Navigating The Journey Ahead

Your sales team may be exceptional at selling legacy products, but are they adept at co-creating mutual value with your most important customers? Today’s industry leaders recognize that it takes agility to transition from a transactional, productfocused organization to a strategic, customer-focused organization, and this includes a mindset-shift and focus that goes beyond the traditional sales process.

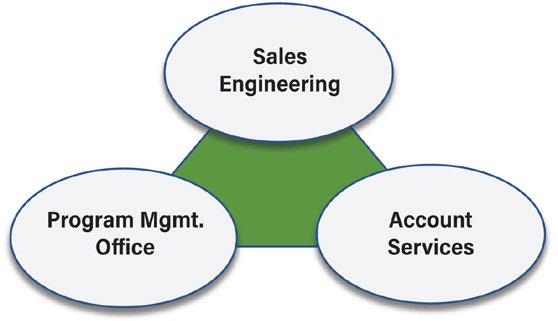

To get there, you’ll need a contemporary approach to sales and account management that is customized to your business and a collaborative methodology that thoroughly assesses your customers’ needs and focuses your cross-functional account teams on the entire customer experience, not just the sale.

At PMI, our experienced consultants will help you better align your sales team to engage more strategically with your customers. Our proven approach to selling value equips salespeople and account managers to co-discover what matters most to their customers, articulate and co-create value that connects with customer objectives, and grow and evolve trust-based customer relationships for increased retention and loyalty.

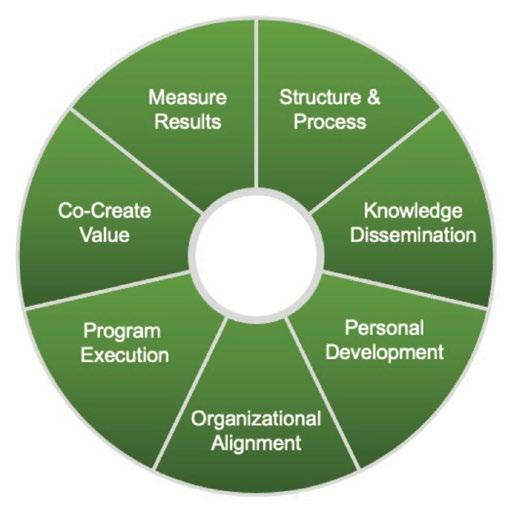

Our Value-Focused Selling solution will ensure predictable, repeatable and sustainable success through the deployment and implementation of a sales performance solution that fits your business, exceeds your requirements, and helps you engage, win and grow with your customers.

Read our latest use case and learn more about our approach to value co-creation at performancemethods.com.

Our approach equips your team to co-discover what matters most to their customers and co-create value to grow and evolve trust-based customer relationships for increased retention and loyalty.

3M Company

Abbott

ABM Industries Inc.

Aggreko Agilent

Airbus Defence and Space Air Liquide

Allergan

Allied Universal (fka G4S USA)

AmerisourceBergen

Amgen Canada

Arcadis

Astellas

Avient Corporation

AVI-SPL

Axis Communications Inc.

Azenta Life Sciences

Bailey International Bayer AG

Bellevue University bioMérieux

Boehringer Ingelheim

Bracco Diagnostics

Brenntag Specialties Inc.

Buckman North America

Bunge CAS

CenterPoint Energy

Ceva Santé Animale

CH Robinson

Cisco Systems, Inc. Clarios

Cox Automotive CPC Worldwide Danaher Companies DHL

Donaldson Company, Inc. Ecolab

Elanco Animal Health

EMERSON Automation Solutions

Endress + Hauser

Essilor International

Exact Sciences

Expeditors

FCM

Freeman Greene, Tweed & Co.

Grifols Therapeutics Inc.

Henkel

Hilton Worldwide Honeywell Hovione Hyatt Hyland Hypertherm

IBM

IDEXX Laboratories, Inc.

Iris Powered by Generali John Deere

Johnson & Johnson Lilly USA, LLC

Lonza

LP Building Solutions Lubrizol Medtronic Merck+ Michelin

Mölnlycke Health Care

New York Power Authority Inc.

Nilfisk Novo Nordisk Inc. O-I

Organon LLC Otsuka US

Owens Corning

Pacific Gas and Electric Corporation

Pfizer, Inc. Premier Inc.

Rockwell Automation Saint-Gobain Schneider Electric Sealed Air Corp. Sherwin-Williams Sidel Siemens Solecta, Inc. Sonoco Suez Sunovion supplyFORCE Thales

The AAK Group

The Qt Company

Thermo Fisher Scientific Inc.

TÜV SÜD UL Solutions United Airlines

Universal Robots A/S Vallourec

VSP Global W. L. Gore & Associates, Inc. Wajax Corporation

Waters Corporation

West Pharmaceutical Services, Inc.

Wolters Kluwer Belgium WorkCare, Inc.

Zoetis

Zurich Insurance Group

Steve Andersen

President and Founder

PMI

Dino Bertani

Executive Director, International Strategic Account Management

AbbVie

Anju Birdy

Strategic Account Management Excellence, Vice President

Schneider Electric

Noel Capon

R.C. Kopf Professor of International Marketing Columbia Business School

Mauro Cerati

Senior Vice President, Global Customers Bunge

Dominique Côté

Owner and Founder COSAWI in/Sprl

Ron Davis

Executive Vice President, Head of Customer Management

Zurich Insurance Group

Jim Ford

Chief Commercial Officer Solecta, Inc.

*Chairman of the SAMA Board*

Denise Freier

President and CEO SAMA

*John F. Gardner

Retired - President, Global Strategic Accounts Emerson Automation Solutions

*Rosemary Heneghan

Retired - Director, International Sales & Operations, Worldwide IBM

Gerilyn Horan

Vice President, Group Sales & Strategic Accounts

Hilton

Denise Juliano

Group Vice President, Life Sciences Premier Inc.

Renae Leary

Chief Commercial Officer – Americas Ansell

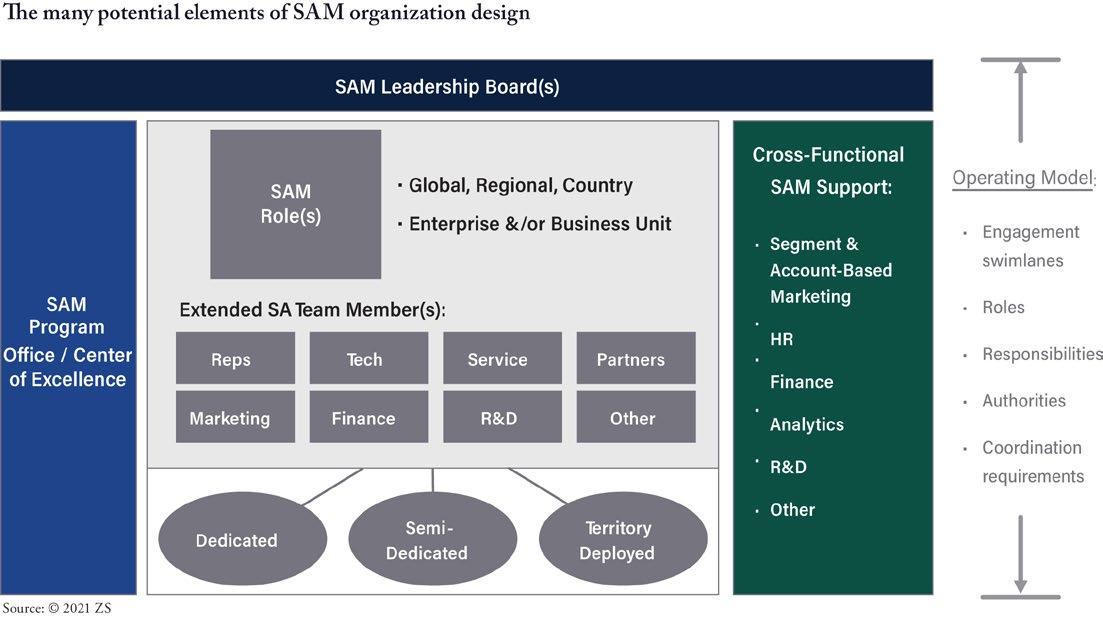

Mike Moorman

Managing Principal, Sales Solutions

ZS

Joseph Pinzon

Regional Vice President, Corporate Key Accounts Konica Minolta

Dr. Hajo Rapp

SVP Strategic Account Management & Sales Excellence

TÜV SÜD AG

Kevin Reilly

Global Sales Development Leader, 3M Healthcare Business Group 3M Company

Tony Stanich

VP Global Corporate Accounts - Food & Beverage for Water and Process Services Nalco, an Ecolab Company

Jennifer Stanley Partner McKinsey & Company

*Dr. Kaj Storbacka

Retired - Hanken Foundation Professor Hanken School of Economics

Geoff Williams

Vice President, Global Accounts Danfoss

*Distinguished Board Advisors (lifetime contributors; nonvoting members)

Publisher: Denise Freier

Editor-in-Chief: Harvey Dunham

Associate Editor: Nic Halverson

Creative Director: Aimee Waddell

Advertising: Ashley Davis

President & CEO: Denise Freier

Director of Finance, Meetings and Operations: Fran Schwartz

Senior Manager, Meetings and Events & Individual

Member Liaison: Rhodonna Espinosa

Finance & Operations Manager: Jaclyn Such Registration Manager: Shannon Feeney

Managing Director, Strategy and Marketing: Harvey Dunham

Director, Customer Solutions: Christopher Jensen

Sr. Corporate Account Manager: Bobbie Zimny

Corporate Account Manager: Michael Johnson Sr. Corporate Solutions Manager: Ed Zupanc Salesforce Analyst/Administrator: Erin Pallesen

Business Leader – AMS: Stephanie Fahey

Knowledge, Certification & Training

Director, Knowledge, Certification & Training: Libby Souder

Assistant Director of Certification & Training: Frankie Cusimano

Assistant Director, Knowledge & Training: David Schweizer

Knowledge and Training Manager: Brad Maloney

General Manager, Research & Customer Experience: Joel Schaafsma

& Communications

Creative Director: Aimee Waddell

Associate Editor: Nic Halverson

Marketing Manager & Sponsorship: Ashley Davis

Join the conversation with SAMA on LinkedIn at www.linkedin.com/company/strategic-account-management-association.

