Calcutta Group Anticipates $50 million Home Furnishings Business in Five Years

News Network

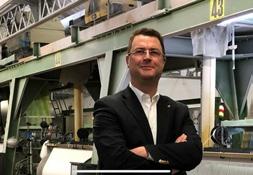

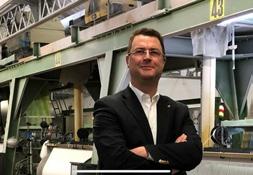

EVERGEM, BE—Calcutta Mills antic ipates major growth from its current sales of $15 million to $50 million within five years through its current business and other future acquisitions, according to Christof Vermeersch, CEO.

Guy Parmentier has been working with Vermeersch for the past two years and will function as sales director of the growing enter prise. Brigitte Gyselinck, managing director of

Takomi in St. Niklaas, Belgium will head prod uct development and design new collections for Annabel.

Crypton® branded upholstery and wall coverings are planned for Heimtextil 2023, Parmentier says. This is the first European mill to brand product with Crypton®.

Calcutta brand roller shades, Annabel branded upholstery, Fortune and Jackie & the Fish branded carpet and Mublo branded high end furniture are part of the current business.

Vermeersch has a long history of successful turn around manage ment in the textile industry.

Twenty years ago, he was CEO of De Poortere Velvet in Belgium as a bankrupt company and put it on solid footing. He later focused on the rug business and left his part

Global Home & Contract Sourcing News Volume 34, Number 1 • Winter 2022/23

Guy Parmentier, Brigitte Gyselinck Join Forces with CEO Christof Vermeersch

F&FI

(continued on Page 1) Stout Textiles Scores Double Digit Sales Gains • P20 A Tale of Two Markets: Retail upholstery business suffers. Post Covid Hospitality Business Rises

John Greenawalt

merchandiser

The Lord and Lady of Hospitality Fabrics: Dan and Judy Dobin, Founders, Valley Forge Fabrics with Eric Schneider, Publisher (cen ter back). See BDNY Action on Page 13.

Alison Groarke, visual

ROMO Los Angeles showroom with Nicola Henry, President RomoUSA; Skye Makhani, senior manager, DCOTA Florida and Frederic Henry, CEO Romo USA.

HeimtextilEdition Nobilis Scores Record Sales, Builds With Younger Buyers • P26 (continued on Page 28) Romo USA Sales Up OneThird in Two Years • P22

Christof Vermeersch Norman Halard

We arrived in Morcambe Lancashire on Friday evening having cycled 380 miles and climbed 21,000 ft. In 6days; including snake pass in the Peak District and the road from Skipton to Settle near Giggleswick. The person that told me the road from London to Lancashire was all uphill was right!

Thank you to all those that sponsored us, if you did not there is still time on my just giving page.

So far we have raised over £23,000 for deserv ing Charities. Well done to all the great people that took part, and organized the trip. Thank you!

Published by Sipco Publications Inc. 726 Jefferson Avenue, Suite 2 Miami Beach, FL 33139 U.S. Tel: +1.917.251.9922 www.fandfi.com

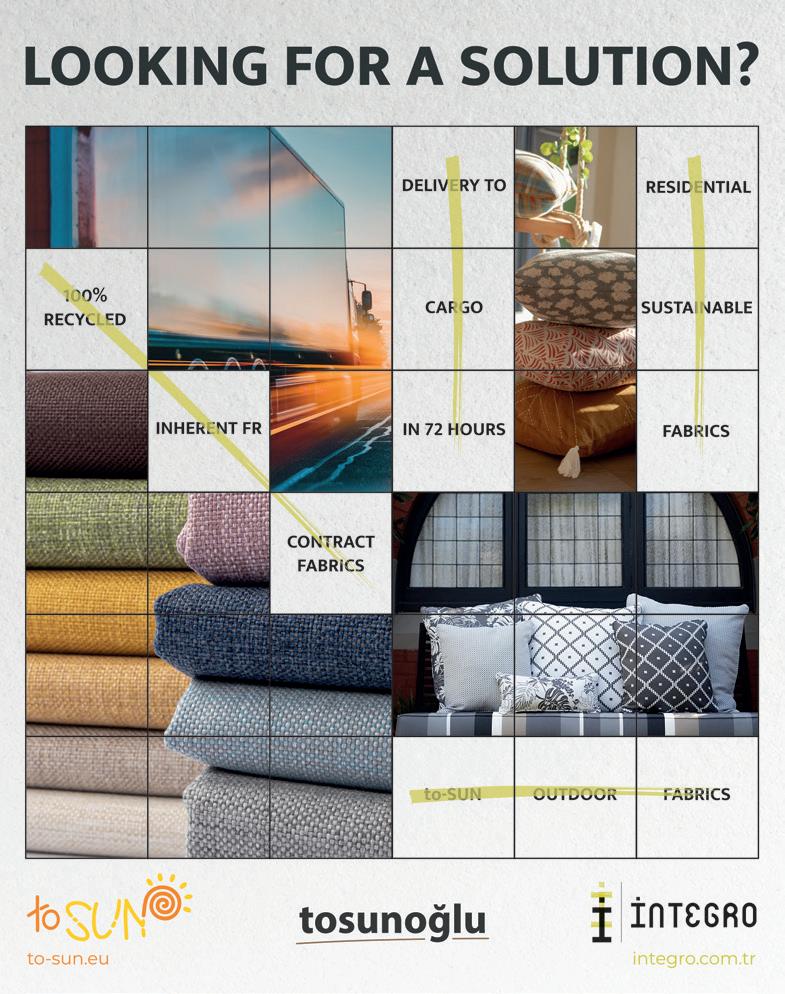

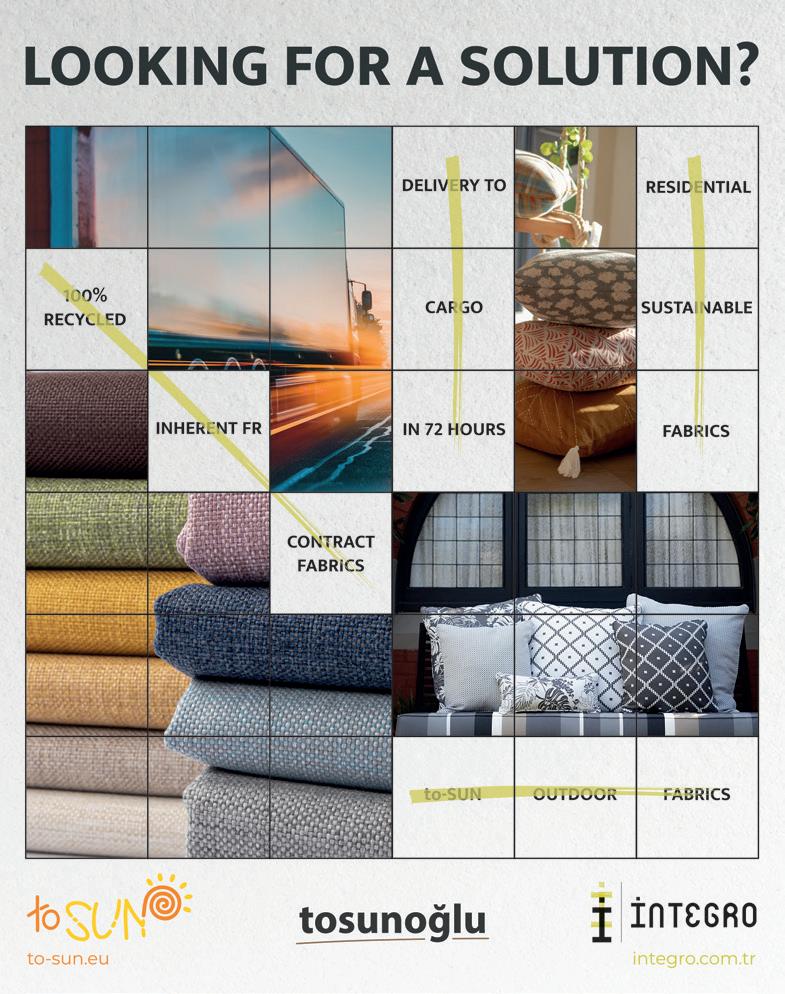

LETTER FROM TURKIYE Russian War Push Turkish Mills Towards US Market

Rapidly Rising Costs Create Havoc for Turkish

Mills

ISTANBUL—”Due to the Russian-Ukrainian war, the Turkish mill business with Europe has almost halved,” according to Baris Coskun, principal of BSAB Sourcing, a wellknown agent for Turkish mills.

“Therefore, Turkish mills are more and more interested in selling to the US market,” he adds.

In addition to the effects of the Russian-Ukrainian war, “there are incredibly serious hikes in electricity and natural gas prices,” says Coskun, making matters for Turkish mills that much worse.

“This year Turkish mills received 15-20% hikes from the dying plants for the third time just last week (October 20.) “They cannot forward those

cost increases to their clients, who don’t expect or want any more price increases this year yet again.”

The increased costs for Turkish mills and the loss of the Russian market which was so important to their business is further compound ed by the rapidly dropping Turkish Lira, now 18 to the US$.

“The dropping Turkish lira is especially hurting the Turkish mills, which have substantial amounts of business domestically.,” Coskun says. To com pete, “they must be sell ing with a minimum of three-month terms to be in the domestic mar ket, but when the time comes to collect the funds, funds are not as valuable as they were at the time of sales.”

SUBSCRIPTIONS

Exclusive distributor in India: Get and Gain Centre

3rd Floor , 301 The Sagar Shopping Centre

Opp to Bombay Bazar, JP Road, Andheri West Mumbai 400058 India

F&FI SHOW CALENDAR

• Heimtextil — January 11-13, 2023, Messe Frankfurt, Germany

• Deco Off — January 18-22, 2023, Paris

• Proposte — April 18-20, 2023, Villa Erba, Como, Italy

• Hometex — May 16-20, 2023, Istanbul Fair Center, Istanbul, Turkiye

• Decosit — September 5-6. 2023, Brussels-The Heysel

4 • www.FandFI.com • Winter 2022/23

International Rights Reserved.

