ANALOG RELATIONSHIPS IN A DIGITAL WORLD Craig Steven Development Corporation has been a critical part of community growth and tenant expansion throughout the region.

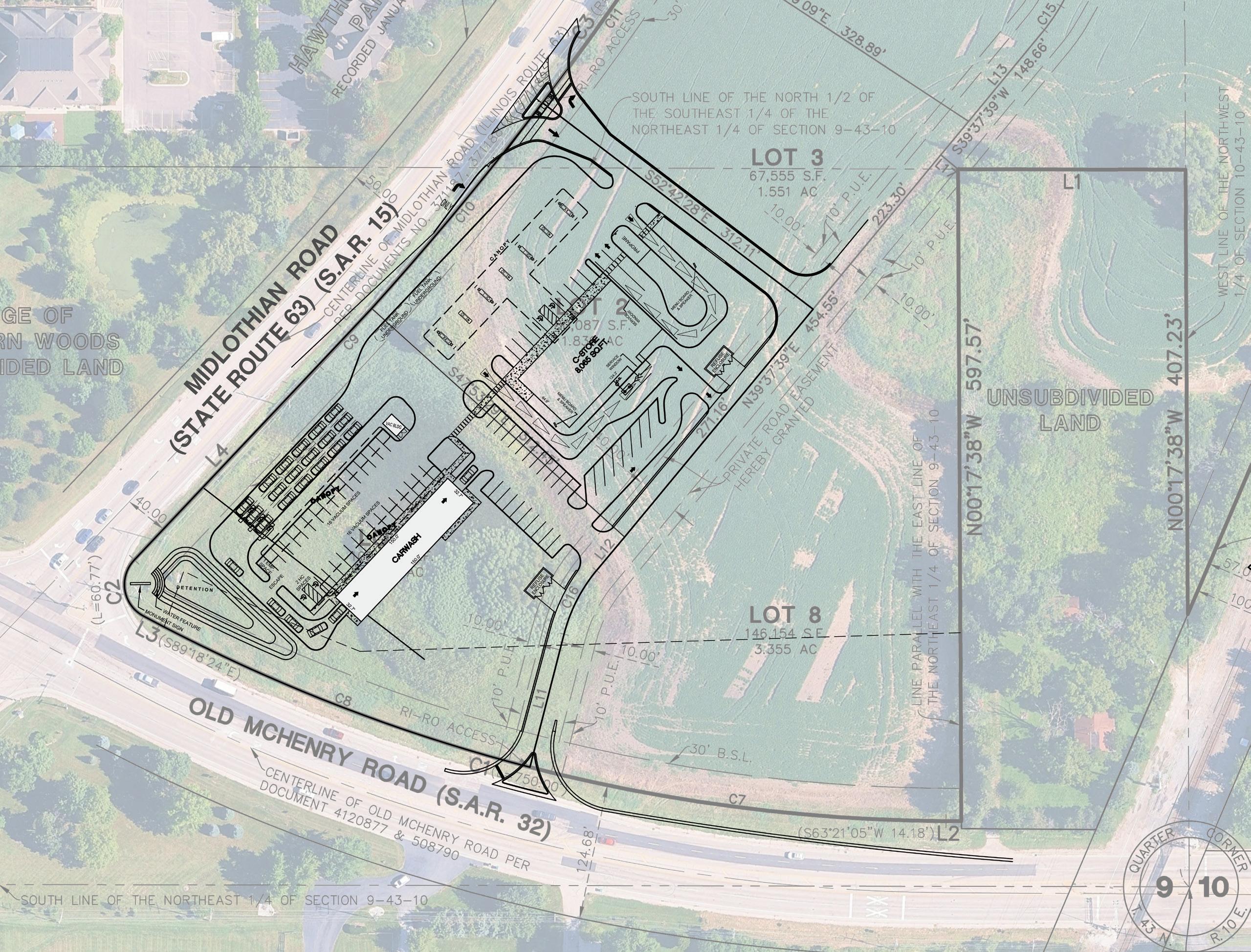

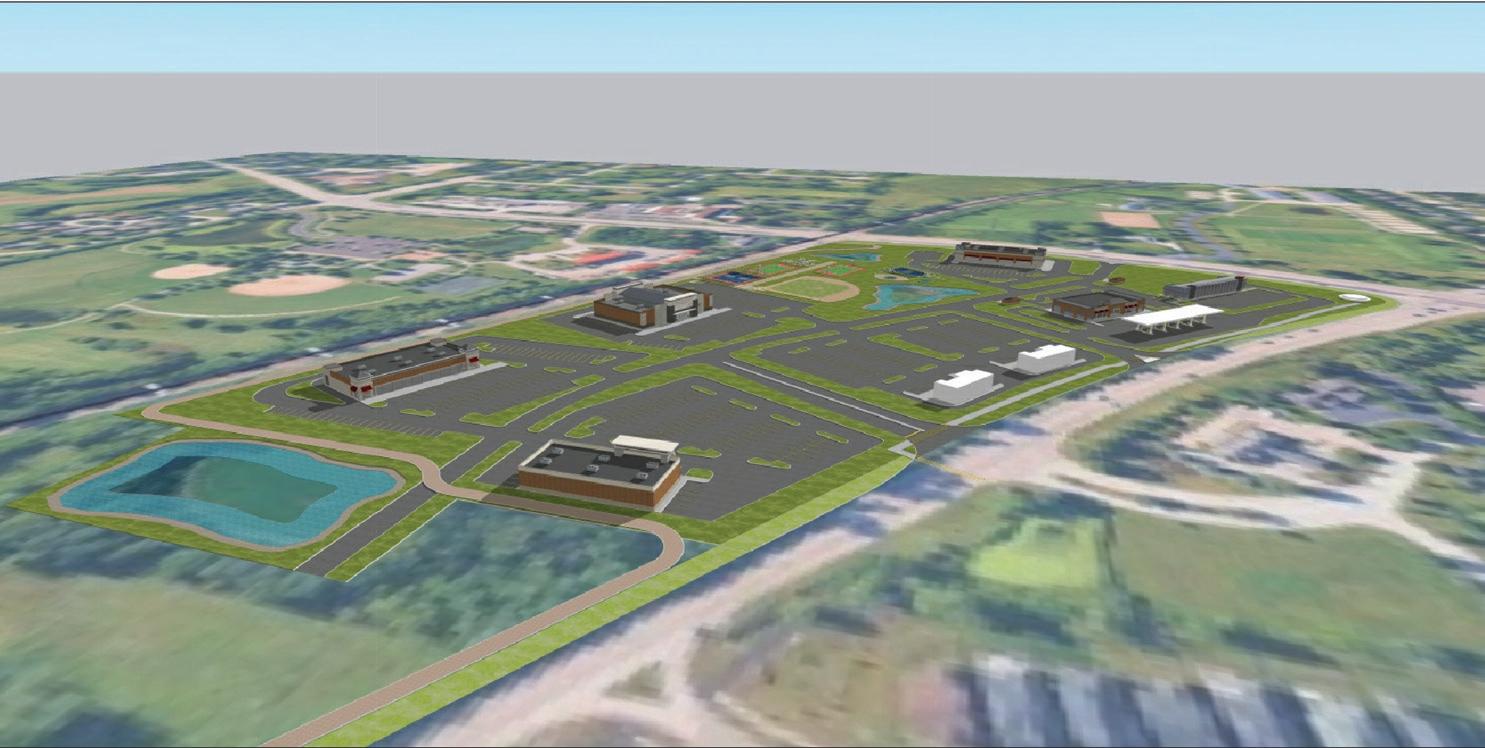

In early 2023, Jonathan Berger, a Chicago real estate investor and owner of a 20+-acre parcel in Hawthorn Woods announced new and revised zoning/ development plans to create Hawthorn Woods Town Center on eight lots at the northeast quadrant of the Old McHenry Road and Midlothian Road intersection.

CHICAGO RETAIL: LOOKING FOR THAT INSTAGRAM MOMENT

The 2025 Chicago Mid Year Sentiment Report, published by The Real Estate Center at DePaul University in collaboration with ULI-Chicago, found grocery anchored centers to be the 3rd most attractive investment segment right behind suburban multifamily.

RETAILERS BANKING ON A STRONG HOLIDAY SHOPPING SEASON THIS YEAR

Retail sales are expected to grow 3.5% to 4% this holiday season, bringing the total expected spend in excess of $1.7 trillion, according to ICSC’s 2025 holiday shopping forecast.

