The Next Step

A Bold Approach to Quality Plan Rick Allen

This information should not be the sole basis for any decision. Past performance may not be indicative of future results. Therefore, no person should assume that the future performance of any specific investment or investment strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit. Different types of investments involve varying degrees of risk and there can be no assurance that any specific investment will either be suitable or profitable for a particular investment portfolio.

The author and publisher of this book and the accompanying materials have used their best efforts in preparing this book. The author and published make no presentations or warranties with respect to the accuracy, applicability, fitness or completeness of the contents of this book. The information contained in this book is strictly for educational purposes, therefore, if you wish to apply ideas contained in this book you are taking full responsibility for your actions.

YOU RUN A SUCCESSFUL BUSINESS.

You’re busy. You have limited time to look, listen, and determine if a plan makes sense for your situation. Most times, you just need the facts. The items that are important, yet provide a clear understanding of how it would work for your organization is what you want to look at.

Here’s a thought...

How about an easy to read, straight to the point book that provides most of those answers. A book that you can go back to for reference when you need more clarity. Wouldn’t that be great?

Qualified plans can be hard to understand. While the term “401k” sounds great, what does it mean to you and the people you care about the most? We will look at all types of plans and I’ll give my opinion on those.

Most importantly, don’t push away a decision for lack of information or lack of time. Over one fourth of Americans have never saved a penny, not a dime. Over 27 percent of retirees have no savings. That’s serious business.

Your attention to the consideration of a plan is important. Let us start you on an overview of what you can expect and alternatives that could provide an answer for your team.

Well, that’s why I wrote this.

HERE’S THE NEXT IMPORTANT PART.

Most agents and advisors never come back to meet with you or service the plan.

Why?

It’s not what they do. This is my primary business. Period. I know that if this is not serviced properly, it will fail. So many times, an employer chooses their current “trusted” advisor because they know them. I suspect the advisor assures them that they have their best interests and that they mean what they say. However, these types of plans could be a bit over their heads because it’s not what they do.

Let’s jump in and decide on our best course of action. I want to partner with you to make your plan the best it can be for years to come. There are so many items to consider. Hopefully, this book can provide us a path to fulfilling your dream of the best plan possible.

My crusade is to help more people save money and make it through retirement with dignity. And along the way, when a crisis hits, there will be money and solutions to help you through. Always happy to meet with you, your team, (or) your accountant about our pathway to success.

Rick Allen

TAX CREDITS

A small business is defined as a business with less than 100 employees. If your company meets that definition, you might be eligible for a tax credit.

If you have not had a qualified plan in at least three years, you qualify. There are three ways to obtain a credit.

One, a tax credit of up to 50% of the first $1,000 in initial plan expense or a total of $500.

Two, a tax credit of $250 for each non-highly compensated employee up to a maximum of 20 employees that fit that description. In 2023, a non highly compensated employee is anyone that makes less than $150,000 and/or owns less than 5% of the company. Maximum tax credit of $5,000.

Three, $500 for adding automatic enrollment into your plan document. Automatic enrollment is when an employee doesn’t provide a yes or no at enrollment. Thus, he or she is automatically enrolled based on the percentage and subaccount that the employer chooses. Finally, the tax credits are good for up to the first three years of the plan!

WHAT ARE TAX CREDITS?

A tax credit is a dollar for dollar tax reduction of the income tax that you owe. For instance, if you received a $5,000 tax credit for the year and your total tax obligation was $7,500, your tax would be reduced to $2,500.

Congress passed the law and the President signed it in December of 2019 providing small businesses an incentive to start a plan. SIMPLE IRA, SIMPLE 401k, 401k, Profit Sharing, 403b, and 457 are all included under the tax credits.

The employer does not even have to match to get the tax credits.

According to a Boston College study Americans have a $7.1 trillion shortfall when it comes to retirement savings and over half of Americans will have a lower standard of living when they retire. So, savings through work becomes crucial for many employees.

TOP THREE REASONS WHY

EMPLOYERS DON’T START A PLAN

There have been several “employee surveys” done recently. In one survey when asked about retirement, employees used words like “concerned”, “scared” and even “terrified”.

87% of the employees noted that “an employer has to help”. In another survey, the question was asked what is the most important benefit that an employer can provide? It was not higher wages, more time off, childcare, more hours, or less hours. The number one benefit ask was “Provide a retirement plan”. Working in this business for years, I’ve noticed that most small business owners know their employees name and their spouses' names. In fact, most know their children’s names and their ages. Most of the time the employer knows the financial condition of those families. When asked, “Wouldn’t you at least offer your employees an opportunity to save on a payroll basis?”, I rarely have an employer to say no.

1. 2. 3.

Cost

Revenues are not certain. Because it’s a small business, revenues are uncertain from year to year.

