Canadiana Cabinets

Sustainable Growth and Operational Success

FACING THE TARIFF WAVES

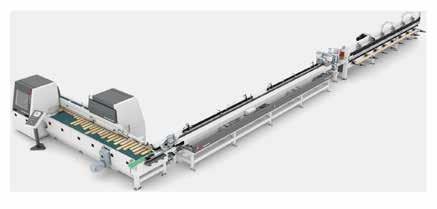

Customized RF Press Lines

KALLESOE PRESS LINES

Complete production solutions for CLT, glulam, solid wood boards, multi-layer panels, scantlings, posts, and beams.

• Custom-made and highly technological RF (radio frequency) presses and production lines

• Optimized for flexibility and just-in-time production

• High-capacity lines with reliable production flow

• Long equipment lifespan with upgrade possibilities

Timber Processing Solutions

TIMBER PROCESSING SOLUTIONS

System TM is the world’s leading fullsolution provider of integrated solutions for the solid wood industry.

• Automated production systems designed to increase your capacity, improve efficiency, and reduce labor costs

• End-to-end solutions built around your needs, from production line design and installation to training and maintenance

• Seamless machinery and software integration, including optimizing crosscut saws, finger-jointing systems, material handling, and more

KALLESOE COMBI-PRESS LINE

12

FROM AUTOMATION TO ADOPTION

AI, CNC and robotics reshape prefab manufacturing, but adoption hinges on skilled teams and training partnerships, writes Akhurst Machinery’s Jayden Campbell, outlining steps manufacturers take to align people and processes.

16

WOODWORKING TECHNOLOGY DAYS 2025

Explore nine GTA showrooms with expanded space, live machinery and software demos, plus consultations from distributors including Akhurst, Biesse, HOMAG, SCM, Felder, IMA Schelling, Weinig Holz-Her, Normand, and Taurus Craco.

40

BETWEEN

THE GRAIN AND THE GRIND

CFIB’s Francesca Basta reports wood manufacturing SMEs squeezed by trade uncertainty, rising costs, weak demand and skills gaps; confidence falling, fixes include labour mobility, training, regulatory relief and trade supports.

50

FACING THE TARIFF TIDE

WMCO’s Brayden DeWitt outlines Cayuga Displays’ tariff strategy: shared costs, differentiation, communication, cluster support. Automation and ERP investments help Ontario manufacturers preserve relationships, stay competitive, and pursue new global markets.

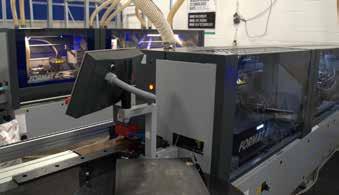

CANADIANA CABINETS

Family-run Canadiana Cabinets scaled smartly through digital SOPs, kanban inventory and cross-trained teams. The Barkers pair custom craftsmanship with disciplined flow, reducing waste, sustaining growth, nurturing dealer and customer relationships.

CANADIANS ARE COMING TOGETHER

In times of uncertainty, connection provides clarity. Across the country, Canadian manufacturers are forming stronger networks through associations, trade events, and shared initiatives that support growth, resilience, and learning.

This issue reflects that momentum.

Associations remain essential to the health of our industry. They offer structure, advocacy, and opportunities for shared learning that individual businesses cannot achieve alone. Whether through training, standards, or peer exchange, associations help wood manufacturers stay informed, supported, and connected across regions and company sizes.

The Canadian Kitchen Cabinet Association will host its 2025 National Forum in Kelowna this September, bringing together manufacturers and suppliers for education, plant tours, and focused discussion. Events like this strengthen peer relationships and create space for timely problem-solving.

The Architectural Woodwork Manufacturers Association of Canada continues to advance its training and inclusion efforts. In a feature by Carolynne Yeomans and Kasia Robinson, we meet Shiori Ito, the 2025 AWMAC National Apprenticeship Contest winner. Her path into woodworking underscores the importance of mentorship, visibility, and access in shaping a strong, diverse workforce.

The Wood Manufacturing Cluster of Ontario supports manufacturers in navigating ongoing trade and cost pressures. In Brayden DeWitt’s article, Cayuga Displays shows how strategic product planning and ERP adoption—supported through WMCO’s network—can turn economic challenges into operational gains.

Upcoming trade events extend this collaborative momentum. Woodworking Technology Days and WMS 2025 will provide platforms for hands-on learning, technology evaluation, and industry-wide conversation. These shows allow manufacturers to make informed decisions in real time, directly engaging with suppliers and peers.

Innovation in production is also a central focus this issue. In his column for Akhurst Machinery, Jayden Campbell outlines how off-site construction is advancing through automation, regulatory adaptation, and workforce development. In a complementary article by Sahar Aslani and Don Goudreau of Biesse, first-time CNC buyers are guided through critical decision points that influence both present efficiency and future flexibility. Together, these pieces demonstrate how investment in technology and training can drive meaningful progress.

Inside the shop, we visit Canadiana Cabinets, where digital SOPs, lean inventory systems, and a supportive workplace culture enable controlled, sustainable growth. Their example reflects a broader shift across the sector—measured progress built on shared knowledge and sound systems.

As the season of trade shows and forums unfolds, one thing is clear: Canadian wood manufacturing moves forward when it moves together. From national associations to local shop floors, connection remains our strongest tool.

Thank you for reading, and for continuing to be part of that progress.

ART DIRECTOR

PUBLISHER

Jake Blanchard jakeb@mediaedge.ca

EDITOR Tyler Holt tylerh@mediaedge.ca

PRESIDENT Kevin Brown kevinb@mediaedge.ca

PRODUCTION MANAGER

Ines Louis Inesl@mediaedge.ca

Published by

Annette Carlucci annettec@mediaedge.ca

GRAPHIC DESIGNER

Thuy Huynh-Guinane roxyh@mediaedge.ca

CIRCULATION circulation@mediaedge.ca

Wood Industry is published four times annually, Spring, Summer, Fall, Winter, for the secondary wood products manufacturing and marketing industries in Canada. Subscriptions are free to qualified participants in Canada’s secondary wood processing industry. Subscribe at www.woodindustry.ca. Paid subscriptions rates: $40 to Cana dian addresses, $60 U.S. and foreign, $20 student rate. Please mail payment to Wood Industry, 251 Consumers Road, Suite 1020 Toronto, Ontario M2J 4R3. For subscription inquiries, e-mail circulation@mediaedge.ca

© 2025 by MediaEdge Communications All rights reserved. MediaEdge Communications and Wood Industry disclaim any warranty as to the accuracy, completeness or currency of the contents of this publication and disclaims all liability in respect to the results of any action taken or not taken in reliance upon information in this publication. The opinions of the columnists and writers are their own and are in no way influenced by or representative of the opinions of Wood Industry or MediaEdge Communications

Tyler Holt

A Pocket Door System That Listens

www.blum.com/ca-revego

Canusa Wood is celebrating its 50th anniversary in 2025, marking five decades of growth and operational resilience. Founded in 1975 as a joint venture, the company has remained privately owned, navigating recessions, trade shifts, and global supply disruptions. Canusa gained early traction during the 1980s downturn by ensuring dependable delivery. In response to the 2017 U.S. tariffs on Chinese hardwood plywood, it introduced Premcore Plus and Kingcore to meet evolving quality and compliance demands. A 2000 management buyout and 2016 leadership transition to Jeevan Manhas and Ross McLaren brought modernization and expansion across North America. Now employing nearly 30 staff, the company emphasizes transparent sourcing and customer-focused solutions. “Fifty years... is proof that a steady hand and strong partnerships can go a long way,” said CEO Manhas.

Thermwood Appoints New President and EVP to Drive Continued Growth

Thermwood Corporation has promoted Jason Susnjara to President and Jennifer Watt to Executive Vice President, following the retirement of longtime President David Hildenbrand. Susnjara, with over 30 years at Thermwood, previously served as EVP and brings extensive operational and strategic experience. Watt, who joined as Chief Legal Officer in 2019, has led legal and governance functions and serves on the company’s Board. These executive shifts aim to support Thermwood’s continued innovation and expansion across CNC machining and Large Scale Additive Manufacturing. Based in Dale, Indiana, Thermwood operates a 175,000-squarefoot facility and remains a global leader in advanced manufacturing systems for woodworking, aerospace, defense, and automotive applications.

