EXPANDING HORIZONS

A New Era of Strategic Partnerships

Change Behavior. Change Results.

Whetstone changes behavior, and our method is significantly stickier than other approaches. Fortune 500 companies and mid-to-large companies see change within 30 days. They gain immediate benefits and ROI because we provide a pragmatic step-by-step roadmap based on 25 years’ experience and thought leadership.

The end result is substantially larger deals, faster sales cycles, and greater profitability.

Helping salespeople think like businesspeople.

Publisher:

Editor-in-Chief:

Creative

Advertising: Ashley

VELOCIT Y ®

The Strategic Account Management Association is a global knowledge-sharing and networking organization devoted to developing, promoting, and advancing strategic customer-supplier

collaboration, and learning. No part of this publication may be reproduced or transmitted in any form or by any means without written permission. Copyright © 2024 by the Strategic Account

Management Association (SAMA). The SAMA ® logo is a registered trademark of the Strategic Account Management Association.

Velocity ® is published three times a year. The annual subscription rate is $65. For membership information or to join SAMA, contact Chris Jensen at 312-2513131 x10 or jensen@strategicaccounts.org Changes of address, suggested

ABM Industries Inc.

Advanced Industrial Devices

Agilent

Airbus Defence and Space

Air Liquide

Alnylam Pharmaceuticals

Amgen Canada

Arcadis

Astellas Pharma Inc.

AVI-SPL

Axis Communications Inc.

Bayer AG

Bellevue University

bioMérieux

Black & Veatch

Blue Cross Blue Shield of North Dakota

Boehringer Ingelheim

Brenntag Specialties Inc

Carlisle Construction Materials

CAS

Ceva Santé Animale

CH Robinson

Cisco Systems, Inc.

Clarios

CPC Worldwide

Danaher Companies

Day & Zimmermann

DHL

Donaldson Company, Inc.

Ecolab

Eisai, Inc.

Elanco Animal Health

Endress + Hauser

Exact Sciences

Expeditors International

Formerra

GE Healthcare

Genmab US, Inc.

Geotab Inc.

Greene, Tweed & Co.

GSK

Hilton Worldwide

Hovione

Hyatt

IDEXX Laboratories, Inc.

John Deere

Johnson & Johnson

Lilly USA, LLC.

LP Building Solutions

Lubrizol

Medtronic

Merck/MSD

Michelin

New York Power Authority Inc.

Nilfisk

Novelis Inc.

Novo Nordisk Inc.

O-I

Optum Inc

Otsuka America Pharmaceutical, Inc

Owens Corning

Pfizer, Inc.

Philips

Premier Inc.

Pure Storage

Saint-Gobain

Sanofi Vaccines

Siemens

Solecta, Inc.

Solenis

Sonoco

Southworth Products Corporation

supplyFORCE

Terumo Europe N.V.

The AAK Group

The Sherwin-Williams Company

TreviPay

TÜV SÜD

UL Solutions

Valneva

Veolia WTS USA Inc

Viatris

Wajax Corporation

West Pharmaceutical Services, Inc.

Xylem Inc.

Zoetis

Zurich Insurance Group

SAMA BOARD OF DIRECTORS

Dr. Michael Ahearne

Professor of Marketing and C.T. Bauer Chair, Bauer College of Business, EMEA University of Houston

Steve Andersen President and Founder PMI

Stephen Anderson SVP & General Manager, F&B Ecolab

Dino Bertani

Executive Director, International Strategic Account Management AbbVie

Anju Birdy Vice President, Strategic Account Management Excellence Schneider Electric

Noel Capon

R.C. Kopf Professor of International Marketing Columbia Business School

Ron Davis

Executive Vice President, Head of Customer Management Zurich Insurance Group

*John F. Gardner Retired - President, Global Strategic Accounts Emerson Automation Solutions

Tom Derry CEO Institute for Supply Management

Jim Ford Chief Executive Officer Solecta, Inc. Chairman of the SAMA Board

Gordon Galzerano President and CEO SAMA

Eric Gantier

President, Global Engineering, Manufacturing & Energy DHL Customer Solutions and Innovation (CSI)

Denise Juliano

Group Vice President, Life Sciences Premier Inc.

Renae Leary Chief Commercial Officer –Americas Ansell

Mike Moorman Managing Principal, Sales Solutions ZS

Shawn Parker Executive Director, Strategic Account Management & Corporate Group Sales Hilton

Namita Powers Principal ZS Associates

Dr. Hajo Rapp SVP, Strategic Account Management & Sales Excellence

TÜV SÜD AG

Jennifer Stanley Partner McKinsey & Company

Sara Theis Program Manager, Regional Growth Americas Owens Corning

Max Walker Director, Strategic Account Management EMEA Medtronic

*Rosemary Heneghan Retired - Director, International Sales & Operations, Worldwide IBM

*Distinguished Board Advisors (lifetime contributors; non-voting members)

SPECIAL THANKS TO SAMA’S PROVIDERS

*Dr. Kaj Storbacka Retired - Hanken Foundation Professor Hanken School of Economics

Publisher: Gordon Galzerano

Editor-in-Chief: Nic Halverson

Editor: Harvey Dunham

Creative Director: Aimee Waddell

Advertising: Ashley Davis

Interim President & CEO: Gordon Galzerano

Finance/Operations/Meetings

Director of Finance, Meetings and Operations: Fran Schwartz

Senior Manager, Meetings and Events & Individual

Member Liaison: Rhodonna Espinosa

Finance Manager: Christina Ponstein

Creative Director: Aimee Waddell

Salesforce Administrator/IT Manager: Erin Pallesen

Registration Associate: Tessa Fahey

Customer Success

Director, Customer Success & Business Development: Christopher Jensen

Senior Manager, Customer Success: Michael Johnson

Senior Manager, Customer Success: Lisa Maggiore

Customer Success Manager: Michelle Ward

Customer Success Manager: Brad Maloney

Knowledge, Certification & Training

Director, Knowledge, Certification & Training: Libby Souder

Assistant Director, Knowledge & Training: David Schweizer

Assistant Director, Certification & Training: Stephanie Fahey

Knowledge, Training & Certification Coordinator: Steven Allen

Research

Research Manager & Customer Experience: Joel Schaafsma

Strategy, Marketing, & Communications

Managing Director, Strategy and Marketing: Harvey Dunham

Editor-in-Chief: Nic Halverson

Marketing Manager & Sponsorship: Ashley Davis

Join the conversation with SAMA on LinkedIn at www.linkedin.com/company/strategic-account-management-association Follow SAMA on X at www.twitter.com/samatweet

SAMA 2024 EVENTS

SAMA Academy Online 2024 January-December SAMA 2024 Pan-European Conference October 9-10

Vienna, Austria Imperial Riding School, Autograph Collection ABM Academy: Next Generation Account-Based Marketing Customer-Led, Team-Enabled November 13-14 Live online SAMA Academy Online 2025 January-December SAMA 2025 Annual Conference May 19-21 Orlando, Florida

SAVE THE DATE

Marriott Orlando, Grande Lakes SAMA 2026 Annual Conference May 18-20 Phoenix, Arizona Arizona Biltmore Hotel

EDITOR’S CORNER

Nic Halverson Editor-in-Chief

Strategic Account Management Association (SAMA)

Over the summer, I spent a couple weeks in the mountains of Colorado — hiking, fly fishing, and marveling at the rugged, breathtaking landscape. But what mesmerized me the most were the aspens and their leaves quaking in the breeze.

Aspen trees are known for their remarkable underground root systems, which connect vast groves into a single living organism. This interconnected network allows the aspen grove to share water and nutrients, helping the trees collectively withstand environmental stress. Much like an aspen grove, SAMA’s global network unites a community of practitioners who share resources and insights to help one another thrive in a dynamic environment.

With that in mind, we kick off this issue of Velocity with an in-depth interview with SAMA’s new President & CEO, Gordon Galzerano, as he reflects on our own interconnected community in “Leveraging SAMA’s Ecosystem to Navigate the Future.” So, get ready, lace up your boots, and join us on this exciting path to discover where SAMA is heading next.

