By Catherine Hicks / Managing Editor, RETHINK Retail

Interview with Lisa Kinney VP of Enterprise Analytics at Albertsons and Sean Higgins, Managing Director of Future Proof Insights

Interview with Tina Potthoff, Senior VP of Communications at Hy-Vee

By Catherine Hicks / Managing Editor, RETHINK Retail

Interview with Lisa Kinney VP of Enterprise Analytics at Albertsons and Sean Higgins, Managing Director of Future Proof Insights

Interview with Tina Potthoff, Senior VP of Communications at Hy-Vee

By Alex Lindstrom // Contributor at RETHINK Retail

It isn’t enough to say that retail customers today want value in their shopping experience. In the face of a turbulent economy that continues to shift around inflation, consumers feel both a desire and a need for relief, doubly so in the grocery industry where prices have risen 25.8%

While delivering ‘value’ to customers is fundamental to the retail industry yesterday, today, and tomorrow; how value is delivered, understood, and maintained is a wildly different beast than it once was. The retail atmosphere has continued to shift rapidly in recent years, affected by geopolitical realities, massive supply chains, and technological advances that have informed service delivery and how customers understand the shopping journey.

Despite these challenges, according to a recent report by the Federal Trade Commission, grocery retailer profits have risen and remained elevated.

“Food and beverage retailer revenues increased to more than 6% over total costs in 2021, higher than their most recent peak in 2015 of 5.6%. In the first

three-quarters of 2023, retailer profits rose even more, with revenue reaching 7% over total cost,” the report stated

Over time, grocery store sales have grown dramatically. From 1992 to 2023, sales more than doubled, with a total sales figure in 2023 of $884.8 billion in 2023 alone, according to findings by Statista.

In particular, Walmart continues to see remarkable success, accounting for 66% of grocery store shopping by brand in the U.S. as of March 2024, well ahead of its nearest competitor (and with growing brands such as Costco accounting for 24% of all shopping).

Furthemore, as a report by Grocery Dive notes, “Walmart doubled down on its strong position in the grocery sector last year—and the retailer is in a pole position to further consolidate its power in 2024, particularly in e-commerce,” going on to note that a growing express-delivery service will bring the brand into full competition with other e-commerce

grocers and help fuel more growth. The brand also plans to bring new electronic shelf labels to thousands of stores by 2026.

Meanwhile, the Kroger-Albertsons merger and the many legal proceedings negotiating it—remains an ongoing hot-button topic in the industry, with major implications for the broader grocery landscape should it proceed.

Though grocery retailers seem to be faring particularly well amid inflation rates that have some corporations participating in mass layoffs and budget cuts, they remain faced with the struggles of retaining inflation-

squeezed consumers searching for the best deals and developing innovative marketing strategies for their personal brands to retain loyal customers.

“Consumers are more cautious about what things cost”, said Anders Mittag, Chief Commercial Officer at Lobyco. “As a retailer, we need to cater to that.”

In 2023, private label sales accounted for 20.7% of grocery industry unit sales, a record level according to newly released data from the Private Label Manufacturers Association. This increase accounted for a $10.1 billion increase in the private label industry, bringing the industry to a total market value of $239.3 billion.

The report states that the results “show that today’s consumers are directing more of their budgets to private label items.”

Aldi and Trader’s Joe’s have developed sustainable brands surrounding private label products, with their owned brands accounting for more than twothirds of their overall sales, according to Numerator Insights report on Private Label Performance

The industry is also experiencing the next stage of investment and implementation in its retail media efforts. Albertsons, for example, has recently partnered with tech partner Rokt to broaden its retail media reach, including expanded ad capabilities. These efforts are aimed to engage the growing e-commerce grocery consumer segment, a smart move moving forward.

“There is a lot of retail media where the grocers are using the store advertising and digital screens to enhance the overall shopping experience,” said Vivek Choudaha, SBU Head and Associate Vice President of Cognizant.

The retail landscape is increasingly shifting

toward integration with AI, personalization, omnichannel optimization, and data informed marketing strategies that aim to improve consumer experience.

While some large chains are booming, small to mid-level grocers have struggled to compete when working to attract and maintain consumer bases. Yet, whether you are a small local grocer or a larger national chain, value should remain the key value you seek for a global consumer populace as hard strapped for cash as ever in recent memory.

