Inverta, Kyndryl, Microsoft, SAP, and Telstra.

• Part Three examines each of the key customer-facing teams: account management and sales and account-based marketing and customer success. In addition, we look at how a company’s executives can sponsor and engage top customers more effectively, with further perspectives from Cranfield University, Deloitte, Micro Focus, Virgin Media O2, Red Hat, Salesforce, and ServiceNow.

• Part Four contains a checklist to enable companies to

assess their own position against the key elements of account-based growth, clarifying the areas for improvement as they pursue an account-based growth strategy.

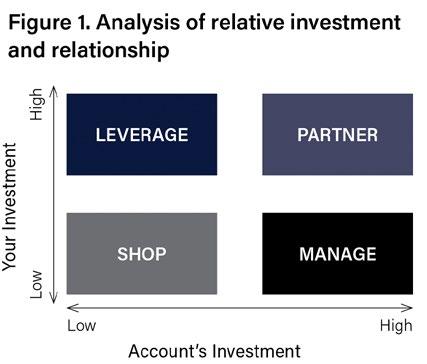

Adopting an account-based growth strategy is a decision which deserves company-wide engagement. Most companies, over the last several decades, have used segmentation to make choices about where to compete and how to win. However, this segmentation has most often been focused on products, services, industry sectors, and geographies — not specifically in relation to customers. An account-based growth strategy demands a similar approach to segmentation, choosing which accounts will drive sustainable, profitable revenue growth and defining what is the appropriate level of investment and approach for each type of account, and then following through with company-wide execution.

Good business strategy is always about making choices, and the opportunity to build strategy around accounts alongside choices around services, products, industries, and countries is no exception. Good business strategy is also based on data and evidence of what works, appropriately integrated across the company. We are beginning to see a revolution in the way that companies think about their growth, focusing more on the accounts that will make the difference and placing their bets accordingly, often cutting costs overall, while investing more in the most important accounts they have today and those they aspire to acquire.

With the perfect storm of geopolitical uncertainty, economic pressure, and the climate challenges facing all of us, now is the time to focus on those customers that matter most — to work with them to build sustainable long-term value for your companies, your communities, and the planet. n 1 “Dragons’ Den,” a reality television show where entrepreneurs pitch business ideas to venture capitalists, is the precursor to the U.S. version, “Shark Tank.”

Bev Burgess and Tim Shercliff are long-time collaborators and co-founders of Inflexion Group, a company focused on accountbased growth. Bev can be contacted at bev@inflexiongroup.com and Tim can be reached at tim@inflexiongroup.com. Learn more by visiting www.inflexiongroup.com.

Vol. 25 Issue 1 2023 V elocity ® 25

AREYOU’RE LOOKING FOR NEGOTIATION IMPROVEMENT FOR YOUR ACCOUNT MANAGERS?

THREE REASONS WHY WE MIGHT BE A GOOD FIT FOR YOU.

#1 ENOUGH WITH FLUFF

We don’t use slightly customized generic methodology to teach your team general negotiation skills. Our work is 100% custom to you and focused on how to:

• Negotiate your actual commercial terms

• For your actual products and services

• Against your actual competitors

• Given actual verbatim tactics from your customers

#2 WE CALL B.S.

Negotiation has long been thought of as unpredictable and hard to measure. Sadly, it’s how most legacy training companies define it and treat it. The result? Long lists of tactics and countermeasures that prepare your team for, well, “random.”

Our approach is different. Our research (yes, we have proof) shows that buyer tactics are 97% predictable and fall into two categories

We’ll train your team to systematically plan their negotiation by answering just 3 questions.

Easy. Account managers can do it, managers can coach it.

#3 HOLD US ACCOUNTABLE

Case in point:

• Documented case studies that show 466% average ROI for our clients .

• Clients include Google, Microsoft, FedEx, across 47 countries over 17 years. It’s all we do. And we’re pretty good at it.

If you like our approach, let’s jump on a call or drop me a note to discuss.

