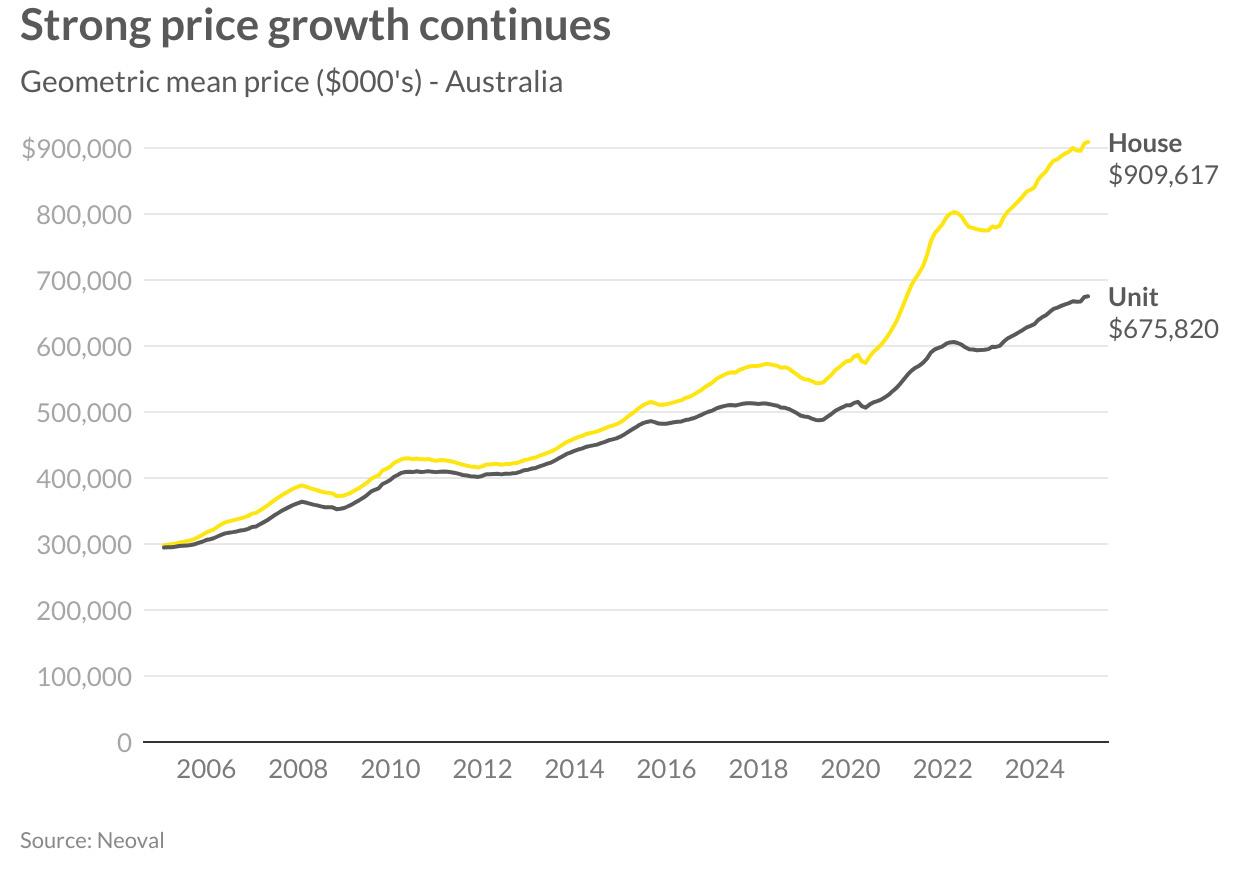

Australian property prices continue to demonstrate resilience with modest monthly growth across February 2025. House prices recorded a 0.2 per cent monthly increase, bringing the national mean to $909,617, while unit values rose by 0.2 per cent to reach $675,820. The market’s steady performance reflects ongoing supply constraints balancing against affordability challenges, with both market segments now well above their previous peak values.

The recent interest rate cut by the Reserve Bank of Australia marks a significant shift in monetary policy, potentially signalling a more favourable environment for property market activity in the coming months. This development, coupled with sustained population growth and continued construction sector challenges, suggests the market’s upward trajectory may strengthen through the remainder of 2025.

