CHINA LOOKS set to play a key role in helping the New Zealand wool sector shift away from trading as a commodity supplier.

A major conference on wool, held in Nanjing last week, was attended by Associate Agriculture Minister Mark Patterson and Wool Impact chief executive Andy Caughey. Both men spoke at the conference, promoting NZ strong wool.

China is New Zealand’s largest wool market: in the year ending June 30 2025, NZ exported $446 million worth of wool, with $176 million going to China.

Speaking to Rural News from Nanjing, Caughey pointed out that the conference is held once per year and is considered an important venue for New Zealand’s wool market because China purchases approximately 35% of New Zealand’s wool.

Caughey said there had been a lot of research around the growing awareness of health and wellbeing among Chinese consumers in terms of both the home and offices.

“In China, you’ve got real value placed on their children and the home environment – they don’t have big homes like us – and so everything they put in the home is carefully chosen because they don’t have a lot of space and what we’re promoting is bringing natural fibres into that living space,” he said.

“We look at the Chinese market… and what’s happening is that with their

growing affluence within their society, they are increasingly churning through a lot of products domestically at home, so people are trading up.”

Patterson said New Zealand has a great story around the innovation, sustainability, integrity and quality of our premium strong wool.

“This means we’re well placed to meet consumer demand in China for premium wool products.

“This opportunity brings together industry representatives, wool growers and processors, and trade experts to foster cooperation and promote and build on the commitment of the coalition Government to ensure the future success of New Zealand’s wool.”

China could also buffer some

effects on tariffs imposed by the Trump Administration.

Caughey said that as tariffs from the US come into effect what may be lost in some export markets, will result in an increase in other markets like China.

He said New Zealand’s strong wool sector needed to shift away from trading as a commodity and instead trade based on relationships and what makes the product special.

“It’s the crux of what we’re trying to do to get a better price, a better return for growers.

“We’ve got 100,000 tonnes of wool and 85,000 tonnes – so 85% of that –is exported overseas and we’ve just sold it through the auction and it just

disappears… growers don’t know what products, what company or even which country their wool goes to and so how can we command a better price if we don’t know what the product’s being used for?”

He said that this shift meant working towards segmenting that 100,000 tonnes into different wool types and then overlaying that segmentation with accreditation programmes like the New Zealand Farm Assured Programme (NZFAP) and then getting into the details of growers and grower groups.

“So, offering something special that differentiates the wool over and above a commodity market.

“Instead of pushing our product

in the market, what we’re looking at doing is connecting with brands and building programmes around the manufacturing brands who are seeking products and giving them access to tailor-made recipes of fibre,” he added.

According to Caughey, New Zealand wool makes up a quarter of the wool traded around the world, but New Zealand makes up approximately two thirds of the premium wool traded.

“We’re trying to sell the best of the best and when you’re selling the best of the best, you need to take a different approach and be working closely, intimately, with brands in New Zealand and overseas to make them realise ‘You’ve got access to something that not everyone gets’ but at the moment, we’re just putting it out there.”

Globally, the future for wool looks bright, said Caughey.

“The world is becoming increasingly aware of the issues around microplastics on human health and on the environment… So, I think we’re getting a change in culture and mindset and buying quality products that last longer.

“I believe there will be a change in attitudes in the way we think and purchase and consume products.

“There’s a lot of things that will support wool in its positioning as a better fibre for the environment than synthetics but we’re less than 1% of the global fibre, so we’ve got to shout loud and… if you’re only 1% of the global fibre market, you’re not a commodity, you’re a specialist niche fibre and so you should be treating it quite differently.”

9am - 12pm FRID AY 3RD O C TOBER.

Kids can bring in their used toys and negotiate with our friendly Brandt teams to get the best price to go towards a new John Deere toy. Traded toys will then be donated back into the local community.

Maxsyn Perennial

The next generation Perennial legend with NEA4 and now with NEA12 for superior persistence and summer growth.

The superstar perennial, delivering high intake, Yield, N uptake and persistence. The diploid of the future! Array Perennial

With these big pasture performers, led by Maxsyn, New Zealand’s top-selling perennial ryegrass. Now that’s huge! Ask your resellers, or learn more at Barenbrug.co.nz/spring-2025 Grow with Confidence

4front Perennial

The benchmark in tetraploid perennials. Grows longer, is good for the environment and animals love it.

Forge 3-5 years

The phenomenal 3-5 year pasture. With environmental benefits, delivers performance your neighbours will envy.

Shogun 1-3 years

The outstanding hybrid, still setting the standard for 1-3 year pasture. Available with NEA and supercharged NEA12.

1-15

15-18

20-21

22-23

HEALTH 24-25

26-30

TRADER 31

HEAD OFFICE

Lower Ground Floor, 29 Northcroft Street, Takapuna, Auckland 0622

Phone: 09-307 0399

Fax: 09-307 0122

POSTAL ADDRESS

PO Box 331100, Takapuna, Auckland 0740

Published by: Rural News Group

Printed by: Inkwise NZ Ltd

CONTACTS

Editorial: editor@ruralnews.co.nz

Advertising material: beckyw@ruralnews.co.nz

Rural News online: www.ruralnews.co.nz

Subscriptions: subsrndn@ruralnews.co.nz

PETER BURKE peterb@ruralnews.co.nz

PUBLIC BACKLASH has forced the Ministry of Education (MoE) and Education Minister Erica Stanford to do a U-turn on a proposal to axe agriculture and horticulture science as standalone academic subjects in the secondary school curriculum.

The ministry had proposed that these subjects should be downgraded to a ‘vocational level’ – meaning the focus would be on practical farm and orchard skills and not provide an academic pathway to degree courses at university level. In other words, ag and hort were to be dumbed down in schools.

This move was seen as outrageous and unbelievable by ag teachers, academics and industry leaders when announced with much fanfare by the Minister.

Ironically, the announcement came just days after a front page story in Rural News September 9 issue stating there was a huge upsurge in demand from students right around

the country to do the standalone courses in agri business, agriculture and horticulture. Also, that more than 200 schools were already teaching agriculture and horticulture and 100 teaching agribusiness. It went on to say that to meet this demand, Massey University and the ag and hort teachers were planning to run special courses to upskill teachers in these subject areas. Particularly concerning was the fact the organisation that represents the teachers of these subjects, the Horticulture & Agriculture Teachers Association (HATA) was not consulted on the proposed changes, and they were blindsided by the move and not given any pre-warning of them.

Literally within minutes of Stanford’s announcement, the phones ran hot and emails flooded into the Beehive and MoE to point out the folly of the proposal. Clearly the Minister was caught by surprise and embarrassed at the strength and breadth of the opposition to the MoE’s proposal. Given the weight and size of the opposition, Stanford quickly ordered the ministry to check the

KERRY ALLEN of Horticulture & Agriculture Teachers Association (HATA) says they are very pleased and excited at the Minister’s change of heart. She says it was particularly pleasing the way educators and industry worked together to get the desired outcome – the restoration of agriculture and horticulture science in the academic pathway.

“We would have liked to have had

agribusiness as a standalone subject but we are not unhappy that it will be integrated into the business studies curriculum,” she told Rural News.

“Potentially that may have a wider audience so we might be able to pick up more students than we had before and that is a win as well,” she said.

Allen said that following the initial announcement by Stanford they voiced

validity of and integrity of its advice.

Over the next few days, ministry officials pondered over their initial advice and deemed it flawed. A day later they issued a press statement saying they had “reviewed and revised” their advice and decided that

their concerns to her and then had ongoing discussions with the Ministry of Education that led to the outcome they wanted. She says she has no real insight into why the MoE made its original decisions but she wonders whether earlier discussions with industry about making changes to the vocational courses may have resulted in the importance of the academic courses being overlooked.

agriculture and horticulture would be standalone academic subjects and that agri business would be merged into general business studies. But there was no real apology for what turned out to be a major error on their part, and one that left their Minister red-faced.

Allen said she hopes that in future HATA will be consulted.

“Finally, HATA would like to thank all the support they had from educationalists and industry, and also the Minister and her team for reversing the changes. I am thankful she [Stanford] listened to HATA and the Agribusiness in Schools team. Potentially she didn’t have to, and we are grateful that she did,” she said.

NIGEL MALTHUS

WITH THE Alliance board starting a series of roadshows next week to sell the Dawn Meats deal to shareholders, a group of farmers is working on a counter proposal.

