Back-to-School Tips: Connecting with Families

By Tawanna Carver, associate publisher

As summer vacation winds down and the scent of sharpened pencils fills the air, it’s the perfect moment to explore the exciting realm of back-to-school marketing. Just like kids preparing for a new school year, families are often on the hunt for a new place to call home. As real estate agents, we’re constantly adapting to the ever-changing needs of our clients. The backto-school season presents a unique opportunity to connect with families in search of their dream homes. With the anticipation of a new school year in the air, here are some insightful back-toschool marketing ideas and valuable tips to help fellow real estate agents effectively engage with families during this pivotal time.

Leverage the Appeal of School Proximity

Families often prioritize the proximity of

quality schools when house hunting. To resonate with these families, arm yourself with knowledge about the schools in your market. Familiarize yourself with their academic strengths, extracurricular activities, and educational philosophies. As you showcase homes, emphasize the convenience of living near exceptional schools. Highlight how this proximity can enhance their children’s educational journey while simplifying their daily routines.

Curate Listings with Family Focus

Tailor your listings to cater to the unique needs of families. Consider properties that feature spacious backyards for play, dedicated study areas for homework, and communal spaces that encourage family bonding. By curating listings that resonate with family-oriented needs, you position yourself as an agent who understands and caters to the aspirations of modern families.

Elevate Virtual Tours for Families

Incorporate technology to offer families a comprehensive view of potential homes. Virtual tours provide a dynamic way to immerse families in the property, showcasing its features and layout. Take this a step further

by crafting virtual tours that highlight homes in close proximity to schools. This personalized touch allows families to envision their daily routines and the convenience of their new location.

Collaborate with Local Schools

Strengthen your community ties by collaborating with local schools. Participate in school events like open houses, fundraisers, and parent-teacher conferences. Set up information booths to showcase your expertise in family-oriented housing. Engage with parents and educators to build rapport and establish yourself as a valuable resource within the community.

Ease the Moving Transition

Moving during the school year can be overwhelming for families. Position yourself as an expert who can ease their transition by providing valuable moving resources. Offer guidance on changing schools, adapting to a new environment, and making the move a seamless experience for parents and children alike.

Designate Study-Friendly Space

Back-to-School: continues on page 10

Stanberry REALTORS applauds JOHN ROSSHIRT on his well-deserved appointment as the 2024 Chair of the National Association of REALTORS Sustainability Advisory Group.

Stanberry REALTORS applauds JOHN ROSSHIRT on his well-deserved appointment as the 2024 Chair of the National Association of REALTORS Sustainability Advisory Group.

Presorted Standard U.S.. Postage PAID Austin, Texas Paid Permit #715 A FAMILY-0WNED PUBLICATION SERVING THE AUSTIN METRO AREA AND SURROUNDING CITIES REALTYLINE.US VOLUME 28, ISSUE 4 | AUGUST 2023

in the RE NEWS (interactive LINKS)

Austin Board of REALTORS: This week’s episode of Driving It Home is LIVE! Watch now.

Champions School of Real Estate: Learn real estate secrets in “Master Your Real Estate Game in 90 Minutes” with The Trey Stone. Discover insights in this intensive course from Aug 16 - Nov 15, 2023. Enroll for real estate success! Sign up here.

WCREALTORS: Get ready, we’ve officially dubbed September TOURNAMENT MONTH at WCREALTORS!

2 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US

PUBLISHER/PRESIDENT DOREN CARVER

doren@myrealtyline.com

ASSOCIATE PUBLISHER TAWANNA CARVER

tawanna@myrealtyline.com

HOW TO REACH US

Editorial Submissions

To submit a news release or editorial inquiry email tawanna@myrealtyline.com

Print & Online Advertising

Send request to tawanna@ myrealtyline.com or reach Doren at (512) 514-3141

Postmaster

EDITORIAL ASSISTANT CAROLINE CARVER caroline@myrealtyline.com

Founded in 1995, RealtyLine is a trade publication for real estate professionals. As a non-subscription publication, it is distributed by the US Postal Service to over 18k+ members of the Austin Board of REALTORS® (ABoR), over 1,800+ members of the Williamson County Association of REALTORS® (WCREALTORS) and the Home Builders Association of Greater Austin, as well as those involved in the real estate industry.

It is our pleasure to be a member of ABoR, WCREALTORS, HBA, and have been designated as an honorary member of the WCR Austin Chapter. We are equally proud to be a Major Investor in TREPAC (2019, 2020).

In advertising or editorial copy, RealtyLine is not responsible for viewpoints, facts, or errors expressed by non-staff writers. REALTOR® is a registered trademark. There are times when REALTOR® appears in this publication without the registered trademark symbol (®). A registered trademark should be assumed whenever the word REALTOR® appears in this publication.