Thanks for reading, Brian CALL ME AT: 3122.925.9326 | EMAIL ME AT: BJD@THINK5600.COM

MESSAGE FROM THE CEO

Brian Dietmeyer

Founder & CEO of Think! Inc.

HOW TO DRIVE RESULTS AND MAKE AN IMPACT: A TOOLKIT FOR STRATEGIC ACCOUNT MANAGERS

By Tom Kurt Strategic Account Manager, CSAM Sonoco and Aaron Erbe Director Film Segment, CSAM Sonoco

Sonoco, the global leader in paper tube and core manufacturing and sales, relies on a proven strategic account manager toolkit to protect our most important strategic accounts, grow the business, and manage profitability. Here, we’re speaking to the strategic account manager trying to make a difference and seeking a place to start, to ignite the spark of momentum toward helping their company succeed by using a process and tools they can trust to make an impact. In this article, strategic account managers will learn concepts they can utilize with challenging strategic accounts right now.

Our basis for the strategic account manager toolkit blends all we’ve learned at SAMA over the many years as a corporate member. We’ve applied SAMA learnings to our business with some creativity of our own. Sonoco has been a consistent annual conference attendee. Each year, Sonoco sends strategic account managers to SAMA University. We’re proud of our certified strategic account managers and have several candidates pursuing their own certificates. Also, Sonoco has joined in support of our SAMA partners in the role of presenter at annual conferences.

We know the strategic account toolkit provides utility and can be deployed in varied markets, as Sonoco sells into more than a single customer set. Here, we’ll look at the strategic account situation and apply a battletested strategic account management tool.

Are you a strategic account manager or

strategic account management leader working to both meet and exceed internal and external expectations? More than likely, you’re looking to improve results amid all the complexity today’s business environment has to offer. The strategic account manager, who’s constantly on the move, traveling through airports, camped in the hotel lobby, or organizing the next video conference call, is searching for a solution. Well, at Sonoco, we’ve walked the same airport terminals as you, and we promise our experience will help you gain insight and give you a dependable framework to deploy.

The strategic account manager toolkit has been assembled to assist all levels of the strategic account manager skillset and provides an immediate opportunity to make an impact. Let’s start by looking at the strategy Sonoco believes is most important.

Broader and Deeper Strategic Approach — Best Practice Benchmarking Tool

Sonoco leadership requires strategic account managers to sell broader and deeper within their strategic accounts. We want to professionally work at higher levels inside the account and outside of procurement — without risking established procurement relationships. We feel that, by developing more points of contact, Sonoco creates true value for the customer. The strategic account manager does not want to get stuck only talking the language of price in a tactical discussion. An

Vol. 25 Issue 1 2023 V elocity ® 27

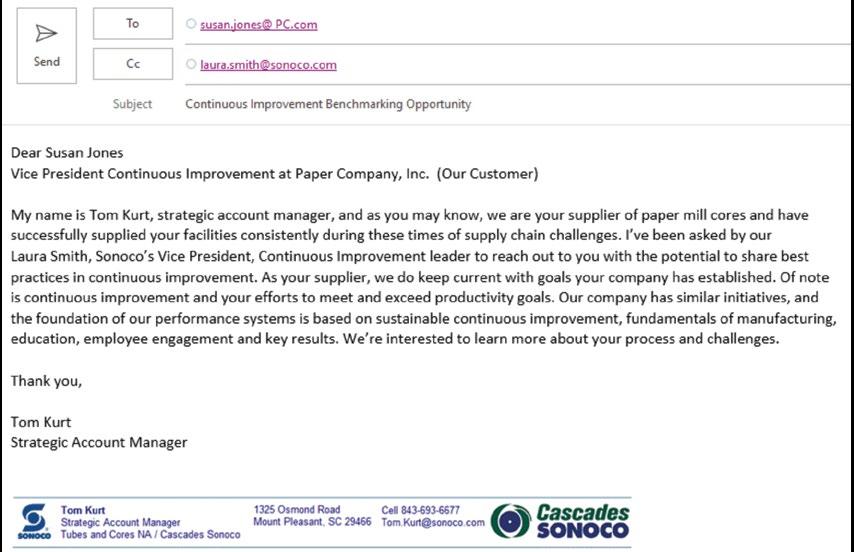

available strategic account manager tool that we term “best practice benchmarking,” takes the approach of introducing our subject-matter experts to customer experts so they can learn from each other.