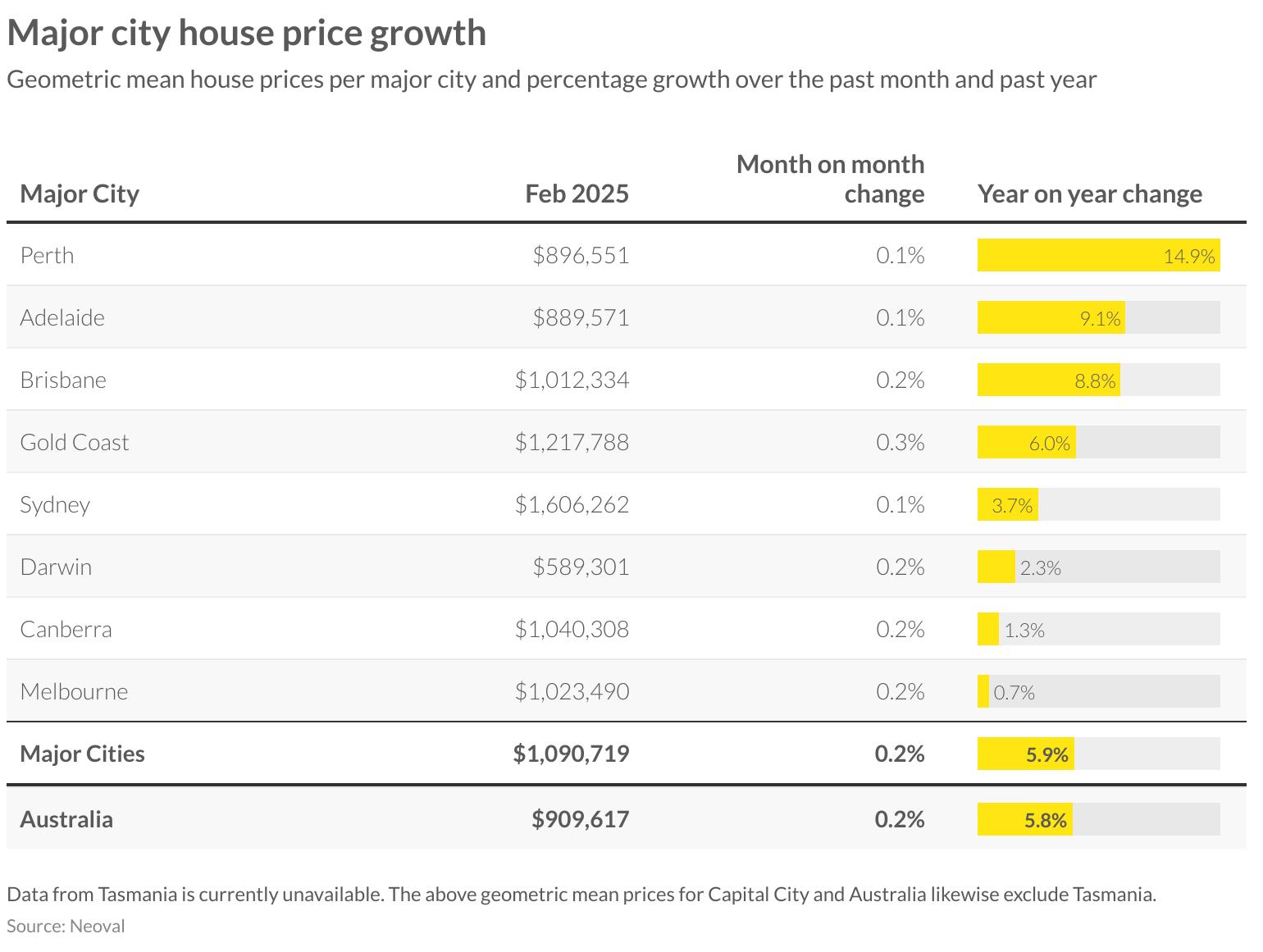

The capital city housing market continues to show varied performance across Australia’s major cities, with Perth maintaining its position as the standout performer. With a mean price of $896,551, Perth recorded a modest 0.1 per cent monthly gain but an impressive 14.9 per cent year-on-year increase, reflecting the ongoing economic strength in Western Australia’s mining sector.

Adelaide remains in strong territory, with its median house price of $889,571 representing a 0.1 per cent monthly increase and solid 9.1 per cent annual growth. Brisbane has firmly established itself as a million-dollar city, with its median of $1,012,334 reflecting a 0.2 per cent monthly gain and 8.8 per cent annual growth.

Gold Coast continues to command premium values at $1,217,788, rising 0.3 per cent for the month, while Sydney maintains its position as Australia’s most expensive market at $1,606,262 with a more modest annual growth of 3.7 per cent. Melbourne shows the least momentum among major capitals, recording just 0.7 per cent annual growth despite its $1,023,490 median.

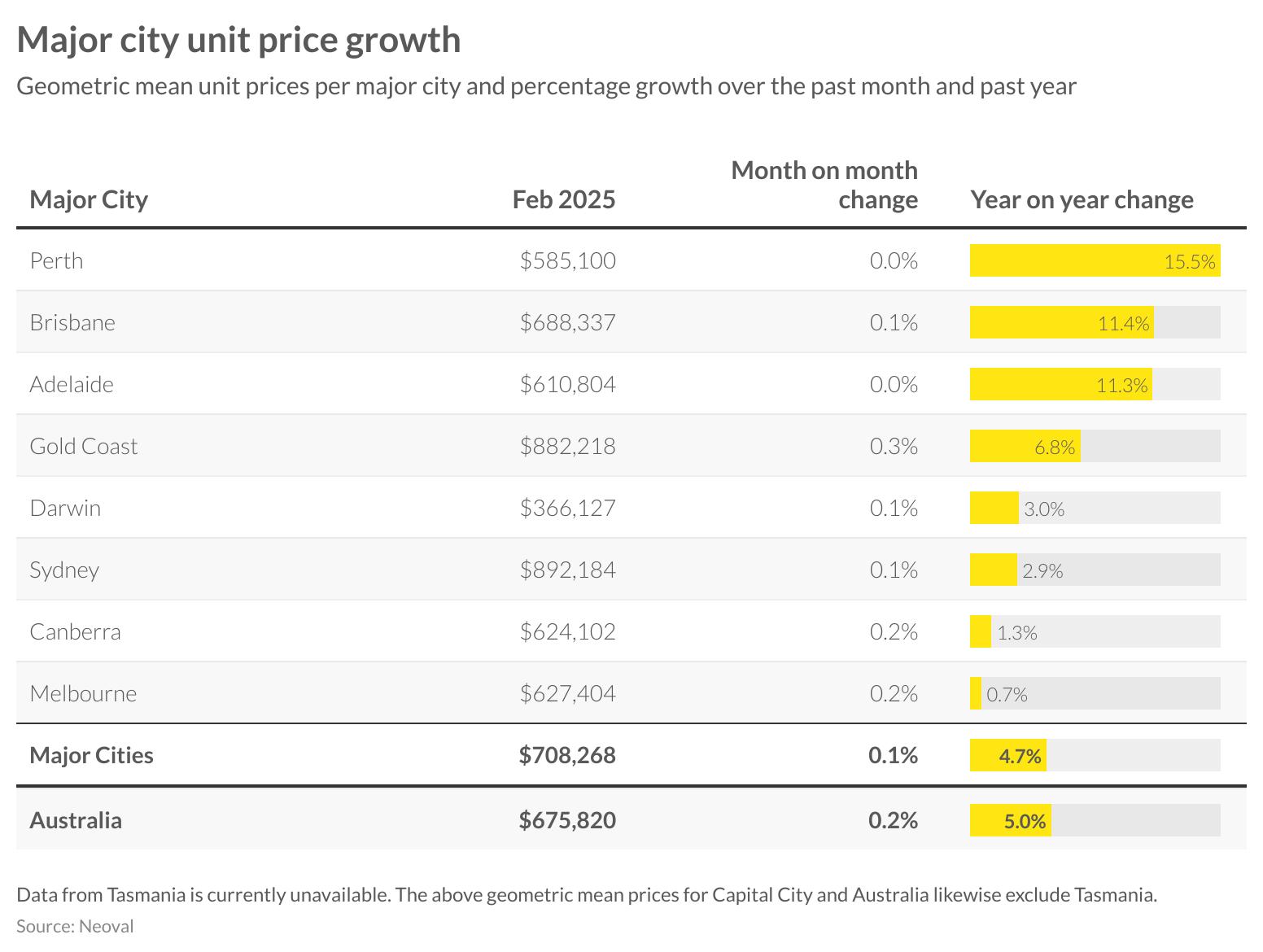

The unit market across major cities has stabilised in February, with overall values increasing by 0.1 per cent for the month. Perth units continue to lead year-on-year growth metrics at 15.5 per cent, though show no movement in February with a median value of $585,100. This performance aligns with broader economic strength in Western Australia.

