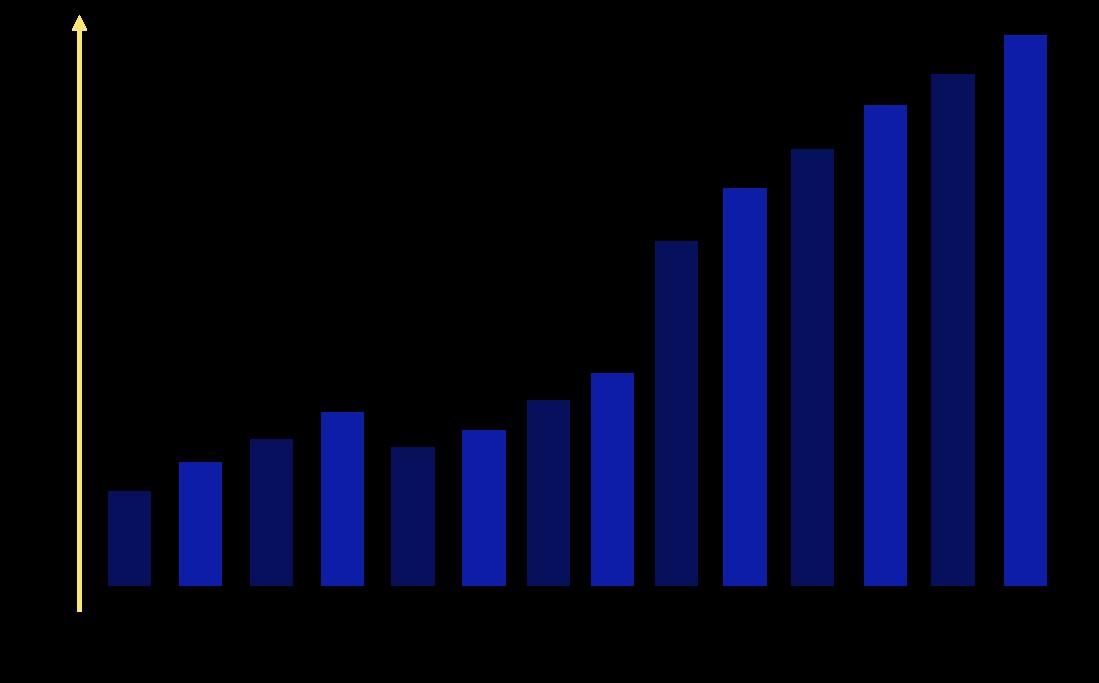

The Virtual Payment Systems market is experiencing significant growth, driven by increased digital transactions and e-commerce. As of 2023, the market size is projected to reach approximately $9 billion, reflecting heightened consumer demand for convenience and security. Market conditions favor innovation and expansion, with emerging technologies enhancing payment efficiency. Request Sample Report

◍ Paytm

◍ MobiKwik

◍ PayUmoney

◍ Vodafone Mpesa

◍ Idea Money

◍ ABPB Wallet

◍ HDFC Bank

◍ ICICI Bank

◍ Axis Bank

◍ PhonePe (Flipkart)

◍ Samsung

◍ Apple

The virtual payment systems market features companies like Paytm, MobiKwik, and Vodafone Mpesa, enhancing digital transactions through user-friendly apps and secure gateways. Major banks like HDFC, ICICI, and Axis integrate these systems to boost sales. Notable figures include Paytm with ₹4,974 crore revenue and PhonePe's rapid growth in user adoption. Request Sample Report

Retail

Healthcare

Transportation

Request Sample Report

Blockchain

Digital Wallets

Mobile Money

Digital Money From Banks

P2P Apps

Others

$ 107.18 Million

Request Sample Report