Scope: Industry Analysis, Market Size, Growth, Trends Till 2031

Request Sample Report

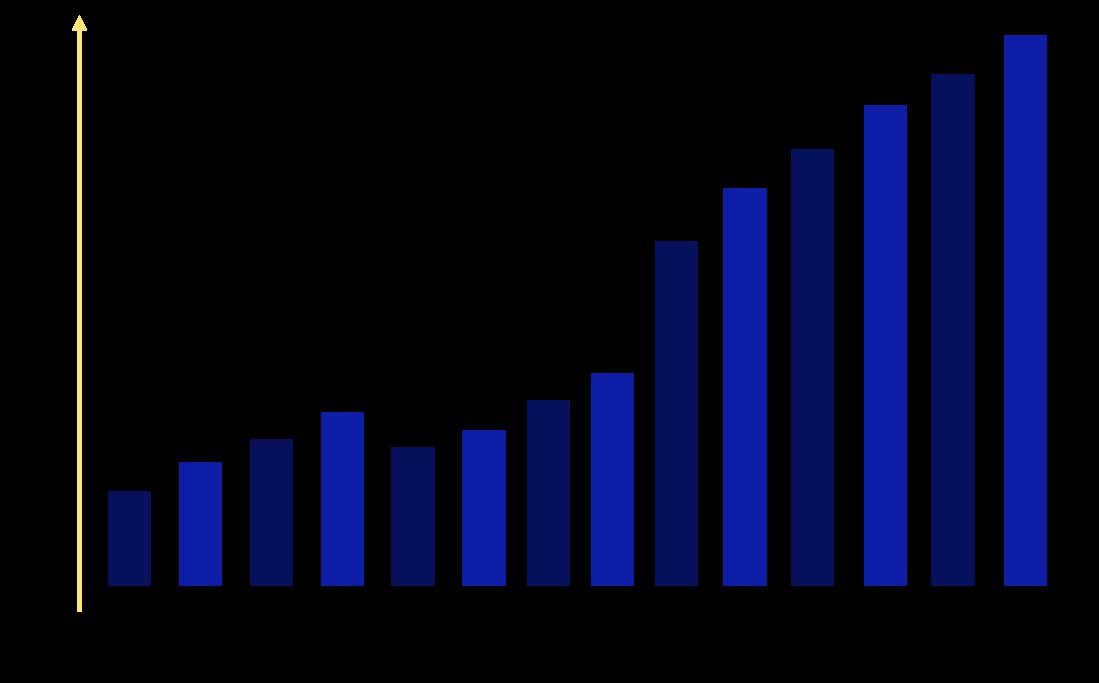

The Investment Portfolio Management Software market is experiencing significant growth, driven by increasing demand for efficient asset management and analytical tools. As of 2023, the market size is estimated to reach approximately $5 billion, with a projected annual growth rate of over 10% fueled by technological advancements and regulatory compliance needs.

◍ Misys

◍ SS&C Tech

◍ SimCorp

◍ Eze Software

◍ eFront

◍ Macroaxis

◍ Dynamo Software

◍ Elysys

◍ S.A.G.E.

◍ TransparenTech

◍ Riskturn

◍ SoftTarget

◍ ProTrak International

◍ PortfolioShop

◍ Beiley Software

◍ Quant IX Software

◍ Quicken

◍ OWL Software

The Investment Portfolio Management Software Market features key players like Misys, SS&C Tech, and SimCorp, offering comprehensive tools for asset tracking and performance analytics. These companies enhance market growth through innovative solutions that streamline portfolio management, optimize investment strategies, and improve client reporting, ultimately driving efficiency and profitability. Sales figures vary widely among them.

Request Sample Report

SME

Large Enterprise

Personal Use

Others

Request Sample Report

Cloud-Based

On-Premise

Request Sample Report

$ 21.08 Billion