Printer Sutherland Art Director Roxanne Clapp, RoxC LLC Distribution APC & Express Air Freight E.U. Legal Counsel Herman Nayaert CHINA, SOUTHEAST ASIA Sonia Tan

GERMANY Sevim

ş

INDIA

SOUTH

Renato

SALES F&FI NEWS NETWORK India |

UK |

Global Home & Contract Sourcing News ©COPYRIGHT 2022 by Fabrics & Furnishings International. All U.S. and

EDITOR & PUBLISHER US, UK, IRELAND, FRANCE, SPAIN Eric Schneider Mbl: +1.917.251.9922 eric@sipco.net

Tel: +86 133 8601 9288 WeChat: SoniaTan25034704 sonia@sipco.net TURKIYE, BELGIUM, HOLLAND,

Güne

Mbl: +31 6 8290 9965 Whatsapp: +90 532 2362524 sevim@sipco.net

S. Wishwanath Tel: +91.93.42821379 vish@sipco.net PORTUGAL,

AMERICA

Strauss Mbl: +55.11.99188-8966 renato@sipco.net

S. Vishwanath

Jennifer Castoldi

Free subscription if you qualify. Otherwise: $125 a year 4 issues Winter • Spring • Summer • Autumn SECRETARY Candace Muhlrad

Baris Coskun

LETTER TO EDITOR

Tony Attard, Chairman of Panaz

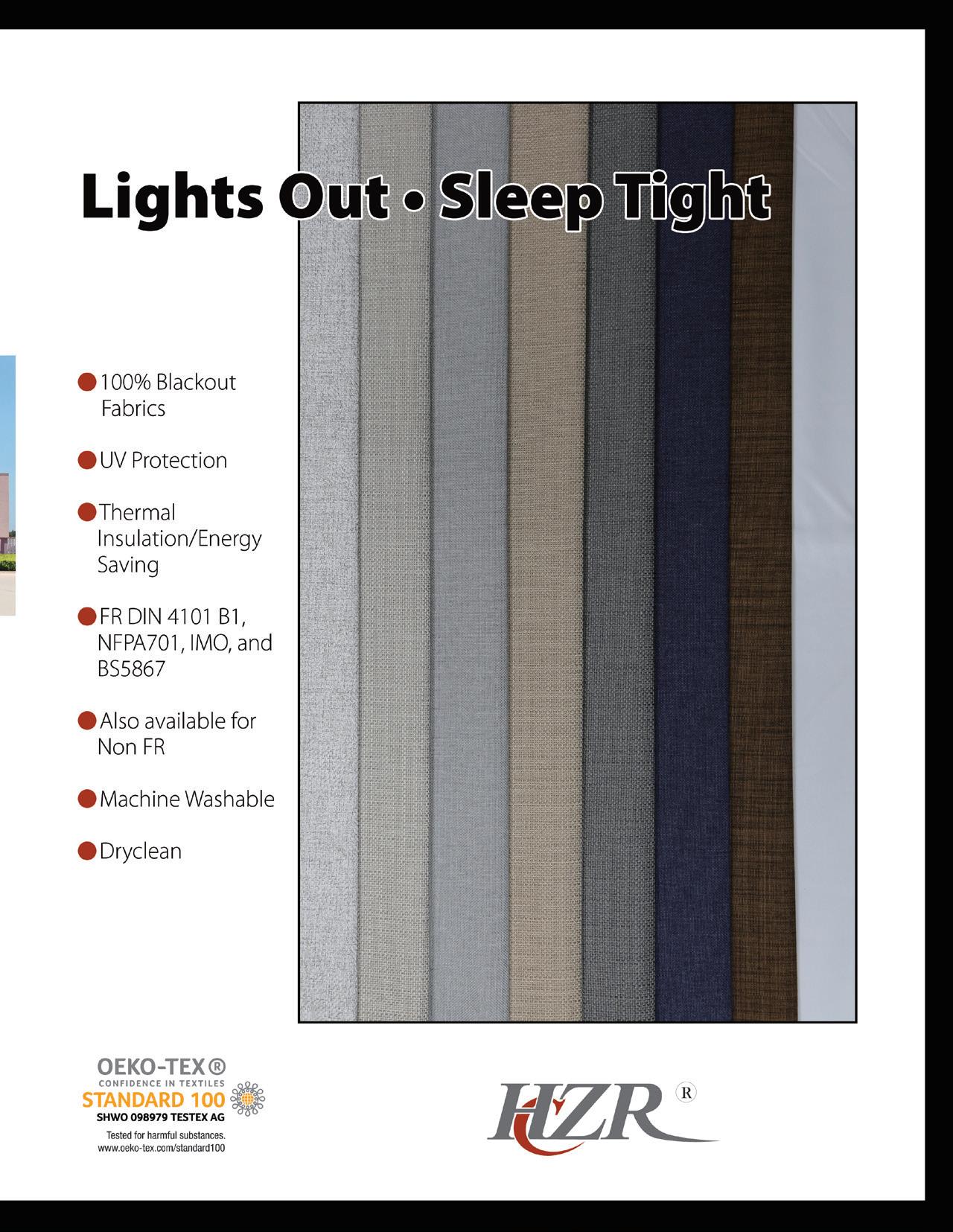

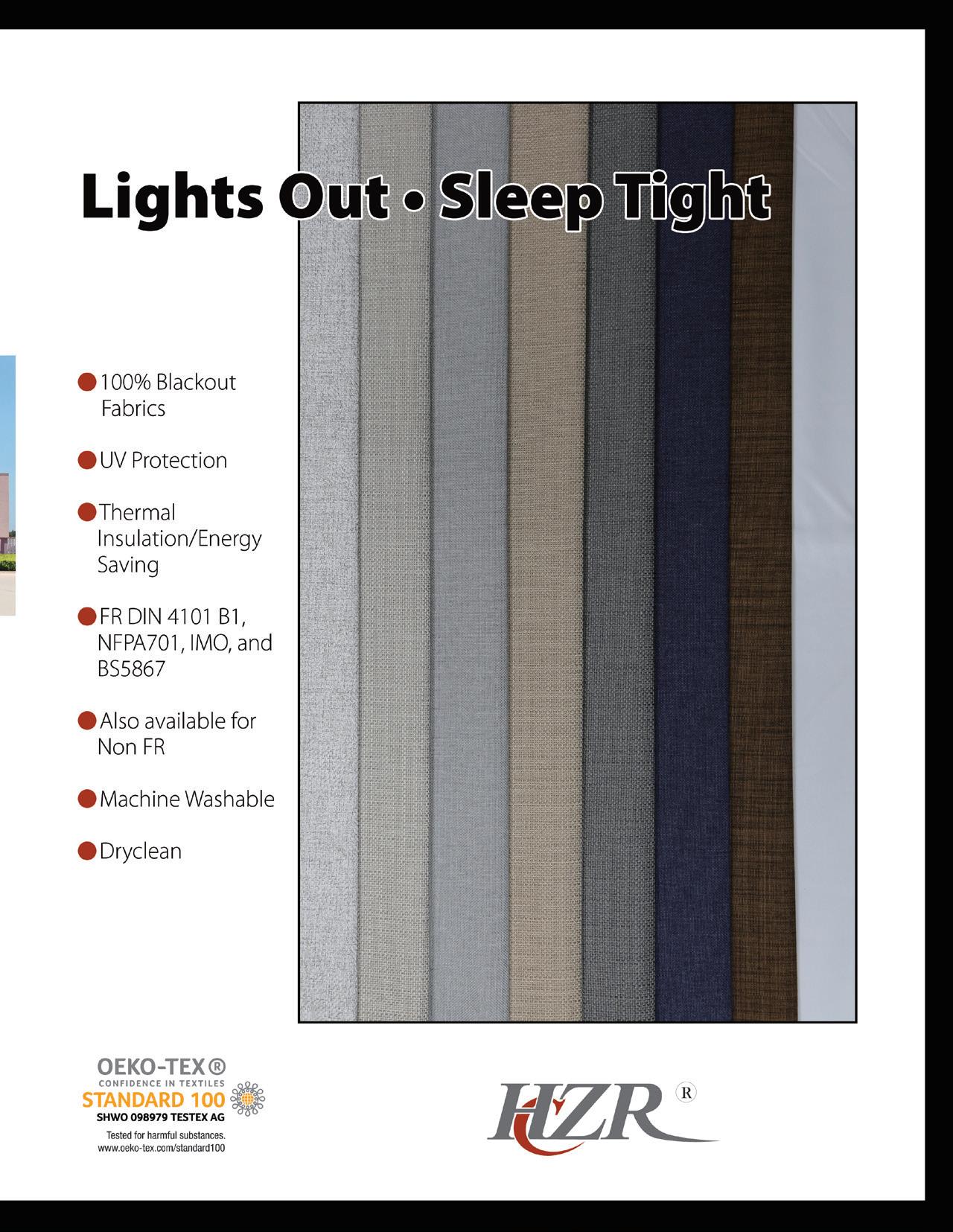

Vista Furnishing Acquires India’s Alps Industries; Expect to Double Blackout Production by 2023

By Vishwanath.S

NEW DELHI — Vista Furnishing Limited (VFL) assumed control of Alps Industries manufacturing last April.

“Coating capacities are overbooked and Vista is under pressure to complete orders on time,” says Nidhi Agarwal, Vice President, Marketing. “As a result, we have decided to inject fresh capital to add capacity to meet the increased demand of the blackout cur tain and roller blind customers in the next 12 months,” she says. Nevertheless, she says Vista Furnishing, with a current turnover of $50 million, 65 percent from export, will grow by 20 percent by 2025.

