Evolving regulation

Matt Brewis outlines new FCA strategy to support growth

Evolving regulation

Matt Brewis outlines new FCA strategy to support growth

With gold prices hitting record highs, discover how insurers handle the risks of this valuable asset

Pet project

Insurers must unite to tackle pet and equine sector challenges

April – May 2025

Raising standards

Empowering insurance professionals in the Middle East

5 President’s opinion

Nicola Stacey on the value of an international perspective

6-13 News

UK and international news from the CII

35 Regulation

updates from the UK 50 Opinion

A day in the life of a claims professional

14–16 Interview Matt Brewis on the Financial Conduct Authority’s strategic direction

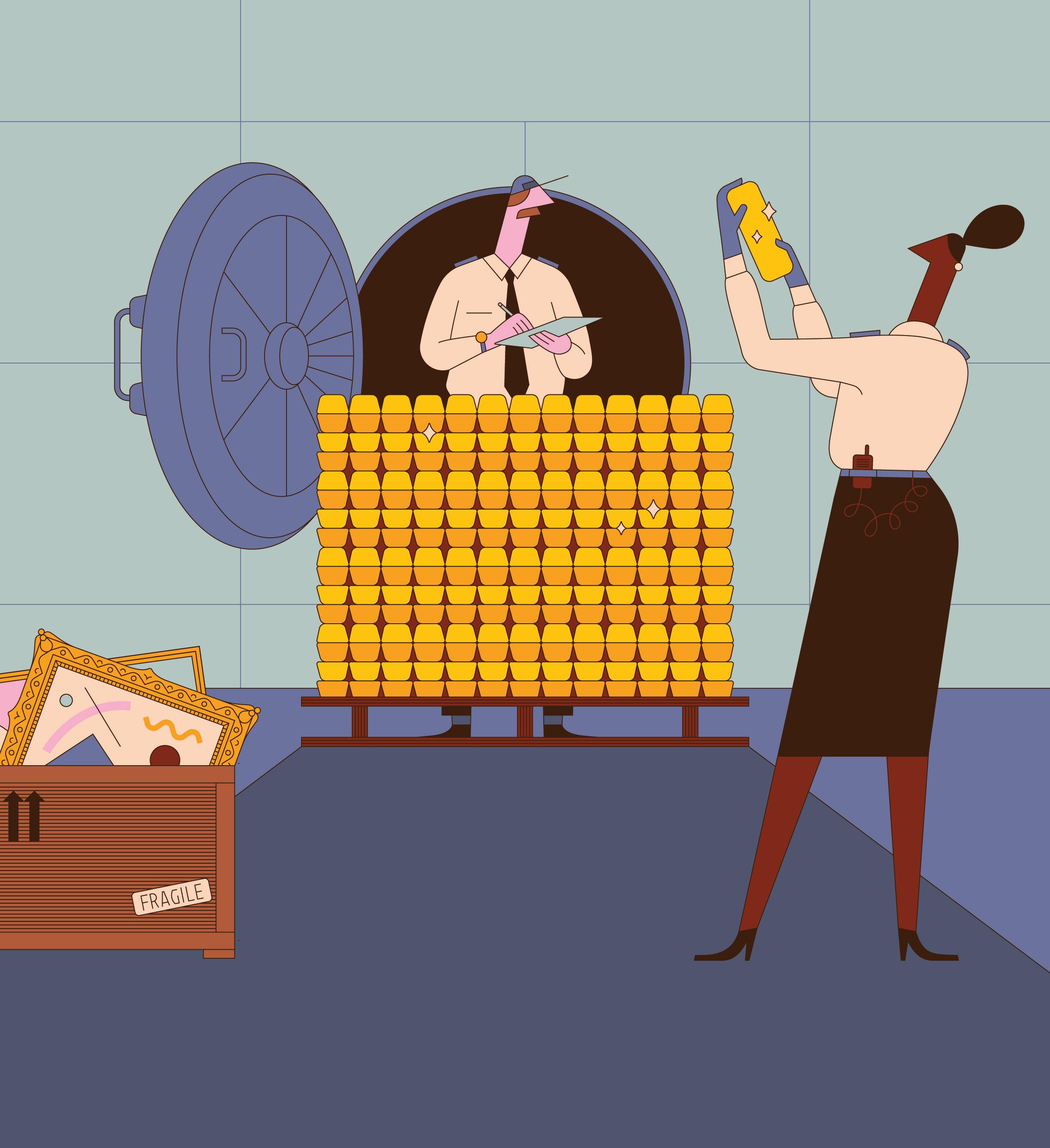

17–19 Gold

Global risks in insuring gold and fine art

20–21 Pet A new association for pet and equine insurance

22–23 Economy Spring Statement: Implications for insurers

24–25 Vehicles

UK legal and liability issues around e-scooters

26–27 Professional Development

Using the CII Professional Map to shape skills and behaviour

local institute president on the value of giving back

Mentoring

benefits of face-to-face and online mentoring

tips to help to achieve exam success

your knowledge with 10 key questions

The Chartered Insurance Institute

The Chartered Insurance Institute

20 Fenchurch Street, London EC3M 3BY

Fenchurch Street, London EC3M 3BY

Tel: (020) 8989 8464

(020) 8989 8464

The Journal is online at www.thejournal.cii.co.uk

The Journal is online at www.thejournal.cii.co.uk

The Journal is the official magazine of the Chartered Insurance Institute (CII). Views expressed by contributors or advertisers are not necessarily those of the CII or the editorial team. The CII will accept no responsibility for any loss occasioned to any person acting or refraining from action as a

The Journal is the official magazine of the Chartered Insurance Institute (CII). Views expressed by contributors or advertisers are not necessarily those of the CII or the editorial team. The CII will accept no responsibility for any loss occasioned to any person acting or refraining from action as a result of the material included in this publication.

The Journal is online at www.thejournal.cii.co.uk

Cover Image: Edited by Craig Zaduck

Chief executive: Sian Fisher

EDITORIAL

Editor:

Editor: Luke Holloway (020) 7417 4778 luke.holloway@cii.co.uk

Contributing

Contributing editor: Liz Booth

Senior Designer: Will Williams

Picture editor: Claire Echavarry

Senior

Production: Jane Easterman

Nicola

reflects

Ihave always regarded business travel as a highly valuable part of working in our industry. Not only does it enable you to take a break from the daily grind of Teams calls and allow yourself some thinking time, but it also gives you a chance to engage with the cultures of different regions. It was with great pleasure then that I boarded a flight to Dubai to visit Chaucer’s MENA office and took the opportunity to drop by the CII’s office in Dubai – my first visit to an international CII office.

Dubai is a vibrant city with a great café culture, providing so much opportunity to engage with peers, clients, brokers and competitors over excellent coffee. ‘Globalisation by localisation’ is a phrase often used, but that is because it makes sense. It is so important to embrace local cultures and ways of working to deliver the service and products the local markets need.

During my visit, I was fortunate enough to meet Gaenor Jones, CII regional director, Middle East, along with the rest of the team in Dubai. I heard first-hand about regulatory developments in the region, including new legislation mandating professional qualifications for senior insurance representatives and outlining criteria for continuing professional development (CPD).

While these changes are currently targeted at corporates residing onshore, there is a feeling that once enacted,

IT IS SO IMPORTANT TO EMBRACE LOCAL CULTURES AND WAYS OF WORKING TO DELIVER THE SERVICE AND PRODUCTS THE LOCAL MARKETS NEED

they will flow to offshore businesses, which could result in greater demand for the CII’s services in the future.

We also discussed a wide range of initiatives in the region, including professional development and accreditation.

In London this spring, it was a great pleasure to spend some time with some of our members at a speed mentoring event, which focussed on leadership and professional development skills. The evening not only provided a forum for mentors to share stories of their personal career journeys and for mentees to ask questions in an informal environment, but it was also a great networking opportunity.

I also enjoyed supporting the CII’s Cycle Management workshop at the Institute’s London offices in March. It was great to meet a mix of professionals as they continue their professional development in the light of changing market conditions and anticipation of how the market will adapt in future. The course was guided by individuals who have led underwriting divisions through previous cycles and looked at cycle-based performance management systems and the role of artificial intelligence (AI) in measuring underwriting behaviours.

