Excitement mounts as ABC One Minute Giveback returns John Goodenough: the lithium pioneer passes on Bringing the industry together www.batteriesinternational.comTHELASTWORD:TALESOFDARKNESSFORETOLD Issue 128 Summer 2023 Neutron diffraction digs deep into lead battery structures CBI chiefs talk about 20% stake into ESS bonanza Finding the sweet spot for lead and lithium A question of balance

A B C ’ L E S S B -BE(TM) P R E G S (TM) T . B -BE S D M E S N T F G . D D B B , B W (C), B -B S D E , S E R . www.advancedbatteryconcepts.com info@advancedbatteryconcepts.com 1-855-230-3390 A B C ’ L E S S B -BE(TM) P R E G S (TM) T . B -BE S D M E S N T F G . D D B B , B W (C), B -B S D E , S E R . www.advancedbatteryconcepts.com info@advancedbatteryconcepts.com 1-855-230-3390 A B C ’ L E S S B -BE(TM) P R E G S (TM) T . B -BE S D M E S N T F G . D D B B , B W (C), B -B S D E , S E R . www.advancedbatteryconcepts.com info@advancedbatteryconcepts.com 1-855-230-3390

For the last 15 years, the lead battery industry has been trying to come to terms with its potential usurper, lithium ion in all its shapes and forms. Most of the major firms have made real headway in their understanding but there’s still a long way to go. It’s always been about choosing the right chemistry for the right product.

• In defence of lead … and lithium 54

• Lithium iron phosphate — the new BESS standard

• Sunlight Group: ‘What dilemma in moving between lithium and lead battery chemistries?’

• Amara Raja invests to grow beyond India

• Back to basics, the core lithium battery chemistries

EDITORIAL

The developed world vs the rest of the planet

John Goodenough, lithium battery pioneer: 1922-2023

PEOPLE

10

Taylor succeeds Longney as TBS group MD, Davis retires • Straw named director of new ENTEK Manufacturing unit • Doe Run promotes Mangogna to VP operations and COO • International Lead Medal awarded to ILA veteran Maura McDermott • Macchiarola joins ACP as chief policy officer • Metair makes interim CEO,CFO appointments permanent • Oliver Gross appointed senior fellow at Stellantis • EUROBAT’s Westgeest steps down, Meylemans takes over as GM • Skyllas-Kazacos joins Tivan advisory group • Roden joins ENTEK International as North America account manager

NEWS

17

Lead batteries still no.1 recycled product in US, new study shows• Battery equipment firm CMWTEC plans new factory

• Gravita recycling plant back in operation after India cyclone • The ONE Minute Giveback returns for 20ABC in Cambodia • Amara Raja wins $130m solar plant contract for Bangladesh • EU leaders formally agree new Batteries Regulation • WaveTech’s CCT takes lead battery technology into Indonesian telecoms • Lead-air performance boost for Port Pirie operating licence

• Clean energy switch needs ‘$4tn and historic mining expansion by 2030’ • ABC, Quench partnership signals ‘important development’ for EV charging stations in US • Windfall benefits for Tesla as IRA kicks in • Breathing space for lead in REACH talks • Global refined lead metal demand exceeds supply in first quarter • BCI revamps Source BCI • Leoch to cooperate on solid-state batteries with Chinese university • Banner posts battery sales record despite ‘burdensome EU red tape’ • Brill Power unveils ‘chemistry-agnostic’ battery booster tech • Gopher Resource joins materials recovery tech consortium in US • Trafigura silent on Stolberg output as smelter restarts • Strong start for EnerSys in sustainability checks • Yuasa, Honda step up joint venture battery plans • Sustainability certification boost for Birla Carbon’s Italy facility • Amara Raja posts pre-tax profit rise • Clarios completes refinancings to extend debt maturity profile • $22m overtime pay verdict for East Penn • Amara Raja breaks ground for giga-corridor complex

RECYCLING NEWS

33

• ACE Green in lead recycling licensing deal with Hakurnas • US $192m boost for Li R&D, battery recycling, innovation

Altilium, Marubeni plan EV battery recycling partnership

• Gravita expands LAB processing capacity in Chittoor • Study to consider switch from lead to Li recycling at Glencore’s Portovesme • Hoppecke in Li recycling agreement with Huayou

• Sunlight plant set to double lead recycling

• Fortum, Terrafame launch battery material recycling partnership

CONTENTS www.batteriesinternational.com Batteries International • Summer 2023 • 1 COVER STORY: LITHIUM 54

6

Farewell to John Goodenough

4

OBITUARY 6

63

68

70

33

Ace Green in licensing deal

11

McDermott wins lead medal

24

Leoch to work with university on solid state battery

ENERGY STORAGE NEWS 49

• Canada agrees battery incentives deal for Stellantis, LGES plant

Pexapark backs solar-BESS agreement ‘first’ for UK

• SVOLT breaks ground for Thai battery plant

• California close to 6GW online BESS milestone

• Yuasa BESS goes live for Japan wind power project

• European Court of Auditors warns on EU battery ambitions

• EU batteries chief on guard over battery subsidies in China, US

• Report reveals €13bn cost of Europe battery materials plan

• PowerCo’s COO Wolf joins Batteries Event

• Morrow loan deal boost for for giga plans in Norway

• Fitch upgrades China’s CATL to A- rating

• Australia critical minerals blueprint launched

• €500m R&D cash awaits EU battery projects

• Emeren, Matrix partnering for BESS in Italy

• ESS in 50MW iron flow Germany battery project

• India to review EV policy amid lithium ion over reliance on China

•

• ABB starts up 50MW BESS in Philippines Morrow opens Norway R&D hub • Schuler project to expand battery sector expertise • Slovenia gets EU green light for BESS state aid • KORE Power set for $850m US battery cells plant loan • Toray investment ‘to boost Korean separators business’ • Posco de-risks battery material supply chain with EcoGraf deal • Redflow to supply California microgrid flow battery • ACC opens flagship gigafactory in France • Powin selects Jabil to produce BESS in US • €4m expansion plan for BMZ’s Visatronic • Brazil takes Li investments drive to NYSE • Russian EV, ESS battery prototypes ‘ready this year’

Nano One in LFP collaboration with Our Next Energy

PROFILE: CBI

76

The Consortium for Battery Innovation is seeking to tap 20% of the burgeoning $550 billion ESS market NEUTRON

Pat Moseley and David Rand dig deeper into the structures at the heart of the lead battery

79

Our definitive guide to the global conferences and exhibitions in the months ahead

Missing in action • Big brother is watching you! • ABC and HUSK, conference bags with a difference

• NewsDonkeyTM our latest recruit for investigative journalism

Publisher

Karen Hampton karen@batteriesinternational.com

+44 7792 852 337

Editor-in-Chief

Michael Halls editor@batteriesinternational.com

+44 7977 016 918

Advertising director Jade Beevor jade@batteriesinternational.com

Editor John Shepherd john@batteriesinternational.com

+44 7470 046 601

Researcher, journalist Frances Jones frances@batteriesinternational.com

Finance administrator

Juanita Anderson juanita@batteriesinternational.com

Subscriptions, enquiries subscriptions@batteriesinternational.com admin@batteriesinternational.com

Production/design

Antony Parselle aparselledesign@me.com

International advertising representation advertising@batteriesinternational.com The

Disclaimer: Although we believe in the accuracy and completeness of the information contained in this magazine, Mustard Seed Publishing makes no warranties or representation about this. Nor should anything contained within it be construed as constituting an offer to buy or sell securities, or constitute advice in relation to the buying or selling of investments.

CONTENTS 2 • Batteries International • Summer 2023 www.batteriesinternational.com

contents of this

protected by copyright.

or reproduction is permitted.

Mustard Seed Publishing

company no: 5976361. Printed in the UK via Method

publication are

No unauthorized translation

ISSN 1462-6322 © 2023

UK

Last Word: Our investigative journalist braced and ready for stories and news scoops 108 Neutron diffraction, at the heart of lead understanding 79 EUROBAT farewell and much thanks to Alfons Westgeest 86

DIFFRACTION

REVIEWS

EUROBAT annual forum, Madrid, Spain, June 6-7 86 • PB23, Athens, Greece, June 21-23 88 • International Flow Battery Forum, Prague, Czech Republic, June 27-29 90 • Advanced Tech & Innovation Shows, Birmingham, England, June 29-30 92 EVENTS 95

EVENT

•

LAST WORD

THE

108

Ambitious CBI plans 76

The developed world vs the rest of the planet

It’s the latest and possibly the last great myth of the 21st century: climate change is containable and even reversible through concerted human action.

And the frantic drive into renewables and its corollary energy storage — for this read the battery business — will save the planet.

From simple manufacturers of an essential component in modern and industrial life, we, collectively, have become visionaries for the future and saviours of mankind. That pesky carbon dioxide and that tricky global warming will be solved by our engineers, our entrepreneurs and not-forgetting our everresourceful innovators.

But one question doesn’t seem to be attracting much attention. And that’s whether the huge sums of money being committed to reducing emissions are worth the effort?

Certainly, it sounds the case when listening to the soundbites of politicians, that salvation is at hand. US president Joe Biden last year called the signing of the Inflation Reduction Act committing the country to huge tax breaks as the “biggest step forward on climate change ever.” The Brookings Institution, a think-tank, reckons the final cost of the package will top $1 trillion and almost three times larger than the US government estimate of $369 billion. The IRA, said Brookings, “ has the potential to lower energy costs, contribute to lower inflation, increase productivity, and raise economic output over time.”

It might be nice to think this is the case. The fact is that though the developed world — essentially North America, Japan and Europe —

is making huge strides in reducing its emissions of CO2 levels, it is still a far-cry from carbon neutrality.

And meanwhile any shortfall created is being picked up elsewhere. Given what’s happening in other parts of the world, this is going to be just a drop removed from an ever-growing ocean of greenhouse gases.

Batteries International is not a climate-change denier, nor do we believe our drive into renewables and energy storage is a waste of money, time or effort.

However, on a planet of almost 8 billion people our efforts are not, so far, enough — failure of a sort will become inevitable.

The emerging world will not hesitate to put climate change lower down a list of priorities that contains elements such as better health care, education and a better standard of living, A quick look at their growing needs is reflected on their targets for climate neutrality — China aims for its CO2 emissions to peak by 2030 (and which already emits roughly a third of all climate change gases) and to be carbon neutral by 2060.

China provides more than half of the world’s steel and cement, but the CO2 emissions from just those two sectors in China are higher than the European Union’s total CO2 emissions.

India, with a similar population of around 1.4 billion souls, is aiming for climate neutrality by 2070. Already in 2022 India’s emissions are higher than that of Europe in its entirety.

The move into electric vehicles across the developed world is unlikely to make much of

China provides more than half of the world’s steel and cement, but the CO2 emissions from just those two sectors are higher than Europe’s total CO2 emissions.

Mike Halls • editor@batteriesinternational.com

EDITORIAL 4 • Batteries International • Summer 2023 www.batteriesinternational.com

a dent into the emissions from those two countries — auto manufacturers may boast that some 500 EV types will be launched in the next five years but China’s own cement and steel manufacturing already accounts for more than the whole of the emissions from Europe.

There’s also no need to simplify the world into the good guys and the bad ones — the developed North versus this pair of the environmentally irresponsible two. The fact is the rest of the developing world is on the same trajectory as China and India. We tut, tut — hypocritically — at our peril about emerging nations’ irresponsibility in wanting a standard of living closer to ours at the expense of the environment.

Robert Bryce, the commentator, points to the issue of energy inequality in his brilliant and highly recommended blog, https://robertbryce.substack. com.

“The average American consumes 20 times more energy per year than the average resident of Africa, … there are 1.4 billion Africans, who, on average, consume about 600kWh of electricity per head, per year. The average American consumes that every three weeks.”

He writes: “The average American consumes 20 times more energy per year than the average resident of Africa, and four times more than the average of Asia. There are 1.4 billion Africans, who, on average, consume about 600kWh of electricity per head, per year. The average American consumes that much electricity every three weeks.

“The reductions in the US and Western Europe are being swamped by increases in the rest of the world, and in particular, in India and China. Thus, the big challenge facing the world is not how many Teslas are being sold in Marin County, but how many coal plants are going to be built in Bangladesh, Cambodia, and other desperately poor countries.”

He points out that nearly 19 gigawatts of new

coal-fired capacity was brought online last year, with the biggest new additions happening in India, Japan, and Pakistan. Between 2000 and 2022, global CO2 emissions increased by 10,700 million tonnes. Of that increase, about 10,300 million tonnes occurred in the AsiaPacific region.

So where does this all leave the battery industry? First the good times will continue for lead manufacturers and, if the world supply of the huge quantities of metals required holds up, the lithium battery manufacturers will do excellently too.

But we shouldn’t deceive ourselves as being visionaries of the future or saviours of the planet. Or not yet anyway.

Mike Halls, Editor-in-Chief

EDITORIAL www.batteriesinternational.com Batteries International • Summer 2023 • 5

John Bannister Goodenough, 1922-2023: 'A life well lived'

We are sad to report that John Goodenough, father of the lithium ion cell, and one of the three figures that created today’s huge lithium battery industry, died on June 25 a month short of his 101st birthday.

John, who was interviewed several times for Batteries International, was awarded the joint Nobel Prize for Chemistry in October 2019 with the two other pioneers of the lithium battery, Stanley Whittingham and Akira Yoshino.

In our subsequent interviews with Whittingham and Yoshino each acknowledged the huge debt the world owes to Goodenough who discovered the cathode material of choice and so made the lithium ion battery truly portable and rechargeable.

“John was an unassuming, modest and gentle man whose work has touched everyone’s life,” said Bob Galyen, the former CTO of CATL and a friend. “It was a life well lived and John had an intellect of astonishing proportions and his contributions to science extend well beyond the lithium cell.”

Oddly enough for someone whose research has ended up in the household or pocket of most of the planet, he was regarded as a backward child. It was only much later that it was found that he was dyslexic and he later described how he dealt with this problem by studying abstract mathematical thought and Greek and Latin.

Aged 18 he left school as top of his class and received a scholarship to Yale. After the bombing of Pearl Harbor, he volunteered for service, but was not called up until January 1943. This gave him time to complete his undergraduate degree in mathematics. He had entered Yale as a freshman with a background in Latin and Greek and little idea of what he would do after the war was over.

He graduated while working as a meteorologist in the US Air Force. A crisis of faith around this time led him to dedicate himself to a life of service starting with studying physics at the University of Chicago or Northwestern University.

“When I arrived at Chicago the registration officer, professor Simpson, said to me, “I don’t understand you veterans. Don’t you know that anyone who has ever done anything interesting in phys-

ics had already done it by the time he was your age; and you? You want to begin?”

Undeterred, he earned a master’s degree in 1951 and a doctorate the following year.

Ground breaking

For the next six decades his astonishing academic career and research led him from his early work at MIT on computer memory to the University of Oxford in his 50s where most of his ground-breaking work on lithium cells was pioneered. The last three decades of his life were at the University of Texas, where he held the Virginia H Cockrell centennial chair in engineering.

He was still working until his late 90s and in the last years of his life was pioneering a solid state battery.

As recently as 2017 he announced patents for new battery cells using a solid glass electrolyte instead of a liquid one, using an alkali metal anode. The glass electrolytes allow for the substitution of low-cost sodium for lithium. This had the possibility of being a second worldchanger to the energy storage industry.

Caring little for money, John signed away most of his rights. He shared patents with colleagues and donated stipends that came with his awards to research and scholarships.

He was married to Irene Wiseman for 65 years. She died in 2016. In the latter part of her life he would work at the university in the morning and visit her

care home in the afternoons, she suffered from dementia.

In addition to being a Nobel laureate John was feted internationally being a member of the US National Academy of Engineering a member of the National Academy of Sciences, French Academy of Sciences, the Spanish Royal Academy of Sciences, and the National Academy of Sciences.

He wrote more than 800 articles for scientific journals, 85 chapters and eight books. He was a co-recipient of the 2009 Enrico Fermi Award and elected a Foreign Member of the Royal Society and was presented with the National Medal of Science by US president Barack Obama.

