For those of you that are unaware, we occupy the entire top floor of 416 Broadway Newmarket.

Spring is in the air and it's time for a revamp of our office space to inject some fresh enthusiasm and smell of fresh paint!!

As often when you are selling your home, we too have engaged the help of a professional interior designer, the wonderful Victoria Wilks who has been making some fantastic changes to our office environment. We are excited to see the end result which is going to include some great paint colours and new furniture.

In addition light filled open spaces with private call areas are providing our agents with the best possible inspiration to make calls, create competition and sell your home. Heather has moved into one of the calling pods with her two toy schnauzers who like the idea of sharing the bench seat with her.

So - for a professional energetic competition creator expert agency to list and sell your home with please call in or contact us directly.

On another note, if you are looking to restart a career or reignite your real estate career call me direct on 021968946 for a confidential discussion.

Selling Principal

Heather Walton 021 432 167 heather.walton@raywhite.com

Franchise Owner

Mark Bycroft 021 968 946 mark.bycroft@raywhite.com

Sales Manager

Jeff Tubman 0274 558 717 jeff.tubman@raywhite.com

Digital Marketing Manager

David Kennedy 021 075 5200 david.kennedy@raywhite.com

Black Group Property Management. General Manager Mac Bycroft

021 223 6893 mac.bycroft@raywhite.com

Black Group Realty Ltd. Licensed (REAA 2008)

The Black Book is subject to copyright in its entirety and the contents may not be reproduced in any form, either in whole or in part, without written permission. Opinions expressed in The Black Book are those of the contributors and not necessarily those of Black Group Realty Ltd or Ray White Ep som. No responsibility is accepted for unsolicited material.

Bill Myers has carved out an incredibly successful and awardwinning career in real estate since gaining his licence 15 years ago.

His tenacity, hustle, negotiation skills, and incredible work ethic have seen him quickly become one of the go-to agents to sell highend homes for Ray White Epsom.

The market might be changing, but that has not stopped Bill. With $327,688,950 in career sales, he is still at the top of his game.

His recent sales and listings include a beautiful character villa on a 749m2 site in Epsom, a completely reimagined and contemporary home in Mt. Eden, and a number of listings on Mt Eden Road, proving that living locally and selling locally work hand in hand.

Maree, who is Bill’s partner in business and in life, joined Team Myers in 2011 as Bill’s Executive Assistant. A teacher for over 10 years at local schools including Maungawhau and Three Kings Primary. Her exceptional administrative skills ensure everything runs smoothly for Team Myers, and her focus on putting clients first makes her an invaluable asset.

“We have grown year on year and now Maree has her real estate licence so we can keep up with the demand.”

“Which necessitated a new EA! Introducing Matt Posa, with a degree in property valuations, he is smart and thorough, we just couldn’t do it without him.” Bill says he loves living and selling in Epsom.

“Maree and I are blessed to share our passion for helping others and striving for the best results for both clients and our own life balance.”

“Our daughter walks to school and we have many good friends in the area, it’s just a lot of fun being part of the Epsom community.”

Bill has been awarded Elite status or Premier status year-on-year since moving to Ray White’s Epsom office in 2017, has been named in the Top 2% of Ray White agents nationwide, and was awarded Ray White Epsom’s Top Team for 2018.

Bill says he chose to work for Ray White, after forging a successful career at Harcourts, because it’s “such a progressive brand”.

“They have brought the very best level of representation to vendors and an unparalleled market reach to every homeowner and buyer.”

When asked what was behind the team’s success, Bill says “being an Epsom expert, listening to your clients, and being approachable and genuine” was key. Bill adds that while you’ll always need to put in the hours and work weekends it’s always satisfying to help clients literally “move” to their next stage in life.

“We are blessed to be surrounded with an amazing company and office to ensure the resources we have benefit our clients and make an ever more complicated process easy.”

“The leadership at our office and company is second to none, and that is evidenced by our strong number one market share throughout Auckland and New Zealand,” he added.

“I get the best of both worlds by connecting the two and helping guide people in finding their dream home.”

Leanne and Katy Carter say Team Myers was the “go-to choice” when they went to sell their property

Bill’s attention to detail and genuine interest in people is second to none. Even when he’s not making a deal, he takes the initiative

to get to know people. He remembers my daughter’s name from our first interview and it’s small details like this that his clients appreciate.