The idea is to exchange business learnings at a higher level with vice presidents or directors responsible for continuous improvement, sustainability, quality, manufacturing, health and safety, or logistics. Before the meeting, the strategic account manager writes the agenda and afterward captures all discussion points and follow-up actions. Later, during contract negotiation, the strategic account manager can list value created during the best practice sharing sessions.

We know through experience that procurement is not acting alone in selecting suppliers. Working internally, procurement will most likely interview key stakeholders and ask questions about Sonoco’s performance. The more positive votes of support the Sonoco strategic account manager can develop will immediately create value and dilute the significance of the price discussion.

Now, to get started, when thinking about the best practice benchmarking as your tool, the strategic account manager utilizes the power of their own company. Sonoco’s strategic account managers have access to their own key leaders, who are willing to join discussions and even make initial contact

with their customer peer.

An example benchmark topic could be continuous improvement. Sonoco, founded in 1899, is a manufacturing company serving industrial and consumer markets. We’re constantly making certain our operations run efficiently and safely. We sell paper tubes and cores to large industrial clients making paper, film, metal, and textiles. Our customers are challenged to meet productivity goals just like us. In our experience, we find little resistance to a discussion about how to improve manufacturing reliability, reduce waste, and/or increase productivity. Now it’s time for the strategic account manager to make connections with leaders on both sides.

As the strategic account manager, work to link your leader of continuous improvement to the customer’s leader in the same area of responsibility. Wait, you might be thinking procurement will become upset for working around them, and this is intimidating! All you need is a little research and a meeting invite. The Sonoco strategic account manager has reviewed the strategic account’s 10K and published objectives. There, the strategic account manager identifies key customer objectives and begins to solve for how to connect the dots.

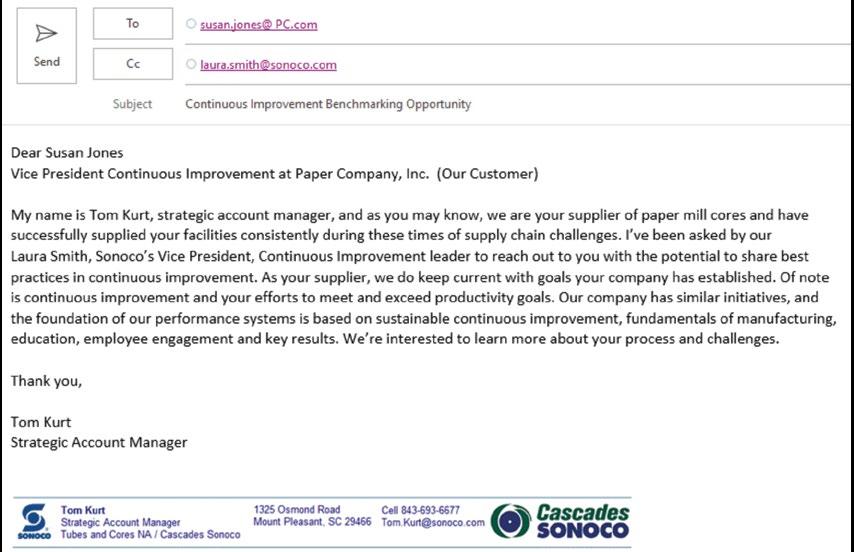

The strategic account manager can directly send an email to the customer leader of continuous improvement:

28 V elocity ® Vol. 25 Issue 1 2023

Broader and deeper strategy places the strategic account manager into a leading position between their own company and the customer organization. By appealing to the higher cause of continuous improvement, the shared example offers added benefit to corporate procurement. The customer procurement organization has their own supplier goals. One could be the identification of suppliers with capabilities beyond basic product delivery. In our experience, we find procurement professionals typically provide support in benchmarking events. A productive best practice sharing session provides procurement an example of positive work and engagement coming from their top-level suppliers. However, a note of emphasis is needed. Don’t stop at one high-level benchmarking meeting. Work to engage the strategic account for consecutive meetings. Publishing clear goal-oriented meeting agendas and action follow-up notes. Always set the next meeting time and date before the call ends. Enjoy the result and satisfaction from finding new ways make a strategic impact.