Brisbane and Adelaide remain strong performers in the unit sector, recording annual growth of 11.4 per cent and 11.3 per cent respectively. Brisbane’s median unit price now sits at $688,337, while Adelaide’s reaches $610,804. Both markets experienced minimal monthly change but maintained their positions as growth leaders.

Gold Coast units continue to command premium values at $882,218, with monthly growth of 0.3 per cent and annual appreciation of 6.8 per cent. Sydney units remain the most expensive at $892,184 but with more subdued annual growth of 2.9 per cent. Melbourne continues to underperform the national average with just 0.7 per cent annual growth, reflecting broader challenges in Victoria’s property market.

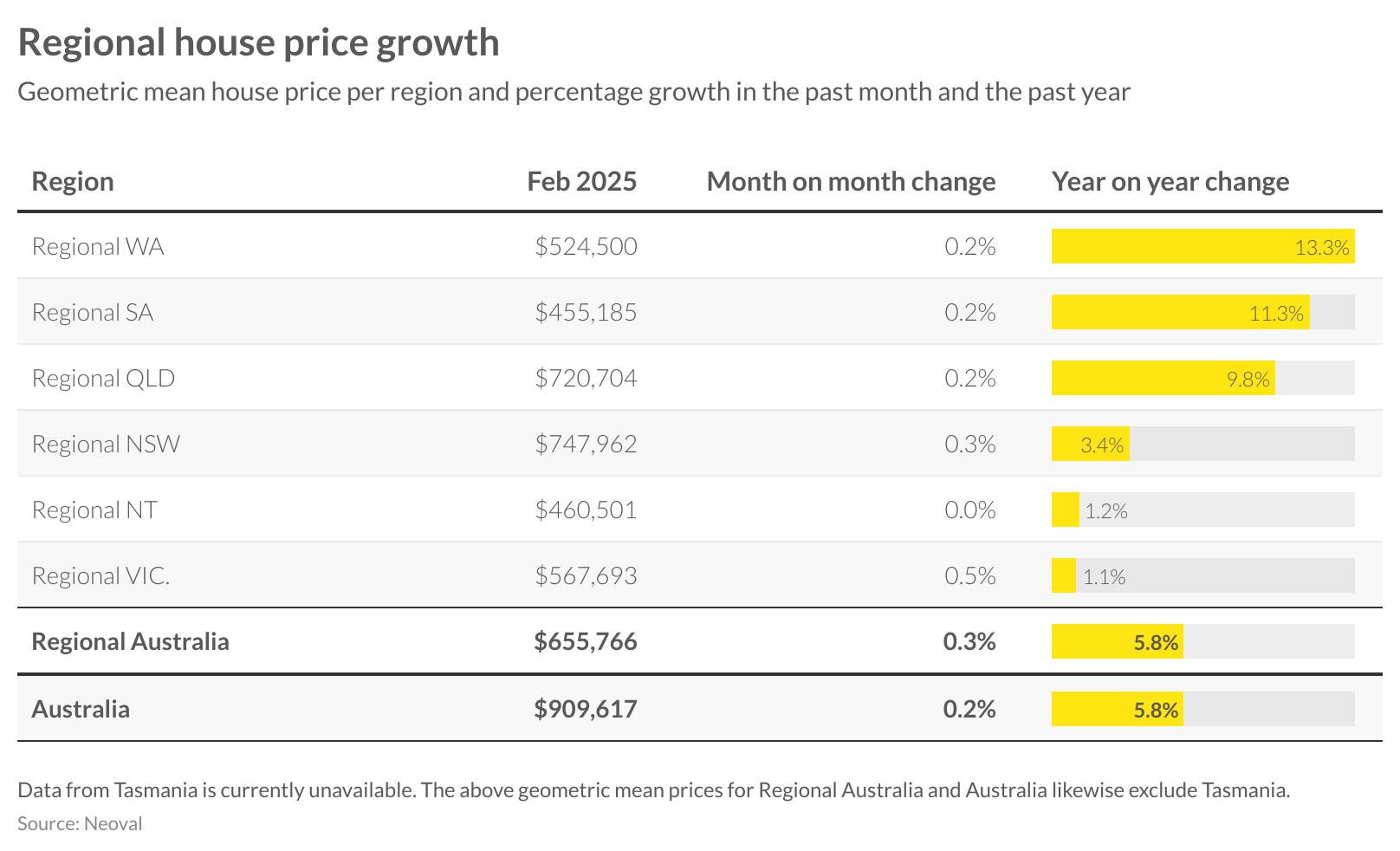

Regional housing markets continue to show significant variation in performance, with resource-rich states maintaining their leadership positions. Regional Western Australia leads with 13.3 per cent annual growth and a mean price of $524,500, followed closely by regional South Australia at 11.3 per cent growth and a median of $455,185. Both regions recorded 0.2 per cent monthly increases.

Queensland’s regional markets remain strong with 9.8 per cent annual growth and a 0.2 per cent monthly increase, bringing the median to $720,704. This represents the highest median value among regional markets, reflecting the ongoing popularity of Queensland’s coastal lifestyle locations.

Regional New South Wales saw a 0.3 per cent monthly increase to $747,962 but a more modest annual growth of 3.4 per cent. Victoria’s regional market recorded the highest monthly growth at 0.5 per cent but remains subdued on an annual basis at just 1.1 per cent. The Northern Territory showed no monthly movement and minimal annual growth of 1.2 per cent.

