YOUR COMMERCIAL REAL ESTATE PARTNER

APPRAISAL

Property, farmland, and portfolio appraisals, commercial market analysis, preliminary tax assessment.

BROKERAGE

Property & investment acquisition/disposition, leasing, and tenant representation.

MANAGEMENT

Retail, multi-family, office, industrial. Over 1 million SF under management.

Naperville & St. Charles, IL

815-436-5700

CatonCommercial com

10 THINGS YOU NEED TO KNOW ABOUT RETAIL REAL ESTATE There are several significant elements of Retail real estate that contribute to our understanding of the industry in Chicago today.

RETAIL MARKET REMAINS

STRONG IN OSWEGO One Chicago suburb continues to experience significant commercial growth.

WITH CONSUMER SPENDING UP AND SAVINGS DOWN, WORKERS TURN TO PART-TIME EMPLOYMENT AND SECOND JOBS FOR RELIEF Many economic reports in March came in stronger than expected, justifying the Fed’s current stance of being patient in making the decision to lower interest rates.

THE TOP 100 FASTESTGROWING RETAILERS: CONSUMERS STILL HUNTING FOR CONVENIENCE AND BARGAINS By understanding the needs and preferences of the typical U.S. consumer, the most successful retail brands have evolved to deliver on these expectations.

2023 ANNUAL LOOP RETAIL

ANALYSIS The Loop endured its fourth straight annual vacancy rate increase in 2023, jumping to 30.13% in 2023 from 28.32% in 2022.

2023 FULTON MARKET RETAIL ANALYSIS Stone Real Estate Corp. continues its retail market analysis of the Fulton Market trade area with its second Fulton Market Retail Trade Area Analysis 2023. THE BOULDER GROUP NETLEASE MARKET REPORT

Publisher: Mark Menzies • menzies@rejournals.com

10 Things You Need to Know About Retail Real Estate

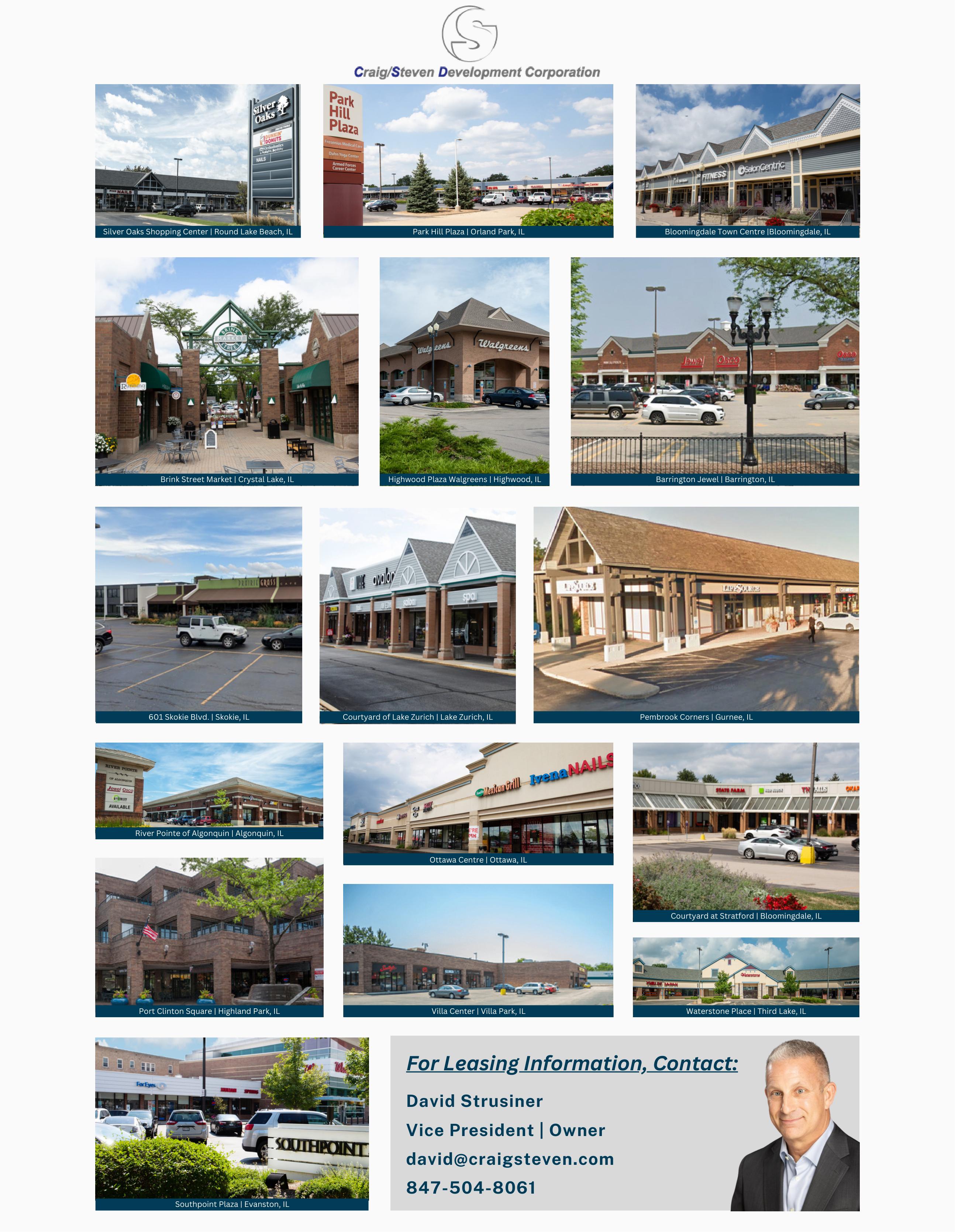

By David Strusiner, Craig Steven Development CorporationIn January, I had the pleasure of moderating a panel of peers for the Annual Forecast Conference in Chicago hosted by RE Journals. As I reflected on the commentary provided by the panelists, I realized there are several significant elements of Retail real estate that contribute to our understanding of the industry in Chicago today.