“The residential segment has worked well for VFL in the last two years in most of the regions like the US, UK, Middle East, and the domestic Indian market,” Agarwal says. “The domestic market is showing good signs of recovery and the Vista network is spread over 1,200 retailers. The contract or hos pitality segment has also started to pick up well in the last quarter as orders have been good from all of our customers in the US, UK, Australia, and the Middle East.”

“Further innovation and creativity will

LETTER TO EDITOR

continue to drive our brand Vista. “Now the focus is on a range of value-added decorative fabrics and home furnishings. With inherent strength in designing and marketing, expanding the home furnishing business remains the key strategy in the coming years,” she says.

“Vista also specializes in 100% blackout coated curtain fabrics and we are planning to grow on our strength by adding two wide-width coating lines: this will double our capacity. We shall be ready to service the requirements of wide-width blackout fabrics by the end of January 2023,” Agarwal says. “Sunflame a textured / jacquard black out curtain and “Paolo” a poly-cotton plain upholstery are the most trending products in all of the markets,” she says.

“In the past, we never focused much on draperies which is the largest market seg ment in home furnishings but now we have successfully launched multi-color dobby and jacquard draperies in our product range as well as, blended cotton upholsteries and a range of multipurpose fabrics.”

VFL has also added several collections of upholstery with blends of cotton, poly ester, viscose, and linen. “The requirement

from our customers indicate an upward trend for these kinds of fabrics,” she adds. Vista has also introduced a mélange tex tured multi-purpose fabric collection called “Candella” with a palette of 50 colors. priced at $2.50-$12 a meter. F&FI

After More than, 43 years in the textile industry, I am now able to fully concentrate on my hob bies. These include making custom ize wood bird houses and collect ing model trains. After sustaining a major brain injury, I find that doing my hobbies is very soothing. My col lection of bird houses, include many customized celebrity Bird houses along with their autographs. You can find my bird houses all over the world. My model train collection started when I was young. Haven’t been so busy in the textile industry, I never had time to focus on them. Now that I have all the time in the world, I am able to create and col lect model trains from all over the world.

6 • www.FandFI.com • Winter 2022/23

Thanks! Mark Kresel, former sales manager at Rockland Mills, Baltimore, MD

A few of the many awards earned by Mark Kresel

Nidhi Agarwal

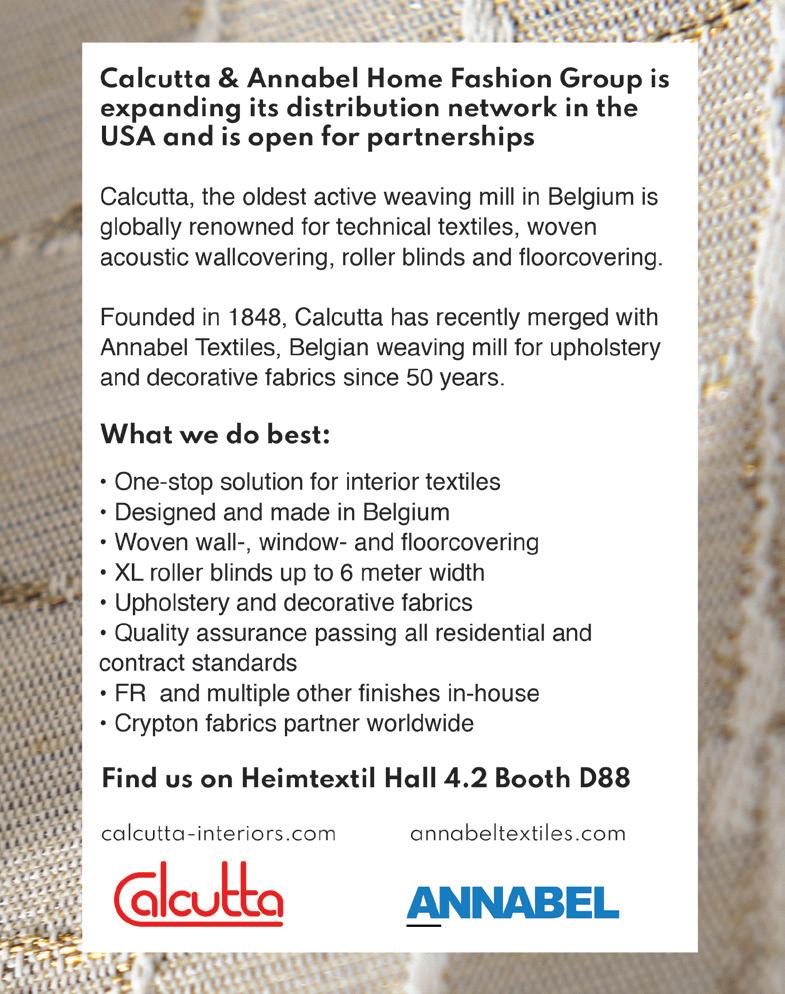

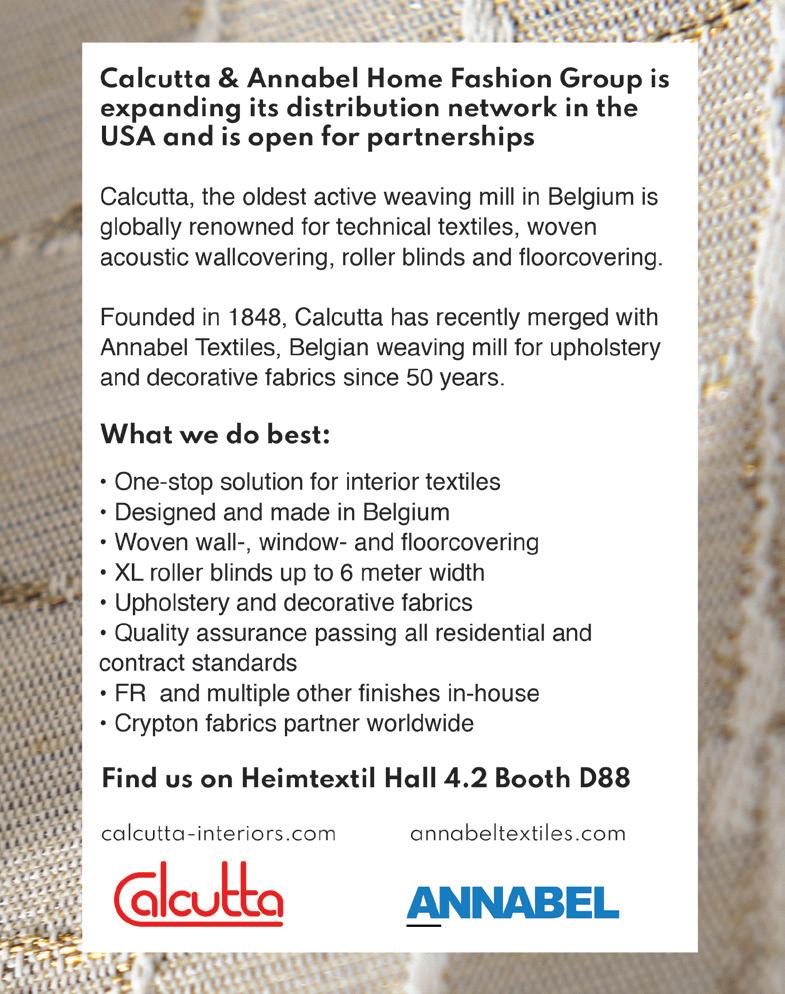

Calcutta Group Acquires Annabel Group

Derumeaux’s Remain Involved

F&FI News Network

EVERGEM, BE—Christof Vermeersch, CEO of the Calcutta Group together with Saffelberg Investments has purchased a majority interest in Annabel Group and Interspinning in Ghent.

Vermeersch, who bought the shares of Calcutta in July from a British-Emirate company, will man age both Calcutta and Annabel as CEO.

Christof Vermeersch

Vermeersch expects to realize the synergy between the two companies which he says complement each other.

Bruno Derumeaux and Benoit Derumeaux, principals of Annabel will remain active on the board of the Annabel Group and will also take stakes in the Calcutta Group. The Derumeaux’s will remain operationally active in both groups according to Vermeersch.

Calcutta and Annabel are weavers of residential and contract fabrics. Annabel also offers automotive and outdoor fabrics and is well known for its face-to-face woven velvets.

Calcutta offers technical textiles, and

interior textiles including wallcoverings, upholstery, roller blinds and woven carpet.

Prior to purchasing Calcutta, Saffelberg Investments owner Jos Sluys enabled Vermeersch also to make the acquisi tion of Annabel. Sluys joined forces with Vermeersch this past April. F&FI

Covington Finds New Niches, Continues Investment

F&FI News Network

NEW YORK—Covington Fabric & Design LLC is finding success with market segmentation and the development of niches within the fabric world according to Greg Tarver, CEO.

Tarver was speaking to F&FI from Covington’s newly renovated headquarters in New York City. Standing in their expand ed showroom, Tarver said, “we felt the need to enlarge our showroom not just to incorporate the Magnolia Home Fashions line, but to also add state-of-art lighting, upgrade furniture and create a more open floor plan”.

Magnolia Home Fashions is entering its third year under Covington’s stewardship and continues to thrive, exceeding expecta tions which were high, according to Tarver. “The Magnolia program presented an excel lent opportunity to revisit customer classifi cations and further refine product needs”, he continued.

One example Tarver mentioned, was a new washed and tumbled collection from Magnolia which targets the slipcovered fur niture. “We’re doing very specific physi cal testing for these products to measure dimensional stability, washed appearance and color fastness which might not apply to other upholstery end-uses”, said Tarver. “This is part of the process of identify ing new product niches within the jobber, retail, and manufacturer market segments.