Shareholder James Anderson, from Waikaia in Southland, was outspoken at Alliance’s last annual meeting in December about the need to maintain the company as New Zealand’s only 100% farmer owned meat co-operative.

He has now told Rural News that “a group of us” was working on putting a proposal up to the shareholders, which would keep the company in their hands.

Anderson said he could not disclose too much of the proposal, but it involved keeping the PDS alive - the Public Disclosure Statement that defines the company’s ability to take a per stock unit deduction to

gain capital – along with a lot of costcutting.

But he said it was achievable.

“First of all, we’ve got a profitable company going forward. This year, they should be turning a profit.

“Then we’ve got to work on shareholder capital going in: to keep it as a co-operative we’ve got to have that.

“Then the rationalisation within the company. So, taking a big axe to a lot of costs within the company.”

Anderson said a lot of rationalisation could happen without closing more plants (in addition to Smithfield which was closed last year) but the big thing was to try to keep all the plants full.

Farmers needed to support the company with throughput.

Anderson said more details of the counter proposal would come out about the time of the first of the roadshow meetings.

“We are working on something and whether we can achieve it or not, it’s going to be interesting.”

“We are working on something and whether we can achieve it or not, it’s going to be interesting.”

The Dawn Meats proposal, like Silver Fern Farms with Shanghai Maling, represented money up front for shareholders but Anderson said they “ought to stop and think for five minutes.”

“If the shareholders don’t think about what they’re doing, we’re going to lose the only farmer owned co-operative meatworks in New Zealand. And in 10 years’ time, we could be regretting it.

“So how do you sell that to young people? I’m not sure. But we’re trying.”

The roadshow begins in Southland on September 29 and will work its way northwards with up to three meetings a day for about two weeks. A vote on the Dawn Meats proposal will then be conducted at a Special General

Meeting in October.

Alliance says chair Mark Wynne and chief executive Willie Wiese will attend the roadshow meetings to provide more details on the proposed deal.

“We encourage all shareholders to attend one of the roadshow meetings,” said Wynne.

“This is an important opportunity to hear directly from the company, ask questions and gain a clear understanding of the proposed investment partnership.”

Shareholders can also expect to receive a Scheme Booklet and accompanying information in the coming weeks.

Alliance is advising famers to register for the roadshow meetings to ensure admittance, as some venues have capacity limits.

FARMERS WANT the Government to scrap controversial freshwater rules that “put river spirits and ideology ahead of practical water use”, says Federated Farmers board member Mark Hooper.

“We

welcomed the Government’s commitment last year to fix unworkable, expensive freshwater rules – but they need to do the job properly.”

The rules – known as Te Mana o te Wai – have created huge consenting problems for farmers, councils and communities alike, says Hooper.

“The concept of Te Mana o te Wai will require local councils to regulate vague spiritual concepts like the ‘life force’ of water, causing untold issues around the country,” he says.

“I’ve never met a farmer who didn’t care about improving freshwater quality, or want to play their part, but this is getting out of control. The rules are totally unworkable.”

Te Mana o te Wai requires councils to regulate not just measurable standards like water clarity, fish life, or E. coli, but also concepts such as the ‘mana’ or ‘mauri’ of water.

Hooper says legislating for vague and undefined spiritual concepts that most New Zealanders don’t even subscribe to will only lead to confusion, inconsistency, and unnecessary costs.

“That’s why Federated Farmers is standing up, putting a stake in the ground, and calling on the Government to unequivocally rule out the concept of Te Mana o Te Wai.”

He says the Government must replace Te Mana o te Wai with plain-language law that is clear, certain and enforceable.

He says trying to regulate intangibles like a river’s life force raises huge questions about who decides when that life force is protected.

“If we’re measuring clarity or nitrogen levels, that’s straightforward because we can ask an ecologist to test it and, if needed, get another expert to peer review it.

“But how on earth do we determine when the ‘mauri’ of a river is protected?”

The answer, in many cases, has been to hand

that responsibility to local mana whenua – iwi and hapū with historical association to a waterway.

Hooper says this will, in effect, just grant mana whenua a monopoly on deciding what is, or isn’t, allowed to happen in New Zealand.

“We’ve seen examples where mana whenua groups say mixing two water bodies, like a water race does, may reduce mauri because it mixes two river spirits together.

“We’ve also seen claims that any discharge of treated wastewater into a waterway, despite being scientifically clean, would reduce mauri too.

“These blanket requirements pose a significant barrier to

rational and open debate when one group’s beliefs can override the needs of an entire community.”

According to the Feds, Te Mana o te Wai was embedded in regulations first passed under National in 2017 and was made even more complicated by Labour’s 2020 freshwater reforms.

Hooper says farmers and rural communities across New Zealand have had enough of the uncertainty and unnecessary costs it has created.

“We welcomed the Government’s commitment last year to fix unworkable, expensive freshwater rules – but they need to do the job properly.

“A decision on Te Mana o te Wai is due soon but, of the three different options the Government has floated, only one of them fully repeals Te Mana o te Wai.”

Federated Farmers believes the only way forward is to repeal the rules and replace them with clear, science-based standards.

“New Zealand needs fair and practical environmental limits that everyone can easily understand and work with,” Hooper says.

“That’s just not possible while the concept of Te Mana o te Wai sits at the heart of our national freshwater laws.”

NEW ZEALAND Winegrowers chief executive Philip Gregan has announced his plans to retire in June 2026, marking 43 years of service to the New Zealand wine industry.

Gregan commenced his career in the industry in 1983, fresh out of university. He joined the Wine Institute as the organisation’s Research Officer. He was appointed CEO of the Wine Institute, playing an integral role in New Zealand wine’s international trade negotiations, which resulted in the formation of the World Wine Trade Group. In 2002, the Wine Institute merged with the Grape Growers Council to form New Zealand Winegrowers Inc, and Philip was appointed CEO of the new organisation.

“There have been many highlights over the years, but without doubt, the biggest highlight has been the privilege of working with and for our brilliant growers and winemakers,” he says.

“Their passionate commitment to everything that New Zealand wine stands for continues to inspire me. It has been a privilege to work on behalf of the wine industry for so long. I look forward to handing over to my successor so they can help the industry further build its reputation and global success in the years ahead.”

ACADEMIC AND former Fonterra director Nicola Shadbolt has been elected as LIC director. Shadbolt beat two other candidates – Kevin Argyle and Pamela Storey – and joined the co-operative’s board at its annual meeting last week. LIC shareholders also approved a resolution to increase the remuneration of LIC chair and board members – 75% voted for the resolution while 25% opposed it.

Shareholders also approved the appointment of Hamish Rumbold and Blair O’Keeffe as appointed directors.

FEDERATED FARMERS say Environment Canterbury’s decision to declare a ‘nitrate emergency’ is a shameless political stunt that won’t help anyone.

“It’s incredibly disappointing to see Environment Canterbury (ECan) playing these kinds of petty political games,” says Federated Farmers vice president Colin Hurst.

“Declaring a nitrate emergency isn’t helpful or constructive. All it will do is create unnecessary panic and drive a wedge between our urban and rural communities.

“I think most reasonable Cantabrians will see the declaration for what it is: a cynical and alarmist stunt from a group of councillors trying to score points during the local body elections.”

‘As

FARMERS WHO find the land next to them is about to be converted into forestry, face potential damage and costly consequences.

That’s the message from Bruce Wills, former president of Federated Farmers and successful businessmen, who says he personally knows what’s ahead of these farmers and they may not know what is coming their way. He says he lived with the situation for many decades on his farm, Trelinnoe Station, on state highway 5 just north of Napier. The property was famous for its beautiful garden as well as its farming operation, but the beauty was constantly under threat from the surrounding forestry.

farmers need to be prepared to deal with what will be in store for them.”

“We were an island of grass surrounded by trees. We had four commercial pine tree neighbours and then DOC,” he told Rural News

“The forest gives our pest animals shade and shelter during the day then at night they come streaming out onto any open pasture and consume the grass that we have carefully grown at

a cost for our own stock,” he says.

Wills says pine trees would fall and break fences and as well as the damage, it made it easier for the red deer to stroll onto his pastures and devour

CARBON FARMING

is threatening the economy of the central North Island, according to Federated Farmers Whanganui president Ben Fraser.

He warns that whole communities are at risk unless it is stopped.

