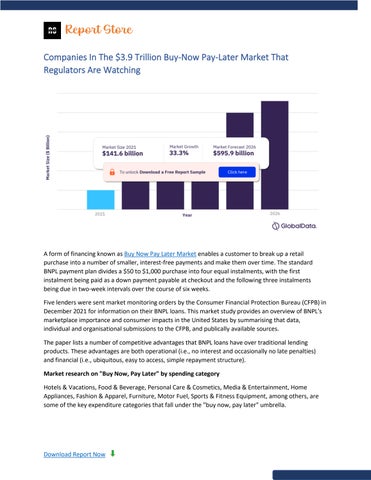

Report Store Companies In The $3.9 Trillion Buy-Now Pay-Later Market That Regulators Are Watching

A form of financing known as Buy Now Pay Later Market enables a customer to break up a retail purchase into a number of smaller, interest-free payments and make them over time. The standard BNPL payment plan divides a $50 to $1,000 purchase into four equal instalments, with the first instalment being paid as a down payment payable at checkout and the following three instalments being due in two-week intervals over the course of six weeks. Five lenders were sent market monitoring orders by the Consumer Financial Protection Bureau (CFPB) in December 2021 for information on their BNPL loans. This market study provides an overview of BNPL's marketplace importance and consumer impacts in the United States by summarising that data, individual and organisational submissions to the CFPB, and publically available sources. The paper lists a number of competitive advantages that BNPL loans have over traditional lending products. These advantages are both operational (i.e., no interest and occasionally no late penalties) and financial (i.e., ubiquitous, easy to access, simple repayment structure). Market research on "Buy Now, Pay Later" by spending category Hotels & Vacations, Food & Beverage, Personal Care & Cosmetics, Media & Entertainment, Home Appliances, Fashion & Apparel, Furniture, Motor Fuel, Sports & Fitness Equipment, among others, are some of the key expenditure categories that fall under the "buy now, pay later" umbrella.

Download Report Now