February – March 2025

February – March 2025

Georges De Macedo on how Covéa has put innovation and sustainability at the centre of its ambitions

Up, up and away Travel insurers launch the tech evolution

Chosen field Making insurance the career path of choice

Uncertain ground

The shifting landscape of geopolitical risk

5 President’s opinion

CII president Nicola Stacey on the benefits of mentoring

6-13 News

UK and international news from the CII

23 Regulation

Regulatory updates from the UK

50 Opinion

How insurers are facing ever more complex challenges

14-16 Interview

Georges De Macedo discusses Covéa’s strategic plans

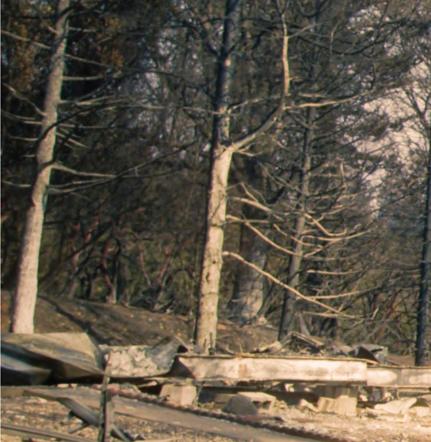

17-19 Climate change

The fallout from the recent California wildfires

20-22 Regulation

Government dialogue with regulators could mean reform for the sector

24-25 Risk

Increasing geopolitical risk may impact insurance

26-27 Protection

New project insures those most vulnerable to the impact of climate change

28-29 Travel

The evolving world of travel policies powered by technology

International CII CEO Matthew Hill visits the Asia-Pacific region 42-43 Members

Benefits of engaging with your CII local institute

37 Claims

Introducing new CII Claims Community chair Richard Napoli

38-39 Claims – wellbeing How physical intelligence impacts performance

40-41 Claims – legal

Examining a complex case of claims fraud

36 Mentoring

Asking the right questions is key for mentors

46-47 Professional standards

Firms achieving accreditation from the CII

49 Q&A

The big 10 questions to test your knowledge

The Chartered Insurance Institute

20 Fenchurch Street, London EC3M 3BY

Tel: (020) 8989 8464

The Chartered Insurance Institute 20 Fenchurch Street, London EC3M 3BY Tel: (020) 8989 8464

The Journal is online at www.thejournal.cii.co.uk

The Journal is online at www.thejournal.cii.co.uk

The Journal is the official magazine of the Chartered Insurance Institute (CII). Views expressed by contributors or advertisers are not necessarily those of the CII or the editorial team. The CII will accept no responsibility for any loss occasioned to any person acting or refraining from action as a result of the material included in this publication.

The Journal is the official magazine of the Chartered Insurance Institute (CII). Views expressed by contributors or advertisers are not necessarily those of the CII or the editorial team. The CII will accept no responsibility for any loss occasioned to any person acting or refraining from action as a result of the material included in this publication.

The Journal is online at www.thejournal.cii.co.uk

Cover Image: Edited by Craig Zaduck

Chief executive: Sian Fisher

CEO: Matthew Hill

EDITORIAL

Editor: Luke Holloway luke.holloway@cii.co.uk

Editor: Luke Holloway (020) 7417 4778 luke.holloway@cii.co.uk

Contributing editor: Liz Booth

Contributing editor: Liz Booth

Senior Designer: Will Williams

DESIGN

Picture editor: Claire Echavarry

Production: Jane Easterman

Printing:

Production: Jane Easterman

Printing: The Manson Group

PUBLISHER

Redactive Publishing Ltd., 9 Dallington Street, London EC1V 0LN

For sales and advertising please contact us on cii-sales@redactive.co.uk or 020 7880 7661 ISSN 0957

Nicola Stacey highlights the value of professional learning and the power of mentoring

Success in a career is rarely something that can be achieved alone, particularly in a people-centred business such as insurance. Our ecosystem is a hugely valuable living resource for everyone to tap into regardless of their career stage.

Although much can be learned by spending time with colleagues on the job – through conversations in the market, or at networking events – for me one of the most powerful ways to develop personally is through mentoring. Having one-to-one time with an experienced person from your own industry can help you gain a realistic view of your career and provide you with a fresh perspective.

I would encourage anyone given the chance to take up a mentoring opportunity, whether you are early in your career, experienced, at manager or executive level, there will be someone you can learn from about matters you might never have considered before. Whether that’s training suggestions or sharing tips on coaching, networking or inclusion, mentoring can help build confidence and self-awareness.

There are many skills and behaviours that can be developed through a mentoring relationship, for example, evolving leadership, presentation and communication skills, as well as how and when to make the right career moves. Having a mentor or sponsor can help build your profile and give you the confidence to pivot to the next role. They can help you build resilience and cope with occasional rejections.

A mentor can help you learn how to drive a business forward and gain corporate awareness. They can help you anticipate changes in the business and adapt to new environments, as well as balance long-term goals with the prioritisation of shorter-term responsibilities.

Finally, they can advise you on how to energise and engage teams, as well as foster teamwork across different functions. Our business relies heavily on communication skills and

through a mentor you can learn how to articulate your own vision and the career path you wish to pursue.

A few years ago, I attended my first speed mentoring event, in which mentees spend time in small groups with an industry leader before moving on to the next one – so I am really excited to now be introducing speed mentoring in conjunction with the CII. At our first event in March, we are bringing together individuals with seven to 12 years’ experience in the insurance and financial planning professions, with leaders from across our sector. We are looking forward to an evening where attendees can make meaningful connections and receive actionable advice to fast-track their careers.

It’s not just early- and mid-career associates who can benefit from the experiences of a colleague. An interesting way to flip the script on this is through reverse mentoring, in which senior leaders learn how their decisions and actions impact the business from younger or less experienced people with different backgrounds and fresh perspectives. I’m delighted that Chaucer has recently launched a six-month pilot reverse mentoring programme, in which selected senior leaders are mentored by a more junior colleague, selected based on the learning needs of the senior leader and their involvement in Chaucer’s equality, diversity and inclusion agenda. It’s very much a two-way process where we have the opportunity to discuss Chaucer’s culture and inclusion, while the senior leader gets the opportunity to sponsor and provide career direction to the mentor.

I am a big believer in engaging with your network to gain development opportunities. Provided everyone understands the roles and responsibilities of each party, it can be much easier to remain focused on development goals and fast-track your career. ●

Nicola Stacey is president of the CII

The CII has reported a 15% annual increase in the number of its insurance qualifications completed in 2024. The professional body saw an increase in completion of the majority of its insurance qualifications in 2024. The most popular CII qualifications during the past year were the Level 3 Certificate in Insurance (3,990 completions), the Level 3 Award in London Market Insurance (1,255 completions), and the Level 4 Diploma in Insurance (1,104 completions).

Significant year-on-year increases were seen for the CII Level 2 Award in Home Insurance (26%), and the CII Level 3 Certificate in Insurance (22%). The uplift includes a 14% increase in insurance qualifications completed across the CII’s international market.

APPOINTMENTS

Gill White, executive director of member engagement and learning, said: “The CII exists to support aspiring professionals to develop the skills, knowledge and behaviours that benefit societies and help to build public confidence in the insurance sector globally. We have seen higher numbers of domestic and international learners, reflecting the value that policymakers and firms place on our learning and assessments around the world. We hope to motivate even greater numbers of learners in coming years by fully embedding the CII’s Professional

The CII has announced the appointment of two new executive directors.

From March, Adam Harper will take on the role of executive director, strategy, advocacy and professional standards, while Holly Porter will take on the role of executive director, markets and opportunities.