Employers believe employees would rather have more money now instead of planning for retirement

“National Association of Plan Advisors”, writer Ted Godbout Surveys done by the Employer Benefit Research Institute, The Pew Charitable Trust, and the Transamerica Institute

Employers believe it’s too expensive

UNDERSTANDING YOUR PLAN

When you think about qualified plans for a small employer, the three plans that are most frequently used are a SIMPLE IRA, 401k, and Profit-Sharing Plans. While a 401k is a type of Profit-Sharing Plan, we will separate the two in this book for a better understanding.

A SIMPLE IRA has no administrative expense but carries restrictions. In a 401k and Profit-Sharing plans, you have a startup fee to design the document, put together the Summary Plan Description, enrollment books and general set up of the plan. That onetime fee usually runs between $500 and $1,500. Most plans have a document maintenance fee annually between $200 and $500. Depending on the type of plan and the number of employees, the annual fee varies. The fee covers an array of items including testing, preparation of the 5500, and a variety of technical services like participant daily valuation that can be provided through the internet. These services are provided by a Third Party Administrator (TPA). They work closely with you or your contact person on uploading current salaries, hours, and status to ensure the proper testing. The TPA may be a part of the provider, or they could be independent. Understanding their role is critical to a successful plan

SIMPLE IRA

More than likely, a SIMPLE IRA was suggested to you by your accountant. Why? No administrative fees and it’s simple. It sounds incredible. It’s important to review the pros and cons of this plan. But I must admit, I’m not a fan.

In 2023, you will be able to save up to $15,500. If 50 or over, you can add catch up contributions of another $3,500 for a total of $19,000. How in the world could you beat that? Right.

Now, as the employer you must provide the employees with a 2% contribution, not a match, contribution and it is 100% vested. One small advantage is if you are having difficulty doing that you can reduce that figure down to 1% two out of each five years.

WHAT IS VESTING?

Well, it’s ownership. It’s the amount that the employee will vest, or own, during the plan year. If an employee is 100% vested, he owns 100% of it. The employer cannot forfeit or take it back for any reason

Now, here’s the rub for me. Restrictions. First, there is little liquidity. While that may not be a concern initially, think about a young worker who has a rather large retirement account, and he needs money but can’t get to it. I’ve always felt that when a man needs money, he will find a way to get it. If it means leaving work to do it, he might do it. The typical penalty if you are under 59 ½ is 10% but in a SIMPLE the last two years of contributions is 25%!

Now, there are three hardship provisions available. One, you can take up to $10,000 out to buy, build, or rebuild your FIRST home. Two, you can take up to 7.5% of your adjusted gross income (or $10,000) for unreimbursed medical expenses. And three, you can take money out for qualified educational expenses. That’s it.

You see, a SIMPLE IRA does not provide for loans. So, there’s no way, other than those three conditions, to take money from the account. In addition, there is no ROTH provision in a SIMPLE IRA. In my mind, that’s HUGE! All monies saved are on a before tax contribution, which means every single penny will be 100% taxed at distribution. In today’s world, with heavy government debt, while tax rates are one of the lowest ever in the history of our country, what do you think will happen? No one knows the future, but wouldn’t you prefer to have the option to save on an after tax basis to have tax free distributions later?

Did you know that you, the employer, can only get out of your SIMPLE IRA once a year? That’s right.On December 31 with a 60-day notice to the employees. Hope you remember the notice early enough if you decide to cancel the plan!

Almost no liquidity. No loans available. No ROTH provision inside the plan. Only one day a year to get out of the plan. Is that the direction you wish to offer?

A 401k plan is a salary deferral plan. While it is a type of a defined contribution profit sharing plan, the employees may participate by putting money into the plan. For 2023, you may put in $22,500. If age 50 or older, you can do catch up contributions of $7,500 for a total of $30,000. While that sounds sensational, it comes with restrictions for the highly compensated and key employees. If the rank and file (non-highly compensated) employees average a low salary deferral into the plan, the highly compensated may not be able to put what they wish into the plan.

For instance, if the rank and file average 1% into the plan, the highly compensated employees can only do one percent more or 2%. For instance, if John makes $200,000 and the average salary deferral from rank and file is 1%, he could only put in $4,000 into the plan (or 2%). If the employees average between 2% through 8%, the HCE can do 2% above. For example, if the average was 5%, John could put in 7% or $14,000. That’s where the TPA comes in. The TPA’s job is to do quarterly testing to make sure the plan remains in compliance. It’s imperative that the plan doesn’t become top heavy and the employer is obligated suddenly to put more money into the plan for the employees. One of the positives of a 401k plan is to offer a match or not. In fact, you can even design your plan to do a discretionary match. That’s right, if you know you want a plan but you’re just not sure you can meet the obligations, you can literally say, “I’ll like to do 100% of the first 3%. But, if I can’t, I reserve the right not to.” Now, that could make for some unhappy employees if you didn’t, but in a small business environment, chances are the employees know how the business is doing and understand. Just remember, it’s an option on many plans. The employer can provide 100% vesting immediately if he or she wishes. There are two different types of vesting graded or cliff. Graded is a gradual increase of vesting through the years up to six years. For instance, zero percent in year one, 20% percent in year two, 40% in year three, 60% in year four, 80% in year five and 100% in year six. On cliff vesting, the employer could choose 0% year one, zero percent in year two, zero percent in year three and 100% in year four.

