4 Editorial The prompts behind this issue’s content, by editor Yiannis Parizas

17 Data: Free for all Yiannis Parizas delves into the rewarding and collaborative world of open-source programming

20 Careers: Figuring it out

For Wendy Johnson, actuarial training provided an unusual onward career path

22 Data: Brain power

Is neuromorphic computing about to revolutionise risk management?

By Amarnath Suggu24 COVER STORY

Careers: Take your pick Job-hunters have the upper hand right now, says Austin Brislen

27 Insurance: Seek cover Marco Spagnuolo on boosting customer engagement during times of high inflation

38 Soft skills: Is anybody out there? Effective communication begins with good listening, says Tan Suee Chieh

40 Extra-curricular Reema Uppal tells us about her work with the Met Police

41 People/society news

The latest updates and events

44 Puzzles

7 IFoA news

The latest IFoA updates and events

14 Interview: Tony Burdon

The head of the Make My Money Matter campaign on the power of putting your pension where it counts

30 Environment: Data detective How artificial intelligence could help spot greenwashing. By Arjun Brara

33 Careers: Rising in the East Three women working in Asia share the career journeys that have taken them to the top

36 Pensions: By halves Alexandra Miles investigates why women are retiring with smaller pensions than men

Did you know you can also read The Actuary magazine on any tablet or Android phone? Click through to read more online, download resources, or share on social media via our links in the app. It’s an exclusive free benefit for our members. Download on the App Store at: www.theactuary.com/ipad Visit: www.play.google.com

46 Student Ciara Izuchukwu on how behavioural science principles could impact the insurance space

Global economy focus

We put a spotlight on reinsurance in today’s global context. Plus, we meet systems engineer Anthony Finkelstein

Additional content including daily news can be found at www.theactuary.com

Weekly newsletter: for the latest actuarial news, features and opinion direct to your inbox, sign up at bit.ly/1MN3bXK

PUBLISHER

Redactive Publishing Ltd

9 Dallington Street, London EC1V 0LN

PUBLISHING DIRECTOR

Anthony Moran

MANAGING EDITOR

Melissa Walton +44 (0)20 7880 6246 melissa.walton@redactive.co.uk

SUB-EDITOR

Kate Bennett

DISPLAY SALES

theactuary-sales@redactive.co.uk

+44 (0)20 7324 2753

RECRUITMENT SALES theactuaryjobs@redactive.co.uk +44 (0)20 7880 6234

ART EDITOR

Sarah Auld

PICTURE EDITOR

Akin Falope

SENIOR PRODUCTION EXECUTIVE

Rachel Young +44 (0)20 7880 6209 rachel.young@redactive.co.uk

PRINT PCP

EDITOR

Yiannis Parizas editor@theactuary.com

FEATURES EDITORS

Kimberly Chimsasa: Pensions and investment

Travis Elsum: Environment and sustainability

Alex Martin: Environment and sustainability

Blessing Mbukude: Life

Fiona Neylon: General insurance

Ruolin Wang: Life and health Rajeshwarie VS: General insurance

STUDENT EDITOR Adeetya Tantia student@theactuary.com

IFOA EDITOR Kate Pearce +44 (0)207 632 2118 kate.pearce@actuaries.org.uk

EDITORIAL

ADVISORY PANEL

Peter Tompkins (chairman), Chika Aghadiuno, Nico Aspinall, Naomi Burger, Matthew Edwards, Jessica Elkin, Richard Purcell, Sonal Shah, Nick Silver

INTERNET

The Actuary: www.theactuary.com

Institute and Faculty of Actuaries: www.actuaries.org.uk

I wonder if the cover has prompted you to consider your options? Now might just be the right time for your next move, given the promising climate for actuarial job hunters (p24).

Find more inspiration along these lines in our feature highlighting the stellar careers of three women who have been making their mark in top actuarial jobs across Asia (p33). It’s also a fitting nod to International Women’s Day on 8 March – as a magazine, we look forward to seeing more women in senior positions.

It can be hard to listen to others. We all think we do, but… really listen. For the second article in our new soft skills series (p38), former IFoA president Tan Suee Chieh describes his experience of how beneficial and career advancing this underrated art can be.

Subscriptions from outside the actuarial profession: UK: £110 per annum. Europe: £145 per annum. Rest of the world: £175 per annum.

Contact: The Institute and Faculty of Actuaries, 7th floor, Holborn Gate, 326-330 High Holborn, London WC1V 7PP.

+44 (0)20 7632 2100 kate.pearce@actuaries.org.uk.

Changes of address: please notify the membership department. membership@actuaries.org.uk

Delivery queries: contact Rachel Young rachel.young@redactive.co.uk

Published by the Institute and Faculty of Actuaries (IFoA).

The editor and the IFoA are not responsible for the opinions put forward in The Actuary. No part of this publication may be reproduced, stored or transmitted in any form, or by any means, without prior written permission of the copyright owners.

While every effort is made to ensure the accuracy of the content, the publisher and its contributors accept no responsibility for any material contained herein.

© Institute and Faculty of Actuaries, March 2023

All rights reserved ISSN 0960-457X

Listening is also the thrust of Marco Spagnuolo’s piece ‘Seek cover’ (p27). He argues that life insurers must engage with their customers more than ever right now, to keep up their premia while they’re feeling the pinch. Indeed, the European Central Bank has raised interest rates by three percentage points since last summer and markets expect at least another percentage point before rates peak. With the economic situation these days, it’s understandable that people are increasingly mindful about where they invest their money. On page 14, Tony Burdon, the CEO of campaign Make My Money Matter, urges us to think about how our pension savings impact on the world.

Finally, something totally gratis – and close to my heart. In ‘Free for all’ (p17), I share my passion for contributing back to the profession through open-source software. Happy reading!

YIANNIS PARIZAS EDITOR editor@theactuary.com

When the IFoA was formed in 2010, our two predecessor bodies agreed the governance arrangements that we retain today: an elected governing Council, a Management Board that bridges our organisation’s strategy and operations, and an Executive that advances the IFoA day by day. Add on committees, practice boards, working parties and others, and we have a large group of well-intentioned, dedicated leaders. However, this is also a group whose visions and desires sometimes conflict. The system brings both challenges and opportunities.

Council has decided it’s time to consider the system that will lead us into the future, and has instigated a comprehensive governance review with that aim. As president, I have heard from those who take comfort in our community and prioritise the connections they have made. I have heard from those who love the IFoA’s ambitious aspirations and pour their energy into securing our future. We must consider what kind of leadership structure and culture will reflect our common aims and support future generations.

This structure and culture must serve our members’ diverse wants and needs. It needs to reflect our purpose and values, strategic direction, public interest role and accountabilities, and commitment to diversity and inclusion. It should reinforce our ambition to be not just a leading professional body, but a leading global body, growing in influence and scale. Our governance must enable all these things.

Each member’s vision for how these aims should come to life will be as unique as their contribution to the IFoA. Along with Council, I look forward to recognising the IFoA’s rich history, considering its future opportunities and charting a course for our governance that will serve our members, our organisation and our profession well into the future.

When the IFoA launched its latest strategy in early 2020, we also launched a fresh organisational purpose: to be the voice of actuaries, and to support, develop and be the voice of our members.

Listening to members – through our annual member survey, at events, catching up over coffee – I see your passion and pride in being actuaries. I hear your hopes for the profession’s future. While all members genuinely want the best for the IFoA, everyone’s view of what ‘the best’ entails is different.

During the past three years, despite challenging circumstances, we have adjusted, adapted and made gigantic leaps together. The IFoA offers members more value than ever before. Our voice is heard and well-regarded in the public sphere. Financially, we are strong. While appreciating that there is always room to grow, particularly in the service experience that we offer members, I am proud of what we’ve accomplished: not just for its own sake, but also for the commitment, resilience and willingness to dare that our volunteers, members and colleagues have demonstrated in accomplishing it.

As our leadership structure and culture evolve, any change in this regard needs to be meaningful. Radical change can dazzle and inspire, but incremental change reassures and stands the test of time. True leadership requires a balance of both – and effective governance, strategy and culture along with it.