The pair bring a wealth of experience from extensive careers across a range of sectors. Harper will join the CII from his role as director of professional standards and policy at the Association of Accounting Technicians (AAT), where he leads the development and enhancement of its professional standards regulatory framework. As an executive leadership team member, Harper has

Map into new qualification pathways and providing an enhanced learning experience that develops the skills our sector needs.”

→ For more information on CII learning, visit: www.cii.co.uk/qualifications

contributed to the development of the AAT’s strategic vision, plans and policies, and has experience of coordinating corporate strategies and business plans.

Porter joins from BCS, the Chartered Institute for IT, which supports technology and digital professionals across different sectors in the UK and internationally. She currently leads the professional membership community and registrations portfolio as managing director and was formerly membership director. She works closely with organisations, members and the volunteer network, which has more than 100 regional and special interest groups. Her focus has been to help members drive

their professional development and shape the future of technology as part of the BCS membership community.

CII CEO Matthew Hill said: “Adam and Holly bring extensive skills and perspectives that will help us meet our strategic ambitions and drive our public value mission forward. Their leadership will play a crucial role in shaping the future of the CII Group, strengthening our ability to deliver for CII and PFS members alike. I look forward to the insights and expertise they will bring.”

Entries are now open for the CII and the Personal Finance Society (PFS) Apprenticeship Awards, the annual celebration of apprenticeships across insurance and financial services. The awards also recognise the vital role played by employers to support rising stars in our professions.

The ceremony is an opportunity to showcase the development of outstanding talent, as well as commitment and innovation

within the profession. Winners receive a cash prize, sponsored by the Worshipful Company of Insurers Charitable Trust, to reward their achievements and support continued development.

The CII and PFS Apprenticeship Awards 2025 categories are:

● Insurance Practitioner Apprentice of the Year

● Insurance Professional Apprentice of the Year

● Senior Insurance Professional Apprentice of the Year

● Financial Adviser Apprentice of the Year

● Paraplanner Apprentice of the Year

● Financial Services Administrator

● Apprentice of the Year

● Large Apprenticeship Employer of the Year

● Small Apprenticeship Employer of the Year

A panel of experienced sector practitioners will review the applications to select finalists

The CII and University of Greater Manchester have announced the launch of a new executive MBA in Islamic Insurance and Risk Management, developed in collaboration with the Islamic Insurance Association of London and the Centre for Islamic Finance.

The online course has been developed to support a comprehensive understanding of Islamic financial products, the operations of Islamic insurance and in-depth knowledge of Takaful insurance. The course structure

is designed to help prepare students for senior positions in organisations that provide or require Shari’ah compliant or Takaful insurance, with a focus on good practice in management and commerce.

and winners. Applications are open to apprentices and employers across the UK until 31 May 2025.

Nicola Stacey, president of the CII, said: “We are delighted to deliver the CII and PFS Apprenticeship Awards for the third consecutive year, celebrating the hard work and achievements of apprentices, and the invaluable support of employers and training providers. Apprenticeships offer a fantastic pathway into the profession, combining practical skills, technical knowledge and professional qualifications. We look forward to recognising the impact of apprentices and employers at this year’s awards.”

→ For more information and to enter, visit: www.cii.co.uk/careers-in-insurance/ aspire-apprenticeships/apprenticeshipawards-2025

Alongside the management subjects within an MBA, it includes modules on Islamic insurance and Islamic risk management, offering contemporary knowledge and understanding of the methodologies and concepts of Islamic law, as well as the application of legal principles

within Islamic business transactions. Islamic insurance is one of the fastest growing sectors in the global profession, and it is predicted that Islamic insurance will be worth an estimated US$97bn (£77bn) by 2030.

→ For more information, visit: https://bit.ly/432f6fA

Registrations are now open for the CII’s new leadership course: Commercial Insurance Cycle Management: Managing a Softening Market. The event will combine expert training and collaboration with senior peers to deliver an insightful two-day session that will enable underwriting professionals to lead their business through the next market cycle.

Key speakers include:

● Tony Buckle, partner UWX, former chief underwriting officer (CUO) and board member at Allianz

● John Carolin, partner UWX

● Mandy Hunt, managing director of MGAs the Clear Group and chair of CII Underwriting Community board

The annual Volunteer Awards celebrate significant and extraordinary contributions by volunteers to the furtherance of the CII and Personal Finance Society (PFS) in their aims of delivering ‘Standards, Professionalism and Trust’.

The CII’s volunteers are members who not only commit themselves to professionalism in what they do but those that go the extra mile by giving their own time.

Individuals who truly excel in supporting the CII or PFS locally, regionally or even nationally, can be recognised for those contributions by being nominated for a Distinguished Service or Exceptional Service Award.

If you know a volunteer in your local institute or regional PFS committee who is an unsung hero deserving of an award, then submit your nomination now. Contact linetwork@cii.co.uk for an application pack.

The face-to-face training course has been created in collaboration with commercial underwriting consultancy UWX and will be delivered by former chief underwriting officers, finance directors, chief reserving actuaries and class underwriters who have led underwriting divisions through previous market cycles.

● Nicola Stacey, CUO Chaucer Syndicates and president of the CII

● Neil Arklie, former head of cyber underwriting at Lloyd’s, senior underwriter of cyber at Aviva and Swiss Re

● Finlay Smith, director at Accelerate Underwriting

● Ilker Aslan, casualty treaty underwriter, Axis Re

● Mehmet Ogut, senior advisor to the group risk management team at Ageas

Date: 2-3 April 2025, 08:30-17:30 (UK)

Location: CII Offices, 20 Fenchurch Street, London, EC3M 3BY

→ For more information and to register, visit: https://bit.ly/3EFcdXU EVENTS

Nicola Mellor, qualifications and assessment director at the CII Group, has been appointed to the board of the Federation of Awarding Bodies (FAB). The FAB represents the UK’s qualifications and assessments industry, with members committed to providing high-quality qualifications and assessments that recognise achievement, improve productivity, support social mobility and change lives.

Alongside Mellor’s appointment, Alison Parkes of EAL Awards, Kelle McQuade of Training Qualifications UK, Steve Smith of SIAS UK and Terry Fennell of FDQ have also joined the board. The FAB board elections, conducted independently by UK Engage, ensure the Federation’s governance remains transparent, impartial and reflective of its diverse membership base.

Rob Nitsch CBE, FAB chief executive, said: “The calibre of our board reflects the strength and diversity of the Federation’s membership and I look forward to working closely with all members to ensure FAB continues to champion the vital role of awarding and assessment organisations across the UK. Congratulations to everyone elected – your leadership will undoubtedly help us achieve great things together.”

I have met so many people since my arrival at the CII, both here in the UK and recently on a trip to Asia – which I summarise in this edition of The Journal – who have described to me the difference that being a member of our organisation has made to them professionally. They often talk about how the CII has helped them invest in their own development and build meaningful careers in ways that exceeded their expectations. These reflections are an inspiration for me and my colleagues as we look to add even greater value for our members and the next generation of aspiring professionals.

One way we will achieve that in the coming years is to fully embed our Professional Map into our learning offer, ensuring we deliver what is truly needed and demanded by professionals across the insurance and financial planning space. We also believe that there is a need to simplify our learning journey while continuing to deliver world-class qualifications and assessments. We have begun carefully exploring how we can achieve these related goals under the banner of ‘CII Futures’, with any changes expected toward the end of our current Strategic Plan cycle.