Follow SAMA on Twitter at www.twitter.com/samatweet.

Whether it’s to heed the call of adventure or take decisive action in a time of crisis, when we embark upon journeys, we accept change and eventually learn to embrace it. The first initial steps of a journey, however, can be daunting and full of doubt about the trials and tribulations that lie ahead. But with the right set of tools — a road map, a compass, a GPS device — to navigate the blind spots and unexpected obstacles, we find that we possess the courage, strategy, and acumen to not only triumph, but see the journey for what it truly is: a thrill ing discovery of the self.

Upon your journey as SAM, you’re no stranger to the pitfalls and risks that can affect your industry. Still, as you maneuvered your way through the pandemic and supply chain disruptions, the last couple years have probably left you feeling like you got blindsided by a few unexpected “black swan events.”

Here at SAMA, it’s our belief that by facilitating a knowledge exchange and sharing best practices, we can provide you with the right navigational tools to anticipate black swan events. These tools can help adjust your focus, so when you look through your binoculars toward the future, these highly prob able and highly predictable events will appear as “gray rhinos,” as you will soon read about in this issue of Velocity

In their piece “Managing the Hidden Buying Journey,” Martyn Lewis and Anthony Rocha invite you to peek through the key hole to see “how much hidden friction there can be in the blind spots of a seller.” Their article will not only give you a sharper image of what’s behind a customer’s door, it will also help you open that door and cross the threshold to generate growth and co-create value.

“Nothing is as constant as change, and strategic account management is not exempt from constant evolution,” writes Dr. Axel Thoma. For the journey ahead, his piece “Unlocking New Value With the ’Value Creation Compass’” is full of sage advice to help you stay on positive footing as you follow the path of your customer relationships. And, according to Noel Capon and Gus Maikish, you’d be wise to stay on that path, since “the customer relationship is the one thing that can never be disrupted or replaced.” They outline this and more

in their wonderful article “The Acumen Sextet: An Evergreen Framework for Account Management and Customer Success” about what SAMs “must master to do right by their own firms and their customers.”

This leads us to high-performance territory, where Dr. Javier Marcos occupies a unique vantage point. In “The SAM as a Strategist: Defining the Approach to Transform Your Key Customer’s Business,” Marcos elaborates on how elite SAMs must use strategic and intrapreneurial abilities to get everyone on board.

Coupling all this guidance with the wisdom of David R. Barnes Jr.’s “Emerging SAM Opportunity: Your Customer’s Diversity, Equity, Inclusion, and Belonging Strategy,” we come to the final stage of the journey — the culmination — marked by success and achievement. Here, we highlight our 2022 SAMA Excellence Awards winners, whose precedent we can follow on our own path to greatness. In many a quest, it’s the elders who are the torch bearers of expertise, as is the case with the co-winners of our outstanding mature program of the year — AVI-SPL and Brenntag.

Read on to learn about AVI-SPL’s meteoric rise to Trusted Advisor status and how they did it by securing unanimous internal buy-in from the get-go. And no successful journey is complete without a celebratory toast, right? In raising his glass to Brenntag (and AVI-SPL), SAMA’s own Harvey Dunham uncorks the “many ingredients [that] must come together in the right proportions at the right time to create” a successful SAM program and how it “must age for many years to reach a point of excellence.”

As I embark upon my own new adventure as the new associ ate editor of Velocity, I look forward to sharing this issue — and this journey — with you.

Nic Halverson Associate Editor Strategic Account Management Association (SAMA)

We don’t use slightly customized generic methodology to teach your team general negotiation skills. Our work is 100% custom to you and focused on how to:

• Negotiate your actual commercial terms

• For your actual products and services

• Against your actual competitors

• Given actual verbatim tactics from your customers

Negotiation has long been thought of as unpredictable and hard to measure. Sadly, it’s how most legacy training companies define it and treat it. The result? Long lists of tactics and countermeasures that prepare your team for, well, “random.”

Our approach is different. Our research (yes, we have proof) shows that buyer tactics are 97% predictable and fall into two categories

We’ll train your team to systematically plan their negotiation by answering just 3 questions.

Easy. Account managers can do it, managers can coach it.

Case in point:

• Documented case studies that show 466% average ROI for our clients .

• Clients include Google, Microsoft, FedEx, across 47 countries over 17 years.

It’s all we do. And we’re pretty good at it.

If you like our approach, let’s jump on a call or drop me a note to discuss.

Thanks for reading, Brian CALL ME AT: 312.925.9326 | EMAIL ME AT: BJD@THINK5600.COM

In their recent article “It’s time for CEOs to put suppliers first” for Fortune.com, authors Christian Schuh, Wolfgang Schnellbächer, Alenka Triplat, and Daniel Weise check off the many ingredients that created a recipe for disaster for international business lead ers in recent years. When combined, the U.S.-China trade war, the COVID-19 pandemic, rampant inflation, and the Russian inva sion of Ukraine served up a bitter dish to make us feel like we are living in an “age of crisis.”

These immense challenges wreaked havoc for CEOs running global companies with worldwide footprints. As supply chain disruptions rippled across industries, and bottom lines and profit margins took a hit, many CEOs, as the authors observe, were “quick to make their excuses, claiming these were unexpected ’black swan’ events that could never have been predicted.”

But could these events have been predicted? Should CEOs have been better prepared?

“In a word, yes,” the authors write. “None of these events [were] a ’black swan’ event, a term coined by bestselling author Nassim Nicholas Taleb to describe a random, highly improbable occurrence. On the contrary, they were what the business writer Michele Wucker has called ’gray rhino’ events: highly probable, highly predictable, high-impact but neglected threats that were charging toward companies like a crash of rhinos.”

The authors — all partners at the Boston Consulting Group and coauthors of the book “Profit From the Source: Transforming Your Business by Putting Suppliers at the Core” — point to past events, such as Russia’s 2014 annexation of the Ukrainian region of Crimea and previous pandemics, epidemics, and outbreaks, that foreshadowed our current “age of crisis.”

So, why were leaders of some of the world’s largest multina tional companies caught off guard by these events? Why didn’t they see or hear the crash of the charging rhinos?

“In our view, it is because today’s CEOs are too introspective, too focused on the here and now, and oblivious of what is hap pening in the rest of the world,” the authors proclaim. “Research from Harvard Business School found that CEOs spend only 1% of their time with their suppliers. Given that suppliers account for more than half of a typical company’s budget, this is not only impractical, it borders on the absurd.”

Lest we forget: suppliers are critical

gears in an organizational ecosystem. “When they stop, the company they supply stops, too,” the authors correctly assert. Suppliers are the lifeblood of the company — providers of “mission-critical components,” not to mention “commercial intel ligence” about competitors and current trends. “As such,” the authors write, “they are a window to the world beyond the confines of the corporate headquarters.”

So, what can CEOs do to predict and prepare for future supplychain disruptions?

“They should put suppliers at the very heart of their business,” the authors declare. “For too long, these vendors have been marginalized, treated as dispensable, come-and-go providers of goods and services who can be hired in good times and fired in bad times. At a personal level, CEOs should make supplier relations their leadership imperative by spending more time with them. In particular, they should nurture one-on-one relationships with the CEOs of their top suppliers, the 20 to 40 companies that account for half of their supplier budget. So often, CEOs are surrounded by corporate yes-men.”

In a nutshell, supplier CEOs occupy a unique position. “Unencumbered by institutional loyalties,” the authors write, they “can tell CEOs what they should hear: How it really is. At

a companywide level, CEOs should raise the profile of the chief procurement officer and revamp their procurement function, which ’owns’ the corporate relationship with suppliers.”

