3 minute read

Cost Projections

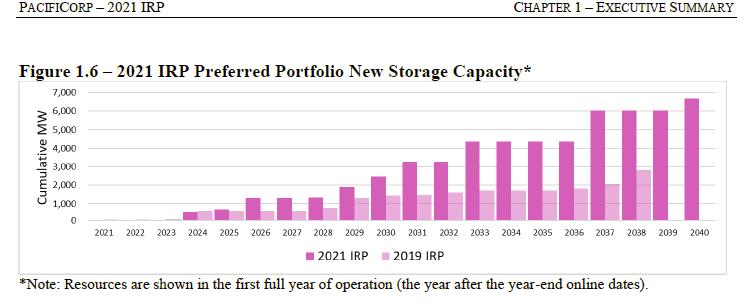

Source: PacifiCorp 2021.

Figure 5.0-1. PacifiCorp’s 2021 IRP Preferred Portfolio New Storage Capacity BESS Cost Projections

5.1 Adjusting BESS Costs for Comparison

5.1.1 Baseline BESS Cost Projections

PacifiCorp’s 2021 IRP uses a figure of $1,820 per kilowatt (kW) for a 50 MW x 4-hour lithium-ion BESS, or $455/per kilowatt hour (kWh), with a design life of 20 years. Energycomponent costs for BESS are forecasted to continue to decline through the early 2030s before leveling out. National Renewable Energy Laboratory (NREL) (2021) projects a 2030 capital cost of ~$1,200/kW (in 2020 dollars) for a 6-hour, lithium-ion BESS.

5.1.2 Adjustment for Duration Comparison

Duration is the amount of time an energy storage device or facility can generate and transmit electricity to the grid at full output. The Project will have a full-capacity storage duration of 10 hours. Most BESS being installed today have storage durations of 2 to 4 hours. As electricity is increasingly generated from variable and non-dispatchable generation sources, grid requirements to balance supply and demand, while maintaining a reliable and stable system, will increasingly require longer than 2 to 4 hours of energy storage duration.

To compare the cost of the Project with a BESS alternative, a BESS storage duration of 10 hours should be assumed, with adequate augmentation required to maintain a full 10 hours over the operating life of the BESS. The NREL projections for 6 hours cited above can be extrapolated to ~$2,000/kW for a 10-hour duration system. This is equivalent to $200/kWh of storage capacity in 2030. The estimated cost for the Project, entering operation in 2030, is approximately $311/kWh of storage capacity. These figures, however, do not provide a sufficient basis for comparison because they do not include the significant lifespan difference between the technologies, which is addressed below.

5.1.3 Adjustment for Lifespan Comparison

BESS systems are known to have a substantially shorter lifespan than pumped storage plants. Figures vary, but NREL’s 2021 Update of Cost Projections for Utility-Scale Battery Storage selects a figure of 15 years from among a range of estimates in other studies. PacifiCorp’s 2021 IRP assumes a design life of 20 years, while Idaho Power’s 2021 IRP uses 15 years (Idaho Power 2021). These compare with a lifespan of over 100 years for pumped storage. To conservatively compare the costs, a 50-year period and two BESS system replacements (i.e., three installations) should be used. Fixed O&M can be estimated at $20/kW-yr for the pumped storage and $30/kW-yr for the BESS. Applying a 5 percent discount rate, the pumped storage has a lower Project cost over the 50-year period, which is only half of its true expected life.

The ITC for stand-alone storage will provide greater advantage to pumped storage than to BESS systems, for two reasons. The first is that pumped storage cost is more front-loaded than that of batteries, while lifespan is significantly longer. The ITC will thus have a greater cost-reduction effect for pumped storage. The second reason is that pumped storage is very likely to qualify for the 10 percent bonus adder for domestic content, while battery supply chains are not close to reaching the threshold needed to qualify for that bonus.

5.2 DOE 2020 Comparison

For another basis of comparison, the Department of Energy’s (DOE) 2020 Grid Energy Storage Technology Cost and Performance Assessment (Dec 2020) (DOE 2020) includes projected costs for an 8-hour, lithium-ion BESS, using the Lithium iron phosphate chemistry that is expected to become dominant. The total installed cost for the BESS is $2,131/kW, or $266/kWh. However, the calendar life estimated for the BESS is 10 years (2,100 cycles). In its storage technology assessment, DOE assumes the calendar life for pumped storage is 40 years and 13,870 cycles (DOE 2020). Thus, when the figures are annualized, the cost for pumped storage—using figures similar to those for the Project— is shown to be much lower (Figure 5.2-1).