Another important contribution will come from the completion of a review we are conducting into our Corporate Chartered status rules. We are incredibly proud of the more than 700 firms who currently hold our status, including Covéa, whose chief executive – Georges De Macedo – talks about the recognition he feels it brings his firm in this edition of The Journal. However, I believe it is also perfectly fair to say that Corporate Chartered status has not captured the public imagination across insurance and financial planning in the way that similar schemes have in other parts of the economy and we need to change that. We intend to transition to a new approach for awarding Chartered status from 2026, giving us good time to have the necessary conversations that I know will shape an offer in which every participating firm can have real pride and confidence for the long term.

Finally, I am pleased to say that supporting us to both ends will be our two new executive directors, Adam Harper and Holly Porter, who joined us in early March. They will play a crucial role in helping to shape all aspects of the CII Group, strengthening our ability to deliver for CII and PFS members alike.

MIDDLE EAST

The CII Middle East office is delighted to have won a Middle East Insurance Industry Award in the category of ‘Educational & Training Initiative of the Year’ at the end of 2024, with the trophy recently received by the CII team.

The annual awards organised by Middle East Insurance Review magazine, recognise organisations in the insurance sector that have made an outstanding contribution to the sector’s progress and innovation within the region.

The CII was praised for its continued commitment to providing relevant qualifications and continuing professional development that is furthering the essential upskilling of the sector’s professionals.

MIDDLE EAST

The United Arab Emirates Central Bank has introduced new legislation which mandates professional qualifications for senior insurance representatives and cites the CII Advanced Diploma as exemplary of the internationally recognised qualifications that will be required by CEOs and other similarly ranked management representatives.

Article 5 of the recently introduced ‘Insurance Brokers’ Regulation’ stipulates the need for sector professionals to meet necessary qualifications, knowledge and experience requirements and to have “a record of integrity, competence and financial soundness”.

The regulations also outline the criteria for continuing professional development, including 15 hours for insurance brokers’ representatives, senior management and specialised employees.

MIDDLE EAST

The CII’s relationship with the Financial Academy of Saudi Arabia has received a boost with the organisation becoming officially recognised as an Accredited Professional Development Centre (APDC).

The Financial Academy has long been a leader in training, career development and professional certification services for the financial sector in Saudi Arabia. Its offerings include banking, finance, insurance, and capital markets, aimed at professionals and those seeking a career in these fields.

The organisation’s collaboration with the CII began four-and-a-half years ago when it signed an agreement to host the CII’s internationally recognised qualifications to insurance and financial planning students seeking to propel their professional development.

CII Hong Kong held the third cohort class for the Certified Insurance Professionals induction course in January. As part of his visit to the Asia-Pacific region, CII CEO Matthew Hill attended the session held at the facilities in HKU SPACE and addressed the learners, encouraging insurance practitioners to embark on their journey of professional development in insurance and financial planning.

The CII team also held a Graduation Ceremony for the first and second-cohort graduates of around 30 attendees. Hill was invited as special guest, giving a congratulatory speech to the successful candidates.

As part of his continued visit to Hong Kong, Matthew Hill, CII CEO, made a courtesy visit to the Legislative Council of the Hong Kong Special Administrative Region to meet with the Honourable Chan Kin-por, GBS, and JP. The Hon. Chan shared his insights with the CII CEO followed by a tour of the Legislative Council complex.

Matthew Hill, CII CEO signed a memorandum of understanding at Hong Kong Shue Yan University (HKSYU) supported by Dr Lee marking a new partnership with HKSYU to explore future collaborative efforts to enhance education opportunities and development for students and ClI members.

The signing was followed by networking drinks organised for CII members to meet Matthew Hill and the CII team.

CII Hong Kong and Matthew Hill, CII CEO, were invited to attend the Asian Financial Forum 2025 Networking Reception Hosted by the British Consulate-General Hong Kong. The Asian Financial Forum is a two-day conference supported by the Hong Kong SAR government which brings together influential leaders from government, finance and business communities globally to exchange insights on the global economy from an Asian perspective.

MARCH

STOKE-ON-TRENT

A dedicated mentoring programme hosted by the Insurance Institute of Stoke-onTrent has achieved great results, with members becoming empowered with valuable skills and fostering significant career growth.

Mindful of the current narrative around local skilled labour shortages, Stoke-onTrent council members discussed ways they could help elevate those members looking to improve themselves and bring greater value to their employers.

The institute partnered with local consultant Katie Beardmore to map out the requirements and deliver the sessions. An important consideration was to have a group large enough to encourage diverse discussions, but small enough that everyone could still thrive.

The mentees were Michael Salmon, Claire Skellern, Keith Campbell, Jenny-Lea

Birchall and Nikita Phillips. They reported significant improvements in their emotional intelligence, enabling them to make more insightful choices about difficult decisions they may face, with one member of the group commenting: “This programme gave me the self-belief and the ability to pursue my dreams.”

Beardmore said: “This powerful testimonial highlights the transformative impact of the programme on its participants. By nurturing personal and professional growth, the Institute is empowering members to achieve their full potential. Newfound self-awareness not only helps them navigate their current situations more effectively but also equips them with crucial skills for long-term career success.”

→ For more information, visit: www.cii.co.uk/stoke

SOUTHAMPTON

Amanda Sayers, council member of the Insurance Institute of Southampton, completed her 100th marathon in October 2024, joining the prestigious 100 Marathon Club.

A Chartered insurer and recently a Fellow of the CII, Amanda is senior reinsurance associate at Zurich UK where she is also a mental health champion and active member of the Zurich Community Trust, frequently taking on challenges to support those in need.

Having served as a local institute council member for several years, Amanda supports her institute by organising events, coordinating continuing professional development programmes and advocating for CII learning.

→ For more information, visit: www.cii.co.uk/southampton

10.30am – 11.30am Insurance Institute of Chelmsford & South Essex www.cii.co.uk/chelmsford 13 MARCH

Twelve local insurance institutes from across the South and Southwest joined forces for the inaugural Regional Forum Conference in Bristol on 22 January 2025. Local institute volunteers from Cardiff to Mid-Kent came together to share ideas, good practice and ways to enhance their proposition for members at local level.

Ian Callaghan, 2024 CII president, was the keynote speaker, updating attendees on current CII activities and thanking volunteers for the work they do to support members locally.

The day’s core group discussions followed as delegates explored three key topics focusing on how to best engage and support younger and new entrants to the profession, ways to improve succession on local institute councils, and how to work smarter and more

collaboratively in delivering CPD and other support activities for members.

Kal AbuQuora, chair of the Bristol Next Gen committee, led the session on new talents in the profession – focusing on how to best engage and support them at the start of their journey. Lizzi Modi, regional forum officer for the Insurance Institute of Sussex, led the discussion around succession and ways to encourage

involvement with local Institute councils. Finally, Lee Smith, president of the Insurance Institute of Southampton, led the debate on collaborative working, exploring ideas to achieve excellence in providing CPD support and learning development for members.

→ For more information, visit: www.cii.co.uk/bristol

Local institutes are run by volunteers from the profession, with support from the CII, and none of the support provided would be possible without the many hundreds of volunteers who give their time, enthusiasm and expertise each year.

If the idea of helping to shape the support

→ To find out more, including contacts at your local institute and the date of your institute’s AGM, visit: www.cii.co.uk/local MEMBERSHIP

– as well as benefiting from it – interests you, then you could get involved. Local institute AGMs take place between March and May, and are a great way to discover what your institute offers and hear firsthand from council members about your institute’s activities.

If you feel you could make a positive contribution, it is an ideal first step to becoming involved.

Georges De Macedo tells Luke Holloway about Covéa’s strategic vision, which puts profitability, innovation and sustainability at the centre of its ambitions

As Covéa Insurance embarks on its threeyear strategic plan for 2025 and beyond, CEO Georges De Macedo emphasises the importance of profitability, operational efficiency, strong relationships and sustainability in helping it thrive as one of the UK’s largest major insurers.