At SAMA, we couldn’t agree more. Suppliers are key in their ability to deliver value to their customers. And the CEO should know who their strategic suppliers are, and they should be in contact with them. But there are many people that a CEO should be in contact with — everybody wants a piece of their time. Most large companies have thousands of sup pliers. Being strategic about identifying the important ones and developing relationships with them, deciding how and where to focus one’s time — this is the central challenge for a CEO (and the exact challenge of a SAM program, as well).

Which really gives rise to the question, “How can the CEO do this at scale?”

For answers to this question, look no further than AVI-SPL, co-winner of SAMA’s Excellence Award for Outstanding Mature Program of 2022. As you will read later in this issue, AVI-SPL, a Tampa-based provider of collabora tion and audio video technologies, is a perfect example of how quickly a SAM program can take flight when there is unilateral, internal buy-in. From the moment the senior leadership proposed the program and AVI-SPL’s Board of Directors sponsored it, there was unanimous support from the entire executive team — the CEO, COO, CFO, EVP of Technology & Innovation, and EVP of Sales and Marketing — to promote the program and advocate for its growth as active and engaging participants.

One of the main ways AVI-SPL achieved such success — at scale — was through their development of a Customer Advisory Board (CAB), which included senior leaders from customer com panies. Each of AVI-SPL’s Global Accounts was asked to partici pate in the CAB, giving them exclusive C-suite access to strategy discussions, oversight, peer-to-peer knowledge exchanges, and community building. Aligning in such a symmetrical way builds trust, relationships, and joint value creation, and it’s the reason

why the C-suite of AVI-SPL’s strategic accounts see them as trusted advisors.

In AVI-SPL’s case, they applied their CAB — as the name sug gests — to their customers. However, SAMA spoke with Betsy Westhafer, CEO of The Congruity Group, an organization that builds and deploys Customer Advisory Boards, and we asked: Can the same reasoning and structure behind CABs be applied to suppliers, too?

“Absolutely,” Westhafer said. “It’s bidirec tional. The goal is to have mutually beneficial, consistent, and valuedriven dialogue. Whether that’s between the C-suite and their strategic accounts or between the C-suite and their strategic suppliers, the goal is the same. How can we work better together now and into the future, and how can we strengthen the rela tionships in the process?

We believe there is no better way to insulate your organization from black swans, gray rhinos, or any other impending disruption than with a commitment to having these types of insightful conversations,” Westhafer concluded.

If more CEOs followed this example of putting, as the authors suggest, “their suppliers and their procurement function at the heart of their business,” we at SAMA agree that “they too can stay one step ahead of their rivals.” n

Adapted from “It’s time for CEOs to put suppliers first,” published at Fortune.com, by Christian Schuh, Wolfgang Schnellbächer, Alenka Triplat, and Daniel Weise, partners at the Boston Consulting Group and coauthors of the book “Profit From the Source: Transforming Your Business by Putting Suppliers at the Core.” https://fortune.com/2022/06/27/ceo-suppliers-firstsupply-chain-crisis-uncertainty-economy-world-business-leadership-bcg/

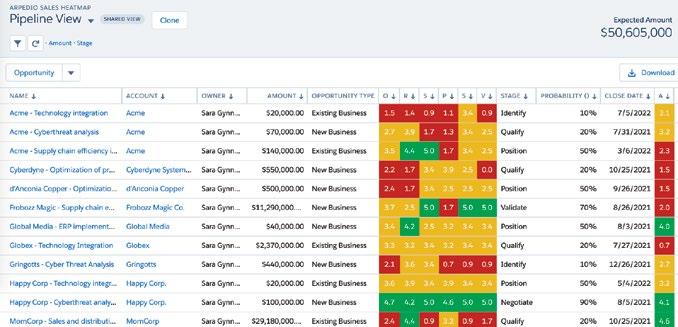

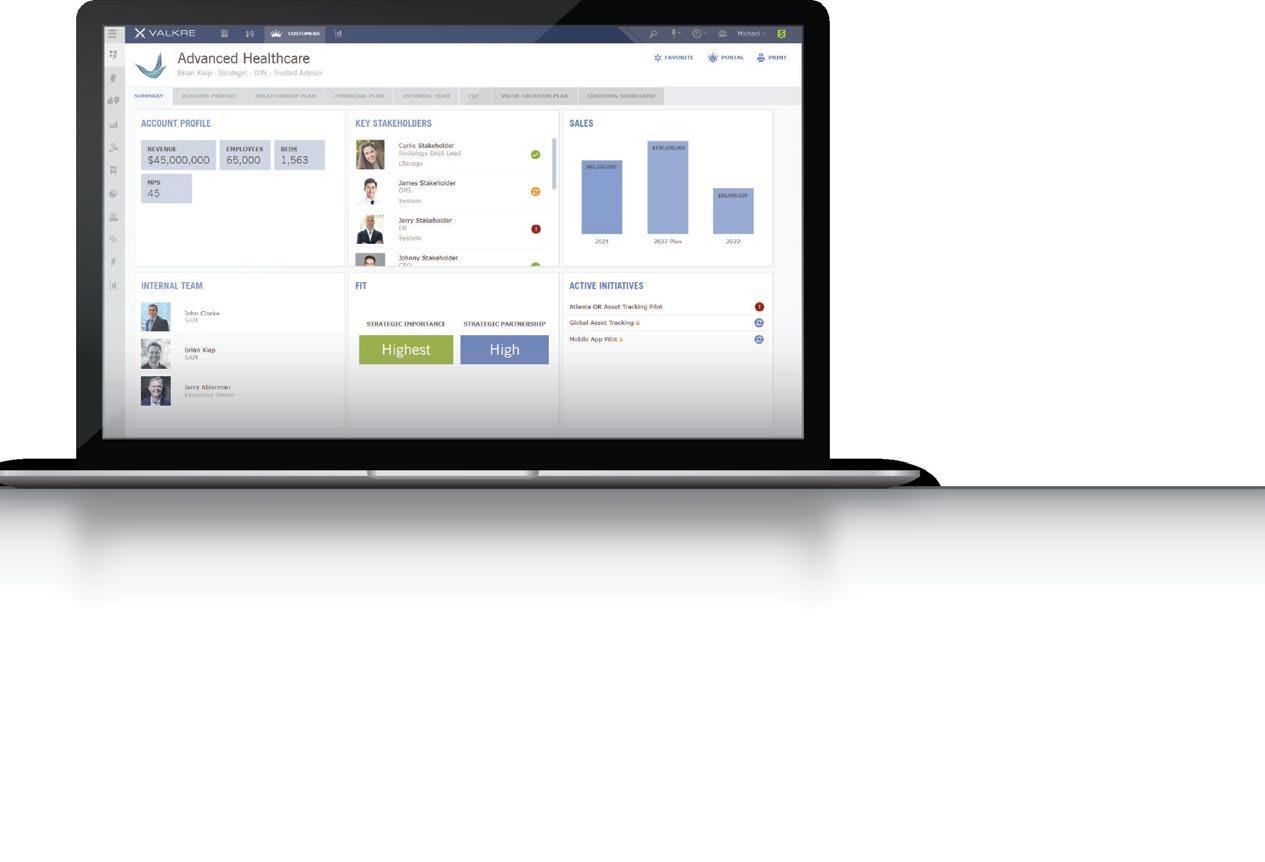

Intelligent software for account planning and relationship mapping in Salesforce to retain and grow your most important customers.

ARPEDIO's simple user interface, the SAMA framework, and the high level of customizability made it extremely easy to implement The implementation has improved our understanding of our clients and focused our efforts in the areas where we can make the biggest impact.

Denise Juliano, Group VP of Life Sciences, Premier Inc.

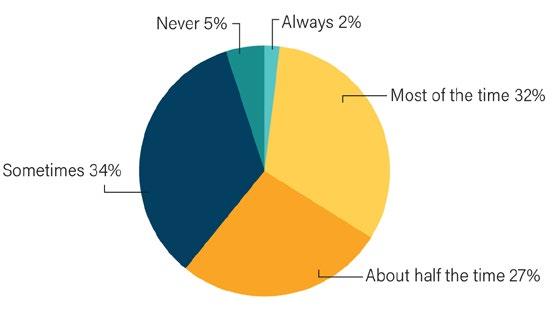

According to a recent survey among the SAMA community, two-thirds positively indicate that they have a defined process for quantifying value propositions for their customers. However, only one-third indicate that they consistently go back to quantify the realized value. When customer relationships are tested through organizational change or other impacting factors, a documented proven success record is important to smooth that transition.

To what degree would you say your organization has a defined process for quantifying value propositions for your customers?

Post implementation, how often does your organization get customer agreement on quantified realized value?

