$8,900,000

LOCAL AMENITIES

Bruce Highway

3K | 5 mins

Brisbane CBD

50K | 50 mins

Sunshine Coast

57K | 43 mins

Brisbane Airport

46K | 33 mins

Port of Brisbane

62K | 44 mins

EARLY LEARNING CENTRE

KFC

ST PETER’S AQUATIC CENTRE

YOUR OPPORTUNITY

Ray White Commercial Northern Corridor Group is proud to present to the market an exceptional opportunity to acquire a high-performing, government-leased commercial asset located in the heart of the Caboolture CBD.

Positioned at 21–25 Hasking Street, this immaculately maintained freehold property offers investors the rare combination of income security, strategic location, and long-term capital growth potential.

The property is fully leased to strong government tenants, with the majority tenant secure until 2030 and with options to 2036. Extensive internal and external refurbishments have already been completed, ensuring the asset presents as truly “set and forget.”

KEY FEATURES

Freehold CBD asset with 2,329m²* land area and 1,744m²* GFA

Fully leased to Queensland Government departments

Net annual income of $537,362* with strong lease covenants

WALE of 4.43 years providing income security

Extensive recent capital works completed by both owner and tenants

Centre zoned within a strategic growth location in Moreton Bay

Surrounded by key amenities – Court House, Transport Hub, Medical Super Centre

Attractive yield potential with rents below market benchmarks

Low-risk investment with passive appeal to private investors, syndicates & funds

NABERS Rating of 4.5

FOR SALE $8,900,000

For further information or to take advantage of this unique opportunity to secure this property in one of the most sought-after areas of the Northern Corridor. Contact Chris or Troy today.

Chris Massie

Director

0412 490 840 chris.massie@raywhite.com

Troy Sturgess

Sales & Leasing Executive 0432 701 600 troy.sturgess@raywhite.com

EXECUTIVE SUMMARY

21-25 Hasking Street, Caboolture, QLD 4510

Legal Description Lot 25 on Registered Plan 840826

Land Area 2,329m²*

Building Area GFA: 1,744m²* NLA: 1,471m²*

Zoning Moreton Bay City Council - Centre

Local Authority Moreton Bay City Council

Unimproved Land Value

$921,433 (3 year average for Land Tax purposes)

Current Net Income $537,362 *

WALE 4.43 years

3.5% fixed annual reviews

Two tenants, giving income security

Tenant Features

Government departments, further cementing security

Staggered lease expiries provide predictable continuity of income

Solid recent supporting leasing evidence

Services The site is connected to local reticulated water, sewer, electricity and telecommunications

