Houston, Texas • Redlands, California

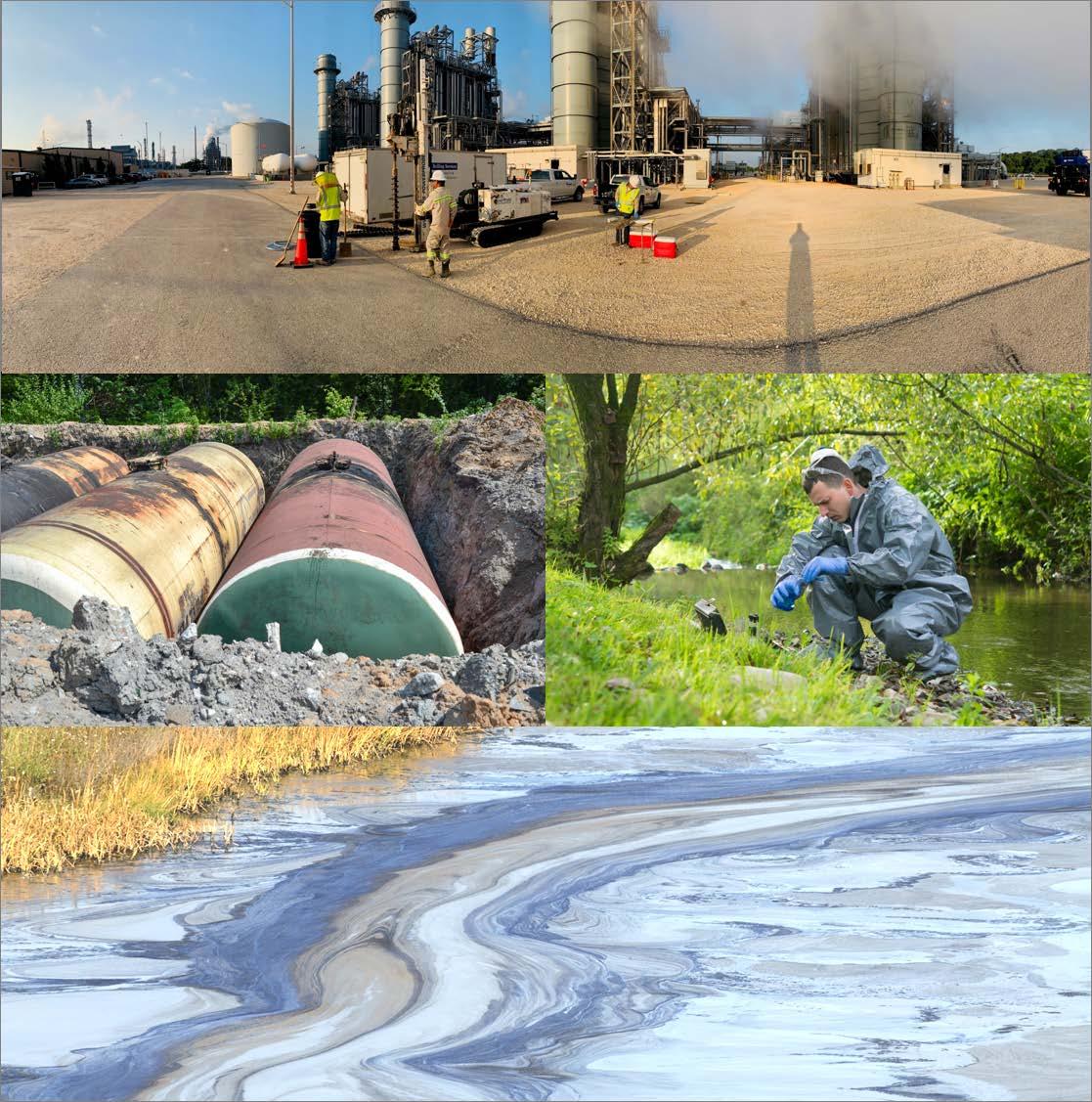

National Environmental Services, with offices in Houston, Texas and Redlands, California, is an environmental consulting company, established in 1995, that conducts a full range of reliable and cost-effective environmental assessment and corrective services, with competitive pricing and convenient turnaround.

• Phase I Environmental Site Assessments (ASTM E1527-21)

•Transaction Screens (ASTM E1528-22)

• Asbestos & Lead-Based Paint Inspections (Licensed Texas Asbestos Consulting Agency)

• RSRAs (Records Search with Risk Assessments)

• Phase II Subsurface Investigations*

• Remediation and Corrective Activities*

• Soil, Water, and Air Testing Ser vices

• Indoor Air Quality/Mold Sur veys (Licensed Mold Consulting Agency)

• Underground Ground Storage Tank Testing Ser vices*

* Performed in Texas in partnership with Terrain Solutions, Inc., Texas Geoscience Firm Registration # 50018

National Environmental Services

5773 Woodway Dr, Suite 96, Houston, TX 77057: Phone (281) 888-5266

700 East Redlands Blvd, Suite U618, Redlands, CA 92373: Phone (951) 545-0250

Toll Free: (833) 4-Phase1 www.nationalenv.com • www.gabrielenv.com

PUBLISHER

Mark Menzies menzies@rejournals.com

SENIOR VICE PRESIDENT

Benton Mahaffey benton@REDnews.com

ADVERTISING & CONFERENCE SALES

April Daniel april.daniel@rejournals.com

Jeff Johnson jeff.johnson@rejournals.com

CLASSIFIED DIRECTOR

Susan Mickey smickey@REDnews.com

Texas Brokers: 8,150

Texas Leasing/Tenant Rep: 6,232

Texas Investors: 4,979

Texas Developers: 4,710

Outside Texas Investors, Brokers, Developers etc: 26,387

TOTAL QUALIFIED ONLINE

REDnews DISTRIBUTION: 50,458

To subscribe to REDnews call (713) 661-6300 or log on to REDnews.com/subscription.

Difficult and challenging: Industry experts reflect on 2023 capital markets In the realm of commercial real estate, where fortunes are forged and landscapes are reshaped, the heartbeat of the industry resonates within the corridors of real estate capital markets.

Get creative: Industrial experts share 2024 predictions The Texas industrial commercial real estate market weathered its fair share of challenges and triumphs in 2023.

Improve the housing options: NRP Group’s Jason Arechiga breaks down the Texas multifamily sector In a candid interview with Jason Arechiga of NRP Group, the state of the Texas multifamily sector in 2023 comes to light.

“The flight to quality is real”: Texas office experts share their 2023 takeaways As the dust settles on the transformative year that was 2023, the Texas commercial real estate market's office sector stands out as a lively arena marked by resilience, challenges and shifting paradigms.

Low vacancy, high rent; Texas retail experts are monitoring interest rates and construction costs in 2024 The Texas retail commercial real estate market in 2023 has proven to be a dynamic landscape, with various challenges and opportunities shaping the sector.

Houston's Industrial Market Sails Towards Healthier Fundamentals in 2024 In the ever-evolving landscape of industrial real estate, Houston has consistently set itself apart, due to its strategic location, robust transportation network, rapid population growth.

In the realm of commercial real estate, where fortunes are forged and landscapes are reshaped, the heartbeat of the industry resonates within the corridors of real estate capital markets. These financial hubs, pulsating with the ebb and flow of investments, hold the key to the development dreams of investors and developers alike. On the precipice of this new year, we’re unraveling the complexities of 2023 and casting an anticipatory gaze toward 2024.

In 2023, the commercial real estate industry found itself navigating treacherous waters within the realm of real estate capital markets. To encapsulate the essence of the year, Jay Porterfield, Executive Director at PGIM Real Estate, aptly characterized it as "challenging," emphasizing the profound impact of significant rate movements from the Federal Reserve and the often discordant dance between fiscal and monetary policies.

"It has been very difficult to find an equilibrium,” Porterfield noted.

Cheryl Higley, Senior Vice President at Northmarq, underscored the seismic shifts in interest rates, proclaiming that they have reached levels not witnessed in more than two decades.

"Interest rates are at their highest level in 22 years, nearly doubling over the past 18 months," she pointed out.

This surge, coupled with an inversion in the 10-year and 2-year yield — a historical recession indicator — created a lending landscape akin to a tsunami.

The repercussions are not confined to commercial properties alone, as the residential real estate sector bears witness to a similar storm.

"As of October 25, 2023, the average rate on a 30-year residential mortgage is 8.01%, the last time it was this high was in August 2000,” highlighted Higley.

John Manning, Senior Vice President and Head of Production, Western Region for Marcus & Millichap Capital Corporation, provided a candid assessment of the challenges faced during this tumultuous year.

"I would say 2023 was an exceptionally difficult year," Manning states.

The Federal Reserve's swift ascent in interest rates, driven by the imperative to quell inflation, exacted a toll on capital markets. Manning pulled no punches, acknowledging the adverse impact on both borrowers and lending institutions, particularly banks.

"It’s been a very difficult and challenging year for both borrowers and for a lot of the lending institutions," he asserted.

Amidst the headwinds of rising rates and policy uncertainties, market participants, traders, and investors find themselves grappling with the notion of a "new normal" for interest rates. The adjustments required in this shifting landscape echo the sentiment that 2023, while tumultuous, may be a harbinger of a recalibrated equilibrium in the commercial real estate capital markets.