WINTER 2026 METRO CHICAGO RETAIL SPACE GUIDE 4 6 8 10 16 18

THE BOULDER GROUP NETLEASE MARKET REPORT

Publisher: Mark Menzies • menzies@rejournals.com

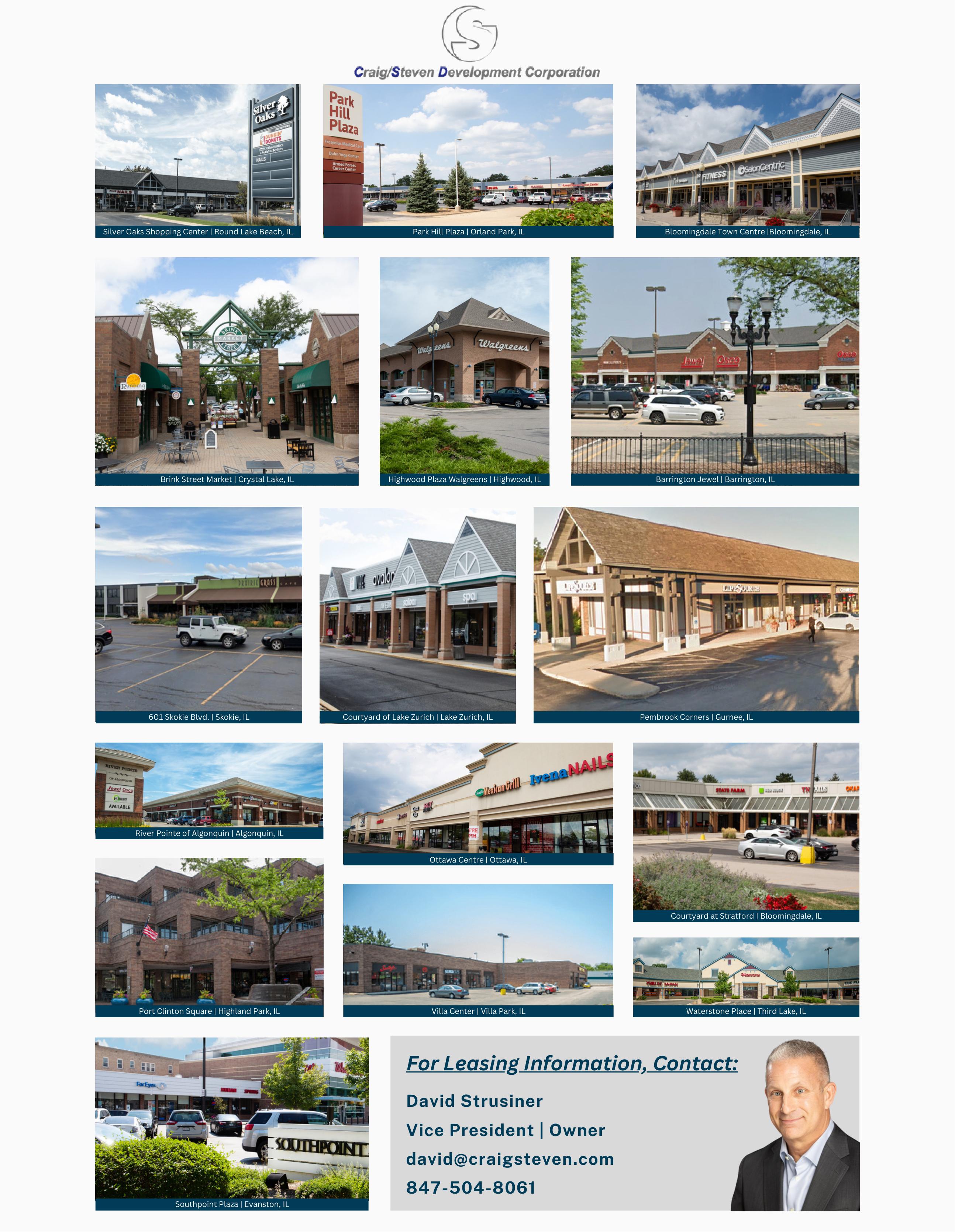

By David Strusiner, Craig Steven Development Corporation

As owners of shopping centers throughout suburban Chicago for the past 50 years, with a portfolio that expanded from one center to more than 1.25M square feet, our firm has been a critical part of community growth and tenant expansion throughout the region. None of our work would have been possible without our commitment to cultivating deep and enduring relationships, but in today’s market disrupted by technology the fundamentals are questioned more than ever. Do relationships still matter in commercial real estate?

Ownership: An Evolving Business Model

Acquiring and owning shopping centers today requires flexibility. The complexities extend beyond physical and economic to the digital

world, as nearly all of the tools of yesteryear remain in place though often modernized through technology. There is also substantive investment required for additional tools critical to performance today. We are more cognizant of lifecycles – ours and the property’s – and the need to ensure we have the resources in place to be prepared for all eventualities. We build reserves, track our tenants’ performance, analyze data and cycles, and maintain and update each property’s digital assets.

We’ve discovered, thus far, that each facet of property ownership still requires relationships to keep it on track. Even when we’re adopting new a process or technology, our relationships are leading to our selection of the tools. Peer and

vendor relationships are critical to determining the appropriateness of our use case.

What we never considered before is true today: technology makes it possible to engage an external partner. Over the past year, we’ve engaged external partners on a programmatic basis for property management in addition to our outsourced retail leasing and marketing partnerships.

The property manager and the owner don’t need to be in the same office; they need to be available to ask and answer questions. The need for constant communication is met through devices, laptops and phones.

There is a learning curve when an owner transitions to an external resource. Our internal methodologies were replaced with different processes and perspectives than had ever been considered. While these improvements are more robust and efficient than we could do on our own, we had to trust that the onboarding process would lead to ongoing success.

Relationships are what got us here, by the way. We started with our external property management firm a year ago because we had an existing relationship with them. Our family members knew their family members. We researched extensively through industry knowledge and conversations with colleagues. We identified our partners as successful landlords with a much broader organization and hierarchy than ours, who would manage our portfolio with the same diligence and care they managed their own. They accepted that parts of the engagement – such as retail leasing, architecture, and space planning – were going to remain within our company, without issue. They didn’t need to control every aspect and worked with us to create the right parameters and scope of engagement. They understood the flexibility required.

