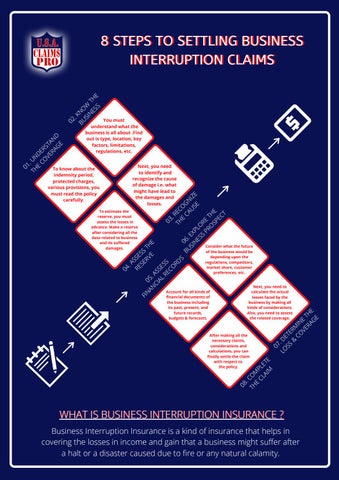

You must understand what the business is all about .Find out is type, location, key factors, limitations, regulations, etc. Next, you need to identify and recognize the cause of damage i.e. what might have lead to the damages and losses.

Consider what the future of the business would be depending upon the regulations, competitors, market share, customer preferences, etc. Next, you need to calculate the actual losses faced by the business by making all kinds of considerations. Also, you need to assess the related coverage.

Account for all kinds of financial documents of the business including its past, present, and future records, budgets & forecasts.

07 LO . D SS ETE & RM CO IN VE E T RA H G E E

04

To estimate the reserve, you must assess the losses in advance. Make a reserve after considering all the data related to business and its suffered damages.

E

TH

08

.C

O

M

After making all the necessary claims, considerations and calculations, you can finally settle the claim with respect to the policy.

CL PLE AI TE M

To know about the indemnity period, protected charges, various provisions, you must read the policy carefully.

.A RE SSE SE SS FI RV TH N 0 5 AN . E E A CI AL SSE RE SS 03 CO .R RD TH EC S E OG BU 06. CA N U IZ SI EX SE E N P ES LO S PR RE O TH SP E EC T

01 . TH UN DE E CO R VE STA RA N G D E

02

.K

BU NO SI W N ES TH S E

88 STEPS STEPS TO TO SETTLING SETTLING BUSINESS BUSINESS INTERRUPTION INTERRUPTION CLAIMS CLAIMS

WHAT IS BUSINESS INTERRUPTION INSURANCE ? Business Interruption Insurance is a kind of insurance that helps in covering the losses in income and gain that a business might suffer after a halt or a disaster caused due to fire or any natural calamity.