“Bill’s outgoing and friendly neighbourliness (way before we even knew we were wanting to sell), made him the obvious choice for us to approach to sell our beloved home. His diligence, commitment, and obvious passion for the job convinced us we were right. Bill and team do their research, take extra care of the marketing, kept us informed every step of the way, and we trusted them to do the best job possible. We were not disappointed!”

Bill suspects growing up in a military household, where he moved from one house to the next, set him up for a career in real estate.

“My path to real estate was probably destined from an early age, even though I didn’t know it then. My father was an officer in the Army, so we moved a lot, by the time I was 13 we had lived in eight different houses all over the world.”

Bill was raised and went to school in Santa Cruz, California. He has lived in central Auckland for over 25 years. When he’s not at work, he loves having fun with Maree and his family, sailing, caravanning, and riding anything with two wheels.

RichardThode RayWhiteEpsom

Armed with his considerable accolades, Richard has earned his laurels at the top 5 Ray White International Salespeople for Customer Satisfaction.

This comes as no surprise to those who have interacted with Richard, as he lays out an exemplary track record from only three years in real estate, he has achieved Elite status in his beginning year and Chairman’s Elite in the subsequent two.

of this degree leaves clues and such glowing reviews are what create the business. Richard is renowned for his ability to communicate clarity and integrity beyond all else.

Thode is the rare breed of agent, the kind that breaks records while holding his client’s home closely as if it were his very own.

new build will generally be defined as a self-contained residence that receives a CCC confirming the residence was added to the land on or after 27 March 2020. It will also include a self-contained residence acquired off the plans that will receive its CCC on or after 27 March 2020 confirming it has been added to the land. Banks sometimes define new builds as 'RBNZ exempt' given they are exempt from the prescribed LVR guidelines which can provide more flexibility when providing finance options. Some attributes when purchas ing a new build home:

LVR: Up to 90% LVR for owner-occupied and investment purposes.

Pricing: Cheaper finance options such as ANZ's Blueprint to Build product which allows a 2.76% p.a. discount off the ANZ Hobme Loan floating rate for 2 years when building or buying a newly built home. Strong cash back offerings from other main banks.

Servicing: Generally favoured by banks given the in terest deductibility may provide a greater amount of gross rent to be utilised and potentially more debt to be approved.

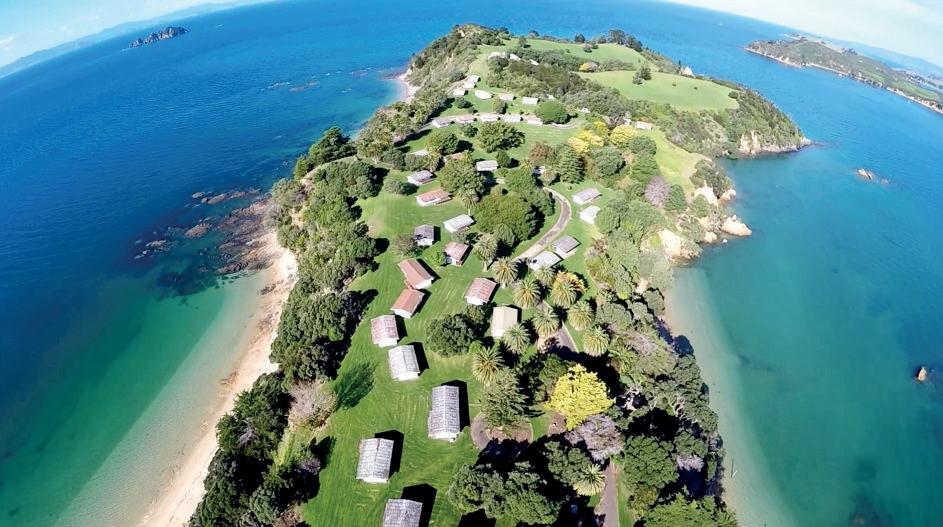

Welcome to Edition, a striking and cutting-edge contemporary apartment building nestled in the heart of Parnell.

The confident piece of architecture, which the acclaimed architectural studio Monk Mackenzie designed, oozes luxury and will accommodate just 19 stunning and spacious homes.

Sixteen boutique apartments have already been sold off the plans, and construction of the architectural masterpiece is nearing completion.

Now on offer are two-bedroom apartments priced from $3,495,000 and three-bed room pads priced from $6,250,000.

Previous sales at the Edition have broken records, with a three-bedroom and three-bathroom 333 sqm penthouse selling for $9.25 million in 2018, beating a pre vious record sale in Remuera of 8.7 million in 2017.