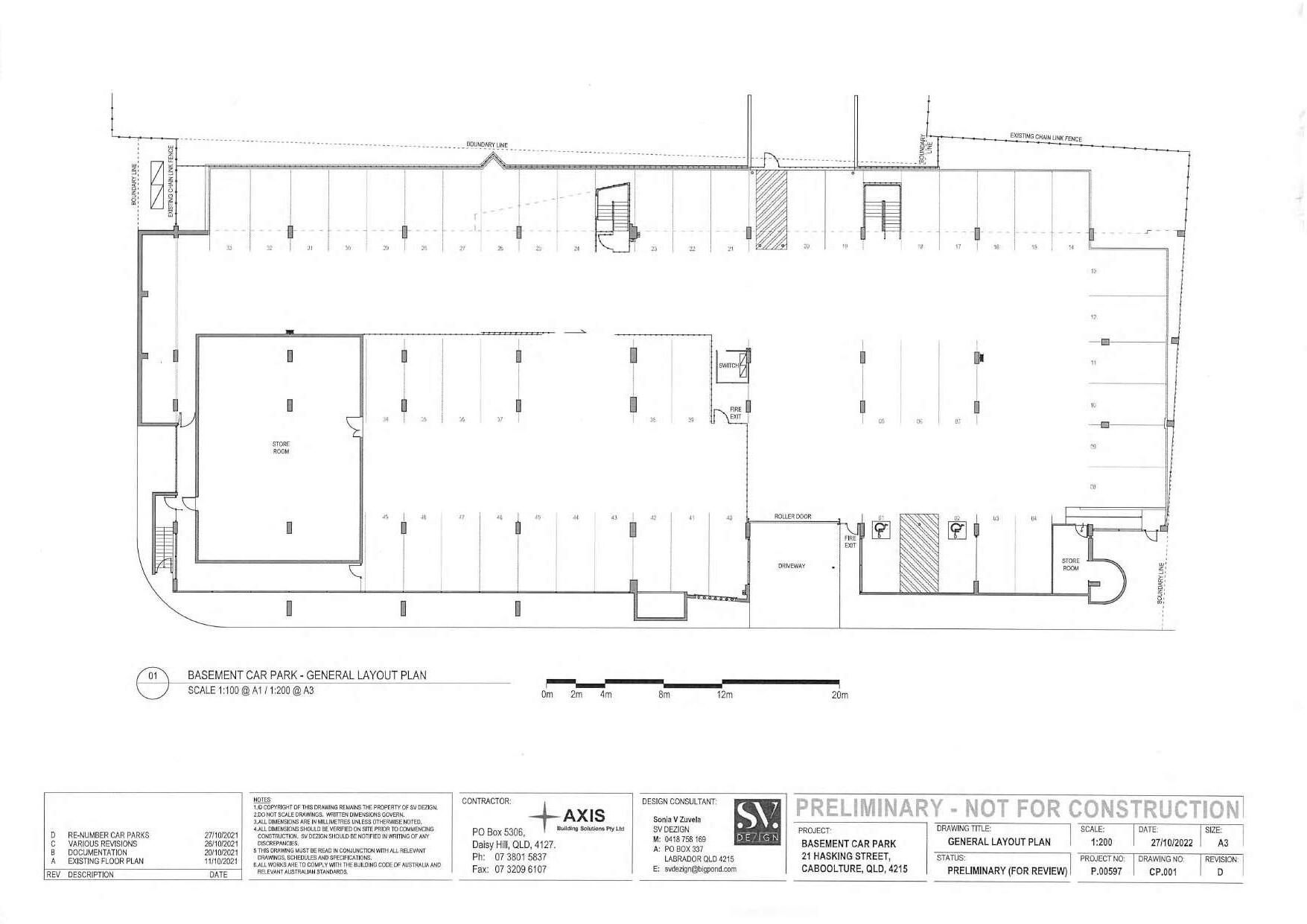

Car Parks 49*

NABERS Rating 4.5 Star energy efficiency rating

TENANCY SCHEDULE

OUTGOINGS SUMMARY

SITE PLAN

TENANCY 1 TENANCY 2

TENANCY 1

TENANCY 1 960m2

ARTIST’S IMPRESSION ONLY: While every attempt has been made to ensure the accuracy of this floor plan all items are approximate and no responsibility is taken for any error, omission, or mis-statement This plan is for illustrative purposes only and should only be used as such by any prospective purchaser.

TENANCY OVERVIEWS

TENANCY 1 HIGHLIGHTS:

Tenant

Queensland Government –

Department of Public Works (Child & Youth Justice)

Use

Youth justice casework, community programs, court support, and intervention services

Lease Covenant

Backed by the State of Queensland – AAArated security

Community Impact

Integral part of the region’s youth rehabilitation and justice services

Location Advantage

Centrally located within Caboolture’s government and civic precinct

Fit-for-Purpose

Secure, functional layout tailored to operational and client needs

NLA 960m²

Gross Lease Term 7y 5m

Expiry 31/5/2030

The Department of Public Works – Child & Youth Justice is a cornerstone government tenant delivering essential services with deep community impact. Their long-term presence at 21 Hasking Street adds stability, social value, and investment-grade security to this quality commercial asset.

The Department of Public Works, on behalf of the Department of Youth Justice, operates a key government tenancy at 21 Hasking Street, delivering critical support services to vulnerable young people within the Moreton Bay region. This office plays an essential role in the Child and Youth Justice system, supporting early intervention, community supervision, restorative justice, and case management for at-risk youth.

The service is a frontline operational hub that facilitates youth engagement programs, probation services, court support, and re-integration pathways for young people in contact with the justice system. With a strong focus on rehabilitation and reducing reoffending, the Caboolture centre is a vital part of the Queensland Government’s broader youth justice strategy.

As a State Government tenant, the Department of Public Works represents a blue-chip covenant and provides investors with the security of a long-term, AAA-rated lease. Occupation at this central Caboolture address highlights the strategic importance of the region as a growing administrative and service delivery centre.

The tenancy is purpose-built to government specifications, including secure interview rooms, flexible workspaces, and enhanced safety features that meet operational requirements. Its proximity to key infrastructure—such as Caboolture Courthouse, police services, and public transport—makes it an ideal location for youth justice operations.

