Vacancy to vitality: Chicago’s industrial market poised for rebound

By Brandi Smith

By Brandi Smith

Chicago has weathered its share of storms, flurries of economic fluctuations, and global uncertainties. Its industrial real estate market has demonstrated remarkable resilience in the face of those challenges, faring better than many other markets.

“I'm a developer at heart, so I always see the glass half full,” said Susan Bergdoll, Senior Vice President & Partner for CRG’s Midwest region. “I choose to see the

good. I see a lot of promise for the second half of 2024. I see even more promise for the first half of 2025.”

Bergdoll said she often finds herself reminding others that while 2024’s metrics may differ from those in 2021, they’re comparable to results in 2018 and 2019.

“No one complained about where the market was then,” Bergdoll said. “The market is still good.”

Vacancies remain relatively stable, especially in buildings 300,000 square feet and less, a segment of the market experiencing a shortage.

“If you can find a site and put up a 250,000- to 300,000-square-foot building, you're going to lease it quickly because there just aren't a lot of opportunities like that, and many companies want newer modern real estate,” Bergdoll explained.

INDUSTRIAL (continued on page 17) VOL.34 NO.2 MARCH/APRIL 2024 THE LEADING NEWS SOURCE FOR INDUSTRIAL REAL ESTATE PROFESSIONALS & USERS

CRE MARKETPLACE (pg.26): CONSTRUCTION COMPANIES/GENERAL CONTRACTORS ECONOMIC DEVELOPMENT CORPORATIONS FINANCE & INVESTMENT FIRMS REAL ESTATE LAW FIRMS

The Cubes at ORD.

INVESTS DEVELOPS MANAGES

Our experts have the creativity and know-how to tackle your toughest supply chain challenges, continuously giving you a competitive edge to realize your success.

centerpoint.com

Dan Barrins Associated Bank

Ron Behm Colliers International

Susan Bergdoll CRG

Corey Chase Newmark

Dan Fogarty Stotan Industrial

Barry Missner

The Missner Group

Adam Moore First Industrial Realty Trust Inc.

Joe Pomerenke Arco/Murray National Construction Company, Inc

Adam Roth

NAI Hiffman

Mike Yungerman Opus Group

1

Vacancy to vitality: Chicago’s industrial market poised for rebound Chicago has weathered its share of storms, flurries of economic fluctuations, and global uncertainties. Its industrial real estate market has demonstrated remarkable resilience in the face of those challenges, faring better than many other markets.

4

Record number of industrial deliveries in Chicago in 2023?

Yes. But don’t expect the same this year Colliers recently reported that the Chicago industrial market saw a record number of deliveries in 2023, with developers adding 40.1 million square feet of new industrial product to the market last year.

8

Constructing success: Insights into Chicago's industrial market The industrial construction market in the Chicago area has been through a series of shifts and adaptations, as revealed by Trevor Ryor, Vice President of Clayco's Industrial Business Unit.

10Women’s History Month: Celebrating the many women who are making an impact in commercial construction March is not only Women’s History Month, but it’s also the month that features Women in Construction Week.

14Guardians of your bottom line: The power of experienced attorneys in property tax appeals Law firms specializing in property taxation encourage property owners to involve counsel through the life cycle of real estate.

16Current state of lending and capital markets causing bottleneck for speculative industrial development While the Chicago industrial market saw a record 40.1 million square feet of new construction deliveries in 2023, according to Colliers’ year-end market report, speculative industrial development starts across the Chicago area have cooled considerably.

18Tenants didn’t flock to bulk warehouses and distribution space in 2023. But what about this year? Industrial tenant demand cooled during 2023, particularly in bulk warehouse and distribution space.

20The record-setting years keep coming: Colliers report highlights a data center sector that keeps on booming Another record-setting year. That's what the data center industry enjoyed in 2023, according to the latest research from Colliers.

22

3 MARCH/APRIL 2024 CHICAGO INDUSTRIAL PROPERTIES

News Briefs 26Marketplace Chicago Industrial Properties® (ISSN 1546-377X) is published bi-monthly for $59 per year by Real Estate Publishing Corporation, 1010 Lake St Suite 210, Oak Park, IL 60301. Contact the subscription department at 312.933.8559 to subscribe. © 2024 by Real Estate Publishing Corporation. All rights reserved. No part of this publication can be reproduced or transmitted in any form or by any means, electronic or mechanical including photocopying, recording or by any information storage or retrieval system. PUBLISHER Mark

312.933.8559 MANAGING EDITOR Dan Rafter drafter@rejournals.com VICE PRESIDENT OF SALES & MW CONFERENCE SERIES MANAGER Ernie Abood eabood@rejournals.com VICE PRESIDENT OF SALES Frank E. Biondo Frank.biondo@rejournals.com CLASSIFIED DIRECTOR Susan Mickey smickey@rejournals.com

Menzies menzies@rejournals.com

2024 EDITORIAL

CONSTRUCTION COMPANIES/ GENERAL CONTRACTORS ECONOMIC DEVELOPMENT CORPORATIONS FINANCE & INVESTMENT FIRMS REAL ESTATE LAW FIRMS

BOARD CONTENTS

Record number of industrial deliveries in Chicago in 2023?

Yes. But don’t expect the same this year

By Dan Rafter, Editor

Colliers recently reported that the Chicago industrial market saw a record number of deliveries in 2023, with developers adding 40.1 million square feet of new industrial product to the market last year.

That total was 28% greater than Chicago’s previous record-setting year, 2022, when 31.3 million square feet of new industrial product was added to the Chicago market.

But 2024? Don’t expect another record-setting year when it comes to either the construction of new industrial buildings or industrial sales activity.

Chicago Industrial Properties spoke with Mike Senner, vice chairman with the Rosemont, Illinois, office of Colliers about the state of the Chicago-area industrial market in 2024. Here is some of what he had to say.

Will we see fewer industrial deliveries in Chicago market this year?

Mike Senner: The deliverables have already slowed. We did have a record number of industrial deliveries in 2023. But a lot of that had been agreed to way prior to 2023. If you look at last year, because of the debt markets and where the 10-year Treasury went, a lot of new industrial space wasn’t being built here.

We just saw a lot of development that started before last year wrap up in 2023.

We will, then, see less new industrial product in the Chicago industrial market this year. But as interest rates have stabilized, we are seeing new discussions about future development. That’s the best way to put it. New conversations about vacant land sites slowed in the second half of last year. Those conversations are once again picking up.

Still, at this moment it is very difficult to secure debt and find capital to build spec industrial in the Chicago metro area. In the first quarter of 2024, we are in the same boat as we were in the last couple

of quarters of 2023. We anticipate more of the same in the next quarter.

Will those record deliveries we saw last year boost vacancy rates in the Chicago industrial market this year?

Senner: The Chicago industrial market saw vacancy rates as low as 3.6% at one point in 2022. That is very low. Now because of all the new space delivered in 2023, we will see vacancy rates creep up slightly, maybe above 6.5% in 2024. That will only be temporary, though. We anticipate vacancy rates tapering below that level in 2025, primarily because

4 CHICAGO INDUSTRIAL PROPERTIES MARCH/APRIL 2024

DELIVERIES (continued on page 6)

Photo by Adrian Sulyok on Unsplash.