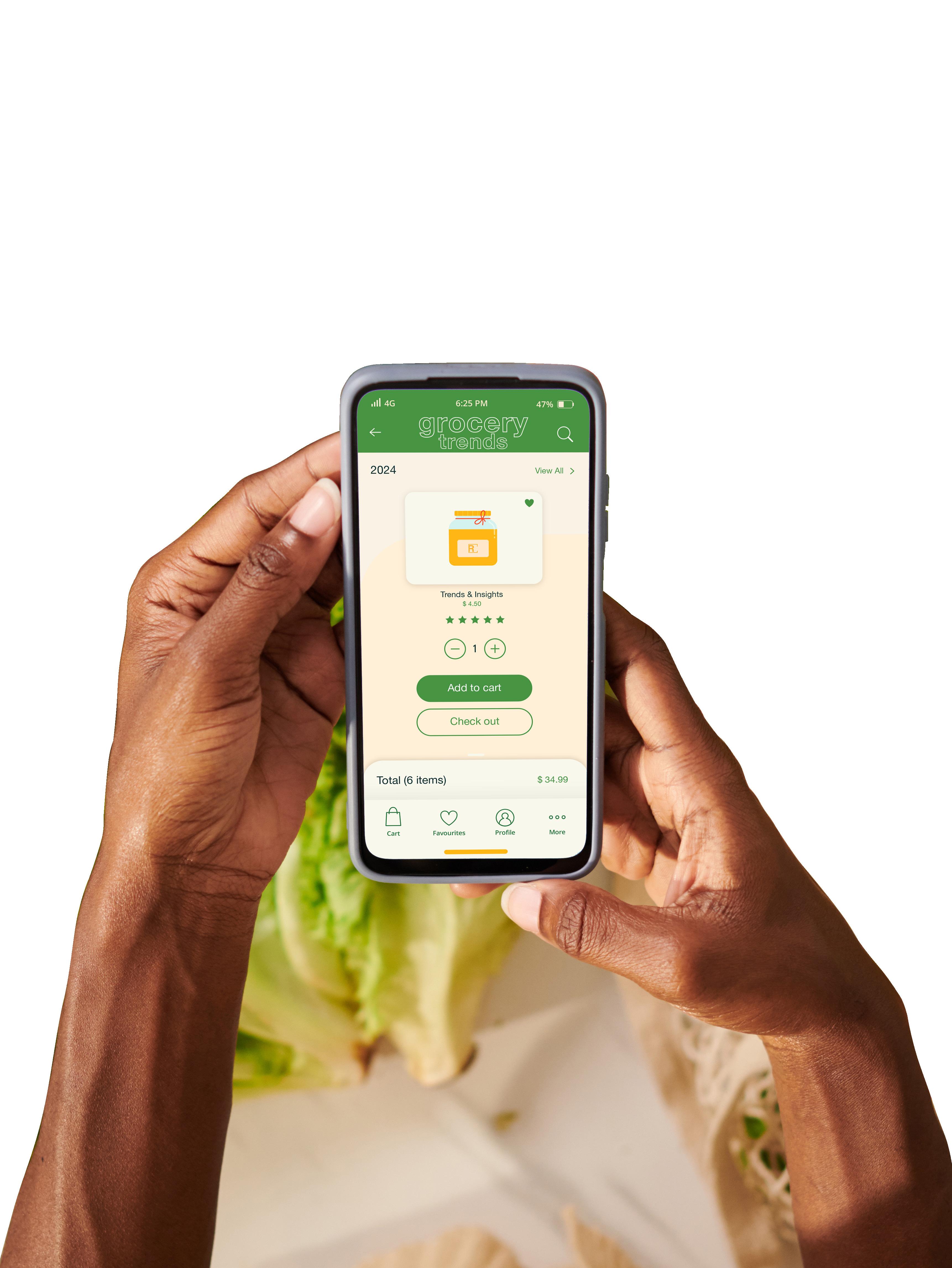

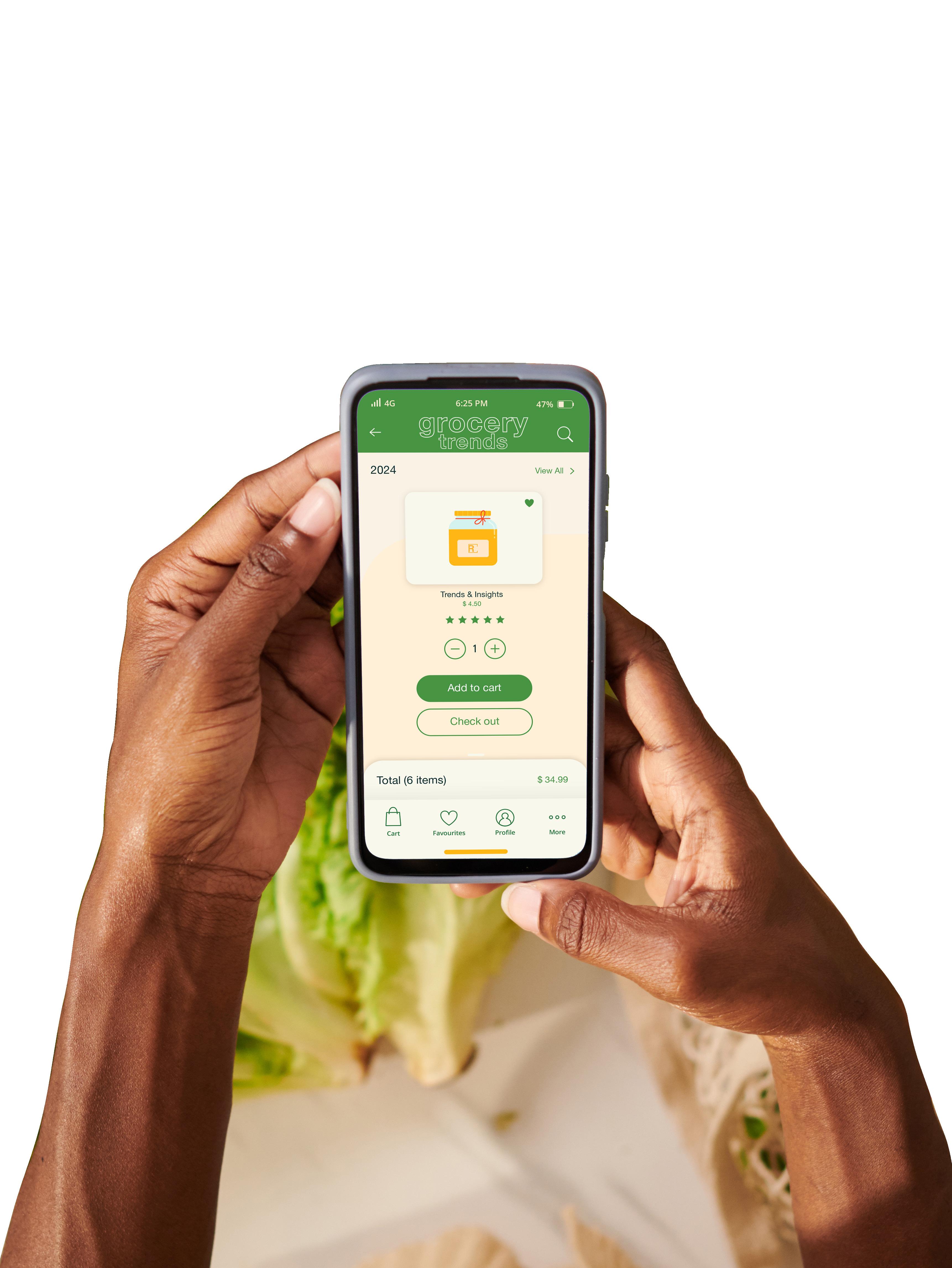

The question quickly becomes how to actualize better value propositions for today’s consumer, one that is ‘always-on,’ mobile, focused on convenience, seamless in-store experiences, and greater personalization on a scale that was once not possible.

Today, what value means in a digital landscape and how it can be captured is defined in no concept better or more succinctly than unified commerce, where each of the tremendous data silos retailers have access to today are brought together to create insights, opportunities, and innovations that were

In 2023, private label sales accounted for 20.7% of grocery industry unit sales

according to the Private Label Manufacturers Association

previously just not possible.

As these opportunities continue to expand, consumers’ expectations rise with them; according to FMI’s recent study on grocery shopper trends, consumers continue to seek ways to find increased value at the stores they patronize, even outside of price point.

“To manage higher prices, shoppers are increasingly prioritizing getting good value, which involves focusing more on quality and optimizing purchases for personal enjoyment, convenience, and waste-reduction at home,” the study stated.

To answer this demand, many grocers have already begun driving investments into realizing nextgeneration digital storefronts both for customers and associates, including a more sophisticated approach to unified commerce; whether that looks like a greater investment into multi-cloud system integrations, AI-powered monitoring, speedier networking, or even automated in-store assistants—including literal robots.

To help achieve that next level of sophistication,

small-to-medium-sized grocers in particular may struggle to understand where to start. Thankfully, a wide range of providers now exist to help integrate new tech solutions into existing, legacy systems via universal-API-driven software stacks--or even help to take difficult parts of the business off manager’s plates entirely via actively managed solutions.

This report will dive into a closer look at hot topics in the grocery retail industry, ranging from the rise of AI technology and data informed business, to brands can distinguish themselves from the competition and create a memorable brand, to sustainability as a business strategy targeting younger demographics, and even the future of the industry as a whole.

No matter how you choose to approach the challenges of today and tomorrow, join RETHINK Retail for this dive into the grocery industry of 2024 so you and your team can gain an edge on what a truly unified grocery looks like.

By Catherine Hicks // Managing Editor at RETHINK Retail

Data and neuroscience enable retailers to better understand consumer behavior, leading to more retailers to better understand consumer behavior, leading to more personalized shopping experiences and increased loyalty.

Retail media and advanced technologies like AI and machine learning allow for targeted marketing and operational optimization, driving revenue and customer engagement.

Retailers must adapt their strategies using data insights to meet the needs of diverse consumer groups, such as Gen Z and Hispanic shoppers, who prioritize personalized and culturally relevant shopping experiences.

In the retail industry, shopper sentiments and habits are constantly evolving; challenging retailers to employ smarter, more innovative methods to discover their customers’ preferences and needs. This is especially true in grocery stores, where shoppers motivated by increasing inflation make decisions based on individual preference, allergies, quality preferences, or sustainability concerns.

The strategic use of data and technology is not merely advantageous but essential for staying competitive in a rapidly evolving industry. As consumer behaviors shift and new digital tools emerge, retailers must adapt to maintain relevance and drive growth. By utilizing retail media, integrating advanced technologies, and adapting changing demographics, retailers can deepen their understanding of consumer behavior; enhancing customer experience and optimizing operations.

Neuroscience plays a crucial role in understanding consumer behavior; helping retailers decode how consumers make purchasing decisions and providing valuable insights that can lead to a more effective marketing strategy.

“Our brains are hardwired for ease... we’re on autopilot the vast majority of the time,” said Sean Higgins, Managing Director of Future Proof Insights. “(This) means that in some of the more traditional

ways that we look at consumer behavior, we are often looking at the conscious response of consumers. The challenge (in that) is… that part of the brain that is answering the questionnaire or responding in the folks group, it’s not the part of the brain that actually selected the product in the store or didn’t select the product in the store… You’re not really getting the answer straight from the source.”

Lisa Kinney, Vice President of Enterprise Analytics at Albertsons, highlights that understanding consumer behavior through neuroscience reveals multi-channel shopping can lead to increased spending and loyalty, while also emphasizing that retailers will face the challenge of balancing computing costs with identifying the specific data requirements for developing a comprehensive retail media strategy.

“The good news is that the data is available and it’s there and we’ve solved for, you know, all of the privacy guidelines that any retailer needs to adhere to. But what comes with that is a cost of computing that nobody really talks about,” said Kinney.

“One might be, you know, the amount of data that you’re pulling out of the environment. And I think those commercial constructs for data processing and cloud environments are going to have implications… Do we really need to run that

77% of grocery executives believe that real-time inventory management powered by AI will be a key component of their operations within the next 5-10 years

according to Deloitte Research

Every retailer is in the space of monetization of consumer touch points, and I do wonder when we will get to a point where you’re over-exhausting customers relative to impressions.

code? Do we really need to have that answer? That’s going to cost us $1 ,000 to write that query… Probably nobody thinks about it. I do from time to time; how is this going to change the way we think about the cost for personalization or the cost for just basic fundamental analytics?”

