ASSET/PROPERTY MANAGEMENT FIRMS

BROKERAGE FIRMS

CONSTRUCTION COMPANIES/GENERAL CONTRACTORS

ECONOMIC DEVELOPMENT CORPORATIONS

FINANCE FIRMS

RE LAW FIRMS

ASSET/PROPERTY MANAGEMENT FIRMS

BROKERAGE FIRMS

CONSTRUCTION COMPANIES/GENERAL CONTRACTORS

ECONOMIC DEVELOPMENT CORPORATIONS

FINANCE FIRMS

RE LAW FIRMS

By Brandi Smith

Chicago’s industrial real estate market stands at a fascinating crossroads in 2025, defined by a paradox that presents both challenges and opportunities for developers and investors.

“We’re seeing very strong absorption rates in Chicago with vacancy rates under 5%,” said Matt Goode, Managing Partner of Acquisitions with Venture One. “Despite this, institutional capital hasn’t been as aggressive here compared to coastal markets.

demand and an investment opportunity waiting to be fully realized.

This unique dynamic underscores Chicago’s dual identity: a logistics powerhouse delivering robust

At the same time, economic headwinds, client demands and sustainability imperatives are reshaping

FORECAST (continued on page 8)

PUBLISHER

Mark Menzies menzies@rejournals.com 312.933.8559

MANAGING EDITOR Dan Rafter drafter@rejournals.com

VICE PRESIDENT OF SALES & MW CONFERENCE SERIES MANAGER Ernie Abood eabood@rejournals.com

VICE PRESIDENT OF SALES Frank E. Biondo Frank.biondo@rejournals.com

CLASSIFIED DIRECTOR

Susan Mickey smickey@rejournals.com

Chicago Industrial Properties® (ISSN 1546-377X) is published bi-monthly for $59 per year by Real Estate Publishing Corporation, 1010 Lake St Suite 210, Oak Park, IL 60301. Contact the subscription department at 312.933.8559 to subscribe. © 2025 by Real Estate Publishing Corporation. All rights reserved. No part of this publication can be reproduced or transmitted in any form or by any means, electronic or mechanical including photocopying, recording or by any information storage or retrieval system.

Dan Barrins Associated Bank

Ron Behm Colliers International

Susan Bergdoll CRG

Corey Chase Newmark

Dan Fogarty Stotan Industrial

Barry Missner The Missner Group

Adam Moore

First Industrial Realty Trust Inc.

Joe Pomerenke

Arco/Murray National Construction Company, Inc

Adam Roth NAI Hiffman

Mike Yungerman Opus Group

1

A view from the top: 2025 market leaders forecast Chicago’s industrial real estate market stands at a fascinating crossroads in 2025, defined by a paradox that presents both challenges and opportunities for developers and investors.

4

Robust capital flows set the stage for Chicago’s industrial growth in 2025 As capital flows into Chicago’s industrial real estate sector show no signs of slowing, Brennan Investment Group, led by Managing Principal Jack Brennan, is strategically positioned to capitalize on this momentum. Brennan’s combination of deep industry expertise, robust capital relationships and broker-friendly practices has positioned the company as a leader in the Midwest’s competitive industrial real estate market.

6

Chicago’s Industrial Market Steady in 2024 Chicago’s industrial market continued to exhibit steady fundamentals during 2024, though the market has seen a reset towards a new normal from the historic pace set during 2021 and 2022. The market registered 638,047 square feet of positive net absorption during the fourth quarter, bringing the year-end total to 8.1 million square feet

ASSET/PROPERTY MANAGEMENT FIRMS

BROKERAGE FIRMS

CONSTRUCTION COMPANIES/GENERAL CONTRACTORS

ECONOMIC DEVELOPMENT CORPORATIONS

FINANCE FIRMS RE LAW FIRMS

By Brandi Smith

As capital flows into Chicago’s industrial real estate sector show no signs of slowing, Brennan Investment Group, led by Managing Principal Jack Brennan, is strategically positioned to capitalize on this momentum. Brennan’s combination of deep industry expertise, robust capital relationships and broker-friendly practices has positioned the company as a leader in the Midwest’s competitive industrial real estate market.

