10 minute read

How to withdraw money from Exness in India

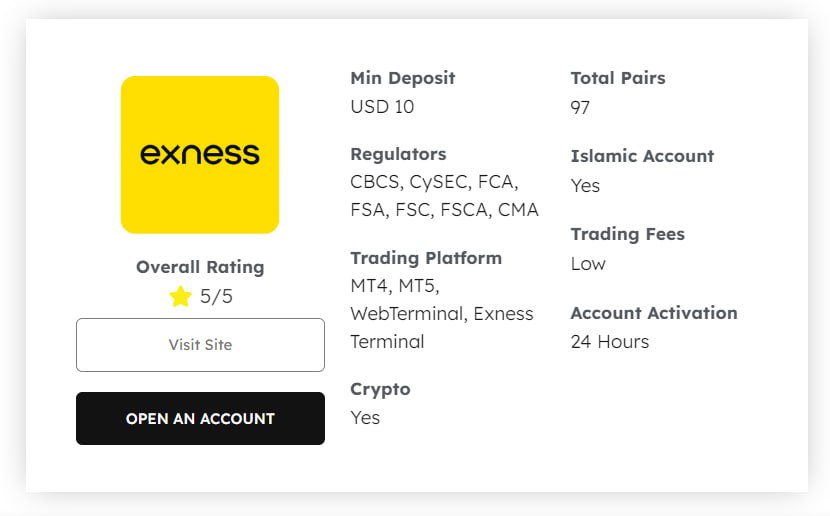

Understanding how to withdraw money from Exness in India is a crucial aspect for traders who operate on this platform. Exness has gained significant popularity among Indian investors and traders due to its robust trading features, extensive resources, and user-friendly interface. However, the withdrawal process can sometimes be confusing, especially for new users. This guide aims to provide a comprehensive understanding of the various aspects involved in successfully withdrawing funds from Exness.

👉 Visit Website Exness Official ✅

💥 QR Code Exness 👇

Understanding Exness Withdrawal Methods in India

When it comes to withdrawals from Exness, understanding the different methods available is vital. Each method has its own set of advantages and limitations that can impact your overall trading experience.

Overview of Withdrawal Methods

Exness offers several withdrawal methods tailored to meet the needs of its diverse clientele. These include bank transfers, e-wallets, and card services. The choice of method can depend on factors such as transaction speed, fees, and user preference. By familiarizing yourself with these options, you can select the most suitable one for your financial goals.

Importance of Knowing Your Options

Knowing your withdrawal options not only simplifies the process but also enhances your trading strategy. For instance, if you require quick access to your funds, an e-wallet might be preferable due to its faster processing times compared to traditional bank transfers. On the other hand, some traders may prefer the security and familiarity associated with bank transactions.

👉 Visit Website Exness Official ✅

Risk Factors and Considerations

While understanding the withdrawal methods is essential, it's equally important to consider potential risks. Factors such as currency conversion rates, additional fees, and processing times should all be assessed before making a decision. Additionally, ensuring compliance with local regulations can prevent unnecessary delays or complications during the withdrawal process.

Step-by-Step Guide: Withdrawing Funds from Your Exness Account in India

Navigating the withdrawal process can seem daunting, but breaking it down into manageable steps can simplify the journey. Below is a step-by-step guide to help you withdraw funds from your Exness account effectively.

Logging into Your Exness Account

The first step is to log into your Exness account. Make sure you have your credentials handy. Once logged in, navigate to the 'Withdrawal' section. This area is usually found in your account dashboard and will give you access to all the relevant withdrawal options.

👉 Visit Website Exness Official ✅

Selecting Your Preferred Withdrawal Method

After accessing the withdrawal section, you'll need to select your preferred withdrawal method. Depending on your earlier selections, this could range from bank transfers to e-wallets. Choose the option that best fits your needs.

Entering Withdrawal Details

Once you've selected a method, you’ll be prompted to enter specific details. This may include your account information, the amount you wish to withdraw, and any additional verification required. It’s crucial to double-check this information to ensure a smooth withdrawal process.