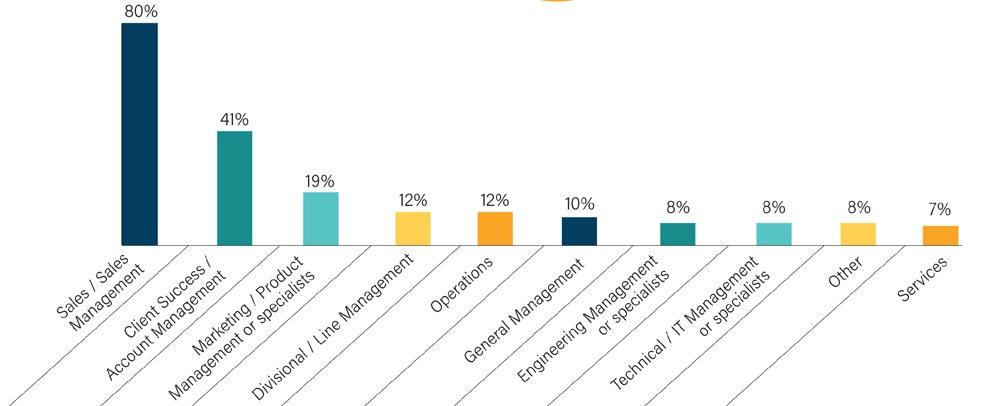

Most companies start their SAM talent search from within their sales organization. However, it is important to remember that being a top-performing sales professional does not always translate to guaranteed success in a strategic account management role. Strong strategic thinkers who can effectively engage and create value with the customer can also come from other departments within the company. Keep that in mind next time you are seeking talent for the SAM role.

Of the SAMs hired in your company, from where were they promoted or transferred? (Check all that apply)

By David R. Barnes Jr. Co-Founder, Managing Partner Diversity Inclusion Equity Group

By David R. Barnes Jr. Co-Founder, Managing Partner Diversity Inclusion Equity Group

The importance of a company’s Diversity, Equity, Inclusion, and Belonging (DEI&B) strategies to their overall performance has skyrocketed in the past few years. In a recent Gartner CEO survey, “organizational culture” was their #3 priority. In 2021, Fortune Magazine inserted a new metric into its Fortune 500 ranking called “Measure Up,” which ranks an organization’s level of embracing DEI&B practices. Refinitiv is another well-respected organization that selects the top one hundred global companies that demonstrate the most robust level of diversity, equity, inclusion, and belonging in their organizations.

It’s time for businesses to look at all their vendor relationships to ensure they’re not complicit in supporting injustice within another organization. Investigating your vendors’ commitment to diversity and inclusion is not just necessary from an ethical standpoint but from a competitive perspective as well. – ADP Guidance to Customers

More importantly, organizations are now asking for more informa tion from vendor partners regarding their DEI&B strategies. As more companies see value in these initiatives, this industry trend will likely intensify. As proof, organizations like Society for Human Resource Management (SHRM) and ADP are providing companies with the following guidance.

So, what are the emerging opportunities for a SAM within this new landscape?

There are two ways to address this trend. You can reactively pro vide information about your organization’s diversity, equity, inclusion, and belonging strategy, activities, and results. Or, better yet, you can proactively take the lead and connect DEI&B strategy leaders in both organizations, as you would your Chief Operating Officer, Chief Marketing Officer, Chief Technology Officer, etc., to form strategic relationships to enhance the business partnership.

Having had a 30-plus-year career in sales and having been a SAM for eight years, I always ask current customers and pros pects, “How are you monetizing your diversity, equity, inclusion, and belonging program to contribute to your bottom-line revenue or profitability? Is your DEI&B program robust and effective?”

Inevitably, whether the answer to that question is positive or negative, the conversation brings up the question: What are you requiring of your vendors, as it relates to your diversity, equity, inclusion, and belonging strategy? In many Fortune 500 compa nies and smaller companies, the responsibility for that strategy usually resides with the Chief Diversity Officer.

Identify your organization’s DEI&B strategy. Discuss this opportunity and see if they are open to engaging with their counterpart at the customer level. Discuss what real-world benefits they see for both organizations. If for any reason they are not ready to engage, “stop and don’t pass go.” Know that you have planted a seed. Nurture it and someday there will be a harvest.

If the answer is “yes,” go through the appropriate channels in the customer organization, have the same conversation, and follow the same proto col as you did with your organization’s diversity, equity, inclusion, and belonging leader. Consider setting up a meeting for all parties involved.

• In the initial meeting, have only the SAM discuss the potential opportunities, then hand it off to both leaders to take the ball and run with it.

Depending on your company’s SAM planning process and customer interaction agenda, there should be regular internal updates on the prog ress of this initiative with the customer.

“Diversity, equity, and inclusion are cornerstone priorities for our organization that go beyond specific programs,” James Chalmers, CEO of Cortex Design, told Forbes.com. “These pri orities have a direct correlation with stronger short-, mid-, and long-term financial performance. Diverse teams identify and explore a broader range of opportunities and identify risks more effectively, while equitable and inclusive environments encour age free-flowing ideation.”

As the importance of DEI&B strategies — and how they affect bottom lines — resonates across industries, what is the oppor tunity for the SAM? To be clear, the opportunity may not be for every selling organization or every SAM, but there are some prerequisite “must haves” for organizations and customers before the opportunity can be realized.

1. Both your organization and the buying organization should have a diversity, equity, inclusion, and belonging strategy busi ness owner that sits on the executive team.

2. Both your organization and the buying organization should see their DEI&B strategies as an integral part of the overall business strategy of their organizations.

3. Both your organization and the buying organization are open to exploring opportunities to partner with each other to create internal and customer-facing solutions that could be executed without partnering with each other.

In some organizations, the diversity, equity, inclusion, and belonging strategy may be part of the organization’s sustainability strategy and the “prerequisites” may already exist. However, note that every company’s readiness to partner on DEI&B strategy is fluid and dynamic. Some companies may have already broached the subject. Other companies might be ready to have the conver sation, but just haven’t contacted you yet. And some companies are not ready, but are moving toward the opportunity to do so.

Recently, I moderated a SAMA virtual conversation to discuss DEI&B topics with Joseph Machicote, Chief Diversity Officer at Premier Inc., who has a background in sales, and two members of the SAMA Advisory Board. All in all, more than 20 participants contributed to a rich conversation, and some key questions emerged that we feel compelled to share.

Answer: You do not need to know a lot about DEI&B strategies at all. You just need to identify the diversity, equity, inclusion, and belonging business owner in your organization and the buying organization, and explain to them that this is an extension of the

1. I am not an expert on diversity, equity, inclusion, and belonging. How much do I have to know to get this process started?

pre-established partnering process of your organization. Connect with them, keep abreast of their meeting’s outcomes, insert them into your strategic plan, then facilitate where needed to achieve those goals.

customer’s executive team. But if you seek guidance, see the Road Map for Success sidebar on the previous page.

Answer: There is a lot to unpack with this question. To be concise, one suggestion could be for that person to view a diversity, equity, inclusion, and belonging strategy as just another pure-business initiative to execute, like operations, marketing, or sales, which they don’t necessarily have to be excited about. Or, perhaps this is a chance for them to examine whether or not their values and beliefs align with those of their organization, and whether or not they are a “good fit” at the company.

Looking ahead toward next steps, we are currently canvassing organizations and SAM teams to ensure that the best practices SAMA provides on DEI&B initiatives are rooted in real-world application and directly related to the SAM’s role. As we continue to seek and share best practices, we are excited to explore all the opportunities that diversity, equity, inclusion, and belonging strategies can bring, and how they can elevate relationships, bring returns, and add value between organizations and their customers. We look forward to all our members joining us in this important conversation. n

1 Forbes.com (2021). 11 Ways DEI in the Workplace Can Boost a Company’s Bottom Line. https://www.forbes.com/sites/ forbesbusinessdevelopmentcouncil/2021/12/15/11-ways-dei-in-theworkplace-can-boost-a-companys-bottom-line.

Answer: This simple answer is you already have it if you are doing this with other members of your executive team and your

David R. Barnes Jr. is a Co-Founder, Managing Partner, and DEI-Performance Consultant at the Diversity Inclusion Equity Group, an organization that facilitates the sustainability of social innovation within organizations by marrying business growth to an optimal, inclusive, and diverse culture. David can be contacted at david@diversityinclusionequitygroup.com.

Just because you can’t travel doesn’t mean you have to stop developing your account management skills.

Your customers rely on you to help them solve their biggest business challenges. For you, that means probing them for opportunities and then marshalling your internal resources to create new, innovative solutions that solve your customers’ most pressing issues.

SAMA online courses offer the same high-quality, interactive training as our in-person SAMA Academy but at your own pace and from the comfort of your home office.

For more information, please visit https://bit.ly/samaonlinetraining.

2. What if someone isn’t personally excited to move forward with a DEI&B initiative?

3. Is there a road map I can follow to start this process?

In 25 years of consulting, I can safely say that our team at Market-Partners Inc. has never seen a product or service that was valueless. In fact, of the more than 200 clients who have brought us in, the majority of their offerings have had a clear, demonstrable, often proven return on investment. So why then do so many customers have second thoughts on, or even flatly turn down, what we know to be great offerings?