SERVING

Send changes of address to RealtyLine, P.O. Box 81366, Austin, Texas 78708-1366

Social Media

facebook.com/ @myrealtyline linkedin.com/ @myrealtyline

Digital Issues Issuu.com/realtyline

instagram.com/ @myrealtyline YouTube.com/ @realtyline6267

Up-to-date Calendar of Events

Subscribe

3 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US

THE AUSTIN METRO AREA AND SURROUNDING CITIES

Home Builders Association of Greater Austin Builders for Babies: Scott Turner

Introducing Unlock MLS and Its New Mobile App!

• Stay on top of the market: Get real-time hotsheet activity and market statistics at your fingertips, empowering you to make informed decisions for your clients.

• Access agent-only details: Gain a competitive edge by accessing exclusive listing details, property history, and Realist® tax data.

• Enhance communication: Connect and collaborate with other agents, view comparables, and contact agents directly from the app. • Leverage social media: Automatically share your listings and open houses on social media platforms, amplifying your reach and engagement.

• Personalized branding: Import your contacts and invite them to use your own branded app, establishing your identity and fostering client loyalty.

• Centralize client interactions: Track client activity and communications in one place, streamlining your workflow and enhancing customer service. Unlock MLS is more than just a name change; it represents a bold leap into the future, aligning our association with the cutting-edge tools and resources you need to thrive in a dynamic and ever-changing real estate landscape. As your 2023 President, I am incredibly proud to lead an association that continually strives to elevate the real estate profession and equip its members with the tools they need to excel. Unlock MLS is just one more step in our ongoing commitment to your success. I encourage you to download the Unlock MLS app today and unlock the door to endless possibilities for your business.

Last month, I was fortunate enough to moderate ABoR’s 2023 Central Texas Housing Summit, which was a resounding success featuring insightful panels and economic updates from local and national experts. I want to express my gratitude to all who attended and contributed to this summit, and I’m eager to see how the knowledge shared at the event will continue to drive our businesses forward.

But that wasn’t all! You may have seen that we announced the rebranding of ACTRIS MLS to Unlock MLS and unveiled a new Unlock MLS mobile app that is fully integrated with Matrix. This transformative change is the result of careful consideration by your association leadership, extensive feedback, and an unwavering commitment to advancing your opportunities as real estate professionals in Central Texas.

For years, the MLS has served as the cornerstone of our business, but we believe it’s time to unlock a new era – an era of limitless possibilities for you, your clients, and the Central Texas real estate market. The redefined brand, Unlock MLS, reinforces the vital role of REALTORS® and the MLS working hand in hand to guide Central Texans in their journey to buy, sell, or rent a home.

ABoR’s Board of Directors has listened to your survey responses, engaged in meaningful focus group discussions, and diligently considered your feedback, and with the launch of Unlock MLS, you can expect a wealth of client-facing resources that will magnify your value as an agent. We firmly believe that the MLS unlocks opportunity, but it’s the dedication and expertise of our REALTORS® that bring that opportunity home for each and every client. The centerpiece of Unlock MLS is our groundbreaking mobile app, which sets new standards in user experience and functionality. Designed with your needs in mind, this advanced app seamlessly integrates Matrix and Realist directly from the MLS, giving you a powerful toolkit to manage your business on the go.

With Unlock MLS, you can:

• Quickly search properties: Access comprehensive property information using varioussearch criteria such as address, map location, and more.

KW Leadership Introduction and Celebration: Melanie Kenneman, Mike Ray, Wendi Harrelson and Michelle Bippus all of Keller Williams Realty

and

4 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US

RECOA Membership Drive: Kim Samson of All City Real Estate

Michelle Pflueger of Gordon Realty

ASHLEY JACKSON 2023 PRESIDENT

Austin Board of REALTORS

5 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US

Prioritizing Safety: A Guide for REALTORS® during REALTOR® Safety Month

With the shift in the market that has taken place over the past 14 months, REALTORS® find themselves showing more properties, conducting open houses, and spending more time out in the field than in the last few years. Constant vigilance is the key to staying safe. Stay aware of your surroundings, avoid distractions, and always be prepared to react to unexpected situations. If you conduct an open house, make sure that all doors are unlocked and that you are familiar with the layout of the house before opening the doors. The best practice would be to partner with a colleague or assistant so that you are not alone on the property. Mortgage Loan Officers love to partner with REALTORS® during open houses, and it’s a great way to get the buying process for a potential client in motion.

Keeping a personal safety kit in your vehicle that includes water, a flashlight, a personal alarm, pepper spray, and other essentials will help you respond effectively in challenging circumstances. Enrolling in a local self-defense class will help equip you with the skills and confidence needed to handle potentially dangerous situations.

In our industry, safety should be one of our top priorities. Creating a safety protocol is not as daunting as it seems. By taking steps to create healthy habits, you may not only be saving your life but those around you as well. The real value in real estate is you. Stay vigilant, trust your instincts, and prioritize your security, making each transaction a safe and successful one. Not only in the month of September but every time you conduct your business.

