Facts & Trends Real Estate

Winter 2014 Ruhl&Ruhl REALTORS 2013 Was a Very Good Year

Patrick Fennelly Realtor (563) 441-5131 patrickfennelly@ruhlhomes.com

patrickfennelly.ruhlhomes.com

IN THIS ISSUE: page 2

Real Estate Activity Chart

page 4

Ruhl&Ruhl Realtors Celebrates Record Year!

page 4

Regional Home Price Appreciation By Market

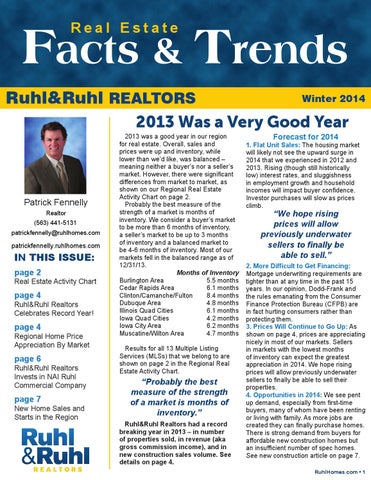

2013 was a good year in our region for real estate. Overall, sales and prices were up and inventory, while lower than we’d like, was balanced – meaning neither a buyer’s nor a seller’s market. However, there were significant differences from market to market, as shown on our Regional Real Estate Activity Chart on page 2. Probably the best measure of the strength of a market is months of inventory. We consider a buyer’s market to be more than 6 months of inventory, a seller’s market to be up to 3 months of inventory and a balanced market to be 4-6 months of inventory. Most of our markets fell in the balanced range as of 12/31/13. Months of Inventory Burlington Area 5.5 months Cedar Rapids Area 6.1 months Clinton/Camanche/Fulton 8.4 months Dubuque Area 4.8 months Illinois Quad Cities 6.1 months Iowa Quad Cities 4.2 months Iowa City Area 6.2 months Muscatine/Wilton Area 4.7 months

page 6

Results for all 13 Multiple Listing Services (MLSs) that we belong to are shown on page 2 in the Regional Real Estate Activity Chart.

page 7

“Probably the best measure of the strength of a market is months of inventory.”

Ruhl&Ruhl Realtors Invests in NAI Ruhl Commercial Company New Home Sales and Starts in the Region

Ruhl&Ruhl Realtors had a record breaking year in 2013 – in number of properties sold, in revenue (aka gross commission income), and in new construction sales volume. See details on page 4.

Forecast for 2014

1. Flat Unit Sales: The housing market will likely not see the upward surge in 2014 that we experienced in 2012 and 2013. Rising (though still historically low) interest rates, and sluggishness in employment growth and household incomes will impact buyer confidence. Investor purchases will slow as prices climb.

“We hope rising prices will allow previously underwater sellers to finally be able to sell.”

2. More Difficult to Get Financing: Mortgage underwriting requirements are tighter than at any time in the past 15 years. In our opinion, Dodd-Frank and the rules emanating from the Consumer Finance Protection Bureau (CFPB) are in fact hurting consumers rather than protecting them. 3. Prices Will Continue to Go Up: As shown on page 4, prices are appreciating nicely in most of our markets. Sellers in markets with the lowest months of inventory can expect the greatest appreciation in 2014. We hope rising prices will allow previously underwater sellers to finally be able to sell their properties. 4. Opportunities in 2014: We see pent up demand, especially from first-time buyers, many of whom have been renting or living with family. As more jobs are created they can finally purchase homes. There is strong demand from buyers for affordable new construction homes but an insufficient number of spec homes. See new construction article on page 7. RuhlHomes.com • 1