“Profitability was the very top priority when I joined the business because we had reported significant losses. It remains a priority because it is what provides us with the freedom to invest, grow and have credibility in the market,” De Macedo tells us.

“The insurance market can be volatile and very competitive, but we build plans that take that volatility into consideration to ensure the sustainability of the company.”

When De Macedo joined Covéa Group in 2022, his initial role was to lead the integration of the then recently acquired PartnerRe and his priority was to bring stability to the firm. Since becoming UK CEO in June 2023, these ambitions have evolved to focus on growth, customer service and the long-term resilience of the insurer and its customers.

“An insurer has different stakeholders and the first one is the customer. As an insurer, you provide a service and, when there is a claim, the customer expects you to deliver that service to an excellent standard.

If you miss this opportunity and don’t do a great job, the risk is that you lose credibility and you lose your customer,” says De Macedo.

Covéa’s strategy also focuses on collaboration with brokers, fostering “win-win relationships” that benefit both parties and, most importantly, customers, believes De Macedo.

The company’s relationship with regulators is another cornerstone of its strategy. “It is important we continue to meet regulatory and Consumer Duty requirements. Regulation is something you must embed into your way of operating because if you don’t, you will not remain relevant. You need to translate regulation into something that makes sense for your business and then implement it efficiently in your processes.”

Another key element of Covéa’s long-term strategy is the integration of environmental, social and governance (ESG) principles and building a sustainable business model. De Macedo is firm in his belief that companies that ignore ESG concerns –particularly in the context of climate change – will struggle in the future. “If a company today doesn’t take ESG into consideration, it will fail at some point,” he warns. “If we want to be a sustainable business, we have to integrate ESG and climate change into our strategy.

very beginning, from my perspective, it was a key success factor to have people really behind this strategy. Ambition was very high. I am pretty sure that some people in the market believed our plan was too ambitious. But I am really proud of our teams because so far we have done an excellent job and achieved our aims.”

With a background in engineering and experience across various industries, De Macedo brings a fresh perspective to his role.

“I am an engineer by background, I did a lot of maths and physics, working on very large projects. That didn’t quite prepare me for the insurance industry and certainly not for the UK insurance market,” he says. “But I believe the key lesson for me has been the importance of learning and adapting. Methodologies from other industries can bring a lot of value in our field and I’ve worked hard to develop my expertise in insurance while applying these methodologies.”

“I enjoy challenges and this was certainly a big one,” De Macedo continues. “I joined Covéa to lead the change, not just from a technical standpoint, but to inspire the people within the company to get behind the vision and strategy and, 18 months later, I am really pleased with where we are. We have met our profitability targets but we have also transformed the company’s culture, which

“The final pillar of our plans is what we put in the middle – the people that support this strategy. From the 5

I believe was key to our success.”

Covéa was awarded Chartered status by the CII in 2016, recognition of the professional standards and continued learning that De Macedo feels are a fundamental part of the company’s culture.

“The clarification and certification of being Chartered is well recognised in the market and it is very important for us to have people in our business with this type of expertise. In terms of qualifications and development for insurance professionals, Covéa encourages all employees across underwriting, broking and claims to engage with learning and make sure that their knowledge and skills are the best they can be.”

Covéa’s approach to talent development is not just about providing training; it’s about aligning professional growth with career development. De Macedo acknowledges that talent attraction is a challenge for insurers but believes demonstrating clear company values and direction is the key to retaining those who join the business.

“Trust is key. If you can’t build trust, you won’t retain talent,” he says. “A company needs to be very clear on its strategy and its ability to deliver that strategy, while also

ensuring that people can trust you. You need strong values that align with your employees and create a positive culture, making people want to join the organisation and, importantly, stay as well.”

The increasing role of artificial intelligence (AI) in insurance is an area that De Macedo believes is hugely significant and Covéa is exploring how AI can improve core processes like pricing and claims management. However, he is cautious not to jump on the AI bandwagon without a clear, practical purpose. “If you just put technology on top of an existing process and there is no rethink about it, you missed the point. It is not innovation,” he says. “If we want to innovate, we need to almost start from a blank page and understand the opportunities and new way of working the technology offers. And, if it makes sense, we move on.

“With any initiative in the business, we are very disciplined. We ask: what are we trying to achieve? What does it bring? What is the plan? I believe we have been successful with that approach so far.

“There is still a lot to do, but small areas of progress are generating

significant value for the business. We are investing money, but at the same time we are ensuring the return that we are expecting. This contributes to our profitability and finances the next steps of our transformation journey. We never use AI for the sake of using AI.”

The future of the insurance profession is fraught with both challenges and opportunities, says De Macedo, with climate change and its associated risks as a significant concern, along with the increasing protection gap, where certain people or regions are inadequately insured. While AI and new technology bring both opportunities for innovation and risks for companies that fail to adapt, he says. “Climate change is incredibly significant. It is a very uncertain risk but I expect mediumsize events to become more frequent and this will raise a lot of questions in terms of pricing, capital protection and reinsurance.”

He also highlights the importance of education – both for insurance professionals and the public. “As the insurance market faces rate increases and other disruptions, it is vital to ensure that customers understand the reasoning behind these changes. A better-informed public will lead to a more resilient insurance industry that is better equipped to serve the evolving needs of the economy.”

Looking ahead, De Macedo is optimistic about the role insurance can play in supporting economic transformation and sustainability. “Insurance is an important player in the economy,” he concludes. “It’s not just about collecting premiums and paying claims; it’s about helping to finance projects and supporting the transition to a more sustainable world.”

For Covéa, the journey towards profitability, operational excellence and sustainability is not just a strategic plan – it is a commitment to making a positive impact on the profession and wider society. ●

Luke Holloway is editor of The Journal

After the initial shock and horror of a natural catastrophe, the focus nearly always turns to insurance. However, even as the recent fires were still burning around Los Angeles, the conversation quickly shifted to the insurers in the region and the cover the homeowners did – and more importantly did not – have in place.

Liz Booth reports

The California wildfires sparked a critical debate, exposing growing concerns about insurers who have withdrawn cover from properties due to escalating fire risk.

One of the reasons for this is that the US has some of the highest penetration rates globally for insurance, so a fair number of people do buy insurance. But also, because insurers had withdrawn from the market, in considerable numbers, just last year, leaving policyholders reliant on a state system. Some 3,600 policies in three California zip codes were reportedly dropped by State Farm last year alone.

In terms of what had happened by 28 January, the Palisades and Eaton wildfires in Los Angeles were fully contained, but not before they were reported to have cost 29 lives and damaged or destroyed 18,000 structures.

The estimated cost to insurers, including losses to the California FAIR Plan, ranges from $20bn (£16.1bn) to $45bn (£36.2bn). A large portion of that will be homeowners’ coverage. The expectation is that most insured losses will be shared among standard and excess and surplus lines (E&S)

homeowners’ insurers, the California FAIR Plan and commercial property insurers, with smaller losses for fine art and collectibles and auto insurers.

Reinsurers too are likely to feel the heat of these fires, with claims from primary companies under a variety of reinsurance coverages, including quota-share treaties and excess-of-loss property catastrophe coverages, as well as facultative and per-risk reinsurance. Additionally, most reinsurance contracts also cover assessments on insurers imposed by the California FAIR plan. The experts are predicting that the reinsurance sector will assume at least 30% of total insured losses; however, that is unlikely to play out for at least the next six to 12 months.

There is also a risk of more costs for insurers to bear should FAIR plan claims exceed its resources, as California insurers are required to participate in FAIR plan losses through assessments proportionate to their prior market shares.