JENNIFER TUCKER-NEELY 2023 PRESIDENT

Next month is REALTOR® Safety Month, the time of year where we slow down to look at prioritizing our safety protocols, tools, and habits to ensure that we are practicing in the safest manner possible. Working in our industry involves meeting complete strangers, showing vacant properties, and navigating various communities. This not only makes our profession exciting, but it also poses potential safety risks.

According to the 2022 REALTOR® Safety Survey, last year over 45,000 REALTORS® were victims of a crime while performing their duties, and over 300,000 REALTORS® felt fear for their safety while on the job. Upon further analysis, it was found that an alarming 400,000 REALTORS® admitted to not having safety protocols in place to protect themselves.

Creating an entire safety protocol may seem like a daunting task, but it is easier than you think. Working to create habits that prioritize your well-being is the first step in being the safety-first REALTOR® that you are meant to be.

Pre-screening potential clients is an essential step to gaining a baseline of who you are conducting business with. It is good practice to require your potential clients to complete a registration form and provide a valid ID. With the uptick in seller/buyer impersonation fraud, always insist on conducting business in person for the first meeting. Always meet your client in a neutral public location before taking them to view properties.

Your safety should always be your top priority. Make sure that you are listening to your inner voice, and don’t dismiss any red flags when conducting business. If something feels off or makes you uncomfortable, don’t ignore it. It’s okay to excuse yourself from a situation or reach out to a trusted friend with your location before proceeding. Technology is an invaluable tool in REALTOR® safety, as there are many apps that allow you to share your whereabouts with others during meetings or showings.

6 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US

Brohn Homes San Marcos Happy Hour: includes (far back) Doren Carver owner/publisher, of RealtyLine along with local area agents.

Williamson

AYREP Working with Investors: Jessica Lopez and Erin Morrison of Twelve Rivers Realty

County Association of REALTORS

7 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US CELEBRATING 40 YEARS OF EDUCATION EXCELLENCE CALL A CAREER COUNSELOR TO ENROLL (512) 244-3545 AUSTIN CAMPUS 13801 RANCH ROAD 620 N AUSTIN, TX 78717 Open to the public. TREC provider #0005. Courses: Essential Topics: 3-hour Contract Review 44460; Legal I 42039; Legal II 42040; Emotional Intelligence in RE 46133; RMLO for Agents: 426; Know Your Landlord & Tenant Rights 45377. 18-HOUR CE PROGRAM

Learn practical applications of emotional intelligence, explore the finer points of landlord/tenant law, and complete the rest of your TREC renewal requirements. SEPT 7–8 & OCT 5–6 THU: 8:30 AM – 7:30 PM FRI: 8:30 AM – 5:30 PM SEPT 11–14 MON TO THU: 6 PM – 9:45 PM NEW 30-HOUR SAE COURSE A Realtors Resource Guide on Mortgage Financing This course examines the world of residential mortgage loan origination through the lens of a real estate agent. Learn about the mortgage process, the SAFE Act, credit reports, financial math, ethics and consumer protection, and more. Central Texas Housing Summit: ABoR President Ashley Jackson, Mark Sprague of Independence Title, Dr. Selma Hepp and Dr. Claire Losey of ABoR ABoR Policy Forum: Taylor Smith of ABoR, Bill Morris of RE/MAX Capital City, Julia Parenteau and Seth Jurergens Brohn Homes TopAgent Happy Hour: Dave Kapur of All City Real Estate and Terry Swets of Berkshire Hathaway Texas Realty SouthStar

Group

Modern Approaches to Real Estate Business

Bank - Leander Touch-a-Truck Breakfast: New Hope Realty

and Shirley Sears of SouthStar Bank

KW

Navigating Interest Rates and Their Impact on the Real Estate Market

KACEY TAYLOR 2023 PRESIDENT

Buyers and sellers in the real estate market are influenced by various economic and financial factors. High interest rates impact mortgage affordability, affecting home buying demand. When rates rise, borrowing costs increase, potentially making mortgages less affordable. Consequently, some potential buyers may opt to rent, reducing home demand.

Sellers may face challenges in a market with hesitant buyers due to high interest rates. This situation could lead to offers below asking prices or necessitate price reductions to attract potential buyers in a slower market.

Predicting future interest rates is a complex process, involving considerations by central banks, governments, and economic indicators like inflation, unemployment, and economic growth. Additionally, global events and geopolitical tensions play a role. Government policies, housing supply and demand, along with broader economic trends, further shape the real estate market.

For the most accurate and current information on the real estate market, interest rates, and future predictions, consulting financial and real estate experts or trusted economic analysis sources is recommended.

Please join us for our next event from 2 to 4 p.m. on August 24. This event is to be held at UFCU at 8303 N. Mopac Expressway, Building C, Suite 150, with a first-floor parking garage available.

We are excited to welcome Jack Stanley as our speaker, focusing on the topic of “Resilience.” This interactive presentation aims to help you manage stress, overcome limiting beliefs, and make confident decisions.

Attendance is free for Women’s Council of REALTORS members and $10 for non-members.