Fraser says farming plays a huge role in the economy of the region but, increasingly, productive sheep farming is being turned in permanent pine trees.

He wants the Government to urgently close loopholes and

strengthen rules to stop carbon forestry conversions on productive sheep country. He says farming is a big income earner for the region, generating jobs right across the community, but points out that increasingly sheep are being displaced on productive land by permanent pine trees. He says this a huge concern for those who live rurally, but it’s equally concerning for those who live in town.

“At the end of the day, we’re all one community,

supporting the same local economy. Lock-upand-leave pine forests just aren’t going to generate the same level of economic activity. They may create carbon credits, but they don’t create jobs. We at Feds are highly critical of the Government’s proposed carbon forestry rules, and we say they don’t go anywhere near far enough to be effective,” he says.

Fraser says the Government’s proposal is to cap the amount of farmland that can

be registered in the Emissions Trading Scheme (ETS) at 25%.

But he says that limit applies only to land use capability (LUC) classes 1 to 5 – the land least likely to be targeted for carbon farming in the first place.

“Only 12% of recent whole-farm conversations to carbon forestry have actually happened on land classes 1 to 5 anyway, so it’s not really a solution at all. The remaining 88% have happened on land classes 6 and 7, which also happens to be the land

the grass. The other problem was an increase in possum numbers which also came out of the forest and had the potential to cause an outbreak of bovine TB. He adds there was also the constant risk of forest fire which again can have disastrous consequences for a neighbouring farmer.

“Farmers live on their place 24/7, unlike the forestry people who generally don’t work on the weekend or public holidays, and trying to get them to fix the fences their trees broke down was impossible. Some of the owners were overseas and just not interested in our problems, so in the end we just gave up. The result was it cost us thousands of dollars repairing the fences ourselves, and dealing with the other problems forestry caused,” he says.

Wills says having a forestry owner

where most of our sheep and beef farms operate,” he says.

Fraser says LUC is a tool designed for determining the land’s capability and it’s been used to set rules and limits, but points out that capability is often confused with productivity. He says it’s productive sheepbreeding country that’s critical in NZ’s farming and food production system.

“If productive sheep and beef farms continue to be replaced by

for a neighbour is way different from having another farmer whom you know and who is part of the local community. He says forestry people are seldom part of the local community. He says basically a gang comes in and plants the pine trees and it’s often years before there is any contact with the owner of a forestry block.

Wills says the widespread advent of carbon farming next to their pastoral block is a challenge that many farmers would not have given much thought to.

“As forestry conversions continue, the problem is going to get worse and farmers need to be prepared to deal with what will be in store for them,” he says.

@rural_news facebook.com/ruralnews

permanent pine forests, soon we’ll be bartering pinecones for a new pair of boots,” he says.

Fraser says that class 6 and 7 land is far from barren or marginal, rather it’s the picturesque hill country that features on postcards, calendars and TV shows such as Country Calendar which celebrate NZ farming life.

“This is the landscape many Kiwis are most proud of – the classic sheep and beef hill country that defines our rural identity,” he says.

According to Fraser, the impacts of carbon forestry on the Central North Island can already be clearly seen in places like Taumarunui, where local communities, rural schools and businesses have been decimated.

“I would hate to see the same thing happen to Taihape or Whanganui.

Once that land’s planted in pine trees for carbon forestry, it’s gone for good and never coming back. Is that really the future we want for our country?”

– Peter Burke

SUPERPHOSPHATE IS still the go-to product for New Zealand farmers looking for spring growth, says Mike White, Ravensdown’s head of product and service development.

White says he is often asked what is “the next thing” after superphosphate but he always responds that plants and pastures have not fundamentally changed in the way they take up nutrients.

It works, it is price competitive, and it is flexible in how farmers can use it, he says.

“Superphosphate has the two things that farmers need at this time of year - phosphorus and sulphur as sulphate, which is immediately available for plant uptake,” White told Rural News

White said that what differentiated the New Zealand pastoral system from others is our predominately mixed swards of ryegrass and clover. Because it fixed atmospheric nitrogen, clover was the nitrogen engine of our pastures. Promoting pasture was therefore about promoting clover, and superphosphate was the “really appropriate” fertiliser for doing that.

He said some alternative products have only a little sulphur, or elemental sulphur that must first be converted in the soil to sulphate before the clover can utilise it. Sulphur is already in sulphate form in superphosphate, so spring application gives results in that season’s growth.

Research showed that applying phosphorus

and sulphate together delivered “more than the sum of its parts”, with growth responses better than when applied separately, said White.

Decades of New Zealand research had given farmers confidence about timing, rates, and responses. Modern precision practices and technology such as soil testing and GPS-enabled spreading allow farmers to match application rates to stocking pressures, soil types, and seasons.

With increased understanding of how best to use it, our use of superphosphate was more sophisticated now, but the product was as relevant to modern New Zealand farming as it was to our farming grandparents.

“Its ingredients are the nutrient bedrock

of all farming. Some products disappear with age. Superphosphate has appeared even better.”

White said global market conditions also worked in superphosphate’s favour.

It was cheaper to import the raw materials and manufacture here than to bring in finished products, and local manufacture also

improves supply chain resilience.

The alternative product DAP (DiAmmonium Phosphate) was made overseas and was prone to more volatile pricing, swinging up to 74% above the 10-year average price, compared to price swings of only 37% for superphosphate.

Over the last 10 years phosphorus derived from Ravensdown’s superphosphate worked out at 11% cheaper than phosphorous derived from DAP, said White.

A major difference is that DAP includes nitrogen as well, albeit at a fixed ratio. White said that could be appropriate when planting a crop that wants nitrogen as a starter.

“So, certainly we sell it, because it has a place in the market, and it also

has a place if someone’s looking for a fixed ratio nitrogen product.”

But where superphosphate differentiated itself was that it allowed the farmer to apply nitrogen separately at more appropriate rates. New technologies around Precision Ag let them apply “the right product, in the right place, and the right amount,” he said.

“You can look at the areas of your farm where it makes sense to do a nitrogen application. You can just specifically target those areas.”

White said it was not only about targeting spatially but also targeting on timing.

“The application of P may not necessarily be the best time for an N application as well, so that gives you that leeway.”

However, Ravensdown also had an own branded product, Flexi N, which is nitrogen coated with magnesium. That allowed it to be applied with superphosphate for those times and areas where it was appropriate to apply the two together.

Meanwhile, New Zealand soil fertility has been built up over decades, so superphosphate is mostly now used as a maintenance fertiliser to replace the nutrients used up in production. However, applications may have been reduced during the last few years of lean income experienced by sheep and beef farmers, so soil fertility would have suffered. Now may be the time for catch-up applications, said White.

A WINDFALL of billions of dollars is good news for the agricultural sector and the economy in general, following the sale of Fonterra’s global consumer businesses.

But financial services provider Findex says that farmers may not reinvest the payout quite as one might expect.

“The sale of parts of Fonterra to Lactalis for $3.845 billion raises the issue of where that capital injection to the cooperative members might be applied,” says Findex Wealth Management partner Craig Smith.

“As is the case with anyone’s funds, the answer varies based on individual circumstances. However, we’re seeing sentiment turning away from putting that money straight back into the land that produced the payout.”

The deal between Fonterra and Lactalis represents a significant financial event for Fonterra shareholders, a substantial number of whom are New Zealand dairy farmers.

The transaction could potentially increase to $4.22 billion (with the inclusion of Bega licences) and is expected to result in a tax-free capital return of $2 per share. This dividend accrues to shareholders including around 10,000 farmers who are in line to receive a share of approximately $3.2 billion.

“That’s obviously an enormous boost for farmers and regional communities,” Smith notes. “For instance, a farm producing 100,000 milksolids annually could see a $200,000 payout, with most farmers

potentially receiving $100,000 to $1,000,000 as a capital injection.”

Smith combines the capital injection with observations from the field, which indicates farmers reaching the end of their tether.

“We’re seeing growing negative sentiment from dairy clients turning away from buying more land, reinvesting in their properties and doubling down into farming after a challenging decade on a number of fronts,” he says.

Instead, Smith says there is an apparent appetite for other investments and a move towards diversification.

Cash, of course, provides the ultimate flexibility, and there is no shortage of options available to the “capital flush”. Strategies can include:

• Diversified investments: Farmers can consider diversifying beyond dairy, with multiple instruments available, including equities (share) markets, bonds, managed funds, commercial property or other vehicles. Smith says selections rest on risk appetite and goals. “This helps reduce the highly concentrated risk faced when farmers have all assets and income tied into the farm, a commodity driven business prone

to large profitability fluctuations.”