Our very first client engagement is what sparked our interest in buyer behavior. This initial client’s service had seemingly no down sides for customers. Since the costs to the buyer were completely tied to the savings the buyer received, if there were no savings, there were no costs. With such an obviously ben eficial purchase, our client was left pondering why all their prospects were not buying. That is when we began interviewing would-be cus tomers in hopes of finding the sources of their hesitation. From our first discussions, it became apparent why this purchase — like so many others — was not so “obvious” after all.

These conversations tipped us off to how much hidden friction there can be in the blind spots of a seller. There are key players, activi ties, considerations, concerns, and decisions all affecting the likelihood of a purchase that most selling organizations are not aware of or involved in. We now recognize these elements as essential parts of the buying journey.

However, these factors are not random. Once a buying journey has been properly mapped, it becomes evident that buyers, within a spe cific market, buy in remarkably similar ways. This means firms can create strategies to help account managers influence these onceinvisible elements, thus generating growth by helping customers buy.

Since before the inception of MarketPartners Inc., buying has been changing — and not in ways that make things easier for buyers, let alone sellers. The unfortunate truth is that no matter how compelling an offering’s value may be, buying has been complicated by these changes in critical ways that cannot be overrid den by value alone.

• No Single Decision Maker Today, buy ing decisions are comprised of a dynamic network of individuals, sometimes including individuals outside the company itself. Many of these individuals — notably those not tra ditionally considered key players — have the power to slow or stop a buying journey in its entirety. One of the most common responses we receive when asking about how part of a purchasing decision was reached could be summarized as, “I don’t know, but a lot of people were involved.”

• Unprecedented Choice Even if an offering has a proven and easily demonstrable ROI, there are countless ways an organiza tion can reduce costs, increase market share, boost employee morale, etc. It is genuinely rare for one offering to be the only conceivable solution to a problem or bar none the biggest opportunity every firm has, or for an initiative to be so timesensitive it supersedes every other plausible course of action.

• Constrained Resources Regardless of the size of an organiza tion, there is still a finite amount of resources. Additionally, most organizations are not actively sitting on additional resources when they are available. Whether it is time, money, or people, we have found in most cases that resources are fully deployed and difficult to reallocate without substantial pushback or internal bureaucracy.

• Information Overload The advent of the internet has given buyers access to an unprecedented amount of both informa tion and misinformation. This bottomless well means would-be buyers can spend untold hours just doing research: reading reviews, diving into consulting reports, cross-referencing case studies, learning about your suppliers, and networking with your previous clients. This not only takes time, but also adds an additional layer of complexity to all buying journeys — espe cially when multiple stakeholders come back with different, or even conflicting, information.

There is one more point that cannot be overemphasized: buy ers are not focused on “buying,” they are focused on using and benefiting.

A significant amount of the activity across the buying journey is then naturally dedicated to how the organization will use the proposed product or service and how they will realize their investment’s benefit. This is why many firms have transitioned to a more inclusive approach, one that brings in stakeholders and end users across departments who, as stated previously, would not be imaged as buyers. These are instead the parties that would be impacted in some capacity by the offering’s envisioned use and adoption.

We see these stakeholders given a more prominent voice throughout the buying journey as they plan for adoption, oversee changes in workflow, train users, mitigate risk, and manage integration with existing systems, technologies, and processes. As they are the ones preparing for an offering logistically, they are frequently seen as experts in the implications of any offerings a firm is evaluating, including next steps, potential barriers, addi tional requirements, and impact on suppliers and approaches.

A market’s end-to-end buying journey therefore encompasses numerous players, activities, and decisions both big and small. Some of these players, activities, and decisions will be clearly visible to an account manager, and accordingly, we have found that account managers usually do their best to play an active role in these parts. That said, there is often more going on behind the scenes. Almost every account manager has heard that their champions or key contact needs to “get folks onside,” “gain align ment,” “do some internal work,” or “solve a few issues.” These casual comments clue us into the hidden buying journey.

There are two central reasons why key contacts share with an account manager that they “just need to sort out a couple of things” when in reality they have a mountain of effort and competing agendas to climb.

The contact may truly believe the task is not that difficult, most likely because they have never purchased your offering before. In spite of their positive attitude though, this naivety can be costly as activities prove more challenging than originally thought. Not only does cumulative fatigue eventually set in but mobilizing an organization through interest to a purchase is one of the most taxing parts for champions during any buying journey.

Perhaps most crucially is that the contact — reflective of the buyer as a whole — does not perceive the account manager can assist them with these tasks in a meaningful way. Therefore, the contact is somewhat dismissive of the account manager’s ability to contribute, even if it is not intentionally exclusionary.

The perceptions in points one and two have caused a mea surable disconnect between sellers and buyers. Our research shows that buyers do not reach out to salespeople until they are at least 50% of the way through their buying journey. Moreover, salespeople are typically involved in less than 10% of a buyer’s overall buying activities.

Regardless of which has had more of an impact on these statistics, in either scenario, the account manager has become detached from the buying journey. Worst of all, if the account manager does leave the journey with their contact — expecting them to manage the appropriate initiatives and convince the necessary parties to come onside — that journey is far less likely to result in a purchase.

As mentioned previously, many account managers are not aware of the internal challenges their buyers are facing given the small lens in which they have to view the buying journey. This often leads to a critical situation where an account manager has received verbal commitment from a buyer and understandably forecasted the sale.

Although the account manager imagines their champion is handling things from there, in the hidden buying journey, that champion is becoming bogged down with internal resistance. As the buying process proves harder than they imagined, without someone to guide them, the contact might soon decide the offering is no longer worth the effort. This is a huge part of why we find over 50% of buying journeys end in “no decision.”

Ironically, while it is probably a cus tomer’s first time navigating the pur chase of an offering, it is probably not an account manager’s first time watching a customer do so. If too focused upon why a customer should buy their offering, an account manager may miss the gold mine of insight they have in terms of how to purchase their offering. Even if they do not know every detail, they at least have a good outline of what happens, who gets involved, and where organizations get tied up.

This is why we believe account managers are in the perfect position to both support and positively influence the buying journey — and why their organizations should move to back them. Not only does a more customer-centric and buying-centric approach differentiate a business from those using more traditional sales approaches, it also capitalizes on a massive growth opportunity by way of helping customers buy.

The good news is that every account manager does not have to work this out for themselves. As we shared, buyers in a particular market, when buying a specific offering, will behave in remarkably similar ways. This enables organizations to decode the market’s buying journey and provide an insight-driven sales playbook for account managers, describing how to navigate and

support the customer through each stage of their buying journey.

As such, we are proposing a three-step action plan to bring these ideas to fruition:

I. Map the Market’s End-to-End Buying Journey: Understand exactly how your customers buy and, most importantly, what slows and stops their journeys.

II. Create the Market Engagement Strategy: Build an engage ment strategy based on your customer’s buying journey to effectively support their buying activities.

III. Provide the Sales Road Map (Buying Journey Navigator): Translate the engagement strategy into step-dependent action items, supporting your buyer throughout their buying journey.

Before you can overcome the hidden friction with your cus tomer’s buying journey, we must start by under standing how customers buy.

Over our decades of research, we have developed a model to decode and develop a map for any buying journey. The key is the Buying Journey DNA, which are the six strands (or factors) that comprise and influence all buying journeys.

While the nature of these strands can vary greatly between markets, a similar DNA code will define a single market; conversely, if two buyers purchase the same offering in a different manner, that indicates two distinct markets.

The six strands of the Buying Journey DNA are as follows.

1. Triggers (and Dependencies): The catalysts and prerequi sites that initiate and precede a buying journey.

2. Steps: The activities and stages in which a buyer will likely engage.

3. Key Players: The relevant individuals and groups across all the steps of the buying journey.

4. Buying Style: How a buyer determines what and where to buy.

5. Value Drivers: The motivations of the buyer.

6. Buying Concerns: The inhibitors that can slow and/or stop the buying journey.

It is the DNA of a buying journey that forms the basis of a comprehensive market engagement. Keep in mind that strands three through six can all, and likely will, change with each step of the buying journey. This can occur for many reasons, including buyers learning more about the offering, buyers better under standing their own needs and situation, or new players and agendas getting involved.

Equally relevant to how customers buy is why they do not. Our data show more than 90% of concerns go unaddressed by sales and marketing, so these hurdles are of special interest for those seeking the hidden friction within their market’s buying journey.

There are nine distinct categories of buying concerns, any one of which can derail a buying journey from its tracks. Like journeys as a whole, there is great commonality of buying concerns across each step within a specific market.

1. Process: The actual process (i.e., purchasing, sourcing, and so on) within the buying organization expressly for the acquisition of this type of product or service.

2. Priority: The urgency and timing of the purchase, and how it aligns with the organization’s current and upcoming directives, strategies, and goals.

3. Individual: The personal motivations and objections of the individual “carrying the ball” at any stage of the buying journey.

4. Organizational: The “political” friction, including all the vari ous agendas, objections, and concerns that are likely to arise across the organization.

5. Alternatives: Any and all alternatives an organization may consider before they move forward with a particular acquisi tion, including doing nothing.

6. Business: The fiscal side of the equation — the business case. Is there a complete and compelling business reason to trigger and complete the buying journey?