Despite the investment that it requires, according to Kinney, the prevalence of retail media and the importance of strategic differentiation in a competitive market will only continue to rise.

Retail media has emerged in recent years as a powerful tool in the grocery sector, projected to grow into a $61 billion dollar industry in 2024, according to research by Bain & Company. Retail media allows retailers to monetize their digital platforms through targeted advertising, creating new revenue streams while also gathering valuable customer data.

Retailers should lean into this opportunity, Kinney advises, while also cautioning over exposing consumers to advertisements.

“Every retailer is in the space of monetization of consumer touch points, and I do wonder when we will get to a point where you’re over-exhausting

customers relative to impressions,” Kinney noted, stressing the importance of approaching retail media not just as a monetization tool, but also as a key component of broader strategic goals.

As retailers continue to gather data from countless sources, interpreting and creating actionable plans from this data is key to developing personalized shopping experiences and optimizing supply chain operations. By integrating advanced technologies such as AI and machine learning, retailers are able to analyze vast amounts of data to predict consumer behavior, tailor marketing campaigns, and streamline logistics.

PepsiCo has fully embraced this evolution, implementing their Pepviz platform to leverage proprietary data to drive human-centric innovation and growth. By implementing this platform, PepsiCo is able to create actionable, data-based insights that enhance partnerships with retailers and cater to evolving shopper demographics.

“By tapping into unique shopper data from pepviz, we can share insights unique to individual locations that help our retailers win new cohorts, expand multicultural markets, and use data to provide hyper-targeted personalization at scale,” said

Ellen Webb, the Vice President of Strategy, Analytics and Insights for PepsiCo’s Demand Acceleration Team.

“Our agile approach allows us to quickly adapt and respond to a changing business environment, confidently delivering solutions and insights for our partners and across our portfolio of brands,” said Webb, noting that this approach is especially important for future business strategies, as Gen Z and Hispanic shoppers display increased purchasing power. According to Webb, PepsiCo is innovating product offerings and marketing strategies to be more culturally relevant.

“Gen Z is the most diverse generation in history, and they are quickly poised to become one of the most important growth cohorts for food and beverage,” said Webb, referencing data that Gen Z and Hispanic shoppers are heavily motivated by personalized shopping experiences and brands that resonate with their values.

The retail industry is at a pivotal moment where the integration of data and technology is not just beneficial but essential for maintaining a competitive edge. As consumer behaviors evolve and technology continues to advance, retailers must adapt by leveraging insights from neuroscience, strategically utilizing retail media, and embracing advanced data analytics to deliver personalized experiences.

This approach not only enhances customer satisfaction but also optimizes operations and drives growth. By focusing on these key areas, retailers can better meet the diverse needs of their customers, stay relevant in a rapidly changing market, and build stronger, more loyal customer relationships. The future of retail will increasingly depend on the ability to harness data effectively and create a seamless, personalized shopping experience across all channels.

Lisa Kinney, VP of Enterprise Analytics

Lisa Kinney, Vice President of Enterprise Analytics at Albertsons, highlighted the increasing importance of omnichannel shopping and the need for seamless, frictionless experiences. She noted that while e-commerce presents challenges like maintaining impulse purchases, it also offers opportunities to increase customer loyalty and overall spend when digital and physical channels are well-integrated.

Kinney also emphasized the need for differentiation in a competitive market and warned against overexposing customers to retail media without a clear strategy. She highlighted the importance of privacy-compliant data systems for personalization and the ongoing need for supply chain optimization. Throughout, Kinney stressed that a customer-first approach is essential for success in the evolving grocery retail landscape.

By Catherine Hicks // Managing Editor at RETHINK Retail

Private label brands like those from Aldi and Trader Joe’s have become essential for maintaining customer loyalty by offering high-quality items at competitive prices amid rising inflation.

Retail media and advanced technologies for customer retention, with companies like HyBee investing in strategies that cater to specific customer needs to enhance convenience and satisfaction.

Retailers can use neuroscience and advanced technology to consumer behavior, creating engaging and memorable shopping experiences that boost brand loyalty.

In an economic climate that is increasingly characterized by rising inflation, today’s shoppers are motivated to search for alternative brands that offer better value. This shift is particularly prevalent in the grocery industry; as average prices have risen over 25% from January 2020, placing an increased strain on consumers to find brands that offer the best value for their money without compromising on quality.

As shoppers begin to become more and more aware of their spending habits, brand loyalty rises as an important factor for retailers to leverage in retaining consumers. Studies show that customers spend 43% more on brands they are loyal to compared to those they are not, and 89% of customers say they will remain loyal to a brand if it shares similar values.

However, as inflation continues to put pressure on the average consumer’s grocery budgets, many have opted for switching brands. In 2024, reports began emerging that name brands were experiencing a decline in sales; a Wall Street Journal report found that 65% of shoppers choose to store brands or private labels over national brands due to lower prices. Circana found that dollar sales of private brands increased 6% from 2023, indicating a continued opportunity for retailers to refine private label strategies and invest in increasing efforts in building a memorable brand to target price-affected consumers.

“With today’s economy, I think people are really looking at ways that they can save… They’re looking for ways that they can save a couple pennies, that they can get the deals, that they can get the bargains,” said Tina Pothoff, Senior Vice President of Communications at Hy-Vee, “They’re looking at places like Walmart (and) Aldi, and making sure that they’re getting the best deals. So for everyone else who’s in the industry who may not have that type of size behind them, it’s really important that we’re finding ways to overcome that challenge and showing that we too are providing value as a regional grocer.”

In recent years, private label brands have surged in popularity, becoming a key strategy for grocery

retailers to build memorable brands and maintain customer loyalty. Aldi and Trader Joe’s are leading this trend, with private label products accounting for the majority of their sales. This success is driven by the ability of these stores to offer high-quality products at competitive prices, appealing to valueconscious consumers amidst rising inflation.

Trader Joe’s has cultivated a strong brand identity through its unique private label offerings, each with its own story that resonates with customers. Similarly, Aldi has capitalized on its private label strategy to provide a wide range of affordable products, making it a favored choice for budgetconscious shoppers. Private label items continue to have significant growth, with dollar sales of private brands increasing by 273% in US grocery since 2009, 6% of which in 2023, according to research by PDG Insights. Furthermore, one in five dollars spent on groceries goes toward private label products. This indicates that investing in private labels not only helps in customer retention but also boosts overall sales performance.

A key aspect of mastering this aspect of customer retention is recognizing the importance of understanding customers needs and preferences. Personalization remains an area of opportunity for retailers; as studies show that 78% of consumers are more likely to make repeat purchases

With today’s economy, I think people are really looking at ways that they can save… They’re looking for ways that they can save a couple pennies, that they can get the deals, that they can get the bargains.

Tina Pothoff // Senior VP of Communications at Hy-Vee

from companies that personalize. The findings also show that consumers are more likely to expect personalization from retailers, as 71% of consumers expect personalization and 76% get frustrated when they don’t receive it.

Pothoff emphasized this by explaining how HyVee is investing in this customer-centric approach; focused on integrating dieticians with pharmacy services, developing efficient self-service kiosks, and optimizing store layouts to enhance convenience. These implementations are designed to personalize the shopping experience and reduce friction, ensuring that “the soccer mom coming to pick-up snacks (can easily) get in and out,” and allowing a child the special experience of “picking out a special birthday cake,” said Potthoff.

“The biggest thing right now that a lot of people, including suppliers and retailers, have the challenge of trying to figure out is really where the customer is at, where they’re located and what their needs and wants are. Some people have been looking at retail media as another way to reach the customer and

Customers spend 43% more on brands they are loyal to compared to those they are not, and 89% of customers say they will remain loyal to a brand if it shares similar values

according to TechJury

in a non-traditional way, which is becoming more traditional as more people get into this space,” said Potthoff.

Neuroscience offers a powerful toolkit for retailers aiming to leverage both retail media, personalization, and subconscious shopping behaviors to build memorable brands and enhance customer loyalty. By understanding how the brain responds to sensory stimuli, retailers can create engaging shopping experiences that leave lasting impressions.

“From our perspective and from a neuroscience point of view, decision making is made on a complex interplay of emotions, motivation and reward systems…” says Sean Higgins, Managing Director of Future Proof Insights, “These judgements are kind of guided by rules, biases, associations, and heuristics that simply and speed up decision making, particularly in the shopper sense… (This is) even more pronounced in the grocery shopper because it’s a highly competitive, highly stimulating visual experience.”