Ahead on the trail, you’ll find profiles of 2024 SAMA Excellence Award winners — Zurich Insurance Group and Bellevue University — that really capture the art (and success) of what’s possible when organizations leverage SAMA’s ecosystem. Bellevue’s “From Underdog to Top Dog” is particularly inspiring, as it demonstrates how strategic account management can be applied to almost any industry. “Being the only SAMA education organization to date makes us both a valuable resource to others and an experiential pioneer to those institutions considering utilizing SAM,” writes

Liz Pettinger, Director of Key Account Management and Operations at Bellevue University.

In recent years, one of the biggest stressors in our SAM community has been the disruption of global supply chains. Thankfully, DHL’s report on “Supply Chain Diversification” shares perspectives and frameworks for strategic supply chain reconfiguration to help alleviate that stress and discover new solutions.

Next, walk alongside Martyn Lewis, Principal and Founder at Market-Partners Inc., in “New Trends in Buyer Behavior” as he “delves into these changes [of] what buyers want, and how account managers can adapt to meet these evolving expectations.” As an expert guide, Lewis will help you see what’s around the bend.

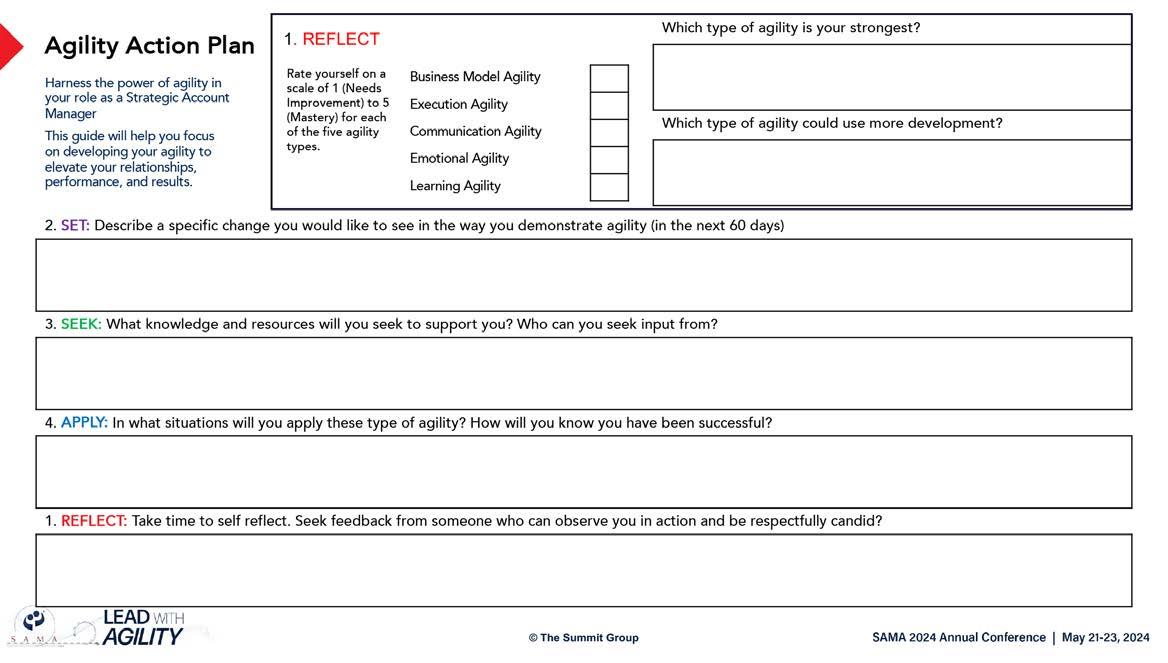

The aspen’s unique and agile leaf stalks allow the leaves to tremble in the breeze, a physiological benefit that promotes air circulation, optimizes photosynthesis, and prevents overheating. Likewise, being agile in a strategic account management environment shares similar operational benefits — and Shakeel Bharmal, Senior Vice President at The Summit Group, will tell you all about it in his piece, “Mastering Agility in Strategic Account Management: Thriving in Times of Uncertainty.”

But before your start your journey with these articles, be sure to stop at the trailhead and check out our mountainous Data Watch section, courtesy of LinkedIn member profile data. Here, you’ll find captivating statistics that convincingly underscore the value of SAM and prove that those who tread on the path of strategic account management are a few steps ahead of others on the trail. n

HUMAN-CENTRIC LEADERSHIP: THE INSIDE-OUT JOURNEY

When it comes mastering executive skills, most CEOs check all the right boxes. Experienced leaders — check. Fluent in strategic and operational management — check. A history of financial expertise — check.

But according to “The Journey of Leadership: How CEOs Learn to Lead from the Inside Out,” a new book by McKinsey authors Dana Maor, Hans-Werner Kaas, Kurt Strovink, and Ramesh Srinivasan, there is one major box that often remains unchecked, leading to disconnect between leaders and their organizations.

“After a careful analysis of what was holding back these otherwise talented executives, we concluded that on a deep psychological level they were not reflecting enough about how to become a more human-centric leader who is able to connect authentically with themselves and their teams,” the authors write in a recently published excerpt

It’s tempting for leaders to immediately focus on the pieces at play on the corporate chessboard and the strategy of their next move. However, to truly make a lasting impact with teams and the broader organization, the authors advise CEOs to, first, lead from the “inside out.” But what does that mean?

“This inside-out journey is nuanced and complex. It calls for personal growth, which means you must constantly be learning,

listening, inspiring, and caring,” they write. “Leadership is not only about those seemingly endless business-related tasks you need to take care of when you’re an effective CEO. It’s just as important to be aware of who you are, and what your shortcomings are, so that you can first change yourself and then lead others.”

For over ten years, the authors worked with more than 500 CEOs, including many leaders of Fortune Global 500 corporations. “We’ve discovered that leaders have no trouble defining or acquiring the logical, tangible skills of leadership,” they write. “However, when we asked how they can use these hard skills along with soft skills — being more self-aware, humble, vulnerable, resilient, confident, and balanced — they are less sure.”

By no means do the authors suggest that leaders abandon their practical and pragmatic competencies — it’s about maintaining a balance between the hard and soft skills. And those that do reap more than just elevating themselves as an authentic leader.

“According to a McKinsey Global Institute study of 1,800 large companies across sectors in 15 countries, businesses that focused on human capital development in addition to financial performance were roughly 1.5 times more likely than the average company to remain high performers over time and have about half the earnings volatility,” they write.

The authors remind us that the business world has changed dramatically in recent years, moving away from the era when

QUICK TAKES

powerful, imperial CEOs were idolized. Today’s leaders face a complex and fast-changing environment where it’s impossible for any one person to have all the answers. Modern CEOs serve as the central point for navigating various business tensions, from balancing short-term and long-term goals to aligning social purpose with financial performance.

“It is therefore imperative for leaders to develop the inner resources to navigate the demands of their many stakeholders in a fast-changing world,” the authors write. “When leaders work on their resilience, empathy, humility, versatility, and authenticity, they are pursuing that inside-out personal growth that leads to human leadership.”

The book includes many personal success stories, including:

• The president of a media company who cultivated “truth tellers” at every level of the organization.

• The head of a pharmaceutical company who used a deep learning technique to predict the severity of the COVID-19 pandemic, which gave his company a jump on producing a new vaccine.

• An admiral, leading US special-operations forces, who trained his teams to respond to changes in the terrain rather than stick to a preconceived plan.

• The head of a major hospital who succeeded in leading his employees by connecting with them on an emotional level.

• The CEO of a global automotive company who took the time

to learn more about his top executives — their life stories and personal issues — before coaching them.

Most importantly, the book offers more than just insights and anecdotes. Each chapter concludes with a practical workbook for the reader to complete.

“Our hope was that this book would be not only a story or a collection of stories but also a journey that allows you, as an individual, to take yourself through that journey, if you chose to do that,” Dana Maor said in a recent interview. “You can do that chapter by chapter, or you can take on the full framework.”

