12 minute read

How to withdraw money from Exness to bank Account

With the increasing popularity of online trading platforms, many traders are looking for secure and efficient ways to manage their funds. One such platform is Exness, which offers a variety of withdrawal methods, including direct transfers to bank accounts. In this article, we will explore how to withdraw money from Exness to bank account, providing a comprehensive guide that includes preparation steps, verification requirements, troubleshooting tips, and more.

👉 Visit Website Exness Official ✅

💥 QR Code Exness 👇

Understanding Exness Withdrawal Methods

Before you can successfully withdraw funds from your Exness account, it’s essential to understand the various withdrawal methods available. Exness provides several options to suit different needs, ensuring that users have flexibility in choosing how they want to receive their earnings.

Bank Transfers

Bank transfers are a traditional and widely-used method for withdrawing funds from Exness. This option allows you to move your earnings directly to your bank account, making it convenient for those who prefer a straightforward approach.

Bank transfers typically involve transferring funds electronically from your Exness trading account to your bank’s account. The advantages of this method include security and reliability. However, it may take longer than other methods, depending on your bank's processing times.

E-Wallet Services

E-wallets such as Skrill, Neteller, and others have gained popularity due to their speed and ease of use. With these services, withdrawals are often processed much faster than traditional bank transfers.

Users can link their e-wallet accounts to their Exness profiles, allowing them to transfer funds quickly. While e-wallets offer improved convenience, it is crucial to consider transaction fees that may apply.

👉 Visit Website Exness Official ✅

Cryptocurrencies

For those who prefer digital currencies, Exness also facilitates withdrawals via cryptocurrencies. This option is gaining traction due to its borderless nature and lower fees associated with transactions.

Cryptocurrency withdrawals tend to be processed almost instantly, making it an attractive choice for traders looking to access their profits promptly. However, one must ensure familiarity with cryptocurrency wallets and exchanges to use this method effectively.

Payment Cards

Another option for withdrawing funds from Exness is through payment cards, including credit and debit cards. This method is practical for those who prefer receiving funds directly onto their cards, which can then be used for purchases or ATM withdrawals.

The key advantage of using payment cards is the immediacy of access to funds. However, it is vital to verify whether your card type is accepted by Exness before proceeding with this method.

👉 Visit Website Exness Official ✅

Preparing for Your Exness to Bank Account Withdrawal

Successful withdrawals require careful preparation. Before initiating a withdrawal request, there are several steps you should follow to ensure a smooth process.

Verify Your Account Information

One of the first steps in preparing for a withdrawal is to verify that all your account information is accurate and up-to-date. This includes your name, address, and bank details. Any discrepancies may lead to delays or rejected requests.

Take the time to double-check your bank account number, bank name, and any additional required identifiers. Accuracy is crucial to avoid complications during the withdrawal process.

Ensure Sufficient Funds

Another important aspect of preparing for a withdrawal is ensuring that you have sufficient funds available in your Exness account. Check your balance and ensure that it exceeds the amount you plan to withdraw.

It’s also advisable to consider any potential fees that may be deducted during the withdrawal process. By anticipating these costs, you can avoid surprises that could affect your desired withdrawal amount.

Understand Withdrawal Limits

Every trading platform has specific limits regarding withdrawal amounts. Familiarize yourself with Exness’s policies regarding minimum and maximum withdrawal limits.

This understanding will help you make informed decisions about how much money you wish to withdraw and whether you need to break your request into multiple transactions if necessary.

👉 Visit Website Exness Official ✅

Step-by-Step Guide: Initiating a Withdrawal Request

Once you are prepared to withdraw funds from your Exness account, you can follow these step-by-step instructions to initiate the process.

Log Into Your Exness Account

To begin, log into your Exness trading account using your credentials. Once logged in, navigate to the 'Withdrawal' section in the menu.

It's important to ensure that you're accessing the correct account—especially if you have multiple accounts or platforms. This will minimize the risk of errors during the withdrawal process.