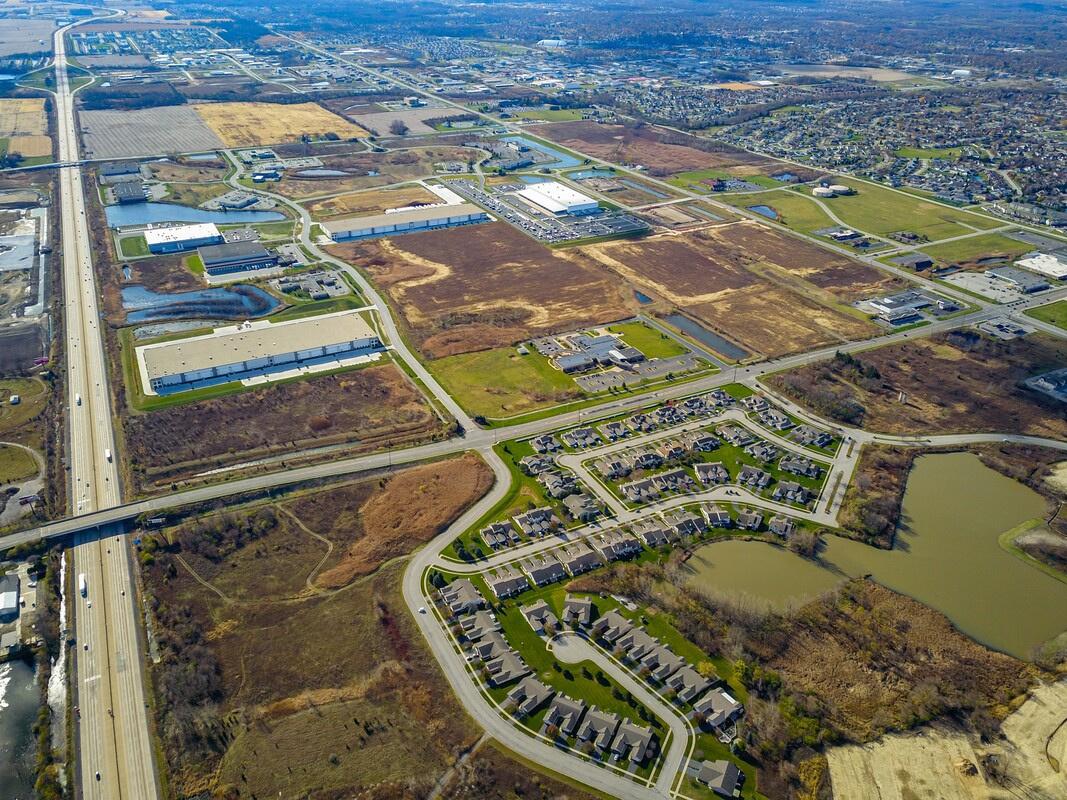

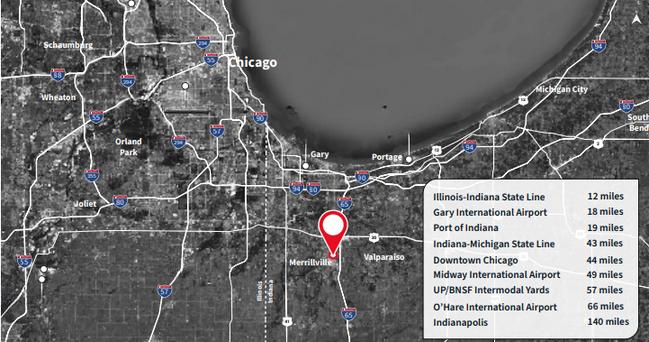

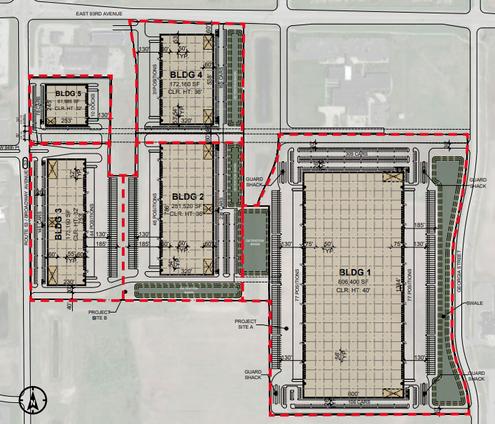

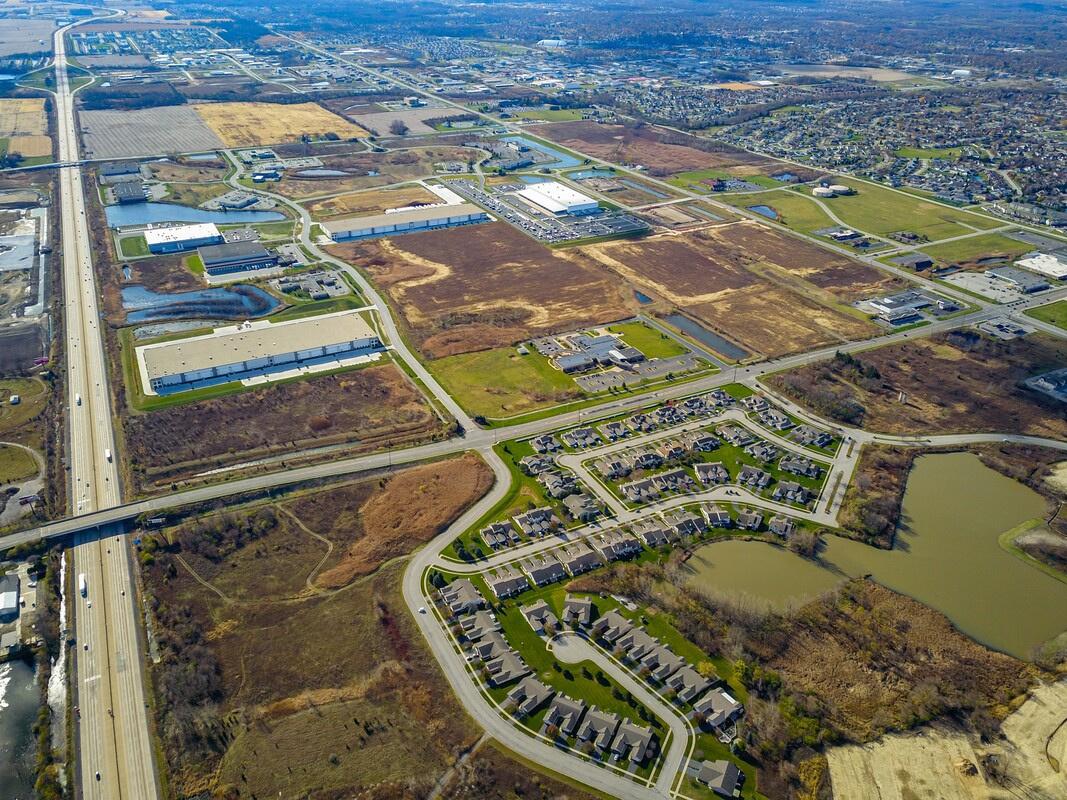

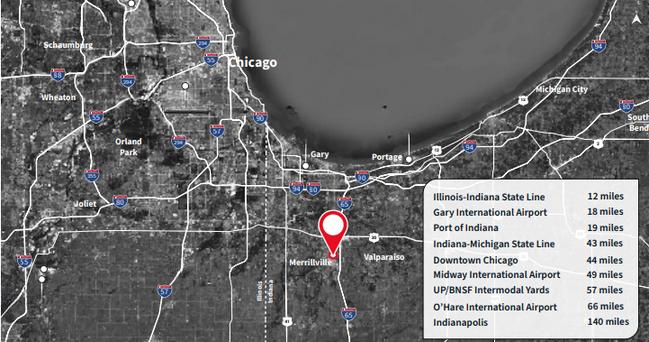

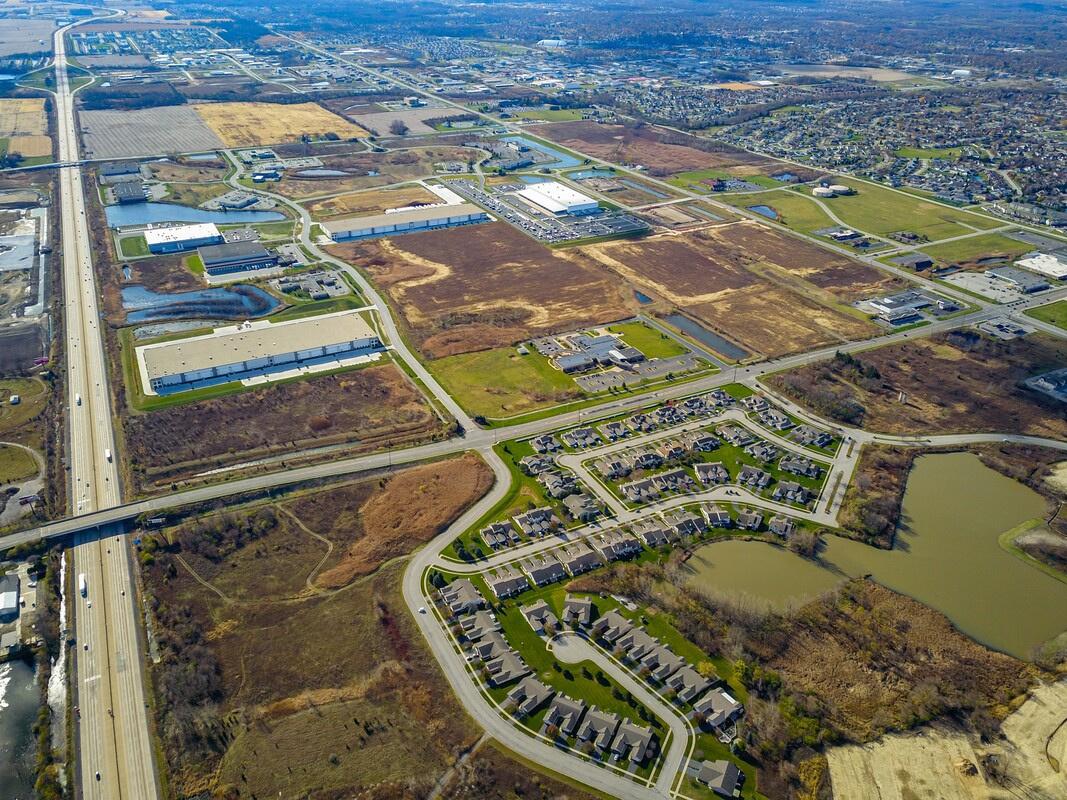

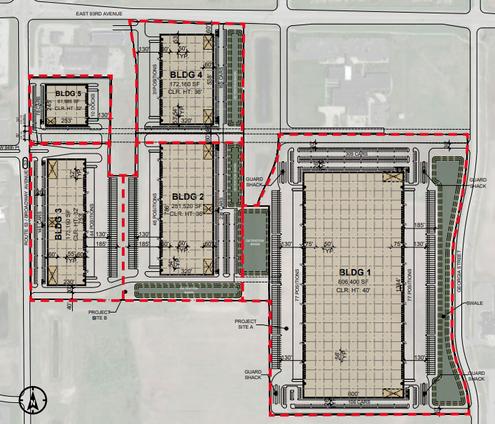

Low Lake County Taxes Up to 1.5M SF of Class A Industrial MERRILLVILLE COMMERCE CENTER MERRILLVILLE COMMERCE CENTER FULLY ENGINEERED AND PERMITED

there won’t be as many new deliveries in 2024.

What impact will a more stable interest-rate environment have on the industrial sector in Chicago?

Senner: The lending environment needs to improve. It seems that interest rates have leveled off. We need to see predictability and cuts. That will be helpful in getting new industrial buildings built. As the buildings that were put on the market in 2023 get absorbed, then you will have a better argument for building on spec again. Once the space that is out there gets absorbed, you can then argue that we don’t have enough inventory. That will help bring about an improved capital markets environment.

Is demand from tenants looking for industrial space in the Chicago market still strong?

Senner: Tenants are still looking for industrial space. But I think there are fewer tenants looking today than what we had seen in recent years. Absorption has been down the last four quarters. We saw record absorption in 2022 and 2021. Those were unbelievable years for absorption. We were off those numbers last year. We were slightly below pre-COVID absorption numbers. But I wouldn’t say we are experiencing a soft market. We were just a little off on the historic absorption of 2022.

Tenant demand will be somewhat flat this year. There are still tenants out there. It’s not like in a recession where no one is looking for space. But everyone will tell you that demand is soft.

What about industrial rents in the Chicago market?

Senner: We saw very solid industrial rent growth here through 2021. And rent growth in 2022 was off the charts. In 2023 we saw some rent growth, but it certainly wasn’t like what we saw in

"In 2024, we anticipate that industrial rent growth in the Chicago market will be slightly above what you would think a typical consumer price index bump would look like."

the previous year. In 2024, we anticipate that industrial rent growth in the Chicago market will be slightly above what you would think a typical consumer price index bump would look like.

In our market, rents might not necessarily compress. But I do think they will be flat. Landlords are going to have to offer more concessions.

Of course, not all industrial properties are equal. Buildings near O’Hare and in the city of Chicago, or those close to the

city that are strategic and in demand, will see higher rent growth. Rent will continue to grow for those properties. When you are looking at commodity properties where there are more choices, rents will probably remain flat.

How about industrial sales? Will we see more sales activity in the Chicago market this year?

Senner: The properties that are selling today are those with short-term leases remaining and rents that are below mar-

ket. The buyers can then push rents up after purchasing these buildings. Those are the kind of deals getting done. We are seeing a lot fewer 10-year-lease deals closing.

The consensus is that it remains slow on the capital markets side. There is not as much being built and user demand is fine but not robust. People are eager to get back into the sales side of this market. They are just waiting for rate cuts or even more stability in the economy.