7. Implications: The logical implications of acquiring a certain offering — what actually happens when someone buys some thing.

8. Fit: The way a potential acquisition aligns with how and what that company would usually buy.

9. Change: The intangible changes, including the very percep tion of change, that must occur to adopt the new offering. This concern can be especially deadly and is potential deal-breaker territory.

While some buying concerns are very straightforward and objective, others are completely subjective and emotional. Handling a long list of concerns like this may seem complicated at first, but once the DNA has been mapped, the patterns emerge. You will quickly know what to expect around each turn of the buying journey, and how to avoid or resolve these concerns every time.

With the buying journey in hand, account managers can then work to support and positively influence customers through those steps and activities. This all begins with the Market Engagement Strategy.

A good engagement strategy is built upon these four pillars.

a. When to Engage: When is the best time in the buying journey to engage in terms of ability to influence?

b. How to Bring Value: How will we meet the wants and needs of our buyers, both in style and channel?

c. How to Stay Relevant: How will we keep ourselves top of mind throughout the duration of our engagement and beyond?

d. How to Overcome Barriers: How will we avoid, bring forward, mitigate, or resolve our market’s buying concerns?

It bears repeating that these answers must come from the voice and perspective of the customer.

It is the DNA of a buying journey that forms the basis of a comprehensive market engagement.

• Defining Value and Relevance: If an initiative is not valuable or relevant to the specific market, it is not valuable or relevant.

• Helping the Buyer Buy: The final strategy will include numer ous nontraditional sales and marketing initiatives — some of which might not relate to the offering at all. These initiatives may include assisting the buyer in gaining alignment across their organization, handling process implications, preparing for adoption, and managing change.

Finally, these four pillars should then become the foundation for the sales playbook — what we like to call a Buying Journey Navigator. A Navigator translates the engagement strategy into a series of optimal selling activities for each step of the buying journey. As stated previously, four of the six DNA strands can change as the journey progresses, so this synchronization to each step is vital.

In no uncertain terms, this is not a sales process. While that may feel counterintuitive at first, unlike other methodologies, a Buying Journey Navigator inverts the buyer-seller relationship. We are not trying to take our buyers through our steps, our checklist, our sales process. Rather, we are now navigating and managing our buyers through their steps, their checklist, their buying process. We call this innovative approach Outside-In™.

To truly optimize selling, for each step of the buying journey, an organization needs to answer several questions about their buyers’ activities.

What should you be doing to support and manage the cus tomer, bringing value and relevancy at each step of the way?

• What do you need in order to complete this successfully? What collateral or information will be delivered?

• What resources will this require from the company?

• What tools or technology will make this effective?

• How will success be measured?

With the Buying Journey Navigator complete, strategic account managers can now sell based on the reality of how their cus tomers buy. This approach also reconnects sellers to buyers, addressing our key findings cited in prior sections: that account managers are invited into buying journeys late, are involved in a small amount of buying activities, and address a small number of concerns.

For that reason, a switch from focusing on sales process and value-based selling to supporting the buying journey comes with benefits for strategic account managers and buyers alike.

• A switch from a product-centric to buying-centric approach occurs.

• Higher involvement is seen across the buying journey.

• Strategic account managers become a resource to their cus tomers throughout the buying journey.

• Strategic account managers provide the success pathway for their customers.

Strategic account managers provide expertise on how to buy.

• Sustainable market growth through helping buyers buy.

• Increased likelihood of buying journey not only ending in a pur chase but continuing onwards to successful use and benefit.

• Enhanced differentiation in the mind of the buyer.

• Added value for buyers across the buying journey.

• More intimate customer relationships.

• Greater collaboration between sellers and buyers.

Increased dependency on the seller from the buyer.

Buying has changed, but that does not mean our account man agement cannot change with it. There is an apparent opportunity to become more engaged with our accounts across the hidden aspects of their end-to-end buying journey.

• Increase engagement in buying journeys from less than 50%.

• Increase engagement in buying activities from less than 10%.

• Decrease amount of buying journeys that end in “no decision.”

This can advantage firms not only through greater customer intimacy and differentiation, but also by growing market share via helping our customers buy.

Once an organization has gone through our three-step action plan, account managers will be synchronized to the reality of how their customers buy. This means account managers will be able to support their customers through the once hidden parts of their buying journey — not just towards a successful purchase, but onwards to being successful users and beneficiaries of their offerings. n

Martyn Lewis is the Principal and Founder of Market-Partners Inc., author of best-selling book How Customers Buy...& Why They Don’t, and three-time SAMA Annual Conference speaker. Since 1995, Martyn and his team have been decoding the Customer Buying Journey to create actionable sales and marketing strategies for organizations across every industry. Martyn can be contacted at mlewis@market-partners.com. For more info on Market-Partners Inc., visit www.market-partners.com.

Any person, team, or company who embarks on building a successful SAM pro gram soon realizes that this is a long journey. It is analogous to creating a great red wine. Many ingredients must come together in the right proportions at the right time to create the wine, and then it must age for many years to reach a point of excellence.

From SAMA’s perspective, here are examples of the challenges we expect a Mature SAM Program applicant to address — just to be considered by our board of indepen dent judges — much less selected:

• Maintain and evolve strong executive leadership and governance of their SAM program.

• Adapt to changing competitive, economic, societal, and digital disruptions. Continually improve SAM processes and enablement tools. Accelerate the drive for innovative, mutual value co-creation with their strategic accounts.

In 2022, our judges deemed that two companies — AVI-SPL and Brenntag — over came these challenges better than the other applicants and tied for the top honors in this prestigious category.

To understand how each of these companies succeeded, let’s start by examining the history, highlights, and lessons learned from Brenntag, a German chemical distri bution company founded in 1874. The company is headquartered in Essen, Germany, and has operations in more than 78 countries worldwide.

In 2009 Brenntag formally established their Global Key Account (GKA) program following a strategic review of their major custom ers. A Brenntag Board Member sponsored this initiative, and an external consultant performed the analysis.

The outcome of this analysis was to select and focus on a double-digit number of key accounts by assigning them to a small team of Global Account Executives.

By 2015 the number of key accounts grew by 29% and their total revenue doubled. The financial benefits of establishing the GKA program were clear; however, the GKA program suf fered growing pains as their key accounts wanted Brenntag to consistently serve them globally. This was mainly true outside of North America and Europe where there were not enough qualified support people and processes to cover the rest of the world.

In 2020, Brenntag announced the hire of a new CEO and a business transformation. The comprehensive program included their go-to market strategy, site network optimization, and the introduction of business services. The most visible change was to transform the operating model from a full-line, regionally managed distributor into a business with two global divisions with a differentiated steering approach: Brenntag Essentials and Brenntag Specialties.

For their existing Key Accounts, Brenntag’s organizational changes had a relatively low impact as their Key Account Executive

continued to be their single point of global contact.

However, the changes provided the impetus to reimagine the future with each key account by:

• Addressing the historic internal challenges of managing regional differences and complexities.

• Making it easier to deliver consistent value to each key account anywhere in the world via stan dardized processes.

• Discovering new ways to co-create value with each key account.

To make this happen the new Global Key Account leadership created and launched a new GKA pro gram with the following targets and objectives to:

• Achieve full organizational clarity.

• Harmonize best practices globally.

• Implement clear decision-making rules.

• Empower enhanced accountability.

• Accelerate organic growth through doubling Brenntag’s wallet share.

• Meet growth targets for their new global divisions.

To address these new strategic objectives the GKA leadership team started by re-evaluating their existing key cus tomers to establish and confirm those with the best strategic fit and scope for development. This gave rise to repositioning each key account in one of three categories:

For the Core and Developmental Key Accounts, the role of the GKA Program Leadership, each Key Account Manager (KAM) and their supporting team members were redefined to have a global scope, a new job description, and KPIs.

At the GKA program leadership level, a Senior VP was appoint ed with a VP assigned to lead the Key Account sales organization and five regional VPs to create consistent global processes and procedures.

At the Key Account Manager level, every global customer was assigned:

A global Executive Sales leader

• Regional KAMs

A local KAM in each country where the customer had critical assets

In addition, a Global Commercial Excellence Manager was appointed to develop, implement, and harmonize all the GKA commercial excellence initiatives and execution.

To evaluate, decide upon, and implement the anticipated accel erated growth opportunities and significant contracts, Brenntag created a Board Approval Request team comprised of members from finance, legal, compliance, tax and ESG, plus the Key Account Board member. This team empowered the KAM to lead the process of grow ing their account while giving them direct access to their top manage ment experts when required.

Finally, a Key Account Service Group, developed in North America, was replicated in Europe to help efficiently and effectively respond to Key Account requests. (Herein lies another best practice of identifying and implementing best practices within your own company!)

The outcomes of this new organization included:

• Enabling each KAM to spend much more time on customerfacing development activities.

• Enhanced visualization and measurement of each key account and the entire program via a visual dashboard.

• Creation of more targeted and realistic growth objectives for each Key Account in line with each customer’s strategic direc tion.