While we are all probably aware of the vast potential that AI has to aid the insurance market in terms of processing and analysis, using generative AI as a tool to provide real-time insights could open up a world of data-centred possibilities. However, as an industry, it’s essential we ensure we’re using the tools correctly and feeding them with carefully curated and relevant information.

Given the importance of continuing professional development, I encourage you all to head over to the CII website

to see whether there is training you could benefit from as an experienced professional or leader. ●

Nicola Stacey is president of the CII

A CII roundtable report calls for a ‘coalition of the willing’ to move beyond identifying characteristics of vulnerability and put customers ahead of targets.

The Managing Vulnerability in Insurance Roundtable Summary Report says boards and senior leaders must ‘walk the walk’ by engaging directly with customer experiences, instead of delegating responsibility to compliance or customer service teams.

The report follows a CII roundtable in March at which representatives from the UK Financial Conduct Authority and Financial Ombudsman Service, joined representative bodies, sector leaders, academics and other experts to examine vulnerability management within insurance.

Panellists identified a lack of high-

quality management information and the challenge of joining the dots between data, actions and outcomes as a key consideration.

The development of sector-wide standards is proposed in the report, that would set out baseline expectations for:

● Vulnerability identification processes.

● Training and capability building across all roles.

● Incorporation of vulnerability in product and service design.

● Monitoring and evidencing customer outcomes.

The CII plans to develop practical guidance for firms to address the issues identified in the report. The CII will further support the sector by hosting a follow-up session concentrating on data sharing across the distribution chain, a crucial element of Consumer Duty delivery and vulnerability management, as well as a webinar to delve deeper into the key discussions from this roundtable.

→ To read the full report, visit: bit.ly/4jtB4gE

The CII New Generation Programme 2023/24 London market group has published a new report that considers how the insurance profession can help to build public confidence. The group uses case studies of the sector’s response to previous

global and national events to identify three core principles through which the London market can help to build public trust in insurance: ‘Collaboration, Certainty and Creativity’.

The report, titled When uncertainty calls, how does insurance answer?, considers the reputational impact from the London market’s response to the war in Ukraine, IRA bombings and the Grenfell Tower disaster.

The report recommends that the London market should apply the principles of collaboration, certainty and creativity to evolving

risks such as systemic cyber risk to create solutions for consumers that build further trust in the insurance profession.

Commenting on the report, Matthew Hill, CII CEO, said: “The CII New Generation Programme provides an excellent opportunity for talented individuals at the start of their careers to demonstrate thought leadership and shape the future of our profession. Public trust is a vital component of insurance and I commend the New Generation group for examining these case studies, identifying the lessons we can all learn and helping to build and maintain public trust in the process.”

→ To read the full report, visit: bit.ly/4j2uZbd

Entries are due to close for the CII and Personal Finance Society (PFS) Apprenticeship Awards – the annual celebration of apprenticeships across insurance and financial services. The awards also recognise the vital role played by employers to support rising stars in our professions.

Applications are open to apprentices and employers across the UK until 31 May 2025.

The ceremony is an opportunity to showcase the development of outstanding talent, as well as commitment and innovation within the profession. Winners receive a cash prize, sponsored by the Worshipful Company of Insurers Charitable Trust, to reward their achievements and support continued development.

The awards categories include Insurance Practitioner Apprentice

of the Year, Insurance Professional Apprentice of the Year, Senior Insurance

It has been announced that the International Underwriting Association (IUA) will provide sponsorship for two CII marine unit prizes. Beginning this year, the IUA will sponsor prizes for the M90 and M98 units, to be awarded as part of the CII’s annual prizegiving ceremony.

The IUA is the representative body for companies in London providing international and wholesale insurance and reinsurance coverage. The body has participated in sponsorship of CII qualification prizes since 1999, including the CII Diploma in Insurance prize. It will now also sponsor M90 – Cargo and Goods in Transit Insurances; and M98 –Marine Hull and Associated Liabilities.

All candidates who have successfully completed the units will be automatically entered. Each unit has an associated cash prize, which will be awarded to the candidate who achieves the highest overall score for the respective unit.

Professional Apprentice of the Year, Large Apprenticeship Employer of the Year, and Small Apprenticeship Employer of the Year.

On winning Insurance Professional Apprentice of the Year 2024, alongside her team at Farmers Union of Wales (FUW) Insurance Services winning Apprentice Employer of the Year, Heledd Roberts said: “The firm was hugely supportive throughout my apprenticeship. They put time aside for me to do the extra technical learning that comes with the apprenticeship. FUW gave me the opportunity and it is a fantastic way get into the profession. For anyone considering an apprenticeship, I can’t recommend it enough.”

→ For more information and to enter, visit: www.cii.co.uk/careers-in-insurance/ aspire-apprenticeships/apprenticeshipawards-2025

The CII awards 34 qualification prizes each year, which are sponsored by a wide range of insurance and personal finance organisations.

Nicola Mellor, qualifications director at the CII, said: “We are delighted that the IUA has committed to sponsorship of the CII single-unit marine prizes. Our qualification awards are a wonderful opportunity to recognise exceptional

performance from our students, and encourage the pursuit of excellence within the insurance and personal finance professions.”

→ To find out more about CII qualification awards, visit: www.cii.co.uk/aboutus/initiatives/engagement/awards/ qualifications-awards

The United Arab Emirates (UAE) Central Bank has introduced new legislation that mandates professional qualifications for senior insurance representatives, and cites the CII Advanced Diploma as exemplary of the internationally recognised qualifications that will be required by CEOs and other similarly ranked management representatives.

Article 5 of the recently introduced Insurance Brokers’ Regulation stipulates under the need for sector professionals to meet the necessary qualifications, knowledge and experience requirements, and to have “a record of integrity, competence and financial soundness”.

The regulations also outline the

criteria for continuing professional development, including 15 hours for the insurance broker’s representatives, senior management and specialised employees.

Gaenor Jones, CII Middle East regional director, welcomed the new legislation and commented: “This will have a major impact on the sector’s credibility, with corporates and organisations’ senior teams now mandated to attain accredited qualifications which prove their robust knowledge and capabilities.

“We continue to work very closely with the central banks, not only in the UAE but across the Middle East and CSA region, to educate organisations about the importance of their employees pursuing

and attaining internationally recognised qualifications. This latest legislation firmly underpins the CII’s mission to boost professional standards. We look forward to working with a wealth of UAE corporate organisations to help them comply with the new legislation.”

Read our article on UAE insurance qualifications on page 28 of The Journal

The Financial Academy (FA) of Saudi Arabia has received accreditation from the CII as an Approved Professional Development Centre (APDC). Accreditation represents the FA’s adherence to the CII Code of Ethics, as well as best practice and principles in professional training and development.

The FA is a leader in training, career development and professional certification services for the financial sector in Saudi Arabia and has worked with the CII since 2020, when the Academy began hosting the CII’s internationally recognised qualifications. The prestigious accreditation sees the FA reinforcing its position as a key player in shaping the future of the financial sector’s workforce in Saudi Arabia.

Existing CII-accredited APDCs in the region include the Al Ghad Training Institute, the Bahrain Institute of Banking & Finance, the Applied College in Saudi Arabia, Excellence Training Solutions in Bahrain, Phoenix Training Centre in Saudi Arabia, and the Training Plus Institute in Bahrain.

Mohammed Alhamazany, chief of capability development at the FA, commented: “The FA is truly honoured to receive recognition as an APDC by the CII. This accreditation reflects our longstanding commitment to upholding the highest standards of professionalism and our ongoing efforts to support the growth and development of those in the insurance and financial sectors.”

CHARTERED

Six insurance and financial planning firms achieved CII

Chartered status in the first quarter of 2025. Chartered status is a symbol of technical competence and signifies a firm’s public commitment to professional standards.

In receiving Chartered status, firms declare their adherence to the CII Code of Ethics and commitment to supporting initiatives that build public trust, ongoing people development, a customer-centric approach and the development of the profession.

