79th Annual Stockholders’ Meeting March 23, 2024 Welcome Stockholders 1

ORDER OF BUSINESS

• Introduction of Board of Directors

• Roll Call of Directors by Secretary

• Proof of Notice of Meeting

• Minutes of 2023 Shareholders’ Meeting

• B.O.Ds’ Annual Review

• Results of Election

• Q&A

• Adjournment

2

ROLL CALL OF DIRECTORS

• Dan Burke– Treasurer (2022-2023) President (2023-2025)

• Joel Goldberg – Vice President (2022-2025)

• Bill Hoffman– Secretary (2023-2026)

• Cheryl Mullane- Treasurer (2023-2026)

• Andy Klein – Vice President (2021-2022) House (2022-2024)

• Mike Lanni– Social (2023-2026)

• Ryan Hollender – Golf (2022-2025)

• Victor Ortiz – Pool & Paddle (2021-2024)

• Nate Goldman – Buildings & Grounds (2021-2024)

3

PRESIDENTS’ REPORT

4

•

•

•

5

OVERVIEW

RGCC 101

Business Overview

Financial Review

RGCC 101

RGCC’s Reason for Existing….Why are we here?

The Ramsey Golf and Country Club, Inc., (the “Club”) shall be dedicated to the furtherance of social, recreational and athletic activities of the Stockholders of the Corporation. The various social, recreational and athletic activities shall operate and function under the guidance and supervision of committees appointed by the Board of Directors for that purpose.

6

RGCC 101 FEES

Capital Assessments

• Clubhouse renovation

• Golf equipment

• Paddle courts

Dues - turn on the lights

• Taxes/Insurance

• Utilities

• Admin and Management

• Maintenance

Activities – a la Carte

• Golf

• Paddle /Pool/Pickle

• Social

Restaurant Minimums

Real Estate Transfer Fees

Why not pay one price?

Not fair to those who don’t want to participate

Nothing is free at RGCC, and it cant be. Due to a court order…since 1981.

7

RGCC 101 BUSINESSES

Cyclical Businesses - have ups and downs with economic cycles and or inflation

Golf…bad weather also influences golf

Catering

Food Real Estate Transfer Fees

Services - are intended to “pay for themselves”