Cabico, a cabinetry manufacturer based in Coaticook, has received the 2025 Prix d’intégration innovante entreprise at the Regional Immigration Awards. Presented by the Fédération des Communautés Culturelles on May 1 in Sherbrooke, the award recognizes businesses that support immigrant integration beyond the workplace. Selected by a diverse jury from across Estrie, Cabico was praised for fostering inclusion through partnerships with local organizations, including the Centre d’action bénévole, the school board, and regional authorities. The company’s strategy helps immigrant employees adapt both professionally and personally to life in the region. “Welcoming someone into the workplace also means helping them feel at home in the community,” Cabico stated. Organizers highlighted the company’s role in strengthening regional cohesion, calling the recognition a tribute to solidarity in action.

Lisa Goulet, President and CEO of Aiguisatek, has been named one of the Top 50 Women Leaders of Montreal for 2025 by Women We Admire—her third consecutive year receiving the honour. Goulet has led the Delson-based tooling and sharpening company since 2010, transforming it into a provincial leader in precision and PCD cutting solutions. Under her direction, Aiguisatek has expanded operations and now runs from a modern, high-tech facility. With a background in healthcare management and a Master’s in Applied Sciences from McGill, Goulet brings strategic and values-based leadership to the industrial sector. She is also active in the EntreChefs PME business network and has received several regional award nominations. Goulet credited her team and partners, stating: “Every voice matters... leadership is rooted in values and in trust.”

Blum Canada has appointed Pierre Isele as its new Managing Director, effective September 1, 2025. A 15-year company veteran, Isele brings international experience across Austria, New Zealand, Asia Pacific, and the Americas. He previously held senior roles at Blum USA and Blum Austria, focusing on team development and partner engagement. Isele stated he is honoured to lead during a dynamic moment for the Canadian market, emphasizing a commitment to service, collaboration, and innovation. Blum cited his cross-regional leadership and customer-focused approach as key reasons for the appointment. In his new role, Isele will prioritize enhancing customer experience, deepening market partnerships, and supporting innovation. Blum expects his leadership to strengthen the company’s growth trajectory in Canada’s competitive furniture fittings sector.

MasterBrand Inc. will acquire rival cabinet maker American Woodmark Corp. in a $3.6 billion all-stock merger, consolidating its position as North America’s largest cabinetry manufacturer. Announced August 6, the deal grants American Woodmark shareholders 5.15 MasterBrand shares per share owned, with MasterBrand holding 63% of the combined company. The merger is expected to generate $90 million in cost synergies within three years and become earnings accretive in year two. The combined equity value stands at $2.4 billion. The move comes amid rising M&A activity in building products and long-term housing demand drivers. The merged firm will retain the MasterBrand name, be headquartered in Ohio, and maintain operations in Virginia. Closing is expected in early 2026, subject to approvals and debt refinancing.

The Canadian Kitchen Cabinet Association (CKCA) has elected three directors to its 2025/2026 Board during its June 19 Annual Meeting. Trevor Chaulk (Chaulk Woodworking) returns for another term, while Craig Bauslaugh (Columbia Kitchens) and Rishelle Tarr (Westwood Cabinets) join the board for the first time. The election drew a record eight candidates, signalling rising member engagement. Executive officers were reappointed: Amrita Bhogal (Sunrise Kitchens) continues as President, with Luke Elias (Muskoka Cabinet Company) as Vice-President, Craig Atkinson (Marathon Hardware) as Treasurer, Pete Fournier (Triangle Kitchen) as Past President, and Sandra Wood as Secretary. The 11-member board reflects a broad cross-section of the industry. The CKCA also acknowledged the retirement of long-serving members Heidi Boudreault and James Dewinetz. The next CKCA National Forum will be held in Kelowna, BC, September 23–25.

Upper Canada Forest Products (UCFP) celebrated 30 years in the British Columbia market with an event in Vancouver, bringing together customers, suppliers, and staff to recognize the company’s longstanding presence in the province’s secondary wood manufacturing sector. UCFP entered B.C. in 1995, expanding from its Ontario origins where it was founded in 1986 by Warren Spitz. Starting with a small team and a single truck, the company has grown steadily, moving its B.C. operations to Burnaby in 2005 to support product expansion and improved customer experience. Company representatives emphasized the role of relationships in driving growth: “Trust, innovation, and community have always been at the heart of our journey.” UCFP will celebrate its 40th anniversary nationally in 2026, marking four decades of industry service.

The federal government has launched a $1.2 billion strategy to modernize Canada’s softwood lumber industry and reduce reliance on U.S. exports, following a sharp increase in U.S. tariffs. Announced by Prime Minister Mark Carney in Kelowna, the plan includes $700 million in loan guarantees for restructuring and $500 million for market diversification, value-added production, and Indigenous-led forestry ventures. Nearly 90% of Canadian softwood exports currently go to the U.S. The strategy supports expanded exports to Asia and Europe and mandates Canadian lumber use in federal housing projects. Innovation funding includes investments in automation, AI, and sustainable materials. The plan also allocates $50 million for worker training and support. Industry groups welcomed the move, calling it a strong step toward long-term sector resilience and domestic demand growth.

Executive Millwork has received the 2025 GIS Award of Excellence from the Architectural Woodwork Manufacturers Association of Canada (AWMAC) for its work on the BMO Centre Expansion in Calgary. Presented at AWMAC’s President’s Gala during the national convention in Saskatoon, the award recognizes the year’s top project for craftsmanship and compliance with AWMAC’s Guarantee and Inspection Service (GIS) standards. Designed by Stantec and built with PCL Construction, the BMO Centre project was noted for its technical complexity and quality execution.

Vice President Stephanie Roll accepted the award on behalf of the company, citing the team’s collective effort. The honour highlights both Executive Millwork’s commitment to excellence and AWMAC’s emphasis on third-party quality assurance in architectural woodwork across Canada.Untitled-2 1

Roberto Selci, Chairman of Biesse S.p.A. and son of company founder Giancarlo Selci, has assumed the role of Chief Executive Officer following the resignation of Massimo Potenza on June 12, 2025. Selci now holds full executive authority, consolidating leadership during a critical phase of the company’s strategic development. Thanking Potenza for his role in shaping Biesse’s integrated, crossmaterial “One Company” structure, Selci reaffirmed the company’s continued focus on innovation and operational integration across its machinery and automation offerings for wood, glass, stone, and advanced materials. The leadership transition is not expected to impact Biesse’s long-term trajectory, with Selci now overseeing both strategic direction and execution.

Cyncly has named Jon Harper as senior vice-president of professional services, tasked with leading the implementation and support of the company’s software solutions across its global customer base. With over 20 years of experience in SaaS and consulting, Harper has held leadership roles at Protiviti, Johnson & Johnson, and Smartsheet, building high-performance service teams through periods of rapid growth. At Cyncly, he will focus on customer success and aligning services with business outcomes for designers, retailers, and manufacturers. Chief Customer Officer Kristina Lengyel cited his strong track record in value-driven delivery. Harper called the appointment “an

Teknaform, an edge banding manufacturer based in Bolton, Ontario, has donated

approximately 200 children’s books to James Bolton Public School in a literacy initiative led by employees Erica Stabile and Meena Randhawa. Timed with International Children’s Book Day in April, the drive gathered books from staff across departments and marked the company’s first major community outreach of its kind. The donated books were added to the school’s library, covering a range of genres and reading levels. Randhawa and Stabile emphasized the project’s personal value and the positive response from staff. Teknaform is exploring future initiatives, including food or clothing drives, to deepen its local engagement. “Reading opens up entire worlds,” said Stabile. “I wanted to give kids the same opportunities I had—to dream, imagine, and escape into a story.”

Dorel Industries will shut down its Cornwall, Ontario-based Ridgewood Industries facility and exit domestic furniture manufacturing as part of a major restructuring of its Dorel Home segment. The move follows a strategic review with EYParthenon and aims to restore profitability by 2026. The closure, affecting a facility that once employed 350 people, is expected to complete by Q3 2025. Dorel will retain only high-performing SKUs under its Cosco brand and consolidate back-office operations with Dorel Juvenile in Indiana. The company reported a Q2 net loss of US$44.9 million, with Home segment revenue down 43.5%. In contrast, Dorel Juvenile grew 0.8% in Q2, driven by European markets. Dorel is now focused on debt restructuring and expansion of its profitable Juvenile division.

Rover

Elevate your nesting game. Rover Multi Up N G

Precision. Autonomy. Efficiency.

Designed for manufacturers who demand more from every square foot, the Rover Multi Up N G delivers unmatched nesting flexibility, clean finishes, and scalable automation-all in one intelligent machining centre.

FROM AUTOMATION TO ADOPTION

The New Era of Building, Training, and Regulations

:: By Jayden Campbell, Product Manager, Akhurst Machinery

The off-site construction industry is entering a transformative era, one driven by groundbreaking technology, evolving workforce needs, and shifting governing landscapes. Once viewed as a niche segment of construction, prefabricated building is now at the center of conversations about efficiency, sustainability, and housing affordability. The adoption of automation, advancements in workforce development, and improvements within governing regulations are creating both opportunities and challenges for builders, manufacturers, and policymakers.

