The residential property market in Australia continues to demonstrate resilience, with both houses and units experiencing a modest price increase of 0.4 per cent this month. While this represents a deceleration in growth, it underscores the market’s ongoing stability. Notably, there is an increasing divergence in market performance across various states and regions, reflecting the nuanced impact of localised economic factors.

A significant development in the broader economic landscape is the August CPI result of 2.7 per cent. While this is just a monthly result, it does fall within the Reserve Bank’s target inflation range of two to three per cent, fuelling expectations of potential interest rate cuts in the coming year. This positive outlook has invigorated the market, with early indicators suggesting an uptick in spring listing activity compared to previous years.

Looking at the longer-term trends, the housing market has shown substantial growth over the past 12 months. House prices have surged by 8.3 per cent, pushing the national average to $900,122. The unit market, while growing at a slightly slower pace, has still seen a robust 6.4 per cent annual increase, with the national mean now standing at $669,708.

The past month witnessed diverse price growth across Australian property markets, further accentuating nationwide value disparities. Encouragingly, all cities experienced increases in mean house prices, though the pace varied significantly. Melbourne and Canberra showed the most modest gains, each recording just a 0.2 per cent increase over the last month. Their annual growth rates remain subdued at 1.4 per cent and 1.5 per cent respectively, indicating a more tempered market in these capitals.

Sydney and Darwin markets have also cooled, both improving by 0.3 per cent over the month. Their respective annual growth rates of 3.1 per cent and 6.2 per cent now fall below the capital city average of nine per cent.

Perth continues to lead the pack with impressive growth figures. The city saw a robust one per cent monthly increase and a remarkable 23.2 per cent annual growth, pushing its mean house price to $873,501. This performance significantly outpaces other major cities, reflecting Perth’s strong local economic conditions. In an interesting market shift, Adelaide has surpassed Brisbane in terms of annual growth. Adelaide grew by 0.5 per cent in September, translating to a solid 13.0 per cent annual increase. Meanwhile, Brisbane’s yearly growth reached 12.6 per cent, with its mean house price now standing at a substantial $989,390.

