Cash and Liquidity Management Market Scope:

Request Sample Report

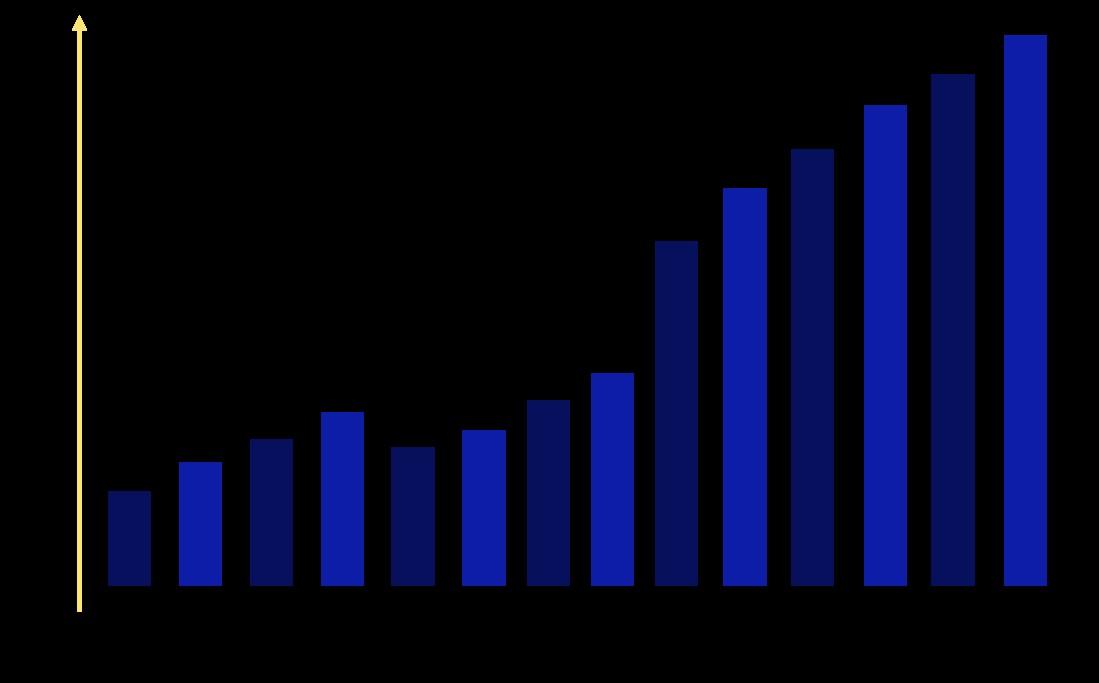

The Cash and Liquidity Management market is projected to reach approximately $XX billion by 2025, driven by increasing demand for efficient cash flow management and financial forecasting. Current market conditions emphasize digital solutions and regulatory compliance, enhancing operational efficiencies for businesses. Companies are prioritizing liquidity optimization strategies amidst economic fluctuations.

Sample Report

◍ "BNP Paribas"

◍ "Bank of China"

◍ "Citigroup Inc"

◍ "China Exim Bank"

◍ "ICBC"

◍ "JPMorgan Chase & Co"

◍ "Mizuho Financial Group"

◍ "Standard Chartered"

◍ "MUFG"

The Cash and Liquidity Management Market is competitive, with key players like BNP Paribas, Citigroup, and JPMorgan Chase offering innovative solutions. They enhance cash flow visibility and optimize liquidity, driving market growth. Notable revenues include Citigroup (approx. $74 billion) and JPMorgan Chase (approx. $127 billion).

◍ "Sumitomo Mitsui Banking Corporation"

◍ "Credit Agricole"

◍ "Commerzbank"

◍ "HSBC"

◍ "Riyad Bank"

◍ "Saudi British Bank"

◍ "ANZ"

◍ "EBRD"

◍ "Japan Exim Bank"

Request Sample Report

◍ "Corporate Cash Management"

◍ "Government Cash Management"

◍ "Others"

◍ "Treasury Management"

◍ "Risk Management" ◍ "Payments" ◍ "Working Capital" ◍ "Others"

Request Sample Report

Request Sample Report

$ X Billion USD