• Farm succession: Individual capital injections may be significant enough to facilitate succession or co-investment plans while providing for the previous generation’s retirement. “The monies could allow for a structured transition of farm ownership or management to the next generation or other parties, ensuring the retiring farmers have a secure financial future independent of daily farm operations,” says Smith.

• Supporting ventures outside farming: The capital presents an opportunity for supporting family members in their personal ambitions. “Not all the children of dairy farmers want

to go into farming. The capital can support their entrepreneurial or career aspirations in other sectors, fostering family wealth across diverse fields, leaving rural income and assets supporting the farmer and their own retirement,” notes Smith.

• Debt reduction: Retiring existing debt provides immediate financial relief, improves resilience against future milk price volatility, and reduces exposure to rising interest rates.

• Farm investment:

While the obvious path isn’t necessarily the strongest, it remains an option, says Smith. “Reinvesting into the farm infrastructure, technology, or sustainability measures increases long-term efficiency, profitability, and reduces future costs. It is therefore still an important option for many farmers.”

Where Smith’s view is firm, is that the windfall is welcomed by the nation’s rural communities. “It has unquestionably been a tough decade, so the monetary relief is palpable. Farmers now have options to leverage and improve their circumstances, and as always, the decisions ahead require close assessment of potential returns.”

Smith adds that as these discussions and decisions routinely involve the entire/ wider family, they can be improved with an impartial facilitator providing financial knowledge, metrics and advice.

With the inclusion of insecticides, fungicides and micronutrients, you’ll help ensure your forage crop or pasture gets off to the best start and reaches its full potential.

For generations, Kiwi farmers have backed Ultrastrike® and Superstrike® to protect their seed and make every seed count. PROTECT YOUR SEED, PROTECT YOUR FUTURE .

THE 2025 Young Grower of the Year, Phoebe Scherer, says competing with other finalists felt more like being among friends.

“It was a very high calibre field of competitors, and everyone did so well. I could not have asked for a better cohort to have shared such a great experience with,” she says.

“In some ways, it didn’t feel as if we were competing because we were all so supportive of one another – it was more like being among friends, all going out there to take on the challenges and do our very best.

“Thank you to the organisers - a big shout out to Horticulture New Zealand (HortNZ) - to the sponsors and all the people who are part of

making Young Grower such a great event.”

Scherer, technical lab manager at Apata in Tauranga, is also the Bay of Plenty regional champion. She competed against six other regional winners in a series of challenges at Lincoln University in Christchurch on September 10-11.

Scherer says she thoroughly enjoyed stepping up to the many challenges.

“The science and

technical modules were my ‘safe space’ but others I found much more challenging, particularly the machinery section. We had to drive a big tractor along a GPS line.

It was the biggest piece of equipment I have ever

stepped into but we were very well supported.”

Scherer gained an evolutionary biology degree and did an OE before taking a job in the kiwifruit industry in Tauranga seven years ago.

That led to a

RUNNER-UP Steven Rink, the production manager of Oakley’s Premium Fresh Vegetables, Southbridge is originally from Cape Town, South Africa and studied conservation ecology at the University of Stellenbosch. He came to New Zealand in December, 2019, for what was intended to be a gap year, until he found himself “pleasantly locked down” because of Covid.

“I ended up at Oakley’s Vegetables, got stuck in there, hands-on, and learnt everything I know there,” he told Rural News. His plans to continue travelling fell by the way, and Rink is now

laboratory job and ongoing career progression. She joined Apata, a specialist service provider for New Zealand kiwifruit and avocado growers, last year.

The Young Grower competition celebrates

settled with a long-term partner, and “very happy where I am.”

“I am enjoying the opportunities that I had, the knowledge I was learning, the growth that I was experiencing individually and professionally.”

Rink said that when he learned of the Canterbury regional competition, Oakley’s managing director, Robin Oakley, was keen for him to enter because it was his only opportunity because of the age limit.

Not knowing what to expect, Rink said he went in blind but found it a very fun experience with lots of learning.

the success of young people in the industry as well as encouraging others to consider a career in horticulture.

Runner up was Steven Rink, the Canterbury regional champion, who is a production manager for Oakley’s Premium Fresh Vegetables in Southbridge.

Third spot went to Amelia Marsden, representing Nelson, who is a kiwifruit manager at Willisbrook Orchards in Brightwater.

“The key takeaway was that you get pigeonholed in our roles.

“As the production manager, I focus on the on-farm, the tractor driving, the quality of growing the crop, the irrigation.

“Then having to actually sit back, lift your head up and go ‘oh there’s marketing, there’s the business aspect side of it’. Having to do all of that, be exposed to itnot even doing it in real life but just having to start thinking of it - has been fun and awesome.”

Oakley’s staple crops are potatoes, broccoli, pumpkin, beetroots, and some cereals, with the likes of grass seed and peas to complete the rotations. In the interests of diversification they also tried a crop of quinoa last season and will do it again, said Rink.

– Nigel Malthus.

For the Innovation Award, Rink presented a proposal for an AI-integrated chemical shed that monitored everything going in and out to give an up-to-date live inventory. He said he had received a lot of encouragement to make it a reality because keeping track was currently his “Achilles heel” and such a system would be a game changer for the company.

LEO ARGENT

WITH PRODUCTION volumes

contracting in most major beefproducing regions, global cattle prices have continued to rise across recent months.

That’s according to Rabobank’s recently released Q3 Global Beef Quarterly report. It says reductions in production volumes in Europe, New Zealand, Brazil and the US contributed to a 2% fall in global beef production for the first half of 2025, helping to increase global cattle prices through Q2.

While Australia and China saw beef production increases of 10% and 4% for the first half of the year, RaboResearch senior agricultural analyst Jen Corkran said global production was still expected to reduce 3% for 2025.

“Northern hemisphere countries continue to stand out at record prices, but US and Canada prices have moderated in recent weeks, suggesting some of the heat is slightly reducing in this market.

“Meanwhile, prices in southern hemisphere countries continue to increase. Reduced volumes in the North American market, plus a slight

improvement in the Chinese market, have generated stronger demand for southern hemisphere beef suppliersand we’re continuing to see this strong demand flow through to cattle prices.”

Brazilian beef exports to the US through July 2025 were 94% higher than the same period last year, partly due to the latest round of US tariffsannounced July 31 but not implemented until August 6- encouraging Brazilian exporters to frontload volumes before the deadline which brought total tariffs on Brazilian beef to 76.4%.

Nearly a month after, shipments remain strong in a year-over-year comparison through to the fourth week of August 2025, remaining stable even after the tariffs took effect.

Corkran said projections of rising live cattle prices in Brazil may explain the current appetite from American importers for Brazilian beef.

“US imports from Brazil may drop an estimated 10,000 metric tonnes (mt) to 15,000mt per month as we progress through the remainder of the year. Coincidentally or not, the tariffs came into effect at the end of the US domestic peak consumption period from May to August. This timing may also see reduced demand from US

buyers of Brazilian exports.”

“August saw the announcement of a 15% tariff on NZ beef entering the US. As Australian beef continues to face only a 10% tariff, this poses a competitive challenge. Nonetheless, strong US demand for NZ lean trimmings supports a positive outlook for farmgate prices in the second half of 2025.”

The US remains New Zealand’s leading market, absorbing 40% of total volume whilst China accounted for 24%. Canada saw a 54% Q2 yearon-year volume increase to 11,345mt.

Following what was a steady Q1 performance, New Zealand’s Q2 beef production saw volume dropping 16.6% year-on-year to 177,000mt. Given limited cattle availability across the country, Corkran said the decline aligns with expectations.

“NZ Meat Board data shows national cattle slaughter fell 15% in head count year-on-year, totalling just over 700,000 head compared to more than 840,000 head in Q2 2024.

“The breakdown reveals a 14% drop in bull beef, a 15% decline in cull cow numbers and a significant 20% reduction in steer slaughter.”

Looking ahead, Q3 production is

forecast to reach just under 118,000mt, representing a further 5% decline.

Corkran said that RaboResearch maintains its full-year outlook of a 4% to 5% year-on-year drop in total beef slaughter numbers.

