W emocle A mehtn

uoyWcesoohnalp ruoyhtlaeh

ecnedfinocw

ll’uoyekamC dnaruoyt tnemllornef troppusy raey.gnoly ,uoymorfT nacplehb dellorney

htlaehAmehtn.nalp

W A mehtn

AtAmehtn, ytilauqegarevoceht4noillim7evahelpoepohw anAmehtn.nalphtlaeh1dna,ecivresweiverehtstfieneb p tseihtlaeh.fles

WhtiAmehtn:gnidulcniyteirav,stfieneb

T krowten

seviguoyAmehtnsseccam naht7.1noillimsrotcoddnaslatipsoh,sredivorp —ehts’noitantsegralkrowtenerac w eht.S.U2

N tsoc-wol erac evitneverp evitneverP,eracY s ylraenehw .taertt

Cerac lautriv V a.aremac tiaw.emitY3

ecnavelE:htlaeH1 2 sredloherahSdnayxorPtnemetatS dessecca(yaM,12:)5202h fdp.tnemetats-yxorp-htlaeh-ecnavele-4202/ra/4202/slaicnanfi_cod/selfi/069913566/moc.ndc4q.202s//:sptt dleihS:noitaicossA2 eulBssorCeulBdleihSmetsyST desseccayaM,12:)5202(bmoc.sbc 3 yam.rehgihuoYyam ruoyhtlaeh.nalpa

.erachtlaehYAmehtn,erom htlaehnalpseviguoytahtdna .tegdubs

R htlaehnalpsb eesruoysrotcoderaehts’nalp .yenomn

P 4 nal

W )OPP(,nalpuoy c gniviguoy .ytilibixeflm

• krowtenrof .sgnineercsp rotcod• cidepohtrorotcodsa dna.yenomc seitilicaf• s'nalp.krowteny

P 7 nal

• uoYnacetubirtnoc004,4$roflaudividnidna $ 057,8rofa.ylimafer'uoy,redlouoynac etubirtnoartxe000,1$a.raeyc

P 9 nal

T tniopecivres)SOP(nepOsseccAnalpswollauoy t oeessrotcoddnaedistuoruoys'nalp,krowten gniviuoydeddaytilibixefldna.seciohcg

• ll'uoYesoohcayramirperacrotcodmorfehtnalprof evitnever,erachcusspukcehcdna.sgnineercsp uoydeeneracmorfa,tsilaicepshcus• cidepohtrrotcoda,tsigoloidracuoyt'noddeenoa larrefemorfruoyyramirperac.rotcodsihTnacevasr emitdna.yenomy

A )ASH(nalp a roferacxat f defiilauq m latipsoh,stisiv p .syapoc1

• raeyraey a htlaehsnalp ,sboj.eritero

• uoYnaceessrotcodedistuoeht,nalptubll'uoyevas eroyenomnehwuoyeessrotcodohweratrapm SOP.nalpt

Uruo FeraC dni ruoysrotcoderaehts’nalpkrowtengnitisiv aerac-dnif/moc.mehtn

defiilauq,sesnepxe3aemq/moc.mehtn

er’eWerehH gnivas.yenomh

Y:srevoc nalp •B ruoygurd.tsil elbadroffa•C tsoc.uoye

•M taertgniogno suoires.ssenllih

Cstnemeriuqer C rehtospets srevoc.mehtb

• S :ypareht pet uoYyamdeenyrtrehtoenicidem erofenacrevocehtenoruoyrotcod.debircserpb

• Q :stimil ytitnau plehtcetorpruoy,htlaehruoynalp m timilwohhcumnoitacidemuoynaceviecer hca.htnome

• D :noitazimitpo eso arehgihhtgnerts,elbaliava y yamelbahctiwsmorfgnikatelpitlumsesod oaelgnisesodhcae.yadt

• 9 :ylppus yad-0 uoyekatecnanetniamnoitacidem gniognosnoitidnocekil,amhtsa,setebaidhgihf

• P,noitazirohtua hsple .etairporppae n rotcoddnfi ruoy.trapt

cpua,loretselohruoynalperiuqertahtuoytes s

9 yad-0ylppusalacolycamrahphguorht xRnoleraycamrahPemoh.yreviledC

Rtsil gurd ruoy yrevecitueparehtY c yllaicepsenehw t’nera.derevocc ;snoitacidemY rehtosnoitpot

V:tisi

•

ttps://fm.formularynavigator.com/FBO/143/Essential_Direct_ h

4_Tier_ABCBSVa.pdf

T:stfieneb

•R snoitpircserp a.derevoc

Sylppus yad-09 a htiw eva

noitacideMloot•U Syendy SM htlaeH

fi ,krowtenhcihwnac .senicidems ycamrahp•C y aycamrahP tloo Syendy SM htlaeH ycamrahP•E m snoitacidem rewolruoy.stsoce

•G ytlaicepsycamrahp o ytlaicepssgurdera deen.mehtc

•R erehwruoy evas.yenomm

R :09 ecnanetniaM x yad-03sllfierenicidemretfA2uoy t eka,ylralugerll’uoyderiuqerhctiwsayad-09 s .ylppuecnanetniaMsenicidemnacyrav.stnuomalliF y ruoyad-09ylppushtiwxRnoleraCycamrahP—ruo emoyreviledecivres—ecnanetniaMh liate.ycamrahpr

elbitcuded dna stfieneb ruoy

Hkrow

Pelbitcuded ycamrah ruonalpsemochtiwaetarapesycamrahp,elbitcudedY w hcihehttestnuomauoyyaptuoruoytekcoprof m enicideerofebehtycamrahpnalpstratserahs t.tsoc

T 1 rei derrefercirenegsgurdP $

T 2 rei derrefereman-dnarbdna,rewenP tsoc-rehgicirenegsgurdh

T 3 rei derreferpnoeman-dnarbN cirenegsgurda

T 4 rei derreferytlaicepssgurdP dnarbemandna)cireneg(

Ysnoitpo ,snoitpircserpgnidulcniY krowtenladn c .ycamrahP y dellfi .ycamrahpt

T A krowteN egatnavd serutaef5000,8seicamrahp n seicamrahpekil C .tramlaWtsoM i .dedulcnioTdnfi a ,ycamrahptisiv a lmth.skrowtenxr/noitamrofniycamrahp/moc.mehtn krowteN.tsila

dnfi.eracY

F eraC dni

O FeraC dni uoyt’nevahtey,dellorne u eciohcgnirud .ytilicafo

evahIAmehtnloot uoynacllitssseccaehtdniFeraC a erac-dnfi/moc.mehtn dnahcraes a.tseug sa

•Stcele Bhcraes cisa .

•S krowten— M krowteN nalP lacide —nehttcelesehtetatshcihwruoys’reyolpmenalp era.detacoli

•S .)derosnopS

•C gniretneehtN draCeulB()OPPsrepeeKhtlaeHSOPtceleS()krowteN.nehT seht tcele Ceunitno .nottub

•Eruoy retn cyti , cytnuo , Zedoc rotcod,erudecorpllewgnisurehto detaler-era.smretc

•V.stluser wei

AsediuG htlaeH sediugohwHc plehuoyhtiwllaruoyerachtlaeh.sdeen

T evitneverp evahsAmehtnhcaerhtlaeh,nalpanmehtnAhtlaeHediuGrebmun gnillaceht gnisuehty Syendy SM htlaeH ,ppagnitisiv amoc.mehtn

Syendy SM htlaeH ppa evahOAmehtnssenllew latigidhtlaehnalp,drac dnaehtr FeraC dni loothtiweht

T ediuguoy llarevo.htlaeht

Syendy SM htlaeH .ppa

Summary of Benefits of Coverage (SBC’s)

Effective January 1-December 31, 2026

4

The Summary of Benefits and Coverage (SBC) document will help you choose a health plan . The SBC shows you how you and the plan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium ) will be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, https://eoc.anthem.com/eocdps/aso . For general definitions of common terms, such as allowed amount , balance billing , coinsurance , copayment , deductible , provider , or other underlined terms , see the Glossary. You can view the Glossary at www.healthcare.gov/sbcglossary/ or call (833) 5972358 to request a copy.

Matters:

Why This

Important Questions Answers

$750 /person or $1,500 /family for InNetwork Providers . $750 /person or $1,500/family for NonNetwork Providers .

Generally, you must pay all of the costs from providers up to the deductible amount before this plan begins to pay. If you have other family members on the policy, the overall family deductible must be met before the plan begins to pay. Are there services covered before you meet your deductible ? Yes. Preventive Care for InNetwork Providers . Vision for InNetwork and NonNetwork Providers . This plan covers some items and services even if you haven’t yet met the deductible amount. But a copayment or coinsurance may apply. For example, this plan covers certain preventive services without cost -sharing and before you meet your deductible . See a list of covered preventive services at https://www.healthcare.gov/coverage/preventivecare -benefits/ . Are there other deductibles for specific services ? Yes. $150 /person or $300 /family for Prescription Drugs InNetwork Providers . There are no other specific deductibles . You must pay all of the costs for these services up to the specific deductible amount before this plan begins to pay for these services .