The world is changing, and we are grateful for the members who cherish our heritage and have stewarded the IFoA into the organisation it is today. We appreciate our risk-taking members who push the profession to greater heights. Whatever your hopes for the IFoA, we value what you bring to it – and I look forward to what you will bring to it next.

The Quality Assurance Scheme (QAS), the IFoA’s voluntary, outcomes-based accreditation scheme for employers of actuaries, was reviewed last year to optimise value to members. It now operates with streamlined digital-first processes, offers access to exclusive QAS insights and best practice, and supports the latest diversity standards.

Here, some actuaries from accredited organisations describe some of the benefits that QAS membership has delivered for them.

“Clients, especially those who are themselves global, want to see global accreditations, global benchmarks being met – even in regional work. It’s important to them to see that their service providers are meeting those benchmarks. QAS accreditation is well recognised.” Raghav Ohri, senior consulting actuary at Lux Actuaries & Consultants

“When we achieved QAS accreditation, I had great feedback from senior stakeholders in the organisation. It demonstrated that, even though they weren’t all actuaries and may not have been familiar with the scheme before, they did recognise that this was an important achievement, and that it was a sign of the high standards that my team and I aspire to.” Matthew Byrne,

head of actuarial function at NFUMutual

“The QAS provides reassurance on the fitnessfor-purpose of our processes from an external party. We’ve found the auditor’s recommendations on best practice and things we can do better helpful in considering how we might further improve our processes. That continual improvement, getting an external party’s view rather than just our potentially biased internal view, brings value to the accreditation.” Scott Cameron, head of actuarial and investment function at Spence & Partners

Bespoke continuing professional development (CPD) scheme

“As part of our QAS accreditation, we have chosen to opt out of the IFoA CPD programme and run our own, which I’ve helped to design – so that means we are able to directly influence the CPD carried out by colleagues to ensure their ongoing competence is maintained and is highly relevant to their role.” Jane

Curtis, senior partner at Aon

Curtis, senior partner at Aon

To learn more and begin the process of earning accreditation for your organisation, visit actuaries.org.uk/qas

26-27 JUNE

Following the success of 2022’s inaugural cross-practice IFoA Conference, we are delighted to announce it is returning to London this year, in person and online.

Last year saw a schedule of more than 50 sessions, panel discussions and workshops, attended both in person and virtually by more than 500 people. With so many of you telling us how valuable you found the access to cross-practice content, we’re looking forward to doing it all again this year.

This year’s conference will highlight such topics as:

The cost-of-living crisis

Life after covid

The future of pensions

The Edinburgh Reforms

Climate risks and sustainability.

Attending gives you the opportunity to extend your domain expertise and expand your knowledge of subjects beyond your field, meet and connect with peers both inside and outside of your practice area, engage in thought-provoking discussions on issues that affect us all, and feel part of the actuarial community.

Here’s a taste of the positive feedback from attendees of last year’s event:

“The conference seamlessly brought together the global actuarial community across specialisms, enabling us to grow together, using technology to its best advantage.”

“It was fascinating to see how many different fields of work colleagues had expanded into. Very inspirational and encouraging to step outside of my comfort zone and see where that leads!”

“Good to see high-quality, interesting cross-discipline content.”

Every year the IFoA recognises excellence in research by awarding prizes for outstanding research papers in actuarial science or related disciplines. These awards continue the IFoA and its predecessor bodies’ tradition of awarding excellence.

Named after a former president of the Institute of Actuaries, thePeter Clark Prize is awarded for an outstanding paper presented to or published for an actuarial audience. For 2022, this went to Tim Berry and James Sharpe for their paper ‘Asset-liability modelling in the quantum era’, published in the British Actuarial Journal in July 2021 (bit.ly/BAJ_quantum_ALM).

The judging panel agreed that the paper was original, well-structured and highly relevant, being one of the first instances in which our profession has exploredthe potential of quantum computing. Actuaries can use the paper to start developing quantum solutions to wider financial problems.

“We are honoured and grateful that our work has been recognised in this way,” said the co-authors. “There is a long history of actuaries using quantitative methods to match assets and liabilities, since the very start of the profession. The emergence of quantum computing provides another step forward in what actuaries can do. It has been a joy applying a fascinating area of science into the actuarial field.”

The Geoffrey Heywood Prize, named after another former Institute president and originating from a bequest in his will, is awarded for excellent communication and engagement with a general actuarial audience. For 2022, this went to Samal Abdikerimova and Runhuan Feng for their paper ‘Peer-to-peer multi-risk insurance and mutual aid’, published in the European Journal of Operational Research in June 2022 (bit.ly/EJOR_p2p_aid).

The panel agreed that this well-written paper developed original actuarial techniques that are theoretically sound and practically useful. It contained a high level of clear and accurate mathematical detail and had an extensive bibliography. This paper presents several seminal results in peer-to-peer insurance and mutual aid pools, and could serve as a guideline for risk allocation for peer-to-peer insurancefocused fintech start-ups.

Both of these awards are funded by the IFoA Foundation and have prize money of £1,000 each.

In addition, Benjamin Avanzi, Greg Taylor and Melantha Wang’s paper ‘SPLICE: a synthetic paid loss and incurred cost experience simulator’, published in Annals of Actuarial Science in May 2022, was Highly Commended (bit.ly/AAS_ SPLICE). This high-quality technical paper described simulation models that can be used to test estimation procedures.

The IFoA is consulting on proposals to introduce a revised Actuarial Profession Standard (APS) Z1 on ‘Duties and responsibilities of members undertaking work in relation to UK trust-based pre-paid funeral plans’. APS Z1 sets out specific ethical and professional obligations that apply, in addition to the Actuaries’ Code, for members providing advice relating to funeral plan trusts.

The proposed revised APS Z1 reflects the new regulatory framework for the pre-paid funeral planning market, overseen by the Financial Conduct Authority. For more information and to take part in the consultation, which closes 8 May at 5pm, visit bit.ly/IFoA_CurrentConsult

Are you an experienced pensions actuary who is keen to be involved in responding to pensions industry consultations? Do you have technical expertise in UK defined benefit and/or defined contribution occupational pensions, and an interest in broader social and regulatory policy? If so, the Pensions Consultations Sub-committee of the Pensions Board is looking to appoint a new member.

The sub-committee helps to shape the IFoA’s responses to parliamentary inquiries and consultations from government departments, regulators and other public interest bodies.

You will provide technical and policy input and assist with drafting and reviewing. You will work collaboratively with sub-committee members, the Pensions Board and other IFoA groups to produce consultation responses that are based on rigorous and independent analysis, that represent the views of the IFoA and that support the public interest.

For more about the role, including time commitments and how to apply, visit bit.ly/Volunteering_pensions_consult

In the January/February issue of The Actuary, we told members about our recently launched consultation on embedding diversity, equity and inclusion (DEI) values into the Actuaries’ Code. Here, chair of the Regulatory Board, Neil Buckley, explains the reasoning behind this.

The Actuaries’ Code is the ethical code that sets out the expected behaviours and conduct for all actuaries who are members of the IFoA. One of its tenets is that members must show respect for others – and an important aspect of respect is how we react and respond to people who are different from us. Such differences can manifest themselves in many

forms – not just gender, race or sexuality, but also background and education.

The IFoA also recognises that diversity of thought leads to new ideas, improved approaches and enhanced outputs.

Diversity of thought comes from a diversity of people. To ensure the IFoA’s membership and our workplaces are diverse, we as individuals, groups,

companies and a society need to actively remove barriers and encourage inclusion. Only then can we harness our differences, which will provide opportunities to broaden our horizons and start thinking and acting in new ways.

For these reasons, we feel it’s appropriate to embed DEI in the Code. The proposed changes amplify existing obligations to make it clear that members, when

showing respect for others, should consider how this manifests itself in the context of DEI.

To find out more, join Neil Buckley to discuss these proposals at our consultation webinar on 29 March. Or visit bit.ly/IFoA_CurrentConsult if you would like to take part in the consultation.