Firms that gained Chartered status between January and March 2025 are Sentio Insurance Brokers, Eva Capital Management, Ocaris Wealth Management, One Four Nine Wealth, Parker Kelly Financial Services, and Path Financial. Nicola Stacey, president of the CII, said: “It is an honour to award Chartered status to six new firms, and welcome them to the Chartered community. Chartered status represents a public declaration of professional standards, supporting our collective mission of building public trust in the insurance and financial planning professions. We look forward to working alongside these firms to deliver excellent client service.”

→ For more information on Chartered status and eligibility criteria, visit: www.cii.co.uk/membership/join-us/chartered

We have all experienced those moments when someone makes an observation that encapsulates so clearly something you believe in so passionately that you can’t help but feel enthused and excited to get back to work the next day. I had one of those moments recently, when I attended the Insurance Institute of London gala dinner, held at the Tower of London.

It was a wonderful occasion, organised to an exceptionally high standard and supported by dozens of leaders from across our profession. In her speech, the Institute’s president, Lucy Clarke, gave a compelling analysis of the challenges facing the global economy. Her conclusion resonated most with me and many others in the room: “We must drive through the importance of education, so we are equipped to deal with the challenges we face. We must make sure we are the most professional people in the world.” I couldn’t agree more.

It is therefore a welcome coincidence that so much of this edition of The Journal is dedicated to the advancement of education and professionalism. In particular, CII president Nicola Stacey discusses her recent visit to Dubai, which followed recent legislation by the UAE Central Bank mandating professional qualifications for senior insurance representatives. We are delighted that the legislation makes specific reference to CII qualifications, noting their internationally recognised quality. We have long argued that a similar approach should be adopted in the UK and, while Matt Brewis, director of insurance at the FCA, questions whether this would be appropriate in his interview with us, he acknowledges that the regulator’s expectation is that firms should uphold high standards without regulation.

If anything, that adds extra weight to the responsibility my colleagues and I feel towards the profession, with the benefits that our members and other aspiring professionals might gain from using our Professional Map. If you’re in any doubt, please read the article by Ajay Mistry, a member of our Broking Community board, as he explains the personal benefits he and his team have experienced from using it.

Finally, we recognise that taking exams can be nerve-wracking, so we’ve put together a ‘top tips’ article to smooth the process for those taking our online assessments. If you are taking one of our exams soon, I wish you great success and I am delighted that we can help you to become one of “the most professional people in the world”.

The CII Middle East office has welcomed Mazen Nimri, FCII, as the new Goodwill Ambassador representing Jordan. Nimri is deputy general manager at Jordan Insurance Company where he leads teams comprised of more than 200 professionals across Jordan, the United Arab Emirates and Kuwait. He boasts more than 26 years of experience in the insurance profession, having begun his career as an agent, is a Fellow of the CII, and member of the life and health insurance committee at the Jordan Insurance Federation.

Nimri said: “It is a privilege and an honour to be selected as a Goodwill Ambassador of the CII and I am very excited to extend all the support needed to promote the insurance industry through the high standards and professional courses of the CII.”

Gaenor Jones, regional director of the CII, Middle East and central & south Asia adds: “Mazen is a highly regarded senior figure in the insurance sector in Jordan and we are really looking forward to working with him. He boasts an extensive network in his home country and across other Gulf Cooperation Council nations. We know he will prove a very valuable asset to us in furthering our mission to boost professional standards across the region.”

The Middle East office continues to engage with major players in the Middle East insurance sector, particularly organisations representing an emerging and progressive market.

Recently, CII Goodwill Ambassador for Turkey, Kerem Erberk, met with the Insurance Association of Türkiye – one of the country’s leading industry bodies –amid rapid growth in economic development and financial services. The insurance sector is quickly gaining ground on banking, with new products and distribution channels emerging to meet evolving market needs.

The meeting focused on expanding opportunities and the value of collaboration in promoting professional qualifications for sector employees – key to raising standards and enhancing professionalism across the industry.

Those in attendance with the CII Middle East team, led by regional director, Gaenor Jones, included, Ozgur Obali, general secretary; Aysun Ozer, deputy secretary general; and Ugur Gulen, chair, all of the Insurance Association of Türkiye.

CEO Matthew Hill also met with Obali and Gulen at the Dubai World Insurance Congress event during his visit to the Middle East in April.

The Uzbekistan operation of global firm Apex Insurance JSC has been accredited as an International Professional Partner Firm (IPPF). Based in Tashkent, the organisation offers a wide range of products and services across various sectors.

A few months ago, Apex’s senior team visited the CII’s London head office (pictured below with CII CEO, Matthew Hill) to explore the benefits of becoming an IPPF. The official certification was awarded recently.

Gaenor Jones, CII regional director of the Middle East and central & south Asia, commented: “Apex has demonstrated a strong commitment to the CII’s best practices and professional standards by supporting their employees in attaining CII qualifications and encouraging continuing professional development. It is the first privately owned company in Uzbekistan to be recognised for these efforts and we look forward to continued collaboration.”

Apex Insurance JSC is the leading insurance provider in Uzbekistan, holding the country’s highest gross written premium. The company employs 521 people, 317 of whom are based in Tashkent.

Two emerging talents from the Hong Kong Federation of Insurers (HKFI) Elite Talent Development Programme visited the CII Hong Kong office.

The participants met with the CII team to gain greater insight of the CII and its professional development initiatives in Hong Kong and the broader Asia-Pacific region.

During the meeting, Agnes Koon, chief executive of KSY Specialty and longstanding CII member, also shared her insights and experiences within the Hong Kong insurance profession.

The 169th meeting of the Vocational Training Council (VTC) Insurance Training board took place in March.

Established in 1982, the VTC is the largest vocational and professional education and training provider in Hong Kong.

During the meeting, Alpha Ho, regional corporate development manager, represented the CII as a member of the Insurance Training board.

The meeting provided a platform for discussing key developments and initiatives aimed at advancing training and professional development within the insurance profession.

MAY

UNDERSTANDING BROKERS → 12pm – 1pm Insurance Institute of Royal Tunbridge Wells www.localinstitutes.cii.co.uk/ royal-tunbridge-wells

MAY

The Insurance Institute of Bournemouth (IIB) recently had the pleasure of visiting Parkstone Grammar School in Poole to dive into the world of insurance, financial planning and apprenticeships with students, parents and local employers.

Institute president Jana Langdown, education officer Theo Chamberlain and Next Generation secretary Rachael Martin (both pictured) represented the IIB at the job fair and were kept busy talking to attendees and answering lots of questions.

Langdown commented: “The energy was incredible at the event. With so many curious minds asking thoughtful questions,

our team was certainly kept on our toes. We hope we were able to leave a spark of inspiration for young talent to consider exciting careers in the insurance and financial services industries.

“If you are part of a school or college in the Bournemouth, Poole or Dorset area and you’re eager to spotlight career opportunities, we would love to visit and showcase the rewarding journeys in our sector. Let’s connect and make an impact together!”

→ For more information, visit: www.cii.co.uk/bournemouth

The Insurance Institute of Bristol’s annual dinner in March was the celebratory backdrop chosen to recognise the achievements of a select group of members.

Almost 400 attendees helped generate a special atmosphere at the city’s Ashton Gate football stadium, including special guests the Right Honourable Lord Mayor of Bristol, councillor Andrew Varney and 2024 CII president Ian Callaghan.

The focal point of the evening was the presentation of trophies and certificates to the institute’s highest achievers in the CII and PFS Certificate

and Diploma examinations.

The recipients were:

● Matt Beck of Chase de Vere for Excellence in Certificate Achievement in Financial Planning.

● Kyra Brake of the Old Mill Group for Excellence in Diploma Achievement in Financial Planning.

● Mark Lawford of Gallagher for Excellence in Diploma Achievement in Insurance.

● Emma O’Loughlin of NFU Mutual for Excellence in Certificate Achievement in Insurance.

The ceremony concluded with a special presentation for lifetime

achievement to Bristol council member and past president, Richard Smith.

Smith has served on a number of local institute councils over the years and is currently Local Institute national forum officer for the Southwest region, having recently also served on the CII’s Education and Learning Committee.

