NPV Doesn’t Work For Risky, High-Potential Projects.

Here’s A Better Approach.

This article was co-authored with Claus Hirzmann of Strategic Finance

Never test the depth of the river with both feet.” Ironically, this is the very behavior that plagues many of the innovations that ended up in Rita’s “flops file.” From Disney’s Star Wars Hotel to Google’s Stadia to AnheuserBusch-Keurig’s DrinkWorks and more, these projects all feature massive up-front investment and detailed years-long plans. There’s a smarter way to allocate resources to big bold things.

The net present value (NPV) decision rule is widely adopted and often applied to decisions with respect to investing in innovative new ventures. The rule simply suggests that one project cash flows in and cash flows out for a given initiative over some period of time, then discount back to the present to account for the cost of capital. This is more than highly problematic for new ventures.

Here are reasons why.

That you can anticipate cash flows for a highly uncertain business over time

That you will definitely launch the business, not decide to stop it at some point

Although a lot of people will nod in agreement at this argument, when they face actual venture budgeting conversations, it is very difficult to leave the hunger for some kind of NPV calculation behind.

This is why I (Rita) was so excited to see Claus’ approach to modeling option value at work. Indeed, NPV and real options are both financial metrics for expected value creation; NPV applies to predictable, linear projects, and real options applies to agile, discovery-driven initiatives.

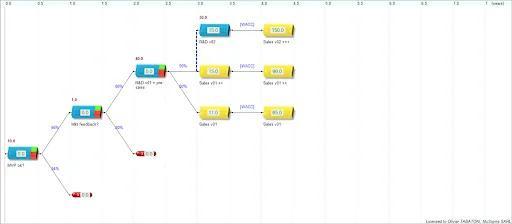

The way the software is constructed is that it models the possible paths a project might take and attaches financial assumptions to each decision. Each project step (see blue bricks) provides an option on the next step and ultimately on the financial returns (ROI, see yellow bricks). The investments in each step are shown as red figures with the possible returns as green figures. There were three major outputs from the planning process envisioned – an early proof-of-concept version of the solution, similar to a minimum viable product (MVP), version 1 of the software (V01) and the more evolved version of the software that would fully deliver the vision for it (V02).

Each step forward is assigned a probability, which allows the software to calculate the value of the option of moving forward.

Successful corporate innovators approach managing their initiatives through a portfolio approach. By using the software, each time new discoveries are available, new opportunities arise or the strategic context changes, entering new information into the software allows for dynamic recalculation of portfolio value. This valuation can drive focus and efficiency, and further can provide financial prioritization metrics, useful for allocating constrained budgets.

Innovation leaders are often accused of operating without discipline, of wasting money, and of going off on tangents when funds and talent could better be allocated to an existing business. Using disciplines such as real options modeling combined with discovery driven planning, leaders can demonstrate to the rest of the organization that thoughtful planning and execution has indeed happened. That is very different from promising specific results and is much more suitable to the high uncertainty / high reward investments in innovation than standard issue planning is.

Book Now

https://thoughtsparks.substack.com/