Our upcoming REALTOR safety event is scheduled for 2 to 5 p.m. on Sept. 21 at the Austin Board of REALTORS Headquarters. We’re proud to collaborate with Asian Real Estate Association of America - Austin Chapter (AREAA) for this event and have exciting plans to announce in the near future.

The significance of REALTOR safety cannot be overstated within our industry, and we eagerly anticipate the opportunity to learn together.

8 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US

Women's Council of REALTORS®

AYREP Working with Investors Class: AYREP President Ian Grimes, Dustin Weiss, Matthew Robins, Mark Kendrick, Lisa DeRoche and Phillip Chang

Leadership Introduction and Celebration: Sherri Williams, Kevin White and Jordan White, all of Keller Williams Realty

Brohn Homes TopAgent Happy Hour: Candyss Bryant of Realty Texas, Sarah Thompson of CB&A REALTORS, Kirk Moore, Janene Salomon and Oksana West, all of Realty Texas

ABoR Policy Forum: John Rosshirt of Stanberry REALTORS and Becky DeButts of LPT Realty

Brohn Homes TopAgent Happy Hour: The Coldwell Banker Northwest Austin Team

bilingual

E S C R O W T E A M

Veronica and Linda are both bilingual and proud to represent the growing Hispanic community in our industry. They will deliver an informative and accurate translation of the closing documents and ensure a smooth transaction.

VERONICA HARRISON

SVP/Escrow Manager

Bilingual Escrow Officer

Veronica Harrison@austintitle com

512-823-2814 Direct / 512-247-8739 Mobile

Bilingual Escrow Assistant

Linda Rivera@austintitle com

512-823-2815 Direct

TEAM.HARRISON@AUSTINTITLE.COM

T e a m H a r r i s o n o f f e r s o v e r 2 5 y e a r s e x p e r i e n c e a s w e l l a s p e r s o n a l i z e d m e e t i n g s w i t h S p a n i s h s p e a k i n g b u y e r s / s e l l e r s , A u s t i n T i t l e A g e n t O n e S p a n i s h c l o s i n g c o s t a p p , t r a n s l a t e d m a t e r i a l s d e t a i l i n g t h e c l o s i n g p r o c e s s , S p a n i s h e m a i l c o r r e s p o n d e n c e , c l a s s e s a n d n e t w o r k i n g e v e n t s f o r R e a l t o r s , S p a n i s h s p o k e n a t t h e c l o s i n g t a b l e a n d m o b i l e c l o s i n g s a t a l l A u s t i n T i t l e l o c a t i o n s .

Reach Out to Veronica if you would like an invitation to her recently established Hispanic Networking Group

C E D A R P A R K O F F I C E - 1 3 5 3 0 R O N A L D R E A G A N B L V D , S T E 1 0 1 , C E D A R P A R K , T X 7 8 6 1 3

With remote learning becoming a norm, families value homes with dedicated study areas. Identify properties with quiet corners, spare rooms, or transformed spaces that can serve as functional study nooks. Highlight these features in your marketing materials, underscoring their potential to support a conducive learning environment.

Extend Support to Educators

Reach out to educators who are searching for new homes. Offer exclusive benefits or incentives as a token of appreciation for their contributions to the community and education. By connecting with educators, you showcase your commitment to supporting those who shape young minds.

Engaging Back-to-School Giveaways

Capture the excitement of the back-to-school season by organizing engaging giveaways. Initiate contests that offer prizes such as school supplies, backpacks, or tech gadgets. This interactive approach not only fosters community engagement but also showcases your dedication to enhancing the lives of families.

Foster Informed Decision-Making

Guide families toward informed decisions by providing comprehensive information about neighborhoods, schools, and local amenities. Encourage them to explore potential homes at their own pace, inviting questions and discussions to ensure they find a property that aligns with their goals.

Embrace the REALTOR’S Role as an Ally

Above all, remember that your role as a real estate agent extends beyond transactions. You’re a guide, an advocate, and an ally in families’ journey to finding a home where they can thrive. Approach your interactions with empathy and authenticity, forging connections that transcend the business aspect and focus on the well-being of the families you serve.

The back-to-school season presents a window of opportunity for real estate agents to connect with families seeking a fresh start. By aligning your strategies with the needs and aspirations of families during this significant time, you position yourself as a REALTOR who understands the intricacies of modern family dynamics. Approach your marketing efforts with enthusiasm, authenticity, and a genuine desire to facilitate families in discovering their perfect home. As you navigate the back-to-school landscape, remember that your impact reaches far

THE RELIABLE & TRUST DRIVEN RESOURCE FOR YOU AND YOUR INVESTORS

With over 37 years in property managment, our family business is only focused on managing and leasing properties. Our wealth of knowledge and experience provide investors with the tools to be successful.

MICHAEL FRANCIS BROKER, INSTRUCTOR, MPM®, RMP®, TRLS, TRPM TREC #460192

MICHAEL FRANCIS BROKER, INSTRUCTOR, MPM®, RMP®, TRLS, TRPM TREC #460192

10 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US (512) 327-4451 rollingwoodmanagement.com

CLICK HERE FOR CUSTOMYOUR QUOTE!