IFoA Conference: 26 – 27 June 2023, etc. venues, London

Asia Conference: 12 – 13 September, KL Convention Centre, Malaysia

GIRO Conference: 1 – 3 November 2023, EICC Edinburgh

Life Conference: 22 – 24 November 2023, ICC Birmingham

“As an exhibitor you’re never sure if you’ll get the footfall at a conference but the IFoA run a superb event. Great speakers and well organised means they run smoothly and have a great atmosphere. This ensures we get loads of networking time, a chance to spot the people we want to see and probably arrange more follow-up meetings in two days than we get from the rest of the year.”

HFG, Exhibitors at the IFoA Conference, GIRO and Life 2022.

IFoA communities is a place for you to link up globally, discuss emerging topics, learn from experts, meet like-minded individuals and collaborate in an organic, easy-to-navigate environment.

Our practice area boards, committee members and volunteers have spent the past few months building a rich and active community, ready for you to join hot-topic debates and access a range of engaging actuarial content.

“Through IFoA communities, I have made connections with actuaries from different practice areas and locations. The platform has created a vibrant community where we are more able to engage in idea sharing – something that was not possible without it. I have had insightful discussions with student and qualified actuaries about non-exam related topics, such as sustainability.”

Simbarashe Manzungu, data analytics consultant at Deloitte (Zimbabwe) and research volunteer in the IFoA Sustainability Volunteer Group

“The communities platform is a really easy way to be in touch with actuaries I have known for years, and also to liaise with actuaries that I am meeting for the first time now.

“I have joined the Life and Sustainability groups, both of which are going to be useful in my work. The Sustainability group provides easy access to a weekly news update newsletter and other great resources.

IFoA communities is a space built by members for members, where you can quickly and easily find relevant practice area information, events and resources, and share your views on IFoA initiatives and activities.

“I have already exchanged messages and had meetings with people who work in different actuarial disciplines and indeed different continents from me. I expect that the platform will enable connections easily.”

Patrick Cleary, senior actuary at the Prudential Regulation Authority and member of the IFoA Sustainability Board

You can start or join a discussion on any subject in our all-member forum or take part in topic-based discussions in our community group forums. The forums are great places to collaborate, learn and problem-solve with your peers, as well as keep up with emerging topics and debates in your areas of interest. You can also start your own discussion on topics you want to hear about.

It’s easy to find and connect with your peers and colleagues in IFoA communities. Click on the Members tab to see who else is online, or search for community members by geography, job title or shared areas of interest.

Once you have connected with someone initially, you can then contact them by direct message.

Visit our community groups to find out more about our practice areas and discuss hot topics and the latest research in the community group forum. You can explore topics in depth through the community collection of The Actuary articles, new blog posts on developments in the field and links to relevant community resources.

IFoA communities is your new online digital community. Here’s how to get started on the platform

You can also subscribe to daily or weekly email digests so you don’t miss any new community publications, discussions or activities – a great way for you to stay up to date. By joining community groups, you can connect with like-minded individuals and collaborate on topics that are of interest to you. You can share interesting resources and updates by posting on the community group home page or run polls to get a snapshot of your peers’ views on emerging issues.

You will be able to read the latest practice area board updates, which cover recent board initiatives and activities, and stay abreast of volunteer vacancies and opportunities to get involved. Meanwhile, in our IFoA highlights area, you can explore the latest IFoA news, updates and events.

If you haven’t already joined IFoA communities, simply log into your members’ area on the IFoA website (actuaries.org.uk/user) and click on the IFoA communities logo.

Once you have logged into IFoA communities, the platform instructions will explain how to set up your profile and get started. As soon as you set up your profile, you’ll be able to create a new discussion or join an existing one, and contact other community members directly.

You can learn more about IFoA communities by signing up to any of our platform events and demonstrations. All our IFoA communities support events are listed under ‘communities events’ in our IFoA highlights area; simply click on the event you would like to attend and then on ‘register’.

Join

For links to IFoA events and IFoA news, find them in the announcements section.

In one click you can navigate to a range of resources that will support your career development, including our virtual learning environment, the IFoA buddy system, careers blog content and The Actuary jobs board.

You can also keep up with the latest IFoA press releases, social media posts and podcast feed, all in one place.

Now you have the details, why not go and find out all about it for yourself? Don’t forget to spread the word to your friends and colleagues in the industry. This initiative really offers something worthwhile for everyone.

our new actuarial digital community. We look forward to welcoming you

In April, the Climate Risk and Sustainability course will be one year old. During its first year, we welcomed 155 participants and awarded 148 certificates. Members from more than 19 countries came together at the seminars to discuss and share what they had learnt.

Before the course was launched, a team of volunteer members worked with the IFoA for more than a year to devise, curate and create the content for the nine modules.

From the moment we opened the course for bookings, we saw huge interest from members and, after the first one, we were quickly able to double the cohort size to meet the demand.

Participant Sian Eltman told us that the key takeaways for her were “just how serious and imminent an issue combatting climate change is, and how actuaries can play a key role in encouraging and assisting our clients, members, policyholders,

regulated entities and related stakeholders in a smooth transition to a net-zero world.”

The opportunity for members to learn in diverse groups is also a benefit of this online course; Sian said that it opened her eyes to “people living in areas that are already experiencing the consequences of climate change and how they are working to combat the issue”.

The course has appealed to a wide range of members and is a unique opportunity to come together and think about the impact of climate change.

The three course dates that we ran last year have given us great insight into what members want from taking part in it, and it is pleasing to see that more than 94% of participants would go on to recommend it to colleagues.

Given the pace of change in the climate change arena, our team of volunteers came together to review and refresh the materials for the coming year, and take into

Explore views from across the profession at blog.actuaries.org.uk

How did the COVID-19 pandemic impact accelerated critical illness and the causes of claims?

Chris Reynolds, chair of the CMI assurances committee, discusses the recently published Working Paper 167 bit.ly/Covid_ACI_claims

account comments we’d received from the first three courses. Their insights were that there is a balance to be struck between information overload and enabling members to grow their knowledge, apply the lessons to the workplace and feel encouraged to undertake further learning, as the subject is complex and so vast.

For this year, we will continue to build on the success of the course. The first of our 2023 courses began in January, with more to follow in April, July and October. For information, including how to book, visit: bit.ly/Climate_risk_sust

The Climate Risk and Sustainability course is one way in which the IFoA is supporting its goal in making climate-related risk understood and generally considered by members – in the same way that we understand and consider other major life risks, such as interest rates and mortality.

IFoA Conference 2023: collaboration to bring wider perspectives

Sophie Wright and Shuyan Liang, co-chairs of the IFoA Conference 2023 organising committee, preview the event. bit.ly/IFoA_Conf_2023

How actuaries are using artificial intelligence and machine learning

Chris Paterson, who works at the Government Actuary’s Department, explains its research into this area. bit.ly/Actuaries_AI_ML

In the ‘Project New Horizon’ article in the Jan/Feb 2023 issue, we incorrectly billed the initiative as an IFoA programme. Project New Horizon is separate from the IFoA, and is an independent group comprising a number of IFoA members.

P22 Brain power

Processors that work like the human brain could be about to expand the possibilities of risk management

P30 Data detective

Artificial intelligence is all over the news – but how could it help investors?

P38 Is anybody out there?

Actuaries have a duty to speak up, says Tan Suee Chieh – but we need to start by listening

COVER STORY

The balance of power in the jobs market has tipped in favour of employees, says Austin Brislen P24

P27 Seek cover

Boosting life insurance engagement in tough times

Overleaf

Interview with Make My Money Matter’s Tony Burdon

P17 Free for all

Sharing the benefits of open-source programming

P20 Figuring it out

How qualifying led one actuary to psychology

P33 Rising in the East

How three women from across Asia rose to the top

P36 By halves

What can be done to close the gender pensions gap?

ony Burdon’s career has long been driven by his desire to make a positive impact. This has been the north star that has guided him across the world, from poor villages to disaster zones and back to the UK, each role building on the last. As CEO of Make My Money Matter, he steers a successful campaign that engages and empowers UK pension scheme members to demand positive change for a better future.

