Thursday 02 November 2023 ICC Wales, Newport

4 theatres

4 hours’ CPD

Whilst many firms are currently working hard to demonstrate consumer duty compliance, we recognise that most practitioners already push beyond minimum regulatory standards. On 02 November we want to shift the focus from rules to “Loving your clients to death” as a cultural necessity for client centricity.

The conference will explore how our ethical duty to clients can evolve as part of a greater focus on contributing positively to our environment and wider society.

Speakers include Don’tmiss

Summer 2023

39-41

29

20 Fenchurch Street, London, EC3M 3BY

Tel: (020) 8989 8464

Fax: (020) 8530 3052

Cover illustration: Jedi Noordegraaf / Ikon Images

Personal Finance Professional is the magazine of the Personal Finance Society (PFS). Members receive a copy as part of their membership. The cost to non-members is £7 per copy. Views expressed by contributors or advertisers are not necessarily those of the PFS. The PFS will accept no responsibility for any loss occasioned to any person acting or refraining from action as result of the material included in this publication. Reading issues of Personal Finance Professional can be included as part of members' CPD requirement (35 hours per year).

EDITORIAL

Editor: Luke Holloway luke.holloway@cii.co.uk

Contributing editor: Liz Booth

DESIGN

Art editor: Yvey Bailey

Picture editor: Claire Echavarry

Production: Jane Easterman

Printing: The Manson Group

For sales and advertising please contact us on pfs-sales@redactive.co.uk or 020 7880 7661

32-34

Is

PUBLISHER

Redactive Publishing Ltd, 9 Dallington St, London EC1V 0LN

ISSN 1754-8055

© Personal Finance Society.

As we head into the peak of summer, there is much to look forward to in terms of initiatives for our members in the coming months.

We are really excited about the return of the PFS National Conference, taking place on Thursday 2 November at the ICC Wales in Newport.

Last year’s Festival of Financial Planning demonstrated the value of being together among peers, where ideas are exchanged and new partnerships forged. We’re excited to be bringing together financial advisers, paraplanners, compliance specialists, support teams and business leaders – together with our key partners – in one place for an invaluable day of networking, ideas, CPD and inspiration.

With a packed programme of 20 sessions across the keynote and breakout theatres, and more than four hours of CPD, this one-day conference is not to be missed. Registration is now open – why not book your free ticket now?

To find out more, head over to: www.pfsdutybound.org

If you can’t wait that long, then why not join one of our much-loved summer conferences or book ahead for our autumn conferences? With 75 events taking place across the country, there is something for everyone.

Volunteers from our PFS regions will guarantee you a warm welcome, while each conference will focus on topical updates from subject matter experts. During the first half of 2023, we’ve made a conscious effort to freshen things up too. Feedback has been really positive, especially about the instant polling – which creates natural talking points – and the designated times for ‘lunch and learn’ and ‘conversations over coffee’ slots.

To find the conference closest to you, visit: www.thepfs.org/events

As our profession moves closer to adoption and implementation of the FCA’s Consumer Duty requirements, how ready is your firm?

The new rules and guidance come into force on a phased basis. For new and existing products or services that are open to sale or renewal, the rules come into force on 31 July 2023. For closed products or services, the rules come into force on 31 July 2024.

You are likely to already be meeting many of these requirements but may still need to take some additional steps. The PFS emailed all members at the end of April with a list of resources and reading, to help ensure you and your firm are fully prepared. These included:

● Good Practice Guide: A practical guide to the Consumer Duty

● PFP article: ‘Duty bound’ (in the February 2023 issue)

● PFS Radio podcast: Getting to grips with the Consumer Duty. You will find all of these on our website at: www.thepfs.org

Our in-person events are supplemented by a varied programme of digital events, available to watch live or on demand at a time that suits you. Forthcoming events are always listed in the PFS member newsletter, with the following taking place later in June:

● Raising awareness of economic abuse and transforming responses to it.

● Can low-cost multi-asset ever be ‘responsible’?

● Retirement portfolio challenges.

Find out more about the benefits in this article by visiting:

PFS local conferences and digital events thepfs.org/events

PFS National Conference pfsdutybound.org

Personal Finance Awards 2023/24 pfsawards.org

PFS POWER pfspower.org

If you are a financial planner or aspire to deliver a holistic financial planning service, have you checked out PFS POWER recently? It is content written and spoken by financial planning practitioners for financial planning practitioners. A key purpose is to keep financial planners at the forefront of the personal finance profession, while a core focus is on achieving great outcomes for consumers.

Head over to www.pfspower.org to check out the latest POWER podcasts, articles and weekly webinars, covering every aspect of financial planning. There’s plenty to catch up on in the on-demand library too.

Our paraplanning community is delivering a series of ‘paraplanner lab’ sessions on the first Wednesday of each month. These one-hour virtual workshops welcome all paraplanners to hear from a variety of experts, participate in open discussions and network with peers (to book, follow the links in the PFP newsletter).

We have also published a new good practice guide for paraplanners, called A practical guide to confident, constructive and challenging conversations. It gives paraplanners the confidence to hold constructive and challenging conversations with clients. Find it in the Learning Content Hub on: www.thepfs.org

Later this year, we’re looking forward to celebrating the best our profession has to offer when we present the Personal Finance Awards 2023/24 to those firms and individuals who most impressed the judges.

SEPTEMBER:

● Autumn local conferences

OCTOBER:

● Personal Finance Awards 2023/24 – presentation

NOVEMBER:

● PFS National Conference

There’s still time to enter too –visit www.pfsawards.org to view the categories and submit your entry before the Friday 14 July deadline. ●

Simon Webster is membership marketing manager of the PFS

The Chartered Insurance Institute (CII) published its new five-year Strategic Plan in April. The plan contains six strategic themes that place a renewed emphasis on professional standards and the value of CII and PFS membership supported by world-class learning and qualifications. It also reflects the organisation’s unique member proposition, which encompasses ‘Credibility, Community and Career’.

Launching the plan, CII CEO

Alan Vallance said: “I am delighted to announce this new plan and the detailed set of actions we will be taking in the next five years to achieve the Institute’s mission – ‘to educate and support our members to deliver services to the highest professional standards and to advocate for the public good’. We are an international organisation, with members living and working in more than 150 countries around the world and our vision is to ensure we help them in every way possible to build a world that delivers ever greater financial resilience for individuals and societies

The PFS is delighted to announce that this year’s Personal Finance Awards are now open for entries.

The Personal Finance Awards recognise and celebrate outstanding individuals and firms who strive to deliver exceptional consumer outcomes within the financial planning profession. Shining the spotlight on those who excel in delivering high standards and commit to continuous improvement, the awards are an opportunity to showcase success and celebrate remarkable achievements.

@G4Christina

And we’re off ! @pfsconf

#PurelyParaplanning #Manchester

@HiltonHotels @ArgonautPP hosted by the esteemed Alan Gow of Argonaut Paraplanning Have a great day everyone

@CFNIreland

more broadly.”

The plan is organised into two distinct phases. The first year of the plan – 2023 – focuses on addressing legacy systems issues, acknowledging that in recent years the experience encountered by some members has not always been up to the high standards the organisation believes they should expect. The subsequent phase, from 2024-27, will see the Institute develop products and services intended to provide an excellent member experience for every individual member and corporate customer around the world, as well as stimulating interest among others to join the insurance, financial planning and mortgage advice professions.

To read the new CII Strategic Plan, visit: www.cii.co.uk/strategicplan-2023-2027

To find the category or categories relevant to you, check the entry criteria and find out more information, visit: www.pfsawards.org

Attended the @pfsconf NI Spring Conference. Our Fund Development Manager, Marcus Cooper spoke to a packed hall on the benefits of the legacy match fund and how giving a gift in your will can help local communities

@DDHub_

Delighted to join the Stamford branch of @pfsconf for the Spring Conference, talking about Investment #duediligence in the context of #consumerduty

The CII has published the Green Finance Companion Guide, which supports delivery of its Code of Ethics and particularly the duty for members to act with the highest ethical standards and integrity.

