Dean Jones President & CEO

Realogics Sotheby's International Realty

Taylor Robinson Publisher | Bellevue

City Lifestyle Magazine

City Lifestyle Magazine 12/24

“We have to look to other cities, (areas) such as South of Market in San Francisco, or Yaletown in Vancouver B.C. — there is precedent for this much development to emerge in this amount of time.”

MYTH & FACTS OF CUSTOM

HOMEBUILDING

03 01 02 ECONOMISTS DEBATE TRUMPONOMICS , CONSUMERISM & TRAJECTORY OF FUNDAMENTALS

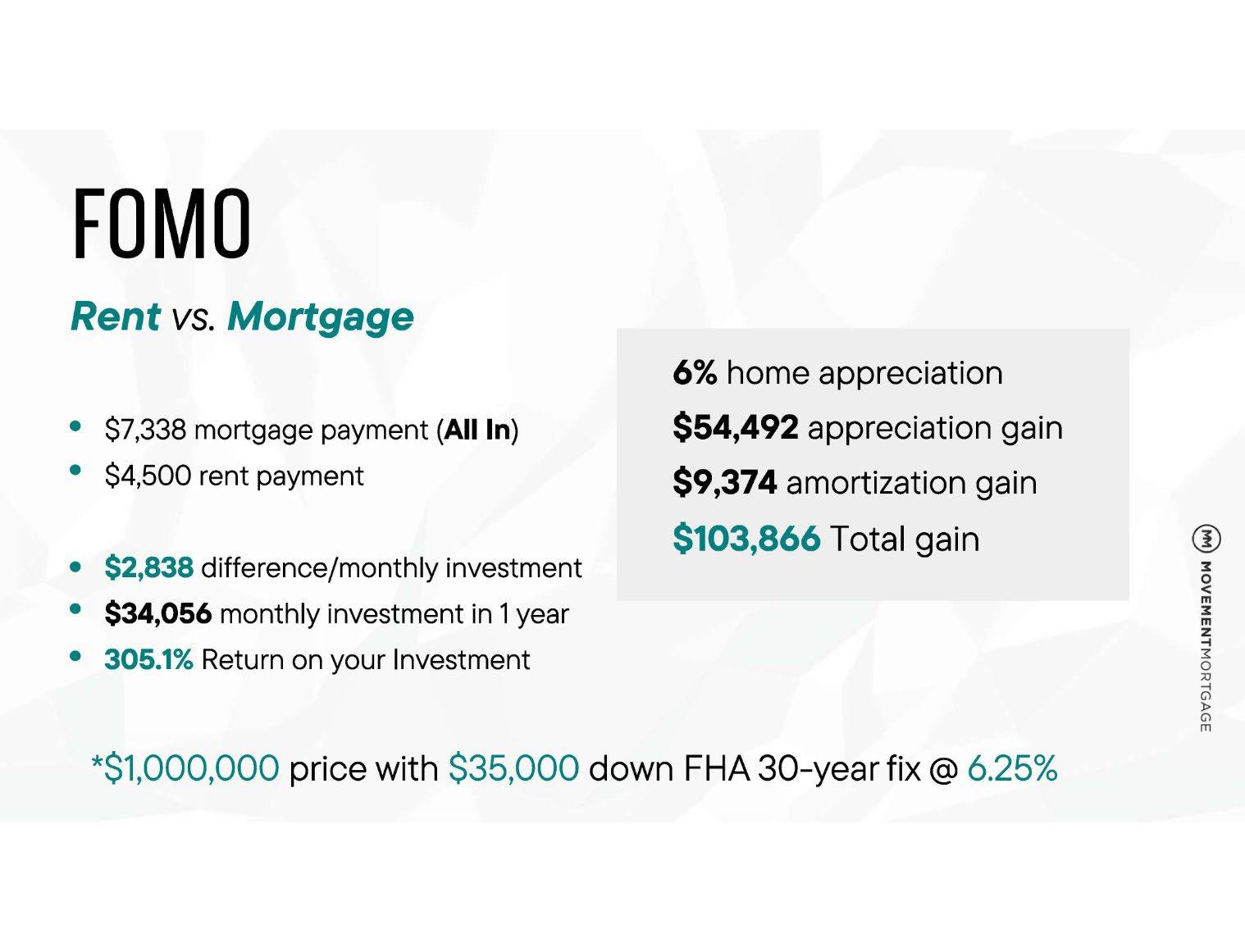

FOMI VS FOMO & FIRST - TIME BUYER DESIRES

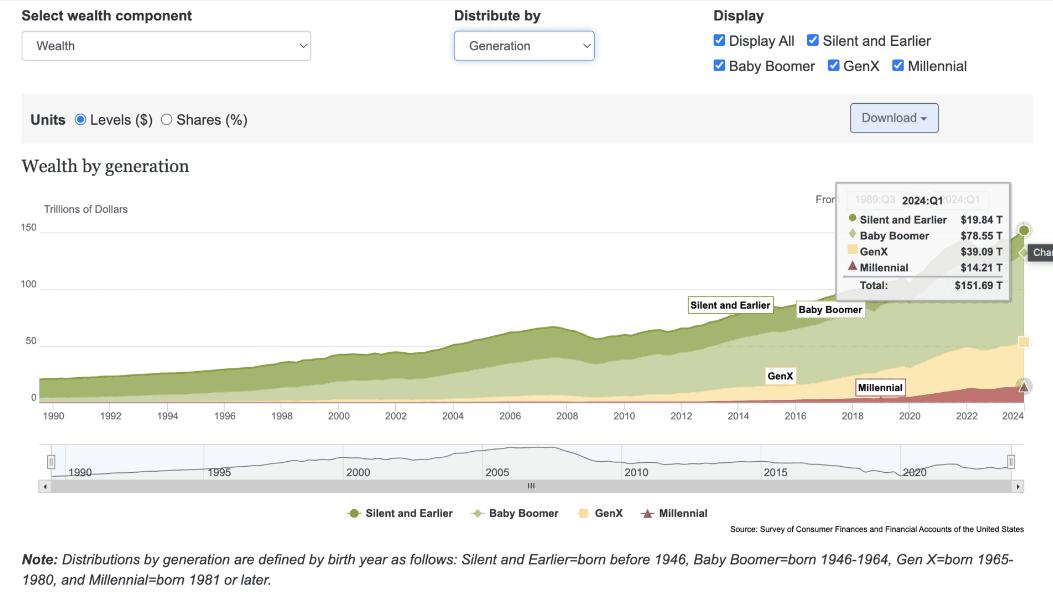

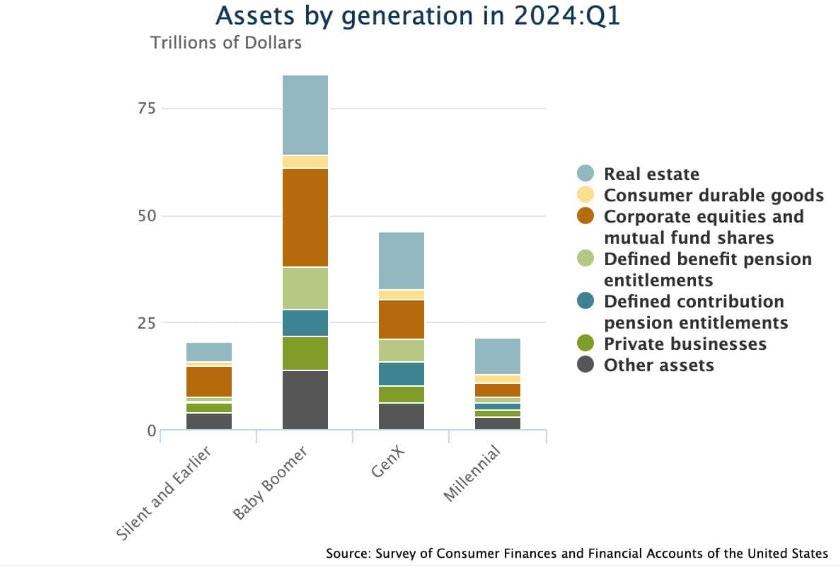