Supply and Demand

The simple law of supply and demand has created a decreased inventory of retail space. Since the Great Recession of the late 2000’s, development of retail shopping centers has been stagnant. This has allowed for more than 15 years of absorption and repositioning of retail space, leaving shopping center owners with space that has been backfilled – and limits market vacancy.

Experiences Continue to Rise

Beyond the experiential retail that each owner on the panel, including myself, has in our own

portfolios, the clear message was that these types of users are not going away. Furthermore, smart municipalities are embracing experiential draws. Panelist Kevin Leighty from the Village of Oswego shared his community’s plans to

build a cricket stadium on a large land parcel. It was the keen observation of Charlie Margosian of Highland Management that shopping itself is an experience. In our post-COVID world, the resurgence of in-person shopping and correlative retail sales underscore Charlie’s point. Keith Lord of The Lord Companies reminded us that eating at a restaurant is a fun experience as well.

Ex-Urban Migration Patterns

The advent of COVID, political and economic turmoil in city centers led to residents relocating to the suburbs in record numbers. The winners (suburban retail) and losers (loop retail) have been further amplified by hybrid and remote

Image by wendy julianto from Pixabay. David Strusinerwork schedules and a slow and inconsistent “return to the office” standard. Furthermore, panelist Keith Lord pointed out that retail businesses such as restaurants who were historically successful in the downtown environment are seeking suburban locations.

Certain Retail Sectors and Locations are Still Volatile

As the panel discussed pharmacies in particular, the generalized conclusion is that long term, high rate leases in core corner locations may not be sustainable for all users. The real estate strategy of locking up strategic locations as a blocking position and overserving a community doesn’t bear out. Rather, right-sizing the real estate portfolio has become the broader goal. For some retail sectors, that means fewer locations. For others, it means exiting a market. Panelist Andy Hochberg, CEO of Next Realty, referred to this as the “rationalization of the retail sector.”

Grocery Growth

The competitive landscape of grocery has unique entrants, successes, and repositioning. Our friend and colleague, Mike Mallon of Mallon and Associates, was in the audience and shared his observations with the attendees. Though some grocery investments by major companies have been unsuccessful to this point, the leaders will figure it out and future forays into the sector are likely to be successful as they improve their model. Subsectors within the grocery industry continue to evolve as well – value grocery, specialty grocery, and experiential grocery continue to expand.

From Online to Brick and Mortar

As Keith Lord reminded the audience, there is a continued pull to physical locations for web-based retail concepts. Just as companies with brick-and-mortar locations have largely evolved to an omni-channel strategy including internet-based sales, the drive for omni-channel solutions for companies that made their start on digital platforms continues to feed retail location demand and backfill vacancies with established brands who have an online following and are expanding their products and services to the local community through physical locations.

Rental Rates have Plateaued

Chicago is a mature market. While the collateral value of retail has never been better and occupancy rates are high (panelist Charlie Mar-

gosian’s portfolio has a 96% occupancy rate and other panelists expressed similar levels), only outside of traditional retail uses are there opportunities for rent growth. Tenants have hit the limit of what they are able to pay and maintain operations, and pass-throughs have become the only areas where expense can be added to their bottom lines.

No End in Sight to Development Challenges

In addition to the high cost of land, developers face continued scarcity and unpredictability of material delivery in addition to the national shortage of skilled tradespeople. For a shopping center owner, as Andy Hochberg pointed out, it can be uneconomical to reinvest in your properties. These challenges coupled with the aforementioned limited opportunity for rent growth make it nearly impossible to make the numbers work.

Successful Operations = Successful Locations

For every national story that indicates a mass store closure, there is a location-specific story to tell. Very seldom is it all or nothing in the world of retail corporate consolidation. Rather, retailers look at each store’s performance and make selections based on their store portfolio footprint. The takeaway from this observation

from Next Realty’s Andy Hochberg, a former national sporting goods retail company CEO, is that how the leadership and team within each specific retail location prioritize customer service and maximize the operation itself determines the long-term viability of the store.

The Labor Conversation is Front and Center

Each growing sector of retail real estate – including restaurants, grocery, and entertainment – relies heavily on an engaged workforce to achieve success. In this post-COVID world, labor remains a continued challenge forcing locations to operate with limited staff which often decreases levels of service and morale at the location and contributes to high training and staffing costs for retailers.

The conclusion of the panel, which correlates with my own experience as an owner of over 1 million square feet of retail shopping center space across dozens of properties in the suburban Chicago market, is that retail is back… and changing. The onus is on us, as commercial real estate professionals and leaders in Chicago’s Retail real estate market, to understand and adapt to these changes to better serve our tenants, clients, and communities.

Retail Market Remains Strong in Oswego

In a market where new commercial development opportunities have been stymied by high material costs and interest rates, one Chicago suburb continues to experience significant commercial growth. Located 40 miles west of Chicago, Oswego is currently home to 35,000 residents but is expected to continue growing exponentially with over 3,000 new residential units approved for construction.

Catalyzed by more than 1,000 newly constructed residential units in the last few years alone, several new retail tenants have set down roots in Oswego through new construction and redevelopment projects. Oswego’s Route 34 corridor is home to numerous anchor stores which will soon be joined by Barnes & Noble, Vasa Fitness, Bibibop Asian Grill and Sherwin Williams.

New Construction and Adaptive Reuse on Route 34

“A limited number of opportunities in the downtown area are still available for new investment including a pair of Village-owned land sites suitable for restaurant and mixed use.”