The ability to spot and share innovation and best practices. All these changes proved to be incredibly successful and timely, and really distinguished Brenntag in their customers’ point of view. Their ability to respond to their customers’ global supply chain issues, connect them with new suppliers, and create entirely new processes and procedures helped keep their customers’ production lines running globally. Many of their customers swiftly “promoted” Brenntag from being classified as a vendor or preferred supplier to being trusted advisors — the ultimate goal of strategic account management.

Other unanticipated innovations included: Re-imagining their Executive Sponsorship program thanks to a SAMA best practice case, as there were not enough executives to individually cover each key account.

• Leveraging the power of virtually managing a customer to effec tively and efficiently discover and develop new key relationships within each Global Key Account.

• Using Brenntag’s global reach and expertise to identify new sources of supply.

Along the way Brenntag’s key accounts rewarded their “reimagined” 148-year-old supplier with double-digit growth, year over year.

In addition, their Excellence Award submission included examples of glowing, unsolicited thanks from some of their key accounts for taking such good care of them in their time of need.

In terms of lessons learned, Brenntag’s quick pivot from inperson to virtual selling enabled them to implement their new GKA program at triple speed. Who among us could have imagined a threefold improvement in their ability to help their largest and most important customers while working from home?

The final lesson learned is proof that Winston Churchill was right when he quipped, “Never let a good crisis go to waste.”

Customer-excellence research carried out following past cri ses — including the “dot.com” crisis from 2002–2005 and the global financial crisis from 2009–2011 — show that companies like Brenntag, who invest, focus on, and prioritize their customers dur ing a crisis, take significant market share from their competitors who elect to cut costs and ride the crisis out. Brenntag clearly took market share from their customers during the overlapping COVID-19 and supply-chain crises because they dared to invest in their customers during a crisis. It pays to be focused and brave. Could this be how a company lives to become 148 years old?

Congratulations, Brenntag. Well played. Thank you for sharing your amazing story with the SAMA community. May the next 150 years bring you even more success than the past 148 years! n

In November of 2016, I had the privilege of flying to Tampa, Florida, to visit AVI-SPL, a provider of collaboration and audio video technologies. I was there to address the inaugural meeting of AVI-SPL’s SAM team to introduce them to SAMA and share strategic account management best practices.

From that first meeting on, it was evident to all of us at SAMA that AVI-SPL was on a mission to build a great SAM program — period. Not only did they do so, they did it in record time.

Even before our first meeting, their goal was crystal clear: to learn how from the best practices of others. Impressively, AVI-SPL learned so well that they have been creating and implementing new best practices and sharing them with the SAMA community since joining.

For proof of their meteoric rise, look no further than AVI-SPL’s familiar presence at our annual Excellence Awards™. Every year since joining SAMA, they have won an award in a different catego ry, leading up to this year’s coup de grace when their SAM program reached the five-years-in-existence minimum to apply for this prestigious category.

Congratulations to AVI-SPL for being a cowinner of the Outstanding Mature Program of 2022! Read on to learn more about how they did it.

First, let’s look at what they set out to achieve. AVI-SPL said their strategic account management program “was established to drive long-term value through strategic alignment with our most valued global clients.”

Their mission was to establish and maintain a trusted-advisor business partnership that produces mutual innovation, value creation, and measurable outcomes for their global strategic accounts.

To accomplish this, they oriented their program around three core pillars:

1. Creating a customer-centric culture.

2. Delivering on the promise of strategically aligning as a trusted advisor with global strategic accounts.

3. Continually optimizing and scaling in their global delivery model to drive consistent client experience and exceed expec tations worldwide.

With this clarity, focus, and resolve they achieved measureable growth, relationship equity, and strategic engagements with their accounts, leading to increases in sales, profitability, and wallet share expansion far exceeding their industry’s standards. This equates to a 55% growth over projected revenues had they not created a strategic accounts program.

To accomplish their mission, the SAM program leadership team employed a product management philosophy, i.e., they treated their SAM program as a product to offer to an exclusive group of customers who agreed to engage with them in this new way.

Their approach proved so effective that AVI-SPL has expanded their SAM program within their existing customer set and lever aged their SAM program to win new customers with whom they had never done business.

Many of us, myself included, think that you must start as a vendor in the eyes of the customer and toil for years to achieve the privileged status of becoming a trusted advisor in the eyes of the customer. AVI-SPL has shown that it is possible to start as a trusted advisor with a newly acquired customer and stay there.

So, what did AVI-SPL do for their SAM teams to bring to each of their strategic accounts that made their SAM program value proposition so successful?

By programmatically equipping each SAM team with auto mation and centralized processes, they can keep each SAM team and the whole of AVI-SPL’s extended business focused on fulfilling the promise of being a trusted advisor to each customer. This started with in-depth mapping of the customer journey, which then led to identifying key points of friction that negatively impacted the customer, thus causing the SAM team to spend an inordinate amount of time reactively addressing issues instead

of implementing, refining, and improving enhanced customer experiences. This gave the SAM team more time and bandwidth to do things right and look for new opportunities to improve the customer experience — a win-win for everyone involved.

As a result of this focus, here are some specific enhancements that AVI-SPL made to their strategic account approach:

• They added a Global Program Manager role to each SAM team to unify the customer’s experience globally.

• They assigned a single senior engineer to each strategic account who knows the customer’s technology standards and insures they are applied globally on behalf of the customer.

• They created a new analytics dashboard that enables the SAM team and the customer to globally track progress.

It pays to proactively focus on continuous improvement of value creation processes. Giving each customer and SAM team the ability to see what each other is doing improves customer sat isfaction, increases employee satisfaction, and opens the doors to new avenues of value co-creation.

As you contemplate AVI-SPL’s approach, notice how they are getting strong support from their whole company. At this point, you might be wondering how AVI-SPL does this, as getting and sustaining internal alignment for strategic customers is always rated as the biggest obstacle a SAM team has to overcome. The answer is clear. The advancement and growth of their SAM pro gram is truly an organization-wide effort, starting at the very top.

Before the program even launched, it was first proposed by the senior leadership team and sponsored by AVI-SPL’s Board

of Directors. As the program grew, the Board and the entire executive team — includ ing the CEO, COO, CFO, EVP of Technology & Innovation, and EVP of Sales and Marketing — have remained actively involved in support ing the vision, growth, and resource development for the program.

Another new feature of AVI-SPL’s SAM “product” is a Customer Advisory Board (CAB), comprised of senior technology and employee experience leaders from some of the world’s largest companies across multiple industries. This forum allows these leaders to discuss issues like how to prepare for employees’ return to the office, how human behavior has changed as a result of the pandemic, and how will that affect them at work.

Each of their designated Global Accounts is invited to partici pate in this exclusive feature of board members to advise on stra tegic direction, peer-to-peer learning, and community building.

If you want to become a trusted advisor to your strategic account, you must be seen as one from your customer’s C-suite. A CAB approach makes this happen at scale. Unsurprisingly, AVI-SPL recognized this and is making it happen.

The key point to highlight is that the C-suite members don’t just sponsor the program, they personally engage in it. Decisions like funding and sponsoring the new analytics dashboard, add ing centralized engineering resources to their SAM Center of Excellence, and meeting directly with executives at Customer Advisory Boards require executive commitment, buy-in, money, and time. When internal employees see examples and hear stories of executive leadership actively making a difference with their customers, support for the SAM program increases. Everyone wants to play on a winning team.

As for third-party validation, AVI-SPL provided plenty of it from the leadership ranks of their strategic accounts. Several well-known global firms praised them for their efforts to bring the community into consideration with the Customer Advisory Board and cited specific examples of exemplary customer-centric behavior.

“I just wanted to send a quick email to make sure you knew how incredible the support was from your team on our vir tual Annual Stockholder Meeting on Monday,” said one happy

customer. “They executed a flawless meeting for us no matter how complex we made it and how many curve balls we threw their way. We could not have pulled it off without their diligence and dedication. So, a big thank you to you and your entire team for their efforts and support.”

In addition, AVI-SPL hired Forrester Research to help quan tify the total economic impact of the AVI-SPL Digital Workspace Solutions for their strategic customers. Some key findings include:

• Total cost of ownership (TCO) savings of $8.4 million (present value) up 52% from $5.5 million.

• Productivity increase of $12.4 million (present value) up 4% from $11.9 million at program launch.

• Time savings for the average client of 141,500 hours per year because meetings start on time and conference technology is more intuitive (up from 122,500 hours at program launch).

Their impressive list of findings goes on, but you get the idea. With glowing third-party validation like this, it is no wonder that AVI-SPL’s customers and SAMA’s independent judges rated their SAM program so highly.

From launching their SAM program late in 2016 to winning the SAMA Excellence Award in their first year of eligibility, AVISPL’s ascendance has been impressive. Here are some standout examples of lessons they learned:

• Determine how to make the customer impacts of your program tangible.

• Ensure there are key measurements which track your invest ment in building the program. If anyone questions it, you can prove that the true business value/returns are there, and they will not get distracted by the costs.