“Final production volumes will hinge on pasture conditions through spring and average carcass weights during the lower-volume quarter period. New Zealand is expected to process fewer bobby calves this year, which will increase beef production in

two years’ time.”

In line with reduced production, New Zealand’s total beef export volume fell 11% year-on-year Q2 2025, to 129,670 metric tons. Despite this, export values increased 7% to $1.432 billion, driven by strong global demand and firmer pricing.

The quarter also included a new record average export value of $11.17/ kg Free On Board (FOB) in April, followed by a new $11.20/kg FOB in July.

LEO ARGENT

WITH PRODUCTION volumes

contracting in most major beefproducing regions, global cattle prices have continued to rise across recent months.

That’s according to Rabobank’s recently released Q3 Global Beef Quarterly report. It says reductions in production volumes in Europe, New Zealand, Brazil and the US contributed to a 2% fall in global beef production for the first half of 2025, helping to increase global cattle prices through Q2.

While Australia and China saw beef production increases of 10% and 4% for the first half of the year, RaboResearch senior agricultural analyst Jen Corkran said global production was still expected to reduce 3% for 2025.

“Northern hemisphere countries continue to stand out at record prices, but US and Canada prices have moderated in recent weeks, suggesting some of the heat is slightly reducing in this market.

“Meanwhile, prices in southern hemisphere countries continue to increase. Reduced volumes in the North American market, plus a slight

improvement in the Chinese market, have generated stronger demand for southern hemisphere beef suppliersand we’re continuing to see this strong demand flow through to cattle prices.”

Brazilian beef exports to the US through July 2025 were 94% higher than the same period last year, partly due to the latest round of US tariffsannounced July 31 but not implemented until August 6- encouraging Brazilian exporters to frontload volumes before the deadline which brought total tariffs on Brazilian beef to 76.4%.

Nearly a month after, shipments remain strong in a year-over-year comparison through to the fourth week of August 2025, remaining stable even after the tariffs took effect.

Corkran said projections of rising live cattle prices in Brazil may explain the current appetite from American importers for Brazilian beef.

“US imports from Brazil may drop an estimated 10,000 metric tonnes (mt) to 15,000mt per month as we progress through the remainder of the year. Coincidentally or not, the tariffs came into effect at the end of the US domestic peak consumption period from May to August. This timing may also see reduced demand from US

buyers of Brazilian exports.”

“August saw the announcement of a 15% tariff on NZ beef entering the US. As Australian beef continues to face only a 10% tariff, this poses a competitive challenge. Nonetheless, strong US demand for NZ lean trimmings supports a positive outlook for farmgate prices in the second half of 2025.”

The US remains New Zealand’s leading market, absorbing 40% of total volume whilst China accounted for 24%. Canada saw a 54% Q2 yearon-year volume increase to 11,345mt.

Following what was a steady Q1 performance, New Zealand’s Q2 beef production saw volume dropping 16.6% year-on-year to 177,000mt. Given limited cattle availability across the country, Corkran said the decline aligns with expectations.

“NZ Meat Board data shows national cattle slaughter fell 15% in head count year-on-year, totalling just over 700,000 head compared to more than 840,000 head in Q2 2024.

“The breakdown reveals a 14% drop in bull beef, a 15% decline in cull cow numbers and a significant 20% reduction in steer slaughter.”

Looking ahead, Q3 production is

RaboResearch

forecast to reach just under 118,000mt, representing a further 5% decline.

Corkran said that RaboResearch maintains its full-year outlook of a 4% to 5% year-on-year drop in total beef slaughter numbers.

“Final production volumes will hinge on pasture conditions through spring and average carcass weights during the lower-volume quarter period. New Zealand is expected to process fewer bobby calves this year, which will increase beef production in

two years’ time.”

In line with reduced production, New Zealand’s total beef export volume fell 11% year-on-year Q2 2025, to 129,670 metric tons. Despite this, export values increased 7% to $1.432 billion, driven by strong global demand and firmer pricing.

The quarter also included a new record average export value of $11.17/ kg Free On Board (FOB) in April, followed by a new $11.20/kg FOB in July.

Questar with Inatreq active offers a unique mode of action for persistent curative and protective control against all Septoria strains.

Using our patented i-Q4 formulation, it provides near 100% leaf coverage and high flexibility in application, delivering robust, market-leading protection so you can secure your yield and the future of your farm.

Many farmers have invested in solar energy for dairy sheds or houses, but little hard data exists on the viability of solar panels in open paddocks or the loss of drymatter this may cause. Massey University scientist Dr Sam Wilson is conducting research to get more information about this. Rural News reporter Peter Burke went to investigate.

FOR A start, let’s be clear. This is not about measuring the financial returns of any solar power generated by the panels.

The focus is on pasture growth – losses and gains due to the light and rain shadows caused by the panels. Also, the trial involves sheep only, not cattle.

On two small paddocks adjacent to the main Palmerston North Massey campus, Wilson’s research team has set up five look-a-like solar panels. Look-a-like because they are not real panels, they are made of iron, but are made to the exact dimensions of normal panels that would be placed in a paddock. They face north to get the maximum sunlight and are spaced three metres apart – the same as if they were normal solar panels. One paddock is the ‘control paddock’ with no panels so a comparison between the two situations can easily be drawn.

The paddock with the panels in it contains a huge range of datagathering devices that measure, rainfall, wind, light, soil moisture and temperature and these are placed strategically under, around and outside the panels. There are also small ‘cages’ over the grass in similar strategic locations to capture any differences.

Wilson began the project just on a year ago and some preliminary results have come through, but he says they plan for at least another year of trials to ensure the validity of the data.

“In a previous pilot study we did in Taranaki we found there was an 84% reduction in pasture growth under the panels but a 38% increase between the panels. This

site is aimed at putting more explanation around why those differences were occurring, hence the extra measuring devices,” he says.

DR SAM Wilson says the panels are in effect creating shelters from wind, rain and sun resulting in a series of ‘microclimates’ at various points around the structures.

Not surprisingly, there is a variation between summer and winter. In winter he says the angle of the sun is lower and this combined with cooler temperatures caused a 25% reduction in pasture growth between the panels.

“But in summer when the sun is higher, about 90% of the light gets through to the middle of panels and there is an increase in pasture growth of around 30%,” he says.

The light loggers placed around and under the panels form an interesting aspect of the research project.

Dr Wilson says this measures photosynthetic active radiation, which is the light that is available for the plants to use.

But in the summer the shading effect of the panels slightly reduces this by about 10%.

“However, this is not a problem because we know that pasture plants don’t necessarily need full sunlight all day to grow at their maximum potential rate, and in fact, if they get too much sunlight, it can be harmful. So, 90% availability of sunlight caused by the shading is likely closer to the optimum level for the pasture to grow, particularly in summer,” he says.

This effect, along with the extra water that this area receives from rain running off the panels,

are the most likely drivers for the extra growth in summer.

One of the first things that strikes you when walk into the paddock with the panels is the bare patches underneath them, clearly caused by the lack of rain and sunlight, but it isn’t entirely all bad news.

Sam Wilson says, during lambing, the shelter provided by the panels is great for the lambs. He says it protects them from wind, which can be a major cause of lamb losses, is dry and warm and allows the ewe to leave her lamb under the solar panel and feed herself.

So, in the end, it all becomes something of a trade-off. Probably a lower stocking rate may be offset by benefits during lamb with shelter and seeing how the various microclimates perform in terms of pasture growth. He says there is an obvious loss of pasture growth in winter, but a potential gain in summer.

Other research on the use of solar panels is being done at Lincoln University and there are extensive studies being done in Europe and there is some work being done in Australia. Wilson says in Europe they are looking at planting arable crops between the panels which are spaced wide enough for a combine harvester to get through.

He says in a couple of years’ time, similar trials may be done in NZ. The aim he stresses is to give farmers some hard data on which to base their decisions around installing solar panels, rather than relying on anecdotal evidence.

We deliberately challenge our Romneys by farming them on unfertilised native hill country in order to provide the maximum selection pressure and expose ‘soft’ sheep.

GROWTH RATE & SURVIVAL

Over the last 20 years ewes (including 2ths) have scanned between 185% and 210% despite droughts.

Over the same period weaning weights (adj. 100 days) have exceeded 36kg from a lambing % consistently above 150%.

• All sheep DNA and SIL recorded.

• Ram hoggets have been eye muscle scanned since 1996. IMF scanned since 2023.