On the heels of Belle Tire’s ground up construction project recently completed by Troutman & Dams; Oswego will soon be welcoming Barnes & Noble to the community. The book retailer will open a 16,000 SF store later this summer in the Prairie Market shopping center, owned by PMAT Companies.

In a neighboring center owned by Kite Realty, Vasa Fitness is finishing up work on a substantial renovation project to rehab a 65,000 SF former grocery store space. In an outlot of that same center, MJK Real Estate is redeveloping an

Continued on page 8

Development Partners Wanted

Prime investment opportunities are available now with pad-ready sites owned by the Village.

Why choose Oswego?

• One of Chicagoland’s fastest-growing communities

- Over 1,000 new residential units added to market since 2022

- More than 3,000 new residential units approved for construction

• $114K median household income

• 16,000 vehicles per day on Washington Street

• Financial incentives available

• Join several new high end retailers and independent restaurants in this evolving commercial area

For more information, visit oswegoil.org/downtown or scan the QR code below.

Continued from page 6

old bank structure into a multi-tenant retail building which will be occupied by a Bibibop Asian Grill restaurant and a Sherwin Wiliams paint store.

Orchard Road Development Includes Entertainment Uses

On the west end of Oswego, residential development has sparked new commercial investment along the Orchard Road commercial corridor. The future homes of standalone Starbucks and Valvoline buildings are under construction by Core Acquisitions in an outlot of anchored by Jewel Os¬co. Once the project is completed later this year, they will join Beef Shack as the newest retail/restaurant tenants in the area.

Just north of the Starbucks/Valvoline project, the Whitetail Ridge Golf Club recently opened its brand-new indoor golf facility which was also built ground-up. The concept utilizes similar technologies to Top Golf in Naperville and Schaumburg. This will serve as a compli -

mentary entertainment option to the Breybourne Cricket Stadium project that was approved at Orchard and Tuscany Trail. Phase I of the project is expected to start later this year with the construction of the cricket field and pitch. Additional phases call for a hotel, restaurant and a stadium capacity of up to 25,000 seats.

Downtown Is Renaissance-Ready

Oswego’s historic downtown business district continues to undergo transformative redevelopment. Over the last three years, tens of millions of dollars have been invested to catalyze new high-end, mixed-use developments which include several independent restaurants and retailers. Recent projects include an upscale restaurant development with office space above; a 280-unit high-end apartment building with first floor retail; and a 339-space public parking deck.

Earlier this spring in the downtown center, a new restaurant and live entertainment venue, Nash Vegas Saloon, was also approved. Spearheaded by established restaurateurs,

the project will extend and renovate 6,200 SF of a former brewery space. Offering a unique blend of food service, a full bar, live music and line dancing, the project is expected to start construction in spring and open later in 2024.

Development and Restaurant Partners Wanted

A limited number of opportunities in the downtown area are still available for new investment including a pair of Village-owned land sites suitable for restaurant and mixed use. Financial incentives may be available for projects that qualify. A full list of downtown development opportunities can be found at oswegoil.org/downtown.

To learn more about these options and set the stage for success in Oswego, visit oswegoil. org/business or contact Economic Development Director Kevin Leighty at kleighty@ oswegoil.org or (630) 551-2334.

With consumer spending up and savings down, workers turn to part-time employment and second jobs for relief

By John Beuerlein, Chief Economist at the Pohlad CompaniesMany economic reports in March came in stronger than expected, justifying the Fed’s current stance of being patient in making the decision to lower interest rates. Despite the downward trend in inflation readings since June 2022, the “last mile” in getting inflation down to the Fed’s 2% target is proving to be more challenging.

The ongoing resilience of the economy causes the Fed to be less concerned about the lagged impact of the tightening of the past two years, and more focused on the potential impact of lowering rates too soon.

Inflation and consumer spending

The February Core Consumer Price Index (CPI) increased 0.4% for the second month in a row. Although the year-over-year core CPI edged down to 3.8% from 3.9%, the three-month annualized rate has accelerated to 4.2%. The headline CPI also increased 0.4% for the month, causing its year-over-year growth rate to increase from 3.1% to 3.2%.

The Fed’s preferred measure for inflation, the core Personal Consumption Expenditure Index (PCE), recorded a 0.3% increase in February and remained at 2.8% year-over-year. It should be noted that inflation indices often show stronger readings at the beginning of the year due to many price adjustments that occur at the outset of a new year.

As for the consumer, despite a weaker than expected retail sales report, overall consumer spending was stronger than anticipated in February, driven by spending on services. The increase in spending occurred even though inflation-adjusted disposable personal income declined in February after a flat reading in January. With spending up and income down, personal savings declined to the lowest level since December 2022.

Economic indicators and GDP

The leading economic indicators (LEI) ticked higher in February following 23 consecutive months of decline. Further improvement in the LEI is needed to confirm that the economy is poised to re-accelerate, but at least this suggests that most of the factors that have been cited as holding back economic growth are stabilizing. The biggest positive contributor to the LEI was the improvement in the length of the average workweek, while the biggest negative contributor was interest rates.

Improvement was also seen in the manufacturing sector via the ISM survey for March. That index moved above the neutral level of 50 for the first time since September 2022. The Production, New Orders, and Employment components provided much of the strength for the overall survey. Expectations for stronger demand and low customer inventory levels suggest support for future production.

The final reading on real GDP in fourth quarter 2023 was revised up to 3.4% from 3.2%. Stronger consumer spending and business investment

were drivers of the upward revision. Nominal corporate profits in fourth quarter 2023 were up 4.1% during the quarter and up 5.1% yearover-year.