Pool Paddle Pickle

Social

8

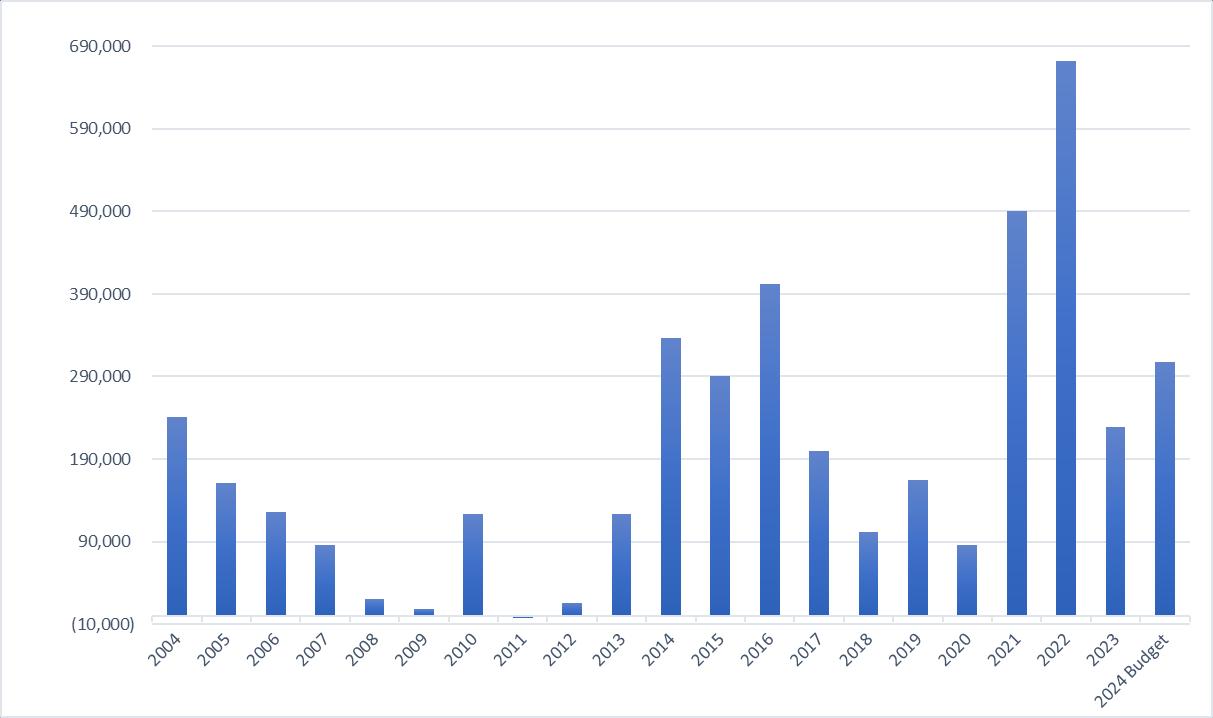

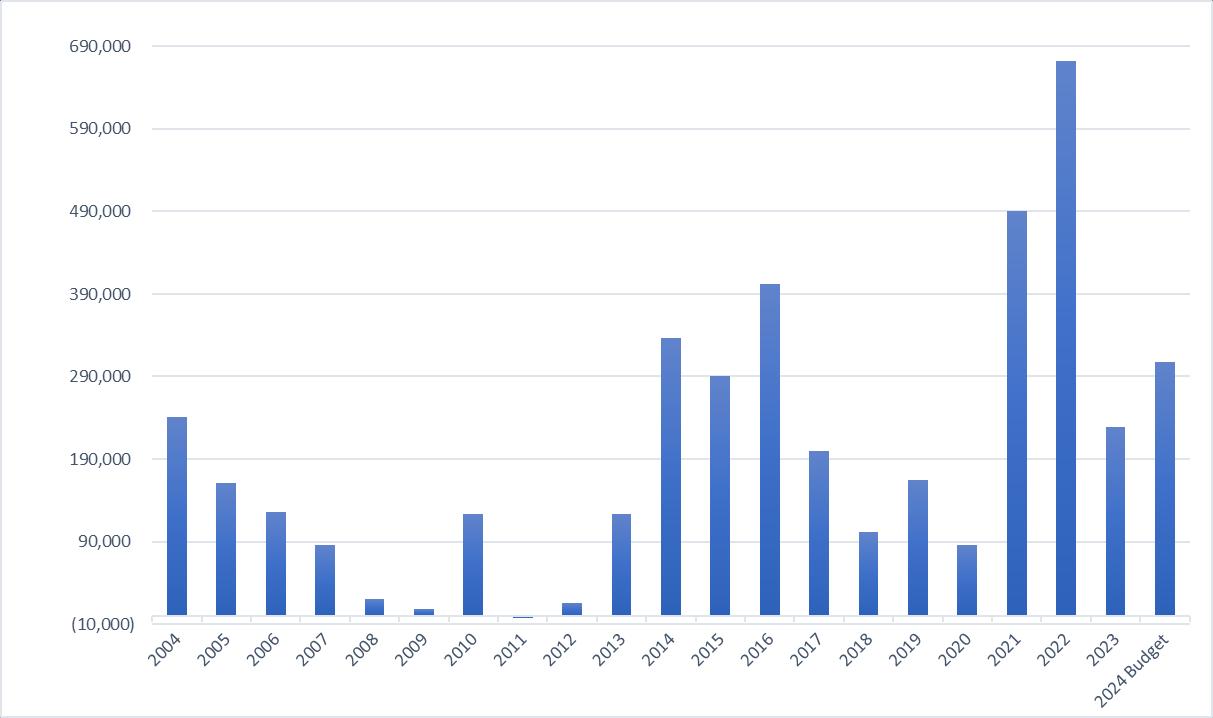

RGCC 101 - GOLF PROFITS 20 YEARS

AVG 199,133 20 years

BEST 671,817 2022

WORST (3,000) 2011

STDDEV 167,533

Total 4,181,788

Since 2011 3,419,798

9

RGCC 101 BUSINESSES

Non Cyclical Business = Recession Proof

Reliable sources of revenue no matter the current economic condition.

Booze

Dues

Our auditors and our lenders closely monitor our dues income.

10

RGCC 101 - DUES VS ADMIN EXPENSES

An additional $21.5 per member per month beginning in 2004 provides $2.8 in additional revenue and covers fixed admin costs.

Over the same period there were $3M in real estate transfer fees

We have been relying of cyclical revenues to cover fixed expenses

11

20 Year Dues Gap 2,836,645 $ Stockholders 550 Gap per Member 5,158 Years 20 Annual dues Gap 258 Monthly dues Gap 21.5 $

RGCC 101 – MASTER PLAN

Why did we need the Master Plan?

Short term view and lack of long term planning. Over many years, annual plans didn’t provide enough funding for reinvestment or maintenance on the clubhouse and facilities.

Low Dues offset by profits and the assumption that profits would always provide for the needs for the future

Last Major renovation was in the 1980’s

In 2004 the club took out a loan to replace the roof and upgrade greens and irrigation.

In 2009 the club renovated the restaurant with operating funds and reserves.

But in 2019 we had…

Decaying facility, in need of a renovation

Inadequate ancient golf irrigation, didn’t cover the entire course, Tee to green.

Tired and unprofitable restaurant, aging ballroom

An estimated 3.2 in maintenance that need to be completed if the master plan wasn't passed.

The master plan was passed by 74% affirmative vs 26% negative.

Members will pay $87 a month plus 75% of CAPEX to a MP account until 2040

Master Plan Brochure - Ramsey Golf and Country Club (ramseycountryclub.com)

12

RGCC 101 RISKS

Everything is Great…. what could go wrong?

RGCC Risks

• We over rely on profits to offset dues

• We flood the golf course with associates

• Under fund annual golf maintenance

• Don’t invest in our Staff

• We don't reserve for maintenance or future investments

• We don’t break even on services

• Member delinquency

• Home sales are our only hope

• Inflation

• Tax Reassement

• Key person risk

• Legal and regulatory complexity

• Small footprint

• Knowledge gaps in FB

• Short term view

• Over reliance on golf associates

• Other people stop showing up

• Board goes “rogue”

13

MASTER PLAN LOAN PROCESS

We met with 6 banks over 18 months, decision came down to two banks

We decided that the lower interest rate and the simple closing process was a better fit for us. We went with TD.