• Ewe hoggets have been mated (to Romney sires) for over 20 years.

• Breeding programme puts an emphasis on worm resilience - lambs drenched only once prior to autumn. FE tolerance introduced more recently.

• Scored for dags and feet shape. Sires DNA rated for footrot and cold tolerance.

• We are ‘hands on’ breeders with a focus on detail and quality.

• We take an uncompromising approach - sheep must constantly measure up.

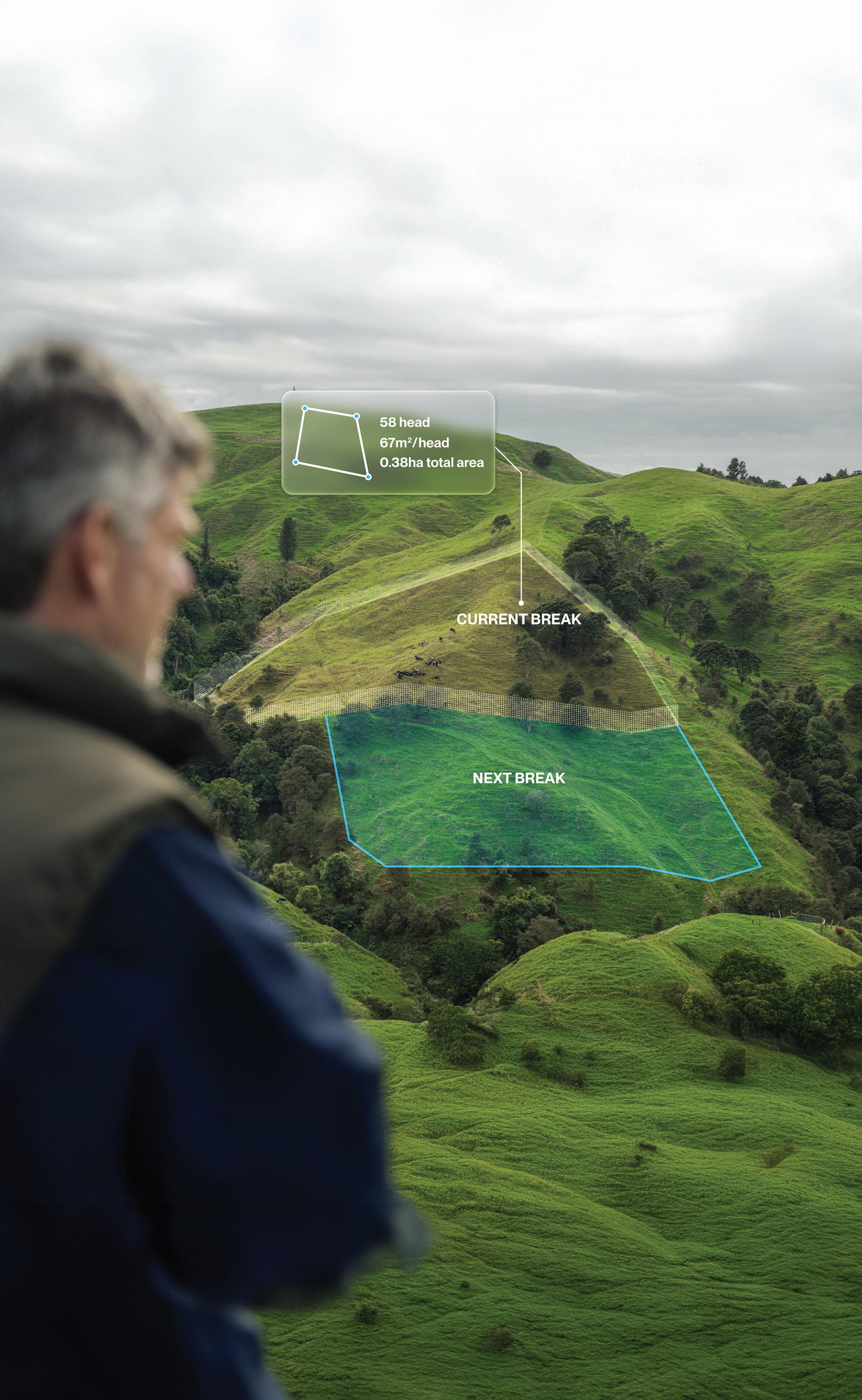

NESTLED IN Waikite Valley in Rotorua, Stokman Angus is one of the first beef farms in New Zealand to try virtual fencing technology.

In partnership with Halter, owners Mark and Sherrie Stokman have been using Halter collars on their 456-unit farm – comprising Angus stud cows and commercial Angus cows and yearling bulls.

Stokman Angus holds regular bull sales. In 2024, it sold 115 bulls averaged at $5340/bull with 65 head selling for under $5000. The 380ha effextive farm includes hilly terrain.

At a recent Beef + Lamb New Zealand council meeting and field day on the farm, Mark told farmers that physical fencing can be a barrier to rotational grazing on beef farms. It’s been expensive, labour intensive, and restrictive.

He says they are excited to team with Halter to test the world-leading virtual fencing technology to the beef industry.

Mark says he’s been very impressed

I

with Halter. Pasture is being managed effectively, even on hilly terrain. The technology helps optimise grazing and feed management by providing realtime data and provides a live map of the herd and allows for remote management, giving Stokman Angus more flexibility and control over their cattle.

“It’s so simple to make that virtual fence line, we are grazing to a more consistent residual and getting better regrowth behind. I would say we are saving three hours of labour a day and we are going to get 15kg weaning weight gain,” he says.

“After a tougher summer and a slow autumn to follow, our sale bulls spent a few months on the hills to build up some cover on the flats. Halter was a game changer to be able to graze effectively and evenly over areas we don’t usually run the yearling bulls.

“We definitely can say the team didn’t complain about not having to run reels and standards up and down the hills.”

Mark says he did his homework on Halter and believes a 15kg weaning weight gain on yearling bulls made

“I’m half Dutch and an ex-dairy farmer and we’ve got a big mortgage. I believe you can have whatever you want - if you’re throwing money at it and you make enough off it to make it work well.

“When we first got Halter, I think I calculated that if you’ve got an extra 15kg weaning weight, say at $4 a kilo, there’s $60.

“Well, that’s over 50% of your collar

cost on a yearly basis, so I think that’s quite a return.

“Then when we look at our labour saving, a lot less side-by-side usage, freeing up time block, then as a whole I’m impressed with Halter.”

A Halter representative at the field day told farmers that the beef sector is the focus of the New Zealand company that has now gone global.

“It’s the core of where we see all our growth. a couple of years ago we

really saw value in the beef space,” she said.

“We’ve got a whole team working on the development of the product now and there’s going to be some pretty cool things coming out for our New Zealand beef farmers and also for international beef farmers.”

She says Halter has about 90% of the dairy virtual fencing market in New Zealand and remains the fastest growing provider in the dairy space.

At FMG, we’re happy to cover all your insurance needs under one roof. On-farm and off-farm. It saves you time, is way less hassle, and builds your relationship with one insurer that really gets rural. Just give us a call on 0800 366 466 and we’ll help sort everything out for you.

We’re here for the good of the country.

DEFENDERS OF New Zealand remaining bound to the Paris Agreement typically run the same argument. They do not explain the benefits of remaining bound to Paris, because there are none. At least none that are certain and enduring.

The only one they can muster is the possibility of export trading advantage. But given the international perception of New Zealand as clean, green and world leaders in sustainable emissionsefficient food production, that argument is tenuous. Instead, they prey on our fear. Not of what will happen, but speculation what could happen. This scaremongering led to the widely publicised claim of a loss of $3 per kg on the dairy farmers milk payout if we exited the Paris Agreement. The source of this $3 claim came from a discussion between

one of our industry leaders and a dairy company employee. When we requested evidence backing up this claim, communication ceased.

Another key piece of information defenders of Paris avoid outlining is the costs of being bound by the Paris Agreement. No mention of the $400 million the Government is pouring into agriculture emissions research over the current 4-year period. Or the multiple bureaucracies such as the 50/50 government/private sector AgriZero investing $200 million into speculative methane cures and the Pastoral Greenhouse Gas Research Centre’s $90 million in the last 22 years, and what to show for it? Or the up-to-$24 billion bill that Treasury warned we could face to meet Paris climate targets.