6 CHICAGO INDUSTRIAL PROPERTIES MARCH/APRIL 2024

DELIVERIES (continued from page 4)

Mike Senner

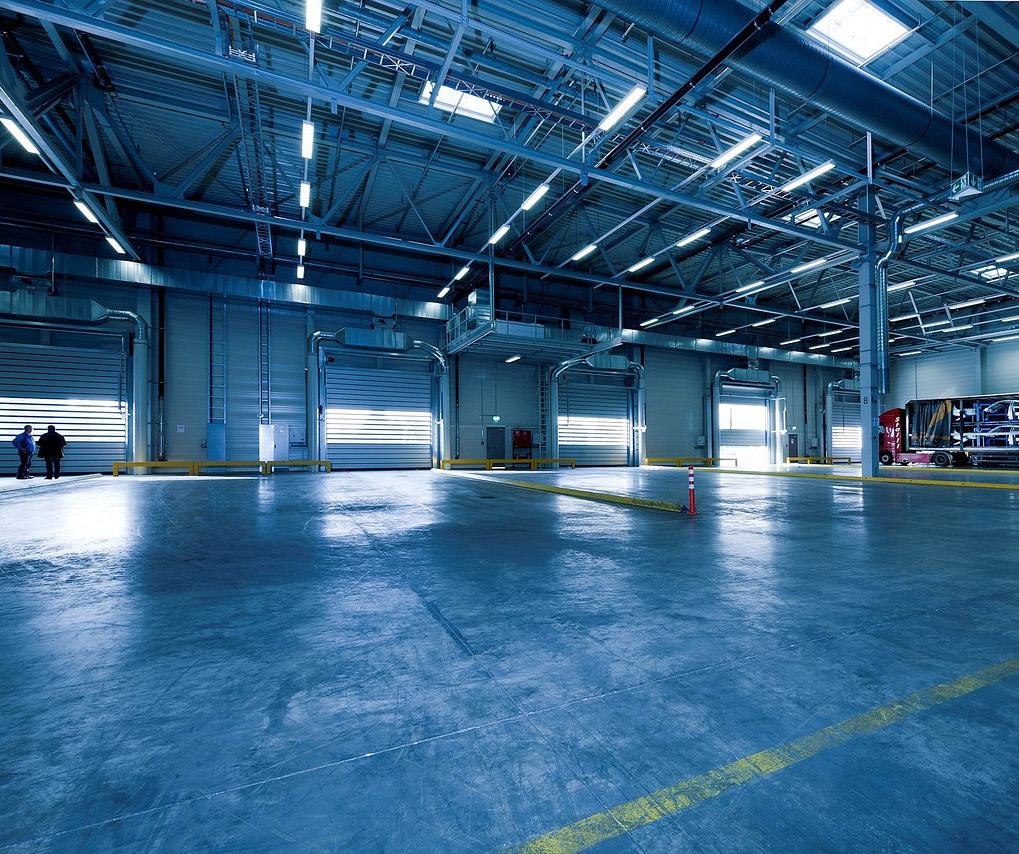

Image by EFAFLEX_Schnelllauftore from Pixabay.

Please contact us for any upcoming project needs! 847.374.9200 · www.meridiandb.com DESIGN BUILD · GENERAL CONTRACTING CONSTRUCTION MANAGEMENT UNDER CONSTRUCTION... Think of us for your next Build-to-Suit project... Corteva Agriscience Anderson, IN - 300,000 SF ARCHITECT: Curran Architecture CIVIL ENGINEER: American Structurepoint Inc.

Constructing success: Insights into Chicago's industrial market

By Brandi Smith

The industrial construction market in the Chicago area has been through a series of shifts and adaptations, as revealed by Trevor Ryor, Vice President of Clayco's Industrial Business Unit. It may face its share of challenges, but the market is characterized by resilience, adaptability and a forward-looking approach, which promises exciting opportunities for stakeholders.

“There are conversations being had on build-to-suit opportunities,” Ryor shared. “Capital lenders appear to be more cautious regarding their investments, which is affecting what deals can get done and/or may require longer holding periods. The speculative warehouse/distribution market has subsided a bit, whereas interest and discussions in cooler/cold storage facilities have seen an uptick.”

Addressing the record completions delivered in 2023, Ryor said that has led to a rise in vacancy rates in the Chicago industrial landscape. With minimal new developments in 2024, rental rates are starting to tick up.

“Until new construction begins, and new space is made available, rental rates will most likely see a slight rise,” said Ryor.

The announcement from the Fed regarding the absence of further interest rate hikes, however, offers a glimmer of hope, potentially alleviating some pressure within the market and allowing developers to strategize for upcoming projects.

“This will allow developers to begin working on deals that will start later 2024 or 2025,” Ryor said.

That’s advantageous because of the shifting demands of clients, particularly in response to the COVID-19 pandemic. Companies, having reevaluated their inventory management strategies during the pandemic, are now transitioning back to a "just-in-time" mentality. This shift prompts them to reconsider the size of facilities they require, with a trend towards downsizing, explained Ryor.

“As companies begin to look for topnotch, best-in-class buildings to operate out of, we are also seeing less focus on warehouses and distribution facilities and more of an investment in manufacturing facilities,” said Ryor. “This also includes an influx of mission-critical and data center projects.”

In terms of geographical areas of interest, Ryor points to Northwest Indiana as a hub where significant discussions

"Until new construction begins, and new space is made available, rental rates will most likely see a slight rise."

and deals are taking place. Additionally, there's a spotlight on smaller infill sites in and around downtown Chicago. Meanwhile, the west and southwest suburban regions remain attractive due to available land for larger distribution and manufacturing ventures.

Clayco is a formidable player in the industrial construction arena, boasting a comprehensive suite of services encompassing real estate, architecture, engineering, design-build and construction. With a legacy spanning more than three decades, Clayco has consistently delivered projects of the highest quality,

earning the trust of clients across North America. Its commitment to innovation, efficiency and excellence has established Clayco as a frontrunner in the industry, with accolades from Engineering News Record reaffirming their stature as a top design-builder and contractor.

One project that stands out in Clayco’s pipeline is the CRG Cubes at ORD project in Franklin Park. This speculative building spanning 66,500 square feet is strategically located near O'Hare International Airport, promising to cater to the robust demands of the O'Hare market corridor. Set to be available in

Spring 2025, this venture underscores the confidence and strategic foresight of Clayco amidst evolving market dynamics.

With strategic initiatives underway and innovative projects on the horizon, there's a palpable sense of optimism permeating the Chicago industrial construction market. As stakeholders harness the lessons learned from past experiences and capitalize on emerging opportunities, the future of the market shines bright with potential.

8 CHICAGO INDUSTRIAL PROPERTIES MARCH/APRIL 2024

Trevor Ryor

Image by Jonathan from Pixabay.

Women’s History Month: Celebrating the many women who are making an impact in commercial construction

By Dan Rafter, Editor

March is not only Women’s History Month, but it’s also the month that features Women in Construction Week, which ran March 3 through 9 this year. To celebrate these two events, Chicago Industrial Properties profiled a select few of the many women who have built thriving careers in commercial construction.

Here is a look at seven women making an impact in Chicago’s commercial construction industry and at the steps they’ve taken to succeed in what remains a largely male-dominated industry.

Michelle Palys,

What led you to pursue a career in construction?

Michelle Palys: I was part of the Scouting Movement in my hometown in Mexico. The groups were co-ed and most of my leaders were male civil engineers who were always sharing their experiences with me. Their professional stories were quite enticing as they presented an opportunity to do challenging work and travel to different places. Around the same time, I also befriended a lady in high school who was convinced she wanted to become a civil engineer. She had everything perfectly planned like the classes she would take, the visits to jobsites and the place she wanted to work after graduation. She was persuasive and the stories from my Scout leaders inspired me to enroll in an engineering school, majoring in civil engineering. To my surprise, my high school friend became an architect.

What challenges have you faced in building a career in a male-dominated industry like construction?

Palys: Early in my career, a male friend once mentioned that women often need to put in twice the work to be recognized in this industry. There is a lot of truth to that. One of the biggest challenges I’ve faced has been the perception that my work may not measure up to the performance of my male counterparts. I have had to work hard to demonstrate my capabilities, learn to advocate for myself and develop supportive relationships to overcome this challenge. Thankfully, there is greater awareness and education regarding unconscious bias in the industry. Graycor, my current company, has been one of my greatest allies in supporting my journey.

Have you noticed an increase in the number of women entering the construction industry? If so, why do you think that is?

Palys: There has been a slight increase compared to previous years. Construction companies, in general, are recognizing the value women can bring to their organizations and the industry at large. More and more companies are partnering with high schools and colleges to promote the benefits of working in our industry. They are also evaluating their recruiting, compensation and retention practices, as well as their company cultures to create more inclusive work environments. Consistency across the industry will be key to sustaining the ongoing growth in female participation.

What do you find most fulfilling about working in the construction industry?

Palys: Our industry is high-risk and low-profit. All of us who are working in this industry know that one mistake can be extremely costly. The fact that we can build buildings and infrastructure to support economic development and enhance the quality of life of people with such a small margin for error amazes me.

What advice do you have for other women interested in pursuing a career in construction?

Palys: The construction industry is not for the faint of heart. It is a demanding industry, and you will be challenged almost every day. However, the reward is proportional to your effort. You will

grow professionally and personally. You can be compensated well (especially if you are in the field). This is the best time for females to join our industry. Companies are recognizing more and more the value that you bring to the table and are looking for you. Seize the opportunity, we need you!

Maureen Ramirez, senior project manager in the Chicago office of Clayco

What led you to pursue a career in construction?

Rameriz: I received my bachelor’s degree in interior design and then pursued a dual master’s degree in architecture and civil engineering (construction management). While completing my graduate studies, I found myself falling in love with my construction coursework over design. I was captivated by the hands-on nature of construction, the idea of bringing projects to life and working alongside teams actually constructing buildings.

What challenges have you faced in building a career in a male-dominated industry like construction?

Rameriz: During my first project, I encountered skepticism from an individual who told me he believed that “women didn’t belong in construction,” but I refused to let that attitude deter me, and instead asserted myself saying, “Well, I am not going anywhere so let’s get to work.”

Throughout my 17 years in the industry, I have firmly demonstrated my commitment and have worked hard to prove my capabilities. Additionally, there is a

common perception that women can’t do it all, that you must choose to either have a family or a successful career in construction. While the construction industry is certainly demanding, it can be done. I have a family with three very active young boys at home and a successful career in construction, so I am proof that this is simply a myth.

Have you noticed an increase in the number of women entering the construction industry? If so, why do you think that is?

Rameriz: Yes, thankfully, there has been a noticeable increase in the number of women entering the construction industry. I attribute this to earlier exposure to STEM within primary education classrooms, giving girls opportunities to develop confidence in their abilities. These days, there are also more targeted initiatives aimed at women in construction that help to enhance networking within the industry. Lastly, there is a growing awareness within women in the industry about the importance of reaching back to younger female audiences and pulling them up, helping to uplift one another.

What do you find most fulfilling about working in the construction industry?

Rameriz: There are two aspects of working in construction that bring me immense fulfillment. The first is being able to see my work directly contribute to the end result of a finished building. It is so rewarding to look at a space and know that I worked to help bring it to life.

My first construction job wasn’t easy. I was on a project where we built a 24story addition on top of an existing, and fully operational, 33-story office tower. My experience on that project gave me incredible exposure to so many aspects of construction, and it was very rewarding to see the fruits of my labor contribute to the end product.

Second, I find the relationships I’ve made along the way to be invaluable. Over time, the industry becomes smaller, and it’s great to reconnect with colleagues and learn about their projects and personal growth. I have been fortunate to have had great mentors along the way – both men and women – who have seen my potential and challenged me in a way that has helped me to grow.