We are learning that in many cases, we have fabric constructions with end-use applications beyond what was initially envi sioned.” Tarver continued, “there are similar opportunities in all Covington customer segments”.

The Hilary Farr license has also done well for Covington. “Certainly, Hilary having a huge fan-base is important; but her design aesthetic is truly striking and uniquely com plements our core collections. Plus, she is delightful to work with”, Tarver stated.

When asked by F&FI to discuss the gen eral business climate, Tarver replied, “Cost controls remain front and center. We have the mindset that our customers have come to expect excellent design and they have an equal requirement for excellent service, competitively priced.”

(continued on Page 10)

8 • www.FandFI.com • Winter 2022/23

Annabel factory

Greg Tarver, CEO, Covington with Magnolia pattern ‘Thornbury’

Covington’s new flagship showroom in New York City features an open floor plan in 8,000 square feet with hybrid lighting.

Hilary Farr

Richloom Expands Weaving By 30 Percent with Marlatex Looms

F&FI News Network

F&FI News Network

NEW YORK—Richloom Weaving expects to expand its upholstery busi ness by 30 percent with the acquisition of most of Marlatex’s weaving equipment.

Marlatex Corp., a small weaver in Belmont, NC (near Charlotte) has sold most of its weaving equipment to Richloom Fabrics Group, a major converter and mill owner based in New York.

At the same time, Weavetec in Blacksburg, SC has purchased parts of the Marlatex product line in terms of specific designs and yarn systems for upholstery.

“We will absorb parts of the Marlatex line and will pick up some of their customers as a result,” says Harold Pennington, Vice President of Weavetec, a highly diversified weaver with 50 employees. Weavetec pro duces throws, upholstery, industrial fabrics, and other specialty fabrics since 1987.

The purchase price was not disclosed.

Marlatex has been a fami ly-owned mill producing dobby and jacquard upholstery for the domestic US fur niture and jobber market since 1982 with 25 employ ees. The deal is expected to close by yearend.

Efforts to reach Carolyn Martonffy, CEO or Barnabas

Covington Finds New Niches, Continues Investment

Tarver added that Covington had just low ered freight surcharges. “Overseas freight surcharges are coming down”, he said, add ing, “we have begun systematically stepping down temporary freight surcharges that were first implemented in August 2020.”

Tarver, who is entering his twelfth year at the helm of Covington, also discussed on-going work to prepare the business for evolving regulatory standards. “We began trials well over a year ago in order to tran sition to non-fluorinated stain and water repellent chemistry on fabrics that specify them.”

In other developments at this major con verter, Tarver points to the forthcoming

Martonffy, the owner of Marlatex were not successful. It is not known whether Marlatex will continue in the upholstery business in 2023 but it looks like only the mill building is left for sale.

Richloom expects to expand its uphol stery weaving operations in the USA by 30 percent with the acquisition according to Michael Saivetz, COO of Richloom. Richloom also has a substantial trading company in Shanghai which imports and sells China made upholstery both in China and in the USA.

The company also purchased the Chambers fabric mill in High Point, N.C. in December 2019 and this became the basis for Richloom Weaving.

The acquisition of Marlatex assets further enhances Richloom’s ability to produce and deliver upholstery to the American furni ture industry.

With the previous purchase of Chambers, Michael Saivetz was quoted in F&FI as follows: “As a global company, we’re able to make products everywhere. The one area we were actually lacking was made-in-theUSA wovens.” F&FI

modernization of its warehouse in Calhoun Falls, South Carolina. “Post pandemic, due to increased demand as well as container shortages, our warehouse personnel were routinely faced with receiving and efficient ly unloading a truck with many as 900 rolls of fabric. Our team is fantastic and always rose to the occasion. But we’ve identified a few engineering solutions that we believe will improve ergonomics and efficiency. This will be an area of focus in 2023.” F&FI

10 • www.FandFI.com • Winter 2022/23

Harold Pennington

Carolyn Martonffy

Chari Voehl, Vice President, Design, Covington with pattern ‘Wow’, a printed faux embroidery picked by a reclining chair manufacturer

(continued from Page 8)

Stefanie Wotton, Vice President, Marketing shows off Magnolia pattern ‘Oxford Stripe’

Bruno Named EVP, Culp Home Fashions

F&FI News Network

F&FI News Network

HIGH POINT, NC—Effective September 6, Tommy Bruno has been named Executive Vice President of Culp Home Fashions and is expected to assume the role of President of this division follow ing the retirement of the current President Sandy Brown December 31.

Bruno joins Culp from Tempur Sealy where he was a Vice President.

Brown will retire after 39 years with Culp. Over the next few months, Brown will work with Bruno and will provide guidance as

a strategic advisor to the company, a Culp spokesman says.

Culp, Inc. is a major manufacturer and marketer of mattress fabrics for bedding and upholstery fabrics for residential and commercial furniture. The company mar kets a variety of fabrics to its global custom er base of bedding and furniture produc ers, including fabrics produced at Culp’s manufacturing facilities and fabrics sourced through other suppliers. Culp has manufac turing and sourcing operations located in the United States, Canada, China, Vietnam, Turkia and Haiti. F&FI Tommy Bruno

Isle Mill Plans Global Sales Growth

F&FI News Network

PERTH, Scotland—Isle Mill expects to increase sales of its woolen furnishings fabrics through international sales according to Simon Cotton, chief executive and owner with his wife Clare.

Isle Mill is owned by Macnaughton Holdings Ltd. which the couple purchased on August 17th.

It consists of a textile mill in Scotland, warehousing and head office facilities and a kilt manufacturing facility.

The Group trades under the brands of Macnaughton, Scoutneckers, Whitehill & Wilson and House of Edgar in the tartan fabric and apparel market.

Macnaughtons has a continuous history tracing back to 1783 and was in one family until the sale to the Cotton’s. According to Cotton, it is one of the oldest textile mills and one of the oldest family businesses in Scotland.

“The Isle Mill is highly respected in the market for the production of beautiful wool fab rics, which perform exceptionally well,” Cotton adds.

Prior to purchasing Macnaughton, Cotton was the MD of Johnstone of Elgin Ltd. for eight years. F&FI

Van Herk, Straatman Buy Leotex

F&FI News Network

HILVARENBEEK, Netherlands—Bjorn van Herk, and Mark Straatman purchased 41 year old Leotex Fabrics on September 1 from Inge Debets, the owner since 2007.

Van Herk has been commercial manager since 2018 while Straatman has been the purchasing manager since 2007.

The purchase price was not disclosed but the sale included all assets of Leotex Van Herk says.

“Our first order of business is to develop a web portal for our customers. We’re also focused on recycled fabric lines,” Van Herk told F&FI at the recent Decosit Exhibition in Brussels.

Leotex has 20 employees with a turnover of about $5 million. It has business ijn 20 countries, and the new owners expect to expand the turnover. F&FI

Pelusio Heads Richloom Contract

F&FI News Network

NEW YORK—Lauren Pelusio has been named SVP of Richloom Contract replacing SVP John Ringer who will focus solely on the Richloom Decorative division.

“John has been at the helm of Richloom Contract for 12 years and was responsible for the growth and accomplishments of the division,” says COO Michael Saivetz. “During the Covid-19 pandemic it was John’s leadership and professionalism that saw us through,” he added

Pelusio has been with Richloom for five years as VP of Design and has a 20-year background in textiles.

Richloom says the transition will occur over the last quarter of 2022 and will be finalized by the end of this year. F&FI

12 • www.FandFI.com • Winter 2022/23

Lauren Pelusio

Bjorn van Herk

Simon Cotton

BDNY

High Point’s ‘Interwoven’ Reflects Weak Furniture Sales. Boutique Design NY Reflects Strong Hospitality Uptick

By Eric Schneider

By Eric Schneider

MIAMI

BEACH—Covid was good for the upholstery business; consumers stayed home and redecorated; but now those same consumers and business travelers are spending money on going places.

Major mills geared up for the Covid busi ness and now wonder what happened. The backlogs have been reduced and the retailer is drowning in upholstery inventory.

In stark contrast to retail, the hospitality fabric business is starting to thrive again as hotels move forward with overdue refurbs

To a person interviewed, this was the story at the recent BDNY at New York’s Javits

AT INTERWOVEN: Steve Lehman, Chairman, Smith Brothers of Berne, Berne, Indiana (upholstery furniture of course with 600 employees) with Blake Millinor, CEO, Valdese Weavers in the new Valdese showroom

Mike

F&FI publisher Eric Schneider with Jacob Javits at Javits Center during Boutique Design NY: “Hospitality is on the upswing again.”

This

Winter 2022/23 • www.FandFI.com • 13 PHOTO GALLERY

on North Hamilton. VIP division of Valdese is looking to diversify its sourcing.

Stacy Garcia, CEO, LebaTex, Nanuet, NY hospitality converter and friend Daphna Rami, general manager, Metro Wallcoverings, Concord, Ontario, CA

Kravet stand at Javits

Stacy Schwartz, Sales Associate, and Ian Schwartz, VP Contract Sales, (sister/ brother) at Kravet.

designer couple was on their way to BDNY by NY subway!

Ann and Dee Duncan, principals of KB Cotract, Atlanta, GA are having a fabulous year!

Simon Kincaid and Tina Morden, Conran and Partners, London and Hong Kong with Ian Tatnell, Managing Director, Sekers, Scotland UK

At BDNY, Valley Forge rocked the young and the hip designer world with a live dj and design seminars when the music wasn’t playing.

Dobin, President of Valley Forge, Pompano Beach, FL with customer BRE Hotels, Jason Goldberg, Littleton, Colorado

Eduardo Jose Perez Hoyos, Managing Director, Adriana Hoyos Furniture says high end residential and contract furniture business is excellent, especially in Florida.