Select Your Preferred Withdrawal Method

In the withdrawal section, you’ll be presented with various options based on the methods you've previously set up. Choose ‘Bank Transfer’ as your preferred method if you intend to withdraw to your bank account.

Ensure that you select the right option, as choosing a different method may complicate the process.

Enter Withdrawal Details

After selecting your preferred method, you will need to enter your withdrawal details. This typically includes your bank account information, the amount you wish to withdraw, and any other relevant data.

Be meticulous when filling out this information. An error in your bank account number or withdrawal amount could lead to significant delays or failed transactions.

Review and Confirm Your Request

Once you have filled in all the necessary details, review your withdrawal request carefully. Double-check the amount, your bank account details, and the selected method.

After confirming that everything is accurate, submit your withdrawal request. You should receive a confirmation message or email, indicating that your request has been successfully submitted.

👉 Visit Website Exness Official ✅

Verification Requirements for Secure Withdrawals

Verifying your identity is crucial for secure withdrawals on Exness. This process helps prevent fraud and ensures compliance with regulatory standards.

Know Your Customer (KYC) Process

Exness implements a Know Your Customer (KYC) policy that requires users to provide identification documents before withdrawing funds. This typically includes proof of identity and proof of address documents.

Commonly accepted forms of identification include a passport, national ID card, or driver’s license. Proof of address can include utility bills or bank statements with your name and residential address.

Document Submission Guidelines

When submitting your documents, ensure they are clear and legible. High-quality scans or photographs are recommended to avoid delays in processing.

Follow Exness’s guidelines for document submission closely, as any deviation from their standards may result in rejection or further requests for information.

Awaiting Verification Approval

After submitting your KYC documents, there may be a waiting period while Exness verifies your identity. This process can take anywhere from a few hours to several days, depending on various factors.

During this time, it’s important to refrain from making multiple submissions or inquiries, as this could hinder the approval process. Patience is key when navigating the verification stage.

