NACo PHARMACY BENEFIT MANAGEMENT (PBM) COALITION SURPASSES 105,000 COVERED LIVES

Counties Working Together for Better Health & Better Value

The NACo Pharmacy Benefit Management (PBM) Coalition continues to make an extraordinary impact for counties, their employees, and their families

Today, the Coalition proudly covers more than 105,000 public employee lives, representing an impressive $200 million in annual pharmacy spend across participating counties nationwide

This milestone underscores the true power of collective action. By pooling the purchasing strength of NACo member counties, the PBM Coalition delivers best-value pricing, long-term cost stability, and enhanced prescription benefits to local governments and their employees. Counties & other public sector pools benefit from the same volume-based discounts and multi-year contract stability typically reserved for the largest private-sector employers

(Continued on page 4)

Lives Covered by Recent Additions to NACo’s PBM Coalition

Montana Association of Counties Health Trust: 3,300

Mecklenburg County, NC: 15,000

Kern County, CA: 15,000

Teamsters Local 1932, San Bernardino: 7,300

Maricopa County, AZ: 10,000

Cecil County, MD: 1,800

Boulder County, CO: 3,800

Skagit County, WA: 1,600

Charlotte County, FL: 3,660

Miami-Dade County, FL: 45,000

NACo High Performance Leadership Academy 2026 Register Now: Rolling Cohorts

The NACo High Performance Leadership Academy is currently enrolling cohorts offered in 2026.

This virtual 12-week program teaches proven methods and equips frontline county professionals with practical leadership skills, empowering them to succeed as members of a strong public sector workforce.

January Cohort: 1/5/26

April Cohort: 4/6/26

July Cohort: 7/13/26

October Cohort: 10/5/26

Enroll now in NACo HPLA

New Leading on Purpose Academy Now Enrolling

Leading On Purpose, a continuation of HPLA, is a virtual 8-week program to helping leaders reappraise any longstanding purpose or uncover one for the first time with selfassessments, interactive exercises, online and real-time peer discussions, cohort-based webinars, and self-reflection

October Cohort: 10/20/25

November (AI Academy): 11/3/25

January Cohort: 1/12/26

April Cohort: 4/27/26

July Cohort: 7/27/26

October Cohort: 10/5/26

Enroll now in Leading on Purpose

Proud Partner Spotlight

45 YEAR PARTNERS: NATIONWIDE & NACo RETIREMENT PLANS

NACo and Nationwide have partnered for 45 years to bring innovative retirement solutions and a deferred compensation program focused on the public employees Learn more at edge.naco.org

BECOME PART OF THE NACo WORKFORCE NETWORK

The NACo Workforce Network provides a platform to share resources, best practices and learning opportunities around human resources and benefits. In a collaborative network of your peers, County Administrators, HR professionals and Benefits Managers can workshop shared areas of concern and utilize other members’ experiences to solve challenges. Membership is free. nacoorg/program/naco-workforce-network

MAXIMIZING STUDENT LOAN REPAYMENT BENEFITS FOR COUNTY EMPLOYEES & THEIR FAMILIES

ISavi is a NACo Public Promise Insurance resource for counties and their workforces to help reduce monthly payments & achieve forgiveness through federal and state programs to reach financial security

To learn more about this benefit program, visit publicpromiseinsurance.org/studentdebt

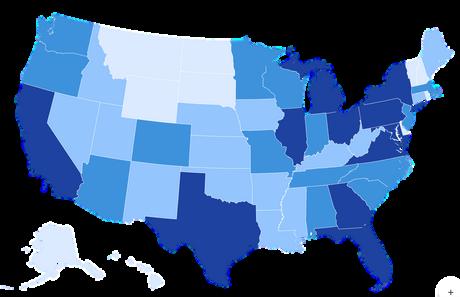

Savi’s Interactive Map

See student loan data across the United States Click on any state to view detailed information or hover to see a quick summary Savi's Forgiveness Found represents the total amount of student loan forgiveness identified for borrowers in each state.

Explore student loan data using the map here

CLEARGOV 2025 LOCAL GOVERNMENT BUDGETING & PLANNING OUTLOOK

In ClearGov’s 2025 Local Government Budgeting & Planning Outlook Report, nearly half of local government leaders rated developing budget books as difficult, a bigger challenge than even the most time-intensive budgeting tasks.

For counties, the hurdles of formatting, compliance, and transparency often make reporting especially complex

This new research unpacks what your peers across counties and other local governments say about the realities of their budgeting process and what they’re prioritizing in the year ahead

This report captures the latest nationwide research from nearly 200 finance and executive leaders across local government, including counties like yours

Inside, you will uncover the most common challenges local governments face are across budgeting and planning, top success factors your peers rely on to drive outcomes, and the prioritized initiatives that counties and other local governments are taking heading into 2026

WHEN RETIREMENT IS LONGER THAN PLANNED:TALKING LONGEVITY RISK

Feature Partner Article: Nationwide Retirement Services

American workers continue to face a retirement crisis We know many workers need to save earlier in their careers and more throughout their careers But we also know the need is stronger than ever for workers to have a plan for how they will live off their savings once they retire