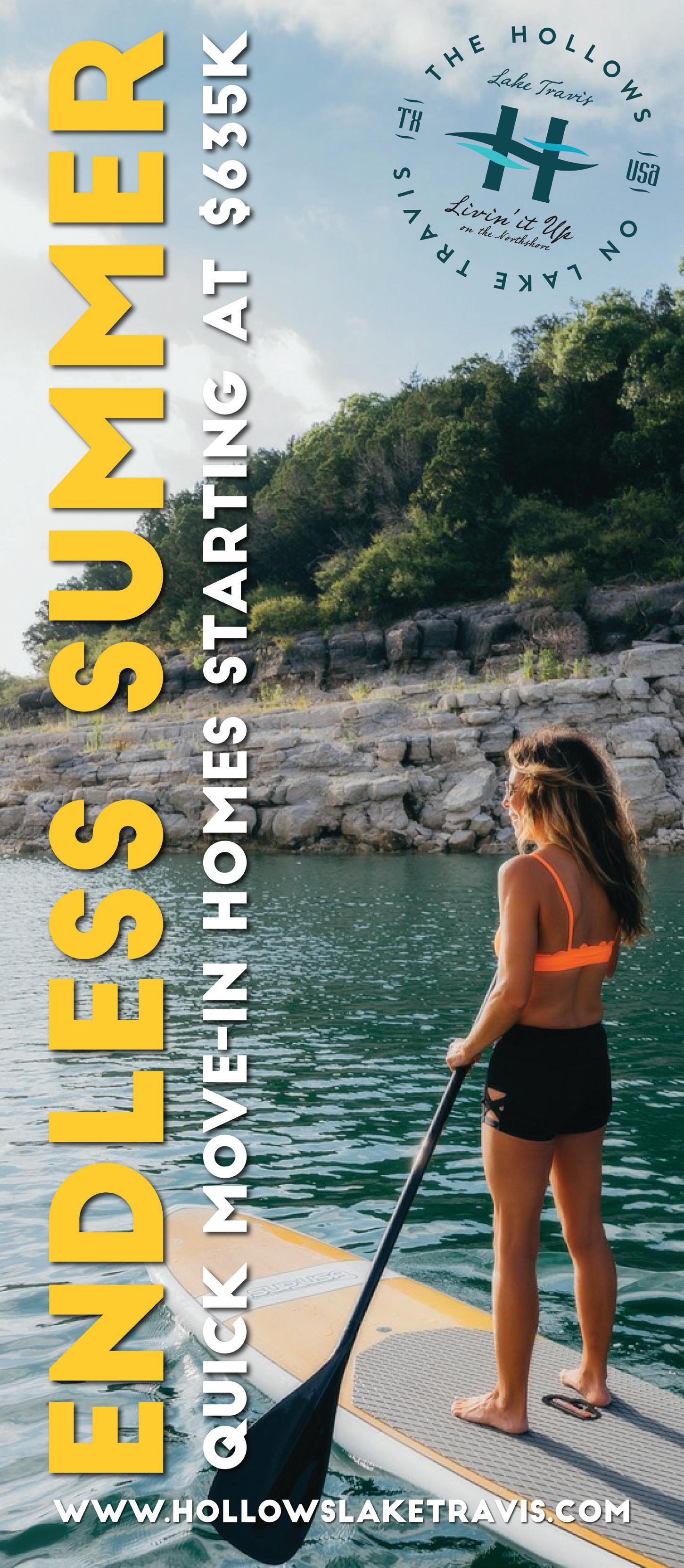

$20,000 $20,000 O N S E L E C T I N V E N T O R Y H O M E S R E A L T O R B O N U S ! $923,000 261 ROSETTA LOOP • Liberty Hill 1St | 4Bed | 4 5Bath | Study | 3Car SANTA RITA RANCH $4,500 $4,500 Offer subject to change at any time Bonus to be paid in addition to standard 3% commission $989,000 4916 DESTINATION WAY • Jonestown 1St | 4Bed | 4.5Bath | Study | Game | 3Car THE HOLLOWS ON LAKE TRAVIS See Sales Manager for details $10,000 $10,000 $939,000 200 SPENCE LANE • Liberty Hill 1St | 4Bed | 4Bath | Study | Game | 3Car NORTHGATE RANCH Back-to-School continued from front page beyond property transactions — you’re helping families find a space where they can create cherished memories and embark on new beginnings.

11 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US Models Open Daily! #EndOfSummer LACIMATX .COM AVAILABLE NOW!

