Request Sample Report

(FCC)

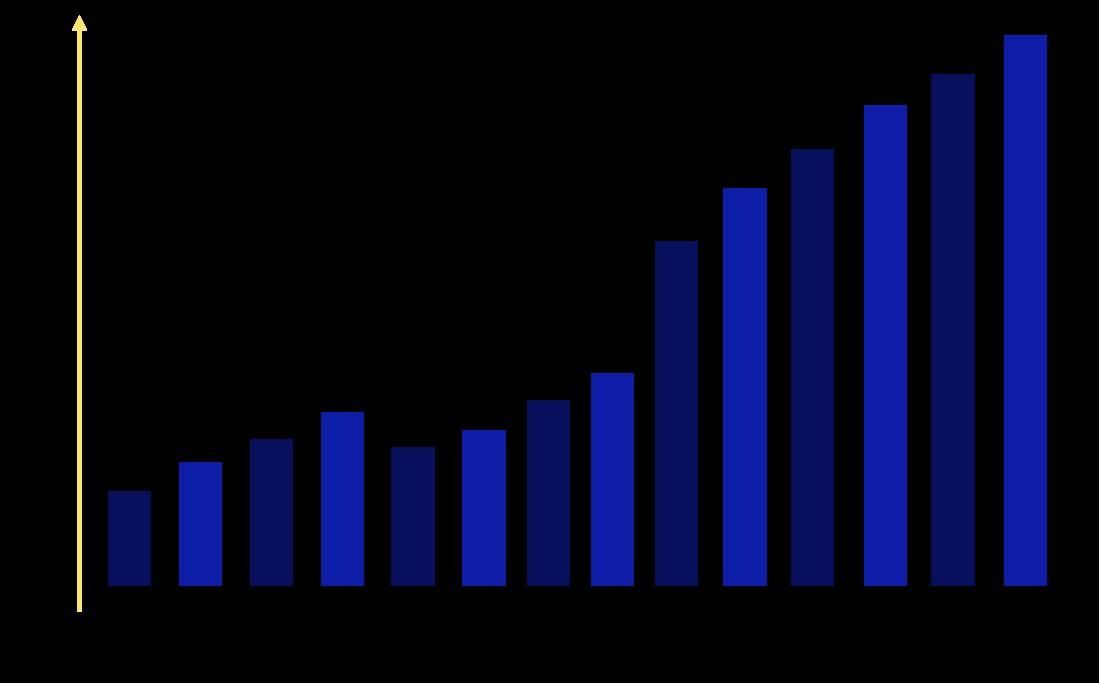

The Financial Crime Compliance (FCC) market is experiencing robust growth, driven by increasing regulatory demands and heightened awareness of financial crimes. The global FCC market is projected to reach approximately $XX billion by 2025, reflecting a CAGR of around XX%. Enhanced technology adoption and stricter compliance measures are key market dynamics influencing this sector.

Request Sample Report

◍ Pwc

◍ TCS

◍ Accenture

◍ Genpact

◍ Wipro

◍ Cognizant

◍ WNS

◍ TaskUs

◍ Infosys

◍ IBM

◍ Capgemini

◍ HCLTech

◍ AML RightSource

◍ EY

◍ Deloitte

◍ Exela Technologies

◍ KPMG

◍ Guidehouse

The Financial Crime Compliance (FCC) market comprises various firms offering solutions for risk management and regulatory compliance. Companies such as PwC, Accenture, and Deloitte leverage technology and expertise to enhance compliance processes. Their services drive market growth by improving efficiency and efficacy in detecting financial crimes.

- PwC: Approximately $50 billion in revenue

- Accenture: Around $61 billion in revenue

- Deloitte: Approximately $59 billion in revenue

- KPMG: About $32 billion in revenue Request Sample Report

◍ Banking and Financial Services

◍ Insurance

◍ Securities and Asset Management

◍ Fintech

◍ RegTechs

◍ Others

◍ Anti-Money Laundering (AML)

◍ Counter-Terrorist Financing (CTF)

◍ Fraud Prevention and Detection

◍ Sanctions Compliance

◍ Bribery and Corruption Prevention

◍ Regulatory Compliance

◍ Others

Request Sample Report

Request Sample Report

$ X Billion USD