The labor market

The March employment report provided further evidence of the strength of the labor market. Non-farm payrolls in the establishment survey rose 303,000 – the largest gain since May 2023 –and the household survey showed an increase of 498,000 jobs. The unemployment rate dropped back to 3.8% from 3.9%, the growth rate of average hourly earnings declined from 4.3% to 4.1% which was the weakest growth since June 2021, and the average weekly hours worked ticked higher.

In a separate report, the National Federation of Independent Business (NFIB) said that the net percent of firms planning to raise worker compensation decreased from 26% to 19%, not only fully reversing the jump in compensation plans that occurred in late 2023 but also hitting its lowest level since March 2021.

It is interesting to note that over the last 12 months, 1,347,000 full-time jobs have been lost while 1,888,000 part-time jobs have been added. Consequently, on a net basis, the yearly gain in jobs has come from part-time employment. Multiple job holders have increased by 492,000.

Interest rate expectations

As expected, at their mid-March meeting the Federal Open Market Committee (FOMC) kept the target range for the Fed Funds rate at 5.25% to 5.50%. Their official statement following the meeting said that they don’t “expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2.0%.”

Of particular interest was the economic projections that the FOMC updates on a quarterly basis. The median projection for real GDP growth (from fourth quarter 2023 to fourth quarter 2024) was revised up to 2.1% from 1.4%. The median projection for core PCE inflation in fourth quarter 2024 was revised up to 2.6% from 2.4%.

“Stronger consumer spending and business investment were drivers of the upward revision.”

On the topic of interest rate cuts, the median forecast of the 19 members was for three interest rate cuts this year. Interestingly, 10 members forecast three or more cuts, while nine members forecast two or fewer cuts. In other words, although the median projection came out as three cuts, it was a close call that could have been changed by the forecast of a single committee member.

Undoubtedly, the Fed is leaning towards cutting rates this year at some point. However, the stickiness of inflation in some categories along with the strength of the labor market is causing

them to be patient. The recent rebound in some economic metrics has reduced the urgency of a near-term interest rate cut. Further evidence that inflation is moving sustainably toward their target of 2.0%, along with the continued rebalancing of supply and demand in the labor market, will be necessary for the FOMC members to have the confidence to make the initial cut in rates. Markets have moved expectations for the timing of the first interest rate cut to July.

John Beuerlein is Chief Economist at the Pohlad Companies.

THERE’S A SPARK OF EXCITEMENT IN

This past year was one of the busiest and most exciting for economic development in Hoffman Estates in recent memory. For the first time in decades, a new multifamily development is under construction, with more Class A rental development proposals expected soon.

To encourage targeted future development, the Village recently created a Tax Increment Financing district, the Village’s 5th TIF district, to incentivize mixed-use redevelopment along the I-90 corridor in an area that includes older industrial buildings.

Phase 1 work is complete on the first 200,000 square foot building for the $450 million Microsoft Data Center in Hoffman Estates, with plans calling for a second similarly-sized building on the on 53-acre site. These buildings, and the significant infrastructure improvements for both sewer and electric on the site, reflect a longterm investment in the community.

Bell Works Chicagoland continues to attract a variety of new

businesses. Located in a former AT&T Campus, Bell Works has a unique, malllike atmosphere, with office and co-working space, a conference center, fitness centers, restaurants, and event spaces.

HOFFMAN ESTATES

The Village also recently facilitated significant reinvestment its the retail sector, with Home Goods, Crumbl Cookies, and Bath & Body Works opening in 2022. New retail outlets for 2023 include two approved marijuana dispensaries – Sparked Dispensary and Exxotic Strains, two Popeye’s Chicken restaurants, and a new Dunkin’ Donuts.

There is certainly a lot of energy right now in Hoffman Estates! Explore how your business can be part of this dynamic community.

ALL IN THE PAST 12 MONTHS:

$750M INVESTMENT IN THE COMMUNITY

500+ JOBS ADDED

MANY NEW RETAILERS AND RESTAURANTS OPENED, UNDER CONSTRUCTION OR APPROVED

NEW TIF DISTRICT TO INCENTIVIZE REDEVELOPMENT

BELL WORKS CHICAGOLAND REINVENTION CONTINUES WITH NEW LEASES

The top 100 fastest-growing retailers: Consumers still hunting for convenience and bargains

By Lanie Beck, Senior Director, Content & Marketing Research at NorthmarqBy understanding the needs and preferences of the typical U.S. consumer, the most successful retail brands have evolved to deliver on these expectations. Today, significant expansion is underway across several diverse retail sectors including automotive, discount and dollar stores, fitness and sporting goods, and, of course, the dynamic restaurant industry.

While expansion in these categories isn’t necessarily a new trend, there have been some recent announcements that promise to contribute even more substantial growth than originally anticipated. Conversely, a handful of retailers have also announced consolidation strategies that could present some challenges in the coming months and years.

Announcements from these retailers aren’t just headlines though. Developers, potential investors, and current owners rely on these plans to help form their own strategies, drive investment decisions, and identify both obstacles and opportunities across the market.

U.S. consumers love a bargain

The allure of a great deal resonates deeply with most U.S. consumers, and many retailers cater to this preference by offering coupons, discounts through loyalty programs, or even structuring their entire concept around discounted merchandise.

In recent years, escalating inflation has caused consumers to cut back on discretionary spending, and shoppers are now pinching pennies on even the most essential goods and services. Not surprisingly, retailers that cater to the cost-conscious consumer are some of the brands growing the fastest.

• Dollar General recently reached 20,000 total locations and is planning an additional 800 new stores in fiscal year 2024.

• ALDI successfully acquired Southeastern Grocers and will add 800 total locations to its foot-

“In April, Target will launch a new fee-based membership loyalty program, presumably to compete with Walmart+ and Amazon Prime.”

print through new development and rebranding by year-end 2028.