12 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US See a David Weekley Homes Sales Consultant for details. Prices, plans, dimensions, features, specifications, materials, and availability of homes or communities are subject to change without notice or obligation. Illustrations are artist’s depictions only and may differ from completed improvements. Copyright © 2023 David Weekley Homes - All Rights Reserved. Austin, TX (AUS-23-003360) Homes from the mid $300s to $1 million+ in the Austin area 512-767-1757 A David Weekley Homes Sales Consultant with Real Estate Agent Mindy Fung and Vickie & Charles Taylor David Weekley Homes Pancake and Donut Pop-Up: Ginna Smith and Laura Szalay, both of Keller Williams Realty LPT Realty Take Over Texas: Stacye Black Jackson of Priority Settlement Group and Kristin Lancaster of LPT Realty ABoR Policy Forum: Bill Evans of Austin Real Pros, Brandy Wuensch of City View Realty and Emily Chenevert of ABoR, CEO

SouthStar Bank Mortgage

BY RACHEL ARTERBERRY

South Star Bank, dating back 103 years, was originally part of three rural banks owned by the Schindler family. In 2015, the three banks were combined to create the SouthStar Bank brand. Now in its third generation, this family-run business sets the standard for “Texas-style banking.”

Alexis Michael, regional executive for the Urban North region, explains, “Our culture here at SouthStar as a family-run organization is banking... Texas style. We are all about relationships. We like to know our people. We have this amazing internal culture that our president, David, really leads, and he’s just a genuine soul that feeds down all the way to the frontline staff. It’s a caring organization. It is just one of the best places I’ve ever worked. If you like coming to work every day and you have products that are helping others in creative ways, it makes it a great environment to work in.”

“What we’re known for is making common sense credit decisions,” says Ryan Noyce, SouthStar Bank’s regional executive for the Urban South region. “We’re local lenders; we’re local bankers. We understand the environment and the market and make those (credit) decisions locally. We also have all the products and services of a big bank, but we offer them with a local community bank feel. And that’s really what sets us apart.”

SouthStar Bank’s claim to fame on the lending side of the bank is being ‘everything single-family resident,’ including secondary mortgage lending. In fact, both Noyce and Michael are excited to announce two new loan products offered through its 16 full-service branches along the I-10 corridor between Houston and San Antonio.

• H.O.P.E., or Housing Opportunities are a Priority forEveryone, is a mortgage program geared toward emerging markets, including those in a low- to moderate-income census tract or a majority-minority market. This loan product provides 100% financing at a 30-year fixed rate at below-market rates with no fees.

• The ITIN program offers applicants who experience a barrier to homeownership due to their ITIN status the opportunity to purchase a home without a social security number.

SouthStar is proud to offer these loan options and others that meet the needs of a diverse population. “We all don’t want to sell vanilla ice cream cones. At SouthStar Bank, we want different flavors,” says Michael.

In addition to its common sense lending, SouthStar Bank offers flexible banking solutions, often thinking outside the box and being more creative to assist customers with all their banking and financial needs. While mortgage lending and commercial banking are integral to its success, SouthStar Bank remains a small-town personal banker at its core, serving households in the southeast Texas urban and rural markets specifically. This full-service institution “can do it all,” as Senior Vice President of Retail Banking Trey Bertelson shares. “In 2023, in retail banking, you have to have widgets. You have to offer online banking, Zelle, and mobile deposits. You must have the ability to allow customers to move and bank on the go. We have all that stuff. What separates us is that we don’t have the things people don’t necessarily want. For example, we don’t have a call center. If you want to talk to somebody at the bank, you’ll call your local branch and speak to your personal banker that you see when you go

into that location. It’s important to us to have that personal connection. We take all the things you have to have in 2023 to be relevant, but we get rid of all the stuff people don’t want. We want to be that bank with the old-school banking appeal but with the tools and services to get you there—a small-town community bank. That’s very important to SouthStar Bank and what we are. It’s a culture for us.”

As an organization, executives like Bertelson, Noyce, and Michael always keep their ears to the ground to learn about emerging markets and opportunities where they can develop and offer products and services that will benefit the community. From youth accounts to CD rates, self-directed IRAs, and 401Ks, SouthStar Bank wants to be the bank that knows how to do it all. “We’re always looking for ways to be innovative. We love to explore things and make them happen for our customers,” says Bertelson.

But being a small-town community bank means more than products and services or a friendly face. SouthStar Bank’s motto of banking Texas style also means going back into the community. Each of its 16 branches is tasked with hosting marketing events, some of which have included ice cream socials, feeding first responders, coffee with the mayor, and a Touch-a-Truck school supply drive. The Harker Heights branch, for instance, designed a movie night where they projected a film into a large field behind the branch.

And while community involvement is essential in any local area, what happens inside the branch with employees lays the foundation for Texas-style banking to be successful. SouthStar Bank’s culture is based on that same genuine care and concern that trickles down from the top of the organization and gets instilled into everything the organization does. Bertelson says, “When I hire a personal banker, a lot of times it’s somebody that’s just out of college or has never worked in a bank before. We hire people based on their attitude. We want to hire good people first, and we can teach you how to be a personal banker.” Internal promotion is also important, as employees are nurtured and encouraged to enjoy what they do. “The most rewarding thing for me is to hire someone and then promote them,” continues Bertelson.