Be the Value Score Keeper — The Prioritized Value and Quantification List Tool

As strategic account manager, you need to be the value scorekeeper. The seat you possess, to observe and manage the value game, is perfect. You see both sides of the buy-sell game. We all know the strategic account expects perfection and will keep asking for added services and high-level

product. We recommend the prioritized value and quantification list as a method to keep track. Add up and list all the good your company does for the strategic account. Consider value at a higher level.

If you can, focus on differential value. We define differential value as the added value our company creates for strategic accounts made possible because of proven expertise. We’re not being overconfident or brash. We simply know how to develop a strategic account solution through our experience. We’ve made the investment in people, technology, and equipment. Your company likely does the same. Just don’t lose the opportunity to track the positive impact your company makes on the strategic account. Differential value may not end up as a line-item charge at the bottom of the invoice — it should end up in the prioritized value and quantification list and be talked about during your strategic account business reviews. What does the list look like and how do you make one?

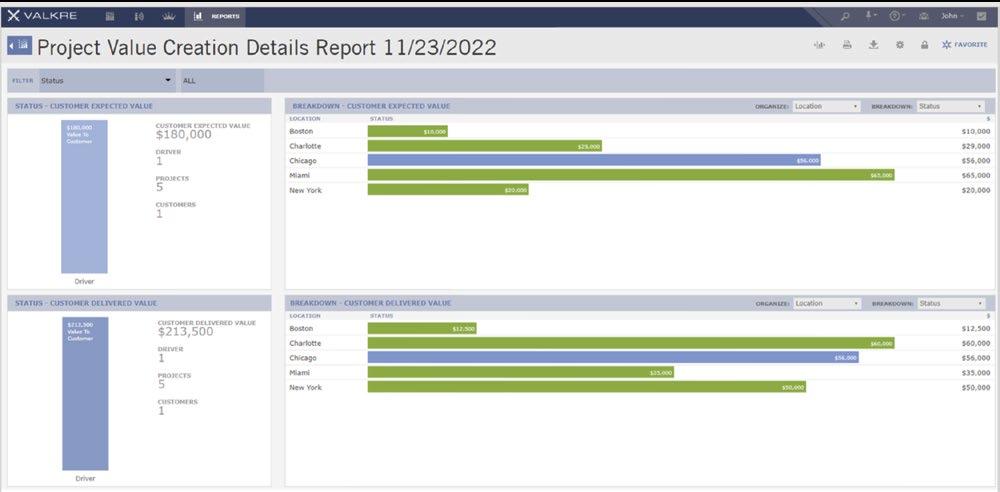

Here’s where you get ideas. SAMA’s many training sessions have emphasized the importance of researching goals of the strategic account. Following our SAMA training, we used our new skills to research web sites, read 10Ks, and interview the strategic account leaders and colleagues to better align Sonoco resources to meet their goals. Here is where value creation starts. During our own journey we wanted to try to institutionalize our value collection. We’re not perfect but getting better.