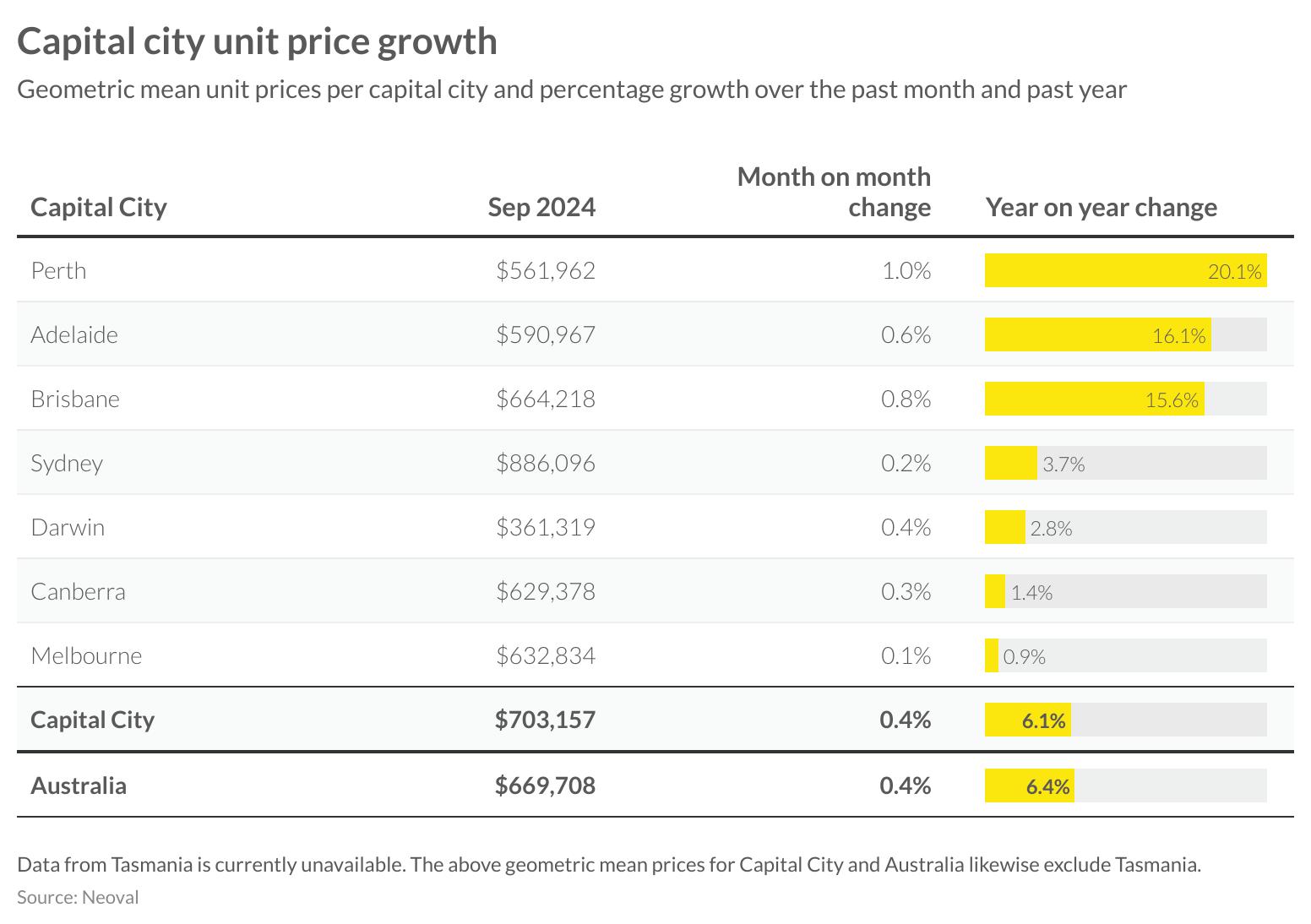

The unit market across Australia demonstrated consistent price growth this month, underscoring its appeal as an affordable housing option. Perth emerged as the frontrunner, mirroring its strong performance in the housing sector. The city recorded a one per cent monthly increase and an impressive 20.1 per cent annual growth, bringing the average unit price to $561,962.

Brisbane exhibited robust monthly growth of 0.8 per cent, yet its annual increase of 15.6 per cent was surpassed by Adelaide’s stellar performance. Adelaide continued its upward trajectory with a 16.1 per cent yearly increase, accompanied by a 0.6 per cent monthly growth.

Melbourne’s unit market faced headwinds, resulting in short-term price moderation. The city saw a minimal 0.1 per cent monthly increase and a modest 0.9 per cent annual growth. Canberra experienced similar conditions, with units appreciating by 1.4 per cent over the year. Sydney maintained its position as Australia’s most expensive unit market, with an average price of $886,096. The city recorded a 0.2 per cent monthly increase and a 3.7 per cent annual growth. In contrast, Darwin remained the most affordable unit market, with an average price of $361,319 and an annual appreciation of 2.8 per cent.