Hoyos buys fabric from Spain, Belgium and Turkiye

Hanes Hospitality blackout is rising up with the industry. Mitch Brown, Sales Director with Amber Di Fruscio, digital director, Opuzen, Inglewood, CA and Deborah Newberger, Hanes sales manager, Midwest.

Steven Amitai and Christina Gutierrez, sales team at Greentex Fabrics.

Greentex weaves dye sublimated polyester fabrics, narrow and wide width in Bogota, Colombia.

General Manager Steven Amitai is offering digital printing in New York location with fabric inventory in Miami. New source!

and new builds.

Center here.

Stout Textiles Scores Double Digit Sales Gains Through New Product Efforts

Wallcovering, Printed Fabrics, Custom Window Coverings, Trimmings Added

F&FI News Network

COLMAR, PA—Stout Textiles rolled into 2022 with a great vibe and a booming business,” says John Greenawalt, Vice President, Operations of this fami ly-owned distributor about 35 miles from Philadelphia.

Sales were at record levels in 2021 with double digit growth in 2022 approaching an F&FI estimate of $30 million in sales. Greenawalt hopes for more of the same for this 35-man distributor with 40 salespeo ple on the road. Greenawalt credits a slow but steady push for new products which includes a major wallcovering collection with companion printed fabrics.

However, Stout, like many other whole salers had to deal with some double-digit price increases this past year which mandat ed a four percent wholesale price increase at wholesale and the first mid-year price increase in 30 years, he points out. “Price increases seem to be settling down now,” he says.

“We had not been in wallcoverings for 20 years,” he says. ‘The Art of Color’ wallcover ing brand in the $75 price range has made huge gains for Stout, he says. “Our focus is on unique designs created by textile design ers which coordinate with several hundred printed fabrics.”

“Stout also offers some wovens in solids and textures with the wallcovering and a 3,500 sku collection of trimming to comple ment the look,” he points out. Two collec tions are planned each year. Upholstery is offered in two collections a year with four to five books each, he says.

In finished products, Stout introduced custom window treatments in partnership with a local workroom “which has been unbelievably successful for us.” The pro gram includes draperies, panels, Roman shades and cornice boards.

Marcus William, Stout’s high end con temporary brand in the $100 per yard range is also growing, he says. “We just launched four books with two more to follow next year,” he says. A decorative trim line to go

with it is planned for 2023.

Bassett McNab, which was purchased by Stout in 2019 was relaunched with four new collections in the $100 price range. The imported fabrics in this line are grow ing, especially with UK and Italian based suppliers.

Stout, the third line is priced in the $35 range. Stout is reviewing new sources con stantly under the watchful eye of Barbara Godwin, design director and her assistant Janie Grace Robertson.

Stout products are now available in 30 independent showrooms from coast to coast and one to two showrooms are added each year, Greenawalt explains.

Originally, one of the Stout’s married a Greenawalt and John is the third generation of Greenawalt’s to operate the company.

The family run fabric wholesaler includes his sister Kate Vice President of sales and their father Bill also Vice President in sales and uncle Bob (Bill’s brother) who handles the finances and holds the President title. F&FI

Frey To Relaunch Newly Acquired Bernard Thorp Brand

F&FI News Network

PARIS—Pierre Frey will relaunch its recently acquired Bernard Thorp brand in its showrooms in autumn, 2023.

Frey acquired this 50-year-old hand screen custom print fabric and wallpaper house based in London last March for an undisclosed price.

Frey is the largest editeur in Europe today largely due to its aggressive acquisi tion strategy since 1990 under the direction of Patrick Frey, Chairman. The 87-year-old company has acquired Braquenie, Boussac, Fadini Borghi and Le Manach since then. More recently, it acquired Sequana, an Irish woolen brand. The purchase of Bernard Thorp includes three printers, 470 patterns in 300 colors. Customers will be able to cus

tom design prints in five-meter minimums.

“It is taking longer than planned to orga nize the Bernard Thorp collection, which was all bespoke,” says Kim Huebner, direc tor of marketing. “We are taking care to preserve the brand as we have done for our other acquisitions Braquenie and Le

Manach. For the moment everything is kept as we found it. The London store was closed at the beginning of the pandemic by the former owner, and we have not re-opened it. No decision is made yet. Our London design center showroom will have the collection on display, as will our US showrooms.” F&FI

20 • www.FandFI.com • Winter 2022/23

(continued from Front Cover)

Patrick Frey

The Bernard Thorp showroom in Chelsea, London has been closed.

