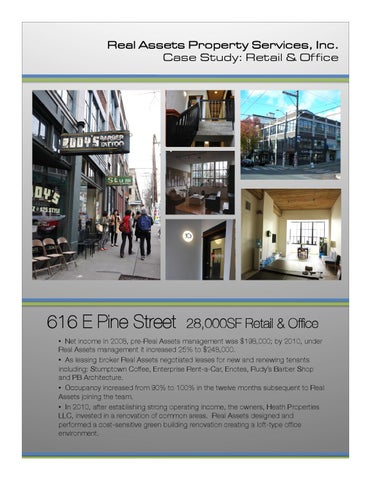

Real Assets Property Services, Inc. Case Study: Retail & Of fice

616 E Pine Street

28,000SF Retail & Office

• Net income in 2008, pre-Real Assets management was $198,000; by 2010, under Real Assets management it increased 25% to $248,000. • As leasing broker Real Assets negotiated leases for new and renewing tenants including: Stumptown Coffee, Enterprise Rent-a-Car, Enotes, Rudy’s Barber Shop and PB Architecture. • Occupancy increased from 90% to 100% in the twelve months subsequent to Real Assets joining the team. • In 2010, after establishing strong operating income, the owners, Heath Properties LLC, invested in a renovation of common areas. Real Assets designed and performed a cost-sensitive green building renovation creating a loft-type office environment.