10 CHICAGO INDUSTRIAL PROPERTIES MARCH/APRIL 2024

vice president of performance excellence and ESG at Oakbrook Terrace, Illinois-based Graycor.

Michelle Palys

Maureen Ramiriz

What advice do you have for other women interested in pursuing a career in construction?

Rameriz: I have several pieces of advice for women interested in construction. First, don’t be afraid to take a chance on yourself. Second, put your head down and get to work. Don’t get distracted by what you think other people might think of you. It’s all about the work. Get involved and learn as much as you can by offering to help on that project or initiative that you are interested in or think you can learn from. Lastly, get connected. Try to identify someone that can be a mentor who will both challenge and encourage you on your career path. Join industry networking groups and volunteer your time and remember to lift up others in the industry.

Jessica Herrejon, project manager with Chicago's Urban Innovations

What led you to pursue a career in construction?

Jessica Herrejon: I grew up in a family household where the majority worked in construction. Hearing them talk about their day at work intrigued me and motivated me to look into this career path. I enjoy learning how something is

built and having the opportunity to be creative.

What challenges have you faced in building a career in a male-dominated industry like construction?

Herrejon: One of the challenges I've faced is finding my own style and approach of project management. Being the only female in the workforce had its challenges because I was taught there is only one way. Learning from other mentors and colleagues, I found my

style and a more feminine approach to certain situations.

Have you noticed an increase in the number of women entering the construction industry? If so, why do you think that is?

Herrejon: I have noticed a slow increase, and I am hoping to see more in the near future. I believe social media has increased visibility of the industry, so it is becoming a well-known career path that wasn't presented before to young women.

What do you find most fulfilling about working in the construction industry?

Herrejon: When working on a project it feels as if I am making an impact on history. With new construction projects I am part of a team that builds a structure from the ground-up knowing that it will last for decades. It's a great feeling driving by previous projects and knowing that I took part in the construction process of that building. I also enjoy knowing that I am helping the community by renovating old buildings and giving them life again.

What advice do you have for other women interested in pursuing a career in construction?

Herrejon: Become a sponge and absorb as much knowledge as you can. Do not be afraid to ask questions of your colleagues, mentors and even the subcontractors working in the field. Sit at the table instead of on the sidelines and make your presence known. Be true to yourself. Also build a strong foundation of honesty and trust. Follow through on your word.

Dalania LaSorella, administrative assistant with the Chicago office of Alston Construction

What led you to pursue a career in construction?

Dalania LaSorella: Growing up in a family of tradesman, construction has always been a significant part of my life. From an early age, I was surrounded by the sights and sounds of building projects, and I developed a deep appreciation for the craft and skill involved in construction work.

Twenty years ago, at a pivotal juncture in my life, an opportunity presented itself in the form of an entry-level position within a construction firm. Recognizing this as a gateway to actualizing my ambi-

WOMEN (continued on page 12)

11 MARCH/APRIL 2024 CHICAGO INDUSTRIAL PROPERTIES

Jessica Herrejon

tions, I seized the chance with unwavering determination. Little did I know then that this seemingly modest beginning would serve as the cornerstone upon which I would build my career.

One of the defining characteristics that have shaped my journey in construction is my steadfast commitment to collaboration and teamwork. From my earliest days as an entry-level clerk to my current role as a seasoned professional, I have always recognized the intrinsic value of collective effort. In an industry where success is often measured by the seamless coordination of diverse talents and skills, being a team player is not merely a desirable trait but an indispensable asset.

What challenges have you faced in building a career in a male-dominated

industry like construction?

LaSorella: While the construction industry has its formidable challenges, they are by no means insurmountable. As times change and attitudes evolve, there is a growing recognition of the importance of diversity and inclusion in driving innovation and success. By addressing the systemic barriers that hinder progress and fostering a culture of respect, equity and opportunity, the construction industry can embrace its potential as a truly inclusive and dynamic field where individuals of all backgrounds can thrive and contribute to its continued growth and success.

Have you noticed an increase in the number of women entering the construction industry? If so, why do you think that is?

LaSorella: There has been a noticeable increase in the number of women entering the construction industry compared to 20 years ago. More women are pursuing education and training in construction-related fields, leading to greater representation in various roles within the industry.

There has also been a shift in perceptions regarding women's roles in construction. While stereotypes and biases still exist, there is growing recognition

of the value that women bring to the industry in terms of diverse perspectives, skills and contributions.

There are now more resources and support networks available for women in construction, including mentorship programs, networking groups and advocacy organizations. These resources help women navigate challenges, access opportunities and advance in their careers.

Some companies and organizations have implemented policies and initiatives to promote gender diversity and inclusion in the construction industry.

What do you find most fulfilling about working in the construction industry?

LaSorella: The combination of seeing tangible results, solving challenging problems, working as part of a team, making a positive impact and continuous learning makes working in the construction industry incredibly fulfilling.

One of the most satisfying aspects of working in construction is being able to see tangible results of your work and its impact on the community. Whether it's constructing affordable housing, improving infrastructure or building sustainable structures, being able to physically see what you've helped create and knowing that your work is making a positive difference in the world can be incredibly rewarding.

What advice do you have for other women interested in pursuing a career in construction?

LaSorella: Advice that I would give women interested in pursuing a career in construction includes:

• Believe in Yourself: Have confidence in your abilities.

• Educate Yourself: Seek out educational opportunities to learn about the various aspects of the construction industry, including different trades, technologies and project management skills.

"The increasing occurrence of women in the industry serves as encouragement that we can flourish in a traditionally maledominated role."

• Network: Build relationships with other professionals in the construction industry, including both men and women. Networking can open doors to job opportunities, mentorship and professional development.

• Develop Your Skills: Focus on developing soft skills such as communication, problem-solving and leadership.

• Be Resilient: Recognize that you may face challenges and obstacles along the way, but don't let them discourage you. Stay resilient and persevere in pursuing your goals, knowing that your hard work will pay off in the end.

The construction industry is constantly evolving, so stay curious, keep learning, and be open to new opportunities for growth and development throughout your career.

Taylor Verdon, project manager with Rolling Meadows, Illinois-based BEAR Construction Company

What led you to pursue a career in construction?

Taylor Verdon: Although somewhat unexpected given my past background and interests, what led me to my current career were the unlimited chances the construction industry offers, such as career development, skill improvement and the need for greater diversity and inclusion in a traditionally male-dominated industry. My inspiration is confronting stereotypes and breaking barriers as I grow in my career.

What challenges have you faced in building a career in a male-dominated industry like construction?

Verdon: The most common challenges I’ve faced since beginning my career in construction were under-representation and the stereotype that I, as a woman, would have limited knowledge about the work. It can be intimidating to enter an industry where few women hold jobs let alone in leadership positions, which made it difficult to identify role models and mentors. But providing

a welcoming environment to other women through networking events and within my project interactions, I’ve been able to find validation in my work.

Have you noticed an increase in the number of women entering the construction industry? If so, why do you think that is?

Verdon: The increasing occurrence of women in the industry serves as encouragement that we can flourish in a traditionally male-dominated role. More and more organizations, like BEAR Construction, place an emphasis on diversity and inclusion to create supportive environments for women. However, I still see there are challenges in the form of workplace discriminations, a lack of women in leadership positions and a lack of training throughout the construction industry, including the subcontractor community.

What do you find most fulfilling about working in the construction industry?

Verdon: The construction industry offers a dynamic and rewarding environment. The experiences I find most fulfilling are overcoming challenges, establishing and nurturing client relationships and the opportunity to rise into a leadership position. Overcoming obstacles such as tight deadlines or navigating complex projects provides great satisfaction, whether it is developing innovative solutions to problems or effectively managing resources. Each challenge I solve builds confidence in my ability and spurs growth.

Working closely with clients of all levels to understand needs, preferences and project vision allows for the opportunity to form trust and connections. I believe an essential characteristic of construction and our success is the ability to grow a strong reputation, which leads to repeat business and referrals. I also like that by establishing my expertise, professionalism and ability to deliver results, my opportunity to hold a leadership position intensifies, and as my abilities to influence project outcomes and mentor others develop, I will begin to shape the future of the industry.

12 CHICAGO INDUSTRIAL PROPERTIES MARCH/APRIL 2024

WOMEN (continued from page 11) Taylor Verdon

Dalania LaSorella

What advice do you have for other women interested in pursuing a career in construction?

Verdon: Stay persistent. Some stretches of time will feel sluggish and some challenges will seem insurmountable, but hard work and dedication ultimately pays off. Staying committed to your goals and believing in yourself will lead to a successful career in construction.

What led you to pursue a career in construction?

Samantha Skopek: I have always been fascinated with architecture and buildings. I went to school for architecture at Illinois Institute of Technology. When I graduated, I wanted something more tangible. I wanted to be a part of the building being built, not just drawn on paper.

I enjoy working in construction because new challenges are presented every day. I enjoy working with different people with different backgrounds who come together to solve problems creatively and provide the best solution possible for our clients.

What challenges have you faced in building a career in a male-dominated industry like construction?

Skopek: I face all challenges with determination and perseverance. I put my best foot forward in everything I do and work as hard as I can to get what I want. I have always had strong male role models in my life that encourage me to do anything I set my mind to. Because of that, I never had the mindset that I would have challenges just because I am a woman. I chose to focus on how I can grow and not dwell on the things I can't control.

I never walk into a room thinking I am the smartest person. I always try to find something new I can learn from others. I also have a problem-solving mindset. When you are trying to work together to solve an issue and the “best idea wins,” it’s much easier to work with others. I believe my team-oriented mindset has

gotten me where I am today with a lot of respect from my peers.

What do you find most fulfilling about working in the construction industry?

Skopek: I love working with people. Construction is a relationship-based industry, from working with our clients to our subcontractors to our construction team. I enjoy learning from everyone on a project and being able to come up with creative, cost-effective solutions.

What advice do you have for other women interested in pursuing a career in construction?

Skopek: For anyone entering the construction field, never be afraid to ask questions and get advice. Be curious. And if there is an opportunity to learn something new, take it!

Cortney Boswell, project manager for Chicago’s GI Stone

What led you to pursue a career in construction?

Cortney Boswell: I sort of fell into the construction industry in 2013 when I started working for my family’s construction company in southern California. As a young girl, I had dreamt of being a fashion designer. While to most people fashion design may seem like a totally different field than construction, the two do go hand-in-hand, which is endlessly fascinating to me. Eventually, I found my niche with GI Stone, where I enjoy the opportunity to work on designing the stone and tile for iconic buildings like the Tribune Tower Residences.

What challenges have you faced in building a career in a male-dominated industry like construction?

Boswell: One of the biggest obstacles I face is being a woman in an industry many consider to be a man’s line of work, that women somehow aren’t suited for this kind of job. Sometimes our voices get drowned out in team discussions. Some teammates question our knowledge. And on multiple occasions, I’ve seen contractors walk past me to seek help from male project managers with far less experience. But that has begun to change in recent years, which I attribute not only to my positive attitude, experience and professionalism, but also to a rise in number of female colleagues in the industry. The more of us they see on job sites, in the board room and speaking on panels, the more things will change.