Developer Rory O’Conner from Pink Beluga says the larger apartments could easily replace the family home.

The sun-drenched open-plan living spaces in this world-class residence have been flawlessly designed.

With floor-to-ceiling windows, you’ll be welcomed by abundant natural light as soon as you enter. The upper levels of the building boast views overlooking Judges Bay and the Hauraki Gulf to the north and the east. The breathtaking interior design will quickly capture your attention when you’re not admiring the gun barrel harbour views.

Award-winning architecture and interior design stu dio Bureaux is behind the stunning interior design for Edition. Bureaux’s commitment to quality of finish and furnishing is apparent, with the company saying it used high-quality and enduring materials, including travertine and solid wood, throughout, and bespoke pieces of furniture and cabinetry were designed for each of the apartments.

The sophisticated master features a sleek tiled ensuite and you can access the deck area through a sliding door. The master and second bedroom also include large ward robes and storage options.

The apartment’s location is incredible, with Just like Martha your on-site barista and cafe, the gym and supermarket on your doorstep, and you’re within walking distance to Three Kings Plaza.

You’re also spoilt with beautiful walkways and parks, including Big King Reserve, Mon te Cecilia Park, and Watling Reserve, just a short stroll away.

Myers says the property is perfect for downsizers, lock-up and leavers, pet owners, and a professional wanting a direct route to the CBD. There is also a town-pad for those with larger holiday homes.

“Life is easy here. The perfect balance of simple luxury and a superb location.”

he cantilevered building is set to be completed at the end of the year, with settlements occurring in March 2023.

O’Connor says the back end of the build has been “ex tremely busy with a lot going on”.

“We are well into fitting out the internal apartments with tiles down and kitchens starting to go in so it is really starting to feel like we are getting very close to finishing,” he says.

O’Connor says he believes Edition will compare “ex tremely well” to properties in Auckland and outside the region.

“This is a very special building, and with the cost of construction rising so much in the last few years it may be very difficult to build buildings of this quality in the future, as they will not stack up financially.”

Superb location and breathtaking in presentation, Edition is a property you can’t walk past.

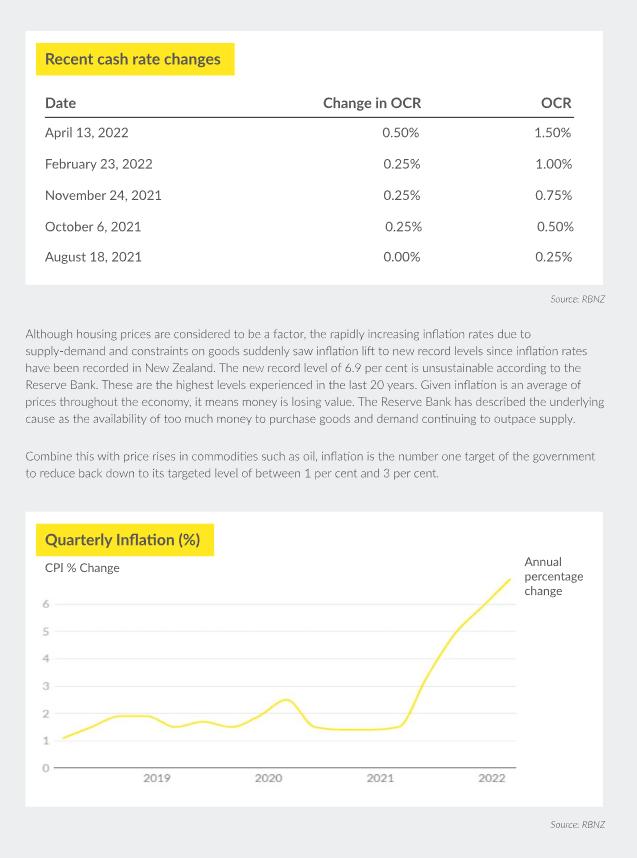

The Reserve Bank of New Zealand has increased the Official Cash Rate again in an attempt to rein in inflation.

The RBNZ stung mortgage holders with another 0.5 percent interest rate increase sending the Official Cash Rate (OCR) to 3.5% on Wednes day.

It’s the eighth consecutive rise since October 2021 when the rate was 0.25 percent, and the fifth increase of 50 basis points in a row. The move brings the rate to the highest level since mid-2015.

The Monetary Policy Committee said in a state ment released today that it had discussed in creasing the OCR by 75 basis points, with some members saying it would “reduce the likelihood of a higher peak in the OCR being required”.