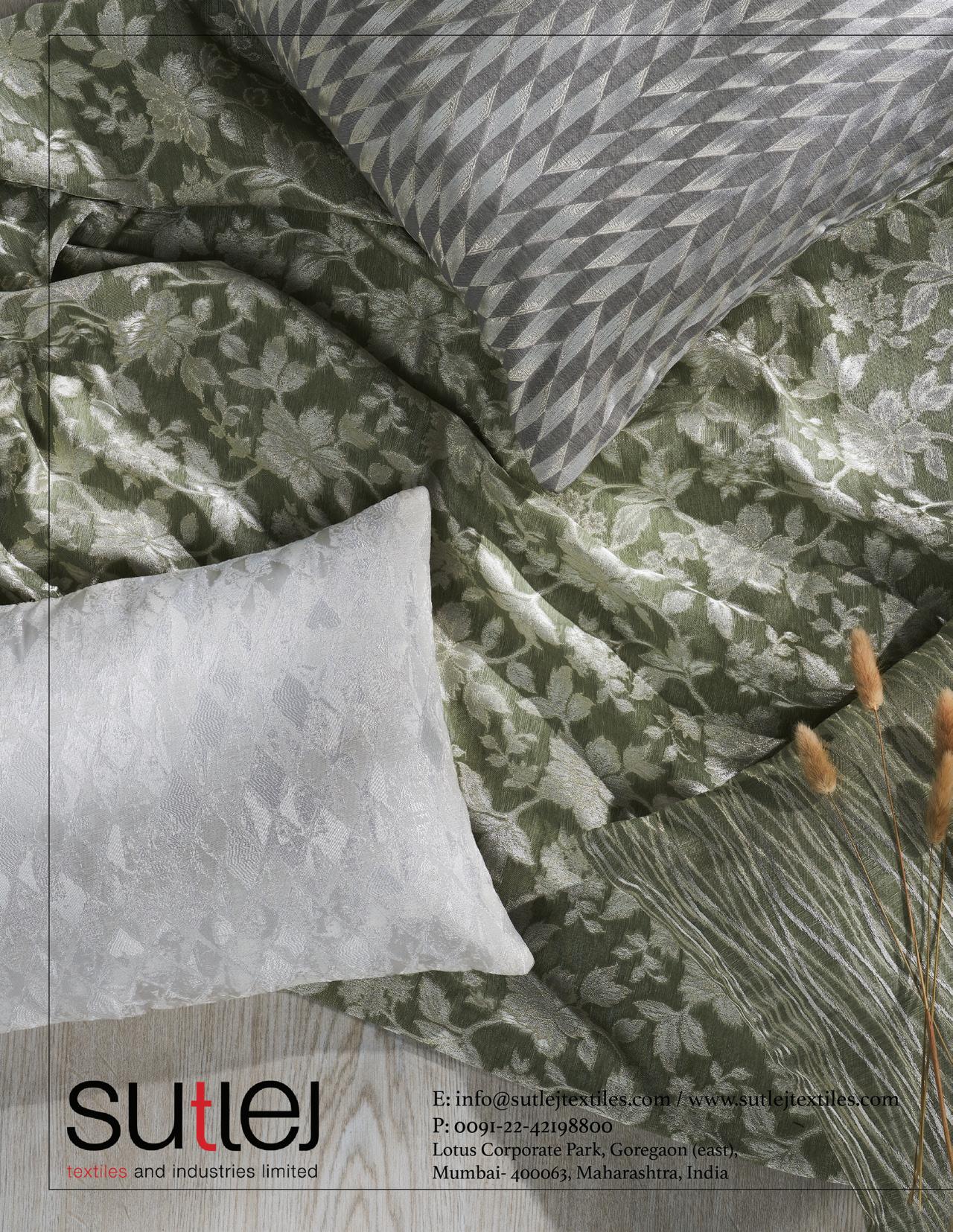

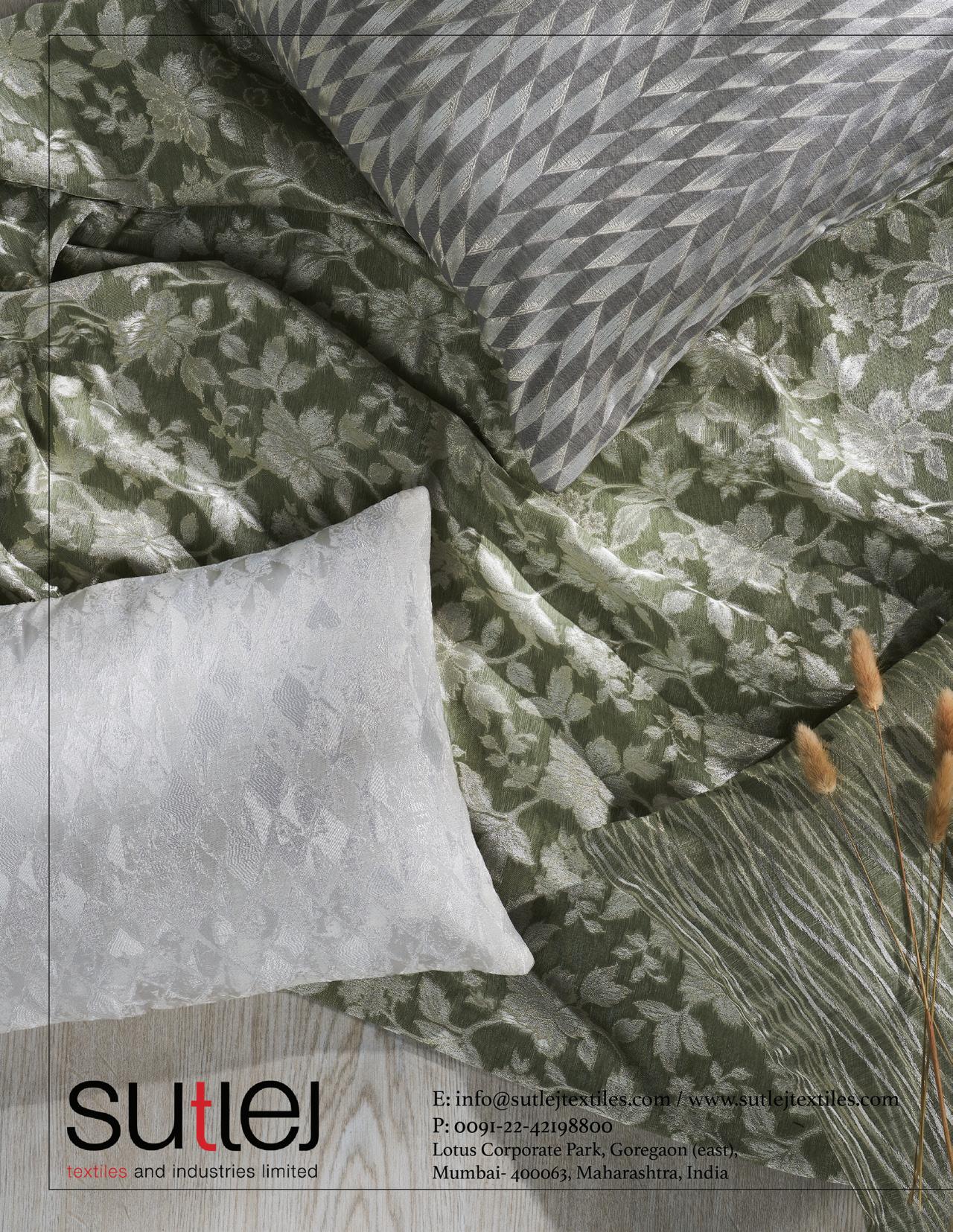

EnduroLiving™ Outdoor Fabrics, Jobbers Boost American Silk Sales by 25 Percent

F&FI News Network

F&FI News Network

DALLAS—American Silk Mills Is coming off a big year in 2022 with a 25 percent sales increase and another double-digit increase is planned for 2023, according to Oscar Reig-Plaza, CEO.

As part of this growth, American Silk has adjusted its focus in 2022 to include more jobbers in its customer base accord ing to Reig-Plaza, CEO for the past 18 months.

“We’re upping our game in the mid to high end distribution channel,” he says. “Our product looks rich, but the price is very reasonable,” he feels.

At the same time, the company is main taining its relationship with the American furniture manufacturer, he says. He is looking to balance production on a 30/70 basis with the jobber and manufacturer respectively.

In terms of product outdoor fabrics is the main push for this mill with 120 new sku’s produced for Interwoven in High

Point, NC under the EnduroLiving™ brand. This collection is woven in polyes ter with a 1,500-hour abrasion spec that is guaranteed for five years, he says. In 2023, a collection of 50-50 sku’s of acrylic outdoor fabrics is expected—where the demand is greater. The collections of out door fabrics are in the $20-$30 per yard range to the jobber, he adds.

American Silk is commission weaving its outdoor fabric domestically in the USA with several different mills and as well as its own mills in Gujurat, India. American

Silk is also weaving velvets and suedes in cotton, cotton/linen, and polyester, about 30 percent of its business. Overall, American Silk weaves 35 percent of its fabrics in India; 35 percent in the USA 30 percent in Indonesia and Italy.

Reig-Plaza says he is away three weeks each month including seven-week stints in Mumbai, India and Gujurat covering the mills of the parent company, Sutlej. “I love Indian food and the people,” he laughs. F&FI

Winter 2022/23 • www.FandFI.com • 21

Oscar Reig-Plaza

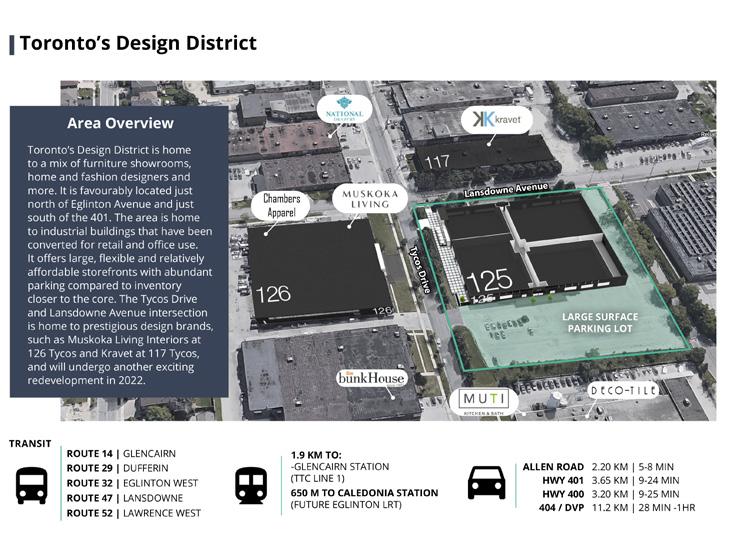

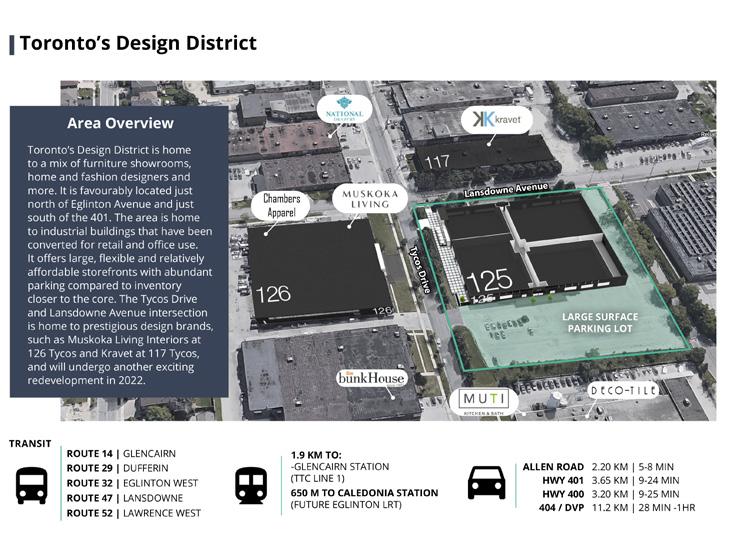

Romo USA Sales Up by One-Third in Two Years; Los Angeles Showroom Opens, Toronto Follows

F&FI News Network

CHAGRIN

FALLS, O.—ROMO USA, the American subsidiary of Romo Ltd. turned in substantial growth of 25 percent in 2021, its biggest year yet, according to Frederic Henry, CEO.

“We grew about eight percent in 2022 and 2023 will be flat due to the macroeco nomics not being conducive to growth,” he says. “We certainly rode the Covid boom for two years but that is behind us now,” he reasoned.

Nevertheless, Henry is still pushing for ward for growth despite the slowing econ omy in North America. Romo USA has just opened its first Los Angeles showroom of 4,200 feet on the sixth floor in the Pacific Design Center. Romo had been represent ed by multiline agent Thomas Slavin since 2005.

The new LA showroom opened September 20 with a big party of 300 people for the opening.

Atlanta opened in 2017 and sales bal looned to the point where sales were greater than in Southern California,” Henry points out. “That’s when we realized we needed our own showroom in LA,” he adds.

Plans are now underway for Romo’s first (continued on Page 27)

22 • www.FandFI.com • Winter 2022/23

Here’s the ROMO Los Angeles showroom team! CEO Frederic Henry front row center.

Warwick India Targets $10 million Fabric Sales by 2025

Company Plans to expand dealer network from current 350 to 500 and add made-up collections.

By Vishwanath.S

BANGALORE, INDIA—Warwick Pvt. and now sells $5 million worth of furnishing fabrics and is targeting $10 million in the coming by 2025 according to Matt Gillam, International Sales Director, Warwick Fabrics (Australia) Pty. Ltd.

Warwick Australia began exporting to India in 2006. The business started up in New Delhi and then a new company called Warwick India (Pvt) Ltd. opened in 2017.

Warwick is now working to have 500 dealers from the current 350.

Warwick Australia stands out as a sole exam ple of how to successfully establish operations in India while other foreign companies contin ue to export furnishing fabrics through other distribution channels or by export ing to select dealers.

The company observes that refurbishing activity in the hospitality segment after the covid lockdown is in full swing while Northern India markets lead in terms of demand and southern cities are catching up equally well. “In terms of trends in the market, velvets, leather look polyester, chenille and leather ettes lead,” informs Mohit Agarwal, Sales Director, Warwick fabrics (India) Pvt. Ltd.

Warwick also reaches furnishing markets of India’s neighbouring countries like Sri Lanka, Nepal, Maldives, and Pakistan (shipments come from Warwick Australia directly) and mostly constitute hospitality fabrics as well high-end home furnishing fabrics.