Have you noticed an increase in the number of women entering the construction industry? If so, why do you think that is?

Boswell: Yes, I’ve seen an increasing number of women project managers and even stone installers onsite over the past few years. I think our society is realizing the old notions about gender roles are outdated. If you feel passion-

ately about something and you have the skills, your gender doesn’t matter. I see women increasingly aware of and drawn to the design aspects of the job. I see it growing in the next few years to more woman project managers and eventually a growth in construction jobs for onsite female superintendents.

What do you find most fulfilling about working in the construction industry?

Boswell: When I am driving down Lake Shore Drive or taking my visiting

friends and family on the architectural boat down the Chicago River, I’m able to look at Chicago’s amazing skyline and say I was a part of creating some of the world’s greatest skyscrapers with some of the very best contractors. While I realize I’m just one cog in a complex machine, I feel like I’m leaving a legacy behind, and that gives me pride.

What advice do you have for other women interested in pursuing a career in construction?

Boswell: I would recommend volunteering with an organization like Habitat for Humanity, which will give you some experience on a job site. And then if you enjoy that experience, develop a skill by enrolling in either a trade school or studying project management or engineering. Ruth Bader Ginsberg once said, “Women belong in all places where decisions are being made,” and all decisions determine the future. Construction is, was and always will be the future. For my fellow women in commercial construction, stay focused on doing good work and be your own cheerleaders. No one wants me to succeed more than myself . . . and my mom.

13 MARCH/APRIL 2024 CHICAGO INDUSTRIAL PROPERTIES

Samantha Skopek, program manager with Buffalo Grove, Illinois’ PREMIER Design + Build Group

Samantha Skopek

Cortney Boswell

Guardians of your bottom line: The power of experienced attorneys in property tax appeals

By Brandi Smith

“It’s unfortunate, but it happens all the time,” said Fran O’Malley, managing partner at Worsek & Vihon, recalling the abundant and often too-late calls that come in from commercial property owners concerned about their property taxes.

Recently, O’Malley, who began working on property tax cases when he first joined Worsek & Vihon in 1991, shared that a client who bought a piece of property without consulting the Worsek & Vihon team was blindsided by taxes three times higher than expected.

“It will impact their marketability to sell the property going forward,” O’Malley lamented. “They're paying three times the amount of taxes that they'd be paying if it was located in most other areas of the county, but they didn’t call us until after they got the first tax bill, which was too late.”

That example is one of the myriad reasons law firms specializing in property taxation encourage property owners to involve counsel through the life cycle of real estate.

“Our firm works with organizations during the acquisition process, helping them underwrite the taxes, so they know what their pro forma is going to be moving forward realistically,” shared Molly Phelan, managing partner of the Chicago office of Siegel Jennings, a national property tax law firm.

Through Phelan’s experience, which ranges from multi-family portfolios to national commercial investment funds, including special use properties such as hospital campuses to multi-million-dollar manufacturing facilities, she is able to identify the nuances of each property and can outline a structure and strategy that aligns with the taxpayer’s goals.

“Then when they're looking to buy or sell a property, we help with the transition and structure of the sale to limit liability on current and future taxes after the sale,” Phelan said. “There are many opportunities to protect or lower taxes throughout the life of a property.”

In the interim between acquisition and sale, she and her peers are often helping clients navigate the property tax assessment system. For owners of commercial properties, these assessments represent more than just a bureaucratic exercise; they directly impact the bottom line, influencing profitability and investment viability.

"It’s not surprising that government officials sometimes overshoot the mark on value, or simply assess improperly."

“If you don't work with somebody who has a very in-depth knowledge of valuation for your specific asset class, you're going to be most likely overvalued in your appeal,” said Phelan.

Navigating the complexities of property tax assessments can be daunting, particularly when faced with inaccuracies, unfair valuations and escalating tax burdens.

“There are just so many pitfalls for the unwary,” said O’Malley. “For example, it’s not like the IRS, which has an April 15 deadline every year to file your federal income taxes. Instead, property tax appeal filing deadlines vary from year to year depending on the property’s location in each county and township. Plus, you have different customs and practices within each jurisdiction as well.”

In such circumstances, the expertise of experienced tax attorneys becomes invaluable. These professionals possess a deep understanding of tax law and assessment procedures, allowing them to effectively advocate for commercial property owners and challenge unjust assessments.

“The property tax assessment system is complex and impacted by many variables. The system is flawed in some ways due to the volume of real estate parcels to be assessed and the limited resources in local government,” added Brian Forde, partner at O’Keefe Lyons & Hynes, who has more than 20 years of experience representing Illinois commercial, retail and industrial property owners in real estate taxation appeals and litigation.

In Cook County, he explained, government assessing officers are tasked with valuing almost 2 million parcels of real estate with about 250 staff members handling that load.

“It’s not surprising that government officials sometimes overshoot the mark on value, or simply assess improperly,” Forde said. “That’s why it’s important to have property reviewed by someone outside of government who understands the system and can determine if the assessment is in line with similar properties.”

In the absence of a formal reassessment, fluctuations in interest rates and vacancy rates can cause market values to shift,

potentially reducing a property's actual value despite stagnant assessed values.

“The market is always in flux, so just looking at the market value of a property on a reassessment year is potentially missing an opportunity to reduce your taxes,” said Phelan. “It should be reviewed every year.”

In cities like Chicago, where office buildings represent a substantial portion of the assessed value, upcoming decreases in assessed values are anticipated. Such decreases, affecting approximately 25 percent of the city's assessed value, will necessitate adjustments in tax rates to compensate for the reduced revenue, impacting all property owners in the city. Thus, ongoing assessment and advocacy are essential to ensure that property taxes accurately reflect current market conditions, maximizing opportunities for tax savings and mitigating financial burdens for commercial property owners.

Property tax assessments wield significant influence over financial outcomes, often serving as a critical determinant of profitability and investment feasibility.

As O’Malley, Phelan and Forde have aptly highlighted, the landscape of property taxation is rife with challenges – from inaccuracies and unfair valuations to the limitations of government resources. Yet, amidst these complexities lies an opportunity for property owners to proactively manage their tax liabilities and safeguard their financial interests. By engaging the expertise of seasoned tax attorneys, property owners can navigate the intricate nuances of assessment procedures, leverage market insights to optimize tax outcomes and effectively challenge unjust valuations.

14 CHICAGO INDUSTRIAL PROPERTIES MARCH/APRIL 2024

Brian Forde

Fran O’Malley

Molly Phelan

Current state of lending and capital markets causing bottleneck for speculative industrial development

By Mike Yungerman, Executive Vice President and General Manager, Opus Development Company, L.L.C.

While the Chicago industrial market saw a record 40.1 million square feet of new construction deliveries in 2023, according to Colliers’ year-end market report, speculative industrial development starts across the Chicago area have cooled considerably. Construction starts have slowed to the lowest level since 2019. Developers, accustomed to the rapid pace of record-setting activity between 2020 and 2022, saw a swift decline in their pipelines that correlated with the Federal Reserve’s hiking of rates in 2022. In just a matter of months, it became tricky and sometimes impossible to pencil new speculative industrial projects due to inflationary pressures, increased interest rates and strains on capital availability.

Some new projects are happening, but underwriting new Class A speculative industrial projects remains challenging. The cost of debt remains higher than today’s exit cap rates, making the math difficult. Developers and investors are counting on future interest rate relief and continued rent growth to pencil deals.

When interest rates were low on construction loans, the cost of debt had some, but minimal impact on development proformas when compared to other risky line items (aside from leasing risk). Today’s higher rates significantly impact proforma costs for developers. When the Fed started raising interest rates in 2022, there was an immediate effect. Unlike interest rates for home mortgages that can be locked, construction loans are variable rate loans based on Secured Overnight Financing Rate (SOFR). While there isn’t usually a lot of movement day-to-day or month-to-month, there can be volatility over the course of a two- to three-year construction loan.

Recently SOFR rates have been trending around 5.25%, up from 4.5% a year ago with construction loan rates adding a 2.75% - 3.0% spread, putting loan rates around 8%. SOFR trending back downward will ease the cost of short-term, variable construction debt, which will hopefully enable more activity in the capital markets for developers.

Best-of-the-best projects

Many large banks like Chase, Wells Fargo and Bank of America are currently sidelined for construction loans. Their real estate portfolios, for the most part, are fully allocated with little to no

room for new loans. Meanwhile, regional banks have mostly limited lending to their best, existing clients and only for the best-of-the-best industrial projects – those with high barriers to entry, like infill sites and locations that are otherwise irreplaceable within the market. One example is Alsip Park 294.

Under construction and scheduled for completion in August 2024, Alsip Park 294 is an Opus project that checks all the boxes. It’s a two-building, 360,000-square-foot spec industrial development in a tight submarket on a 22-acre infill site. Just 25 miles south of downtown Chicago, Alsip Park 294 is a few blocks from the Cicero Avenue commercial corridor with abundant nearby labor and amenities. With immediate access to a full I-294 interchange, it’s visible from the interstate and is nine miles from the UPS package sorting hub in Hodgkins, nine miles from Chicago Midway Airport and 33 miles from O'Hare International Airport.

Even when debt and equity markets were at their tightest back in September 2023, Opus was able to secure

both a capital partner, Principal Asset Management, and a construction lender. The project made the cut due to offering unique site attributes that cannot be duplicated in the market.

Value-add development

Today’s financial environment, combined with higher construction costs, is generating more interest in value-add industrial developments.

Some capital investors are looking to buy older or non-traditional buildings or blighted projects for below replacement costs and then renovating, repositioning, and stabilizing them. Another approach is investing in a development that has near-term lease expirations that are at or below market rents. Upon lease expiration, rent renewals may be increased to market levels or new tenants could bring in market-level rents. If a building or site needs only modest improvements, a developer’s basis can be below replacement cost, providing higher return on investment and less risk than ground-up developments. However, there are a limited number of properties available that qualify for value-add

development, so we will likely see an up-tick in ground-up development starts in 2024, even if rates remain high.

What’s on the horizon

There are no two ways about it – the combination of the higher cost of debt and capital constraints are contributing to the lack of new speculative projects starts in the market. If I had a crystal ball, I’d estimate we won’t see movement on interest rates until the second half of 2024.

While this might sound like a lot of gloom and doom, there are reasons to be optimistic. The economy and job markets are strong and interest rates have stabilized – there hasn’t been a Fed increase since July 2023. And in recent months we’ve seen a slight uptick in activity for speculative industrial starts as compared to the second half of 2023. That could very well be an indication of what’s to come. We are watching the horizon closely.

16 CHICAGO INDUSTRIAL PROPERTIES MARCH/APRIL 2024

Alsip Park (Photo courtesy of Opus.)

While the market may have experienced a slowdown in activity, recent happenings indicate a resurgence of interest and activity. Factors such as stabilizing interest rates and the gradual shift from stockpiling to just-in-time inventory management contribute to this positive outlook.