Tenant

Queensland Government –

Department of Public Works (Metro North Health)

Use Health program administration, community health services, and outreach coordination

Lease Covenant

Backed by the State of Queensland – AAArated security

Strategic Fit

Supports non-clinical functions in coordination with regional hospitals and health services

Social Impact

Facilitates vital programs supporting preventative health, mental health, and community wellbeing

Locational Strength

Centrally positioned within Caboolture’s civic and medical precinct, enhancing accessibility for staff and stakeholders

NLA 511m²

Gross Lease Term

6y

Expiry 31/12/2028

With health service demand forecast to grow significantly across South East Queensland, long-term tenants like Metro North Health provide both stability and social value. Their presence at 21 Hasking Street underpins the asset’s appeal as a secure, missioncritical facility within one of Queensland’s most rapidly developing regions.

The Department of Public Works, acting on behalf of Metro North Health, occupies a critical tenancy at 21 Hasking Street, supporting the delivery of public health services to residents across the Caboolture and Moreton Bay regions. As part of the Queensland Health portfolio, Metro North Health is one of the largest and most complex health service providers in the country, delivering hospital and community-based care to over 900,000 people.

This Caboolture-based facility is a non-clinical administrative and outreach centre, providing coordination, planning, and community engagement functions that support a wide range of health initiatives across the region. Services may include public health outreach, mental health and wellbeing support, Indigenous health programs, and preventative health initiatives—reflecting Metro North Health’s mission to promote healthy communities through integrated care.

Backed by the State of Queensland, the tenancy offers investors a government-grade lease covenant with low-risk, reliable income. The presence of Metro North Health at this address highlights Caboolture’s growing importance as a health and community services hub, with strong demographic and infrastructure fundamentals to support long-term government operations.

The space is purpose-adapted to suit administrative workflows and confidential client interactions, with secure access, adaptable interiors, and close proximity to both Caboolture Hospital and allied service providers.

TENANCY 1 NLA 511 m ²

ARTIST’S IMPRESSION ONLY: While every attempt has been made to ensure the accuracy of this floor plan all items are approximate and no responsibility is taken for any error, omission, or mis-statement This plan is for illustrative purposes only and should only be used as such by any prospective purchaser.

ARTIST’S IMPRESSION ONLY: While every attempt has been made to ensure the

of this floor plan all items are approximate and no responsibility is taken for any error, omission, or mis-statement This plan is for illustrative purposes only and should only be used as such by any prospective purchaser.

3 BIG REASONS TO INVEST

The City of Moreton Bay is quickly gaining recognition as one of Queensland’s most attractive regions for office property investment, offering a compelling mix of growth potential, infrastructure development, and long-term security. Rising construction costs, limited future supply, and proximity to key transit routes position Caboolture as a hotspot for savvy investors—making properties like 21-25 Hasking Street prime opportunities.

1. A Mandate for Growth

Moreton City has been designed as a new polycentric city, meaning that there are three different city hubs, instead of the more traditional solo-CBD model.

Caboolture CBD is one of the three hubs identified as Principal Activity Areas in the greater region. This means two things:

a. No other CBD-like office precincts will be approved in the upcoming master planned growth areas

b. Any Government departments or Government funded enterprises wanting to operate in this area MUST first look for options within this Principal Activity Area at properties like 21 Hasking Street.

2. A Booming Population

Caboolture is strategically positioned in Brisbane’s northern growth corridor, with immediate access to the Bruce Highway, North Coast Rail Line, and expanding local infrastructure. As businesses seek alternatives to Brisbane’s expensive and congested CBD, Caboolture offers a more affordable, accessible option, without sacrificing connectivity or amenity.

Access to labour is a key driver of business decision making. The fact that Caboolture will see 100,000 new residents move to the area in the next 12 years means many more businesses will be looking to Caboolture for their staffing solutions.

3. Strategic Capital Value Uplift

Whichever way you view this property, the potential for significant capital uplift is evident. Vacant land constraints and ballooning construction costs put the replacement cost of this asset comfortably into the the eight figure range.

Recent leases for comparable stock in the surrounding area have achieved over $100m2 more than the current passing rent of this property, indicating further potential uplift in the medium term.

Tightening yields and dropping interest rate projections mean your return could continue to improve from day one of ownership.

Why Act Now?