As our leadership becomes more technologically savvy, the workplace has been transformed. We can lead from anywhere. (and we do!)

we prioritize analog relationships. Whether it’s attending conferences, getting involved in organizations, or facilitating in-person meetings and conversations, the long-term result is sustained velocity. I am sure that you, like me, have seen real estate parents walking with their adult children at trade shows. There’s a reason they do that. Where else does a younger professional meet a critical mass of colleagues? Off the top of my head, I can think of a half dozen owners like me whose children were in meetings and events surrounding ICSC@MIDWEST. If you’re a broker who doesn’t go, and your relationship is with the parent, what’s going to happen when the new generation takes over?

Relationships allow each of us to stay relevant within the industry. Digital tools have the ability to maximize how we interact and what we are doing, while the long term success of our partnerships – who we are working with – is determined by the depth of our relationships.

I am even more convinced that real estate is still a relationship business. People work with people they trust. The digital world delivers ample opportunity to meet new people and stay in front your contacts, but as professionals,

David Strusiner Is vice president and owner of Craig Steven Development Corporation. To explore the Craig Steven Development Corporation portfolio of retail space, visit https://craigsteven. com/retail/.

By Michael Millar

In early 2023, Jonathan Berger, a Chicago real estate investor and owner of a 20+-acre parcel in Hawthorn Woods, had an epiphany.

Berger, his company Berger Asset Management, and other investors always recognized the broader, long-term potential of the land site, as a retail development, a grocery-anchored center or other commercial uses. But after a number of years, and almost as many attempts at helping developers realize their vision for the development parcel, Berger had a revelation: if you want a job done well, sometimes you may have to do it yourself.

“After going in and out of contract for various unresolved issues, we came to believe that we’d ultimately be more successful clearing those hurdles first and then moving forward with development plans,” Berger said.

Earlier this year, with most of the heavy lifting accomplished, Berger along with the Village of Hawthorn Woods, announced new and revised zoning/development plans to create Hawthorn Woods Town Center on eight lots at the northeast quadrant of the Old McHenry Road and Midlothian Road intersection. Ultimately, the Town Center development will provide “intown” services to Hawthorn Woods residents

(and surrounding communities) and will generate as much as $1 million annually for the Village Hawthorn Woods.

Much like they have over the course of late 2024 and 2025, things are shaping up and falling into place for Hawthorn Woods Town Center.

In early November, lots 1 and 2, totaling 4.2 acres, went under contract with Gas N Wash, a private, locally owned gas station, convenience store, and car wash business that currently has more than 30 locations throughout the Chicago metro area. In addition to selling a

highly curated selection of convenience items and prepared foods, this Gas N Wash location will include gaming, liquor sales, an internal restaurant with a drive thru, and an adjacent stand-alone state-of-the-art car wash.

Construction is expected to begin in Spring of 2026, Berger said. He and his investment partners are excited and pleased with the trajectory of the project since taking on the arduous and expensive process of commercial land development.

“Hindsight is always 20/20, but we made the right decision to work through the challenges that foiled others as we are now almost shovel ready,” Berger said.

The land site is being subdivided into eight parcels ranging from 1.5 to 4.4 acres and it is currently being marketed to primarily retail businesses that are attracted to the over 30,000 cars that drive by the property each day.

Among the remedies that enhance the viability of the site include significant rezoning and incentive actions. Originally, the zoning of the Town Center property required a huge 300foot setback for all retail commercial buildings. Berger, however, ultimately was able to secure 30-foot setbacks which are typical in most retail properties. Additionally, the Village has indicated a willingness to incentivize grocery stores, including small store footprints, to help the project succeed.

“The collaboration with the Village is indicative of its motivation to move forward with a development that will provide its residents with much needed services and the Village with significant tax revenue.” Berger said. “They are eager for this site to reach its full potential and have shown so by unanimously approving the requested zoning changes and offering incentives (without tenants in hand) in order to spur further interest in the Town Center Development.”

One of the broader community issues impacting both Lake County and its residents as well as the development of the Town Center property has been the presence of the Elgin Joliet & Eastern Railroad that runs grade-level freight train tracks throughout the county including one that crosses Old McHenry Road adjacent to Berger’s property. The at grade crossings can create delays sometimes reaching as long as 60 minutes causing huge traffic back-ups.

“We made the right decision to work through the challenges that foiled others as we are now almost shovel ready.”

When the decision was made to not pursue the extension of Rt. 53, the County turned its attention to solving the at-grade railroad crossing problem. After several public hearings pertaining to the location of the proposed improvements, it was decided that an underpass will be built on Old McHenry Road adjacent to Berger’s property. While this has added additional development challenges, ultimately the improvements will benefit the site as County residents use the underpass to avoid delays associated with the at grade crossings.

The rerouting of traffic under the railroad tracks, once it is complete, will also allow pedestrians and bikers with an uninterrupted path that will connect the Hawthorn Woods Town Center site with the Village’s Community Park to the east and Village’s Aquatic Center to the north. According to the Hawthorn Woods website, the Aquatic Center and the Community Park are the signature Hawthorn Woods community amenities. Located adjacent to the Town Center property, the 30-acre community park and the Aquatic Center are the primary gathering spaces for special events, baseball tournaments, summer concerts, and more.