The guide provides an explanation of green finance, gives members guidance about how to incorporate green finance-related thinking into their decision-making and sets out their need to act as role models when it comes to sustainability. While the guide is written for members, it is intended to be used by all members of the insurance and personal finance professions.

The guide also recognises that protection of the natural environment

We are delighted to announce the PFS National Conference is back for 2023. Join us on 2 November at the ICC Wales as we shift the focus from rules to ‘Loving your clients to death’ as a cultural necessity for client centricity.

The conference will explore how our ethical duty to clients can evolve as part of a greater focus on contributing positively to our environment and wider society. By becoming a truly diverse and inclusive sector we have a real opportunity to not only plan to meet the aspirations and goals of the few, but to support the financial resilience of the many.

She’s a jolly good fellow! Congrats to @EmmaCActive who’s now a Chartered financial planner and @pfsconf #Fellow “The benefit to clients in having this level of knowledge is immeasurable!” - @PaulGActive Well done Emma

Every day is a learning day & yesterday certainly was no exception. Great speakers at the @pfsconf roadshow looking at retirement & later life advice. Time to provide the best advice & support to those who have supported us

is a global concern and highlights action plans, resources and commitments made by regulators, governments and federations across the world to enable effective change.

The guide summarises the CII’s expectations of members in relation to each element of its Code of Ethics. Specific details of what else our members can do in relation to green finance to ensure compliance with the other duties in the Code of Ethics are also provided, along with a selection of further reading

To read the guide, visit: bit.ly/3WhmLB8

Read our article on the new guide on page 20 of PFP

With a packed programme of 20 sessions across the keynote and breakout theatres which will cover four hours of continuing professional development, this one-day conference is not to be missed. Sessions will include financial planning skills, leadership, business ethics, advice and wealth management, sustainability, diversity and inclusion, as well as technology.

Speakers include many familiar names, including Chris Budd, Melissa Kidd, John Dashfield and Julia Dreblow.

The Conference is FREE to attend for all PFS members. Secure your ticket today at: www.pfsdutybound.org

10,475

The Chartered Insurance Institute (CII) is delighted to announce five financial planning firms that have gained corporate Chartered status. Chartered status is a symbol of technical competence and signifies a public commitment to professional standards.

Firms that have been awarded Chartered status at the beginning of 2023 are: Aspire Wealth Management, Darnells Wealth Management, Informed Choice, Lane Financial Management and Progeny Wealth.

Melissa Collett, executive director of

professional standards at the CII, said: “We are proud to welcome these firms into our Chartered community. In achieving corporate Chartered status, they have made a public declaration to professional standards and committed to upholding the Chartered ethos of nurturing knowledge, client-centricity and serving society. Corporate Chartered status is a key instrument in building public trust and is a true mark of professionalism.”

To find out more about becoming Chartered, visit:

www.cii.co.uk/chartered

Stonebridge, the national mortgage and insurance network, has announced it has become the first mainstream mortgage network to be recognised as an Associate Firm of the Society of Mortgage Professionals (SMP), cementing its commitment to high professional standards.

Becoming an Associate Firm means that Stonebridge is aligned with the principles of the SMP, which strives to build public trust in financial services and elevate the importance of financial wellbeing through mortgage and protection advice.

The core principles of being an Associate Firm of the SMP include:

● Act in the best interests of clients, using a customer charter to aid transparency.

● Demonstrate integrity, probity and fairness by aligning with the code of professional ethics and conduct.

● Invest in your people by funding a policy of ongoing training and

professional development.

● Operate a clear diversity and inclusion policy, for both staff and clients. As an Associate Firm, Stonebridge

will work with the SMP and Chartered Insurance Institute community to raise the levels of professional knowledge and technical competence within the advisory space.

Rob Clifford, chief executive of Stonebridge, commented: “Stonebridge has always been committed to the raising of professional standards within our business, our individual firms, but also in terms of the entire mortgage sector. This is why we’re very pleased to be announcing our membership of the SMP as an Associate Firm, which will allow us to leverage the collective knowledge, expertise, support and resources that come with it, and for us to share that with our member firms. We’re looking forward to playing a contributory part in everything the SMP has to offer in the months and years ahead.”

For more information about Associate status visit: www.smp.org.uk/ membership/associate-firm

The Institute for Fiscal Studies (IFS) has launched the first report of a multi-year project looking at the challenges facing the pension industry and making the case for a review of the entire UK pension framework. The timing is chosen to mark 20 years since the final report of Lord Turner’s Pensions Commission, which led to the introduction of auto-enrolment and increases to state pension ages.

The new Pensions Commission will assess future risks and determine what needs to be done to secure decent retirement outcomes for current workingage generations. The IFS has the former Labour Chancellor, Alistair Darling and former Conservative Work and Pensions Secretary, David Gauke, helping to oversee the Pensions Commission, which will centre on three key questions:

● Are people saving appropriately for retirement, in terms of both the amount and the form of saving, and if not, how can government policies help?

● How should the state support people from late working life and through retirement?

● Do people require more assistance to use their wealth appropriately in retirement?

The last 20 years have seen:

● Continued decline of defined benefit pensions in the private sector.

● Abolition of state earnings-related pensions.

● Low interest rates.

● Falling homeownership.

● Low average contributions to defined

PODCASTS

contribution arrangements.

● The introduction of pension freedoms, which offer flexibilities but reduce the extent of risk-sharing in retirement.

● A collapse in pension saving among the self-employed.

In the IFS’s view, this combination means a major review of pension provision is now needed to give the UK a chance of avoiding a future that looks worse than the present.

The intent is to produce a final report, including specific policy recommendations and options, in early summer 2025.

The Intermediary Ambassador Network (IAN) is calling on PFS members to join the network and raise the profile of T-Levels, apprenticeships and other skills programmes

The IAN is looking for personal finance professionals to join its network of engaged advocates promoting the benefits of technical education and hosting industry placements.

T-Levels are technical-based qualifications in England, developed in collaboration with employers and businesses.

The IAN costs nothing to join, spans virtually all sectors across England and gives members access to accurate, up-to-date information about our range of skills offerings. It will also give you access to a wide variety of intermediary colleagues whose experience can help you.

Find out more, email: tlevel.ambassadors@education.gov.uk

The PFS’s podcast channel, PFS Radio, has launched its 10th season.

The channel – hosted by the Personal Finance

Professional website – invites industry experts to discuss an array of themes from across the financial advice profession as well as give PFS members and the wider sector an insight into the work of the professional body.

This series features episodes covering a range of topics, including ‘Benefits of Professional membership’, ‘Simplified Investment Advice’, ‘Green and Sustainable Finance’ and ‘Vulnerability and the Consumer Duty’.

The podcasts are also available to Android users via SoundCloud, Stitcher Radio or via Apple.

To listen to the latest season and access a complete library of previous episodes, visit: www.pfp.thepfs.org/pfs-radio

The Financial Conduct Authority (FCA) and the Treasury have published their proposals for a review of the senior management regime. The Treasury review is focusing on “the compliance requirements for authorising the appointment of new senior managers, the differing levels of scrutiny applied to different firms and the interaction of the senior managers and certification regime (SM&CR) with other regulatory regimes.”

UK and EU aim to improve post-Brexit financial services regulation while the FCA and PRA announce proposals for a review of the senior management regime

The UK and EU have published the draft of a memorandum of understanding (MOU), intended to improve postBrexit regulatory cooperation on financial services.

The draft agreement commits the two to “jointly endeavour to pursue a robust and ambitious bilateral regulatory cooperation in the area of financial services”.

The MOU was heralded as a “significant step” to a more constructive relationship by Economic Secretary to the Treasury and City Minister, Andrew Griffith.

The draft agreement outlines that Britain and the EU have “a shared objective of preserving financial stability, market integrity and the protection of investors and consumers”, which needed to be reassessed when the UK left the EU and stopped being subject to its regulations.

Griffith said: “This is just the first yet signifi step towards a more constructive financial services relationship between the UK and the EU – one that is built on mutual benefit and the spirit of cooperation.

“Our financial markets are deeply interconnected and this framework will mean we can engage with our partners in the EU, much as we do with other major partners like the US.”