Being a product of promotion from within during her five years with the bank, Alexis Michael shares, “We want to ensure everybody in the branch knows their why, why they’re coming into work every day, that everybody understands the difference they’re making when they walk in the door, and how their actions are contributing to the better purpose of the bank and, ultimately, to the profitability of the bank.”

SouthStar Bank’s 175 employees enjoy festivities like Fourth of July celebrations, potlucks, and themed events organized by the “fun committee.” This builds community, trust, and loyalty, fostering a positive work environment. According to Ryan Noyce, “We proudly wear SouthStar Bank on our shirts, enjoy working together, and promote positivity.”

Offering a comprehensive suite of products, SouthStar Bank aids financial growth, including flexible niche products for personalized banking. The bank’s relationship-driven approach ensures personal bankers understand clients’ needs, providing tailored solutions. Banking Texas style entails personal service, a practical approach, and adaptable options, reflecting a commitment to customers.

At SouthStar Bank, Texas-style banking means personalized service, a common-sense approach, and flexible options.

13 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US

IN CONVERSATION

14 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US David Weekley Homes Tour of The Point at Rough Hollow: April Garsson of David Weekley Homes, Wes Womack of Womack Real Estate and Jackie Van Meter of David Weekley Homes Hymeadow – Hays County, TX Morningstar – Georgetown, TX Trace – San Marcos, TX C ase tta Ranch – Kyle, TX La go Vista – Lago Vista, TX Do u ble Eagle Ranch – Cedar Creek, TX O aks a t Sa n Gabriel – Georgetown, TX Ha rvest Ridge – Elgin, TX C l e ar Creek – Round Rock, TX Cloverleaf - Austin, TX With So Many Incentives, See Available Homes Today! At Brohn, we are always looking for ways to help home shoppers and even with the current market trends, our incentives keep fixed interest rates and monthly payments surprisingly low. New quick move-in homes available throughout Greater Austin. *6% Commission only available for select quick move-in homes that are contracted after 8/ 23 and close by 8/31/23. *© 2023 CMG Financial, all rights reserved. CMG Financial is a registered trade name of CMG Mortgage Inc., NMLS #1820 in most, but not all states. CMG Mortgage, Inc. is an equal opportunity lender. Registered Mortgage Banker with the Texas Department ofSavings and Mortgage Lending.To verify our complete list of state licenses, please visit www.cmgfi.com/corporate/licensing and www.nmlsconsumeraccess.org.All loans subject to creditapproval and only eligible with CMG Financial, Brohn’slender partner. Offers onlyvalid when financing through Brohn’s lender partner,CMG Financial, and will full price offer on home. Please see a Brohn Homes Sales Consultant for complete details. Offer may not be available with all programs in all states. All figures are estimates and subject to change at any time. The information here is provided as a general guide to help you determine if a property may be viable for you. Rates, APR's & programs are illustrations subject tochange at any time. These do not constitute a 'Loan or Good Faith Estimate' for payments and closing costs. Everyone's situation is different and it's best to be pre-approved for a range of potentialprices, payments or loan programs. The flex cash amount is contingent on the price of the home and only valid on participating homes and in participating communities. Speak to a Brohn Homes Sales Consultant for details on participating homes and participating communities. If using flex cash to reduce the price of the home, the reduction cannot bring the home price below base price. Flex cash incentive only available in select communities The flex cash can only be used in one of the four ways, including reduction in purchase price (not being less than base price of home) or applying towards closing costs or long term rate locks or buying down the interest rate (specific interest rate and associated APR fluctuate on a daily basis and change due to individual situations). FHA Payment example: Stated rate may change or may not be available at time of rate lock. If you bought a $469,990 home with a down payment of 3.5%, for a loan amount of $453,540 on a 30 year loan at a fixed rate of 3.99% (4.724% APR), you would make 360 monthly payments of $2,200 not including mortgage insurance/taxes/homeowners insurance which will result in a higher payment. Example based on a home priced at $469,990 in Morningstar. APRs will change based on home price. This is a limited time incentive program that can be stopped at any time and withno prior notice. Real Estate Agent Bonus Program available only when your client closes on a home in a participating Brohn Homes community pursuant to a contract your client signs and executes on or between 1/1/23 and 12/31/23. Bonus will be dictated by order of closing: 3% upon first closing, 4% upon second closing, and 5% upon third closing and thereafter on contracts written by 12/31/23. All bonuses will be paid at closing. Payments of total commissions and bonuses will only be made to actively licensed Texas brokers. Bonus paid to Broker upon client’s successful closing and funding and is based on the original contract price as stated in the Purchase Agreement, excluding any Seller incentives, subsequent change orders, re-writes, or upgrades. Broker is responsible for all applicable taxes. Since seller reserves the right to modify or discontinue this program at any time without notice, please call the applicable sales center in advance to confirm that the program is still in place. Bonus/commission offer not valid for Purchase Agreements signed by buyer prior to publication of this advertisement. Commission cannot be used with any other special offers. May not be combinedwith any other broker bonuses or offers. Please see a Brohn Homes Sales Consultant for complete details. Clayton Properties Group, Inc. Formerly known and Qualified to do business in Texas as CMH Parks Inc. DBA Brohn Homes reserves the right to make changes to pricing, loor plans, specifications, features, dimensions, elevations, and incentives without prior notice. Plus... We're still giving the perks AND 3.99% Interest (4.724% APR)* on Select Homes for Your Buyers Partner 1st Closing 3% COMMISSON Ambassador 2nd Closing 4% COMMISSION Elite 3rd Closing 5% COMMISSION New Homes $250s - $500s + BrohnHomesAgents.com | 512-643-5400 More for You and Your Buyer 6% COMMISSION* *On homes that close by the end of August in select communities ABREP Monthly Lunch and Learn: Shreya Kolluri and Chelsea Bucklew, both of HawkinsBucklew Property Group; Jenny Newman, Blair Renner and Pam Carroll, all of Austin Title Central Texas Housing Summit: Lockie Ealy of Realty Austin and Lori Goto of Encore Real Estate RECOA Tax Strategies Class