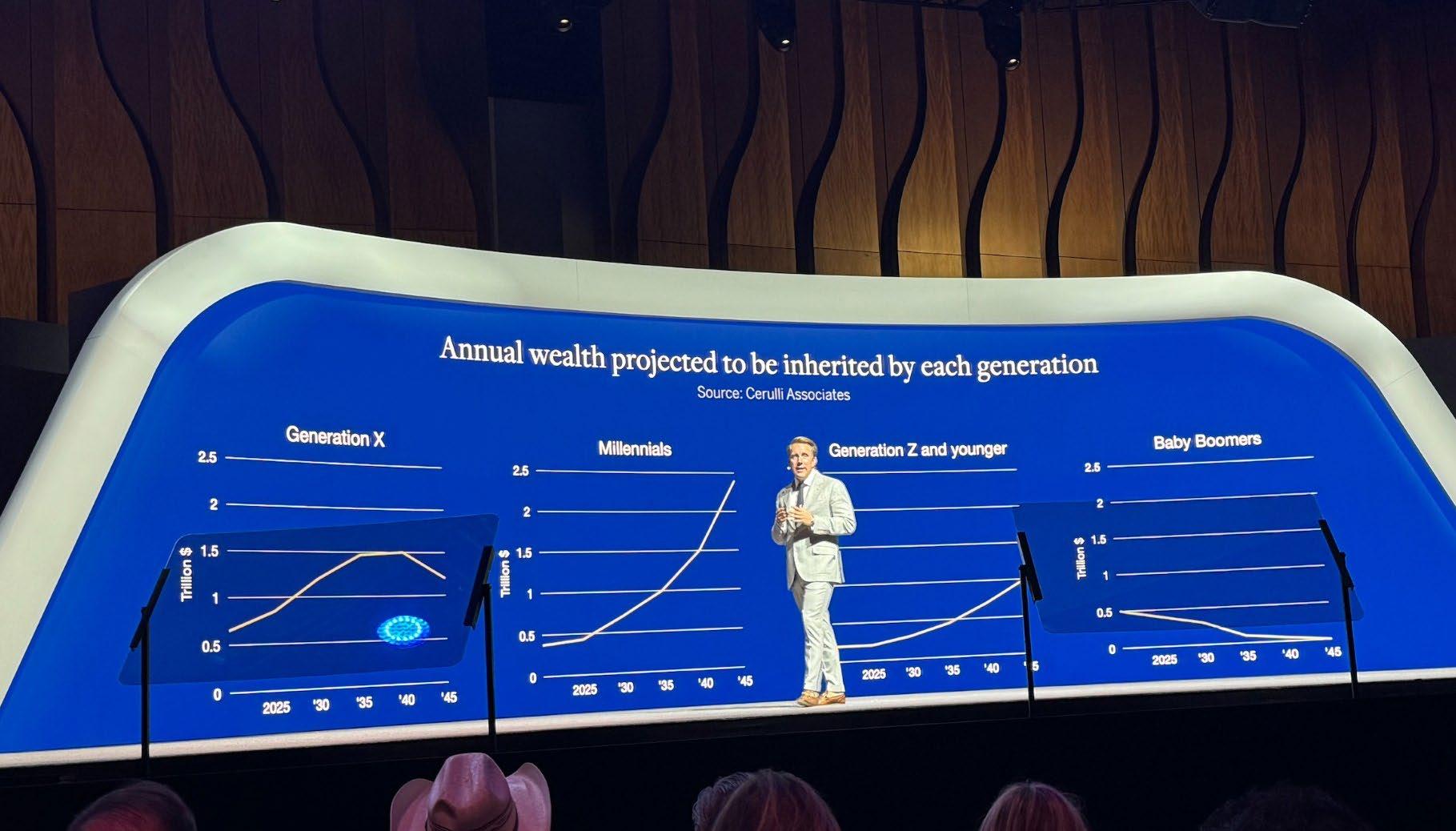

HB1110 & THE FUTURE OF HOUSING IN WASHINGTON STATE 06 04 Agenda 05 07 08 SILVER TSUNAMI & THE $90 MILLION GREAT WEALTH TRANSFER

ARTIFICIAL INTELLIGENCE: IMPACT ON REGIONAL ECONOMY & HOUSING

CITYSCAPE 2.0 & URBAN RENAISSANCE

ADJOURNMENT

Trumponomics, Consumerism & Trajectory of Fundamentals

Matthew Gardner

Principal, Chief Economist

Gardner Economics

Jonathan Woloshin

CFA, UBS Wealth Management

Chief Investment Office

UBS Financial Services

1. If implemented as laid out on “liberation day,” the risk of retaliatory tariffs, increased inflation, and a weaker US dollar increase.