In the face of that adversity, capital markets witnessed remarkable resilience and strategic maneuvering, as industry leaders navigated challenges and sought out opportunities.

"I think we did a lot of things right as a company,” said Manning. “I think our value proposition to our clients is higher this year than it is almost any other year."

Despite the fewer deals closed, Manning emphasized the positive impact of assisting borrowers in securing financing, even when faced with a challenging market.

"This year, we're helping borrowers just get that one lender to get the deal done. Finding lenders under rocks, building new lender relationships, I think that's been very positive this year," he affirmed.

Manning underscored the dedication of the team, stating, "I think a lot of our clients view us as heroes for deals that we’ve done. There may have been fewer deals closed, but I think there’s been a lot of great work done on the

Continued on Page 8>

When

CONSULTING

▪ Environmental Due Diligence Services, Phase I ESA, Phase II ESA

▪ Remediation Services Phase III ESA

▪ Soil and Groundwater Sampling -Field Services

▪ Storm Water Pollution Prevention Plan -SWPPP

▪ Construction Storm Water Pollution Prevention Plan- CSWPPP

-

▪ Leaking Petroleum Storage Tank Program -LPST

▪ Texas Risk Reduction Program - TRRP

▪ Voluntary Cleanup Program - VCP

▪ Innocent Owner/ Operator Program -IOP

▪ Wetlands Identification and Delineation

▪ Threatened and Endangered Species

▪ NEPA permitting

▪ Facilitating Sound Decision-Making

▪ Coordinating with Regulators

part of our originators and support staff."

Higley identified a standout highlight in the surge of interest witnessed in Central Texas. She acknowledged that, despite not all numbers aligning perfectly, the enthusiasm among groups to acquire assets was notable.

"Buyers have been receptive to learning about the proposed capital stacks that they may not have considered in 2022, including preferred equity and/ or mezz,” Higley said.

This openness to novel financing structures hints at the adaptability and innovative spirit prevailing in the market.

"We’re optimistic that buyers, sellers, and lenders will all work even harder in 2024 to find the deals that work for them," said Higley.

Porterfield pointed to the steadiness of the agencies in providing liquidity to the market. Despite facing lower transaction volumes, Fannie Mae and Freddie Mac maintained their commitment to stability.

"It's important to note that neither Fannie nor Freddie have made any significant changes to their underwriting standards," Porterfield underscored. "On the contrary, they have actually aimed to find new and creative ways to provide capital, including T1 underwriting for lease up/ near stab properties, and increased amortization and lower DSCR when creating or preserving affordable housing."

This commitment to flexibility and innovation in financing avenues has been a beacon of stability in an otherwise dynamic market landscape, added Porterfield.

He also wanted to direct attention to the pivotal role played by the trajectory of the 10-year UST yield.

"It is among the most important indicators," Porterfield stressed, offering a hopeful outlook. "Since it appears that the Fed is at the end of the tightening cycle, I think the 10-year will stabilize sooner rather than later."

While stability is on the horizon, Porterfield acknowledged the need for a recalibration in property values.

"It is likely that values still need to fall by another 10% on average in order to reach an equilibrium point," he cautioned.

Furthermore, Porterfield advised stakeholders to have a measured perspective, stating, "Have a short memory with regard to the historically low interest rates and cap rates we saw during the Covid era."

Recognizing the progress made, he encouraged a forward-looking approach, "We’re coming out on the other side of the tunnel with regard to disruption in the markets."

Higley is “cautiously optimistic as we head into mid-late 2024," highlighting the expectation of diminishing market volatility.

She emphasized the importance of monitoring economic data, especially as the Federal Reserve navigates the delicate balance of maintaining elevated rates.

"Patience and planning are crucial to any business plan," Higley added.

As short-term debt matures in 2024, she encouraged industry participants to engage with trusted lending partners for accurate market insights and optimal capital market solutions.

Manning brought a touch of humor to the forecast, likening the Federal Reserve's influence to an elephant in the room.

"The elephant’s sitting on the couch, cracking open a beer, watching Netflix," he laughed.

Manning underscored the critical importance of the Fed's decisions, not just in the present, but in shaping expectations for the future. He expressed confidence in the availability of various lender types as well.

"They're going to be cautious at times, but they're open," Manning predicted.

He also expected a potential turning point in buyer behavior.

"At some point, a big well-respected buyer is going to make some huge, highprofile national buy,” said Manning, adding that this event could usher in an optimistic outlook for real estate in 2024.

The amalgamation of these insights paints a nuanced picture of a market in flux, where challenges coexist with opportunities and strategic foresight is the key to navigating the evolving landscape of commercial real estate capital markets come 2024.

The Texas industrial commercial real estate market weathered its fair share of challenges and triumphs in 2023. In the words of Matt Hyman, Vice President of Industrial Development for Ryan Companies, this year has been a mixed bag, characterized by both challenges and opportunities.

“Despite construction starts falling off drastically, population growth (realized and projected) continues to provide tailwinds for the top industrial markets in Texas. This includes Dallas-Fort Worth, Houston and Austin, which rank among the top industrial markets for population growth in the country,” he shared. “However, with brokers and developers reporting a large disconnect between high asking prices for industrial and what developers need to pay to make a development pencil, it has factored into a slowdown on land acquisition for speculative development. Tightening construction lending requirements aren’t helping matters. With this being realized, we’re expecting there to be a lack of available product 18 to 24 months from now.”

Robert Clay, President and Owner of Clay Development & Construction, Inc. in Houston offered a nuanced perspective, portraying the 2023 Houston industrial market as robust in both manufacturing and distribution.

“Distribution has seen the delivery and lease up of a large amount of product and manufacturing has seen an almost 0% vacancy rate because of the lack

of construction of new product,” Clay explained. “Both sectors have seen significant increases in rental rates.”

Underscoring the economic vibrancy within the Texas industrial landscape, Bill Baumgardner, Executive Vice President of Development for VanTrust Texas, highlighted the resilience of the Texas industrial sector amidst economic slowdown and rising interest rates.

“Dallas-Fort Worth had good tenant activity, and absorption is getting close to 25 million square feet for 2023, which is a strong year. The same thing is occurring in the Houston market. Houston has strong industrial absorption, and it will continue with a limited amount of product,” said Baumgardner. “Laredo and El Paso also remain very strong with their nearshoring.”

One of the most significant challenges faced by the Texas industrial market this year, according to Clay, was the surge in interest rates and equity requirements.

“Interest rates have almost tripled in the last 12 months and equity has almost doubled,” he pointed out.

Those rates, along with a slower-than-normal investment market, generated a shift in capital markets.

“Developers still have to get creative as they struggle to pencil out deals long-term,” Baumgardner said, adding “Those challenges will remain.”

Tenant demand posed a challenge as it slowed in all markets, shared Hyman.

“However, the deal pipeline is still robust compared to historical averages and is more in line with 2018/2019,” he said with some optimism.

Other obstacles he noted included large multi-phase and bulk development being difficult to get started, even as smaller infill sites still have the ability to get capital. Plummeting sales transaction volume contributed to the uphill battle waged within the Texas industrial market in 2023.

Despite the challenges, the Texas industrial sector has notable highlights. Hyman underscored the resilience of infill industrial submarkets.

“They’re still performing well with most holding steady at less than 4% vacancy,” he said.

While large speculative buildings face slower leasing, Hyman also mentioned that Texas remains attractive to new developers and capital investment, albeit at a slower pace.

A highlight for VanTrust was its recognition as the 2023 Developer of the Year by NAIOP, emphasizing its strong presence in major Texas markets and plans for expansion.

“Tyler Chapman, who was recently promoted to director of development, will be responsible for discovering and evaluating development and buildto-suit opportunities,” Baumgardner said. “VanTrust will deliver product throughout 2024. We’ll be active in all the Texas markets with projects in DFW, El Paso, Laredo, San Antonio and soon-to-be Austin.”

Clay emphasized the exceptional performance in distribution, marked by a surge in deals exceeding 350,000 square feet. For manufacturing, the steady price of oil between $70-$85/bbl sustains demand for industrial buildings, creating a dynamic market in 2023.

Looking ahead to 2024, Clay anticipates a significant reduction in product construction in 2024 compared to the preceding year, presenting a potential buying opportunity.

Meantime, Baumgardner envisions a substantial decrease in industrial starts, but emphasizes the importance of monitoring stabilized interest rates to bring stability to the market. He highlights the role of well-capitalized companies in capitalizing on the market's current state, emphasizing the need to grow market share over the next two years.

Hyman directs attention to key considerations in 2024, including refinancing challenges for existing industrial buildings, monitoring leasing

activity and tenant behavior, and evaluating investor participation in the market. He underscores the importance of communication and collaboration with quality brokers in navigating the challenges that may persist into the new year.

While uncertainties exist within the Texas industrial sector, the insights provided by these industry experts offer a roadmap for navigating the evolving landscape in 2024. As Texas continues to be a beacon for businesses and investors, strategic planning and adaptability will be key to unlocking the full potential of the state's industrial sector in the c

lanepropertytax.com/rednews A WINNING RECORD IN THE FIGHT AGAINST HIGH COMMERCIAL PROPERTY TAXES

Overinflated commercial property valuations rob businesses of hard-earned funds. Lane Property Tax Advocates protests on property owners’ behalf to alleviate stress, save money and unburden your business.