The outofpocket limit is the most you could pay in a year for covered services . If you have other family members in this plan , they have to meet their own out-ofpocket limits until the overall family out-ofpocket limit has been met.

$3,250 /person or $6,500 /family for InNetwork Providers . $4,500 /person or $9,000/family for NonNetwork Providers . This plan has a separate Out of Pocket Maximum of $3,35 0/person or $6,7 00/family for Prescription Drugs InNetwork Providers .

What is the overall deductible ?

What is the outofpocket limit for this plan ?

What is not included in the outofpocket limit ? Premiums , balancebilling charges, and health care this plan doesn't cover. Even though you pay these expenses, they don’t count toward the outofpocket limit . Will you pay less if you use a network Yes, KeyCare . See www.anthem.com or call (833) This plan uses a provider network . You will pay less if you use a provider in the plan’s network . You will pay the most if you use an out-of-n etwork provider , and you might receive

provider ? 5972358 for a list of network providers. a bill from a provider for the difference between the provider’s charge and what your plan pays ( balance billing ). Be aware , your network provider might use an out-of-n etwork provider for some services (such as lab work). Check with your provider before you get services . Do you need a referral to see a specialist ? No. You can see the specialist you choose without a referral . All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.

You may have to pay for services that aren't preventive. Ask your provider if the services needed are preventive. Then check what your plan will pay for.

Costs may vary by site of service.

Costs may vary by site of service.

For more information, refer to “ Essential Direct Drug List ” at http://www.anthem.com/pharm acyinformation/ *See Prescription Drug section Medications on the VPCBC Preventive Rx List are free of charge and are not subject to the deductible.

/visit Or 20% coinsurance in a facility setting

(CT/PET scans, MRIs)

$10/prescription, Prescription Drug deductible does not apply (retail and home delivery ) Not covered (retail) and Not covered (home delivery)

Greater of $40 or 30% coinsurance up to $80/prescription, Prescription Drug deductible applies (retail) and Greater of $80 or 30% coinsurance up to $160/prescription, Prescription Drug deductible applies (home delivery) Not covered (retail) and Not covered (home delivery)

Greater of $60 or 40% coinsurance up to Not covered (retail) and Not covered (home delivery)

If you have a test

Tier 1Typically Generic

If you need drugs to treat your illness or condition

Tier 2Typically Preferred Brand & NonPreferred Generic Drugs

More information about prescription drug coverage is available at http://www.anthe m.com/pharmacyi nformation/

Tier 3Typically NonPreferred Brand and Generic drugs

* For more information about limitations and exceptions, see plan or policy document at https://eoc.anthem.com/eocdps/aso .

Rx Maintenance

What You Will Pay

NonNetwork Provider (You will pay the most)

InNetwork Provider (You will pay the least )

$120/prescription, Prescription Drug deductible applies (retail) and Greater of $120 or 40% coinsurance up to $240/prescription, Prescription Drug deductible applies (home delivery)

90You may get two 30 day supply fills of the same maintenance medication at a retail pharmacy. Prior to your 3 rd fill, you must switch to home delivery . Tier 4Typically

One copayment per pregnancy for office visit services . Maternity care may include tests and services described elsewhere in the SBC (i.e. ultrasound).

PCP / $40 Spec. pregnancy for the first 1 visit deductible does not apply .

If you are pregnant

For more information about limitations and exceptions, see plan or policy

(You will pay the most)

Services & Other Covered Services:

Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services . )

• Dental care (Adult)

• Glasses for a child

• Longterm care

• Cosmetic surgery • Dental Check -up

• Infertility treatment

• Weight loss programs

• Acupuncture

• Dental care (Pediatric)

• Routine foot care unless medically necessary

Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.)

• Chiropractic care 30 visits/benefit period

• Routine eye care (Adult) 1 exam/benefit period

• Hearing Aids

• Bariatric surgery

• Most coverage provided outside the United States. See www.bcbsglobalcore.com Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is: Virginia Bureau of Insurance, 1300 East Main Street, P. O. Box 1157, Richmond, VA 23218, (800) 5527945 , Department of Labor, Employee

• Private -duty nursing 16 hours/ member/ benefit period Facility Setting only

Benefits Security Administration, (866) 444EBSA (3272), www.dol.gov/ebsa/healthreform , or contact Anthem at the number on the back of your ID card.

Other coverage options may be available to you too, including buying individual insurance coverage through the Health Insurance Marketplace . For more information about the Marketplace , visit www.HealthCare.gov or call 18003182596.

* For more information about limitations and exceptions, see plan or policy document at

Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim . This complaint is called a grievance or appeal . For more information about your rights, look at the explanation of benefits you will receive for that medical claim . Your plan documents also provide complete information on how to submit a claim , appeal , or a grievance for any reason to your plan . For more information about your rights, this notice, or assistance, contact: ATTN: Grievances and Appeals, P.O. Box 27401, Richmond, VA 23279

Department of Labor, Employee Benefits Security Administration, (866) 444EBSA (3272), www.dol.gov/ebsa/healthreform

Does this plan provide Minimum Essential Coverage? Yes Minimum Essential Coverage generally includes plans , health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid, CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage , you may not be eligible for the premium tax credit . Does this plan meet the Minimum Value Standards? Yes If your plan doesn’t meet the Minimum Value Standards , you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace . To see examples of how this plan might cover costs for a sample medical situation, see the next section.

* For more information about limitations and exceptions, see plan or policy document at

About these Coverage Examples: This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will be different depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost sharing amounts ( deductibles , copayments and coinsurance ) and excluded services under the plan . Use this information to compare the portion of costs you might pay under different health plans . Please note these coverage examples are based on self -onl y coverage.

* This plan has other deductibles for specific services included in this coverage example. See “Are there other deductibles for specific services?” row above.

covered services.

The plan would be responsible for the other costs of these

(TTY/TDD: 711)

Albanian (Shqip): Nëse keni pyetje në lidhje me këtë dokument, keni të drejtë të merrni falas ndihmë dhe informacion në gjuhën tuaj. Për të kon taktuar me një përkthyes, telefononi (833) 5972358 Amharic (

(833) 5972358 : (833) 5972358 . (833) 5972358 (833) 5972358

Chinese ( 中文 ) : 如果您對本文件有任何疑問,您有權使用您的語言免費獲得協助和資訊。如需與譯員通話,請致電 (833) 5972358 。 (833) 5972358 .

Dutch (Nederlands): Bij vragen over dit document hebt u recht op hulp en informatie in uw taal zonder bijkomende kosten. Als u een tolk wilt spre ken, belt u (833) 5972358 . (833) 5972358

Language Access Services:

French (Français) : Si vous avez des questions sur ce document, vous avez la possibilité d’accéder gratuitement à ces informations et à une aide dans votre langue. Pour parler à un interprète, appelez le (833) 5972358 .

German (Deutsch): Wenn Sie Fragen zu diesem Dokument haben, haben Sie Anspruch auf kostenfreie Hilfe und Information in Ihrer Sprache. Um mit einem Dolmetscher zu sprechen, bitte wählen Sie (833) 5972358 .

Greek (Ελληνικά)

(833) 5972358 .

કરો (833) 5972358 .

,

.

Haitian Creole (Kreyòl Ayisyen): Si ou gen nenpòt kesyon sou dokiman sa a, ou gen dwa pou jwenn èd ak enfòmasyon nan lang ou gratis. Pou pale ak yon entèprèt, rele (833) 5972358. (833) 5972358

Hmong (White Hmong): Yog tias koj muaj lus nug dab tsi ntsig txog daim ntawv no, koj muaj cai tau txais kev pab thiab lus qhia hais ua koj hom lus yam tsim xam tus nqi. Txhawm rau tham nrog tus neeg txhais lus, hu xov tooj rau (833) 5972358 . Igbo (Igbo): Ọ b ụ r ụ na ị nwere aj ụ j ụ ọ b ụ la gbasara akw ụ kw ọ a, ị nwere ikike ị nweta enyemaka na ozi n'as ụ s ụ g ị na akw ụ gh ị ụ gw ọ ọ b ụ la. Ka g ị na ọ k ọ wa okwu kwuo okwu, kp ọọ (833) 5972358 .

Ilokano (Ilokano): Nu addaan ka iti aniaman a saludsod panggep iti daytoy a dokumento, adda karbengam a makaala ti tulong ken impormasyon babaen ti lenguahem nga awan ti bayad na. Tapno makatungtong ti maysa nga tagipatarus, awagan ti (833) 5972358 .