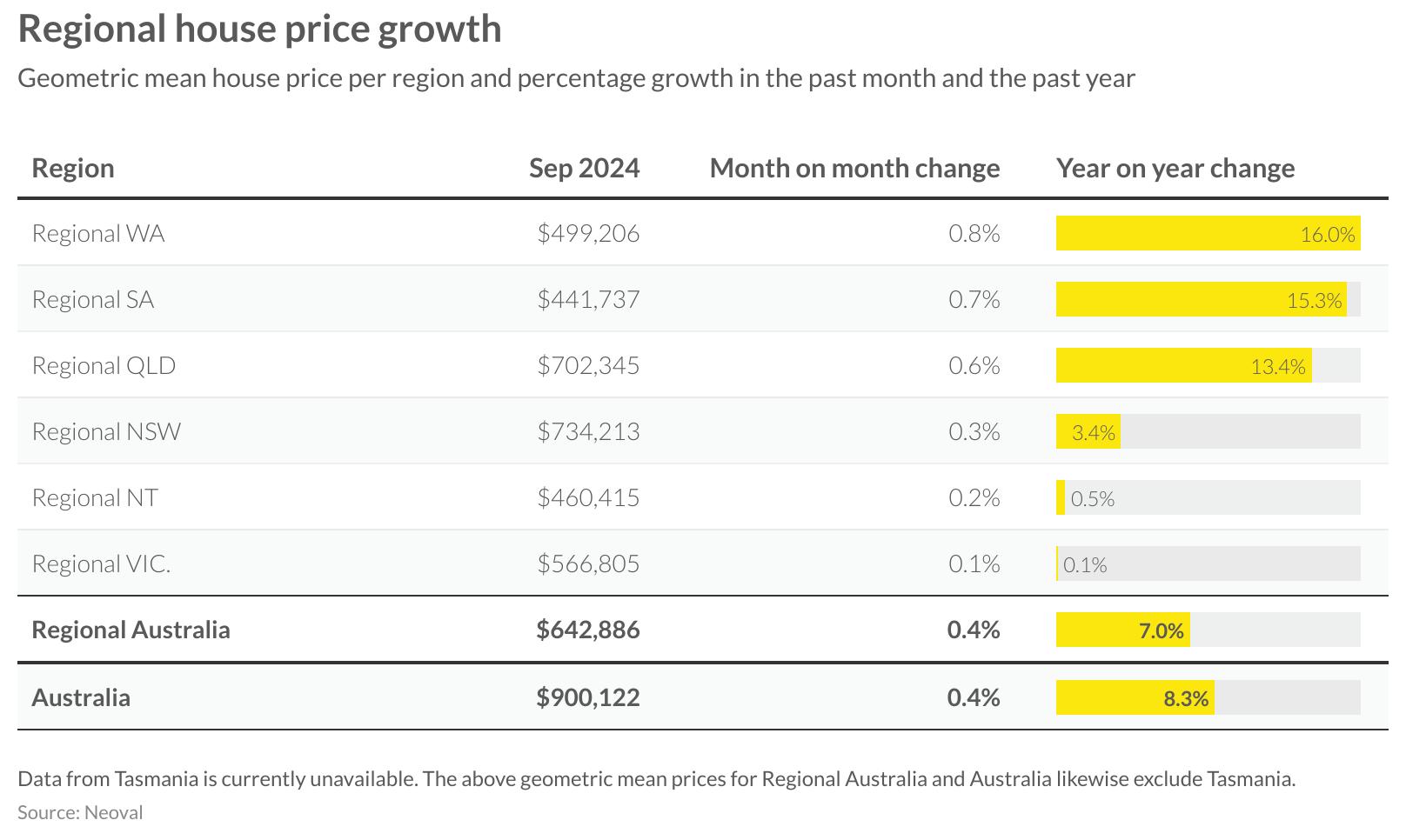

Australia’s regional property markets are mirroring trends seen in their metropolitan counterparts. House values across the country in regional areas have risen by seven per cent over the past year, though this falls short of the national average of 8.3 per cent.

Regional Western Australia continues to outperform, despite showing signs of slowing. It recorded a 0.8 per cent monthly increase, pushing the average price to $499,206, and maintains the highest annual growth rate at 16 per cent.

South Australia and Queensland’s regional markets follow closely behind. South Australia posted a 15.3 per cent yearly increase, with prices rising 0.6 per cent this month to reach $702,345. Queensland saw a 13.4 per cent annual growth, with a 0.7 per cent monthly uptick bringing the average to $441,737.

In contrast, some regions experienced more modest growth. Regional Victoria saw a minimal 0.1 per cent annual increase, while the Northern Territory recorded just a 0.5 per cent yearly gain. Regional New South Wales demonstrated moderate performance with a 0.3 per cent monthly change and a 3.4 per cent annual growth rate. These varied results underscore the diverse nature of Australia’s regional property markets, reflecting local economic conditions and demand factors.