15 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US

2023 AUSTIN REALTOR INCENTIVE SELL MORE EARN MORE PROGRAM

Congratulations on selling with Drees in 2023!

You’re now automatically enrolled in our Earn More Rewards Program! You’ll receive the standard 3% commission on your first closing.

You’ll earn even more with each subsequent sale with Drees Custom Homes.*

*On first closing, selling agent is enrolled in the Earn More rewards program and can take advantage of the 3% standard commission. On second closing, selling agent will receive 4% commission on the sale. On 3rd closing and subsequent closings, selling agent will receive 5% commission. Program begins April 1, 2023 and runs through March 31, 2024. All bonuses, including Earn More rewards, will be paid on the settlement statement at closing. Realtor must have written authorization from their Broker and a completed W-9 form to be paid by any other method. Earn More rewards applies to individual Realtor sales only, no team sales. Must be a licensed Texas Realtor. Programs subject to change or termination without notice. See Drees Market Manager for additional information on Realtor Rewards Program.

©2023 The Drees Company. All rights reserved. 24-0148-125 4/23

16 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US

RECOA Membership Drive: Capital Title’s (left) Kim Correa and (right) Aaron Lee Doren Carver co-owner/publisher of RealtyLine, Marnie Colehour of Austin Homescapes Realty

KB Home Lifestyle Headshots: Deb Vetters-Kirchner of KB Home and Edie Phillips of Elegant Estates Realty & Auctions

RECOA Membership Drive: Capital Title’s (left) Kim Correa and (right) Aaron Lee Doren Carver co-owner/publisher of RealtyLine, Marnie Colehour of Austin Homescapes Realty

17 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US

SalesAustin@mihomes.com mihomes.com/SaveByTheBell PLUS 3% of your loan amount to use with M/I Financial towards any of the following*: • Buy down your interest rate • Lock in your interest rate • Money towards closing costs Best prices of the year on all homes that can close by September 29th! *Buyer to receive up to 3% of their loan amount, to use with M/I Financial on any home that contracts between June 15th and July 31st and closes by September 29th 2023. Buyer must use M/I Financial in order to qualify. Buyer must submit loan application within 48 hours of writing the contract. Buyer must occupy the property and meet all the qualification requirements. Offer subject to change without notice. Financing is offered through M/I Financial, LLC (NMLS #50684) EXTENDED THROUGH July 31st!

David Weekley Homes Pancake and Donut Pop-up:

18 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US

SouthStar BankLeander Touch-a-Truck Breakfast: Kristen Sparkman of New Hope Realty Group and Heather Gaddes of Independence Title

WCREALTORS TREPAC Major Investor Dinner: Matt Lipina of Texas REALTORS, Julie Jones of Keller Williams Realty, Ruby Johnson of Urban to Suburban Realty, Jennifer Tucker-Neeley of Amazing Realty and Kriston Wood of Keller Williams Realty

David Weekley Homes Tour of The Point at Rough Hollow with Womack Real Estate

Stewart Title First Time Homebuyer Class

19 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US Tuesday, August 29 10:00 - 11:20am Zoom Videoconference Connect with your TNT Sales Executive for registration SpeakeR: David Tandy CEO, TNT www.TexasNationalTitle.com

20 AUGUST 20, 2023 - SEPTEMBER 19, 2023 | REALTYLINE.US

Stanberry REALTORS applauds JOHN ROSSHIRT on his well-deserved appointment as the 2024 Chair of the National Association of REALTORS Sustainability Advisory Group.

Stanberry REALTORS applauds JOHN ROSSHIRT on his well-deserved appointment as the 2024 Chair of the National Association of REALTORS Sustainability Advisory Group.

MICHAEL FRANCIS BROKER, INSTRUCTOR, MPM®, RMP®, TRLS, TRPM TREC #460192

MICHAEL FRANCIS BROKER, INSTRUCTOR, MPM®, RMP®, TRLS, TRPM TREC #460192