The Treasury is keen to produce a regime that strengthens the UK internationally, stating: “Given the UK’s long-established position as a global financial services hub, the government believes that it is important that high standards for regulation are delivered in a way that does not create unnecessary or disproportionate compliance burdens.”

The joint FCA and Prudential Regulation Authority (PRA) review puts a more optimistic spin on these issues, stating: “The FCA and PRA are aware that some stakeholders have previously raised concerns about delays in obtaining regulatory approval for Senior Manager appointments. Significant improvements have been made already, and there have been reductions in delays both at the FCA and the PRA, with a substantial reduction in the number of total open applications and those over three months.”

They go on to ask about different aspects of the SM&CR, including the effectiveness of regulatory references and criminal records checks.

The FCA has reminded borrowers they can get help from their lenders if they are struggling to keep up with payments, as it found the number of people struggling to meet bills and credit repayments has risen by 3.1 million since May 2022.

The number of adults who missed bills or loan payments in at least three of the last six months has also gone up by 1.4 million in the same period. e FCA has repeatedly reminded firms of the importance of supporting their customers and working with them to solve problems with payment, including by writing to industry bosses to make sure they are aware of the regulator’s expectations. Where firms have not supported their customers properly, the FCA has told them to make changes. It reminded 3,500 lenders of how they should be supporting borrowers in financial difficulty and told 32 lenders to make changes to the way they treat customers. ●

he latest Budget may have left many across the UK feeling the chill with its tax freezes, but on pensions, Chancellor Jeremy Hunt announced the standard annual allowance will increase from £40,000 to £60,000 and the lifetime allowance charge will be removed.

The minimum tapered annual allowance will increase from £4,000 to £10,000, as will the money purchase annual allowance.

The move was broadly welcomed. However, as Alex Thornton, international pensions partner at KPMG in the UK, says: “For those with relevant lifetime allowance protections, it will be critical to confirm how these reforms will affect their tax-free pension commencement lump sum.”

There are others who also need to take a close look at the fine print, according to Thornton: “Those with UK tax relieved savings in international pension plans where the annual and lifetime allowances apply, who are considering pension consolidation, or are approaching retirement, should consider taking detailed personal advice to confirm their specific UK tax positions.”

The key here is the requirement for advice – something that should be music to the ears of advisers looking for good reasons to be in touch with their clients and to attract younger clients who may be considering their pension options.

Another group of people looking for advice, suggests Thornton, are those considering their inheritance tax planning. “As the annual allowance will increase and unused annual allowance can still be carried forward – and as a lifetime allowance charge will no longer potentially be incurred on reaching age 75 (or on dying before reaching age 75) – some individuals might want to consider whether enhanced pension contributions might have a role in inheritance tax planning,” he said.

Another consequence that will require advice is that, as registered pension scheme savings will no longer be subject to lifetime allowance ‘testing’ at age 75, this may encourage many members to delay taking benefits, says Thornton, adding that there could also be further complications in relation to defined benefit arrangements.

Finally, he suggests advisers might want to discuss with their clients the potential implications of any future changes to the proposed reforms.

“As has become clear over recent years, the taxation of pensions is subject to change, which presents a challenge for those seeking to plan ahead for retirement over the longer term. Any potential steps in response to the reforms announced at the Spring Budget should be considered in light of the possibility of further future change, such as a future government potentially reintroducing a lifetime allowance,” he warns.

Meanwhile, the case for encouraging younger clients to start saving into a pension is being repeated again and again.

For example, Clever, a real estate data company, has conducted a survey revealing that nine in 10 Gen Xers (90%) have financial regrets, with nearly one in five (19%) not confident they will be able to retire by age 80 and only a third of Gen X thinking they will retire by the age of 65.

The survey found that a majority of Gen Xers (53%) aren’t very confident they will retire by 75 and a frightening 11% of Gen Xers don’t think they will ever retire. Of those, a staggering 73% said it’s because they can’t afford to. Only 4% of respondents said it’s because they don’t want to retire.

Despite the majority (69%) of Gen Xers wanting to retire before age 65, only 37% believe they will be able to do so.

Financial corporation

Fidelity recommends having $555,000 (£446,170) saved for retirement, says Clever, but in reality, only 9% of Gen Xers have this amount saved. The study found 64% of Gen Xers are saving 10% or less of their monthly income for retirement, despite Fidelity’s recommendation to save 15%.

Even more concerning, 20% of Gen Xers have never saved for

The UK government has changed the lifetime allowance for pensions in a bid to str engthen the labour market. Liz Booth reports on the opportunity this poses for financial advisers

53% OF GEN XERS ARE NOT CONFIDENT THEY WILL RETIRE BY 75

retirement. Nearly half of respondents (47%) admit they do not have their finances under control and more than one third (35%) have sacrificed saving for retirement to cover basic necessities.

Meanwhile, Insurance Europe has waded into the fray with new guidance, encouraging younger consumers to start their savings habit as soon as possible.

It warns: “Europeans are getting older. While today there are around three working-age people per retired person, it is expected that in 2070 there will be fewer than two, putting pressure on state pension systems.”

Insurance Europe continues: “Thinking ahead about retirement needs can be hard. Many young –and not so young – people believe that pensions are something to think about later in life and postpone pension-related decisions. The guidance outlines some steps people should consider when saving for their future.”

As part of its #InsureWisely campaign, it likens pension saving to gardening. “Like growing plants or trees, saving for retirement requires some planning and foresight. A gardener must plan their garden and determine which plants will thrive in that environment.

“Similarly, when saving for retirement a person must consider their current financial situation, their expected future needs in retirement and the income required to cover

An excerpt from Insurance Europe’s latest guidance for young people on starting to save for their pension.

Start early

The first step to growing your retirement savings is to start saving early and enough. The earlier you start, the more time your money has to grow. It is important that your long-term pension plan matches your long-term goals and will provide you with enough to live on in retirement.

Insurers provide different types of long-term savings solutions, including occupational pensions and personal pensions. The products offered by insurers often combine an investment element with some form of protection, for example financial guarantees protecting the money you invested. Your insurer can help you to find the product that best suits your needs.

Provide sunlight

Just as plants and trees need sunlight to grow, pension savings need exposure to the right asset mix to achieve your retirement goals. Different types of insurance savings products enable you to gain exposure to a well-diversified, long-term investment portfolio. Many investors are also concerned about the impact that their investments have on the world around them. By incorporating sustainable investments into your pension plan, you can not only secure your financial future but also contribute to a better world.

Watch it grow

Your retirement savings are now beginning to grow. Keeping an eye on how your savings grow will motivate you to keep up your efforts. Bear in mind that important life events such as getting married, moving abroad or changing your job can have an impact on your retirement plans.

Many people are at significant risk of realising too late that their pension will not be enough to ensure an adequate standard of living. To avoid this, it is important to review your financial planning for retirement on a regular basis.

our future pension entitlements These cover your nt income and

translate into in terms of expected can use these tools to check whether ck to goals.

Many European countries have set up pension tracking tools that can give an overview of your future pension entitlements. These usually cover your state retirement income and your occupational pensions. You might also receive an annual statement providing an overview of your current personal pension savings and what they might translate int benefits. You can use these tools to check whether you are on track to reaching your retirement goals. By starting early, choosing the right pension plan, monitoring your savings regularly and remaining disciplined and committed to your goals, you can enjoy your retirement doing the things you love, knowing that your savings are there to support you.

d committed to your you can rement the you love, pport you

Source: Insurance Europe

ey can choose the

best suits

them, so that they can choose the pension plan that best suits their needs.” ●

Liz Booth is contributing editor of PFP

buting editor PFP

As the FCA launches another thematic review, Dr Matthew Connell reflects on regulation and the value of advice

r re

SSo far this year, everyone has been talking about the Consumer Duty, and rightly so. But by the end of the year, another Financial Conduct Authority (FCA) initiative that is likely to be on everyone’s lips is the thematic review of retirement income advice, which was launched quietly on the FCA’s website in January and is due to be completed in the last quarter of this year.

Taken together, the two projects form the strategic and operational arms of the FCA’s work on retail financial investments. Understanding how they might fit together is the key to understanding regulatory risks in this sector going forward.