Bristol president, Nigel Taylor, said: “On behalf of the council, I would like to thank all our sponsors and guests for making the evening such an enjoyable event. We are already thinking about next year’s event, while focusing on our comprehensive support programme for members for the rest of 2025.”

→ For more information, visit: www.cii.co.uk/bristol

Three council members from across the local institute network came together in March to record a dedicated ‘Local Matters’ episode of The Journal Podcast. Danielle Ashmore, president of the Insurance Institute of Coventry, Sarah Hughes, communications officer for the Insurance Institute of Cardiff, and Kath Harvey, president of the Insurance Institute of Aberdeen, discussed their institutes’ ambitions and plans to engage their

membership in 2025.

The volunteers also consider what inspired them to become involved with volunteering for their institute, why they still give their time and what they enjoy most about giving support to others working in the profession. All three agreed that they continue to volunteer because they want to give something back to the next generation and help promote career paths within the financial industry.

→ Listen to the episode at thejournal.cii.co.uk/podcasts and find out more about becoming a volunteer at www.cii.co.uk/membership/ local-institutes

The 12th annual Kent Regional Conference took place in April, with the theme ‘Growing in a World of Opportunities’, providing a day of learning, discussion and networking for more than 120 attendees.

Chaired by Ray Johnson, vicepresident of the Insurance Institute of Mid-Kent, the conference included a diverse range of speakers who helped delegates understand challenges and opportunities in different areas of the profession.

The opening speakers were: Beki Colyer, regional manager, RSA; David Sparkes, director, British Insurance Brokers’ Association; and Nick Smallcorn, managing director of corporate speciality at Clear Group. They shared their perspectives on the implications of declining commercial rates and increasing capacity, set against the backdrop of ongoing

regulation and a shortage of experience in the market.

Tudor Price, of the Kent Invicta Chamber of Commerce, spoke next and demonstrated

his knowledge of the profession and the key challenges it faces. During an insightful talk packed with interesting statistics and information about businesses in Kent, Price stunned delegates by revealing that 97% of businesses in Kent employ less than 10 people.

Further sessions featured Elizabeth Stephens, who provided a talk on geopolitical risk, including a fascinating explanation of the power changes since World War II and what this means today; Jeff Heasman explaining human versus automation; and Reg Brown, chairman of the Insurance Museum, who held a fireside chat about the great history of insurance.

Kate Allatt concluded the day with a powerful account of her ongoing journey with Locked-In Syndrome, inspiring attendees through her honesty and resilience in adapting to the extraordinary challenges she has faced.

Matt Brewis speaks to Luke Holloway about how the FCA is fostering a collaborative relationship with firms to evolve regulation in insurance and financial services and further enhance protection for consumers

The UK’s Financial Conduct Authority (FCA) is evolving its priorities to meet the changing landscape of the insurance and financial services sectors. As this issue of The Journal is published, the FCA has unveiled its new strategy, which focuses on growth, innovation, tackling financial crime and becoming a more efficient regulator all with the intention of best supporting consumers.

“These priorities are central

to the entire FCA, including the insurance sector,” Matt Brewis, director of insurance at the FCA, tells us. “In recent years, we’ve made significant progress, particularly with the implementation of the Consumer Duty, which has strengthened our

focus on consumer protection. We are also nearing the completion of our biennial portfolio strategy, which outlines our key goals for the insurance sector with an emphasis on growth and innovation.”

The FCA is also exploring areas

where rules could be streamlined. A strong regulatory foundation is vital to maintaining the UK’s appeal as a business hub, says Brewis, however, there is a danger that if rules become too rigid, they could create challenges for insurers.

“When we introduced the Consumer Duty,” explains Brewis, “it unintentionally expanded its scope to cover corporate businesses that didn’t require the same level of protection as consumers. This created challenges for commercial insurers, who had to conduct fair value assessments for clients that didn’t need such protections.

“To address this, we are consulting on redefining the line between commercial and corporate insurance. It’s important to distinguish between businesses that can manage risks independently and those – like small and mediumsized enterprises (SMEs) – that need the level of support and protection provided by the Consumer Duty.

“We are also listening to industry feedback on fair value assessments,” he continues. “While these assessments are a vital part of our regulatory toolkit, conducting them annually has proven to be difficult for firms. It has become more of a compliance exercise than a valuable tool. We are looking to streamline the process and will be consulting on potential changes in May.

“We want to ensure our regulatory

framework remains effective while removing or refining elements that aren’t providing value.”

KEY PROPOSALS

At the start of 2025, FCA chief executive, Nikhil Rathi, wrote to the Prime Minister in response to

the UK government’s call to ensure regulators support growth. The letter outlined 50 key proposals for growth covering mortgage affordability, digital payments, removing redundant data returns, supporting international promotion of UK financial services, opening up to more innovative firms and cutting barriers between regulators.

Brewis says there is a significant opportunity for the FCA to collaborate with government and firms along with other regulators to turn these proposals into better ways of working for insurers and better outcomes for customers.

“For instance, in life insurance, it can take an average of two to three months for protection products to pay out after a death – that is far too long. The government’s ‘tell us once’ system allows one notification of a death to inform multiple departments. If this data can be used efficiently by the government, why can’t we use it to speed up insurance processes?

“Similarly, insurers spend significant resources tracking down customers who have moved address. HM Revenue & Customs has up-todate information, so why not use it to save costs and reconnect people with their long-term insurance products?

“These are areas where there’s a real opportunity. I’ve always advocated for a mature relationship between regulators and firms. While disagreements will arise, a parentchild dynamic isn’t productive. We aim to foster a collaborative relationship to improve insurance in the UK,” says Brewis.

The important role insurance plays in society is one of the key reasons why it remains so essential, says Brewis. It’s also why he is so passionate about his role at the FCA.

“Insurance plays such a vital role in society. Take the pandemic, for example. One of the key actions the insurance sector took was ensuring the transfer of goods into the UK, so they could be stocked on shelves. During that time, the government had to step in to support trade credit insurance.

“Without insurance, goods simply wouldn’t move. When people had to suddenly adjust to new ways of working and living, a wide range of insurance types became crucial in supporting them. Insurance is there for people during their worst times, providing essential support,” says Brewis.

Unfortunately, there is still a large portion of the population that doesn’t have enough insurance when it’s needed most, especially among vulnerable groups.

“One thing I’m passionate about is how we can help those who truly need insurance coverage,” he says. “People in rental accommodation or social housing may lack contents insurance, leaving them unable to replace their possessions if something happens. We’re working to address this as part of the financial inclusion task force set up by the Treasury, along with insurers, brokers and charities. Together, we’re trying to solve this issue so that people can help themselves and insurers can better support them.”

Brewis joined the financial services sector in 2001, initially working at the Bank of England and for most of the past decade with the FCA.

OUR GOAL IS TO SUPPORT UK CONSUMERS AND BUSINESSES BY HELPING CREATE PRODUCTS THAT MEET THEIR NEEDS AND ENABLE THEM TO GROW

“I started at the Bank and held many different roles across the organisation. It’s a great place with lots of opportunities to move around. During the financial crisis, I was heavily involved in all aspects of the banking side of things, including the bailouts of RBS and Lloyds, as well as the Greek and Cypriot crises that followed.”

Brewis joined the FCA in 2016

when Andrew Bailey, then-deputy governor of the Bank, became CEO, working as his chief of staff throughout Bailey’s time at the regulator.

“I enjoyed my first role at the FCA and really connected with its mission of supporting consumers. I then moved into my current role as director of insurance. For the past five years, I’ve learned a great deal. Of course, within the first few months, the pandemic took hold and we found ourselves in the Supreme Court regarding the business interruption test case.

“I have certainly had a lot of interesting experiences and complex challenges always seem to find their way to me,” he says.

Though the FCA’s role is domestic, Brewis has found it valuable to engage in ongoing dialogue with international counterparts, with many challenges faced by the UK also experienced in other jurisdictions.

“I have learned a great deal from international experiences,” he says. “Every country handles insurance differently due to its unique circumstances. There are examples –such as the Flood Re scheme – where insurance innovation in the UK has helped in other parts of the world.