New rules that came into effect as recently as December 2024 mean insurance companies will only have to pay the first billion dollars out of

Between 1980 and 2023, there were 46 confirmed weather/climate disasters with losses exceeding $1bn each that affected California, averaging 1.0 events a year. But between 2019 and 2023, the annual average nearly doubled, to 1.8 events.

Source: National Oceanic and Atmospheric Administration

pocket before they can start adding surcharges to the bills of any and all of their customers in the state.

Meanwhile, US-based Insurance Business reports that California lawmakers were advancing legislation to enhance the California FAIR Plan's claims-paying capacity and expedite the insurance claims process for homeowners amid the Los Angeles wildfires.

The proposed FAIR Plan Stabilization Act would authorise the California Infrastructure and Economic Development Bank to issue catastrophe bonds to support the FAIR Plan during liquidity shortfalls, according to AM Best.

“The loss in Southern California is inconceivable,” says Assembly member Lisa Calderon, chair of the insurance committee and co-author of the legislation. “AB 226 will alleviate some of the uncertainty that FAIR Plan policyholders may encounter as a result of this tragedy.”

Looking ahead, after an event such as this, the California Department of Insurance issues mandatory one-year bans on non-renewals in affected areas. However, the industry’s assessment of wildfire risk will likely increase significantly.

Firas Saleh, director of product management at ratings agency Moody’s, says: “Already the most destructive wildfire event in Los Angeles County history, it is certainly now in the top three deadliest fires in the state and potentially the costliest in US history.”

Moody’s adds: “It is clear the wildfires are a major insured and economic loss, with significant losses expected to be retained by primary insurance providers, reinsurance coverage likely to be triggered and the insurance-linked securities market keeping a close eye on wildfireexposed bonds.”

The ratings agency has also provided some figures:

● As of September 2024, exposure in Los Angeles County was $112.2bn

(£90.3bn), representing approximately 23.1% of the entire FAIR portfolio and year-over-year growth of 53%.

● Between September 2020 and September 2024, FAIR residential total exposure in Pacific Palisades ZIP Code 90272 jumped approximately 576%, from $436.2m (£351.1m) to $2.9bn (£2.3bn), while commercial total exposure increased by about 2,770%, from $8.5m (£6.8m) to $241.5m (£194.2m).

● Limits to FAIR coverage suggest challenges from potential underinsurance and coverage gaps, i.e the median listing price of homes in the Pacific Palisades is $4.5m (£3.6m), beyond the $3m (£2.4m) FAIR Plan limit.

Meanwhile, fellow ratings agency AM Best notes: “Insured losses are trending above long-term averages in California due to more frequent severe weather events, with no sign of reversal.”

According to data from the National Oceanic and Atmospheric Administration, from 1980 through 2023, there were 46 confirmed weather/climate disasters with losses exceeding $1bn (£794m) each that affected California, averaging 1.0 events per year (on a CPI-adjusted basis). In the last five years (20192023), the annual average has nearly doubled, to 1.8 events, evidence that California residents have recently dealt with an increasing variety of severe weather events.

Business impacts aside, the California wildfires were a major human disaster, with hundreds of thousands of people forced to flee, lives lost, homes looted and ultimately 18,000 structures impacted by the flames.

With international and national media picking up on the insurance implications within a couple of days of

the fires starting, it is also no wonder that many people were worried about whether or not they would have a valid claim or whether the insurers would actually pay up.

It could have been a major opportunity for insurers to do good PR work and come out fighting, however report after report said media had spoken to insurers but the response was ‘no comment’.

Reuters was one of the first to pick up on this angle and by 11 January was reporting on local resident Ivan De La Torre, who said: “My concern is that the insurance companies won’t be able to handle all the claims, file for bankruptcy and that’s that. It’s scary.”

His uncle and sister both lost their houses in a fire in Altadena.

Leo Frank III, a 66-year-old actor who lost his family home in Altadena, said he fears insurers could drag their feet on paying claims and fail to cover the full cost of reconstruction.

“We will rebuild. No one is taking our house,” said Frank, as he hunted for a shower seat for his 96-year-old mother in a parking lot full of donated supplies in Pasadena. “But it will be a mess.”

Frank said he knows some neighbours who lost their homeowners coverage prior to the fires, as insurers retreated from parched regions in California increasingly prone to wildfires.

“We were lucky we still had a policy,” he said.

Reuters contacted nine of the top home insurance companies in California for comment.

State Farm, Nationwide, Allstate, Mercury, Liberty Mutual and Farmers responded with statements saying they were working with policyholders to help them make claims, without addressing specific concerns about residents not receiving sufficient payouts or rising future premiums.

As one loss adjuster explained: “The question is: how would the losses be adjusted? This calls into play the basis of insurance contracts, i.e. utmost good faith especially in situations where the insurance for the property has been renewed severally through the years.

“Good faith would apply to both parties, i.e. underwriters and the policyholders, especially if the latter had the opportunity of removing some of the valuable items. Once the circumstances have been validated and it is accepted that the subject matter has been completely destroyed, perhaps beyond recognition, the underwriters – unless they get any reasons to the contrary – should pay the claims in full as per the sums insured.”

Time will tell whether that is done or whether insurers will argue individual cases, but there is a potential missed opportunity for insurers to show themselves as having a human side and to deliver on the promises made when policies were bought. ●

Liz Booth is contributing editor of The Journal

The Chancellor of the Exchequer, Rachel Reeves, announced a package of reforms in November, aimed at ensuring the UK remains a “global powerhouse for financial services”.

A call for evidence (now closed) was launched in the same month to help develop the government’s financial services growth and competitiveness strategy, which is due to be published

in the spring. It focuses on five priority growth opportunities, including insurance and reinsurance.

It also acknowledges the insurance industry’s considerable contribution to the UK economy, stating: “Insurance markets are pivotal in supporting growth. By protecting against and managing risk, these markets make the whole economy more resilient.”

Fiona Nicolson reflects on potential regulatory developments that could create opportunities for the insurance industry

Jane Kielty, UK chief executive of Aon, says: “We fully support the government’s mission to drive economic growth through planning reform, increased investment and deregulation. Its focus on the insurance and reinsurance sector is particularly welcome.”

Commenting on the government’s growth focus and on its strategy,

Caroline Wagstaff, chief executive of the London Market Group, notes: “The prominent inclusion of the insurance and reinsurance markets in the government’s growth and

competitiveness strategy is an encouraging sign that the economic value of our sector is becoming widely acknowledged in Whitehall.”

Figures published by the Office for National Statistics in November reveal that, in 2022-23, exports of insurance and pension services amounted to £26bn, up by 14.4% on the previous year and representing the thirdhighest growth rate of any sector.

Furthermore, a 2024 survey by the Association of British Insurers (ABI) estimates that ABI members’ total tax contribution amounts to £18.5bn.

There is scope for the insurance sector to grow further. “The UK is home to the most dynamic and innovative insurance market globally. However, there remains significant untapped potential to unlock further opportunities,” says Kielty.

launched a consultation (now closed) on the potential for a new approach to captive insurance, with the goal of supporting the competitiveness of the UK insurance sector.

“The consultation is likely to send a positive signal that the UK is open for business,” Kielty says. “While this may not immediately result in significant premiums flowing into the UK reinsurance market, a marginal increase in inflow would be a logical outcome.”

Considering developments in the captive market to date, Dr Matthew Connell, director of policy and public affairs at the CII, says: “Up to the mid-2000s, most captives were located in specialist hubs such as Guernsey and Bermuda because regulatory principles required each jurisdiction to have broadly the same approach to regulation for all insurance companies.