TECHNOLOGICAL INNOVATIONS IN PREFABRICATION

The modern off-site construction industry is no longer defined by repetitive manual assembly-line processes. It is now a highly sophisticated sector leveraging advanced manufacturing technologies and processes to produce precision-engineered building components.

CNC Automation and AI-driven manufacturing are streamlining design-to-production workflows. Building Information Modeling (BIM) systems are now directly linked to CNC machinery, allowing digital blueprints to be translated into physical components with minimal human intervention. AI algorithms and BIM software optimize cutting patterns, material usage, and production sequencing, minimizing waste and maximizing throughput.

Robotics are transforming the production floor. From robotic arms capable of complex joinery to mundane tasks such as sheet feeding and material organization, robotics enhance precision, reduce physical strain on workers, and allow for continuous operation.

These innovations are removing barriers between construction and manufacturing, establishing prefab as a leader in the modern building industry. While the idea that “machines don’t get tired” delivers consistent quality – essential where exact tolerances are critical for module assembly on site – technology alone is not enough. Its success depends on people.

Workforce Development and Skills for Prefabrication

The integration of CNC automation, robotics, and advanced digital design tools is reshaping the skill sets required

in prefab manufacturing. While traditional carpentry, blueprint reading, and assembly skills remain essential, the industry is now seeing heightened demand for workers proficient in:

CNC operation and digital fabrication – Translating BIM data into precise manufacturing commands.

Robotics programming and maintenance – Ensuring automated systems run at peak efficiency.

Data analytics and AI integration – Using real-time production data to improve processes.

This shift is happening as construction continues to face chronic labor shortages. Many regions in North America are already struggling to fill roles in skilled trades, and the specialized nature of new prefab technologies intensifies the challenge.

To address this, training programs and educational partnerships are evolving. Universities and technical colleges are introducing courses on digital construction methods, automation controls, and advanced manufacturing techniques. Some prefab companies are partnering with universities to develop co-op programs that immerse students in real-world production environments.

Strategic partnerships – such as those between Akhurst Machinery, H&M Machines, and X-Floc are helping drive innovation

H&M MACHINES FULLY AUTOMATED CNC FRAMING STATION WITH IN-HOUSE SOFTWARE

H&M Machines Fully Automated CNC Framing Station with in-house software

THE QUIET EDGE

JUNIOR ACOUSTICS

This low-profile hardware and retractable seal system for wood doors up to 100 kg (220 lbs) offers effective sound attenuation while blocking odors, drafts, and light. Ideal for pocket and wall-mount sliding doors, these smooth automatic seals create a quiet interior perfect for office spaces and residential kitchens. Open the door to a peaceful environment.

TALK TO AN EXPERT

1-800-619-5446

media@richelieu.com

There is also a growing emphasis on upskilling the existing workforce. Rather than replacing traditional tradespeople, automation often changes the nature of their work—transforming a carpenter into a CNC operator, or a welder into a robotic cell technician. Employers who invest in this transition benefit from retaining experienced and dedicated workers while enhancing productivity.

Importantly, workforce development is not just about technical skills. As prefab projects often involve tight timelines and precision coordination between off-site manufacturing and on-site assembly, project management, logistics planning, and cross-disciplinary communication are becoming equally valuable skills. The next generation of prefab professionals will be as comfortable reading a 3D model as they are reading a tape measure.

REGULATORY AND CODE CHALLENGES

While technology and workforce training in prefabrication are advancing rapidly, regulatory frameworks often lag. Building codes and zoning laws were largely designed for traditional construction, creating hurdles for modular adoption. Prefabricated components, especially volumetric modules, don’t always align with existing classifications, leading to delays, costly redesigns, or additional engineering sign-offs.

In Canada, CSA A277 sets the standard for factory certification of modular buildings, while CSA 2240 and 2241 address volumetric modules, helping ensure consistency in manufacturing and on-site assembly. These frameworks provide a foundation, but interjurisdictional differences remain a challenge. A module approved in one province may still face modifications before acceptance elsewhere, slowing scalability and adding costs.

Policy changes are beginning to bridge these gaps. In British Columbia, Bill 44 supports increased density and

modular solutions, positioning prefab as a key tool in addressing housing shortages. At the same time, organizations like Intertek, QAI, and CSA are collaborating with government, associations, and industry to harmonize requirements, streamline approvals, and develop performance-based codes that emphasize outcomes such as safety, energy efficiency, and structural integrity.

Together, these shifts mark progress toward a supportive environment that enables modular construction to deliver on its promise of speed, quality, and affordability—supported by solutions such as pre-approved panel designs and certified factories.

FROM AUTOMATION TO ADOPTION

The future of prefabrication and off-site construction is being shaped at the intersection of advancements in technology, workforce development, and regulation. Automation and robotics are enabling unprecedented precision and efficiency, but their true impact depends on how quickly the industry can build a skilled workforce and navigate an evolving regulatory landscape.

For manufacturers, success will hinge on integrating innovation with practical training—ensuring every new machine, software platform, or design approach is supported by workers who know how to use it effectively. For governments and regulators, the challenge is to adapt codes and policies to reflect the realities of modern construction without compromising safety or quality.

Over the next decade, prefab could evolve from an alternative building method into a mainstream standard –not only for cost savings, but for its ability to deliver sustainable, high-quality buildings faster and with fewer resources. Achieving that vision will require collaboration across sectors: technology providers, educators, construction firms, and policymakers working together to remove barriers and accelerate adoption.

Strategic partnerships—such as those between Akhurst Machinery, H&M Machines (formerly Modular Building Automation), and X-Floc are helping drive this transformation by providing the advanced machinery, training programs, and support systems needed to meet industry demand.

As the saying goes, innovation moves at the speed of adoption. The tools to revolutionize the built environment are already here—the question is whether the industry, and the systems that support it, can evolve quickly enough to seize the opportunity.

October 21 - 24, 2025

Mississauga, ON

SELEXX SERIES CNC ROUTERS

High-performance nesting CNC router for maximum output.

The Anderson Selexx Series CNC Router has been developed specifically with higher production CNC router requirements demanding the utmost precision and accuracy, all within a cost-effective investment. The Selexx is the ideal CNC router for nesting applications as it is packed with standard and optional features to maximize output.

Woodworking Technology Days 2025

Expanding Innovation Across Nine Showrooms

As President of the Canadian Woodworking Machinery Distributors Association (CWMDA) and an active exhibitor, I’m pleased to announce the 6th annual Woodworking Technology Days (WTD), scheduled for October 21–24, 2025, from 9 a.m. to 5 p.m. across nine premier showrooms in Mississauga, Brampton, Vaughan and Cambridge, ON

This event stands out as a uniquely successful “open house hop,” where CWMDA members—each typically hosting their own open houses throughout the year—have synchronized their schedules to deliver a concentrated, multi-location showcase. Visitors can flow effortlessly from one showroom to the next—much like moving booth to booth but with the ease of driving just 15 to 45 minutes between top-tier facilities. By aligning our showroom open houses, we’ve created a dynamic, environment where visitors can engage deeply with technology, in a relaxed yet professional setting.

The event features a 30 %+ expansion in showroom space, including offerings from leaders such as Akhurst, Biesse, Weinig Holz-Her, Taurus Craco, IMA Schelling, HOMAG, SCM, Felder, and Normand, totaling nine distinct venues across the Western Greater Toronto Area

WTD emphasizes personalized consultations, live machinery and software demonstrations, and hands-on interaction. Attendees can explore cutting-edge production machinery, software, tooling, adhesives and automation within a format designed for efficiency and depth...

Registration is now live at woodworkingtechnologydays. com. Visitors are encouraged to plan their visit in advance using the interactive map and schedule appointments with exhibitors to maximize their “showroom-hopping” experience

-Murat Dogan, President of the CWMDA

FROM THE EXHIBITORS

IMA SCHELLING

As the IMA Schelling Group Canada, we’re excited to showcase the following, at our Open House at the Woodworking Technology Days:

• Edgebanding with PUR glue: We’ll hold demos and workshops where manufacturers can learn about the “tricks of the trade”, regarding edgebanding with PUR glue.

• Displaying/ discussing various ways of automating a shop: Board Storage + Cutting / Nesting + Edgebanding + Drill/ Dowel + Sorting, using our interactive software application.

• We’ll also be available to discuss other usual topics, such as edgebanding with various edge-types and glues, CNC contour edgebanding, and cutting with a beam saw.