One of the successful reasons to offer vesting is to reward those employees that stick with you. So, what happens if someone leaves and is only 40% vested, what happens to the other 60%? The employer has the option of 1) get that amount based on income to the remaining employees or 2) use it for future matching. It cannot come back directly to the employer to use as he or she wishes.

Once again, the TPA handles those distributions and keeps up with the vesting schedules

If the employer wants to help the upper management and the highly compensated employees, then many employers choose a safe harbor plan. By adding a safe harbor plan, everyone can reach the maximum threshold of contributions.

An employer can achieve a safe harbor plan in one of two ways. The first one is often used but I’m not a fan of it. If you provide a 3 percent across the board to all of the participants, then there is no further testing. The reason I don’t like that aspect is because even if the participant didn’t match, the employer still has to put the money in for that participant. I want the employee to understand the importance of retirement and “be in the game” by participating with their own dollars as well. The second way, and my favorite, is to offer a match of 100% of the first three and 50% of the next 2. Meaning, if John is willing to do a 5% salary deferral, the employer puts in 4% for a total of 9%. Imagine, if John is making $100,000, $9,000 a year is going into this plan!

One of the significant reasons to offer vesting is to reward those employees that stick with you. So, what happens if someone leaves and is only 40% vested, what happens to the other 60%? The employer has the option of 1) get that amount based on income to the remaining employees or 2) use it for future matching. It cannot come back directly to the employer to use as he or she wishes.

If the participant doesn’t want to match, the employer is under no obligation to provide any dollars to them. Yet can max out the employer’s salary deferral of $30,000 if 50 or older.

All contributions by the employer on safe harbor plans are 100% vested by the employee.

Another great option that an employer has with a 401k plan is the ability to determine if loans and hardships are available and at what levels. I’ve said before and will say again that I believe liquidity is important. Many accountants might disagree and tell you that loans are just another nightmare to consider as you become a loan office. Nothing could be further from the truth if properly designed. Don’t offer loans of $25 or even $250, as you could be overrun with loans. Plus, the TPA can do all of the heavy lifting. My suggestion is to offer no loans less than $1,000. In other words, when there is a real need. So, let’s look at the rules. If you take a loan, it, of course, comes out of the account balance. The participant must pay a current interest rate on the loan. The participant can only take up to 50% of the account balance or $50,000, whichever is less. That’s a key piece in the loan process. In addition, the participant has up to five years to repay the loan. If he or she doesn’t, it would be deemed a withdrawal and the remaining amount would be taxed then hit with a 10% penalty if under the age of 59 ½.

Almost all plan documents include hardship withdrawals but that does not keep those withdrawals from penalties or taxes.

Almost all plans also provide daily valuations for the participants. Today, employees can keep up to date on their balances and make changes whenever they wish. Plans today offer an assortment of subaccounts to choose from with a variety of risk tolerance.

Amendments are easy to do in a 401k plan. An employer makes an initial decision but may want to make a change. For instance, you started a plan where an employee had to be with the business for one year before being able to participate. Now, you have recruited a potential key employee and you want to be able to have him be a part of the k immediately. A simple amendment to the plan can take care of that. Amendments usually run between $150 to $500.

On k’s and profit-sharing plans, you must sign and return to the Department of Labor a 5500 filing no later than the end of the seventh month after the plan year. The TPA provides that return for the trustee to sign.

What if you have an existing plan and it’s just not being serviced properly? Every day that I’m out in the field talking to an employer, I hear the same thing.

"I haven't seen my advisor or agent since we enrolled the plan.”

“I seriously don’t even know my advisor’s name."

"I don’t even know what funds I have in the plan or how they are doing!”

Here’s why I’m hearing that, I believe. It’s not their primary job. They don’t understand 401k’s and Profit Sharing plans. It’s not their passion. When times are good, they don’t want to rock the boat. When times are bad and the market is down, they don’t know how to discuss it. A successful plan requires and demands that you have at least annual meetings. If you’re unhappy with your plan, let me do a review

This is what I do. Yes, there are a lot of rules and regulations with qualified plans. Let me help you navigate those those jungles.

PROFIT-SHARING

I’m adding this chapter on Profit Sharing Plans for that small employer that has six or less employees or fifteen and less if several family members are involved with the business.