Higgins delves into neurosciences effect on retail media, exploring how tapping into the subconscious provides meaningful insights into the decision-making process that a shopper experiences, and employs advanced neuroscience techniques like EEG and eye tracking to delve deeper into the subconscious mind, providing a more accurate picture of consumer behavior.

Utilizing neuroscience to craft connected and meaningful interactions can help grocery retailers differentiate themselves in a competitive market, ultimately driving brand loyalty and long-term success.

For many retailers, investing in developing a strategic business relationship with a software provider is the most cost-effective and simple route to ensure a widespread adoption and maintain constant troubleshooting and updates.

“(Retailers) need to invest in a more flexible digital infrastructure that supports and understands the

needs of not just your consumers, but actually also the marketers, the people that are working with the promotions every day,” says Anders Mittag, Chief Commercial Officer of Lobyco, a leading Softwareas-a-Service (SaaS) provider for grocery retailers.

While many software platforms offer similar benefits, Lobyco’s solutions are uniquely tailored to optimize promotions, boost loyalty, and innovate self-checkout. Their data-driven platform manages everything from white labels to customer shopping lists. Partnering with software management platforms or services helps management teams create an informed, seamless digital and mobile customer experience, enhancing brand loyalty and customer satisfaction.

Each grocer must consider their strategic needs when choosing to pursue any given strategy for building a memorable and unified brand. Universally, however, retailers must invest in developing a plan that integrates every stage of the shoppers experience and needs, whether digital

or in-person, and configures them into an arrangement that harmonizes with retailer operations.

As inflation continues to pressure consumer budgets, the growing trend towards personalized shopping experiences that encourage brand loyalty to private labels and store brands presents both challenges and opportunities for retailers.

In order to capitalize on the opportunities, retailers must be prepared to invest in business partners, processes, or technologies that develop brand loyalty. As customer loyalty continues to evolve, retailers must ensure they appeal through both customization strategies and value propositions while also leveraging data, technology and neuroscience to develop a strategy to engage consumers on an emotional level.

Tina Potthoff, Senior Vice President of Communications at Hy-Vee, discussed the biggest trends in grocery retail, emphasizing the importance of providing value to customers, especially in today’s economy where price sensitivity is paramount. She highlighted how consumer shopping habits have evolved since COVID-19, with many seeking out the best deals at stores like Walmart and Aldi. For regional grocers like Hy-Vee, this means finding ways to demonstrate value and convenience to remain competitive.

Potthoff also spoke about Hy-Vee’s focus on customer-centric innovation. She highlighted their efforts to integrate services like dietitian and pharmacy consultations, as well as implementing self-service technologies that enhance the shopping experience. Additionally, she mentioned Hy-Vee’s flagship stores, like the one in Gretna, Nebraska, which showcase a range of innovative features from expanded food services to sports shops, catering to diverse customer needs. This culture of innovation extends to their retail media efforts with Red Media, aimed at targeting customers more effectively through localized and personalized advertising.

By Ronald Margulis // Managing Director at RAM Communication

In an era when e-commerce has become increasingly important, the in-store experience remains crucial for attracting and retaining customers. As consumers’ expectations evolve, retailers must adapt to offer personalized, engaging, and seamless experiences. This shift is dramatically impacting the grocery sector, which was late to the online game and was pushed into it by the COVID-19 pandemic.

Today’s grocery shoppers seek more than just products; they desire experiences that resonate with their personal preferences and lifestyles. Personalization has become a key driver in fulfilling these needs. Customers appreciate when retailers remember their preferences, offer tailored recommendations and provide customizable products and services.

A recent survey from SPAR Group, a provider of merchandising, marketing and distribution services, revealed that in-store shopping remains a fixture of most consumer’s routines, with more

than 80% preferring to purchase groceries in-store and more than 45% choosing to shop in-store at discount, convenience, home improvement and apparel stores. The ability to try on/demo products, select new products and plan meals are important motivators consumers give for shopping in-store. Once in the store, consumers rate customer service (71%), a speedy checkout (69%) and an engaging atmosphere (51%) as important attributes for a successful shopping experience.

“The SPAR Shopper Insights Survey tells us that while today’s customer is demanding, there are a variety of opportunities for retailers and brands to create value for them and build long-term loyalty. Several storylines from the data conclude the need for companies in the industry to be even more dedicated to engaging shoppers at every point in the buying journey, improving inventory management and service levels, especially within the store,” said Mike Matacunas, CEO and president, SPAR Group

Grocery retailers are leveraging data analytics and customer insights, creating a shopping journey that not only enhances customer satisfaction and increases loyalty but also emulates the digital path to purchase they are now accustomed to and often prefer. Some of the key tactics they are deploying include:

Personalization is at the forefront of customer expectations. Retailers can achieve this through personalized recommendations, customized products, and targeted marketing. For instance, food retailers are offering personalized menu advice based on a customer’s previous purchases and dietary preferences/restrictions. This not only enhances the shopping experience but also fosters a deeper connection between the customer and the brand.

Customers value a hassle-free shopping experience with streamlined checkout processes, easy

navigation and efficient service. Implementing self-checkout kiosks, mobile payment options and clear signage can significantly reduce friction and improve the overall shopping experience.

Engaging customers through interactive displays, product demonstrations and knowledgeable staff helps make each visit to the store memorable. For example, food stores are back to sampling new items after pulling back during the pandemic. Cooking demonstrations are also back and there is a proliferation of quick response codes providing educational links and ingredient backstories to enhance the overall shopping experience.

In-store shopping remains a fixture of most consumer’s routines, with more than 80% preferring to purchase groceries in-store and more than 45% choosing to shop in-store at discount, convenience, home improvement and apparel stores

according to a SPAR report

The store’s ambiance has always played a crucial role in shaping the customer experience. Aesthetic and comfortable store design, along with pleasant sensory elements such as lighting, music and scent, creates an inviting atmosphere. Grocery retailers like Wegmans and Publix are investing in creating a visually appealing and comfortable environment that encourages customers to spend more time in the store.

In today’s digital age, seamless integration between online and offline channels is essential. Customers expect a cohesive shopping experience across all platforms. Retailers are achieving this by integrating loyalty programs, mobile apps and click-and-collect services. For instance, a customer should be able to browse products online, reserve them and pick them up in-store, enjoying a seamless transition between channels.

Technology plays a pivotal role in creating the desired in-store experiences. Artificial intelligence (AI) and data analytics enable retailers to gain insights into customer behavior and preferences, allowing for more personalized interactions. Digitization of the aisles, through digital shelf tags (DSLs) and displays, offers convenience and seamlessness, meeting the expectations of techsavvy customers. Both tools are being deployed by some of the most successful food retailers in North America with Walmart, Kroger and Hy-Vee leading the charge.

For Walmart, DSLs started as a workforce performance improvement tactic buy has quickly morphed into a promotional strategy. “Changing price shelf labels in stores is important, but time intensive for our associates. We’ve been testing digital solutions that will help us manage these price changes electronically, allowing associates more time to help our customers and ultimately

enhance the overall customer experience,” said John Crecelius, Senior Vice president, Walmart U.S. “We’re seeing positive results and are expanding the rollout of these electronic shelf labels.”

At NRF earlier this year, Yael Cosset, Kroger CIO and SVP, said the retailer has invested significantly in customer facing digital innovations based on AI insights to provide greater value and savings. “We continue to invest in our digital transformation journey by enhancing our customer and associate experiences, recognizing that both are equally impactful to gaining loyalty and earning our customer’s next trip,” said Cosset. “Our aim is to be the fresh food destination by providing customers with an experience that gives them exactly what they want no matter how they shop and use our digital capabilities to support associates, making their jobs easier and enabling them to spend more time doing what they are best at—interacting with customers.”

Hy-Vee is working on an overall re-imagining of the physical store with DSLs and displays as a critical element. “The digitalization of its stores enables HyVee to create a richer experience for employees and shoppers, led by human-first innovation. Through automation, the retailer has more time to connect with today’s consumer where and when they need it,” said Philippe Bottine, CEO North America and Group Deputy CEO for VusionGroup, which is supplying much of the digital technology to Hy-Vee.

