LANDLORD TIMES

Stratford MP, Nadhim Zahawi has promised to take landlords’ concerns about the proposed abolition of periodic tenancies to the heart of government.

The idea was put forward as part of the Renters’ Reform Bill which was published by Michael Gove MP in June. Of all the elements within the Bill, it is arguably the most contentious.

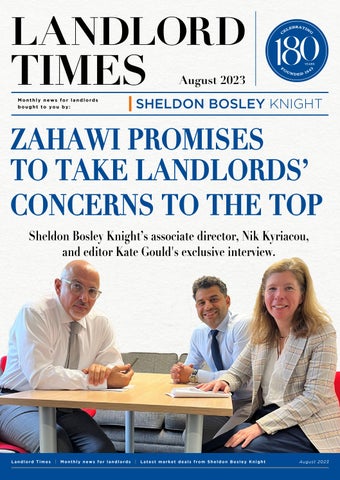

In a meeting with Sheldon Bosley Knight’s associate director Nik Kyriacou, Mr Zahawi said he recognised the issue would have a negative impact on landlords, not least financially.

Mr Zahawi said the driver of the Bill was to “deal with rogue landlords” but agreed “at the same time we must listen to legitimate concerns”. He said: “We all want a fair private rental sector. This [the abolition of periodic tenancies] will make it more difficult in terms of finance and security of tenure.

“I believe in contract laws and one of the best things about investing in the UK is we have the best legal framework in the world. Contracts matter and so fixed terms make sense to me.

“It would be disturbing if they [tenants] left a tenancy under those [new] conditions. A landlord would be stuck.”

He also recognised the issue of abolishing fixed term tenancies would be a problem for students and student landlords.

During the meeting, Nik outlined other issues facing landlords and tenants including increased taxation for investors, more demand than there are properties available, increased rents and the cost associated with upgrading properties to conform with the EPC requirements. He told Mr Zahawi Mr Gove had not responded to his letter regarding the Bill.

The meeting took place on the day Rightmove announced average

Housing secretary Michael Gove MP has hinted EPC reforms could be delayed.

In an interview with the Sunday Telegraph on July 23, he said the government was “asking too much too quickly” of landlords.

In the interview, he argued the government should "relax the pace" of proposed reforms which would prevent landlords from renting out their homes if they fail to meet a new minimum energy efficiency threshold by 2028.

He wrote: “We do want to move towards greater energy efficiency, but just at this point, when landlords face so much, I think that we should relax the pace that’s been set for people in the private rented sector,

particularly because many of them are currently facing a big capital outlay in order to improve that efficiency.”

The comments, while welcome for those landlords faced with a bill of thousands of pounds for the work to convert their properties to be compliant, are in contrast to the proposals which Mr Gove put forward in the Renters’ Reform Bill published in June.

Following a consultation in January 2021 it was proposed landlords would only be able to sign new tenancies if the properties achieved an EPC of C or above by April 2028.

It could have meant landlords spending thousands on fitting a heat pump, insulation or solar panels.

rents across the country and excluding London had reached a new record of £1,190 per month. The property portal also produced figures to show 16% of properties currently on the market were previously rentals. This figure is up from 13% before the pandemic. Nik said: “Our meeting with Mr Zahawi was extremely positive. He was receptive and responsive and has promised to look into our concerns and raise them with the government.

“He was the only MP in our patch who responded to not just our letter to Mr Gove regarding the Bill, but also our requests to meet and discuss the proposals which we believe will have a detrimental impact on both landlords and tenants and could result in landlords leaving the sector.

“If this happens it will be devastating to tenants who will find even fewer rentals available resulting in an increase in rent.”

Sheldon Bosley Knight’s head of lettings Becca Dean said: “This is welcome news for landlords but we do need clarity on when the rules will be changed and exact timescales on when landlords need to comply.

“It is curious the news comes out after the Bill has been published and just adds to the confusion and landlords’ anxiety. It is to be hoped this clarity comes as soon as possible.”

"It is curious the news comes out after the Bill has been published"

Tenant demand is fuelling buy-tolet investors’ plans to expand their portfolios.