“2024 was our company’s most active year from an acquisition’s standpoint, purchasing over $750 million in industrial assets,” said Brennan. “In 2025, we anticipate even greater investment in the sector as our appetite for industrial assets remains very robust.”

Brennan, who moved to the firm last fall, brought with him more than 12 years of experience in commercial real estate. Prior to joining the company, Brennan served as Senior Vice President at CBRE, where he co-led an industrial landlord and tenant representation team. During his tenure, Brennan managed more than $1 billion in transac-

"Given the breadth of our capital relationships, we can find the right partner for any given transaction."

tions nationwide and earned accolades such as CBRE’s RISE-ING Star Award and recognition on the Top Global Producers List in 2023.

Brennan Investment Group’s outlook for 2025 is supported by strong allo-

cations from capital partners. These investments span a variety of industrial specialties, including single-tenant net lease, value-add projects, development, industrial outdoor storage (IOS), data centers and corporate surplus properties.

“Given the breadth of our capital relationships, we can find the right partner for any given transaction,” said Brennan. “Our dedicated Capital Markets team has been an asset in securing equity and favorable debt terms. We continue to be very bullish in 2025 and have a skilled

team in place to navigate the challenges of the current environment.”

As a value-add industrial investor, Brennan Investment Group remains open to exploring new and emerging opportunities. While maintaining a generalist approach, Brennan highlighted the firm’s flexibility in evaluating adaptive reuse projects and logistics-focused developments.

Among the projects spearheading Brennan Investment Group’s 2025 portfolio is the Ninety Logistics Center in Hoffman Estates. The 201,600-square-foot property features prominent I-90 exposure and 34 trailer parking positions. Situated just 17 miles from O'Hare International Airport, the center benefits from excellent tollway visibility and a strategic location within The Huntington 90 Business Park. Additionally, the property boasts a 6B real estate tax incentive, making it an attractive investment opportunity.

“The Ninety Logistics Center is a particularly compelling opportunity for a user buyer,” said Brennan. “The long-term stable income on half of the property makes it an attractive investment.”

Brennan Investment Group attributes much of its success to its strong relationships within the brokerage commu-

nity. Many members of the company’s senior management, including Brennan himself, previously worked as brokers. This experience has shaped the firm’s broker-friendly approach, which includes paying fees if sellers will not, reciprocating on leasing and sale assignments and allowing brokers to invest in its deals when possible.

“The success of 2024 was made possible through our deep connections in the brokerage community,” Brennan said. “In 2025, we look to further those relationships and acquire more industrial assets.”

With a portfolio that spans 572 properties across 29 states, totaling 56.2 million square feet and $6.5 billion in

assets, Brennan Investment Group has established itself as a leader in industrial real estate investment.

“We’ve built our portfolio by marrying veteran industrial expertise with an unwavering commitment to our investors,” Brennan said. “This fusion of principle and perspective is what makes our performance possible.”

By NAI Hiffman

Chicago’s industrial market continued to exhibit steady fundamentals during 2024, though the market has seen a reset towards a new normal from the historic pace set during 2021 and 2022. The market registered 638,047 square feet of positive net absorption during the fourth quarter, bringing the year-end total to 8.1 million square feet.

Leasing activity slowed during the fourth quarter, with Chicago registering 5.7 million square feet of new leases signed, down 15.4% from Q3. Annual new leasing totaled 31.8 million square feet in 2024, down from 56.9 million square feet in 2023.

Following a 2021 that saw a record-high 81.7 million square feet of annual new leasing activity, velocity has cooled over the last several quarters due to economic pressures and slowing demand. While the number of leases remains active, the average size per lease is down from 2023. This is largely a product of the slowdown in new big box industrial deliveries, as well as a shift in strategy to a more localized approach towards shipping and logistics.

The I-80/Joliet Corridor paced all industrial submarkets in 2024 with 4.0 million square feet of new leasing activity during the year, adding several notable tenants including: Post Consumer Brands (1.0 MSF), Ecolab (677,028 SF), and RJW Logistics Group (639,917 SF). The I-80/ Joliet submarket has seen unabated demand over the last few years, with 37.0 million square feet of new leases signed since the start of the pandemic in 2020.

Additionally, while larger industrial buildings have seen moderated demand over the past 24 months, I-80/Joliet’s average lease size of 166,000 square feet underscores the continued demand for modern facilities strategically located with access to multiple transportation routes, including major interstates, rail, and relative proximity to major population centers.

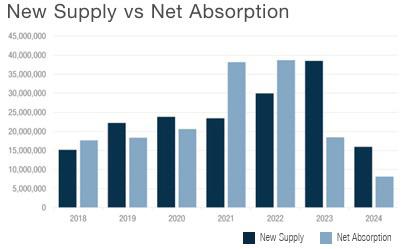

Vacancy measured 5.8% during the fourth quarter, up from 5.5% one year ago, and a cyclical low of 4.0% during Q4 2022, as 15.9 million square feet of new deliveries have come to market over the past 12 months. New supply has outpaced net absorption since the start of 2023, leading to some softening in the market. However, speculative construction starts have slowed significantly over the past year, which should begin to level the supply/demand imbalance that has resulted in rising new availability.

Additionally, we have begun to see a shift in the strategic direction of new construction, with developers adopting a more conservative approach with only 30.2% of inventory under construction

built on a speculative basis. With leasing velocity moderating, developers are now waiting for a major tenant commitment to break ground on new projects, a stark contrast from two years ago where nearly 80% of new development was being built on a speculative basis.

Chicago’s industrial outlook remains bright but economic pressures, elevated interest rates, and rising construction costs have recently slowed new groundbreakings and will contribute to a pullback from the historic inventory

growth levels of 2021 through 2023. However, Chicago remains uniquely positioned for sustained momentum, as its centralized location and expansive transportation infrastructure continue to draw major industrial players to the region.

Key expansions in sectors like biomedical research, technology, logistics, and manufacturing, highlight the city’s commercial vitality and innovative edge, making it a magnet for corporate relocation and expansion.

Additionally, with a myriad of global conflicts threatening to disrupt supply chains, we continue to see a push towards reshoring, accelerating domestic production and manufacturing demand. The overhaul of global supply chains is expected to increase demand for specialized industrial product, driving greater demand and potentially higher rental rates. Chicago stands to be a major beneficiary, as it maintains a competitive advantage over other large peer markets due to its superior water and power capabilities, as well as reduced climate risks.

Construction completions in Chicagoland trended back to prepandemic levels during 2024. Despite an uptick in construction completions in the fourth quarter to 4.3 million square feet, the yearly total came to 15.9 million square feet delivered in 2024 compared to 38.5 million square feet delivered in 2023.

Chicagoland’s industrial development pipeline has seen the return of buildto-suit developments in 2024. Having a committed tenant before breaking ground on a new development is now favored by developers as confidence in leasing new speculative space has decreased. Out of the 14.1 million square feet currently under construction, 9.9 million square feet are build-to-suit facilities with the remaining 4.3 million square feet being speculative developments. Respectively, build-tosuit represents 69.8% of all ongoing developments while speculative developments are 30.2% of all construction projects. 2.7 million square feet broke ground during the fourth quarter.

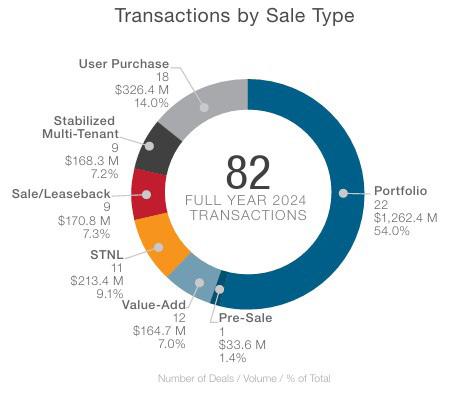

The total fourth-quarter 2024 industrial investment sales volume in the Chicago MSA is estimated at $740.2 million, representing a decrease of 4.4% from the prior quarter. During this period, 29 transactions occurred, totaling 8.4 million square feet across 37 buildings.

The full-year 2024 industrial investment sales volume is estimated at $2.3 billion, representing a 23.2% increase from the total annual sales volume of 2023. 82 transactions occurred, totaling 25.6 million square feet across 148 buildings.

Institutions and Advisors represented the most active buyers and sellers in 2024. The group purchased almost 8.5 million square feet of industrial product accounting for $852.6 million in acquisition sales, or 36.4% of overall volume. Institutions and Advisors were also responsible for selling almost 10.9 million square feet of industrial product - $970.7 million in disposition sales volume, or 41.5% of overall volume.

• Unemployment remains low at 4.2% as of November 2024, below pre-pandemic levels.

• Consumer spending continues to drive economic activity, but elevated inflation has prompted the Federal Reserve to maintain high interest rates, curbing price increases while creating headwinds for growth.

• Persistent inflation, rising interest rates, and global economic volatility pose risks to consumer confidence and financial markets, with potential ripple effects on commercial office and industrial demand.

• Unemployment in Chicago dropped to 4.9% as of November 2024, reflecting improvement in the local labor market.

• Total nonfarm employment declined by 7,500 jobs since the start of the year, signaling localized job market pressures.

• Sectoral Growth Highlights: Year-overyear gains were led by the Other Services sector (+4.7%) and Government sector

Our mission is to be a leading national developer of industrial real estate We will measure our success by the career growth of our employees, tenant satisfaction, investor returns, and our partners’ success Our shared values are the guideposts for achieving success

the industrial landscape, pushing industry leaders to adapt and innovate. From embracing clean energy solutions to capitalizing on Chicago’s strategic location as a logistics hub, the market is evolving to meet the challenges of the year ahead.

Perhaps the source of the most concern is the financial markets. The interplay of tariffs, treasuries and interest rates will remain central to industrial development this year.

“The industry will continue to be cautious and see what direction markets head under the new administration and the absorption of new deliveries,” said Michael Brazeal, Manager of Development Transactions with CenterPoint Properties.

“We’re still seeing the risk-averse nature of institutional capital at play, with many groups appearing to be waiting for some further clarity regarding interest rates and potential tariffs in Q1 and Q2 before aggressively deploying capital again,” said Matthias Trizna, Vice President of Development and Sales at Northern Builders. “It’s difficult to opti-

tion. “If the economy charges forward, we might continue to see inflation and rising interest rates, but that could also drive higher demand for industrial space.”

Conversely, an economic slowdown might lead to rate cuts but temper demand. Despite these challenges, several submarkets continue to show resilience and opportunity.

“Demand has remained strong in the I-80 corridor, where we concentrate our development efforts in the Chicagoland market,” said Brazeal.

He and Robin Stolberg, Executive Director and Head of Acquisitions with Clear Height Properties, both emphasized the enduring strength of the I-55 corridor and areas around O’Hare as well.

“O’Hare and Central DuPage are poised to continue their trend of near-record demand and low vacancy,” shared Vince Pergande, Vice President of Project Management for Logistics Property Company. “Both submarkets have exhibited significant rent growth, demonstrating occupiers’ willingness

"These properties continue to provide a strategic and valuable niche in the industrial landscape, particularly as their supply remains tight due to limited new construction and redevelopment trends"

to pay a premium for prime, infill locations near the airport.”

Venture One is also making waves with acquisitions like a 224,000-square-foot building in Joliet’s Cherry Hill Industrial Park. Goode described it as “a unique asset with a secured, paved, lit yard for outside storage and significant power

capacity.” The firm also recently purchased land in Crown Point, Indiana, to accommodate over two million square feet of industrial development.

Stolberg emphasized the value of multi-tenant, shallow-bay industrial properties in these areas.

“These properties continue to provide a strategic and valuable niche in the industrial landscape, particularly as their supply remains tight due to limited new construction and redevelopment trends,” he said.

“The lack of speculative product coming online poses a competitive advan-

"The rapid e-commerce growth in today’s world has been and will continue to fuel the rapid growth of the industrial footprint in Chicago and throughout the nation. Our buildings will continue to evolve along with our clients."

tage for developers that can break ground in the next 12-24 months,” Pergande explained.

Northern Builders just completed a speculative 221,000 square foot development in Bolingbrook and is advancing on two speculative projects in Joliet, consisting of an 802,000-square-foot facility (expandable to 1.2MSF) and a 183,000-square-foot building.

“While I-80 and I-55 remain clear leaders from a demand and leasing standpoint, we are seeing an increase in businesses, specifically out of South Cook County, inquire about lower tax alternatives in the I-57 Corridor and Northwest Indiana submarkets” Trizna said, adding that 35 cent taxes at their forthcoming Monee Corporate Center, for example, has been a major attraction for prospective tenants.

With clients increasingly seeking specialized facilities, elasticity in land use has also become a priority.

“Land inventory is integral when it comes to maintaining the flexibility to chase these specialized manufacturing, processing and cold storage requirements while concurrently developing speculative product,” said Trizna. “We are continuing to double down.”

As e-commerce and supply chain evolution reshape industrial needs, Brazeal emphasized the importance of staying close to clients.

“The rapid e-commerce growth in today’s world has been and will continue to fuel the rapid growth of the industrial footprint in Chicago and throughout the nation,” he said. “Our buildings

will continue to evolve along with our clients.”

Pergande, meanwhile, shared that clients are focused on getting as close to their consumers or critical logistics infrastructure as possible to minimize delivery times and costs.

“This is driving infill redevelopments of older non-functional industrial assets,” he said. “Further, with the demand for class B suburban office space continuing to fall, this provides another source for redevelopment opportunities to fulfill user demand.”

A prime example is Logistics Property Company's 1237 W. Division project, the region's first multistory logistics facility. Located in downtown Chicago's Goose Island neighborhood, the 1.2 million SF facility is within 5 miles of approximately $2 billion in e-commerce customers.

Evolving supply chain demands also favor specific asset classes.

“We’re seeing increased interest in cold storage facilities and data center space, reflecting broader trends in industrial land use,” Goode said.

These specialized assets often attract high-credit, low-risk tenants, which are particularly appealing to investors.

Chicago’s industrial real estate market is attracting institutional capital, albeit with some unique challenges and opportunities. Stolberg emphasized the importance of fundamentals.

“Our focus remains on what we can control: adhering to core fundamentals like well-located, high-quality real estate, ensuring comfort with our basis through replacement cost analysis, and delivering highly functional, efficient industrial units that meet the needs of our tenant base,” he said.

Chicago’s central location also plays a vital role in its investment appeal.

“Its position as a transportation and logistics hub makes it ideal for businesses requiring efficient distribution and supply chain operations,” Stolberg added. “The market’s accessibility, combined with its vibrant economy, sustains long-term institutional interest.”

Technological advancements and sustainability initiatives are shaping industrial development strategies.

“Solar is the renewable energy technology that everyone is talking about in the commercial real estate space,” said Trizna. “I think we will see more solar projects announced in Illinois within the next ten years than we have seen in all the previous years combined. Between federal and corporate sustainability initiatives and the explosive growth trajectory of data centers and the EV market, why would anyone not take advantage of utilizing and/or monetizing vacant rooftop real estate if it is a net positive?”

Brazeal noted that sustainable construction is a core pillar of CenterPoint Properties

“Our developments in Chicagoland achieve LEED certifications and offer users renewable energy options, energy-efficient HVAC and lighting, and water-saving landscaping,” he said.

Pergande observed that sustainability will continue to integrate with industrial projects.

“We expect to see continued integration of sustainable design and construction standards and energy-efficient technologies in 2025,” he said.

Stolberg added that sustainable construction aligns with both regulatory needs and tenant preferences.

“Sustainable construction ensures our developments are ready for future regulatory and environmental conditions. It is also high on users’ lists of needs when evaluating development opportunities,” he said.

Goode emphasized the role of alternative energy and data centers in driving absorption within the industrial market.

“The production of clean energy and batteries along with the growth of data centers is contributing significantly,” he said. “These trends reflect broader shifts in industrial demand.”

While 2025 brings uncertainty, industrial developers and investors are positioning themselves to adapt and succeed.

“Many developers are in a wait-and-see mode right now, but they’re positioning themselves to hit the ground running when favorable news hits and underwriting metrics improve,” said Trizna.

Principle is currently working with Stotan Industrial and their partner, PCCP, on a state-of-the-art, 100,400 SF speculative warehouse located at 350 N. Wolf Rd., in Mt. Prospect. The 100,400 SF building will offer a 32’ clear height, 12 truck docks (expandable to 21), 21 trailer stalls, and ample auto parking. Converting vacant office building to Class A Industrial in

100,400 SF Spec. Warehouse Mt. Prospect, IL.

ALVAREZ & MARSAL PROPERTY SOLUTIONS

205 W Wacker, Ste 516 Chicago, IL 60606

P: 312.606.0966

Website: ampsre.com

Key Contacts: Kevin Halm, Managing Director, khalm@ampsre.com; Pete Kontos: Managing Director, pkontos@ampsre.com

Services Provided: AM-PS provides property management, project management, and brokerage services to owners and occupiers of office, retail, and industrial real estate. Company Profile: AM-PS was born out of the desire to take the strategic mindset and processes of the renowned business restructuring firm Alvarez & Marsal and reframe them for the commercial real estate world. Our approach solves problems, improves performance, and unlocks value for our clients. Our work has positively impacted real estate and those who interact with our properties nationwide.

S74 W16853 Janesville Road

Muskego, WI 53150

P: 414.369.3511 | F: 414.435.0251

Website: outlookmgmt.com

Key Contact: Ray Balfanz, President/Partner, ray@outlookmgmt.com

Services Provided: Full service property and asset management services, financial analysis and reporting; budget preparation and expense reconciliations; lease administration; construction management; preventative maintenance and consulting services.

Company Profile: Outlook Management Group, LLC AMO provides comprehensive property and asset management services for all asset classes in multiple states and markets.

Notable Properties Managed: Washington Corners, Naperville, IL; Ironwood Office Park, Glendale, WI; Wood River Condominiums, West Bend, WI; Seven 10 West Luxury Apartments, Chicago, IL; MDJD Aesthetic MOB, Rockford, IL, Ascension Health MOB Milwaukee, WI; Henry Ford Health Systems Pharmacy Services Bldg. in Rochester Hills, MI; Henry Ford Medical Center in West Bloomfield, MI; Baptist Medical Center South, Montgomery, AL; and Lee Memorial Health Systems Building in Fort Myers, FL.

SPACESHIFTS

3 E. Huron St. Chicago, IL 60611

P: 872.267.2691

Website: spaceshifts.com

Key Contact: Delanie Prince, Operations Manager, info@spaceshifts.com

Services Provided: SpaceShifts is a platform for optimizing vacant workspaces, not subleasing. It enables the options of utilizing vacant workspaces, sharing staff overhead, and amenities, and helping businesses maximize their property and resources.

Company Profile: SpaceShifts is a unique platform connecting individuals seeking workspace with businesses having extra space to rent. Terms are flexible and arranged by the parties involved. The service is currently free. Sign up at SpaceShifts.com to explore this opportunity.

9550 W. Higgins Road, Suite 400 Rosemont, IL 60018

P: 847.374.9200 | F: 847.374.9222

Website: www.meridiandb.com

Key Contact: Paul Chuma, President; Howard Green, Executive Vice President

Services Provided: Meridian Design Build provides construction and design/build construction services on a national basis with a primary focus on industrial, office, medical office, retail and food and beverage work.

Company Profile: With a team of in-house professional project managers, Meridian has extensive experience coordinating the design and construction of new buildings, tenant improvements, and additions/renovations from 15,000 square feet to 1,000,000+ square feet. Meridian Design Build has been a Member of the U.S. Green Building Council since 2007.

Notable/Recent Projects: Venture Park 47, Huntley, IL - 729,800 sf speculative industrial facility for Venture One Real Estate. Lion Electric, Joliet, IL - 928,500 sf electric bus / medium duty truck assembly plant for Clarius Partners. Greenwood Truck Terminal, Greenwood, IN - 125 door truck terminal on 43 acres for Scannell Properties.

9450 West Bryn Mawr Ave., Suite 120 Rosemont, IL 60018

P: 847.615.1515 | F: 847.615.1598

Website: pccdb.com

Key Contacts: Mark L Augustyn, COO, maugustyn@pccdb.com, James A.. Brucato, President, jbrucato@pccdb.com

Services Provided: Principle specializes in commercial and industrial property and is committed to providing clients with the highest level of design/build construction services with an absolute dedication to each project.

Company Profile: Design/Build General Contractor established in 1999 specializing in the design and construction of Build-to-Suit, Speculative, Retail, Food Processing, Expansions/Additions, Tenant Improvements, & Specialty Facilities. Principle also has extensive experience in interior improvements, site evaluation, due diligence, and value engineering.

Recently Completed Projects include:

• 282,588 SF dry-cleaning facility for Tailored Brands, at 2000 Deerpath Rd. in Aurora, IL.

• 31,200 SF facility for Alvil Trucking, at 2570 Millenium Dr. in Elk Grove Village, IL

• 6,200 SF Warehouse for Superfast Trucking, at 1001 Raddant Rd. in Batavia, IL

2000 Center Dr., Suite East C219 Hoffman Estates, IL 60192

P: 847.392.6900

Website: victorconstruction.com

Key Contact: Zak Schuttler, President, ZakS@victorconstruction.com

Services Provided: Victor Construction Co., Inc. manages projects from ground-up site developments to interior buildouts, specializing in retail, industrial, and commercial markets.

Company Profile: Victor Construction Co., Inc. remains a family-owned and operated General Contractor. Having been in business since 1954, our firm has extensive experience managing every aspect of interior construction for the corporate, manufacturing, industrial, and retail sectors.

Notable/Recent Projects: Owens + Minor Distribution – 600K SqFt distribution facility that involved a full LED lighting upgrade, new HVLS fans, 200K SqFt section that required new cooling for medical distribution, an office renovation of 20K SqFt, and a new exterior employee pavilion.

ECONOMIC DEVELOPMENT CORPORATION OF MICHIGAN CITY

Two Cadence Park Plaza

Michigan City, IN 46360

P: 219.873.1211

Website: www.edcmc.com

Key Contacts: Clarence Hulse, Executive Director, chulse@edcmc.com

Karaline Cartagena Edwards, Economic Development Manager, kcedwards@edcmc.com

Services/Demographic Info: Up-to-date inventory of commercial buildings, site selection and orientation tours.

Incentives: Tax-Increment Financing, Façade Improvement Grants, Property Tax Abatements, Enterprise Zones, Job Training Programs

Recent CRE Activity: Double Track Northwest Indiana: $1.6 Billion development reducing train travel to Chicago to 60 minutes; The Franklin at 11th St. Station: $100 Million Development with Residential & Retail Space; “You are Beautiful”/SoLa: $311 Million Mixed-Use Multi-Family Development with 235 boutique hotel rooms & 174 Luxury Condos; Burn ‘Em Brewing: $3 Million Expansion project with 30 new jobs.

WORSEK & VIHON, LLP

180 North LaSalle Street, Suite 3010

Chicago, IL 60601

P: 312.917.2307 P: 312.917.2312 | F: 312.596.6412

Website: wvproptax.com

Key Contacts: Francis W. O’Malley, Managing Partner fomalley@wvproptax.com; Jessica L. MacLean, Partner jmaclean@wvproptax.com

Services Provided: Worsek & Vihon, LLP represents tax payers in Illinois by limiting their property tax liabilities through ad valorem appeals. We have over 40 years of experience and can handle basic to the most complex assessment issues while offering the dependable, personalized attention our clients deserve. We have experience representing owners of all property types. In addition to filing thousands of appeals with the Cook County Assessor, we have been involved in numerous proceedings before various Boards of Review, the Illinois Property Tax Appeal Board, and the Circuit Court of Illinois, and have appeared before the Illinois Appellate and Supreme Courts.

Company Profile: Worsek & Vihon LLP, is a team of experienced attorneys singularly focused on real estate tax law. The firm is dedicated to minimizing property tax liabilities through strategic tax portfolio management, well-researched, creative appeal preparation and aggressive advocacy.

VILLAGE OF HUNTLEY

10987 Main Street

Huntley, IL 60142

P: 847.515.5268

Website: huntleyfirst.com, huntley.il.us

Key Contact: Melissa Stocker, Development Manager, mstocker@huntley.il.us

Services/Demographic Info: Huntley, a northwest suburban Illinois community of greater than 29,000 residents, is conveniently located at the crossroads of Interstate 90 and IL Route47. Proximity to the interstate and to international and cargo airports in Chicago and Rockford make Huntley an ideal location for businesses looking to escape the congestion of more populated areas while reaping the benefits of a Chicago market location. Village of Huntley staff provides comprehensive services including site selection assistance and demographic resources, visit huntleyfirst.com to start the search for your new home for business. Residential construction continues with three subdivisions actively building. Huntley is home for your business, and home to the right employees for your business.

Population In Primary Trade Area: 97,283

Incentives: TIF District, Fast Track permitting and development approval process

CRE Activity: Huntley is home to leaders in business. Join Weber, Northwestern Medicine, Amazon and many others that chose Huntley as their home for business. Hampton Inn recently opened in Huntley. Amazon has begun operations in two Huntley facilities. E-Logistics firm headquarters are underway. Speculative development is underway and available near the tollway. Multiple retail strip centers are in the planning and construction phases. With land available for custom-tailored facilities, businesses seeking sites recognize Huntley as a prime location for operations.

10000 W. 151st Street

Orland Park, IL 60462

P: 708.364.9131

Website: emarquettebank.com

Key Contact: Gene Malfeo, Senior Vice President, gmalfeo@emarquettebank.com

Services Provided: Full line of Commercial, Business and Real Estate loans customized to your individual needs including: commercial and residential construction loans, commercial mortgages, equipment loans and working capital lines of credit. Company Profile: Marquette Bank started in Chicagoland in 1945 and is still locallyowned/operated. Expect quick decisions, competitive rates, easy application and personal service. Personal/business banking and lending, home mortgages, land trust services, estate planning, insurance services, wealth management and multifamily lending.

1000 N Water Street, Suite 1700

Milwaukee, WI 53202

P: 414.298.1000

Website: reinhartlaw.com

Key Contact: Joseph Shumow, Shareholder, jshumow@reinhartlaw.com

Services Provided: Reinhart is a full-service, business-oriented law firm that delivers innovative, value-added solutions for today’s most important real estate needs, including land use and zoning; tax incremental financing; tax credits; leasing; construction; and condemnation and eminent domain issues.

Company Profile: With the largest real estate practice in Wisconsin and offices throughout the Midwest and across the country, Reinhart’s attorneys offer clients customized real estate insight rooted in broad knowledge and deep experience to help you capitalize on opportunities no matter where you do business.