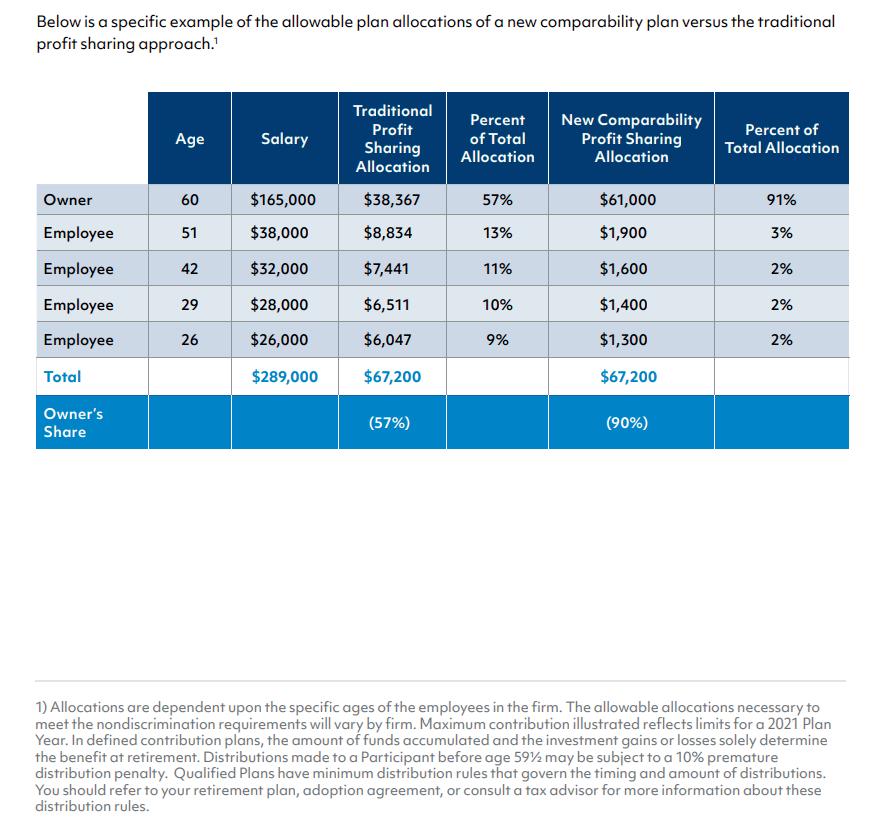

There are several types of profit-sharing plans like the traditional method based on income of each participant. Then, you have age weighted that provides more benefits to those who are older. But my favorite is called “New Comparability” or “Cross Testing”.

Imagine if you’re the owner and, more than anything else, you want to make sure you take care of yourself first or your family, etc. Let me show you an example.

Here we have five participants. The owner is placed in his own category. Since he makes a good bit more than the other employees, he’s positioning himself to take the majority of the profit share. He names two additional classes based on management and then “everyone else”. Take a look. He’s able to take 94% of the total contributions!

If you like this idea, let’s take your census and see what it would look like for your business. There are a couple of items you must be aware of. This type of profit share is not for everyone. As I said, it’s for those businesses with a few employees.

In 2023, the total you can put into qualified plans is $66,000. If you are 50 or older, you can add an additional $7,500 for catch up contributions for a total of $73,500.

That’s thrilling!

In this case, you might could build to maximize your contribution and there would be no need to do a 401k. You did it all in your profit sharing plan.

You do NOT have to profit share just because you have a profit. You can do a contribution even if you didn’t have a profit. This is not something you have to do each year.

Plus, you can add a vesting schedule and can even add loans to your profit sharing plan. A profit sharing plan can provide a lot of flexibility and is relatively inexpensive to administer.

FINANCIAL EDUCATION

In 2023, a recent survey showed that 78% of all employees are concerned that they will not be able to retire on time. Economic uncertainty has investors lost in the woods. OneAmerica’s recent survey found that consumers place the highest importance on saving enough money for retirement at 86%. Elimination of debt came in second at 74% followed by having liquidity for emergencies at 68%.

As an employer, that tells you volumes. But here’s the problem. More than likely your employees were never schooled concerning financial matters and savings. One quick enrollment meeting isn’t going to solve what they have missed their entire lives.

See, they were not taught in grammer school about how to save money. Nor were they taught in high school about investing. They didn’t learn in college about putting away money for the future or the importance of compound interest.

FINANCIAL EDUCATION

I love providing a multi night financial workshop that teaches the basics of planning and savings. I talk about risk management and risk tolerance. We discuss financial terms and go more in depth about the plan you have chosen for them.

Along with the course, I provide a 222-page workbook that they can keep for future reference. It’s a critical step and a key piece in making the plan as successful as it can be. You might think that your employees wouldn’t have an interest. But are you sure? Just read what the surveys are saying. This financial education course that we offer might be the value add to help you retain and recruit the best employees

FINANCIAL ORGANIZER

In addition to financial education, it makes sense to help each participant learn the importance of their finances. Many of us tend to put the inevitable in the back of our minds. Thus, we leave our loved ones in a situation no one wants to be in. If something happened today, where would your loved ones go to find out your wishes? Where are your important papers? Where are your important documents?

For those that attend our financial education class, we go a step further. We provide a comprehensive financial organizer to each family. We will even assist in putting it together for them. Keeping everything together for review is important but having your wishes completed is even more important.

Organize while you're living so you don't have to go digging and combing through papers, computers, and old files in an effort to find important documents and passwords. Organize for your family so they don't have to spend days in an effort to know what to do once you're gone.

