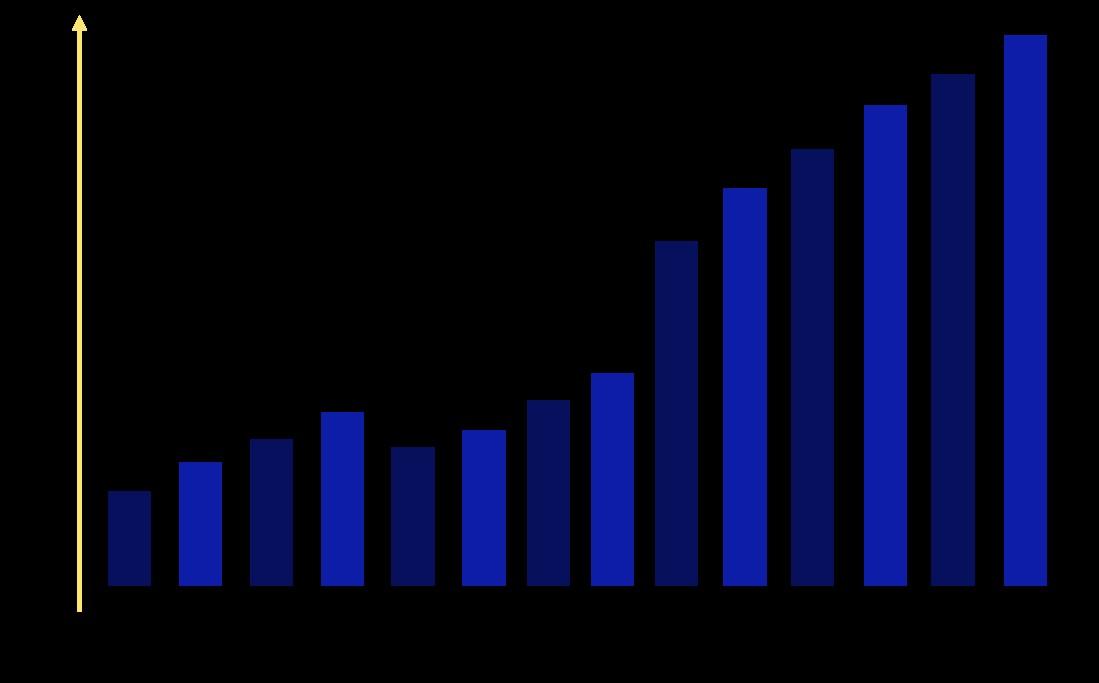

Insurance Fraud Detection Market Size and Growth

The global insurance fraud detection market is expected to reach $6.4 billion by 2025, with a CAGR of 26.4%. Increasing instances of fraudulent claims and advancements in technology are driving market growth. Key players include IBM, SAS Institute, and FICO. Advanced analytics and AI technologies are key trends in the market. Request Sample Report

Companies Covered

(Covid 19 Impact Covered)

◍ FICO

◍ IBM

◍ BAE Systems

◍ SAS Institute

◍ Experian

◍ LexisNexis

◍ Iovation

◍ FRISS

◍ SAP

◍ Fiserv

◍ ACI Worldwide

◍ Simility

◍ Kount

◍ Software AG

◍ BRIDGEi2i Analytics Solutions

◍ Perceptiviti

The insurance fraud detection market is highly competitive, with key players including FICO, IBM, BAE Systems, SAS Institute, Experian, LexisNexis, Iovation, FRISS, SAP, Fiserv, ACI Worldwide, Simility, Kount, Software AG, BRIDGEi2i Analytics Solutions, and Perceptiviti. These companies offer advanced fraud detection technologies to insurance companies, helping them prevent and detect fraudulent claims.

- FICO: $1.19 billion

- IBM: $16.34 billion

- SAS Institute: $2.43 billion

Request Sample Report