The latest landlord survey from Landbay suggests 41% will add to their investments in the next 12 months.

According to the research, 35% of the 1,100 respondents said an increase in the number of tenants was the main driver for their expansion plans. This is up from 30% in the last Q4 survey. A third of those surveyed said a potential drop in house prices would persuade them to increase their portfolio.

The strongest intention came from landlords with between 11 and 20 properties, with more than half (54%) planning to expand their portfolio. While 40% landlords with more than 20 properties shared the same sentiment, so did almost the same number of those with two or three properties in their portfolio (44%).

Landbay also surveyed the same landlords on whether or not they planned to sell any of their properties in the next year. Two thirds (64%) said they were not.

Three quarters of those with individual properties said they would not sell, 69% of those with two or three said they would not and 65% of those with a portfolio of more than 20 said they would not. Although the number of landlords planning to shed some properties increased slightly to 30%, from 28% in the previous Q4 2022 survey, only 6% plan to get rid of all their properties.

Unsurprisingly, the deciding factor for 60% of landlords intending to sell is rising interest rates – an increase from 45% in the previous survey, while almost half (45%) said rent doesn’t cover their mortgage costs – up from 28% in the Q4 2022 survey. Respondents also mentioned landlord taxation (47%), the cost of meeting the

proposed EPC requirements (40%) and worries about evicting tenants (34%).

Sheldon Bosley Knight’s associate director Nik Kyriacou said: “This is encouraging news. There is so much negativity around the private rental sector at the moment with the publication of the Renters’ Reform Bill and the on-going uncertainty over proposed legislative changes.

“However, this shows many landlords are looking at the long-term picture and displays a confidence they will be able to navigate their way through.

“We should encourage those landlords who are choosing to stay in the sector and continue to provide a vital service – that of providing housing to those who need it.

“As ever if you need any advice or support, we can help especially when it comes to choosing the right investment opportunities.”

John Lewis (JLP) has submitted planning applications for its Build to Rent sites at West Ealing and Bromley in London. Plans for a vacant warehouse site in Reading will be brought forward later this year.

The retail giant said it was pushing ahead with its commitment to build and manage rental homes as part of a drive to help “address the UK housing crisis”.

It follows its announcement last December of a £500m multidecade joint venture with global

investment company abrdn to build around 1,000 new homes across the three sites.

The plans would see 428 new homes in West Ealing and 353 in Bromley, and JLP’s ambition is 35% of the properties would be affordable housing with a focus on key workers.

A public piazza, a new Waitrose shop and café, pedestrian and cyclist access, roof gardens, flexible workspaces and a gym are all proposed as part of the developments.

Sheldon Bosley Knight’s associate director, Nik Kyriacou said: “Landlords should take comfort from the fact an organisation the size of JLP is stepping into the rental market. It shows there is confidence in the sector which is a good thing.

“However this is just the tip of the iceberg when it comes to increasing supply and I hope other such organisations who have sites at their disposal think about how they can best use it to create more much-needed rental stock and follow this example.”

Buy-to-let investors are set to see their average monthly mortgage repayments go up by approximately £275 by the end of 2025.

The statistics were published in the Bank of England’s July Financial Stability Report.

It says: “Landlords are currently subject to a combination of factors that are putting pressure on their profitability: higher interest rates and structural changes – including adjustments to income and capital gains tax rules and proposed changes to building energy efficiency regulations and tenancy protection.”

It notes the private rented sector is an “important part of the UK housing market” covering around

19% of households, adding: “Many private landlords finance their investment through mortgage borrowing: around 7% of the total UK housing stock has a buy-to-let mortgage on it and this type of lending comprises around 18% of the overall mortgage market by value.”

Sheldon Bosley Knight’s head of lettings Becca Dean said: “Landlords are increasingly finding themselves in an impossible position thanks to a combination of increasing mortgage costs, inflation and the cost of living.

“They are having to choose between leaving the market altogether and thus increasing the demand for housing which has long been outstripping supply, or increasing rents to cover their

costs or try and absorb those costs themselves. Most simply cannot afford to do this.