AKHURST

Akhurst Machinery is excited to welcome attendees to experience the Anderson Selexx Full Line CNC Router at this year’s Woodworking Technology Days. The full line system builds on the already feature-rich Anderson Selexx Series, adding automated part labeling and automatic loading and offloading capabilities, giving you unmatched precision, efficiency, and flexibility. Available as a complete system or in customized selections, the Selexx Full Line speeds up production by reducing cycle times and improving part identification—helping your workflow run smoother and faster than ever.

We’re also proud to feature the Omnirobotic PSA-80 PRO Panel Sanding Assistant, the ultimate solution for tackling

skilled labour shortages. Powered by AutonomyOS™, this AI-driven robot autonomously performs every sanding task with flawless consistency and unmatched quality. Simple enough for anyone to operate, it’s the last touch on each panel before the paint booth, making it the simplest and most effective robotic sanding solution on the market.

Also on display is the Centauro ALFA, a versatile NC-controlled machining centre ideal for doors, windows, shutters, stairs, and furniture components. With a touchscreen interface and built-in macro programs, it makes programming fast and intuitive, delivering precision machining across a wide range of applications.

Alongside these highlights, visitors will have the opportunity to explore a range of other machinery solutions in our showroom, all designed to showcase the cutting-edge technology and automation Akhurst Machinery brings to woodworking operations.

See the precision and performance of the Anderson Selexx Full Line, OmniRobotic PSA-80 PRO, and Centauro ALFA in action, along with a range of other innovative machinery solutions, at our Mississauga showroom during Woodworking Technology Days.

BIESSE

This October, Biesse is proud to welcome visitors to the Woodworking Technology Days 2025 at our newly opened Material Hub in Vaughan, Ontario, a space that represents the next evolution in how we connect with Canadian manufacturers.

This year’s event is especially meaningful as it marks the first WTD held in our brand-new showroom. Built as part of Biesse’s global transformation, the Material Hub is designed to offer an immersive, hands-on environment where technology, people, and expertise come together. During WTD, visitors will experience the value of our woodworking solutions through live demonstrations, expert-led discussions, and a guided exploration of our latest innovations.

The spotlight will be on CNC nesting, 5-axis machining, automated edgebanding, MDF and Veneer door sanding, and B_SUITE software—all showcased with real-world workflows and production scenarios in mind. These solutions reflect

Biesse’s ongoing commitment to making technology accessible and practical, whether you’re a small shop looking to automate or a high-production facility seeking advanced performance.

WTD 2025 is more than a showcase—it’s an opportunity to rethink the way woodworking technology supports growth, quality, and sustainability. We look forward to welcoming you to our space and helping you explore how Biesse can support your next step forward.

HOMAG

The highly anticipated Woodworking Technology Days (WTD) are set to return this fall, promising to be a pivotal event for professionals across the wood industry. As always, Homag Canada stands at the forefront, reaffirming its commitment to driving technological advancement and supporting the industry’s evolution.

At this year’s WTD, Homag Canada will showcase a comprehensive range of manufacturing solutions, from advanced stand-alone machinery to fully integrated industrial automation systems. Visitors can expect live demonstrations of equipment and of the latest digital tools designed to streamline production, enhance precision, and maximize efficiency. Homag’s digital solutions, including software for production planning and machine monitoring, are tailored to meet the growing demand for smart and efficient manufacturing.

Beyond technology, Homag Canada continues to set the standard for after-sales support. Homag’s dedicated service team ensures that customers receive expert guidance, timely response, and access to a robust inventory of spare parts. This commitment to excellence extends the lifecycle of equipment and maximizes return on investment for woodworking businesses of all sizes.

Woodworking Technology Days offer a unique opportunity to connect with industry experts for industry professionals to experience firsthand the innovations shaping the future of woodworking. Homag Canada’s ongoing investment in technology, automation, and customer support underscores its role as a trusted partner in the industry’s ongoing transformation. Don’t miss the chance to connect with Homag Canada and dis-

cover how the latest advancements can elevate your business at this year’s WTD.

WEINIG HOLZ-HER

Weinig Holz-Her Canada is excited and proud to again participate in the Woodworking Technology Days 2025. This annual event is a cornerstone of the Canadian woodworking calendar, and we are thrilled to open the doors of our state-of-the-art Ontario showroom to industry professionals, craftsmen, partners, and customers from across the country.

Our continued participation in this event reflects our deep commitment to the Canadian woodworking industry. With decades of innovation, support, and partnership, Weinig HolzHer Canada remains dedicated to helping Canadian manufacturers grow their businesses with the most advanced, reliable, and precise woodworking technology on the market.

At this year’s event, we are especially excited to showcase the new PUR Pro GluJet System, the best just got even better!! This innovation underscores Holz-Her’s industry-leading position in edge banding. As pioneers of modern edge banding systems, Holz-Her continues to lead the way by delivering unmatched quality, performance, and flexibility. The patented PUR Pro GluJet System offers the best possible technology for processing the best possible adhesive, PUR (Polyurethane reactive). PUR combined with GluJet ensure perfect quality, optical zero joints, maximum durability, with superior moisture and heat resistance.

Visitors to our showroom will see firsthand how Holz-Her’s cutting-edge solutions are designed to meet the evolving needs of today’s competitive market, from small shops to large-scale manufacturers. Whether it’s high-speed production or custom craftsmanship, our machines and systems deliver consistent excellence.

We invite all woodworking professionals to join us, experience our latest technologies, and discover why Weinig HolzHer continues to be the trusted leader in Canadian woodworking solutions. We look forward to welcoming you to our Ontario showroom this fall!

TEMPORA F1000

FELDER GROUP CANADA

Machines + Tools for woodworking

The new Format4 tempora F1000 sets a new benchmark for edge processing. Combining durability, precision, and efficiency, this machine delivers exceptional quality at high speeds. Its robust frame, advanced feed drive, and automated adjustments guarantee smooth operation, even in multi-shift environments.

From the top-mounted glue pot for fast heat-up to the multi-radius corner rounding unit, every feature is designed for precision, minimal maintenance, and maximum productivity. Whether handling delicate surfaces or high-volume production, the tempora F1000 makes perfect edges effortless.

YOUR BENEFITS

Installation length: 8000 mm

Edge thickness 0.4–12 mm,

Workpiece height: 8–60 mm

Feed speed: 12–25 m/min

Top-mounted application-controlled glue pot

Automation: e-motion

Corner rounding unit (CNC controlled)

Complete edge processing

Top pressure belt

Premilling unit “professional”

Multifunction trimming unit “professional”

Radius scraping unit “professional”

Twin-engine linear end trimming unit

Feed speed: 12 & 25 m/min

WATCH THE MACHINE WORKS SCAN HERE! new

NORMAND

This year, Normand is proud to highlight a complete range of woodworking solutions designed to meet the needs of small to mid-sized shops.

At the forefront are the renowned Altendorf sliding table saws and edge banders, recognized worldwide for their German engineering, accuracy, and durability.

Visitors will also discover the Vitap Point K3 CNC machine, a compact yet powerful system that simplifies drilling, routing, and grooving operations, bringing CNC efficiency within reach of smaller workshops. Alongside it, the Vitap Blitz dowelling machine delivers flawless accuracy and high-speed performance, accelerating production while maintaining exceptional quality.

For edge processing, our lineup of Cehisa edge banders offers versatile, budget-conscious solutions that adapt perfectly to the unique requirements of each shop. Compact, reliable, and precise, they represent true workhorses on the production floor.

Finally, Normand is particularly proud to present the full range of Steel City traditional woodworking machines. Manufactured in Taiwan by highly skilled and experienced producers, Steel City equipment is built to deliver dependable performance, robust construction, and outstanding value — a proven choice for shops that rely on traditional machinery.

Come visit our showroom and experience the power of precision.

SCM CANADA

At Woodworking Technology Days 2025, SCM Canada will highlight a selection of its most advanced woodworking solutions, reflecting the company’s longstanding focus on precision, productivity, and versatility. Among the featured technologies is the Gabbiani P automatic single-blade beam saw, engineered to simplify panel processing with speed, accuracy, and intuitive controls. Complementing it is the Morbidelli M100/200 series, a highly modular and versatile line of CNC machining centres for drilling and routing. These systems are designed to handle complex machining with efficiency and

flexibility, combining ease of programming with robust performance to support both small shops and large-scale operations.

In addition to these core machines, SCM emphasizes the growing role of digital integration in modern woodworking. Its smart software and connected services are developed to support smoother workflows, reduce downtime, and enable manufacturers to adapt quickly to shifting demands. This technology focus is backed by SCM’s extensive Canadian presence, including three technology centers across Vancouver, Montreal, and Toronto. Together, these facilities provide more than 35,000 square feet of demonstration space, service support, and training resources, underscoring the company’s investment in its customer base.