Several retailers outside the grocery sector are successfully implementing novel strategies to

enhance their in-store experiences and food retailers are paying close attention to the results these other companies are seeing. Nike’s flagship stores, for example, feature personalized experiences with custom shoe designs and interactive displays. Apple stores are known for their hands-on product testing and expert support. Sephora offers in-store beauty services and AR tools for virtual makeup try-ons. These examples demonstrate how focusing on customer needs and leveraging technology can create memorable and satisfying in-store experiences and are applicable to retail grocery.

While implementing these experiences, retailers may face challenges such as high costs, technological integration issues and adapting to rapid consumer trends. Balancing investment with

customer satisfaction is crucial. Food retailers need to stay agile and continuously innovate to meet changing expectations. Specifically, retailers and consumer brands need to 1) improve on shelf

inventory management, 2) optimize staffing to provide an engaging experience and 3) invest in more tech to empower the consumer’s shopping experience, according to analysis of the research by SPAR Group.

“The next generation of leaders in retail and consumer brands will differentiate on service, both from an in-store and application point of view. Operating a physical store must be reinvented to provide value to today’s consumer. The physical layout, the experience, staffing, product availability and responsiveness need to work in concert,” said SPAR’s Matacunas.

The in-store experience remains a vital aspect of retail success. By understanding and meeting customer needs through personalization, convenience, engagement, ambiance and omnichannel integration, retailers can create

compelling in-store experiences. Leveraging technology further enhances these experiences, ensuring that customers remain loyal and satisfied. As the retail landscape continues to evolve, staying attuned to customer desires and embracing innovation will be key to thriving in the competitive market.

My grandfather, a ShopRite Supermarket owner and operator in New Jersey for decades, had a mantra that went something like this: “My job as a retailer is to make it as easy as possible for my customers to buy from me and as hard as possible for them to buy from anyone else.” It’s likely he would never have even considered the possibility of the internet, let alone having digital channels compete with bricks and mortar stores, but he would have nonetheless worked as hard as possible to make the physical location easier and more engaging to shop in.

Ron has more than 35 years of professional and managerial experience at RAM Communications, Forbes and Tribune Media. His articles on the food, retail, tobacco, technology and transportation industries have appeared in dozens of newspapers, magazines and websites around the world. Ron has won several awards for his writing, created 27 industry studies and is contributing editor for five professional reference books. He graduated with honors from George Washington University, received his MBA in economics from New York University, studied journalism at University College, University of London, and completed a management internship and meat cutter’s apprenticeship at Shop-Rite Supermarkets.

By Catherine Hicks // Managing Editor at RETHINK Retail

Sustainability within the modern grocery retail landscape has shifted from a concern among a niche sector of consumers to a central pillar of business strategy.

Research shows that high-income households, those with children, and younger generations are more motivated to purchase from quality, sustainably sourced brands.

Implementing a full scale sustainability plan throughout all levels of the business is an effective strategy to improve business brand perception, deepen consumer trust and loyalty, and refine a customer’s shopping experience.

76% of retailers recognized sustainability as a strategic priority, acknowledging the relevance of this issue and signifying the overall acceptance that retailers must act in environmentally responsible ways

according to a Cognizant report

As the effects of climate change become more pronounced, consumers are demanding more from the brands they patronize, prompting significant shifts in the grocery retail business model.

Facing a host of challenges within the grocery retail industry, such as fluctuating demand, supply chain disruptions, and changing consumer preferences, sustainability is poised as an important business choice for stakeholders in improving brand perception, securing loyal customers and standing out from the competition.

The COVID-19 pandemic exacerbated the current issues within the grocery retail industry, highlighting vulnerabilities in global supply chains and shifting consumer behaviors towards more healthconscious and sustainable choices. Additionally, rising inflation has pressured both retailers and consumers, making cost management and efficiency crucial.

Consumers today are more informed and concerned about the environmental impact of their purchases. According to a 2023 U.S. Brand Sustainability Benchmark Report for the Food and Grocery Industry by Glow, 1 in 2 consumers have started or stopped using a food and grocery retailer based on the brand’s environmental, social, and governance (ESG) decisions. This number climbs to 7 in 10 for millennials and those with children.

As Vivek Choudaha, SBU Head and Associate Vice President at Cognizant, noted, “There is always a growing emphasis on environmentally friendly products, waste reduction, and responsible sourcing.”

“GenZ (in particular) are known for their strong commitment to sustainability, which significantly influences their shopping habits, especially in the grocery sector. This generation prioritizes eco-friendly products and practices, often valuing them over brand names. They are more likely to purchase from companies that use sustainable materials, reduce carbon footprints, and support fair trade initiatives,” said Choudaha.

Several grocery retailers have successfully implemented sustainability initiatives, building trust with consumers and enhancing their brand perception. Aldi and Walmart serve as prime examples of this trend.

Are you ready?

GenZ (in particular) are known for their strong commitment to sustainability, which significantly influences their shopping habits, especially in the grocery sector.

This generation prioritizes eco-friendly products and practices, often valuing them over brand names.

Vivek Choudaha // SBU Head and Associate VP at Cognizant

In the United States, Aldi has taken significant steps to reduce plastic use, removing plastic bags from their stores and encouraging customers to bring their own bags or purchase paper alternatives. The company also announced it would transition to natural refrigerants across all of its U.S. stores by the end of 2035, saving nearly 60% of potential carbon emissions.

Brands also must remain aware of sustainability pressures, especially from rising demographics such as Gen Z and Hispanic shoppers that are experiencing an increase in buying power.

“Gen Z is the most diverse generation in history, and they are quickly poised to become one of the most important growth cohorts for food and beverage,” said Ellen Webb, Vice President of Strategy, Analytics and Insights for PepsiCo’s Demand Accelerator team.

“We’re constantly finding new ways of doubling down on our digital transformation and leaning into our pep+ agenda where our brands will continue to bring smiles and drive sustainable growth for people and the planet,” said Webb.

Facing the dual challenges of retaining inflationimpacted high-income customers and enhancing their brand, Walmart launched BetterGoods, a high-quality private label focused on sustainability, quality, and price effectiveness. John Clear, Senior Director at Alvarez & Marsal Consumer Retail Group, noted, “It’s a bit of a total solutions play… to move slightly away from just the image of only being price, commodity and value-focused, to also quality, ingredient and sustainability-focused, to bring in that higher tax bracket.”

As retailers navigate a consumer landscape driven by brand connection and eco-awareness expectations from the most desired audiences, many need assistance in coordination of implementing sustainability plans. Cognizant, an award-winning global professional services company, is at the forefront of helping grocery retailers implement sustainability as a core business strategy. By developing comprehensive sustainability plans that address every level of the organization, from supply chains to customer interactions, Cognizant’s practices ensure that sustainability is embedded into the very fabric of the business rather than being an afterthought.

A 2023 study by Cognizant and Oxford Economics examining the role of sustainability in the future of business, found that 76% of retailers recognized sustainability as a strategic priority, acknowledging the relevance of this issue and signifying the overall acceptance that retailers must act in environmentally responsible ways.

“Rather than seeing sustainability as an afterthought or as a series of standalone initiatives, retailers need to put it front-andcenter from the very beginning of every modernization program and incorporate it throughout the enterprise and across the entire product lifecycle,” notes Dana Vannen Anderson, Senior Director of Retail and Consumer Goods Sustainability at Cognizant.

Cognizant helps retailers develop sustainability plans by ensuring responsible sourcing, adherence to environmental standards, and waste reduction in supply chains. They leverage real-time data and analytics for informed decision-making on inventory, sourcing, and waste management. Additionally, they implement AI-driven inventory systems to optimize stock levels and reduce waste, while adopting energyefficient technologies to minimize power usage and carbon footprint.

As sustainability becomes increasingly critical in the grocery industry, retailers must adapt to meet the demands of informed and conscientious consumers. By implementing robust sustainability initiatives, grocery retailers can improve their brand perception, build consumer trust, and create a smoother shopping experience. Companies like Cognizant are leading the charge, providing the expertise and technological support needed to make these transitions seamless and effective. The shift towards sustainability is not just a trend but a necessary evolution in the face of global environmental challenges. To learn more about how Cognizant helps businesses embrace sustainability, visit their website.

Vivek Choudaha, from Cognizant, discussed the significant changes reshaping the grocery industry, emphasizing the importance of technology and data in driving efficiency and enhancing customer experiences. He highlighted the growing demand for environmentally friendly products and the challenge of integrating emerging technologies like AI and Gen. AI into grocery operations. Cognizant’s approach involves co-creating innovative solutions with clients, leveraging their deep expertise in the grocery sector to deliver personalized and efficient services that meet the evolving needs of consumers and businesses alike.