Among his many publications is a very personal one: “Witness to Grace”, in which he describes how his intellectual journey had also included “a religious quest for meaning in what or whom I would choose to serve with my life.” He was born into an agnostic family but during the war years he developed a faith and was a devout Christian to the end of his life.

Career development

To return to his spectacular career: the crucial point in Goodenough’s researches and associated lithium battery’s development was when he was offered a position of professor and head of the Inorganic Chemistry Laboratory at Oxford University.

Up till then. Goodenough had been

OBITUARY 6 • Batteries International • Summer 2023 www.batteriesinternational.com

We also offer matching terminal bolts

working as a research scientist at MIT’s Lincoln Laboratory where he had been part of an interdisciplinary team that developed the first random-access memory (RHM) for the digital computer.

His fundamental research had focused on magnetism and on the metal–insulator transition behaviour in transitionmetal oxides. He also developed a set of semi-empirical rules to predict magnetism in these materials in the 1950s and 1960s, now called the Goodenough–Kanamori rules which is a core property for high-temperature superconductivity.

Goodenough’s contribution was to the development of the ferrimagnetic, ceramic memory element, a contribution that put him in charge of a ceramics laboratory and that gave him a decade in which to explore the magnetic, transport, and structural properties of transition-metal compounds.

MIT Lincoln Laboratory

In 1952, he joined the group at MIT Lincoln Laboratory charged with the development of a ferrimagnetic ceramic to enable the first random-access memory (RAM) for the digital computer.

“The air defence of this country depended on having a large digital computer, and the computer had no memory!” Goodenough later said.

“The rolled alloy tapes first tried did not switch fast enough. Although the Europeans who had developed ferrimagnetic spinels were convinced that it would be impossible to obtain the required squarish B-H hysteresis loop in a polycrystalline ceramic, the magneticcore RAM was delivered within three years of my arrival with a read/rewrite cycle time of less than the required six microseconds.”

In the course of this work, Goodenough showed how cooperative orbital ordering gives rise to crystal distortions, and he used this ordering to articulate the rules for the sign of the spin-spin magnetic interactions in solids.

These rules have subsequently provided a true guide to the design as well as the interpretation of the magnetic properties of solids; they are known as the Goodenough-Kanamori rules, and they inspired the title of Goodenough’s first book, Magnetism and the Chemical Bond.

Although these were astounding advances in both physics and chemistry. It was his appointment to Oxford University in 1976 that so much came together.

Once there, Goodenough recognized that the layered sulfides would not give the voltage needed to compete with

batteries using a conventional aqueous electrolyte, but that an oxide would provide a significantly higher voltage.

From previous work, he knew that layered oxides analogous to the layered sulfides would not be stable, but that discharged LiMO2 oxides could have the same structural architecture as discharged LiTiS2

Goodenough assigned a visiting physicist from Japan, Koichi Mizushima, the task of working with Goodenough’s postdoc, Philip Wiseman, and a student, Philip Jones, to explore how much Li could be extracted reversibly from layered LiMO2 cathodes, and with M = Co and Ni he found he could extract electrochemically over 50% of the Li at a voltage of around 4.0V versus a lithium anode, nearly double that for the sulfides, before the oxides began to evolve oxygen.

Their groundbreaking findings with Li1-xCoO2 were published in the Materials Research Bulletin 15, 783-789, (1980).

The report concluded with the statement, “Further characteristics of the intrinsic and extrinsic properties of this new system are being made.”

However, when Goodenough went to patent his cathodes, no battery company in the UK, Europe, or the US was interested in assembling a battery with a discharged cathode, so he gave the patent to the AERE Harwell Laboratory.

Nevertheless, with his postdoc Peter Bruce, now a professor in St Andrews, Scotland, and a new student, MGSK Thomas, Goodenough continued in Oxford to demonstrate that the Li+-ion mobility in Li1-xCoO2 is even higher than that in the sulfide cathode LiTiS2.

The wireless revolution

This finding meant that a Li1-xCoO2 cathode would provide the needed voltages and rates that would usher in what was later termed the “wireless revolution”.

Meanwhile, Rachid Yazami in Switzerland, exploring Li insertion into graphite, reported that a discharged graphite anode did not have a problem with dendrites if the carbon/LiCoO2 cells were not charged too rapidly, and Akira Yoshino in Japan then assembled the discharged cell Carbon/LiCoO2 to demonstrate the Li-ion battery that was licensed to the SONY Corporation, which marketed with it the first cell telephone.

Today, almost everyone from five years upwards has an application of this battery in his or her pockets.

Michael Thackeray was working on

the Zebra battery (see Batteries International passim), a modification of the sodium-sulfur battery, in South Africa when he read the article in the Materials Research Bulletin. He immediately applied for a sabbatical to work with Goodenough in Oxford.

He came to the city with the announcement that he was inserting Li reversibly into magnetite, the ferrimagnetic spinel Fe3O4 used by Greek sailors in an early version of the compass. He wished to replace cobalt, which is expensive and toxic, with iron, which is abundant and benign. The spinels A[B2]O4 contain a threedimensional framework of BO6/3 octahedra sharing edges; in the layered LiMO2 oxides they form 2-dimensional layers.

Spinel memory

The A atoms of a spinel occupy interstitial tetrahedral sites that are bridged by empty, face-sharing octahedra, and Goodenough realized from his earlier work on spinel memory elements that the Li inserted into Fe[Fe2]O4 was entering and displacing that interstitial A-site Fe into the bridging interstitial octahedral sites to create a rock-salt structure with the [Fe2]O4 framework remaining intact.

Bill David, at the Rutherford Laboratory, had just joined Goodenough’s group from the Clarendon with a PhD involving structural analysis, so he and Thackeray demonstrated that Goodenough’s hypothesis was correct.

Meanwhile, Goodenough told Thackeray to investigate the electrochemical reversible insertion of Li into the spinel Li[Mn2]O4; it gave a voltage of 3.0V versus lithium. Manganese is also abundant and benign.

On his return to South Africa, Thackeray showed his students that extraction of Li from Li[Mn2]O4 gives a voltage of 4.0 V versus lithium. A modification of the Li1-x[Mn2]O4 spinel cathode was later used by Nissan to power their Leaf electric car.

By then the next stage in the development of the lithium battery was complete. Akira Yoshino in 1985 fabricated the first prototype of the LIB and received the basic patent. This configuration was commercialized by Sony in 1991 and by A&T Battery in 1992.

“It’s rare that we’ll see a figure like John Goodenough again in our lifetimes,” said one commentator. “He had a life of modest and quiet achievement — a well lived life and with a legacy that the whole planet can thank him for.”

OBITUARY 8 • Batteries International • Summer 2023 www.batteriesinternational.com

Taylor succeeds Longney as TBS group MD, Davis retires

at the Gloucestershire HQ.

In 2022, Taylor accepted a new role as group aftermarket director.

Longney said: “It was a difficult decision to step down, however, I believe in my time as MD we have moved the business forward in many ways, placing TBS in a strong competitive position for the future.

much-respected Paul Davis was retiring from the firm after 39 years.

Davis joined TBS in February 1984 as a service technician, moving to sales several years later.

UK-based TBS Engineering has announced the appointment of Richard Taylor as its new group MD following the announcement that David Longney will be stepping down.

TBS said on July 3 that Longney, who has worked with the company for nearly 40 years, had decided to make way for new leadership as TBS starts a new

phase of its development program.

However, Longney will remain a director of TBS and support Taylor in his new role.

Taylor has been with the company since 2019 when he joined as group operations director, responsible for all UK manufacturing operations, supply chain and facilities management

Straw named director of new ENTEK Manufacturing unit

turer and supplier of replacement wear parts in the industry.”

Straw will have profit and loss responsibility for the division and reports to Linda Campbell, VP of extrusion sales.

“I am confident that Richard will be a success in the role that I am leaving.”

Taylor said: “We have an exciting phase of growth planned and I want to keep TBS as a competitive market leader now and in the future.”

In a separate LinkedIn announcement on July 3, TBS announced that the

He travelled extensively on behalf of TBS for more than 20 years, becoming a well-known and respected member of the team among the global battery industry, TBS said.

Doe Run promotes Mangogna to VP operations and COO

The Doe Run Company, the mining group and natural resources firm, announced on June 28 it had promoted Brian Mangogna VP for mining and milling to be chief operating officer and VP for operations.

and mills.

Tammy Straw has been named as director of ENTEK Manufacturing’s new wear parts division, which will make and sell replacements for all brands of twin-screw extruders.

The June 9 announcement followed the February opening of ENTEK’s 98,000 ft2 manufacturing and engineering facility in Henderson in the US state of Nevada.

ENTEK Manufacturing president Kim Medford said the new division was key to the group becoming the number one manufac-

Straw has worked with ENTEK for 24 years and has been the company’s marketing and business development manager since 2016, also leading ENTEK’s inside sales team.

She is also the vice chair of the NPE sales and marketing committee for the US Plastics Industry Association.

Also joining the new Wear Parts Division is Kelsey Dennis, who will be responsible for wear parts sales. She has been with ENTEK since 2010, and most recently worked in customer support and inside sales.

Mangogna has spent almost 25 years with Doe Run, starting as a metallurgist, advancing over the years as mill superintendent, mill manager and general manager for the company’s Southeast Missouri (SEMO) Mining and Milling Division. In 2021 he joined the executive team and was promoted to VP of mining and milling.

In his new job he will oversee day-to-day operations for the company’s mining and metals operations, its battery recycling plant as well

as its mines

Mangogna said: “Doe Run has a long history of being a global provider of lead, copper and zinc — three base metals that enable modern society — but can also recover cobalt, nickel, tin and antimony from resources within our control, whether ore bodies or metals by-products. These metals have never been more important to US mineral security.

“I look forward to bringing forward new technologies to diversify and sustain our operations for future generations.”

PEOPLE NEWS 10 • Batteries International • Summer 2023 www.batteriesinternational.com

International Lead Medal awarded to ILA veteran Maura McDermott

Maura McDermott, one of the International Lead Association’s longestserving employees, office and events manager, was awarded the International Lead Medal on June 22 at the Pb2023 conference in Athens.

The medal, the industry’s highest honour, marks her retirement after 35 years of service and in particular honours her unstinting work behind the scenes. She has been one of the key figures in making the events activities of the ILA — starting in 1990 with 2ELBC in Brussels, right up to 18ELBC in Lyon — an integral part of the lead battery industry calendar.

“It’ll be a shame to see her go,” one delegate at Pb2023 said to Batteries International . “She’s always been a well-liked and popular figure in the conferences — she’s been scrupulously fair with everyone even with some of the more difficult exhibitors who can be very pushy.

“She’s very much a landmark at our events and a welcome face too!”

Maura joined the Zinc and Lead Development Association in November 1988, as executive assistant to the chief executive, David Ward. She started work at the association’s offices in Berkeley Square, London.

Following a series of reorganizations, the Zinc Development Association moved to Birmingham, and Maura stayed at the International Lead Association, and worked as EA to David Wilson who was then managing director of

ILA until his retirement in 2012.

It was during this period that she helped induct a new ILA recruit, Andy Bush, who joined the association on completing his doctorate and eventually becoming managing director.

Commenting on her ca-

reer and the International Lead Award, she said: “It’s a real honour to be recognized by the industry to which I’ve devoted almost my entire career. It’s such a social and friendly industry, I will take with me many happy memories and just as many friends.

“I’ve enjoyed many

aspects of the job, but I’ll particularly miss the events and the colleagues and delegates who helped make them such a success.

“Keep the lead light burning!”

Andy Bush, ILA managing director, said: “In three and a half decades Maura has made a huge contribution to the work of the lead association helping to make two of the major conferences supporting our industry — Pb and ELBC — the leading events they are today. She has been a much loved and respected point-of-contact for so many members and partners, as well as our employees. She’ll be greatly missed.

“On behalf of the whole industry I would like to thank her for her unstinting loyalty and service over so many years and wish her a long and wellearned retirement.”

See our full Pb23 event report on page 88.

Frank Macchiarola joined the American Clean Power Association as chief policy officer on June 20, the trade organization announced.

Macchiarola, former senior VP of policy, economics and regulatory affairs at the American Petroleum Institute, is leading a team working on regulatory and legislative proposals to boost development of advanced clean energy technologies.

Jason Grumet, ACP’s

chief executive officer, said: “The clean energy sector is at a pivotal moment, and growing our team to embrace the opportunities before us

will ensure this industry has the bench strength in place to match the moment.”

ACP said in a report published last December that more than $40 billion of grid-scale clean energy investments, including several new battery storage plants, were announced in the US in the three months up to November 30 — underlining the impact of policies rolled out by the federal government.

PEOPLE NEWS www.batteriesinternational.com Batteries International • Summer 2023 • 11

Macchiarola joins ACP as chief policy officer

Metair moves interim CEO, CFO appointments to permanent positions

Interim CEO of battery and auto components group Metair Investments, Sjoerd Douwenga (pictured), has been appointed to the role permanently, the company said on May 31.

Interim CFO Anesh Jogia has also been appointed permanently. He will also work as executive director and a member of the firm’s investment committee.

The interim appointments of Douwenga and Jogia were announced in March, following the resignation of then CEO Riaz Haffejee.

Metair said the permanent appointments “will allow for a seamless leadership transition”.

The group’s energy storage division includes Tur-

ABTC appoints Deutsch as CFO

key’s Mutlu Akü lead battery business, Romanian lead and lithium company Rombat and South Africa’s First National Battery.

In March, Metair reiterated that plans to sell off the energy storage business remain suspended as a result of the geopolitical climate in Europe and global financial instability.

ECS award for Argonne Lab scientist Meng

Senior Argonne National Laboratory scientist Shirley Meng has been honoured by The Electrochemical Society for her work on battery tech innovations.

Argonne said on July 10 Meng will be presented with the ECS 2023 battery division research award in October, in recognition of her work on interfacial science, which has led to improved battery technologies.

Meng is chief scientist at the Argonne Collaborative Center for Energy Storage Science and is a professor at the Pritzker School of Molecular Engineering at The University of Chicago.

Her research focuses primarily on energy storage materials and systems, specifically rechargeable bat-

teries for EVs and trucks, power sources for the internet of things and gridscale storage integration with renewables.

ECS highlighted two papers published last year by Meng in the Journal of The Electrochemical Society, one exploring the use of external mechanical pressure to regulate the growth of dendrites that form at the interfaces in batteries and lead to an electrical short.

The second paper looked at the process of lithium plating and stripping in rechargeable lithium batteries.

The battery division research award was established in 1958 to encourage excellence in battery and fuel cell research.

American Battery Technology Company said on May 22 it had appointed Jesse Deutsch as CFO.

Deutsch has more than 25 years of financial leadership experience including as a former CFO of global brands such as Kraft Foods.

He now oversees all financial operations of the company including those supporting an acceleration of battery recycling and battery metals manufacturing.

Deutsch, who has an MBA from New York Uni-

versity and a Bachelor of Science in economics from The Wharton School of the University of Pennsylvania, will also have responsibility for corporate functions including financial planning and analysis, accounting and controls, risk management, financial performance and revenue growth, investor relations, and reporting and compliance.

ABTC’s CEO Ryan Melsert said: “As we ramp up our commercial scale manufacturing operations over the coming months, we are excited to have such an experienced leader as Jesse join ABTC.

“We have an immense number of financial and strategic opportunities in front of us, and with this enhanced leadership team we are looking forward to driving them to execution.”

Deutsch’s appointment followed ABTC’s announcement in January that it had expanded its team toward commissioning of the firm’s lithium battery recycling plant.

Oliver Gross appointed senior fellow at Stellantis

Oliver Gross has been promoted to a new post as a senior fellow for energy storage and electrification at auto giant Stellantis.

Gross confirmed the appointment to Batteries International on May 12.

Gross is an expert in lithium ion and NiMH chemistries with a focus on motive applications.

His career to date has included being responsible for operations of analytical labs, electrical, environmental and abuse test labs, pilot lines and

supporting services.

Gross has also designed, developed and brought to manufacturing cells and modules for consumer electronics, military, aerospace, and automotive industries.

PEOPLE NEWS www.batteriesinternational.com Batteries International • Summer 2023 • 13

EUROBAT’s Westgeest steps down, Meylemans takes over as GM

Alfons Westgeest, general manager of EUROBAT, announced on June 5 he was stepping down and Gert Meylemans, previously director of communications, would take over.

Westgeest, who tried to retire four years ago but came back, has been a central figure in EUROBAT since his involvement in 2002 and arguably the key creator of the present trade organization.

Westgeest, a well-known and well-liked figure in all sections of the European energy storage industry, said he had enjoyed his time with EUROBAT.

“It’s not just been fun to build up and strengthen the organization but we have achieved real success in helping influence the direc-

tion of battery regulation across the EU.”

Marc Zoellner, president of EUROBAT and CEO of Hoppecke Batteries, in a touching speech at the conference dinner, paid tribute to Westgeest’s relentless commitment to building up EUROBAT and its members.

“I will truly miss him and thank him for the wonderful work he has done,” he said.

Meylemans, who joined EUROBAT in August 2018, said he had a very tough act to follow but “hoped to continue to build on the great work Alfons has done”.

EUROBAT — the association for European automotive and industrial battery manufacturers and

Skyllas-Kazacos joins Tivan advisory group

Vanadium redox flow battery pioneer Maria SkyllasKazacos has joined a new technical advisory group set up by minerals processing tech company Tivan.

Tivan said on May 31

Skyllas-Kazacos’s technical knowledge and experience would be keenly sought in developing and standardizing the global value chain in VRFB.

Other initial appointments to the group included Stéphane Leblanc and Simon Flowers.

Leblanc is a former MD of Rio Tinto Iron & Titanium. Flowers is the director and principal of Sustainergy Consulting and a former international team leader with US energy firm ConocoPhillips.

The group will provide independent technical advice to support development of two projects, including Tivan’s Mount Peake in Australia’s Northern Territory — which the company says has one of the largest flat-lying, shallow vanadium-titanium deposits in the country.

The other is the Speewah vanadium-titanium-iron project in Western Australia, of which Tivan acquired 100% ownership in April.

supply chain in EMEA — was formed in 1957 and was originally based in Switzerland.

But it was only when it moved to Brussels at the turn of the century that it became the lobbying and trade body that it is today.

EUROBAT is a non-profit association under Belgian law and is staffed by association management company Kellen. Westgeest became Kellen Europe’s board member for global develop-

ment in 2022.

Before EUROBAT, Westgeest was the founder and managing partner of Ernst & Young’s association management practice in 1988 in Brussels. He joined EY in 1981 and left the firm in 2004.

This year’s EUROBAT general assembly and convention was held on June 6-7 in Madrid.

See our event review towards the end of the magazine.

Roden joins ENTEK International as North America account manager

James Roden has joined ENTEK International’s lead acid separator sales team as North America account manager, the company announced on May 31.

Roden, who has more than 10 years of sales experience in the automotive industry, will be based at ENTEK’s headquarters in Oregon.

ENTEK announced last year that it was to expand its manufacturing of AGM battery separators to India and the US, in response to expanding demand for energy storage solutions for inverters, industrial applications and electric vehicles.

In March, the company said it was also investing

$1.5 billion to build a lithium ion battery separator production facility in the US state of Indiana. The Terre Haute plant, on a 340-acre greenfield site, will be the biggest investment to date by the US-based producer of wet-process lithium-ion battery separator materials, in support of the growing EV industry in Indiana and across the country.

PEOPLE NEWS 14 • Batteries International • Summer 2023 www.batteriesinternational.com

Gert Meylemans Alfons Westgeest

CONTACT US: INNOVATIVE SOLUTION PROVIDER IN INJECTION MOLDING FOR ALL KIND OF BATTERIES & ACCESSORIES OF BATTERIES. sales@accumalux.com B.P. 2153, L-1021 Luxembourg www.accumalux.com +352 36 70 62 Components & Accessories for SLI, Motive Power, Storage Power, Lithium

by

OXIDES FOR THE HEART OF BATTERIES

Strengthened by its fifty years’ experience in Red Lead Oxide production both for crystal and ceramics, Colorobbia is able to support the market of Lead Batteries manufacturing with centennial transversal knowledge and worldwide recognized competence.

Colorobbia can offer different product grades with constant quality and high purity, proving a trustful partner for your future of success.

www.colorobbia.com

excellence to improve your ceramics since 1921

Lead batteries still top recycled product in US, new study shows

Lead batteries continue to be the most recycled consumer product in the US with a 99% recycling rate, according to latest analysis published by Battery Council International on July 12.

The results of the BCI National Recycling Rate Study, commissioned by BCI and prepared by Vault Consulting, show that lead batteries have maintained the outstanding recycling record they have held for a number of years.

And BCI said the industry’s strong circular economy keeps 160 million batteries from landfills annually with a “near-zero waste model of sustainability”.

By comparison, only 50% of aluminium cans in the US are recycled, along with under 40% of consumer

electronics and around less than 3% of lithium ion batteries, BCI said.

Roger Miksad, president and executive director of the trade association representing the global battery manufacturing and recycling industry, said the achievement underscored its members’ unwavering commitment to environmental sustainability and highlighted the industry’s enduring foothold

Battery equipment firm CMWTEC plans new factory

Battery finishing line equipment major CMWTEC Technologie will be expanding its manufacturing capacity at a new greenfield site in Germany as the company invests to meet an increasing order book, Batteries International has learned.

CMWTEC vice-president of sales, Michael Wipperfürth, confirmed the expansion plan during the firm’s latest customer open house event at its factory in Grossmannswiese in Germany on July 12.

Wipperfürth said the firm will be moving from its current factory site of up to 1,000m2 to a nearby greenfield site of 6,000m2 where construction is set to start soon. He hopes the move

will be made next year.

The new site is adjacent to the Limburg-Süd railway station, offering easy access for the firm’s customers to the country’s high-speed rail network and key destinations including Frankfurt International Airport.

New and existing customers were among those at the firm’s open days on July 12 and 13 to see and secure orders for CMWTEC’s extensive new range of machines.

Latest products include an end-of-line test machine for lead acid batteries and AGM/EFB finishing lines with proprietary data management software to record key data such as battery codes, test results, filling quantity and height control measurements.

in advancing responsible recycling practices.

Miksad said lead batteries continued to be key to the transition to clean energy storage in the US, with the recycling of raw materials instead of relying on newly mined minerals significantly reducing the manufacturing footprint for batteries.

“Lead batteries are critical to our low carbon future by being a critical component in many sustainable applications,” Miksad said.

“Our industry is minimizing the environmental impact of battery disposal with a highly successful circular

‘manufacture-use-reuse’ model. It has become the blueprint for newer battery chemistries, as well as other industries.”

The new study updates aggregated data for the five-year reporting period of 2017-2021. The lead battery recycling rate for that period was derived by dividing the total pounds of lead batteries recycled by the total pounds of lead available for recycling in the US.

To account for significant market disruptions during the pandemic, the study averaged BCI recycling rate studies spanning 2011-2021 to derive the sustained recycling rate of 99%.

Overall, the study confirms the exceptional achievements of the lead battery industry in perfecting recycling processes and a circular economy for lead batteries.

Details of the study and other recycling facts and figures are available on BCI’s website.

Gravita India said on July 10 that its Mundra Port lead battery recycling plant in Gujurat was back in operation after work at the site was suspended in June when a cyclone hit the region.

The company said the estimated cost of damage caused as a result of cyclone Biparjoy was about Rs2.50 crore ($300,000) although losses would be covered by insurance.

Gravita announced in April that it had increased lead recycling capacity at Mundra by 40,500 tonnes per annum, which took the

overall recycling capacity at the flagship facility to 60,000 tpa.

Around 19,500 tpa of the new capacity came from switching some recycling from the firm’s facility at Gandhidham, about 60km northeast.

The company said it had also started commercial production of red lead and plastic granules at Mundra, with a capacity of 4,800 tpa and 7,500 tpa respectively.

Gravita announced the start of the first phase of battery recycling operations at Mundra in December 2021.

NEWS www.batteriesinternational.com Batteries International • Summer 2023 • 17

Gravita recycling plant back in operation after India cyclone

The ONE Minute Giveback returns returns for 20ABC in Cambodia

The ONE Minute Giveback, a charity initiative that started at the 18ABC in Bali will be returning to this year’s Asian Battery Conference in September in Cambodia.

At 18ABC some $40,000 was raised for three local charities and the organizers hope that a similar sum will be available to support the Angkor Hospital for Children, an independent nonprofit paediatric healthcare hospital in Siem Reap, Cambodia.

The fund-raising branded as the ‘ONE Minute Giveback’ is being managed by Mark Richardson, one of the event organizers of ABC and Scott Fink, president of Sorfin Yoshimura.

“All proceeds from our ONE Minute Giveback will be used to help ensure families living in poverty have access to healthcare for their children via the free medical services the hospital provides,” says Fink.

“We’d like to see as many delegates involved as possible and we have five ways you can giveback.”

• The first is acting as a partner that will help as well as donate in the running of the appeal.

• Alternatively one can donate one minute of time onsite during 20ABC and drop by the giveback area in the foyer where goods and items that the hospital has identified as critically needed will be

sorted and packed.

• Give just one dollar! Delegate’s partners will be out taking onsite donations with the help of the event team. Any cash donation from the value of $1 is gratefully received.

• Donate online. “We will be accepting donated items onsite,” says Fink. “And we will share a wish list of items the hospital have requested. Should you wish to donate larger amounts of items please contact us to discuss.”

One industry veteran told Batteries International, “Conference Works [the organizers] and Sorfin achieved a first for the lead battery business in Bali and

added another dimension to the travel aspect of conferences across this region.

“More importantly it also offers a possibility for elsewhere too. I wish ELBC or BCI would do something like this as well.”

The mission of the hospital is to improve healthcare of Cambodia’s children by creating a sustainable, replicable model of a healthcare institution in cooperation with the Cambodian government.

20ABC will be held at the Sokha Siem Reap Resort & Convention Center, Cambodia between September 5-8. It will be preceded by the Recycle 100 conference looking at battery recycling.

Amara

Raja wins $130m solar plant contract for Bangladesh

Amara Raja Batteries said on June 27 a subsidiary had won a contract to build a $130 million solar plant in Bangladesh, funded by the India Exim Bank.

The 100MW solar facility will span more than 326

acres near Dhaka and is set for completion in the next 18 months.

Amara Raja Infra Pvt Ltd (ARIPL) the battery group’s engineering, procurement and construction arm, will provide the engineering,

design, supply, installation, and be responsible for commissioning of the plant for the country’s Rural Power Company. ARIPL will work with Indian solar manufacturer Premier Solar Powertech.

EU leaders formally agree new Batteries Regulation

EU leaders formally voted in favour of the bloc’s new Batteries Regulation on July 10, paving the way for the package of new measures governing the entire lifecycle of batteries to enter into force 20 days later.

The European Council, which includes the heads of state or government of all EU member states, said the regulation will apply to all batteries including all waste portable batteries, EV batter-

ies, industrial batteries, SLI batteries and batteries for light means of transport such as e-bikes.

Adoption of the new regulation followed the approval of EU lawmakers on June 14.

However, battery industry leaders have warned more still needs to be done to ensure consistency and support for all battery chemistries.

EUROBAT has called for battery manufacturers to be involved in the

development of necessary related legislation to support climate change and clean energy goals.

And the International Lead Association regulatory affairs director, Steve Binks, has urged legislators to ensure the plethora of upcoming secondary legislation linked to the new regulation supports “strong and globally competitive battery value chains for all chemistries”.

Vikramadithya Gourineni, ARIPL director, said the project would help to establish the group as a serious player in the domestic and international renewables market.

ARIPL has a solar portfolio of 1GW in the pipeline, including the Bangladesh project.

At the time of going to press, the lead and lithium batteries group had yet to respond to Batteries International about whether it would be supplying any associated BESS systems for the Bangladesh project.

In May, Amara Raja broke ground for its 16GWh lithium battery cells factory and research complex in the southern Indian state of Telangana.

The company announced last December that Telangana would become the company’s giga corridor, featuring advanced laboratories and testing infrastructure for material research, prototyping, product life cycle analysis and proof of concept demonstration.

NEWS 18 • Batteries International • Summer 2023 www.batteriesinternational.com

Custom-designed equipment for the battery and chemical industry

We design, engineer and manufacture reliable systems regarding filling, mixing, diluting and handling of highly corrosive chemicals such as acid and alkaline. Our systems are compact and fully automatic with an exceptional level of precision, accuracy, safety and reliability, utilizing the latest technology.

North America

Chris Glascock

Office +1 (706) 841 1184

Mobile +1 (423) 595 2326

glascockinternational@gmail.com

Head Office Åkerivägen 19 241 38 Eslöv, Sweden

Office +46 40 671 1200

office@kallstrom.com

South Korea

Gabriel Kim

Office +82 32 438 3347

Mobile +82 10 5307 0459 gabyeolk@naver.com

India

Suresh Pemmaiah Office +91 80 40 976620 Mobile +91 98 45 021623 hpi@hpinstruments.com

For more information visit kallstrom.com

Power Electronics representative in Scandinavia

Digatron

Five station Acid Filler SF4-8P (AGM)

Fully automatic acid-mixer SB1

Four station Acid Filler SF4-2Q (SLI)

WaveTech’s CCT takes lead battery technology into Indonesian telecoms

WaveTech’s German subsidiary is to test the group’s Crystal Control Technology (CCT) on a combination of lead batteries and solar power providing backup power for telecoms systems in Indonesia.

WaveTech said it will monitor progress by treating lead batteries with CCT — its proprietary tech which it says enhances the performance and lifetime of lead batteries used in ESS.

WaveTech said on July 3 it was partnering with Mitratel Indonesia to optimize an unspecified number of Mitratel’s off-grid telecoms backup energy storage systems.

The project aims to enhance battery performance, extend longevity, reduce costs, and minimize the carbon footprint associated with lead battery usage in telecom backup power.

The collaboration marks WaveTech’s expansion into

Indonesia, a country the company says has over 200,000 telecoms sites.

WaveTech plans to scale up and deploy the technology, under a commercial agreement, across a larger number of sites with the goal of covering the majority of Mitratel’s network.

The field trials will involve critical live sites where hybrid lead battery and solar energy systems are in operation.

The project follows WaveTech’s successful completion, announced in February, of the first commercial installation of CCT in Malaysia with Maxis Telecommunications.

In March, WaveTech said it had signed a deal with rolled aluminium producer Niche Fusina Rolled Products to test CCT on electric forklift trucks.

CCT is based on applying a specifically modulated periodic signal during charge,

and monitoring the state of charge and state of health of the battery. The innovation is mostly used in telecoms, where lead batteries globally represent the majority of battery demand.

WaveTech’s R&D department is optimizing the technology for doubling the lifetime and tripling the energy throughput of the batteries for this and other stationary energy storage applications.

CCT helps WaveTech charge the batteries faster and more efficiently. The power pulses sent to the battery enhance the mobility of ions in the electrolyte and optimize crystallization in the positive and negative plates of the battery. The surface of the plates remains active, sulfation is slowed down, and the highly porous microstructure of the lead and lead dioxide crystals formed in the active materials is kept sustainable.

Clean energy switch needs ‘$4tn and historic mining expansion by 2030’

Minerals and metals required for the global clean energy transition, including electric transportation, may need investments of up to $4 trillion by 2030 — but temporary supply chain shortages could still hamper progress, according to a new study.

Analysis published on July 6 by McKinsey & Company says investments in mining, refining, and smelting will need to increase to around $3 trillion to $4 trillion by 2030 (about $300 billion to $400 billion per year), the report says.

Meanwhile, an additional 300,000 to 600,000 specialized mining professionals will be needed worldwide

and an additional 200GW to 500GW will need to come online by 2030 to power these assets, equivalent to 5% to 10% of estimated solar and wind power capacity by 2030.

There are likely to be modest shortages of around 10%-20% of nickel and up to 70% of dysprosium, the highly magnetic rare-earth metal used in most electric motors. These shortages will hinder the speed of decarbonization.

The report forecasts continued high concentration of mineral and metals supplies in a handful of countries including China, the Democratic Republic of the Congo and Indonesia.

Combined with a regulatory landscape that is increasingly focused on regionalization — as seen through the US Inflation Reduction Act and the EU Green Deal Industrial Plan — these concentrated supplies could affect regional access to materials, even when the global market is balanced.

According to the report, it will be crucial to scale up materials supply projects already announced, but this will require mining “to accelerate beyond historical growth rates for many materials”.

Smoother permitting processes, timely infrastructure deployment, equipment availability and adequate

Lead-air performance boost for Port Pirie operating licence

Nyrstar Australia’s Port Pirie multi-metals processing plant has been granted an extended five-year operating licence, the company announced on June 30. This was in part due to its upgrades in leadin-air environmental performance.

Nyrstar co-CEO Dale Webb said the licence from the Environmental Protection Agency — which has only issued yearly licences for the past three years — was the result of intensive efforts to improve the site’s performance.

“We make critical metals that the world needs for the green transition and a lower carbon future such as zinc, lead, copper and silver,” Webb said.

“Over recent years we have had a strong focus on improving our environmental performance in all areas, and especially reducing lead-in-air concentrations.”

Over the past four years, average leadin-air concentration levels measured across Nyrstar’s monitoring network have reduced by 40%, the company said.

Meanwhile, Nyrstar is working on a new A$23 million ($15.4 million) product recycling facility, co-funded with the South Australian state government, that will store and mix intermediate production materials.

NEWS 20 • Batteries International • Summer 2023 www.batteriesinternational.com

ABC, Quench partnership signals ‘important development’ for EV charging stations in US

Advanced Battery Concepts is set to deploy its bipolar lead battery storage tech for the developing US market to power electric vehicles in collaboration with Quench EV Chargers.

“This is an important moment in the future evolution of the US charging market,” says one lead battery commentator. “The US needs to urgently adopt a charging regime given the amount of EVs that some are predicting will be driven in just seven years’ time. The country is already well behind proposed charging station targets outside of states such as California.

“The arguments over the viability of using lead bat-

teries — in terms of price and also recyclability are clear — and the notion of using an advanced bipolar one with its better performance over conventional ones makes this project a potential winner for lead.”

The ABC/Quench partnership builds on the economic advantages of using lead batteries in charging stations were first shown in a 2019 study in the US state of Missouri. Part of the difference between then and now will be the use of ABC’s bipolar batteries which give a superior performance against other lead types.

ABC and Quench announced on June 15 they

were partnering to help give “unwavering confidence” to EV drivers embarking on journeys.

ABC’s energy storage systems can be sited in remote locations to help tackle issues of peak draw from charging stations and to reduce demand and associated power costs for each charging location.

The partners said the US government predicts a need for 2.5 million EV charging sites by 2030.

However, they said there are doubts that the US electrical power grid can support what would represent a 28% annual growth rate between now and 2030.

ABC president Michael

Everett said: “That’s a big concern.”

He said the company’s EverGreenSeal battery tech levels demand peaks and reduces costs to consumers by sourcing in-coming electricity during off-peak hours.

The BESS also minimizes charging station time-ofuse because direct DC-toDC charging is faster and more efficient than ACto-DC charging — which Everett said is the current charging station norm.

And with a constant supply of energy to the charger, “faster charging means lower per-visit time, cost and allows more EVs to refill per hour”.

Windfall benefits for Tesla as IRA kicks in

The US Inflation Reduction Act has provoked a flurry of approval and disapproval — one commentator said it was both the worst and the best piece of US legislation on batteries — but the full financial impact on US car makers is only still becoming clear.

Bob Galyen, the former CTO of CATL and also acknowledged as one of a small coterie of international lithium battery experts said on June 29 that the IRA was going to provide huge benefits for US auto-manufacturers and battery makers.

Speaking to Batteries International after addressing an audience at the Battery Cells & System Expo in Birmingham, UK, Galyen painted a bright picture for the industry.

“If you look at research from Benchmark Mineral Intelligence you’ll see that Tesla and its battery partner could receive $41 billion in government tax credits by

the end of 2032 — that’s far more than its key Detroit rivals,” he said.

There two credits available (but you could only apply for one of the two) — the Advanced Energy Project Credit and the Advanced Manufacturing Product Credit. The AMPC is where the market interest is.

The rewards from the production credits that are part of the IRA are based on volumes of business so the more batteries and EVs a company makes in the US (or in countries included in the Treasury regulations), the more money it gets via tax credits. Tesla, which had started battery production in 2013 at its first gigafactory has put Tesla and Panasonic far ahead of their competition.

“It’s first mover advantage,” says one analyst. “So those ahead of the game will stay ahead of it until 2030 when the credits taper off. Another reckoned that Tesla

would use the investment credits to cut the price of its cars. Already Tesla sells more of its EVs than the rest of the competitors in the sector combined.

Galyen’s talk also provided a fascinating insight as to the areas in lithium battery technologies which he regarded as being both cutting edge and soon to be mainstream. He was particularly enthusiastic about Titan AES which uses ultrasound technology for quality inspection and homogenous product manufacturing.

The next step forward in lithium battery recycling

will come from Chromatopgraphic separation which Galyen says is a leap ahead from solvent extraction.

Goldman Sachs says the credits baked into the IRA could total $1.2 trillion, which is three times more than the government estimated at the time the IRA was passed. That could lead to political pushback if reactionaries regain control of the US government in the future. “It’s a real risk. People are not giving it 100% likelihood to survive,” said Mark Wakefield, head of the automotive practice at AlixPartners.

NEWS www.batteriesinternational.com Batteries International • Summer 2023 • 21

“If you look at research from Benchmark Mineral Intelligence you’ll see that Tesla and its battery partner could receive $41 billion in government tax credits by the end of 2032 — that’s far more than its key Detroit rivals”

Bob Galyen, the former CTO of CATL

Breathing space for lead in REACH talks

European Commission officials are not expected to take immediate action to push through proposals for lead metal to be listed on an expanded chemicals authorization register in the near future — Batteries International has learned.

Battery industry leaders have been in talks with European Commission officials, after the European Chemicals Agency said in April it had submitted proposals for lead and seven other substances to be added to its REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) list — indicating that the substance would eventually be substituted and could only be used in the meantime with specific permission from the Commission.

Informed sources close to the talks told Batteries International on the sidelines of the ILA’s Pb 2023 conference in Athens on June 22 that, privately, Commission chiefs indicate there is “no appetite” to add lead metal to the list — for the time being — not least because it would trigger a huge administrative burden as thousands of applications would flood in and risk clogging up the regulatory process.

Preparing for REACH listing would also ramp up pressure on battery manufacturers and associated industries at a time when the sector is being urged to invest to support the EU’s energy transition, including increasing the use of wind, solar and battery storage.

Meanwhile, the political composition of the European Commission is set to change next year following European Parliament elections.

An ILA spokesperson said discussions had been held with the REACH unit of the Commission’s Directorate for the Internal Market, Industry, Entrepreneurship & SMEs (DG GROW), but declined to give details.

“The unit was keen to hear arguments and the basis of industry’s concerns and are aware of what is at stake,” the spokesperson said.

“From the discussions, we do not anticipate DG GROW progressing lead metal towards REACH authorization listing — at this time.”

However, the spokesperson stressed that initial talks have been held with only one unit of the Commission — so the feedback does not necessarily represent the views of other units involved with REACH.

Global refined lead metal demand exceeds supply in first quarter

World refined lead metal demand exceeded supply by 46kt in the first four months of 2023, according to latest data published on June 21 by the International Lead and Zinc Study Group (ILZSG).

The Lisbon-based group said provisional data it had received indicated stock levels fell by 8kt over the same period.

However, global lead mine production increased

BCI revamps Source BCI

Battery Council International announced on June 28 it had launched an updated and improved website for Source BCI, its data base for vehicle battery fitment. It contains figures for more than 160,000 vehicles spanning more than 85 years.

“The improved Source BCI website is easier and faster to use, with a new mobile-ready interface, and provides more detailed information for the professional battery service technician and consumers alike,” said a BCI statement.

“As the digital counterpart to the traditional Battery Replacement Data Book, Source BCI revolutionizes the way industry professionals access essential battery information,” said Roger Miksad, BCI president and executive director.

“With Source BCI, industry professionals can retrieve the information they need at their fingertips, eliminating the hassle of flipping through pages. It’s a quick and powerful tool for those across the battery industry.”

by 2.3%, which the group said was primarily a consequence of increases in Kazakhstan, South Africa and Turkey, which were partially balanced by a reduction in the US.

Global lead metal production rose 2.2%, mainly as a result of higher output in China, India and South Korea. But output in Bulgaria and Italy fell sharply.

The usage of refined lead metal increased by a mod -

est 0.3% over the period as rises in China, India, Mexico and the UK were largely offset by decreases in the Czech Republic, Germany, Italy and Turkey.

Meanwhile, Chinese imports of lead contained in lead concentrates rose by 44% to 217kt. Net exports of refined lead metal totalled 50kt, an increase of nearly 18% compared to the same period of 2022.

BCI says it provides: enhanced functionality with an integrated payment processor on the website allows for instant access upon purchase, eliminating wait times and the need for access codes. It has added a battery location field within the vehicle, providing users with comprehensive information for an expedited battery replacement process.

An annual subscription costs $14.99 and registering for Source BCI can be made at www. sourcebci.com

NEWS 22 • Batteries International • Summer 2023 www.batteriesinternational.com

Leoch to cooperate on solid-state batteries with Chinese university

Lead and lithium battery giant Leoch signed a framework agreement on June 8 to cooperate on solid-state tech R&D with China’s Fuzhou University.

Singapore-headquartered Leoch said the move is in line with development of its new energy batteries business — and can nurture training and scientific research on both sides.

Leoch owner and chairman Dong Li (pictured) said process control, scientific research technol-

ogy and collaboration are key to advances in battery technologies.

He said he looked forward to Leoch working with the university’s materials science and engineering college.

In March, Leoch announced plans to build a manufacturing plant in Mexico to ramp up its market presence in the Americas.

Dong Li said then that the location had been chosen because of its unique geographical location and

the USMCA free trade

Banner posts battery sales record despite ‘burdensome EU red tape’

Lead battery manufacturer Banner reported record full-year sales of €307 million ($333 million) on June 6 — but warned increasing European red tape and rising energy prices were major burdens.

The Austria-based firm said auto batteries were the key driver of its sales for the year ended March 31, which it said were up by more than 7% over the previous year.

Banner said it sold more than four million starter batteries over the period.

Meanwhile, a new licensing partnership with Leoch International for the Banner brand in China and an extension of the company’s licensing deal with Duracell should boost future sales in Asia and Europe.

Banner said the past financial year was characterized by far-reaching, global changes throughout the entire automotive industry, rising energy, raw material and labour costs and increasingly problematic supply chain issues.

Group commercial CEO

Andreas Bawart said the rise in sales was despite “massive cost increases in every area from raw materials to labour and naturally the meteoric upturn in energy prices.

“A short-term improvement is not in sight and un-

fortunately the EU and Austria are contributing to these difficulties.

“A vast number of regulations have been introduced, the implementation of which has led to a huge increase in the administrative burden upon small and medium-

sized enterprises like ours.” Bawart said it was inexplicable that political leaders were presiding over a situation where European battery makers “are suffering enormous competitive disadvantages” while trying to challenge Asian competitors.

Brill Power unveils ‘chemistry-agnostic’ battery booster for performance, safety

Brill Power unveiled chemistry agnostic tech on June 14 that it claimed could significantly improve battery performance and safety.

Brill, a spin-out from Oxford University, said its power battery intelligence platform boosts battery performance explicitly for larger battery systems in industrial, commercial and utility-scale applications.

The company’s BrillCore hardware and proprietary BrillOS operating system

are at the heart of the technology — providing “intelligent active loading of battery cells or modules” to overcome inherent performance limitation of the weakest cell in the pack that limits existing BMS solutions.

Active loading allows all of the potential from battery cells to be utilized, extending battery lifetime by up to 60%, Brill claims.

According to Brill, BrillOS is chemistry-agnostic and can be updated

wirelessly to be compatible with future battery technology.

Brill CEO Christoph Birkl said the system addressed “all of the pain points” that can be encountered by battery pack and systems developers. “Industrial and gridscale battery systems are necessarily large and expensive investments, so any frailty in the technology can have profound implications for the success and viability of the solution.”

NEWS 24 • Batteries International • Summer 2023 www.batteriesinternational.com

export policy advantages for the region — such as

agreement (formerly Nafta) between the US, Canada and Mexico.

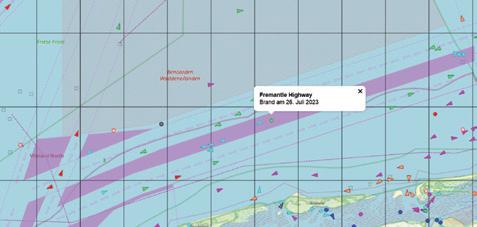

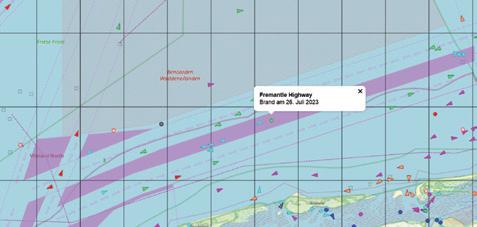

Fire-damaged EV cargo ship towed to Dutch port with batteries blamed for blaze on board

YOUR ITALIAN PARTNER FOR BATTERY RECYCLING AND LEAD PRODUCTION

STC REFINING EQUIPMENT

Stricken car carrier the Fremantle Highway was being towed into a Dutch port, as Batteries International went to press, after a fatal onboard blaze, with initial reports suggesting an EV battery was to blame.

According to Lloyds List, nearly 500 EVs were among the 3,784 cars on board the vessel when fire broke out on July 25, while en route from Germany to Singapore via Egypt.

Dutch broadcaster RTL has released a recording of an initial emergency responder reporting that the fire “started in the battery of an electric car”.

But the Netherlands Coastguard has distanced itself from the recording, saying it is too early to say what triggered the blaze that led to the death of one of the 23 crew members and injured many others.

Rijkswaterstaat, part of the Dutch Ministry of Infrastructure and Water Management, said yesterday there were no indications that the fire was continuing.

A towing operation began this morning to take the Fremantle Highway into the port of Eemshaven, with experts from a number of agencies on board the vessel.

Rijkswaterstaat said the cargo could be safely unloaded at the port allowing investigators to establish the cause of the blaze.

Only two of the rescued crew members remained in hospital as of July 30, according to vessel charter company Kawasaki Kisen Kaisha.

The was built in 2013 and has the capacity to carry 6,000 vehicles.

An industry observer told Batteries International: “As terrible as the incident has been, one can only imagine how much worse thing might have been if the ship had been filled to capacity.”

In a separate report published on July 27, Allianz Commercial said fires on vessels like the Fremantle Highway remain one of the biggest safety issues for the shipping industry.

The report said lithium ion fire risks will likely ease over time as manufacturers, carriers, and regulators address the current challenges.

“In the meantime, attention must be focused on preemptive measures to help mitigate the peril.”

S T C d e s i g n s a n d s u p p l i e s c o m p l e t e l e a d r e f i n i n g u n i t s a s w e l l a s s i n g l e e q u i p m e n t i n c a s e o f r e v a m p i n g o r m o d e r n i z a t i o n o f e x i s t i n g f a c i l i t i e s , w i t h t h e f o l l o w i n g a d v a n t a g e s :

D e s i g n f l e x i b i l i t y t o a d a p t t o a n y l a y o u t

E a s y p r o c e s s p a r a m e t e r s c o n t r o l

S t r o n g , r o b u s t a n d s i m p l e e q u i p m e n t ,

r e l i a b l e , e a s y t o u s e w i t h l o w m a i n t e n a n c e r e q u i r e m e n t s

T o p q u a l i t y “ m a d e i n I t a l y ” a t v e r y c o m p e t i t i v e c o s t

P r e - a s s e m b l e d i n o u r w o r k s h o p

S a f e f o r t h e o p e r a t o r s