Vol. 25 Issue 1 2023 V elocity ® 29

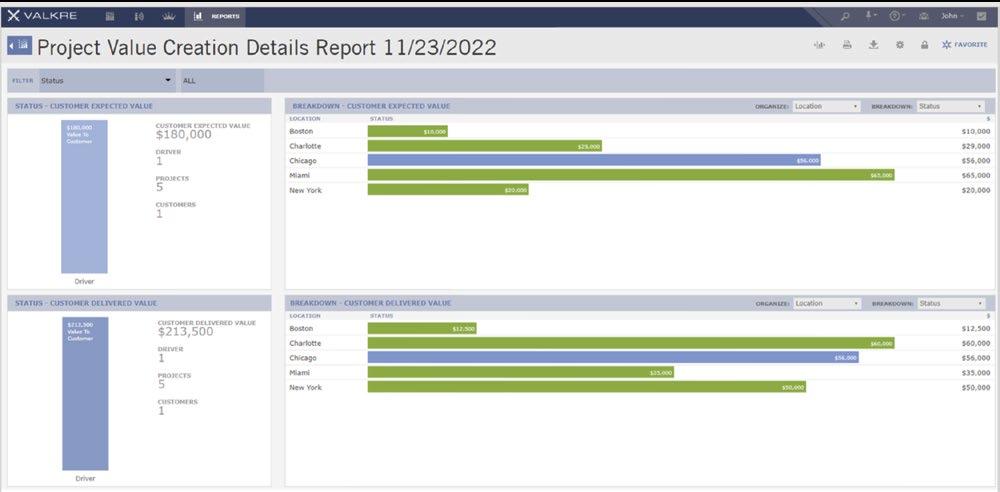

SAMA introduced Sonoco to Valkre during our years as a corporate member. The Valkre tools and process allow us to develop and present quantified value creation to strategic accounts. While Valkre is useful and important to Sonoco, as we work to standardize and benchmark quantified value creation across our network, you — as the individual strategic account manager working to make an immediate impact — can start by making a list of important services, projects, and offerings for the strategic account. The key is to start documenting value facts right now in any available format.

Study your prioritized value project list. Set up an appointment with the procurement manager you sell to. Reaffirm you’re working in the right areas. Also, take the opportunity to engage in discussions about the actual value for each project. You will build alignment and make it difficult for your customer to discount if they are involved in the co-creation. Adding up total value in dollars can create a challenge, yet don’t allow the challenge to stop you. Trying to assign a harddollar value creates considerable discussion and can create an opportunity to really understand how your procurement contact sees value. Once you communicate a dollar value or benefit, enjoy the dialogue! While the procurement leader may debate the ultimate value, you as strategic account manager are now talking value and co-creation, not price. You’re making an impact.

Co-creation can happen at the procurement level or at various functional levels. No matter where in the organization a project is identified, you begin a dialogue and start to reach agreement on the value of the projects you are working on. The strategic account manager works as a quarterback for the account team, establishing business objectives, connecting dots between the organizations, and communicating at all levels to ensure alignment and progress throughout the relationship.

Where customers have multiple locations/lines manufacturing complementary or like items, this exercise opens the door to leverage efforts and savings as well as to standardize across your customer and your own manufacturing network. The effort becomes a springboard for continuous improvement across the partnership. The strategic account manager acts as a resource for the procurement team to tie supplier capabilities to their own organizational priorities, bridge competing objectives, and increase their own value within their company. A funny thing happens when you are talking value and not stuck on price: your customer takes your calls and reaches out to you as a confidant and a problem solver.

Now the good news. There’s another tool to help the strategic account manager keep score, and this comes through leveraging the power of your entire team. The tool is the large-deal team.

The Large-Deal Team — Value Waterfall Tool

At Sonoco, preparing for large-deal renewal negotiation starts early. Here, we leverage the collective experience of key Sonoco colleagues to define value and develop negotiation strategy. Leaders from manufacturing, sales, finance, technology, and quality converge 120 days out from the negotiation, 90 days out, 60 days out, and finally 30 days out. Agenda-led meetings are used to level set our position and quantify value.

Work includes developing the value library, listing all the good we do, added services we offer, and advantages our products provide the customer. But it’s also an opportunity to identify where we may have fallen short as well. As a team, we work to protect Sonoco’s position at the most important customers. We like the phrase “protect the fort accounts.” We want the strategic account to see the most value and all the resources Sonoco can offer, and the job of the large-deal team is to document Sonoco’s performance. In the end, the Sonoco strategic account manager has several information sources available to ultimately build a negotiation strategy to include several procurement options called multiple solution offers. SAMA introduced Sonoco to Think! Inc., a consulting firm whose training we use to develop negotiation blueprints and multiple solution offers.