• In April, Target will launch a new fee-based membership loyalty program, presumably to compete with Walmart+ and Amazon Prime, and in recent months it announced its intent to continue exploring large format new store development, which contradicts the downsizing trend we’ve seen across other brands.

• Five Below plans to exceed last year’s growth by opening up to 235 new locations during

fiscal year 2024, putting the discount brand on target to reach its goal of 3,500 total stores by 2030.

U.S. consumers value convenience

Convenience remains a cornerstone of the consumer experience, but convenience extends beyond just products. It encompasses ease of access, swift service, and helpful technology among other characteristics.

From one-stop shopping destinations to graband-go offerings, retailers that promise a speedy and efficient experience are gaining market share as brand loyalty rises. The availability of self-checkout kiosks, mobile apps that allow ordering on the go, and multiple drive-thru lanes to ensure quick service all combine to deliver a convenient experience that consumers crave, which is helping to drive not only growth across the sector but additional innovation, too.

• Sheetz & Wawa: More than 1,000 locations are planned long-term by these two rapidly growing gas station and convenience store brands.

• Take 5 Oil Change, the “stay in your car” oil change pioneer, embodies convenience and speed, and recent growth has taken the brand beyond 1,000 locations, with long-term plans calling for 150 new locations to open each year.

• In the growing “medtail” space, Aspen Dental has emerged as a provider of choice, offering appointments and locations that are more convenient for some patients than a traditional dentist can offer.

• Chipotle Mexican Grill & Chick-fil-A: Both brands have embraced unique drive thru concepts, relying on mobile ordering and multiple pick-up lanes. It’s estimated that more than 80% of all new Chipotle stores will feature Chipotlanes, while nearly all Chick-fil-A stores will include a double or triple lane drive-thru to accommodate high volumes.

U.S. consumers are investing in their well-being

“(Personal wellness ) has become a driver of growth for retail brands offering health-centric goods and experiences.”

Following the pandemic, consumers have increasingly been focused on personal wellness, and this has become a driver of growth for retail brands offering health-centric goods and experiences. From fitness centers promoting active lifestyles to grocery stores and restaurants offering organic and healthy food options, consumers are actively seeking out brands that align with their goals and preferences.

According to McKinsey & Company, the U.S. wellness market has reached $480 billion and is growing at a rate of 5 to 10% each year. Retailers who deliver health-conscious goods and services are capitalizing on this growth and many are looking to expand in the coming year and beyond.

• Built on a reputation of being a “judgement-free zone,” Planet Fitness has seen tremendous growth in recent years, and expects to add another 600 locations globally in the next three years to reach a total of 5,000 club locations.

• With up to 140 new stores planned in the next few years, Academy Sports + Outdoors sees an opportunity for significant expansion as it works to capture market share from primary competitors in this growing space.

• While not the fastest growing grocery concept, specialty brand Sprouts Farmers Market has a target demographic that values healthy and fresh offerings, and they expect to reach a broader consumer base by opening 35 new stores in 2024.

For more information about these retailers and other top brands, read Northmarq’s Q1 2024 Top 100: Tenant Expansion Trends report.

Lanie Beck is senior director of content and marketing research at Northmarq.

2023 Annual Loop Retail Analysis

The Loop endured its fourth straight annual vacancy rate increase in 2023, jumping to 30.13% in 2023 from 28.32% in 2022. Significantly, the vacancy rate has now doubled from its pre-Covid level of 14.92% in 2019. In the 22 years that Stone Real Estate Corp. has conducted its Annual Loop Retail Survey, the lowest recorded vacancy rate was 9.91% in 2015 and now it reached its high of 30.13% in 2023.

According to John Vance, Principal of Stone Real Estate and author of the Survey, the key reasons for this year’s high vacancy rate are as follows:

• The continued closings of pharmacies, led by Walgreen’s closing an additional three (3) locations at Michigan & Adams, Madison & Wells and The Thompson Center (now the Google Building);

• Additional store closings on State Street, from large stores like Old Navy at Randolph & State to multiple small shop closings at the base of the Palmer House;

• Several store closings throughout the Loop without significant leasing to counter the blow.

MICHIGAN AVENUE CORRIDOR (bounded by the Chicago River to the North, Ida B Wells Drive to the South, Lake Michigan to the East and the east side of Wabash to the West)

This submarket added 27,000 square feet of vacant space and suffered a vacancy rate increase to 28.18% in 2023 from 25.90% in 2022. The two large contributors to this increase are the shuttering of Walgreen’s across from The Art Institute and the closing of Liberty Travel at Michigan & Lake. While the storefronts facing Michigan Avenue and Millennium Park enjoy strong pedestrian traffic from tourists and residents, the submarket will struggle to backfill these two large spaces.

CENTRAL LOOP (bounded by the Chicago River to the North, Ida B Wells Drive to the South, the west side of Wabash to the East and the east side of Clark Street to the West)

The data shows ‘only’ a 25,000 square foot increase in vacant storefront spaces for a modest percentage jump of 24.75% in 2022 to 26.59% in

2023. If there is any positive news in these numbers, it is that while State Street endured several visible losses as Old Navy, Journey’s, Vans and several retailers at Palmer House that vacated their stores, the ordinary leasing of storefronts within the subtrade area mitigated some of the damage from State Street. Attempts at optimism aside, State Street’s vacant storefronts cast a palpable pall over the entire submarket. The entire east side of the block between Monroe & Adams is vacant, which deters any significant leasing on the adjacent block to the south. Of the 644,703 square feet of retail inventory fronting State Street, 226,131 square feet sit vacant or over 35% of the total inventory. Most distressing is that of the 291,084 square feet along the east side of State Street, 146,967 square feet remains vacant, which is over 50% of the total square footage fronting the East side of State Street. (These numbers exclude Macy’s & Target).