It's a sensible, prudent step in developing a person's financial plan.

ALTERNATIVE PLANS

You might be thinking that you don’t want the obligations involved when implementing a traditional plan. The testing, the reporting, and the rules are thoughts that keep you up at night.

Consider this.

In 2021, Congress passed the revision of the 7702 regulations. 7702 is the definition of life insurance. Before the passage of this revision, you could “overfund” (put more money into the policy that was required to keep the policy active).But, today, you can truly build a ‘plan of action’ potentially keeping expenses lower and assets higher. It could provide a perfect way to develop a strategy of asset building using the rules and laws of life insurance and being able to take tax favored distributions.

In today’s world of life insurance, you may be able to get up to $1,000,000 in coverage in just a few minutes by answering a few questions concerning your health.

RETIRING WITH DIGNITY IS A GOAL FOR MANY BUT FEW OF US HAVE A PLAN FOR HOW TO ACTUALLY DO IT.

Using the force of life insurance, which provides a tax free death benefit, let’s think about other uses. What would happen if you lost a key employee? It just makes sense to insure that person through the business. When you think about replacing that employee, imagine recruiting, training, and developing that expertise that he/she had. It could have a dramatic effect on the bottom line of your business. The business can pay the premiums and own the death benefit and the cash value of the policy.

What about retaining that key employee? Now, here is an excellent way to enhance the highly compensated employees plan if the testing on the 401k prevents it. The business can pay premiums on the policy and receive a tax deduction. While it’s taxable to the employee, you can even provide a bonus to the bonus to take care of the taxes, if you wish. What a grand way to retain your top talent and take care of those important employees that you have.

Now, why would you even consider such a direction?

Let’s take a look at an illustration. If properly designed, the liquidity in the policy could be outstanding. Remember when we discussed the maximum requirements in a 401k and/or a Profit Sharing plan? Only 50% or $50,000 of the account value can be used, whichever is less for a loan. Plus, the money drops out of the account balance and the participant must pay a “real” current interest rate.

In an indexed universal life insurance plan illustration, you might see upwards to 75% liquidity by the end of the second year if properly designed. And that number, most likely, will rise.

Here’s the best part, if you use the variable loan option, the money actually stays in your crediting strategy. The carrier uses your money as collateral and only charges the Moody’s bond rate. With rates on the rise, a concern could be that the loan rate could exceed the gains on the crediting strategy but there are companies that offer a maximum loan rate of 5% while providing no cap options on certain indexes.

Worth a look?

In addition, let’s look at how an index truly works. After a premium is paid, expenses are deducted, and the remainder is put into bonds or fixed buckets by the insurance carrier. Meaning, safe. With some of the expenses that were paid, the carrier purchases options on the strategy that you select. The strategies can be realigned at the end of each term if you desire. If the index has risen at the end of the term (typically one year), the option is exercised, and the policyholder takes the gain based on how that strategy worked. If the index lost money in that period, the carrier simply doesn’t exercise the option. Thus, your money stays in the fixed account. Either way, at the end of the term, the gain or non gain is locked in and reset at whatever the index is at for the next term. No matter what, the crediting strategy can never lose money. By overfunding, you are reducing the expenses. You are also reducing the amount of life insurance, but you are maximizing the potential by placing more money into the various strategies.