14 Criteria TD Bank Webster Interest rate 4.75% est blended 7% Structure Floating Fixed Loan to Project Value 70% 70% Cash Contribution RGCC first $3M Pari Passu Swap To fixed Un Swapped Closing Costs Lower Very High Closing Process Simple Complicated Loan Consolidation None Yes Prepayment Option None 900k annual Term 10 bullet 10 year roll

RGCC 101

However, we have an emerging new risk stemming from the loan

If we don’t change our approach this could happen….

In 6 years our financials are in bad shape

The Bank doesn’t renew our loans

$2M in bullet payments are due in 2030

$8M in bullet payments are due in 2034

The Bank forecloses on RGCC

What are we doing to mitigate this risk?

15

RGCC 101 FINANCIAL PRINCIPALS

How do we mitigate this new risk?

We adopt sound financial principals and have the operational discipline and sound governance in place to stick to them.

We consider our businesses long term investments.

Don’t rely on profits to offset dues

Defend golf revenue

We budget, but with an eye on the future

Break even on services.. Social pool and paddle

Don’t micro manage or window dress our businesses

Pay attention to pricing and close rates in Golf and Catering

Expect bad things to happen…they will in our businesses and we plan for it

Don’t borrow to fund maintenance

Don’t expect a good year is the new normal

Plan for maintenance costs

Don’t hope for home sales to save us

Cover fixed costs with fixed revenue streams and stay ahead of inflation

Profits deployed to pay down debt at roll date.

16

FIX the Restaurant…

RGCC 101 PLANNING FOR THE FUTURE

Financial Goal: Pay off outstanding principal in 10 years, 10 In 10

Eliminates $87 in loan payments from shareholders

How will we do that?

Fix the Restaurant

Cover fixed costs

Profits and Real Estate Transfer Fees are reserved for the future pay off dates.

17

BUSINESS REVIEW

18

RGCC 101 – BUSINESS ENVIRONMENT

19

RGCC 101 – BUSINESS ENVIRONMENT

20

RGCC 101 – BUSINESS ENVIRONMENT

21

RGCC 101 GOLF

Golf is a long term investment

• 12 year transformation of the course and the financials

• Got the right team

• Had a vision

• Made investments in People and Infrastructure

• Greater economy drives golf

• Weather

• Dependent on associates

• Associate fees too low vs members

• Better Carts = More revenue

• Drive member participation = simulators

• Proactive maintenance = better product

• Get the Price right for associates and members

22

RGCC 101 CATERING

Long History of success in Catering

• $2.3M In Profits over 10 years 22% margin over the same period

• $1.65M was an all-time record in sales and a 24% margin.

• Weddings are $788K of our sales and $188K of profits

• 2025 weddings are selling 30% above where weddings were priced in 2023

23

RGCC 101 POOL

New facility is amazing, best thing RGCC has done in years

• Working out the kinks with hours and pricing

• Need to rebuild the Swim Team

• 250K in F&B sales…70% B, 30%

2024

• New Pool Manager

• Towel Program

24

RGCC 101 ADMIN & B&G

The team is thriving after a leadership change

Our new GM saved the day with the closing pre reno!

• Inventory EVERYTHING

• Keep and Store vs Chuck out

• Trailer and paddle hut reno vs giant trailer

• Upgrade WIFI

Need More efficiency and Improve in some areas

• Going paperless, less data entry

• Transition from transaction processing and controls to reporting and analysis

• Training and education

• Going to be more open to member suggestions…Social, Pool and Paddle

• Getting to YES!

• Communicate in a more business like manner

• Do we need better software?

• Hire experts…watch and learn, do it your self next time

FYI…

• Staff spends most of their time with the same 15-20 members

25

2023 Dues of $243 Cover Administrative & Building/Grounds Costs. For 2023: Dues Covered 83% of these Expenses. WHERE DO MY DUES GO? 26 2022 Cost Per Shareholder 2022 Covered By Dues 2023 Cost Per Shareholder 2023 Covered By Dues 2024 Cost Per Shareholder 2024 Covered By Dues Payroll $162 $139 $172 $143 $150 $143 Ins. & Real Estate Tax $29 $25 $35 $29 $42 $39 Utilities, Cable & Phone $7 $6 $10 $9 $10 $10 Supplies & Office $19 $16 $17 $14 $16 $15 Computer & Professional $28 $24 $40 $33 $37 $36 Misc. & Social $22 $19 $19 $16 $11 $10 Total $267 $229 86% $292 $243 83% $267 $253 95%

RGCC 101 – BUSINESS REVIEW

can’t drive a car with a flat tire…but we have been

27

COMBINED CATERING & RESTAURANT PROFITABILITY CHART

28

RGCC 101 F&B

The lakeside grille has not been successful

• Massive drag on the financials

• Club industry views F&B as a loss leader for golf

• F&B COGS are higher due to food inflation in the last 2 years

• Trying to please everyone

• Huge menu is difficult to consistently execute

• No bench in kitchen

• Service is friendly and personable but not efficient

• Small staff = big overtime $

• End of quarter to go orders create havoc for in person dining logistics

• Don’t advertise specials

• Open to the public , but little outside business

• Key person risk in food ordering

What are we going to do?

29

All in on the Pool Café!

RGCC 2024 F&B

April: Weather dependent…limited offerings…limited days and hours working on more heaters

May: New F&B Management arrives!