Think that tax bill’s too high?

Lane will fight to lower the coming year’s valuation. 832.358.2000 | info@lanepropertytax.com

In a candid interview with Jason Arechiga of NRP Group, the state of the Texas multifamily sector in 2023 comes to light. The Senior Vice President reflected on the challenges faced this year and offered insights into the future, providing a nuanced picture of the Texas commercial real estate landscape.

The Texas multifamily sector, like its counterparts globally, has faced challenges in 2023. While signs of a struggle are evident, Texas stands resilient, driven by a continued influx of people seeking the state's unique appeal. Arechiga noted that despite the global and nationwide struggles in the multifamily sector, Texas remains attractive to those looking for new opportunities.

One of the primary challenges is the increasing wariness from capital providers. Rising cap rates and skyrocketing insurance rates, particularly in Houston, have impacted the market significantly, as have construction costs.

“They're no longer going up like they were. They've stabilized, but they're not coming back down,” said Arechiga.

As those costs have increased, the struggle lies in maintaining returns comparable to those seen during the prosperous years, with some investors contemplating redirecting their capital to alternative investments.

“We need to improve the housing options across the board, all the way from public housing and the deepest targeted, lower-end, lowest incomes to market rate housing.”

“Some are opting to park their money elsewhere,” Arechiga said.

In the face of these challenges, Texas holds onto its allure. People are still moving to the state, ensuring a consistent stream of demand. Arechiga dispelled doomsayer sentiments, emphasizing that the current situation is far from the economic downturn of 2008.

“It’s nothing like that,” he stressed. “What’s happening now was kind of inevitable because we were riding a high for so long. Eventually, the market will adjust itself.”

Instead, he highlighted the emergence of creative ventures, such as publicprivate partnerships and innovative financing models, as a positive trend in the market.

With an eye toward 2024, his focus remains on external factors that could influence the multifamily sector.

“We’re always going to be looking at what the Fed is doing,” said Arechiga. “We're going to be looking at any continuous rate hike, although I don’t think there will be any more.”

Arechiga stressed the importance of also monitoring global events and potential legislative changes at both the national and state levels. In particular, NRP Group, known for its public-private partnerships, aims to ensure responsible usage of such programs to avoid legislative challenges in 2025.

At the end of the day, Arechiga encouraged continued investment in Texas. Recognizing the cyclical impact of construction on the economy, he underscored the importance of promoting affordable housing. While he acknowledged his perspective as a public-private developer in the field could be biased, Arechiga vouched for those developments as a crucial step.

“We need to improve the housing options across the board, all the way from public housing and the deepest targeted, lower-end, lowest incomes to market rate housing,” he said. “So long as people have those options, we’ll be able to keep some affordability of rents to a degree, especially in some of the hottest markets, such as Austin and Dallas.”

Arechiga also highlighted San Antonio, with its steady growth, as a market to watch, sharing that it offers a more predictable landscape amidst the variability in other regions. While its slow-and-steady approach hasn’t always been the most appealing to developers, it’s proven successful for the city.

“We keep bringing a whole lot of people to San Antonio every year,” Arechiga pointed out.

Reflecting on the ever-changing landscape of the real estate industry, he noted the old saying that the only constant is change. Each year brings its unique set of challenges, whether it be insurance rates, construction costs or global events like the pandemic. Another constant, however, is the demand for housing in Texas, which ensures a degree of stability and optimism. As long as people desire to move to the Lone Star State, the multifamily sector is poised to weather the storms and continue its evolution.

Commercial real estate.

It’s a dynamic industry, full of obstacles to overcome and opportunities to be realized That's why at Wilson Cribbs + Goren, we continuously recognize the unique value our female attorneys bring to the firm's culture and to our clients. Coupled with an array of experience in the industry, it's no wonder we're a leading real estate practice group in Houston.

Rising Above the Odds: Triumphing on the Path to Success Moderator: Tiffany Melchers-Boyar Miller Panelists: Tiffany Ryland-ARVO Realty Advisors; Kaci Hancock-REIS Associates; Fowler Knight-Wan Bridge Group; Christen Vestel-Provident Realty Advisors

Takeaway: Thirty years ago there were almost no women in commercial real estate-now there are many, with a higher percentage than men in residential. However, women are closing the gap based on their acquisition of skill sets and ability to solve problems for their clients. Slowly biases are fading away as women demonstrate equal or better competence.

Bullets:

• There has been an amazing growth of women in commercial real estate (CRE), especial in the industrial sector, which has long been almost all men

• Women still earn at levels somewhat behind men but the gap is shrinking

• Property management was once male-dominated but is now womendominated

• Women must make intentional efforts in the workplace to be treated equally; minority women make up about 2% of women in CRE in general; women should not be shy to ask for what the need, whether for career advice or better compensation

• Women now exceed men in many law schools

• To succeed, women must not be shy to push the boundaries, form support networks, reach out to men and women for advice and mentoring, and develop allies as they climb the career ladder

• Women should network aggressively since this is a referral business; while you are moving up, look for someone who is struggling and help her

• Always try to 'be in the right room' by joining CRE professional groups, attending industry seminars, and getting to know the leaders in your field

• Identify your personal 'super power/specialty' and grow it and sell it to your clients

• Don't take 'no' for an answer-if you do, consider it to be a 'temporary no'; perseverance is a super power available to everyone

• Find a mentor and give your mentor something in return

• There is such a thing as 'women's intuition' and it is a 'super-power' we have

• The most successful transaction is where both parties have gotten what they want; if you can shepherd the parties to that conclusion, they will remember you for their next deal

• Minority women in CRE actually have an advantage, since they 'stand out'-they can build on that

• Build your personal professional 'brand' so you stand out

• You don't have to always being a dues paying member to attend functions of the real estate societies the top professionals attend; always try to 'be in the room' with other quality CRE people

• Volunteering and giving back is a wonderful way to meet people

• Always acknowledge other successful people; they will remember you for it

• We are in a very demanding industry so manage your physical and mental health and don't let stress build up-take care of yourself first so you are able to help others along the way

• Working from home lessens human connections and it is not a good way to build relationships in your company or in the industry

Real Estate Development, Construction, and Design Market Outlook

Moderator: Arlis Brodie-Telios Panelists: Amy English-HOK; Amy FarrellBank of Texas; Catherine Bellshaw-Inventure; DeLea Becker-Beck-Reit Commercial Real Estate; Leslie Baker Gukhool-CBRE; Sarina Landers-Corvus Construction

Takeaway: Construction in CRE is in flux, with projects on hold due to higher cost of funds, logistics problems, work from home pressure on office buildings, and steady demand for housing resulting from in-migration to Houston and Texas in general. It is best to cooperate early on in the design phase with your sub contractors and general contractors to keep abreast of costs and availability of materials. Everything in development is materially more expensive now.

Bullets:

• There is a big opportunity to build affordable housing; multi-family demand is strong; older office buildings should be remodeled if possible, and banks do not want to repossess them

• Class A office building are usually full and in high demand; repositioning of buildings is in full swing

• Sunbelt cities are drawing businesses away from traditional business centers such as NY and Chicago

• Specialty developments are taking place even in this inflationary market, such as the moving of the HQ of the Houston Port Authority to East River

• People are slowly realizing it is better to work from the office

• Specialty construction and engineering firms like Fluor and Bechtol are experiencing strong growth

• Industrial development remains strong

• Residential development is hot in outlying areas such as Waller and Magnolia, where land is available and less expensive

• There are significantly higher equity requirements in CRE development but there is also a lot of cash on the sidelines, and with a good project you may be able to attract that cash

• In last three years costs of construction equipment such as trucks is up 2030% and your contractors must pass the costs on to you

• Costs are starting to level off and some even dropping a bit, but it is unclear if and how much they will drop

• In the meantime, there are labor shortages and wages are being driven up

• Texas CRE will boom because it is driven by population growth, so get

ready for it! Invest and gear up now! There is 5-6% employment boom here. We are a business-friendly state and we have the 9th strongest economy in the world if TX were a country; get ready for the continuing boom!

• The pandemic forced many office building owners to re-position and upgrade their building so they can remain competitive

• Banks are trying to slowly lessen their exposure to office building loans, but some may be in trouble down the road

• In commercial brokerage and consulting and construction counseling, always be honest and forthright with your clients-don't tell them 'what they want to hear'-they will respect you for that

Pioneering Women: Leading the Way in the Real Estate Industry Moderator: Pauline Odutola-Braden Real Estate Group Panelists: Amber Burton-HAR; Amber Carter-Seven Fourteen Realty Inc; Elaine Howard- Andrews Myers: Elke Laughlin-Laughlin Consulting Group; Anya Marmuscak-JLL

Takeaway: Networking is key-we are a collegial industry and referrals are vital to all CRE professionals. Stay focused through changes and cycles, all the while keeping your eyes open for opportunities. Learn from your colleagues. Ask questions-get a mentor. Never stop learning, and growing.