There is also no mention of the opportunity cost of our hundreds of millions of taxpayer’s dol-

lars that would be better utilised helping our ailing health system or desperately needed key infrastructure upgrades.

It is not just financial costs but other costs like loss of productive farms and indigenous biodiversity to pines driven by the Paris Agreement’s flawed myopic focus on emissions to the detriment of other values. Oh, but food production is protected under the Paris Agreement, they say, not reconciling the fact we are losing hundreds of thousands of hectares of food producing land because of the Paris Agreement.

By contrast to the one-sided defenders of Paris, Groundswell NZ acknowledges there are risks either way. However, when considering knowns verses unknowns, the answer is clear. The Paris Agreement as currently written is bad for many countries, not just New Zealand. Bad for farmers,

bad for our economy, bad for our landscapes and environment.

Our politicians need to show some courage and stand up for our country. It is not a ques-

tion of giving Paris the middle finger and doing nothing. It is a question of highlighting to other signatories the significant flaws and unsustainable cost implications of being bound to Paris, while at the same time telling the amazing story of New Zealand farmers environmental journey and how we will continue to lead the world in environmentally sustainable food production, regardless of whether we are in Paris or not.

• Jamie McFadden is Groundswell environment spokesman

Tues 23 Sept Napier The Crown Hotel

Wed 24 Sept Taihape Kokako Street Hall

Fri 26 Sept Stratford Stratford TET Stadium

Mon 29 Sept Ashburton St Andrews Presbyterian Church

Tues 30 Sept Kaikoura Donegal House

Wed 1 Oct Westport Westport Bridge Club

Thur 2 Oct Hokitika Hokitika Golf Club

Mon 6 Oct Omarama Omarama Hall

Tues 7 Oct Wedderburn Wedderburn Woolshed

Wed 8 Oct Otautau Otautau Connect

FORESTRY IS not all bad and planting pine trees on land that is prone to erosion or in soils which cannot support livestock farming makes sense.

And yes, production forestry does make a significant contribution to the country, but at what price? Just picture the devastation caused by forestry slash on the East Coast during cyclone Gabrielle.

Also note the comments of former Feds president Bruce Wills – the damage by forests to neighbouring pastoral farms in the form of broken fences, the invasion of pests such as deer and possums and the fire risk. By all accounts many forestry owners go bush when it comes to paying for the damage and cost incurred on their pastoral neighbours.

The other big problem highlighted by Whanganui Feds boss Ben Fraser is deeply worrying. The advent of planting forests for carbon credits provides almost no benefits to local rural communities. ‘Lock up and leave’ is not a bad description of farming for carbon credits because it provides little or no ongoing employment, unlike pastoral farming which offers jobs on farm and employment to a raft of people in the community.

The government claims to be putting the brakes on carbon farming, but they are not doing enough, say farming and community leaders. Drive down just about any country road and you will see large tracts of hill country where once was, and still should be, the home of our ewe flocks producing export lambs, which is now sprouting little or bigger pine trees for what purpose?

The heart of the problem seems to be the misinterpretation of the land use capability (LUC) system, closely followed by a complete lack of common sense and understanding of NZ’s soils and land.

The LUC system is quite prescriptive and inflexible and fails to recognise what the human eye can see in terms of what is the best use of land.

If urgent decisive action is not taken by the government now, Godzone will change from being known as Ewe Zealand to now maybe New Treeland – Peter Burke

HEAD OFFICE POSTAL ADDRESS: PO Box 331100, Takapuna, Auckland 0740

Phone 09-307 0399

PUBLISHER: Brian Hight Ph 09 307 0399

GENERAL MANAGER: Adam Fricker Ph 021-842 226

EDITOR: Sudesh Kissun Ph 021-963 177 sudeshk@ruralnews.co.nz

“What a waste of time - none of them had a clue where Razor’s getting it wrong!”

AFTER A run of bad polls and mixed economic news, PM Christopher Luxon was no doubt hoping for a bit of luck. The Hound doubts the PM expected that luck to arrive wearing a hoodie and posting racist Tik Toks in the wee small hours after having a few.

But Tākuta Ferris might be just the loose cannon Luxon needs as the next election appears over the horizon. Ferris embodies the radical, unfit-for-office image many middle voters have of The Māori Party, which also embodies Labour leader Chris Hipkins’ worst nightmare, because anyone that can count knows Labour will need Te Pati Māori and the Greens to form a viable government. However, Luxon can’t afford to sit back, ironing his suit and waxing his head in anticipation of his victory speech in the election – the poor polls are shouting, “must try harder!”

A FEW armchair experts have dumped on Fonterra’s $4.22b sale of its consumer business, but the more your old mate reads about it, the more it seems like a smart move. Kiwis feel a surge of pride when they see the old Anchor brand when they’re overseas, but national pride isn’t exactly the last word in financial analysis. A better yardstick is the opinion of the likes of Forsyth Barr senior analyst Matt Montgomerie and analyst Ben Crozier, who refer to the assets sold as “the poor-performing Mainland Group”. They view Fonterra as a “much higher-quality business” without it. The Consumer business has long been a problem area for Fonterra and its return on capital is typically abysmal compared with the co-op’s Foodservice and Ingredients arms. Fonterra’s core strength is clearly milk processing—not branded consumer products.

THIS OLD mutt is loath to sound like Groundswell has been topping up his bowl with brisket off-cuts, but the ginger group makes a good point about the arguments raised in favour of toeing the Paris Agreement line. From the Government through to the levyfunded lobby groups, they all calmly claim we will be penalised in the market if we drop Paris. Little or no effort is made to verify this claim. “Instead, they prey on fear.” And with their myopic focus on emissions, they never reconcile the fact we are losing hundreds of thousands of hectares of food producing land to pines because of the Paris Agreement. As the ginger group says, it’s not about giving Paris the middle finger and doing nothing, it’s about highlighting to other signatories the significant flaws and unsustainable cost implications of being bound to Paris.

Want to share your opinion or gossip with the Hound? Send your emails to: hound@ruralnews.co.nz

IF THE comments about the deceased Tom Phillips posted on social media by keyboard warriors were representative of parenting standards in NZ, your old mate would be worried about our collective future. Fortunately, most Kiwis don’t think a Barry Crump novel (Wild Pork and Watercress) is a good blueprint for parenting and can recognise that taking little kids bush for four years, involving them in crimes and putting a child in danger by starting (and losing) a gun battle with police is not the resume of Dad of the Year. There are no winners in this tragedy, particularly not those three kids, and the efforts of a few to canonise Phillips as some sort of rebel-hero could set a dangerous precedent; nobody wants to see any feral copycats trying this sort of thing ever again.

EDITOR-AT-LARGE: Peter Burke Ph 021 224 2184 peterb@ruralnews.co.nz

REPORTERS: Nigel Malthus Ph 021-164 4258

Leo Argent

MACHINERY EDITOR: Mark Daniel Ph 021 906 723 markd@ruralnews.co.nz

PRODUCTION: Becky Williams Ph 021 100 4381 beckyw@ruralnews.co.nz

AUCKLAND SALES CONTACT: Stephen Pollard Ph 021 963 166 stephenp@ruralnews.co.nz

WAIKATO & WELLINGTON SALES

CONTACT: Lisa Wise Ph 027 369 9218 lisaw@ruralnews.co.nz

SOUTH ISLAND SALES CONTACT: Kaye Sutherland Ph 021 221 1994 kayes@ruralnews.co.nz

DIGITAL STRATEGIST: Jessica Marshall Ph 021 0232 6446

LAND USE change is to the fore (again) because of headlines indicating the potential for growing rice, expansion of dairying in some regions, and ongoing concerns about carbon farming.

It seems that everybody has an opinion about what should happen in New Zealand, whether that opinion is informed or not.

“The problem is always the unintended consequences of decisions made on opinion”.

The problem is always the unintended consequences of decisions made on opinion. This is the case even when that opinion has been informed by research.

Was the research done on Google? Or did it involve the land under discussion, incorporating food production, environmental impact and economics? Has it considered infrastructure requirements on farm and in local businesses? Labour availability? Or the impact on rural

communities?

Or has the research been informed by scenarios and models, in which case, were the assumptions and constraints appropriate –and were they informed by Google? Or actual research by landbased scientists? How appropriate was that land-based research for the area now under consideration – or were the results from elsewhere extrapolated to the current geographical location?