"Other members emphasised the degree of policy tightening delivered to date. Members also noted

the lags in monetary policy transmission and a slow pass-through to retail interest rates. On balance, the Committee agreed that a 50 basis point in crease was appropriate at this meeting,” the RBNZ said in its monetary policy statement released today.

The Committee noted that “inflation is currently too high and employment is beyond its maximum sustainable level”.

“The Committee agreed to continue increasing the Official Cash Rate (OCR) at pace to maintain price stability and support maximum sustainable employ ment.”

It also discussed the downward pressure on the New Zealand dollar placed by higher global interest rates and increased risk aversion in global markets.

“Members believed that this would contribute toward a rebalancing of New Zealand’s current account over the long-term. However, a lower New Zealand dollar, if sustained, poses further upside risk to inflation over the forecast horizon.”

The Committee says household balance sheets remained “resilient despite recent declines in house prices”.

“Members agreed that falling house prices and declines in other asset prices will negatively im pact household consumption. Members noted that

household debt servicing costs were rising and had further to increase on average as more fixed-rate mortgages are reset at higher interest rates. The impact of higher debt servicing requirements are an important channel of monetary policy transmission.”

The announcement comes as house prices experi enced a significant fall in the last quarter.

“The quarterly fall of -4.1% from July to the end of September ranks as one of the worst periods for national value falls on record, only marginally better than the three months to the end of August 2008 (-4.4%), in the wake of the Global Financial Crisis,” CoreLogic NZ Head of Research, Nick Goodall says.

“As interest rates have increased, and credit is hard er to attain, the housing market is firmly in retreat following an exceptional period of growth. Values increased 41% over a 19-month period when the COVID-19 pandemic closed borders and fiscal and monetary stimulus drove a push to asset owner ship,” Goodall added.

CoreLogic reports that values fell a further 1.5% in September, easing slightly from the -1.8% fall in August.

“Despite the rate of decline easing in September, it’s probably too early to suggest the housing mar ket has moved through the worst of the downturn. With the OCR expected to increase a further 50 basis points to 3.5% later today, that downwards

pressure on house prices is likely to continue,” Goodall says.

He says the market share for cash multiple proper ty owners (MPOs) has also risen, up from around 9-10% late last year to 14-15% recently. Meanwhile, ANZ’s latest NZ Focus Property report says prices are expected to continue to fall by 1% a month until the end of this year “before gradually finding a floor over the first half of 2023”.

“We don't see any good reasons why the housing market might suddenly turn a corner over the com ing months," the report says.

"Mortgage rates are still lifting, housing scarcity has been greatly eroded, and affordability remains dire (albeit a little better).”

The economists forecast a peak-to-trough decline in prices of about 15%.

“Importantly, if the market does put out any green shoots while the labour market remains too tight and CPI inflation too high, the OCR (and mortgage rates) will very likely need to go higher than other wise, and for households with a high debt-to-in come ratio, that would be particularly bad news.”

The economists reiterated their earlier prediction for a peak OCR of 4.75% by mid-2023.

A new build at a set price, no pre-auction jitters, and you can dodge LVR restrictions - there are some incredible benefits to buying “off the plans”.

Buying “off the plans” is when a buyer agrees to purchase a proper ty based on the building plans and designs before it’s built. Rory O’Conner from Pink Beluga is the developer behind two de velopments in Auckland which can be bought off the plans, including a luxury boutique apartment block The Garnet at 1 Garnet Road in Westmere, as well as the cut

Situated on the border of two of Auckland's most desirable sub urbs, O’Connor says the location is “amazing”.

“There have been a lot of apart ments built in other parts of Grey Lynn in the more commercial areas along Great North Rd, however very few around this location. From this development, you have the West mere and Grey Lynn shops in very close proximity – residents will be spoilt for choice in terms of dining options.”

“The property is also positioned on

back towards the city which looks amazing at night,” O’Connor says.

Dylan Thomas, Sixtus Director and Financial Adviser, says there are several perks for buyers who buy off the plans, including the fact they could receive an “early bird discount”.

“Buying off-plans may allow a comparatively lower price rather than purchasing a finished prod uct. Therefore, this could allow for further capital gain.”

O’Conner agrees that the price is one of the major advantages.

price of the apartments often go up, for example, our remaining apart ments at Edition are up 20% from their original price. This is because at the start the developer wants to get some sales away so they can start construction, as the build pro gresses they are happy to wait to achieve the price they want.”