Choudaha also noted the impact of omnichannel experiences, social commerce, and sustainability on the grocery landscape. He emphasized the importance of understanding consumer behaviors, particularly among younger generations like Gen Z and Gen Alpha, to tailor grocery experiences that resonate with them. Cognizant helps grocery retailers stay ahead by developing advanced digital solutions, such as digital marketplaces and merchandising systems, that optimize operations and improve customer engagement across various channels.

By Alex Lindstrom // Contributor at RETHINK Retail

Within any given industry, the same stories are likely to be told again and again, well-practiced and often heard from podiums at every trade show.

For retail, one of those stories has long been the need for an omnichannel approach to doing business, particularly when it comes to customer engagement, retention, and ultimately loyalty.

Like any trendy industry strategy, omnichannel retail was a response to changes and challenges such as rapidly changing consumer preferences, a rise in climatologically disruptive events, supply

chain disruptions (including shortages and shipping fiascos), the ongoing labor shortage, and a generally more fiercely competitive business landscape. The urgency of its adoption—and for retailers to digitally transform in general—was only accentuated by the lockdown era.

It is simple enough to understand a marketer should reach out to customers both traditionally and on mobile platforms, but then phrases like ‘omnichannel retail transformation’ became a ‘status’ to be achieved, further confusing things.

We build engaging loyalty, promotions & checkout solutions. Go ahead, have a look!

14%

increase in monthly spend after transforming members from non-digital to digital.

18% increase in store visits in weeks members use the app.

2.5B+ personalised offers allocated in 2023.

115% increase in spend from game winners in months after a campaign.

Through enough industry debate and reflection—or perhaps simply due to exhaustion with the term—an arguable successor to ‘omnichannel retail’ eventually became apparent: unified retail.

While some have argued that omnichannel and unified are complimentary terms, unified has also often been used to simply replace omnichannel. This change can be attributed to brevity and clarity, as retail commerce that unifies all of its data to create better streamlined, more efficient, and increasingly insightful recommendations, particularly for modern, customer-centric retail models.

“Unified retail may sound like an industry buzz phrase but experts believe it represents the inevitable next step. Retailers need to transition from a channel mentality to one where the ultimate goal is to provide a customer-centric experience based on the shopping behavior of the modern consumer,” according to a report by Retail Week.

Anders Mittag, Chief Commercial Officer at Lobyco, identified inflation, digital transformation, retail media, and gamification as the key trends reshaping grocery retail. He emphasized that retailers must innovate in digital promotions and customer engagement, with gamification playing a crucial role in boosting loyalty and enhancing customer experiences. To stay competitive, retailers need to invest in flexible digital infrastructures and focus on integrating digital and physical shopping experiences.

Mittag also discussed significant challenges, such as outdated legacy systems and the shift towards discount stores. He stressed the importance of modernizing digital infrastructures and implementing frictionless shopping experiences like mobile scanand-go. Additionally, effective change management and leveraging data for personalized promotions are vital for overcoming these challenges and maintaining customer trust.

“While omnichannel was largely about the technical integration of the different channels at the back end,” the report continues, “the consumer would still have a relatively contrasting experience between different touchpoints at the front end.

The ethos behind a unified retail approach is to create a shopping experience entirely on the customer’s own terms rather than those imposed by the retailer,” further explaining that unified retail offers a more holistic understanding of modern, customer-centric retailing.

Some may claim that the rise of AI-powered platforms in retail has provided a clear path towards effective unified retail. This partnership allows the infusion of machine learning and generative algorithms into every API, cloud solution, and digital assistant to

help identify patterns and synthesize data where once it was cost prohibitive to do so.

Anders Mittag, Chief Commercial Officer of Lobyco is familiar with the vast amounts of data required to inform grocery retailers decisions.

As a leading Saas provider for grocery retailers, Lobyco is a partner to retailers, offering a seamless unified approach for consumers, retailers, and marketers to leverage the immense levels of data available for use.

“The issue with a lot of grocery retailers, is we have millions of transactions every week; to be able to actually digest all that data and turn it into real one-to-one communication requires a lot of AI, a lot of machine learning,” says Mittag, “Looking at the behavior can forecast what would be the next likely offers to buy.”

Streamlining systems to improve their solutions to better communicate and flow with one another, producing more efficiency, providing results that ultimately affect every aspect of both operations and the customer experience.

As a multifaceted solution that rethinks and restructures an organization’s data infrastructure to be more efficient, unified retail works toward a cohesive whole that serves both operations and the customer experience. This breadth of responsibility allows unified retail to provide implications for every solution a retailer might employ.

From heat mapping to computer vision, in-store monitoring to autonomous assistants, and AIpowered reporting to virtual reality experiences, a unified retailer is one whose individual ‘data silos’ are better integrated, able to access one another’s data touchpoints seamlessly and in time to create better-personalized in-store and eCommerce experience.

“One of the key lessons is don’t underestimate the power of all the data you get, and don’t underestimate the competences and capabilities you need to have in place to actually be able to leverage all this data,” said Mittag.

“The issue with a lot of grocery retailers is we have millions of transactions every week; to be able to actually digest all that data and turn it into real one-to-one communication requires a lot of AI, a lot of machine learning.

Anders Mittag // CCO of Lobyco

Nearly 58% of U.S. consumers are willing to share their data with retailers if it means receiving discounts in return, highlighting the importance of personalized and connected shopping experiences

according to Ayden

One recent report argues that unified grocery is a response to the rise of eCommerce shopping modalities and the rise of discount and private labels in addition to a growing focus on customer convenience, value, and values, such as sustainability.

“Bringing these together, there is a clear shift towards an industry that is more digital, more convenient, and more cost-and-environmentallysensitive,” the report notes, “Traditionally, grocery stores have operated in silos. In-store point-ofsale systems were generally not connected to e-commerce platforms, often for legacy reasons.”

“However, this led to inaccurate information about stock levels both online and in-store, resulting in frustrated customers,” continuing to explain that many industry grocery leaders have already identified unified commerce platforms as a solution to bring together sales and inventory management, the ‘back-end,’ and the customer experience.

As grocers need to emphasize value to customers above all else amid inflation, the imperatives of customer-centric unified retail are even more pressing.

While e-commerce is essential, situations such as these demonstrate that it is crucial to enhance

shopping experience across all platforms, integrating online and physical shopping experiences as seamlessly as possible, as many instore processes have experienced negative impacts from the rise of online order fulfillment within stores.

This dissatisfaction can be observed in shoppers’ preference to in-store shopping; 85% of grocery sales still occur in-store, says Gireesh Sahukar, Vice President of Digital at Dawn Foods.

“You cannot really start to talk about how your e-commerce is doing and forget about 85% (of the) experience. That experience (also) needs to improve and get better,” said Sahukar.

To address these concerns, in-store and online shopping experiences should emphasize convenience, personalization, and efficiency; developing a cohesive omni-channel experience for consumers that is influenced by proprietary data gathered by retailers.

Even the best teams couldn’t possibly collate all of the data available to the store, not when customers can potentially produce up to 15.67TB of data per person, per day. With a unified commerce data platform, a heat mapping and monitoring tool can communicate more seamlessly and quickly with customer app data, inventory levels, supply chain

estimates, and team schedules to produce a recommendation for how and when to best improve the customer experience.

Using AI, these recommendations could be collated and produced within minutes, providing guidelines for management teams that can tremendously boost efficiency. For grocers, this approach can ensure sections like produce are laid out in the most efficient way possible by synthesizing data points from every end of their operation to create an optimal customer experience while minimizing shrinkage due to spoilage or even theft.

Efficiency improvements can help grocers remain competitive for a buying public focused on value-per-dollar, especially at a time when food prices have risen by 25% from 2019 to 2023. A unified grocer ensures seamless integrations and consistent promotions which define the omnichannel customer experience, leveraging advanced technologies such as smart shelves and AIintegrated IoT devices.

A unified commerce platform facilitates easier integrations for popular shopping modalities like BOPIS (Buy Online, Pick Up In-Store) and curbside pickup. Walmart, the largest grocery brand in the U.S., is heavily investing in eCommerce and mobile shopping methods that leverage GenAI in 2024.

Each grocer must consider their strategic needs when choosing to pursue any given strategy. Unified commerce involves sorting out how to take all the different pieces available and configuring them into an arrangement that harmonizes with customer needs. While the specific implementation will vary for each grocer, the overarching goal remains to ensure that all collected data is properly and securely leveraged through an integration platform that has access to all of it. This ensures that the data serves customers effectively today and in the future in a retail landscape where efficiency rules.