LASALLE WACKER CORRIDOR (bounded by the Chicago River to the North, Ida B Wells Drive to the South, the west side of Clark Street to the East and the Chicago River to the West)

This Corridor saw its vacancy percentage increase to 36.22% in 2023 from 34.48% in 2022. Most of this increase is caused by the removal

of occupied square footage from the Survey due to the

closing of Walgreens, PNC Bank and the United States Post Office in the Thompson Center as Google’s massive renovation of the building has commenced. All eyes now look to the completion of that project and subsequent occupancy by Google employees as one of the drivers for the Loop’s resurgence. Until that day arrives however, the trade area again holds the highest vacancy rate of the three submarkets for the fifth year in a row. 39.80% of the LaSalle Street’s storefront square footage sit vacant, consisting of 79,232 vacant square footage from an inventory of 199,058 square feet fronting LaSalle Street.

WEST LOOP (bounded by the Chicago River to the East, I90/94 to the West, the south side of Lake Street to the North and Ida B. Wells Drive to the South)

While the vacancy rate for this West Loop trade area dropped from 27.95% to 25.04%, this drop is solely attributed to the removal from the Survey of the ground level square footage at 10 and 120 S. Riverside while those buildings complete their renovations.

2023 Fulton Market Retail Analysis

Stone Real Estate Corp. continues its retail market analysis of the Fulton Market trade area with its second Fulton Market Retail Trade Area Analysis 2023. Part of the story this year is that Fulton Market was one of the few significant Chicago trade areas to demonstrate stability within its retail boundaries. In 2023, this submarket did not experience any notable closings or openings, unlike most of the other significant trade areas in Chicago.

The boundaries of the trade area are as follows:

• I-90/94 to the east and Racine Avenue to the west;

• Washington Street to the south and the Metra tracks to the north.

The basic data points within these boundaries are as follows:

• Total Retail Inventory: An additional 40,000 sf to its inventory in 2023 for a new total of 1,433,651 square feet within 33 blocks;

• Total Vacancy: 299,817 vacant square feet representing 20.91% of the Total Retail Inventory. In 2023, the market added 47,000 sf of vacant space, and the introduction of the 40,000 sf of new retail space significantly contributed to the vacancy rate increase from 18.09% in 2022 to 20.91% in 2023.

Fulton Market has certainly matured since the openings of pioneers like Girl & The Goat in 2010, Next in 2011, Au Cheval in 2012, SoHo House in 2014 and Google in 2015. With so many years passing since the arrival of these key neighborhood fixtures, we can now evaluate how the Fulton Market retail trade area compares to the other key retail areas in Chicago.

While Fulton Market made headlines of late for its ability to attract new office tenants and the development of multi-family buildings, the area remains fundamentally a Food & Beverage (F&B) focused trade area. F&B users occupy 593,356 sf of ground level space, which is almost 36% of the total ground level inventory. Fulton Market compares favorably to River North in this F&B category. In River North, the F&B category occupies 39.03% of the ground level space, and in a trade area that is almost 2.5X the size of Fulton Market. The relocation of some

design firms from River North to Fulton Market recently garnered some media attention. While the block west of 1K Fulton (Google’s Midwest Headquarters) on Fulton Street did attract a core group of design firms, Fulton Market’s Design category occupies just 53,500 sf in Fulton Market where in River North, the Design category occupies 325,236 sf of its ground level space.

Retailers and retail brokers across the country continue to monitor how the apparel category performs, and whether it will expand its presence in Fulton Market. Currently, apparel occupies only 69,443 sf or just 4.84% of the ground level square footage. In comparison, as Will Winter of Stone Real Estate shows in his annual Armitage/Damen/Southport Retail Survey, of the three (3) dominant boutique apparel streets in Chicago, Southport Avenue has 101,272 sf of apparel users, Armitage has 72,775 sf and Damen has 46,985 sf.

Somewhat concerning is that no new apparel users entered Fulton Market in 2023. When apparel users tour the area, they first gravitate to Randolph or Fulton Streets. Availability exists on these two thoroughfares, but most of it is considered to be too far west from where apparel users

wish to locate today. In a positive sign for the long-term health of the market, the north/

south streets of Green, Peoria, Sangamon and Morgan have attracted a balanced mix of F&B, apparel and other categories.

A retail presence on both the east/west and north/south streets is one of the fundamental strengths of Fulton Market, because the overall trade area can expand along a ‘grid’ pattern rather than on a linear path like most other key shopping areas in Chicago. One of the few weaknesses of streets like Armitage, Southport and Damen is that once the shopper comes to the end of the core portion of the street, the shopping experience ends and further expansion of the street becomes difficult, if not impossible. A grid-like expansion of the retail trade area allows for a much broader expansion of the viable retail trade area.

If Fulton Market can continue to add non-F&B concepts to the north-south streets and bring more soft goods categories to the trade area, this neighborhood can continue to attract the attention on a national basis as one of the top tier retail markets in the entire country. For Fulton Market to hold the focus of retailers and brokers across the country, categories other than restaurants must establish a significant presence so that Fulton Market can grow beyond its national reputation as just ‘a great place to have dinner.’

Net Lease Market Report

NATIONAL ASKING CAP RATES

Market Overview

Cap rates in the single tenant net lease sector increased for the eighth consecutive quarter within all three sectors in the first quarter of 2024. Single tenant cap rates increased to 6.42% (+7 bps) for retail, 7.60% (+5 bps) for office and 7.02% (+2 bps) for industrial. Cap rates in the first quarter of 2024 represented the highest levels since 2014 for single tenant retail properties. However, cap rates for single tenant retail and industrial assets remain lower than their 20-year historical average by approximately 40 basis points. Elevated interest rates continue to impact transaction volume which is lower than prior years. Furthermore, a lack of 1031 exchange buyer activity is resulting in an increased supply of net lease properties on the market.