Berger originally acquired 40+ acres, in two distressed 20+-acre land parcels in 2009-2010. In late 2019, Berger sold the site on the south side of Old McHenry Road to a Dallas-based residential developer. Seventy homes were built on that property—a significant departure from the typical low-density housing found in Hawthorn Woods.

While assuming the position of traditional land developer, Berger is not ruling out constructing a multi-tenant building this spring prior to securing tenants. Such a strategy will attract smaller retailers, medical and commercial users, according to Berger.

“Incentive dollars, zoning changes and greater accessibility are welcome big headlines for Hawthorn Woods Town Center,” said Holly Estler of Newmark who along with Larry Kling is marketing the property. “The outcomes achieved by the Village of Hawthorn Woods and Jonathan Berger, represent a tremendous breakthrough for the Town Center project.”

Michael Millar is a communications and public relations professional and one of the co-founders of Open Slate Communications.

By Dan Rafter

Retail real estate covers a wide range of asset types including regional malls, grocery anchored centers, lifestyle power centers and of course, free standing shops clustered along select city streets, including famed high streets like Michigan Avenue and State Street.

Each asset has different supply/demand dynamics. The 2025 Chicago Mid Year Sentiment Report, published by The Real Estate Center at DePaul University in collaboration with ULI-Chicago, found grocery anchored centers to be the 3rd most attractive investment segment right behind suburban multifamily. This is not surprising. Because of its focus on necessities like food and services, grocery anchored centers are quite recession resistant.

Nationally, investors have been aggressively seeking out these defensive assets. Chicago has also benefited from the trend, but due to its overall shortage of institutional capital, there are still attractive opportunities, as reflected by the survey scores.

Suburban retail has been performing well, characterized by high occupancies, rising rents and increasing absorption levels. According to Adam Firsel, Principal, Core Acquisitions, one of the signs of strength in the suburban retail market is the backfilling of junior box tenants taking place as bankruptcies occur.

“The retail sector is showing larger allocations of investment than in the past 15 years,” Firsel said. “While other property types have really gotten hurt from high rates and the Post-Covid world, retail has been resilient with great underlying fundamentals. It’s been nice to have retail get back into the investing spotlight.”

Out lots are also performing well. Shopping centers that have opportunities to create new out lots, or re-tenant defunct ones, will have good opportunities. Panera, Dutch Bros., 7 Brew, Starbucks, Shake Shack, Portillo’s, Cava, Chipotle, and others are among the users with great credit willing to pay high rents supporting new construction on outparcels.

Outside of the defensive grocery anchored segment, the DePaul Report found that retail is much more of a mixed bag. The economy is showing signs of weakening as consumer spending has slowed and likely will be further impacted by the tariff impact and employment concerns.

Firsel anticipates more retail bankruptcies on the horizon as sectors like furniture and luxury have started to weaken. Still, real estate professionals surveyed for this report noted a resurgence and evolution of retail space throughout Chicago.

Michael Edwards, Chicago Loop Alliance, expressed his optimism saying cities are very resilient. “Cities are the greatest invention because they show creativity.”

Edwards also called for greater levels of progressive innovation citing the example of a retailer in Asia whose storefront display projects a shopper’s hologram onto a screen in a featured suit or outfit. “We need that progressiveness here.”

Regina Stilp, a principal and co-founder at Farpoint who sits on the board of the North Michigan Avenue Association, is seeing interesting and steady movement on Michigan Avenue, where Farpoint is a property owner. She characterized the market as evolving to be more experiential.

“People are looking for their Instagram moment,” Stilp said. “You draw people in by being experiential.”

Examples include a flagship Aritzia store, equipped with a bar and the Canada Goose store where shoppers can walk into a freezer to test the warmth of their coats at 20 below. Other attractions, where there often are lines and smart phones clicking as Instagram posts are created, include the Harry Potter Museum and the Starbucks Roastery.

Ryan Segal, Vice President of Property Management, with the $2.6B market cap Acadia Realty Trust, also expressed general optimism for the Chicago retail market, suggesting Michigan Avenue will continue to be successful and attract tenants as it becomes increasingly more experiential.

He is bullish on various neighborhood and corridor markets, like the Armitage and Clark/Diversey, where his firm has considerable holdings. “The strength of neighborhood markets, like Armitage, Clark & Diversey and the Gold Coast, is that people like to stay close to home and shop where they live,” Segal said.

Because of the demographics and popularity of some of these areas, Segal said there often is a waiting list for space. That type of demand has paved the way for strong year over year and fiveyear rent growth trajectories. It is also attracting institutional investors.

“It’s not just happening in highly recognized corridors like Michigan Avenue,” Segal said. “It’s happening in some of the neighborhoods too.”

Cap rates in the single tenant net lease sector remained stable in the third quarter of 2025, with overall cap rates increasing just one basis point to 6.80%. This minimal movement reinforces the market stabilization observed in the second quarter of 2025. Retail cap rates were unchanged at 6.57%, while office cap rates increased to 7.90% (+5 bps) and industrial cap rates compressed to 7.20% (-3 bps). After holding steady in the first half of 2025, the Federal Reserve cut rates by 25 basis points with a target range of 4.00% - 4.25%. Following two years of cap rate expansion, participants in the net lease sector appear to be adapting to the current capital markets.

Stability in the net lease market was further demonstrated in the third quarter of 2025 with the supply of net lease properties. The supply of properties was relatively stagnant as well with a 0.5% decrease in overall market supply. Retail and office inventory declined 1.4% and 1.1% respectively. Conversely, industrial properties on the market increased by 6%, suggesting increased seller activity in this sector.

Consistency in cap rates and market supply suggests greater alignment between pricing expectations between buyers and sellers. Accordingly, the bid-ask spread remained narrow across the net lease sector. The spread between asking and closed cap rates tightened to 29 basis points (-1 bp) for retail properties. Industrial spreads widened slightly but remained at levels similar to the retail sector at 30 bps (+3 bps).

The net lease market continues to demonstrate resilience and stability in not only pricing but investor demand. Transaction velocity still lags the historical peaks, however market stability and buyer/seller alignment provide optimism for increased transaction volume in the next twelve months. Institutional demand for net lease properties remains high, however current cost of capital remains the variable for salability. Investors will be carefully monitoring the policy of the Federal Reserve with two additional meetings remaining in 2025. If rate cuts continue from the Federal Reserve, the net lease market would benefit. However, historically cap rates have not moved in lock step with interest rates and supply and demand drives pricing in the market as well.

carter@bouldergroup.com

By ICSC

Photo by Tofros.com

Retail sales are expected to grow 3.5% to 4% this holiday season, bringing the total expected spend in excess of $1.7 trillion, according to ICSC’s 2025 holiday shopping forecast.

ICSC also released the results of its annual Holiday Shopping Intentions Survey exploring consumer expectations for the season, finding that 243 million consumers (91%) plan to shop this year, an increase from last year.

“Despite economic concerns, our survey shows that consumers are committed to their holiday traditions and plan to shop,” said ICSC President and chief executive officer Tom McGee. “Our forecast reflects that resilience, but our data also signals a selective shopper, putting pressure on retailers to connect with shoppers in new ways and offer memorable shopping experiences that entice them to spend.”

Amid the uncertain economic environment, 65% of consumers agree that it’s more important than ever to celebrate holiday traditions. In line with this, many holiday shoppers are turning to activities and experiences. Respondents that plan to gift activities like tickets to movies and

events increased by five percentage points to 21% year-over-year. One in three also plan to spend more on experiences this holiday season compared to last year.

The survey found that 92% of shoppers plan to spend in a physical store, led by younger generations. Omnichannel shopping continues to grow in popularity, with 52% of consumers indicating they plan to take advantage of buy-online, pick-up-in-store options. Discount department stores (63%) and traditional department stores (29%) remain the most popular types of retailers consumers plan to visit. In a sign of opportunity for emerging retailers, 80% of consumers are open to visiting new stores or trying new brands.

Gift cards continue to be the most popular item this holiday season, with 64% of respondents planning to buy them, up six percentage points since 2024. Sixty-three percent of holiday shoppers agree that giving gift cards enables them to stick to a budget and avoid higher prices on individual items. Apparel (55%), toys and games (54%), and food and beverages (43%) rounded out the top categories.

Tariffs are a significant factor shaping consumer attitudes this season – and consumers indicated that they will also impact where they plan to shop. Seventy-one percent of respondents plan to be more selective when making holiday-related purchases due to perceived price increases from tariffs; further, 63% would avoid buying from retailers that raise prices significantly.

Shoppers plan to use many different tactics to find lower prices. Sixty-four percent plan to spend more time looking for deals this year, and 67% believe the search for discounts or exclusive offers will encourage them to take more trips to stores. Thirty-two percent plan to use AI tools to help them with their holiday shopping and gift ideas, an increase over 25% in 2024.

“It’s clear from our research that economic factors aren’t just shaping consumer sentiment – they’re directly impacting where and how consumers shop,” said McGee. “Convenience, competitive pricing, and attentive service are table stakes in this environment. Retailers that truly listen to consumer signals have ample opportunity to capture consumer dollars this season.”