Indonesian (Bahasa Indonesia): Jika Anda memiliki pertanyaan mengenai dokumen ini, Anda memiliki hak untuk mendapatkan bantuan dan informasi dalam bahasa Anda tanpa biaya. Untuk berbicara dengan interpreter kami, hubungi (833) 5972358 .

Italian (Italiano): In caso di eventuali domande sul presente documento, ha il diritto di ricevere assistenza e informazioni nella sua lingua sen za alcun costo aggiuntivo. Per parlare con un interprete, chiami il numero (833) 5972358 (833) 5972358

(833) 5972358

Kirundi (Kirundi): Ugize ikibazo ico arico cose kuri iyi nyandiko, ufise uburenganzira bwo kuronka ubufasha mu rurimi rwawe ata giciro. Kugira uvugishe

umusemuzi, akura (833) 5972358 .

Korean ( 한국어 ): 본 문서에 대해 어떠한 문의사항이라도 있을 경우 , 귀하에게는 귀하가 사용하는 언어로 무료 도움 및 정보를 얻을 권리가 있습니다 . 통역사와 이야기하려면 (833) 5972358 로 문의하십시오 . (833) 5972358 . (833) 5972358 . (833) 5972358

Oromo (Oromifaa): Sanadi kanaa wajiin walqabaate gaffi kamiyuu yoo qabduu tanaan, Gargaarsa argachuu fi odeeffanoo afaan ketiin kaffaltii alla argachuuf mirgaa qabdaa. Turjumaana dubaachuuf, (833) 5972358 bilbilla.

Pennsylvania Dutch (Deitsch): Wann du Frooge iwwer selle Document hoscht, du hoscht die Recht um Helfe un Information zu griege in dei Schprooch mitaus Koscht. Um mit en Iwwersetze zu schwetze, ruff (833) 5972358 aa.

Polish (polski): W przypadku jakichkolwiek pytań związanych z niniejszym dokumentem masz prawo do bezpłatnego uzyskania pomocy oraz informacji w swoim języku. Aby porozmawiać z tłumaczem, zadzwoń pod numer (833) 5972358.

Portuguese (Português): Se tiver quaisquer dúvidas acerca deste documento, tem o direito de solicitar ajuda e informações no seu idioma, sem qualquer custo. Para falar com um intérprete, ligue para (833) 5972358. (833) 5972358

(833) 5972358 . (833) 5972358 .

Samoan (Samoa): Afai e iai ni ou fesili e uiga i lenei tusi, e iai lou ‘aia e maua se fesoasoani ma faamatalaga i lou lava gagana e aunoa ma se totogi. Ina ia talanoa i se tagata faaliliu, vili (833) 5972358.

Serbian (Srpski): Ukoliko imate bilo kakvih pitanja u vezi sa ovim dokumentom, imate pravo da dobijete pomoć i informacije na vašem jeziku bez ikakvih

troškova. Za razgovor sa prevodiocem, pozovite (833) 5972358 .

Spanish (Español): Si tiene preguntas acerca de este documento, tiene derecho a recibir ayuda e información en su idioma, sin costos. Para habla r con un intérprete, llame al (833) 5972358 . Tagalog (Tagalog): Kung mayroon kang anumang katanungan tungkol sa dokumentong ito, may karapatan kang humingi ng tulong at impormasyon sa iyong wika nang walang bayad. Makipagusap sa isang tagapagpaliwanag, tawagan ang (833) 5972358 . Thai

(833) 5972358

(833) 5972358 . (833) 5972358 Vietnamese (Ti ế ng Vi ệ t): N ế u quý v ị có b ấ t k ỳ th ắ c m ắ c nào v ề tài li ệ u này, quý v ị có quy ề n nh ậ n s ự tr ợ giúp và thông tin b ằ ng ngôn ng ữ c ủ a quý v ị hoàn toàn mi ễ n phí. Đ ể trao đ ổ i v ớ i m ộ t thông d ị ch viên, hãy g ọ i (833) 5972358 . . (833) 5972358 (833) 5972358 .

Language Access Services:

It’s important we treat you fairly That’s why we follow federal civil rights laws in our health programs and activities. We don’t discriminate, exclude people, or treat them differently on the basis of race, color, national origin, sex, age or disability. For people with disabilities, we of fer free aids and services. For people whose primary language isn’t English, we offer free language assistance services through interpreters and other written languages. Interested in these services? Call the Member Services number on your ID card for help (TTY/TDD: 711). If you think we failed to offer these services or discriminated based on race, color, national origin, age, disability, or sex, you can file a complaint, also known as a grievance. You can file a complaint with our Compliance Coordin ator i n writing to Compliance Coordinator, P.O. Box 27401, Mail Drop VA2002N160, Richmond, VA 23279. Or you can file a complaint with the U.S. Department of Health and Human Services, Office for Civil Rights at 200 Independence Avenue, SW; Room 509F, HHH Building; Washington, D.C. 20201 or by calling 18003681019 (TDD: 18005377697) or online at https://ocrportal.hhs.gov/ocr/portal/lobby.jsf . Complaint forms are available at http://www.hhs.gov/ocr/office/file/index.html

H S A (Embedded Deductible)

Plan 7 PPO

The Summary of Benefits and Coverage (SBC) document will help you choose a health plan . The SBC shows you how you and the plan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium ) will be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, https://eoc.anthem.com/eocdps/aso . For general definitions of common terms, such as allowed amount , balance billing , coinsurance , copayment , deductible , provider , or other underlined terms , see the Glossary. You can view the Glossary at www.healthcare.gov/sbcglossary/ or call (833) 5972358 to request a copy. Important Questions Answers Why This Matters: What is the overall deductible ?

$3, 4 00 /person or $6, 8 00/family for InNetwork Providers . $3, 4 00 /person or $6,8 00/family for NonNetwork Providers . An HS A is available to reimburse you for certain deductible and coinsurance amounts.

Generally, you must pay all of the costs from providers up to the deductible amount before this plan begins to pay. If you have other family members on the plan , each family member must meet their own individual deductible until the total amount of d eductible expenses paid by all family members meets the overall family deductible . Are there services covered before you meet your deductible ? Yes. Preventive Care . Vision. For more information see below. This plan covers some items and services even if you haven’t yet met the deductible amount. But a copayment or coinsurance may apply. For example, this plan covers certain preventive services without cost sharing and before you meet your deductible . See a list of covered preventive services at https://www.healthcare.gov/coverage/preventivecare -benefits/ . Are there other deductibles for specific services ? No. You don't have to meet deductibles for specific s ervices .

$3, 4 00 /person or $6, 8 00/family for InNetwork Providers . $6,000 /person or $12,000/family for NonNetwork Providers . The outofpocket limit is the most you could pay in a year for covered services . If you have other family members in this plan , they have to meet their own out-ofpocket limits until the overall family out-ofpocket limit has been met.

What is the outofpocket limit for this plan ?

Even though you pay these expenses, they don’t count toward the outofpocket limit .

Premiums , balancebilling charges, and health care this plan doesn't cover.

What is not included in the outofpocket limit ?

This plan uses a provider network . You will pay less if you use a provider in the plan’s network . You will pay the most if you use an out-of-n etwork provider , and you might receive a bill from a provider for the difference between the provider’s charge and what your plan pays ( balance billing ). Be aware , your network provider might use an out-of-n etwork provider for some services (such as lab work). Check with your provider before you get services .

Yes. KeyCare . See www.anthem.com or call (833) 5972358 for a list of network providers.

Will you pay less if you use a network provider ?

You can see the specialist you choose without a referral .

Do you need a referral to see a specialist ? No.

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.

Virtual visits (Telehealth) benefits available.

Virtual visits (Telehealth) benefits available.

You may have to pay for services that aren't preventive. Ask your provider if the services needed are preventive. Then check what your plan will pay for.

Costs may vary by site of service.

Costs may vary by site of service.

Will Pay

Provider (You will pay the most)

What

Provider (You will pay the least )

May Need

care visit to treat an injury or illness

covered (retail) and Not covered (home delivery) For more information, refer to “ Essential Direct Drug List” at http://www.anthem.com/pharm acyinformation/ *See Prescription Drug section Medications on the VPCBC Preventive Rx List are free of charge and are not subject to the deductible. Rx Maintenance 90You may get two 30 day supply fills of the same maintenance medication at a retail pharmacy. Prior to your 3 rd fill, you must switch to home delivery .

coinsurance (retail and home delivery )

visit

/ screening / immunization

If you visit a health care provider’s office or clinic

If you have a test Diagnostic test (xray, blood work)

(CT/PET scans, MRIs)

Typically Preferred Brand & NonPreferred Generic Drugs (Tier 2) 0% coinsurance (retail and home delivery) Not covered (retail) and Not covered (home delivery)

Typically NonPreferred Brand and Generic drugs (Tier 3) 0% coinsurance (retail and home delivery ) Not covered (retail) and Not covered (home delivery)

Typically Preferred Specialty (brand and generic) (Tier 4) (Specialty 30 day fills) 0% coinsurance (retail) and (home delivery) Not covered (retail) and Not covered (home delivery)

More information about prescription drug coverage is available at http://www.anthe m.com/pharmacyi nformation/ Typically Generic (Tier 1)

If you need drugs to treat your illness or condition

Facility fee (e.g., ambulatory surgery center)

Physician/surgeon fees

.