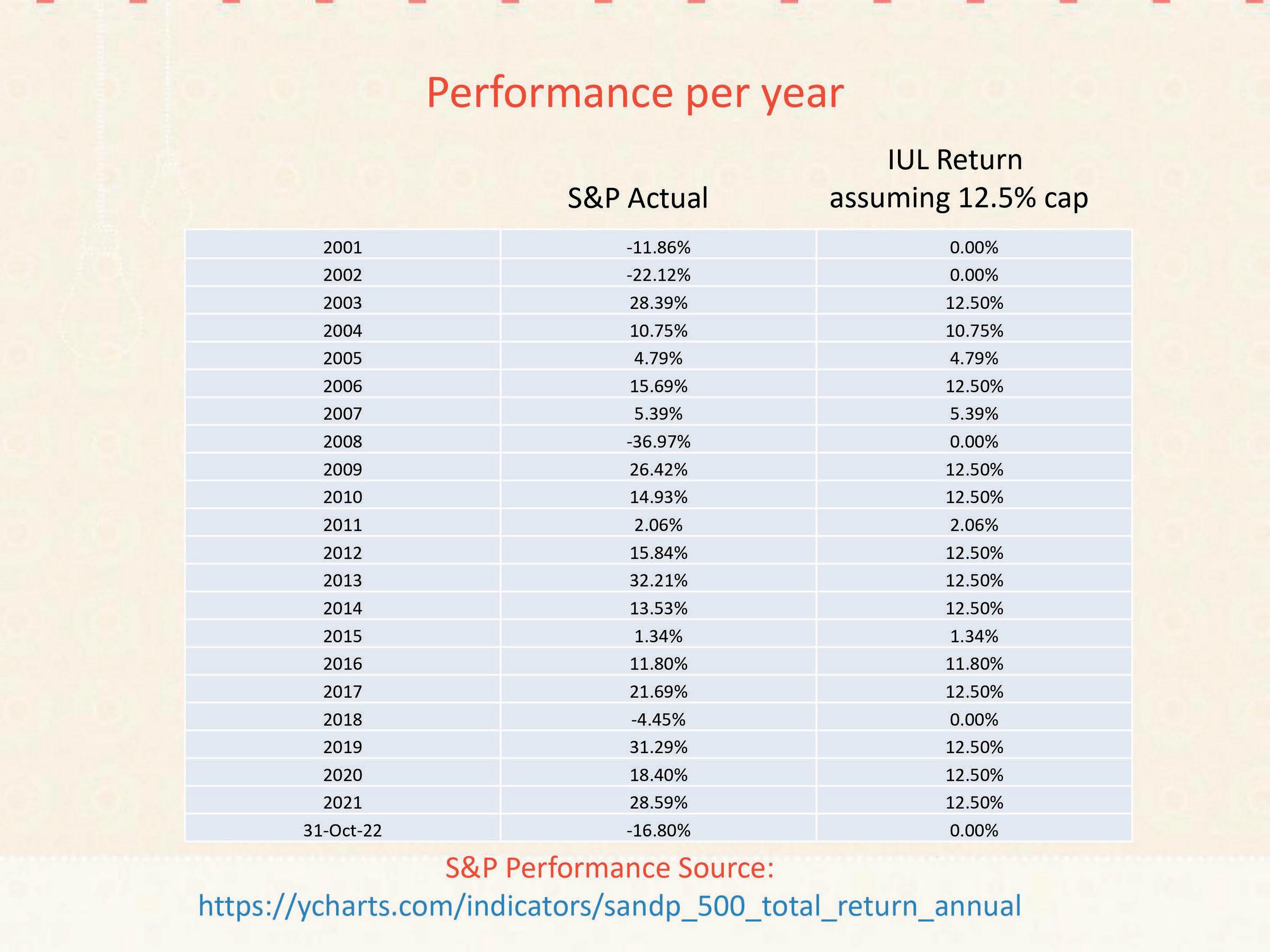

Let’s see if we can make that simple to understand. Here is a chart that we will use as an example. We make no declaration that this is any particular carrier or cap rate currently being used by a company. We do not imply that the future of a policy will make this return. In fact, the carrier will declare new cap rates, participating rates, spreads and charges at the end of each term. It is always in the best interest of the client to have a review with me each year about every aspect of the policy to have a full understanding of how it works.

In our example, let’s see what would have happened if the client would have placed $100,000 into the S & P 500 back on January 1, 2000 vs. placing an option into a crediting strategy that had a 12.5% cap rate. Our end date that we’re using is October 31, 2022, which was the date of this printing. This example does not include expenses of the policy as it would vary on carrier age and other factors

What you will note is when the market went down, our crediting strategy stayed level due to the fact that we didn’t exercise the option. When the market went up, the crediting strategy grew as well. Thus, the difference in the two accounts are significant. Another consideration that you may have is that many of your key employees may not be as versed in the market as they wish. Thus, trying to navigate the waters of the market inside a 401k could be tricky. With indexing, they might be able to smooth the waters a bit.

I have mentioned the “rules and laws” of life insurance several times in this book. Let me explain one of the big advantages of being able to use your account value as collateral when you need money from the account. Imagine, if you had $100,000 in the account. You needed $75,000 of it immediately. As a business owner, it might be necessary expenses to keep the business moving or it might be wanting to buy out a competitor! Whatever the reason, you need the money now. Let’s assume the Moody’s Bond Rate is 7% but you are in a product with a max loan rate of 5%. The carrier sends you the $75,000. First, there is no time frame to ever repay it. At death, if not repaid, it will simply be deducted from the death proceeds.

In the first year, the index made 1%. What is the cost of the loan? It would be 4% or $3,000. The next year, you make 12% in the crediting strategy. Remember, the cost of the loan was 5%. Guess what? You would net out a 7% gain or a gain of about $5,250! Most policies have a historical of how the various indexes have done, so look at that closely. But remember, past performance is no indication of future performance.

Now, this type of program is not new. See, for decades, large corporations and top CEOs have used this method for building towards their future asset building. Yes, the well informed have use tax favored programs. It’s not just a plan for the affluent. We can take advantage of building assets into these asset classes as well.

By learning a few key concepts and taking the small steps necessary, you can ensure that your goals can be reached. Indexing can be a solid path toward that.

I’ve mentioned “tax favored” on several occasions. Let me explain. When building assets inside life insurance, when you take out a loan, it is not deemed a distribution by the government since it was not a withdrawal. Thus, there are no taxes to be paid on that. However, it is imperative that you are aware that if you lapse or cancel the policy, any gains that have been made would be taxable. There are no 10% or 25% penalties, although there could be surrender charges. But, if you just cancel the policy, you could be faced paying taxes on the gains.

