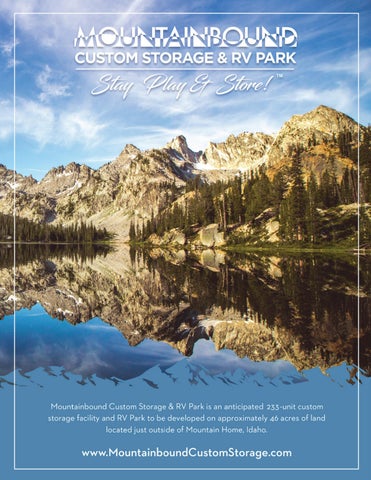

Mountainbound Custom Storage & RV Park is an anticipated 233-unit custom storage facility and RV Park to be developed on approximately 46 acres of land located just outside of Mountain Home, Idaho. Our goal is to build a thriving community of RV and outdoor recreational enthusiasts. The facility will offer customizable 1,000-square-foot climate controlled storage units or “man-caves” in addition to 1,000-square-foot RV spaces with full hookups. The park will include first-class amenities, including a heated pool and jacuzzi that are available year round, a golf driving range, a dog park, a vehicle wash, a general store, customizable VIP concierge services, and easy access to off-road trails and local outdoor attractions. Designed to be a “ one stop shop” community, Mountainbound Custom Storage & RV Park will offer a wide variety of services and amenities designed to meet the demands of the most serious outdoor enthusiasts, with customer satisfaction our primary goal.

The project developer and its management team have extensive hands-on experience in the development and construction of custom storage and RV facilities. The team is four years into a first-of-its-kind facility near Lake Havasu, Arizona – a high-end, 400-unit custom storage facility and RV park being constructed on a 160-acre parcel of land adjacent to Highway 95 just north of the famous resort community of Lake Havasu in the Arizona/California desert. For an overview of that project, which the Mountainbound project developer plans to duplicate in beautiful southwestern Idaho, go to www.riverboundcustomstorage.com. The project developer’s plan is to build the Mountainbound facility in multiple phases over a five to ten year period. The developer anticipates breaking ground and commencing construction as quickly as possible following the acquisition of the land, once all legal and regulatory matters are satisfied. The project developer expects the first phase of the Mountainbound Custom Storage & RV Park facility to be available for occupancy in 2025.

As of the time of this brochure, it is our plan to offer a rewards program to our tenants at our Riverbound and Mountainbound projects, creating a reciprocal arrangement between the two sites for “snowbird” storage at Ri verbound and late spring/summer/early fall storage at Mountainbound. Our preliminary analysis and review suggests that a cross-promotional arrangement with loyalty rewards between the two sites will be an attractive opportunity for a significant number of tenants who would like to split their tenancy seasonally.

The Mountainbound project is intended to take advantage of overall aggressive demand in the RV park and custom storage industry, filling a need in southwestern Idaho near the major cities of Boise, Nampa, and Meridian. Much of Idaho's population growth has been concentrated around these cities (an approximate 26% increase over the last 10 years), driven by favorable career opportunities and job prospects in the technology and farming industries, increasing opportunities for entrepreneurs, a business-friendly tax and regulation environment, and low crime rates. With the emergence of remote work since the outbreak of the COVID-19 Pandemic, many disaffected residents of Washington, Oregon, and California – with punitive tax rates, high-crime, overcrowding, and a high cost of living – are seeking a never-before-available opportunity to live elsewhere. Additionally, California and Oregon are particularly prone to some of the most devastating natural catastrophes in the country, such as the constant threat of earthquakes and a seemingly never-ending wildfire season. In other words, Idaho, for many people, represents stress-relief

Market research indicates that there is currently only one storage facility that can accommodate outdoor recreational vehicles with outdoor, shaded storage near Mountainbound’s proposed project site. There are only four RV parks overall in the area, which are typically occupied at full capacity during prime season with a waiting list. Yet the opportunity for outdoor activities are almost endless: the Snake River area offers hiking, hundreds of miles of ATV trails, fly fishing, big- and small-game hunting, boating, kayaking, whitewater rafting, stargazing, cycling, bird watching, sandboarding, shooting sports and archery, motor sports, mountain trails, and horseback riding. Boise is 45 minutes away from the proposed Mountainbound project. Twin Falls is 90 minutes away. Bruneau Dunes

State Park is located just 25 minutes from Mountain Home, Idaho, with one of the tallest freestanding sand dunes in North America (its highest peak reaching 470 feet). And famous ski resort and celebrity-packed Sun Valley is a scenic two-hour drive from Mountain Home.

We see a tremendous opportunity to offer RV and boat storage in southwestern Idaho in a facility unlike anything people in the area have seen before. With our Mountainbound project, we hope to build a dominant, market-leading presence and benchmark for nearby RV parks, custom storage facilities, and recreational venues in general. We anticipate immediate demand and enthusiasm for our project. Our finished facility will offer 233 “man-cave” sites. We plan to have 25 of these sites available for occupancy by 2025.