He adds that it is also important to be aware of developments in other countries that could benefit the UK market. “For instance, there is significant growth in parametric insurance in some developing

countries,” says Brewis. “This type of insurance can trigger a claim if certain thresholds of rainfall are met in a specific area, helping farmers and communities with rapid financial support during natural disasters.

“While these issues aren’t as prevalent in the UK, the growth of parametric insurance in other markets could bring value here as well. It’s essential for us to learn from what works in other countries and assess where we can apply those lessons,” says Brewis.

In terms of professional learning, the United Arab Emirates has been the latest country to mandate qualifications for senior insurance professionals. Does Brewis think the UK insurance market could follow a similar path?

“I believe we have a well-developed insurance market, with the senior managers and certification regime in place along with the expectation that firms appoint individuals with

the necessary skills for their roles. Firms are already incentivised and required to ensure employees have the right qualifications and many firms require certain accreditations – such as CII qualifications – for these roles.

“Given the diversity of our market, a one-size-fits-all approach wouldn’t be effective. While we strongly support CII accreditation – many FCA team members hold CII qualifications and use its training materials – we expect firms to uphold high standards without making this a regulatory requirement,” says Brewis.

“The CII is important, particularly in terms of learning, training and qualifications, which are crucial for the sector. Since Matthew Hill became CEO, we have developed a great relationship. The CII plays a key role and wherever our interests align, we’ll be happy to collaborate when the opportunity arises.”

Looking forward, Brewis believes insurance will become even more crucial to the UK economy, with opportunities for growth to maintain the UK’s global position. To thrive, he says, insurers must remain profitable while ensuring they meet consumer needs and drive industry innovation.

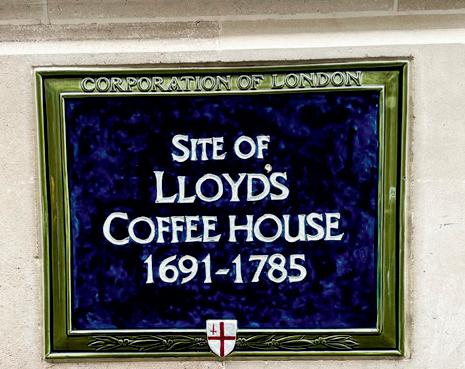

“I believe there are opportunities for growth and I know there are areas where we, as regulators, can collaborate with firms, Lloyd’s, the London market, trade associations and the CII to help maintain the UK’s position as a dominant player in global insurance markets.

“This requires continuous innovation and a clear understanding of our role. We must be mindful not to hinder progress while ensuring the UK remains competitive in the global market. For the sector to thrive, it’s essential that insurers are profitable. If they aren’t, they can’t provide the services people need.

“Our goal is to support UK consumers and businesses by helping create products that meet their needs and enable them to grow. We are working constructively with the industry and I am committed to continuing that positive relationship.” ●

Luke Holloway is editor of The Journal

With the price of gold soaring and demand for its secure transport growing, Chris Shadforth discovers the risks involved in insuring the movement of gold around the world along with the challenges of insuring fine art

The Bank of England is one of the largest repositories of gold in the world, holding approximately 400,000 bars. While the physical movement of this precious commodity is rare, it has become more common in recent years as increasing numbers of investors seek safer havens in uncertain times.

Gold has long been seen as a secure investment, with its price rising during periods of economic or geopolitical instability.

Following the Covid-19 pandemic, the price surged from £1,100 per troy ounce in 2019 to £1,500 by August 2020 amid economic uncertainty. After a brief dip, it climbed again following Russia’s invasion of Ukraine. However, the most dramatic increase came in 2025, when it soared to more than £2,400 per troy ounce – a 50% rise in just one year, driven by inflation and political instability.

As demand for gold has risen, so too has the need for its transportation around the world. Ross Drabble, underwriting manager of fine art and specie at Liberty Specialty Markets, explains that one of the primary concerns when insuring gold is verifying its existence and authenticity. “It might sound ridiculous, but the first concern is ensuring the gold is actually there. We sometimes bring in third-party services to confirm its presence, but only in extreme cases.”

Once it is established that the gold exists, its movement can occur in various ways, depending on the value and urgency of the shipment. “Smaller shipments, like commemorative coins, can be sent via common carriers such as FedEx or UPS. However, larger and more valuable shipments require more secure transportation methods. A few years ago, for example, Poland shipped its entire gold reserves back from the Bank of England. The gold was transported with a police convoy, including a helicopter, to Heathrow Airport, then sent via a freight carrier to Poland, where it was met by the army. The total value of the gold was nearly £4bn and was completed in eight trips.”

Transporting gold necessarily involves multiple parties, which must all be factored into the risk considerations. “There might be a secure logistics carrier in London, an aeroplane, then a carrier on the other side as well. So, who is insuring all of that? Are we comfortable with everyone involved?”

Using multiple parties and commercial airlines creates challenges

GOLD CAN SOMETIMES BE TRANSPORTED ON COMMERCIAL PASSENGER PLANES, MEANING IT COULD BE UNDERNEATH YOU WHEN YOU’RE FLYING

THE IDEAL SCENARIO IS THAT THE GOLD MOVES FROM A TO B TO C VERY QUICKLY, BUT THE REALITY IS THAT SOMETIMES IT DOESN’T WORK LIKE THAT

for insurers. Drabble notes: “The ideal scenario is that the gold moves from A to B to C very quickly, but the reality is that sometimes it doesn’t work like that. Gold can sometimes be transported on commercial passenger planes, meaning it could be underneath you when you’re flying. As a result, timings don’t always match up and the gold may end up in what we call ‘incidental storage’ for short periods of time. Understanding that risk is key.”

Despite the increased volumes in recent years, Drabble suggests that the risks have not changed significantly. “The key is ensuring that the gold remains in a secure environment throughout the journey, so we know that the gold that started in one location is the same when it reaches its destination.”

Given these challenges, it’s not surprising that specialist movers have carved out a niche in the market. This offers some comfort to those underwriting the risks involved in transportation. “Carriers that regularly ship gold will have well-established operational procedures. These procedures are reliable, ensuring that gold is transported securely every time. While each transit may vary in terms of destination, the procedures remain largely consistent.”

Despite careful planning, incidents and losses can still happen. Drabble recalls a case where gold shipped from South America to the US and Europe never fully arrived. While the insured carrier is responsible for the entire shipment, airlines have limited liability and less stringent procedures for gold transport. Investigations followed, but a loss occurred, which had to be addressed.

In contrast to gold, art holds unique, subjective value to individuals, making insurance more complex. Drabble, also a specialist in fine art, points out that valuations can vary due to market trends, historical significance, or personal perceptions. “Certain commodities we insure have fixed prices, making it easy to determine their value. Cash, for instance, is insured at its face value. Art, however, is more complicated. The valuations can fluctuate based on the market, trends and individual opinions. It is a very challenging environment.”

To navigate these complexities, Drabble and his team rely on various data sources when pricing risk.

“We use market trends and data on sale prices for similar works, or for a particular artist. We typically consult third-party expert valuers to assess these pieces, as it’s impossible for insurers to cover the vast array of valuable goods and fully understand their valuations. From an insurance perspective, it’s essential that we insure art for as close to its market value as possible.”

The art market is known for its unpredictable twists and turns. Drabble recounts an interesting case involving a Banksy artwork. “We were once asked to insure the removal of a brick wall that featured a Banksy piece. For us, we insure art and gold, but we don’t cover the removal of walls and the associated risks. That said, we’ve also insured exhibitions of human bodies that have been plastinated. One situation involved a person fainting and falling into one of the exhibits, which was certainly a unique event.”

Like that member of the public, Drabble says he “fell” into his field of expertise, but he believes the niche nature of his work is what excites new talent. “It is a unique area of insurance, and it’s particularly interesting to new graduates and placement students. They find it a very compelling area to learn about.” ●

Chris

Shadforth is communications director of the CII

The pet and equine insurance sector is at a crossroads. Rising claims costs, the affordability of cover, concerns around fraud and the lack of collaboration between insurers, veterinary professionals and consumer representatives have all contributed to a breakdown in trust. If we want to ensure a sustainable future for the market, the industry must come together to address these issues proactively – before regulatory intervention forces change on us.