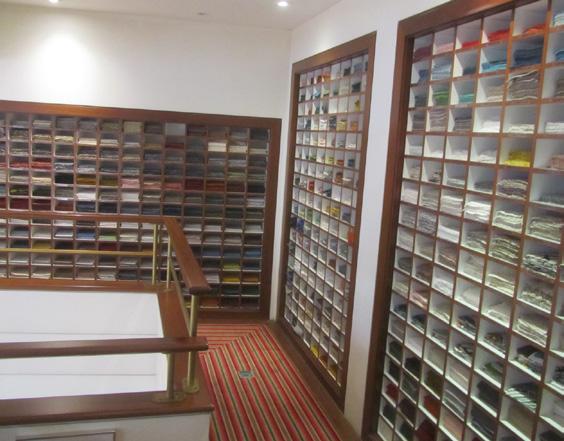

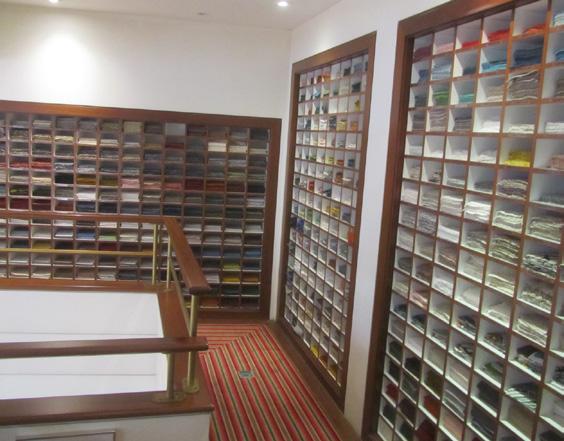

“We knew that India had much more poten tial and there were opportunities to reach a wider market base”, Gillam says. “Warwick studied the intricacies of the Indian market and realized that it needed to reconsider its business strategy. The new model was direct import from Warwick Australia with stock goods. We started our office in New Delhi with a showroom backed by a 2,500 square feet warehouse. I believe this is the smartest thing we ever did,” Gillam reveals.

Warwick was encouraged by the response in the Indian market. As a result, it was quick to add another 2,500 square feet of warehouse space in 2018 and another 4,500 square feet in 2022. Warwick is now planning to upgrade its infrastructure by moving into a single larger office space measuring 5,000 square feet and a warehouse of 15,000 square feet.

“During covid, though sales were sluggish, we had understood the clear signals that the

market needed ready stocks of best sellers as well as an additional range of collections. We quickly acted and increased fabric stocks (delivered by sea), and consequently sales grew as we were able to meet additional demand as we held ready stocks,” Gillam adds.

“Looking forward, Warwick is in the pro cess of consolidation and its increased product range has been well accepted be it home fur nishing or hospitality fabrics,” Gillam states. While the majority of Indian suppliers focus on the price range of less expensive fabrics that retail between the $6 to $12 range for draper ies, our prices range from $14-$30 a meter that cater to the luxury segment,” he adds. F&FI

Winter 2022/23 • www.FandFI.com • 23

Matt Gillam and Mohit Agarwal

DESIGN: Old and New Techniques Create Value in Textiles

By Jennifer Castoldi

By Jennifer Castoldi

Morphing lifestyles lead to advancing product development. This column dives into the latest in material innovation, localized manufacturing, printing, dyeing, and leather alternatives, as well as promoting wellbeing and mindful living. Supporting biodiversity with design can also create economic stability and improved processes.

Manufacturing techniques dating back to 1900 share center stage with digital production and newer concepts like NFTs that contribute further to textiles’ worth.

At Dutch Design Week, weaves found at various design hotspots within Eindhoven impressed with their intricate detail ing. It turns out that they are all produced in the small village of Heeze. It all began back in 1900, with woven ribbons for the local cigar industry, eventually progressing to labels. One hundred years later and custom-made jacquard fabrics, with the same ultra-high definition as seen in label making, are produced for fashion, interiors, and design. All works for WEEEF by EE Exclusives are created at the factory of Van Engelen & Evers BV.

There’s value in heritage and technology. In this project scouted at the new Park Royal Design District of London, Chino Ridge and Gil Wedam explore how 758 silk kimono swatches interact with non-fun gible tokens (NFTs). These heirloom swatches have been digitized and minted as NFTs, preserving the archive permanently in the blockchain. People can buy a swatch, owning the source material for future artworks, and over time as new physical artworks are created with the swatches, the owners co-own the new artwork as an NFT.

At Kazerne the stunning works of Tjitske Storm added to the story, “The symbiosis between tropical flowers and honeyeaters (birds) was the inspiration for this tapestry. The flowers’ deep calyxes have evolved to make the flow er nectar exclusively available for honeyeaters. Birds, in their turn, eat the insects that are attracted to these flow ers. The tapestry celebrates this symbiosis: in the exuber ant composition, more than a hundred images merge into a harmonious entity. Digital and tactile techniques come fused together.”

24 • www.FandFI.com • Winter 2022/23

Color is frequently a driver of trends. It is also an influencer of our emotions. “Color coaching” has even become a thing. The power of color was in full swing at the recent Maison&Objet exhibition in Paris. Color Power by Elizabeth Leriche staged influential room settings, product ranges, and color/material combinations relevant to today and tomorrow’s interiors.

Indigo Turns Green. Denim is gaining popularity again, moving from a classic to a trendy design category. The industry, aware of the huge negative ecological impact the manufacturing of denim has on the environment, is tak ing action. Alternatives such as nitrogen, foaming and spray dyeing, ozone fading to replace bleaching, and laser wash fin ishing, among others are pav ing the way to more friendly manufacturing, as presented at Techtextil/Texprocess.

One of the trends to be presented at Ambiente 2023 in Frankfurt is “unknown beauty_strange + gracious: mixed reality aesthetics meets the unknown”. Here, the desire for new, surprising experi ences plays a significant part. This trend embraces a topic that combines avant-gar de grace and incredible new creations. The unexpected journeys into the familiar living environment; an example is the upholstery range from Philippe Malouin for SCP.

In the Heimtextil 23/24 trend Nature Engineered, it “elevates organ ic material through mechanical means, redefining our concept of ‘natural’”. Designers and makers labor compas sionately with natural, regenerative substances, using bleeding-edge tech niques to develop them into sophis ticated, smart, and functional textiles and materials. Mycelium, hemp, and nettles are some unexpected ingredients.

Jennifer Castoldi is the CEO and Chief Creative Director of Trendease International. Since 2004, Trendease has been providing cutting-edge and competitive design information to readers and clients spanning over 170 countries. Trendease is an influential resource reporting and consulting on global trends and key international design events. Hundreds of images and forward-thinking articles are presented on www.Trendease. com each month, additionally videos and podcasts are available on www.Trendease.TV.

Winter 2022/23 • www.FandFI.com • 25

Nobilis Scores Record Sales, Builds With Younger Buyers

F&FI News Network

PARIS—Nobilis had a record year in 2021 and 2022 should even be better,” says Norman Halard, MD for the past ten years.

“The high end is the place to be in times of crisis,” he says. Nobilis has sales of more than $25 million he says and 100 employees worldwide.

Halard predicts another 20 percent increase in sales for 2023 but prices are still going up due to increased transportation and energy costs. Transportation costs have risen three times what it was pre-covid, he says. “As much as 10-20 percent price increases have come from our vendors and his can change from month to month. Hopefully, this will stabilize by the end of 2023. We have less of an impact on our prices because our fabrics are trucked in Europe.”

Under his watch, Halard says Nobilis has successfully repositioned itself as a youthful high-end fabric brand for the world market. Halard is the third-generation family man ager of the company started by his grandfa ther Adolphe in 1929 and further developed by Norman’s dad, Denis (77) who now spends his retirement in Sicily. The origi nal showroom on 29 Rue Bonaparte is still operating but there is additional space at 38 Rue Bonaparte which opened in the 1950’s.

A major part of Nobilis’ success rests in the hands of Eric Valero who Norman Halard hired to direct the design effort ten years ago. Valero is Beaux Arts educated

while Norman went to business school.

“Prior to our involvement, Nobilis was an old school brand favored by the French bourgeoisie. We needed a more mod ern and younger clientele,” he explains. “We are confident we have achieved this transformation.”

Nobilis has 80 suppliers and is always looking for new ones. However, Halard says 80 percent of his sourcing is with 20 com panies, mostly in Como, Prato and Naples, Italy; linen and velvet in Belgium; embroi dery from India and a little from Turkey in wide width curtaining.

Aside from fabrics, Nobilis is seeing big growth in wall coverings due to digital print ing. “There is no constraint on the number of colors in digital printing and you are no longer limited by the size of the roller. Art for the wall is possible with digital printing. No repeats and no limits!”

Halard says Nobilis does 70 percent of its business outside of France today through 80 distributors; 50 percent of its business is outside of Europe with a growing US busi ness. Nobilis also sells directly to its custom ers in Europe with a special emphasis on the hospitality trade. Nobilis is an exhibitor at the Equip Hotel Exhibition in Paris. In November and will participate in Deco-Off in January.

“More business is going through the spec ifier today and retail is trending downward,” he points out. He says this trend started in the US which he feels is ten years ahead of Europe. “Internet only accounts for 10 per

cent of the fabric business today and Nobilis is not involved in this channel” he points out. He feels that the internet is geared to finished product—not to piece goods.

“We can deliver product to 60-80 percent of our export customers in one week from our 10,000 square meter warehouse south of Paris. We stock everything there.”

Halard and Valero will attend Heimtextil and Proposte in 2023, he says. Halard has final say on everything chosen for the line, but Halard’s strength is his financial back ground. He was with Deloitte prior to start ing his own business prior to joining Nobllis ten years ago. He is still in his late 30’s.

Nobilis has ten showrooms worldwide and plans have been made to refresh Milan, Madrid and New York showrooms in 2023.

26 • www.FandFI.com • Winter 2022/23

F&FI

Norman Halard

Nobilis

Showroom

Romo USA Sales Up by One-Third in Two Years; Los Angeles Showroom Opens, Toronto Follows

Canadian showroom, 3,400 square feet in York, Ontario in Toronto scheduled to open in March 2023. Here, the Romo agent retired and Romo initially worked out of a pop-up showroom. Romo will move out of the downtown designer’s walk area to 125 Tycos Drive near Kravet and other fur niture showrooms. Joanne Fabrics headquarters is also located one hour away.