Burdon got his start with development charity Voluntary Service Overseas. Fresh out of university, civil engineering degree in hand, he was sent to Malawi to work on projects bringing water to villages. Seeing the impact of running water on the villagers’ lives was formative. “That was it – I could use my skills to help people,” he explains. “I decided I was going to work in international development for the rest of my life.”

On returning from Malawi, he joined Oxfam as a humanitarian engineer, working to establish water infrastructure and sanitation in refugee camps and war zones from Angola to Rwanda, Somalia to Iraq. He enjoyed the work, but found it relentless: “You go from one disaster to another, one emergency to another, unable to tackle causes.”

Facing burnout, Burdon undertook a master’s degree in development studies before returning to Oxfam to manage overseas programmes. He then moved to policy work and represented Oxfam on the board of Jubilee 2000, a campaign that drove the cancellation of more than US$100bn of debt owed by 35 of the world’s poorest countries. Seeing the power of finance to achieve “impact at scale” was another watershed moment.

His next move was to the Treasury, where he joined a team advising the then-chancellor Gordon Brown on international development. He worked

there for five years, with highlights including working with Sir Nicholas Stern on the prime minister’s Commission for Africa. He then tried a core Treasury job in taxation, but did not find the work motivating and ended up moving to the now-defunct Department for International Development (DFID), working in Nepal and Nigeria, as well as in London.

It was while he was leading DFID’s private sector department, grappling with the challenge of mobilising investment into developing countries, that Burdon started talking to screenwriter and director Richard Curtis about “a campaign to let investment ‘make poverty history’”. Curtis and former government special adviser Jo Corlett developed these ideas, consulting widely, including with industry, to co-found Make My Money Matter (MMMM). Burdon later joined as CEO and launched the campaign in 2020.

MMMM aims to “give people more voice and choice around how their money is invested”, Burdon explains. An influence on the campaign was a TED talk by Dr Bronwyn King, an oncologist who saw the impacts of the tobacco industry first-hand while working on a lung cancer ward. After meeting her pensions representative, she was horrified to discover that her pension was invested in tobacco companies.

UK pension scheme members collectively have £3trn of savings but many people are not engaged with their pensions. Burdon believes this lack of engagement is a key driver of the misalignment between people’s values and their investments, as in King’s case. “People know they are not saving enough, they’re scared, and when they’re scared, they freeze,” he says. He thinks a lot of people avoid looking at their pension, but this only leads to worse outcomes.

TYears working in international development showed Tony Burdon, head of Make My Money Matter, that sustainable pensions can harness trillions of pounds to build a better world – at a scale governments and charities can’t. He talks to Travis Elsum

A good way to increase engagement, he argues, is “to help pension members understand what impact their investments have on the world around them, and then try to align that in a way that meets with their values.” The climate emergency is one area over which pension scheme members have deep concerns, and they are often shocked to realise that the money in their pension has contributed to the problem.

MMMM’s impressive level of success during its three years of existence shows that it is possible to engage people with their pensions, and the financial services industry would do well to learn from it. Brand recognition has reached 42%, and is even higher among the under-30s, at 60%. This has been helped by witty and shareable social media messaging and videos.

One such message is the ‘21x challenge’: the idea that greening your pension is 21 times more effective at cutting carbon than other lifestyle tweaks, such as stopping flying and going vegetarian. This figure is based on analysis supported by Aviva and sustainability consultancy Route2, Burdon explains: they compared a conventional global investment fund’s emissions with those of a sustainable fund for a £30,000 pension pot, and then compared that difference with the emissions savings associated with lifestyle choices.

He acknowledges that the analysis has limitations but explains that it is primarily designed to get people thinking about the impact of their savings. “No one talks about pensions, and it is your second biggest financial asset after your house, if you’re lucky enough to own one.”

MMMM has conducted surveys to better understand what is important to pension savers. The general message is clear and simple: “They want their money to be doing the right things, and are shocked when they find out it isn’t,” says Burdon.

According to surveys carried out by MMMM, 60%–70% of pension scheme members want their pension to be invested in sustainability. Deforestation and climate change are the top two issues but they are also concerned about gender equality, diversity and workforce conditions.

Burdon argues that aligning with pension scheme members’ values is not a trade-off but a prudent approach to optimising risk-adjusted long-term returns, considering the commitments and momentum behind a sustainable transition. He points out that more than 50 leading schemes in the UK –totalling some £1.5trn in assets – have committed to net zero. “Where do you want to be?” he asks. “Do you want to invest in the companies of the future or the dinosaur industries of the past? If we know that all companies will eventually align with net zero, that’s where you need to be heading.”

Once people are aware of their pension’s impact, MMMM helps them understand how to use it to drive positive change. It has focused on getting default funds to align with net zero. “We’re saying to people, demand that your fund changes,” says Burdon.

To this end, MMMM has email templates on its website for people who want to contact

their pension fund. If their fund has not made a net-zero commitment, pension scheme members are encouraged to pressure it to do so. If it has, MMMM encourages members to hold it to account by asking for further details, including short-term emissions reduction targets, better stewardship and plans for eliminating deforestation.

MMMM is planning to release a consumerfacing report this year that will rank how well funds are performing on climate change and deforestation. It will consider emissions targets, deforestation policies, proxy voting records, changes in portfolio emissions intensity and stewardship, among other criteria. Burdon believes the report will provide “the sort of information consumers should have. And then I think people –as well as employers – can start to make more informed pension choices.”

He acknowledges that it will take time to get the balance right in providing accessible and beneficial sustainability information to pension investors. He points to progress on reporting initiatives, such as the Taskforce on Climate-Related Finance Disclosures and the International Sustainability Standards Board, and believes we will eventually see “impact information, such as climate disclosures or workforce conditions, routinely coming from companies as part of their financial reporting”.

Burdon mentions that a fellow MMMM board member has a T-shirt that says ‘accountants will save the world’, and wonders if it should say ‘actuaries’. He recognises the profession’s sustainability commitments and work in this space, and acknowledges that actuaries have “a deep understanding of risk and the management of it”. The profession could be more vigorous in clarifying what the risks are to finance and to people and planet, he notes, and needs to play a leadership role in moving financial institutions forward.

He reflects on his time as a humanitarian engineer, thrown into disaster situations where everyone would work relentlessly to save lives. With the impacts of climate change set to become more pervasive, frequent and severe, he asks actuaries and the finance sector as a whole to treat their work on sustainability risks and managing the net-zero transition with the same urgency and effort. “What’s the use of retiring in a world on fire?”

Greening your pension is 21 times more effective at cutting carbon than stopping flying or going vegan

Coding: those who love it can benefit those who don’t by creating open-source tools. Yiannis Parizas outlines two popular data science programming languages, and the simulator he devised and shared

An open-source programming language is one that is not proprietary; the source code is accessible for the public to view, modify and redistribute. R is an example of one such language. It is specialised in statistical analysis, and rich in packages for data visualisation, processing, analysis and reporting. It is one of the IFoA’s ‘preferred’ programming languages and is now included in the CS1 and CS2 exam curricula.

The IFoA’s official guide to installing and using R can be found at bit.ly/IFoA_RGuide

Insurers can use R to perform analysis in all areas of pricing, reserving and capital modelling, and there are already specialised R packages that support our work. There are significant benefits in creating and sharing such packages with the public.

Alongside R, Python is the other open-source language that is popular in insurance. While R is specialised in statistical analysis, Python is a multipurpose programming language. Users occasionally opt for Python because it is considered more robust for production and has a larger community of users –and therefore more resources – for non-statistically specialised tools. An example is when deploying a machine learning model or pricing infrastructure as an application programming interface (API); here, Python wins out over R. Moreover, R is perceived as harder for a beginner to learn, and IT department colleagues are more likely to have knowledge of Python. Both languages have a large community of users but R has a larger academic community. This means that newer technologies from statistical research are likely to appear in R before Python.