2. Port-oriented and trade dependent markets could be adversely impacted.

3. Appeals court and SCOTUS actions essential.

4. What other tariff option does the administration have in the event SCOTUS rules against the administration?

1. Current bill likely to be revised in the Senate given significant deficit expansion. Reconciliation actions key.

2. SALT, Medicare & Medicaid key sticking points.

3. Will Trump raise taxes on the wealthy?

4. Political calculus of mid-terms as it pertains to passage. Deficit/debt vs political survival.

1. Federal Reserve likely to be data dependent regarding direction of future rate cuts.

2. Direction of 10-year yields highly dependent on deficit impacts of tax bill/tariffs/other policies.

3. Interest rate volatility likely to keep 30-year fixed rate mortgage/10-year Treasury spread wider than history.

4. What are the potential impacts of taking FNM/FRE out of conservatorship on mortgage rates?

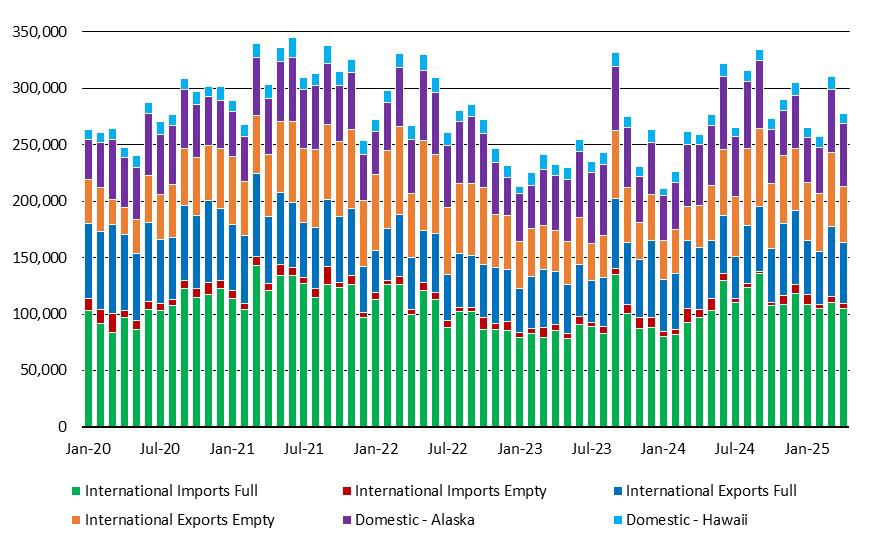

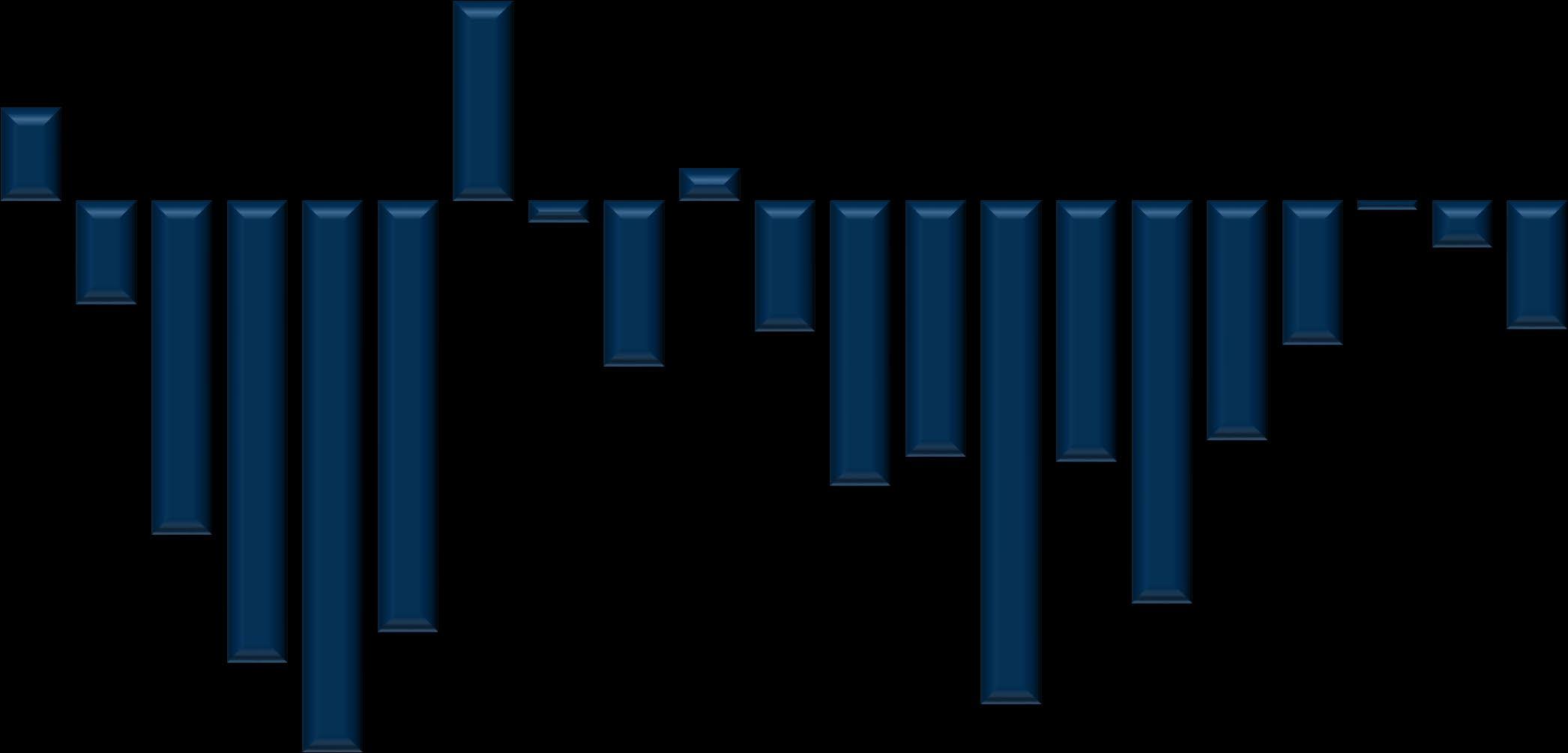

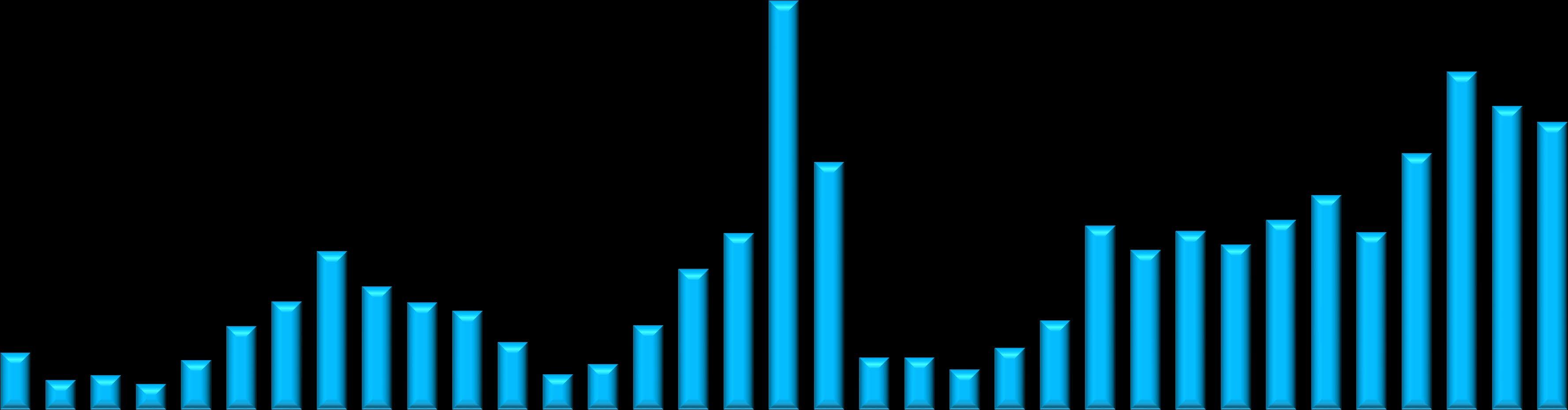

2020 to April 2025

Source: Northwest Seaport Alliance, UBS

• Beyond lumber, the estimated impact becomes significantly more challenging, as the tariff goal posts keep moving. When the "reciprocal" tariffs were originally announced, the NAHB estimated tariffs would increase the cost of the average home by more than $9,000/home.

• The NAHB estimates that the repair and remodel (R&R) market accounts for 35-40% of lumber demand while single-family home construction accounts for an additional 35%.

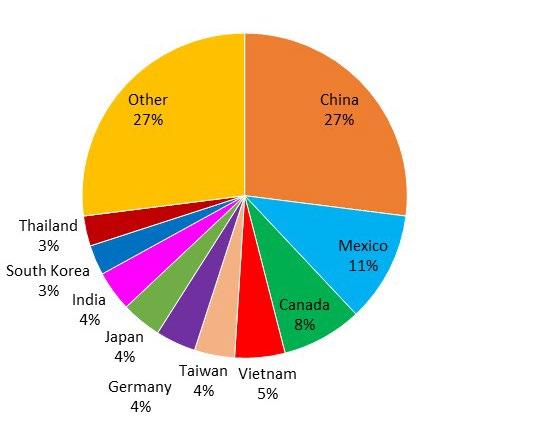

• The NAHB provided some additional information regarding construction-oriented imports, including:

54% of household appliances are imported from China.

70%-plus of Lime and Gypsum products are imported from Mexico.

More than USD 500mn of gas ranges are imported from Mexico.

Approximately USD 3bn in light fixtures, AC units thermostats, and ceramic bathtubs are imported from Mexico.

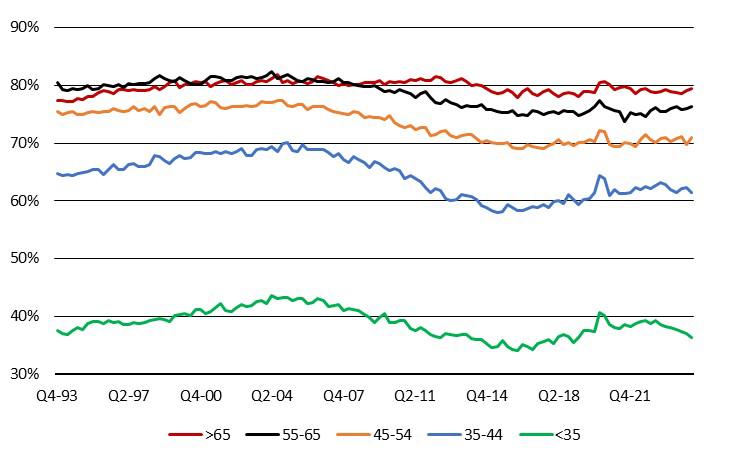

Is Room for Rates to Drop Spreads are higher due to cost of capital & to offset pre-payment risk

77.8% of mortgaged homeowners have a rate at or below 5%

Periods of turbulence will continue, but rates should trend modestly lower. (That said, don’t hold your breath for a return of 3% mortgages!)

Co.:

2 properties (467K SF)

$54.5M balance

Co.:

37 properties (5.64M SF)

$1.25B balance

Co.:

3 properties (240K SF)

$24.8M balance

19 buildings are already in special servicing – all of which are in King County

A) May excludes certain income based surcharges,

B) Local tax rates could be higher or lower than average state rate.

C) Based on 2024 data.

D) Certain assets including real estate are exempt.

(2023-2024)