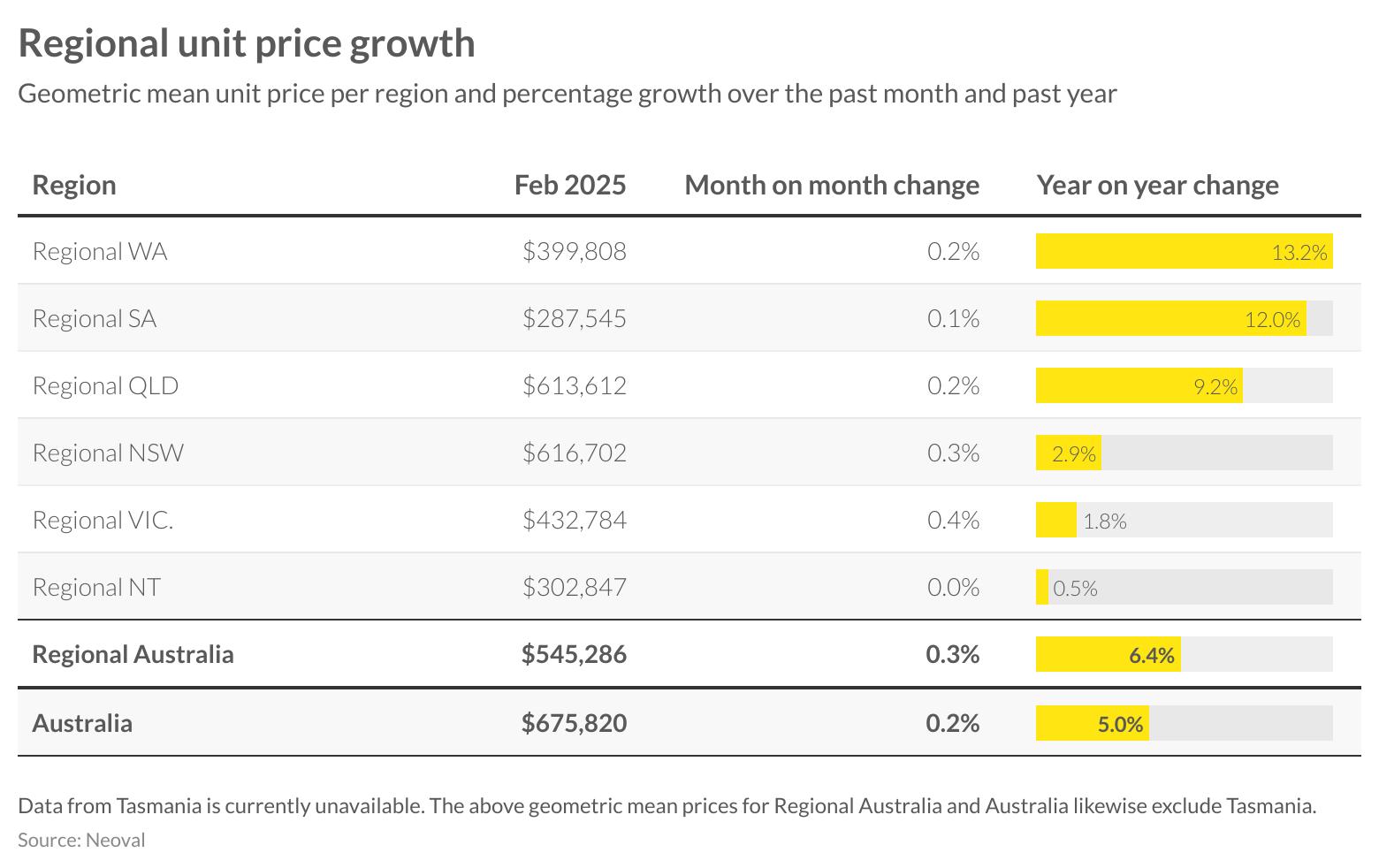

The regional unit market continues to mirror trends seen in the regional housing sector, with Western Australia and South Australia leading annual growth at 13.2 per cent and 12.0 per cent respectively. Western Australia’s median unit value now sits at $399,808 after a 0.2 per cent monthly increase, while South Australia reached $287,545 with a 0.1 per cent monthly gain.

Regional Queensland maintains strong market conditions with 9.2 per cent year-on-year growth and a 0.2 per cent monthly increase, bringing its mean to $613,612. New South Wales regional units recorded the highest monthly growth at 0.3 per cent, though annual growth remains more modest at 2.9 per cent with a median of $616,702.

Victoria’s regional unit market showed signs of improvement with a 0.4 per cent monthly increase, though annual growth remains subdued at 1.8 per cent. The Northern Territory continues to be the most challenging regional unit market with no monthly movement and minimal annual growth of just 0.5 per cent.