The build up of Olympic infrastructure, combined with the peak period of residential construction across Caboolture West over the next six years will create a perfect storm of supply/demand constraint as these tenancies approach their future market review dates. As the new owner, you will enjoy carefree passive income on the way to a significant capital uplift

“Caboolture represents a unique blend of growth, limited supply, and strategic accessibility. For investors seeking dependable returns and future upside, now is the time to secure premium office property in this high-growth corridor.”

-

Ashley

Rees, Senior Analysis

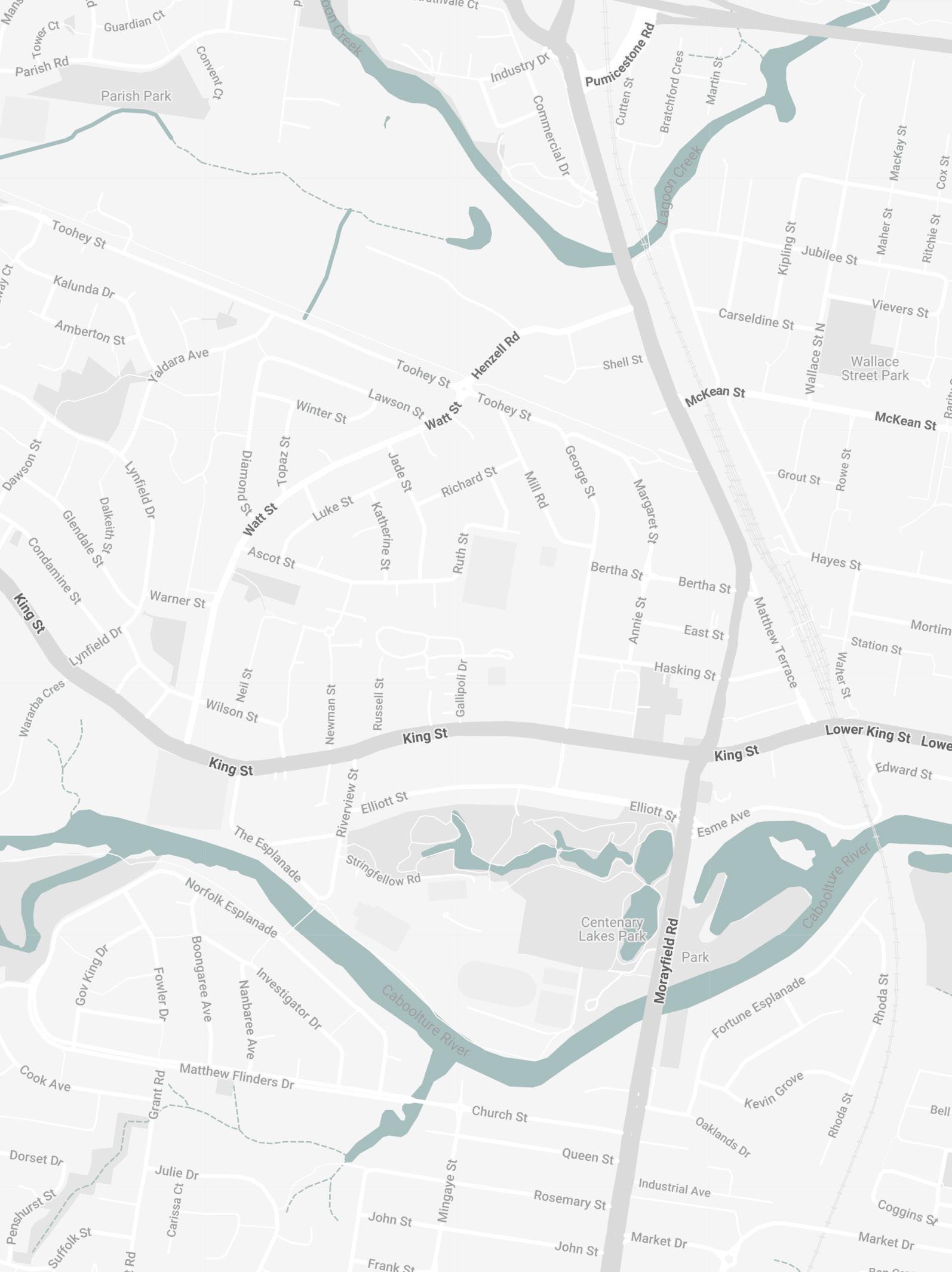

AMENITIES MAP

CABOOLTURE SQUARE MALL

CABOOLTURE STATE HIGH SCHOOL

CABOOLTURE HOSPITAL

BRUCE HWY M1 ON RAMP

BRUCE HWY M1 ON RAMP

AMPOL

LOCATION OVERVIEW

By 2031, Moreton Bay will have a larger population than Tasmania!