1950: 3 people per household

2010: 2.3 people per household

2040 2 people per household

More Houses Needed for the Same # of People 37%

More Houses Needed for the Same # of People

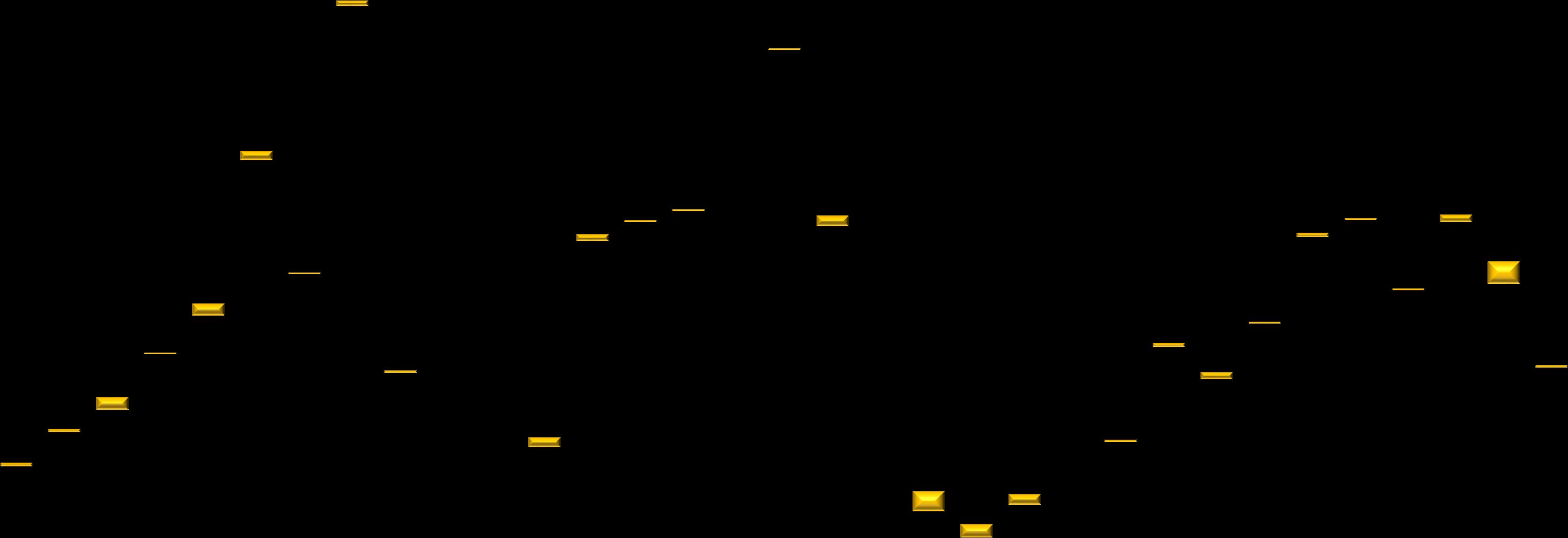

$1,200,000

$1,000,000

$400,000

$0 $200,000

$455,000

$960,000

$340,000

$167,000

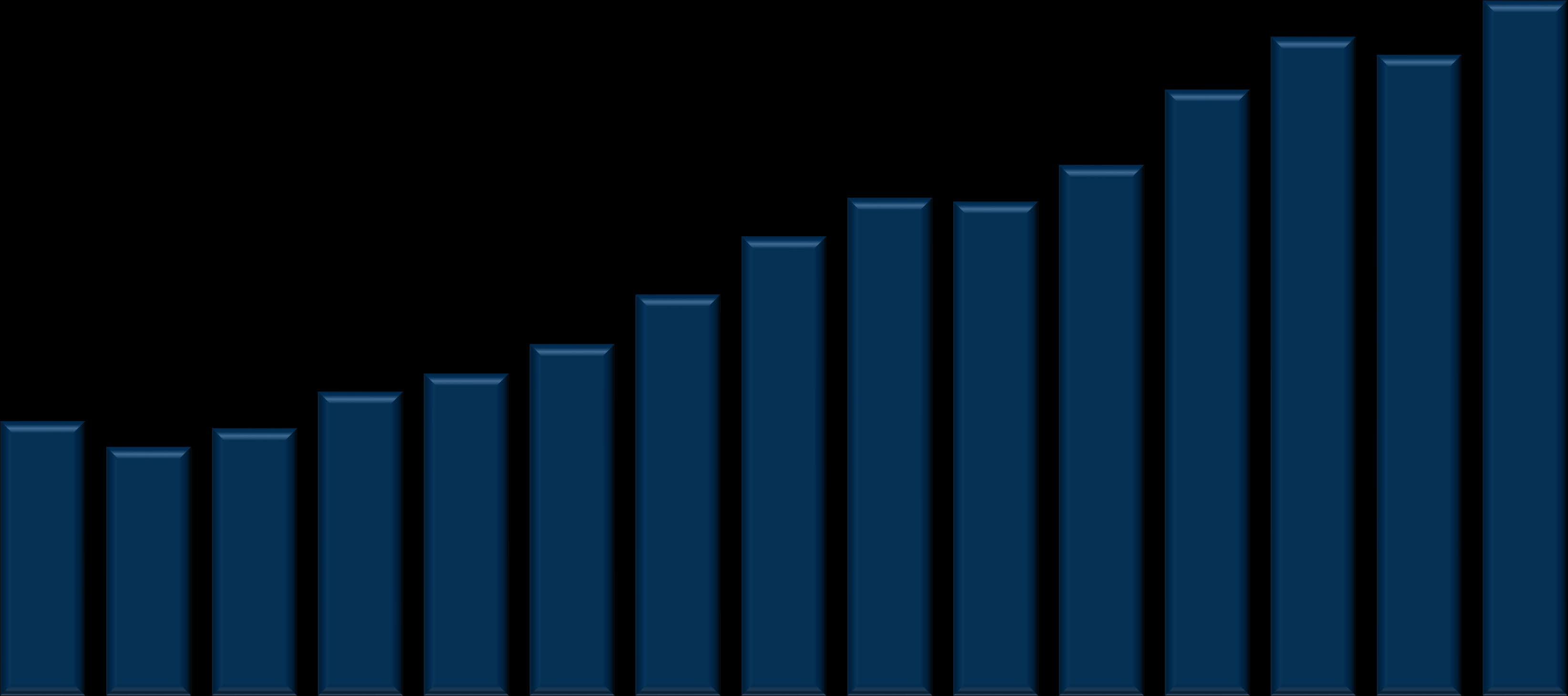

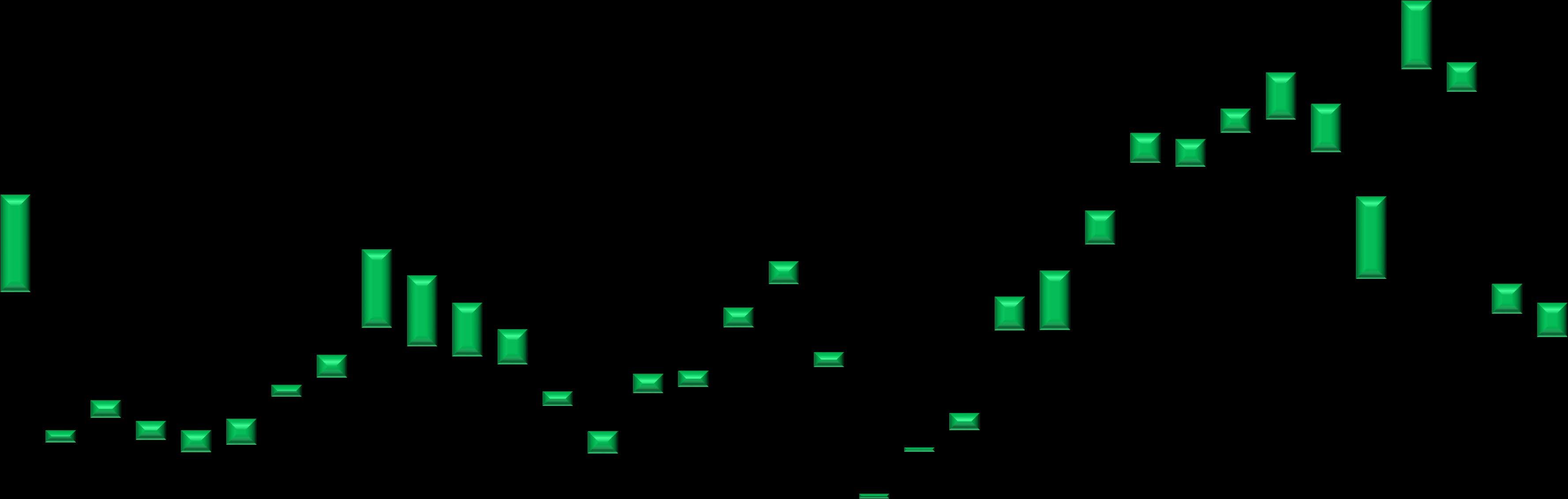

Over the past 30 years, home prices have risen by 475% while household incomes are up by 176%

KING COUNTY HOME PRICES

(MEDIAN SALES PRICES OF EXISTING SINGLE-FAMILY RESALE HOMES)

Monthly principal and interest payment as a % of median household income: Assumes a 10% DP and 7% mtg rate

Source: NAR, Freddie Mac, UBS

Monthly principal and interest payment premium (discount) to apartment rent:

Assumes a 10% DP and 7% mtg rate

Source: NAR, Freddie Mac, CoStar, UBS

Source: US Census, UBS

Custom Home Building and Integration of Technology

Stacy Eakman Founder & CEO

Alair Homes

Lee Travis President & CEO

Wipliance

• Custom doesn’t have to mean chaotic. The key is working with a builder who provides structure, transparency and trusted trade partners, including home automation.

• While clients should take the lead with design decisions, a seasoned custom builder offers proven processes, clear timelines, and coordinated communication with architects, designers, and integrators, ensuring you get all the correct details right from the get-go.

• A good integrator makes smart tech feel simple—designing systems that work seamlessly in the background, so homeowners enjoy the benefits without needing a manual. Early involvement lets us tailor the experience to be intuitive, not overwhelming.

which is more complicated?

• Only focusing on the best price means you’ll inevitably compromise on quality. Whether you are paying to upgrade materials, products or construction installation, inevitably you compromise on what you want and need.

• Consider your builder or integrators’ experience, track record, and reputation.

• A lower bid may leave out critical details like future-proofing, proper documentation, or post-install support—cutting corners you can’t afford later.

• You’re not just paying for a product—you’re investing in a flawless execution, warranty-backed work, and a partner who collaborates with your architect and designer from day one.

• Rising costs in construction materials, labor shortages, supply chain shortages, and impending tariffs only increase year-over-year.

• For example, concrete has risen 15% nationally since 2020. Copper wire and cable prices have increased by 9.6% year-over-year as of February 2025.

• Postponing decisions often means reopening walls or reworking designs— driving costs up, not down.

• Demand for skilled construction and trade labor continues to grow. The U.S. Bureau of Labor Statistics notes a projected 6% growth in demand for electricians and low-voltage specialists through 2032, continuing to push wages—and installation costs—up. Projections indicate that the construction industry will need to attract an estimated 439,000 new net workers in 2025 to meet anticipated demand.

• The global smart-home market is projected to grow from $149.43 billion in 2025 to $633.2 billion by 2032, reflecting a compound annual growth rate (CAGR) of 22.9%.