Our project site is located near Mountain Home Air Force Base. In addition to providing temporary housing to travelers and outdoor and RV enthusiasts, we have been advised by state and local officials that there is a serious shortage of affordable and/or temporary housing for Air Force and civilian personnel in the area due to the rising cost of residential real estate. We anticipate offering our Mountainbound project as a partial solution to this problem, which will hopefully help alleviate some unnecessary stresses placed on our men and women in uniform and the families and civilians who support them. It is our understanding that Mountain Home Air Force Base comprises 4,500 active-duty servicemen and servicewomen, 6,000 family members, 650 civilian personnel, and 7,000 retirees who have stayed in the area following their service. The local economic impact of the base is believed to be in the range of $1 billion. We know that the vast majority of our business partners, investors, and friends are patriots who love their country as much as we do, so we are looking forward to helping our servicemen and servicewomen in this way We also strongly believe in being good citizens who make a positive impact to the areas in which we operate, and our contribution to the community in helping provide solutions to a local housing shortage for our men and women in uniform will create goodwill and favorable public opinion.

The property is located in Elmore County, Idaho, near the junction of I-84 and Highway 20, near the town of Mountain Home. The environment is high desert with vegetation typical for the area. The elevation is generally flat with some small hills, at over 3,000 feet. The property is not known to be in a flood zone. Net usable land at the site property will be around 35 out of the 46.64 acres. This project will be of a higher density use and design compared to that of our Riverbound project based on the acreage available in the prime Opportunity Zone location we have selected. (Assessor Parcel Number RP03S07E300200A)

We anticipate that a total of 11 out of the 46.64 acres of property at the site will be dedicated to interior roads, setbacks, water detention, and common areas. We will construct additional turning lanes on Highway 20 to allow customers with larger RVs and other equipment and trailers to access the property with the appropriate turning and stopping radius. A paved access road from Highway 20 will provide direct access to the heart of the proposed project site, including convenient access to the project’s entry gate, general store, and main road to the storage facility area. Access to the park will be monitored through a keypad system with each individual customer assigned their own individual keypad code.

We anticipate drilling water wells at the project site as needed, and we will construct large-capacity domestic water storage tanks and an above-ground fire tank. We will install underground pipes designated to boost water from the storage tanks to each individual site within the development.

We will install single-phase underground electrical primary conduit, wire, SES’s and transformers at the project site. Knowing that connectivity is critical in today’s virtual environment, we will build a 46-foot-tall communications tower for the delivery of WiFi services to our customers and common areas.

Using innovative technology, we will design and install our own state of the art wastewater treatment plant. Our plant will be constructed using the EZ-Treat products, allowing for future water reuse within the development, with the goal of being recognized as a “Green Facility ” Each individual RV pad and man-cave site will include a dedicated lateral septic line, allowing users to dump directly into this advanced treatment system.

The park will have a pool and jacuzzi, a dog park, a pickleball court, basketball courts, showers, bathrooms, access to off-road trails, a wash facility for vehicles, a general store, a septic dump, VIP concierge services, and maintenance and other related services. An on-site manager will be available. We will provide 24/7 video security for the park

Each individual RV site/unit will comprise one-tenth of an acre, or 4,356 square feet (generally 66’ x 66’). This is sufficient to construct a 40' x 50' storage structure on each RV site (leaving a minimum of 13 feet of open width on either side of each structure), with a 20' x 50' enclosed “man-cave” structure and a 20' x 50' lean-to awning area wide enough and long enough to park Class A motor coaches up to 45 feet in length. Our design concept is fully customizable and built to suit. Man-cave structures can be designed as an oversized living room area, with a minibar, with indoor sleeping areas, bathrooms, additional interior storage, or any other amenities an individual user may desire. The 26 feet between each structure (13 feet on each side of each unit) will allow for outdoor storage, kitchen areas, fire pits, or casitas. Each unit will include its own driveway from the project’s interior streets. If a user requests a custom-sized storage unit for storage of longer RVs, boats, or other equipment we will generally be able to accommodate those requests with a slight adjustment to the configuration of a particular site. We will adhere to all federal, state, county, and local laws and regulations in the construction of individual RV sites. We will also have available a few drive through units allowing the RV owner the luxury of not ever having to back in or out of their unit.

Empirical data and extensive market analysis reveals that demand for this type of multi-use in Idaho is very strong. Reports have shown that the national average for self-storage rental is $0.50/square foot. In Idaho, our preliminary analysis shows self-storage rates averaging between $0.35/square foot and $0.55/square foot. Recent market research shows very limited availability for both indoor and outdoor storage with extended waiting lists for larger-size storage units. We have built our larger-size storage units with this demand in mind. Our Riverbound project near Lake Havasu, Arizona, continues to have a waiting list.