LISTINGS ACTIVITY

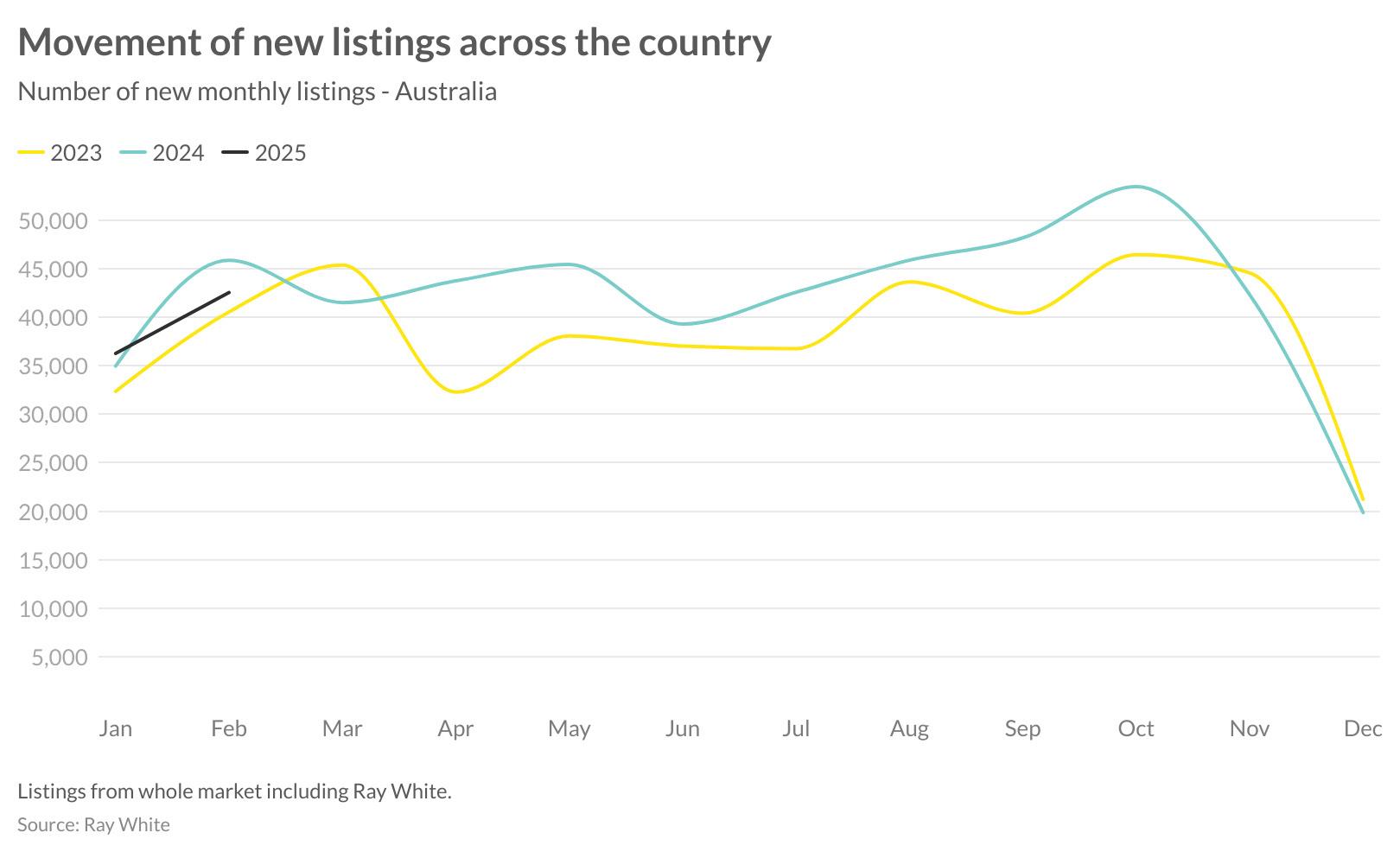

February listings data shows a notable seasonal recovery following the traditional January lull, with approximately 42,000 new properties coming to market across Australia. This represents not only a significant monthly increase but also positions 2025’s early-year activity ahead of the same period in both 2023 and 2024.

The February figures demonstrate robust market engagement, with listings trending approximately six per cent higher than February 2024 and 10 per cent above February 2023 levels. This upward trajectory suggests growing vendor confidence, potentially influenced by sustained price growth and early signals of a shifting interest rate environment.

The strong start to 2025’s listing activity defies typical seasonal patterns, with February often showing more gradual recovery following the holiday period. Instead, we’re seeing accelerated activity that might indicate sellers are moving quickly to capitalise on favourable market conditions before the anticipated effects of interest rate cuts potentially draw even more buyers into the market.

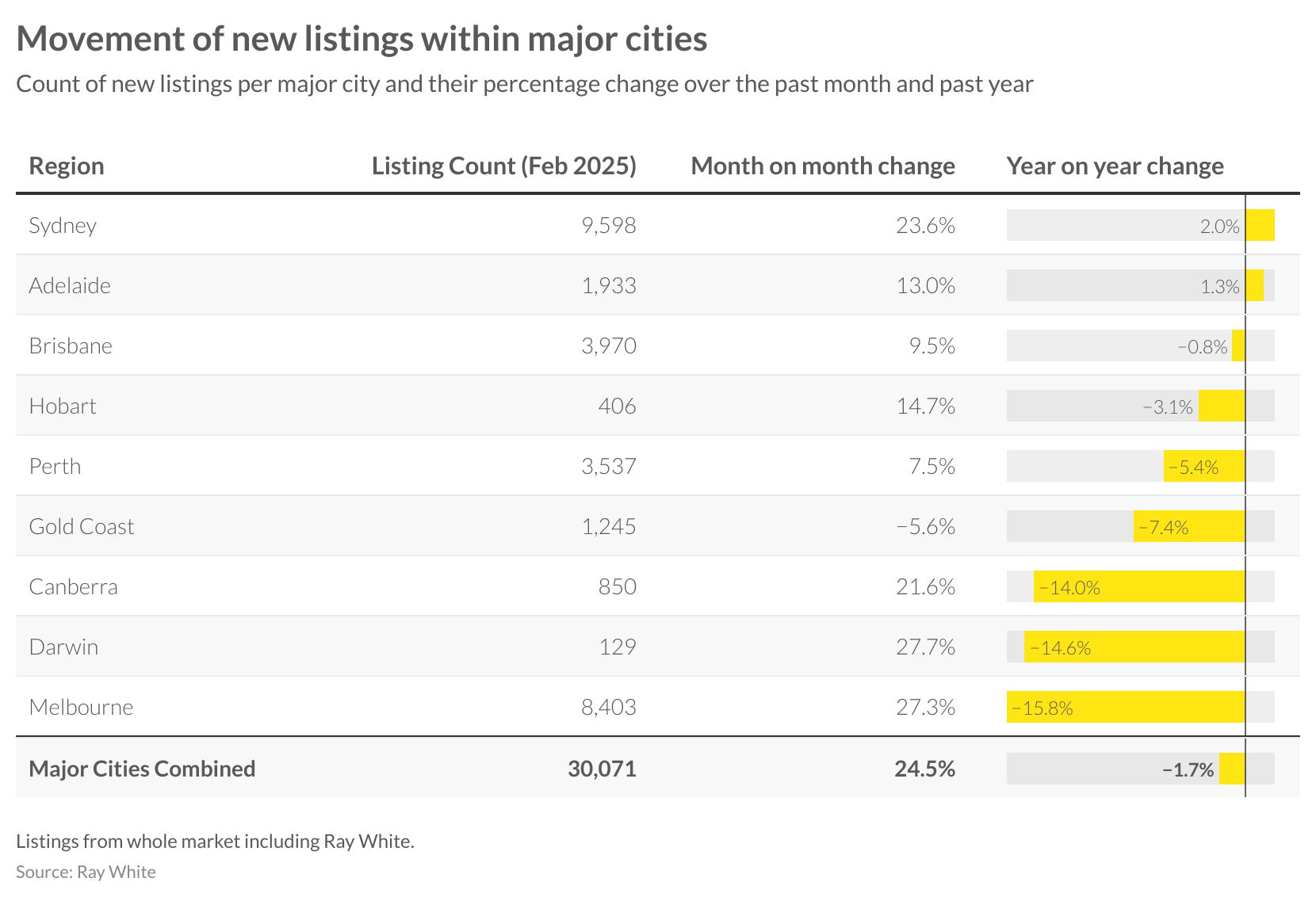

February saw a substantial seasonal uplift in listing activity across the country, with major cities recording 30,071 new properties coming to market. This represents a 24.5 per cent increase from January but a slight 1.7 per cent decline compared to February 2024.