With this combination of proven machinery, digital tools, and strong nationwide support, SCM Canada continues to position itself as a key partner in advancing efficiency and competitiveness across the industry.

TAURUS CRACO

Taurus Craco returns to Woodworking Technology Days 2025 with an emphasis on its role as a trusted distributor of advanced woodworking machinery, supplies, and training. Marking over 30 years of service to the Canadian market, the company continues to strengthen its position by representing some of the most respected names in the industry through its Brands of Distinction portfolio. From high-performance CNC

FROM THE EXHIBITORS

ADVANCED COATINGS FOR EVERY SURFACE

Canlak Coatings develops and produces advanced, high-performance coating systems by focusing on innovation, quality products, and exceptional technical service.

The highest-quality coatings and unmatched support

With a legacy of excellence, a strengthened R&D team, and an integrated sales service, we provide manufacturers of kitchen cabinets, pre-finished flooring, furniture, and specialty products with the highest-quality coatings and unmatched support.

Engineered for durability, precision, and lasting protection

Get to know our lineup of coatings for manufacturers today!

machinery to edgebanders, moulders, sanding systems, dust collection, and finishing solutions, Taurus Craco connects manufacturers with technology designed to improve efficiency, precision, and long-term reliability.

In addition to machinery and tooling, Taurus Craco is distinguished by its commitment to customer education and technical support. The company’s training programs provide practical instruction for operators at all levels, ensuring that investments in new equipment translate into immediate value on the production floor. Supported by a knowledgeable service team and a comprehensive parts operation, Taurus Craco helps Canadian manufacturers maximize uptime and performance while adapting to the evolving demands of modern production.

At WTD 2025, Taurus Craco underscores its reputation not only as a supplier but as a partner in growth, offering Canadian woodworkers access to premium brands, technical expertise, and the resources needed to compete with confidence in a dynamic market.

FELDER GROUP CANADA

Felder Group Canada will present a wide range of woodworking solutions at Woodworking Technology Days 2025, emphasizing versatility, innovation, and reliability across its product

lines. With more than 20 categories of machinery available, the company offers complete solutions for shops of every size, from compact workshops to high-volume production facilities.

The portfolio includes CNC routers and advanced 5-axis machining centres for complex processing, along with edgebanders, wide belt sanders, panel saws, and drilling machines that deliver consistent precision in everyday production. In addition, Felder’s expertise extends into robotics, automation, and material handling systems, ensuring manufacturers have access to technology that supports efficiency and scalability.

What distinguishes Felder is the breadth of its offering under four respected brands—Felder, Format4, Hammer, and Mayer—each engineered to meet different demands within the woodworking sector. From traditional woodworking equipment to state-of-the-art automation, the product range is designed to help manufacturers improve productivity, maintain high quality standards, and adapt to changing customer expectations.

By combining advanced technology with practical, shop-floorready solutions, Felder Group Canada continues to serve as a trusted partner for woodworkers looking to expand their capabilities and remain competitive in a dynamic marketplace.

INNOVATION MEETS OPPORTUNITY

Woodworking Technology Days has grown into a landmark event for Canada’s secondary wood manufacturing sector, offering an unmatched opportunity to experience machinery, software, and automation solutions in one coordinated format. By bringing together nine leading distributors under the CWMDA umbrella, the event ensures that visitors can not only evaluate technologies side by side, but also engage directly with the expertise behind them. From high-precision CNC systems to integrated robotics, training programs, and traditional machinery, WTD 2025 reflects both the breadth and depth of innovation available to Canadian manufacturers.

FROM THE EXHIBITORS

OCTOBER 21 ST - 24 TH 2025

Toronto Technology Center

Explore a broad range of dependable, innovative machines designed to simplify your workflow. Watch live demonstrations that show how these machines can boost productivity and improve efficiency.

Edgebanders, sanders, beam saw, drilling CNC center, CNC machining centers, drill and dowel machine, and more!

Q2 2025 HOUSING STARTS

Reveal a Fragmented Recovery

:: By Tyler Holt, Editor of Wood Industry Magazine

Canada’s housing construction sector delivered a mixed message in the second quarter of 2025. On the surface, national housing starts rose nearly 13% year-over-year, marking a statistically strong quarter. But dig deeper, and a more fractured story emerges. While Alberta, Québec, and a handful of mid-sized centres posted substantial gains, Ontario—the country’s largest housing market—recorded a significant contraction. Diverging regional performance, combined with softening builder sentiment and rising costs, suggest that Canada’s housing pipeline remains under pressure despite signs of progress. The picture that unfolds is one of measured expansion, undercut by affordability issues, policy delays, and investor hesitation.

NATIONAL TRENDS: VOLUME UP, CONFIDENCE DOWN

National housing starts in Q2 2025 totaled 68,747 units, up from 60,862 in the same period last year. The growth was largely concentrated in the multi-family segment, which posted a 15.9% increase year-over-year, reaching 54,026 units. Single and semi-detached starts rose more modestly by 5.3%, totaling 15,083 units.

Completions, however, saw a slight decrease. In population centres over 100,000, multi-family completions dropped by −6.17 year-over-year, at 40,539units, while single/semi completions remained flat from 11,510 to 11,505 units. The continued stagnation of completions amid the rise in housing starts adds to the complexity of the Canadian housing market, with a backlog of over 350,000 marked as under construction.

Builder sentiment remains far from optimistic. According to the Canadian Home Builders’ Association (CHBA), Q2’s Housing Market Index showed near-record lows, with the single-family index at 24.9 and the multi-family index at 22.8, both firmly in negative territory for the twelfth consecutive quarter.

Despite the improved topline numbers, much of the construction momentum appears to be regionally concentrated, with Ontario notably weakening.

BRITISH COLUMBIA: STRENGTH IN SELECT MARKETS, SHARP PULLBACKS ELSEWHERE

British Columbia reported 13,707 housing starts in Q2 2025, up from 12,091 in Q2 2024—a 13% year-overyear increase. While this headline growth suggests resilience, the provincial picture is more complex. A small number of urban centres are driving the gains, while several midsized markets experienced steep declines.

HOUSING

PROVINCIAL STARTS Q2 2024

STARTS Q2 2025

STRONG PERFORMERS: VANCOUVER AND SECONDARY HUBS

• Vancouver: 6651 → 7937 (+19%)

• Victoria: 990 → 1727 (+74%)

• Abbotsford-Mission: 247 → 590 (+139%)

• Chilliwack: 165 → 175 (+6%)

The surge in Victoria and Abbotsford-Mission signals growing development interest beyond Metro Vancouver. These markets benefited from increased multi-unit construction and a comparatively more accessible cost structure.

Vancouver itself remained a national leader in volume and showed moderate yearover-year growth, driven primarily by a rebound in multi-family activity in June.

SIGNIFICANT CONTRACTIONS: INTERIOR AND ISLAND CMAS

• Kelowna: 1863 → 1273 (-32%)

• Kamloops: 134 → 41 (-69%)

• Nanaimo: 491 → 103 (-79%)

Kelowna’s decline is particularly notable given its position as a fast-growing city in recent years. However, affordability challenges, elevated land costs, and shifting

investor sentiment may be weighing on pre-construction demand. Kamloops and Nanaimo posted some of the sharpest contractions of any CMA in the country.

Overall, the data illustrates a “twospeed market” in British Columbia: coastal urban hubs are gaining momentum, while many interior and island centres are pulling back sharply. This divergence raises concerns about whether housing supply is expanding in the areas most in need of new inventory.

THE PRAIRIES: ALBERTA LEADS, BUT MOMENTUM MAY BE FADING

The Prairie provinces posted a strong showing in Q2 2025, led by Alberta. However, emerging signals from builder sentiment point to potential softening.

ALBERTA: RECORD-SETTING QUARTER, BROAD-BASED GROWTH

Alberta reported 16,999 housing starts in Q2 2025, up from 11,880 the year before—an increase of 43%, making it the top-performing province by volume.

• Calgary: 5793 → 8441 (+46%)

• Edmonton: 4961 → 6773 (+37%)

• Red Deer: 92 → 238 (+159%)

• Lethbridge: 151 → 179 (+19%)

The surge reflects high demand for both single-detached and purpose-built rental units, fueled by relative affordability and strong in-migration. That Calgary outpaced Toronto in starts marks a significant shift in the national housing landscape.

MANITOBA AND SASKATCHEWAN: STEADY IN MANITOBA, SURGING IN SASKATOON

Manitoba recorded a slight dip in starts, down from 1,978 to 1,822 units (-8%), with construction activity in Winnipeg remaining nearly flat:

• Winnipeg: 1457 → 1452 (-0.3%)

Saskatchewan performed strongly, with total starts rising from 932 to 1,592 units (+71%). Gains were con-

centrated in Saskatoon, which posted one of the largest increases in the country:

• Saskatoon: 451 → 1020 (+126%)

• Regina: 389 → 428 (+10%)

Saskatchewan’s performance highlights growing confidence in mid-sized urban centres, supported by more manageable construction costs and rental demand.

MULTI-FAMILY SALES MAY BE SLIPPING

Despite Q2 strength, the CHBA raised a cautionary flag in its Q2 Housing Market Index. The organization observed a noticeable downtrend in sales conditions for multi-family developments across the Prairies compared to last year. If investor caution and affordability pressures persist, the current pace of construction—particularly for apartments and condominiums—could falter in the quarters ahead.

ONTARIO: SHARP DIVERGENCE AS GTA STUMBLES AND SECONDARY CITIES STRUGGLE

Ontario recorded 17,326 housing starts in Q2 2025, down from 19,255 in the same quarter last year—a 10% decline. This marks the most significant provincial contraction among major regions, and reflects an increasingly fragile construction environment in Southern Ontario.

GTA AND SOUTHERN ONTARIO UNDER PRESSURE

Ontario’s slowdown was led by steep contractions in the Greater Toronto Area and other key CMAs:

• Toronto: 10,381 → 7503 (-28%)

• Kitchener-Cambridge-Waterloo: 1164 → 372 (-68%)

• Windsor: 800 → 292 (-64%)

• London: 778 → 485 (-38%)

• Hamilton: 526 → 405 (-23%)

• Oshawa: 550 → 231 (-58%)

• Guelph: 79 → 41 (-48%)

• Barrie: 222 → 150 (-32%)

• Peterborough: 97 → 11 (-89%)

These figures indicate a widespread retreat in new construction outside of a few outliers. Several of these CMAs, including Kitchener, Windsor, and Oshawa, saw some of the steepest year-over-year percentage declines in the country.

According to RBC, Ontario’s six-month trend in housing starts has fallen to its lowest level in over a decade. Developers are constrained by rising land and material costs, significant municipal fees, and a shrinking pool of pre-construction condo investors.

“High development charges and growing inventories have made it exceedingly difficult to bring new housing to market,” RBC noted.

EXCEPTIONS: OTTAWA AND KINGSTON BUCK THE TREND

Despite the broader downturn, a few Ontario markets posted significant gains:

• Ottawa-Gatineau: 2656 → 3810 (+43%)

• Kingston: 97 → 589 (+506%)

• St. Catharines-Niagara: 516 → 534 (+3%)

• Belleville-Quinte West: 71 → 66 (-7%)

• Brantford: 56 → 865

Brantford and Kingston’s explosive increase likely reflects one or two large projects rather than a sustained trend.

With buyer demand faltering and pre-construction condo sales falling sharply, Ontario’s construction pipeline is under pressure. Many builders hold permits they cannot profitably act on, while ongoing affordability issues limit consumer take-up, particularly for multi-unit offerings in the GTA.

QUÉBEC: MID-SIZED CITIES DRIVE BROAD-BASED EXPANSION

Québec delivered a strong performance in Q2 2025, with 17,843 housing starts, up from 14,910 in Q2 2024—marking a 20% year-over-year increase. Unlike other provinces where growth was concentrated in one or two centres, Québec’s gains were broadly distributed, with both major metros and regional CMAs contributing to the rise.

Major Centres Maintain Momentum

• Montréal: 6558 → 7365 (+12%)

• Québec City: 2167 → 3321 (+53%)

Montréal continues to be one of Canada’s most stable high-volume housing markets. Growth was largely fueled by multi-unit starts, particularly rental apartments. Québec City’s 53% increase reflects strong demand and favorable construction conditions, including relatively lower input costs compared to Ontario and BC.

REGIONAL CMAS POST DOUBLE-DIGIT GAINS

• Sherbrooke: 430 → 557 (+30%)

• Trois-Rivières: 294 → 531 (+81%)

• Drummondville: 234 → 358 (+53%)

• Saguenay: 100 → 154 (+54%)

Québec is the only province where every reporting CMA posted a year-over-year increase. Builders cite strong rental demand and better cost containment as key enablers. The availability of provincially aligned financing and infrastructure incentives has also supported growth in mid-sized markets.

This consistency contrasts with the volatility seen in other provinces and suggests a more balanced housing pipeline. If sustained, Québec’s approach could offer lessons in how to expand supply across a range of urban scales and not just in major cities.

ATLANTIC CANADA: MODEST GROWTH WITH STANDOUT LOCAL GAINS

The Atlantic provinces delivered steady but regionally varied growth in Q2 2025. While total starts across the region increased moderately, the strongest performances came from select smaller CMAs. The data suggest a stable construction environment, though overall volume remains low compared to larger provinces.

NOVA SCOTIA

• Halifax: 1811 → 1960 (+8%)

As the region’s largest market, Halifax continues to see incremental growth, supported by demand for both ownership and rental housing. Construction activity has remained relatively stable, reflecting balanced market conditions.

STRENGTH IN NUMBERS

Our cluster thrives on the collaborative model of sharing best practices, gathering new ideas, and working together.

Join us and become part of a dynamic and supportive community dedicated to helping each other succeed.

TO LEARN MORE VISIT

www.wmco.ca

NEW BRUNSWICK

• Fredericton: 185 → 344 (+86%)

• Moncton: 798 → 765 (-4%)

• Saint John: 164 → 150 (-9%)

Fredericton stood out with one of the highest growth rates in the country, driven largely by a surge in multi-unit developments. Moncton and Saint John, however, saw slight year-overyear declines, suggesting more tempered demand or delivery timing shifts in those markets.

NEWFOUNDLAND AND LABRADOR

• St. John’s: 220 → 306 (+39%)

St. John’s posted a solid increase, as local developers ramped up production of purpose-built rentals and smaller-scale infill projects. Demand from new household formation and provincial housing initiatives may be contributing to the rebound.

Let’s Build Something Great Together

At Planit, we don’t just sell software— we partner with you to grow your business.

With powerful tools like Cabinet Vision and Alphacam, we help you connect design and production seamlessly, saving time and boosting efficiency.

But the real difference? It’s our commitment to your success. Whether you’re optimizing workflows, automating production tasks, or tackling complex projects, we’re with you every step of the way.

Growing your business together.

Ready to see what’s possible? SCHEDULE A DEMO, SCAN HERE

P.E.I’S ONLY CMA IS CHARLOTTETOWN, WHERE STARTS HAVE REMAINED FLAT (~200).

While the Atlantic provinces remain smaller players in the national housing supply picture, their positive trajectory is encouraging. These markets may become increasingly important in absorbing demand as affordability challenges persist in larger urban centres elsewhere in the country.

POLICY PARALYSIS AND BUYER HESITATION: A DRAG ON DEMAND

Beneath Canada’s regional housing performance lies a critical structural gap between announced policies and actionable incentives. The most prominent example is the First-Time Home Buyers’ GST Rebate, which was unveiled in May 2025 but remains unimplemented as of the end of Q2. Though retroactive to May 27, the legislation enabling the rebate is not expected to pass until the fall.

This delay has created a bottleneck in new home transactions. Builders report that many prospective buyers—particularly in the entry-level and move-up segments—are delaying purchases in hopes of eventually benefiting from the rebate. However, with no legal mechanism in place, contracts remain unsigned, and projects stall.

Compounding this are broader affordability and confidence issues. While some government measures—like the 30-year amortization window for first-time buyers of new homes— have been introduced, they have yet to meaningfully shift market momentum. In the meantime, builders lack pricing clarity, and buyers lack transactional confidence.

Even beyond entry-level housing, developers say that uncertainty around taxes, municipal charges, and cost inflation have made financial modeling for new projects extremely difficult. The result is a market characterized by tentative movement and deferred decisions.

THE CONSTRUCTION WORKFORCE AT A TURNING POINT

Canada’s construction workforce is nearing a critical inflection point. Builders across the country report rising layoffs, with 35% indicating they had reduced staff as of Q2 2025, up sharply from 21% one year earlier. The increase in layoffs could be another symptom of the geographic shift in market demand.

However, while layoffs are often positioned as temporary, the longer the slowdown continues, the greater the risk that workers exit the sector permanently.

This issue is particularly acute in Ontario and British Columbia, where weak sales, rising municipal charges, and stalled multi-family starts have pushed many small- and mid-sized builders to the brink. Tradespeople, once retained in hopes of a market rebound, are now being let go as project pipelines shrink.

“This means if and when buyers do come back to the market, this exodus of workers… will make the labour shortages even more challenging the next time there is high demand,” CHBA cautioned.

Even if demand rebounds in 2026 or 2027, a reduced and fragmented workforce may slow supply response. This would worsen the housing shortage in the very markets most in need of rapid scale-up.

While factory-built and offsite construction methods have been cited as potential solutions, CHBA and others note (and many readers will recognize) that such investments require high demand and sustained certainty, conditions that are largely absent in the current environment.

A REGIONALIZED RECOVERY WITH NATIONAL CONSEQUENCES

Canada’s Q2 2025 housing performance illustrates a recovery that is statistically positive but structurally inconsistent. While overall housing starts increased, that growth was concentrated in select provinces and mid-sized CMAs, with Alberta, Québec, and parts of Atlantic Canada outperforming. Ontario’s sharp decline, particularly in the GTA and Southern Ontario, raises significant concerns about future housing supply in the country’s largest and most pressured markets.

For Canada to reach its national housing target—5 million new homes over 10 years—the human capacity to build must be preserved. That means not only supporting permits and policies, but also stabilizing the industry’s workforce and project pipelines now.

Moving forward, the country will require faster legislative follow-through, more robust support for workforce retention, and tailored interventions in lagging regions. Without coordinated action, today’s regional divergences may evolve into long-term structural deficits, with consequences for affordability, mobility, and economic resilience.

INSIDE CANADIANA CABINETS

Sustainable Growth and Operational Success

:: By Joy Doonan, Wood Industry Writer

CANADIANA

Canadiana Cabinets is a Peterborough family business that has been operating for three decades. In that time, it has weathered market collapse, undergone major shop site relocations, and seen prodigious growth. By cultivating impeccably organized shop floor and inventory practices and building a lateral communication structure that values the input of all its workers, the business has established long-standing positive relationships with dealers, employees, and customers alike.

The Barker family first moved to Peterborough in 1993, when Bill Barker was hired by modular homes manufacturer Royal Homes. Bill’s background in woodworking and cabinetmaking, combined with his experience selling Cabnetware software, gave him the right crosssection of expertise to step into the role of running Royal Homes’ kitchen

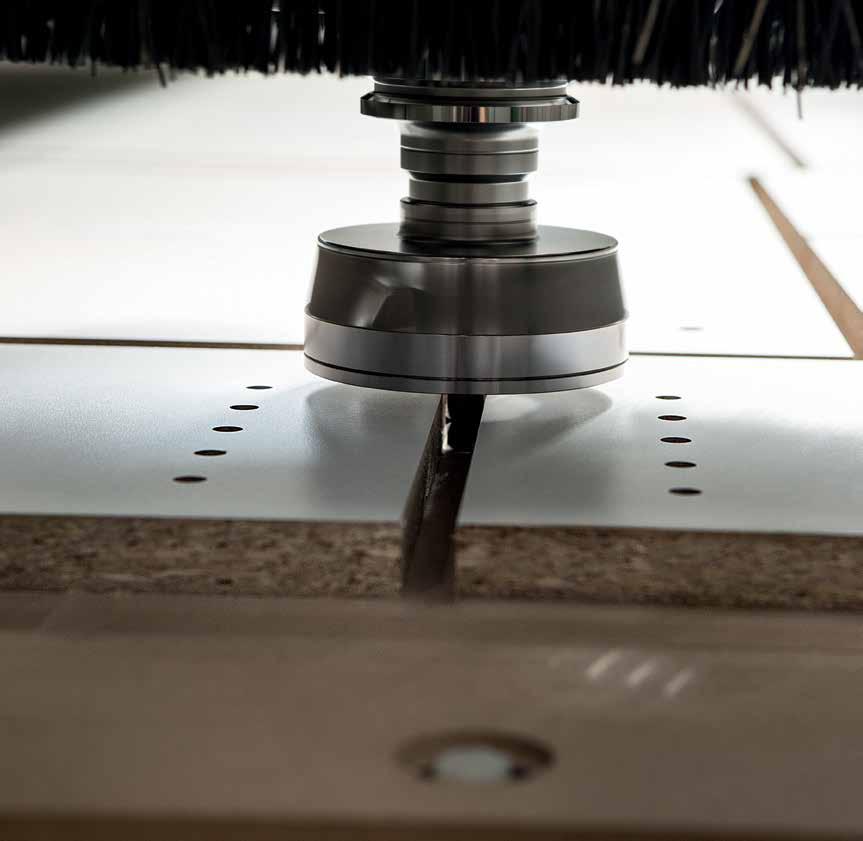

Outfitted with two Omnitech CNCs, an Altendorf-Hebrock K36 edgebander, Alpha Brush sanding systems, a Venjakob Ven Spray Smart line, and a HOMAG MPH 410 case clamp, Canadiana controls quality from cut to finish.

cabinetry factory. Two years later, when Royal Homes closed their Peterborough plant due to economic downturn, Bill played a critical role in moving and developing their manufacturing efforts to Cambridge, Ontario, where he continued supplying to Royal Homes until 2011, when he had the opportunity to move manufacturing back to Peterborough.

“30 years later, Royal Homes still buys from us,” Bill remarks.

In 2011, when Canadiana Cabinets returned to its hometown, his son, Ian, joined the family business. Ian would carry over his core people-management and communication principles from his management experience in the restaurant industry to the wood industry, quickly learning and taking on more responsibility, from programming the CNC machine to eventually operating all of the business’s key machinery.

As Ian remembers it, “I wanted to be helpful and was eager to learn. Everything looked interesting and I ended up loving it.”

In 2015, Canadiana Cabinets moved to its current 13,000 square foot facility. The business steadily grew approximately 20% each year from 2015 to 2019 and added an additional ten employees to its initial five. The space is equipped with two Omnitech CNC machines, Infinity drum sander, edge sander, manual

spray area and Sun Spot drying system. At its current size, the shop has the power to operate on an industrial scale, but it also the facilities and expertise to perform custom work orders, making anywhere between 25-60 boxes a day.

“What makes us special,” says Ian, “is being able to do the custom things people are looking for. A dealers or customer might send us some pictures from the internet with just a general idea, and we’ll work with them to design and fabricate something that meets and exceeds their expectations.”

“We don’t want to just build more for cheaper,” Ian asserts, and Bill adds that, “If someone comes in and wants to buy a $700 vanity, even if that’s a little outside the scope of what we usually do, we don’t want to turn them away and say ‘it’s not worth the trouble.’ That’s not how we think it is. Every customer, big or small, is entitled to be looked after.”

SCALING COMMUNICATION AND CULTURE THROUGH THOUGHTFUL LEADERSHIP

As Canadiana Cabinets has grown, Ian has taken over as the general manager and implemented several communication and software solutions to allow the company to scale gracefully with its increased capacity.

“When there’s just five guys, everyone knows what to do,” he explains, but

“What makes us special is being able to do the custom things people are looking for. We don’t want to just build more for cheaper.”

The Barker family’s Peterborough base keeps service personal while the shop scales.

“We look for people who want to make sure it’s done right. It’s about pulling your weight, being part of the team, helping each other out.”

as the number of employees quickly grew, the company needed a good communications infrastructure. It also needed strategies for minimizing excess materials and maximizing shop floor space.

The inventory system, for example, helped to drastically cut down on number of extra sheets being held in stock. “We reduced it by about 160 in three months, just by knowing we had material available to assign to jobs at a

more optimized rate,” Ian says. “Before we started tracking inventory and throughput, we were just making sure we had more than enough as opposed to the right amount.”

Fostering a healthy workplace culture is also a top priority for Canadiana Cabinets. Ian explains that, when he hires staff, the right attitude is more important than highly specific technical expertise: “We look for people who want to make sure it’s done right. Someone

might not have all of the experience, but if they’re willing to learn, we’re happy to have them. We’ve got so many hardworking guys, and we want to make sure that everyone who joins is going to be part of that culture.” He elaborates, “It’s not about working at 110% all day-it’s about pulling your weight, being part of the team, helping each other out.”

Workers are encouraged to take on cross-training to improve their versatility and make the most of their own time in

the shop. “If a guy is in the sanding room, but he is interested in something else too, like CNC or design, we like to utilize a bit of his time to try and grow in those areas as well,” says Ian.

DIGITAL SOPS: STREAMLINING SHOPFLOOR KNOWLEDGE

“We’ve spent the last few years really focused on making sure everyone knows what they’re supposed to be doing and when,” Ian explains. “That’s where scheduling, due dates, and checklists come into play. It’s also the foundation for how we’re building out our standard operating procedures (SOPs) and maintenance protocols.

We’ve integrated all of this into Microsoft OneNote, which gives us an editable, searchable, and shareable platform.Everyoneintheshophasaccess from their phones or shop computers, so they can find what they need in real time. Whether it’s production steps, equipment maintenance, or even how to replace printer toner, it’s all in there.

Each workstation has its own OneNote section. There are two types of documentation: one for how to operate each piece of equipment, and another for how to perform the actual job at that station. For example, the edge bander’s page includes how to start the machine, change glue, clean it, and troubleshoot problems.

BecauseOneNoteisdigitalandinformal, it’s flexible. Anyone can contribute, even if they just start with a single sentence like “Turn on the machine.” From there, we can build step-by-step instructions and add troubleshooting tips. If an issue is critical or recurring, we spin it off into its own dedicated page.

Ultimately, it’s about giving people the tools to succeed from day one. If a new hire can follow steps and do the job correctly, that’s a win. The more accessible the information is, the fairer it is to hold people accountable. You can’t expect someone to maintain a machine properly if they’ve never been shown how.

Training is ongoing. People run into new situations every week. But if we’ve

Precision where it counts, with hand checks at each stage of build and finish.

We’ve had the information, but without a system, it ended up stuck in a few people’s heads. This approach changes that.’

documented it once, they don’t need to ask someone again, they just check the information base. That takes pressure off experienced staff and spreads knowledge across the whole team.

For me, knowledge sharing has always been a challenge. We’ve had the information, but without a system, it ended up stuck in a few people’s heads. This approach changes that.’

A careful approach to project scheduling that always allows leeway for time also helps to prevent unnecessary production bottlenecks. Ian explains that “every step of production has its own deadline—so, even though a kitchen that doesn’t require finishing could get done in about five hours, it’s staged over, say three days. While that would seem to create longer individual lead times, it really means a better flow and an overall lower time across the production. Everyone at every stage can hit their own deadlines, we have buffer time to make sure we are always getting it right, and there is no need to work late.”

Another innovative means of increasing efficiency has been the use of high-density mobile shelving units for inventory storage and sorting. The units were scoped out and purchased for a deal from a government surplus website. The business uses a kanban system to keep track of the inventory items, “so everything has a home,” explains Ian. “All the individual boxes have our own labels on them with a QR code, so the guys can just scan it and see where it’s supposed to be used.“

He elaborates, “even if the inventory system might seem like overkill, it’s integrated with everything we do, so it was worth it to set that up. I hate the idea of growing when you’re not efficient, because if there’s a mess, it just becomes a bigger mess.”

These interconnected systems ensure that efficiency scales alongside production, allowing Canadiana Cabinets to grow without losing the

organization and flexibility that define its work.

SUSTAINABLE GROWTH, SUSTAINABLE RELATIONSHIPS:

Over three decades, Canadiana Cabinets has evolved from a small, resilient operation into a well-equipped and strategically managed manufacturer without losing its familydriven ethos. Each chapter of its growth has been marked by thoughtful investment— whether in high-density shelving sourced from a surplus auction, software integrations that streamline communication, or process buffers that protect quality and morale. The Barkers’ leadership has balanced expansion with sustainability, ensuring that scale never comes at the expense of custom craftsmanship or client relationships.

This measured approach has cultivated trust among dealers, customers, and employees, reinforcing Canadiana Cabinets’ reputation as a reliable partner and employer.

By prioritizing adaptability, the company can meet unique project demands while still operating with the predictability that keeps schedules and quality intact.

In an industry where speed and cost often overshadow craft, Canadiana Cabinets

stands as an example of how sustainable growth, operational discipline, and respect for people can coexist. For the Barkers and their team, success is not simply measured in output, but in the lasting relationships built.

Joy Doonan is a writer from Ottawa. She has a degree in Sociology and a certificate in Technical Writing, and she takes a special interest in small business sustainability.

HOLZ-HER CANADA

GLU JET 725 PUR PRO

HOLZ-HER’s Next Gen Glue Application System

Same Quality Zero Joint Technology with Several Key Upgrades

• Vacuum-sealed PUR processing system for maximum efficiency.

• Swivel arm that allows the GLU JET to rotate outward for easy cleaning.

• New dosing sleeve for precise dosing and fast and efficient rinsing.

• PUR optimized pre-heating unit, allowing for higher tolerances and ensuring a clean, constant, even flow of the adhesive.

• DLC (Diamond-Like Coated) dispensing sleeve allowing for reduced scanning pressure of sensitive material surfaces.

Between the Grain and the Grind

Canadian Wood SMEs Brace for Trade and Cost Pressures

:: By Francesca Basta, research analyst at the Canadian Federation of Independent Business (CFIB).

Canadian small and medium-sized enterprises (SMEs) are facing mounting pressure on multiple fronts. In a recent Canadian Federation of Independent Business (CFIB) survey, 71% of manufacturers identified trade uncertainty as their top challenge, followed by economic and political uncertainty (62%), and operational costs (47%).

Canada’s wood manufacturing firms—which produce cabinetry, furniture, millwork, and wood-based components—are among the most trade-exposed and cost-sensitive businesses in the country. With economic conditions tightening in 2025 and skilled labour shortages continuing to strain operations, these firms are navigating a landscape marked by shrinking margins and growing unpredictability.

Manufacturing remains a pillar of Canada’s economic foundation - accounting for 10% of GDP, over half (53%) of total goods exports, and ranked second only to wholesale trade in import value. In 2023, Canadian manufacturers exported $375 billion worth of goods , with $156.5 billion coming from SMEs. SMEs also accounted for $85.8 billion in imports, roughly one-third of total manufacturing imports.

SMEs make up about 99% of all manufacturing enterprises and employ over half of the sector’s workforce. Within this broader context, wood and furniture manufacturing represent roughly 5% of total manufacturing trade value. Their footprint is significant—especially in regions like Quebec, British Columbia, and Ontario where wood-product businesses are essential to local economies.

In 2025, their reality is shaped by converging pressures, namely inflation, international trade disruptions, and a persistent shortage of skilled labour.

TARIFFS AND TRADE HEADACHES

Charts created by CFIB’s data analyst, Hemamalini Somasundaram.

As highly trade-reliant businesses, wood-product manufacturers are disproportionately exposed to geopolitical uncertainty. Recent CFIB data shows

that 70% of manufacturing SMEs are affected by Canadian import tariffs on U.S. goods, and 30% are burdened by export tariffs imposed by the U.S. While these figures focus on North American trade, they highlight just how dependent the wood industry is on cross-border flows and international policy stability. Trade-related disruptions include:

• Softwood lumber duties, which currently hover around 14.5%, with possible increases to 30% or more by late 2025.

• De minimis threshold changes in the

U.S., eliminating tariff exemptions for shipments under USD $800. This adds paperwork and cost for small-batch deliveries, samples, or replenishment orders.

• Administrative costs tied to Canada-United States-Mexico Agreement (CUSMA) compliance, which disproportionately affect small firms lacking in-house trade or legal expertise.

For SMEs, the challenge isn’t just higher costs—it’s volatility. Frequent rule changes and documentation require-

ments make it difficult to manage logistics, pricing, and customer relationships. These factors are compounded by the inability of smaller firms to buffer disruptions. Larger manufacturers might reroute through other suppliers or markets—but SMEs typically lack that flexibility.

An Ontario-based wood cabinet maker noted, “The threat of tariffs eliminated our U.S. sales overnight. We simply couldn’t compete once landed costs crossed a certain threshold.” Another firm reported being wrongly charged tariffs exceeding $7,000 on goods that should have qualified under CUSMA provisions.

Some businesses are changing sourcing strategies altogether. One British Columbia manufacturer said, “Everything that we bring in that is made in the USA has a tariff, so we have since stopped buying from the USA. We have plenty of good Canadian furniture manufacturers to buy from. We will never buy American again.”

Others have exited the U.S. market entirely, echoing the sentiment. Another furniture retailer shared, “We’ve stopped exporting altogether. The risk isn’t worth it. Even if we win on price,

WOODWORKING TECHNOLOGY DAYS

THE ANNUAL MACHINERY EVENT YOU DON'T WANT TO MISS

OCTOBER 21 - 24, 2025

GREATER TORONTO AREA, ONTARIO

Mississauga - Brampton - Cambridge - Vaughan

MORE MACHINERY

MORE LIVE DEMOS

Don't miss WTD 2025 - Canada's only major machinery event this year.

Visit all 9 showrooms and explore expanded showrooms, live demonstrations, and cutting-edge technology from the industry's leading distributors.

Whether you’re looking for the latest technology, new equipment, or expert demos, WTD 2025 delivers it all.

MEMBER SHOWROOMS

www.woodworkingtechnologydays.com

the uncertainty with customs and tariffs can kill the deal.”

CONFIDENCE COLLAPSING