👉 Visit Website Exness Official ✅

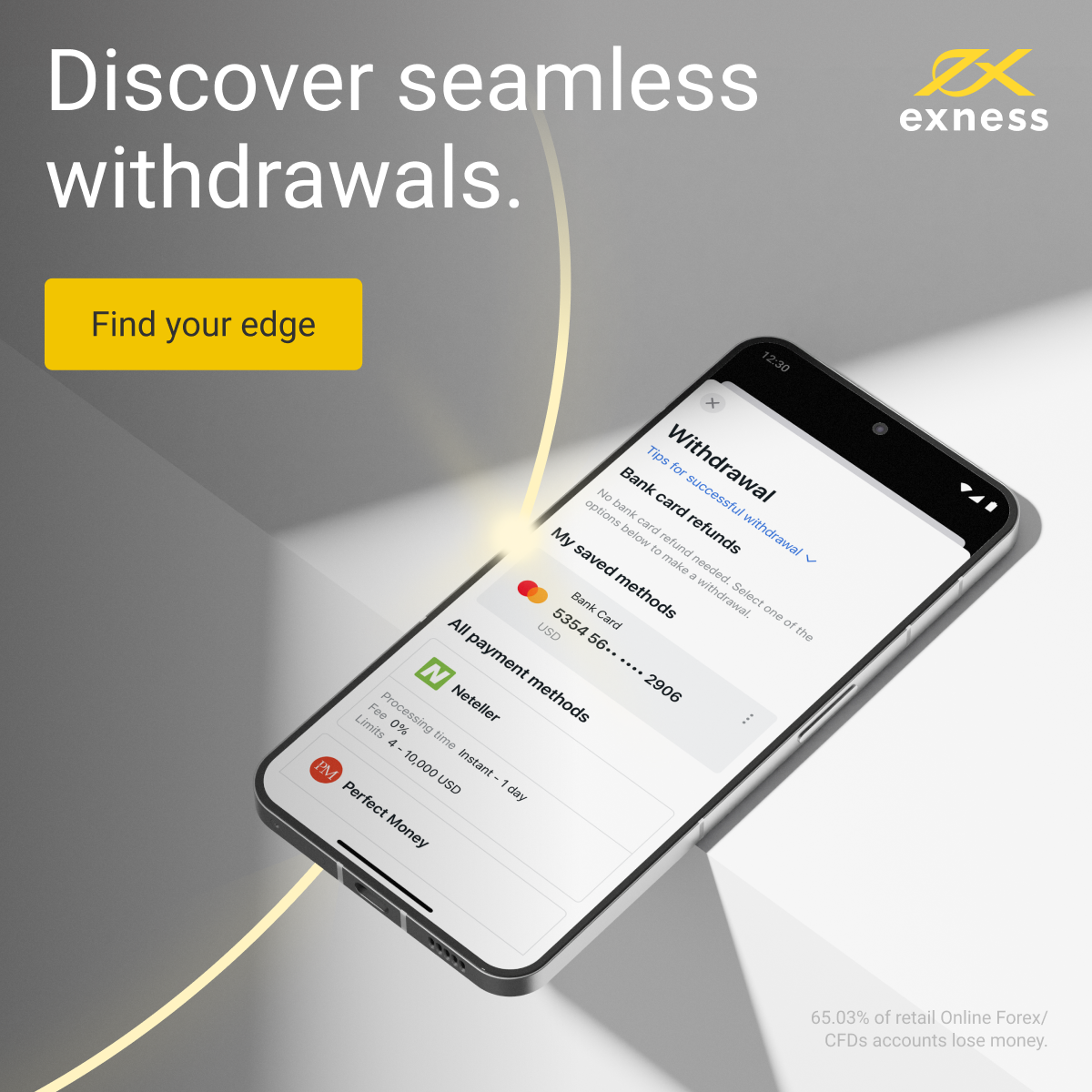

Withdrawal Processing Times and Fees

Understanding processing times and fees associated with withdrawals is essential for managing expectations. Each withdrawal method comes with its own time frame and potential costs.

Withdrawal Processing Times

Processing times for withdrawals can vary based on the chosen method. For instance, bank transfers generally take longer compared to e-wallets.

While e-wallet withdrawals are often processed within 24 hours, bank transfers may take several business days. It’s beneficial to refer to Exness’s official resources or customer support for the most accurate estimates.

Withdrawal Fees

Alongside processing times, consider the fees that may apply to your withdrawal method. Some methods might incur transaction fees charged by Exness or your banking institution.

E-wallets may have their own fee structures, so be sure to compare the overall costs of each withdrawal method to select the most cost-effective one for your needs.

Free Withdrawals Promotions

Occasionally, Exness may run promotions that offer free withdrawals for certain methods or under specific conditions. Keep an eye out for any announcements related to these promotions, as they can save you money in the long run.

👉 Visit Website Exness Official ✅

Troubleshooting Common Withdrawal Issues

Just like any online transaction, withdrawal processes on Exness may encounter issues. Being aware of common problems can help you address them efficiently.

Delays in Processing

A common concern among traders is experiencing delays in processing withdrawal requests. Several factors can contribute to this, including high traffic periods or incomplete documentation.

If your withdrawal hasn’t been processed within the expected timeframe, check your Exness account and email for any notifications. If necessary, contact customer support for assistance.

Rejected Withdrawal Requests

Sometimes, withdrawal requests may be rejected due to inaccuracies in provided details or failure to meet KYC requirements.

In such cases, carefully review your submission for any mistakes and ensure all required documentation is complete. If a request is denied, Exness usually provides a reason, allowing you to rectify the issue.

Fund Availability Concerns

Traders may also face issues related to fund availability, particularly if they attempt to withdraw more than their available balance.

To avoid this situation, always check your account balance before placing a withdrawal request. Additionally, familiarize yourself with Exness's policies on margin calls and leverage, as they can affect available funds.

👉 Visit Website Exness Official ✅

Choosing the Optimal Withdrawal Method for Your Needs

Selecting the right withdrawal method can significantly impact the speed and efficiency of accessing your funds. Here’s what you need to consider.

Assessing Urgency

Evaluate how urgently you need access to your withdrawn funds. If you require immediate access, options like e-wallets or payment cards may be more suitable, as they typically offer quicker processing times.

