Sales Tax and VAT Compliance Software Market

Sales Tax and VAT Compliance Software Market

Scope: Industry Analysis, Market Size, Growth,

Trends Till 2031

Request Sample Report

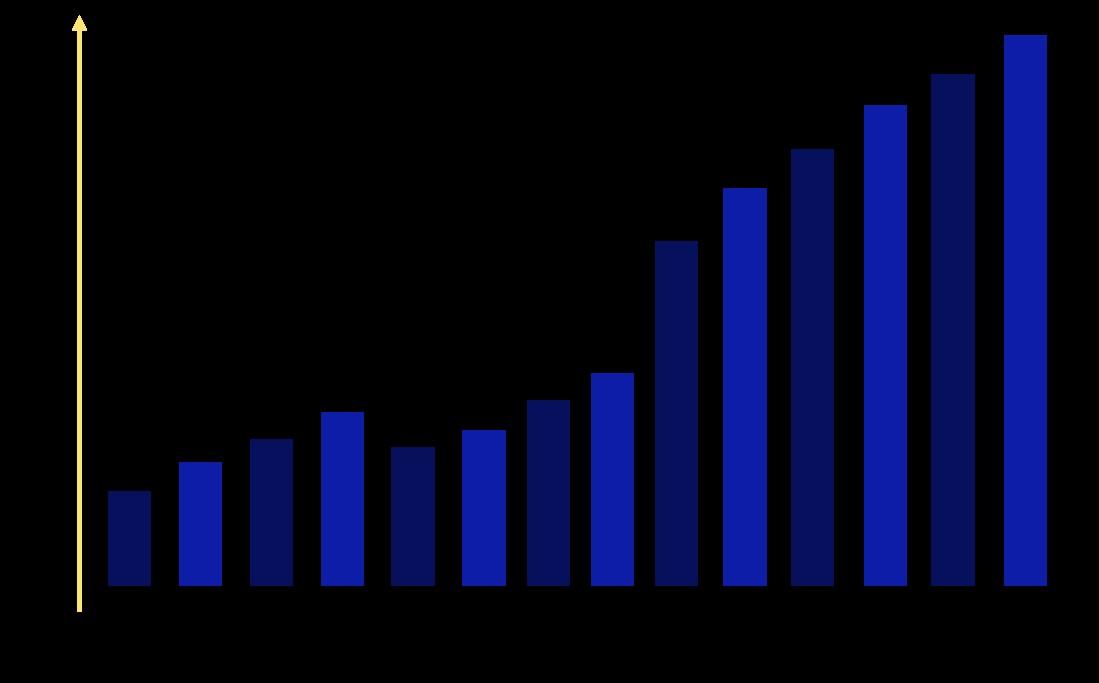

Sales Tax and VAT Compliance Software Market Size and Growth

The Sales Tax and VAT Compliance Software market is experiencing significant growth, driven by increasing regulatory requirements and the need for streamlined tax processes. The market size is projected to reach $XX billion by 2025, reflecting a CAGR of XX%. Businesses seek efficient solutions to manage compliance and minimize risks effectively.

Companies Covered

(Covid 19 Impact Covered)

◍ Avalara

◍ Stripe

◍ Vertex

◍ Webgility

◍ Paddle

◍ Canopy

◍ Sovos

◍ Lovat Compliance

◍ Thomson Reuters ◍ cPaperless

◍ Wolters Kluwer ◍ FedTax

◍ EXEMPTAX

◍ Sales Tax DataLINK

◍ SAP

◍ Taxmann

◍ VATBox

◍ AccurateTax.com

The Sales Tax and VAT Compliance Software Market is competitive, with key players like Avalara, Stripe, and Sovos offering integrated solutions for tax calculation and compliance. Companies like Vertex and Thomson Reuters enhance automation, driving market growth through efficiency. Revenue figures include Avalara at $500M and Stripe over $7B in 2022.