16 minute read

How To trade in EXNESS on for beginners

If you’re looking to embark on an exciting journey into the world of trading, the question on your mind may be How To trade in EXNESS on for beginners. EXNESS is a popular online trading platform that enables both novice and seasoned traders to engage in various financial markets. This guide aims to provide a comprehensive overview of how to navigate this platform effectively, ensuring that you start your trading career on a solid foundation.

👉 Visit Website Exness Official ✅

💥 QR Code Exness 👇

Getting Started with EXNESS: A Beginner's Guide

Starting your trading journey can be overwhelming, especially with so many platforms available today. EXNESS stands out due to its user-friendly interface, extensive support, and educational resources. It's essential to understand the basic steps involved in setting up your trading account and becoming familiar with the platform before diving into actual trading.

Creating Your EXNESS Account

The first step in your trading journey is creating an account on the EXNESS platform. The registration process is straightforward, allowing users to get started quickly.

You will need to provide basic information such as your name, email address, and phone number. After completing the registration form, you’ll receive a verification email. Clicking the link within this email confirms your account and allows you to log in.

Once logged in, it's crucial to set up two-factor authentication for enhanced security. This extra layer of protection ensures that your account remains secure against potential threats, providing peace of mind as you begin trading.

Exploring the EXNESS Dashboard

After successfully logging into your account, familiarize yourself with the dashboard. The user interface is designed to be intuitive, featuring various sections like account balance, trading instruments, and market analysis tools.

Take time to explore these sections, as understanding their layout will significantly enhance your trading experience. The more comfortable you are with the dashboard, the more efficient you'll be when executing trades or analyzing market trends.

Funding Your EXNESS Account

Before you can start trading, you must deposit funds into your account. EXNESS offers several payment methods, including bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller.

To initiate a deposit, navigate to the 'Finance' section of your account dashboard. Choose your preferred payment method, enter the amount you wish to deposit, and follow the prompts. Be mindful of any minimum deposit requirements associated with your chosen payment method, as these can vary.

👉 Visit Website Exness Official ✅

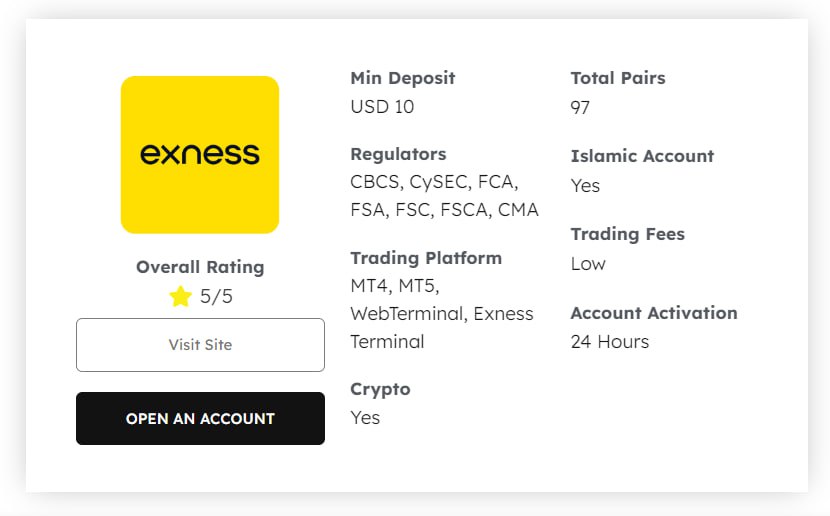

Understanding EXNESS Account Types and Choosing the Right One

EXNESS offers various account types tailored to meet the needs of different traders. Understanding these accounts is vital in choosing the one that best aligns with your trading goals and strategies.

Standard Accounts vs. Professional Accounts

When starting out on EXNESS, you have the option to choose between Standard and Professional accounts.

Standard accounts are ideal for beginners due to their simple structure and lower minimum deposit requirements. These accounts offer fixed spreads, which can make it easier to manage your trading costs. In contrast, professional accounts, such as ECN and Raw Spread accounts, are designed for experienced traders who require tighter spreads and faster execution speeds.

Consider your trading style when selecting an account type. If you're still learning the ropes, a standard account might be the most suitable option, allowing you to practice and gain confidence without substantial financial risk.