Conversely, if you’re not in a hurry, a bank transfer might suffice, particularly if you're comfortable with waiting a few days for the funds to arrive.

Factor in Costs

Consider any associated fees with each withdrawal method. Comparing costs can help you determine the most economical choice for your situation.

You should also factor in potential conversion fees if you’re withdrawing to a currency different from that of your Exness account.

Balance Between Convenience and Security

While convenience is important, never compromise on security. Ensure that the withdrawal method you choose is reliable and trusted.

Research user reviews and feedback on various methods to gauge their reliability. Prioritizing security will give you peace of mind when managing your funds.

👉 Visit Website Exness Official ✅

Security Best Practices for Exness Withdrawals

Maintaining security throughout the withdrawal process is crucial. Here are some best practices to safeguard your funds.

Enable Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your Exness account. By enabling 2FA, you can protect against unauthorized access, significantly reducing the risk of fraudulent activities.

Whenever possible, opt for methods such as SMS or authenticator apps. These require a second form of verification beyond just your password, enhancing your account's security.

Use Strong Passwords

Creating a strong, unique password is fundamental to securing your Exness account. Avoid common phrases, and mix uppercase letters, lowercase letters, numbers, and special characters.

Regularly update your password and refrain from sharing it with anyone. Good password hygiene greatly reduces the risk of unauthorized access.

Monitor Your Accounts Regularly

Stay vigilant by regularly monitoring your Exness account for any irregularities or suspicious activity. Prompt reporting of any concerning changes can help mitigate risks effectively.

Review your withdrawal history and account balances frequently. This practice can aid in early detection of potential issues that need addressing.

👉 Visit Website Exness Official ✅

Contacting Exness Support for Withdrawal Assistance

If you encounter challenges or have questions regarding the withdrawal process, reaching out to Exness support can be beneficial.

Channels of Communication

Exness offers various channels for contacting their support team, including live chat, email, and phone support. Choose the method that best suits your preference and urgency.

Live chat is often the fastest way to get real-time assistance, while email can be useful for detailed inquiries. Whichever method you choose, be clear and concise in your communication to facilitate a prompt response.

Prepare Relevant Information

When reaching out to support, prepare relevant account information such as your account number, withdrawal method, and any reference numbers related to your inquiry.

Providing comprehensive details upfront will help support agents assist you more effectively and expedite the resolution process.

👉 Visit Website Exness Official ✅

Follow Up on Your Inquiry

If you don’t receive a timely response or resolution, don’t hesitate to follow up on your inquiry. Persistence can sometimes be necessary to obtain the assistance you need.

However, maintain patience and professionalism in your communications, as the support team is working to assist numerous clients simultaneously.

Frequently Asked Questions about Exness Bank Withdrawals

Many traders have questions regarding the withdrawal process on Exness. Below are some frequently asked questions along with detailed answers to guide you.

What is the minimum withdrawal amount on Exness?

The minimum withdrawal amount can vary depending on the method you choose. Generally, Exness sets specific thresholds to ensure efficient processing. Always check the latest information on their official website or within the withdrawal section of your account.

Can I cancel a withdrawal request after submission?

Yes, in most cases, you can cancel a withdrawal request before it is processed. However, once the processing begins, cancellation may no longer be possible. To cancel an active request, contact Exness support as soon as possible.

Are there limits on how much I can withdraw daily?

Exness may impose daily withdrawal limits based on your account type and withdrawal method. Familiarize yourself with these limits to manage your transactions effectively.

Conclusion

In conclusion, understanding how to withdraw money from Exness to bank account involves a series of steps that range from preparing your account to choosing the optimal withdrawal method. Whether you opt for bank transfers, e-wallets, or cryptocurrencies, ensuring accuracy and security throughout the process is paramount.

By following the guidelines in this article, you can effectively navigate the withdrawal process, troubleshoot common issues, and make informed choices tailored to your financial needs. Remember to stay vigilant, secure your account, and leverage Exness support whenever necessary to enhance your withdrawal experience. Happy trading!