The rapidly expanding catchment has been the beneficiary of a perfect storm of post-COVID market conditions that will see the population double by 2041.

A strong pipeline of residential master planned precincts like Caboolture West, Morayfield South and North Harbour has seen a flood of State and Federal infrastructure investment geared to capitalise on Moreton Bay’s capacity to deliver a high volume of much needed affordable housing to help address the accommodation crisis.

The young, active demographic of the region provides a ready made labour pool that is proving increasingly attractive to businesses struggling with the tight labour market of today.

The result of these factors is an extremely strong industrial property market, as businesses jockey for position to capitalise on the workforce and construction pipeline of this booming region.

Moreton Bay has experienced a perfect storm of market conditions in the last four years that now has it positioned as one of the most strategic hubs in South East Queensland.

– Ashley Rees. RWC Senior Analyst

Act now to position yourself at the epicenter of success!

FOR SALE

$8,900,000 Due Diligence Information

A full suite of due diligence information is available upon request, including:

Leases & Renewals

Outgoings budgets & receipts

Council reports & surveys

Historical invoicing & payment history

Rental market evidence

To learn more about this investment opportunity, arrange an inspection or receive a copy of the compressive due diligence pack, please contact exclusive marketing agent Chris Massie or Troy Sturgess.

Troy Sturgess Sales & Leasing Executive 0432 701 600 troy.sturgess@raywhite.com Chris Massie Director 0412 490 840 chris.massie@raywhite.com

DISCLAIMER

The information contained in this Information Memorandum and any other verbal or written information given in respect of the property (“Information”) is provided to the recipient (“you”) on the following conditions:

1. North Coast Commercial Properties Pty Ltd trading as Ray White Northern Corridor Group and or any of its officers, employees or consultants (“we, us”) make no representation, warranty or guarantee, that the Information, whether or not in writing, is complete, accurate or balanced. Some information has been obtained from third parties and has not been independently verified. Accordingly, no warranty, representation or undertaking, whether express or implied, is made and no responsibility is accepted by us as to the accuracy of any part of this, or any further information supplied b y or on our behalf, whether orally or in writing.

2. All visual images (including but not limited to plans, photographs, specifications, artist impressions) are indicative only and are subject t o change. Any measurement noted is indicative and not to scale. All outlines on photographs are indicative only.

3. The Information does not constitute, and should not be considered as, a recommendation in relation to the purchase of the property or a solicitation or offer to sell the property or a contract of sale for the property.

4. You should satisfy yourself as to the accuracy and completeness of the Information through your own inspections, surveys, enquiries, and searches by your own independent consultants, and we recommend that you obtain independent legal, financial and taxation advice. This includes as to whether any listing price is inclusive or exclusive of GST.

5. We are not valuers and make no comment as to value. “Sold/ leased” designations show only that stock is “currently not available” – not that the property is contracted/ settled. If you require a valuation we recommend that you obtain advice from a registered valuer.

6. The Information does not and will not form part of any contract of sale for the property. If an interested party makes an offer or signs a contract for the property, the only information, representations and warranties upon which you will be entitled to rely will be as expressly set out in such a contract.

7. Interested parties will be responsible for meeting their own costs of participating in the sale process for the property. We will not be liable to compensate any intending purchasers for any costs or expenses incurred in reviewing, investigating or analysing any Information.

8. We will not be liable to you (to the full extent permitted by law) for any liabilities, costs or expenses incurred in connection with the Information or subsequent sale of the property whatsoever, whether the loss or damage arises in connection with any negligence, default or lack of care on our part.

9. No person is authorised to give information other than the Information in this Information Memorandum or in another brochure or document authorised by us. Any statement or representation by an officer, agent, supplier, customer, relative or employee of the vendor will not be binding on the vendor or us.

10. To the extent that any of the above paragraphs may be construed as being a contravention of any law of the State or the Commonwealth, such paragraphs should be read down, severed or both as the case may require and the remaining paragraphs shall continue to have full force and effect.

11. You may not discuss the Information or the proposed sale of the property with the vendors or with any agent, friend, associate or relative of the vendor or any other person connected with the vendor without our prior written consent. We accept no responsibility or liability to any other party who might use or rely upon this report in whole or part of its contents.

12. The Information must not be reproduced, transmitted or otherwise made available to any other person without our prior written consent.