“There are a lot of people who were pencils down, so to speak, and they've picked them back up in the past 90 days,” said Bergdoll. “It'll take a little bit of time for everybody to get going again, but that's why I'm hopeful for the second half of this year and the first part of the next.”

CRG's commitment to both speculative and build-to-suit projects reflects a versatile approach tailored to market demands. The company’s latest venture, the Cubes at ORD, marks a significant addition to Chicago's industrial landscape. Spanning 66,552 square feet on a 4.27-acre site in Franklin Park, this speculative project exemplifies the city's appeal to developers seeking prime locations. Situated southeast of O'Hare International Airport, the Cubes at ORD offer unparalleled transit infrastructure, including direct access to Interstate 294,

catering to the needs of small and midsize users in search of Class A space.

The project is scheduled for completion in the fourth quarter of 2024, and boasts modern amenities such as ESFR sprinkler systems, high-efficiency LED lighting, ample dock doors and storage spaces, and parking for both cars and trucks. With CRG's parent company, Clayco, leading the construction and CRG affiliate Lamar Johnson Collaborative serving as the architect, the Cubes at ORD promise to deliver top-tier facilities sought after by leading companies.

“At Darwin PW, clients rely on our deep experience in the Commercial and Industrial real estate industry to accurately value their holdings, and much more.”

For over 45 years, Darwin Realty has been a leader in industrial and commercial real estate. The company specializes in brokerage, property management, investment and development services primarily in the Midwest. Darwin’s highly qualified professionals are problem solvers and utilize a breadth of tools and knowledge to serve our clients best.

"There are a lot of people who were pencils down, so to speak, and they've picked them back up in the past 90 days."

“What's great about this project is that we will start construction in June of this year, and finish by the end of the year,” Bergdoll said. “We’ll be in a great position to take advantage of all this activity that's going to start again in the coming months.”

CRG gravitated toward that site, despite turmoil in the interest rate and investment markets, because of its size and A+ location.

“We are focused on locations similar to Cubes at ORD, and we’re definitely giving anything that is suitable for a 50,000- to 300,000-square-foot building a harder look,” said Bergdoll, pointing out that

the O'Hare submarket has maintained a vacancy rate of around 2 percent, showcasing consistent demand and limited land availability. “We know that's what’s needed in the market right now, so we’re looking for those opportunities.”

CRG's Cubes at ORD development illustrates Chicago's enduring appeal as a hub for industrial development. Against the backdrop of a dynamic market landscape characterized by resilience, demand, and strategic investments, the project exemplifies the city's ability to adapt and thrive amidst changing economic conditions.

Ed Wabick, SIOR Principal

17 MARCH/APRIL 2024 CHICAGO INDUSTRIAL PROPERTIES

INDUSTRIAL (continued from page 1)

Susan Bergdoll

Tenants didn’t flock to bulk warehouses and distribution space in 2023. But what about this year?

By Craig Hurvitz, director of national industrial research for Colliers

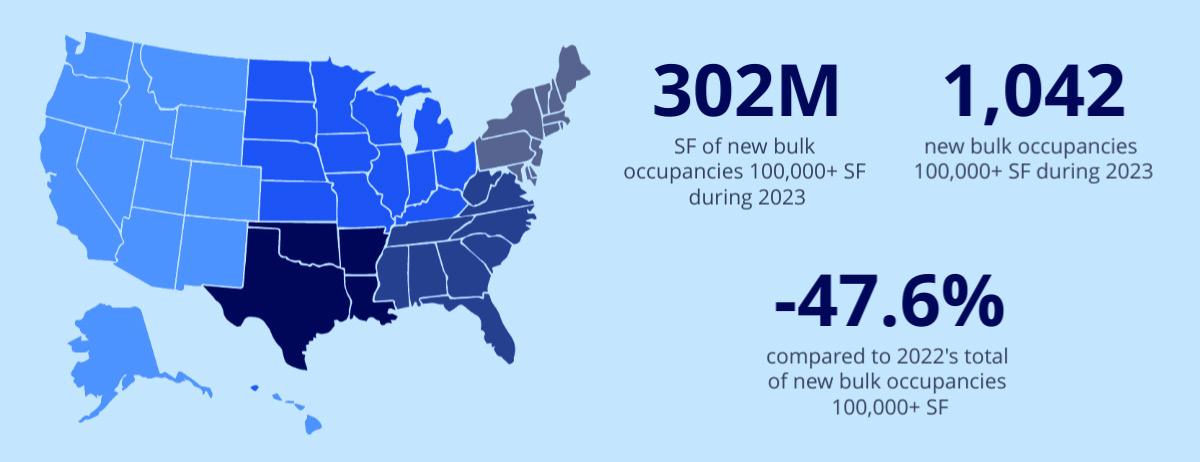

Industrial tenant demand cooled during 2023, particularly in bulk warehouse and distribution space.

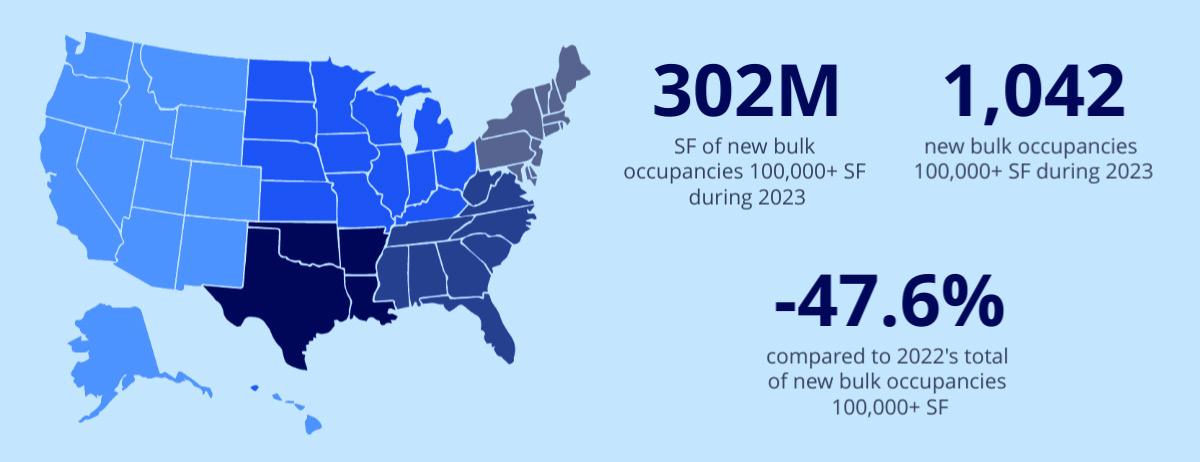

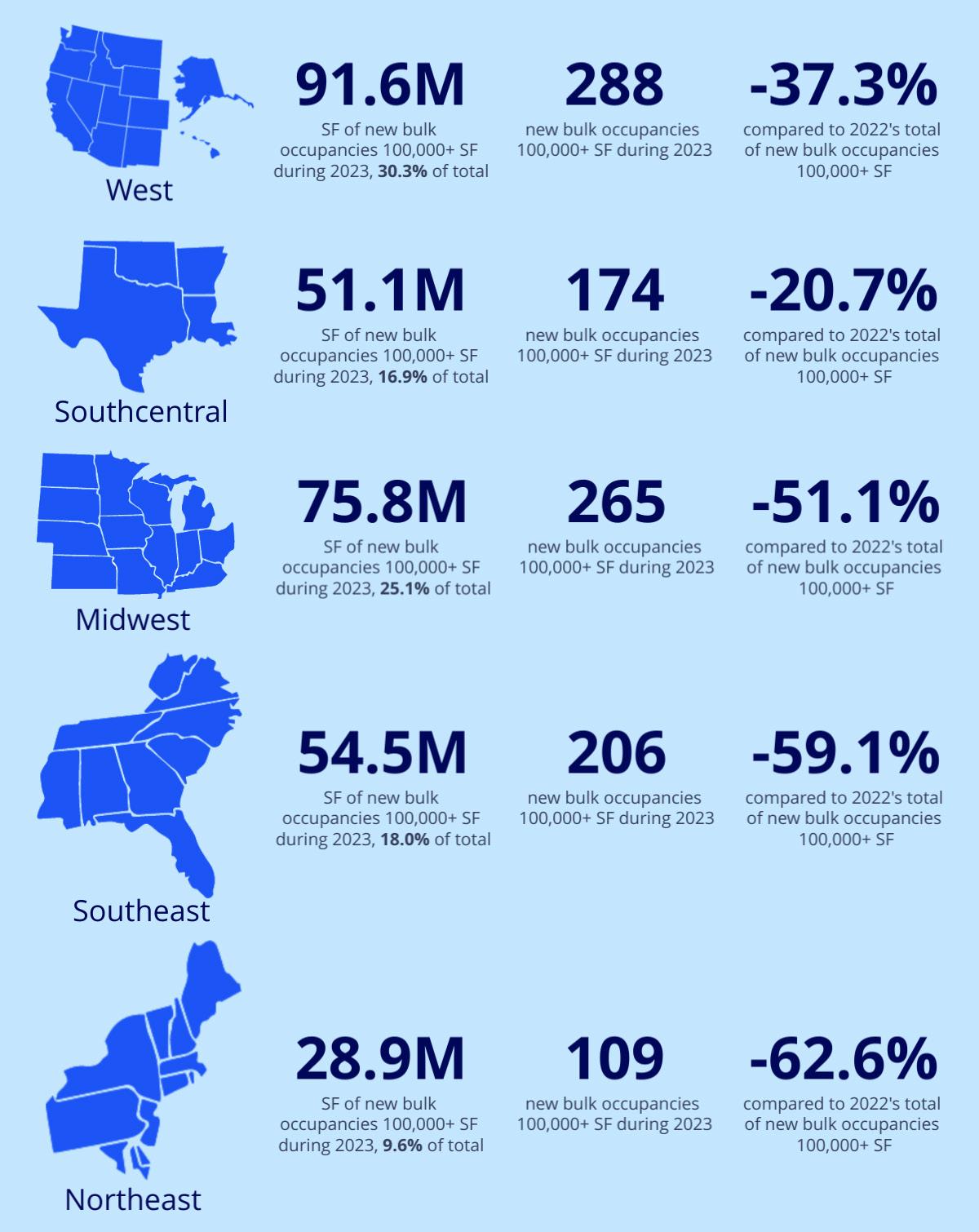

New industrial occupancies greater than 100,000 square feet totaled 302 million square feet during the year, a 47.6% decrease compared to 2022’s total of 576 million square feet. Tenants took occupancy on a total of 1,042 new leases and user sales in 2023 compared to 1,956 in 2022. The average transaction size for new bulk occupancies was 289,840 square feet, slightly smaller than last year’s average of 294,659 square feet.

New supply set a new bar as developers delivered 607 million square feet of new industrial construction, nearly 85% of which was built on a speculative basis. This new product, combined with the drop in demand and new bulk occupancies in 2023, pushed vacancy higher in every region of the country and in nearly every market nationwide.