Expanded new Menu and Drink offering

To Go menu

Enhanced golf BEV Cart

Mobile ordering at pool and golf cart

Working on extending hours

Exploring delivery and member shuttle

30

RGCC 2025 F&B PLANS

What do we need to be successful in the Restaurant?

The Right Space

Correct utilization of the space

Design, Furniture and Finishes

Kitchen Infrastructure

Customer base

Menu Concept

Food ordering scale

Menu Execution

Experienced Management

Trained Staff

Advertising/Marketing strategy

KPI’s metrics/PL analysis

Course correct as needed

All of these elements have to be in synch/cohesive

31

RGCC 2025 F&B PLANS

Balancing Risks and Rewards and Control

Options:

Keep doing the same thing…

Hire a manager and run it ourselves

Up to us…but we have to start over from scratch

Lease to a third party

Nice to be rid of the headache and have a fixed cash flow

Great if we can find someone, may leave us with less control

Hire a Management Company

Expensive…costs may offset the financial benefit

But the product may be improved

Partner with a 3rd party

Share Risks and Rewards and Control

Our partner is successful but juggles many balls

New F&B due diligence team has been formed to evaluate options

32

2023 ACCOMPLISHMENTS

An extremely complex and complicated year

Master Plan Progress

Building Permit Approved

Obtained a Loan Commitment

Management Turnover

Club Closure

Staff Release

Staff Relocation

Litigation Free

Settled the largest and oldest delinquent account…2024 subsequent event

Started F&B planning for the future

33

2024 GOALS

Finish the Club House renovation on Time and on Budget

FIX THE RESTURANT

Break even outside of Golf

Codify Financial Principals

The new Board will convene next month to set goals for 2024 aligned with our long term vision.

34

RGCC 101 Homework 35 Take advantage of our Beautiful Community Join an Activity if you haven’t Go to a social event Try the new food offerings at the pool Volunteer for a committee Bring friends Behave yourselves Relax. Things aren’t so bad Compliments in person, complaints in email Feed back to Club management, then to the respective Board member, then to the President Or just call or email me..I'd prefer to talk though I can be reached at: president@ramseycountryclub.com dan.burke44@Gmail.com 201-887-6623, ask for Jenn

PROFIT & LOSS - SUMMARY

36

2023 2022

$ 7,748,162 (1,278,864) (4,023,923) (1,936,903) (600,838) (92,366) (690,543)

1,023,122 $240,213 Total

$ 7,536,302 (1,195,793) (3,827,292) (1,702,394) (507,562)

303,261

1,684,508

976,573 $2,964,342

COMPREHENSIVE RESULTS

Revenue Cost of Sales

Benefits

Charges/Taxes

Operating Income Depreciation & Other Capital Assessments Net Income 37

Payroll &

Other Expenses Fixed

Net

Revenue 2023 2022 2021 2020 2019 Resident Dues $1,635,877 $1,543,958 $1,480,791 $1,438,866 $1,422,655 Golf Dues 2,017,839 1,881,391 1,706,714 1,239,489 1,294,758 Initiation Fees 230,850 723,750 520,205 470,125 266,200 F&B Revenue 3,297,202 3,001,327 2,531,101 1,363,822 3,045,050 Golf, Pool, Paddle, Admin 566,394 385,876 437,538 354,932 458,217 Total Revenue $7,748,162 7,536,302 6,676,349 4,867,234 6,486,880 Variance from prior year 3% 13% 37% -25% 1% Expenses 2023 2022 2021 2020 2019 Cost Of Sales- F&B 1,278,864 1,195,793 1,021,249 609,567 1,077,426 Total Payroll 4,023,923 3,827,292 3,265,963 2,752,049 3,095,487 Department Expenses 1,936,903 1,702,394 1,686,988 1,574,015 1,742,474 Property Taxes 321,787 292,504 290,277 289,936 278,582 Fixed Charges 279,051 215,058 176,637 145,683 135,114 Total Expenses $7,840,528 7,233,041 6,441,114 5,371,250 6,329,083 Variance from prior year 8% 13% 16% (13%) 1% Operating Income (92,366) 303,261 235,235 (504,016) 157,797 38

COMPARISON OF FINANCIAL OPERATIONS

INCOME

DEDUCTIONS Other Additions & (Deductions) 2023 2022 2021 2020 2019 Depreciation (626,186) (575,139) (454,999) (398,052) (381,597) Government Grant - 1,252,345 - -Employee Retention Credits - 610,608 - -Loss on Disposal of Assets - (1,681) (39,511) -Interest Rate Swap Adj (64,357) 398,375 124,074 (92,709) (10,449) Capital Assessment Imp Fee 1,023,122 976,573 960,362 943,994 362,232 Total Other Items 2,661,081 589,926 453,233 (29,814) 39 Net Income $240,213 $2,964,342 $825,161 (50,783) (127,983)