Today, the old “3-legged stool” of retirement income pensions, savings and Social Security is wobbly Many employees no longer have access to defined-benefit pension plans that once provided retirees a source of steady income, and those who do may still see their pension income decline as average employee tenure declines Market volatility, which is common these days, increases the risk around personal savings. And with Social Security, the future is anything but certain

On top of this stool, longevity risks are adding to the pressure on retirees’ income plans. It’s no secret that people are living longer, but the increasing likelihood of a retiree reaching their late 90s or even age 100 means retirement income may need to last many more years than planned

A growing need for long-term retirement security

Nationwide’s Eric Stevenson, President of Retirement Solutions, recently had the opportunity to participate at this year’s Milken Global Conference in Los Angeles on a panel to discuss planning for the ideal retirement Joining him on stage for this discussion were three financial industry leaders: Christine Benz from Morningstar, Thomas Lee from the New York State Teachers’ Retirement System and Rebecca Tadikonda from Athene The following are Stevenson’s remarks:

"At Nationwide, retirement success means helping more Americans prepare for and live a secure, dignified retirement even when retirement lasts longer than they expect. For plan sponsors, that last part is growing in importance as more savers face the financial challenges that come with living longer lives

"Think about this: The number of Americans living to age 100 and beyond is expected to quadruple over the next 30 years, according to the US Census Bureau For couples, there’s a 20% chance that one partner will live to at least 100

"While still only a small number of Americans will attain centenarian status, many more will live well into their 90s For a saver who retires at age 65, their retirement may last 30 years or more. The average retirement today is just 18 years That means many current and future retirees run the risk of running out of money before they run out of time"

The reality, however, is that many people are living longer than they thought they would Those extra years can increase the risk of running out of money later in life. Research by the American College of Financial Services found that extending retirement by just 5 years from 30 to 35 years raises the likelihood that a retiree would run out of money by nearly 60%.

The reality is that less than half of Americans1 take into account how long they are likely to live when making decisions about saving and investing Bringing more attention to longevity risk is one way you can stand out with savers and emphasize your valuable role as an industry professional.

Awareness of the longevity challenge is important, but solutions matter too. Partners such as Nationwide and others in the financial industry are working to address these risks with innovative protected retirement solutions that offer savers two types of protection: principal protection and lifetime income.

Most Americans2 consider their workplace retirement plans to be their primary source for saving and investing for a secure financial future. The financial industry has done a good job developing innovative solutions around accumulation: auto-enrollment and autoescalation features in retirement plans are helping workers save more. But it’s time to pay more attention to protection strategies and the other side of the retirement planning equation: decumulation.

In-plan lifetime income funds provide the certainty of a pension-like3 monthly paycheck,4 helping workers convert their savings into regular payments they won’t outlive. These “auto-income” solutions offer retirees a predictable paycheck stream, boosting financial confidence about the future.

Acceptance of in-plan protected retirement solutions is growing, but it’s incumbent on all of us in the retirement planning industry to increase adoption of these options in workplace retirement plans

Read the full article from Nationwide here.

For more information about NACo’s retirement solutions and the Deferred Compensation Program administered by Nationwide, visit edge.naco.org.

PBM COALITION SURPASSES 105,000 COVERED LIVES

Continued from page 1

For local government employees, the results are tangible: access to affordable medications, predictable co-pays, and a network that prioritizes wellness and continuity of care. For county officials and administrators, the Coalition provides budget predictability, transparency in pricing, and relief from the volatility of annual renewals, as evidenced by the $7.5M in projected savings realized by officials and taxpayers in Mecklenburg County, NC

As the Coalition continues to grow, it demonstrates how collaboration among NACo members can transform the way counties deliver essential services and benefits Every new county that joins strengthens the negotiating power and ensures that even more public servants can enjoy affordable, high-quality pharmacy coverage.

The NACo PBM Coalition is more than a benefits program it’s a testament to the power of counties coming together to drive meaningful savings and better outcomes for their employees and communities

Learn more about how your county can join this national effort at www.publicpromiseinsurance.org.

NACo’s Pharmacy Benefit Management (PBM) Coalition is endorsed by the Florida Association of Counties, the California State Association of Counties, the Nebraska Association of Counties, and the Washington State Association of Counties

COAL COMMUNITIES SEEK TO REVITALIZE AND DIVERSIFY WORKFORCES & LOCAL ECONOMIES

NACo's Building Resilient Economies in Coal Communities (BRECC) initiative serves coal communities seeking to revitalize and diversify their economies including local workforces.

BRECC is a knowledge-sharing community of practice, connecting coal communities across the nation, supporting local leadersand building economic development capacity As a result, BRECC prepares communities to advance new approaches and projects for economic diversification

By joining the initiative’s online community platform, you gain access to subject matter experts featuring strategies for recovery from coal's decline, including topics on investing and funding streams, workforce training, economic planning opportunities, community development strategies, broadband project management, federal agency resources, automation and employment

To join the BRECC Online Community Platform, sign up here

HEAR FROM YOUR PEERS

NACo EDGE is the #1 trusted resource for empowering our people. Listen to your colleagues share their stories of success.

Save with NACo’s Pharmacy Benefit Management (PBM) Coalition

Prepare for & Live Comfortably in Retirement with NACo-Nationwide’s Deferred Compensation Program

Equip Your County Leaders with Practical Leadership Skills & Training