To get started, as the strategic account manager, you can assemble your own internal team of account leaders. Make a list of everything your company does to meet and exceed customer expectations. Add up your annual revenue. From your list of added value, take your best effort to quantify customer benefit in dollars. We use the economic waterfall to visually display for the customer the benefit beyond price.

Working to clearly show the value your company creates for the strategic account is an essential element of what will eventually take place in the negotiation. Each value bucket shaded in green creates dialogue with the strategic account. Visually, the green bars represent the value Sonoco creates. As you present the waterfall, enjoy the strategic account dialogue, have fun with valuation, and demonstrate how indispensable your company is to the strategic account.

One of the key takeaways from our work in large-deal

30 V elocity ® Vol. 25 Issue 1 2023

Economic Value Waterfall — Sonoco Value

efforts is that the kickoff of the team is not the beginning of the value creation and quantification work. The negotiation cannot be the first time your customer is seeing the value you are bringing to them. If so, the value becomes one-sided and easy to discount. When the customer is involved in the quantification effort and has a steady diet of reviewing and prioritizing a project value list, it becomes much more difficult to discount the value you are bringing during the negotiation. Even more important, procurement will buy into these efforts, and this should help to move the customer off a price-only evaluation of your proposal.

Value creation must be a fundamental element in how you work throughout your normal business with strategic customers. Connecting business leaders at broader and deeper touchpoints must happen long before your next contract negotiation. By incorporating value creation into your periodic business review process, consistently identifying resources to drive business improvements, and elevating dialogue to touch on all critical business needs, the strategic account manager will already have increased the value of the relationship and the value waterfall becomes a tool to visually demonstrate what has already been accepted. The large-deal effort becomes a way to ensure organizational alignment and to identify critical gaps and touchpoints leading into the negotiations.

Price Optimization — Bubble Chart Tool

Sonoco has devoted extensive focus toward price strategy. We utilize a database that improves our pricing consistency within a market, increases visibility and decision-making efficiency, creates price guardrails, and allows for bubble charting comparisons. Obviously, the price optimization

software represents financial investment. Still, a strategic account manager can work on a more basic level with their pricing team to analyze price per unit and challenge the price data. Knowing where you make profit and where you don’t creates an opportunity to improve pricing, enhance profitability, and build better negotiation offers. This area of work is a large part of what the strategic account manager at Sonoco is asked to deliver.

As described earlier in the section on the large-deal team, understanding what your company does for the strategic account is important as the strategic account manager compares price levels of similar strategic accounts. The strategic account manager wants to be in the position to answer the question, “Are we getting paid for the products and services we provide?”

Look at the size of the account and the price level in play. The strategic account manager can easily spend time with the pricing analyst and create a baseline bubble chart looking at price and volume.

The bubble chart shows three types of accounts:

A – Large green, strategic account: Full co-creation of value. Make certain that the SAM collects, quantifies, and documents value and offers the best price for the customer.

B – Medium blue, developing account: Areas to develop value. The SAM offers increasing value and resources while assuring the price is appropriate for what you offer and deliver.

C – Smaller gold, emerging account: Many areas to develop value. This size account will ask for all the SAM resources. Make 100% certain that the price level is higher. Note the smaller gold bubbles below the market line that call for a

Vol. 25 Issue 1 2023 V elocity ® 31

Price(Y axis)

Strategic Account Value

Volume - (X axis)

SAM’s attention to make upward adjustment by finding more value in justifying a higher price.

Pretty quickly, the true picture will come into focus. On the x-axis, the larger the bubble, the larger the account. A smaller bubble means a smaller account. The y-axis reflects price level. From there, the strategic account manager needs to assess if price, volume, and value are in proper alignment. If not, your path is clear. Ask yourself, “Are we being compensated for value delivered?” The bubble chart tells the truth. If you’re not satisfied with your bubble chart tool results, begin working to better define value delivered to the strategic account. Write it down and describe the value. Start with your words and then add data. As you prepare for negotiation, consider creating a multiple solution offer where you can build price levels based on added value.