These opportunities could potentially be found in the field of captive insurance (self-insurance for compliance or risk management purposes). The government also

“Jurisdictions like the UK designed their regulatory system for mainstream insurance companies with large numbers of retail and small business clients, whereas specialist

hubs for captives set up lighter-touch regulation that was more appropriate for captives.

“However, in the last 15 years there has been a move in larger jurisdictions, including the EU, towards allowing a two-tier structure – one for mainstream insurers and one for captives.

“The UK is looking to adopt this two-tier approach to promote growth. Changes floated in the consultation include lower capital requirements for captive insurers; reduced application and administration fees; a faster authorisation process; and reduced ongoing reporting requirements, compared to those for insurers and reinsurers.”

Reflecting on how regulation could be streamlined to promote the establishment of captive insurers in the UK market, Wagstaff also highlights these points: “First, the capital requirements laid out by the Prudential Regulation Authority are designed for commercial insurers, but given the lower risk posed by a captive insurer it follows logically that they 5

should not be required to reserve as much capital.

“Second, the process for authorisation and establishment, and the ongoing reporting requirements, should be eased to reflect the lower risk profile presented by a captive insurer.”

She adds: “The London market is a world leader when it comes to insurance. By regulating captives proportionately, we would ensure that London can offer all the tools in the toolkit, helping London to maintain its position as a global leader.”

Looking at how insurance regulation more broadly could also be streamlined and how it can encourage growth, Kielty says: “Effective regulation is vital for promoting growth. When well designed and implemented, it creates a favourable environment that protects consumers, maintains financial stability, boosts investor confidence, reduces business costs and solidifies the UK’s reputation as a safe and rewarding place to invest.

“That said, the regulation of the commercial insurance sector can sometimes be overly burdensome. A more tailored or liberal regulatory framework is needed – one that acknowledges the sophistication of commercial clients rather than treating them as retail consumers.

“By focusing on establishing an efficient, resilient and responsive regime, particularly during times of crisis, the sector can be better positioned to thrive. Improved communication from policymakers and regulators regarding objectives, capacities and results would support this goal.”

Dr Connell also highlights ways insurance regulation could be improved beyond captive insurance, explaining: “Insurance regulation could be streamlined by changing the scope of the Consumer Duty to focus only on retail customers and small and medium-sized enterprises (SMEs). It does not apply to large insurance risks, but these are defined in Solvency II legislation, and still means that some corporates that are large enough to employ their own risk experts are treated in

a similar way to retail customers and micro businesses.”

In addition, he suggests making changes to product governance reviews: “Many insurance companies and brokers deal with thousands of insurance products, so reviewing all these products in line with product governance rules every year is a massive task – a risk-based approach, where the products that could cause the greatest harm are reviewed more frequently, could help cut costs.”

Streamlining reporting requirements for brokers could be beneficial too, believes Connell: “The number of reports that brokers have to give to the Financial Conduct Authority has increased from two to around 10 during the last 20 years. While this information is essential, reporting could be streamlined, so firms do not have to fill out as many forms and can share information in the most efficient way, to avoid duplication or calculating the same figures more than once a year.”

He adds: “Regulation undoubtedly benefits consumers and has a positive impact on trust in insurance. If we didn’t have a regulator and an Ombudsman, we would have to invent them quickly to avoid a dramatic fall in consumer trust.

“The UK will never benefit from a ‘race to the bottom’, where regulation is stripped away to stimulate shortterm growth. Experience shows that in the long run, reckless deregulation leads to greater complaints, higher levels of compensation and stricter rules for everyone, including well-run firms.”

But he concludes: “Where the UK insurance sector can really make a difference is by using its strengths to win a ‘race to the top’ – encouraging talent into the sector to provide highquality risk management advice to enterprises and high-quality service to all. This will foster trust in insurance, demand, productivity and economic growth – creating a virtuous circle of quality and prosperity.” ●

Fiona Nicolson is a freelance journalist

In December, the UK Financial Conduct Authority (FCA) published a consultation on operational risk reporting. The key change is that operational reporting should be more forward-looking, taking into account events that could result in intolerable harm for consumers.

As the FCA puts it: “The bar we propose for incident reporting is different from the bar set in our operational resilience rules. For incident reporting, firms should report incidents that have the potential to cause intolerable harm, as well as incidents that have actually caused intolerable harm.”

For greater clarity, the FCA has proposed a more detailed definition of an operational incident, which is as follows:

“A single event or a series of linked events that disrupts the firm’s operations, where it either: disrupts the delivery of a service to the firm’s clients or a user external to the firm; or impacts the availability, authenticity, integrity or confidentiality of information or data relating or belonging to the firm’s clients or a user external to the firm.”

The FCA’s threshold on reporting an operational incident is where “the incident could cause or has caused intolerable levels of harm to consumers and they cannot easily recover as a result”.

For its existing operational resilience regime, the FCA has already provided examples of what intolerable levels of harm could be for insurance customers.

One example was of a firm which “has identified that disruption to its claims handling process for motor insurance could lead to potential consumer harm”, adding: “For example, consumers being unable to obtain a courtesy car in a timely manner which could cause further disruptions in their lives… So, Firm B considers the maximum tolerable period for disruption to both their online portal and contact centre should be set at two days. Firm B considers it important to have both channels available as some consumers may not have access to one channel or have preferences to use one channel over another.”

The consultation paper also focuses on thirdparty relationships that may not be outsourcing arrangements. For example, firms may rely on cloud computing services that are available as a utility and not delivered as part of a formal outsourcing arrangement.

The consultation paper addresses this by saying: “Over the years, firms’ operations have become more complex and dependent on technology, increasingly relying on a wide range of services delivered by third parties. Under current requirements, we receive limited and inconsistent data on third-party arrangements relating only to firms’ outsourcing arrangements. This has resulted in gaps in our knowledge of potential risks that third parties pose to individual firms and the financial services sector. As a result, we are proposing to introduce material thirdparty reporting rules, which include outsourcing and non-outsourcing arrangements for a subset of firms that have the biggest consumer and market impact.”

The FCA’s proposals continue a trend towards making insurance companies accountable for impacts on customers that may be the result of failures beyond the strict corporate boundaries of an insurance company. They will require insurers to ‘read the road’ even more carefully than before, reducing the number of occasions when they can say ‘no-one could have seen this coming’. ●

Dr Matthew Connell is director of policy and public affairs of the CII

Donald Trump’s victory in the US election brought an end to the super cycle of elections that saw almost half the world’s population head to the polls during 2024 – the largest election year in history.

Trump’s win brings international trade into the geopolitical battleground and the early signs from his second presidency are that tariffs and protectionism will be weaponised.

Meanwhile, elections in Germany, France, Austria and South Korea saw incumbents ejected and highlighted an increasingly fractured global landscape.

Recent research has highlighted the increase in political risk. The World Economic Forum’s Global Risks Report identifies state-based armed conflict as the most pressing immediate global risk for 2025. And geopolitical risk overtook cyber incidents and changes in regulation during the course of last year as the top risk facing organisations, according to the results of an Airmic survey.

John Lentaigne, head of credit and political risks at the broker Tysers, says: “There was globally a strong anti-incumbent vote in most countries that had elections in 2024, with a notable shift towards the right and nationalism, and against multilateralism. For instance, in the US, former President Donald Trump [reclaimed] the presidency with 50%

of the popular vote.

“This shift suggests an era of increased protectionism and a further decline of the rules-based international order that has prevailed since the end of World War Two. This trend was observed in more than 70 countries, representing nearly half of the global population.”

According to Control Risks, the coming year is set to be another where companies will be challenged to manage a volatile mix of geopolitics, economic competition, lawlessness and rapid technological change.