Confirming the Withdrawal Request

After filling in your withdrawal details, review the information once more and confirm your withdrawal request. You may receive a notification regarding the estimated processing time, so keep an eye out for any updates from Exness.

👉 Visit Website Exness Official ✅

Available Withdrawal Options for Exness Users in India

Exness provides multiple withdrawal options to cater to the diverse preferences of its users in India. Understanding these options can significantly improve your trading experience.

Bank Transfers

Bank transfers are a conventional and widely used method for withdrawing funds. They offer a sense of security since they involve direct transactions with your bank. However, they might take longer for processing, which could delay access to your funds.

E-Wallets

E-wallets like Skrill and Neteller are popular choices among traders for their quick processing times. They allow nearly instant fund transfers, which can be particularly beneficial for those requiring immediate access to their capital. However, be aware of any service charges that may apply.

Credit/Debit Cards

Withdrawing funds back to your credit or debit card is another viable option. This method allows for easy tracking and management of your finances. Nonetheless, processing times can vary depending on the bank and card provider.

👉 Visit Website Exness Official ✅

Choosing the Best Withdrawal Method for Your Needs in India

Selecting the right withdrawal method involves evaluating your personal preferences and financial needs. Here’s how to choose wisely.

Evaluating Speed vs. Security

A common dilemma faced by traders is balancing withdrawal speed with security. If quick access to your funds is your top priority, then e-wallets may be the best option. Conversely, if you prioritize security, bank transfers could be your go-to method.

Considering Fees

Each withdrawal method comes with its distinct fee structure. Some options may incur higher transaction fees than others, which can eat into your earnings. Being aware of these fees can help you make an informed decision that aligns with your trading strategy.

Assessing Accessibility

Not all withdrawal methods may be accessible for everyone. For instance, while e-wallets may offer speedy transactions, you must have an active account with those platforms. Determine which methods are readily available to you and factor that into your decision-making process.

👉 Visit Website Exness Official ✅

Withdrawal Fees and Processing Times for Exness in India

When planning to withdraw funds from Exness, understanding the fees and processing times associated with each method can significantly influence your choice.

Breakdown of Withdrawal Fees

Different withdrawal methods have varying fee structures. Bank transfers typically have lower fees; however, they often come with longer processing times. E-wallets can charge higher fees but generally offer quicker processing. It’s advisable to check Exness's official website or communicate with customer support for the most current fee information.

Average Processing Times

Processing times can differ widely based on the method chosen. Bank transfers may take several business days, while e-wallet transactions can be instantaneous. Knowing these timelines helps you manage your funds effectively, especially when you have urgent financial obligations.

Tips to Minimize Fees and Delays

To minimize fees and avoid delays, consider using the same payment method for both deposits and withdrawals. This can often streamline the process and help avoid additional charges. Additionally, staying updated on any promotions or reduced fees offered by Exness can prove beneficial.

Security Measures & Verification Process During Exness Withdrawals in India

Security is paramount when it comes to withdrawing funds. Exness takes multiple measures to ensure that your funds and personal information remain safe throughout the withdrawal process.

Two-Factor Authentication (2FA)

One of the most effective security measures employed by Exness is Two-Factor Authentication (2FA). Enabling 2FA requires a second form of identification—such as a code sent to your registered mobile number—thus adding an extra layer of security to your account.

Know Your Customer (KYC) Policies

Exness adheres to stringent "Know Your Customer" (KYC) policies, which require users to verify their identity before initiating withdrawals. This process can involve submitting identification documents and proof of residence. While this may seem cumbersome, it is essential for safeguarding both your account and Exness against fraud.

Monitoring Unusual Activities

Exness employs sophisticated monitoring systems to track any unusual activities in user accounts. If any suspicious behavior is detected, they may temporarily freeze accounts until further verification is conducted. Staying vigilant and reporting any inconsistencies on your account can enhance your security.