Ramesh Srinivasan agrees: “Our hope is that this book and the process that we’ve described, as well as some of the micropractices in the appendix of the book, can help leaders construct their own process for self-reflection, leading themselves and their teams, and ultimately having impact in whatever context that they’re in in the world.” n

Adapted from “The ‘inside out’ leadership journey: How personal growth creates the path to success,” by Dana Maor, Hans-Werner Kaas, Kurt Strovink, and Ramesh Srinivasan, McKinsey & Company, June 17, 2024. https://mck.co/4c2X26N

We train over 20,000 people each year. In over 50 countries and in 20 languages.

LINKEDIN DATA SHOWS STRATEGIC ACCOUNT MANAGEMENT IS ON

THE RISE

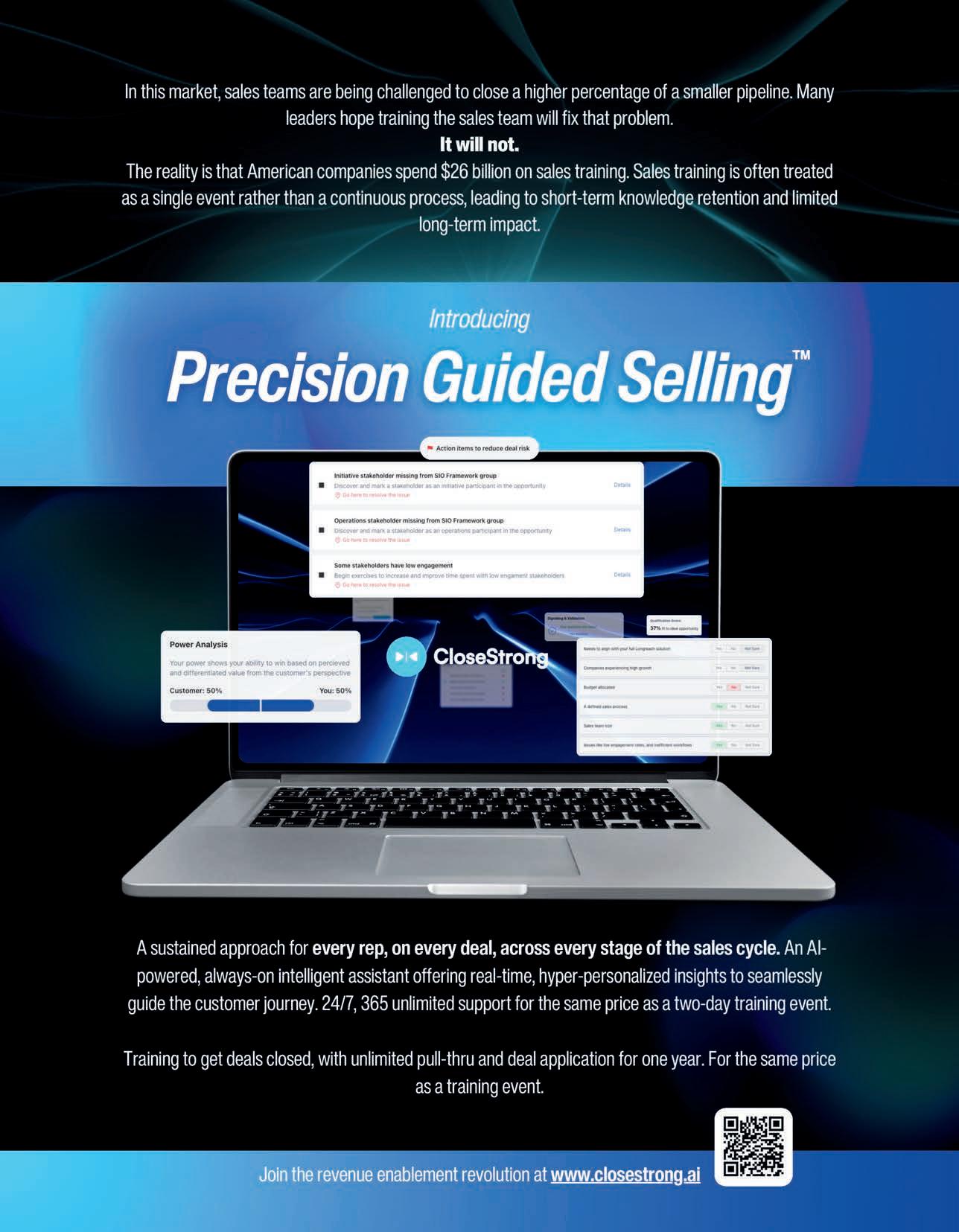

Strategic account management as a profession, and the role of the strategic account manager, has proven to be resilient, even in uncertain times — and here is the evidence why. At the 2024 SAMA Annual Conference, LinkedIn presented compelling data on strategic account management, both globally and in North America. This data, derived from LinkedIn users, convincingly underscores the value of investing in SAM through three key points, showing that SAM:

• Served customers who were among the most resilient through the economic cycle.

• Grew as a global profession across diverse industries.

• Continued its transition as an analytic and consultative profession.

33% more connections

Overview of strategic account managers (SAMs) in North America

100K+

Strategic account managers in North America (2024)

+4%

Increase in SAMs year over year

Strategic account managers are actively engaging on LinkedIn

What do SAMs do on LinkedIn?

56% more companies followed

*Note: Comparison to all sellers in U.S. and Canada

Despite the economic slump — inflation, rising interest rates, and disrupted supply chains — strategic accounts have increased globally in companies with 10K+ employees.

8% more likely to work with other professionals

27K+ Organizations employing SAMs across North America

↑ 46% more monthly visits

Strategic accounts have grown by 7% in the U.S. and Canada

This held true even for global companies with 5K+ employees Albeit at a modestly slower pace in the U.S. and Canada

Concurrently, SAMs have seen growth globally — and in the U.S. and Canada

Number of strategic account managers in U.S. and Canada

Change in skills rank among strategic account managers over the last four years

The skills of strategic account managers have changed. Analysis of the profiles of over 100K+ strategic account managers over the last four years shows an increasing rank of importance of people skills and analytical skills.

While manufacturing, tech, and professional services have the greatest number of SAMs in North America, we are seeing rapid growth in construction, education, and consumer services industries as well.

LEVERAGING SAMA’S ECOSYSTEM TO NAVIGATE THE FUTURE

In conversation with SAMA’s President and CEO, Gordon Galzerano, on the state of strategic account management and the drive to embrace emerging trends, enhance member support, and maximize customer-centricity.

What is your vision for the future of strategic account management over the next three to five years?

If I think about how I view the vision, direction, and future for strategic account management over the next three to five years, I think we have to look back at the last three to five years. The coronavirus created the most amazing level of disruption — not only across industries, but across the globe.

And that has forced businesses to think and act differently — in support of how they go to market in the future,

how they mitigate the risk in the event of another pandemic or global event that disrupts their organizations, their businesses, and their customers and partners. It’s an incredible use case, unfortunately, but it has really helped organizations think and act differently in a useful way.

So, tomorrow is going to be all about the level of importance to cultivate and maintain long-term, beneficial relationships with those strategic customers, in order to drive growth, profitability, and customer satisfaction not only for our organizations, but also through the lens of our customers.

How do they drive profitable growth? How do they help manage and reduce cost in their businesses? And most importantly, how do they mitigate risk? Risk to their supply chains, risk of cyberattacks, and other episodes that all organizations are thinking about today in the spirit of how they manage the business going forward.

What key trends do you foresee impacting SAM, and how should organizations adapt to these changes?

Through the lens of industry trends, what organizations must think about is how they take more of a customerspecific approach to how they engage with their most strategic customers. In other words, personalization is no longer going to be an option. It’s going to become the norm versus one size fits all.

To do that, we have to understand the customers better: the industries that they’re in, the customers that they serve, and therefore, with that empathy and understanding, we can start to tailor what we do as organizations toward the things that they care about most.

When I say that, I’m talking about the member companies at SAMA and those strategic customers that they serve, and recognizing how they have to flex and be agile in support of those customers. That’s a really “big rock” industry trend that I think is important.

Second, there’s a greater emphasis on digitization and technology that’s going to become increasingly pervasive — how automation is going to replace a lot of what is manual today, and how automation and technology will enable organizations to better understand their customer behavior. Therefore, they can respond to it in a personalized way and hopefully upsell and cross-sell new services in support of what they’re trying to achieve.

The other big trend that’s happening is this dependency on strategic alliances and partnerships. Why that's important — going back to the pandemic for a moment — is because supply chains were disrupted. Organizations, in terms of talent and how they acquired, developed, and retained talent, were disrupted. Resources across their entire ecosystem were disrupted.

What organizations are viewing now as a competitive differentiator is leveraging the capabilities of others. And to do that, it’s about formulating strategic alliances and partnerships.

Gordon Galzerano President and CEO, SAMA

One other piece that I would point out is this focus on global and multinational engagement. So, if you think about strategic accounts, they generally are national, multinational, and global in scope. What those strategic customers expect is that when they do business with ABC company, the experience is seamless and it’s consistent around the world. That’s not to say that they don’t understand that terms and conditions are going to be different, but they recognize that it’s a single point of accountability — that the engagement is consistent and the expectations, therefore, are consistent.

So, if I were to come full circle, three things: First, greater emphasis on technology and data-driven insight because there’s going to be a greater emphasis on digitization and technology.

Second, I think the strategic account management function and the SAM as an individual will become more specialized and focused on delivering customized solutions because the needs of customers are unique and differentiated, based on the individual organization. And of course it’s going to involve greater collaboration across teams. I want to come back to that because it’s a really, really important point.

The third piece is that SAM is becoming more global in nature. It’s focusing across borders and time zones. It’s requiring a greater understanding of cultural differences, plus the ability to navigate complex, international business environments.

When we think about the vision for SAM and we think about what good looks like, the organizations that are doing

this well as part of the SAMA ecosystem, whether these are practitioners, consultants, or partners in our community… the ones that have figured it out have cracked the code on the importance of what I call the SAM functional ecosystem within their own company — the organization functions that directly impact strategic account management.

All too often today, the strategic account management strategy sits in sales operations, or maybe it sits in marketing, or maybe it sits in some other function. But what’s unique is when that organization is well-aligned and ingrained and embedded in the other functions that directly or indirectly influence SAM, for example, sales, marketing, customer success, which is a big one because that usually is a profit center for most organizations, because they’re selling services and renewals and repeatable annuity type programs — services in support of the product function.

Speaking of which, you’ve got the product development teams, you’ve got the operations and logistics, and the most important part of this is executive leadership — not just from a pure sponsorship perspective, but also from an engagement perspective. When those functions participate, when they have aligned priorities, KPIs, outcomes, that is the secret sauce to where strategic account management is going and how those industry trends are capitalized.

How do you see SAMA’s role evolving to better support its members in the rapidly changing business landscape?

The good news is, SAMA — our role — we sit at the epicenter of all of this. Based on the ecosystem that we have developed, we can show our members what good looks like. We can leverage our ecosystem of partners, practitioners, consultants, and our community to help them engage with the right people around the right frameworks and structures at the right time to capitalize on the opportunities that are in front of them.

I think it’s a really important point to say this: the customers that organizations would say are the logos that are most strategic to their business, whether that’s in the automotive industry, financial services, manufacturing, or fill in the blank…it’s pretty obvious that those same strategic accounts are going to show up on their competitor’s radar. They’re chasing after, they are engaging with the same clients. What they’re struggling with is, how do I differentiate? How do I create a value proposition? How do I engage differently? How do I mitigate the risk of my competitors creeping into

my space and into my clients?

And that is where SAMA can play a critically important role to help them build and execute the strategies to do exactly that. And I think that speaks volumes to our value proposition and where we’re trying to take the organization.

What specific strategies do you believe SAMA should implement to help its members achieve their successes in SAM?

I think what our members are really craving is the ability to share knowledge and best practices and by leveraging that ecosystem of SAMA to do exactly that.

But I think there’s also another dimension. The other dimension is for SAMA to shape communities of interest and communities of practice around those critically important functions to SAM, for example, marketing or customer success.

In talking to our member community, it’s becoming crystal clear that what they’re looking for is that knowledgesharing capability with their peers at the table. They want the opportunity, even if there are competitors in the room, the opportunity to share best practices, to share knowledge, to share lessons learned because the things that they’re chasing are in common. They’re not going to divulge any IP by being in the room together. Instead, they’re taking some of those innovative concepts, ideas, and lessons learned and shaping them in support of what they’re trying to do.

A big part of what we’re talking about, relative to knowledge sharing and best practices, is looking at that through a more functional lens, like marketing, customer success, et cetera.

As a unique differentiator and value to our members, the more SAMA can create structured networking opportunities and communities of interest in practice, that is a dynamic, agile, and flexible capability that we need to build — and should.

In service of our members, as the markets shift, as disruption occurs, they need to think about new ways to engage with their most strategic customers. I think SAMA, because of our ecosystem, can play a very valuable role there.

Another thing that they’re looking for in a role that SAMA can play is around industry insights and trends — for us to help them look around corners in anticipation of what’s coming next. Help them understand: Where are the risks of being disrupted? Where are the value opportunities to create

competitive differentiation? And so, the more we can foster that, the greater value that we can provide.

And make no mistake, our training and development and enablement capabilities, our world-class certifications, our training programs around the seven-step process at SAMA — all of these are plays that they can run today in support of enhancing their skills and capabilities…but also frameworks, processes, and plays that they can run in support of their strategic customers to create the stickiness that they’re looking for.

What new skills and competencies will be crucial for SAM professionals to develop, and how can SAMA facilitate this development?

Because of the level of digitization and technology now becoming pervasive in all businesses, and how AI and machine learning are able to use data to predict and model what good looks like in their environment to shape and understand customer behavior and capitalize on that in anticipation of how they could change customer behavior and/or upsell and cross-sell, the most crucial skills and capabilities are going to center around data analysis and interpretation.

Strategic account managers are going to need to be proficient in analyzing and interpreting large volumes of data to identify not only trends and patterns, but insights to drive strategic decisions with their customer. Either they’re going to do it, or the organization is going to have to invest in the skills and capabilities in others to do it, in service of the SAM.

To do that, there has to be an increased level of technology proficiency as it continues to advance. SAMs will need to be proficient in leveraging all different types of technology platforms and tools to manage customer relationships. But also to track performance metrics of their clients and collaborate with the cross-functional teams that are really, really important — to be able to look at those trend lines around customer behavior, but then also uncover and discover what those new selling opportunities might be.

Another crucial skill or competency centers around strategic thinking and problem solving. The most strategic customers are the ones that are generally complex. They’re looking for personalization versus one size fits all. They’re looking for unique differentiation from you as a vendor or trusted advisor. That strategic thinking and problem-solving skill set is something that they expect. They want SAMs

to possess strong strategic thinking and problem-solving skills to anticipate what their needs are. Not just their needs today, but as I was saying earlier, help customers look around corners in anticipation of what’s next. To help them identify opportunities for growth. And most importantly, address the challenges that they face. Effectively, that’s going to be a very big differentiator.

Because the business environment now is moving at such an accelerated pace, change management and agility is a huge competitive advantage in organizations — having the right people and the SAMs, in particular, being adaptable and agile in responding to what the market dynamics are reflecting, what customer demands are today, how those are changing, and the competitive pressure that they face to differentiate and continue to look for new streams of value.

And I think the last piece that’s critically important — and it’s not necessarily a new skill and capability, but it is by far one that customers expect of their SAMs — is effective communication and negotiation skills. It’s critical to SAMs to be able to convey value propositions and how the solution or the outcome is going to be impacted by us, for and in service of the customers that they serve.

And the ability to resolve conflicts, not just internally to their own organizations, but also within the customer organizations where they’re generally siloed. Is there an opportunity for the SAM and the team to be able to help break some of those barriers and silos? To share what the left hand is doing, because the right hand doesn’t understand what’s going on because the customer organization is siloed.

How do you see technology influencing SAM practices, and what role should SAMA play in helping members leverage new technologies?

The level of emphasis that’s being placed now on companies moving from analog to digitized environments and using technology to now use and extract that data to do things like predictive modeling, etc. — this is now a big part of how organizations are investing and how they’re thinking about their business to ensure that they’re mitigating the risk of disruption.

So if you think about the overarching question of how technology is going to enhance — let’s call it strategic account management and the processes — it’s because technology is going to provide access to things like real-time data, improving efficiency based on the processes that now

It’s critical to SAMs to be able to convey value propositions and how the solution or the outcome is going to be impacted by us, for and in service of the customers that they serve.

have been digitized. Enabling customer expectations around personalization — technology is going to be an enabler to do that.

I think another big piece is the ability to foster better collaboration, which will ultimately drive greater value for both the strategic account managers and their strategic customers that they serve. So, when we talk about things like alignment, buy-in, and cross-functional collaboration inside of the company, technology is a clear enabler to do that.

If I think about it in the context of SAMA, and then align that to where technology is going and how it’s influencing SAM practices, I’m going to bundle these two concepts together. One is, what are they? And then how is SAMA going to respond to it? Data analytics and insights are absolutely critical, because now the SAMs have access to so much information.

And how do we analyze that data? How do we provide insights into customer behavior, their preferences, and their opportunities? That data-driven approach is going to help SAMs understand customer needs and tailor those strategies to meet them.

When we think about AI and predictive analytics, it’s a big part of what we’re talking about: to be able to forecast that behavior, to be able to identify risks and opportunities and automate routine tasks that SAMs have to do today — to give them time back to be more highly productive.

The rise of collaboration and communication tools: we’re seeing it already, post-COVID, how organizations have

moved to either exclusively a virtual or a hybrid working environment — using collaboration technology as an enabler, along with other communication tools to make that happen. That’s becoming the new norm, how technology has enabled that.

When we think about the personalization and targeting — advanced technology such as machine learning and marketing automation, in particular — that’s going to help create that personalized, targeted communication and offerings for key accounts based on their specific needs and behaviors.

The good news is, when we think about the SAMA ecosystem today — our partners, our practitioners, our consultants — we are currently leveraging some of the bestin-class organizations to do the things we just talked about, relative to technology. And wherever we might see a gap, today or based on the trends of SAM, we need to partner with other organizations around these types of capabilities. We’re going to do exactly that. This is a necessary part of our ecosystem. And based on how technology is becoming increasingly pervasive, our member organizations need this to understand how next-gen SAM is going to evolve, and technology is going to be at the center of that.

With the increasing globalization of business, what steps should SAMA take to support its members in managing international strategic accounts?

Without question, globalization has significantly impacted how organizations are engaging with their global strategic customers. I think there are three areas that have become very profound.

The first of which: globalization has really created this dynamic where competition has increased in the market and has forced organizations to focus on building strong relationships with their global strategic customers in order to retain their business and ensure the long-term success.

The organizations that have figured it out have created a customer experience that is consistent, globally. As I said, terms and conditions based on buying programs and local tax laws will disrupt part of that, but as a whole, what

customers expect is that the experience they have in doing business with ABC company is consistent around the world.

The second is having a cultural understanding or empathy. Organizations are now operating in a very, very diverse cultural environment. To engage effectively, organizations are going to have to have a deeper understanding of the cultural nuances and preferences of their customers in different regions. And so that continues to be a competitive differentiator. With empathy and understanding comes relationships and an ability to respond to the needs of customers.

And then third, kind of tied into that, globalization has brought about a need for effective communication across different languages and time zones. Organizations need to invest in the technology and skills that enable them to communicate and engage with their global strategic customers in a seamless manner.

Those three factors from increases in globalization, how they’re influencing business, I think SAMA can play a role in a couple of different areas. When we think about what customer experience looks like globally, in a large multinational or global company, this is where the SAMA ecosystem comes into play — through our practitioners/organizations that have been there, done that.

The partner and consulting community that understands how to build and execute against a global strategy, to ensure customer experience is consistent — SAMA is at the center of access to those relationships, those partnerships, those alliances.

And then I think there’s another piece to this, which is SAMA’s presence in regions around the world, like Europe and Asia Pacific. I think the shorter-term play is our ability to build up our ecosystem in Europe, which is comprised of member organizations, partners, practitioners, and others. The longer-term play will be in Asia, because it’s evident that that’s a high-growth area for most organizations, and particularly the IT industry. Therefore, I think there’s a role for SAMA in play there as well.

What types of partnerships or collaborations should SAMA pursue to enhance its offerings and value to members?

Partnerships will continue to be a core part of our strategy. As we talk about the trends in strategic account management, as we talk about the vision, and what the next three to five years look like as we discuss the complexities in business

now, and this concept of disrupt or be disrupted — this change is happening at an accelerated pace. And therefore, SAMA needs to continue to focus on what next-generation partnerships look like.

How does that ecosystem of SAMA continue to build and evolve based on technology trends, based on priorities around personalization, based on sustainability and corporate social responsibilities?

SAMA plays an important role in building the partnerships, based on the future of strategic account management and ensuring that our member community understands who they are and how to engage.

That can be through a couple of different lenses. One lens, of course, is in business and when you double-click into specific vertical industries. The other lens is the academic community. They’re doing a tremendous amount of great work around SAM, the future of SAM, how selling is becoming disrupted and more automated, et cetera, et cetera. We will continue to look for new partnerships while continuing to nurture the ones that we have because it will absolutely enhance our offerings. And it will absolutely enhance our value to our members.

How can SAMA improve member engagement and ensure that its resources and programs meet the evolving needs of SAM professionals?

To me, SAMA should be a best-in-class use case for strategic account management. In other words, part of my vision for SAMA over the next three years is that we put in place the processes and the capabilities to do exactly that, so SAMA becomes a use case for strategic account management.

Just as we’re talking about personalization and the expectations of companies, the greater emphasis on digitization and technology, strategic alliances and partnerships, crossfunctional alignment, collaboration, value-based selling — we will continue to level up what we do and how we do it, both in terms of how we engage and where we engage.

For example, just as I was saying earlier, that the functions of sales, marketing, customer success, etc. are critical to the success of strategic account management — SAMA will be putting greater emphasis on those member organizations that we work with today, and go deeper and wider into those functions because of the direct and sometimes indirect relationship they need to have in support of SAM and the strategic customers that they serve.

SAMA plays an important role in building the partnerships, based on the future of strategic account management and ensuring that our member community understands who they are and how to engage.

When we think about personalization of the experience, when we talk about fostering a sense of community, all of these practices will be embedded in how we engage with our members and how we promote aspects of our portfolio and the capabilities of our partners to ensure that, number one, they are aware. Number two, they understand how to consume. And number three, they have access — access to us, access to our resource library, and other capabilities that we have so that they can respond to the needs of their business.

And so that member engagement needs to be easy. It needs to be effective, and at the end of the day, it needs to be scalable and repeatable.

What metrics or indicators should SAMA use to measure its impact and success in supporting its members and advancing the field of SAM?

If I think about measuring impact of SAMA, one of the key performance indicators that I’m looking at is what degree are we engaging and participating with our members.

How are we looking at aspects of how our business development and customer success teams engage? Who they engage with? What are they engaging about? And with what frequency is that going to have an impact? How they’re connecting with our members virtually, through podcasts and other resources; how our members are consuming the capabilities and the portfolio of offerings that we have. Then, I’ll look at attendance for our big-tent events, like the SAMA Annual Conference in the US or the Pan-European Conference.

When I think about engagement and participation, I’m looking at it from two dimensions. The first dimension is how we, SAMA, engage in a regular and consistent valuecentric way with our members. Second is their participation, virtually, with us relative to how often they are accessing our content, our information, our resource library, how often they’re participating in our in-person and face-to-face conferences and events. Those are the types of things that we will continue to look at.

We will also, as part of that, look then at program and event effectiveness. We’re always going to look at new ways to innovate and create new values. So, we need to assess the success of our programs, our events, our educational offerings, and we’ll look at what participants are saying.

We’ll look at the achievement of those learning objectives, relative to things like educational offerings. And I think the other piece that’s really important here is our impact on our members’ professional development. The first thing I think about is our CSAM program and the opportunity for that to be the industry standard.

The certification around strategic account management is a competitive differentiator: so, when sellers or marketers or others have that badge of honor, their customers recognize that as a competitive differentiator and someone who truly understands strategic account management and how that’s going to impact their business directly.

I think we have an opportunity to continue to nurture and enhance and develop people. CSAM certification is one example of that. I think there’s two other areas that I’d like to call out. One is around advocacy effectiveness. Are we, SAMA, truly having an impact in the organizations that we serve today?

There’s a couple of different ways that we can measure that, and we will. And some of that’s going to come through engagement, of course, but also measures of influence and where we’re bringing part of our ecosystem together. We talked about partnerships and collaborations earlier — bringing the more forward-looking thought leaders into the organization. That is going to create a level of advocacy that we haven’t seen historically. And that’s a good thing.

And then, of course, member satisfaction and loyalty will always be part of what we do. How do we measure that? How do we continue to actively listen to our member community on where they see SAMA creating great value and the areas for us to enhance what we do and how we do it?

That will be, and continue to be, a consistent part of our culture. It will be a consistent enabler for us to evolve, grow, and continue to drive greater value in support of our members, our partners, the consultants, and all of our ecosystem participants as we continue to capitalize on the forward-looking trends of strategic account management. n

Transforming salespeople into businesspeople since 1993.

ZURICH INSURANCE GROUP’S MARKETLEADING STRATEGIC ACCOUNT MANAGEMENT IN ACTION

By Ron Davis

Executive Vice President, Global Head of Customer Management

Zurich Commercial Insurance and Daniela Wedema Head of Market Management

Zurich Commercial Insurance

Staying true to its core principles of customer centricity, simplification, and innovation, the Commercial Insurance unit of Zurich Insurance Group (Zurich) has built a strong framework for strategic account management that helps to deliver market-leading service to many of the world’s largest companies. It’s an approach that the Switzerland-based insurer has relied on for more than two decades, and one that has earned it the 2024 Excellence Award for Outstanding Mature Program of the Year from the Strategic Account Management Association (SAMA).

“The SAMA Excellence Award is wonderful recognition that further supports what we see in our customer satisfaction scores,” said Sierra Signorelli, CEO of Commercial Insurance at Zurich. “We are grateful for this recognition, and we will continue to build on this strength to meet the evolving needs of risk managers and their organizations.”

Zurich pioneered an approach to strategic account management in the early 2000s that appoints global relationship leaders to large commercial customers. The global relationship leaders are responsible for supporting customers that manage some of the most complex risks in the world and are challenged with navigating the intricacies of local and cross-border insurance markets.

Altogether, the insurance group does business in more than 200 countries and territories and has around

60,000 employees. Zurich provides coverage to over 80% of Fortune’s Global 500 companies and to more than 90% of Fortune 500 companies in the United States (based on Zurich’s analysis). In 2023, it achieved USD 62 billion in insurance revenue and fee income.

Vinicio Cellerini, Global Head of Customer and Distribution Management for Zurich Commercial Insurance, said the insurer’s strategic account management philosophy mirrors its overall strategy of customer focus, striving for simplicity in a complex industry and placing a high priority on innovation.

“We have been able to validate this approach over the years by closely monitoring key metrics such as customer retention, product density, profitability and relationship net promoter score to measure customer satisfaction,” Cellerini said.

Real world results

Working closely with customers that face the demands of managing risks across the globe has led to groundbreaking solutions, bearing out Cellerini’s emphasis on innovation as a key part of the account management approach.

In one case, a European-based customer voiced concerns with the amount of data required for their insurance program. The dedicated global relationship leader

and other team members brought together Zurich resources that included IT and others to find a solution. The result was the creation of an application programming interface (API) that automated data sharing between the customer’s risk management information system and Zurich’s platforms.

The Zurich Connector API Solution turned a frustration into a solution that won a 2023 Business Insurance Innovation Award from Business Insurance magazine and the European Risk Management Association’s Technology Innovation of the Year award.

In another case, an account review for a large manufacturer that was seeing rising roof-mounted solar panel property losses led the Zurich team to develop installation and maintenance guidance and insights that are now widely used to help other customers avoid similar situations.

Rigorous, yet flexible management

SAMA judges said in announcing Zurich’s win that it was based on the insurer’s ability to “build sustainable programs, measure and maintain profitability of strategic customers, drive meaningful decisions through data and insights, and expand the strategic account management philosophy beyond strategic customers.”

Zurich has put into play several strategic account management elements in serving their customers, the judges

Zurich’s win was based on the insurer’s ability to “build sustainable programs, measure and maintain profitability of strategic customers, drive meaningful decisions through data and insights, and expand the strategic account management philosophy beyond strategic customers.”

said. They include team engagement, performance metrics, a customer-centered culture, actionable feedback, and executive involvement.

Ron Davis is EVP, Global Head of Customer Management at Zurich. He describes the insurer’s methodology and framework of strategic account management as rigorous yet flexible enough to tailor for each customer without reinventing the process each time.

In a Q&A session, Davis discussed the development of the award-winning program, its unique place in the insurance marketplace, how Zurich’s strategic account management philosophy has spread within the company, and other topics related to the approach that has helped set it apart from other global providers of products and services.

Why is this an important award for Zurich?

Ron Davis: We are proud that SAMA has recognized the work Zurich is doing through its strategic relationship customer model. This competition is open to all industries, so this win makes a powerful statement that our valueadded approach is not only a differentiator in the insurance industry, it is what makes Zurich a standout performer among global firms representing a wide range of industries.

Your strategic account management (SAM)

program built a solid foundation from its inception in 2000. What did you consider as you have worked to advance the program over the years?

Ron Davis: Everything we do links back to our core principles that drive the entire organization: a customer focus, simplification, and innovation. We are regularly reevaluating our process to ensure that we are meeting our goals to deepen customer relationships, providing thought leadership internally and externally, and achieving the desired results for our customers and for Zurich. Being part of the SAMA community has enabled me and my colleagues to learn how other global organizations manage their strategic customers, and we’ve gained many insights which we’ve integrated into our approach.

Who from Zurich is involved in this work?

Ron Davis: A successful strategic account management program requires involvement from a variety of key stakeholders within an organization. We collaborate with our executive leadership team and business leaders from underwriting, claims, data and analytics, operations, risk engineering, and other areas. We rely on product and industry experts from across the company to create a complete understanding of the customer and its business, and we often engage these experts directly with our customers. Our global relationship leaders head up teams that jointly develop a customer strategy specifically tailored to each customer’s situation and their needs. Things change, so the customer strategies and supporting efforts are updated as often as necessary.

How do you measure the program’s success?

Ron Davis: We have a number of KPIs that assess how well our program is working. Some are quantitative and others are qualitative. Through customer satisfaction surveys and other customer feedback we develop a good understanding of the strength of our program and how we can enhance it. Most importantly, we interact frequently with our customers and their intermediaries to determine how the program is performing for them, and their feedback helps us refine our approach. In addition to frequent oneon-one contact with our relationship customers, many of them come to Zurich-hosted events, some of them are part of our Customer Advisory Boards, and we also interact with them at industry events.

What validation do you have that the program is contributing positively for your customers?

Ron Davis: Any strategic account management program must keep a pulse on how their approach is impacting the customer. Customer satisfaction surveys, relationship net promoter scores, for instance, are ways we evaluate our impact, and we use industry benchmarking statistics to challenge ourselves to always improve our performance.

We’ve been gratified to see that a very high percentage of our customers who participated in our latest customer satisfaction survey have a positive or very positive perception of Zurich and our product offering. And, we have meaningful interaction with our customers throughout the year in many different ways, including at the Global Risk Management Summit (Zurich’s flagship event for large corporate customers), which we’ve been hosting for over 15 years and is recognized as an industry-leading thought leadership event. The interest of our strategic customers to attend this event represents the value they derive from it.

A good number of our strategic customers have Zurich Executive Sponsors assigned to them. The engagement of our top executives from across the world in supporting our strategic customer management program enables us to get direct feedback from multiple levels of customer contacts about their needs and priorities and how we’re performing. Creating a strong and direct feedback loop with our customers is an important way for us to validate the strengths of our program.

How has your business benefited from the strategic management approach?

Ron Davis: We monitor the performance of our strategicaccount-managed portfolio and know that it performs very well across all key performance indicators. Like most businesses, we have a lot of competitors, which means our customers have options with whom they wish to do business. A measure of the scope of our relationship with a customer is the breadth of our engagement across a wide variety of their business needs. We’ve achieved a high level of product density for these customers and our retention averages above 90%, which shows our customers value what we’re able to deliver. They appreciate our responsiveness and that we are solution-oriented. We also know this is working as we believe we see competitors trying to emulate our business model.

What are the risks of not closely monitoring a strategic account management program?

Ron Davis: One critical element of our program is the importance of refreshing and reinforcing the core account management principles with our global team of account managers and throughout our organization, including with new hires. This includes the need to stay current with the evolution of our products and services. We want to avoid complacency or taking our position for granted, so challenging our strategic account managers to stay fresh, current, and agile in an ever-changing marketplace of customers with evolving needs is critical.

What makes for a good relationship leader who can bring a thorough understanding of the customer’s business and needs?

Ron Davis: The role of our global relationship leaders is the cornerstone of our relationship management strategy. These leaders have strong business acumen and bring a range of industry expertise and insurance knowledge. They understand our business culture and learn how to navigate the Zurich organization to access whatever expertise is needed, all in support of delivering the best possible responses from Zurich for customer challenges and needs.

The global relationship leader creates a customer strategy in collaboration with internal stakeholders, leads the execution of the strategy, monitors customer satisfaction, and provides other services. The relationship leader also helps identify new growth opportunities. And for events, such as the World Economic Forum, where our executives will have meetings with customer contacts, we count on our relationship leader to provide an executive briefing well ahead of time. They help colleagues from across our company with context of how their area of involvement supports our overall relationship, and they provide a total customer understanding for each of their assigned customers.

How do you maintain customer engagement in your strategic management relationships?

Ron Davis: Proactive engagement with our strategic customers is best practice for our global relationship leaders. In addition to meetings that take place throughout the year, we emphasize the importance of an annual stewardship meeting. This enables us and the customer to formally review how the past year has gone, if we’ve met each other’s expectations, and the priorities for the year ahead. The relationship

leader coordinates the meeting agenda, which often includes a discussion on opportunities to co-create solutions through thought leadership, risk engineering services, data insights, or in other ways. Important meetings are followed by an internal team discussion on takeaways, any updates to our strategy, and next steps with associated timelines.

How much attention do you give to innovation as part of your SAM approach?

Ron Davis: The economy, world events, and our customers’ needs are constantly changing. Buyer sophistication increases, market dynamics shift, economic uncertainties arise, and unique business pressures appear. This demands innovation in strategic account management. The underlying foundation of our strategic management philosophy is to create meaningful relationships with our customers and be their insurer of choice. That makes it imperative for us to constantly challenge what we’re doing and find ways to innovate, elevate, and drive value for our customers. The same applies for our own company; we need to be attentive to creating value for Zurich.

Insurance market conditions have been particularly unsettled in recent years. How do these conditions factor into your SAM approach?

Ron Davis: As an example of what we and our customers are contending with, the 2024 Global Risks Report, the World Economic Forum’s annual publication that Zurich supports and contributes to, based on input from 1,400 risk experts, found that extreme weather events pose the most likely long-term risk to create a material crisis on a global scale. That’s not surprising, considering the increase in frequency and severity of weather events across the globe.

The impact on the insurance industry is considerable in terms of coverage capacity for property risks, supply chain implications, business interruption, and other issues. Also ranking in the top ten of long-term risks are AI-generated misinformation and cyberattacks.

This challenging insurance environment is a major concern for our customers. Thanks to our strategic account management program, we can help them navigate this turbulence using our principles of customer planning and execution, early communication, and, perhaps more importantly, co-creation of solutions led by our global relationship leaders.

The leadership and alignment of our strategic account

managers with their internal teams is a critical factor in successfully navigating these challenges.

Are there data-driven tools available to customers?

Ron Davis: We’ve been involved in numerous market-leading technological innovations. I’ll hone in on one example. In order to streamline the flow of data between our organization and customers, we co-created with a strategic customer the API referred to earlier. To our knowledge it is the first of its kind offered in the commercial insurance market, facilitating ease of customer access to accurate data. Zurich received the Technology Innovation of the Year award in 2023 from the European Risk Management Association for our API solution and its bi-directional data exchange capability. And, since creating this tool, we’ve now implemented it with an increasing number of our strategic customers across the world.

Have you expanded your SAM philosophy beyond strategic customers?

Ron Davis: Zurich has consistently been told by our customers and their brokers that they appreciate having someone help them navigate the Zurich organization to access expertise and facilitate responsiveness. These insights encouraged us to consider expanding our philosophy to a subset of customers who have the potential to move into strategic relationships. To that end, we created the Top Market Customer program by leveraging our strategic account management principles. Having done so, every year we see a number of these Top Market Customers being re-segmented into strategic relationships.

We are well aware that our commitment to relationship development, regardless of the business segment, is a key differentiator for Zurich.

Sharing the SAM experience

Zurich has taken to heart the lessons learned in implementing a SAM program and believes it can help others considering such an approach.

“A critical lesson that we would share with other organizations is the necessity of having alignment,” Cellerini said. “We define it in terms of internal coordination, leadership,

and the influence of our global relationship leaders within the Zurich organization.”

Seamless communication and execution on a customer strategy does not happen by chance, especially within a global operation the size of Zurich, Cellerini said. “We believe that having a global relationship leader build more meaningful customer relationships, coordinate multiple products, and demonstrate strategic thinking internally and externally sets our strategic account management program apart from most others.”

Zurich’s experience is a lesson to others on the importance of having strong account management principles, according to Signorelli.

“Change is consistent and expected,” Signorelli said. “But if a strategic management program has fundamentals ingrained throughout the organization, it will not only weather the challenges that arise from change but will thrive in the face of them.” n

Ron Davis is Executive Vice President, Global Head of Customer Management at Zurich Commercial Insurance. Connect with him on LinkedIn at linkedin.com/in/ron-davis-5a917b3/. Daniela Wedema is Head of Market Management at Zurich Commercial Insurance. Connect with her on LinkedIn at linkedin.com/in/ daniela-wedema

How does Bellevue University cultivate the talents of its own sales team and foster a culture of growth? The same way we help our partners do it—through skill-based learning.

Our Workplace Portfolio offers single courses and pathway programs focused on the technical and durable skills that will keep your employees and your organization competitive, viable and profitable.

Your company thrives when your people do Research shows that 63% of organizations that embed a skills-based approach are more likely to achieve results than organizations that have not adopted those practices.*

Your business will grow through:

•Increased employee retention

•Enhanced employee performance and proficiency in their roles

•Talent mobility

•Improved employee loyalty

•Bottom line ROI

*Deloitte Insight report.

Start your employee growth planning journey today!

partners.bellevue.edu/join

FROM UNDERDOG TO TOP DOG

Bellevue University shines from an unlikely place to win the 2024 SAMA Excellence Award for Outstanding Young Program of the Year

By Liz Pettinger Director, Key Account Management and Operations Bellevue University

One of these things is not like the others

You are familiar with the story. The one where the character you least expect, the one that everyone prejudges as different, surprises everyone and becomes the plot hero. From fairytales like “The Ugly Duckling” to more modern pop-culture stories like “Legally Blonde” or “Rudy,” the one , unlike the others, busts the stereotypes and stands tall in their success.

In the world of strategic account management (SAM), an institution of higher education might also be viewed as “different” or “unexpected” among the better-known industries like manufacturing, healthcare, retail, and transportation. Busting the norms is something Bellevue University is very familiar with. Since its beginning in the mid-1960s, the university has been an innovative, yet disruptive leader in the world of higher ed.

Now, in just three short years, Bellevue University has continued down that innovative path with its transition to strategic account management, proving any organization can also find success with SAM.

Here is how our small, non-profit university in the middle of America did it.

Rising to the challenge, post-COVID

In 2021, as the world grappled with the aftermath of COVID-19, Bellevue University knew it needed to elevate its game. Other universities were forced to immediately shift to new online technology to offer education programs, and organizations had an urgent need to retain, develop, and recruit new talent. With our deep-rooted culture of learning, our rich expertise in online learning, and a decades-long track record of successful partnerships, shifting to SAM was just what the university needed to navigate the changing landscape of higher education and corporate partnerships.

Why SAMA? Why now?

Bellevue University (BU) has always prided itself on its entrepreneurial spirit and innovation in corporate education. Our unique sales approach, focusing on six key market areas, sets us apart from other higher education institutions. However, as the demand for degrees wanes in certain industries, emphasizing the value of higher education for employee growth and training has become increasingly challenging. It has been shown that companies that invest in their employees’ professional development experience higher retention rates,

leading to a stable workforce and, ultimately, a healthier bottom line.

One of BU’s key differentiators, even before the pandemic, was our expertise in online learning. While many institutions scrambled to offer online programs during COVID-19, Bellevue University had long been a pioneer in this space. Our nearly 30-year head start has allowed us to stay competitive and relevant as online learning gains wider acceptance and competition intensifies.

When our Corporate Learning Solutions team began in the early 2000s, Bellevue University was among the few institutions partnering with corporations. Today, we face numerous competitors in this arena. To stay ahead, university leaders chose to invest in SAM to strengthen our ability to identify the right partners who fit BU’s mission and to co-create solutions that benefit both entities. Bellevue University is now in its fourth year of implementation of its SAM program.

From inconsistency to excellence

Before implementing our SAM program, there was a lack of consistency in how our organization serviced clients across various key market areas. Each key account manager operated differently, and each had varying measures of success. This led to varied levels of service based on personal approaches rather than client needs. We needed a better method to deepen client relationships, grow our business, meet university goals, and create stronger leaders within our key account management (KAM) team. SAMA provided the tools to drive ROI and success and truly drive customer centricity.

Executive support and involvement

Account Management team of eight individuals. By utilizing SAMA’s vast resources and with collaboration and ideation among the team, big change became evident, proving that regardless of team size or organization, SAM makes an impact.

As the SAM foundation continued to develop, other sales teams within the university began to implement SAM theories and ideas. To date, three sales teams are at various stages of execution.

Key components from BU’s SAM implementation

Prior to working with SAMA, the account teams treated all their accounts equally, which resulted in some great projects but also some inefficiencies. One of the first components implemented at BU was account segmentation through tiers. To do this, we segmented and tiered 120+ accounts, enabling better resource allocation and efficiency. This new approach allows account managers to now focus 80% of their time on strategic planning and conversations.

This approach has helped us justify actions through leading indicators, facilitating resource allocation, and identifying potential wins.

Next, we needed to organize the processes with consistent conversations and ways of tracking opportunities. Structured co-discovery conversations, a client scorecard, and formal account plans became very important. Using modified SAMA co-discovery questions, we fostered deeper, more strategic conversations with our partners, resulting in significant revenue-driving projects and a streamlined way to design and track plans for our most strategic accounts. To confirm that we were making data-driven decisions, we also utilized the Whetstone Scorecard app to keep our focus on the most important attributes for success.

Our journey with SAMA began when our Chief Operations Officer (COO) introduced the organization to key operational leaders. Recognizing the potential to learn and grow, our COO and our VP of Strategic Partnerships decided to invest in a corporate partnership with SAMA. Leadership then chose one individual, the Director of the Corporate Learning division, to become CSAM certified. As the director completed the program, SAM implementation began within the Corporate Learning Solutions

Throughout this process, we are always mindful of the leading indicators to forecast future success and lagging indicators to show the revenue and results. This approach has helped us justify actions through leading indicators, facilitating resource allocation, and identifying potential wins.

And wins there have been.

One, in particular, is the strategic partnership between the university and Union Omaha, a United Soccer League (USL) franchise. The partnership involving all teams in

USL gives players, staff, and season ticket members options for education programs, as well as tuition assistance and scholarship funding toward that education. Beyond the franchise-specific development goals, one main strategy is to deepen Union Omaha’s ties to the community through Bellevue University.

Martie Cordaro, President of Union Omaha, feels it is working. “Bellevue University is collaborative and creative in structuring partnerships that allow for open communication and innovation to achieve mutual benefits,” he said.

The partnership expanded and Bellevue University became the official education partner of the United Soccer League. This partnership remains strong, in large part due to refined efficiencies and executing key components of SAM.

KPIs and future plans

Like other sales-focused industries, identifying the key performance indicators (KPIs) is necessary to measure partnership wins and organizational success. In the world of higher education, these KPIs may be similar to most other industry/organizational goals with simply different nomenclature. For example, some may identify leads , which we call inquiries ; others measure wins , which we label enrollments .

The KPIs used in our SAM program include qualitative and quantitative measures such as increasing student inquiries into BU, more frequent and consistent strategic conversations, new product offerings, and overall organizational efficiencies throughout the multiple departments that work with any strategic account.

leads to partner success.

Being the only SAMA education organization to date makes us both a valuable resource to others and an experiential pioneer to those institutions considering utilizing SAM. As a learning organization, our goal in all things is to continually learn and share that knowledge to help others on their journeys. Here are the lessons we’ve learned by implementing SAM at Bellevue University, and thus, the advice we’d like to share:

• SAM is for everyone, regardless of industry or position. As demonstrated in our presentation at the 2023 SAMA conference, the principles and methods of SAM are applicable across various sectors.

• Trust the process. Be patient and implement changes iteratively. There’s always more to do and improve upon, and the journey is continuous.

• Size does not matter. Whether you are a sales team of 75 or 8, you can move the needle toward the positive.

transform your business by transforming your people

Future plans involve more fully implementing the account plan strategies, tracking the success of the scorecard app, utilizing assessments for effective coaching, revisiting the SAMA assessments to evaluate KAM talent, developing SAM as a product, and expanding SAM methodologies to other sales departments and key market areas.

• Find your SAM network. Everyone can be a valuable resource regardless of industry. Collaborate, ideate, and share wins, losses, and lessons learned with each other. Everyone benefits.

One might not think strategic account management theories and methods would apply to an institution of higher education. Yes, the sales markets may differ from others, and one may feel like that different duckling among the swans. But if you work in an organization in which sales are vital, SAM is a resource that can help. n

How does Bellevue University cultivate the talents of its own sales team and foster a culture of growth?

The same way we help our partners do it—through skill-based learning.

A journey of learning and innovation

Our Workplace Portfolio offers single courses and pathway programs focused on the technical and durable skills that will keep your employees and your organization competitive, viable and profitable.

Bellevue University’s SAM program exemplifies our commitment to innovation, learning, and making a meaningful impact through education. Just as we work with some of the largest employers in the world to develop their talent, we, too, have partnered with SAMA to develop our talent in order to better serve our partners and their employees. Development leads to better development; internal success

Your company thrives when your people do Research shows that 63% of organizations that embed a skills-based approach are more likely to achieve results than organizations that have not adopted those practices.*

Your business will grow through:

For more information, contact Liz Pettinger, Director, Key Account Management and Operations, at epettinger@bellevue. edu or visit Partner.Bellevue.edu/join. Founded in 1966, Bellevue University is a non-profit university with more than 60,000 graduates worldwide. The University is a recognized national leader in preparing students for lifelong success with careerrelevant knowledge and skills, while making college affordable. Routinely ranked among the nation’s top military and accessible institutions, the University serves residential students at its main campus in Bellevue, Nebraska, and everywhere online with more than 80 degree programs uniquely designed for working adults.

Start your employee growth planning journey today!

SUPPLY CHAIN DIVERSIFICATION

A DHL perspective and framework for strategic supply chain reconfiguration

By Dr. Klaus Dohrmann Vice President, Head of Innovation and Trend Research

DHL Customer Solutions & Innovation and Team at DHL Customer Solutions & Innovation. Please see end of the report for individual contributors.

While not a new concept, supply chain diversification has become a hot topic in recent years, driven by the need to mitigate risks and enhance resilience in a volatile world. In practice, supply chain diversification comes in all shapes and sizes, with the level of intensity depending on each company’s markets, strategies, objectives and risk-taking appetite, to name a few.

The public discourse often oversimplifies the complexities of this topic, focusing on popular terms such as near-shoring, re-shoring, friend-shoring, China +1 and the like, but failing to consider the full breadth and depth of diversification.