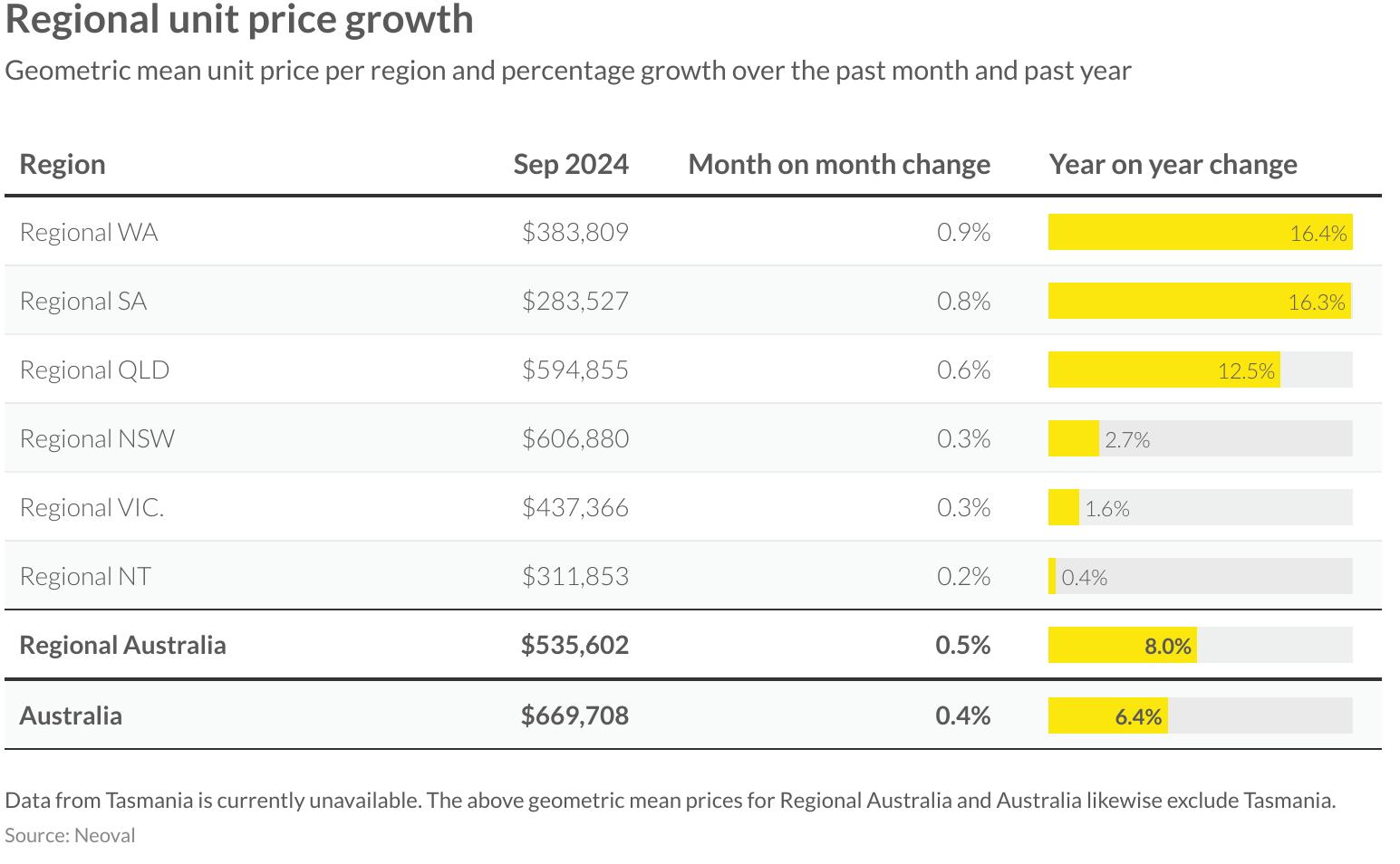

Regional unit markets have continued to outperform their housing counterparts for the second consecutive month, reflecting an ongoing shift towards more affordable living options. This trend is particularly pronounced in Western Australia, South Australia, and Queensland, which are leading the growth charge.

Western Australia’s regional unit market has maintained its position at the forefront, recording a robust monthly growth of 0.9 per cent and an impressive annual increase of 16.4 per cent. However, South Australia is hot on its heels, posting a 0.8 per cent monthly rise and a yearly growth of 16.3 per cent, nearly closing the gap with its western neighbour. Queensland’s regional unit market has also shown strong performance, with a 0.6 per cent monthly uptick. While its annual growth figure wasn’t specified, the state’s average unit price of $594,855 indicates a competitive market.