Sydney led the capital cities with 9,598 new listings, showing a 23.6 per cent monthly increase and a 2.0 per cent annual improvement. Melbourne recorded 8,403 new listings, the second highest volume, with a robust 27.3 per cent monthly gain despite showing a 15.8 per cent annual decline. Brisbane and Perth also demonstrated strong monthly increases of 9.5 per cent and 7.5 per cent respectively, though Perth’s annual figures remain down 5.4 per cent.

The Gold Coast was the only major market to record a monthly decline in listings, falling 5.6 per cent while also showing a 7.4 per cent annual reduction. Darwin and Canberra saw the most significant monthly increases of 27.7 per cent and 21.6 per cent respectively, though both remain well below their 2024 levels.

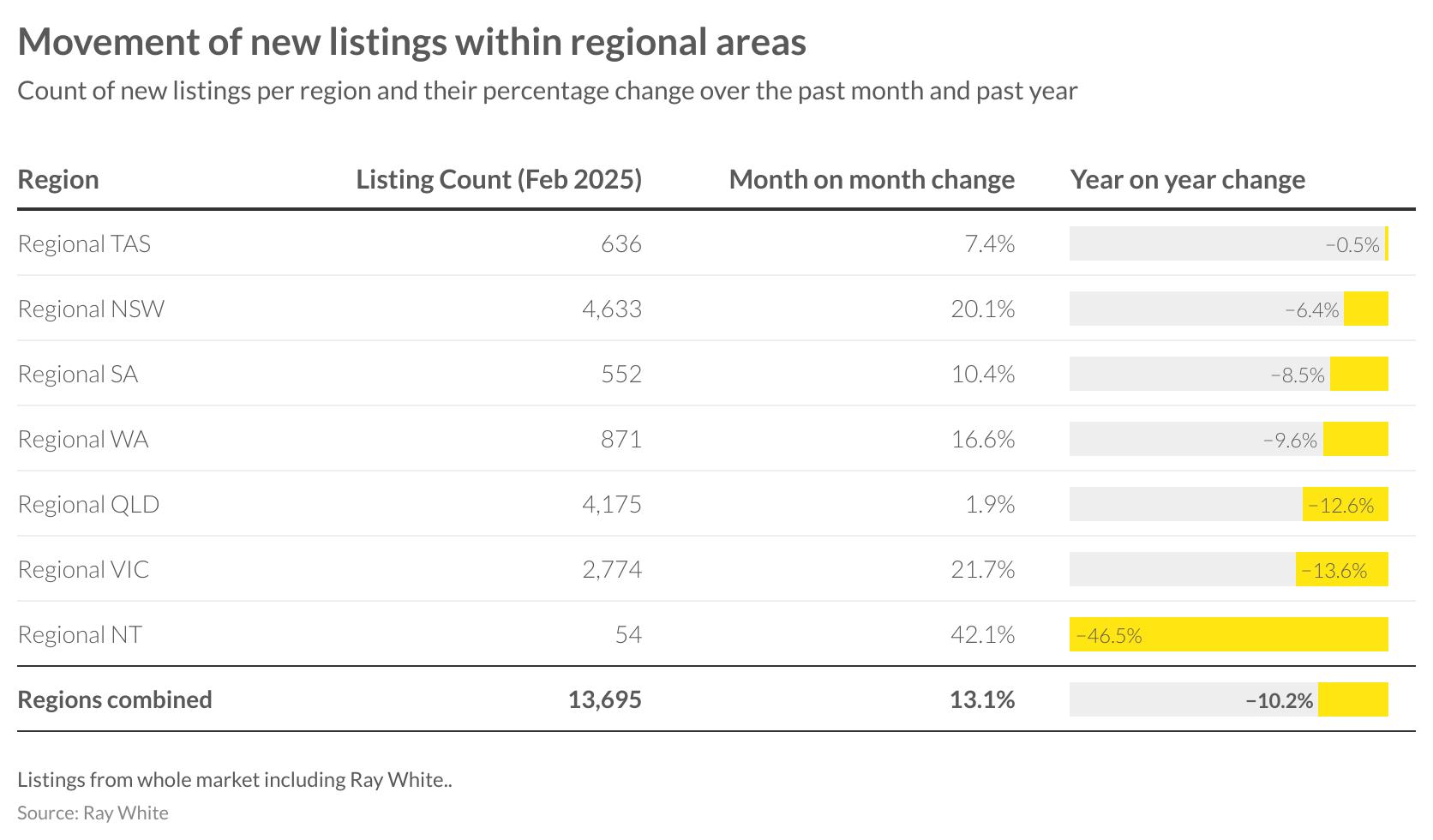

Regional listing activity shows a more subdued recovery compared to metropolitan markets, with combined regional areas recording 13,695 new listings in February. This represents a 13.1 per cent monthly increase but a more substantial 10.2 per cent annual decline.

Regional Northern Territory recorded the strongest monthly increase of 42.1 per cent, though this comes from a low base of just 54 listings and represents a significant 46.5 per cent annual decline. Regional Victoria and New South Wales both demonstrated robust monthly gains of 21.7 per cent and 20.1 per cent respectively, but remained below 2024 levels.

Queensland’s regional market, which includes the popular Sunshine Coast and Gold Coast areas, recorded the highest absolute number of listings at 4,175, though this represents just a 1.9 per cent monthly increase and a 12.6 per cent annual decline. Regional Tasmania showed the most modest annual decline at just 0.5 per cent, suggesting greater stability in this market compared to other regional areas.