Price-optimization efforts serve multiple purposes for the strategic account manager and create confidence when faced with pricing pressure. The result should be improved trust and confidence for the strategic account manager, the strategic team, leadership, and the customer as they sell your proposal within their organization.

Guardrail development incorporates segmenting customers by size and type of offering and evaluating pricing by item compared to peer offers. This becomes powerful data that the strategic account manager — and strategic account team — can use when balancing priorities and making decisions on how to approach a negotiation.

Understanding the true picture of market pricing gives the strategic account manger the ability to turn the conversation from a price comparison exercise to a negotiation where price becomes a piece of the overall value being offered. Based on

the entire picture of the offer, the strategic team can break out individual elements to create negotiation trades. Using identified trades, the strategic account manager can build multiple solutions that are acceptable to your organization and allow the customer to select the features that are most important to them. This, in essence, makes the customer tell what their priorities are and what they are willing to trade for price.

The biggest takeaway from price optimization and the bubble chart tool is the ability to understand strategic account needs, quantify the value delivered, and align our offer and pricing to meet the requirements of both the customer and Sonoco. It was not uncommon to buckle to procurement pressure and drop price to secure business. The confidence created using price optimization tools combined with a strong, quantified value funnel and the focused effort from our large-deal teams have allowed the strategic account manager team at Sonoco to make better decisions and to show creativity in our offers as we keep and even grow pricing in a mature market.