“The government needs to step in to help and protect the market from this growing crisis before it’s too late.

“This could take the form of helping renters in terms of housing benefit and energy bills and for landlords, more favourable terms on buy-tolet mortgage deals and scrapping the proposed changes to the capital gains tax threshold.”

"The government needs to step in to help and protect the market from this growing crisis before it’s too late."

More than 20,000 homes could be created in England from empty local authority buildings.

This is the finding from the all-party parliamentary groups for Housing Market & Housing Delivery and Ending Homelessness. The two groups published a report after a joint inquiry into repurposing empty properties into residential homes.

Their joint report says there is significant potential for housing supply to be increased this way, providing there are safeguards in place to ensure that the homes delivered are of high quality and genuinely affordable.

The MPs reviewed evidence from housing and homelessness organisations, local government, planning experts and developers. It

found 14% of retail space and 7% of office space is currently vacant. They have called on the government to strengthen standards and implement a Healthy Homes Principle to ensure high quality homes.

Ben Everitt MP, chairman of the APPG for Housing Market and Delivery, said the groups wanted to look at creative housing supply solutions that are available in the short-term and hoped the government would take forward the recommendations.

Although their inquiry was targeted at increasing stock for sale that is genuinely affordable, the principles could be used to provide more accommodation in the private rental sector.

Sheldon Bosley Knight associate director Nik Kyriacou said: “This report makes some interesting recommendations and it will be interesting to see if the government acts on them.

“We all know there is a demand for housing which is affordable and up to a decent standard. However, adopting this strategy could also have the potential to create more rental units as there is a significant imbalance between supply and demand in this sector.

“The government has abandoned its manifesto pledge to build 300,000 homes per year, and as we don’t want to encroach on greenbelt land, there needs thought put into creative ways in which we can gain more units both for sale and for rent.”

After a decade of steady growth, the number of older renters is set to increase rapidly over the next 10 years.

According to research by Hamptons, the number of over 65 rented households will more than double from 400,000 households currently to 1 million by 2033.

It cites a decline in homeownership rates among the tail end of the Baby Boomer generation and older members of Generation X.

This increased demand could represent good news for buy-tolet investors keen to expand their portfolios.

Currently, households of those aged 65 and above have some of the highest homeownership rates in history. Only 5.7% of households with those over 65 today rent their homes privately.

However, the English Housing Survey suggests the following generation are nearly twice as likely to rent privately and within

a decade the share of over 65s renting will rise to 11.5%.

With the increasing number of older renters, the total amount in annual rent paid by over 65s is projected to increase from £5.1bn in 2023 to £12.7bn by 2033 (assuming no rental growth and reflecting rents at 2023 rates).

However, rents are rising across the board, thanks to demand outstripping supply and an increase in landlord costs.

Additionally, high mortgage rates are pricing out potential first-time buyers fuelling rental demand.

In June, the average rent on a newly let property in Britain rose to £1,273 pcm, an increase of £110 pcm or 9.4% compared to the same period last year. This marked the sixth strongest annual rent increase since Hampton’s records began in 2014.

Strong growth has meant the average one-bed rent (£1,017 pcm) now costs the same as the average two-bed just 15 months ago in April

2022. The average rent of a onebed home in Britian passed the £1,000 pcm mark in May. Similarly, the average two-bed rent (£1,170 pcm) is now the same as what a three-bed cost in January 2022.

Rents are rising in all regions, and with interest rates set to stay higher than most people are used to, these pressures seem likely to continue building over the medium term. Sheldon Bosley Knight’s head of lettings, Becca Dean said: “The potential increasing numbers of those renting into retirement could represent an opportunity for buyto-let investors keen to expand their portfolios.

“With house prices stabilising it gives buy-to-let investors an opportunity to snap up properties which could be suitable for those in the retirement age bracket who will still want to or have to rent.

“As ever if you would like any help or advice on such investments, please pop into one of our branches for a chat.”