Claims costs and pricing pressures

In the past decade, veterinary fees have increased significantly, with some estimates suggesting a 48% rise since 2016. There are several factors driving this:

● The corporatisation of veterinary practices, leading to price variations and concerns about over-servicing.

● Prescription markups, which remain unregulated, often leaving consumers unaware of more cost-effective options.

● A growing reliance on insurance as the primary means of funding veterinary treatment, particularly where policyholders are unaware of the longer-term implications, can lead to increased claims. This is especially true when non-essential diagnostics or treatments are undertaken, potentially exhausting policy limits or contributing to higher renewal premiums.

These challenges are further compounded by a lack of transparency in veterinary fee pricing, making it difficult for consumers to compare costs, assess value, or understand how their claims behaviour may impact the future affordability of insurance.

Safeguarding vulnerable consumers

Pet owners often make claims in highly emotional situations, with limited understanding of how insurance policies work, what exclusions apply and the impact of

Sharon Brown reveals the work of a new association that aims to tackle the challenges facing pet and equine insurance

claims on renewal pricing. There is a risk that some consumers struggle to make informed decisions, particularly in urgent or emergency scenarios. More needs to be done to educate policyholders, ensuring they understand their coverage, the costs of treatment and alternative options such as preventative care and telemedicine.

Increasing fraud risks

The sector is facing growing concerns

around fraud, from exaggerated claims to misrepresentation at the point of sale. Some issues include:

● Policyholders misrepresenting pre-existing conditions to obtain cover.

● Inflated vet fees on insured treatments compared to self-paying clients.

● Organised fraud rings targeting pet insurance, including falsified claims for stolen or missing animals.

Greater data-sharing and collaboration between insurers and veterinary professionals could be key to tackling fraud while ensuring fair outcomes for genuine claims.

Lack of collaboration

There is an urgent need for better engagement between insurers, vets and consumer representatives. The disconnect between these groups has led to mistrust, inefficiencies and frustration, particularly around the following:

● The cost of treatment – insurers question rising fees, while vets feel

Join the Pet and Equine Insurance Sustainability Network on LinkedIn at: www.linkedin.com/ groups/13078306

For more information, email: sharon.brown@ nutshellconsultancy.com

their expertise is undervalued.

● Claims processes – vet practices often struggle with insurance paperwork, creating delays and additional admin burdens.

● The lack of a shared industry voice – unlike other regulated sectors, there is no unified industry body advocating for sustainable solutions.

The Pet and Equine Insurance Association (PEIA) was established to address these challenges by providing a dedicated forum for discussion, collaboration and reform. It is a notfor-profit organisation that exists to support its members – insurers, managing general agents (MGAs), brokers and service providers –ensuring their voices are heard while engaging with veterinary bodies, regulators and policymakers. Following its first steering group meeting, the PEIA has set out its priorities.

● Transparency: encouraging clearer

communication on claims, pricing and policy coverage.

● Sustainability: addressing rising costs to ensure viable pet and equine insurance.

● Trust: Building mutual understanding and stronger relationships with vets and consumer representatives.

● Consumer education: supporting policyholders in making informed decisions.

● Fraud prevention: working towards better data-sharing and fraud detection measures.

Our initial governance framework is in place, with committees on regulation, membership and finance being formed to drive these efforts forward. The website will launch in May, providing a resource hub for members and stakeholders.

This is a critical moment for the industry. Insurers, brokers, MGAs and service providers must come together to shape the future of pet and equine insurance rather than waiting for regulators to step in. There are several ways to contribute:

● Get involved in the PEIA –membership is open to those committed to working towards a sustainable future for pet and equine insurance.

● Engage with the conversation –share insights, data and expertise to help tackle the biggest challenges.

● Support consumer education –ensure policyholders understand their coverage and options.

There is no quick fix but by working together, we can restore trust, drive meaningful change and secure a sustainable future for pet and equine insurance. If you’d like to be part of the conversation, get in touch.●

Sharon Brown is CEO and founder of the PEIA, board director MGAA and CEO of Nutshell Consultancy

Against a backdrop of economic uncertainty, Chancellor Rachel Reeves delivered her highly anticipated Spring Statement at the end of March, outlining her vision for the UK’s financial future.

Meanwhile, the Office for Budget Responsibility (OBR) released its

latest economic forecasts, offering a sobering assessment of the challenges ahead, alongside areas of potential opportunity for the insurance and personal finance professions.

While the announcements did not introduce specific measures directly targeting the insurance sector, several broader initiatives and ongoing regulatory developments are likely to influence the operating environment for insurers in the UK while financial services as a whole remained a key focus on several fronts.

Cuts were announced to government departments, with the Chancellor calling for greater efficiency and

The

Chancellor’s Spring Statement signaled economic shifts that will impact both insurance and financial services. Liz Booth looks at the pros and cons of what the government announced

arguing that the country could no longer afford bloated bureaucracies. She also proposed a shake-up of welfare benefits, claiming that getting more people back to work would improve the country’s budget outlook in the future.

Responding to the Chancellor’s announcement, the Personal Finance Society (PFS) stated: “The Spring Statement underlines how global events have put new demands on already stretched welfare budgets. Many people will have questions about what this spending pressure will mean for them – not just around disability, but more widely around long-term care and other areas where they may have been counting on support from the state. Now, more than ever before, individuals will need a strong, long term financial plan to see them through difficult times.”

The UK Financial Conduct Authority has reported that more than seven million people in the UK are already struggling to pay bills or manage debt and many would find it difficult to cope with a financial shock.

The PFS agreed with the regulator that innovative and competitive financial services are essential to improving the finances of many. To succeed, providers of these products and services must ensure they are tailored to each individual’s needs, helping every customer achieve the best possible outcomes.

Given these financial pressures, the insurance sector will also need to adapt to ensure consumers are adequately protected.

Most of the news contained both positive and negative aspects –exemplified by the push for more construction. Insurers know that more construction will bring opportunities throughout the building process and beyond, but also new risks regarding where these houses are built.

Hannah Gurga, director general of the Association of British Insurers, said: “Certainty and stability are crucial for economic growth and we support the

approach the government has set out in its Spring Statement to deliver this.

“The insurance and long-term savings sector has a vital role to play in the growth mission, including through the commitment to invest £100bn in UK productive finance in the next 10 years. This includes infrastructure, the transition to green energy and building new homes.

“We support the government’s planning and infrastructure reforms but it is vital that new homes are fit for the future, able to withstand adverse weather and are not built in areas at risk of flooding.”

Of course, this is also dependent on whether house builders have confidence that the economy is robust enough for potential homeowners to afford these new houses and whether mortgage providers are confident enough to lend.

“As a provider of mezzanine finance to this market, we know how this sector is still battling cost overruns, high prices for materials, long lead times and expensive labour in a market that might be best described as mixed,” David Norman, of Davon Investments, told us.

“Potential investors in small to medium enterprise residential developments remain cautious. That goes for the developers themselves, equity investors and banks, as well as other first-tier lenders and second-tier lenders such as us. Also, with higher interest rates on savings on offer, many are content to leave their cash in safer places, rather than risk it on speculative ventures.”

The insurance sector will continue to play a key role in providing warranties and coverage for these new developments. As the housing market navigates economic headwinds, insurers must assess how increased borrowing costs and shifting demand could affect property-related risks and claims.

The government also unveiled a £3.25bn transformation fund aimed at modernising public services through digital technology and artificial intelligence. This initiative seeks to enhance efficiency and effectiveness in public service delivery.

Looking at government ambition to reduce red tape across many sectors, Insurtech UK CEO, Melissa Collett, said:

“Insurtech UK echoes the government’s ambition for a regulatory system that encourages new investment, innovation and growth. Commitments to review and refine authorisation processes are a welcome response to issues we have been raising directly with both government and regulators alike.

“Accessing regulatory approvals should help, not hinder, a startup or scaling company’s growth. Delays impact funding runways and a firm’s ability to progress, whether they affect smaller steps like opening a bank account or present significant barriers in securing further investment.”

Collett concluded: “It is a shared goal with government that innovative insurtechs have an accessible and achievable route to regulatory approval here in the UK.”