COMPARISON OF OTHER

&

COMPARATIVE COMPREHENSIVE RESULTS 40 Revenue 2023 2022 2021 2020 2019 Resident Dues $1,635,877 $ 1,543,958 $ 1,480,791 $ 1,438,866 $ 1,422,655 Golf Dues 2,017,839 1,881,391 1,706,714 1,239,489 1,294,758 Initiation Fees 230,850 723,750 520,205 470,125 266,200 Restaurant Revenue 3,297,202 3,001,327 2,531,101 1,363,822 3,045,050 Golf, Pool, Paddle, Admin 566,394 385,876 437,538 354,932 458,217 Total Revenue $7,748,162 $7,536,302 $6,676,349 $4,867,234 $6,486,880 Variance from prior year 3% 13% 37% -25% 1% Expenses 2023 2022 2021 2020 2019 Cost of Sales F&B 1,278,864 1,195,793 1,021,249 609,567 1,077,426 Total Payroll 4,023,923 3,827,292 3,265,963 2,752,049 3,095,487 Department Expenses 1,936,903 1,702,394 1,686,988 1,574,015 1,742,474 Property Taxes 321,787 292,504 290,277 289,936 278,582 Fixed Charges 279,051 215,058 176,637 145,683 135,114 Total Expenses $7,840,528 $7,233,041 $6,441,114 $5,371,250 $6,329,083 Variance from prior year 8% 13% 19% (16%) 1% Operating income $ (92,366) $ 303,261 $ 235,235 $ (504,016) $ 157,797 Other 2023 2022 2021 2020 2019 Depreciation (626,186) (575,139) (454,999) (398,052) (381,597) Government Grant - 1,252,345 - -Employee Retention Credits - 610,608 - -Loss on disposal of assets - (1,681) (39,511) -Interest Rate Swap Adj (64,357) 398,375 124,074 (92,709) (10,449) Capital Assessment 1,023,122 976,573 960,362 943,994 362,232 Net income $240,213 $2,964,342 $ 825,161 $ (50,783) $ 127,983

SEGMENTS*

Depreciation

Assessments Totals Grille Room Catering Golf Paddle Pool Dues & Other Revenue $7,748,162 $1,664,252 $1,655,987 $2,348,123 $61,355 $187,776 $1,830,669 Cost of Sales (1,278,863) ($675,693) (584,884) -- -- (18,286) -Gross Profit 6,469,299 988,559 1,071,103 2,348,123 61,355 169,490 1,830,669 Payroll Expenses (4,023,923) (1,166,476) (514,366) (1,191,533) -- (21,672) (1,129,876) Other Dept Expenses (2,537,741) (375,013) (158,631) (927,787) (25,824) (231,126) (819,360) Contribution Margin ($92,366) ($552,930) $398,106 $228,803 $35,531 ($83,308) ($118,567) 41

BUSINESS

*Excludes

& Capital

BALANCE SHEET

42

ASSETS Current Assets 2023 2022 2021 2020 Cash $1,763,986 $1,353,306 $2,100,657 $1,842,908 Construction Loan Escrow 81,010 1,620,054Accounts Receivable (Net) 931,342 638,800 525,969 394,752 Employee Retention Receivable 610,608 -F&B Inventory 32,574 56,745 50,204 59,665 Prepaid Expenses 93,324 88,010 73.520 57,864 ROU Assets & SWAP Valuation 827,952 683,113 24,003Total Current Assets $3,648,178 $3,511,592 $4,394,407 $2,355,189 Property & Equipment Land & Lease Improvement 6,653,351 6,598,778 6,426,612 5,531,739 Building & Improvements 9,241,275 9,196,938 5,245,538 5,231,730 Furniture, Fixtures, & Equip. 3,502,669 3,411,372 3,183,098 3,064,561 Construction in progress 883,810 332,979 1,526,543 1,129,554 Total Property & Equipment $20,281,105 $19,540,067 $16,381,791 $14,957,584 Less Accum. Depreciation 10,870,627 10,244,442 9,699,353 9,858,046 Net Property & Equipment 9,410,468 9,295,625 6,682,438 5,099,538 Total Assets $13,058,646 $12,807,217 $11,076,845 $7,454,727 43

Current Liabilities 2023 2022 2021 2020 Line of Credit $250,000 $200,000 $- $500,000 Accounts Payable 104,926 194,615 193,804 148,160 Accrued Liabilities & Taxes Payable 138,890 185,888 515,077 115,389 Unearned Dues 1,120,098 918,144 726,573 612,782 Deposits For Functions - - 90,963 87,763 Paycheck Protection Program Note - - 1,160,617 606,445 Current Maturities of Long-term Debt 310,813 415,540 302,951 194,128 Total Current Liabilities $1,924,727 $1,914,187 $2,989,985 $2,264,667 Long-Term Liabilities Disaster Loan, Net of Current Maturities 123,401 132,277 141,150 148,169 Long-term Debt, Net of Current Maturities 3,037,203 3,027,651 3,176,950 1,098,292 Operating Lease Obligations 336,668 Total Liabilities $5,085,331 $5,074,115 $6,308,085 $3,511,128 LIABILTIES & STOCKHOLDERS’ EQUITY Stockholders’ Equity 7,973,315 7,733,102 4,768,760 3,943,599 Total Liabilities & S.E $13,058,646 $12,807,217 $11,076,845 $7,454,727 44