Bullets:

• 38% of CRE professionals are women and the percentage of women is steadily growing

• What you know is key, and also WHO your know in the industry

• If you see something new that needs to be done, CREATE a job to do it; you don't have to 'stay in your lane'-create a NEW lane

• Ask questions-learn; don't be afraid of stepping out of the box

• Get a mentor; BE a mentor-add value to someone else's life

• Find your tribe of similar people who value you, and who you value; don't create stress by being with people you don't click with

• You are a woman and you don't have to act or dress like a man-femininity can be an asset so don't try to hide it

• Let people focus on your skill set, not how you look

• Professional women of color can use the fact as an advantage because they can stand out professionally as well as visually in a crowd-people will remember them

• Walk into every room of your peers like you BELONG there; celebrate your skills and others will recognize them

• Don't be afraid to ask for your 'share of the pie' in compensation conversations or in negotiating

• Be secure in who you are and what you can bring to the tabel

• Recognize and manage any unconscious biases you may have

• Everything is negotiable

• CREW is an excellent organization and it is open to all CRE women

All Nomination forms are due: December 22, 2023 scan to nominate! The Texas commercial real estate industry is filled with inspirational leaders and successful business professionals. These leaders have helped shape the landscape of their cities. And for this, they deserve to be honored

As the dust settles on the transformative year that was 2023, the Texas commercial real estate market's office sector stands out as a lively arena marked by resilience, challenges and shifting paradigms. We spoke with industry leaders Nick Lee, President of the Office Division for NAI Robert Lynn; Jihane A. Boury, Vice Chairman of the Dallas-Fort Worth office of Savills; and Chris Lewis, Managing Principal at Lee & Associates in Houston to gain insight into the highs and lows that shaped the Lone Star State's office landscape.

Nick Lee, at the helm of NAI Robert Lynn's Office Division, highlighted the robust nature of the Dallas-Fort Worth (DFW) market.

"We are very lucky to be office tenant representation brokers in DFW," said Lee.

He noted that the middle market sector, the focus of NAI Robert Lynn, has witnessed a surge in optimism. Clients are not just returning to the office; they are committing to the future with new long-term leases. Lee proudly states that the office division has experienced its best three years in a row, closing over 450 transactions annually.

Jihane A. Boury, Chairman of the Dallas-Fort Worth office of Savills, provided a broader perspective on the Texas office sector, but emphasized Dallas's prominence. In 2023, Texas led the U.S. in office occupancy as companies returned to physical workspaces.

“The Dallas Uptown real estate market continues to thrive, boasting high occupancy rates and the highest rental rates on record,” she said. “There’s been a noticeable surge in activity as companies recognize the importance of bringing their employees back to the office.”

However, success begets its own challenges. Lee identified the recruitment of talented brokers as a hurdle, echoing a sentiment shared by many in the industry. The mismatch between clients' low rent expectations and soaring construction costs is another obstacle. Lee said his team creatively navigated this terrain, leveraging market dynamics to secure long-term leases at belowmarket terms.

“Closing deals takes more time, longer owner review, more background due diligence, more legal language to account for risk of a tenant in the market these days,” added Chris Lewis, Managing Principal at Lee & Associates in Houston.

Challenges revolve around the financial market, with long-term debt and capital playing a crucial role in dominating the leasing market. While

acknowledging the variance between cities and submarkets, Lewis suggested the Houston office sector is heading to a position of overall reduced supply, driven by higher interest rates and limited capital for development and renovation. However, he noted the competition for quality spaces and the potential for landlords to upgrade outdated buildings.

“Higher Interest rates are driving a reduced supply of quality asset counts that have the ability to make deals. And, lack of development, loan maturities and defaults, capital for renovation is limited. The Class B pool of buyers is also smaller, as most are focused on Class A. And just overall, there are fewer quality avails than there used to be,” Lewis shared. “This is creating a bit of competition for quality spaces that do exist, and a position for landlords to convert outdated buildings to a higher quality to capture a user in play.”

Lewis also spotlighted several trends shaping the landscape. Hybrid work models are leading to a smaller footprint, with suburban locations becoming more attractive for small businesses. Larger companies are demanding quality assets, amenity-rich buildings, concierge services, and lease flexibility.

“The flight to quality is real,” echoed Lee. “We have tenants in Class B buildings relocating to Class A buildings. These tenants traditionally have signed 3- to 5-year leases. Now, they are signing 7- to 10-year leases because they want to take advantage of the current market concessions and lock in terms for a long time.”

In DFW, another challenge comes in the form of 10 million square feet of sublease space flooding the market, intensifying competition among landlords. Boury pointed out the struggle for clients in determining the

appropriate office footprint, especially with the ongoing debate over remote work. However, despite these challenges, Dallas remains strong, with landlords renegotiating deals at higher rental rates and new construction projects on the horizon.

As we enter 2024, Boury anticipated the introduction of new properties, with at least two additional buildings expected by year-end or the second quarter of 2024. She emphasized the importance for investors and developers to focus on high-quality buildings with amenities, aligning with clients' desires for

top-notch spaces that contribute to a positive work environment.

Lewis’ focus remains on the Federal Reserve and interest rates. He anticipated an influx of capital and increased buying and selling activity, albeit with a more cautious approach to underwriting transactions.

For investors and developers, Lewis stressed the ongoing impact of the pandemic on leases and the need to anticipate tenant downsizing. Flight to quality, he asserted, is now a permanent trend, urging owners to prioritize renovations, spec suites, and amenities to meet evolving tenant expectations.

As the industry leaders navigate the peaks and valleys of the Texas office sector, their insights offer a compass for investors, developers and tenants looking to thrive in the evolving world of commercial real estate. The stage is set for 2024, where strategic decisions and innovative approaches will continue to shape the future of Texas office spaces.

The Texas retail commercial real estate market in 2023 has proven to be a dynamic landscape, with various challenges and opportunities shaping the sector. To look back at the year that was, as well as assess what we can expect in the year ahead, REDnews talked to key experts in their field: Nadyrshah Dhanani, CEO of Dhanani Private Equity Group, and Greg Bracchi, Principal at Edge Realty Partners in Dallas. Their perspectives offer a comprehensive view of the current state of the Texas

retail commercial real estate market and valuable predictions for what lies ahead in 2024.

As 2023 unfolded, the retail sector in Texas demonstrated resilience, according to Dhanani.

"While other asset types slowed down in 2023, retail activity remained

extremely strong in the Houston market,” he said. “Rent remained steady and vacancies were low."

This robust performance was underlined by a continuous flow of deals, defying concerns related to Debt Service Coverage Ratio (DSCR) constraints.

In Dallas, Bracchi noted the record-high occupancy despite the closure of notable retailers like Bed, Bath & Beyond, BuyBuy Baby and Tuesday Morning. Existing space leasing saw heightened competition due to limited availability, with a slowdown in new construction.

"A higher percentage of retail space nowadays is coming from existing retail spaces,” Bracchi shared.

That was one of the challenges faced in the retail landscape of 2023, but arguably the most significant challenge came in the form of rising interest rates.

“We hope to see this soften in 2024 as we expect macro conditions to improve," said Dhanani with some optimism.

Bracchi echoed the sentiment, identifying high rental rates as a powerful obstacle for retailers. He also suggested the increasing costs associated with new construction and limited availability of existing spaces intensified competition among retailers for prime locations.

“Retailers are competing with a lot of different groups for the same space,” said Bracchi.

Despite challenges, the retail sector witnessed noteworthy highlights in 2023. Bracchi observed a willingness among retailers to pay higher rates to achieve their growth goals, resulting in increased rental rates for landlords. Comparing notes with coworkers at Edge Realty Partners, Bracchi learned that there's plenty of land available in the market for expansion.

“How long will retailers be willing to step up paying what they are currently? If landlords get too aggressive, it's probably going to get to a point where retailers are not able to make numbers work. ”

“You're not having as much retailer or developer purchases, but there are a lot of land opportunities out there for future growth,” he said.

Dhanani spotlighted the success of his group in closing multiple projects, including retail shopping centers, land acquisitions and multifamily projects, underscoring adaptability in the face of market conditions.

As the industry anticipates 2024, Bracchi emphasized the importance of monitoring construction costs and interest rates, posing crucial questions about retailers' willingness to sustain current rent levels.

“How long will retailers be willing to step up paying what they are currently?” he wondered. “If landlords get too aggressive, it's probably going to get to a point where retailers are not able to make numbers work. A lot of retailers have stretched to get where they are now. How profitable can they be long term if rents continue to go up the way they are?”

Bracchi noted the cautious approach needed for landlords in setting rental rates to avoid impeding retailers' profitability.

“Our project leasing team is watching to see if these small shot retail tenants are able to get small business loans in order to open new locations,” said Bracchi.

While Dhanani looks forward to exploring the Build To Rent (BTR) asset type, adding a new dimension to his portfolio, both experts underscored the need for vigilance in navigating interest rate fluctuations and adapting strategies to the evolving market.

As the industry steps into 2024, careful consideration of interest rates, construction costs and strategic portfolio diversification will be crucial for stakeholders looking to capitalize on opportunities in this dynamic market.

Greg Bracchi Nick DhananiIn the ever-evolving landscape of industrial real estate, Houston has consistently set itself apart, due to its strategic location, robust transportation network, rapid population growth and diverse range of employment industries. Houston has firmly established a reputation as an industrial powerhouse, not just regionally, but on a national scale.