👉 Visit Website Exness Official ✅

Troubleshooting Common Exness Withdrawal Issues in India

Despite the reliable systems in place at Exness, users may occasionally face challenges when attempting to withdraw funds. Knowing how to troubleshoot these problems can save you time and frustration.

Common Withdrawal Errors

Some common errors faced during the withdrawal process include insufficient balance, incorrect payment details, or failure to complete KYC requirements. Always double-check your balance and withdrawal details to mitigate these issues.

Contacting Support for Assistance

If you encounter any problems, reaching out to Exness customer support can be invaluable. Their team is trained to assist with various withdrawal-related issues and can offer personalized solutions to your concerns.

Keeping Up with Platform Updates

Withdrawal processes and policies can evolve over time. Therefore, staying informed about any changes made by Exness is crucial. Regularly visiting their website or subscribing to their newsletters can help you stay in the loop.

👉 Visit Website Exness Official ✅

Minimum and Maximum Withdrawal Limits for Exness in India

Understanding the limits placed on withdrawals is essential for effective financial planning. Exness enforces certain minimum and maximum limits for withdrawals, which can vary based on the method chosen.

Minimum Withdrawal Amount

The minimum withdrawal amount can differ per payment method. Generally, e-wallets tend to have lower minimum limits, making them attractive for smaller traders. Conversely, bank transfers might have higher minimum thresholds.

Maximum Withdrawal Amount

On the flip side, maximum withdrawal limits can also vary. Some withdrawal methods may impose stricter caps compared to others. Familiarizing yourself with these limits can help you strategize your withdrawals better.

Practical Implications of Limits

These limits impact your trading strategies significantly. An understanding of these thresholds allows you to plan your withdrawals efficiently, avoiding any unexpected hurdles that could disrupt your financial workflow.

👉 Visit Website Exness Official ✅

Comparing Exness Withdrawal Methods with Other Brokers in India

When evaluating Exness’s withdrawal methods, it can be insightful to compare them with those offered by other brokers operating in India.

Analyzing Withdrawal Efficiency

Withdrawal efficiency is a critical factor for traders. While many brokers may offer similar withdrawal methods, Exness stands out due to its rapid processing times, especially through e-wallets. This is an essential consideration for traders who require quick access to their funds.

Fee Structures Across Brokers

Fee structures can significantly differ among various brokers. While Exness maintains competitive fees, other platforms may have hidden charges that can erode earnings. A thorough comparison can help you identify the most cost-effective broker for your trading needs.

User Experience and Support

Customer experience plays a vital role in the withdrawal process. While Exness boasts a user-friendly interface and supportive customer service, other brokers might fall short in these aspects. Reading user reviews and testimonials can offer insights into the typical experiences of other traders.

👉 Visit Website Exness Official ✅

Contacting Exness Customer Support for Withdrawal Assistance in India

In case you face any issues or have questions about withdrawals, Exness provides robust customer support to assist you.

Multiple Channels of Communication

Exness offers various channels for contacting customer support, including live chat, email, and phone support. Utilizing these multiple avenues ensures that you can get assistance in the way that suits you best.

Getting Quick Responses

For urgent matters, the live chat feature can be particularly helpful as it allows for real-time communication. Be prepared to provide details about your issue, including your account information, to facilitate quicker responses.

Seeking Information through Resources

Additionally, Exness has an extensive resource center featuring FAQs and guides related to withdrawals. Before reaching out for assistance, reviewing these resources may provide immediate answers to common questions.

Conclusion

Navigating the complexities of how to withdraw money from Exness in India can be a seamless experience when armed with the right knowledge and understanding. With various withdrawal options available, along with essential considerations like fees, processing times, and security measures, traders can make informed decisions that align with their financial objectives. Whether it’s choosing the optimal withdrawal method or troubleshooting common issues, knowing the steps involved can empower you to manage your funds effectively. Remember, if in doubt, don't hesitate to reach out to Exness’s dedicated customer support for assistance. Your trading journey should be as rewarding and hassle-free as possible, and mastering the withdrawal process is a key component of achieving that goal.