Year Built/Year Renovated: 1996

Type of Center: Neighborhood No. of Stores: 9

Total Space: 32,246

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: AccuQuest Hearing Center, Pink Hair Studio, DG Market

Rental Rate: $19.00

Total Passthroughs: $6.88

NEC Lake St & Bloomingdale Road

Year Built/Year Renovated: 2005

Type of Center: Neighborhood No. of Stores:

Total Space: 15,000

Total Available Space: 15,000

Available Minimum: 1,200

Maximum Contiguous: 15,000

Anchor Tenants: Future Development

Rental Rate:

Total Passthroughs:

Aurora Restaurant

Year Built/Year Renovated: 2008

Type of Center: Community No. of Stores: 24

Total Space: 14,715

Total Available Space: 6,334

Available Minimum: 1,200

Maximum Contiguous: 6,334

Anchor Tenants: Tropical Smoothie Cafe, Bank of America, Double Yolk Pancake House, Verizon

Rental Rate: $21

Total Passthroughs: Contact Broker

Year Built/Year Renovated:

Type of Center: Mixed Use No. of Stores: N/A

Total Space: 53,000

Total Available Space: 4,000

Available Minimum: 4,000

Maximum Contiguous: 4,000

Anchor Tenants: Paramount Theatre, Altiro Latin Fushion, Craft Urban, Charlie’s Silver Spoon Creamery

Rental Rate: Contact Broker

Total Passthroughs: Contact Broker

The Courtyard at Stratford 357-369 W. Army Trail Road

Year Built/Year Renovated: 1983

Type of Center: Neighborhood No. of Stores: 17

Total Space: 20,890

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: For Eyes, Men’s Warehouse, FedEx, Fry n wings

Rental Rate: $21

Total Passthroughs: $6.28

David Strusiner

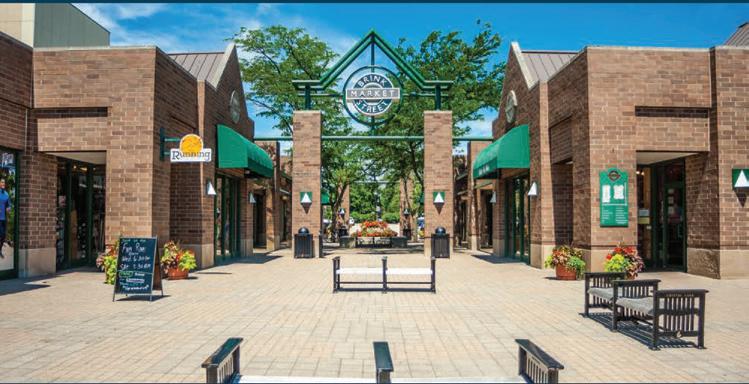

Craig/Steven Development Corporation (847) 504.8061 Brink Street Market 30-40 N. Williams Street

Country Corners

Year Built/Year Renovated: 1989

Type of Center: Neighborhood No. of Stores: 13

Total Space: 28,042

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: Starbucks, Benedicts La Strata, The Running Depot

Rental Rate: $15.00

Total Passthroughs: $7.69 David Strusiner

Craig/Steven Development Corporation (847) 504.8061

Year Built/Year Renovated: 2008

Type of Center: Community No. of Stores: 15

Total Space: 124,000

Total Available Space: 10,650

Available Minimum: 2,400

Maximum Contiguous: 7,650

Anchor Tenants: Petco, Savers, Dollar Tree, LaRosita Market

Rental Rate: $16.00-$20.00

Total Passthroughs: $5.30

Year Built/Year Renovated: 2021

Type of Center: Neighborhood No. of Stores: 16

Total Space: 73,000

Total Available Space: 500

Available Minimum: 500

Maximum Contiguous: 500

Rental Rate: $45.00

Total Passthroughs: $7.05

Anchor Tenants: Jewel/Osco, ATI Physical Therapy, Dunkin Donuts, The UPS Store

Lexington Square NWC York Road & Lexington Street

Plaza

Pembrook Corners

Year Built/Year Renovated: 2004

Type of Center: Neighborhood No. of Stores: 8

Total Space: 33,000

Total Available Space: Please call

Available Minimum: Please call

Maximum Contiguous: Please call

Anchor Tenants: Fresh Start Cafe, Ace Hardware, W3Body

Rental Rate: Please call

Total Passthroughs: Please call

Year Built/Year Renovated: 1985

Type of Center: Neighborhood No. of Stores: 14

Total Space: 29,564

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Charles S. Margosian Highland Management Assoc., Inc. (630) 691.1122

Anchor Tenants: Walgreens, For-Eyes Optical, Kenny The Kleener, Rockstar Nail & Spa

Rental Rate: $19.00

Total Passthroughs: $11.46

Year Built/Year Renovated: 1989

Type of Center: Neighborhood No. of Stores: 15

Total Space: 21,462

Total Available Space: 1,158

Available Minimum: 1,158

Maximum Contiguous: 1,158

Anchor Tenants: Vitalant, Harbor Coin, Jimmy Johns, Kumon Learning Center

Rental Rate: $18.00

Total Passthroughs: $9.84

Year Built/Year Renovated: 1984

Type of Center: Neighborhood No. of Stores: 20

Total Space: 45,188

Total Available Space: 5,593

Available Minimum: 1,297

Maximum Contiguous: 3,340

Anchor Tenants: Walker Bros. Restaurant, Dairy Queen, The Bar Method, New Balance, Stretch Lab