The storage and warehouse leasing industry is one of the fastest growing sectors of commercial real estate. With RV sales breaking all-time records over the last several years in a row, we expect demand to be high and remain high. In Idaho, self-storage facilities enjoy a huge demand for RV, boat, and ATV storage.

A combination of factors – increased work-from-home opportunities resulting from technological and communications advances, the COVID-19 Pandemic, high taxes in neighboring states, over-crowded metropolitan areas, the availability of online shopping, and so forth – have created a perfect storm for “urban flight.” We fully expect demand for rural or semi-rural retreats with modern amenities to continue to increase. In addition,

tourism in southeastern Idaho is consistently steady, with many high-interest and always-in-demand areas near the project site, including the Snake River, Sun Valley, and Bruneau Dunes State Park. We are confident that local and regional interest in storage units with the anticipated amenities at Mountainbound Custom Storage & RV Park will be high because more and more people are relying on RVs for their living arrangements as opposed to hotel and motel accommodations. Our primary anticipated users are RV owners, but we also expect demand from off-roaders, ATV owners, and boaters who travel and play in the western U.S.

The self-storage industry really started in the late 1960s when a few far-sighted people recognized the growing need for residential and commercial storage. The industry has doubled in size each decade since. Returns on investment have been very impressive: over twice that of other forms of real estate investment. Self-storage demand has been on the rise as society has changed with more mobility, tendency to live in rental apartments with limited storage space, and the general increase in property especially leisure articles such as wind surfers, jet skis, RVs, motorcycles, and ATVs. The cost to operate a self-storage facility is minimal in comparison to other real estate ventures, leading to larger profit margins and stronger market caps.

Mountainbound Custom Storage & RV Park will offer a unique storage facility to help meet the increased demand in the Mountain Home area. Features include:

Built-to-suit “man-cave” steel structures on private, one-tenth acre pads including side awnings, outdoor usable space, side awnings, and full RV hook-ups

Cement pads

Climate-controlled environments

Sewage collection, water service, robust electrical service, and WiFi connectivity

On-site 24/7 security including streaming video surveillance via WiFi

Coin-operated laundromat, wash station, general store, pool and jacuzzi, and common areas

Self-service fuel station, including high octane gas, diesel fuel, and propane

Kids play area and dog park

Pickleball & basketball courts

Manager’s office

VIP concierge service to include "on-call" washing/detailing, mobile mechanic, fuel, and towing

Mountainbound Custom Storage & RV Park is expecting, based on current occupancy percentages, to sell or rent 80%-90% of its available units to non-resident purchasers/tenants and the remaining 10%-20% to Idaho residents. We anticipate developing a total of 233 man-caves of diverse size and features, along with full-service RV pads in a location with over 20,000 vehicles passing the project site on I-84 and Highway 20 each day Mountain Home is the midpoint between Twin Falls and Boise and has traditionally been the primary stopping point for travelers between those two cities. The area is well known for its agriculture, scenery, and eco-tourism. What is less well known is that Boise is home to major technology companies (Micron, Cradlepoint, Intuit, American Semiconductor) and a large Amazon administrative office, which supports a well-educated and upwardly

mobile workforce. The present supply of existing RV and boat/toy storage is currently insufficient to meet the demand for these facilities in the western United States. We want to position the Mountainbound project as a destination not only to meet current demand, but also in anticipation of future demand from this ever-growing area.

We will look into various development incentives, including urban renewal credits, fee waivers, build-to-suit incentives, small employer growth incentives, Idaho business advantage incentives, workforce training fund, and various state and local tax credits and temporary incentive abatements. Idaho’s tax rates are competitive, ranking 17th-lowest in the nation, and its health insurance costs are the lowest in the nation.

One of the best ways to compare real-estate investments is to look at the performance of self-storage and other real-estate investments during the past decade. Recently, we completed an in-depth study of the performance of multifamily, office, retail, and self-storage developments in Texas, Oklahoma, New Mexico, and Colorado, and found some staggering statistics:

The number of self-storage properties that ended up for sale in real-estate portfolios analyzed were substantially less than other real-estate properties during the same time period.

Storage facilities and RV Parks thrive in both good and bad economies. Good economies are related to increase in purchases including real estate, vehicles, and personal property. RV sales have been booming over the last several years breaking all-time sales records for the RV industry Storage facilities and RV parks have experienced nationwide outages because of the massive increase in RV and other recreational vehicle use and storage. On the commercial side increased business activity means an increased volume of self-storage commercial tenants.

In bad economies consumers often downsize and have even more use for Storage and RV facilities. Retirees are known to sell their primary home with the intention of moving into an RV facility and using that location as their home base to allow them opportunities for extended travel.

Commercial businesses downsize utilizing self-storage for a more economic means of warehousing inventory. During downswings in the economy multi-family occupancies drop as much as 25 percent while office and retail occupancies drop as much as 30 percent. Who are the office and retail tenants? Businesses that have either failed, downsized operations and moved to a cheaper property or completely moved to another market. This is lost income to office and retail properties and it is not recovered until the markets improve. Self-storage will also have an initial drop in occupancy which differs from one market to another but usually averages b etween 15 percent and 20 percent. A typical self-storage property has a break-even occupancy rate between 60 percent and 72 percent. Compare this to leveraged multifamily, office and retail properties with a break-even occupancy rate between 80 percent and 90 percent. Which real-estate investment has more room to absorb market declines?

Our experience in the sale and leasing of self-storage and RV facilities is extensive now that we have completed the first phase of our Riverbound project in Lake Havasu. Our marketing has been focused primarily on social media and regular email blasts to our large mailing list, but we also generate a surprising amount of interest from people driving by our Riverbound facility. We also have benefitted from a lot of highly complimentary word of mouth. We pride ourselves on our telephone manners and professional handling of on-site inquiries. Even though there excess of demand over supply, an unfriendly or clumsiness over the telephone or in person cause needless lost sales. Our goal is to maximize starting prices and keep an eye on the mark prices increase as demand and popularity project increases.

We anticipate a starting base price of $244,500 a $599/month ground lease) for a 40' x 50'

a 20' x 50' enclosed man-cave structure and a 20' x 50' lean-to awning, which will also include full RV hookups. Our plan is to increase rates slowly over time to maximize profits while at the same time providing bargain basement pricing for our customers. The use of modern technology and futuristic consumer tracking software will allow us to stay at or below market pricing. We can also achieve similar results by reviewing our rent roll on a monthly basis and setting parameters by which we raise existing customers’ rental rates every 12-24 months.

Because demand has been outstripping supply in the RV storage market for some time, Mountainbound Custom Storage & RV Park should be in a constant state of full occupancy with an ongoing waiting list. Monthly prices paid for self-storage units will reflect this strong market demand. Units will start at approximately $0.40 per square foot per month (4,356 ft2), or over $1,749/month. Given our track record at the Riverbound project, we anticipate 100% occupancy the first year, either through sales or monthly rentals, at our Mountainbound project. Our expectations are to remain at or just below 100% occupancy at all

times. Our model is based on customizing storage units to directly meet consumer needs, and as such it makes sense to initiate a contract on a pre-lease or presale basis and in-person presentation.

Not to be forgotten, we will have a spacious general store that will sell items such as ice, refreshments, snacks, sandwiches, drinks, beer, and wine, and we anticipate a healthy amount of income from the general store that will help offset ongoing administrative costs and property taxes at the site, allowing us to stay cash flow positive.

Self-storage units are in high demand as a result of the shrinking size of residential real estate and insufficient garage or yard space. An estimated 40% to 55% of consumers now use self-storage facilities to store personal items such as seasonal decorations, unused furniture, mementos, and other items, along with larger items such as RVs, ATVs, and boats. For non-residents who want to make Idaho a regular travel destination (estimated at 80% of our facility), storing items at a facility like Mountainbound is para-

mount. Users do not want to transport their personal effects back and forth every time they travel to the area. Non-residential and Idaho resident self-storage utilization rates are expected to increase at a 5% annual rate (that has been the average growth rate in the western U.S. for some time). Generally, spots like Mountain Home are a popular destination for affluent Baby Boomers for leisure travel, given the diverse range of activities to enjoy in the area.

Will customers have access to climate-controlled storage units or “man-caves”?

Yes. Upon request we will make sure each customer has access to climate control for their steel shed. With temperatures well above 85 degrees for most of the summer, and dipping below freezing in the winter, we do anticipate climate-control features to be widely requested.

Will park residents be responsible for payment of

Yes. In all fairness to each individual park resident, we will use modern technology allowing us to electronically monitor water and electric usage for all park sites (units). Each customer will be charged for their usage only. Septic and sewage costs will be built into monthly fees and/or rents collected.

numerous locations, our park will allow users to store everything in one spot. RV owners nationwide will be using our facility as a home base for extended stays and opportunities for day-trip excursions to Boise, Twin Falls, Sun Valley, Bruneau Dunes State Park, and the Snake River, among other local attractions.

Is there any other facility in the Idaho area with

No. In fact, Mountainbound Custom Storage & RV Park is now only the second facility of its kind, following in the footsteps of our extremely popular Riverbound project in Lake Havasu. Among other amenities, unlike most facilities we will offer a transportation/concierge-type service to our customers for an added fee. This service can include fueling, detailing, and even drop-off/pick-up at the customer's instructions. We are looking forward to hosting a long-term community of outdoor recreation and RV travel enthusiasts.

Yes. While we are a new concept and feature state-of-the art facilities and amenities, we are conscientious of the market in which we plan to operate and have projected our pricing accordingly. Other than our Riverbound project in Lake Havasu, there is really no other facility in the western U.S. that can match what we are offering. It is a one-of-a-kind concept. We are targeting long-term RV community residents with needs for a larger, climate-controlled storage unit and “man-cave” amenities. Instead of storing RVs, ATVs, off-road vehicles, boats, and personal property in

I’m interested in customizing my own “man-cave”. Will I be allowed to buy the structure?

We do anticipate demand for sales of the “man-caves”. Since we are promoting customization, we want to offer our own customizing services to each of our customers. We will follow all state, county and local laws and regulations related to possible sales and customizations of ”man-caves”

$1,258,440 $2,639,130 $4,151,250 $2,902,280 $2,008,895 $5,033,760 $10,556,520 $16,605,000 $11,609,120 $8,035,579

¹Some storage units could be rented, not sold. Anticipated monthly rental price is currently $1,749/month. Based on our track record at the Riverbound project in the Lake Havasu area, however, we currently expect all units to be sold, not rented.

²

Reflects a 5% year-over-year per unit price increase.

³2025 Operational expenses are based on total average expenses for the previous 6 Quarters at Riverbound RV Resort.

4Does not include ground lease revenues for sold units at $599/month or short term rental revenues. Also does not include Cash Flow once the business is stabilized, although this amount in reality will fluctuate year over year.

general store and other income from site amenities and profit centers. $250,000/year could be attributed to Net Anticipated

This Projected Cash Flow includes forecasts that represent the assumptions and expectations in light of currently available information. These forecasts, etc., are based on industry trends, and other factors, and they involve risks, variables, and uncertainties. They should be read, along with our other projections and anticipated results of operations in this document, as “forward-looking statements” under applicable securities laws. Actual performance may, and likely will, differ from these projections, but we are basing them on the best available information we have, including our track record at the Riverbound project in Lake Havasu, Arizona, and extensive market analysis. No guarantee is presented or implied as to the accuracy of specific forecasts, projections, or predictive statements contained in this cash flow analysis specifically, or in this project brochure generally.

In 2018, then-President Donald J. Trump signed into law the most sweeping tax legislation in a generation, which included the creation of federal “opportunity zones, ” traditionally underdeveloped areas of the United States in need of private investment in infrastructure The Mountainbound project lies within a federally designated Opportunity Zone. As such, the 2018 legislation allows investors to invest in our project with capital gains funds (from sales of appreciated real property, stocks, private business interests, and other capital assets) and to defer those gains to future years.

Qualified investors in the Mountainbound project will have the opportunity to defer taxes on capital gains invested in this project and defer capital gains taxes on sold capital assets, and to get additional tax relief relating to their investment in Mountainbound Custom Storage & RV Park (the legislation allows for nonrecognition of the gain related to appreciation of the opportunity-zone project value). With billions in capital gains on the table, investors, hedge funds, banks, and other financial institutions now have what could be a once-in-a-lifetime opportunity to save substantially on taxes. We urge you to consult with your individual tax advisor regarding Opportunity Zone investments. We cannot provide individual tax advice But you may call us anytime for general details about this tax legislation and its impact on our Mountainbound project (877-917-0142). You may also access the Investor Relations portal on our website to learn more In addition, you can refer to our Riverbound project as to its status as a Qualified Opportunity Fund at https://www.ncsha.org/resource/opportunity-zone-fund directory/ (we will similarly certify and qualify the Mountainbound project in that directory).

Example 1: Sale of stock and investment in QOF; deferral of tax and potential permanent elimination of appreciation in the QOF investment

Suppose an investor sells stock in his investment portfolio at a total capital gain of $100,000. Rather than pay capital gains tax on that amount, by investing that $100,000 in gains into a QOF within 180 days of actually realizing those gains he will be able to defer paying those taxes until the year 2027 (the continuing impact of the Covid-19 Pandemic may extend that period further). In the meantime, while deferring payment on his capital gain, our hypothetical investor will be able to invest the entire $100,000 gain, as opposed to after-tax funds, into the Mountainbound QOF and enjoy a return on a $100,000 investment rather than an after-tax investment of $80,000 or less.

But that’s not all. Opportunity Zone investments allow investors to eliminate capital gains tax on all appreciation (increases in value) of their investment in an Opportunity Zone project if the project is held by the original developer/owner for 10 years. Thus, if the value of our hypothetical investor’s Mountainbound investment grows at what we believe to be a conservative 8% per year, such that our investor’s investment has grown by another approximate $100,000, none of that $100,000 in appreciation will be subject to capital gains tax when the Mountainbound project is sold or the investor sells his investment in the Mountainbound project

An excellent way of saving thousands or in some cases millions in taxes is to invest the capital gains realized from the sale of real estate in a QOF. Retirees who are looking to downsize and travel may find that an investment in our Mountainbound QOF is the ideal way to save thousands/millions in federal taxes

Suppose a hypothetical investor has recently retired and is looking to sell her principal residence and move into a smaller home. She has the option of completing a 1031 like-kind exchange, allowing her to move into like-kind property using all or most of the funds received from the sale of her principal residence. There are tax-deferral benefits to a 1031 like-kind exchange, but where a home seller is looking to downsize, the difficulty is finding a “downsize” property that utilizes all the cash received in the sale of the bigger home. Any cash received in a like-kind exchange is generally immediately taxed

If, however, our investor takes the “cash-boot” and invests the gain from the sale of her bigger home into our Mountainbound QOF, she will get the tax-deferral benefits described in Example 1 and will not need to use all of the proceeds from the sale of her bigger home, allowing her to complete her objective of downsizing and purchasing a small home while still avoiding immed iate capital-gains tax

** This brochure and its content is for informational purposes only. We recommend you do your own research and analysis before making an investment into an Opportunity Zone Fund

This opportunity zone contains most of the city’s commercial and retail business, including a 400 acre industrial campus.