• Today’s buyers, especially Millennials and Gen Z, expect smart infrastructure as a baseline, not an upgrade.

• Lighting control, distributed audio, smart thermostats, and automated shades now add both resale and energy efficiency, making them a strategic, not indulgent, investment.

• While technology evolves quickly, infrastructure doesn’t have to. The key is to future-proof with a strong wired backbone and modular smart hubs that can be updated over time.

• Wireless may be convenient, but wired is more stable, secure, and scalable for the long-term homeowner. A smart home is meant to be intuitive, not intimidating.

• *National data suggests that homes with built-in smart tech sell faster and at a premium.

When architects, builders, and other integrators work together from the initial process, conversations happen sooner in the design phase and can help avoid disappointments with budget and project needs, before unnecessary changes cause additional costs and time.

Planning your prewire from the start allows devices—like speakers, sensors, and control panels to be strategically hidden or flush-mounted, rather than added as visible afterthoughts.

This means:

• Clean lines and uncluttered walls

• No exposed wires or clunky retrofit solutions

• Technology that blends in—or disappears—so your design stands out

When planned early, smart tech and unique construction elements enhance the home without competing with your architecture or décor.

The result? A space that feels intentional, elevated, and seamless.

Dean Jones President & CEO

Realogics Sotheby’s

International Realty

Tadashi Shiga VP of Land Division

Realogics Sotheby’s

International Realty

Kelly Mann Land Use Attorney & VP of Development Strategy

Realogics Sotheby's

International Realty

Trevor Johnson

Blackwood Builders & Former President

Master Builder Association

King & Snohomish County

Applies to cities with populations over 25,000 Ends singlefamily-only zoning in most areas

Legalizes middle housing (duplexes, triplexes, fourplexes)

Effective July 1, 2025

• Decades of exclusionary zoning practices

• Single-family zoning dominates urban land

• Outdated model that no longer meets housing needs

1,000,000 UNITS

NEEDED, IN STATE, BY 2044

SKYROCKETING RENTS AND HOME PRICES DISPLACEMENT AND LONG COMMUTES INCREASING

2 to 4 units per residential lot by right 4 to 6 units near high-capacity transit No off-street parking required near transit Local design standards still apply

• Duplexes, courtyard apartments, cottage housing, pocket neighborhoods

• More inclusive, walkable, connected

• Adds homes without overwhelming infrastructure

ZONING REFORM = HOUSING JUSTICE

ENABLES THOSE WITH FEWER RESOURCES TO ACCESS GREAT SCHOOLS AND AMENITIES MORE CHOICES

• Opportunity to right-size home without leaving their community and friends

• Frees up larger homes for those who need more space

• Ground-related, small homes serve a vital need

Compact housing reduces vehicle miles traveled Supports climate goals by reducing carbon footprint

Efficient land use and conservation

Consumer Preferences Are Changing

• Demand rising for smaller, walkable housing

• Empty nesters + younger buyers seek flexibility

• HB 1110 supports these trends

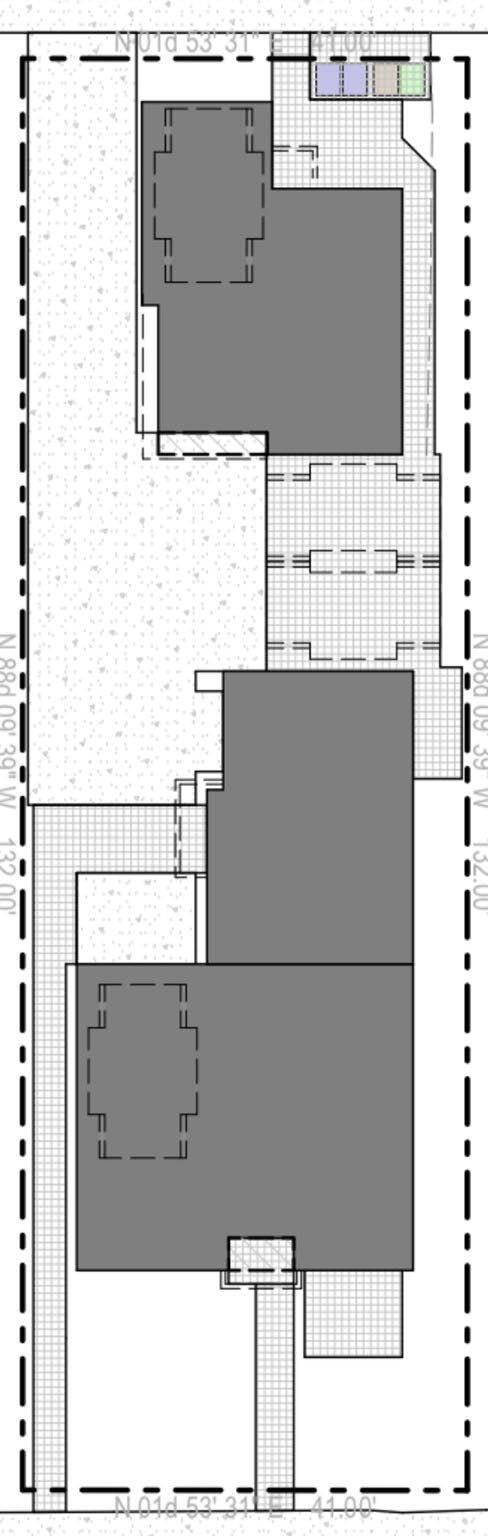

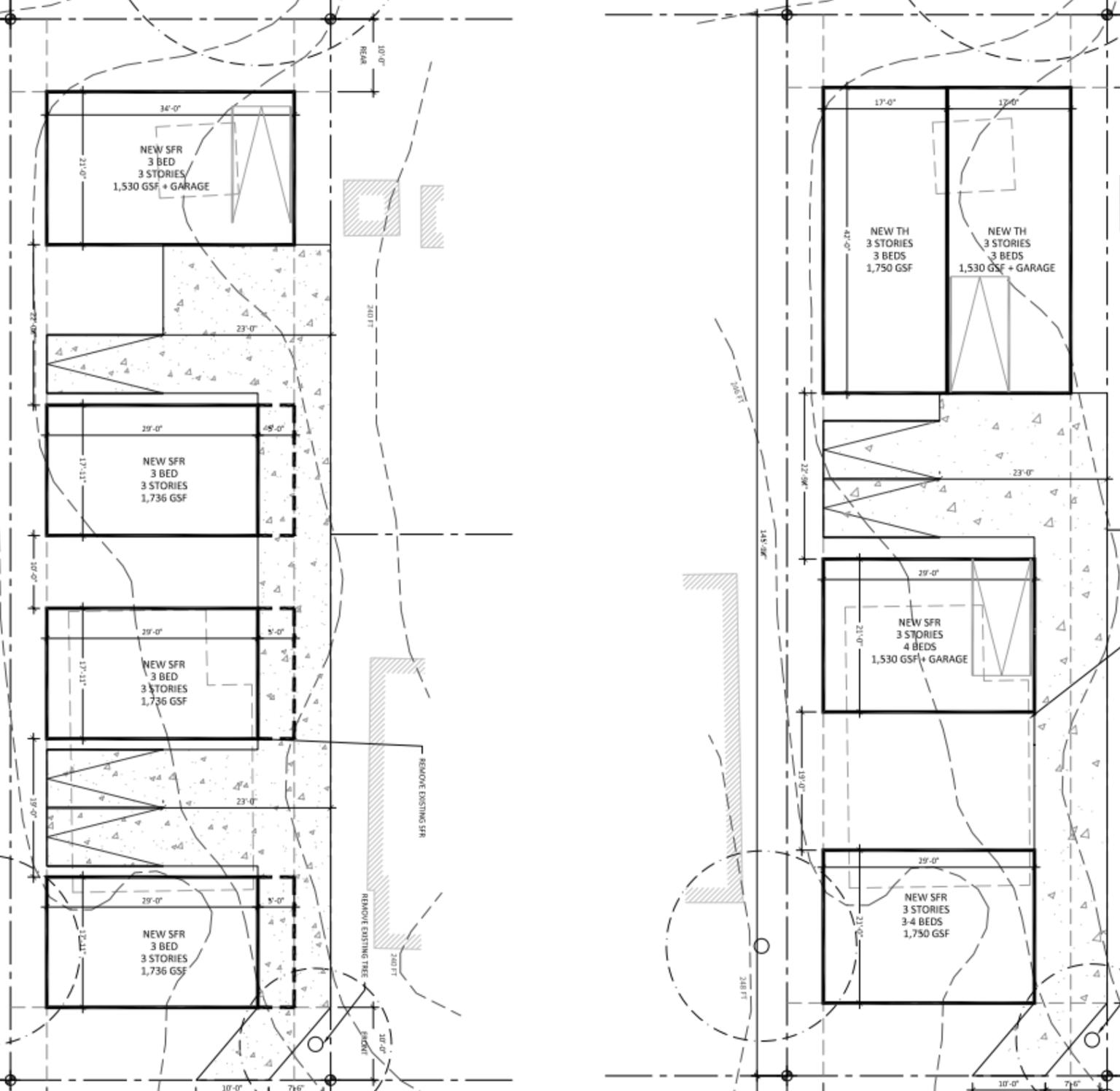

Trevor Johnson - Blackwood Homes

Washington House Bill 1110 - Landmark housing reform law aimed at addressing the state's housing shortage by promoting middle housing in areas traditionally zoned for singlefamily homes

4 SFRs or 2 SFRs & 2 THs

• Baby Boomers' goals?