Another compelling benefit to buy ing off the plan is that new builds are exempt from the high deposits required - 20% for owner-occupiers and 40% for investors - by current LVR (Loan-to-Value Ratio) restric tions. New builds only require a 10% deposit, regardless of if you are an owner-occupier or an inves

Thomas says buying off the plans also gives banks “confidence”.

“Generally speaking banks prefer to secure a level of presales before they are prepared to fund the devel opments. This pro vides some confi dence that these developments are being funded to deliver a finished product.”

There’s also the 10-year building

guarantee to consider.

“Under the NZ Building Act, there is a 10-year implied warranty period. All residential building work in New Zealand, no matter how big or small is covered by the implied warranties set out in the Building Act,” Thomas says.

O’Connor says another major advantage is that when you get in early, you can work with the devel oper and get what you want.

“This might be reconfiguring the layout of an apartment, or some thing smaller such as adding in power points or lights. Once con struction has begun developers are much less likely to make changes for buyers as the cost and loss of time makes it difficult.”

O’Connor says the biggest risk when buying a development is it not getting built.

“This will tie up their deposit for a long period of time and in the end the development doesn’t even get built, that’s why it is important to ensure the development has resource consent and will be fund ed. The other is quality assurance, renders and show suites do not always reflect the quality of the building that will be handed over to the buyer.”

Thomas says cons include income and interest volatility. He says high

er interest rates or changes to your in come could affect how much you can borrow and most banks can only provide approvals for up to one year.

If the build isn’t completed on time, Thomas says there

may be increased costs or incon veniences, for instance, extending current rental arrangements. He says some developers may look to include cost escalation clauses in their agreements so they can pass on construction cost increases should they arise.

O’Connor says there’s a lot of opportunity for undecided buyers in this space at the moment “as the market is a lot slower”.

“As a result, they have more choice, however, they need to be careful when choosing the developments they want to invest in. Funding is getting more difficult to attain and this will likely continue for the next year or so. When choosing develop ments buyers want to be sure that the developer has funding in place, a good track record, and the abil ity to deliver the product they are selling.”

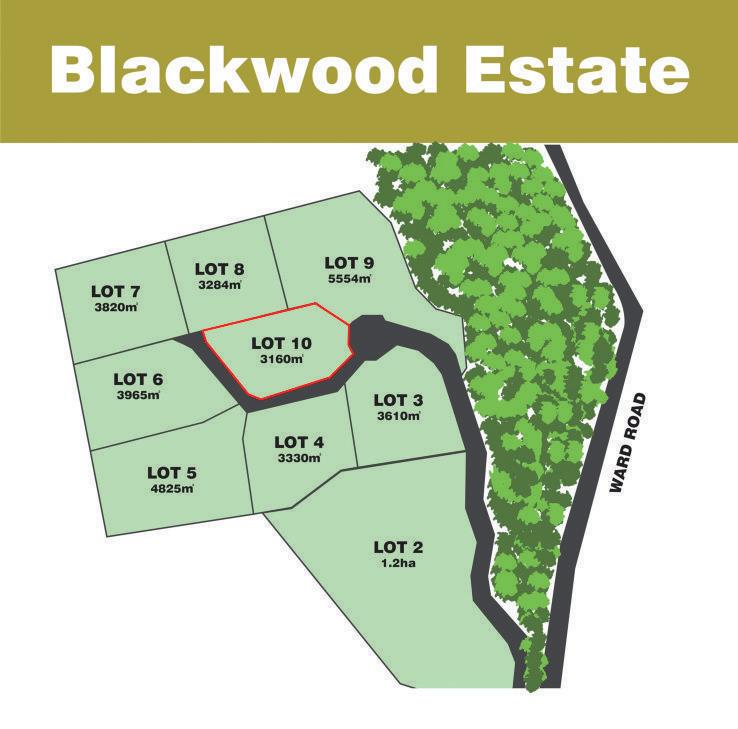

Make sure you get in touch with Ross Hawkins today if you have interest in this fantastic opportunity.