Ellen Webb, Vice President of Strategy, Analytics & Insights for PepsiCo’s Demand Accelerator team, highlighted the company’s commitment to using proprietary data to drive human-centric innovation. Through their pepviz platform, PepsiCo generates insights that enhance retailer partnerships and cater to the needs of Gen Z and Hispanic shoppers, who favor personalized, culturally relevant experiences.

Webb emphasized the importance of understanding shopper behaviors and leveraging data to build brand loyalty. PepsiCo’s dual approach to loyalty targets both retailers and consumers, allowing them to stay ahead of trends and drive growth by providing tailored solutions.

Interview with Gireesh Sahukar, VP of Digital at Dawn Foods

Gireesh, VP of Digital at Dawn Foods, spoke about the challenges and trends in the grocery sector, particularly for CPG companies. He emphasized the ongoing struggle with inflation and its impact on consumer behavior, leading to a shift toward smaller, more affordable product sizes. Dawn Foods conducts extensive research on trends over several years to differentiate between lasting trends and shortlived fads, helping them stay ahead in the market. Technologies like QR codes and miniaturization of product offerings have proven to be enduring trends that resonate with cost-conscious consumers.

Gireesh also discussed the persistent challenges in the food service industry, such as inventory availability and the impact of global conflicts on commodity prices. He highlighted the rapid adoption of new technologies in e-commerce, which brings both opportunities and challenges, particularly in terms of talent acquisition and process optimization. Despite these hurdles, Dawn Foods remains focused on delivering superior quality products and services, which has earned them high customer loyalty and satisfaction.

By Sucharita Kodali // Vice President and Principal Analyst at Forrester

Retail media is viewed as a silver bullet that can generate profitability in the hyper competitive grocery world. Forrester receives weekly briefings from new companies and brands promising to diversify and change the retail media landscape for the better and the flurry of content and conferences on the topic seems never-ending. While there are many companies in the space, there is one player that dominates retail media in North America and Europe: Amazon with its Amazon Ads business, much of which relies on CPG brands. Forrester estimates that in 2023 Amazon generates nearly $40B and is 70% of the market. The Ads business continues to grow 24% year over year.

For grocers, and more broadly any retail media companies to have offerings that are competitive with Amazon, there are a number of things they need to add to their current offerings.

Grow the amount of inventory available for ads, online and offline.

Very few retailers have the breadth or reach of Amazon online, even when their store traffic is added and because of Amazon’s reach of the vast majority of the US population, it dominates retail media. However, all hope is not lost for others. For other retailers to gain more share, they need to grow the places where ads are placed (in stores, on packages, off site through ad networks) and emphasize the time spent in physical stores versus the lesser engagement through digital channels. Consumers consistently tell us that ads in physical stores are the ones they pay attention to, and that they are more likely to ignore digital ads.

Attract more traffic to digital properties.

The bulk of retail media today is on a retailer’s digital properties (ie its website or app). Therefore, the easiest way to grow retail media is to grow the volume of traffic to one’s digital properties. Fortunately, there are tried and true tactics for digital shopper acquisition, such as buying traffic outright (eg paid search, banner ads). Retailers also have another relatively inexpensive weapon at their disposal: messaging in stores, which is perhaps the easiest way to inform shoppers about an ecommerce site. Signage in stores, on receipts and on shopping bags are low hanging fruit to drive incremental web traffic. Retailers are also talking about using their store overhead speaker system to

promote their website and digital touchpoints. One technology vendor we interviewed suggested that a particularly effective way that retailers have shifted shoppers to get accustomed to using an app is to offer online only offers that must be retrieved in store through the app (ie “$1 off corn-on-the-cob but only through the app.”)

The majority of ads now in retail media are from brands that retailers have inventory/merchandising relationships with already. That is called “endemic advertising.” The vast majority of ad dollars overall however are from other large marketers like auto manufacturers, insurance and financial service companies, streaming providers and others. Retailer media networks must tap into nonendemic ads to grow more of the pie. Retailers, especially grocers, are in fact well-suited to capture these dollars since they often have rich data on households and buying behavior which is attractive to marketers in these other categories. Combined with opportunities in offsite advertising (ie digital ads not on a retailer’s site), retail media networks have an opportunity to reach shoppers where other

One of the biggest advantages of a retail media network is the ability of a retailer to target specific segments of shoppers

media companies who were reliant on third party cookies no longer can.

One consistent gripe from brands about retail media networks is that it is difficult to understand the value of retail media ads. Not only is crosschannel attribution challenged but brands complain about the lack of transparency even from within a website. Brands tell us about catching retailers making implausible claims about site visits. While several of the parties we interviewed said we are closer to creating a standard for retail media measurement, we believe that transparent, credible reporting across four dimensions, even without an

established standard, could be valuable. Those measurements include permutations of brand ads in different formats and channels driving sales across different channels.

One of the biggest advantages of a retail media network is the ability of a retailer to target specific segments of shoppers such as say, new mothers, or single person households over age 60. Many retail media networks however underestimate the value of audience targeting and believe that previous purchase behavior is sufficient. Advertisers however have repeatedly told us they want to limit their ads within certain geographies or to target shopper segments, not just category buyers. This type of targeting is what brands are accustomed to through Google, Meta and other digital ad behemoths and retail media networks would be remiss to ignore that industry standard. However, unless more shoppers self-identify during an interaction and more shoppers use digital properties altogether,retailers are left with minimal information about site visitors, which is a formula for failure.

There is a long tail of retail media networks and every brand we interviewed said that they didn’t want dozens of low value ad destinations to log into and monitor. To address this challenge, retail media networks must find the best partners that will give them IT support and ad serving capability without creating another cumbersome tool for brands. This is especially true for smaller networks Grocers for instance should consider joining forces with noncompetitive players, like electronics retailers or sporting goods retailers, as more shoppers can be identified with minimal worry of relinquishing shopper insights to competitors. Retailers should embrace advertising cooperatives for retail media— after all, retailers have been sharing shopper data through co-op marketing services in the catalog industry for years with great success.

Recognize that trade funding no longer has the leverage it once did.

Historically trade funds have been the largest source of marketing spend by brands. However, retailers have shared with us that that source

of funding is declining because of the lack of accountability associated with it. Retail media however is growing and has the ability to replace lost trade fund dollars and be an alternative to digital marketing. Furthermore, retail media has the potential to be more attractive from an accounting standpoint. Whereas trade funds are essentially volume discounts that are not captured in revenue, retail media has the ability to be measured in topline sales.

Consider a lobbying effort to bring retail media into antitrust discussions.

It is no secret that government agencies like the US Department of Justice and Federal Trade

Commission are scrutinizing large technology companies for anti competitive behavior. One retail media expert working with small retailers argues that the concentration of retail media revenue in the hands of one or two players could violate antitrust rules, such as the Robinson Patman Act (which prohibits sellers from unfair discounting to large retailers) particularly if those same large retailers are funding shopper discounts through retail media.

Unless grocers have compelling retail media offerings, they are unlikely to pry away retail media dollars from the current giant in the space, Amazon. But to capture those dollars, they need to employ several of the opportunities mentioned above to improve what they are selling to brands and advertisers.

Sucharita serves digital business strategy professionals. She is an expert in e-commerce, omnichannel commerce, consumer behavior, and trends in the retail and consumer goods space. She is also an authority on technology developments that affect the online commerce industry and vendors that facilitate online marketing and merchandising.

In her research, Sucharita covers areas such as e-commerce trends and global, regulatory, and technology issues shaping commerce. She is the author of Forrester’s “The World’s Most Future-Proofed Brands” report, which reviews global consumer-facing brand manufacturers. She is often the keynote speaker at retailer conferences around the world and is frequently featured in national media such as NPR, The Wall Street Journal, The New York Times, Bloomberg Businessweek, The Information, and more.

Join Sucharita’s LinkedIn network

By Toby Pickard // Retail Futures Senior Partner at IGD

We are living in exceptional times, as bursts of retail innovation driven by technology are countered by challenges around resource availability, economic shifts, and legislative changes. Technology is transforming how industries operate and how shoppers purchase and interact with products and services. Advances in technology will continue to change the shopping experience to provide better services.