“The showroom side of the business is affected by the high cost of rent,” Henry says. “Design buildings which raised rents to a $40 a foot plus figure plus another 20 percent for rental space loss—are losing out to freestanding buildings which cost only $20+ a square foot,” he explains. “We in this business cannot afford $40 plus rents.

Romo USA’s main business is high end residential with contract considered the cherry on the cake. “We focus on 4–5-star hotels and this business is slowly coming back. However, we don’t see occupancy rates coming back because business travel will not return to pre pandemic levels.

Romo USA distributes the same brands as the parent company, namely: Romo, Mark Alexander, Black Edition, Villa Nova, Zinc, Kirkby House and Omexco, the Belgian wallcovering line which is growing along with the overall wallcovering business at Romo USA, Henry says. Orders for these brands are shipped from the UK, normally in 48 hours. “There’s no point in having multiple global warehouses,” Henry says.

All of Romo USA growth

the benefit of acquisitions. “Sure, we look at what is available, but we have grown organ ically. “Jonathan Mould, our leader, believes in the power of the brand which lies with the power of the people who sell it,” he says.

Romo USA began life in 2005 when it bought out its distributor Arte. Today, Romo has 10 showrooms. It opened NY in 2007 and is considered the largest European company in the USA fabric wholesale mar ket. Romo USA accounts for 44 percent of Romo’s global sales, Henry says. F&FI

Winter 2022/23 • www.FandFI.com • 27

“The US is a higher margin, lower volume business than in Europe so we don’t turn the inventory as quickly’” he explains.

has been achieved without

(continued from Page 22)

Frederic Henry (center) with New York Sales Associate Santiago (left) and Jody Dufresne, Los Angeles showroom manager

Mariana Garcia (front), RomoUSA outside sales, Florida with Skye Lakhani, senior manager of RomoUSA DCOTA Florida

Calcutta Group Anticipates $50 million Home Furnishings Business in Five Years

ner running the velvet mill.

In 2019, Vermeersch sold De Poortere shares in order pay for his acquisition of Calcutta Mills, the oldest Belgium weaving mill, established in 1848. He bought it from Muraspec, the wallcovering manufacturer. Calcutta was also in the roller blind weav ing business and buys its mechanisms from Zoomtech in the Czech Republic.

He bought 23-three-meter width looms from a Belgian weaver in Kortrijk and moved them to Calcutta in 2020. This gave

him the ability to produce wide width roller blind fabric without seams. “With these looms, we could make decorative statement with roller blind fabric instead of offering just gray and white fabrics,” he explains. The products are acoustical, anti-bacterial and anti-viral in woven polyester and available in FR, he adds.

“We don’t use PVC so we can set up cra dle to cradle supply chain and take back the products after their lifetime is over. We can do the same with our wallcoverings which

are higher end and unique in design. In 2021, we launched washable and foldable rugs and can coordinate the patterns with the wallcovering and roller blinds.”

With the purchase of Annabel August 1, Vermeersch can now offer upholstery velvets and finished curtains, pillows, and throws. The purchase includes the 55,000 square meters of the Annabel operation.

As previously reported, Vermeersch has purchased a majority interest in Annabel Group and Interspinning in Ghent together with Saffelberg Investments.

Vermeersch, who bought the shares of Calcutta in July from a British-Emirate company, will manage both Calcutta and Annabel as CEO. He expects to realize the synergy between the two companies which he says complement each other.

Bruno Derumeaux and Benoit Derumeaux, the two brothers and prin cipals of Annabel will remain active on the board of the Annabel Group and will also take minority stakes in the Calcutta Group. The Derumeaux’s will remain oper ationally active in both groups according to Vermeersch.

Calcutta and Annabel are weavers of res idential and contract fabrics. Annabel also offers automotive and outdoor fabrics and is well known for its face-to -face woven velvets.

Calcutta offers technical textiles, interi or textiles--including wallcoverings, uphol stery, roller blinds and woven carpet.

Prior to purchasing Calcutta, Saffelberg Investments owner Jos Sluys enabled Vermeersch to also make the acquisi tion of Annabel. Sluys joined forces with Vermeersch this past April. F&FI

28 • www.FandFI.com • Winter 2022/23

(Continued from Front Cover)

Brigitte Gyselinck

Guy Parmentier

Calcutta Home Fashion Group Acquires ‘House of Novalin’

F&FI News Network

GHENT, BE

Calcutta Home Fashion Group acquired ‘House of Novalin’ wall coverings based in The Netherlands on October 4.

within Calcutta Home Fashion Group, Vermeersch says.

‘’House of Novalin is a brand name sold to editors, architects and interior designers.

designs, product innovation and collections. House of Novalin plans to offer a variety of diverse linen products in the near future,’’ he says.

The history of House of Novalin start ed in 1960 when the Novalin was created, launched, and patented. In 2011, VeryFanny AB acquired Novalin, the FannyAronsen wall covering collection from Kvadrat A/S.

Aronsen (1955-2011)

With this acquisition, Calcutta adds a high-end 100% linen wallcovering line as an individual busi ness unit. House of Novalin is based now in ‘s-Hertogenbosch in the Netherlands and will be delocalized and integrated in the produc tion facilities of Annabel Textiles and Calcutta Industries, says Christoph Vermeersch, CEO of Calcutta Home Fashion Group.

Calcutta Home Fashion Group previously acquired the Annabel Textiles Group in July 2022. Annabel is a weaver of technical textiles, decorative wide-width roller blinds, curtains, woven wallcoverings, area rugs, upholstery and decorative accessories for indoor and outdoor.

Bram Voogdt, House of Novalin’s former executive stays in position at House of Novalin

Tram Develops New Design Center

F&FI News Network

F&FI News Network

TORONTO, CA.—Tram Developments is developing and will also own a new sub urban design center of 120,000 square feet for starters about five miles from Designers Walk in downtown Toronto.

The project embraces the decorative trade, namely, rugs, fabrics, and furniture according to Ken Metrick, one of the partners

“The design community has been pushed out of downtown Toronto because of the soaring rents and the lack of parking,” Metrick explains.

So far, Tram has landed Kravet, Primavera, Theo, Cowtan & Tout, RomoUSA and JF. About 30 percent of the space is devoted to fabrics, Metrick says. The new buildings are expected to be open in February 2023. F&FI

The company utilizes an intellectual prop erty protected production method using 100% linen yarns from Europe. The product comes in 63 colors and is delivered from stock,’’ Vermeersch says.

‘’Both companies are perfectly complemen tary and will realize numerous synergies on the cost and revenue side, as well as in the field of organization, production and R&D,’’ he continues.

‘’We look forward to expand the House of Novalin with brand new structures, colors,

VeryFanny AB is a Swedish company, owned and managed by the co-founder and former director of FannyAronsen A/S, Roland van Dinten. The heart of Novalin’s collection of linen wallcoverings were originally designed in 1960 and were re-colored in 2011 by the textile designer Fanny Aronsen who died that same year. F&FI

Winter 2022/23 • www.FandFI.com • 29

Fanny

Decosit Is Back!

BRUSSELS, BE—Decosit reopened in Hall 10 of the Brussels Expo here again September 13-14, 2022.

“We don’t know if it will be easy to start up Decosit again but if we don’t try, we will never know,” one manufacturer said.

For 30 years, Decosit was an annual dec orative fabric, window covering, upholstery and wall covering exhibition.

It’s trying to make a comeback!

Mobus Acquires Clarkson Textiles

F&FI News Network

F&FI News Network

WEST

YORKSHIRE, UK — Mobus Fabrics Holdings has acquired Clarkson Textiles Ltd. in Lancashire.

Clarkson’s becomes the second coating plant within the group and will work closely with Mobus Sian Shaoxing in China,” says Lee Maxman, Mobus MD.

“This will enable Mobus to offer custom ers global access to OEKO-TEX certified FR upholstery fabrics and finishings to domestic and contract classifications,” he says.

“Mobus & Clarkson’s have enjoyed a close association for almost 30 years, with a shared enthusiasm for innovative uphol stery, technical textiles & Fire-Retardant finishing,” Paxman continues.

“This relationship has been further

emboldened in recent years with the two companies participating jointly on the development of halogen free eco-friendly, sustainable FR coatings,” he adds.

Paxman says Mobus has launched this new FR technology into the UK upholstery market, under the GreenFR® brand.

The acquisition of Clarkson “gives Mobus greater accessibility into future technical developments. A focus on new technology, service and quality will underpin the future direction of the company with an emphasis on improving all areas of sustainability,” Paxman says.

Clarkson’s MD, Roger White says he has committed his future to the new venture with a focus on research and development alongside the Mobus technical team. New investments have been identified and will

be made available for future development of new FR technology, he says.

Claire Kelly will continue in her role as Sales Manager at Clarkson. F&FI

30 • www.FandFI.com • Winter 2022/23

PHOTO GALLERY Decosit

Lee Paxman

Eunuch Na and Dain Choi of Han All Curtains & Design based in Seoul, Korea with President Jong Hwa Choi

Martine Manuel and Veronique Bonte of Varam with Koen Vanackere, sales manager for Beaulieu Fabrics, Waregem, Belgium and Alexander Vanraes, director of Varam in Menen, Belgium

Fiorella Huaman, CEO, Contract Division, Hilarte Telas & Accessories, Peruvian wholesaler with Guy Parmentier, sales director, Calcutta Mills, Evergem, Belgium

Carol Vanevoorde, international sales manager for Annabel in Gent , Belgium with Fiorella Huaman, CEO, Hilarte wholesalers in Lima, Peru

F&FI News Network

F&FI News Network

F&FI News Network

F&FI News Network

By Eric Schneider

By Eric Schneider

F&FI News Network

F&FI News Network

By Jennifer Castoldi

By Jennifer Castoldi

F&FI News Network

F&FI News Network

F&FI News Network

F&FI News Network