In some emerging markets, vacancy increased by several hundred basis points during the year, nearing or eclipsing 10%. Following a nearly three-year period of constrained supply and record-low vacancy rates where tenants had few options, this modern product has been welcome, although it will take longer for vacancy to return to historical norms in markets where too much space has been delivered at once and vacancy has climbed into the double digits.

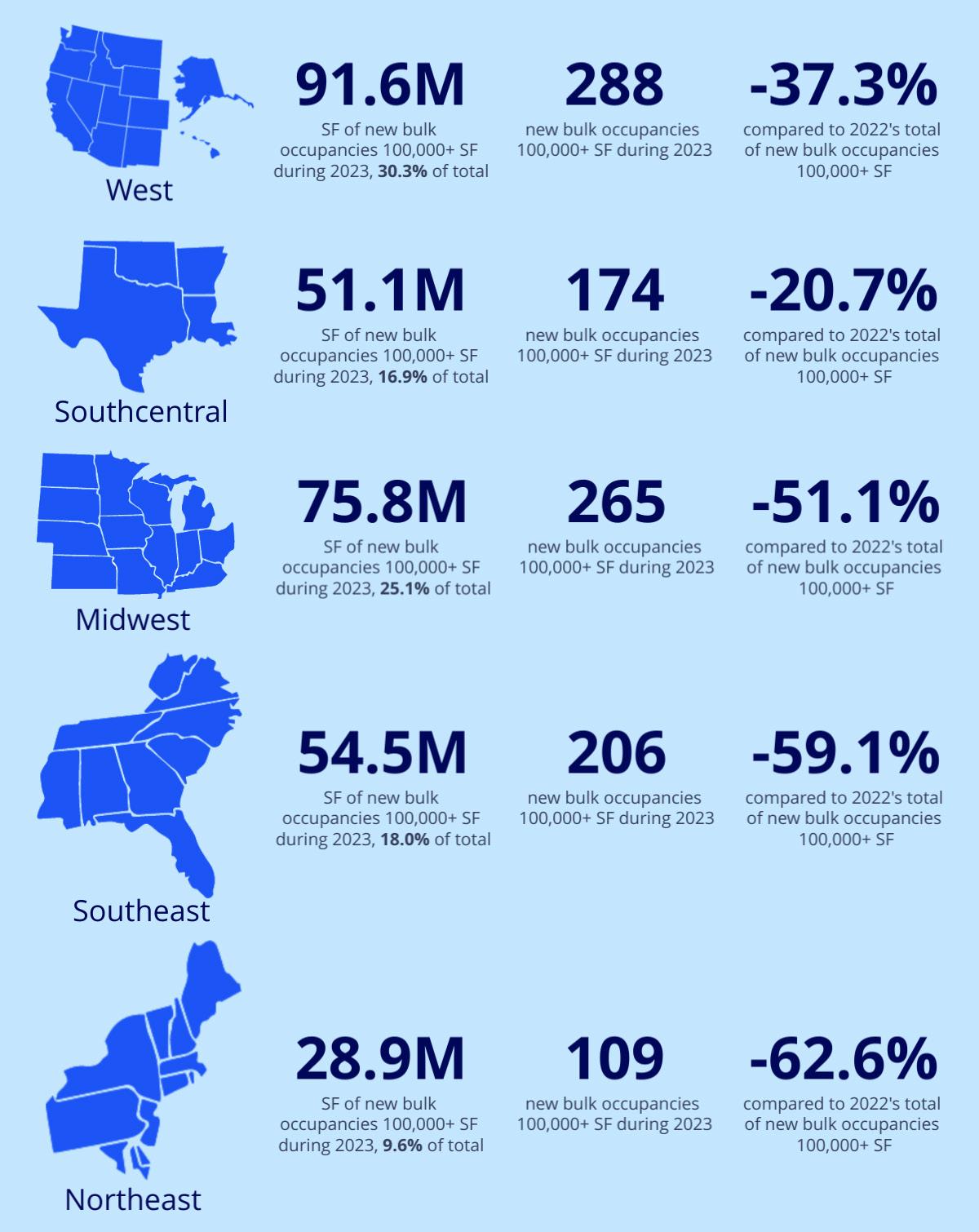

The greatest number of new bulk occupancies during 2023 occurred in the West region, where 288 tenants took occupancy in 100,000 square feet or more during the year, totaling 91.6 million square feet. This was a decrease of 37.3% compared to 2022’s total of 146.2 million square feet.

New bulk occupancies dropped by only 20.7% in the Southcentral region (Texas, Oklahoma, Arkansas and Louisiana), where they totaled 51.1 million square feet during the year. The greatest drop in new bulk occupancies took place in the Northeast region, where they totaled 28.9 million square feet during the year, a decrease of 62.6% compared to 2022.

Velocity fell off by at least 41% yearover-year in all size segments, with new occupancies between 300,000 and 499,999 square feet seeing the greatest decrease of 51.2%. While new bulk occupancies will decrease again in 2024, the year-over-year drop is forecast to be less dramatic as demand normalizes near pre-pandemic levels.

Similar to the last several years, third-party logistics providers and packaging companies occupied the most space in 2023, representing nearly one-third of the new bulk occupancies during the year. Manufacturing occupancies increased slightly to 16%, and this percentage is expected to increase further in 2024 as some of the large-scale manufacturing construction

18 CHICAGO INDUSTRIAL PROPERTIES MARCH/APRIL 2024

projects underway in response to the CHIPS act deliver.

A total of 44 manufacturing projects with an investment of $1 billion or greater were under construction at the end of 2023 or about to begin construction, most of which are semiconductor factories or electric vehicle battery facilities for users like TSMC, Texas Instruments, Samsung or Tesla. E-commerce users represented only 7.6% of new bulk occupancies during the year, a drop from 12.3% in 2022, largely due to Amazon significantly scaling back its expansion plans.

Despite the drop, Amazon was still the largest new occupier during 2023, taking 16.8 million square feet, although that is well below its total of 58.3 million square feet in 2022 and during each year going back to 2020. Target and Walmart followed as the second- and third-largest new occupiers, each taking at least 5 million square feet. Only five users took occupancy of 4 million square feet or more during 2023, compared to seven in 2022, another sign of the drop in demand.

Although new industrial bulk occupancies decreased by nearly 50% during 2023, this drop was anticipated as the

market resets following two years of exceptional and unsustainable demand. A drop in construction starts will limit how high vacancy can climb throughout the country, and moderated but still

19 MARCH/APRIL 2024 CHICAGO INDUSTRIAL PROPERTIES WE KNOW HOW TO GET RESULTS BECAUSE WE KNOW PROPERTY TAX LAW. We are the property tax law firm. It’s all we do, with 50 years of experience and billions in assessment reductions nationwide. Contact Mary Anne “Molly” Phelan and the team at Siegel Jennings for a no-fee, no-risk review of your portfolio. (312) 619-3550 • siegeltax.com PITTSBURGH • CLEVELAND • CHICAGO • COLUMBUS NATIONAL TAX REPRESENTATION LOCAL PROPERTY TAX EXPERTS - EST 1974 -

historically strong demand for industrial space will usher in the next growth cycle for the product type sooner than most expect.

Craig Hurvitz brings 17 years of commercial real estate research experience to his role as Director, National Industrial Research for Colliers' national team.

Image by icondigital from Pixabay.

The record-setting years keep coming: Colliers report highlights a data center sector that keeps on booming

By Dan Rafter, Editor

Another record-setting year. That's what the data center industry enjoyed in 2023, according to the latest research from Colliers.

According to Colliers' 2024 Data Center Marketplace report, the overall U.S. data center vacancy rate tumbled to 1.7% last year, with demand for data center space especially strong in markets such as Dallas, Atlanta and Northern Virginia.

But it's not just these major markets that are enjoying soaring demand. Colliers reported that Midwest markets, too, are seeing demand climb for data center space, pointing specifically to the Ohio market of Columbus as a hotbed of activity in this sector.

The low vacancy rates in the data center space aren't a surprise. Companies need ever more data center space. This is a trend that isn't slowing anytime soon. Just consider these numbers attributed to Statista Market Forecast: Global data center revenue is projected to have reached $325.9 billion in 2023. By 2028, data center revenue is expected to reach $438.7 billion, according to Statista.

What's driving this growth? Plenty of it is because of the explsoive growth of AI.

As Colliers says in its report, 2023 will be remembered as the coming-ofage year for AI. Applications such as ChatGPT and Dalle have captured the

imagination of companies and individuals, both of which are already testing the limits of what this technology can do. Colliers said that ChatGPT reached 100 million users across the globe in just two months. That's impressive, especially when you consider that it took Facebook four-and-a-half years to reach this same milestone.

Colliers says that the ability to scale resources on demand, critical to the rapid growth of AI, is driving demand for hyperscale cloud providers like Amazon Web Services, Google Cloud and Microsoft Azure. Because of this, hyperscale providers increased their megawatt output across North America to more

than 15.2 gigawatts last year, 17.8% more than the previous year.

This all points to 2024 being an even busier year in the data center market. Expect a surge in consruction of these facilities this year and continued tight vacancy rates.

Colliers reported that for the fifth consecutive year, the U.S. data center sector set a new record for absorption last year, absorbing 3,870 megawatts in 2023.

In somewhat of a surprise, the total amount of power under construction last year fell on a year-over-year basis by 68.8 megawatts. This wasn't because

20 CHICAGO INDUSTRIAL PROPERTIES MARCH/APRIL 2024

Image by tstokes from Pixabay.

of a lack of demand, though. Instead, the slowdown was caused by a lack of shovel-ready sites. Still, 282.1 megawatts of power was under construction last year. This doesn't mean that the data center space is free of challenges. Colliers pointed to NIMBYism as a big issue. Many residents don't want large data centers built near them, and they will fight new construction.

Then there is the labor shortage in the construction field. It can be challenging for developers to find the workers they need to build all the data centers that their clients demand.

Construction costs are high, too, which can make it difficult for developers to build today.

"It's harder to source the debt and equity to get the scale of these transactions done," said Michael Johnston, partner with Menlo Equities, quoted in the Colliers report. "The required yields are not going down since you have to make enough of a profit margin to justify taking the associated risk. I don't see this changing in the short term."

"It's harder to source the debt and equity to get the scale of these transactions done. The required yields are not going down since you have to make enough of a profit margin to justify taking the associated risk. I don't see this changing in the short term."

Rafal Rak, president of VP Digital Realty, agreed that costs are posing a challenge to developers.

"Supply chain and associated costs are still in flux," Rak said, also quoted in the Colliers report. "In particular, electrical equipment is still challenging and has tremendous risk."

Then there are the challenges associated with the speed of how the data

center industry is evolving. As Colliers says, data center designers and operators must constantly adjust to evolving technology, everything from the need for increased power density and cooling efficiency to security, remote monitoring, sustainability and green designs.