Allie Zepeda

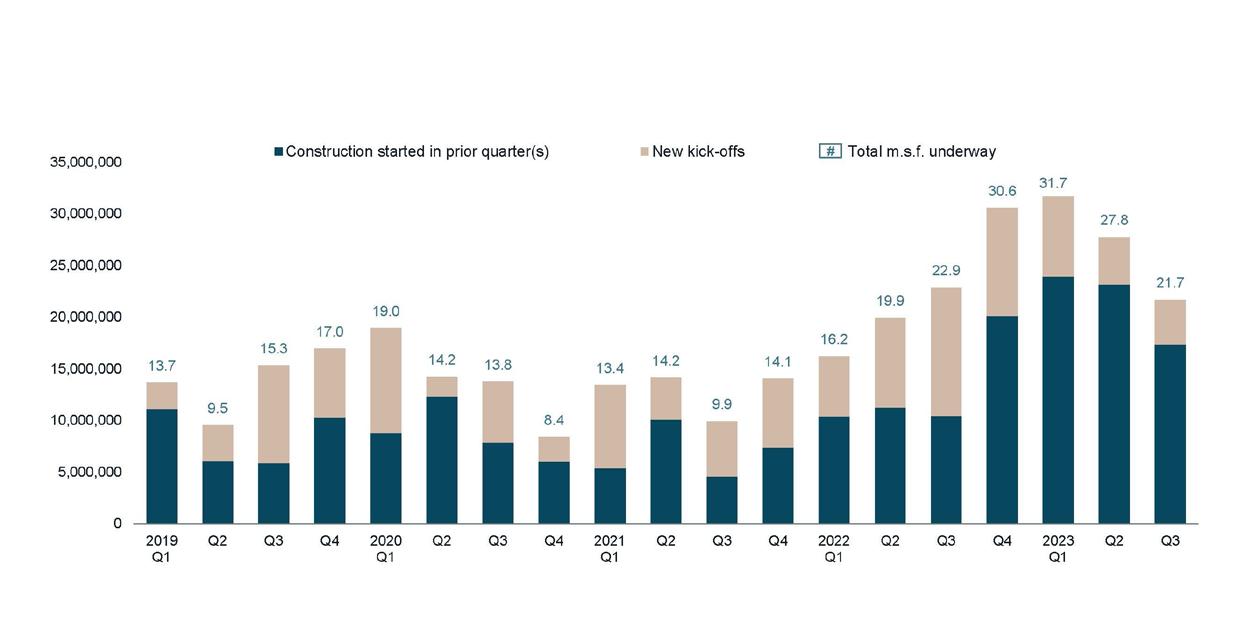

While acknowledging the challenges that the broader market faces, including longer deal conversion times, supply chain hiccups and rising interest rates, Houston's industrial market paints a different picture. Marked by compelling demand drivers and a robust construction pipeline, the story of Houston’s industrial market is one of resilience and growth in the face of economic uncertainties and climbing inflation.

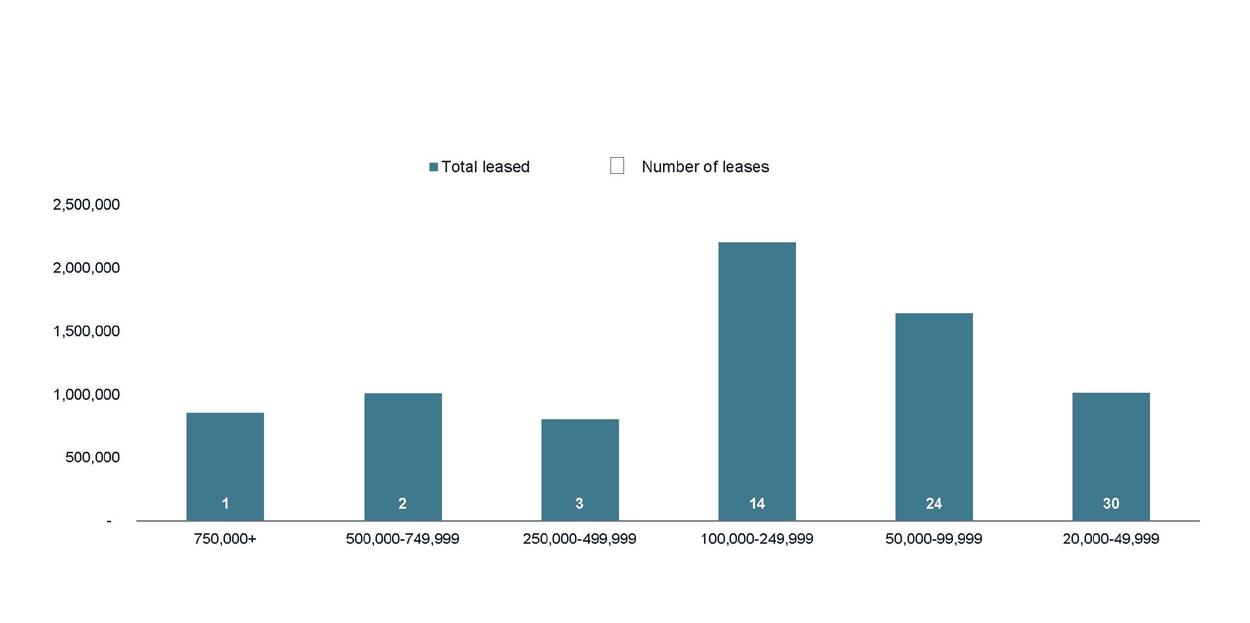

According to JLL’s Q3 Industrial Insight report, leasing activity maintained a healthy pace, buoyed by three deals over 500,000 square feet, dispersed across three submarkets. Transaction volume totaled 7.4 million square feet, with Distribution Alternatives' 855,610-square-foot prelease deal at Kingsland Ranch Logistics Park in the West leading the charge.

One notable trend is the influx of new-to-market deals, primarily driven by the logistics and distribution, energy and utilities and construction, machinery, and materials industry sectors. Together these business lines accounted for nearly 60% of 2023’s new to market leasing volume. Historically these new occupiers have migrated from the East and West coast regions, particularly California, but include an international component as well. Companies are drawn to Houston's competitive rental rates, land availability and a deep and talented labor pool. These newcomers, along with tenant expansions, accounted for nearly half of Q3 leasing activity, highlighting the city's appeal as a thriving hub for businesses seeking long-term footprints. This demand signals a vote of confidence in both the stability and growth potential of the Houston industrial sector.

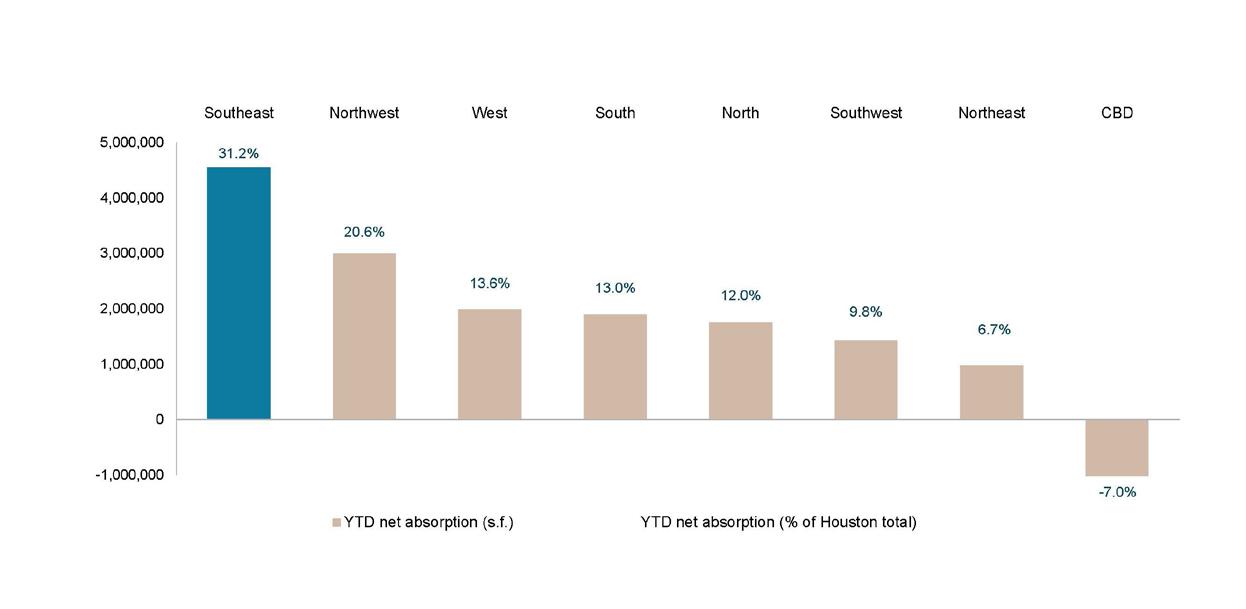

The Southeast submarket continues to be in high demand and consistently ranks in the top three submarkets for leasing activity, net absorption and tenants in the market. A decline in construction activity will allow room for lease-up in vacant space added to the market from new supply additions.

Additionally, the Southeast remains a major entry point for companies new to Houston, helping make it the most targeted submarket for industrial users looking for space.

While the Southeast has always benefited from its strategic location near the port, it has seen even greater success in recent years. Further enhancements at Port Houston will continue to enable employment growth, infrastructure investment and industrial development across Southeast Houston and beyond. These factors, along with population growth, will carry Southeast industrial momentum forward.