If you have outpatient surgery

* For more information about limitations and exceptions, see the plan or policy document at

*See Durable Medical Equipment Section

*See Vision Services section

Reimbursed Up to $30

Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services . )

• Children’s d ental checkup

• Glasses for a child

• Routine foot care unless medically necessary

• Bariatric s urgery

• Dental care (Adult)

• Longterm care

• Acupuncture

• Cosmetic surgery

• Infertility treatment

• Weight loss programs

Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.)

• Most coverage provided outside the United States. See www.bcbsglobalcore.com

• Hearing aids

• Chiropractic care 30 visits/benefit period

• Routine eye care (Adult) 1 exam/benefit period

• Private -duty nursing 90 visits/benefit period combined with Home Health

Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is: Virginia Bureau of Insurance, 1300 East Main Street, P. O. Box 1157, Richmond, VA 23218, (800) 5527945 , Department of Labor, Employee

Benefits Security Administration, (866) 444EBSA (3272), www.dol.gov/ebsa/healthreform , or contact Anthem at the number on the back of your ID card. Other coverage options may be available to you , too, including buying individual insurance coverage through the Health Insurance Marketplace . For more information about the Marketplace , visit www.HealthCare.gov or call 18003182596.

Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim . This complaint is called a grievance or appeal . For more information about your rights, look at the explanation of benefits you will receive for that medical claim . Your plan documents also provide complete information on how to submit a claim , appeal , or a grievance for any reason to your plan . For more information about your rights, this notice, or assistance, contact:

ATTN: Grievances and Appeals, P.O. Box 27401, Richmond, VA 23279

Department of Labor, Employee Benefits Security Administration, (866) 444EBSA (3272), www.dol.gov/ebsa/healthreform

Does this plan provide Minimum Essential Coverage? Yes Minimum Essential Coverage generally includes plans , health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid, CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage , you may not be eligible for the premium tax credit .

Does this plan meet the Minimum Value Standards? Yes If your plan doesn’t meet the Minimum Value Standards , you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace . To see examples of how this plan might cover costs for a sample medical situation, see the next section.

.

* For more information about limitations and exceptions, see the plan or policy document at

About these Coverage Examples: This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will be different depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the costsharing amounts ( deductibles , copayments and coinsurance ) and excluded services under the plan . Use this information to compare the portion of costs you might pay under different health plans . Please note these coverage examples are based on self -onl y coverage.

covered services.

The plan would be responsible for the other costs of these

for

9 HMOPOS Open Access

The Summary of Benefits and Coverage (SBC) document will help you choose a health plan . The SBC shows you how you and the plan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium ) will be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, https://eoc.anthem.com/eocdps/aso . For general definitions of common terms, such as allowed amount , balance billing , coinsurance , copayment , deductible , provider , or other underlined terms , see the Glossary. You can view the Glossary at www.healthcare.gov/sbcglossary/ or call (833) 5972358 to request a copy.

Questions Answers

$1,000 /person or $2,000/family for NonNetwork Providers . Generally, you must pay all of the costs from providers up to the deductible amount before this plan begins to pay. If you have other family members on the policy, the overall family deductible must be met before the plan begins to pay.

This Matters: What is the overall deductible ? $0 /person or $0 /family for InNetwork Providers .

Are there services covered before you meet your deductible ? Yes. Vision for NonNetwork Providers . This plan covers some items and services even if you haven’t yet met the deductible amount. But a copayment or coinsurance may apply. For example, this plan covers certain preventive services without cost -sharing and before you meet your deductible . See a list of covered preventive services at https://www.healthcare.gov/coverage/preventivecare -benefits/ . Are there other deductibles for specific services ? Yes. $150 /person or $300 /family for Prescription Drugs InNetwork Providers . There are no other specific deductibles . You must pay all of the costs for these services up to the specific deductible amount before this plan begins to pay for these services .

The outofpocket limit is the most you could pay in a year for covered services . If you have other family members in this plan , they have to meet their own out-ofpocket limits until the overall family out-ofpocket limit has been met.

$2,500 /person or $5,000 /family for InNetwork Providers . $3,500 /person or $7,000/family for NonNetwork Providers . This plan has a separate Out of Pocket Maximum of $4,1 00 /person or $8,2 00/family for Prescription Drugs InNetwork Providers .

What is the outofpocket limit for this plan ?

What is not included in the outofpocket limit ? Premiums , balancebilling charges, and health care this plan doesn't cover. Even though you pay these expenses, they don’t count toward the outofpocket limit .

Will you pay less if you use a network Yes, HealthKeepers . See www.anthem.com or call (833) This plan uses a provider network . You will pay less if you use a provider in the plan’s network . You will pay the most if you use an out-of-n etwork provider , and you might receive

provider ? 5972358 for a list of network providers. a bill from a provider for the difference between the provider’s charge and what your plan pays ( balance billing ). Be aware , your network provider might use an out-of-n etwork provider for some services (such as lab work). Check with your provider before you get services . Do you need a referral to see a specialist ? No. You can see the specialist you choose without a referral . All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.

You may have to pay for services that aren't preventive. Ask your provider if the services needed are preventive. Then check what your plan will pay for.

If you visit a health care provider’s office or clinic

If you have a test Diagnostic test (xray, blood work) $25 PCP/$50 Spec or Facility copay/visit

Costs may vary by site of service.

For more information, refer to “ Essential Direct Drug List ” at http://www.anthem.com/pharm acyinformation/ *See Prescription Drug section Medications on the VPCBC Preventive Rx List are free of charge and are not subject to the deductible. Rx Maintenance 90You may get two 30 day supply fills of the same maintenance medication at a retail pharmacy. Prior to your 3 rd fill, you must switch to home delivery .

covered (retail) and Not covered (home delivery)

$300/visit

Costs may vary by site of service. Imaging (CT/PET scans, MRIs)

$10/prescription, Prescription Drug deductible does not apply (retail and home delivery )

Greater of $40 or 30% coinsurance up to $80/prescription, Prescription Drug deductible applies (retail) and Greater of $80 or 30% coinsurance up to $160/prescription, Prescription Drug deductible applies (home delivery) Not covered (retail) and Not covered (home delivery)

Greater of $60 or 40% coinsurance up to $120/prescription, Not covered (retail) and Not covered (home delivery)

Tier 1Typically Generic

If you need drugs to treat your illness or condition

Tier 2Typically Preferred Brand & NonPreferred Generic Drugs

More information about prescription drug coverage is available at http://www.anthe m.com/pharmacyi nformation/

Tier 3Typically NonPreferred Brand and Generic drugs

* For more information about limitations and exceptions, see plan or policy document at https://eoc.anthem.com/eocdps/aso .

You May Need What You Will Pay

InNetwork Provider (You will pay the least ) NonNetwork Provider (You will pay the most)

Prescription Drug deductible applies (retail) and Greater of $120 or 40% coinsurance up to $240/prescription, Prescription Drug deductible applies (home delivery)

Tier 4Typically Preferred Specialty (brand and generic) (Specialty 30 day fills) 50% coinsurance up to $200/prescription, Prescription Drug deductible applies (retail) and (home delivery) Not covered (retail) and Not covered (home delivery)

If you have outpatient surgery

If you need immediate medical attention

$25 PCP/ $50 Spec. /visit

100 days/benefit period for Inpatient rehabilitation and skilled nursing services combined. Physician/surgeon fees No charge after facility fee is paid.

$350/day to a maximum of $1,750/admission

If you have a hospital stay Facility fee (e.g., hospital room)

Office Visit $25/visit

Other Outpatient Facility Partial Day: No cost share

Office Visit Virtual visits (Telehealth) benefits available. Other Outpatient none Inpatient services

Outpatient services

If you need mental health, behavioral health, or substance abuse services

Precertification required.

One copayment per pregnancy for both office visit and

$350/day to a maximum of $1,750/admission

$25 PCP/$5 0 Spec /pregnancy deductible does not apply

If you are pregnant Office visits

For more information about limitations and exceptions, see plan or policy

You May Need What You Will Pay Limitations,

InNetwork Provider (You will pay the least ) NonNetwork Provider (You will pay the most)

childbirth/delivery professional services . Maternity care may include tests and services described elsewhere in the SBC (i.e. ultrasound).

90 visits/benefit period for Home Health an d Private Duty Nursing combined.

There is a 30visit limit for physical and occupational therapy, combined. 30visit limit for speech therapy. Early Intervention Services Predetermination of eligibility required.