Let’s make it simple. Allow me to run an illustration for you and your team. I will show you the program's strengths and potential pitfalls. We will go over costs, expense ratios, history of the plan and the carrier. My job is to provide peace of mind with your decisions.

TAKING CARE OF BUSINESS

Sometimes, it makes sense to start a 401k and not even do a match. Why not take advantage of the tax credits, since they are good for up to three years. Plus, take care of your key employees.

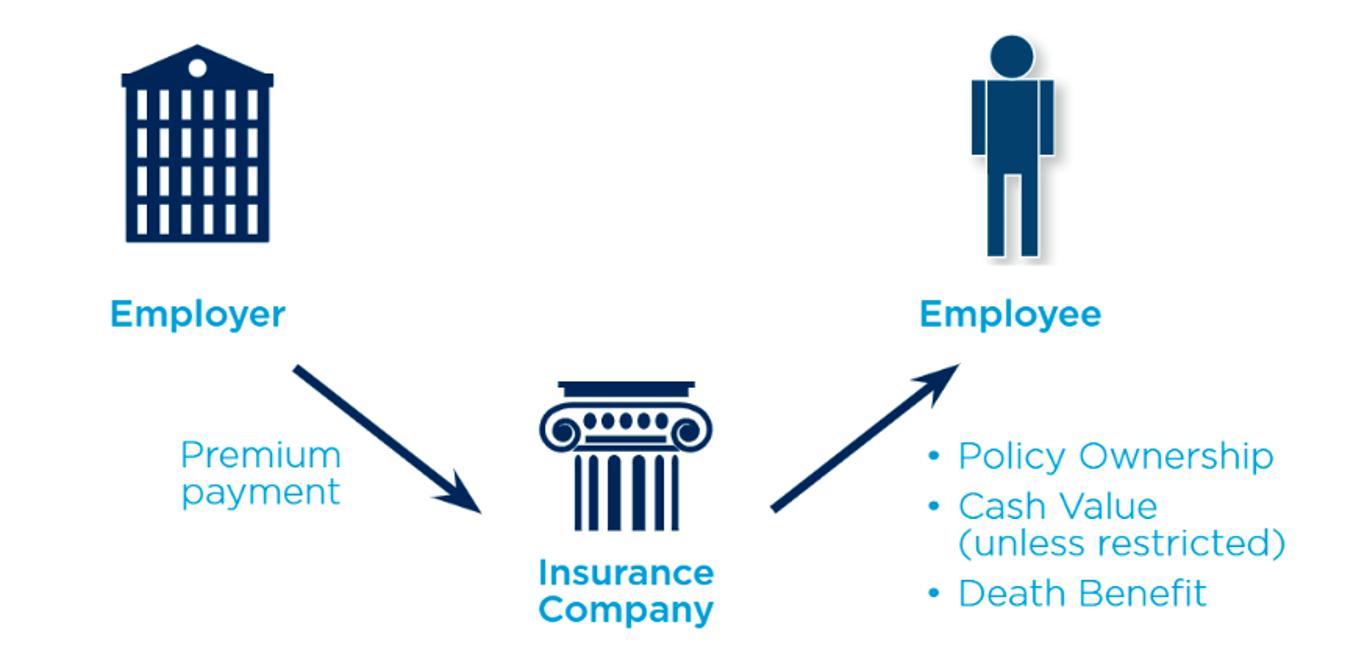

This can be accomplished by doing a Bonus 162 Executive Plan. It has no administration cost, no need for IRS (Internal Revenue Service) approval, nor any type of complicated government reporting. It is a powerful means to attract, motivate, and retain quality employees. Plus, you can provide the plan on a selective basis. Did I mention it was 100% tax deductible?

You the employer takes out a life insurance policy on a key employee. My favorite product to use in this example is a properly designed Indexed Universal Life policy. As the employer, you decide on the amount of premium you would like to pay. The policy is owned by the key employee, and they can even choose who their beneficiary can be.

See How It Works:

TAKING CARE OF BUSINESS

Here is the exciting part to me. You can even do a match and help the key employees that mean the most to your business. Meaning, you would like to pay a portion of the premium and the employee pays the rest. Now, your premium can be attached to the employee’s W-2 so they will pay taxes on your portion. Or you can even DOUBLE BONUS the employee if you like. Meaning, you pay the premium and then pay the tax so the employee’s portion is essentially tax free. With the new revision of the 7702 regulation this could be one of the best ways to build assets. Every employer should consider this benefit for themselves and their top and key employees.

STORY My

Forty years ago, I made a major decision. After careful consideration, I joined The Prudential to be a professional life insurance agent. As the years went by, I was promoted to sale manager to help train other young agents.

After 25 years, I retired.

You see, I had a passion of helping others. When I first joined The Prudential in 1983, I had no idea the opportunities that lay ahead for my clients. I just didn’t realize what was available. In that 40 years, a lot of things have changed in the industry and in 2023, there could not be a better time to start a plan at a business.