Assessing Leverage and Margin Requirements

Leverage is another critical aspect to consider when choosing your EXNESS account type. Leverage allows traders to control larger positions using smaller amounts of capital. However, while leverage can amplify profits, it also increases risks.

EXNESS provides flexible leverage options, which can reach up to 1:2000. As a beginner, it’s wise to start with lower leverage ratios to manage risk effectively. Additionally, understanding margin requirements associated with your selected account type will further assist you in making informed trading decisions.

Evaluating Additional Features

Different account types come with various features, such as access to educational resources, customer support, and trading tools. Take the time to evaluate these additional offerings before making your choice.

For beginners, having access to educational materials and tutorials can significantly enhance your learning curve. EXNESS prides itself on providing numerous resources, empowering traders to improve their skills and knowledge base continually.

👉 Visit Website Exness Official ✅

Navigating the EXNESS Trading Platform: A Step-by-Step Tutorial

Now that you've set up your account and chosen the right account type, it's time to dive into the EXNESS trading platform. Familiarizing yourself with the interface will help you execute trades efficiently and take advantage of market opportunities.

Overview of the Trading Interface

Upon entering the trading interface, you'll notice a range of tools and features designed to facilitate your trading experience. Key components include the trading chart, order entry panel, and market watch window.

The trading chart is where you'll analyze price movements and trends for your chosen instruments. EXNESS offers various chart types, such as line, candlestick, and bar charts, catering to different trader preferences.

The order entry panel is where you’ll place buy or sell orders, adjust position sizes, and set stop-loss or take-profit levels. Understanding how to navigate this section is crucial for managing your trades effectively.

Customizing Your Trading Environment

Personalization is key when using the EXNESS platform. You can customize the layout by adding or removing indicators, changing chart colors, and adjusting the time frame.

Customizing your trading environment can improve focus and efficiency, making it easier to spot trading opportunities. Make sure to explore the various available indicators and tools, as they can provide valuable insights into market trends and potential entry points.

Utilizing Trading Tools and Resources

EXNESS offers a suite of trading tools to enhance your trading strategy. These include economic calendars, trading signals, and market analysis reports.

The economic calendar is particularly useful, as it highlights upcoming economic events that could impact the markets. By keeping an eye on these events, you can better anticipate market movements and adjust your trading strategies accordingly.

Moreover, learning how to use technical indicators, such as Moving Averages or Relative Strength Index (RSI), can help you make informed trading decisions based on historical price data.

Essential Trading Terminology for Beginners on EXNESS

As a beginner trader, familiarizing yourself with common trading terminology is essential for navigating the trading landscape effectively. Understanding the language of trading will empower you to communicate ideas and strategies confidently.

Basic Terms Every Trader Should Know

Before trading on EXNESS, it's crucial to learn some fundamental trading terms. These include concepts like pip, spread, lot size, and order types.

A pip represents the smallest price movement in a currency pair, while the spread is the difference between the buying and selling price, impacting your overall trading cost. Understanding lot size, which refers to the quantity of an asset being traded, is also important as it influences your position size and risk exposure.

Knowing about different order types, such as market orders and limit orders, will help you execute trades according to your strategy. Market orders are executed immediately at the current market price, whereas limit orders allow you to specify a desired entry or exit price.

Advanced Trading Concepts

As you progress in your trading journey, you may encounter more advanced concepts such as support and resistance, trend lines, and Fibonacci retracement levels.

Support and resistance refer to price levels where an asset struggles to move beyond, often leading to reversals. Recognizing these levels can help you identify potential entry and exit points.

Trend lines are drawn on charts to indicate the general direction of the market. They can provide valuable insights into market sentiment and potential future movements.

Fibonacci retracement is another analytical tool that traders use to identify potential reversal levels based on historical price patterns. Understanding these concepts can give you an edge in anticipating market behavior.

The Importance of Continuous Learning

The trading landscape is always evolving, so continuous learning is paramount for success. Engage with educational resources provided by EXNESS, such as webinars, articles, and videos, to deepen your understanding of trading concepts.

You can also participate in online trading communities where you can share ideas, ask questions, and glean insights from fellow traders. This collaborative approach to learning will help reinforce your knowledge and keep you updated on industry trends.