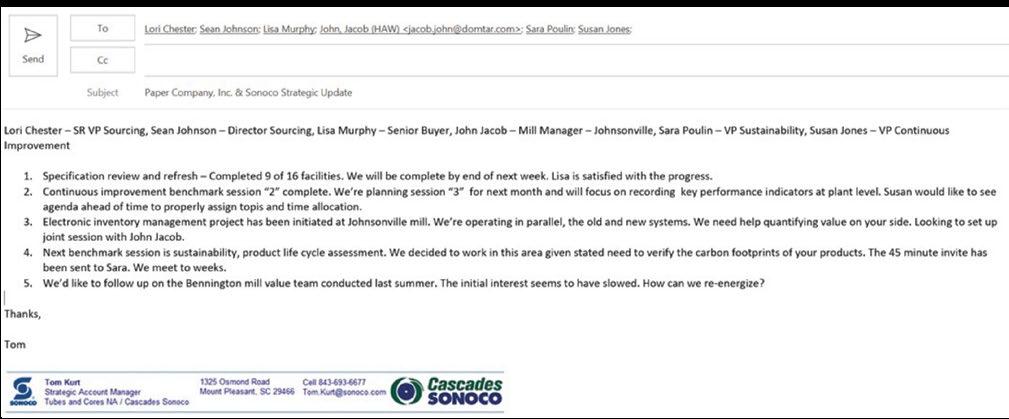

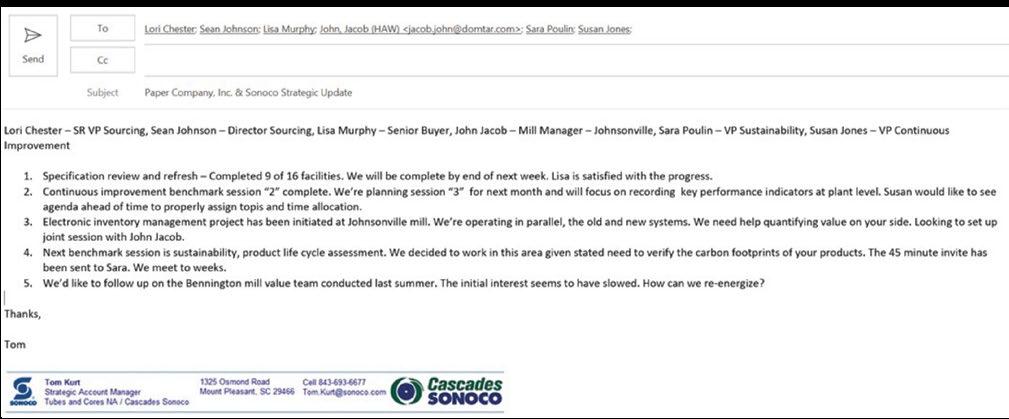

Executive Update Tool

As the strategic account manager, you need to relentlessly pursue and communicate with strategic account customer leaders. Make your work come alive. Here’s an example of a Sonoco strategic account manager tool, the executive update. As strategic account manager, become skilled at keeping the momentum accelerating. Be brief. The best time to communicate is when projects are stuck or there has been an upset.

You might be thinking, “So what? That’s too simple. A short list really matters?” Fair enough. As strategic account manager, your ability to imagine and influence the strategic account’s internal conversation about your company is a factor to consider with each move you make. Now, ponder what the strategic account might be thinking as they read the well-worded and concise executive update:

1. Specification review and refresh — Lisa Murphy, Senior Buyer: “Happy to see the first nine mill specifications complete and more specifications coming by end of week. I can now give operations a projected Sonoco completion date. Happy to know before Monday’s meeting.”

32 V elocity ® Vol. 25 Issue 1 2023

2. Continuous improvement benchmark sessions — Susan Jones, VP of Continuous Improvement: “Sonoco’s move to standardize factory data collection and automation is just what we need to consider. I’d like to know more.”

3. Electronic inventory management — Sean Johnson, Director of Sourcing: “I’ve got to help Sonoco quantify the saving. This will show upper management how well I’m working with a top supplier.”

4. Next benchmarking session on sustainability — Sara Poulin, VP of Sustainability: “Susan said the continuous improvement sessions with Sonoco are worth the time and effort. Our team seems stuck on where to start. I’ll give it a try, accept the Sonoco invite, and have someone from my team join me.”

5. Bennington mill value team follow-up — Lori Chester, SR VP of Sourcing: “Look at the supplier engagement here. This is exactly what I asked for at the annual supplier summit. My team is missing the Bennington opportunity — I’m calling Sean and Lisa to see what the hurdle is.”

As strategic account manager, you will know you are making progress by using the strategic account manager toolkit when a sense of ease appears with the strategic account. Appointments are accepted more quickly. You’re asked for more information. Or a call will arrive asking if your company has ever tried a particular approach, process, or supplier. At this point,

you’re ready to fill in the words of the script — the story being told about your company inside the strategic account’s conference room. You’ve supplied the strategic account with the tools to assess your company on the scale of excellence. n

Tom Kurt is a Strategic Account Manager, CSAM, at Sonoco. He can be reached via email at tom.kurt@sonoco.com, or connect with him on LinkedIn at https://www.linkedin.com/in/tom-kurt-883081a/ Aaron Erbe is Director of Film Segment, CSAM, at Sonoco. He can be reached via email at aaron.erbe@sonoco.com, or connect with him on LinkedIn at https://www.linkedin.com/in/aaron-erbe04a51049/.

Vol. 25 Issue 1 2023 V elocity ® 33

WHAT TO DO WHEN AN ACCOUNT IS NO LONGER STRATEGIC

By SAMA staff

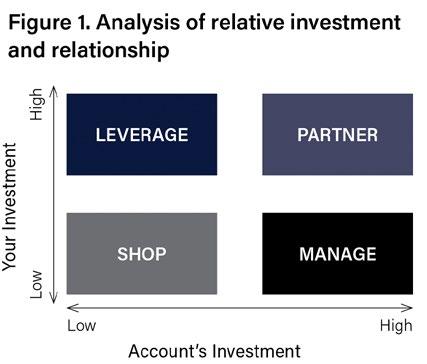

Due to multiple price increases — stemming from global supply chain issues and inflation — today’s business climate is rife with discord between customers and suppliers. Very often this tension can lend itself to difficult conversations where a SAM must reexamine the relationship with their strategic account, and if all else fails, make the tough decision to part ways with a customer.