“Looking ahead, a declining development pipeline will allow the market to absorb the supply overhang over the next year, while a steady volume of prospects actively targeting space in Houston should convert to leasing activity. This sets the stage for a more balanced market in the near future.”

The elevated construction pipeline of the last 18 months resulted in a record 10.4 million square feet of deliveries in Q3, alone. Seven of these deliveries were big-box projects, each exceeding half a million square feet in size. While overall completions stood at 20.2% preleased, leasing momentum is expected to gain stronger traction in the coming months since construction has drawn to a close.

Due to sustained demand, net absorption added another 4.2 million square feet, bringing the year-to-date total to 14.6 million square feet. This ranks Houston second in the U.S. for net absorption so far this year, trailing behind only Dallas-Fort Worth, which is a much larger industrial market. However, with new supply outpacing occupancy gains, vacancy rates inched up to 7.5%, creating opportunities for tenants in select segments of the market. This is expected to be a short-term imbalance, as the resiliency of the industrial sector is well documented through previous cycles, and construction starts are falling. The Bright Outlook

Looking ahead, a declining development pipeline will allow the market to absorb the supply overhang over the next year, while a steady volume of prospects actively targeting space in Houston should convert to leasing activity. This sets the stage for a more balanced market in the near future.

The metro will remain a magnet for new-to-market companies given its competitive rental rates, availability of land and deep labor pool, which is further enabled by Port Houston’s continued expansion efforts. The city's long-standing demand drivers, including the energy and utilities sector, with a particular emphasis on renewables, as well as manufacturing, should provide some additional lift for leasing activity in the coming quarters.

In conclusion, Houston's industrial real estate market is on a trajectory towards healthier fundamentals in 2024.

Taylor Starnes Hired at CapRock Partners

Taylor Starnes joins CapRock Partners as Vice President of Acquisitions for the Central Region. He leads CapRock’s acquisition efforts in Texas with a focus on existing valueadded industrial asset acquisitions and groundup industrial development opportunities. In his new role, Starnes oversees all Texas acquisitions and will be building out an acquisition team that covers all major industrial markets in the state.

Amanda Brown, Recognized at HD Brown Consulting

Amanda Brown celebrates one year as Principal of HD Brown Consulting, a CRE development consulting firm specializing in entitlements, site acquisitions, infrastructure, and more.

Amanda has over 15 years of experience in Austin’s commercial land development industry. She began her career as a Senior Planner for the City of Austin. She later progressed into key roles at prominent civil engineering and real estate law firms, honing her expertise in entitlements and land development consulting.

Alston Construction promotes John Cody to Vice President/General Manager of Dallas Business Unit

Alston Construction is proud to announce the promotion of John Cody to the position of Vice President/General Manager of the Dallas Business Unit. This strategic decision reflects Alston’s dedication to its continued growth and expansion in the industry throughout Texas.

John has been an integral part of the Alston family for 6 years and played an executive role in both Texas business units’ (Houston

and Dallas) success. In John’s previous role as Texas Operations Director and Director of Preconstruction, he played a pivotal role in the successful completion of numerous high-profile projects, contributing to the company’s reputation for delivering quality work on time and within budget. He consistently demonstrated leadership, technical expertise, and dedication to the company’s vision. With an impressive track record of successful project management and a deep understanding of the construction industry’s changing landscape, John is well-equipped to lead Alston Construction’s Dallas division into further success.

As Vice President/General Manager, John will assume a broader set of responsibilities, overseeing the Dallas projects from inception to completion, while also focusing on strategic planning, business development, and ensuring the highest standards of quality and safety are maintained throughout the organization.

John received his Master of Science in Systems Management from the University of Southern California and a Bachelor of Science in Engineering from the United States Military Academy, West Point, NY and has over 30 years of industry experience.

MYCON General Contractors, Inc. names Malynda Dickinson Partner

Dallas-based MYCON General Contractors, Inc. (MYCON) has named Chief Financial Officer Malynda Dickinson, CPA, CCIFP, as partner.

“Malynda is a forwardthinking, compassionate, and proactive leader with a mission to prioritize our people,” said Charles R. Myers, President and CEO of MYCON. “Her strategic initiatives, new profit centers, valuable insights, and focus on people set her apart and continue to drive our forward momentum, securing a prosperous future for MYCON.”

With 18 years of financial and executive leadership experience, Dickinson is responsible for the firm’s financial management and accounting functions. She also oversees the company’s surety and insurance programs and guides its risk management program. Dickinson is actively involved in MYCON’s business operations and supervises various internal departments, including accounting, people operations, and information technology. Since joining MYCON in 2021, she has played a crucial role in enhancing employee benefits and implementing streamlined processes that have introduced innovative cost-saving measures for the company.

Dickinson earned two Master’s Degrees (Accounting and Business Administration) from The University of Arizona and holds a professional certification as a Certified Construction Industry Financial Professional (CCIFP) and Certified Public Accountant (CPA). She is an active member of Urban Land Institute (ULI) Dallas-Fort Worth and Chief, an organization designed for women in leadership roles. She was also recently selected to serve on the finance committee for the National Juneteenth Museum.

Michael Preiss, P.E., promoted to Executive Vice President, Operations

Pape-Dawson Engineers, LLC announces the promotion of Michael Preiss, P.E., to Executive Vice President, Operations. Mr. Preiss joined Pape-Dawson in 1997 and has 24 years of experience in civil engineering.

In his previous role as Managing Principal of Greater Houston, Mr. Preiss led the growth of Pape-Dawson’s Houston staff from a single employee in 2009 to nearly 300 employees today. He has contributed to PapeDawson’s operations across the entire organization by providing exceptional service and management for key clients and ensuring the company’s operational plans are aligned to support short- and long-term initiatives.

In his new role as Executive Vice President, Operations, Mr. Preiss will oversee corporate functions such as Human Resources, Learning and Development, Talent Acquisition, Information Technology, Budgeting and Metrics, and Acquisition Integration.

Outside of work, Mr. Preiss has provided leadership in the civil engineering profession and his community through his involvement in numerous organizations. He most recently completed his second term on the Texas Tech University Whitacre College of Engineering Dean’s Council and his 17th year as President of Fort Bend County Municipal Utility District No. 159.

“Mr. Preiss is a Pape-Dawson legacy leader and has played an instrumental role in who we are today. He established our Houston and North Houston offices and led our recent acquisition of Costello. He has guided our Houston team of 300 as they have developed significant projects that are positively changing the landscape and preparing the region for the future. As we carry out our national growth strategy, Mr. Preiss’s leadership, acumen for operations and financial analysis, and integration expertise continue to provide immense value in achieving our goals,” says Gene Dawson, P.E., President.

CENTERPOINT PROPERTIES

945 Bunker Hill, STE 625 Houston, TX 77024

P: 832.856.4779

Website: centerpoint.com

Key Contacts: Nate Rexroth, Executive Vice President, Asset Management; nrexroth@centerpoint.com; Danielle Radtke, Senior Vice President, Asset Management; dradtke@centerpoint.com

Services Provided: CenterPoint Properties is an innovator in the investment, development, and management of industrial real estate and multimodal transportation infrastructure. CenterPoint acquires, develops, redevelops, manages, leases, and sells state-of-the-art warehouse, distribution, and manufacturing facilities near major transportation nodes. Our experts focus on port-proximate distribution infrastructure assets near America's major population centers.

Company Profile: CenterPoint Properties continuously reimagines what’s possible by creating ingenious solutions to the most complex industrial property, logistics, and supply chain problems. With an agile team, substantial access to capital, and industry-leading expertise, we give customers a competitive edge to ensure their success — no matter how great the challenge.

CMI BROKERAGE

820 Gessner, Suite 1525

Houston, TX 77024

P: 713.961.4666

Website: cmirealestate.com

Key Contacts: Trent Vacek, tvacek@cmirealestate.com; James Sinclair, jsinclair@cmirealestate.com

Services Provided: Central Management, Inc. is a full-service commercial real estate firm providing Brokerage Services; Property, Facility, Construction and Asset Management Services; Landlord and Tenant Representation; Land Sales; Receivership and Real Estate Recovery. Services are available for Industrial, Land, Multifamily, MOB, Office and Retail. Licensed in Oklahoma and Texas.

Company Profile: Central Management, Inc. (CMI) was founded by Houston real estate professional Vic Vacek in 1978. Our team understands the intricacies of the markets that offer investors an edge both from a leasing and an asset management perspective. Certified AMO® 1984, IREM, CPM, CCIM, NAR, HAR, NALP, ICSC, and TREC.

Notable Transactions/Clients: Armada Big Springs Ptnrs, Barbour Invts., Baytown ISD, Core Real Estate, Hoffpauir Estate, JLC Properties, KBR, Prudential, Rawson Blum & Leon, Subway, Texas Hearing Institute, Triple Crown Invts., US Oncology, Vigavi Realty, Walgreens.