It is a few short miles from Mountain Home Air Force Base, a military installation

estimated to have an annual economic impact of $965 million.

The zone consists of approximately one third of the city of Mountain Home as well as the entire downtown corridor

1. E. 8th N., American Legion Blvd.

5.7 - 157 acre lots suitable for commercial or general business.

2. US 20 and Hot Creek Road

10 acres zoned for light industrial and wholes distribution with access to fiber, power and gas.

3. 3100 Foothills Avenue

46.64 acres of development land

I-84 frontage, surrounded by travel-related services.

84

Access to Interstate 84 and Idaho State Highways 20 and 30

Mountain Home Air Force Base

Access to railways

Old Oregon Trail and Bruneau Sand Dunes

14,314 Population

Elmore County, where this opportunity zone is located, is currently working to extend Foreign Trade Zone #280 to include all of Elmore County The Foreign Trade Zone will help better position the area for private investment. This will have a direct impact on proposed industrial park and new housing in large-phased subdivisions.

$51,640

A major goal for this opportunity zone is the attraction of private investment in housing to alleviate the housing shortage and better support Mountain Home Air Force Base with potential expansion and basing decisions in the future.

Mountain Home recently completed a downtown master redevelopment plan which will result in approximately $2.2 million in improvements to underground utilities, streets and sidewalks. The improved walkability and aesthetics is likely to attract both visitors and investment.

Mountain Home has acquired 6.39 miles of railroad main and 0.55 miles of siding from the United States Air Force to develop an industrial park along with a private investor in the contiguous tract 16039960400. The proposed rail park will be approximately 350 acres with a potential to be larger

The investor plans to invest in infrastructure at this site to ensure the railway meets Union Pacific standards, while also upgrading the infrastructure in the area.

“Business valuation is a process and a set of procedures used to estimate the economic value of an owner's interest in a business. Valuation is used by

ey are willing to pay or receive to effect a sale of a business” https://en wikipedia.org/wiki/Business_valuation. A little thinking about the term will ve us some insight into ways of determining an

why someone wants to own either a storage faciliand/or an RV park. The answer is almost always that they want the current income with a potential for growth in that income over time and the ability sell the facility at some time in the future at a

and/or a self-storage facility is for income. With less

percentages are much higher than other types of real estate investments. The principle underlying theme of value as it relates to self-storage is the ability of the facility to generate income and to continue to compete against other self-storage facilities for the business available in the marketplace. Little concern is given to any characteristic of the facility in the valuation process that does not contribute to the production of income. Thus, to

understand not only the amount of income generated by the project, but also the nature and reliability the income. This income “stream” must then be compared to other forms of investment to determine the appropriate level of return on investment that induce buyers to buy self-storage facilities ather than other types of investments.

“Business valuation is a process and a set of procedures used to estimate the economic value of an owner's interest in a business. Valuation is used by financial market participants to determine the price they are willing to pay or receive to effect a sale of a business” https://en wikipedia.org/wiki/Business_valuation. A little thinking about the term will give us some insight into ways of determining an accurate measure of value. The first question to ask is why someone wants to own either a storage facility and/or an RV park. The answer is almost always that they want the current income with a potential for growth in that income over time and the ability to sell the facility at some time in the future at a profit. In reality, the only reason to buy an RV park and/or a self-storage facility is for income. With less expenses in operating these facilities, profit percentages are much higher than other types of real estate investments. The principle underlying theme of value as it relates to self-storage is the ability of the facility to generate income and to continue to compete against other self-storage facilities for the business available in the marketplace. Little concern is given to any characteristic of the facility in the valuation process that does not contribute to the production of income. Thus, to measure the value of a given faclility, we have to first understand not only the amount of income generated by the project, but also the nature and reliability of the income. This income “stream” must then be compared to other forms of investment to determine the appropriate level of return on investment that induces buyers to buy self-storage facilities rather than other types of investments.

self-storage and RV parks, and most other income producing real estate, the source of value is either current actual income or the reasonable potential of future income. The potential future income can come in the form of either increased actual income the proceeds from a sale of the property Income seems like an easy word to understand, but in determining real estate value, the term income has sever-

what is included in income. For purposes of deter-

ing Income (NOI) is important. NOI is merely the

product of subtracting the Operating Expenses from the Operating Revenues. Operating Revenues are those revenues that are generated from the day to day operations of the facility such as rents, reasonable late fees, lock sales, box sales, and other ancillary business revenue. Operating revenues are not proceeds of sales of equipment or partnerships in the property, insurance claim payments, proceeds

key to understanding Operating Revenues is they occur in the ordinary course of the primary business on a recurring basis. In the case of self-storage business, this is collecting rents from tenants. Other revenue can be included only if it is ancillary to the core business of renting spaces to tenants. Other revenues will not be considered as real estate in valuing the project if they become more than ancillary to the real estate business. For example, if box sales contributed sixty percent of the total revenue, that income would be viewed as income of another business rather than real estate value, which unfortunately is less valuable than real estate.

the Operating Expenses from the Operating Revenues. Operating Revenues are those revenues that are generated from the day to day operations of the facility such as rents, reasonable late fees, lock sales, box sales, and other ancillary business revenue. Operating revenues are not proceeds of sales of equipment or partnerships in the property, insurance claim payments, proceeds of refinancing, or other non-recurring income. The key to understanding Operating Revenues is they occur in the ordinary course of the primary business on a recurring basis. In the case of self-storage business, this is collecting rents from tenants. Other revenue can be included only if it is ancillary to the core business of renting spaces to tenants. Other revenues will not be considered as real estate in valuing the project if they become more than ancillary to the real estate business. For example, if box sales contributed sixty percent of the total revenue, that income would be viewed as income of another business rather than real estate value, which unfortunately is less valuable than real estate.

Operating expenses used in valuation are most interesting for what they do not include. Operating expenses do not include interest, depreciation, large equipment costs or amortization on a loan. Also, for valuation purposes, operating expenses do not encompass any personal expenses. However, operating expenses may include some things that are not currently being paid for by the facility such as management fees. The reason for including management fees, even if they are not currently being paid, is that the next owner would have to pay them or provide the service himself Operating expenses that are used in valuing the property can also include increased property taxes caused by the sale of the property because the new buyer will have higher tax expenses (thus, less income) than the current owner The expenses that are included are the usual recurring costs such as labor, utilities, legal, insurance, advertising, repairs, and telephone. “Net” generally equals operating revenues minus operating expenses equaling the net operating income (NOI). As an example, assume the operating revenues are $1,000,000.00 and the operating expenses are $350,000.00 (35%) for a resulting NOI of $650,000.00.

In self-storage and RV parks, and most other income producing real estate, the source of value is either current actual income or the reasonable potential of future income. The potential future income can come in the form of either increased actual income or the proceeds from a sale of the property. Income seems like an easy word to understand, but in determining real estate value, the term income has several meanings, and we need to further define exactly what is included in income. For purposes of determining value, the definition of the term Net Operating Income (NOI) is important. NOI is merely the product of subtracting

Operating expenses used in valuation are most interesting for what they do not include. Operating expenses do not include interest, depreciation, large equipment costs or amortization on a loan.

Also, for valuation purposes, operating expenses do not encompass any personal expenses. However, operating expenses may include some things that are not currently being paid for by the facility such as management fees. The reason for including management fees, even if they are not currently being paid, is that the next owner would have to pay them or provide the service himself. Operating expenses that are used in valuing the property can also include increased property taxes caused by the sale of the property because the new buyer will have higher tax expenses (thus, less income) than the current owner. The expenses that are included are the usual recurring costs such as labor, utilities, legal, insurance, advertising, repairs, and telephone. “Net” generally equals operating revenues minus operating expenses equaling the net operating income (NOI). As an example, assume the operating revenues are $1,000,000.00 and the operating expenses are $350,000.00 (35%) for a resulting NOI of $650,000.00.

Now that the NOI has been calculated, it must be determined what reasonable buyers in the marketplace will pay for the level of NOI the facility has available to a new owner This relates to the buyer’s perception of risk and his requirement for a return on investment. The market value of the property is the capitalized value of the income stream that can be reasonably expected to be achieved in the marketplace while meeting the return on investment expectations of buyers. How is the expected rate of return on investment (ROI) determined for the marketplace? Most commonly, appraisers will use comparable sales to help determine value. In this case, previous sales of self-storage facilities and RV parks are examined to determine what rate of return buyers demanded to earn in order to purchase a given facility For Example: A comparable sale may have been a first-class project in a large metropolitan area with an NOI of $160,000 and sales price $1,641,000. This would indicate the buyer required a 9.75% return on NOI and the seller would