👉 Visit Website Exness Official ✅

Placing Your First Trade on EXNESS: A Practical Walkthrough

Now that you have a grasp of the platform and essential trading terminology, it's time to place your first trade on EXNESS. This hands-on experience will help solidify your understanding and build your confidence as a trader.

Analyzing the Market Before Trading

Before placing a trade, conducting thorough market analysis is crucial. Utilize the tools at your disposal to assess the market conditions and identify potential trading opportunities.

Start by selecting the financial instrument you wish to trade. Use your trading chart to analyze price movements, applying technical indicators to gauge market strength and potential reversal points.

Additionally, consider external factors such as news releases or economic reports that may influence the market. A well-rounded analysis will help you make informed trading decisions.

Executing Your Trade

Once you've completed your analysis and identified a potential trade setup, it’s time to execute your trade. Navigate to the order entry panel, where you'll input the necessary parameters.

Begin by selecting the type of order you wish to place—whether it's a market order or a pending order. Specify the volume (lot size) of the trade, and set your stop-loss and take-profit levels.

Double-check all parameters before clicking the “Buy” or “Sell” button. Once executed, monitor your trade closely to ensure it aligns with your expectations and market conditions.

Reviewing and Reflecting on Your Trade

After closing your trade, take the time to review and reflect on the outcome. Consider what went well, what didn’t, and what you could do differently next time.

This reflective practice is invaluable for improving your trading skills and developing a robust trading strategy over time. Keep a trading journal to record your thoughts, strategies, and results, providing you with a reference for future trades.

👉 Visit Website Exness Official ✅

Managing Risk Effectively on the EXNESS Platform

Risk management is one of the most critical aspects of trading. Without a solid risk management strategy, even skilled traders can face significant losses. Understanding how to manage risk effectively on the EXNESS platform is essential for long-term success.

Setting Stop-Loss and Take-Profit Levels

One of the easiest ways to manage risk is by utilizing stop-loss and take-profit orders. A stop-loss order automatically closes your position when the market reaches a certain price level, limiting potential losses.

Similarly, a take-profit order locks in profits when the market moves favorably. Setting these levels ahead of time takes emotion out of trading decisions and ensures that you're disciplined in your approach.

Determining Position Size Appropriately

Position sizing refers to the amount of capital you allocate to each trade. A common rule of thumb is to risk no more than 2% of your trading capital on a single trade.

By adhering to this guideline, you can safeguard your account against significant drawdowns. Calculating position size involves assessing your stop-loss distance and determining the appropriate lot size based on your overall account balance.

Diversifying Your Portfolio

Diversification is another effective risk management strategy. Instead of concentrating all your capital on a single trade or asset, consider spreading your investments across various instruments.

This approach helps mitigate the impact of adverse market movements. For instance, if one trade incurs losses, other diversified positions might offset those losses, preserving your overall capital.

Understanding Leverage and Margin in EXNESS Trading

Leverage and margin are fundamental concepts in trading that can significantly affect your profitability and risk exposure. Gaining a solid understanding of these elements is crucial for successful trading on the EXNESS platform.

What Is Leverage?

Leverage allows traders to control larger positions than their initial investment would permit. Essentially, it magnifies both potential profits and losses.

EXNESS offers varying leverage ratios, meaning you can tailor your trading strategy according to your risk tolerance. While high leverage can yield higher returns, it also exposes you to greater risks, making it essential to use leverage judiciously.

Understanding Margin Requirements

Margin refers to the amount of capital required to open a leveraged position. When using leverage, your broker requires a certain percentage of the total trade value to be held as margin.

It's important to ensure that your account has sufficient margin to avoid margin calls, which occur when your account equity falls below the required margin level. Regularly monitoring your margin levels can help you maintain control over your trading activities.

Calculating Leverage and Margin Effectively

To calculate your margin requirement, multiply the size of your trade by the margin percentage set by EXNESS. This calculation will help you determine how much capital you need to keep in your account to sustain your open positions.

Understanding how leverage impacts your trading strategy is crucial for maintaining a balanced risk profile. Start with conservative leverage ratios, gradually increasing them as you become more experienced and confident in your trading abilities.

👉 Visit Website Exness Official ✅

Demo Account Practice: Mastering EXNESS Trading Before Going Live

Many beginners are eager to jump into live trading but practicing on a demo account is essential for building confidence and honing your skills. EXNESS offers a demo account option that allows you to trade in real-time market conditions without risking real money.

Benefits of Using a Demo Account

Using a demo account has numerous advantages for novice traders. It provides a risk-free environment to explore the trading platform, experiment with different strategies, and familiarize yourself with various assets.

Additionally, you can practice placing trades, managing positions, and setting stop-loss and take-profit orders without worrying about financial loss. This hands-on experience is invaluable for reinforcing your learning and preparing for live trading.

Developing Your Trading Strategy

In a demo environment, you can test different trading strategies and techniques to find what works best for you. Whether you prefer day trading, swing trading, or scalping, the demo account allows you to refine your approach without the pressures of real-money trading.

Regularly reviewing your performance on the demo account will help you identify strengths and weaknesses in your trading strategy. Use this feedback to make adjustments before transitioning to a live account.

Transitioning to Live Trading

Once you feel confident in your trading abilities and have developed a solid strategy, you can transition to live trading. Begin with a small amount of capital, allowing you to ease into the realities of trading without feeling overwhelmed.

Remember that emotional factors will come into play when trading with real money, as the stakes become higher. Continue applying the principles of risk management learned during your demo practice to ensure you remain grounded in your trading approach.

Common Mistakes to Avoid When Trading on EXNESS

Every beginner trader makes mistakes, but learning to recognize and avoid common pitfalls can greatly enhance your chances of success. Here are several frequent errors novice traders often encounter when using the EXNESS platform.

Overleveraging Your Trades

While leveraging can amplify profits, it can also lead to significant losses if not managed properly. Many beginners fall into the trap of overleveraging, believing that higher leverage will guarantee higher returns.

However, this mindset can quickly deplete your trading capital if the market moves unfavorably. Always stick to a conservative approach when it comes to leverage, protecting your account from undue risks.

Neglecting Risk Management

Proper risk management is crucial for long-term trading success. Failing to implement stop-loss orders, ignoring position sizing, and overconcentrating investments can lead to substantial losses.

Take the time to develop a comprehensive risk management plan that outlines your approach to protecting your capital. Prioritize discipline and consistency in implementing your strategy.

Relying Too Heavily on Indicators

While technical indicators can provide valuable insights, relying solely on them can lead to poor decision-making. Many beginners become overly dependent on specific indicators without considering broader market dynamics.

It's essential to combine technical analysis with fundamental analysis and keep an eye on news events that could influence market behavior. A well-rounded approach will yield more informed trading decisions.

👉 Visit Website Exness Official ✅

Resources and Support for EXNESS Beginners

As you embark on your trading journey with EXNESS, it’s essential to leverage the various resources and support options available to enhance your learning and trading experience.

Accessing Educational Materials

EXNESS provides a wealth of educational resources, including articles, video tutorials, and webinars. These materials cover a wide range of topics, from basic trading principles to advanced strategies.

Invest time in studying these resources, as they can help bridge the gap between theoretical knowledge and practical application. Engaging with diverse content will deepen your understanding and boost your trading skills.

Engaging with Customer Support

Should you encounter challenges or have questions about the platform, don't hesitate to reach out to EXNESS customer support. The team is available through various channels, including live chat, email, and phone support.

Utilizing customer support can save you time and frustration, ensuring that you have the guidance needed to navigate the platform effectively. Remember, seeking help when needed is a sign of a proactive and dedicated trader.

Participating in Community Forums

Joining trading communities or forums can provide additional support and resources. Engaging with other traders allows you to share experiences, learn new strategies, and gain insights into different trading styles.

These interactions can foster a sense of camaraderie among traders, enabling you to grow and evolve together. Look for reputable online communities where members actively share knowledge and expertise.

Conclusion

Embarking on your trading journey with EXNESS can be an exhilarating experience filled with opportunities for growth and learning. By understanding the fundamentals of how to trade in EXNESS for beginners, you’ll be well-equipped to navigate the complexities of the trading world.

From choosing the right account type and mastering the trading platform to implementing sound risk management practices and leveraging educational resources, the path to trading success is a continuous journey of improvement and adaptation. With dedication, discipline, and a willingness to learn, you can establish yourself as a competent trader within the EXNESS community.

See more:

✔ How to withdraw money from Exness to bank Account

✔ How to withdraw money from Exness in India

✔ Where is Exness head office?