Property supply in the single tenant sector increased by more than 9% when compared to the prior quarter. With limited transactions occurring, properties continue to be added to and stay on the market. Despite the headwinds in the market, certain sellers including merchant builders or owners with upcoming loan maturities look to meet market pricing. Net lease retail properties with the largest supply (dollar stores and drug stores) continue to experience the greatest cap rate expansion. Both of these sectors experienced double digit cap rate expansion in the first quarter of 2024 when compared to the prior quarter.

“Cap Rates in the single tenant net lease sector increased every quarter for the last two years”

After multiple Federal Reserve meetings without any interest rate relief, investors will be monitoring upcoming rhetoric from the members of the Federal Reserve. Any cuts to interest rates would be welcomed by net lease owners looking to refinance or sell properties prior to year-end. With stability in the capital markets, the expectation from market participants is for increased transaction volume in the second half of 2024. However, an increase in transaction volume would be relative as transactions are not expected to be anywhere near the amount in prior peak markets including 2020 and 2021.

Net Lease Market Report

1. Net Lease Auto Sector

2. Net Lease Casual Dining Sector

3. Net Lease Dollar Store Sector

4. Net Lease Drug Store Sector

5. Net Lease Quick Service Restaurant (QSR) Sector

River Pointe of Algonquin Phase I

Bloomingdale Town Centre NEC Lake St & Bloomingdale Road

Year Built/Year Renovated: 1996

Type of Center: Neighborhood No. of Stores: 9

Total Space: 32,246

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: AccuQuest Hearing Center, Pink Hair Studio

Rental Rate: $19.00

Total Passthroughs: $6.88

Bloomingdale Town Centre Phase III

NEC Lake St & Bloomingdale Road

Year Built/Year Renovated: 2005

Type of Center: Neighborhood No. of Stores:

Total Space: 15,000

Total Available Space: 15,000

Available Minimum: 1,200

Maximum Contiguous: 15,000

Anchor Tenants: Future Development

Rental Rate:

Total Passthroughs:

Aurora Restaurant

Year Built/Year Renovated: 2008

Type of Center: Community No. of Stores: 24

Total Space: 14,715

Total Available Space: 6,334

Available Minimum: 1,200

Maximum Contiguous: 6,334

Anchor Tenants: Tropical Smoothie Cafe, Bank of America, Double Yolk Pancake House, Verizon Rental Rate: $21

Total Passthroughs: Contact Broker

Year Built/Year Renovated:

Type of Center: Mixed Use No. of Stores: N/A

Total Space: 53,000

Total Available Space: 4,000

Available Minimum: 4,000

Maximum Contiguous: 4,000

Anchor Tenants: Paramount Theatre, Altiro Latin Fushion, Craft Urban, Charlie’s Silver Spoon Creamery Rental Rate: Contact Broker

Total Passthroughs: Contact Broker

The Courtyard at Stratford 357-369 W. Army Trail Road

Year Built/Year Renovated: 1983

Type of Center: Neighborhood No. of Stores: 17

Total Space: 20,890

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: For Eyes, Men’s Warehouse, FedEx, Fry n wings

Rental Rate: $21

Total Passthroughs: $6.28

David Strusiner

Craig/Steven Development Corporation (847) 504.8061 Brink Street Market 30-40 N. Williams Street

Year Built/Year Renovated: 1989

Type of Center: Neighborhood No. of Stores: 13

Total Space: 28,042

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

David Strusiner

Craig/Steven Development Corporation (847) 504.8061

Anchor Tenants: Starbucks, Benedicts La Strata, The Running Depot

Rental Rate: $15.00

Total Passthroughs: $7.69

Country Corners

Year Built/Year Renovated: 2008

Type of Center: Community No. of Stores: 15

Total Space: 124,000

Total Available Space: 3,000

Available Minimum: 3,000

Maximum Contiguous: 3,000

Anchor Tenants: Petco, Savers, Dollar Tree, LaRosita Market

Rental Rate: $20.00

Total Passthroughs: $5.15

Year Built/Year Renovated: 2021

Type of Center: Neighborhood No. of Stores: 16

Total Space: 73,000

Total Available Space: Please call

Available Minimum: Please call

Maximum Contiguous: 1,522

Rental Rate: Please call

Total Passthroughs: $6.85

S. Margosian

Anchor Tenants: Jewel/Osco, ATI Physical Therapy, Dunkin Donuts, The UPS Store

Charles S. Margosian Highland Management Assoc., Inc. (630) 691.1122

Plaza

Pembrook Corners

Year Built/Year Renovated: 2004

Type of Center: Neighborhood No. of Stores: 8

Total Space: 33,000

Total Available Space: Please call

Available Minimum: Please call

Maximum Contiguous: Please call

Anchor Tenants: Fresh Start Cafe, Ace Hardware, W3Body

Rental Rate: N/A

Total Passthroughs: $6.40

Year Built/Year Renovated: 1985

Type of Center: Neighborhood No. of Stores: 14

Total Space: 29,564

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Rental Rate: $19.00

Total Passthroughs: $11.46

Strusiner

Anchor Tenants: Walgreens, For-Eyes Optical, Kenny The Kleener, Rockstar Nail & Spa