Rental Rate: $18.00

Total Passthroughs: $10.51

Year Built/Year Renovated: 2000

Type of Center: Neighborhood No. of Stores: 20

Total Space: 38,980

Total Available Space: 5,618

Available Minimum: 2,250

Maximum Contiguous: 3,368

Anchor Tenants: Jewel/Osco, Starbucks, Orangetheory Fitness, Lou Malnati’s, ATI Physical Therapy

Rental Rate: $20.00-$25.00

Total Passthroughs: $15.55

Year Built/Year Renovated: 1989 Type of Center: Neighborhood No. of Stores: 12

Total Space: 32,849

Total Available Space: 8,744

Available Minimum: 1,206

Maximum Contiguous: 6,331

Anchor Tenants: Walgreens, Lou Malnati Pizzeria, Avalon Spa Rental Rate: $20.00

Total Passthroughs: $8.56

Year Built/Year Renovated: 1983/2003

Type of Center: Neighborhood No. of Stores:

Total Space: 75,000

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: Jewel/Osco, iHop

Rental Rate: Please call

Total Passthroughs: Please call

Total Space: 16,937

Total Available Space: 8,483

Available Minimum: 1,702

Maximum Contiguous: 4,939

Anchor Tenants: Apple Store, Ramsay’s Kitchen, Filson, Bluemercury

Rental Rate: Contact Broker

Total Passthroughs Contact Broker

Year Built/Year Renovated: 2004

Type of Center: Neighborhood No. of Stores: 2

Total Space: 30,000

Total Available Space: 25,000

Available Minimum:

Maximum Contiguous:

Anchor Tenants: Office Depot, Fifth Third Bank

Rental Rate: Please call

Total Passthroughs: Please Call

Year Built/Year Renovated: 2018

Type of Center: Neighborhood No. of Stores: 10

Total Space: 18,500

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: Great Clips, Spice Mart

Rental Rate: Please call

Total Passthroughs: Please call

Year Built/Year Renovated: 2016

Type of Center: Neighborhood No. of Stores: 14

Total Space: 24,883

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: Jewel/Osco

Rental Rate: Please call

Total Passthroughs: Please call

Year Built/Year Renovated: 1988

Type of Center: Neighborhood No. of Stores: 30

Total Space: 61,121

Total Available Space: 11,500

Available Minimum: 1,400

Maximum Contiguous: 3,000

Anchor Tenants:Clothes Mentor, Culver’s, Namaste Grocery Store

Rental Rate: $16.00

Total Passthroughs: $8.11

S. Margosian

S. Margosian

Total Space: 10,000

Total Available Space: 10,000

Available Minimum: 3,800

Maximum Contiguous: 10,000

Anchor Tenants: Rental Rate: $18.00-$25.00 Total Passthroughs:

Total Space: 63,446

Total Available Space: 18,851

Available Minimum: 2,500

Maximum Contiguous: 12,000

Anchor Tenants: AT&T Verizon, Rosati’s Pizza, Brothers Supply Rental Rate:

Total Passthroughs:

Total Space: 137,000

Total Available Space: 7,672

Available Minimum: 1,475

Maximum Contiguous: 4,338

Anchor

Rental Rate: $20.00

Total Passthroughs: $9.25

Total

Available Minimum: 1,440

Maximum Contiguous: 65,492

Anchor

Rental Rate: Contact Broker

Total Passthroughs: Contact Broker

The Shoppes at Stony Creek

Year Built/Year Renovated: 2023

Type of Center: Community No. of Stores: 17

Total Space: 39,393

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: Jewel/Osco, Ace Hardware

Rental Rate: Please call

Total Passthroughs: Please call

Year Built/Year Renovated: To Be Built

Type of Center: Neighborhood No. of Stores: TBD

Total Space: 18,000

Total Available Space: 18,000

Available Minimum: 1,200

Maximum Contiguous: 12,000

Anchor Tenants: Jewel/Osco, McDonald’s, JP Morgan Chase

Rental Rate: Please Call

Year Built/Year Renovated: 2004

Type of Center: Neighborhood No. of Stores: 13

Total Space: 29,748

Total Available Space: 2,561

Available Minimum: 1,169

Maximum Contiguous: 0

Anchor Tenants: Lou Malnati’s, CK Salon, Home of the Sparrow, Aki of Japan

Rental Rate: $12.00-19.00

Total Passthroughs: $5.36

Year Built/Year Renovated: 1985

Type of Center: Neighborhood No. of Stores:

Total Space: 19,553

Total Available Space: 1,200

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: Dollar General, Supercuts, Stella’s

Rental Rate: $16.00

Total Passthroughs: $4.10

Year Built/Year Renovated: 1970/1987

Type of Center: Neighborhood

No. of Stores:

Total Space: 100,000

Total Available Space: 13,685

Available Minimum: 1,500

Maximum Contiguous: 10,000

Anchor Tenants: Jimenez Foods, Mark Drug Medical Supply

Rental Rate:

Total Passthroughs: