Think Be the Build.

pdbgroup.com ADAPTIVE REUSE COMMERCIAL INDUSTRIAL INTERIORS MEDICAL MULTIFAMILY

“decarbonization,” Chicago now requires all new construction warehouses to be built with reinforced steel and roofs that can hold the weight of solar panels, said Paul Heitman, Director of Heitman Architects, Inc. “Though not yet a requirement, the trend will continue into the suburbs because that’s the direction our industry is heading.”

Heitman also said that employee amenities once reserved for office tenants are finding their way into industrial developments. Walking paths, outdoor public spaces and EV charging stations are a material part of master-planned developments. Panelists referenced a new business park in Glenview being developed by Dermody Properties that includes such design elements.

“Industrial tenants want these amenities because they are competing for employees just like office tenants,” Cawley’s Josh Hearne added. Collaborative work spaces with higher-end furniture inside the building are also part of the new amenities package for industrial. “We’re seeing tenants build a little more office space to accommodate these new amenities,” Stauber added.

Hearne and Stauber both predicted that tenants will require more dock positions and more trailer parking next year. “The standard now is one dock for every ten

thousand square feet of warehouse,” Hearne said. “That could grow to seven and a half or eight in the next few years.”

In addition to the information provided by the panel, CRG Principal and Chief Development Officer Chris McKee highlighted the impact of onshoring in Chicago.

“Manufacturing operations that previously took place oversees are moving back or closer to the U.S.,” he said, “where users can take advantage of efficiencies afforded by newly built Class-A facilities that allow goods to be produced closer to end users, reducing transit costs while lowering the risk of future supply chain disruption.”

Accordingly, CRG’s focus is on infill sites and one-million-square-foot “big-box” logistics centers, like its branded facilities collectively known as The Cubes, located about 20 miles SW of Chicago. The project is especially attractive to users who are looking for modern logistics facilities to keep pace with the boom of e-commerce and today’s supply chain needs, and McKee said developments of this kind will remain viable and in high demand for the forseeable future.

CRG currently has 17 active projects of this kind, which are anticipated to deliver over 12 million square feet of Class-A space.

6 ILLINOIS REAL ESTATE JOURNAL DECEMBER 2022

BOOM

(continued from page 4)

Principle has been selected to build a new 31,200 SF new truck maintenance facility at 2570 Millennium Dr. in Elgin. The building will house a 15,400 SF warehouse, a 9,800 SF truck maintenance area, and 6,000 square feet of office space. The office area will have five offices, open office areas, a conference room, separate break rooms for drivers, mechanics and office staff, an IT-room, and two multi-fixture restrooms. Principle is also constructing a 972 SF mezzanine storage area and amenities for truckers using the facilities, including showers and rest areas. 9450 West Bryn Mawr Avenue, Suite #120 • Rosemont, IL 60018 (847) 615-1515 fax (847) 615-1598 31,200 SF New facility Driving forward with a new modern facility. PCC2022 IREJ Nov Ad (f).indd 1 11/28/22 1:55 PM

LEFT TO RIGHT: Keith Stauber, Managing Director, JLL; Moderator John Coleman, Managing Director, MK Asset Brokerage/Asset Management; Josh Hearne, Principal, Cawley Chicago; Paul Heitman, Director New Business Development, Heitman Architects Inc.; William Hasse III, President, Hasse Construction Co, Inc.; David Michael, VP Sales, Peak Construction

630.510.4570 • siorchicago.org The Top Brokers Thank the Top Sponsors! 2022 Platinum Sponsors SIOR Chicago Chapter thanks our 2022 Platinum Sponsors for their support! Sam Badger, SIOR President Peter Billmeyer, SIOR Vice President Sergio Chapa, SIOR Treasurer John Cassidy, SIOR Secretary Sean Henrick, SIOR Director-At-Large Adam Marshall, SIOR Past President FOLLOW US: ! @siorchicago ! SIOR Chicago @siorchicagochapter

dog-friendly building with a hospitality-inspired lounge, rooftop garden and on-site parking, to name a few. 167 Green Street even has a full-size basketball court, an extreme amenity, but sets a standard, nevertheless.

Mark Goodman & Associates is currently working with a company that surveys employees to identify the demands that will differentiate their projects from others, but Goodman added that the responsibility doesn’t fall solely on the building owner. It’s up to the businesses, too, to establish a company culture that attracts employees to the workspace.

“Employees are unable to form an attachment to where they work,” Goodman said, “if they don’t have a relationship with their co-workers” that goes beyond the screen.

But this might sort itself out in time as businesses continue to figure out what works and what doesn’t. Some aren’t requiring people to work in office at all, while others are, and many maintain the option that the latter will perform better across the board. How long it will take for businesses to share the same view is unknown.

“That’s not the case now because employees want flexibility, but if businesses that require in-office attendance perform better

than those that don’t, eventually that will begin to take hold,” Goodman said.

Multifamily/Mixed-Use

With thousands of units delivered this year alone, some might call it a year for the books. The market itself remained strong, with rent up about 9% in Chicago YOY. Because of the delay in units being delivered as a result continued economic roadblocks, rent is predicted to remain robust throughout 2023.

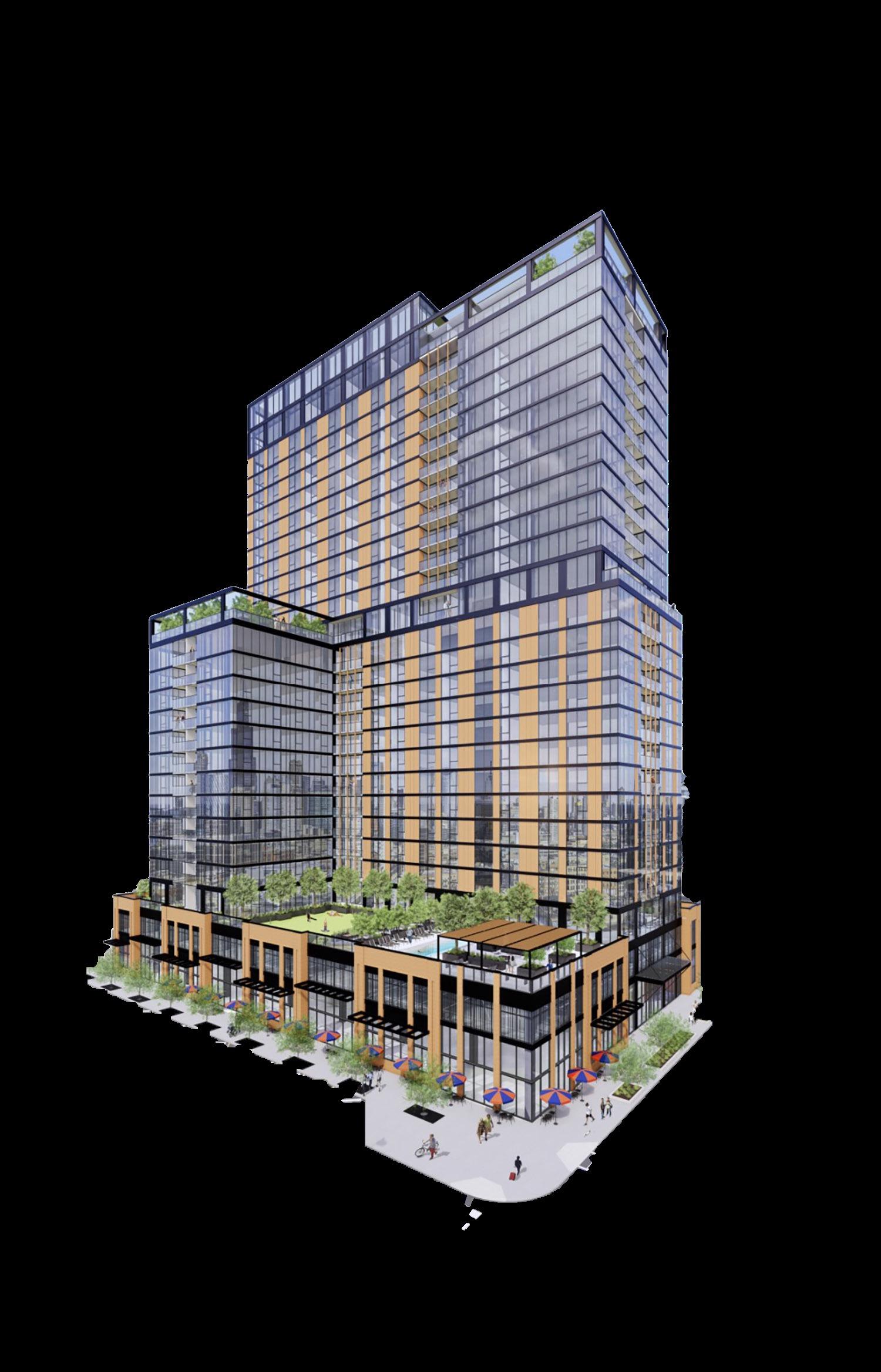

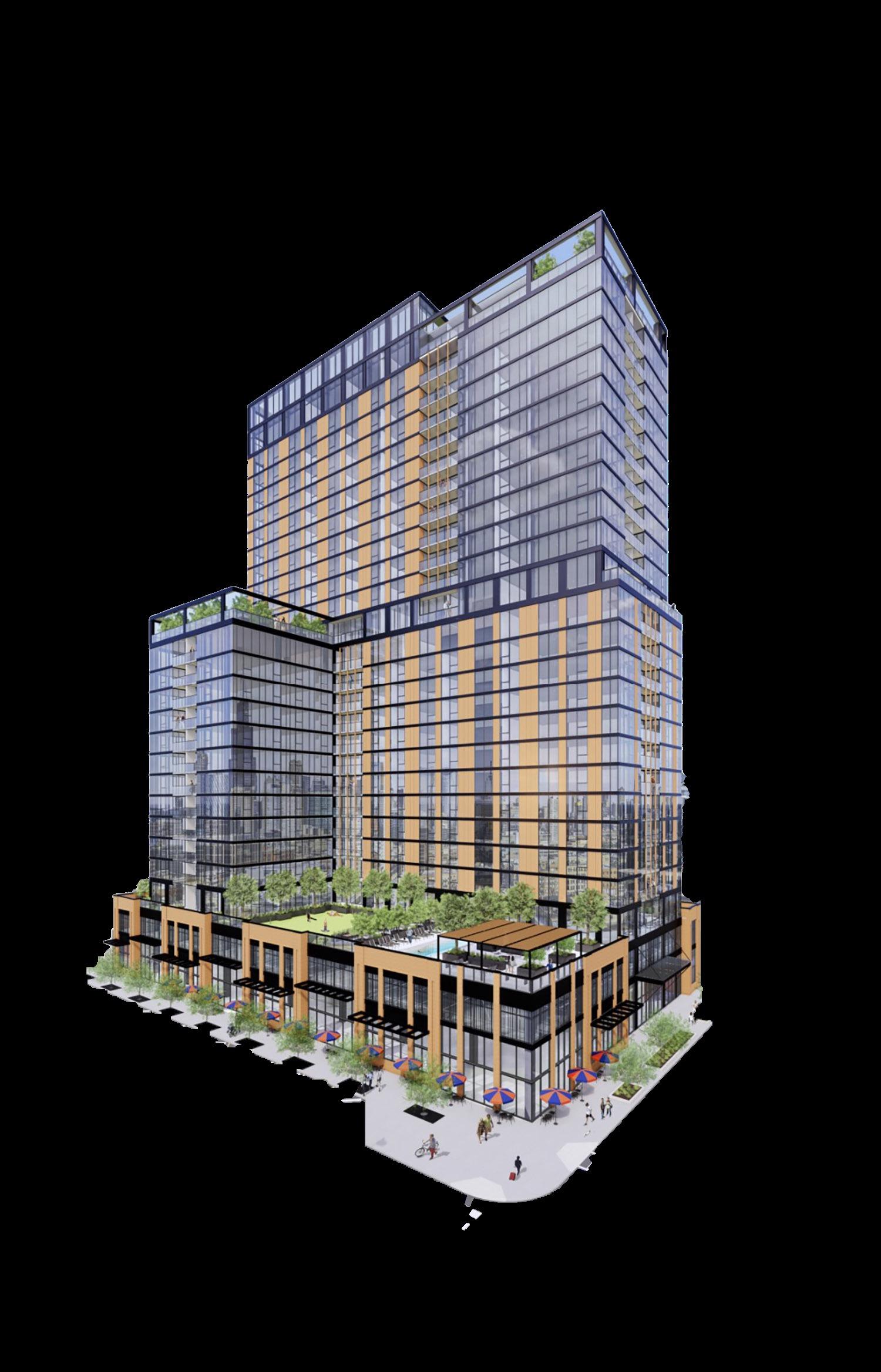

Trends included emphasis on co-living and mixed-use, and Chicago-based Structured Development is working on a project that encompasses both, according to Mike Drew, Founding Principal.

As part of The Shops at Big Deahl, a $250 million mixed-use, mixed-income complex being built in Chicago’s Lincoln Park, Structured Development is adding one multifamily, one condo and one co-living community sited on a half-acre, newly constructed park at 1450 N. Dayton St., bounded by Blackhawk, Dayton and Kingsbury Streets.

One of the buildings, Common Lincoln Park, is a 10-story, 400-bed co-living community—the first of its kind in the neighborhood—that will offer one to four private bedrooms per shared apartment, each furnished, and will include a shared kitchen and living space, as well as in-unit laundry. Many of the units will have ensuite bathrooms and all residences will share access to a fitness center, community lounge, screening room and the building’s various coworking spaces, built to accommodate the increase in people working from home.

Although the units are market rate, co-living is more affordable by nature. Drew said the typical monthly rent of a unit in the building is about $1,500–1,600, versus $2,300–2,500 per month for a comparably-sized studio in the same neighborhood. It’s convenient living, especially for newcomers to the market or young professionals looking for a community-based, social atmosphere.

Another draw? Shorter leases are offered portfolio-wide, with the average term length between 10 and 11 months.

Common Lincoln Park is expected to come online in a few months for occupancy in April 2023 but the journey to build hasn’t always been smooth, as has been the case with many projects across Chicagoland.

According to Drew, Structured Development took a hit after buying the construction contract due to a higher construction cost but considering the continually rising inflation rate, the price was locked in at the right time.

Industrial

2022 was a banner year and all things considered, it’s predicted that 2023 will be just fine, potentially delivering some of the biggest projects to date—but not entirely without challenge.

NAI Hiffman Executive Vice President of Industrial Services Adam Roth predicted geopolitical pressure and transportation uncertainty will continue to force corporations to shorten their length of haul, affecting both distribution and manufacturing in North America.

8 ILLINOIS REAL ESTATE JOURNAL DECEMBER 2022

Multifamily Financing Loan Program BankFinancial’s Multifamily Loan Program • Loan Amounts: $750,000 to $3 Million • Purpose: Rate & Term Refinance • Properties: 5+ Units LTV: Up to 65% / 30-Year Amortization To Learn More, Contact Us Today! 1.833.894.6999 | BankFinancial.com Economists are predicting more future rate increases. Now’s the time to lock in your rate on a Multifamily Real Estate Loan. BankFinancial is an experienced Commercial Real Estate Lender with flexible, competitive loan programs. Lock in your interest rate today on a new or refinanced multifamily property loan. Also Available: • Cash-Out Investment Equity Loan • LTV: Up to 80% (Dual Note) • Interest-Only Lines of Credit • Loans Up to $10 Million Commercial Real Estate Lending Capital Markets Discover the BankFinancial Advantage ... As an experienced Commercial Real Estate Lender, we have a deep understanding of lending and market conditions. From our portfolio multifamily loan programs to our extensive Capital Markets lending network, BankFinancial has a variety of financing options that will save you money over any other option you may choose – that is the BankFinancial Advantage. All loans subject to credit approval YEAR IN REVIEW (continued from page 1) Common Lincoln

Exterior

Park

That said, Roth said a growing desire by many U.S. manufacturers to decouple with China is leading them to look elsewhere for factories, including North America, and the promise of onshoring is being felt more and more as the number of manufacturing companies continues to rise throughout the country—including Chicago.

Kyle Schott, Vice President of Real Estate Development for the Great Lakes Region of Ryan Companies, U.S., Inc., said the shift to onshoring helps companies to operate with more certainty by avoiding supply chain disruptions and achieve sustainability goals, as manufacturing in the U.S. is more regulated to restrict greenhouse gas emissions.

As the trend toward onshoring accelerates, Schott also said developers should strategize securing land positions and constructing spec buildings near abundant labor pools.

“Business operations are changing quickly,” he said. “Even with today’s economic headwinds, user demand for space remains

strong and makes a case for continued strategic speculative development that can be delivered to market sooner than traditional built-to-suit. Most users still desire speed to market as opposed to checking every box on their wish-list.”

9 DECEMBER 2022 ILLINOIS REAL ESTATE JOURNAL

THE AR T & SCIENCE OF REAL ES TAT E

Jon Connor

Mark Goodman

“Even with today’s economic headwinds, user demand for space remains strong and makes a case for continued strategic speculative development that can be delivered to market sooner than traditional built-to-suit.”

down even further depending on the type of care needed, whether it be assisted living, memory care, etc.

While the “either or” works for some, it doesn’t for others, and Ryan Companies is just one company working to strike a balance through its new projects like Clarendale Six Corners in Portage Park, a 10-story, 258-unit community offering market-rate housing with continuum care.

Ryan Companies Director of Real Estate Development and Leading Developer of Clarendale, Brandon Raymond, said the company first noticed the pattern years ago. One of the most heavily considered factors when exploring housing is location within one’s current neighborhood, and because nothing (aside from one affordable housing option) existed within a five-mile radius of Portage Park, Ryan Companies seized the opportunity and has been planning since.

“Fifty years ago, Six Corners was the most trafficked intersection in Chicago, but it’s seen massive vacancies over the past decade,” Raymond said. “We wanted to bring it back to life using [Clarendale] as a catalyst for its revitalization.”

And they are. Ryan Companies was the first to break ground and many other businesses have followed suit. Adjacent

projects under construction include a mixed-use multifamily/retail building, a new grocery store and a medical office, as well as a recently proposed project concerning the former Peoples Gas just across from Kilpatrick.

The company has also helped to reestablish neighborhood walkability with updated bike lanes, wider sidewalks and an elevated streetscape with a pedestrian plaza connecting Milwaukee Avenue to Irving Park Road.

Simply, it’s much more than a singular building—it’s the “new wave” of senior living. Unlike what’s pictured on TV, the sector has evolved significantly in the last few decades, with amenities that exceed even the top-of-the-line multifamily buildings while also catering to residents’ age-specific needs.

10 ILLINOIS REAL ESTATE JOURNAL DECEMBER 2022

SENIOR HOUSING (continued from page 1)

Clarendale Six Corners

What Seniors Want

So, what kinds of building amenities do seniors and their families prioritize when looking for a community? First and foremost, Raymond emphasized further their need to age in the same neighborhood.

“Many people lay down roots and live in the same area for much of their life,” he said, “and it’s natural to want to remain socially connected to the shops they visit or the friends they maintain. We’ve found that seniors look for a community in the same neighborhood or just beyond.”

Inside, the building offers bistro-style eatery, cocktail bar and billiards lounge that aid socialization, as well as a massage room, weekly housekeeping, a full-service salon and a specialized fitness/wellness center with specialized nurse care.

The best part? The building was designed with residents in mind and can be reprogrammed in accordance with evolving needs. Raymond said the company’s goal is to maintain flexibility to be molded by the population. The buildings are anything but stale and allow for residents to slip out of the “senior housing” mindset while still taking comfort in the fact that their needs will be met.

Community Engagement

While Clarendale Six Corners is for seniors, the building was designed in partnership with to support the surrounding community.

For example, Ryan Companies has commissioned local artists to paint multiple murals within the building, which not only supports the artists, but in doing so,

celebrates the neighborhood and its history through their work.

The building will also provide over 200 jobs once fully stabilized—not counting those needed to operate 18,000 square feet of surrounding ground-floor retail— even extending opportunity to students.

“The project is an opportunity to introduce nearby students to the business be-

cause there are many professions within the sector,” Raymond said. “We’re also establishing a one-time $100,000 scholarship for Schurz High School—another way to support the community and reflect our eagerness to be a part of it.”

Clarendale Six Corners is expected to deliver in Spring 2023 and related projects the following year.

11 DECEMBER 2022 ILLINOIS REAL ESTATE JOURNAL

Please contact us for any upcoming project needs! 847.374.9200 · www.meridiandb.com Additions / Expansions New Construction Facility Renovations Tenant Improvements for Making 2022 a Success! “The project is an opportunity to introduce nearby students to the business because there are many professions within the sector.”

Chicago’s Roadmap to Becoming the Next Big Life Sciences City

Funding, talent and infrastructure are the keys to unlocking a thriving life sciences cluster in Chicago

By

By Bernie Baker, Executive Vice President (PMA) & Mark Goodman, President (Mark Goodman & Associates)

According to a recent report from CBRE, Chicago ranks No. 6 for job growth out of the Top 25 life sciences markets in the U.S. To establish itself as a prominent hub on par with the coastal life sciences clusters in Boston and San Francisco, Chicago needs to enhance its offering in the areas of funding, talent, real estate and infrastructure. While the city has made many positive strides toward becoming a life sciences destination, there are four key steps city and state leaders can take to accelerate this process.

1. Enhance Long-Term Tax Credits and Other Incentives

To attract life sciences companies to Chicago, the city needs to have purpose-built labs and manufacturing facilities available for them to occupy—and developing these facilities is expensive. According to some developers, purpose-built life sciences buildings, which have highly specialized utility and infrastructure requirements, can be 25-30% more costly to build than traditional offices. Long-term tax credits are one of the primary vehicles available to offset these high costs, but tax credits in the state of Illinois are not competitive with those in other states: Illinois ranks 35th in the nation for tax incentives aimed at businesses.

In addition to tax credits, municipalities can take other measures to help spur the development of lab space and position themselves as destinations for the life sciences industry. For example, California revised building codes to accommodate an “L occupancy,” which allows chemicals used in life sciences research and manufacturing to be stored on higher floors of a building, making additional space available to life sciences tenants. Philadelphia and the “Research Triangle” region in Raleigh-Durham, North Carolina have also used tax credits and other incentives to bolster their emerging clusters. Illinois is starting to follow suit: in October 2021, Governor JB Pritzker announced a $15.4 million investment as part of its Wet Lab Capital program to support eight new wet lab spaces throughout the state. While this program is a step in the right direction, establishing Chicago as a competitive life sciences hub requires long-term commitment from a larger coalition of public and private stakeholders.

2. Cultivate an Ecosystem That Attracts VC Funding

Venture capital (VC) can provide critical funding to life sciences companies and institutions, especially in their early stages. But according to research from JLL, Chicago ranks 15th in all funding among top life sciences markets. As capital conservation becomes top-of-mind due to rising interest rates and concerns about the possibility of a recession, lower-funded markets are likely to see even fewer capital inflows from VC investors.

Chicago needs to engage with the VC community to reinforce its value as an emerging life sciences cluster worthy of investment. One way to increase the city’s appeal in the eyes of VCs is to establish incubators, innovation districts and other partnerships with local universities. Large institutions putting their money where their mouth is to support life sciences firms helps create a healthy foundation for both innovative start-ups and established industry titans, which drives appeal for investors.

In 2022, Chicago’s Northwestern University received more than $500 million in grants from the National Institutes of Health (NIH) to fund medical research. The University of Chicago, Loyola University, University of Illinois, and Rush University also have robust research programs that can help support a thriving pipeline to life sciences business development. Joint efforts between academic institutions and business, like University of California San Francisco’s (UCSF) CoLabs incubator and plug-in labs in the San Francisco Bay Area and The 78 Chicago’s partnership with the University of Illinois’ Discovery Partners Institute strengthen a city’s life sciences ecosystem and help make it a more attractive candidate for VC funding.

BioLabs, an international co-working space for life science startups that provides young companies with the space to test, develop and grow their game-changing ideas, is slated to open its first Chicago location in Spring of 2023 on the second floor of a redeveloped life sciences building formerly owned and operated by Lurie Children’s Hospital. As Chicago demonstrates a steady pattern of development in its life sciences ecosystem, VCs will be more inclined to deploy funding in support of these growing enterprises.

Additionally, Chicago offers a much more affordable price point for high-tech lab space than costlier coastal cities. With averages from $30 to $60 per square foot, compared to coastal hubs that can range as high as $90, Chicago offers a substantial cost benefit to start-up enterprises, making the area more attractive for VC investors.

3. Become a Destination of Choice for Top Industry Talent

For life sciences companies, proximity to talent plays a significant role in selecting a location. In some cases, one lead scientist can be the deciding factor in determining where to establish a new facility. Fortunately, Chicago has a strong pipeline of life sciences talent—and as more brand-new, state-of-the-art facilities are built, the city will become even more attractive to scientists who want to work in a high-quality lab environment. As labs and research facilities emerge in different neighborhoods, Chicago’s life sciences ecosystem will be accessible to a diverse talent pool while remaining in close enough proximity to achieve the benefits of a “cluster.”

Chicago’s emerging status as a life sciences hub also offers industry professionals the selling point of new, Class A building inventory. For example, a brand-new 16story tower under development by Mark Goodman & Associates in Chicago’s uber-popular Fulton Market neighborhood will house office space and wet labs for life sciences tenants. The project,

located at 400 North Elizabeth St., is the first purpose-built lab and research and development building in Chicago designed specifically to accommodate the rapidly growing life sciences and biotechnology industry.

Amenities also play an important role in attracting life sciences talent. In addition to high-quality lab space, scientists and other staff are increasingly looking to work in the kind of “campus” environment made famous by tech companies in Silicon Valley. Outdoor space as well as on-site bars, restaurants, fitness options and other amenities are in demand.

When it comes to delivering these shiny new labs and amenity-rich campuses, upand-coming markets like Chicago often face a “chicken vs. egg” conundrum. Life sciences companies want to locate their enterprises in clusters that can provide the talent and real estate inventory they need to be successful, but developers hesitate to build without the assurance that a robust tenant population already exists. But there are bright spots on the horizon: The Innovation District at the 78, for example, is a planned 200,000 square-foot Chicago innovation hub that will feature 11 acres of mixed-use supporting building, riverfront development and green and open space, mirroring some of the most successful innovation districts in other parts of the country.

12 ILLINOIS REAL ESTATE JOURNAL DECEMBER 2022

Bernie Baker

Mark Goodman

Build the Infrastructure to Support Long-Term Growth

Cities that have cultivated thriving life sciences clusters have made a purposeful effort to satisfy the industry’s unique infrastructure needs. First, encouraging life sciences development in designated neighborhoods displays a city’s commitment to supporting the industry. Boston and San Francisco are good examples of cities that concentrated life sciences activity in a way that provided for companies’ needs without disrupting the daily lives of residents. Creating an industry cluster requires a collective effort, and Chicago is still early in this process.

Second, beyond physical proximity, the other crucial infrastructure need for life sciences development is electricity. Labs and other life sciences facilities can consume twice as much electrical power as a traditional office building. Companies need reliable capacity from local electrical grids and in some cases, space on the roof of their buildings for a sizeable generator. West Coast life sciences clusters have also explored supplementing the industry’s electrical needs with solar power. Energy infrastructure that can continue to deliver the capacity and flexibility these firms demand is a critical element of facilitating growth in Chicago’s life sciences industry.

Chicago’s Commonwealth Edison (ComEd) is capable of keeping up with this demand but must be engaged to build substations in advance of the coming growth. In the past, PMA has worked with ComEd to develop substations in Streeterville for the large concentration of hospital space that has been built there

since the mid-1990s. A similar method can and should be taken for lab development.

As the Midwest’s largest metropolis and the home of world-class academic institutions, cultural attractions and entrepreneurship, Chicago is the ideal destination for a flourishing life sciences hub between the major clusters on the East and West

Coasts. To accelerate growth, the city must galvanize stakeholders to increase funding, attract talent and enhance infrastructure. The life sciences industry continues to be a bright spot in a tumultuous U.S. economy, and Chicago’s journey to becoming the next destination for this dynamic sector is well underway.

For over 45 years, DarwinPW Realty/ CORFAC International has been a leader in industrial and commercial real estate. The company specializes in brokerage, property management, investment and development services primarily in the Midwest. DarwinPW Realty’s highly qualified professionals are problem solvers and utilize a breadth of tools and knowledge to serve our clients best. 630.782.9520 | darwinpw.com

13 DECEMBER 2022 ILLINOIS REAL ESTATE JOURNAL

“No two businesses are alike, our primary goal is to fully understand the requirements of your business in order to tailor the best possible solution to your industrial real estate needs.”

Brendan J. Sheahan Principal

4.

“For life sciences companies, proximity to talent plays a

significant role in selecting a location. In some cases, one

lead scientist can be the deciding factor in determining

where to establish a new facility. Fortunately, Chicago has a strong pipeline of life sciences talent.”

By Mia Goulart, Senior Staff Writer

By Mia Goulart, Senior Staff Writer

Sterling Bay worked in partnership with Skender (GC) and Chicago-based design firm Eckenhoff Saunders Architects, Inc., or ESA.

It was supposed to start in 2019. Developer Sterling Bay had just released a bunch of long lead equipment like HVAC and already-procured brick, but as was the case for many, the project went on pause with the onset of the pandemic.

Project Manager for Sterling Bay Matt Piekarz said that the team had two months’ worth of tricky repricing to account for current market rates once the project made it back out of the pipeline in Summer 2021 before finally breaking ground

in late August. Making the financial model work given updated market conditions was, for him, the most challenging part of the project.

“Construction pricing was extremely volatile at the time and rising,” Piekarz said. Timeline

Once construction started, no time was wasted. In August, Skender started their first caissons, and by September the following year, the project received substantial completion and sign off for occupancy, marking a 13-month completion for all 200,000 square feet.

DEVELOPMENT SHOWCASE: 345 N. MORGAN 15

building by designers, for designers, evident when you walk into Sterling Bay’s newest project 345 North Morgan, a 200,000-square-foot boutique office building in the heart of Chicago’s Fulton Market. A Development Showcase: A look at 345 North Morgan, Sterling Bay’s newest Class-A building in Fulton Market

The structure was poured in January 2022 just five months after breaking ground, followed by precast erection and glass and glazing, which was completed in Spring 2022. Once the windows started going in, Skender worked from the bottom up to finish interior walls, ending with the amenity floors’ bulk of finishes and amenities.

The quick completion wouldn’t have been possible if they didn’t already have the long lead equipment from when they first tried to get the project up and running a few years before. Additionally, Piekarz and Skender Senior Project Manager Marty Barrett agreed that they couldn’t have done it without the collaboration and quick thinking of everyone involved, and many people worked extended hours to see it through.

“It was aggressive, but we assembled a solid team,” Barrett said. “Sterling Bay and Eckenhoff Saunders were quick to answer changes as needed which kept us moving. The fact that we were able to complete the building so quickly is a testament to our team, and I’m thrilled to have been able to work with them to produce this building.”

Clearly everyone involved shared the same appreciation and enthusiasm for the project, and it’s a perfect example of something worth the wait. The building was leased 85–90% prior to completion for a move-in date of March 2023.

Design

First and foremost, ESA Principals Matt Wylie and Jake Wahler said design was made more pleasurable working with an experienced owner.

“Sterling Bay is a fine-turned machine regarding how they approach new projects,” Wylie said, “something we learned while working with them previously. We came into 345 North Morgan with an understanding of the things most important

to them and this was a great project to continue our work with them. Everyone knew what they were looking for from the beginning.”

Since Sterling Bay has an in-house design team, Wahler said ESA’s biggest role included responding to their design goals and bringing the vision to life. For this building, Sterling Bay’s main concept was an elevated warehouse, or a more highend version of the typical facility you’d find in Fulton Market, captured by the arch motif carried throughout the building.

It’s all about the arches, starting with the hand laid, precast archway at the entrance. In collaboration with Illinois Masonry, Skender was able to model each brick and identify what the build would look like from the foundation up, a process that made the project different from any project Barrett has worked on. The arch is about 28 feet deep with a structurally concealed system that holds the arch in place and allows it to be set brick by brick.

“It’s a unique feature, but we nailed it with minimal hiccups due to the front-end effort by the team and everyone who touched it,” Barrett said. “We had to hit the nail on the head with the location, size and details, and the team going the extra mile made the difference in making that feature a success.”

Arches aren’t built often anymore and though it leveraged modern construction methods, ESA said the threshold of entry is just as powerful, setting the tone for what’s to come. The theme is consistent everywhere you look. The pathways on Floors 1 and 11 were arched in a similar manor to the entrance, carrying it from the exterior in.

“It’s fun to work on a project that has a design that entices people from the outside, while bringing those same elements inside, as well,” Barret said. All of

16 DEVELOPMENT SHOWCASE: 345 N. MORGAN

Intimate is how many would describe the experience. The sleek, modern lobby takes inspiration from industrial materials and urban décor. It’s personal and not overly scaled, with sumptuous, railroad-esque details and lots of greenery to welcome people back to the office, yet another reason for the building’s success. Some of the base finishes were even sourced from the building’s future users to give their product a voice in their own space.

But perhaps the most unique feature, and a huge focal point, is the “double-sided” fireplace on the top floor. It isn’t truly double-sided in that it doesn’t share a common firebox, but rather it’s two fireplaces back-to-back, and was designed to center the space and encourage conversation among users both inside the building and out, while also carrying out the arch theme on a smaller scale.

ESA originally specified the piece to be granite, but it wasn’t available in the correct size. Skender worked with them to identify other in-budget options to consider before they landed on the current custom nine-foot slabs of hardened limestone after weeks of back and forth. Together the seven unique layers within the two slabs are 14 inches thick—a first for the quarry and the first time Barrett worked with slabs of that size for a fireplace.

“We had to plan around that, using two systems to install it,” Barrett said. “A gantry system was used to lift it onto the deck, and after it was set on the deck by a crane, another hoisting mechanism was used to set it in place. It’s not often you see limestone this hard or cut this thick, and it won’t flake apart.”

Not to mention the building is just the right size and achieves the critical mass of lease up. Wahler said the 20,000-square-foot plates are appropriately sized for the new world of smaller offices and manageable for businesses that are downsizing or looking for something other than a subdivided floor of 100,000 square feet, sparking more and more to sign leases.

DEVELOPMENT SHOWCASE: 345 N. MORGAN 17

Skender’s form work up the main core of the building was architecture grade, giving it a smooth concrete finish.

345 N MORGAN

Swiftly completed in just 13 months. “Our aggressive schedule, especially through global supply shortages, was possible thanks to a decisive owner, high-performing project team, amazing trade partners and persistent communication,” said Marty Barrett, Senior Project Manager, Skender.

skender.com

The expertise to deliver results. The process to make them extraordinary.

It’s a ripple effect. High-end, hospitality-driven office spaces like 345 North Morgan that are smaller in floor plate size but uniquely designed with a high-end amenity package are the future. Competitors in the area offer massive floor plates and it’s a death spiral for spec buildings in that if you don’t get one lease, you won’t get any.

“No one wants to be in an empty building so buildings must reach a critical mass of interest,” Wahler said. “This project hit a sweet spot in terms of size and intimacy.”

Quality over quantity seemed to be the mindset, and Wylie was impressed with the attention to detail that went into the project over the course of construction. “We had the ability to help Sterling Bay outfit the building with the final elements like vases and books, so we were able to work on not only the structure, but the small-scale details, and I admire the thought that was put into each element.”

Sustainability-wise, while it wasn’t a main objective, the building meets city requirements and exceeds the energy code by about 25% and will reduce water use by 15%. ESA also used low VOC materials throughout the process, and the project will be LEED certified in a few months. Another, just as important aspect of certification has to do with the wellbeing of users, and the private terraces on each floor allow for them to step outside. Outdoor access and natural light are big benefits to users.

ESA’s relationship with Sterling Bay is especially unique because in addition to working together on projects like 345 North Morgan, ESA’s own office is within a building owned by the firm. Sterling Bay has recently started a portfolio-wide program to make the workplace more appealing by providing benefits to employees that make the effort.

“Work should be fun, and the building’s features entice people to go back to the office,” Wylie said. “Sterling Bay is sensitive to making sure their projects encourage people to go in and enjoy working together, and that feels present in 345 North Morgan.”

Tenants want to show off the building and its “wow factor” elements, whether to their own employees or their clients. It’s a showcase building for all involved, especially for those who have already signed to occupy, including Havi/JSI Logistics, Wellington Management and Allsteel.

Sterling Bay Director of Communication Julie Goudie said it was especially interesting that the space was designed for designers. The firm is seeing a big makeup of that kind, with many users relocating from Merchandise Mart for a bigger showroom in a trendier neighborhood, and there’s still a wave to come.

18 DEVELOPMENT SHOWCASE: 345 N. MORGAN

“Our [in-house] designer took a lot of pride in the details included,” she said, “and it’s a very aesthetically pleasing space, by and for those who appreciate it most.”

The building also features a top floor conservatory and lounge with confer encing, private outdoor space on every floor, a coworking library, heated park ing spaces and a full-service fitness center, to name a few.

Maybe the best part of the design is that it’s customizable. ESA, together with structural engineer WSP, worked to fine-tune the structural system to minimize obstructions so users have clear floor plates to plan, according to Matt Wylie. “We try to, as a firm, make sure the designs we’re coming up with are forward thinking toward the next step in the process to make sure that we’re enabling and empowering users to have as much freedom as they can,” he said.

Skender is currently building out some of these projects independent of the base building. Barrett said one of the benefits of this is the flexibility to pivot as needed and get things started quickly. Part of Havi’s lease agreement was that the outdoor space on Floor 11 was going to be for their use only, and Skender was able to modify the landscaping design on the roof in real time to make their desired changes in one swoop, saving them money in the end. Leveraging the money properly for the base building with respect to user allowances saves them 80% of what it would cost to hire a company after the fact for TI. Users have minimal work when push comes to shove to make the space uniquely theirs.

Location

What was it about Fulton Market that attracted Sterling Bay? The land, formerly Pittsburg Paints, wasn’t originally purchased for the current project, but instead was purchased years ago with a specific user in mind. When said user fell through, Piekarz said Sterling Bay had to come up with a new purpose for the land. It was re-concepted for a brewery, and when that fell through, a movie theatre—which also fell through. Everything happens for a reason.

After a handful of failed concepts, the right one stuck, and now it’s the focal point of one of the most dynamic blocks in Fulton Market, directly adjacent to Google’s Midwest Headquarters, 1KFulton, Emily Hotel, Swift & Sons and Roister—and that’s just the beginning.

ing Fulton Market that way. As more buildings like 345 North Morgan and 333 North Green hit the edge, everything continues to move north after it, expanding the neighborhood further.

Barrett said the project sets the standard for what users can and should

gan sets itself apart and, we’ll hopefully have many more opportunities to build buildings of a similar caliber in the future, particularly in this neighborhood.”

Message

The goal was to build a luxe building

SB

MISSION

8

LATEST PROJECTS

Paseo Gulch South in Nashville, TN

Toilet Accessories, Shower Enclosures, Roller Shades, Frameless Mirrors, Antique Mirrors, Wire Shelving, Wall Protection, Fireplace, Fire Specialties, Fire Rated Glass.

345 N Morgan – Chicago, IL

Toilet Accessories, Toilet Partitions, Mirrors.

160 N Elizabeth – Chicago, IL

Lockers, Tenant Storage, Wheel Stops, Parking Mirrors, Toilet Accessories LED Mirrors, Fire Specialties, Mailboxes.

Our mission is to provide viable procurement options that fit today’s tight deadlines and budget constraints From small TI/interior fitouts to multifamily, institutional and commercial construction projects, SB Group offers cost saving alternatives using global supply chains and trusted vendors to ensure minimal risk SB Group has partnered with local Chicago Union subcontractors to provide competitive furnish and install proposals on a variety of scope items 216 N MAY STREET,

We specialize accessories, toilet partitions, shower enclosures, LED mirrors and medicine cabinets, frameless mirrors, glass, roller shades and more

Verve Columbus – Columbus, OH

Toilet Accessories, Framed Mirrors, Bike Racks, Mailboxes, Shower Enclosures Fire Specialties.

oLiv Boulder – Boulder, CO

Toilet Accessories, TP, Heated Towel Racks, Wire Shelving, Shower Enclosures Frameless Mirrors, Bike Racks, Site Furnishings, Roller Shades.

Oakbrook Commons, Oakbrook, IL

Toilet Accessories Mailboxes, Bike Racks, Fire Specialties, Tenant Storage, Site Furnishings.

Albion HP2 – Highland Park, IL

Toilet Accessories Mirrors, Fire Specialties, Bike Racks, Shower Enclosures, Wire Shelving, Mailboxes.

2B CHICAGO, IL 60607

DEVELOPMENT SHOWCASE: 345 N. MORGAN 19

Group is a global construction material supplier, specializing in sourcing and procurement in Division

and Division 10 To ensure high-quality material installation, our team is involved throughout all aspects of each project.

SUITE

Lockers Site Furnishings AED Units Toilet Partitions Fire Specialties Tenant Storage Fireplaces Wall Protection Appliances Toilet Accessories Parking Accessories Shower Enclosures Wind Screens Glass Handrailings Bike Racks Roller Shades Wire Shelving Medicine Cabinets Mirrors Product Line Offerings

of place. With its brick façade and classic, board-formed precast at the entrance, the building does just that.

Challenges

No project is without obstacles, and though they were easy to smooth out, 345 North Morgan was no exception.

During construction, Skender was coordinating the precast around the window system and decided last-minute to switch to a lower-cost glazing system, which Barrett found this to be the most challenging part of the project. The company’s design documents weren’t updated for the new system but in collaboration with the other teams they were able to expedite the process and identify how it would impact other elements, as well. After that the new system went in quickly and was

a good experience for the team, reacting as needed to ensure the base building was pivoting to meet the design needs of the window systems.

Other challenges faced during construction were more obvious, like supply chain issues, but a consistent touchpoint and constant communication with Sterling Bay allowed everyone to to stay ahead of potential risks.

ESA said the same, adding that the sense of partnership between each team was strong throughout the project.

“Construction is difficult, and there are risks involved that make navigating any project tricky,” Wylie said. “If you can emerge on the other side with those relationships strengthened, it’s a win.”

20 DEVELOPMENT SHOWCASE: 345 N. MORGAN

“Construction is difficult, and there are risks involved that make navigating any project tricky. If you can emerge on the other side with those relationships strengthened, it’s a win.”

CENTERPOINT PROPERTIES

1808 Swift Drive

Oak Brook, IL 60523

P: 630.586.8000

Website: centerpoint.com

Key Contacts: Bob Chapman, Chief Executive Officer; bchapman@centerpoint.com; Nate Rexroth, Executive Vice President, Asset Management; nrexroth@centerpoint.com

Services Provided: CenterPoint Properties is an innovator in the investment, development and management of industrial real estate and multimodal transportation infrastructure. CenterPoint acquires, develops, redevelops, manages, leases and sells state-of-the-art warehouse, distribution and manufacturing facilities near major transportation nodes. Our experts focus on rail and port-proximate distribution infrastructure assets.

Company Profile: CenterPoint Properties continuously reimagines what’s possible by creating ingenious solutions to the most complex industrial property, logistics and supply chain problems. With an agile team, substantial access to capital and industry-leading expertise, we provide our customers with a competitive edge and ensure their success — no matter how great the challenge.

FARBMAN GROUP OF CHICAGO

40 Skokie Boulevard

Northbrook, IL 60062

P: 248.353.0500

Website: farbman.com

Key Contacts: Andrew Farbman, CEO, afarbman@farbman.com; Andrew Gutman, President, gutman@farbman.com; Michael Kalil, COO and Director of Brokerage, kalil@farbman.com; Chris Chesney, CFO, chesney@farbman.com; Ryan Nelson, EVP, nelson@farbman.com

Services Provided: Property Management, Leasing & Brokerage, Construction, Investment Sales, Asset Management, Site Selection Services, Acquisition & Disposition, Medical Real Estate Solutions, Move Management, Receivership Services, Facility Management, Net Lease Brokerage Services.

Company Profile: Farbman Group of Chicago, a full-service commercial real estate company, is one of the largest and most respected names in Commercial Real Estate. 1535 Lake Cook Rd, Northbrook | 2250 Point Blvd, Elgin | 280 Shuman - The Atrium, Naperville | 390 Holbrook Dr, Wheeling | 25 NW Point Blvd, Elks Grove Village | 40 Skokie Blvd, Northbrook | 1120 Lake St, Oak Park | 100 N LaSalle Dr, Chicago | 401 S State St, Chicago | 600 W Jackson Blvd, Chicago

HIFFMAN NATIONAL

One Oakbrook Terrace, Suite 400

Oakbrook Terrace, IL 60181

P: 833.HIFFMAN

Website: hiffman.com

Key Contacts: Dave Petersen, CEO, dpetersen@hiffman.com; Bob Assoian, Executive Managing Director of Management Services, bassoian@hiffman.com

Company Profile: Hiffman National is one of the US’s largest independent commercial real estate property management firms, providing institutional and private clients exceptional customized solutions for property management, project management, property accounting, lease administration, marketing, and research. The firm’s comprehensive property management platform and attentive approach to service contribute to successful life-long relationships and client satisfaction. As a nationally recognized Top Workplace, Hiffman National is headquartered in suburban Chicago, with more than 265 employees nationally and an additional five hub locations and 30 satellite offices across North America. For more information, visit hiffman.com

BROKERAGE FIRMS

FARBMAN GROUP OF CHICAGO

40 Skokie Boulevard

Northbrook, IL 60062

P: 248.353.0500

Website: farbman.com

Key Contacts:Andrew Farbman, CEO, afarbman@farbman.com; Andrew Gutman, President, gutman@farbman.com; Ryan Nelson, EVP, nelson@farbman.com

Services Provided: Leasing & Brokerage, Construction, Investment Sales, Asset Management, Site Selection Services, Acquisition & Disposition, Medical Real Estate Solutions, Move Management, Property Management, Receivership Services, Facility Management.

Company Profile: Farbman Group of Chicago, a full-service commercial real estate company, is one of the largest and most respected names in Commercial Real Estate. 1535 Lake Cook Rd, Northbrook | 2250 Point Blvd, Elgin | 280 Shuman - The Atrium, Naperville | 390 Holbrook Dr, Wheeling | 25 NW Point Blvd, Elks Grove Village | 2222 Camden Ct, Oak Brook | 40 Skokie Blvd, Northbrook | 1007 Church St, Evanston | 1120 Lake St, Oak Park | 2604 N Elston Ave, Chicago | 100 N LaSalle Dr, Chicago | 200 W Monroe St, Chicago | 205 W Randolph St, Chicago | 79 Monroe St, Chicago | 70 Monroe St, Chicago | 70 W Monroe St, Chicago | 401 S State St, Chicago | 200 W Jackson Blvd, Chicago | 209 W Jackson Blvd, Chicago

CONSTRUCTION COMPANIES/GENERAL

VICTOR CONSTRUCTION

2000 Center Dr., Suite East C219

Hoffman Estates, IL 60192

P: 847.392.6900 Website: victorconstruction.com

Key Contact: Zak Schuttler, President, ZakS@victorconstruction.com Services Provided:Victor Construction Co., Inc. manages projects from ground-up site developments to interior buildouts, specializing in retail, industrial, and commercial markets.

Company Profile: Victor Construction Co., Inc. remains a family-owned and operated General Contractor. Having been in business since 1954, our firm has extensive experience managing every aspect of interior construction for the corporate, manufacturing, industrial, and retail sectors. Notable/Recent Projects: Owens + Minor Distribution – 600K SqFt distribution facility that involved a full LED lighting upgrade, new HVLS fans, 200K SqFt section that required new cooling for medical distribution, an office renovation of 20K SqFt, and a new exterior employee pavilion.

LAMP INCORPORATED

460 North Grove Ave. Elgin, IL 60120

P: 847.741.7220 | F: 847.741.9677 Website: lampinc.net Key Contact: Ian Lamp, President, ilamp@lampinc.net Services Provided: Design/Build, General Construction, and Construction Management services for additions, build outs, renovations, and new facilities for office, industrial, logistic, technology, and commercial buildings.

Company Profile: Lamp Incorporated has been providing professional construction services for over 80 years. Our commitment of exemplary service to our clients creates projects that are completed early and with exceptional value.

Notable/Recent Projects: Mitutoyo America Corporation North American Headquarters, Aurora, IL. 96,000 SF warehouse addition; 63,000 SF, three-story office addition, which includes high tech showroom, two story atrium, corporate offices/conference room, cafeteria, and locker rooms.

MCSHANE CONSTRUCTION COMPANY

9500 West Bryn Mawr Avenue Ste. 200 Rosemont, IL 60018

P: 847.292.4300 | F: 847.292.4310 Website: www.mcshaneconstruction.com

Key Contacts: Mat Dougherty, PE, President, mdougherty@mcshane.com Services Provided: McShane Construction Company offers more than 35 years of experience providing design-build, design-assist and general construction services on a national basis The firm’s diverse expertise includes build-to-suit and speculative warehouse, distribution and manufacturing facilities, as well as multifamily, commercial and institutional developments.

Company Profile: Headquartered in Rosemont, Illinois with regional offices in Auburn, Alabama, Irvine, California, Phoenix, Arizona, Madison, Wisconsin and Nashville, Tennessee, McShane Construction Company provides comprehensive construction services on a local, regional and national basis for a wide variety of market segments. The firm is recognized as one of the Chicago area’s most diversified and active contracting organizations with a reputation built on honesty, integrity and dependability.

Recent/Notable Project: Industry Center at Melrose Park – the construction of three speculative industrial buildings in Melrose Park, Illinois. The new development incorporates a total of 651,617 square feet.

MERIDIAN DESIGN BUILD

9550 W. Higgins Road, Suite 400 Rosemont, IL 60018

P: 847.374.9200 | F: 847.374.9222 Website: meridiandb.com

Key Contacts: Paul Chuma, President; Howard Green, Executive Vice President Services Provided: Meridian Design Build provides construction and design/ build construction services on a national basis with a primary focus on industrial, office, medical office, retail and food and beverage work.

Company Profile: With a team of in-house professional project managers, Meridian has extensive experience coordinating the design and construction of new buildings, tenant improvements, and additions/ renovations from 15,000 square feet to 1,000,000+ square feet. Meridian Design Build has been a Member of the U.S. Green Building Council since 2007.

Notable/Recent Projects: Clarius Park Joliet Building #2, Joliet, IL - 906,517 sf speculative industrial facility for Clarius Partners. Commerce Park Chicago Building B, Chicago, IL602,545 sf speculative multi-tenant industrial facility for NorthPoint Development. Halsted Delivery Station, Chicago, IL - 112.000 sf package delivery station on a 17-acre redevelopment site for Prologis.

DECEMBER MARKETPLACE 21

MANAGEMENT FIRMS

ASSET/PROPERTY

CONTRACTORS

PEAK CONSTRUCTION CORPORATION

9525 W. Bryn Mawr Avenue, Suite 810

Rosemont, IL 60018

P: 630.737.1500 | F: 630.737.1600

Website: peakconstruction.com

Key Contacts: Michael P. Sullivan, Jr., CEO & Founder, msullivan@peakconstruction.com; John Reilly, President, jreilly@peakconstruction.com

Services Provided: Peak Construction Corporation offers design/build and construction management services through a strategically developed culture, highly regarded for dynamic problem-solving abilities and a network of alliances that allow Peak to bring in experts and partners from a wide spectrum of fields and roles.

Company Profile: Peak Construction Corporation is a privately-held, well-capitalized design/ build general contractor. For 25 years Peak has delivered industrial, hospitality, office, healthcare, retail, multi-family and specialty construction projects on-time and on-budget.

Notable/Recent Projects: Peak’s recent Midwest projects include NorthPoint Development’s Third Coast Logistics Park in Joliet and Building 1 in Bristol, WI; Janko Group’s Bristol Business Park also in Wisconsin; Scannell Properties’ Elgin Distribution Center in Elgin and DuPage Business Center Phase II and TI in West Chicago, as well as various tenant improvements throughout Chicagoland and Wisconsin.

DEVELOPERS

CENTERPOINT PROPERTIES

1808 Swift Drive

Oak Brook, IL 60523

P: 630.586.8000 Website: centerpoint.com

Key Contacts: Bob Chapman, Chief Executive Officer, bchapman@centerpoint.com; Michael Murphy, Chief Development Officer, mmurphy@centerpoint.com

Services Provided: CenterPoint Properties is an innovator in the investment, development and management of industrial real estate and multimodal transportation infrastructure. CenterPoint acquires, develops, redevelops, manages, leases and sells state-of-the-art warehouse, distribution and manufacturing facilities near major transportation nodes. Our experts focus on rail and portproximate distribution infrastructure assets.

Company Profile: CenterPoint Properties continuously reimagines what’s possible by creating ingenious solutions to the most complex industrial property, logistics and supply chain problems. With an agile team, substantial access to capital and industry-leading expertise, we provide our customers with a competitive edge and ensure their success — no matter how great the challenge.

CONOR COMMERCIAL REAL ESTATE

9500 W. Bryn Mawr Avenue, Suite 200

Rosemont, IL 60018

P: 847.692.8700 | F: 847.292.4313

Website: conor.com

Key Contacts: David J. Friedman, President, dfriedman@conor.com; Brian Quigley, Executive Vice President, bquigley@conor.com

Services Provided: Conor Commercial identifies and implements the most suitable commercial real estate strategy to yield increased returns for each real estate opportunity. With offices and seasoned real estate professionals strategically located throughout the country, the firm provides the experience and resources needed to develop and stabilize real estate developments that maximize positive returns to investors and partners.

Company Profile: Conor Commercial Real Estate is the integrated real estate development firm of The McShane Companies headquartered in suburban Chicago, Illinois with regional offices located in Dallas, Houston, Irvine and Phoenix. The firm is active on a local, regional and national basis in the development of master-planned industrial and office parks, multifamily properties, medical office developments and built-to-suit projects for lease or purchase.

ECONOMIC DEVELOPMENT CORPORATIONS

VILLAGE OF HOMER GLEN ECONOMIC DEVELOPMENT

14240 W. 151st Street

Homer Glen, IL 60491

P: 708.301.0632 Website: HomerGlenIL.org

Key Contact: Janie Patch, Economic Development Director, jpatch@homerglenil.org Services: Resource center for brokers, developers, site selectors and businesses providing space and property inventory, trade area demographics, site selection assistance, custom tours, coordination through entitlement process, business opening process guidance and retention services.

Demographic Info: Strategic Will County location 25 miles southwest of Chicago with two I-355 interchanges between I-55 and I-80. Average household income of $137,577. Trade area population of 83,000. Prime commercial corridors include Bell Road, 143rd Street and 159th Street (State Route 7). 159th Street is improved with 4 lanes and access to Lake Michigan water and sanitary sewer.

Recent CRE Activity: The Square at Goodings Grove (106 townhomes) completing construction. The Villas of Old Oak (46 ranch duplexes) under construction. JC Licht opening soon. Restaurant with drive-thru position available at Homer Glen Bell Plaza with Pet Supplies Plus, Dollar Tree and Taco Bell, SWC 143rd/Bell.

DEKALB COUNTY ECONOMIC DEVELOPMENT

CORPORATION/DCEDC

2179 Sycamore Road Unit #102 DeKalb, IL 60115

P: 815.895.2711 | F: 815.895.8713

Website: www.dcedc.org

Key Contacts: Paul J. Borek, Executive Director, borek@dcedc.org Karen K. Hoyle, Administrator, hoyle@dcedc.org Katelyn Lancaster, DeKalb County Marketing Manager, klancaster@dcedc.org **Opportunity Unbound, countywide branding and communications program**

Services Provided: DCEDC assists investor businesses with the following services:

· Market Research

· Site/Building Selection

· Workforce Recruitment & Training, Student Internships

· Supply Chain Analysis

· Product Development Research Partnerships

· Expedited Plan/Permit Review

· Enterprise Zone Incentives.

Located 60 miles west of Chicago/O’Hare Airport on Interstate 88 along the Union Pacific RR, the economy is led by Northern Illinois University together with innovative manufacturing, distribution, health care and agricultural enterprises.

Company Profile: DCEDC is a public/private partnership working to facilitate sustainable & diversified economic growth in DeKalb County. The organization serves 16 industrial parks and over 14.5 million square feet of industrial space in 14 communities along I-88 in the center of the I-39 Logistics Corridor. This location provides congestion-free access to the central United States and Metro Chicago with convenient connections to I-80, I-55, I-94 and I-57.

LAKE COUNTY, INDIANA ECONOMIC ALLIANCE (LCEA)

440 W. 84th Drive

Merrillville, IN 46410

P: 219.756.4317 Website: LCEA.us

Key Contacts: Karen Lauerman, President & CEO, klauerman@LCEA.us; Don Koliboski, VP Economic Development, dkoliboski@LCEA.us Services Provided:The LCEA team provides economic development and site selection assistance; business expansion services; community connections with decision makers/elected officials; workforce analysis, demographics, cost comparisons and other critical information.

Company Profile: LCEA is the Lake County Indiana Economic Development Organization representing 20+ communities just minutes away from Chicago. It is the one resource for developers, site consultants and company executives considering relocation or expansion opportunities in Lake County, Indiana.

NAPERVILLE DEVELOPMENT PARTNERSHIP

22 E. Chicago Ave., Ste. 205 Naperville, IL 60540 P: 630.305.7701 Website: www.Naper.org Key Contact: Christine D. Jeffries, President, CJeffries@Naper.org Services Provided:The Naperville Development Partnership promotes the City of Naperville and its many businesses. Whether you are an existing business looking to relocate or a new company, we will take the time to show you what Naperville has to offer.

Company Profile: The Naperville Development Partnership is a public / private economic development organization that promotes business interest in the City of Naperville. Our mission is to enhance the economic vitality of Naperville and maintain its outstanding quality of life. This is achieved through the retention and expansion of existing businesses as well as attracting new business to the community

FINANCE & INVESTMENT FIRMS

ASSOCIATED BANK

525 W. Monroe Street, Ste. 2400 Chicago, IL 60661

P: 312.544.4645 Website: associatedbank.com/cre Key Contacts: Gregory Warsek, Executive Vice President / Group Leader, greg.warsek@associatedbank.com Services Provided: Our clients include professional developers of income producing commercial real estate, including multi-family properties, retail, office, self- storage, student housing, industrial, and for sale housing.

Company Profile: Commercial Real Estates offices are located in Chicago, Milwaukee, Madison, Green Bay, Cincinnati, Indianapolis, Minneapolis, Detroit, St. Louis, Dallas and Houston. Associated Banc[1]Corp has total assets of $35 billion and is one of the top 50 financial services holding companies in the United States.

DECEMBER MARKETPLACE 22

CENTERPOINT PROPERTIES

1808 Swift Drive

Oak Brook, IL 60523

P: 630.586.8000

Website: centerpoint.com

Key Contacts: Bob Chapman, Chief Executive Officer, bchapman@centerpoint.com; Jim Clewlow, Chief Investments Officer, jclewlow@centerpoint.com

Services Provided: CenterPoint Properties is an innovator in the investment, development and management of industrial real estate and multimodal transportation infrastructure. CenterPoint acquires, develops, redevelops, manages, leases and sells state-of-the-art warehouse, distribution and manufacturing facilities near major transportation nodes. Our experts focus on rail and portproximate distribution infrastructure assets.

Company Profile: CenterPoint Properties continuously reimagines what’s possible by creating ingenious solutions to the most complex industrial property, logistics and supply chain problems. With an agile team, substantial access to capital and industry-leading expertise, we provide our customers with a competitive edge and ensure their success — no matter how great the challenge

MARQUETTE BANK

10000 W. 151st Street

Orland Park, IL 60462

P: 708.364.9131

Website: emarquettebank.com

Key Contact: Gene Malfeo, Senior Vice President, gmalfeo@emarquettebank.com

Services Provided: Full line of Commercial, Business and Real Estate loans customized to your individual needs including: commercial and residential construction loans, commercial mortgages, equipment loans and working capital lines of credit.

Company Profile: Marquette Bank started in Chicagoland in 1945 and is still locally-owned/ operated. Expect quick decisions, competitive rates, easy application and personal service. Personal/business banking and lending, home mortgages, land trust services, estate planning, insurance services, wealth management and multifamily lending.

LAW FIRMS

O’KEEFE LYONS & HYNES, LLC

30 N. LaSalle St., Ste. 4100

Chicago, IL 60602

P: 312.621.0400 | F: 312.621.0297

Website: okeefe-law.com

Key Contacts: Elizabeth Gracie, Partner, elizabethgracie@okeefe-law.com; Brian Forde, Partner, brianforde@okeefe-law.com

Services Provided: The firm’s partners have been on the forefront of understanding, shaping, challenging, and sometimes writing, Illinois property tax laws. Many of the partners honed their skills overseeing taxation matters for Illinois public taxing agencies. Our firm leverages this expertise, along with a proprietary technology database, to create innovative tax and litigation strategies that lead to successful outcomes for our clients.

Company Profile: O’Keefe Lyons & Hynes, LLC has an 85-year track record of supporting commercial real estate interests in property tax matters. We work with corporate, institutional private and not-for-profit entities across the office, multifamily, industrial, retail and hospitality sectors.

SARNOFF & BACCASH

Two N. LaSalle St., Ste. 1000 Chicago, IL 60602

P: 312.782.8310 | F: 312.782.8635 Website: sarnoffbaccash.com

Key Contacts: James Sarnoff, jsarnoff@sarnoffbaccash.com; Robert Sarnoff, rsarnoff@sarnoffbaccash.com

Services Provided: Sarnoff & Baccash is a leading and recognized law firm concentrating solely in the field of property taxation. We help client’s secure favorable taxes in Illinois through property tax appeals, incentives and consulting.

Company Profile: Sarnoff & Baccash’s clients include Owners, Developers, Managers, REIT’s, Fortune 500 Companies, Private Equity Firms, etc., in connection with commercial property, high-rise and low-rise apartment buildings, condominium associations and single-family home portfolios.

WORSEK & VIHON, LLP

180 North LaSalle Street, Suite 3010 Chicago, IL 60601 P1: 312.917.2307 | P2: 312.917.2312 | F: 312.596.6412 Website: wvproptax.com

Key Contacts: Francis W. O’Malley, Managing Partner fomalley@wvproptax.com; Jessica L. MacLean, Partner jmaclean@wvproptax.com

Services Provided: Worsek & Vihon, LLP represents tax payers in Illinois by limiting their tax liabilities through ad valorem appeals. We have over 35 years of experience and can handle basic to the most complex assessment issues while offering the dependable, personalized attention our clients deserve. We have experience representing owners of office buildings, shopping centers, retail stores, manufacturing plants, data centers, distribution centers, mixed-use developments, nursing homes, hospitals, condominium associations, cooperatives, apartments and single family residences. In addition to filing thousands of appeals with the Cook County Assessor, we have been involved in numerous proceedings before various Boards of Review, the Illinois Property Tax Appeal Board, and the Circuit Court of Illinois, and have appeared before the Illinois Appellate and Supreme Courts.

Company Profile: Worsek & Vihon LLP, is a team of experienced attorneys singularly focused onreal estate tax law. The firm is dedicated to minimizing property tax liabilities through strategic tax portfolio management; well-researched, creative appeal preparation and aggressive advocacy. Worsek & Vihon, LLP represents commercial, industrial and multi-family property owners, users and developers, as well as condominium associations. The firm is committed to offering the dependable, personalized attention our clients deserve.

MULTIFAMILY FINANCE FIRMS

ASSOCIATED BANK

525 W. Monroe Street, Ste. 2400 Chicago, IL 60661

P: 312.544.4645 Website: associatedbank.com/cre Key Contacts: Gregory Warsek, Executive Vice President, greg.warsek@associatedbank.com Services Provided:Our clients include professional developers of income producing commercial real estate, including multi-family properties, retail, office, self- storage, student housing, industrial, and for sale housing.

Company Profile: Commercial Real Estates offices are located in Chicago, Milwaukee, Madison, Green Bay, Cincinnati, Indianapolis, Minneapolis, Detroit, St. Louis, Dallas and Houston. Associated Banc[1]Corp has total assets of $35 billion and is one of the top 50 financial services holding companies in the United States.

M&T REALTY CAPITAL CORPORATION

Chicago, IL

P: 312.203.5410 Website: mtrcc.com

Key Contacts: Monty Childs, Managing Director, mchilds@mtb.com Services Provided: Multifaceted Affordable Housing Specialists. Debt financing and loan servicing. Fannie Mae DUS® lender, Freddie Mac Optigo® Lender, FHA/HUD Healthcare & Multifamily lender. Correspondent with life companies and CMBS lenders. Bridge loan program for qualified borrowers.

Company Profile: M&T Realty Capital Corporation® is a wholly-owned subsidiary of M&T Bank—one of the 20 largest US-headquartered commercial bank holding companies. Full-service mortgage banking company that provides competitive financing nationwide for commercial real estate. In 2021, M&T Realty Capital originated $5.1 billion in loans, and currently services a portfolio of more than $24.4 billion. Please review our M&T Insurance Agency, Inc. real estate and construction insurance offerings on page 44.

Service Territory: Nationwide

MARQUETTE BANK

1628 W. Irving Park Road, Unit 1D Chicago, IL 60613 P: 708.873.8639 Website: emarquettebank.com

Key Contacts: Bill Hinsberger, Executive Vice President, bhinsberger@emarquettebank.com; Patrick Tuohy, Senior Vice President, ptuohy@emarquettebank.com Services Provided: Multifamily/apartment building lending for all Chicagoland. Fast, local decision making. Dedicated local servicing staff. Simple, no-hassle paperwork. Quick close. Flexible terms. Clients enjoy ZRent – an automated, hassle-free, no-cost way to collect monthly payments from tenants.

Company Profile: Marquette Bank started in Chicagoland in 1945 and is still locally-owned/ operated. Personal/business banking and lending, home mortgages, land trust services, estate planning, insurance services, wealth management and multifamily lending.

UNION NATIONAL BANK

101 E. Chicago St. Elgin, IL 60120

P: 847.888.7500 | F: 847.888.2662 Website: unbelgin.com

Key Contacts: Anthony Catanese, Business Development Manager, afcatanese@unbelgin.com; Jill Markowski, Director, jemarkowski@unbelgin.com; Jay Deihs, Sr. VP, jddeihs@unbelgin.com Services Provided:Loans customized to meet the individualized needs of our borrowers. Servicing investors and small business owners.

Company Profile: Privately-held, Commercial Bank. 110 years old. Providing Personal service throughout the Chicago Metro area. Known for fast response time and experience in Commercial & Investment Real Estate lending.

Service Territory: Chicagoland including NE Illinois collar counties. FOR ADVERTISING OPPORTUNITIES IN THIS SECTION, PLEASE CONTACT SUSAN MICKEY AT SMICKEY@REJOURNALS.COM OR 773.575.9030

DECEMBER MARKETPLACE 23

ReJournal 10 x 13 print ad.pdf 1 12/21/20 9:14 AM

Chicagoland’s

Union Electrical Team

LEARN MORE AT POWERINGCHICAGO.COM C M Y CM MY CY CMY K

By Mia Goulart, Senior Staff Writer

By Mia Goulart, Senior Staff Writer