• Election tax consequences?

• Stepped up cost basis?

• Tax unrealized gains?

• Unified credit cut in ‘25?

• Estate planning?

• Probate states?

• Rush to unload capital gains?

• Global real estate advisors?

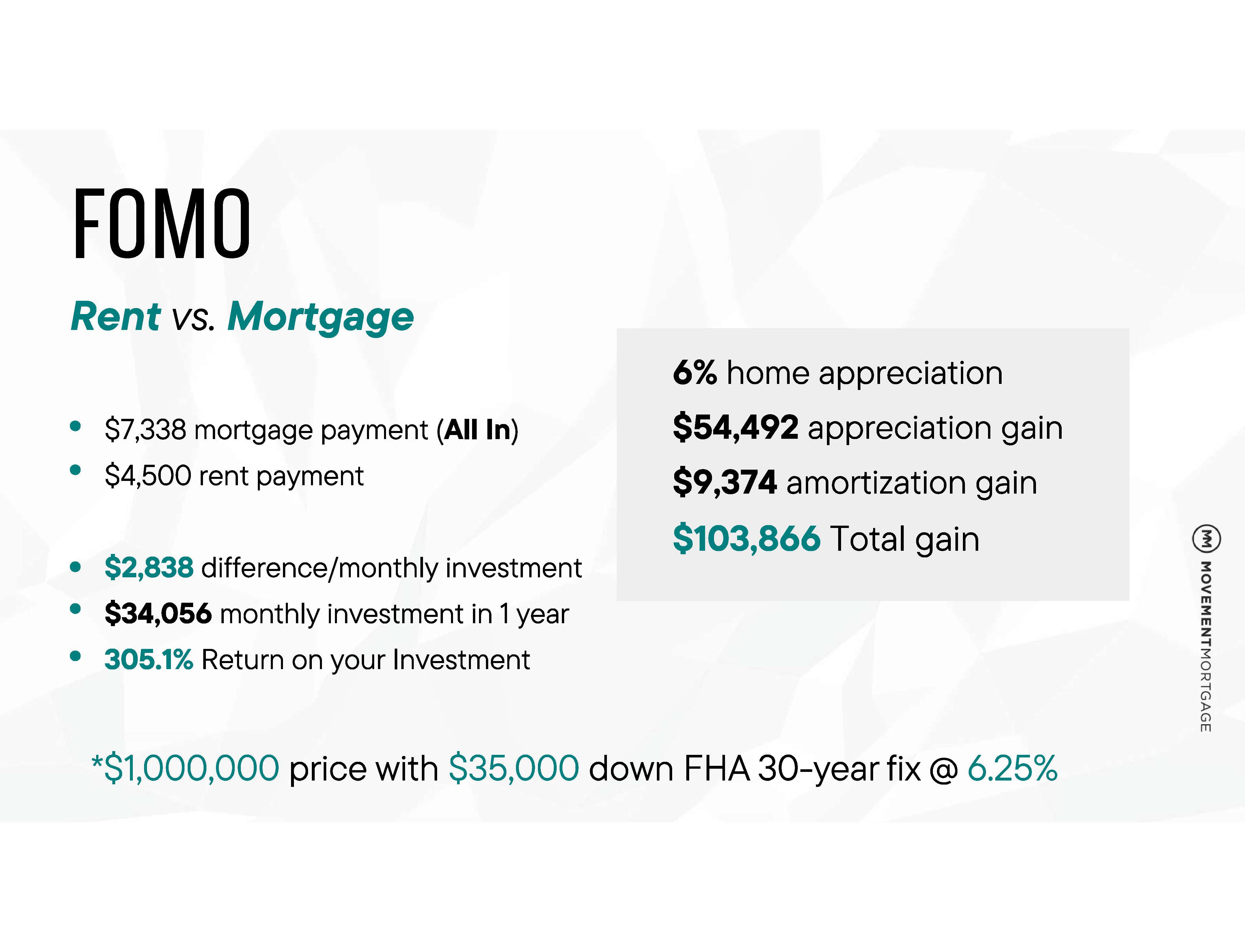

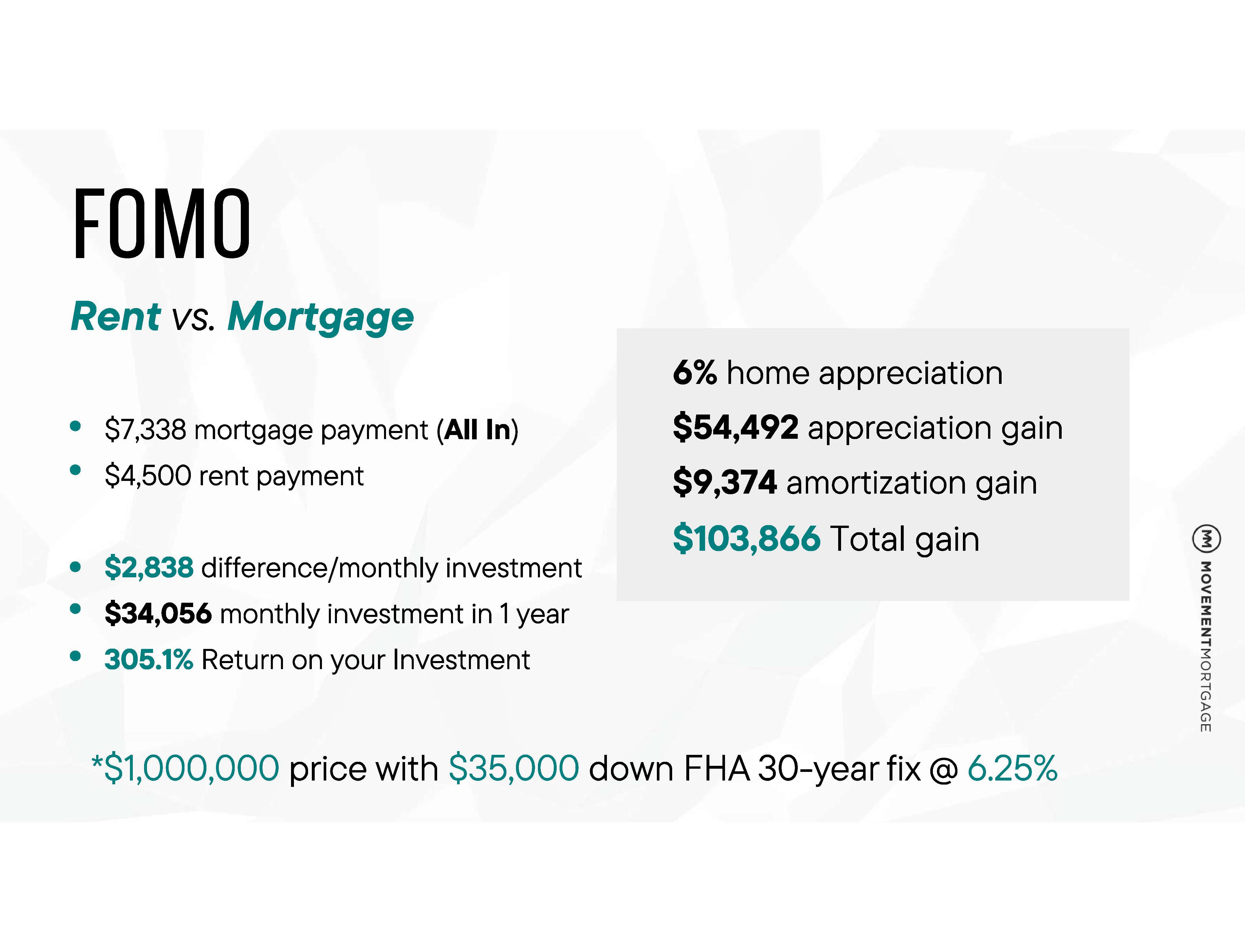

Chris Ishii

Publisher | Writer | Consultant

Mercer Island City Lifestyle Magazine

Jolene Messmer

Loan Originator

Movement Mortgage

Shannon Olcese

VP of Sales

Realogics Sotheby's International Realty

Rebecca Mitsui

Global Real Estate Advisor

Realogics Sotheby's International Realty

Rick King Loan Originator Movement Mortgage

Dehlan Gwo VP of New Developments

Realogics Sotheby's International Realty

Joe Fain President & CEO

Bellevue Chamber

Claire Sumadiwirya Council Member City of Bellevue

Market Imbalance: Demand Soars, Supply Stalls, and Washington State Mandates Solutions

