Commercial Card Market Scope: Industry Analysis, Market Size, Growth, Trends Till 2031

Request Sample Report

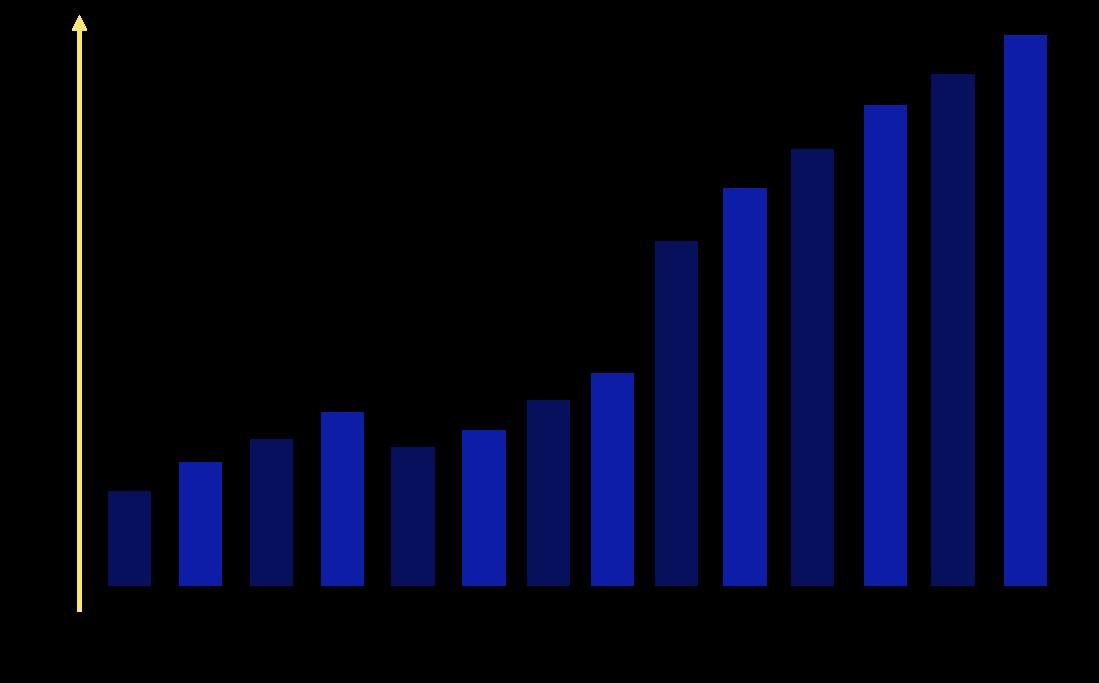

The Commercial Card market is experiencing substantial growth, driven by increased adoption of digital payment solutions and evolving corporate spending needs. As of 2023, the market size is estimated at $500 billion, with projections indicating continued expansion due to enhanced efficiency, cost savings, and greater financial control for businesses.

Request Sample Report

◍ Citigroup Inc.

◍ Wells Fargo& Company

◍ Bank of America Corporation

◍ JPMorgan Chase& Co.

◍ American Ecpress Company

◍ Capital One Financial Corporation

◍ U.S. Bancorp

◍ Synchrony Financial

◍ Discover Financial Services

◍ Barclays Plc

◍ SBI Holdings

◍ MUFG

◍ Resona Bank

◍ SMBC

◍ Mizuho

The commercial card market is competitive, featuring major players like Citigroup, Wells Fargo, and American Express. These companies enhance the market by offering innovative solutions, improving customer experiences, and expanding services. Revenue examples include:

- Citigroup: $76 billion

- Wells Fargo: $73 billion

- JPMorgan Chase: $130 billion

These efforts drive market growth.

Request Sample Report

Small business card

Corporate card

Request Sample Report

Corporate Cards

Purchase Cards

Business Cards

Travel and Entertainment Cards

Other

Request Sample Report

$ X Billion USD