“With the uncertainty of the US election behind us, uncertainty surrounding the US’s role as a reluctant global power remains,” says Nick Allan, CEO of Control Risks “Riven by domestic political tensions, the US is still the essential country that will have an outsized impact on most of the issues that business will face. Despite the competitive and fractured state of geopolitical relations, the world remains globalised and economically interconnected in ways that mean that avoiding turbulence is not an option.”

As tariff threats materialise, trade will become more expensive, likely leading to further inflation in several jurisdictions.

For example, the US has already imposed 25% tariffs on steel and aluminum imports as well as now proposing tariffs of 10%-20% on all imports which could further

Source: Statista

increase the cost of goods and services. The Bank of England noted that global trade growth fell by 5.5 percentage points during the past year due to increased protectionism.

Adam Carrier, head of consulting at Gallagher Specialty, says: “The US, which was the keystone of global markets, has turned to mercantilism. It has started to apply protectionism to the world economy and we’re going to see an acceleration of this and the world splitting into trading blocs.

“Imports and exports will be affected and there will be a turn towards internal markets. If it is more expensive to sell to the US or get raw materials from the US, where are we going to get those from? It will then lead to more state-to-state trade deals as opposed to large blocs engaging on behalf on one another. There’s going to be quite a lot of pain and, on the consumer side, inflation, which hasn’t really gone away, is probably going to continue.”

Tim Evershed highlights the areas of concern as the end of the recent election super cycle heightens political risks for 2025

Carrier expects the UK’s ‘special relationship’ with the US, allied with the fact that the nation meets NATO’s GDP requirements and there is no significant trade deficit, to give the country some protection from Trump’s potential tariffs.

However, he warns: “Even if you are not an entity that’s not directly exposed to the US, every company should be looking into its supply chain and understanding where the potential risks are. Do third parties deal with the US and are they from countries that Trump may sanction? If so, think through what that could mean for input costs, your markets and your output.

“Risk is now changing on an increasing basis. In recent years, the international mechanisms for dealing with disputes have been fundamentally eroded. The unipolar moment where the US could influence the rest of the world to go along with the rules-based order it would apply has subsided for various reasons.”

These factors have caused a significant elevation in political risk, a trend observable since Russia’s invasion of Ukraine. The conflict has led to increased geopolitical tensions, impacting global supply chains and energy markets. It also means that organisations will face a hardening market when purchasing insurance cover.

“Pure political risk insurance is costlier than it has been in many years, but is arguably more necessary, especially for firms with globalised footprints. The cost of political risk insurance has increased by 10%70% for renewals, depending on the country mix within the portfolio,” says Lentaigne.

“However, credit risk premiums have fallen back, including in emerging markets, from highs reached 18 months ago. This indicates a more stable credit environment despite the heightened political risks.” ●

Tim Evershed is a freelance journalist

Humanity Insured has ambitious plans to enable insurance for 30 million people across the globe. Liz Booth reveals how

With the disaster relief gap widening each year and now sitting at a staggering $40bn (£31.7bn), the opportunity for insurance to help address this issue is enormous. However, disaster relief on its own is never going to be enough to bridge the gap.

The development of pre-disaster financing has been discussed for years as a way to build resilience for countries, communities and individuals before disaster strikes, enabling quicker recovery.

With this in mind, David Howden, CEO of the Howden Group, tasked senior members of his team to find a way forward for the insurance industry to play a more meaningful part.

In stepped Charlie Langdale and, inspired by his visit to COP26, in September 2024 Humanity Insured was born. Not an insurer or a brokerage, it is a charity backed by insurance players who have all made a minimum threeyear commitment to the charity. That has enabled the charity to support seven projects across the world since its launch in September, with the aim of supporting a further 10 projects

in 2025, which would mean providing insurance to three million people.

Overall, the charity has the ambitious aim of supporting 30 million people every year, with insured limits of $2bn (£1.59bn). The supporting insurers do not pay out claims but instead inject funding, which is then used by the charity to pay premiums.

Now CEO of Humanity Insured, Langdale gives an example of a community of women in India, earning an average of $2.50 a day. Aware of the risks of extreme heat, the women wanted insurance coverage to ensure that they did not have to work in such harsh conditions, which would have consequences for their

health. The insurance ensures they will receive an income even if unable to work – extreme heat events often last for a couple of weeks in that part of India and that length of time off work would have had severe financial implications for the women. Working with Humanity Insured, each of the women invests $1, matched by $7 from Humanity Insured. They then buy a local policy from a local insurer.

In this way, says Langdale, the local insurance market plays an integral part in the scheme and is not sidelined.

PLAYS AN INTEGRAL PART IN THE SCHEME AND IS NOT SIDELINED

He provides another example from Kenya, where a group of farmers already buys insurance to cover their bank loans. However, the insurance would pay out 100% of their bank loan in the event of crop failure, but leave them no money to buy new seed. Instead, they realised they needed 156% of the loan value in insurance to repay the loan but also to have enough to replace the seed. In stepped Humanity Insured, working with local insurer One Acre, to ensure the farmers can pay for the insurance premium.

Langdale stresses: “In both cases, the insureds wanted insurance. They understood its value and were looking for a solution. In the case of the farmers, they already had insurance and needed a top-up.”

Humanity Insured works closely with organisations such as the World Food Programme but is also keen to work with local insurers too. “They are an essential part of the chain,” says Langdale.

He hopes to build relationships in key countries to embed Humanity Insured into the local communities, build up more projects and increase the impact. The charity aims to build trust in local insurers and in the insurance sector more generally.

Langdale knows it is an uphill battle, particularly to convince potential policyholders of the value of insurance to protect against a future event, rather than to simply rely on humanitarian aid after an event.

There are stories of exactly that happening, he agrees, but he truly believes insurance has the power to change lives: “In the UK we are all guilty of forgetting the value of insurance. We come to work each day, travel home safely and don’t think of the safety net that embraces us. Even buying our car or home insurance remains a grudge purchase.

“But the value of insurance is truly magnified in other countries. A payment to recover from a drought can have an awesome impact, not least because the policyholder can be

comfortable that they will be protected in the event of the drought and it is ok to invest in their family rather than in worrying about how to recover from such events.”

To find out more, visit: humanityinsured.org ●

Liz Booth is contributing editor of The Journal

Kenyan smallholder farmers face severe climate disasters that threaten livelihoods and increase poverty risks. In partnership with One Acre Fund, Humanity Insured is providing weather and pest insurance, loan forgiveness and cash payouts during poor harvests. People protected: 216,000

Women in Papua New Guinea face growing droughts and erratic rainfall that harm livelihoods. With Mama Bank, Humanity Insured is funding an insurance product that provides rapid payouts to farmers, businesses and households, 80% of which are women.

People protected: 50,000

Syria faces worsening droughts, food insecurity and poverty. In partnership with the World Food Programme, Humanity Insured is protecting displaced people and smallholder farmers from drought. People protected: 264,000

As rainy seasons become more erratic in Togo, communes are increasingly vulnerable to floods. Humanity Insured is funding an insurance solution to enhance resilience and emergency response. Local authorities and residents have played a key role in the insurance product and response plans. People protected: 700,000

Smallholder farmers in droughtprone regions face crop failures, livestock losses and vanishing incomes. In partnership with Tearfund, Humanity Insured is funding drought protection for people across Ethiopia, Nepal, Malawi and Pakistan. People protected: 50,000

Luke Holloway gets the experts take on the evolution of travel and how insurers are using technology to innovate cover

Many may still see travel insurance as a grudge purchase but insurers are using technology to evolve and improve the service they offer customers, making it easier – and in some cases instant – to claim money back when your trip goes wrong.

