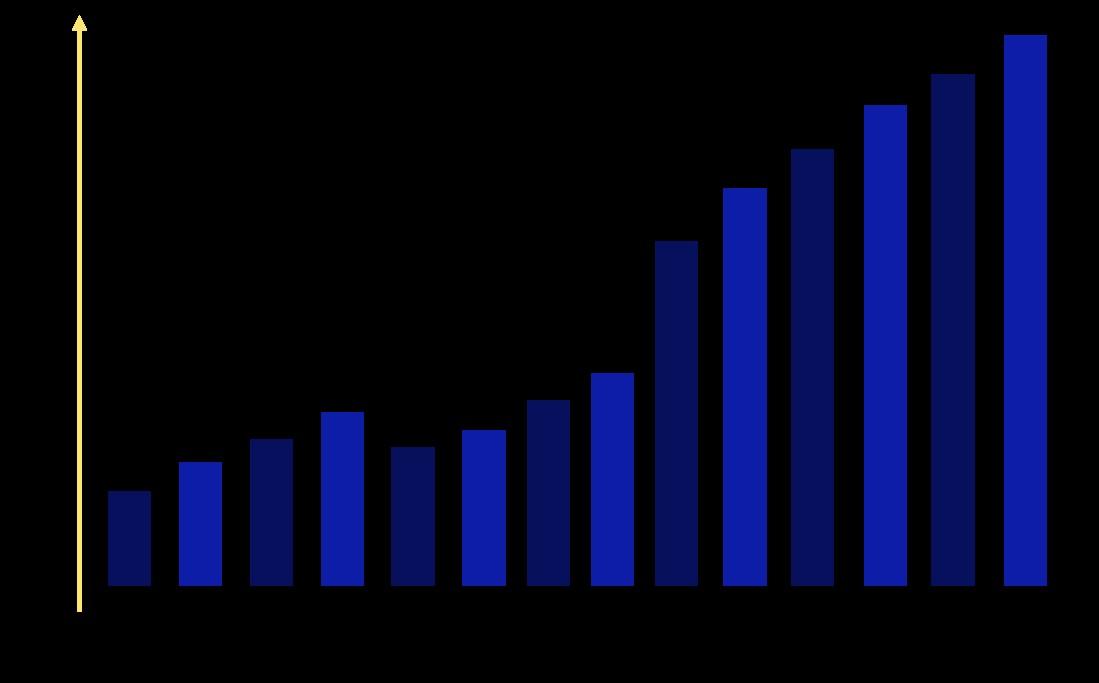

Non-Life/ Property & Casualty Insurance Market Size and Growth

The Non-Life/Property & Casualty Insurance market continues to evolve, driven by changing risk landscapes and technological advancements. As of 2023, the global market size is estimated to exceed $750 billion. Key trends include digital transformation, customer-centric solutions, and increased demand for coverage in emerging risks, enhancing competitive dynamics and growth opportunities. Request Sample Report

Companies Covered

(Covid 19 Impact Covered)

◍ Allian

◍ American International Group

◍ Assicurazion General

◍ Aviva

◍ CGU

◍ China Pacific Property Insurance

◍ State Farm

◍ Berkshire Hathaway

◍ Progressive Group

◍ Liberty Mutual

◍ Allstate

◍ Travelers Group

◍ USAA

◍ Chubb

◍ Farmers Insurance

◍ Nationwide

◍ AIG

◍ Zurich

The Non-Life/Property & Casualty Insurance Market features companies like Allianz, AIG, and State Farm, offering diverse products. These firms enhance market growth through innovative coverage, technology adoption, and customer-centric solutions. Selected 2022 revenues: Allianz - €150B, AIG - $50B, State Farm - $53B, and Progressive - $48B. Request Sample Report