In general, Python is faster than R, but both are slow compared to languages such as C, C++ and Rust. The insurance industry uses R and Python because they have many of the tools we need built-in, providing a degree of programming ease that outweighs the loss of speed.

The most widely used data analysis tool in our industry is still Microsoft Excel, whose main benefit is that everyone can use and understand it. Traditionally, analyses and tools have generally been run through Excel – but this has started to change, with external programming languages being better in terms of scaling and automation.

Excel’s capacity shows its limits as datasets get bigger. Users can access more powerful tools, such as PowerPivot in Excel x64 and PowerBI, but not everyone has experience with these. Excel can be automated with VBA, the programming language embedded within it, but this is slow compared with R and Python. A simulation of 250,000 years with a high claim frequency could take VBA a couple of hours to run, while R or Python would take a few minutes. Considering this, a commercial business may opt to upskill its employees in R or Python to benefit from time savings in the medium term.

Another issue with VBA is that it does not have as big a data science community as R or Python, so there are not as many packages and resources available for actuarial use. R and Python are easily reproducible, enable connection to multiple data sources, and can share reports or tools with other users through tools such as Markdown or Shiny, or an API. In addition, VBA’s syntax is not as clean as those of R and Python.

However, it should be noted that while use of Excel is declining for more complex work, we will still use it for a long time because of its ease, transparency and flexibility for simple calculations.

R packages are extensions of the R programming language. Packages may contain code or functions, data and documentations in a standardised format. The author can also set automated tests to spot bugs in the code. Documentation can be per function or vignette (longer guides in which the authors may include proofs, use case studies etc). Documentation per function is summarised in the reference manual and you can access it in R while you have the package loaded by typing “?function_name”.

R contributors can share their code through centralised software repositories. The most common repository for R is the Comprehensive R Archive Network (CRAN), which is supported by the R Foundation. This is where the packages come from, by default, when you run “install.packages(package_name)”. Alternatively, users can share their code with software development services that offer both internal and public access, such as GitHub and GitLab.

The ability to publish and share code internally means companies can reap the benefits of an open-source language while keeping developments confidential, internally controlled and secure. Developments are secured by file keys, and permissions are centrally governed. Backups are made for every change to the code and changes can easily be reverted. Python works in the same way. CRAN’s benefit for open-source contributing is that the package will install easily with the standard command and must conform to a relatively strict specification, ensuring a better user experience. The requirements include a standardised documentation format, a directory structure and metadata. When R is installed, it comes with 15 base packages and an additional 15 recommended packages.

For those who love coding and enjoy giving back to the profession, there are many benefits in contributing to open-source projects. You can develop your coding skills and learn about technical aspects in a practical way, both of which are valuable for employers looking to make internal developments.

In collaborating with others, you learn from them and their perspectives, and improve your teamwork and communication skills. You learn to accept and understand feedback in order to improve. The more you get involved with projects, the more confident you become in your skills, which can help in interviews and work presentations. You can also make a reputation for yourself in the open-source community, meeting people and forming a network that could help you land a job that utilises your coding abilities, if that is something you are interested in.

Another benefit is that you will stay up to date with the industry’s latest technologies and tools. You will have access to open-source tools in every job (unless IT security does not allow it), which is not the case with licensed software, and the skills you develop through your contributions will be available to your employer. It really is a win-win.

Companies can reap the benefits of an open-source language while keeping developments confidential

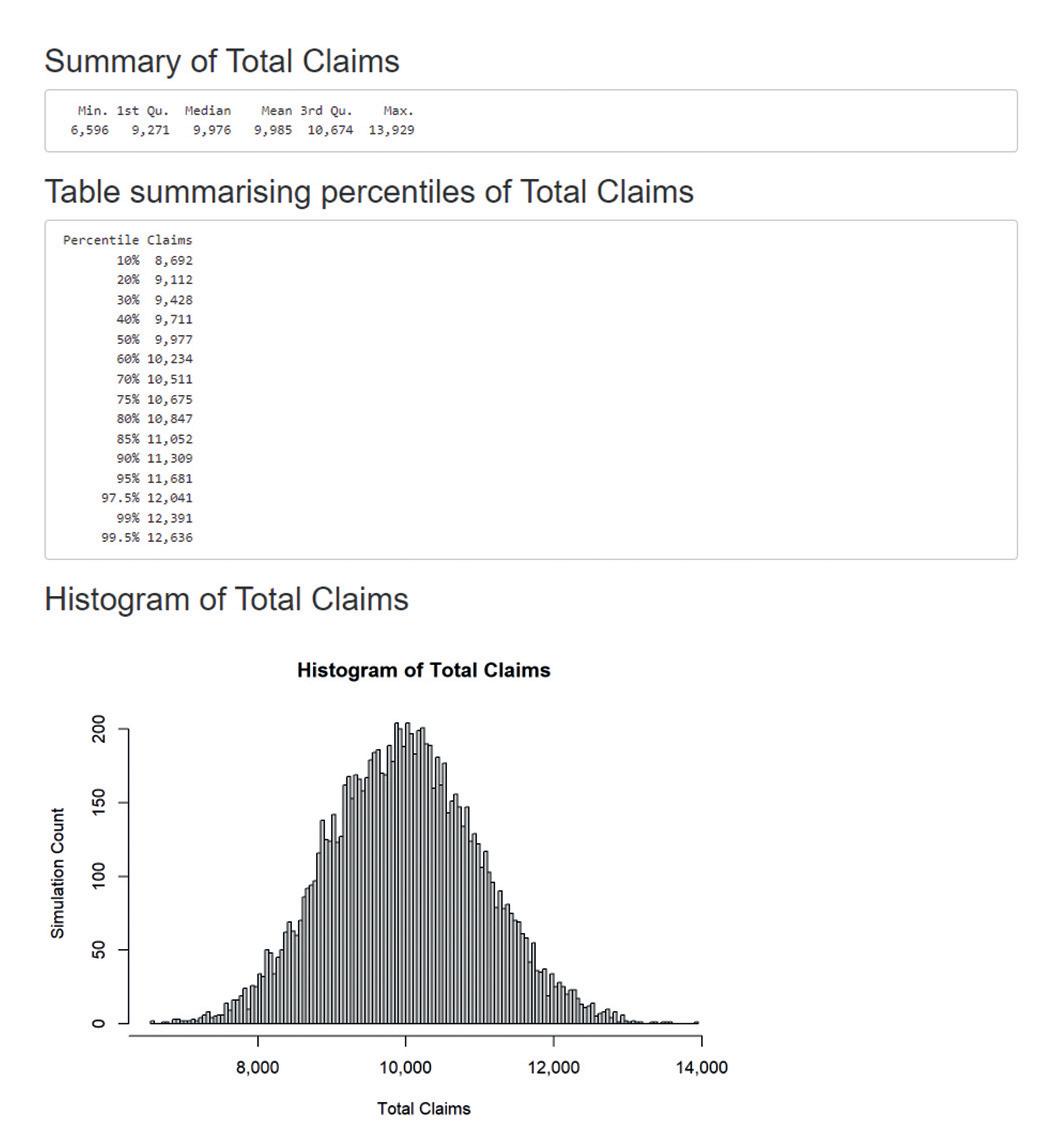

I published the R package NetSimR in CRAN (bit.ly/CRAN_NetSimR) to accompany two previous articles I wrote for The Actuary, ‘Taken to excess’ (March 2019) and ‘Escaping the triangle’ (June 2019). NetSimR has been downloaded by users around 14,000 times so far, which I don’t think is bad for an actuarial product!

The first version of the tool included functions that calculated the analytical mean of capped severity distributions, expanding to increased limit factor curves, exposure curves from severity distributions, and pure incurred but not reported claims functions. Here, I will focus on the latest update to the package: adding a claims simulation tool.

Many (re)insurers have Excel versions of tools to run analyses and simulate claims, usually using VBA. As we have already noted, such tools are slow and cannot handle hundreds of thousands of simulations or a very high claims frequency. Proprietary tools such as MetaRisk can handle more complex setups, but actuaries do not always have a licence, or indeed the experience and training, to use such tools. In addition, many practitioners, especially those from the older generation, are not familiar with coding in R. An R tool with a front end would allow them to use this language without having to code.

The aim was to set up a claims simulation tool with a user interface that could be used by people without coding experience. It would not capture every complex scenario but basic cases; more complex cases could be handled through external manipulation and multiple simulation analyses.

Initially, the tool was set up using CUDA (Nvidia’s programming language that runs on graphics processing units) and C#.net. The implementation and production set-up were complex and could not easily be shared with other people. Simulation speed was therefore sacrificed and the tool rewritten in pure R, with the front end in Shiny – an R package

that allows the functions to be used via a website using buttons and other inputs, thus turning the code into an app.

My claims simulation tool, the NetSimR simulator, is a website that can be used by those without any coding knowledge, using the following R commands: install.packages(“NetSimR”) (only when using the simulator for the first time, to

install or update the package) library(“NetSimR”) run_shiny_simulator()

Once the user runs the simulator, two buttons appear so that they can export the results – either by saving the simulation data as a CSV file or outputting an HTML report produced by a markdown file.

Yiannis explains his open-source tool, NetSimR

Wendy Johnson recalls how qualifying as an actuary and running her own consultancy in the US allowed her to overcome shyness and gave her essential skills for life

is a professor of psychology at the University of Edinburgh

From an early age, my mother had figured I’d become a scientist. Not just any scientist, either, but one worthy of a Nobel Prize. With that came expectations of A-grades all the way – but also constant scoldings, my behaviour always wrong, wrong, wrong. In my second undergraduate year reading maths at Occidental College in Los Angeles, I got a B in my organic chemistry module. “Wendy,” my mother said, “you have ruined your average!”

It hit me like a cold, dirty rag across the face: I realised I’d grown up under ridiculously high standards, and dumped them there and then. I didn’t quit school, get into drugs or take off hitchhiking – but I did disengage, spending hours staring at my dorm room wall, my mind a jumble. B-grades accumulated.

Gradually, though, I pieced together my life story, helped by my mother’s chest of mementoes, which included letters from her family and former beaus. She’d always said I was like my father, not her, but two things became clear: she and I were more alike than she claimed, and she’d been similarly wrong, wrong, wrong, according to her father.

I realised that I had my own life to lead and that it didn’t matter what she thought. Driven by curiosity, I resumed active study, but I knew that my next step would be the workplace, not academia.

When I graduated in the late 1970s, the US economy was wretched: high inflation, high unemployment and jobs scarce as hen’s teeth. Especially the kind of job I wanted: challenging, interesting, using my degree in pure maths. No one was looking for people to do abstract maths with no practical use.

Lowering my horizons, I managed to get two offers: one as a trainee design engineer and one as an insurance underwriter. I took the latter because I liked the people better, despite it paying much less. While fun at first, it became boring as soon as I’d mastered it. Now what?

I ran into a friend who said the pension consulting group he worked for was hiring. I’d always known that the actuarial profession was an option for mathematical types, but had never pursued it because it didn’t involve the pure maths I loved. But, I thought, why not for now? I applied. They took me on. Later, they told me that I’d appeared shy and uncertain in the interview, but so determined that they’d hired me anyway. That was me then – painfully socially hesitant but dogged when pursuing something.

I quickly rose up the ranks, first in pensions and then in casualty work, mostly for public agencies that had formed self-insurance pools – all of which had been cancelled by the global insurance industry in the late 1970s. The demands to convey myself with ‘executive presence’ increased. It isn’t something I can do, but I figured out my own way – to the point where my husband (also an actuary) and I set up and ran our own consultancy for a decade in the 1990s.

The abilities to come across as competent and to help others are some of the primary skills I gained while working in the profession. It also showed me that my insistence on conceptual understandings makes me creative in addressing problems and coming up with insights. Both are valuable in life.

What makes us tick?

I had two children and, boy, were they different, despite their shared home and genetics. Psychology had always interested me, and now I was dying to know how genes and environments intertwine to make us who we are. I did background courses and swapped actuarial work for a PhD at the University of Minnesota, studying behaviour genetics and individual differences. When I finished, a post opened at the University of Edinburgh, where I have been a professor since 2015.

Now, when I come to understand all that can be done in one area, I move to another, expanding on theories, so there’s always a new challenge. I have found that my experience in actuarial business and with clients has enriched my interpretations of psychological and practical realities.

What have I learned? I believe our genes are ‘toolboxes’ that we’re born with, blunt instruments but highly flexible, like Lego bricks that can be put together in any number of ways, to create anything from wasps to spaceships. And that’s how we live – constantly cobbling our tools together to meet what is thrown our way.

If you can slog through the actuarial exams, you’ve got wide horizons. Put your genetic toolbox to work and explore them!

Microprocessors are the heart and soul of modern-day computing. Their processing power has grown exponentially over time, while their size has diminished. While this processing power has been adequate for most general purposes, the advent of the fourth industrial revolution has set the bar higher. Models and machines powered by artificial intelligence (AI) require more powerful and energy-efficient processors with smaller form factors, but traditional processors have reached their limits in terms of miniaturisation and energy consumption. This has resulted in the need for a new chip design that can cater to the present-day requirements of smart devices and autonomous vehicles.

Neuromorphic computing tries to mimic the functioning of neurons in the human brain, using biologically realistic computational models. It achieves a brain-like function by using electronic nodes that act as neurons and electrical signals that act as synapses connecting

the neurons. An input from a sensory organ triggers the brain through a series of electrochemical reactions. Similarly, neuromorphic processors are triggered by discrete events and powered by a series of electrical impulses or spikes. These spike trains, as they are known, are propagated by the third generation of neural networks, called spiking neural networks.

What’s the advantage?

Neuromorphic computing co-locates both the memory and processing together, made possible by the use of special electrical components known as

memristors. This architecture eliminates the Von Neumann bottleneck (the idea that computer-system throughput is limited by the ability of the processor), greatly improving the processing speed and reducing power consumption. Event-driven computation makes these processors all the more energy efficient. The neurons’ architecture enables a high level of parallel processing. All neurons and synapses can work simultaneously on the same or different activities. Multiple neuromorphic processors can be scaled to form one single large network of neurons and

cere Sllftdffiit Thlttihiii

The latest microchips mimic cerebral function. Smaller, faster and more efficient than their predecessors, they have the potential to save lives and help insurers, argues Amarnath Suggu

synapses, drastically increasing computation power.

Studies carried out by Intel showed neuromorphic processors outperforming traditional processors in terms of processing times and energy efficiency: they were nearly 100 times faster and 1,000 times more efficient. They also learned subtle differences in images, including different human gestures, very quickly when compared with existing processors.

Use in insurance

Risk management is inherent to the insurance business. With the advent of the Internet of Things (IoT) (everyday objects with WiFi capabilities built in) and the abundance of data coming from

connected devices, insurers have shifted to risk prevention. By analysing the data from IoT devices, insurers can alert customers to risks in a timely manner, or trigger actions to prevent loss of life or property damage.

Unfortunately, most IoT data is analysed by power-hungry AI models that are hosted on servers. Owing to their size and energy needs, they are usually hosted in the cloud or on the edge (at or near the user or data source’s physical location). As a result, the data has to be transmitted from the source to the cloud or edge. Data analysis outcomes are then transmitted back to the source to trigger an alert or a necessary preventive action. The use of traditional computing processors thus involves delays to the triggering of alerts or preventive actions.

Due to their smaller form factors and power efficiencies, neuromorphic processors enable AI models to be hosted at the source of the data itself. This eliminates the transit delays that exist in earlier models. More importantly, it opens the doors to newer business models and encourages insurers to explore innovative ways of preventing risks and saving lives.

Some of the many possible everyday uses of neuromorphic chips

All vehicles – Connected cars and trucks are equipped with cameras, Internet of Things (IoT) sensors and telematic devices. The data from these is transmitted to a server, where an AI model senses distracted or reckless driving and sends a response back to alert the driver and the authorities. Given the speeds at which cars travel and the possibility of a no-signal zone, the alert can sometimes be too late.

Autonomous cars – Self-driving cars generate nearly 40 terabytes of data per hour and navigate using camera footage. A fully autonomous car (with Level 5 Advanced Driver Assistance Systems) performs nearly 4,000trn operations per second. Neuromorphic processors can make onboard AI engines a reality, helping to process the data faster and prevent accidents in real time while conserving power.

AMARNATH SUGGU is a senior consultant in the BFSI Technology unit at Tata Consultancy Services

Neuromorphic computing has come a long way since its inception in the early 1980s. Many organisations have successfully conducted experiments demonstrating that these new processors are computationally more powerful and energy efficient than traditional ones, as well as requiring a much smaller footprint.

Neuromorphic processors have improved AI’s processing capabilities and allowed it to be deployed at source. As a result, it can identify unknown and known risks much more quickly than earlier models. Insurers should recognise the advantages of neuromorphic processors and adopt them to prevent accidents – and, more importantly, to save lives.

Drones – Insurers use drones to inspect roof and crop damage, and determine the extent of flood damage. A drone’s flight is usually limited by data storage capacity and visibility, necessitating multiple trips and making it difficult to assess damage quickly. Neuromorphic processor-based AI engines on board can help drones to auto-navigate and process the feed in-situ, so damage can be seen in real time. This could expedite claim processing or underwriting.

Accessories – IoT wearables collect vital statistics from the human body and upload this data to an edge server (usually a mobile phone) for analysis by an AI engine. Neuromorphic computing enables this data to be processed within the item itself, without draining the battery. This eliminates transit and processing delays, and can let a user know, for example, that they need to see a doctor immediately. This could improve the survival rates of patients with critical heart illnesses.

Long-term care – Patients in care are monitored, either in person or via a camera, and help is dispatched when required. Neuromorphic processors can identify subtle human expressions, gestures and positions in footage to determine whether a person needs assistance. They can also be incorporated into a robot, which can remind the person to exercise or take medication. This could reduce medical claims and lower premia.

easier we th become accustome even monumental c become the

It’s easier than we think to become accustomed to change; even monumental changes quickly become the ‘new norm’. It’s only when we contrast these new norms with the past that we fully comprehend the shift

The past few years have been turbulent for the UK, from covid to economic and political turmoil – 2022 alone saw us go through four chancellors and three prime ministers. The economic fallout hit the profession in September, when highly skilled actuaries saved pension schemes from the liability-driven investment crisis.

The actuarial market has not been immune to this volatility and in my view, having recruited actuaries since 2010, employees’ influence has never been greater – representing a power shift away from employers.

Five to 10 years ago, a ‘typical’ recruitment process would involve candidates attending a minimum of two or three face-to-face interviews. The client would invite at least three candidates for a final-stage interview, with the decision often taking more than a week, and they would nearly always secure their first-choice candidate. If they were to lose this candidate to a counter offer, they would revert to the second choice. In short, they would, nine times out of 10, fill the role at a pace that suited them. Searching for a role was tough for candidates, although there were still some great opportunities in the market. However, competition was intense, and while I would not say employees were ‘on the back foot’, it was certainly not an equal power dynamic.

Fast forward to 2023 and the tables have turned. It is now the candidate who

has a minimum of three employers lined up for final interview, the candidate who knows they are likely to come away with three offers, and the candidate who knows they are in the driving seat.

What tipped the scales?

No single factor caused the imbalance of power; rather, it was widespread market pressures and a few issues specific to the profession. Demand for talent has simply outstripped supply, and actuaries know how to use this to their advantage.

Demand for actuarial talent has been unprecedented during the past few years, following a long period of sustained growth. The Actuary Jobs, for example, had 787 live job vacancies at the start of Q1 2023 – a 48.5% increase on the figure at the start of Q1 2013, which was 530. This insatiable demand is not limited to the actuarial profession; the overall UK labour market is witnessing off-the-scale demand, and reached a record number of vacancies in 2022.

The immense value that actuaries provide to employers has seen most firms increase headcount on a net positive basis, year on year. The 48.5% increase in demand between 2013 and 2023 is encouraging. The number of actuarial employers did not increase by anywhere near this figure during that period, indicating that growth in demand has been driven by existing firms expanding their actuarial headcount.

All areas of the profession have been implementing regulatory reforms (such as guaranteed minimum pension equalisation, IFRS 17 and the Financial Conduct Authority Pricing Review), and this has placed a huge burden on employers. These programmes are resourced through external hires and by

The upheaval of the past few years means life is sweet for job-hunters, who now have top choice, says recruiter Austin Brislen

The u few y sweet f now ha recru

seconding internal employees from their business-as-usual (BAU) roles. These programmes have directly fuelled demand by recruiting straight onto the programme, as well as indirectly, by backfilling secondees’ BAU roles.

Regulatory reforms aside, there has been plenty of additional demand from employers’ own internal programmes. The profession has been a hive of ingenuity and modernisation, with many employers establishing internal transformation programmes that cover systems, digitalisation and the embedding of machine learning and artificial intelligence.

On top of this, we’ve now started to feel the impacts of Brexit, which has cut off a constant and easy-to-access supply of European talent. While there are still ways to secure overseas actuaries, not all employers have taken to this, citing the cost and complexity involved.

It can feel as though people blame covid whenever something isn’t working in any part of society. However, two specific consequences of covid have impacted both ends of the actuarial profession. First, 2020 saw reduced levels of graduate intake, for obvious reasons. The impact of this reduction will bite later, although it is important to recognise the employers who went above and beyond to onboard new starters during lockdown.

A less talked-about consequence is the delayed retirement plans of many actuarial professionals – who would want to retire in the middle of a pandemic? The knock-on effect of this is that we are seeing higher levels of retirement in 2022-23, further reducing supply and valuable expertise.

Finally, we must acknowledge that the profession has started to suffer a greater level of attrition to ‘non-traditional’ actuarial fields – anything from gaming or gambling to data science. Notwithstanding the changing supply and demand dynamic, employees have capitalised on this, and it is partly why the shift in power has been so evident.

When I first started recruiting actuaries in 2010, LinkedIn was in its infancy, with a mere 65 million users. Fast forward to the end of 2022 and the site had 850 million users worldwide, including a large actuarial

membership in the UK, all engaging with recruiters, employers and content around careers and their value.

Post-pandemic, many employees have refreshed their attitudes towards work. Some have a new perspective on work-life balance, and renewed expectations of what employers should offer. In general, actuaries are more assured of their value than ever before, and have embraced the job-rich market with optimism and opportunism.

The implications are far-reaching for employers, who have been navigating an unusually complex market for the past two years. In 2023, the biggest threat to employers’ talent strategy will not be failing to hire on time or to hire enough staff, but failing to retain their current workforce.

To remain on the front foot, employers should initiate conversations around employee rewards, career progression and skill development goals.

The impact of lower intake levels during the pandemic will be seen in 2023–24, especially for employers that predominantly recruit at the part-qualified level of three to five years. We have seen graduate recruitment increase dramatically across the market, driven by a greater degree of succession planning around key skills, predicted attrition rates and future projects.

The market will also see upward pressure on salaries – particularly external hires. In 2022, we saw permanent employees achieve an average pay increase of 16.1% by changing employer.

One person who has seen the shift from an employer’s perspective is Jay Stewart,

pricing and underwriting director at AA Insurance, who notes that market changes are forcing employers to engage with talent in a more agile way. “Employers used to see several strong candidates in a multistage interview process,” he says. “They now need to be fleet of foot to respond to the best candidates before they lose out to their competitors.”

The implications for employees, on the other hand, are overwhelmingly positive. They’ll have a better choice of roles, a better choice of employers, better remuneration, better flexibility, better interview processes and a better negotiating position with both new and current employers.

Those who are on the fence about changing jobs should be aware of the pitfalls. The market is busy and fast paced, and if you are not fully committed to your job search it may be overwhelming. Before investing time and energy into an external recruitment process, it is first advisable to talk with your current employer to resolve any concerns –rather than doing this when sitting on three or four offers from other employers.

Contractors have also benefited from an increase in employee power, although not on the scale of their permanent counterparts – the competition to secure a contract role is higher and, due to their project-led nature, roles often come in peaks and troughs. It is worth noting, however, that day rates have climbed steadily during the past few years, post-IR35.

The advice I would give to employees considering making a move in 2023 is: make the most of these unusual dynamics while you can, and set out on your search with clear objectives.

My top tips for employers recruiting in 2023 are: speed up and simplify your recruitment process, think of alternate ways to fill roles, and remember that candidates are interviewing you as well.

Employers need to be fleet of foot to respond to the best candidates before they lose out

Inflation dominated headlines around the world in 2022. The magnitude of its increase caught many by surprise and the double-digit inflation rate, largely driven by energy and food costs, has brought back memories of the 1970s for many. The latest reports suggest that price pressure is easing, with inflation in Europe expected to fall to 6.3% in 2023 as current drivers fade and monetary policies kick in. Nevertheless, the consensus is that inflationary pressure is here to stay, with headline inflation expected to remain above the European Central Bank’s target of 2% until 2025, according to Issue 8 of the Bank’s Economic Bulletin (EB8) in 2022.

Due to rising interest rates (caused by central banks’ restrictive monetary policies), the Eurozone’s economic activity is also cooling. The second half of 2022 saw GDP slow down compared to the first six months of the year, and that trend is expected to continue at least during the initial part of 2023. Projections for the Eurozone have been revised downwards and set real GDP growth at 0.5% in 2023 according to EB8, with a mild contraction at the beginning of the year and a rebound into positive territory expected from mid-2023.

Inflation is generally seen as a concern for non-life insurers due to the rising cost of claims, but the risks to life insurers should not be underestimated. In fact, the combination of high inflation, rising interest rates and an economic slowdown can negatively impact customer behaviour through the erosion of purchasing power, which drives people to partially lapse or cancel their policies. Those same factors can also make new business acquisition difficult, as might the public’s decreasing perception and awareness of life risk as the pandemic starts to fade from view.

In short, life insurers could be affected in their profit and loss by a dual impact: lapse-driven reduced value of the in-force portfolio, and lower sales volumes.

It’s no surprise that the economy and interest rates are now among the top five challenges for European insurers, according to NMG Consulting’s L&H Reinsurance Study Continental Europe 2022 Of particular concern, it says, are inflation’s impact on consumer purchasing power and the effect of interest rate increases on asset values and capital management. Meanwhile, the cost of living is

number one in the top 10 global risks (ranked by severity over a two-year period) according to the World Economic Forum’s Global Risk Report for 2023.

Faced with this macroeconomic and risk environment, one toolkit that can help life insurers from the bottom up is customer experience and engagement (Cx&E). Investing in Cx&E knowledge and capability can help insurers to retain policyholders, enhance their persistency and optimise sales volumes and quality.

Investment in the customer journey is showing results, but the customer experience is far from reaching its full potential. Enhancing Cx&E requires a multidisciplinary, cross-functional approach that takes in business processes, communication, data and technology. In my April 2021 article for The Actuary (bit.ly/Lets_stick_together), I elaborated on the first three components. Along with the fourth component – technology – these Cx&E aspects take on increased relevance in a high-inflation environment.

Adapting business processes to new circumstances is key to providing an optimal customer experience throughout a policy’s lifecycle. Insurers can make it easy, quick and intuitive for customers to reinstate missed premium payments, and amend products to reduce potential lapses due to affordability issues. Such amendments might include a reduction in the sum assured and/or scope of cover, or a premium holiday. In addition, incoming requests for policy cancellations could be diverted towards more retention-friendly channels.

Turning to the sales slowdown, an optimal re-engagement journey for lost leads and ‘not take-up’ customers can drive the ‘not take-up’ rate down by double digits and benefit new business volume. This can be achieved by:

1 Understanding the reasons: before you can effectively engage with lost leads and those who have not taken up the policy, it’s best practice to investigate and understand why they did not enroll. This can be done through surveys, focus groups, drop-out analysis and so on.

When it comes to sustaining your products’ performance in a ‘polycrisis’, customer engagement is key. Marco Spagnuolo outlines how life insurers can weather today’s economic storm

2 Personalising outreach: (potential) clients are more likely to engage with personalised and targeted messaging. This can be done by segmenting the audience and tailoring your messaging to specific groups, using behavioural economics and data analytics.

3 Leveraging multiple channels: different people like to receive and engage with information in different ways, so use multiple channels and do so when it’s most convenient for the client. For example, scheduling and appointment booking capabilities can be leveraged for efficient interactions with agents.

4 Simplifying the enrolment process: make sure the enrolment process is as simple and straightforward as possible. This includes a frictionless journey, concise and easy-to-understand information, and a dedicated support team that answers questions according to a specific service-level agreement on quality and performance metrics. Make the subsequent onboarding process optimal to reinforce the purchase decision.

5 Following up: lost leads and those who have not taken up a policy may need extra encouragement. Following up in a timely manner can help overcome the initial hurdle or resistance.

6 Monitoring and evaluating: keep track of your engagement journey, measure the effectiveness of your strategies and adjust as needed.

Behavioural economics can help to make communications engaging and relevant for clients. In addition, communication must be regular. Policyholders often only hear from their insurer at the point of sale and then when making a claim. It’s critical to remind policyholders regularly why they have bought insurance protection – otherwise they tend to forget its benefits. This is particularly important in a tough

macroeconomic environment, with customers tending to overestimate the present cost of insurance relative to its future benefits.

When it’s call centres that are dealing with customer queries and cancellation requests, it’s important to give agents the relevant tools and techniques. Discovering the real cause of cancellations is not a trivial exercise, and affordability is one of the trickiest causes to unearth. Embedding behavioural economics in agents’ conversations and scripts improves the efficiency and efficacy of such conversations. Our experience of working with clients around the world shows that such interventions, if well designed and implemented, significantly increase call centre performance, in terms of save or conversion rates, in a matter of weeks.

By analysing data on customer behaviour, preferences and satisfaction, life insurers can identify where they can improve the customer journey, personalise interactions and increase loyalty. Data analytics can also track the effectiveness of customer engagement initiatives and adjust them as needed. It allows insurers to identify which products, features and services are most in demand and adjust accordingly.

One example of how data analytics can be used is in upselling and cross-selling, which can increase revenue and maintain profitability. Counterintuitively, a high-inflation environment can be a good opportunity for this – in fact, high inflation calls for upselling to ensure clients continue to benefit from adequate protection. As life benefits are usually set at the point of sale, higher inflation means lower real-terms benefits are paid out (except to those with inflationlinked policies). Data analytics can identify customer segments that are most likely to be interested in upselling or cross-selling initiatives, and track the effectiveness of these initiatives.

New technologies facilitate more effective engagement with customers. With expense management set to remain on the agenda for the foreseeable future, technology can also make operations more cost-efficient and resilient to future change. This is the case for ‘conversation intelligence’ (CI), which leverages artificial intelligence and machine learning for speech and text analytics to provide actionable insights from spoken or written conversations. It improves the customer experience by enabling richer conversations to be had with customers, stakeholders and partners.

The adoption of insurance-relevant CI technology can provide automated analytics and dashboards (visualising, for example, agent performance and interaction statistics) and customised scorecards, as well as agent-assist technology and agent-coaching modules. Imagine a technology that enables:

Improved customer service, through monitoring the quality of customer interactions and identifying areas for improvement. Moreover, CI analyses customer interactions and provide agents with real-time insights such as sentiment analysis and key topic identification, which helps them to understand customer needs better and respond more effectively.

Increased efficiency, through automatic transcription and analysis of every call centre conversation, removing the need for manual transcription, random selection and sample listening from supervisors. This saves time and resources.

Higher agent performance, through real-time metrics (such as call duration, sentiment, talk time versus listen time) and feedback that help agents identify areas for improvement and become more effective.