AUCTION INSIGHTS

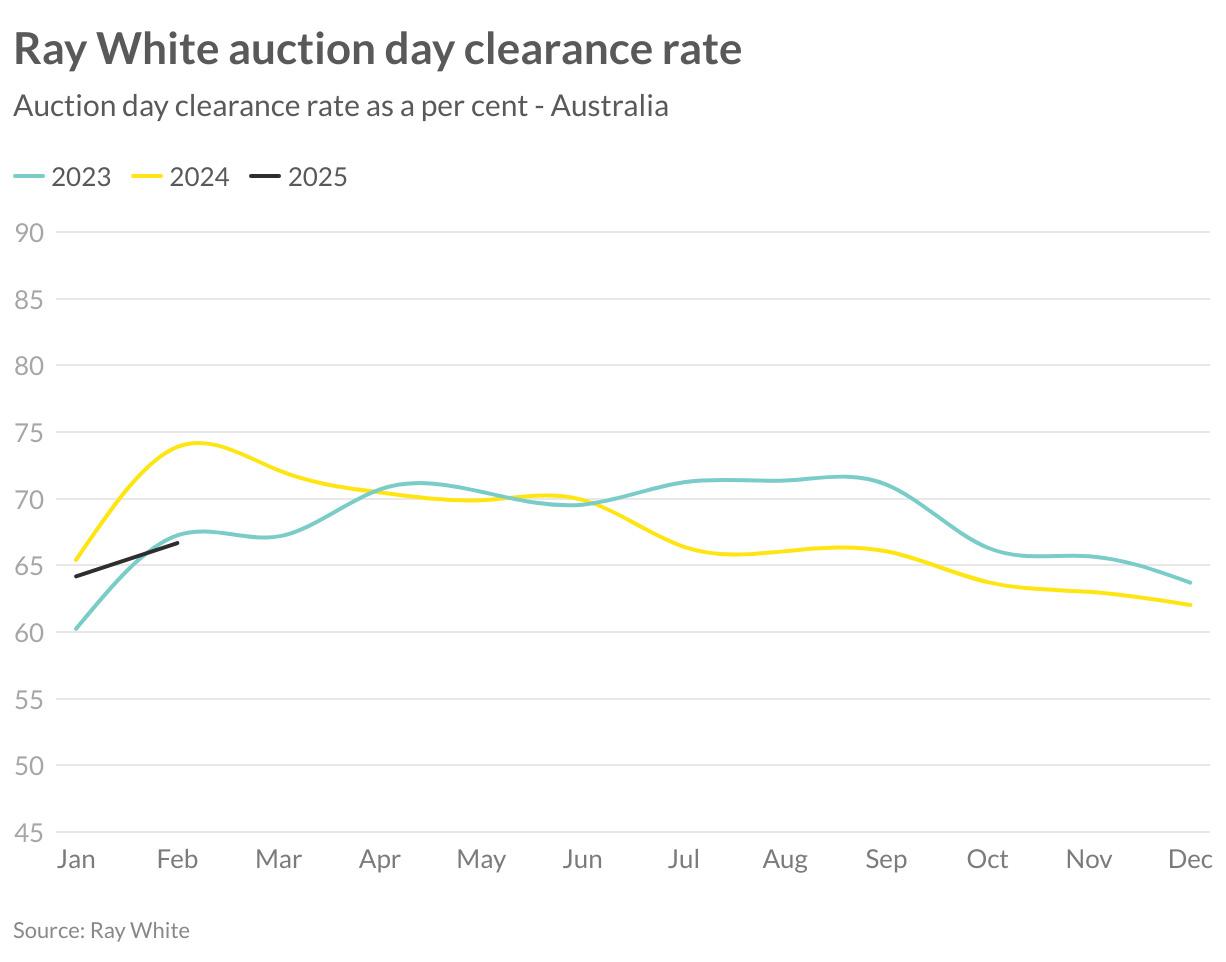

The early auction season has demonstrated positive momentum compared to January with clearance rates in February showing further improvement to 66.7 per cent. This is in line with results in 2023, however far below the two year high of February 2024 which achieved 73.9 per cent. Looking ahead we may see greater buyer confidence influenced by the latest interest rate reduction and expectation of further compression during 2025.