As we know, the Consumer Duty identifies four outcomes for firms to work towards:

● Products and services – this covers elements of product governance for providers and, in particular, matching the right products and services to different target markets.

● Price and value – this does not imply a price cap, or a requirement to be the cheapest in the market. It does, however, mean that firms cannot simply charge as much as they think they can get away with. The FCA says: “Firms should avoid designing products and services to include elements that exploit consumer lack of knowledge and behavioural biases to increase the price paid.”

● Consumer understanding – the FCA makes clear that this does not mean firms must “verify that all individual consumers have in fact understood the information provided”. However, it suggests: “One question firms can ask themselves is whether they are applying the same consumer support standards to deliver good consumer outcomes as they are to generate sales and revenue.”

● Consumer support – this requires firms to “enable consumers to get what they paid for… without unreasonable barriers”. The retirement income review will use these outcomes as a lens to bring common market practices into focus. The FCA says: “The results will… be an important indicator of how firms are implementing the Consumer Duty.”

So, what areas will the thematic review be looking at?

We already have a pretty good idea of some of the potential themes from comments made by FCA leaders, including:

● “Adviser charges [are] clustered at a small number of price points”.

● “This means that advice firms need to think about whether the advisory services meet the needs of different consumers within identifying target markets.”

So, where should firms start when thinking about a response to this challenge?

Although it is natural for the regulator to start talking about price, it is vital to start with the potential benefits that advice brings to clients.

These benefits are numerous, over and beyond the selection of a suitable investment or insurance product, or the ongoing rebalancing of portfolios. These benefits include:

● Setting clear and relevant financial goals – for example, the International Longevity Centre has found that taking advice leads to an average increase in retirement income of £47,000. Once people know what they are aiming for, they are much more likely to achieve it. The research

also found: “Fostering an ongoing relationship with a financial adviser leads to better financial outcomes. Those who reported receiving advice at both time points [2006/2008 and 2014/2016] in our analysis had nearly 50% higher average pension wealth than those only advised at the start.”

● Increased confidence and security – additional research by the International Longevity Centre in 2020 found that people who took advice were more likely to have:

0 Improved financial literacy and capability through interaction with their financial adviser, which helped them better understand the risk and reward trade-offs when saving and investing for later life.

0 Greater control of their financial future, including a sense of relief that their finances are being reviewed constantly by an expert who can guide them through the financial ‘minefield’ and offer a consultative relationship around decision-making.

0 Greater reassurance, knowing that they’re ‘doing the right thing’ by consulting an expert, thereby avoiding constant selfquestioning about whether their decisions are right or wrong, whether they’re ‘on the right track’ and whether they’re ‘missing anything’.

0 A boost in confidence, knowing that they have a clear, detailed plan of how they will achieve their long-term goals, particularly accessing their pension.

0 Less worry than they felt they would have had without advice. Their peace of mind and security came in part from having taken the advice given and actioned their plans and in part from knowing that they had safeguarded their future.

Other research gives more specific and measurable benefits of advice:

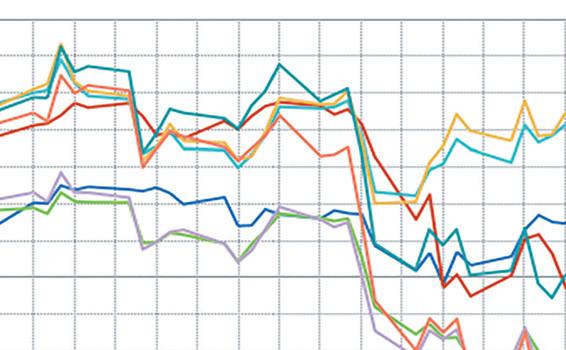

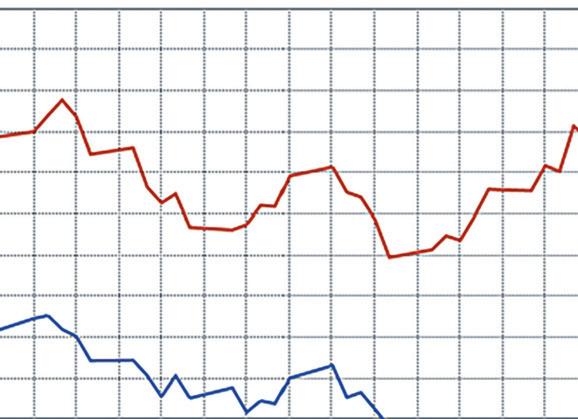

● Giving reassurance during periods of short-term market turbulence. Research by an investment firm in the US concluded: “Statistically, the average stock-fund investor’s inclination to buy high and sell low cost them 2.02% annually in the 36-year period from 1984–2020.”

● Giving advice on taxation, such as writing life insurance in trust to manage inheritance tax liabilities, or on withdrawing pension income from different accounts in the right order, which Vanguard estimates can boost investment returns by up to 1.5%.

● Long-term cashflow planning, which is vital in the relatively new environment of pension freedoms – this is increasingly based on sophisticated models of how to adjust income in the light of investment volatility, rather than simple rules of thumb.

● Helping clients to avoid scams

– ongoing advice gives clients a trusted expert to turn to if they are targeted by investment scams. Firms can match these benefits to the needs of different target markets, to build up a segmentation of their client bank. A non-exhaustive list could include these immediate and ongoing needs:

● Clients’ need for cashflow planning.

● Their need for tax advice.

● The complexity of their attitude to risk and their need for coaching through turbulent markets.

● Their need to consider using assets like their home to achieve their financial plans, either through downsizing or equity release.

● Needs around long-term care planning and inheritance tax planning.

● Wider coaching needs around avoiding hoarding their retirement pot in a way that harms their standard of living.

● Coaching around mitigating risks through non-financial products – for example using new forms of energy to manage their fuel bills.

● Their need for coaching and support to avoid scams.

A firm’s learnings based on consumer needs can then inform pricing strategies – if a firm can demonstrate a clear link between the needs of different groups of clients, the cost of providing services to meet those needs and a range of charges based on that analysis, it will be in a very strong position to defend its proposition. The next stage of its work would be to monitor client understanding and

reactions to the service they are getting, to ensure they have been segmented into the right target group and to gauge where changes in a firm’s proposition are necessary.

The introduction of the Consumer Duty is not the end of the road, but a milestone on the journey – the next will come at the end of the year with the thematic review of retirement advice. Completing this journey does not have to mean huge amounts of bureaucracy, but it will require reflection and, where necessary, changes to propositions.

Ultimately though, this process will leave the advice profession stronger because it will shed light on services that already make a massive, positive difference to the public. ●

Dr Matthew Connell is director of policy and public affairs of the CII

The Consumer Duty is not the end of the road, but a milestone on the journey – the next will come at the end of the year with the thematic review

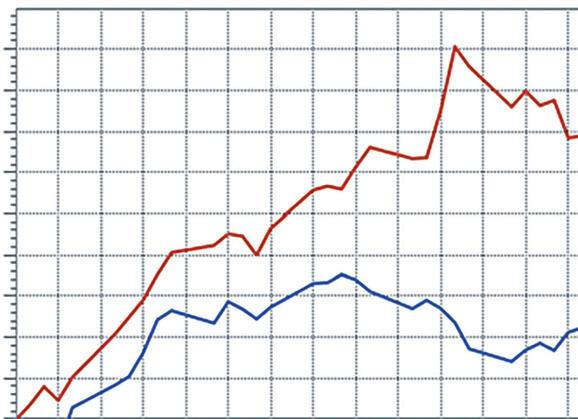

HHM Revenue and Customs (HMRC) has been seeing its income from inheritance tax (IHT) increase steadily in the past few years as more people fall under its net. In fact, in the past year the Treasury has seen its income from IHT increase by £0.9bn to £6.4bn. Not resting on its laurels, HMRC has also been looking to close any loopholes and catch out the unwary. As tax adviser RJP reports: “HMRC has launched many new tax enquiries disputing inheritance tax payments in the last tax year (2021-2022). These enquiries recovered an extra £326m, increased from £254m in 2020-2021 and £273m in 2020-2019.