Carese Busby

Loan Originator

Movement Mortgage

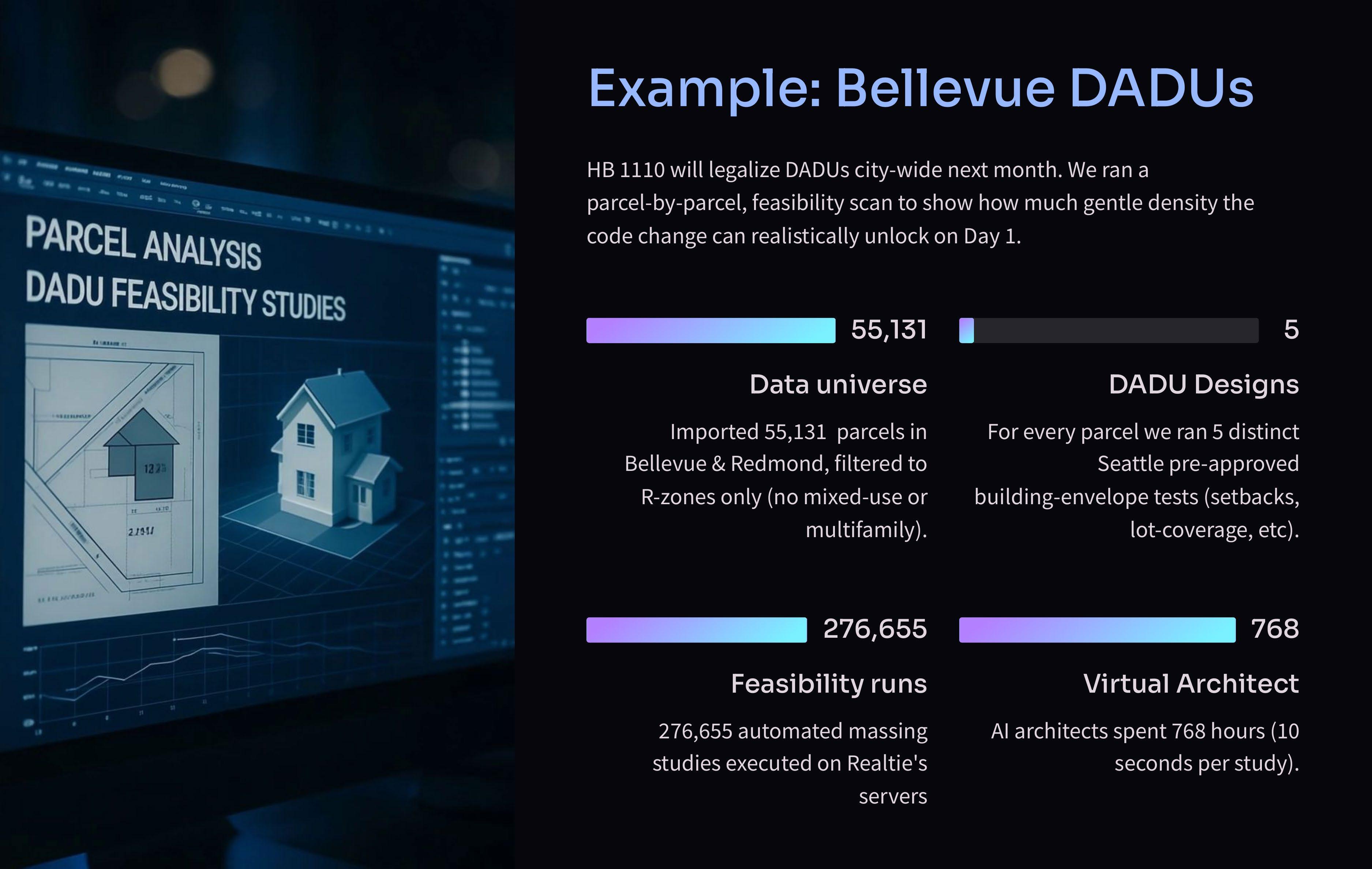

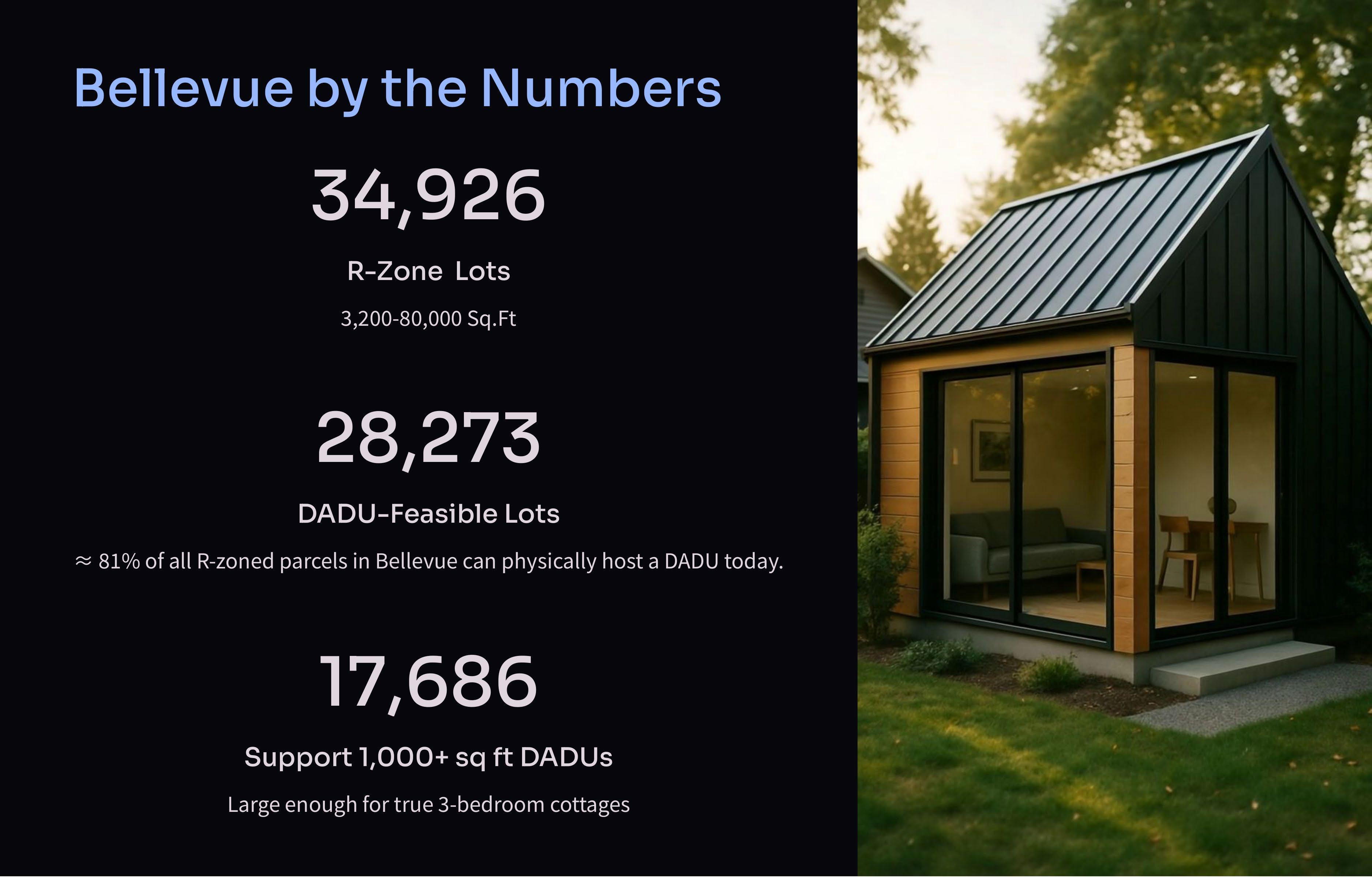

Ofer Avnery

Co-Founder

Realtie

Oren Rubin

AI Expert Serial

Entrepeneur

Matthew Gardner

Principal, Chief Economist

Gardner Economics

Mike Kropp CEO

Iridius

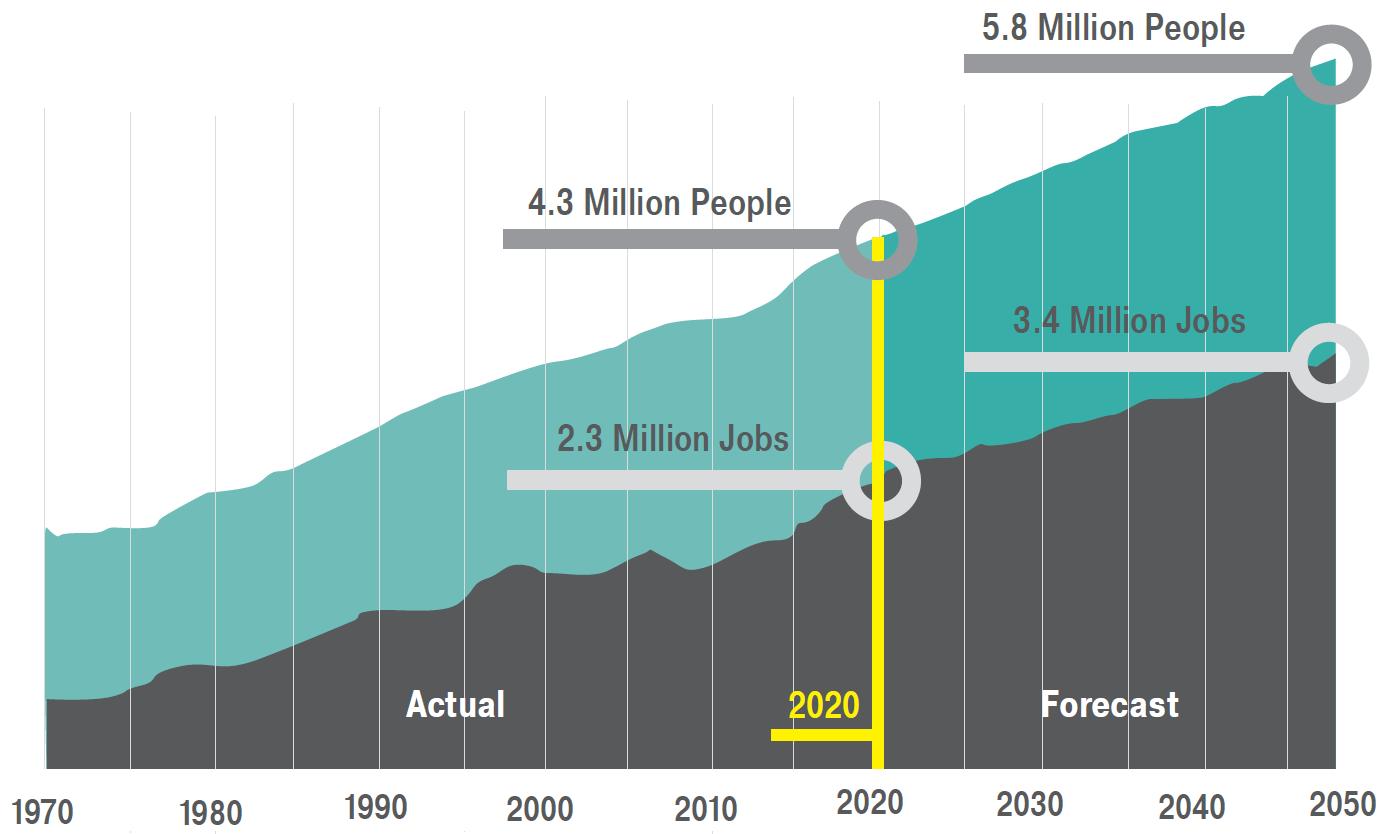

• High AI Exposure in Tech Roles: Approximately 23% of AI engineers in the U.S. are based in Seattle, indicating a significant concentration of AI talent in the region.

• Job Displacement Concerns: Generative AI is expected to automate tasks absorbing up to 30% of hours worked in the U.S. by 2030, potentially impacting a substantial portion of Seattle's tech workforce.

• White-Collar Vulnerability: Wealthy urban centers like Seattle may be more susceptible to AI-driven job displacement, particularly in white-collar professions such as software development, legal services, and financial analysis.

• Growing AI Job Market: Seattle AI engineering roles are forecast to grow 60% this year, with median salaries nearing $190,000, reflecting robust demand for AI expertise.

• Entry-Level Job Squeeze: The adoption of AI tools may reduce demand for entry-level coding positions, potentially affecting new graduates and early-career professionals.

• Reskilling Imperative: Programs like WTIA’s Apprenti are crucial for retraining displaced workers into AI operations, data analytics, and cybersecurity roles.