In contrast, Victoria and New South Wales have experienced more subdued growth, each registering a modest 0.3 per cent increase this month. Despite the slower growth, New South Wales still boasts the highest median unit price in regional areas at $606,880, though Queensland is rapidly narrowing this gap. The Northern Territory’s regional unit market has displayed the most conservative growth, with just a 0.2 per cent monthly increase and a minimal 0.4 per cent annual rise, indicating a more stable market condition in this region.

CAPITAL

LISTINGS ACTIVITY

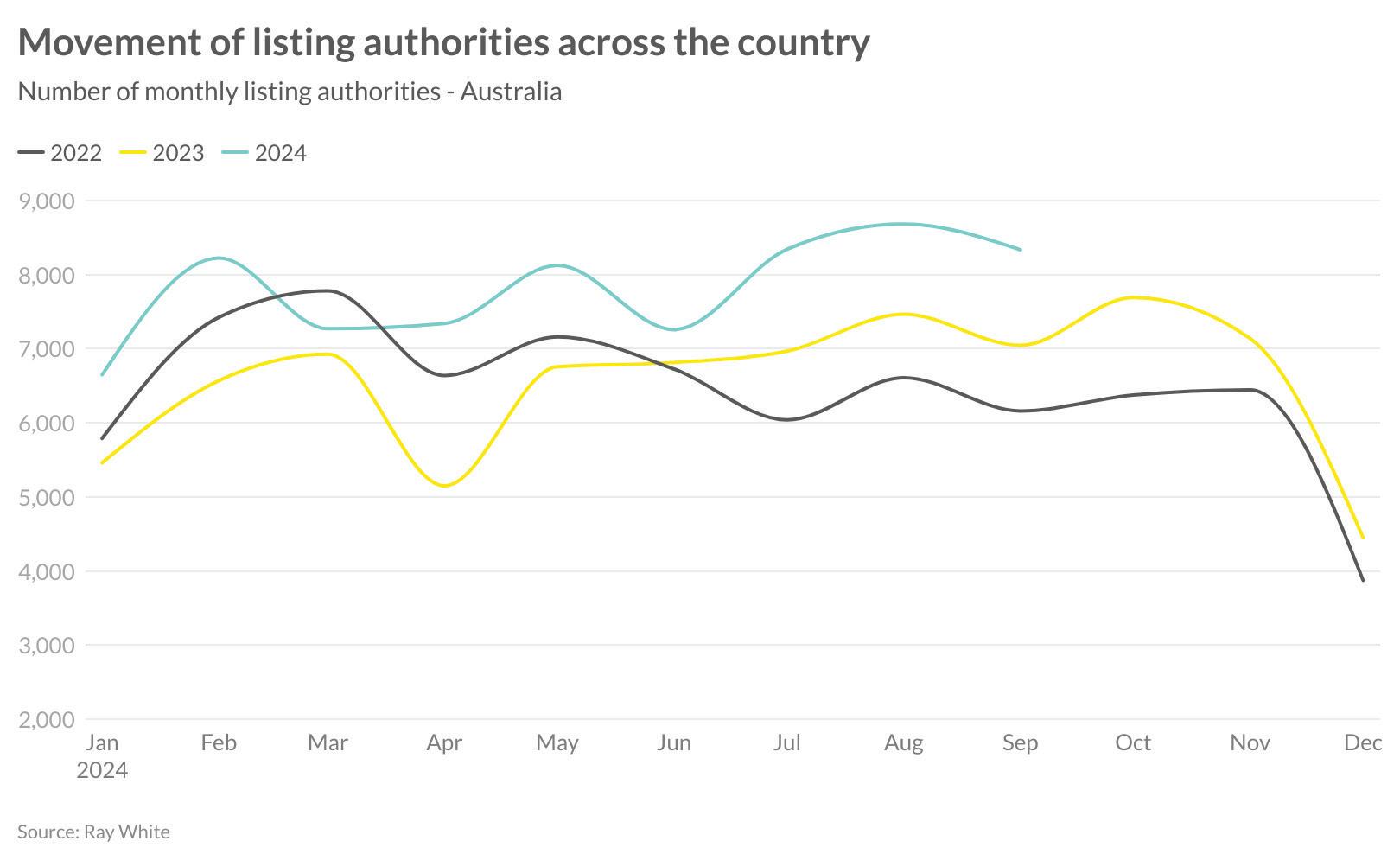

At Ray White, we gauge upcoming listings through listing authorities - the point when a vendor signs an agent to sell their home. With our market share in excess of 15 per cent, this provides valuable market insights. Good news for buyers: nationally, our 28-day rolling sum of listing authorities is at an all-time high. All states show strong volumes, with Victoria | Tasmania leading, followed by South Australia | Northern Territory. New South Wales | ACT shows the smallest increase since last year.

Various factors drive this trend. Strong price growth in Perth, Adelaide, and south-east Queensland motivates sellers. In Melbourne, new investor taxes make rental properties less attractive. Hobart’s falling prices due to low population growth may also encourage listings.

This surge in listing authorities suggests a vibrant spring selling season ahead. Buyers can expect more options and potentially less competition per property. However, the impact on prices remains to be seen, as increased supply meets pent-up demand in many areas.

The property market appears to be emerging from a prolonged ‘holding pattern’, with preliminary data from August and September indicating a modest uptick in listing levels after a subdued winter selling period. This shift suggests a turning point in market sentiment, moving away from the recent period of caution driven by inflation concerns and interest rate uncertainties. The growing optimism surrounding potential interest rate reductions later in 2024 is expected to catalyse a more active spring selling season. This change in outlook is likely to encourage both buyers and sellers who have been hesitant to engage in the market.