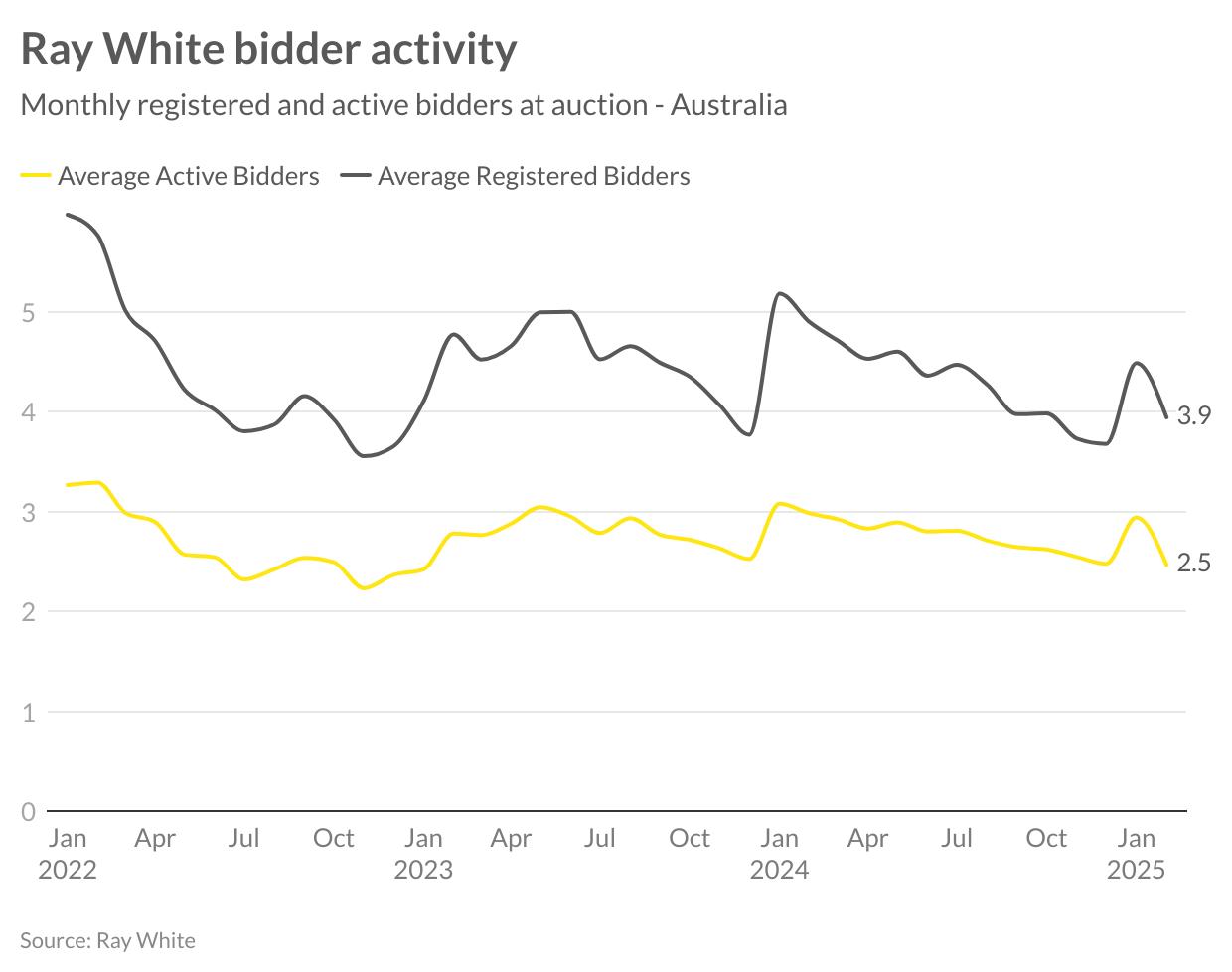

Bidder participation reflects typical seasonal patterns with registered bidders averaging 3.9 per auction in February, up from 3.7 in January. Active bidder numbers have stabilised at 2.5, showing consistency from late 2024. These figures represent a small reduction from the peaks seen in early 2024 but remain indicative of competitive market conditions as we enter the traditionally active autumn selling season.

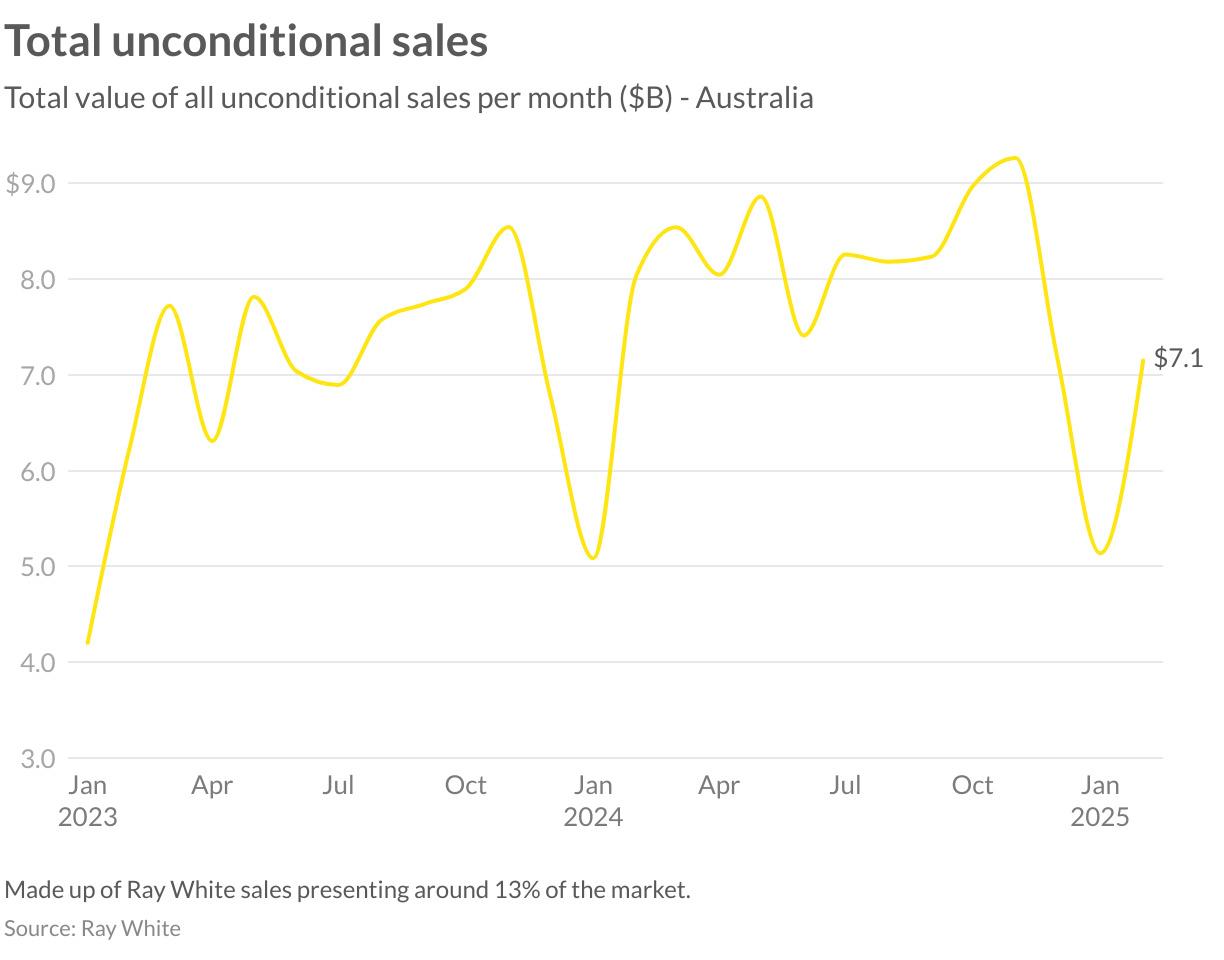

Ray White Group’s sales figures demonstrate a strong recovery in February, with unconditional sales reaching $7.1 billion. This represents a significant 40 per cent increase from January’s seasonal low of approximately $5.1 billion, indicating the market’s swift return to activity following the traditional holiday period slowdown.

While February’s result remains below the exceptional performance seen in late 2024, when monthly sales exceeded $9 billion, it compares favourably to February 2023 and aligns closely with February 2024 figures. This positive trajectory reflects both sustained price growth and increasing transaction volumes as market activity normalises.

The February performance suggests robust underlying demand despite affordability challenges in many markets. With interest rates now beginning their downward cycle, this momentum appears well-positioned to continue through the autumn selling season. The substantial month-on-month improvement highlights growing market confidence following the first interest rate reduction in over three years.