“You have to accept that people loathe travel insurance and a lot of people would say it is an unnecessary extra,” Simon Calder, well-known travel expert, writer, presenter and broadcaster, tells us. “For the vast majority, thank goodness, they are never going to see any visible benefit from it and therefore they are not particularly well disposed towards travel insurance. But if you can automate a travel insurance policy, make it interactive and adaptable, that would bode well for the future of travel insurance.”

The subject of travel was discussed in depth on a recent episode of The Journal Podcast, where Calder was joined by Gary Murphy, head of travel at Gigasure, an insurtech platform offering travel, backpacking and car hire cover aimed at making travel insurance flexible and responsive.

As well as offering a wide range of benefits, including cover for preexisting medical conditions, gadgets and flight and baggage delays, a unique feature of the app is the ability for users to customise their policy in real time by adding or removing key benefits and add-ons.

“We want to deliver insurance in a way that makes better use of technology,” says Murphy. “We work in the background with reputable insurers to provide capacity for the products that we design and we integrate parametrics into travel insurance propositions so users can customise their cover and excesses to meet their needs and budgets.”

One of the key propositions the platform offers is GigaShield, which automatically provides customers with airport lounge access or a prompt cash payment if their flight is delayed by three hours or more.

“From the outset, we wanted to deliver travel insurance propositions that added customer value, including flight delay and missing baggage benefits,” says Murphy.

“If your baggage goes missing, you get a property irregularity report number, upload it to the app and receive a payment of £50 instantly to help you buy some of those immediate necessities.

“It actually sits beside the standard benefits in the

consumer travel policy so when you get back, you can still claim the other benefits on top of it. It’s not ‘instead of’,” he says.

Travel expert Calder praises travel insurers for innovating with customer needs in mind. “I applaud all innovation by the insurance sector, in particular, of course, travel insurance,” says Calder. “Addressing these issues from the point of view of ‘What does the customer actually want and need?’ is terrific.

“The public generally has a pretty poor understanding of the interaction between travel insurance and airlines’ obligations in terms of flight delays and baggage problems. So now, people could be sitting there and suddenly they’ve got a lounge pass and got £50 in their hand, which is about the most tangible and rapid form of benefit being paid out in insurance that I’m aware of.”

Murphy goes on to explain how the CII Public Trust Index (PTI) was an influence in helping shape the GigaShield app. The PTI is quarterly research conducted by the CII that examines the experiences of consumers and businesses in buying and claiming on insurance products.

THE PUBLIC TRUST INDEX REFLECTS A LOT OF THE POINTS THAT WE TOOK INTO CONSIDERATION WHEN BUILDING A BETTER CUSTOMER PROPOSITION

“The PTI reflects a lot of the points that we took into consideration when building a better customer proposition,” says Murphy. “We wanted to answer positively to questions like: Does the insurance policy cover the right risk? How easy is it to set up an insurance policy? Does it recognise loyalty?”

New data from Go.Compare Travel reveals that more than a quarter of holidaymakers (27%) wait until the

day of departure to buy travel insurance, leaving them unprotected against issues that could arise before their trip.

Being prepared, providing accurate details in your application and being sure of what isn’t covered are all important, both Calder and

Murphy agree.

Calder explains: “In terms of the people who get in touch with me about travel insurance complaints, sadly, in 90% of cases it is because the insurer was not fully aware of the risk in the sense of pre-existing medical conditions.

“But ultimately, I suppose one positive you can take from that is it reminds everybody that insurance isn’t just about finding what’s cheapest on the internet. It is about dealing with a very professional industry, but also being absolutely upfront about what your particular personal circumstances are and arranging cover accordingly.”

“Unfortunately, you don’t get many positive stories about travel insurance providers,” agrees Murphy. “But there are a lot of really good providers out there that do look after customers and go above and beyond. We do provide a good safety net for the public.”

“I’m old enough to remember filling out forms by hand,” says Calder. “You’d send that off in the post with a cheque and that would be the last you heard of it. So, it is wonderful you can now interact with your travel insurance policy while on the road – it is marvellous.

“We are living in a time when British and Irish airlines are absolutely the safest in the world. It’s quite extraordinary,” he says. “And that is a wonderful thing to celebrate, getting more people safely to the ends of the earth.”

To listen to the episode in full and on-demand episodes of The Journal Podcast, visit: thejournal.cii.co.uk/ podcasts ●

Luke Holloway is editor of The Journal

The motor market has faced challenges recently, from the push towards green energy and carbon neutrality to the closing of manufacturing plants and an increasingly tricky economic backdrop.

This, in turn, has translated into challenges for the sector’s insurers, with fears of massive payouts for compensation for commission payments and reported government intervention on the cost of motor premiums.

In terms of compensation payouts, there has been talk of those potentially extending beyond the motor industry and even outstripping the cost of the premium protection insurance scandal of a few years ago.

In December last year, the UK Financial Conduct Authority (FCA) announced an extension to the time firms have to respond to complaints about motor finance agreements not involving a discretionary commission arrangement (DCA). Firms now have until after 4 December 2025 to provide a final response to nonDCAs, in line with the extension it has already provided for complaints involving DCAs.

The extension follows the Court of Appeal ruling in Hopcraft v Close Brothers Ltd, Johnson v Firstrand Bank Ltd, and Wrench v Firstrand Bank Ltd, in which the court decided it was unlawful for the car dealers to receive a commission from lenders providing motor finance without first telling the customer and getting their informed consent to the payment.

On 11 December 2024, the Supreme Court confirmed it will hear an appeal against the Court of Appeal’s judgment. However, in the meantime, firms must still comply with the law as it stands.

The FCA has also confirmed that consumers will have until the later of 29 July 2026 or 15 months from the date of their final response letter from the

The motor

insurance market

is far from immune to external pressures on costs, as Liz Booth reports

firm, to refer a non-DCA complaint to the Financial Ombudsman Service (instead of the usual six months).

Finally, it confirmed the complaint handling extension will cover motor leasing, as well as motor finance credit agreements. The Court of Appeal’s judgment did not involve motor leasing agreements. However, consumers also use leasing to access motor vehicles and it is important that consumers using similar products for similar purposes are treated equally, said the FCA.

Meanwhile, the FCA is launching a review of the motor and home insurance market amid concerns about rising prices, alongside the launch of a government motor insurance taskforce. The review – or competition market study – will investigate whether people who borrow to pay for motor and home insurance are receiving fair, competitive deals. Premium finance allows people to pay for insurance in instalments with the average yearly rate on the amount borrowed ranging between 20% and 30%. More than 20 million people are

estimated to pay for their insurance this way and FCA research shows that 79% of adults in financial difficulty have used the product.

As part of the study, the FCA will review whether the products represent fair value, how well customers are made aware of their financing options, the role of commission and other potential barriers to effective competition in both motor and home premium finance markets.

The FCA is also part of a government taskforce, launched last October by the then transport minister Louise Haigh, bringing together industry groups and consumer champions such as the Association of British Insurers (ABI), Citizens Advice, Which? and Compare the Market, as well as insurance regulators, to tackle spiralling costs of car insurance.

It came as motor insurance premiums grew an average of 21% since June 2022, according to FCA analysis – far higher than in comparable economies such as Germany, France, Spain and Italy.

The taskforce will identify factors behind rapidly rising premiums and agree solutions to keep costs under control. Factors driving up the cost of insurance

of UK adults in financial difficulty have used premium finance products to pay for motor and home insurance Source:

include inflation, rising car thefts and the UK’s pothole-ridden roads.

At the launch, ABI director general, Hannah Gurga said: “We are aware just how tough the last couple of years have been for motorists and we have been working hard with our members to tackle the cost of claims that impact on premiums.”