Meanwhile, insurers have expressed a mixed reaction to the government’s focus on pothole repairs. While road improvements may ultimately reduce claims and benefit insurers, in the short term they might lead to more claims elsewhere. Roadworks often involve diversions, sometimes more than 50 miles in rural areas, increasing the likelihood of accidents as drivers navigate unfamiliar routes. As a result, the net effect on claims could be minimal.

Wider reactions to the overall statement vary depending on political views but there are concerns, for example, that the rise in National Insurance costs for employers, combined with higher minimum pay levels, could lead to more unemployment. This may impact insurers offering income protection cover.

As the UK economy adjusts to these policy shifts, insurers must remain agile –balancing risk, innovation and regulatory compliance. Whether through digital transformation, evolving consumer protection strategies, or infrastructure investments, the industry’s role in economic stability will be more important than ever. ●

Liz Booth is contributing editor of The Journal

In recent years, the UK has seen a significant rise in e-scooter usage, driven by their convenience and eco-friendly nature. Despite their popularity, concerns around insurance coverage, legal responsibilities and the impact of illegal riding by minors are growing.

Many cities trialling e-scooters are reducing their numbers and limiting providers to better regulate their use. To the public, however, the regulations, legal implications or appropriate insurance coverage may not be clear.

were originally due to conclude by November 2021 but the deadline has been extended several times. At present, the trials are due to run until May 2026, with a view to gathering additional data.”

The legal status of e-scooters in the UK remains complex. Privately owned e-scooters are classified as motor vehicles under the Road Traffic Act 1988, requiring registration, insurance and compliance with technical standards. However, meeting these requirements is currently unfeasible for privately owned e-scooters, making their use illegal on public roads, pavements and cycle lanes. They can only be ridden legally on private land with the landowner’s permission.

Rental e-scooter trials, launched in 2020, are ongoing in select regions across the UK. Pete Allchorne, head of strategic advisory at law firm DAC Beachcroft, explains: “The trials

Riders must be at least 16 years old and hold a provisional or full driving licence. Rental e-scooters can be used on roads and cycle lanes but are prohibited from pavements. Insurance is provided through the rental schemes, covering third-party liability but not personal injury. Riders of rental e-scooters must comply with traffic laws, adhering to speed limits and avoiding mobile phone use while riding. Failure to comply may result in fines, penalty points or vehicle seizure.

Allchorne adds: “The government has indicated that it intends to legalise the use of private e-scooters on UK roads but has said this will not happen during the current parliamentary session. We do not yet know what obligations will be required of users.”

Rental e-scooters offer thirdparty liability insurance, but liability can still be complex if the rider is negligent, such as failing to follow road rules or riding on pavements. In such cases, the rider could be personally liable for damages beyond the coverage provided by the rental operator’s insurance.

Allchorne notes: “If the motorist is found liable, the e-scooter user’s claim could be substantial. Many e-scooter users do not wear any sort of protection and there is no mandatory requirement to wear a helmet. Injuries sustained can be severe, with head, neck and upper-back injuries making up the majority.”

E-scooter accidents present significant challenges. For privately owned e-scooters, which cannot be insured for public use, riders are personally liable for damages. This makes recovering costs for victims difficult.

If the e-scooter user is liable, the motorist will have to rely on the Motor Insurers' Bureau (MIB) Uninsured Drivers or Untraced Drivers Agreements for compensation. As the number of privately owned e-scooters used illegally on UK roads continues to rise, this negatively impacts motorists more generally, as all motor insurers are required to pay into the general levy that funds the MIB.

The rise of e-scooters, especially among young riders, has created legal and financial risks. Many are unaware that using privately owned e-scooters on

AN IN10 WILL STAY ON A PERSON'S RECORD FOR FOUR YEARS, EVEN BEFORE THEY HAVE A LICENCE, AND WILL LIKELY RESULT IN A SHARP INCREASE IN INSURANCE PREMIUMS

£100 fine for riding through a red light. If a rider is found to be riding with excess alcohol, the penalties are the same as if they were driving a car.”

Allchorne highlights: “An IN10 will stay on a person's record for four years, even before they have a licence, and will likely result in a sharp increase in insurance premiums, as much as 15%-20%. For young drivers, this will add extra costs to an already hefty premium.”

Police can seize illegally ridden e-scooters, issue fines and add penalty points to a rider’s licence but McCabe feels people –particularly younger riders – are still lacking in knowledge on where the law stands. “A widespread public information campaign and clearer guidance from sellers on the law would help reduce illegal use and related injuries,” he says.

Fires caused by e-bikes and e-scooters in London have doubled in three years, with 120 injuries and three fatalities recorded between 2022 and 2024 – more than anywhere else in the UK.

public roads is illegal, leading to an IN10 endorsement for driving without valid insurance. This stays on their record for four years, raising motor insurance premiums and making future coverage harder to obtain. Repeated offences can result in further penalties, including a driving licence ban.

McCabe warns: “Whatever the government decides to do, it would be better to act soon. Years of inaction, coupled with confusion about e-scooter laws, have worsened the situation. What’s needed now is a clear decision and a public education campaign.”

Michael McCabe, researcher at DAC Beachcroft, says: “An IN10 endorsement carries a £300 fine and six points on your licence for riding without insurance. Riders can face a fixed penalty notice and £50 fine for riding on a pavement; £200 fine and six points for using a mobile phone while riding; and a fixed penalty notice and

E-scooters are growing in popularity but riders must understand their legal obligations. While rental schemes are regulated, privately owned e-scooters remain illegal on public roads. Young riders face risks like IN10 endorsements and higher insurance premiums. Clearer legal frameworks and ongoing education are needed to ensure safer use and reduce longterm consequences. ●

Molly Burchell is communications executive of the CII

In the first of our series on how the Professional Map can shape both behaviours and technical expertise at every career level, Ajay Mistry explains how the Map can support personal development, empower your team and drive growth in your business

As a founder and leader in a fastpaced broking environment, it’s easy to focus on immediate priorities like delivery and growth.

But recently, I’ve found real value in stepping back to reflect on my personal development and how I can better support my team in doing the same.

The CII Professional Map –particularly at Band 4 – provided an effective framework for this.

I have encountered many frameworks, processes and models throughout my career, but what I appreciated most about the Professional Map was how relevant and practical it felt. It is particularly useful for those working across different areas of the insurance profession. It’s straightforward and focuses on real-world skills, behaviours, and knowledge that are directly applicable.

The biggest takeaway for me was how clearly the map highlighted areas where I needed to improve. As a relatively new broker – we only launched a year ago – I naturally gravitated towards areas where I felt most confident – such as relationships, vision and delivery –but I realised I wasn’t paying enough attention to the systems and processes that underpin everything.

Some operational processes I had used in previous roles were being overlooked and I knew I needed to address that. The Map gave me the nudge I needed to prioritise these areas.

Since then, I’ve worked closely with my brokers and our head of commercial, Luke Perkins, to realign our internal systems – especially the broking process.

This shift has had a positive impact on the business and it wouldn’t have happened as quickly without that initial reflection.

Building on that, I wanted my team to experience the same benefits. I encouraged everyone to use the Professional Map and now it is a tool we regularly reference in one-to-ones. It’s a great way to discuss where individuals are now and where they want to go. The Map goes beyond just technical knowledge – we’ve had some great discussions about communication, confidence and managing upwards.

Additionally, through my work with the Insurance Cultural Awareness Network (iCAN), we have run successful sessions across the country in partnership with the CII. I have now seen firsthand how effective the

WHETHER YOU ARE THINKING ABOUT YOUR PERSONAL DEVELOPMENT, SUCCESSION PLANNING, OR HOW TO GET THE BEST OUT OF YOUR TEAM, THE PROFESSIONAL MAP PROVIDES A CLEAR AND VALUABLE STARTING POINT

Professional Map is as a development tool for so many people.

At Band 4, you are expected to think and operate strategically – shaping culture, setting the tone and taking a long-term view. What I particularly appreciate about the Map is that it doesn’t just focus on business results; it also emphasises values.

