Microfinance Market Scope: Industry Analysis, Market Size, Growth, Trends Till 2031

Request Sample Report

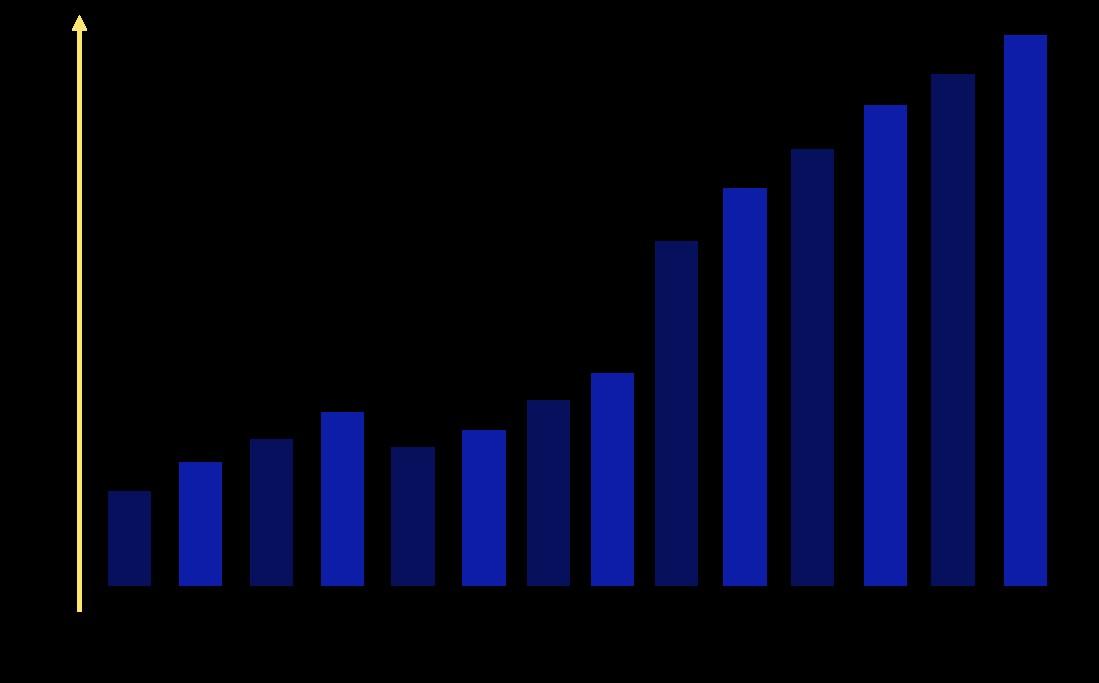

The microfinance market is experiencing significant growth, driven by rising demand for financial inclusion. As of 2023, the market size is estimated to exceed $100 billion globally. Key trends include digital transformation, diversified service offerings, and regulatory support, shaping a dynamic landscape for financial institutions and entrepreneurs alike.

Sample Report

◍ WeBank

◍ ResponsAbility Investments AG

◍ Asmitha Microfin

◍ Utkarsh Micro Finance

◍ Share Microfin

◍ Ujjivan

◍ Spandana Sphoorty Financial

◍ Bhartiya Samruddhi Finance

Limited ( BSFL )

◍ GFSPL

◍ Suning

◍ Grameen America

◍ LiftFund

◍ Opportunity Fund

◍ Accion

◍ Justine Petersen

◍ Malayan Banking Berhad

◍ GC Business Finance

The microfinance market features diverse players like WeBank, Accion, and Ujjivan, each offering unique financial products to underserved populations. They enhance financial inclusion, drive local economies, and support entrepreneurship. Key companies also contribute to revenue growth, with notable earnings such as:

◍ Adie

- Ujjivan: Approx. $150 million.

- Grameen America: Est. $56 million.

Request Sample Report

Personal

SME

Request Sample Report

Below $3000

$3000-$10000

$10000-25000$

Above 25000$

Request Sample Report

$ 0.62 Billion