• Wage Polarization: The average tech salary in Seattle is $172,000, second only to the Bay Area, suggesting that AI skill premiums may widen income disparities.

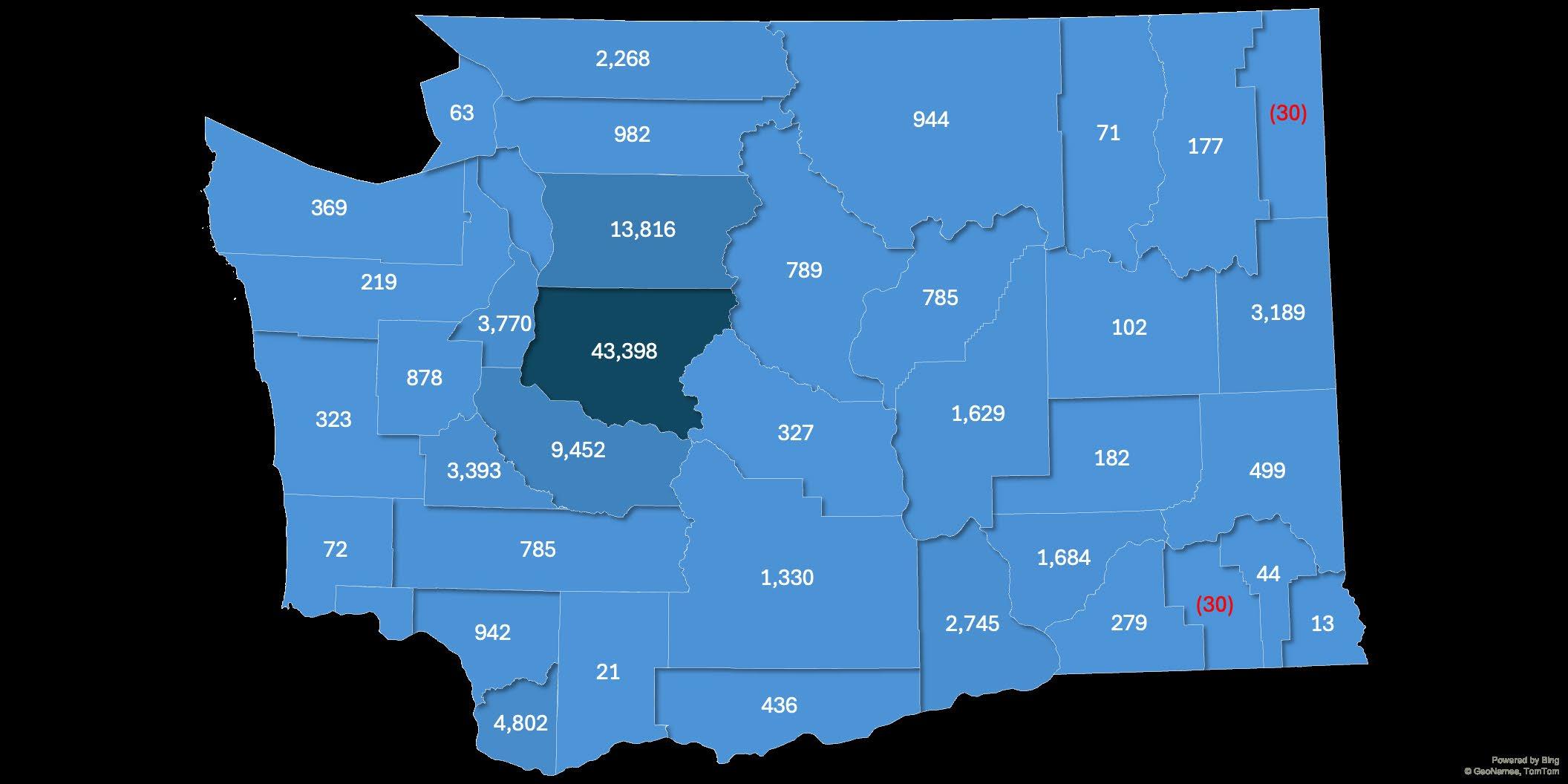

• Housing Shortage: Washington state needs over 1 million new homes by 2044, with significant demand concentrated in King, Kitsap, Snohomish, and Pierce counties.

• Wikipedia+3Axios+3Axios+3Rising Home Prices: Seattle's average home value is $901,000, with areas like Redmond experiencing a 7.5% year-over-year increase, driven by tech sector growth.

• Suburban Expansion: Hybrid work models and high urban housing costs are pushing AI workers toward more affordable exurbs, impacting regional development patterns.

• Zoning Reforms: Legislation has legalized multiplexes in single-family zones, aiming to increase housing supply and affordability.

• AxiosRental Market Pressure: Limited housing supply and elevated mortgage rates are fueling demand in the rental market, leading to stable rent growth and low vacancy rates.

• Data Center Expansion: PNW data center employment has more than doubled since 2018, with Microsoft and Amazon planning significant investments, increasing demand on power grids and land use.

• Energy Consumption: AI's rapid growth is straining energy infrastructure, with companies like Microsoft investing in nuclear power to meet data center demands. Wikipedia+1Wikipedia+1

• Water Usage Concerns: AI data centers are expected to consume substantial amounts of water for cooling, raising sustainability issues in the region.

Thank you. We look forward to seeing you next year!