The difficulty with ‘extrapolation’ is usually why models and scenarios are created in the first place. They are used for exploring or predicting something that can’t yet be measured (what will happen in the future) or is too expensive to do in reality.

It’s complicated.

Which is why sometimes we need gut feeling based on experience, and common sense based on “knowledge, judgement, and taste which is more or less universal and which is held more or less without reflection or argument”.

Where do rice, dairy and pine trees rate in gut feeling and common sense?

Jacqueline Rowarth

Of the three, only one would meet Michael Porter’s criteria of a natural advantage that has been made competitive. Porter states that “Firms can achieve superior profitability by creating greater customer value through cost leadership (lower costs) or differentiation (unique products). A firm possesses a sustainable competitive advantage when it consistently outperforms rivals by operating at a lower cost, commanding a premium price, or both”.

For New Zealand, ‘Firm’ equals Fonterra.

Despite this, New Zealand farmers, rural professionals and policy creators are constantly being urged to do things differently, diversify and generally be more innovative.

Well-meaning as the urging often is, skin

in the game makes a difference. It is attached to risk: the unintended consequence of a new policy can destabilise a business.

Last year, the Parliamentary Commissioner for the Environment (PCE) released a report (Going with the Grain) in which he identified four critical problems and some practical solutions. Considerable research underpinned the report, and the PCE’s aim was to make practical suggestions for managing land use change to meet environmental bottom lines. He also acknowledged that many of the environmental impacts of land use are difficult to measure, do not respect property boundaries and make attribution challenging.

His main suggestion was that New Zealand must take an integrated approach to environmental management (catchments rather than individual properties).

This is occurring in some areas.

Funding was central in the PCE’s report, as it was in the 2025 ASB-funded report ‘Future Land Use in New Zealand’ from

Lincoln University’s Centre of Excellence in Transformative Agribusiness. Lincoln’s report also emphasised the importance of a shift to optimising land use rather that farm systems – integration –noting that the scenarios developed in the Lincoln report acknowledged that dairy is one of the higher value land uses in New Zealand (while also highlighting the associated environmental impact).

Dairy expansion is responding to market forces.

When people want a product, they pay. Increasingly it is being recognised that animal protein feeds more people for lower environmental impact than plant sources can achieve. Plants are important for fibre,

vitamins, polyphenols and deliciousness (and kiwifruit expansion is occurring) – but they can’t provide the essential amino acids in the same efficient ratios as animal protein. And animal protein supplies nutrients other than protein, such as fats, calcium and iron, and deliciousness, as well.

The difficulty with policies that don’t take market forces into account is that there is an opportunity cost. Overseas the opportunity cost has been offset by ‘producer support mechanisms’ also known as subsidies. The problem is that current society doesn’t want to be paying subsidies, but nor do people want to pay more for food.

When a comparative advantage has been turned into a competitive

advantage, a product can be produced efficiently –and in the case of ‘grassfed’ attract premium markets as well. Part of the requirements from premium markets is a goal of minimising environmental impact.

The role of science – from the new Public Research Organisations, the universities and the levy bodies – remains at the core of being able to maintain the economy and the environment – production and protection.

Gut reaction? It’s common sense.

• Dr Jacqueline Rowarth, Adjunct Professor Lincoln University, is a farmerelected director of DairyNZ and Ravensdown. She is also a member of the Scientific Council of the World Farmers’ Organisation. jsrowarth@ gmail.com

MURRAY GOUGH

AS CEO of the Dairy Board in the 1980s I was fortunate to work with a team of experienced and capable executives who made most of the brand investments that created the international consumer business

Fonterra inherited.

Soprole in Chile was the largest, but there were more than 20 countries where consumer marketing companies were established and Anchor and other brands were successfully launched.

The prime motivation at the time for those

investments was not, as many today think, profit and added value. It was to create more secure outlets for New Zealand’s milk; those were the days of butter mountains and dumping and loss of the UK market. New outlets had to be found quickly, and branded consumer products were a much

more reliable ongoing sales opportunity than commodity tenders in places like Algeria and Venezuela.

The brand businesses needed to operate profitably, but the benchmark was the return from selling the same amount of milksolids into crowded – and at times

barely existent – bulk markets.

It was always envisaged that the brand businesses would in time become increasingly valuable, but for many years it was their value as a secure outlet for milk that mattered most.

Fortunately for New Zealand, the GATT Uruguay Round put a stop to European and American surplus mountains and dumping, and in the course of the 1990s and since, world demand for dairy products has steadily grown. World prices have increased to reflect the true cost of production – and production cost is where New Zealand has an ongoing advantage.

The need to own consumer businesses to move our milk no longer exists. There is no difficulty now in selling all we can produce at good prices. And there are also many opportunities to add value in food service and specialised ingredient products. The only justification for Fonterra to continue to own and invest in consumer brands is if it can achieve an attractive return on the capital invested. And sadly that is not the case.

Fonterra was formed more than 20 years ago and over that time it has struggled to achieve an acceptable return on capital in its consumer businesses. Some decisions such as the investments in China have resulted in very substantial losses.

There are clear reasons why Fonterra has found it too difficult:

• Standard high volume food products such as butter and cheese and milk powder are intensely competitive and don’t offer significant brand margins. In most countries the market is dominated by two or three large and very capably managed brands

whose owners work extremely hard to ensure other suppliers struggle to survive.

• Every one of the world’s major dairy brand marketers has a huge domestic market in which to develop and test products and management expertise –New Zealand’s domestic market is simply too small to do that.

• Fonterra would need to be able to recruit highly capable and experienced international brand marketing executives, and have a board of directors experienced in governing a global consumer business –neither has been, or is likely to be, available in New Zealand. We are too remote and our domestic market is too small. New Zealand has had some international business successes, particularly where technology is a factor (such as Fisher and Paykel Healthcare), but we have very limited experience in managing business networks beyond our border.

Fonterra’s decision to sell has been based on what it thinks is best for its shareholders –and the absolute priority for them is the highest achievable return for their milk. It could only sensibly continue to own a branded consumer business if it expected to earn a sound return on the capital invested – and that isn’t the case.

After many years of trying, it should surprise no one that Fonterra has decided to sell, and to focus its energy on opportunities where New Zealand does have the skills and experience to expect to manage successfully.

• Murray Gough was the chief executive of the New Zealand Dairy Board from

JO FINER

THE POTENTIAL for technology to transform the way farms operate and perform in New Zealand and globally is immense and the agritech revolution is well underway.

And that’s before you take into account the wealth of opportunities for the sector being opened up by artificial intelligence (AI).

“The agriculture sector has changed very significantly since then and our profession has evolved to meet those changing needs.”

However, change doesn’t come easily to everyone, and many farmers and growers encounter challenges with adoption. That may be due to uncertainty about return on investment, concerns about compatibility with existing systems, or lack of digital literacy.

Increasingly, a key contribution of farm advisors and rural professionals is the ability to translate emerging technologies into practical, farmready applications.

This was very much a topic of conversation at our recent conference where it was also agreed that our organisation’s name would change to the Institute of Rural Professionals. Our new name better reflects the wide-ranging services and advice our members are providing to farmers and growers. The professional membership body was first incorporated in 1969 as the NZ Society of Farm Management and

in 1999 the name was changed to the NZ Institute of Primary Industry Management.

The agriculture sector has changed very significantly since then and our profession has evolved to meet those changing needs. That change includes a deep commitment to promoting technology uptake and supporting innovation across the primary sector.

As farms become more digitally connected, rural professionals equipped with the skills to identify appropriate tech and discern data quality are playing an increasingly critical role in helping farmers and growers to unlock insights from the tools available, improve productivity and meet sustainability goals.

To support this, and to build capability in data-driven decisionmaking, the Institute is introducing a tailored data science course into our programme of professional development for our rural professional members.

Data based decision-making will become ever more important. The benefits of agritech are increasingly evident across New Zealand’s agricultural landscape. For example, precision irrigation, drone-based crop monitoring, wearable sensors and automated machinery, all of which are enhancing productivity, reducing environmental impact and improving animal welfare.

AI-powered platforms can analyse vast datasets. The output is absolutely transformational and rural professionals are playing a pivotal role in driving the uptake of this everadvancing technology.

Farm advisors with a deep understanding of local farming systems combined with expertise in relevant technologies are well positioned to help farmers and growers navigate this brave new world and identify and make use of the opportunities available to them

• High Flow

• Compact/Robust

• New Pilot Flow Filter