I studied at Lock Haven State College where I majored in Biology and Chemistry. However, I couldn’t keep my mind off of insurance. At night, I read financial planning books. I wanted to know more and when I turned twenty-five, I finally made the decision that it would be my life’s work. I loved learning the basics and soon I realized that one of my favorite quotes was true.

“Money isn’t everything, especially to those that have it!”

“MONEY ISN’T EVERYTHING, ESPECIALLY TO THOSE

THAT HAVE IT!”

My goal was to ensure that people had money when they needed it. No one should have to live in poverty. By consistently putting money back, it can relieve the stresses that lack of money can bring during your working years and at retirement.

I live by the creed of God, family, and community. My wife, Carol, is my best friend. My wife Carol and I recently celebrated 40 years of marriage. Carol is my biggest supporter. Unfortunately, a lot of marriages do not make it when one goes into the insurance business.

We have three children (Terrie, Mark, and Lora) and we have five grandchildren. We’re blessed to also have six great-grandchildren Also, I am a cancer survivor, I had a major surgery when I was 36 years old. I remember as the nurses were getting me settled in my hospital room one of them saying, what is that man doing here he has no pulse or blood pressure. The next thing I remember I was in intensive care. Then 60 radiation treatments followed. I went into remission for 3 years and then went through 6 months of intensive radiation treatment. I have seen so many couples split up when one gets sick. Carol stayed with me the whole time.

I’m honored to be the secretary treasurer and a deacon at Princeton First Assembly of God. I love volunteering at the church in the children ministry.

I also love volunteering on a regular basis at Amy’s House of Hope providing a sit-down meal for anymore that would like a hot supper. I currently am president for The Rotary Club of Princeton. I helped with our version of boy scouts at our church Royal Rangers. I love to see the boys that went through our program become young men.

I believe I have made a difference in the life of the boys that have come through our Royal Ranger program and a difference in the community of hungry and needy that come for a meal at Amys and in the Lifes of the volunteers that help.

Getting Ready to Serve at Amy House

Getting Ready to Serve at Amy House

As I have mentioned, I like to help my clients protect themselves against the what ifs in life. The questions are frequent, and I know there are legitimate concerns.

“What happens if my money doesn’t last for the rest of my life?”

“What if I need home or long term care?”

“What are some ways I can help my kids and grandchildren get that head start that I didn’t have?”

“We need money for our business, where should we take it from?”

“How can we have a guarantee flow of money for the rest of our lives?”

Over the years, I have positioned myself to provide products, concepts and opportunities to not only answer those needs but provide a way to do it, sometimes, in a grand fashion.

Yes, forty years in this incredible industry.

I love talking about tax favored or even tax free ways to protect your family. See, it’s not about the amount of money you have, it’s about the amount of income it can provide.

Today, I’m proud to be known as “family” to many of my clients.

I care.

As Satchel Paige once said,

“Work like you don’t need the money. Love like you’ve never been hurt. Dance like nobody’s watching.”

For me, service to others is one of the greatest honors you can ever provide.

Rick, Carol, and Daughter Lora Headed to Slovenian Heritage Center

Rick, Carol, and Daughter Lora Headed to Slovenian Heritage Center

Having Fun in Guatemala

Ryleigh

Rick's Dad: James Allen WWII Vet

Rick's Mom: Genivieve Allen WWII Vet Ryleigh's Second Birthday

Having Fun in Guatemala

Ryleigh

Rick's Dad: James Allen WWII Vet

Rick's Mom: Genivieve Allen WWII Vet Ryleigh's Second Birthday

The Next Step

A Bold Approach to a Quality Plan

rICK aLLEN

"The Next Step..." is a "straight to the point" book on popular qualified plans and other alternatives. Providing a simple breakdown of the rules and comparisons is invaluable.

It provides the decision maker enough information to ask the vital question, "What is the best course for my business". The book is broken down into several chapters allowing the reader to quickly define their interest and pull valuable points from each subject.

Fact is, over half of small business owners don't have a plan. Yet, recent surveys have shown that employee's number one ask of the employer is to find a way for them to have savings/retirement option at work. The book is designed to provide the critical information concerning the pros and cons written by one whose primary focus is helping employers implement a successful plan.

A B O U T T H E A U T H O R :

S i n c e 1 9 8 3 R i c k A l l e n h a s b e e n h e l p i n g f a m i l i e s i n h i s c o m m u n i t y p r o t e c t a n d p r e s e r v e t h e i r m o n e y . H e w o r k s h a r d t o h e l p h i s c l i e n t s u n d e r s t a n d h o w m u c h m o n e y t h e y w i l l n e e d i n t h e i r r e t i r e m e n t y e a r s . T h e n w o r k s w i t h t h e m o n a p l a n t o m a k e t h a t h a p p e n H e l i k e s t o h e l p h i s c l i e n t s p r o t e c t t h e m s e l v e s a g a i n s t t h e w h a t i f s i n l i f e !