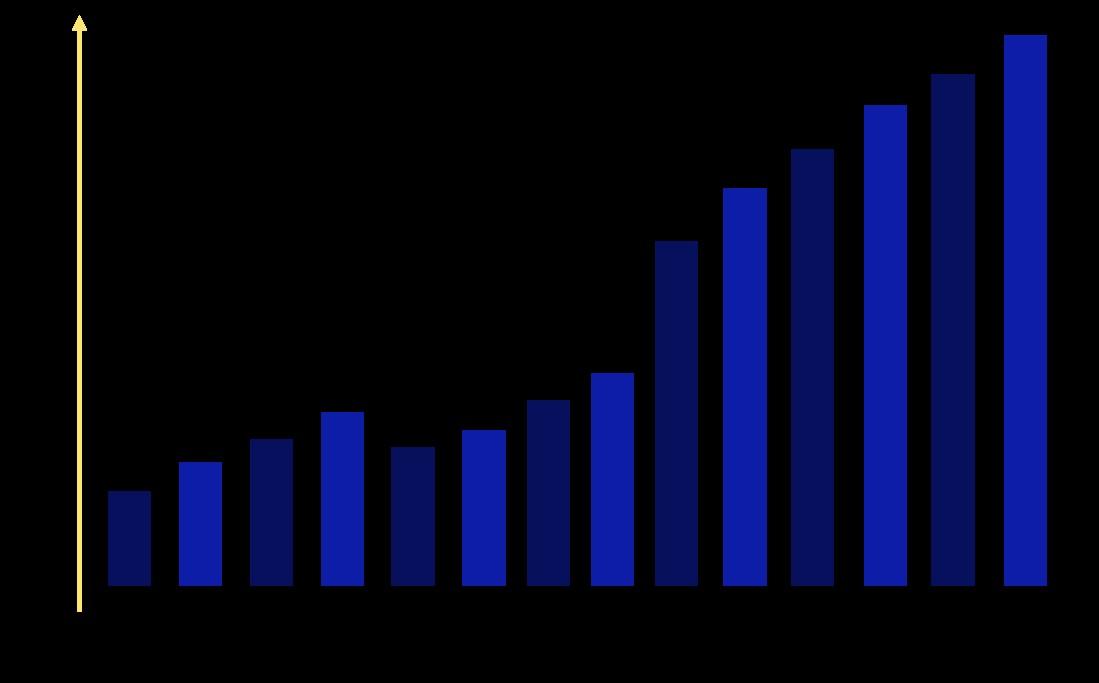

The Index-based Agricultural Insurance market is experiencing significant growth, driven by increasing climate-related risks and demand for financial protection among farmers. The global market size is projected to reach approximately $5 billion by 2026, with advancements in technology enhancing risk assessment and product offerings tailored to diverse agricultural needs. Request Sample Report

◍ PICC

◍ Zurich (RCIS)

◍ Chubb

◍ QBE

◍ China United Property Insurance

◍ American Financial Group

◍ Prudential

◍ XL Catlin

◍ Everest Re Group

◍ Endurance Specialty

◍ CUNA Mutual

The Index-based Agricultural Insurance Market features key players like PICC, Zurich, Chubb, and others, leveraging technology and data analytics to assess risk. These companies enhance market growth by offering innovative insurance products that cater to climate risks, improving farmer access, and ensuring timely payouts. Sales revenues include:

- Zurich: ~$50 billion

- Chubb: ~$38 billion

- ICICI Lombard: ~$3 billion - Farmers Mutual Hail: ~$400 million

◍ Agriculture Insurance Company of India

◍ Tokio Marine

◍ CGB Diversified Services

◍ Farmers Mutual Hail

◍ Archer Daniels Midland

◍ New India Assurance

◍ ICICI Lombard

Request Sample Report

Wheat

Cotton

Others

Request Sample Report

Weather Index

Yield Index

Others

Request Sample Report

$ X Billion USD