45 Mortgage Construction Note Economic Injury Disaster Loan Line of Credit Principal 1,600,000 3,000,000 750,000 2022 Balance 129,062 2,918,990 136,011 200,000 Term 20 year 10 year Bullet 30 Years Revolving Swap Float to Fixed Float to Fixed Fixed Fixed Rate 4.5% 3.7% 2.8% Maturity 11/1/2023 Open Monthly Payment Annual Payment Principal 1,600,000 3,000,000 $150,000 750,000 2022 Balance 129,062 2,918,990 136,011 200,000 Term 20 year 10 Year Bullet 30 Years Revolving Swap Float to Fixed Float to Fixed Fixed Fixed Rate 4.5% 3.7% 2.8% Prime Maturity 11/1/2023 1/1/2031 7/1/2050 Open Monthly Payment 12,003 17,744 731 N/A Annual Payment 144,036 212,928 8,772 Mortgage Construction Note Economic Injury Disaster Loan Line of Credit Principal $1,600,000 $3,000,000 $150,000 $750,000 2023 Balance 0 $2,799,706 $127,239 $250,000 Term 20 year 10 Year Bullet 30 Years Revolving Swap Float to Fixed Float to Fixed Fixed Fixed Rate 4.5% 3.7% 2.8% Prime Maturity 11/1/2023 1/1/2031 7/1/2050 Open Monthly Payment $17,744 $731 N/A Annual Payment $212,928 $8,772

LIABILITY PROFILE

46

CAP-EX

Capital Projects Completed in 2023 2023 CAP-EX ❑ Golf Improvements & Equipment $33K ❖ Equipment Trailer ❖ Golf Maintenance Building Improvements ❖ Irrigation System Pump ❖ Golf Netting ❑ Other ❖ Cloud Based POS Conversion ❖ Fountains ❖ Pool Furniture/Umbrellas $50K Total $83K 47

MASTER PLAN

48

❖

❖

❖

❖

PLAN

49

POOL $134K

Kidde Pool Enhancements

Playground & Fencing

Construction Contractor

2023 MASTER

EXPENDITURES

❑

❖

❖

❖

Landscaping, Kitchen Equipment

CLUBHOUSE $551K

❑

Engineering, Architecture & Design Fees

Legal, Bank, Appraisal & Commitment Fees

Site & Zoning Board Fees

Project Through 12/31/2023 Master Plan Assessment $3,430,751 Loan Proceeds $3,000,000 Total Funding Drawn $6,430,751 Main Building $883,870 Pool Area $4,237,339 Golf Course Irrigation $1,102,632 Golf Course Restrooms $212,585 Total Improvements $6,436,426 50

MASTER PLAN OVERVIEW

•

•

MASTER PLAN

Paddle Hut and Proshop

• Cart Barn Organization for Push Cart and Bag Storage

• Golf Pro Office Renovation

Pool Enhancements

• Playground Installation - Done

• Kiddie Pool Water Features - Done

• More Seating – Done

• Evaluating further this season with updated umbrella layout and pool cap ex budget for the installation of more permanent shade structures

• PARKING, PARKING, PARKING

• New parking area surface and space designating curbs project scheduled for completion prior to pool season

51

MASTER PLAN

• Clubhouse Budget Allocation

• $8,000,000 in Remaining Loan Funding

• Envelope & Code Compliance – 31.5%

• Lakeside Grill – 29.2%

• Catering Facility – 31.5%

• The Abbey – 7.8%

• Construction Progress

• Interior Demolition – 90% Complete

• Window Templating and Ordering – 90% Complete

• Roof Repairs and Repointing – 10% complete

• Construction Schedule

• Structural and Interior Framing – April

• Greenhouse Demolition –May

• Foundations – June

• New Building Construction – July

• MEPS Roughing – July

• Kitchen Equipment & Interior Fitouts – October

• Punchlist and FFE installations – January

• Currently on Schedule for Standard 2025 Opening!

52

MASTER PLAN

Top Left – Looking from bar toward Lakeside Grille entrance

Bottom Left – Looking from Abbey into kitchen

Top Right – Looking through the bar from old band area

53

MASTER PLAN

Top Left – Looking out on the ballroom from the old stage

Bottom Left – Looking through the ballroom towards the staircase

Top Right – Looking towards old bar area and through to kitchen

54

MASTER PLAN

Looking from parking lot

Looking from practice

55

green

MASTER PLAN

56

MASTER PLAN

57

MASTER PLAN

58

B&G UPDATES

• Lake Program

• 5-year plan

• Includes cleanups, repair/replacement of fountains, adding new fountains

• Piers, Islands and Roadsides

• New contract to include defined maintenance plans and staged enhancements

• 10% Savings

• Includes Belgium block repair to scope

• Includes Club Entrance area and Franklin Tpke

• See Golf Section for Trees and Streams

• Other needs? Please give us ideas of areas to improve our Buildings and Grounds.

59

HOUSE

60

2023 F&B OBSERVATIONS

Pool Bar

• Successful First Full Year

• $225K Revenue from Pool Bar & Kitchen

Grille, Bar & Catering Thriving

• Made Many Improvements

• Introduced More Varied Dinner Specials

• Better Consistency

• New Upscale Presentation

• Thursday Night Live Music Continued To Be Popular

• Sunday Brunch Remained Popular

• Adjusted Operational Execution Which Resulted in a $100K Savings vs. 2022

61

CATERING

• Catering Thrived in 2023 to an all-time revenue high of $1,655,987.

• Weddings drive Catering at RGCC. Of the 43 weddings booked in 2023, we brought in $787,945 in revenue. Of the other 211 catered events in 2023, we brought in $868,042.

• If the 254 total catered events, only 48 of them were events booked by members of the Club. The rest of the events were booked by non-members.

• The Club received 2 awards in 2023 for “Best of Weddings” for the Knot Magazine and the “Love it” award from New Jersey Bride Magazine.

• Catering Pricing will increase significantly in 2025 due to the renovation of the Clubhouse, rising food costs and inflation.