• Potential rent of £750 pcm

• Recently refurbished

• Period ground floor apartment

• One bedroom

• Open plan living •

• Two-bedroom town house

• Historically let out

• Currently empty

• Downstairs bathroom

• On-street parking

• Potential rent of £700 pcm

• Freehold property

To follow Sheldon Bosley Knight click here Gross yield of 4.4% £190,000

• Two bedrooms

• With improvements, potential rent of £850 pcm

• EPC - D

• Current rent value of £975 pcm

• Town centre location

• EPC - D

*All rental values and subsequent yields are only estimates unless tenanted, and subject to market fluctuations.

Gross yield of 5.4% £215,000

To follow Sheldon Bosley Knight click here

Railway Crescent, Shipston-On-Stour

• Three-bedroom town house

• Tenant in situ with notice given

• Immaculate condition

• Over three floors

• Garage and parking

• Current rent of £900 pcm

• Popular estate

• EPC - C

Gross yield of 3.4% £310,000

• Four double bedrooms HMO

• Tenancy secured for next academic year (23/24)

• Large breakfast kitchen

• Double glazed with central heating

• Annual rent of circa £24,000

• Off road driveway parking

• Generous size rear garden

• EPC - D

*All rental values and subsequent yields are only estimates unless tenanted, and subject to market fluctuations.

Gross yield of 7.4% £325,000

• Two bedrooms

• First floor apartment

• Walking distance to town centre

• Two bathrooms

• Six bedrooms HMO

• Town centre location

• Three storeys

• Double glazed with central heating

To follow Sheldon Bosley Knight click here

• Tenant in situ, rent of £1,200 pcm

• One allocated parking space

• EPC - D

Gross yield of 4.4% £315,000

• Recent annual rent of £36,300

• Walking distance to train station

• Current HMO licence

• EPC - C

*All rental values and subsequent yields are only estimates unless tenanted, and subject to market fluctuations.

Gross yield of 9.4% £385,000

Thornton House, Leamington Spa Gordon Street, Leamington Spa• Eight double bedrooms

• Current HMO licence valid until September 2024

• Three storeys

• Double glazed with central heating

• Tenant in situ, rent of 11 x £400 pcm

• Off road driveway parking

• Huge scope for further modernisation

• EPC - C

Gross yield of 7.2% £425,000 NEW

• Six bedroom HMO

• Six bathrooms

• Immaculate condition

• Popular location

• Low maintenance rear garden

• Rent starting from £500 pcm per room

• Communal kitchen/diner

• Traditional double bay

• EPC - D

*All rental values and subsequent yields are only estimates unless tenanted, and subject to market fluctuations.

Gross yield of 8.9% £425,000

To follow Sheldon Bosley Knight click here Earlsdon Avenue North, Coventry Melbourne Road, CoventryThe Square, Kenilworth

• Mixed use unit - residential and commercial

• Two upper floor apartments

• Ground floor commercial premises

• Shop - £7,800 per annum

• One bedroom apartment - £795 pcm

• Total annual income £27,240

• Two bedroom apartment - £825 pcm

• EPC - TBC

Gross yield of 5.4% £500,000

• Six one-bedroom apartments and one two-bedroom apartment

• Benefits from workshop, store and toilet block which could be used for further expansion (STPP)

• Detached property

• Tenants in situ, rent of £43,380 per annum

• River views

• EPC - range from D to G

*All rental values and subsequent yields are only estimates unless tenanted, and subject to market fluctuations.

Gross yield of 5.3% £795,000

To follow Sheldon Bosley Knight click here

Boat House, Evesham

To follow Sheldon Bosley Knight click here

Boat House, Evesham

Bridge Street, Evesham

Bridge Street, Evesham, WR11 4SQ

• Highly prominent town centre building

• Suitable for conversion of upper floors to residential (STP)

• Ground floor retail premises and two separately accessed office suites

• ERV £46,000pa

• Mixed use investment property

• EPC - TBC

• Modern, detached office on Warwick University Technology Park

• Grade A interior specification

• 372m2 (4,007sq ft) IPMS3

• Excellent parking

Gross yield of 9.3% £495,000

• Potential rent of £68,000 per annum

• Access to A45, A46 & M42

• EPC - C

Gross yield of 10.18%% £550,000