Inheritance tax is not only an emotive subject but an extremely complex area, where good financial advice can pay huge dividends. Liz Booth takes a look

“In part,” it continues, “these increases are because some assets are rising in value very quickly, helped along by inflation of course. Added to this, HMRC now allocates more resources to exploring individual cases, which is also bringing in more taxes; around 20% more enquiries have been launched into IHT returns.”

However, it also warns: “One other reason why more taxpayers have found themselves facing enquiries is due to the number of people opting to handle their IHT returns (and potentially the grant of probate process) themselves. Rather than use a professional adviser, some are taking a DIY approach. This can be fine in a very simple estate, but it does tend to lead to mistakes.”

This is, of course, where financial advisers can play a very real role in supporting their clients and emphasising the need for specialist help. Even Moneysaving Expert agrees: “This is a sensible step for anyone thinking about the perils of inheritance tax and what happens to your money once you are gone. If you have sizeable assets, then inheritance tax is one of the few occasions where paying for good professional legal or tax advice is well worth it – spend £100s to save £100,000s.”

The reality is that more people are being caught in the net of IHT and Laura Tommis, business and relationship development manager at Zedra, says: “It is not surprising that many families who have not considered themselves wealthy or thought their estates could be within the remit of IHT have been dragged into the statistics.

“While the housing market, which has historically contributed to an increase in IHT receipts, has slowed down recently, stagnant tax thresholds and inflation have resulted in more estates now being liable for IHT than before. With both the nil rate band and residence nil rate band

allowances frozen until 2027/2028, it is inevitable that this trend will only continue.”

She also believes there are ways for the experts to help, “such as lifetime gifting into trusts, which can offer powerful tools when used correctly and appropriately over time”. She adds: “A suitably drafted will can also ensure that families can take advantage of available tax allowances and reliefs, such as the residence nil rate band, where available.

“Professional advice should remain central to any family’s IHT planning goals, both from the outset but also to keep matters under regular review to capture any changes in personal circumstances as well as within the tax and regulatory landscape,” Tommis concludes.

Highlighting the need for this advice, the Office for Budget Responsibility says: “In 2023-2024 we forecast that IHT will raise £7.2bn. This represents 0.7% of all receipts and is equivalent to 0.3% of national income.

“IHT receipts have increased as a share of GDP since 2009-2010, mainly due to rises in asset prices. Residential property makes up the largest share of most estates and average house prices have risen by more than 70% between 2009 and 2022. The rise also reflects significant fiscal drag as the IHT threshold has remained at £325,000 since 2009.”

The number one suggestion from all the experts is that clients should ensure they have a will and a dependably executor to carry out their wishes – and to ensure the correct IHT is paid.

However, as STEP, a global professional body, comprising lawyers, accountants, trustees and other practitioners helping families plan for their futures, points out: “Modern families can often be complicated families: they can be challenging, diverse, intricate and all over the map – often literally – and their needs are equally complex. Identifying and navigating their needs requires expertise and collaboration across borders, cultures and professions.”

STEP has undertaken a research project, sponsored by TMF Group, to gather insight about the families that STEP members advise and what their wealth and succession planning needs are. It identifies the key complexities and constraints currently facing families and their advisers, as well as highlighting the need for advisers and legislators to adapt and modernise to keep up with the needs of today’s families. The results should make for interesting reading. ●

Liz Booth is contributing editor of PFP

In some cases, HMRC has challenged asset and property values following the sale of an asset at a higher value than the figure reported on the IHT forms. Other common errors people make when dealing with an estate can include failure to declare bank accounts or unquoted shares, missing off accrued interest, including assets on the wrong forms or misunderstanding the reliefs available, such as:

● The nil rate band.

● The transferable nil rate band.

● The residential nil rate band.

● The transferable residential nil rate band.

● Business property relief.

● Agricultural property relief.

● Failed PETs (gifts made within the seven years prior to death).

● The calculation of taper relief.

● The evidence requirement for gifts out of income.

Source: RJP

nsuringasustainablefutureforour

Ensuring a sustainable future for our planet is widely recognised as one of the greatest responsibilities we face as a global community. The CII’s newly published Green Finance Companion Guide explores sector-relevant, actionable items, encouraging members to consider climate change and prioritise sustainability within their work.

The development of the United Nations’ 2015 Sustainable Development Goals (SDGs) saw governments and businesses resolving to take action to uphold a global blueprint for peace and prosperity for people and the planet. The commitment by UN member states to uphold the SDGs also led to a raft of additional, specific, commitments made by and for insurance and financial services, such as the UK

government’s2019GreenFinance

government’s 2019 Green Finance Strategy, which explored the roles and responsibilities of the finance sector in sustainability.

The term ‘green finance’ is generally used to describe activities relating to the two-way interaction between the environment and investment, covering areas that involve the quality and function of the natural environment. These include:

● Biodiversity loss

● Greenhouse gas emissions

● Renewable energy

● Energy efficiency

● Natural resource depletion or pollution

● Waste management

● Ozone depletion

● Changes in land use

● Ocean acidification

● Changes to the nitrogen and phosphorus cycles.

Reflecting these important factors, the CII has published a Green Finance Companion Guide to its Code of Ethics, to inform and advise members on how to navigate their responsibilities in making sustainable decisions aligned with the principles of green finance within their work.

“One of the greatest needs of our time is to make sustainable choices for the future and be mindful of protecting our environment and natural resources,” says Alan Vallance, CEO of the CII. “Clients are increasingly aware and concerned about their impact on the planet, while many firms in which professionals work have ESG policies that they expect their staff to uphold.

“This companion guide seeks to help insurance and personal finance professionals understand that their responsibilities when it comes to green finance are part of their duty to act ethically and learn about how they can make a difference day to day, to meet the needs of the planet as well as the needs of their clients.”

The Green Finance Companion Guide seeks to engage CII members with matters of climate change and the environment, while providing a comprehensive understanding of green finance and guidance on acting as a role model on sustainability in the finance sector.

Green finance is an area where self-regulation in terms of ethical decision-making is paramount. The common practice of asking oneself ‘How would my parent/ sibling/partner/best friend react to the decision I have just made?’ is repurposed to encourage an approach reflective of conversations with future generations, where the impact of decisions made now may be topical in years to come – ‘What would my child/niece/nephew/godchild/ grandchild think of this decision if they were to know about it when they are older?’

Tangible actions will include joining networks that seek to promote green finance activities, as well as encouraging your employer to publish its own green finance strategy or sponsor relevant research.

Personal finance professionals may already be seeing an increase in interest in green financial products from their clients, as well as being aware of the Financial Conduct Authority’s vision to create a regulatory environment where financial advisers help their clients capture opportunities to ‘finance green’, as the UK moves to become a low-carbon economy.

The challenge for PFS members is to ensure that they have a well-informed knowledge of sustainable products that will meet the needs of their clients, while ensuring that the green finance products they are recommending are not merely an

example of ‘greenwashing’, where marketing is used to erroneously portray an organisation or product as being environmentally sound.

The Green Finance Companion Guide prompts readers to act in the best interests of each client by asking questions that help you to understand a client’s concerns about the environment, to recommend a product that meets their wishes as well as their needs and to be transparent about the different benefits and risks that may be associated with green products.

There are many social implications involved in the role of finance in sustainability. In many cases, the sustainable option comes at a greater expense – electric cars, organic food, sustainable fashion – thus excluding those with lower incomes. The Green Finance Companion Guide therefore highlights the relevance of green finance to ESG more broadly, drawing the important distinction between an investment product that is ‘green’ and one that is ‘fair’, in terms of accessibility to all.

The impacts of climate change also disproportionately affect poorer communities on a global scale, including those unable to relocate from areas badly affected by climate volatility due to financial restrictions. Understanding how our decisions impact others – positively or negatively – is key to making sustainable decisions and a key message of the guide encourages professionals to put themselves in the position of others and make choices that ‘do good’ for many – not just those in our direct circle.

To read the full Green Finance Companion Guideto theCode of Ethics, visit: bit.ly/4168FUQ ●

Arianne Sheppard is public relations executive and Rebecca Aston is professional standards manager, both at the CII

One of the greatest needs of our time is to make sustainable choices for the future and be mindful of protecting our environment and natural resources

Take your organisation's training and development to the next level.