HIFFMAN NATIONAL

One Oakbrook Terrace, Suite 400 Oakbrook Terrace, IL 60181

P: 833.HIFFMAN

Website: hiffman.com

Key Contacts: Dave Petersen, CEO, dpetersen@hiffman.com; Bob Assoian, Executive Managing Director of Management Services, bassoian@hiffman.com

Company Profile: Hiffman National is one of the US’s largest independent commercial real estate property management firms, providing institutional and private clients exceptional customized solutions for property management, project management, property accounting, lease administration, marketing, and research. The firm’s comprehensive property management platform and attentive approach to service contribute to successful life-long relationships and client satisfaction. As a nationally bestowed Top Workplace, and recognized CRE award winner, Hiffman National is headquartered in suburban Chicago, with more than 250 employees nationally and an additional six hub locations and 25 satellite offices across North America. For more information, visit hiffman.com

KDS de stijl interiors, LLC

2006 E Cesar Chavez St. Austin, TX 78702

P: 512.457.1332

Website: kdsaustin.com

Key Contacts: Jill Laverentz, Owner, jill@kdsaustin.com; Clark Kampfe, Principal, clark@kdsaustin.com

Services Provided: Programming & Client Process Analysis – Due Diligence & Building Analysis – Schematic Design – Test Fit & Pricing Notes – Project Scheduling Goals – Consultant Team Formation – Cost Analysis & Value Engineering – Design Development – Construction Documentation – Racking, Commodity, & Equipment Coordination – Permit Processing – Project Management – Construction Administration – Project Budgeting & Cost Tracking – As-Built Documents

Company Profile: KDS is a full-service commercial design firm with 30+ years of experience including 25,000,000+ SF of Industrial/Flex and 3,000,000+ SF of Office Projects. We are committed to responsiveness and to providing well designed and implemented solutions. Our extensive knowledge base and adept management of critical milestones creates consistently successful projects.

Notable/Recent Projects: American Canning – Austin, TX – 101,000 SF –Manufacturing & Distribution

FlightSafety International – TX & OK – 186,000 SF Combined – Manufacturing GT Distributors – Pflugerville, TX – 58,000 SF – Retail, Office, Fabrication, Storage & Distribution

ALSTON CONSTRUCTION COMPANY

HOU: 1300 W. Sam Houston Pkwy S Suite 225, Houston, TX 77042

DAL: 10440 North Central Expressway Suite 720, Dallas, TX 75231

Website: alstonco.com

Key Contact: HOU: Nick Dwyer, Director of Business Development, ndwyer@alstonco.com

DAL: Brittany Schneider, Director of Business Development, bschneider@alstonco.com

Services Provided: Alston offers a diverse background of design-build experience, general contracting and construction management of industrial, commercial, healthcare, retail, and municipal projects.

Company Profile: Alston Construction’s success begins and ends with our approach to planning, scheduling, and choosing the right team. We have been adhering to an open and collaborative approach since our founding more than 35 years ago.

Notable/Recent Projects: Innovation Ridge Logistics Park, a 1.1 million SF 3 building industrial business park in Forney; 610 Business District, a 388,795 SF industrial park located in Houston; 1.2 million SF logistics facility located in Conroe.

SUMMIT DESIGN + BUILD, LLC

98 San Jacinto Blvd, 4th Floor Austin, TX 78701

P: 512.872.6698

Website: summitdb.com

Key Contacts: Adam Miller, President, amiller@summitdb.com; Doug Hayes, Project Executive, dhayes@summitdb.com; Amber Autumn, Business Development, aautumn@summitdb.com

Services Provided: Summit Design + Build, LLC is a provider of full service general contracting, construction management and design/ build construction services for the commercial, industrial, multifamily residential, office/tenant interiors, hospitality and institutional markets.

Company Profile: Located in downtown Austin and with offices in Tampa, FL, Chicago, IL and North Carolina, Summit Design + Build has been involved in the design and construction of over 400 buildings and spaces totaling more than 10 million square feet over the firm’s 18 year history.

Notable/Recently Completed Projects: Montage – 2323 S. Lamar (Multifamily), Congress Lofts at St. Elmo (Multifamily), UpCampus Student Housing Tallahassee (Multifamily), WeWork (Office TI), Eli’s Cheesecake (Industrial), Lockheed Martin (Industrial), Stadium Lofts North Carolina (Multifamily).

Summit Design + Build

Amber Autumn

Director of Business Development

P: 312.972.8547

aautumn@summitdb.com

98 San Jacinto Blvd, 4th Floor, Austin, TX, 78701

www. summitdb.com

Amber Autumn is the Director of Business Development for Summit Design + Build. In this position, Amber plays a crucial role in bringing prospective projects and clients through the project pipeline and positioning Summit Design + Build as Austin's leading general contractor and construction management firm.

Summit Design + Build is a nationally recognized provider of innovative preconstruction, construction management, general contracting and design/build construction services.

Where do you see yourself in five years?

At the helm of the construction industry, with Summit Design + Build being recognized for innovation, sustainable practices, and excellence in business development and project execution.

What’s the best piece of advice someone has given you?

My very first construction project manager gave me a great piece of advice, "It's best to complete one thing a day as opposed to starting 10 things without one of them completed.”

What is one dream you have yet to fulfill?

Opening Summit in additional markets across the country. This dream centers around the idea of creating a network of trust and cooperation that serves as a foundation for our company's sustained expansion and prosperity.

Would you rather win the lottery or work at the perfect job? Why?

The perfect job. A fulfilling career provides a sense of purpose, personal growth, and the opportunity to create a positive impact on communities and the industry. Money without purpose is empty and depressing.

What is one of your favorite books or movies and why does it resonate with you?

One of my favorite books is "To Kill a Mockingbird" by Harper Lee. Its exploration of justice, empathy, and societal change resonates with my values, and the timeless narrative continues to inspire me.

D: 281.640.2213 M: 832.419.7287

Mari.Bolanos@AltusGroup.com

10497 Town & Country Way, Ste 600A Houston, TX 77024 www.AltusGroup.com

With over a decade of experience under her belt in Commercial Construction, Marisol has proven time and again to possess an unwavering go-getter attitude that sets her apart from the rest. In Business Development, Operations, Project Management, Estimating, Strategic Planning, Data Analysis, Accounting, Bookkeeping & foremost Entrepreneurial Spirit; Founder of Omega Consulting Development, LLC.

She is a risk-taker who fearlessly ventures into uncharted territories, always seeking innovative solutions and pushing the boundaries of what is possible.With a no-excuse mindset, Marisol conquers obstacles head-on and refuses to let setbacks hinder her progress. A lifelong learner, Marisol is driven by an insatiable desire for knowledge. She continually seeks out opportunities to expand her skills and broaden her understanding of the industry, never content with the status quo.

Excited to continue building upon a legacy of accomplishments, fostering meaningful relationships, and propelling businesses towards unprecedented success, Marisol adds another tool to her belt as a Property Tax Consultant in the Commercial Real Estate industry for Altus Group.

Altus Group a leading provider of property tax services internationally, managing over $40B in CRE assets in Texas alone. Honored to represent clients such as CVS, Home Depot, Berkshire, Equity, Residential, HCA Healthcare, Penske, and Principal. Altus Group handles all phases of property tax management.To learn more, please reach out to Marisol.

Where do you see yourself in five years?

God willing, I will be celebrating my son's college graduation in 2027 and cheering on my daughter as she graduates High School in 2028.

What’s the best piece of advice someone has given you?

To trust and rely on God, El Shaddai, for He is all sufficient, Hashem, the name above all names, for Yahweh-Yireh provides my every need. Embracing uncertainty. A reminder that growth and opportunity often arise in the face of the unknown.This advice has empowered me to step out of my comfort zone, take risks, and seize life's unpredictable moments with confidence and resilience as the daughter of El Roi.

What is one dream you have yet to fulfill?

Looking back at my journey, one dream I have yet to fulfill is traveling the world extensively. My past experiences have taught me the value of exploring diverse cultures and perspectives, and I'm eager to continue expanding my horizons through travel.

Would you rather win the lottery or work at the perfect job? Why?

Having experienced the sense of accomplishment that comes from overcoming challenges and making a positive impact through my career, I would prefer to continue down that path.The perfect job, in my opinion, offers more than just financial rewards; it provides a sense of purpose, personal growth opportunities, and the chance to contribute to something larger than oneself. I believe that long-term happiness and fulfillment come from doing meaningful work that aligns with passions and values.

What is one of your favorite books or movies and why does it resonate with you?

A favorite book that resonates with me is, “The Set-Apart Woman” by Leslie Ludy.

“Imagine if your only concern was making Jesus known, even if no one ever remembered your name.”

Strongtower Commercial Dawn Brewer, CCIM, MBA

Principal Broker

P: 281.733.4077

dawn@strongtowercommercial.com 11015 Northpointe Blvd Ste. B, Tomball, Texas, 77375

www.strongtowercommercial.com

CCIM (Certified Commercial Investment Member), CREW Member, Accomplished Professional with 18+ years of experience in Commercial Real Estate. Focused individual with a Heart to serve; proficient in Maximizing Value, Competitive Analysis, and Contract Negotiation in Competitive Markets. Specializing in Industrial & Retail opportunities. High level of Integrity and Dedication to Company Objectives.

Strongtower Commercial Group, the Premier Real Estate Investment, Brokerage and Management firm in Texas. We specialize in creating structured transactions and establishing relationships that last by building trust. We work diligently to understanding the needs of our clients, in order to achieve the results they desire.

Where do you see yourself in five years?