• There will be multiple member events in 2024, all to be held outdoors.

62

MEMBER SURVEY FEEDBACK

Out of 16 Questions 4 Stood Out That I Want To Discuss

Question 3

• Addressed Service at the Lakeside Grille & Bar.

• 88% of the members that responded were categorized as very satisfied and/or satisfied with the service.

• These categories are described as “love the servers and bartenders” or “most of them are good.”

• We are really looking forward to bringing back our most valuable staff members.

Question 4

• Addressed the Lakeside Bar Wine Selection and Cocktails

• 82% of the members indicated that they were again very satisfied and/or satisfied.

• Of the 82%, many comments stated that the wine and cocktail selection are “fantastic”.

• With that knowledge, we absolutely plan to hold this standard and improve on it.

Question 13

• So that we can better understand your needs and wants, why are you choosing to go to other local restaurants?

• Responses indicate that 64% of our Community go out to other restaurants because of food quality. The others indicated that they were just looking to change things up.

Question 14

• Addresses the type of atmosphere and ambiance for post renovation.

• 45% want more upscale and modern dining

• Yet, 55% would prefer a more casual and family friendly atmosphere.

• VERY split in the middle.

63

64

GOLF

PARTICIPATION 0 50 100 150 200 250 2023 2022 2021 2020 232 226 242 199 144 160 150 136 Resident Associate 65

GOLF

GOLF

Membership

• Resident/Associate mix remains healthy:

• 139 Associate members to start the 2024 Season

• We have a referral program for Members who refer a new Associate Member

Golf Course

• Tree Work:

• Continues throughout the golf course/season to prune and remove dangerous and/or damaged trees. Jason works in partnership with the Ramsey Shade Tree Commission on all tree related projects

• With our limited amount of land, we are looking to take back more property and utilize (new tee boxes)

Drainage

• The golf course has never been healthier, and the conditions are only improving.

Drainage around the course was a major focus point this past winter (historically wet areas)

66

GOLF

Projects

• Restoring Stream Banks

• Bunkers

• Par 69 to Par 70 (Hole 9 to a par 5)

• With bigger projects around the course, Jason and his team continue to focus on the fine tuning/beautification

• The replacement of safety netting around the course (greens & tees) has started and will continue during the Season.

67

GOLF

Pro Shop

• We are happy to announce the professional staff will be returning for 2024

• Men's and Women’s leagues are at an all time high with regards to participation

• New Committees have been a big success

• Office renovation/bag storage

• Carts

• Pace of Play

68

POOL & PADDLE/PICKLE 69

POOL

• NEW Complex officially opened with 212 memberships!

• Kiddie Pool geysers with mushroom water features installed.

• NEW Playground opened.

• NEW role of Pool Manager created/hired for ‘24 season.

• Full Swim Team return for ‘24 (50 club members last participated in 2021).

• Many THANKS to our Pool Committee of: Grace Cedeno, Eva Farrar, Bob Feeney, Kathleen Gamble, Chuck Graziano, Brian Nitzberg, Denise O’Dea (in memoriam), Barbara O'Donnell & Ben Roesemann + recent Swim Team Subcommittee (Katie Auty, Jasmine Cacace, Kathleen Gamble, Jennell Piccolo & Erin Schroeder).

70

PARTICIPATION 0 20 40 60 80 100 120 140 160 180 200 2023 2022 2021 2020 185 76 54 27 38 7 Resident/Associate House 71

POOL

PADDLE TENNIS

• Fielded 6 league teams (5 Men's & 1 Women's); with our top 4 Men’s teams once again making the league playoffs (per a top 4 divisional finish) with our #2 & #4 teams winning MIPL championship banners. Our Women’s team competed in WIPL league play with an expanding team roster!

• Our Club Pro (Krisi Behrens) held 4 complimentary beginner clinics and worked diligently with our league teams (Paddle Camps) + conducted numerous private & group lessons.

• Krisi formalized our Juniors Program (36 total kids enrolled).

• Awaiting hut expansion (per formal Master Plan approval) upon Clubhouse renovation completion-potentially 2 phases (bathrooms upgrade first followed by interior modernization).

• Opened the Courvoisier Café on Sundays in repurposed hut annex to the “delight” of both our Men’s league players & opponents.

72

PADDLE TENNIS

•Held weekly Social nights play for Men, Women & Mixed Doubles where every level of player is fully welcomed!

•all per the continued dedicated efforts of Jay Bradley, Joyce Chookazian & Julie Cornacchia

•Ran 3rd straight Men's Club Member/Member tournament (3/9) & two exciting Mixed Social events.

•Many THANKS to our Paddle Committee of: Mike Blasius, Jay Bradley, Bonnie Caliento, Joyce Chookazian, Kristin Graves, Pat Murphy, Kathleen Shevlin, Kevin Wurst & Ari Zweig.

73

0 10 20 30 40 50 60 2023 2022 2021 2020 39 56 42 50 22 23 29 6 17 18 15 2 Resident Associate House 74

PADDLE PARTICIPATION

PICKLEBALL

• Held weekly Social play nights for Men, Women & Mixed Doubles where every level of player is fully welcomed!

• all per the continued dedicated efforts of Joyce Chookazian & Tabitha Lee Damsell

• Our Club Pro (George Cheah) held 4 complimentary beginner clinics + private lesson offerings.

• Provided loaner equipment (paddles & balls).

• 63 members enrolled in 2023, near 60% increase from 37 members in 2022.