As economic confidence builds, we anticipate a surge in listing activities, with property owners who have been reluctant to sell now preparing to enter the market. This potential increase in supply could reshape market dynamics, offering more choices to prospective buyers who have been waiting for more favourable conditions. Overall, this transition signals a possible end to the market’s holding pattern and the beginning of a more dynamic property landscape in the coming months.

Across capital cities there was a seven per cent increase in the number of properties for sale on an annual basis. Brisbane and Sydney lead the recovery, with impressive yearly increases of 20.6 per cent and 20 per cent respectively. On a monthly basis, the results were more mixed with only Adelaide and Hobart seeing more properties for sale in September compared to August.

Melbourne showed the most significant decline over the month, however came off a particularly strong August. Canberra experienced a similar trend with a 10.7 per cent drop.

Unlike capital cities, regional markets haven’t experienced the same level of rebound in listing numbers, only recording a 1.5 per cent increase over the year. The results however were more mixed by state. Regional NSW saw the biggest jump in listings, up over nine per cent for the month and 8.7 per cent for the year. Regional VIctoria was also positive for both the month and by year.

In all other states, we recorded a drop on an annual basis for regional areas. Regional Tasmania however recorded a strong month but still recorded a drop over the year. There are relatively low listing volumes in many regional areas and hence the time series can be volatile.