Competencies such as customer focus, inclusivity, ethics and a drive to deliver aren’t just buzzwords – they are central to how I run my business. These values matter just as much as meeting targets. The Map helps you understand how these areas fit into your wider leadership responsibilities, reminding you that good leadership isn’t just about being effective – it is about doing the right thing, consistently.

If you’re in a leadership role and haven’t explored the Map yet, I highly recommend it.

Whether you are thinking about your personal development, succession planning, or how to get the best out of your team, the Professional Map provides a clear and valuable starting point.

For me, it’s not something you use once and forget about. It is something I’ll revisit regularly as my business grows and my role evolves. It has helped me stay focused, hold myself accountable and ensure I am putting the right strategies in place for the long term.

Sometimes, we just need a bit of structure to help clarify where we are and what we need to work on. The Professional Map does exactly that –so why not give it a try today?

To access the Professional Map selfassessment tool, visit: www.ciigroup. org/professional-map/individuals/ self-assess-your-skills ●

Ajay

Mistry is the co-founder and Co-Chair of iCAN and member of the CII Broking Community board

As new legislation is announced mandating insurance qualifications in the UAE, the CII is playing a key role in shaping a more skilled and trustworthy profession in the Middle

East. Luke

Holloway

speaks to Gaenor Jones to find out

more

For several years, the CII has been working closely with the United Arab Emirates (UAE) regulator with the aim of mandating professional qualifications across the country, helping to raise professional standards and trust in the insurance sector.

In February, the UAE Central Bank announced the introduction of new legislation requiring professional qualifications for senior insurance representatives, while citing the CII’s Advanced Diploma as an exemplary internationally recognised qualification necessary for CEOs and other senior management representatives.

The new regulations also establish criteria for continuing professional development (CPD). This will require 15 hours of CPD for insurance brokers, representatives, senior management, and specialised employees.

“Leaders within the sector must attain and demonstrate internationally recognised qualifications, an objective the CII has been striving towards for many years,” says Gaenor Jones, CII regional director of the Middle East and central south Asia. “Since these rules are being

implemented from the top down, they will encourage more junior employees to invest in their professional development, either independently or with employer support, to enhance their skills.

“Professional qualifications from recognised bodies like the CII ensure advisers are competent and marketready, benefiting consumers with expert advice. CPD requirements will also transition from optional to a mandatory industry standard,” says Jones.

As economic, regulatory and business landscapes evolve, these measures will be key in tackling emerging challenges, with increased regulation expected to further boost consumer confidence in the insurance profession.

The mandate may also influence other Gulf nations to adopt similar policies. The CII is actively collaborating with regulators and semi-governmental institutions across the Middle East, central and south Asia to drive these initiatives.

Recent events, such as the Covid-19 pandemic and last year’s floods in

the UAE and Middle East, along with new regulations, have elevated the insurance sector's profile, making it a national priority.

Jones tells us: “Other initiatives encouraging collaboration with the CII include the International Professional Partner Firm (IPPF) initiative, which continues to thrive and has strong support from prominent corporations in the region. IPPFs demonstrate a commitment to upskilling their employees through CII or other professional qualifications while adhering to our Code of Ethics and best practices.

“Additionally, the CII collaborates with various training organisations through its Approved Professional Development Centres, ensuring that these institutions meet the robust accreditation standards developed by the CII. This initiative has been widely welcomed across the region. The CII frequently deploys trainers to support corporate in-house training, either on-site or online. These sessions cover revision training, technical knowledge and soft skills, and are available in both English and Arabic to meet market demand,” says Jones.

Much of the CII’s work in the region is based on initiatives originally developed in the UK, particularly in London, which are then adapted to the Middle East market.

“To further support accessibility, we have translated study materials and exams to remove language barriers,” says Jones. “We have also broadened our learning content by minimising references to UKspecific entities, such as the Bank of England or the UK Financial Conduct Authority, in favour of more globally relevant terminology.

“Another key initiative is our Goodwill Ambassadors programme. These ambassadors – who are highly qualified professionals in senior leadership positions within the sector – offer valuable support and guidance to students across the region. In the UAE alone, we have three goodwill ambassadors actively mentoring and advising aspiring professionals,” says Jones.

The Professional Map is another significant way in which the CII is helping insurance professionals in the Middle East to identify training

needs, prepare for appraisals, enhance career development and advance within their organisations.

“The Map is central to our efforts, assisting students in achieving workplace success and driving positive business outcomes,” says Jones. “To facilitate ongoing learning, we also provide strong digital learning resources for our members, including webinars, workshops and insightful learning sessions, all of which have been well received in the region. We also actively participate in forums, webinars and roundtables with senior stakeholders to share best practices and explore how the CII can support local initiatives.”

The CII is expanding efforts to support talent acquisition in the Middle East’s insurance sector, with a strong focus on local retention. In the UK, structured work experience, apprenticeships and internships help attract young talent to the profession. However, these practices are not yet widely recognised in the Middle East, making this an area of great interest and as well as opportunity for growth.

“We emphasise to corporate leaders the value of investing in employee learning and development, which serves as both a workforce incentive and a means to foster loyalty,” Jones says.

“We are also working closely to develop and offer relevant qualifications tailored to both general insurance providers and niche operators specialising in areas such as marine and aviation. Moreover, the CII is actively involved in supporting government nationalisation programmes aimed at securing long-term employment opportunities for local populations. We provide training and CII qualifications to Emirati students in financial planning and insurance sectors, helping to build a skilled workforce and enhance talent retention.”

These collective efforts reinforce the CII’s commitment to professional excellence, ensuring that the insurance sector in the UAE and the broader Middle East market continues to grow and thrive. ●

Luke Holloway is editor of The Journal

A new course developed by the CII and the University of Greater Manchester aims to give students a thorough understanding of the growing Islamic insurance sector

In February, the CII and the University of Greater Manchester (UGM) announced the launch of a new Executive MBA in Islamic Insurance and Risk Management, developed in collaboration with the Islamic Insurance Association of London, and the Centre for Islamic Finance.

The course supports a comprehensive understanding of Islamic financial products, the operations of Islamic insurance and in-depth knowledge of Takaful insurance. Its structure is designed to help prepare students for senior positions in organisations that provide or require Shari’ah-compliant or Takaful insurance.

UGM has a history of developing industry-relevant degree programmes, collaborating with professional bodies and industry partners. In the development of the programme, UGM liaised with contacts in the Islamic insurance industry and developed ideas with the CII on how the insurance sector could be best served with an increased awareness of Islamic insurance.

With input from the Centre for Islamic Finance, the programme is based on the Greater Manchester Business School’s MBA, with two of the general modules replaced by specialist modules on Islamic Insurance (Takaful) and Islamic Financial Risk Management. Specialist tutors contributed to the production of course materials, drawing on the latest theory and practice, to provide an academically rigorous yet professionally relevant programme.

The Takaful module will provide a critical understanding of its philosophy, concept, origin and development, including the key

maxims of Islamic jurisprudence related to Islamic insurance. In the Islamic Financial Risk Management course, students will study the unique nature of Islamic financial products and operations, to establish an understanding of the sources of the unique nature of Islamic financial risks. As well as the two specialist modules, students take modules in financial management and decisionmaking, marketing and operations, strategic management and leadership, and strategic human resource management.

The programme comes at a time when the London and UK market is actively examining how it can deliver Shari’ahcompliant insurance and reinsurance to support not only international Islamic risks, but also the provision of products to meet the needs of the rising Islamic population in the UK. While the UK government is keen to further the country’s position as a leading provider of Islamic financial services, the insurance sector has yet to fully develop in this area, despite the huge potential opportunities. To do so, the market needs the expertise and understanding of how Islamic reinsurance products should be structured and delivered.

In launching the programme now, UGM and the CII are positioning themselves at the forefront of a dynamic and rapidly growing sector, providing valuable opportunities for professional development and contributing to the advancement of Islamic finance and insurance.

For further information on the programme, please email Professor Abdel Haq at: mohammed.abdel-haq@bolton.ac.uk ●

Dr Chris Grant is head of centre for independent academic units, and Professor Mohammed Abdel-Haq is director of the centre for Islamic finance, both at the University of Greater Manchester, while Jon Guy is secretary general of the Islamic Insurance Association of London