Continually ask yourself questions like, “How do we make that promise to customers real?” or “How can we give them some thing distinct to point to as a difference maker?”

To sum this point up, AVI-SPL highly recommends “taking the time to understand the product management process and understand how you can implement its principles to develop your program. Doing so will help your team innovate in meaningful ways with your customer as your program grows and matures.”

Achieving excellence in strategic account management is the result of putting the customer at the center of your strategy. Continuously finding new ways to deliver value, and transpar ently and thoroughly quantifying the investment and the return on investment for each customer and the program, as a whole, makes a world of difference. Doing so takes 100% commitment from everyone in your company, including your board. From there, it becomes the gift of growth, innovation, and pride in a job well done. Congratulations, AVI-SPL! We cannot wait to see what you think of next. n

SAMA’s Certified Strategic Account Manager (CSAM) program guides participants through a comprehensive certification journey that assesses competencies, develops skills, enables coaching, and ensures adoption of improved behaviors. SAMA provides a technology tool that was designed to track the inputs of the journey and enables a standardized coaching and assessment process.

For more information, email certification@strategicaccounts.org.

SAMA Competency Assessment & SAM Playbook: Foundational Skills for Driving Superior Customer Results

“Core Four” workshops

Coaching & assessment of mastery of steps 1-4 of SAM process

SAM electives & ongoing account business case project

SAMA assessment & current account business case for SAM certification

SAMA engages with the industry’s top providers of training and uses technology designed specifically for the role of the SAM and the entire SAM process.

Nothing is as constant as change, and stra tegic account management is not exempt from constant evolution. But the last two and a half years of global pandemic and its aftermath have resulted in unprecedented, significant, and last ing change. Supply chain disruption, acceler ated digitization, hybrid customer interactions, and a greater focus on economic value on both the seller and buyer sides are just a few of these developments. Strategic account managers, as guardians of high-value business relationships, have been busy reallocating resources to prove delivery reliability and true partnership in times of crisis. At the same time, many customers were forced (and also had the time) to rethink and adapt their business models and value chains in pursuit of sustainability and competitiveness in the emerging “new normal."

With this in mind, how can strategic account managers continue to cre ate value and growth, both for their company and for their customers? What value should be prioritized; what activities should be practiced? These are questions frequently asked today by executives look ing to future-proof their sales organizations. Five

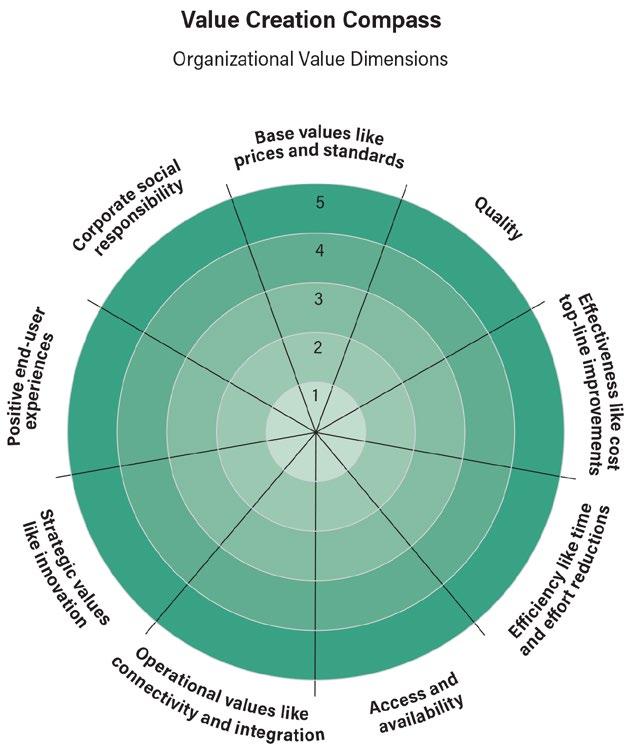

business-to-business companies joined forces in Spring 2021 to explore this shift and find answers to transform their strategic customer management practices. One result of the con sortium's work is the Value Creation Compass.

The “Transforming Sales for Value Creation” research consortium is made up of five Swiss sales organizations from the following compa nies: Elektro-Material (part of the Rexel Group), Lohmann & Rauscher, Mapei, Pistor, and Siga. The companies are active in production and/or sales and all offer customer solutions or product and service combinations that require intensive consulting. Participants include sales directors who lead between 30 and 250 B2B salespeople and strategic account managers.

Through workshops, case analysis, and expert panels, the consortium explored how participating companies should prepare their strategic account management practices and roles for future value creation. The group took an outside-in perspective of value creation. First, they examined potentially relevant value dimen sions in business relationships. This resulted in a differentiated description of the value dimen sions relevant to buying companies and their stakeholders in the decision-making process. Second, the consortium examined activities that promote the creation of such value. Looking at job titles today, many strategic account manag ers are “advisors” or “consultants.” But what

does that mean from a value management perspective? What exactly should a strategic account manager do? Consortium discussions emphasized that value-creation activities go beyond the sales process and encompass the entire customer interac tion. Value creation often occurs after the sale is closed, when something is developed, used, or consumed.

The result of the work of this consortium is the “Value Creation Compass,” which consists of three elements. The first two elements of the compass distinguish potentially relevant value dimensions at both the organizational and individual levels. Simply put: these are the dimensions that should be explored for new value creation in each business relationship. The third element dissects the value creator’s activities in a comprehensive way beyond the point of “closing the deal” in business interactions. It’s a comprehensive description of the activities that have proven essential to creating new value. In this way, the Value Creation Compass serves as a pragmatic tool for businesses and strategic account managers alike to unlock new value in a consistent and repeated manner.

The questions “What value is important to a particular customer?” and “How can we be more business relevant and make the customer more competitive than any other supplier?” are the start ing point for new value creation. The questions are simple and difficult to answer at the same time, and more than one strategic account manager skips over them — subconsciously or consciously —because they supposedly “know what the cus tomer wants and needs.” Therefore, the consortium spent a great deal of time researching and syn thesizing all the potentially relevant dimensions of value, drawing on existing research and analyzing a variety of business relationships.

The example of a medical products company that produces, trades, distributes, and supplies hospitals is emblematic of the shift toward comprehensive value creation. In the past, success was based on a broad product range with high availability and cor responding logistical services to increase efficiency (e.g., digital order connection, goods inspection), naturally at prices in line with the market. This is value-adding, but not substantial and sustainable, as other companies are doing the same. Similarly, key opinion leaders are no longer the decision mak ers and, thus, are the sought-after contacts for strategic account managers. Today, strategic account managers are creating new value by, for example, advising multidisciplinary teams on how to optimize their resource management in specific departments such as intensive care units, and by providing digital tools to help identify and claim lost reimbursements due to errors in cost allocation at the time of patient care.

In total, nine organizational value dimensions were found to be relevant and pronounced at the same time. These include “hygiene” factors such as prices, standards, and quality. More farreaching value dimensions relate to effectiveness (e.g., optimizing the customer’s cost base or improving revenues) and efficiency with, for example, time and effort reduction on the customer side. Access and availability will continue to play a central role as there is no end in sight to supply chain disruptions due to ongoing health and political crises. In the context of digitalization and com plex, intertwined production and supply processes, operational values such as connectivity and integration are gaining impor tance. Collaborative innovation is undoubtedly a strategic value for customers who focus on their core competencies and expect their suppliers to fill the gap. The last two dimensions of value reflect the importance placed on end-user experience, because if the customer’s customers are satisfied and stay satisfied, the

business relationship benefits as well. Corporate social responsibility has been promoted through ESG, which is considered in the decision-making of buyers, end users, and investors alike.

Should strategic account managers track all dimensions of value for a given business relation ship? The answer based on the work of the con sortium is no, because not every dimension may be relevant to the customer or desirable from the supplier’s perspective. However, the consortium's findings suggest that at least three relevant dimen sions — ideally higher-level dimensions — should be identified and explored in any high-value business relationship. The higher-level value dimensions form the basis for significant relevance and competitive differentiation.

It is widely known and accepted that people buy, not organizations. Concepts such as decision-making units and stakeholder management are applied by strategic account managers to better understand and influence decision-making and buying processes. Interestingly, the tactics derived from these are about personal relationships and relationship management. The consortium wanted to dig deeper to explore potentially relevant individual value drivers. Implicitly or explic itly, individuals ask the question, “What’s in it for me?” Business relationships and consortium member cases were analyzed to understand the motivations and individual value dimensions that influence decision making. The results are both intuitive and surprising. They are surprising because strategic account man agers were not aware of the many dimensions they can use in face-to-face interactions, not to charm or persuade, but to create relevant individual value in addition to business value. This applies not only to stakeholders on the buy side, but also to individuals within their own company, as the following example shows. In one company, the strategic account managers had been trying to build bridges to their research and development department for some time. They lacked priority lab resources and timely access to commercially relevant expertise. The turning point came when the chief technology officer was invited to strategic account advi sory boards, which proved to be important personal networking and branding opportunities for him.