In five years, I expect to have completed my Doctoral Program while continuing to make impact in the CRE Industry.

What’s the best piece of advice someone has given you?

Pray without ceasing and trust that with God all things are possible!

What is one dream you have yet to fulfill?

Professionally, I have a desire and dream to transfer the industry knowledge that I have to my team and see them be incredibly successful. Personally, I have a desire and dream to visit Paris, France.

Would you rather win the lottery or work at the perfect job? Why?

Both, winning the lottery would financially allow me to serve and continue working the perfect job ultimately providing a sense of fulfillment that can be obtained no other way.

What is one of your favorite books or movies and why does it resonate with you?

Unshakeable Hope by Max Lucado - Provides encouragement to build a life based on the Promises of God.

Dowdle Real Estate

Lynn DowdlePrincipal P: 214.912.2282

lynn@dowdlerealestate.com

6282 Willowgate, Dallas, TX, 75230

I am a broker specializing in land and specifically hospitality. I cover the state of Texas.

Dowdle Real Estate was founded in 2011. We are a small boutique real estate firm. We consider our clients partners and strive to create value for everyone involved in a transaction.

Where do you see yourself in five years?

Somewhere near water

What’s the best piece of advice someone has given you?

Live your life as you choose. No one else knows what they are doing either.

What is one dream you have yet to fulfill?

I've been pretty blessed. Many dreams have come true. I plan to continue dreaming...If you believe it you can see it.

Would you rather win the lottery or work at the perfect job? Why?

If I won the lottery I would dedicate my life to sharing with organizations and individuals in need. There is so much good work to be done.

What is one of your favorite books or movies and why does it resonate with you?

I believe everyone should read Victor Frankl's "Man's Search for Meaning". It's a handbook to life.

Capital Title of Texas

Tiffany Hanzik-McAllisterAttorney

thanzik@ctot.com

2400 Dallas Parkway, Suite 560, Plano Texas 75093

www.ctot.com

• Serves on corporate legal team, active in commercial/residential closing and development.

• Texas A&M University School of Law, Fort Worth, Texas, Juris Doctor.

• Southern Methodist University, Dallas, Texas, Masters of Arts - Dispute Resolution.

• Yale School of Management Graduate certificate - Womens leadership.

• Texas Land TItle Association - Alex H Halff Leadership Academy alumni 2019.

• Certified Title Insurance Professional and Certified Escrow Settlement Professional.

Capital Title is the Largest Independent Title Company in the United States. It provides its statewide customers with over 100 branch offices serving the Dallas-Fort Worth, Austin, Houston, San Antonio, Rio Grande Valley, Northeast Texas, Coastal Bend Golden Triangle, and Central Texas metroplexes. Capital Title’s corporate office, located in Plano, Texas, is directed by the company’s Owner & CEO, Bill Shaddock and COO Tracy McMahon.

Where do you see yourself in five years?

As fast and strong as our company is growing, I see myself helping our leaders in a National capacity as we continue our takeover. I look forward to seeing my two girls grow into amazing young ladies who will hopefully love real estate as much as i do!

What’s the best piece of advice someone has given you?

Trust your identity as a leader even during challenging times. Do not let fear take over and allow yourself to shrink in the face of adversity. If you werent meant for something greater then you would not have to fight as hard. The challenging times are what prepare you for your greatest breakthroughs in life. Learn from them and help others when theyre going through their challenging times as well.

What is one dream you have yet to fulfill?

My dream is to build generational wealth for those in my family that I haven't even met yet. I want my grandchildren and their children to look back at what we are doing now to see this is where it all started. Specifically that even as a woman, you can be the ONE to make that change and to lead our daughters to be independent successful women. I focus on that thought when the days get tough but I know its time to push on...for them.

Would you rather win the lottery or work at the perfect job? Why?

This is a hard one because winning the lottery would allow me the opportunity to work at the perfect job without money being a factor AND allow me to help others in need which is one of my ultimate goals in life. The blessing is being able to bring others up with you and lottery money could definitely help with that!

What is one of your favorite books or movies and why does it resonate with you?

The Power of One More by Ed Mylett, in this book Ed lays out strategies for the readers that show how we are all just one more thought or action away from transforming our lives from average to extraordinary. I try to use these strategies daily. It may mean one more call or email at the end of the day or pushing myself to go to a networking event even if I am tired. I know that I could be one meeting away from changing my life along with those in my family for generations to come.

Houston Independent School District

Leesa Love, TACS, SR/WA, RW-NAC

Senior Manager, Real Estate & Facility Reservations Office

P: 713.556.9262

llove@houstonisd.org

3200 Center Street, Houston, Texas, 77007 www.houstonisd.org

Public and private sector real estate professional. Senior Right-of-Way Professional (SR/WA). Leads real estate acquisitions (including eminent domain), sales, leases, and right-of-way for a portfolio comprised of over 300 sites, 3,700 acres of land and 31 million square feet of buildings worth $6.2 billion. Texas Accredited Commercial Specialist (TACS) certification.

Houston ISD has more than 189,000 students and encompasses 333 square miles. It is the eighth-largest public school system in the nation and the largest in Texas.

Where do you see yourself in five years?

I will have my Texas Real Estate Broker License!

What’s the best piece of advice someone has given you?

Just start doing whatever you dream! Every day do at least one or two things toward your dream. Very quickly your dream will become your reality.

What is one dream you have yet to fulfill?

Looking back at my journey, one dream I have yet to fulfill is traveling the world extensively. My past experiences have taught me the value of exploring diverse cultures and perspectives, and I'm eager to continue expanding my horizons through travel.

Would you rather win the lottery or work at the perfect job? Why? Win the lottery! Invested properly it helps yourself and many others.

What is one of your favorite books or movies and why does it resonate with you? “Mobile Home Wealth - A Practical Guide for the Savvy Investor ” by Zalman Velvel. This book launched my career in Real Estate.

LGE Design Build

Shelbie McDiffettTexas Director of Business Development

P: 469.498.0128

shelbiem@lgedesignbuild.com

1280 East Levee Street, Dallas, Texas, 75207

www.lgedesignbuild.com

As LGE Design Build's Texas director of business development, Shelbie McDiffett drives company awareness in Dallas-Fort Worth, emphasizing Texas portfolio expansion. Since joining in May 2021, she's spearheaded strategic initiatives, achieving 30% revenue growth and 3,496,204 square feet of growth in the LGE Texas portfolio.

LGE Design Build is a leading design-build construction firm, serving the Southwest's commercial sector for nearly 30 years. Based in Phoenix and Dallas, LGE offers comprehensive services for diverse industries.

Where do you see yourself in five years?

In five years, I hope to build and lead a successful team, nurturing client relationships and driving new business opportunities for the LGE Texas team as we continue to scale

What’s the best piece of advice someone has given you?

The one thing you can control is your effort.

What is one dream you have yet to fulfill?

I would love to own a ranch one day in East Texas, which is where I’m from!

Would you rather win the lottery or work at the perfect job? Why?

I’d rather win the lottery! Money isn’t everything but it provides the freedom to explore what excites you. Plus, I'd be closer to owning my dream ranch in East Texas.

What is one of your favorite books or movies and why does it resonate with you?

One of my favorite books is “Playing Big” by Tara Mohr. It’s been a career-long companion, offering invaluable advice on authentic self-expression and finding your voice.

Wildcat Management

Tanya RaganPresident P: 214.758.0348

mmoreno@wildcatmanagement.net

501 Elm St. Suite 350, Dallas, TX, 75202

Tanya Ragan, owner and President of Wildcat Management, is a real estate developer entrepreneur, and leader of the movement to redevelop Downtown Dallas. As a female business-owner, Tanya is leading the charge for Women in commercial real estate, construction and venture capital.

Wildcat Management is a national, woman-owned real estate investment, development, and management company known for pioneering work. Wildcat takes on mission-driven projects and strategic public-private sector partnerships to spark economic turnaround and community growth.

Where do you see yourself in five years?

My focus is on growth and scaling Wildcat Management. Expanding my real estate investments in other markets, diversifying my businesses and prioritizing capital investment. Time is our most valuable resource.

What’s the best piece of advice someone has given you?

My parents taught me it was okay to be different, set my own bar and expectation of myself. Stay focused on my goals and drown out noise. I always believed I could accomplish anything.

What is one dream you have yet to fulfill?

Design a product. I have years of product development and design experience. I’ve worked with several startups and fortune 500 companies as a consultant but would like to build ground up.

Would you rather win the lottery or work at the perfect job? Why?

I love the art of the deal and having a sense of purpose. I wake up every day excited to start my day and working in a fast-paced industry.

What is one of your favorite books or movies and why does it resonate with you? Hoosiers. I consider myself an underdog. When you have opportunity in front of you take your shot. 90% is showing up and mindset of believing you can win the game.

Texas Icons

Deadline is December 22, 2023

January 17, 2024

Dallas Fort Worth

Commercial Real Estate Forecast Summit

- 4 hours of CE will be Applied for

January 18, 2024

San Antonio Forecast Summit

- 4 hours of CE Approved

January 19, 2024

Austin Apartment Summit

- 4 hours of CE Approved

February 8, 2023

Houston Industrial Summit

- 4 hours of CE Approved

April 24, 2024

Houston Healthcare Real Estate Summit

- 3 hours of CE Approved