Now that the NOI has been calculated, it must be determined what reasonable buyers in the marketplace will pay for the level of NOI the facility has available to a new owner This relates to the buyer’s perception of risk and his requirement for a return on investment. The market value of the property is the capitalized value of the income stream that can be reasonably expected to be achieved in the marketplace while meeting the return on investment expectations of buyers. How is the expected rate of return on investment (ROI) determined for

use comparable sales to help determine value. In this case, previous sales of self-storage facilities and RV parks are examined to determine what rate of return buyers demanded to earn in order to purchase a given facility For Example: A comparametropolitan area with an NOI of $160,000 and sales price $1,641,000. This would indicate the buyer required a 9.75% return on NOI and the of a town

accept that return. Another sale of a Class C facility in a small declining industrial town sold with a $120,000 NOI and a sales price of $1,043,000, indicating that the buyer was willing to buy only if he could achieve a return of 11.5% on this less attractive property because he thought there was more risk and less potential for income growth. After researching many such sales, it has become clear the market for selling self-storage facilities exists almost exclusively at capitalization rates of return to the buyer of between 9.0% for the very best properties and 11.5% for the properties with the most risk and least quality. When this project reaches full occupancy and records steady income for a number of years (we will hold the project long enough to ensure compliance with the Opportunity Zone rules) our investors should expect to be in a preferred position to sell to a real estate investment trust (REIT), private equity firm, or a large regionally/nationally recognized RV park or self-storage business at a significantly attractive valuation.

sold with a $120,000 NOI and a sales price of $1,043,000, indicating that the buyer was willing to buy only if he could achieve a return of 11.5% on this less attractive property because he thought there was more risk and less potential for income growth. After researching many such sales, it has become clear the market for selling self-storage facilities exists almost exclusively at capitalization rates of return to the buyer of between 9.0% for the very best properties and 11.5% for the properties with the most risk and least quality When this project reaches full occupancy and records steady income for a number of years (we will hold the project long enough to ensure compliance with the Opportunity Zone rules) our investors should expect to be in a preferred position to sell to a real or a large regionally/nationally recognized RV park valuation.

December 22, 2021

RE: Riverbound Custom Storage & RV Park Sent via Email and US Post Mail

Dear City of Mountain Home,

This letter is in support of the efforts of Riverbound Custom Storage & RV Park in your town.

Lake Havasu City is home to over 57,000 citizens, and hosts hundreds of events each year and welcomes nearly one million visitors annually. Riverbound is a professional development that offers alternative housing solutions outside of our city limits and has created jobs for our community through construction and ongoing management.

Aside from providing economic benefits to our community, Riverbound Custom Storage & RV Parts has been a good partner in our community.

On behalf of Lake Havasu City, we are pleased with Riverbound’s performance and reputation in the community, and pledge our support for their efforts in other communities.

Please do not hesitate to contact my office for any questions or additional information at (928) 453-4152.

Sincerely,

Cal Sheehy Mayor, Lake Havasu City

Cc: Ryan Rodney, Riverbound Custom Storage & RV

2330 McCulloch Boulevard N., Lake Havasu City, Arizona 86403-5950 (928) 453-4152 sheehyc@lhcaz.gov www.lhcaz.gov

they so choose,” he said. “This cuts down the grunt work for tenants so they can spend more time with family and friends and not have to worry about the time and expense that’s typically associated with getting ready

Mountain Home City Council approved the project in October, and while an official groundbreaking date has not been announced yet, officials estimate construction will begin in the spring of 2023. Extensive improvements will need to be made to develop the site, including bringing sewer, water and

“First, the tract is in a Federal Qualified Opportunity Zone so our accredited investors would reap the special tax deferment benefits,” he said. “Next, we noticed that an attractive percentage of our tenants at our Arizona location had Idaho addresses, and a handful came up to me and said our

Once the project is completed, Rodney said he doesn’t plan on acquiring additional property in other parts of Idaho for similar projects.

“Mountainbound will significantly increase the customer base in the area,” he explained. “Residents of Mountainbound will fill up at Mountain Home gas stations, eat at Mountain Home restaurants and shop at Mountain Home stores.”

Home residents have their RV/boat storage needs met and are provided alternative short-term and long-term living options. Lastly, the unique nature of the development will increase the curiosity of those traveling along the interstate to the point they need to see what is happening for

https://idahobusinessreview.com/2022/12/15/custom-rv-storage-and-park-coming-to-mountain-home/

occupy a funeral home. Coming near you

BY DAVID STAATS, RACHEL SPACEK, IAN MAX STEVENSON, AND MICHELLE JENKINS

UPDATED DECEMBER 07, 2022 12:43 PM

AROUND IDAHO

A recreational-vehicle park and storage center of Interstate 84 southeast of Boise. One city

The Mountainbound Custom Storage & RV Park

The Mountainbound Custom Storage & RV Park says it will offer “amenities like no other RV Park in the area: a general store, laundromat, swimming pool and spa, fitness center, community fire pit, tennis court, pickle ball court, basketball court, a kids park, and a dog exercise area.” Provided by city of Mountain Home

Mayor Rich Sykes said in the release.

The business plans units like this that could rented by the day, week or month, or could be purchased. “Store your snowmobiles, UTV’s, motorcycles, cars, boats, and skis in our community,” the company says. Provided by city of Mountain Home https://www.idahostatesman.com/article269410157.html