An example? Meta has stated that its upcoming AI-powered data centers will

incorporate an expanded utilization of liquid cooling.

"The evolution of the data center industry continues to be dynamic with increasing cloud adoption and expanding use-cases for AI," said Carrington Brown, senior managing director of development for Affinius Capital, as quoted in the Colliers report.

21 MARCH/APRIL 2024 CHICAGO INDUSTRIAL PROPERTIES

9450 West Bryn Mawr Avenue, Suite #120 • Rosemont, IL 60018 (847) 615-1515 Principle Construction Corp. recently started a build out located in the heart of downtown Lake Zurich for Après Pastry & Bakery. The build out will include all the necessary equipment and operations of a French pastry and bakery kitchen, including a walk-in cooler and freezer. With little room for error, precise planning was required to support the space while at the same time maximizing the area for customers and business operations. 2,540 SF Build Out Lake Zurich, IL

leads

enriched interior. PCC2024 IREJ Feb Ad (f).indd 1 2/16/24 2:31 PM

Design

to an

NEWS BRIEFS: The latest deals in Chicagoland

Clear Height Properties, ICP Funds purchase two industrial buildings in Northbrook

A joint venture partnership between Oak Brook-Illinois-based real estate investor Clear Height Properties and Houston-based ICP Funds has acquired two multitenant light industrial buildings totaling 93,059 square feet in Northbrook, Illinois’ Sky Harbor Industrial Park.

Located in Chicago’s infill North Cook County industrial submarket, the buildings are located at 720-730 Landwehr Road and 305-311 Era Drive. The portfolio is fully leased, with the Landwehr building being home to two tenants and the Era building home to three tenants.

Sean Devaney, Kurt Sarbaugh and John Huguenard of JLL were the sole brokers in the sale transaction.

Entre Commercial Realty sells 56,254-square-foot industrial property in McHenry

Entre Commercial Realty closed the sale of a 56,254-square-foot building at 4610 Prime Parkway in northwest suburban McHenry, Illinois.

This unique property had been on the market for more than two years prior to the owner engaging with Entre to evaluate and handle the sale earlier in 2023. The building was extremely specialized as a prior owner had outfitted a significant portion of the interior of the original warehouse building with a two-story production mezzanine.

While the layout worked for the prior occupant it had become evident over twoplus years of marketing time that it was too specialized for most of today’s users in search of higher cube warehouse space, lower office ratios and extra land.

Once retained by ownership, Entre engaged with an architectural firm, structural engineer and construction company to evaluate the feasibility and cost to remove

the partially structural mezzanine and restore the building to a more generic warehouse-type building that would meet today’s user demand.

Entre identified that the property could be transformed back to a smaller 42,000 square foot building with 21-25’ ceilings with an extra two-acre land parcel that could be used for vehicle parking, outdoor storage, etc. Upon completion of the engineering study, Entre re-launched the property to the market and there was significant interest from users searching for these features in a property. Ultimately the property was acquired by Viper Holdings, which provides scissor and boom lifts to the construction industry.

Entre’s Dan Jones, SIOR, Dan Benassi, SIOR, and Sam Deihs represented the seller while Adam Fortino of Marcus & Millichap represented the purchaser in the transaction.

Entre Commercial Realty brokers sale of 42,000-square-foot office property in Solon Mills

Entre Commercial Realty’s client JHB Group Inc., has acquired a 42,000-squarefoot building in northwest suburban McHenry County at 8104 N. Solon Road in Solon Mills, Illinois.

JHB Group designs and manufactures custom mobile response platforms primarily for public service agencies. The company’s products include mobile trailers and equipment used by municipal fire departments, police departments, military and other agencies for use in public safety operations, education, training and community outreach.

The new facility is an expansion for JHB Group which will be relocating from a smaller 15,000-square-foot building in Lake in the Hills, Illinois.

JHB was attracted to the building because of its large land site and potential to add multiple overhead service doors to allow for more efficient flow of trailers through the manufacturing and up-fitting process.

The property features heavy power, ceiling heights to 20’ clear and extra land for ample parking and outdoor storage areas.

JC Forney’s Ralph Huszagh represented the seller and Entre’s Dan Benassi, SIOR and Sam Deihs represented the buyer in the transaction.

22 CHICAGO INDUSTRIAL PROPERTIES MARCH/APRIL 2024

Photo courtesy of Clear Height Properties.

Photo courtesy of Entre Commercial Realty.

Photo courtesy of Entre Commercial Realty.

Brown Commercial Group negotiates 31,379-square-foot industrial sale in West Chicago

As Chicago food industry businesses look for industrial space for expansion, some are facing intense competition and a shortage of suitable locations. One recent example is specialty foods distributor Krishiv Foods, which missed out on a few opportunities to expand its space in 2023 due to the strong demand for space in some submarkets. The company recently found a new location in the western suburbs.

Brown Commercial Group represented the growing distributor of Indian food products in more than tripling its space with the purchase of a 31,379-square-foot building at 310-330 W. Charles Court in West Chicago, Illinois.

This transaction was an off-market opportunity sourced through Brown Commercial Group’s client network. Partner, Mike Antonelli, represented the seller, Spare Tire Enterprises, LLC, who originally purchased the building from Antonelli in an off-market sale in 2018. Given the significant increase in industrial building values since 2018, the seller realized a 55% increase in value.

Hanson represented the buyer, which will be moving from a 9,000-square-foot space in Elk Grove Village, Illinois.

CRG developing the Cubes at ORD industrial development near O’Hare

CRG is developing The Cubes at ORD, a 66,552-square-foot speculative industrial project on 4.27 acres at 3901 Fleetwood Drive in Franklin Park, Illinois, immediately southeast of O’Hare International Airport.

Located at the major intersection of Irving Park Road and Seymour Avenue, with direct access to Interstate-294 and the airport, the multimodal facility will accommodate small and mid-size users looking for Class A space in one of Chicago’s most supply-constrained industrial submarkets. Completion is expected in fourth-quarter 2024.

Well-known for developing large-scale warehouse and distribution centers in major national markets, like the 1.03 million-square-foot Cubes at Country Club Hills in south suburban Chicago, CRG also is acquiring and developing smaller facilities closer to major population centers. As consumers expect ever-faster delivery times, smaller, last-mile industrial facilities have become increasingly valued – and rare.

The O’Hare submarket recorded a 2.49% vacancy rate at the end of 2023, according to Colliers.

Once completed, The Cubes at ORD will offer the same modern features as CRG’s other Cubes-branded facilities, including ESFR sprinkler systems, high-efficiency LED lighting, 20 exterior dock doors, two drive-in doors, 11 trailer storage spaces and car and truck parking for 70 vehicles – all features sought by the nation’s leading companies. CRG’s parent company, Clayco, will serve as the builder for the project, and CRG affiliate Lamar Johnson Collaborative will serve as the architect.

CRG has engaged Avison Young’s Brian Colson and Brian Pomorski, both principals, Industrial Services, to spearhead leasing efforts for its development. In the land purchase transaction, CBRE’s Michael Caprile and his team represented the sellers, with Avison Young representing CRG.

IMPACT Strategies wraps construction work on U-Box Warehouse in Illinois

IMPACT Strategies, Inc. completed its work on the new U-Haul® U-Box® Warehouse Facility in Springfield, Illinois, at 3653 Octavius Via.

Despite recent inclement winter weather, IMPACT was able to complete the building for occupancy as of the end of January – the required time for move in by U-Haul.

With this completion, IMPACT has provided U-Haul with its largest U-Box warehouse facilities to date, sitting at 26,000 square-foot, with the capacity to store more than 1,500 U- Box containers. These U-Box containers provide consumers with an easy, efficient, and secure way to ship and store belongings.

ELIZABETH O’BRIEN represents developers and investors in a wide range of commercial real estate transactions, including acquisitions and dispositions, joint ventures, development, construction financing, construction contracts, and commercial leasing.

As the Real Estate Practice Group Leader, she provides keen legal insights and an innovative spirit to her clients and the industry.

23 MARCH/APRIL 2024

CHICAGO INDUSTRIAL PROPERTIES

120 S Riverside Plaza Suite 1800 Chicago, IL 60606 LPLEGAL.COM

Innovative. Pragmatic. Authentic.

Photo courtesy of CRG.

Photo courtesy of IMPACT Strategies.

The structure of this facility consists of a pre-engineered metal building manufactured by Chief Industries. For the building exterior, IMPACT utilized insulated metal panels (IMP) which are known for their superior thermal properties, design flexibility and fast installation time.

Though this marks the first completed project with U-Haul, IMPACT is well underway with two additional U-Haul projects – a five-story facility in Champaign, IL and two-building complex in Wentzville, MO. All three projects will total 290,306 square feet of new facilities for U-Haul, the industry leader in DIY moving since 1945.

IMPACT Strategies served as the general contractor in Springfield, IL with TR,i Architects as the architect-of-record for the project. With this completed warehousing facility, IMPACT continues to expand its expertise in its warehousing and distribution market experience.

Des Plaines’ The Missner Group names director of preconstruction

Des Plaines, Illinois-based The Missner Group has appointed John Elliott to its construction team. Elliott is joining the company as its director of preconstruction.

In his new capacity, Elliott assumes leadership of the estimating department, spearheading initiatives from the inception of projects. His role entails comprehensive oversight of cost analysis, scheduling, logistical planning, and other pivotal aspects crucial to project success.

With over 25 years of industry experience, Elliott boasts a background in construction management across various market sectors. Prior to joining TMG, he held key positions including Senior Construction Project Manager at Graycor, Construction Project Manager/Estimator at Power Construction Company, LLC, and Senior Estimating and Preconstruction Manager at InSite Real Estate, LLC.

Elliott has previously worked on notable projects such as The Fashion Outlets of Chicago in Rosemont, five different Tesla remodels throughout the Midwest, and 14727 Laplaisance Rd, Monroe Michigan (a 1.1 million square foot build-to-suit warehouse/distribution center). His project history spans across nearly every sector and size range.

The addition of Elliott marks TMG’s latest strategic move in bolstering its construction team.

Lee & Associates closes pair of industrial lease renewals in DuPage County

Lee & Associates has closed a pair of industrial lease renewal transactions in DuPage County, Illinois, totaling 112,917 square feet.

Jeff Janda and Mike Plumb, Principals at Lee & Associates’ Illinois office, represented tenant Atlas Wire’s renewal of 54,690 square feet at 1601 Glenlake Avenue in Itasca, Illinois. The building is owned by Prologis, which was self-represented.

Janda also represented landlord DRA Advisors on a renewal of 58,227 square feet at 951-953 Larch Ave. in Elmhurst, Illinois. Kevin Segerson of CBRE represented the tenant, Closet Works.

Oak Brook’s Core Industrial Realty announces $100 million in completed transactions

Core Industrial Realty, an Oak Brook, Illinois-based industrial brokerage firm, has completed the following transactions in the fourth quarter of 2023 and first of 2024.

950 Ice Cream Drive, North Aurora, IL (174,000 SF)