Serves: 4

Dietary Details: Gluten-free Dairy-free Egg-free Nut-free Vegan

2 tablespoons extra virgin olive oil

2 tablespoons ground cumin

1 tablespoon smoked paprika

2 tablespoons garlic powder

2 tablespoons mustard seeds

2 cloves garlic, finely sliced

1 brown onion, diced

2 stalks celery, finely diced

2 carrots, finely diced 400g organic black beans, drained and rinsed

1 large sweet potato, peeled and chopped 2 tablespoons tomato paste

1L tomato passata 500ml vegetable stock salt and pepper 12 corn tortillas

1/4 red cabbage, finely sliced

1/2 cup coriander, roughly chopped

1 tablespoon lime juice

1 tablespoon pure maple syrup

2 tablespoons extra virgin olive oil 1/2 teaspoon salt

3 avocados

1 clove garlic, finely grated

1/4 pineapple, peeled and diced

2 tablespoons lime juice salt and pepper

Recipes & photography from A Taste of Eden by Eden Health Retreat edenhealthretreat.com.au

Heat oil in a large saucepan over medium heat. Add spices and stir until fragrant. Add garlic, onion, celery and carrot. Sauté for 5 minutes. Add black beans and sweet potato. Stir through tomato paste, passata and stock. Bring to a simmer and cook until mixture has reduced and thickened. Season to taste with salt and pepper.

Meanwhile, place the cabbage and coriander in a bowl. Whisk together lime juice, maple syrup, olive oil and salt in a small jug. Pour dressing into bowl and toss well to combine.

To make the pineapple guacamole, mash avocados using a fork in a bowl. Stir through garlic, pineapple and lime juice. Season to taste with salt and pepper.

To serve, heat corn tortillas as per packet instructions. Place a generous spoonful of black bean filling on each. Top with cabbage salad and guacamole. Garnish with additional coriander.

Get more like this at Verve Magazine!

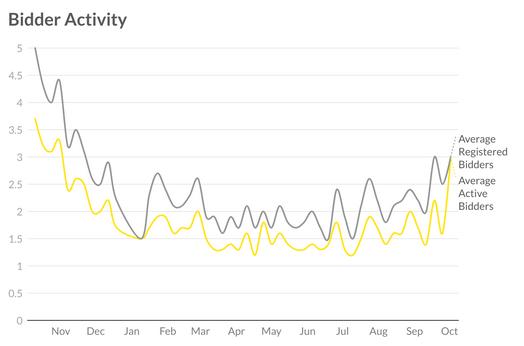

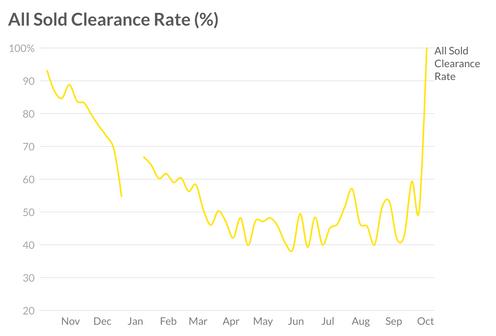

Introducing Ray White Now, an insight to provide clarity to all our customers on what is happening in the market right now.

If you are considering selling, we ex plain how you can take advantage of the current conditions to achieve the best possible sales outcome. The New Zealand housing market is going through a correction period, so it’s more important than ever to stay in formed with real-time information.

As Australasia’s largest real estate group, we are uniquely placed to provide our clients with the most relevant and timely information and data to assess current market activity and outlook. And as a family-owned and led business with 120 years of experience including operating through two world wars, the great de pression and recession and the global pandemic, we know that we can deliver you the highest quality solutions in the current market.

We’re proud to help thousands of New Zealanders sell their home every year.

White

week

White

Ray White New Zealand's average clearance rate last week was 51 7 per cent nationally

There was an average of 2 4 registered bidders and 1 7 active bidders per auction last In Auckland, the majority of buyers were owner occupiers, sitting at 61 9 per cent, while 33 3 per cent of buyers were investors.

Ray White New Zealand

active bidding on 68.4 per cent of auctions last week Auctions sold 9 17 per cent above the highest offer received

Our team here is all about boots on the ground and being present throughout the entire process. We thought it would be special to share those all important mo ments with you! Check out our team doing what they do best.

When you have 3 open homes in the same building and you can walk your open home flag down to the next one - Team Myers

This refreshed Quadrant Apt is ideal for investors

first home buyers who want to be in the central Auckland city - this contemporary Freehold apartment with separate titled 1 carpark (current market price range is over $100,000 worth itself),

is located on the 10th floor with 2bedrooms.

opportunity not to be missed!!

do homes of this quality and thoughtful style

it

to market. Offered for sale for the first

that this home

formed at the top of this driveway on a flat freehold site with complete privacy - yet bathed in all day sun.

virtually