Customer-facing robotic technology is one innovation poised to revolutionise the shopping experience. As retailers’ operating costs rise due to increasing commodity prices and employment costs, companies are turning to technology to drive cost savings, particularly in capital-intensive

areas of retail operations. To stand out and attract customers, retailers must go beyond price matching and excel in in-store services and product availability.

Recent advancements in technology have improved functionality and affordability, while artificial intelligence enhances machine-human communication. As a result, many retailers are trialling in-store robots to improve efficiencies and free staff for more valuable and rewarding roles.

According to IGD’s vision, future stores will emerge from fast-paced reinvention, not futuristic fantasy. The store will be powered by people and technology to enhance efficiency, value, customer

experience and create a more sustainable, positive impact.

Retailers have recently increased their experimentation with robotics, building on a decade of testing in-store customer-facing robots. Back in 2015, Carrefour used a robot, called NAO, to provide an engaging and educational programme on healthy food and eating habits to children in Spain.

Two years’ later, Carrefour Spain introduced a humanoid robot called Pepper into stores. The robot welcomed customers and provided information via an integrated tablet on promotions, discounts and the MiCarrefour app.

Over the years, numerous retailers have introduced humanoid robots into stores. These robots have often performed customer facing tasks, such as welcoming customers to the store, highlighting promotions, educating customers and aiming to create an interactive experience for customers. As people become more accustomed to in-store robots, it is likely this new system will serve as customer service representatives; helping guide shoppers to find products, answer questions, and will provide information about products. With

advancements and reduced costs, more robots will likely be equipped with enhanced natural language processing capabilities.

Like customer-facing robots, functional task robots have also been tested in stores for some time.

In 2016, Target started testing Simbe’s selfscanning robot, Tally, in-store. Since then we have seen a number of retailers trialling robots that perform tasks that are repeatable, predictable and manual. For example, they will help make sure that shelves are not empty in-store, and products are correctly displayed and priced. They help free up staff to do more value-added jobs.

“By automating monotonous tasks, Tally saves teammates up to 50 hours each week—and 3 of 4 store managers say they better support shoppers as a result,” says Simbe’s first annual Store Team Technology Sentiment Report.

Besides operational benefits, many retailers report that in-store robots attract shoppers who want to see the robots in action.

“We see top line growth [as a Simbe customer] and built [the business case] on sales lift. Folks have literally changed their shopping patterns to make sure that they shop when Tally is running,” said Tyler King, VP of Finance & Retail Operations at SpartanNash. “Shoppers stay longer and buy more when Tally is out in the store,” he noted.

In Japan, robots are used to help replenish products on shelves. In similar markets where recruiting and retaining staff can be a challenge, robots are likely to be one of the solutions. FamilyMart, a convenience store operator, is testing artificial intelligence (AI) driven robots to restock shelves in its convenience stores. The robots are designed to replenish drinks in refrigerators. The retailer has also rolled out hundreds of in-store cleaning robots. The robots also merchandise items for sale, and they have a digital monitor that displays product information and adverts to customers.

The introduction of robotics in food services has begun as well, with a Walmart in North Texas opening a new food service offering called Pizza Jukebox, which utilises an AI powered robot to make pizzas for customers. A convenience store operator in Poland, called Zabka, has in-store robots, called Robbie, that prepare hotdogs for shoppers. It is likely that we will see more robotic powered solutions help retailers offer food service solutions 24 hours a day, seven days a week.

Grocery retailers are even relying on robots for delivery of online orders. In the UK, the Co-Op partnered with Starship Technologies to be able to deliver online orders to customers via six wheeled bots that drive autonomously to the customers desired collection point. Since the launch of the initiative during 2018, the retailer has extended this service to other locations and other retailers have also started to utilise the solution.

Retailers aren’t just taking to the road to deliver products to customers, they are taking to the sky.

Retailers around the world have been steadily growing their offer of delivery via aerial drones. In August 2023, Walmart announced: “Two years ago, we embarked on a journey to make the convenience of drone delivery a reality for our customers. Over that time, we’ve grown to offer it across seven states and 36 stores, completing more than 10,000 safe deliveries.”

Robots are already part of the grocery shopping experience, but their adoption is not yet widespread. We will continue to see retailers testing and trialling robots to perform different functions.

However, it is very unlikely that robots will be able to do all the necessary tasks within the grocery retail environment. The reason we believe this is because despite the advantages of robots, some shoppers will always prefer human interaction. Personal touch and empathy are aspects robots cannot fully replicate.

The future of grocery stores is set to be transformed by technology and the integration of robots. They will help bring unprecedented levels of efficiency and convenience. While shoppers may initially have mixed reactions, transparent communication, gradual implementation, and a focus on human-robot collaboration could foster acceptance and enthusiasm.

As robots take on more routine tasks, grocery store staff will be freed to provide enhanced customer service, ultimately creating a better shopping experience. Embracing this technological evolution will benefit stores and their customers, paving the way for a more innovative and dynamic retail environment.

Toby has over 17 years’ of experience researching and presenting insights on the future of retail, innovations, sustainability, digital engagement and trends in the FMCG sector. He regularly works with major brands and retailers to inform them about developments in the industry and help them future proof their operations.

Toby has been awarded the Top Retail Influencer by RETHINK Retail in 2024, 2023 and 2022, the RTIH Top 100 Retail Technology Influencer in 2022, and the 2021 RTIH Top 50 Retail Technology Influencers. Join Toby’s LinkedIn network

By Oliver Banks // Founder of OB&Co retail consulting

As we stand in the year 2035, it’s fascinating to look back at how much the grocery industry has transformed over the past decade.

Back in 2024, we were only just beginning to see the potential of integrating technology into the shopping experience and how it can help adapt retail organisations to the evolving needs of customers. Today, a typical grocery store might still look similar on the surface as it did back in the

2020s, but the differences lie beneath the surface in the operating models, data flows, and customer engagement strategies. These have all been subject to major changes for the benefit of customers and retailers. Specialisation has been a crucial foundation for this transformation, enabling retailers to tailor their offerings and propositions to specific customer types and preferences, making the shopping experience more personalised, efficient and effective than ever before.

In modern grocery stores, understanding and responding to a diverse range of customer missions and behaviours is vital.

Grocers are focused on developing recognised shopper archetypes, and companies have developed an acute appreciation for these different customer preferences and how to best cater for them, with six key archetypes identified.

Quick shoppers are driven by busy lifestyles and seek ultra-convenient options. Highly accessible stores with the ability to shop efficiently and checkout instantly are a hit with these shoppers. These customers also seek curated ranges and enjoy pre-prepared, ready-to-cook meal options, or even cooked-in-store meals that accelerate their fast-paced shopping trips and lifestyle.

Occasion shoppers are those planning for specific events, such as parties, date nights or family gatherings, now find tailored experiences that cater to their needs. Special sections dedicated to themed shopping and pre-packaged meal kits make planning and preparing for these events seamless and enjoyable.

For food lovers, grocery shopping has evolved into an immersive and engaging experience. Sampling stations, in-store cooking demos and

a community of like-minded foodies are big hits. Regularly shifting ranges and discovery opportunities transform grocery shopping into a culinary adventure, whilst detailed provenance and traceability information available through QR codes establishes trust and credibility. Recipe-sharing platforms and community engagement events further enhance their experience, fostering a sense of connection and excitement.

The eco-conscious shopper seeks to minimise food miles and eliminate waste. Retailers and brands often use hyper-eco-friendly packaging to appeal, and refillable options are popular. Locally sourced product ranges are preferred to support community producers, whilst grown-on-site produce is popular, either through vertical farming or rooftop fields. Early adopters in this niche are also now experimenting with innovative grow-athome meat-free brands.

The rise of the wellness-focused shopper required the biggest upheaval for many retailers. These customers demand retailers deliver to their scientifically tailored diet plans. They seek precise meal planning options, supported with detailed product information and supply chain visibility. Many retailers now offer augmented reality (AR) filters that personalise the shopping experience by blocking unsuitable products. Whilst this started as ‘vegan vision’, it quickly gained popularity with the ability to hide products with particular allergens, high salt and sugar content or processed foods.

These AR tools give real-time shopping assistance to these demanding customers to meet their demands and help them achieve their nutritional goals.

However, despite the rise of these other shopping behaviours, the traditional shopper has not disappeared and is especially popular with young families. These customers still prefer the experience of a large in-store shopping trip which blends inspiration, choice and service. These shopping trips are often streamlined by automated or manual pre-ordering of staples for collection or home delivery.