Year Built/Year Renovated: 1989

Type of Center: Neighborhood No. of Stores: 15

Total Space: 21,462

Total Available Space: 1,158

Available Minimum: 1,158

Maximum Contiguous: 1,158

Anchor Tenants: Vitalant, Harbor Coin, Jimmy Johns, Kumon Learning Center

Rental Rate: $18.00

Total Passthroughs: $9.84

Year Built/Year Renovated: 1984

Type of Center: Neighborhood No. of Stores: 20

Total Space: 45,188

Total Available Space: 5,593

Available Minimum: 1,297

Maximum Contiguous: 3,340

Anchor Tenants: Walker Bros. Restaurant, Dairy Queen, The Bar Method, New Balance, Stretch Lab

Rental Rate: $18.00

Total Passthroughs: $10.51

Year Built/Year Renovated: 2000

Type of Center: Neighborhood No. of Stores: 20

Total Space: 38,980

Total Available Space: 2,250

Available Minimum: 2,250

Maximum Contiguous: 2,250

Anchor Tenants: Jewel/Osco, Starbucks, Orangetheory Fitness, Lou Malnati’s, ATI Physical Therapy

Rental Rate: $30.00

Total Passthroughs: $15.25

Year Built/Year Renovated: 1989 Type of Center: Neighborhood No. of Stores: 12

Total Space: 32,849

Total Available Space: 8,744

Available Minimum: 1,206

Maximum Contiguous: 6,331

Anchor Tenants: Walgreens, Lou Malnati Pizzeria, Avalon Spa Rental Rate: $20.00

Total Passthroughs: $8.56

Year Built/Year Renovated: 1983/2003

Type of Center: Neighborhood No. of Stores:

Total Space: 75,000

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: Jewel/Osco, iHop

Rental Rate: N/A

Total Passthroughs: N/A

Total Available Space: 8,483

Available Minimum: 1,702

Maximum Contiguous: 4,939

Anchor Tenants: Apple Store, Ramsay’s Kitchen, Filson, Bluemercury

Rental Rate: Contact Broker

Total Passthroughs Contact Broker

Naper Ridge Plaza Naper Boulevard & Ridgeland Ave

Year Built/Year Renovated: 2004

Type of Center: Neighborhood No. of Stores: 2

Total Space: 30,000

Total Available Space: 25,000

Available Minimum:

Maximum Contiguous:

Anchor Tenants: Office Depot, Fifth Third Bank

Rental Rate: Negotiable

Total Passthroughs: N/A

Year Built/Year Renovated: 2018

Type of Center: Neighborhood No. of Stores: 10

Total Space: 18,500

Total Available Space: 0

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: Great Clips, Spice Mart

Rental Rate: N/A

Total Passthroughs: N/A

Year Built/Year Renovated: 2016

Type of Center: Neighborhood No. of Stores: 14

Total Space: 24,883

Total Available Space: 5,478

Available Minimum: 1,522

Maximum Contiguous: 3,168

Anchor Tenants: Jewel/Osco

Rental Rate: $40.00 - $42.00

Total Passthroughs: $7.85

Year Built/Year Renovated: 1988

Type of Center: Neighborhood No. of Stores: 30

Total Space: 61,121

Total Available Space: 11,500

Available Minimum: 1,400

Maximum Contiguous: 3,000

Anchor Tenants:Clothes Mentor, Culver’s, Namaste Grocery Store

Rental Rate: $16.00

Total Passthroughs: $8.11

S. Margosian

Total Space: 10,000

Total Available Space: 10,000

Available Minimum: 3,800

Maximum Contiguous: 10,000

Anchor

Type of Center: Community No. of Stores:

Total Space: 63,446

Total Available Space: 18,851

Available Minimum: 2,500

Maximum Contiguous: 12,000

Anchor Tenants: .AT&T Verizon, Rosati’s Pizza, Game Stop

Rental Rate:

Total Passthroughs:

Type of Center: Neighborhood No. of Stores: 29

Total Space: 137,000

Total Available Space: 18,399

Available Minimum: 1,495

Maximum Contiguous: 15,115

Anchor Tenants: Ace Hardware, Planet Fitness, Dollar Tree, Sherwin Williams

Rental Rate: $11.00 - $20.00

Total Passthroughs: $9.25

Type of Center: Community No. of Stores: 22

Total Space: 113,422

Total Available Space: 84,065

Available Minimum: 1,440

Maximum Contiguous: 65,492

Anchor Tenants: Ace Hardware, Culver’s, Valley View Dental, ATI Physical Therapy

Rental Rate: Contact Broker

Total Passthroughs: Contact Broker

Anchor

Total Passthroughs: $8.93

The Shoppes at Stony Creek

Year Built/Year Renovated: 2023

Type of Center: Community No. of Stores: 17

Total Space: 39,393

Total Available Space: 1,200

Available Minimum: 1,200

Maximum Contiguous: 1,200

Anchor Tenants: Jewel/Osco, Ace Hardware

Rental Rate: $24.00

Total Passthroughs: $9.65

Year Built/Year Renovated: 2004

Type of Center: Neighborhood No. of Stores: 13

Total Space: 29,748

Total Available Space: 2,561

Available Minimum: 1,169

Maximum Contiguous: 0

Anchor Tenants: Lou Malnati’s, CK Salon, Home of the Sparrow, Aki of Japan

Rental Rate: $12.00-19.00

Total Passthroughs: $5.36

Year Built/Year Renovated: 1985

Type of Center: Neighborhood No. of Stores:

Total Space: 19,553

Total Available Space: 1,200

Available Minimum: 0

Maximum Contiguous: 0

Anchor Tenants: Dollar General, Supercuts, Stella’s

Rental Rate: $16.00

Total Passthroughs: $4.10

Year Built/Year Renovated: 1970/1987

Type of Center: Neighborhood No. of Stores:

Total Space: 100,000

Total Available Space: 13,685

Available Minimum: 1,500

Maximum Contiguous: 10,000

Anchor Tenants: Jimenez Foods, Mark Drug Medical Supply

Rental Rate:

Total Passthroughs: