SOLUTIONS

Independent Sponsor Approach to M&A:

What Defines Them and What Are Their Unique Legal and Structuring Considerations?

January 9, 2025 RISK

What Defines Them and What Are Their Unique Legal and Structuring Considerations?

January 9, 2025 RISK

Joe Ehrlich serves as Brown & Brown’s National Practice Leader for Private Equity, Family Office and M&A. Joe has experience identifying, structuring and providing insurance products and solutions for private equity firms, family offices and other investors, individuals and companies.

Prior to joining Brown & Brown, Joe was the President of the Owens Group, where he primarily focused on private equity, family office and M&A insurance solutions. Prior to joining the Owens Group, Joe practiced corporate private equity and M&A law at O’Melveny & Myers LLP and its predecessor, O’Sullivan Graev & Karabell LLP.

Joe holds a Bachelor of Arts in Classics from Columbia University, and he received his Juris Doctor degree from New York University’s School of Law. Joe is also a member and the immediate past president of the NYU Law Alumni Association Board and frequently presents to professional groups and organizations on insurance-related topics.

Steven E. Brady Partner

Steve Brady is a Partner and Market Leader for Withum’s Transaction Advisory practice. He specializes in mergers & acquisitions and transaction advisory, advising clients to realize value from middle-market transactions across multiple sectors. Steve has extensive expertise in buyside and sell-side due diligence, merger integration and other advisory services for mergers and acquisitions, debt offerings, carve-outs and other transactions..

Steve served as a transaction advisory practice leader in global and national firms for over 20 years, 6 years as a chief financial officer of a middle market diversified mechanical contractor and specialty manufacturer and a start-up medical device company, and audit partner for a global firm.

Steve received his BBA from the University of WisconsinMadison is a licensed CPA in the states of Illinois and New Jersey.

Richard Baum Managing Partner

Richard Baum is the Managing Partner of Consumer Growth Partners (CGP), a private equity firm with an exclusive focus on investing in and advising specialty retail and non-perishable branded consumer products companies. Prior to co-founding CGP in 2005, Richard spent 16 years as a top ranked sell-side equity research analyst at Sanford Bernstein, Goldman Sachs and Credit Suisse. Previously, he spent 6 years in the merchandising organization at Bloomingdale’s and began his career as a strategy consultant with The Boston Consulting Group.

Richard earned a BA degree in Economics from the University of Michigan where he graduated magna cum laude with Phi Beta Kappa honors and a JD degree from Harvard Law School.

Paul Marino Partner

Paul Marino is a partner in the Financial Services and Corporate Groups at Sadis. Paul focuses his practice in matters concerning financial services, corporate law and corporate finance. Paul provides counsel in the areas of private equity funds and mergers and acquisitions for private equity firms and public and private companies and private equity fund and hedge fund formation.

Paul works on a variety of M&A transactions, including leveraged acquisitions, divestitures of business divisions, going-private transactions, and other strategic acquisitions and dispositions, in the following industries: manufacturing, telecommunications, consumer products, hospitality, healthcare, and technology, among others. His practice also includes joint ventures and general company representation matters.

Paul received his B.A. from the University of Delaware and his J.D. from Brooklyn Law School, where he was a member of the Phi Delta Phi National Legal Honor Society.

Sandrock Founder

Cory Sandrock is the Founder and Managing Partner of Pareto & Company. He is also an adjunct professor of finance and economics at Northwestern University and has lectured at The University of Chicago. His career has followed a unique path from theatre and film production to investment banking and private equity, with every role combining his creative approach and robust analytical skills.

Cory has managed more than $3 billion in financing transactions and has held financial, operational, and transaction lead roles for Northern Trust, The University of Chicago, UBS, and other companies.

Cory earned a B.S. in Theatre, cum laude, from Northwestern University, and an MBA in Finance and Economics from The University of Chicago Booth School of Business.

An Independent Sponsor, sometimes historically referred to as a Fundless Sponsor, is an individual or group that seeks to acquire companies but does not have the financing pre-arranged in advance to fund the transactions.

Independent Sponsors are commonly former Private Equity professionals, Investment Bankers or industry experts who want equity ownership and involvement in the growth and operations of a company.

Independent Sponsors may be motivated by a desire to create a “track record” of successful investments prior to raising a dedicated Private Equity Fund or by the ability to pursue a broader range of opportunities outside of a traditional fund structure.

Investment capital for acquisitions usually comes from Hedge Funds, Private Equity Funds, family and friends, and/or Family Offices. The choice of the source of capital often depends on the size and characteristics of the deal.

An Independent Sponsor identifies a target company and then seeks an investor or investors to provide equity (and debt) to acquire the Target company.

Independent Sponsors typically manage the investment and may be generally involved in operating it or work with other institutional partners to provide oversight. Independent Sponsors typically receive equity and fees.

Like most PE Firms, Independent Sponsors typically look to invest behind a strong management team that will stay on post-closing.

In the Independent Sponsor Model, the sponsor sources, diligences, and negotiates the letter of intent before or in tandem with seeking financing partners to consummate the transaction.

With the typical Private Equity structure, the fund sponsor first obtains binding investor commitments and then goes out to source, diligence and close transactions.

• Option for more control over investment decisions

• Greater flexibility on nature/characteristics of specific investments

• No fees on uncommitted capital

• More flexibility on time horizons -- Money no longer needs to be tied up in a strict 7-10-year period but can ebb and flow with the tides of each company’s opportunities and investor expectations

• The Senior Professional is typically a private equity or investment banking professional who leaves a firm after many years of finding, negotiating, documenting, and closing deals, followed by years of monitoring the growth of portfolio companies.

• The Senior Professional is generally seeking involvement in the growth of the operations of a company, without the relentless fundraising involved in a fund.

• Junior Professionals are employees at private equity firms that perform a significant amount of work while the senior professionals take home the vast majority of carried interest and true economics. These people are incentivized to branch out and pursue their own opportunities.

• The main challenge for the Junior Professional is fundraising, as many investors want to see several deals under a management’s team before committing to long-term capital.

• The rise of Junior Professionals is responsible for the sector’s significant growth over the last ½ decade.

• Many Independent Sponsors do not have private equity experience but are nonetheless getting deals done as well.

• Ex: An executive who has a significant domain expertise can overcome a lack of financial services experience, particularly by leveraging their network to close add-on acquisitions and drive organic growth.

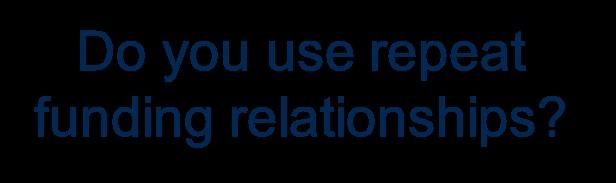

Do you plan on raising a fund with committed capital?

Source: Citrin Cooperman 2024 Report

Source: Ocean Avenue Capital

EBITDA For Companies Invested In or Targeted (Multiple Responses Allowed)

Typical Acquisition EBITDA Multiple for Transactions Closed in Past Year

< $10MM

$10MM-$24.99MM

$25MM-$49.99 MM

$50MM-74.99MM

$75MM-99.9MM

$100MM-$249.99MM

>$250MM

This will be either a Limited Liability Company (LLC) or a Limited Partnership (LP). Either way, it will be taxed as a partnership.

This can include a large family office, another private equity fund, and/or a fundraising effort from friends and family.

The primary advantage of an LLC is that it is a passthrough entity. This makes it much more tax-efficient to pay dividends. If a large dividend recapitalization is contemplated as a part of the strategy, it might be advantageous to establish an LLC.

Structured correctly, a C corporation might qualify the securities held for Qualified Small Business Stock (QSBS), which can result in incredible tax savings on capital gains.

The holding company is established to acquire the target. The Holdco, as it is sometimes referred to, is typically structured as either a C Corporation or a Limited Liability Company (LLC).

Debt will be held at the holding company. The traditional approach would be to work with a senior lender and a subordinated lender.

*The independent sponsor will likely contribute only a very small portion of the capital raised, if any.

Source: A Simple Model

• Control over Investment Decisions

» Unlike investors in a private equity structure, investors in an Independent Sponsor structure have the possibility to exercise control over their investments or have more direct operational involvement alongside the Independent Sponsor.

» Investors in private equity funds usually give up all control over the company’s investment decisions after choosing to invest in the fund.

• More Access to Deals

» Investors get to look at deals that are identified by the Independent Sponsor, often through existing relationships. Investors have the ability to make deal-by-deal investment decisions.

• More Control Over the Investment Terms

» An Independent Sponsor structure often involves the ability to negotiate terms to specifically suit the specific investor(s) and the transaction.

• No Fees on Uncommitted Capital

» Unlike Private Equity Funds, Independent Sponsor do not have “uncommitted capital,” and therefore there are no charges with respect to funds that have not been invested.

• Lack of Restrictions on Time Horizons

» Investments are not limited to a strict 5-year/10-year structure, allowing for longer hold periods.

• Securities Law Compliance

» Independent Sponsors generally work with a small group of investors, which reduces or eliminates the need for filings under state or federal security laws. Conversely, raising capital from a large number of investors (as Private Equity Funds do) requires compliance with federal and state securities laws.

•

» The absence of a dedicated fund under management means fewer administrative obligations and costs associated with accounting, compliance, legal and regulation.

• Flexibility

» Under a typical Private Equity model, the Fund must execute transactions that fit within the investment strategy defined and agreed upon in the governing Fund documents. Independent Sponsor have more flexibility to be opportunistic.

» Independent Sponsors have the ability to use flexible deal and compensation arrangements, which can be negotiated on a deal-by-deal basis.

» More time looking for deals and managing investments instead of dealing with raising and administering a Fund.

• Execution Risk

» A major concern of Independent Sponsors is the ability to raise the funding necessary and timely to close deals.

o Target companies may choose Private Equity or Strategics because of their perceived ability to move with more speed and offer certainty of closing.

• Talent Challenges

» Because the Independent Sponsor model involves variable management fees/revenues to offset expenses, an Independent Sponsor may have difficulty growing and compensating its team.

• Entity Planning

» Depending on factors such as the sponsor’s expectations of generating more profit from capital gains versus ordinary income and its intention to one day raise a commingled fund, structuring options will vary considerably.

• Purpose of Coverage

• Scope of Coverage

• Underwriting

• Exclusions

• General

• Industry

• Deal Specific

• Premium and Retentions

• RWI Buying Strategy

• Industry Specialization

• Small Enterprise Value (EV) Transactions

• Limits

• Retentions

• Exit Strategies/Transferability

• This fee is typically a certain percentage of the Enterprise Value (EV) that is paid at closing.

• Generally, as EV increases, the Closing Fee percentage decreases.

• According to McGuireWood's survey results, roughly 75% of Closing Fees are between 1% and 2.5% of EV.

• The management fee is paid by the portfolio company for advisory/consulting, management and similar services because of the Independent Sponsor's involvement with the company post-closing.

• According to the McGuireWoods Survey, nearly 85% of management fees were calculated based on TTM EBITA as opposed to a set dollar amount.

• According to the McGuireWoods Survey, 75% of Management Fees exceeded 5%.

• Carried interest is the independent sponsor’s share of the profits. It is paid upon exit of the investment.

• Variable with hurdles

• According to the McGuireWoods Survey, Variable with hurdles is used in 61% of Independent Sponsor transactions

• Straight Percentage

Are you required to contribute equity by your capital providers?

Source: Citrin Cooperman 2024 Report

Source: Citrin Cooperman 2024 Report

Average Realized Equity Multiple of Investment Returned to Investors

•2025 & Beyond