FinancialAssess is the online training and competency solution designed for the financial advice sector. Stay up to date and compliant with over 400 courses covering the basic principles of financial services and regulation to the more specialist areas of the profession, available 24/7 on desktop, tablet and mobile.

Start your free 14-day trial or request a demo to find out how FinancialAssess can support you and your business at cii.co.uk/financialassess or scan the QR code.

Cateringforyourtrainingneeds.

Connect is a digital mentoring platform for all PFS members. Whether you are looking for career development support, are keen to share your experience to help others progress, Connect is designed to help you on your journey.

During 2023 we are inviting all members to take a fresh look and consider:

● Registering as either a mentor or mentee (if you have not previously used the platform).

● Returning to update your profile and be involved again (if you have an existing profile).

Mentoring is a great way to boost your career, either as a mentee working with a more experienced mentor to guide and support you through career challenges; or as a mentor using your skills and experience to help mentees while gaining new perspectives.

We are particularly interested in growing the number of mentors on the platform and if you see yourself as a potential mentor, we invite you to create your profile on the site (it’s quick and easy) and allow potential mentees to make contact.

The needs of members across our community of insurance professionals are constantly changing. By operating digitally, it is a great way to help connect our members in the UK and others across the world.

Connect makes it easy for you to decide the best way to establish and progress your mentoring relationship. You choose how you want to interact with one another and what the learning objectives will be. Whether you prefer to meet in person, talk over Zoom or Teams or simply exchange emails, Connect gives you the flexibility to make it work for you.

Typical areas include matters such as career planning, managing the work/life balance, tips for pursuing personal goals and objectives, communication and influencing, raising profile, personal confidence and focusing on a specific skill to improve.

Before embarking on a mentoring relationship there are a number of key things to consider to determine if it is the right path for you.

1 Develop a clear vision of what you want your mentoring relationship to help you achieve otherwise the relationship will drift and stall.

2 Experience matters. Mentoring relationships established with more experienced professionals usually allow the mentee to access an additional depth of knowledge which can be transformational.

3 Communicate your goal. What does a successful mentoring relationship outcome look like to you and what specifically do you want to learn?

4 Define your idea of success. A professional who has proven success in their career and the experience to impart knowledge will then be in a better position to aid you towards your goals.

If you are now ready to take a closer look, login using your MyPFS username and password at: www.thepfs.org/connect ●

Simon Webster is membership marketing manager at the CII

Connect – the CII’s mentoring platform – is evolving. Simon Webster explains what it means for you

provide an overview of key changes in relation to main personal taxes and pensions as announced in the Spring Budget

There were no changes announced in relation to the income tax personal allowance(s), the rates of income tax and national insurance or to the income tax bands and national insurance thresholds. As a result, more individuals will find themselves paying income tax, especially due to the reduction in the additional rate threshold to £125,140. Further, additional rate taxpayers do not benefit from a personal savings allowance and, given the decrease in the dividend allowance to £1,000, and recent increases in interest rates, investing within an individual savings account (ISA) has become more attractive as dividends and interest will not be subject to further taxation in the wrapper. Ensuring your clients use their ISA allowances consistently is even more important where their dividend allowance is fully utilised. For some, investing in venture capital trusts may also appeal as, on amounts invested within the annual subscription limit, these provide tax-free dividends and capital gains.

The government has published a discussion document on modernising HM Revenue and Customs’ (HMRC) income tax services to support better digital communication with taxpayers and reduce administrative burdens. This seeks views on ways in which to integrate and modernise income tax self-assessment and pay as you earn processes, the aim of which is for taxpayers to be able manage their own tax affairs easily online and reduce the need to contact HMRC.

At the time of writing, the consultation responses had not been issued. However, it will be interesting to see what changes may be introduced.

In addition, the government also announced that there will be a phased introduction of a penalty reform for income tax self-assessment from 2026.

There were no changes announced in relation to the main rates of capital gains tax (CGT), so these remain at 10% and 20%, or 18% and 28% where the capital gain is derived from carried interest or a sale of residential property which was not the client’s main residence. The annual exemption is £6,000 for the 2023/24 tax year and will decrease to £3,000 for 2024/25. Given that the annual CGT exemption is given on a ‘use it or lose it’ basis, using the exemption is a core part of financial planning and consideration should be given to structuring assets/investments to make use of it. And let’s not forget that even with the reduction in the annual exemption the Chancellor did not change the rates of CGT in the Spring Budget, resulting in gains continuing to be taxed at a lower rate than income. However, the reductions in the annual exemption will make investing within an ISA more attractive as capital gains will not be subject to taxation.

The CGT legislation dealing with the transfer of assets between an individual living with their spouse or civil partner provides that transfers of assets between spouses and civil partners who are living together are made on a “no gain or no loss” basis in any tax year in which they are living together. This means that any gains or losses from the transfer are deferred until the asset is disposed of by the receiving spouse or civil partner, who will be treated as having acquired the asset at the same original cost as the transferring spouse or civil partner.

In the Spring Budget the government reaffirmed an announcement that was made in July 2022, with legislation being introduced in Spring Finance Bill 2023 that will provide that:

● separating spouses or civil partners will be given up to three years after the year they cease to live together in which to make no gain or no loss transfers;

● no gain or no loss treatment will also apply to assets that separating spouses or civil partners transfer between themselves as part of a formal divorce agreement;

● a spouse or civil partner who retains an interest in the former matrimonial home be given an option to claim private residence relief (PRR) when it is sold;

● individuals who have transferred their interest in the former matrimonial home to their ex-spouse or civil partner and are entitled to receive a percentage of the proceeds when that home is eventually sold, will be able to apply the same tax treatment to those proceeds when received that applied when they transferred their original interest in the home to their ex-spouse or civil partner.

The most significant financial planning changes announced in the Spring Budget related to pensions. For once, pension savers were given some positive news with increases in all the annual allowances from tax year 2023/24 along with the abolition of the lifetime allowance. One of the key drivers for the changes was to help the NHS by removing the incentives for doctors to reduce their hours or retire early. However, rather than trying to specifically target them, the government chose to extend the tax advantages to all with the aim of encouraging more to extend their working lives.

The increases to the annual allowances are relatively straightforward and provide the opportunity for almost everyone to pay more into their pension.

The key changes to the annual allowance for 2023/24 are:

● The standard annual allowance increased from £40,000 to £60,000.

● The money purchase annual allowance (MPAA) increased from £4,000 to £10,000.

● The minimum tapered allowance increased from £4,000 to £10,000.

● The Adjusted Income limit increased from £240,000 to £260,000.

For many, the previous standard annual allowance along with carry forward was already quite generous and most were unlikely to exceed the limits. The key problem was for higher earners in defined benefit schemes who have no direct control over their pension inputs. This was the

issue facing NHS consultants and GPs and the increase will certainly help many to avoid regularly exceeding the annual allowance. It is unlikely to solve the issues altogether particularly where there are spikes in earnings but, undoubtedly, this puts them in a much better position.

For those in public sector schemes, there were also new rules on calculating pension inputs and these will be of further benefit. The change allows negative inputs in a legacy final salary section of the scheme to be offset against the pension inputs in the career average section. Negative inputs can occur where the inflation rate used in the pension input calculation exceeds the annual increase in the pay or revaluation rate used for calculating the final salary benefits.

The other key group to benefit from the increases will be owner/directors of limited companies who will now be able to extract another £20,000 from their companies each year in a very tax efficient manner. The increases in the rate of corporation tax makes pension planning even more attractive from 2023/24 onwards.

The higher standard annual allowance gives those with taxable income of up to £160,000 the opportunity to make pension contributions each year to restore their full personal allowance. With an effective 60% tax rate on income in the band between £100,000 and £125,140 and 45% on income above this, very high rates of tax relief are available for those with income at these levels who have the funds to make significant contributions.

While the annual allowance has increased to £60,000 in the current tax year any carry forward calculations are still based on the previous allowances.

Setting the MPAA at £4,000 did seem particularly restrictive and unfair for those who had unwittingly accessed their pensions without seeking advice. There had been many calls from those in the pensions industry to raise the limit and the increase to £10,000 is welcomed. Those who had triggered the MPAA while still working may have opted out of their workplace pensions or reduced their employer contributions to avoid an annual allowance charge. Individuals who are subject to the MPAA may well have scope to opt back into their workplace scheme or now increase their contributions.

With the increase in the annual allowance to £60,000, the adjusted income limit was also increased to £260,000. However, there was more good news for high earners as the minimum tapered annual allowance also increased to £10,000. This significantly extends the tapering band which now runs from £260,000 to £360,000. The effect of this means that some high earners will see the biggest

increases in their allowances. Those with adjusted income between £260,000 and £312,000 see a £30,000 increase in their allowance assuming the same income level. For example, someone with threshold income of more than £200,000 and adjusted income of £280,000 would have an annual allowance of just £20,000 in the tax year 2022/23. In tax year 2023/24, they see a £30,000 increase with an annual allowance of £50,000.

Therefore, those currently subject to tapering may now have significantly more scope to increase their contributions. Employees may have exchanged their employer pension contributions for a cash alternative and it will be worth reviewing these to see if they can now reverse at least some of this and return to pension funding. The highest earners will be restricted to £10,000, but this is still a big improvement on the previous minimum of £4,000.

The big surprise of the Spring Budget was the abolition of the lifetime allowance (LTA). In the period running up to Budget it become clear that something was going to happen and that there may be a significant increase, but very few expected it to be removed entirely. Signs that this was a very late decision are evident by the two-stage process in which it is being implemented.

For 2023/24, the LTA framework remains in place and everything works in the same way it did previously. The only difference is that no LTA charges will apply wherever there is a LTA excess. For now, providers must still complete all the usual calculations whenever a benefit crystallisation event (BCE) occurs and note the percentages used and available.

For 2024/25, the proposal is to remove the LTA altogether and we will have to wait for future legislation to see how this works.

One downside of the changes was that tax-free cash is now restricted to 25% of the current LTA, i.e. £268,275. However, those with protected amounts can continue to benefit from the higher tax-free cash entitlements. For example, someone with Fixed Protection of £1.8m will continue to have a tax-free entitlement of up to £450,000.

For those with enhanced protection and lump sum protection, the tax-free cash entitlement will be limited to the value of their pension pot as at 5 April 2023. For example, if their tax protection was 30% and their fund value was £3m on 5 April 2023, their maximum tax-free

cash amount will be limited to £900,000 regardless of how much the fund value increases by in the future.

Those with fixed or enhanced protection, provided the protection was in place before 15 March 2023, can now start to contribute again and the protection will remain valid. This means that they will benefit from any associated uplift in tax-free cash even if they make contributions.

Individuals can still apply for fixed protection or individual protection 16 to obtain a higher tax-free cash entitlement. However, there are no changes to the eligibility requirements and individuals obtaining fixed protection post 15 March 2023 will lose this if they make further contributions, join new schemes or have benefit accrual.

For 2023/24, tax-free cash entitlement works in the same way as previously, i.e. it is limited to 25% of the available LTA. Therefore, if, for example, defined benefit pensions have been taken without any tax-free cash entitlement, there is no opportunity to make this up with withdrawals from defined contribution funds now. The cash will still be limited to 25% of whatever LTA they have available. It is possible this may change from 2024/25 onwards and we may see the option to delay taking the tax-free cash entitlement rather than the current “use it or lose it” process that is in place now. However, we will have to wait to see how the revised rules take shape. Certain lump sums that were previously subject to a 55% LTA charge will now be subject to income tax at the individual’s marginal rates of income tax. The lump sums are:

● Uncrystallised funds lump sum death benefit.

● Serious ill-health lump sum.

● Defined benefits lump sum death benefit.

● LTA excess lump sum.

For those with a choice as to how to receive their uncrystallised funds lump sum death benefits then beneficiary’s drawdown is clearly favourable where benefits exceed the LTA. This is because instead of being taxed at marginal rates of income tax the funds can be placed into drawdown and withdrawn without any tax at all.

In terms of planning, clearly the removal of the LTA charge provides a great opportunity to review clients who have previously ceased or reduced their pension contributions or opted out of schemes due to the LTA restriction. For many there will now be an opportunity to recommence or increase their contribution levels.

The most significant financial planning changes announced in the Spring Budget related to pensions

However, the positive news was somewhat marred by the Labour Party’s almost immediate announcement that they will reverse the decision should they win the next election. Clearly, we don’t know if they will win, whether if they do they will go ahead with this, and even if they do, exactly how they will enact the reversal. Any planning now for those near or above the current LTA has to take the risk of this into consideration.

For those over the age of 55 the risk is perhaps less in that they will have the opportunity to crystallise funds before any changes are made.

Individuals who have already used up all of their LTA and have uncrystallised funds may want to consider crystallising the remaining funds in the current tax year. This may offer some protection should the LTA be reintroduced at a later date.

For those yet to use up their LTA, the decision is more complex as they will need to consider whether to take their tax-free cash entitlement out of the pension if they wish to crystalise their funds. This brings the cash into the estate and so can lead to other problems should their estate exceed their available nil rate bands.

It is clear that whilst there is positive news in terms of the annual allowances, the changes in the LTA come with a few more complications and it doesn’t look like pension planning will be getting any easier anytime soon.

There were no changes announced in relation to the rates of inheritance tax (IHT), although, as previously announced, the nil rate band and residence nil rate band will remain at £325,000 and £175,000 respectively until the 2027/28 tax year. Remember that the residence nil rate band is tapered by £1 for every £2 where the total estate exceeds £2 million, so individuals ought to consider their own circumstances and whether they can plan to prevent any lost residence nil rate band. Given that these thresholds remain at their current level, this will no doubt mean that more and more individuals will be brought into the IHT net, so planning in this area is likely to become of more importance and advice will be key.

In the Spring Budget it was announced that the jurisdiction condition within Finance Act 2010 will be amended to remove references to a charity being able to be located in a territory outside the UK for the purposes of qualifying for UK charitable tax reliefs. The effect of this will be that only a charity subject to the control of a relevant UK court

(the High Court in England, Wales or Northern Ireland, or the Court of Session in Scotland) will qualify as a UK charity for tax purposes.

For a community amateur sports club (CASC) the change is to the Corporation Tax Act 2010 and has the effect that a CASC must be based in the UK and provide facilities for eligible sports in the UK to continue being registered as a CASC.

A transitional period will apply until 1 April 2024 for EU and EEA charities that HMRC has previously accepted as qualifying for relief. However, from April 2024, all non-UK charities and CASCs will no longer be eligible to claim UK charitable tax reliefs.

Following the Spring Budget, the government has published a call for evidence and consultation to explore both the taxation of ecosystem service markets and the potential expansion of agricultural relief (AR) from IHT to cover certain types of environmental land management. According to the government, some tax advisers, industry representatives and the recent Rock Review (published in October 2022) of tenant farming in England, have highlighted a desire to clarify the tax treatment in this area. While in some cases, a claim for business relief (BR) could be made as an alternative to AR, this will not be available in all circumstances so this call for evidence is welcomed. It was also announced that the government will restrict the scope of IHT AR and woodlands relief to property in the UK from 6 April 2024. Currently, the relief extends to land in the Channel Islands, Isle of Man or European Economic Area. From a planning perspective, for individuals with agricultural property or woodlands in these areas, thought should be given as to whether interests could be structured to secure BR instead as there is currently no indication that the geographical scope of BR will be likewise restricted.

With every Budget comes more planning opportunities and while the personal income tax, national insurance, CGT and IHT rates didn’t change, the reduction in some of the allowances, exemptions and ‘frozen’ thresholds will require careful planning with your clients and the need to ensure assets/investments are reviewed for tax efficiency as well as to meet their aims and objectives. Equally, the changes announced in relation to pensions were positive and significant which will no doubt mean more individuals will need advice in terms of considering the options available. ●

The big surprise of the Spring Budget was the abolition of the lifetime allowanceChris Jones is a retirement planning specialist and Niki Patel is a tax and trusts specialist at Technical Connection

Welcome to the new Society of Mortgage Professionals (SMP) section of Personal Finance Professional magazine – appearing in the summer and winter issues of your PFS member publication.