AUCTION INSIGHTS

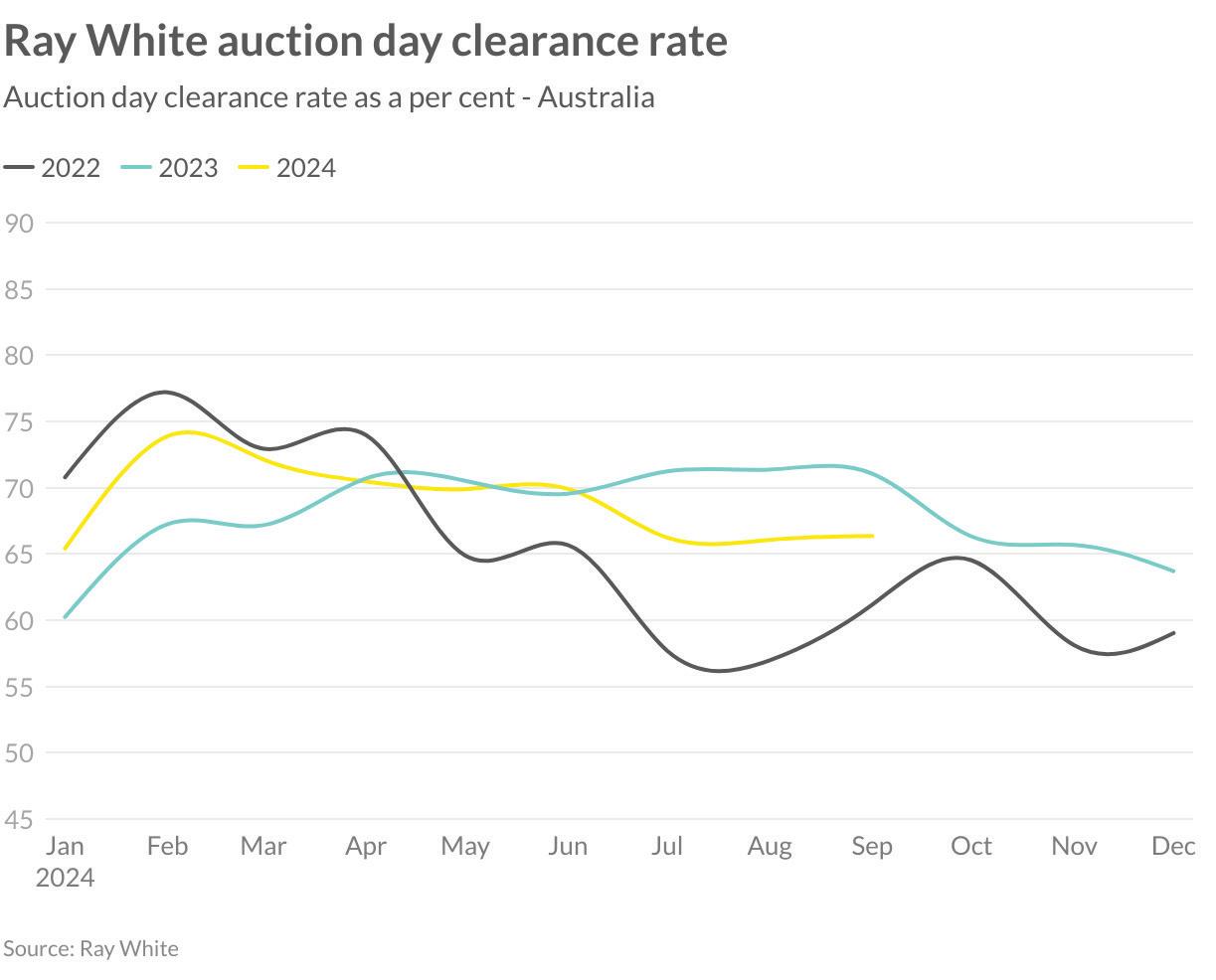

Australian property auctions have maintained a consistent performance over the past quarter, with a clearance rate of 66.4 per cent. While this figure surpasses the levels seen in 2022, it falls short of the 71.1 per cent achieved in 2023. Throughout the year, auction activity has remained robust across all markets, characterised by stable bidder participation - a result of the ongoing imbalance between limited listings and sustained buyer interest.

The outlook for the property market appears promising. The upcoming spring selling season, combined with growing optimism about potential multiple interest rate reductions in the next 12 months, is expected to bolster market sentiment. This positive forecast is likely to further energise the auction sector. As a consequence, we may witness continued enhancement in auction clearance rates as we move towards the year’s end. This trend would reflect a property market characterised by increased confidence and heightened activity.

for the remainder of 2024.

This potential shift in market dynamics could see auction participation rates rebound to back above four per cent. However, the magnitude of this recovery will likely be contingent on the influx of new property listings. A surge in available properties could provide the necessary stimulus to boost bidder engagement.