75

PICKLE PARTICIPATION

0 5 10 15 20 25 30 35 40 45 50 2023 2022 48 19 11 16 4 2 Resident Associate House 76

SOCIAL

77

SOCIAL

• Thank you to my Social Committee: Sami Abbondondolo, Chrissy Lanni, Lindsay Rubin, Michelle DiLello and Samantha Talbot

• Started the year with our Popular Broadway Night.

• Added a new event which sold out and received rave reviews, our Charcuterie Making Class.

• We offered another Family Portrait Day for our members who now have lasting family photos.

• To start of the Summer, over 150 members came to our Pool Ribbon Cutting ceremony and got to enjoy complimentary High Noons and raffle prizes!

• The Summer kept on rolling with a fun Sushi & Sake Night, Ladies Margarita Night, Family Movie Nights, Rose ALL Day, Sounds of Summer and more!

• We finished the year with our Annual Sip & Shop, a visit from Santa at the Tree Lighting Event and the final event to say goodbye to the old Clubhouse, our Last Call Event!

78

UPCOMING 2024 SOCIAL EVENTS

• Starting off the year with the Children’s Spring Party which is just a week away, if you haven’t already be sure to sign up!

• Spring Fling, Disco Down in April!

• Memorial Day BBQ in May.

• We will be having 2 Sounds of Summers this year!

• Summer is going to be action packed with our favorite Wine Tasting Night returning for another fun filled evening along with a Summer Clambake and a Luau with a Pig Roast.

• We are excited to be offering a variety of NEW events this year including a College Day Event and a Food Truck/Craft Beer Day!

Keep an eye our for our Save the Dates and Event Flyers and we look forward to seeing you all at these amazing events!

79

SOCIAL - CANCELLATION POLICY

• In 2023 we had to cancel a few events due to low attendance.

• All of these events had high attendance until about 3/4 days prior to the event.

• We understand that illness and last minute things come up and plans change but we really need to be better about either keeping your reservation or cancelling with further notice.

• Our cancellation policy for all 2024 events will be strictly enforced.

80

REAL ESTATE

81

RGCC 2023 SUMMARY

• Fewest number of RGCC homes sold since 2009 – 13 sales in 2023

• Inventory shortage caused by high interest rates

• Average Sale price for home in the Club- $792,587

• Slightly down from historic high of $806,507 in 2022

• Average Sales Price in homes outside of RGCC - $840,232

• Low number of available $1M+ homes in Club for sale in 2023.

• RGCC homes sold FAST - 21 days

• Ramsey homes outside the club averaged 19 days

• For the 3rd year in a row, RGCC homes sold 101% of list price

• Ramsey homes outside the club averaged 106% of list price

82

Kristin Graves, Broker/Owner, RE/MAX Properties

RGCC HOME SALES – 2013-2023

• 13 sales in the Club in 2023

• Down 60% vs. 2022

• Total Volume: $10,299,99

0 5 10 15 20 25 30 35 40 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 RGCC Sales Volume/$mm

Kristin Graves, Broker/Owner, RE/MAX Properties 83

Average sale price in RGCC: $792,307

Average sale price for outside Club: $840,325

* Source: NJMLS 1/1/20-12/31/23

AVERAGE SALES

RGCC

PRICE VS. RAMSEY HOMES

0 100000 200000 300000 400000 500000 600000 700000 800000 900000 2020 2021 2022 2023 Outside Club RGCC

Kristin Graves, Broker/Owner, RE/MAX Properties

84

• Average sale price: $792,587

• Average List Price: $782,761

RGCC AVERAGE LIST PRICE TO SOLD PRICE – 2013-2023

$$100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $900,000 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Avg List Price Avg Sold

85 2023

Kristin Graves, Broker/Owner, RE/MAX Properties

RGCC 101 Value

If you buy a house in RGCC…you will pay $100k in fees (NPV)…Net present value vs the exact same house outside the club over 30 years.

Based on that, houses in the Club SHOULD be selling for 100k less than houses outside the club…but they aren’t.

Why not?

Buyers have a perceived value of the Club that is priced in when they buy.

86

NPV @ 5.6% Monthly Fees Years Growth Rate 64,166 $ 253 30 3% 12,476 87 20 12,383 71 30 3% 10,000 Today 99,025 $

Board of Director Nominating Process

The By Laws Committee started work last year and recommended a few areas for the Board to consider. While suggested, revisions to the By Laws are not yet complete, the Board has acted in a fashion to help foster transparency and improve our processes.

One area identified is the process of nominating Board Members.

During this year's Board selection process, we made changes to get closer to areas addressed in the committee’s recommendations all while operating within the boundaries of the existing By Laws.

• The nominating committee was open to any shareholder in good standing.

• Four shareholders applied to the nominating committee.

• One of the four decided to apply to be on the board.

• The committee was filled with all of the others who applied.

87

Board of Director Nominating Process

• Five candidates were interested in being on the Board.

• The nominating committee interviewed the five candidates.

• The nominating committee recommended three candidates which are presented before you, to fill the three vacancies opened as a result of three current board members coming off.

• The two other individuals, not recommended by the nominating committee elected not to be placed on the ballot.

Communications to shareholders were done in accordance with the RGCC By Laws

We are looking at improving the process for next year.

88

RESULTS OF ELECTION

89

90

Q&A

ADJOURNMENT Thank you!

91