100 days/benefit period for Inpatient rehabilitation and sk illed nursing services combined . Preauthorization.

$ 300 /pregnancy

$350/day to a maximum of $1,750/admission

Childbirth/delivery professional services

Childbirth/delivery facility services

$25/visit

Rehabilitation services

If you need help recovering or have other special health needs

*See Durable Medical Equipment Section Hospice services No charge

*See Vision Services section

Reimbursed Up to $30

$15/visit

Children’s eye exam

Children’s glasses Not c overed Not c overed

Children’s dental checkup Not c overed Not c overed none

none If your child needs dental or eye care

Excluded Services & Other Covered Services:

Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services . )

• Dental care (Adult)

• Glasses for a child • Longterm care

• Cosmetic surgery

• Dental Check -up

• Infertility treatment

• Weight loss programs

• Acupuncture

• Dental care (Pediatric)

• Routine foot care unless medically necessary

* For more information about limitations and exceptions, see plan or policy document at

Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.)

• Most coverage provided outside the United States. See www.bcbsglobalcore.com

30 visits/benefit period

• Chiropractic care

• Routine eye care (Adult) 1 exam/benefit period

• Bariatric surgery

• Hearing Aids

• Private -duty nursing 90 visits/benefit period combined with Home Health

Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is: Virginia Bureau of Insurance, 1300 East Main Street, P. O. Box 1157, Richmond, VA 23218, (800) 5527945 , Department of Labor, Employee Benefits Security Administration, (866) 444EBSA (3272), www.dol.gov/ebsa/healthreform , or contact Anthem at the number on the back of your ID card. Other coverage options may be available to you too, including buying individual insurance coverage through the Health Insurance Marketplace . For more information about the Marketplace , visit www.HealthCare.gov or call 18003182596.

Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim . This complaint is called a grievance or appeal . For more information about your rights, look at the explanation of benefits you will receive for that medical claim . Your plan documents also provide complete information on how to submit a claim , appeal , or a grievance for any reason to your plan . For more information about your rights, this notice, or assistance, contact:

ATTN: Grievances and Appeals, P.O. Box 27401, Richmond, VA 23279

Department of Labor, Employee Benefits Security Administration, (866) 444EBSA (3272), www.dol.gov/ebsa/healthreform

Does this plan provide Minimum Essential Coverage? Yes Minimum Essential Coverage generally includes plans , health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid, CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage , you may not be eligible for the premium tax credit . Does this plan meet the Minimum Value Standards? Yes If your plan doesn’t meet the Minimum Value Standards , you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace . To see examples of how this plan might cover costs for a sample medical situation, see the next section.

* For more information about limitations and exceptions, see plan or policy document at https://eoc.anthem.com/eocdps/aso .

About these Coverage Examples:

This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will be different depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost sharing amounts ( deductibles , copayments and coinsurance ) and excluded services under the plan . Use this information to compare the portion of costs you might pay under different health plans . Please note these coverage examples are based on self -onl y coverage.

This EXAMPLE event includes services like: Emergency room care (including medical supplies) Diagnostic test (xray) Durable medical equipment (crutches)

example, Mia would pay:

* This plan has other deductibles for specific services included in this coverage example. See “Are there other deductibles for specific services?” row above.

covered services.

The plan would be responsible for the other costs of these

Use your preventive care benefits

Stay healthy and catch problems early for easier treatment

Our health plans offer all the preventive care services and immunizations below at no cost to you1. You won’t have to pay anything when you use a doctor, pharmacy, or lab in your plan’s network. If you go to doctors or facilities outside your plan, you may have to pay out of pocket.

If you are not sure which exams, tests, or shots are right for you, talk to your doctor.

Preventive care vs. diagnostic care: Knowing the difference

Preventive care helps protect you from getting sick. If your doctor recommends services when you have no symptoms, that’s preventive care. Diagnostic care is when you have symptoms, and your doctor recommends services to determine what’s causing those symptoms.

Adult preventive care

General preventive physical exams, screenings, and tests (all adults):

• Alcohol and drug misuse: related screening and behavioral counseling

• Anxiety, depression, and suicide risk screenings

• Aortic aneurysm screening (for men who have smoked)

• Behavioral counseling to promote a healthy diet and physical activity

• High blood pressure (hypertension) screening

• Bone density test to screen for osteoporosis

• Cholesterol and lipid (fat) levels screening

• Colorectal cancer screenings, including fecal occult blood test, barium enema, flexible sigmoidoscopy (exam of the large intestine), screening colonoscopy and related prep kit, and computed tomography (CT) colonography (as appropriate)2

• Diabetes screening (type 2)3

• Exercise interventions to prevent falls in adults over age 65

• Hepatitis B virus (HBV) screening for people at increased risk of infection

• Hepatitis C virus (HCV) screening

• Height, weight, and body mass index (BMI) measurements

• Human immunodeficiency virus (HIV): screening and counseling

• Interpersonal and domestic violence: screening and counseling

• Lung cancer screening for adults aged 50 to 80 years who have a 20 pack year (packs per day X

Women’s preventive care:

• Breast cancer screenings, including exams, mammograms

• Breastfeeding: primary care intervention to promote breastfeeding support, supplies, and counseling4,5,6,7

• Chlamydia and gonorrhea screening

• Contraceptive (birth control) counseling

• BRCA-Related Cancer: Risk Assessment, Genetic Counseling, and Genetic Testing for women with personal family history of breast, ovarian, tubal, or peritoneal cancer8

• Food and Drug Administration (FDA)-approved contraceptive medical services, including sterilization, provided by a doctor

Immunizations:

• Diphtheria, tetanus, and pertussis (whooping cough)

• Hepatitis A and Hepatitis B

• Human papillomavirus (HPV)

• Influenza (flu)

• Measles, mumps, and rubella (MMR)

• Meningococcal (meningitis)

years of smoking) smoking history and currently smoke or have quit within the past 15 years2

• Obesity: related screening and counseling3

• Sexually transmitted infections: related screening and counseling

• Syphilis infection screening for persons who are at increased risk

• Tobacco use: related screening and behavioral counseling

• Tuberculosis screening

• Human papillomavirus (HPV) screening5

• Pelvic exam and Pap test, including screening for cervical cancer

• Pregnancy screenings, including gestational diabetes, hepatitis B, asymptomatic bacteriuria, Rh incompatibility, HIV, healthy weight, preeclampsia, and depression5

• Urinary incontinence screening

• Well-woman visits

• Monkeypox and/or smallpox (at risk)

• Pneumococcal (pneumonia)

• Respiratory syncytial virus (RSV)

• Severe acute respiratory syndrome coronavirus 2 (SARS CoV 2)(COVID-19)

• Varicella (chickenpox)

• Zoster (shingles)

Child preventive care

Preventive physical exams, screenings, and tests:

• Anemia screening

• Anxiety, depression, and suicide risk screenings

• Autism Spectrum Disorder (ASD) screening

• Blood pressure screening

• Cervical dysplasia (abnormal cell growth on the cervix) screening

• Cholesterol and lipid (fat) levels screening

• Development and behavior screening

• Hearing screening up to 21 years

• Height, weight, and BMI measurements

• Hemoglobin or hematocrit (blood count) screening

• Hepatitis B screening

• HIV screening

• Lead testing

• Newborn screening

• Obesity: related screening and counseling

• Ocular prophylaxis for Gonococcal Ophthalmia Neonatorum: Preventive medication: newborns

• Oral (dental health) assessment, when done as part of a preventive care visit

• Sexually transmitted infections: related screening and counseling

• Skin cancer behavioral counseling for those ages 6 months to 24 years with fair skin

• Sudden cardiac arrest/death risk assessment

• Tobacco, alcohol, and drug use assessments

• Vision screening for those ages 6 months to 5 year9

Immunizations:

• Chickenpox

• Flu

• Haemophilus influenza type B (HIB)

• Hepatitis A and Hepatitis B

• Human papillomavirus (HPV)

• Meningitis

• Measles, mumps, and rubella (MMR)

• Pneumonia

• Polio

• Respiratory syncytial virus (RSV)

• Rotavirus

• Severe acute respiratory syndrome coronavirus 2 (SARS CoV 2)(COVID-19)

• Whooping cough

1 evitneverPsecivreSksaT F noitartsinimdASRH( rebmunruoy.dracg lavorppaerprofeseht.secivres2 lamronbaDVCksir.srotcaf3 tnempiuqe)EMD(.sreilppus4 regnuoynahtega.915 yllacidem.yrassecen6 tcatnoCehtredivorp7 secivresera.elbaliavas lacidemyciloprof.sliated8 egarevocrof.sliated9 A ,321eratnednepedni ecnarusnI,seinapmoC.cnIl

Pharmacy item coverage

For 100% coverage of your over-the-counter (OTC) drugs and other pharmacy items listed here, you must:

• Meet certain age requirements and other rules

• Receive and fill prescriptions from doctors, pharmacies, or other healthcare professionals in your plan’s network

• Have prescriptions, including for OTC items

Women’s preventive drugs and other pharmacy items (age appropriate):

• Breast cancer risk-reducing medications, such as tamoxifen, raloxifene, and aromatase inhibitors, that follow the U.S. Preventive Services Task Force criteria2

• Contraceptives, including generic prescription drugs and OTC items like female and male condoms and spermicides7,8

• Folic acid for women who are planning to become pregnant

• Low-dose aspirin (81 mg) for pregnant women who have an increased risk of preeclampsia

Adult preventive drugs and other pharmacy items (age appropriate):

• Colonoscopy prep kit (generic or OTC only) when prescribed for preventive colon screening for members ages 45 to 75

• Generic low-to-moderate dose statins for members ages 40 to 75 who have one or more CVD risk factors (dyslipidemia, diabetes, hypertension, or smoking)

• Preexposure prophylaxis (PrEP) for the prevention of HIV

• Tobacco cessation products, including all FDA-approved brand-name and generic OTC and prescription products, for members ages 18 and older

Child preventive drugs and other pharmacy items (age appropriate):

• Dental fluoride varnish to prevent tooth decay in children ages 5 and younger

• Fluoride supplements for children starting at 6 months for children whose water supply is deficient in fluoride

Relieve pain from the comfort of home

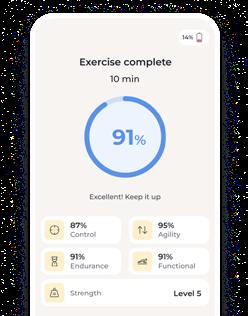

Tired of chronic, post-surgical pain, or loss of mobility? We have you covered! Thrive: Healthy Back and Joints is a digital physical therapy program is designed to help you reduce your back, joint or muscle pain — at home.

Combining licensed physical therapists with easy-to-use technology, Sword is far more than just convenient. It’s proven to work better than in-person physical therapy.

How Thrive: Healthy Back and Joints works

Your dedicated physical therapist designs an exercise program just for you.

Sword will ship you a free digital therapy kit to guide you and provide real-time feedback.

Complete your exercise sessions at home when it is convenient for you.

Your physical therapist is there to support you virtually and is available at any time.

Questions? Call

Bloom: Women's Pelvic Health is your no-cost, digital pelvic health benefit

1 in 3 women suffer from pelvic health disorders¹ including bladder issues, bowel dysfunction, and pelvic pain. Sword Health developed Bloom to give you relief with an easy-to-use, at-home pelvic therapy solution.

Here are signs you need digital pelvic therapy

Leakage (bladder or bowel) Pain or difficulty emptying bladder You are pregnant or postpartum Pain in the lower abdomen Pain during or after intimacy

What you get with Bloom

Expert Care

Bloom’s Pelvic Health Specialists all have Doctor of Physical Therapy degrees and provide guidance throughout the program.

Innovative Tech

Women perform short pelvic-therapy sessions from home, using a safe, intravaginal pod that connects to a mobile app.

Real Results

Bloom sessions are fun and interactive. Members track progress and receive guidance through the app.

Available through the SydneySM Health and LiveHealth Online apps, or Anthem.com and LiveHealthOnline.com

H mret-gnolsnoitacidemtnes htiwxRnoleraCycamrahPt

S snoitidnocekilhgih b yojneeht .ycamrahpc

W :no tnuoc

C .ecneinevno dereviledyltceridruoy .esoohch

•M yendySlaeH a amoc.mehtn tuobaevifsyad•E p .ssecorpadnatS 35.syads

•T ruoy.redro

•S citamotua,sllifer.oot

S.sgniva M nehwuoyllifayad-09 s gnippihs oslanraeli tsoc-rewol.snoitpoa

P .dnim ecae er’uoYsselylekilssimaesoddnaeromylekil t oyatskcarthtiwehttnemtaertruoyrotcoddebircserpnehw y hctiwsemoh*.yrevileduoYnacosla,klat,txettahc7/42 htiadeniarttsicamrahpuoyevahsnoitseuqdeen.plehw

H .ecivres eerf-elssa xRnoleraCycamrahPlliwtcatnocruoy rotcoredroa,wenyad-09noitpircserpuoydeen.enoda m noitacidelavorppaerp,dedeenehtemohyreviledmaetlliw hcaetuouoyroftnesnocerofebgnippihsruoy.noitacidemr

S.ytefa llasredroerofeb gnigakcap:sit foorprepma•T foorprehtae•W ,dellortnocdedeen•T

Wpleh ereh er’e

llaehtxRnoleraCycamrahPtcatnoCretneCC

89030-693-33 esuehteviltahcerutaefyendyShtlaeH or amoc.mehtn

S won yreviled emoh trat

1.L amoc.mehtndnaeht P emoH snoitpircser.egapuoYnacoslagolruoy eliboppadnatcelesm Pycamrah nacsehtedochtiwruoys’enohp.aremacretsigeRruoy tnuoccauoyt’nevah.ydaerlam

2.Go V snoitpircserP wei ehtdediugspetshctiwsxRnoleraC.ycamrahP

rof:ygolonhcetoiB* A noitacideMecnerehdAdnahtlaeHsemoctuOrofredrO-liaMsusreVytinummoCycamrahP :)9102 hcraM(nvog.hin.mln.ibc. ruoyhtlaeh.nalpS ruoyhtlaeh.nalpS nacdeniatboA mehtnAhtlaeHsnalPg M CILAHdnaOMHstifeneb u ,.cnIabdOMH.adaveN mehtnAhtlaeHsnalPI V setirwrednusretsinimdaOPP a SOP;seicilopCICW ecnarusnI,seinapmoC.cnIu

1679170MDOPV SBANEMU

Exam Only A15 Plan

Welcome to your Blue View Vision plan!

Effective 01/01/2026

You have many choices when it comes tousing your benefits. As a Blue View Vision plan member, you have access toone of the nation’s largest vision networks. You may choose from many private practice eyecare doctors. Our networkalsohas many convenient optical stores, including popular national retail stores LensCrafters®, TargetOptical®, and most Pearle Vision® locations. When you receive care from a Blue View Visionparticipating provider, you can maximize your benefits and money-saving discounts. To locate a participating network eye care doctor or location, log in at anthem.com, or from the home page menu under Care, select Find a Doctor. You may also call member services for assistance at the number onthe backof your ID card.

YOUR BLUE VIEW VISION PLAN BENEFITS

Routine Eye Exam

A comprehensive eye examination

USING YOUR BLUE VIEW VISION PLAN

$15 copay Up to $30 allowance

Once every calendar year

When you are ready to schedule your eye exam, just make an appointment with your choice of any of the Blue View Vision participating eye care doctors. Your Blue View Vision plan providesservices for routine eyecare only. If you need medicaltreatment for your eyes, visit aparticipating eye care doctor from your medicalnetwork.

ADDITIONALSAVINGS ON EYEWEAR AND MORE

As aBlue View Vision member, you can take advantage of valuable discountsthrough our AdditionalSavingsprogram. See page 2for further details.

OUT-OF-NETWORK

If you choose to, youmay receive covered servicesoutside of the Blue View Vision network. If you choosean out-of-network doctor, you must pay in full at the timeof service, obtain an itemized receipt, and file a claim for reimbursement up toyour maximum out-of-network allowance. To download a claim form, log in at anthem.com, or from the home page menu locate Support and select Forms, click Change State tochoose your state, andthenscroll down to Claims andselect the Blue View Vision Out-of-NetworkClaim Form. You may instead call member services at the number on the back of your ID card to request a claim form. To request reimbursement for out-ofnetwork services, complete an out-of-networkclaim form andsubmit it alongwith your itemized receipt tothe fax number, emailaddress, or mailing addressbelow.

To Fax: 866-293-7373

To Email: oonclaims@eyewearspecialoffers.com

To Mail: Blue ViewVision

Attn: OON Claims

P.O. Box 8504 Mason, OH 45040-7111

This is a primary vision care benefit intended to cover only routine eye examinations. Benefits are payable only for expenses incurred while the group and insured person’s coverageis in force. Blue ViewVision is for routine eye care only. If you need medical treatment for your eyes, visit a participating eye care physician from your medical network. If you have questions about your benefitsor need help finding a provider, visit anthem.com or call us at the number on the back of your ID card.

This information is only a brief outline of coverage and only onepiece of your entire enrollment package. All terms and condition s of coverage, including benefits and exclusions, are contained in the member’s policy, which shall control in the event of a confl ict with this overview.

Retinal Imaging At member’soption can beperformed at time of eye exam Not

Eyeglass Frame

Eyeglass Lenses

When purchased as part of a complete pair of eyeglasses*

When purchased as part of a complete pair of eyeglasses*: - Single Vision

Bifocal

Eyeglass Lens Options and Upgrades

When purchasing a complete pair of eyeglasses* (frame and lenses), you may choose to upgrade your new eye glass lenses

at a discounted cost. Member costs shown are in addition to the member cost of the standard plastic eyeglass lenses.

Conventional Contact Lenses (non-disposable type)

When purchased as part of a complete pair of eyeglasses*:

- UV Coating

- Tint (Solid and Gradient)

- Standard Scratch-Resistant Coating

- Standard Polycarbonate

- Standard Anti-ReflectiveCoating

- Standard Progressive Lenses(add-on to Bifocal)

- Other Add-Ons

Discount applies to materialsonly

* If frames, lenses or lens options are purchased separately, members will receive a 20% discount instead.

Cannot be combined with any other offer. Discounts are subject to change without notice. Discounts are not ‘coveredbenefits’ under your vision plan and will not be listed in your certificate of coverage. Discounts will be offered from in-network providers except wherestate law prevents discounting of products and services that are not covered benefits under the plan. Discounts on frames will not apply if the manufacturer has imposed a no discount policy on sales at retail and independent provider locations.

Some of the Blue View Vision participating in-network providers include:

Other savingsoffers are available on eyewear, hearing aids and even LASIK laser vision correction surgery through avariety of vendors. Just log in at anthem.com, select discounts, thenVision, Hearing & Dental.

margorP ,segnellahc7/42S YruoE ecnatsissAmargorP(EPA)erehplehy dnaruoydlohesuohsrebmemgib teems’efilsegnellahc— ,troppusruoyoEPApleh enilno,sranimesdnarehtosecruosertahtnac .detcetorpy

Wecnalab

M .noitcetorp tfeht L ,tbednaol,setardna esuruo-tnuocsidr sgnivas.%52s

L .secivres lage alanoisseforptuoballams c gnikama,lliwdna rehtlagel.srettamo

Mgnieb-llew lanoitome dna htlaeh latne

S .noisserped dna ,yteixna ,ssert revocsiDsserts feileseuqinhcetdnatcennochtiwlatnemhtlaehr ,noitamrofn,eracdna.smargorpi

A .yrevocer dna noitcidd erolpxEecnadiugdna troppudesucofmret-gnol.tnemtaerts

G .ssol dna feirdniFlanoitomehtlaehdna llegniebsecruosertahterathgirrofuoyw ssecorpruoy.sgnileefy

P .thgisni dna sloot dniFtrepxeecivda o egelloc,ssenidaer laiceps,sdeendnar dednelb.ylimafb

S .erac rof hcraeteGplehgnidnfiytilauq-hgih ,redlednatep.eracc

Q .gnikoms gnittiu nehWer’uoyydaer,tiuq y gnildnahsgnivarcdna gnolahtiwskniln t nacplehtsoob secnahc.sseccusy

E .troppus artx eludehcSalaitnedfinocnosrep-ni rlautrivtisivhtiwadesnecil.rolesnuoco

E .secruoseR gnieb-lleW lanoitom nraeLwen w syaeldnahs’efilspudna,snwodgnidulcni eganam,sserts,yteixnadnanoisserpedh

H .secruoser dna spit nraeLsyaw dnapeels.stibaht

Y ruoEPAuoy rof ereh Clla 89751-154-44 .

Vtisi w moc.PAEmehtna.ww agol nhtiwynapmoc:emaniVCBCP.

The ins and outs of coverage

Knowing that youhave health care coverage that meets your andyour family’s needsisreassuring.

But part of your decision in choosing a plan also means you need to understand:

Whocanenroll

How you and your employer handle coverage changes

What’s not covered by your plan

How your coverage works with other health plans you might have

Who can be enrolled

Youcan choose coverage forjust you. Or, youcan have coverage foryour family, including you and any of the following family members:

Your spouse

Your children age 26 or younger, including:

A newborn, natural child or achild placed with you for adoption

Astepchild

Any other child for whom you have legal guardianship

Coverage willend onthe last day of the year in which they turn 26.

Some children have mental or physical challenges that prevent them from living independently. The dependent age limit does not apply to these enrolled children as long as these challenges were present before they turned 26.

1. At the employer level, which affects you and other employees covered by an employer’s plan, your plan can be:

Renewed Canceled Changed When

Youremployer:

0 Keeps its status as an employer.

0 Stays in our service area.

•

•

•

0 Meets our guidelines for employee participation and premium contribution.

0 Pays the required health care premiums.

0 Doesn’t commit fraud or misrepresent itself.

Youremployer:

0 Makes a bad payment.

0 Voluntarily cancels coverage (30-days advance written notice required).

0 Is unable (after being given at least a 30-day notice) to meet eligibility requirements to maintain a group plan.

0 Still does notpay the required health care premium (after being given a31-day grace period and atleast a 15-daynotice).

0 We decide to no longer offer the specific plan chosen by your employer (you’ll get a 90-day advance notice).

0 We decide to no longer offer any coverage in Virginia (you’ll get a 180-day advance notice).

• You and your employer received a 30-day advance written notice that the coverage was being changed (services were added to your plan or the copays were lowered). Copays can beincreased or services can be decreased only when itis time for your group to renew its coverage.

2. At the individual level, which affects you and covered family members, your plan can be:

Renewed Canceled When you

0 Stay eligible for your employer’s coverage.

•

0 Pay your share of the monthly payment (premium) for coverage.

0 Don’t commit fraud or misrepresent yourself.

• Give wrong information on purpose about yourself oryour dependents when you enroll. Cancellation is effective immediately.

0 Lose your eligibility for coverage.

0 Don’t make required payments or make bad payments.

0 Commit fraud.

0 Are guilty of gross misbehavior.

0 Don’t cooperate ifwe ask you to pay us back for benefits that were overpaid (coordination ofbenefits recoveries).

•

0 Letothers use your ID card.

0 Use another member’s ID card.

0 File false claims with us.

Your coverage will be canceled after you receive a written notice from us.

Special enrollment periods

In most cases, you’re only allowed to enroll in your employer’s health plan during certain eligibility periods, such as when it’s firstofferedtoyouasa “newhire” orduringyour employer’s open enrollment period, when employees can make changes to theirbenefitsforanupcoming year.

But there can beother times when you may be eligible to enroll. For example, let’s say the first time you were offered coverage, you stated in writing that you didn’t want to enroll yourself, your spouse oryour covered dependents because you had coverage throughanothercarrier orgroup healthplan.If youoryour dependentsloseeligibilityforthatothercoverage(orif the employerstopscontributing towardyouroryour dependents’ other coverage) you may be able to enroll your family later. But youmustasktobeenrolled within30daysafteryouroryour dependents’ other coverage ends (or after the employer stops contributing toward theothercoverage).

Also,if you have a new dependent as a result ofmarriage, birth, adoption or placement foradoption, you may be able to enroll yourself and your dependents. However, you must request enrollment within30daysafterthemarriage,birth,adoption orplacement foradoption.

Finally, a special enrollment period of60 days will be allowed if:

Your or your dependents’ coverage under Medicaid or the State Children’s Health Insurance Program (SCHIP) is terminated asaresult ofalossofeligibility.

You or your dependents become eligible for premium assistanceunderastateMedicaid orSCHIPplan.

To request special enrollment orget more information, contact youremployer.

When you’re covered by more than one plan

If you’re covered bytwo different group health plans, one is considered primary and the other isconsidered secondary. The primaryplanisthefirsttopayaclaimandreimburse according to plan allowances. The secondary plan then reimburses, usually covering the remaining allowable costs.

Determining the primary and secondary plans

See the chart below to learn which health plan is considered the primary plan. The term “participant” means the person who signed up for coverage:

When a person is covered by two group plans, and Then

One plan does nothave aCOBprovision

Thepersonistheparticipant underoneplan anda dependent under the other

The person is the participant in two active group plans

Thepersonisanactive employee on one plan and enrolled as a COBRA participant for another plan

The person is covered as a dependent child under both plans

Thepersoniscoveredasa dependent child and coverage is required by a court decree

The person is covered as a dependent child and coverage is not stipulated in a court decree

The person is covered as a dependent child and the parents share joint custody

The plan withoutCOBis

The plan with COBis

The plan covering the person as the participantis

The plan covering the person as a dependentis

The plan that has been in effect longer is

The plan thathas been in effectthe shorter amountof time is

The plan in which the participant is an active employee is

The COBRA plan is

The plan of the parentwhose birthday occurs earlier in the calendaryear(known as the birthday rule) is

The plan ofthe parentwhose birthday is later in the calendaryear is

Note: When the parentshave the same birthday, the plan that hasbeen in effect longeris

The plan ofthe parentprimarily responsible for health coverage underthe court decree is

The plan of the other parentis

The custodial parent’s plan is

The noncustodial parent’s plan is

The plan of the parentwhose birthday occurs earlier in the calendaryear is

The plan ofthe parentwhose birthday is later in the calendaryear is

Note: When the parentshave the same birthday, the plan that hasbeen in effect longeris

How benefits apply if you’re eligible for Medicare

Some people under age 65 are eligible forMedicare in addition to any other coverage they may have. The following chart shows how payment is coordinated under various scenarios:

When a person is covered by Medicare and a group plan, and Then Your plan is primary Medicare is primary

Is qualifiedforMedicarecoverage due solely to end-stage renal disease (ESRD-kidneyfailure)

Is a disabled member who is allowed to maintain group enrollment as an active employee

Is the disabled spouse or dependent child of an active full-time employee

Is a person who becomes qualified for Medicare coverage due to ESRD after already being enrolled in Medicare due to a disability

During the 30-month Medicare entitlement period

Upon completion ofthe 30-month Medicare entitlement period

If the group plan has more than 100 participants

If the group plan has fewer than 100 participants •

If the group plan has more than 100 participants

If the group plan has fewer than 100 participants •

If Medicare had been secondaryto the group plan before ESRD entitlement

If Medicare had been primary to the group plan before ESRD entitlement

Recovering overpayments

If health care benefits are overpaid bymistake, we willask forreimbursement forthe overpayment. This is referred to as “coordination ofbenefits recoveries.” We appreciate your help inthe recovery process. We reserve the right to recover any overpayment from:

0 Any person to or for whom the overpayments were made

0 Anyhealthcare company

0 Anyother organization

What’s Not Covered

In this section you will find a review of items that are not covered by your Plan. Excluded items will not be covered even if the service, supply, or equipment is Medically Necessary. This section is only meant to be an aid to point out certain items that may be misunderstood as Covered Services. This section is not meant to be a complete list of all the items that are excluded by your Plan.

We will have the right to make the final decision about whether services or supplies are Medically Necessary and if they will be covered by your Plan.

1) Acts of War, Disasters, or Nuclear Accidents In the event of a major disaster, epidemic, war, or other event beyond our control, we will make a good faith effort to give you Covered Services. We will not be responsible for any delay or failure to give services due to lack of available Facilities or staff.

Benefits will not be given for any illness or injury that is a result of war, service in the armed forces, a nuclear explosion, nuclear accident, release of nuclear energy, a riot, or civil disobedience.

2) Administrative Charges

a) Charges to complete claim forms,

b) Charges to get medical records or reports,

c) Membership, administrative, or access fees charged by Doctors or other Providers. Examples include, but are not limited to, fees for educational brochures or calling you to give you test results.

3) Aids for Non-verbal Communication Devices and computers to assist in communication and speech except for speech aid devices and tracheo-esophageal voice devices approved by us.

4) Alternative / Complementary Medicine Services or supplies for alternative or complementary medicine. This includes, but is not limited to:

a) Acupuncture, (Removed when Acupuncture Rider is included)

b) Acupressure, or massage to help alleviate pain, treat illness or promote health by putting pressure to one or more areas of the body,

c) Holistic medicine, d) Homeopathic medicine, e) Hypnosis, f) Aroma therapy, g) Massage and massage therapy, h) Reiki therapy, i) Herbal, vitamin or dietary products or therapies,

j) Naturopathy, k) Thermography, l) Orthomolecular therapy,

m) Contact reflex analysis,

n) Bioenergial synchronization technique (BEST),

o) Iridology-study of the iris,

p) Auditory integration therapy (AIT),

q) Colonic irrigation,

r) Magnetic innervation therapy,

s) Electromagnetic therapy,

t) Neurofeedback / Biofeedback.

5) Applied Behavioral Treatment (including, but not limited to, Applied Behavior Analysis) unless Medically Necessary.

6) Autopsies Autopsies and post-mortem testing.

7) Before Effective Date or After Termination Date Charges for care you get before your Effective Date or after your coverage ends, except as written in this Plan.

8) Certain Providers Services you get from Providers that are not licensed by law to provide Covered Services as defined in this Booklet. Examples include, but are not limited to, masseurs or masseuses (massage therapists), and physical therapist technicians.

9) Charges Not Supported by Medical Records Charges for services not described in your medical records.

10) Charges Over the Maximum Allowed Amount Charges over the Maximum Allowed Amount for Covered Services. The exception to this exclusion is outlined in “Balance Billing by Out-of-Network Providers” in the “How Your Plan Works” section.

11) Clinical Trial Non-Covered Services Any Investigational drugs or devices, non-health services required for you to receive the treatment, the costs of managing the research, or costs that would not be a Covered Service under this Plan for non-Investigational treatments.

12) Clinically-Equivalent Alternatives Certain Prescription Drugs may not be covered if you could use a clinically equivalent Drug, unless required by law. “Clinically equivalent” means Drugs that for most Members, will give you similar results for a disease or condition. If you have questions about whether a certain Drug is covered and which Drugs fall into this group, please call the number on the back of your Identification Card, or visit our website at www.anthem.com.

If you or your Doctor believes you need to use a different Prescription Drug, please have your Doctor or pharmacist get in touch with us. We will cover the other Prescription Drug only if we agree that it is Medically Necessary and appropriate over the clinically equivalent Drug. We will review benefits for the Prescription Drug from time to time to make sure the Drug is still Medically Necessary.

13) Compound Drugs Compound Drugs unless all of the ingredients are FDA approved, require a prescription to dispense, and the compound medication is not essentially the same as an FDA- approved product from a drug manufacturer. Exceptions to non-FDA approved compound ingredients may include multi-source, nonproprietary vehicles and/or pharmaceutical adjuvants.

14) Contraceptives Contraceptive devices including diaphragms, intrauterine devices (IUDs), and implants. (Added when contraceptives are excluded via a qualified religious exemption)

15) Contraceptive Devices Contraceptive devices including intrauterine devices (IUDs) and implants. (Added when contraceptive devices are excluded via partial religious exemption)

16) Cosmetic Services Treatments, services, Prescription Drugs, equipment, or supplies given for cosmetic services. Cosmetic services are meant to preserve, change, or improve how you look or are given for social reasons. No benefits are available for surgery or treatments to change the texture or look of your skin or to change the size, shape or look of facial or body features (such as your nose, eyes, ears, cheeks, chin, chest or breasts).

This Exclusion does not apply to:

a) Surgery or procedures to correct deformity caused by disease, trauma, or previous therapeutic process.

b) Surgery or procedures to correct congenital abnormalities thatcause Functional Impairment.

c) Surgery or procedures on newborn children to correct congenital abnormalities.

17) Court Ordered Testing Court ordered testing or care unless Medically Necessary.

18) Cryopreservation Charges associated with the cryopreservation of eggs, embryos, or sperm, including collection, storage, and thawing.

19) Custodial Care Custodial Care, convalescent care or rest cures. This Exclusion does not apply to Hospice services.

20) Delivery Charges Charges for delivery of Prescription Drugs.

21) Dental Devices for Snoring Oral appliances for snoring.

22) Dental Treatment Dental treatment, except as listed below.

Excluded treatment includes but is not limited to preventive care and fluoride treatments; dental X rays, supplies, appliances and all associated costs; and diagnosis and treatment for the teeth, jaw or gums such as:

• Removing, restoring, or replacing teeth;

• Medical care or surgery for dental problems (unless listed as a Covered Service in this Booklet);

• Services to help dental clinical outcomes.

Dental treatment for injuries that are a result of biting or chewing is also excluded. This Exclusion does not apply to services that we must cover by law.

23) Drugs Contrary to Approved Medical and Professional Standards Drugs given to you or prescribed in a way that is against approved medical and professional standards of practice.

24) Drugs Over Quantity or Age Limits Drugs which are over any quantity or age limits set by the Plan or us.

25) Drugs Over the Quantity Prescribed or Refills After One Year Drugs in amounts over the quantity prescribed, or for any refill given more than one year after the date of the original Prescription Order.

26) Drugs Prescribed by Providers Lacking Qualifications/Registrations/Certifications Prescription Drugs prescribed by a Provider that does not have the necessary qualifications, registrations, and/or certifications, as determined by HealthKeepers.

27) Drugs That Do Not Need a Prescription Drugs that do not need a prescription by federal law (including Drugs that need a prescription by state law, but not by federal law), except for injectable insulin or other Drugs provided in the Preventive Care paragraph of the "What’s Covered" section.

28) Educational Services Services, supplies or room and board for teaching, vocational, or self-training purposes. This includes, but is not limited to boarding schools and/or the room and board and educational components of a residential program where the primary focus of the program is educational in nature rather than treatment based.

29) Emergency Room Services for non-Emergency Care Services provided in an emergency room that do not meet the definition of Emergency. This includes, but is not limited to, suture removal in an emergency room. For non-emergency care please use the closest network Urgent Care Center or your Primary Care Physician.