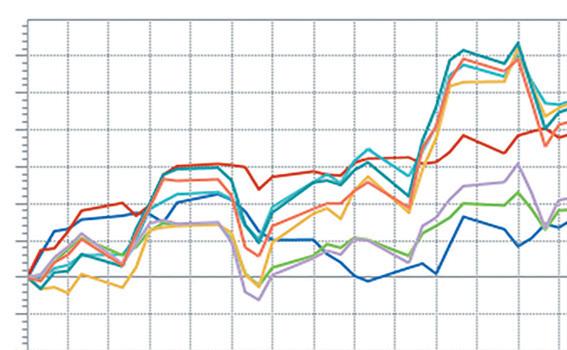

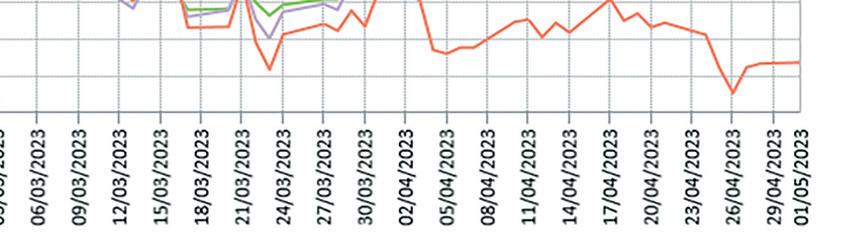

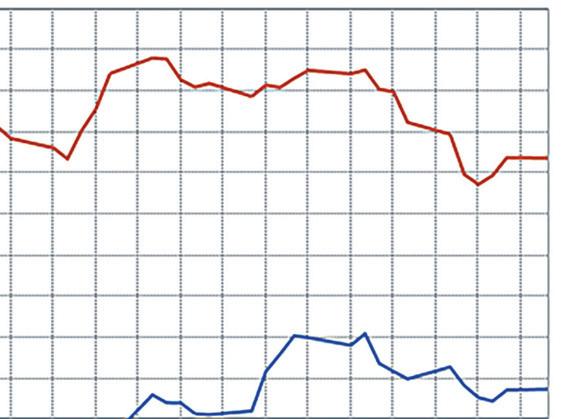

As a board, we are committed to promoting the value of professional standards and advice both within the sector and with consumers. This year, our focus has been to raise awareness of the benefits of professional advice with consumers, firms and protection specialists involved in the mortgage market. This has never been more important than today. Family budgets are under pressure with energy, food and fuel prices rising, growing inflation and increasing interest rates.

In addition, the new Consumer Duty regulations will mean advisers need to take time to understand the implications for their firms – the changes are much more than ‘treating customers fairly’ mark two. The launch of our Associate Firm initiative has broadened the appeal of the SMP to firms and not just individual advisers. It has been a huge success and we now represent thousands of employees across the UK.

The SMP’s focus this year has been on five key themes:

Careers: We aim this year to promote mortgage advice as a socially useful and important career. We also plan to discuss succession planning and managing exit and retirement from the profession.

Professionalism: To provide thought leadership on how to identify a mortgage professional and the values, behaviours and culture of firms.

Sustainability: A core focus for the SMP during 2023. We aim to look at the environmental issues affecting our sector, including heat pumps, energy certificates and working with partners to publish documents on the subject.

Best practice: Providing thought leadership for firms on best practice will cover a number of key areas –technology, client management and engagement, as well as lead generation. We will also look at growing firms, business planning, while developing and maintaining a distinctive and relevant company culture.

Consumer Duty: In any business, building a customer-centric culture is a prerequisite for success. It acts as a framework to ensure the business focuses on key issues to respond to changing consumer demands. From deciding on the core advice proposition

and what services are included, to looking at how to communicate and engage with consumers, we will be looking at a range of subjects to help businesses create long-term value for all stakeholders, as well as preparing for the Consumer Duty requirements.

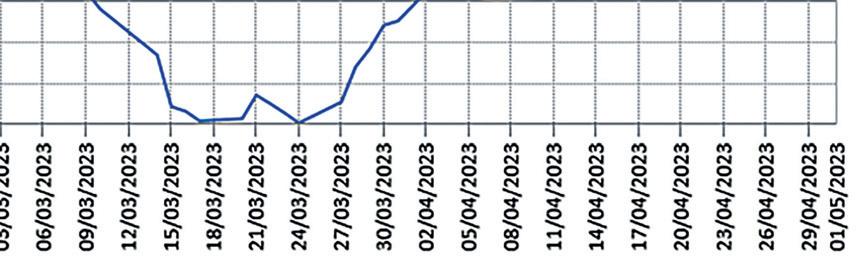

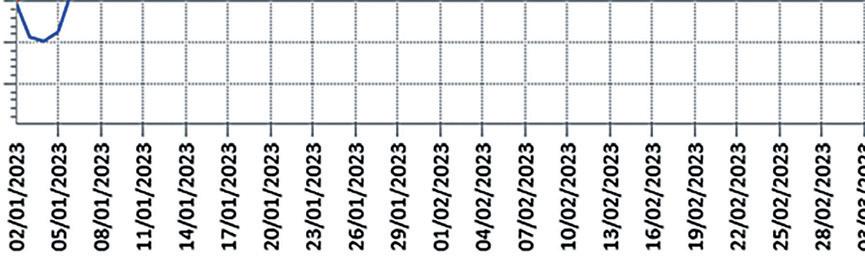

In the following pages, members of our SMP board discuss the current market outlook and how rates are settling after a difficult end to 2022, along with how advisers can provide specialist help to those who are self-employed, who have found it even more difficult in recent times to secure the right mortgage. With pressure continuing on consumer budgets from increases in energy costs and fuel prices, plus increasing interest rates, it has never been more important for advisers to reach out to clients. It will be vitally important in the months ahead to ensure clients’ circumstances are regularly reviewed by ensuring a robust process of client engagement is in place, reinforcing the value of protection in stretched budgets and ensuring suitable advice is in place to reflect individuals’ changing circumstances. ●

More than four million (4.38m) people in the UK are self-employed, according to Office for National Statistics data published in April. And like the rest of the population, many aspire to become homeowners.

One of the things the self-employed have in common, as well as the desire to be their own boss, is the challenges they face in getting onto the property ladder. According to mortgage lender Pepper Money’s specialist lending survey, from November last year, 77% said their self-employed status made it harder to get approved for a mortgage.

As Fred Hicks, senior policy adviser at the Association of Independent Professionals and the Self-Employed, observes: “When applying for a mortgage, the self-employed have

traditionally been asked to jump through more hoops than their employee counterparts.”

Things are particularly tough at the moment, says Phil Anderson, of Phil Anderson Financial Services: “It is now harder for the self-employed than it was in previous years. Lenders often require bigger deposits these days and affordability has certainly tightened due to rising interest rates.”

And that’s not all, as Anderson adds: “The cost-of-living crisis is hitting many people who run their own business and this in turn impacts on their earnings. Lower earnings and a reduction from previous years’ earnings usually means fewer mortgage options are available.”

Previous events such as the global financial crisis and the pandemic have had an impact on today’s self-employed mortgage seekers too.

“We can trace this back to 2008 when lenders decided to stop granting self-certified mortgages,” explains Yasr Al-Din of 2plan Wealth Management. “Also, during the pandemic, lenders took a stricter approach to granting mortgages for the self-employed. This led to applying lower income multiples for the self-employed in comparison with those for the employed.”

David Hollingworth, associate director, communications at L&C Mortgages, also points to the repercussions of Covid-19, commenting: “The pandemic often hit the self-employed hard and lockdowns could have seen income dry up, depending on the type of business.

“It also meant that lenders were faced with the prospect of looking at income history that may not have accurately reflected their current position. Underwriting became more complex as lenders sought clarification of current income levels as well as the usual track record. Some lenders were more restrictive for those that were receiving government support – they wanted to be sure that the mortgage would be affordable on an ongoing basis and that the business would be viable.

“That added complexity saw some lenders pull away or restrict the availability of mortgages for the self-employed altogether.”