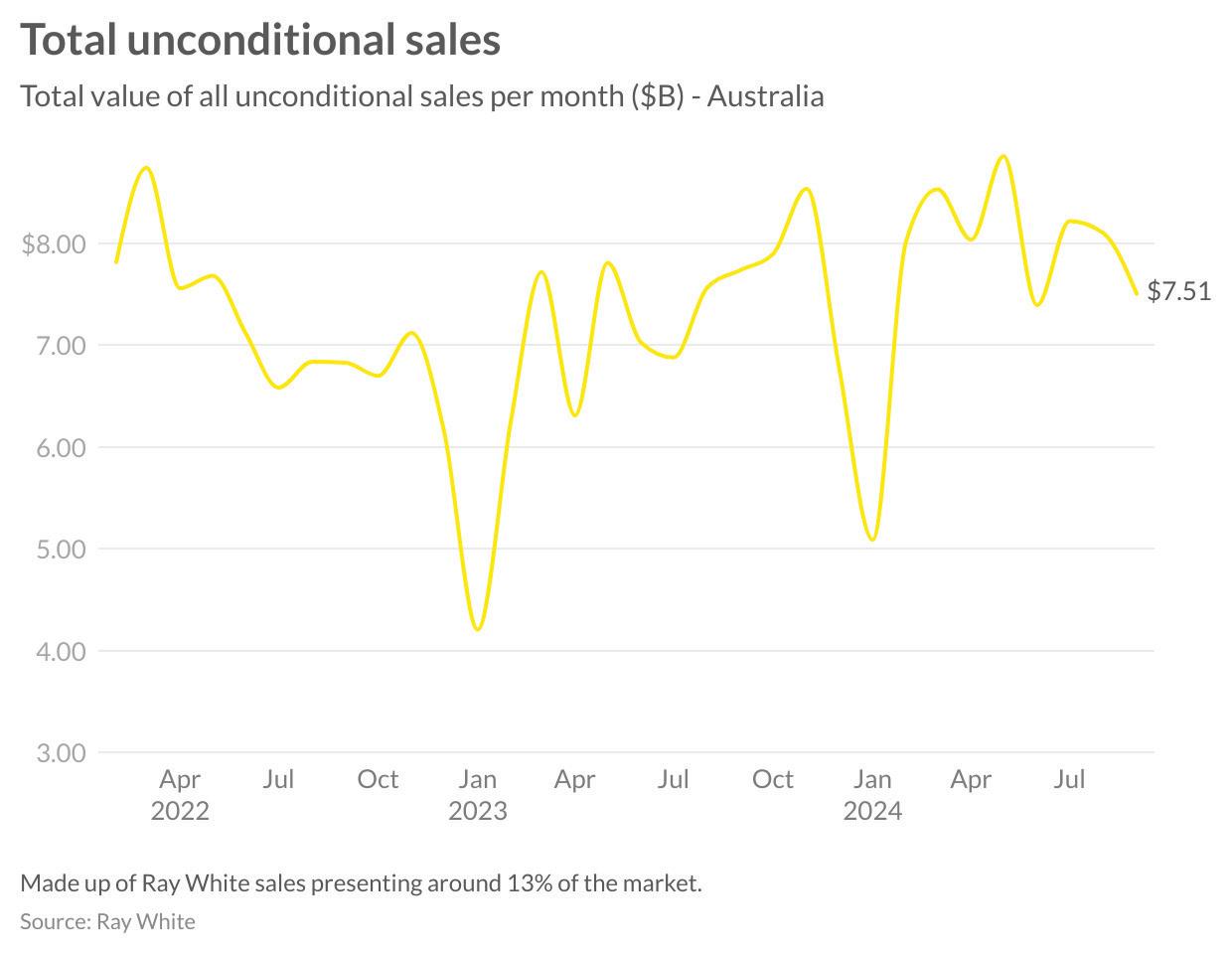

It was a strong start to the spring selling season for the Ray White Group, reflecting an increase in market share, price growth and a lift in properties for sale across the country. The number of listing authorities suggests that the large number of properties for sale will continue, although price growth is now moderating in both Sydney and Melbourne.

Settled home sales set records in all states in September for Ray White with Western Australia seeing the biggest increase in volumes (up 54 per cent) compared to last year. Victoria saw significant uplift (19 per cent), but the total was pulled back by more subdued price growth in the state. In dollar terms, Queensland recorded the largest increase compared to last year.